Attached files

| file | filename |

|---|---|

| EX-23.3 - CONSENT OF DELOITTE & TOUCHE LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - ATLAS TECHNICAL CONSULTANTS, INC. | fs12020a2ex23-3_atlastech.htm |

| EX-23.2 - CONSENT OF GRANT THORNTON LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF - ATLAS TECHNICAL CONSULTANTS, INC. | fs12020a2ex23-2_atlastech.htm |

| EX-23.1 - CONSENT OF MARCUM LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF BOXWOOD - ATLAS TECHNICAL CONSULTANTS, INC. | fs12020a2ex23-1_atlastech.htm |

As submitted to the Securities and Exchange Commission on May 20, 2020.

Registration No. 333-237748

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________________

Amendment No. 2 to

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________________

Atlas Technical Consultants, Inc.

(Exact name of registrant as specified in its charter)

_____________________________________

|

Delaware |

83-0808563 |

|

|

(State or other jurisdiction of |

(I.R.S. Employer |

13215 Bee Cave Parkway, Building B, Suite 230

Austin, Texas 78738

(512) 851-1501

(Address, including zip code, and telephone number, including area code, of registrants’ and registrant guarantor’s principal executive offices)

_____________________________________

L. Joe Boyer

Chief Executive Officer

13215 Bee Cave Parkway, Building B, Suite 230

Austin, Texas 78738

(512) 851-1501

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________________

With a Copy to:

Julian J. Seiguer, P.C.

Michael W. Rigdon

Kirkland & Ellis LLP

609 Main Street, Suite 4500

Houston, Texas 77005

(713) 836-3600

_____________________________________

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: S

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

£ |

Accelerated filer |

S |

|||||

|

Non-accelerated filer |

£ |

Smaller reporting company |

S |

|||||

|

Emerging growth company |

S |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. £

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed |

Proposed |

Amount of |

||||||||||

|

Primary Offering |

|

|

|

|

|

|

||||||||

|

Class A common stock, par value $0.0001 per share, underlying warrants |

23,750,000 |

(3) |

$ |

11.50 |

(4) |

$ |

273,125,000.00 |

$ |

35,451.63 |

|

||||

|

Secondary Offering |

|

|

|

|

|

|

||||||||

|

Class A common stock, par value $0.0001 per share |

27,780,345 |

(5) |

$ |

9.17 |

(6) |

$ |

254,745,763.65 |

$ |

33,066.00 |

|

||||

|

Warrants to purchase Class A common stock, par value $0.0001 per share |

3,750,000 |

|

$ |

11.50 |

(4) |

$ |

37,500,000.00 |

$ |

4,867.50 |

|

||||

|

Total |

|

|

|

$ |

565,370,763.65 |

$ |

73,385.13 |

(7) |

||||||

____________

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), there are also being registered such indeterminable number of shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”), as may be issued to prevent dilution as a result of stock splits, stock dividends or similar transactions.

(2) Calculated in accordance with Rule 457(o) under the Securities Act.

(3) Represents the issuance of (i) up to 23,750,000 shares of Class A common stock that may be issued upon (i) the exercise of warrants (the “Public Warrants”) originally sold as part of the units in our initial public offering (the “IPO”), and (ii) up to 3,750,000 shares of Class A common stock issuable upon the exercise of warrants originally sold both by themselves and as part of units to Boxwood Sponsor LLC (the “Sponsor”) in private placements that closed concurrently with our IPO (the “Private Placement Warrants,” and together with the Public Warrants, the “Warrants”).

(4) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(i) under the Securities Act. The price per share is based upon the exercise price per warrant of $11.50 per share.

(5) Represents 27,780,345 shares of Class A common stock, which includes (i) 3,805,977 shares of Class A common stock held by certain selling security holders named in this prospectus and (ii) 23,974,368 shares of Class A common stock issuable upon exchange of units in Atlas TC Holdings LLC, together with an equal number of shares of our Class B common stock, par value $0.0001 per share.

(6) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low prices of the Class A common stock on May 4, 2020, as reported on The Nasdaq Stock Market.

(7) Pursuant to Rule 457(p), Atlas Technical Consultants, Inc. (the “Registrant”) previously offset this amount in connection with the initial filing of this registration statement, by utilizing a portion of the fee previously paid with respect to the registration statement on Form S-3 (File Number 333-236470) filed by the Registrant with the Securities and Exchange Commission on February 14, 2020.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission (the “SEC”) is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION DATED MAY 20, 2020 |

Atlas Technical Consultants, Inc.

23,750,000 Shares of Class A Common Stock Issuable Upon Exercise of Existing Warrants

_____________________

27,780,345 Shares of Class A Common Stock

3,750,000 Private Placement Warrants

_____________________

This prospectus relates to the issuance by Atlas Technical Consultants, Inc. (formerly known as Boxwood Merger Corp. (prior to the Business Combination (as defined below) “Boxwood”)), a Delaware corporation (the “Company,” “we,” “our” or “us”) of (i) up to 20,000,000 shares of our Class A common stock, par value $0.0001 per share (“Class A common stock”), issuable upon the exercise of warrants (the “Public Warrants”) originally sold as part of the units in our initial public offering (the “IPO”) and (ii) up to 3,750,000 shares of our Class A common stock issuable upon the exercise of warrants originally sold both by themselves and as part of units to Boxwood Sponsor LLC (the “Sponsor”) in private placements that closed concurrently with our IPO (the “Private Placement Warrants,” and together with the Public Warrants, the “Warrants”). Each warrant entitles the holder thereof to purchase upon exercise one share of our Class A common stock for $11.50 per share. We will receive the proceeds from the exercise of the Private Placement Warrants and the Public Warrants, but not from the sale of the underlying shares of Class A common stock.

In addition, this prospectus relates to the resale by the selling security holders named in this prospectus or their permitted transferees of up to (i) 3,750,000 Private Placement Warrants and (ii) 27,780,345 shares of our Class A common stock, 3,805,977 of which represent shares of Class A common stock held by certain selling security holders named in this prospectus and 23,974,368 of which represent shares of Class A common stock that may be issued from time to time, pursuant to the amended and restated limited liability company agreement of Atlas TC Holdings LLC, a subsidiary of the Company (“Holdings”), dated February 14, 2020 (the “LLC Agreement”), to certain members of Holdings, that own units in Holdings (“Holdings Units”), upon exchange of such members’ Holdings Units, together with an equal number of shares of our Class B common stock, par value $0.0001 per share (“Class B common stock”), which were issued to Atlas Technical Consultants Holdings LP, a Delaware limited partnership (the “Seller”), in connection with, and as part of the consideration for, our business combination (the “Business Combination”) with Atlas Intermediate Holdings LLC, a Delaware limited liability company (“Atlas Intermediate”), which we consummated on February 14, 2020.

The selling security holders may offer, sell or distribute warrants or shares of Class A common stock publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from the sale of warrants or the shares of Class A common stock owned by the selling security holders. We will bear all costs, expenses and fees in connection with the registration of these warrants and shares of Class A common stock, including with regard to compliance with state securities or “blue sky” laws. The selling security holders will bear all commissions and discounts, if any, attributable to their sale of the Private Placement Warrants and shares of Class A common stock.

The securities offered pursuant to this prospectus are collectively referred to in this prospectus as the “securities.” This prospectus provides you with a general description of these securities and the general manner in which we or the selling security holders will offer the securities. When securities are offered, we or the selling security holders, as applicable, may provide a prospectus supplement, to the extent appropriate, that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. We provide more information about how we and the selling security holders may sell the securities in the section entitled “Plan of Distribution” beginning on page 81.

Our Class A common stock and Public Warrants are traded on The NASDAQ Stock Market (“NASDAQ”) under the symbols “ATCX” and “ATCXW,” respectively. On May 19, 2020, the last reported sale price of our Class A common stock was $9.22 per share and the last reported sale price of our Public Warrants was $0.45 per warrant. As of May 19, 2020, we had 5,767,342 shares of Class A common stock issued and outstanding, 23,974,368 shares of Class B common stock issued and outstanding, 3,750,000 Private Placement Warrants issued and outstanding and 20,000,000 Public Warrants issued and outstanding.

_____________________

Investing in our securities involves risks. See “Risk Factors” beginning on page 5.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are subject to reduced public company reporting requirements. See “Risk Factors.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

_____________________

The date of this prospectus is , 2020.

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

3 |

||

|

5 |

||

|

18 |

||

|

Unaudited Pro Forma Condensed Combined Financial Information |

19 |

|

|

25 |

||

|

26 |

||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 |

|

|

40 |

||

|

51 |

||

|

57 |

||

|

Security Ownership of Certain Beneficial Owners and Management |

64 |

|

|

66 |

||

|

73 |

||

|

76 |

||

|

81 |

||

|

Material U.S. Federal Income Tax Considerations for Non-U.S. Holdings |

84 |

|

|

90 |

||

|

90 |

||

|

90 |

||

|

F-1 |

_________________________________

Neither we nor the selling security holders have authorized anyone to provide any information or to make any representations other than those contained or incorporated by reference in this prospectus, any accompanying prospectus supplement or any free writing prospectus we have prepared. We and the selling security holders take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions where it is lawful to do so. The information contained or incorporated by reference in this prospectus is current only as of its date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Basis of Presentation

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and as amended by Accounting Standards Updates of the Financial Accounting Standards Board (“FASB”).

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the selling stockholders have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

i

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Company

We were originally formed on June 28, 2017 as a Delaware corporation for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, reorganization, recapitalization or other similar business combination with one or more businesses. On February 14, 2020, we consummated the acquisition of the equity interests in certain of the subsidiaries of Seller (the “Business Combination”) pursuant to that certain unit purchase agreement entered into by and between Atlas TC Buyer LLC (“Buyer”), Seller and the other parties listed thereto on August 12, 2019 (as amended, the “Purchase Agreement”).

Following the Business Combination, we changed our name from “Boxwood Merger Corp.” to “Atlas Technical Consultants, Inc.” and continued the listing of our Class A common stock and Public Warrants on the NASDAQ under the symbols “ATCX” and “ATCXW,” respectively. Prior to the consummation of the Business Combination, our Class A common stock, Public Warrants and units were listed on the NASDAQ under the symbols “BWMC,” “BWMCW” and “BWMCU,” respectively.

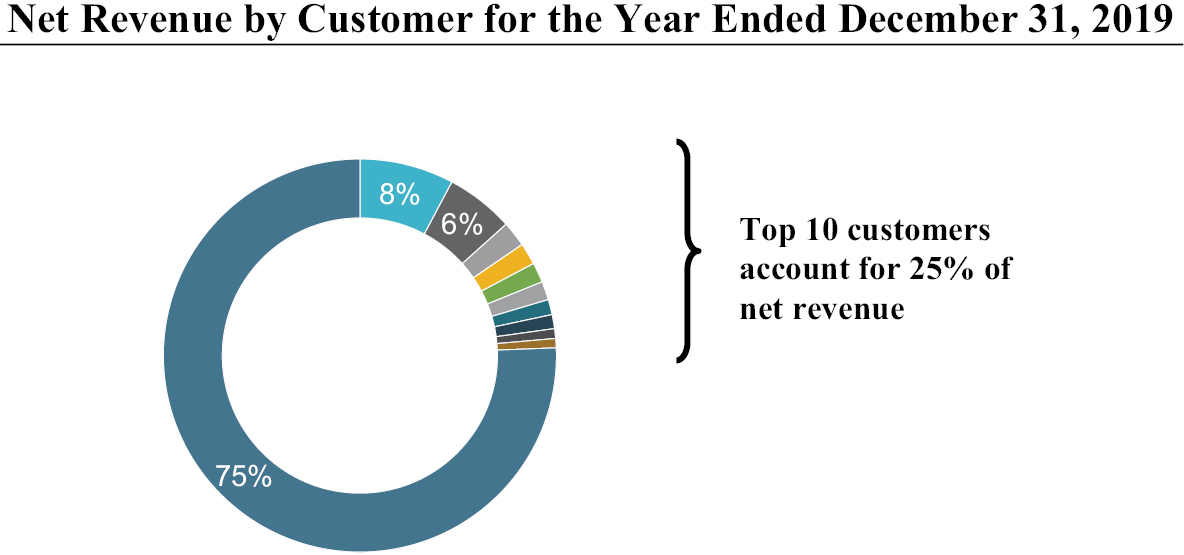

Business Overview

We are a leading provider of professional and technical testing, inspection engineering and consulting services, offering solutions to public and private sector clients in the transportation, commercial, water, government, education and industrial markets. With approximately 140 offices located throughout the United States, we provide a broad range of mission-critical technical services, helping our clients test, inspect, plan, design, certify and manage a wide variety of projects across diverse end markets.

We act as a trusted advisor to our clients, helping our clients design, engineer, inspect, manage and maintain civil and commercial infrastructure, servicing existing structures as well as helping to build new structures.

Company Information

Our principal executive offices are located at 13215 Bee Cave Parkway, Building B, Suite 230, Austin, Texas 78738 and our telephone number is (512) 851-1501. Our website is www.oneatlas.com. The information found on our website is not part of this prospectus.

Our Emerging Growth Company Status

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we are eligible for certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies for as long as we continue to be an emerging growth company, including (i) the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (ii) the exemptions from say-on-pay, say-on-frequency and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements.

We may take advantage of these provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the fiscal year in which the market value of our Class A common stock that is held by non-affiliates exceeds $700 million as of June 30 of that fiscal year, (ii) the last day of the fiscal year in which we have total annual gross revenue of $1.07 billion or more during such fiscal year, (iii) the date on which we have issued more than $1.0 billion in non-convertible debt in the prior three-year period or (iv) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock in the IPO, which would be December 31, 2023.

1

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting standards provided in Section 7(a)(2)(B) of the Securities Act as long as we are an emerging growth company. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the same time private companies adopt the new or revised standard.

Our Smaller Reporting Company Status

We are also currently a “smaller reporting company,” meaning that we have either (a) a public float of less than $250 million or (b) annual revenues of less than $100 million and either no public float or a public float of less than $700 million. In the event that we are still considered a “smaller reporting company,” at such time as we cease being an “emerging growth company,” the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings.

Accordingly, the information that we provide you may be different than what you may receive from other public companies in which you hold equity interests.

Additional Information

Our principal executive office is located at 13215 Bee Cave Parkway, Building B, Suite 230, Austin, Texas 78738 and its telephone number is (512) 851-1501. Our website is https://www.oneatlas.com. The information on our website does not constitute part of, and is not incorporated by reference in, this prospectus or any accompanying prospectus supplement, and you should not rely on our website or such information in making a decision to invest in our securities.

2

We are registering (i) up to 20,000,000 shares of Class A common stock issuable upon the exercise of the Public Warrants and (ii) up to 3,750,000 shares of Class A common stock issuable upon the exercise of the Private Placement Warrants. We are also registering the resale by the selling security holders named in this prospectus or their permitted transferees of up to (i) 3,750,000 Private Placement Warrants and (ii) 27,780,345 shares of Class A common stock, 3,805,977 of which represent shares of Class A common stock held by certain selling security holders named in this prospectus and 23,974,368 of which represent shares of Class A common stock that may be issued from time to time to certain members of Atlas Holdings, that own Holdings Units, upon exchange of such members’ Holdings Units, together with an equal number of shares of our Class B common stock. Our Class A common stock and Warrants are currently listed on NASDAQ under the symbols “ATCX” and “ATCXW,” respectively. Any investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” on page 5 of this prospectus.

Issuance of Class A Common Stock Underlying the Warrants

|

Shares of Class A common stock to be issued upon exercise of all Warrants |

23,750,000 shares of Class A common stock. |

|

|

Shares of Class A common stock outstanding prior to exercise of all Warrants(1) |

5,767,342 shares of Class A common stock. |

|

|

Shares of Class A common stock outstanding assuming exercise of all Warrants(1)(2) |

29,517,342 shares of Class A common stock. |

|

|

Terms of the Warrants |

Each Warrant entitles the holder to purchase one share of Class A common stock for $11.50 per share. The Public Warrants expire at 5:00 p.m., New York time, on February 14, 2025 (which is five years after the consummation of the Business Combination), or earlier upon redemption or liquidation. |

|

|

Use of proceeds |

We will receive up to an aggregate of approximately $237 million from the exercise of the Public Warrants, assuming the exercise in full of all the Public Warrants for cash. Unless we inform you otherwise in a prospectus supplement or free writing prospectus, we intend to use the net proceeds from the exercise of the Public Warrants for general corporate purposes. |

____________

(1) The number of shares of Class A common stock does not include the shares of Class A common stock available for future issuance under the Incentive Plan.

(2) The number of shares of Class A common stock assumes the holders of our Warrants exercise all of their Warrants for cash at the $11.50 exercise price per share.

3

Resale of Private Placement Warrants and Class A Common Stock by Selling Security Holders

|

Private Placement Warrants offered by the selling security holders |

|

|

|

Class A common stock offered by the selling security holders |

|

|

|

Terms of the offering |

The selling security holders will determine when and how they will dispose of the securities registered under this prospectus for resale. |

|

|

Use of proceeds |

We will not receive any proceeds from the sale of securities to be offered by the selling security holders. |

|

|

Trading market and ticker symbols |

Our Class A common stock and Public Warrants are currently listed on NASDAQ under the symbols “ATCX” and “ATCXW,” respectively. |

For additional information concerning the offering, see “Plan of Distribution” beginning on page 81.

4

Investing in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, and our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q and any subsequently filed Quarterly Reports on Form 10-Q before deciding whether to purchase any of our securities. Any of these risks may have a material adverse effect on our business, financial condition, results of operations and cash flows and our prospects could be harmed. In that event, the price of our securities could decline and you could lose part or all of your investment.

Additionally, the risks and uncertainties described in this prospectus or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business.

Risks Relating to Our Business and Industry

Our continued success is dependent upon our ability to hire, retain and utilize qualified personnel.

The success of our business is dependent upon our ability to hire, retain and utilize qualified personnel, including engineers, architects, designers, craft personnel and corporate management professionals who have the required experience and expertise at a reasonable cost. The market for these and other personnel is competitive. From time to time, it may be difficult to attract and retain qualified individuals with the expertise, and in the timeframe, demanded by our clients, or to replace such personnel when needed in a timely manner. In certain geographic areas, for example, we may not be able to satisfy the demand for our services because of our inability to successfully hire and retain qualified personnel. Furthermore, some of our personnel hold government granted clearance that may be required to obtain government projects. If we were to lose some or all of these personnel, they would be difficult to replace. Loss of the services of, or failure to recruit, qualified technical and management personnel could limit our ability to successfully complete existing projects and compete for new projects.

In addition, if any of our key personnel retire or otherwise leave the company, we need to have appropriate succession plans in place and to successfully implement such plans, which requires devoting time and resources toward identifying and integrating new personnel into leadership roles and other key positions. If we cannot attract and retain qualified personnel or effectively implement appropriate succession plans, it could have a material adverse impact on our business, financial condition and results of operations.

The cost of providing our services, including the extent to which we utilize our workforce, affects our profitability. For example, the uncertainty of contract award timing can present difficulties in matching our workforce size with our contracts. If an expected contract award is delayed or not received, we could incur costs resulting from excess staff, reductions in staff, or redundancy of facilities that could have a material adverse impact on our business, financial condition and results of operations.

Our profitability could suffer if we are not able to maintain adequate utilization of our workforce.

The cost of providing our services, including the extent to which we utilize our workforce, affects our profitability. The rate at which we utilize our workforce is affected by several factors, including:

• our ability to transition employees from completed projects to new assignments and to hire and assimilate new employees;

• our ability to forecast demand for our services and thereby maintain an appropriate headcount in each of our geographies and workforces;

• our ability to manage attrition;

• our need to devote time and resources to training, business development, professional development, and other non-chargeable activities;

• our ability to match the skill sets of our employees to the needs of the marketplace; and

• if we over-utilize our workforce, our employees may become disengaged, which will impact employee attrition. If we under-utilize our workforce, our profit margin and profitability could suffer.

5

If we are unable to integrate acquired businesses successfully, our business could be harmed.

As part of our business strategy to pursue accretive acquisitions, we intend to selectively pursue targets that provide complementary, low-risk services and expand our national platform. Our inability to successfully integrate future acquisitions could impede it from realizing all of the benefits of those acquisitions and could weaken our business operations. The integration process of any particular acquisition may disrupt our business and, if implemented ineffectively, may preclude realization of the full benefits expected by us and could harm our results of operations. In addition, the overall integration process may result in unanticipated problems, expenses, liabilities and competitive responses and may cause our stock price to decline.

The difficulties of integrating acquisitions include, among other things:

• unanticipated issues in integration of information, communications and other systems;

• unanticipated incompatibility of logistics, marketing and administration methods;

• maintaining employee morale and retaining key employees;

• integrating the business cultures of both companies;

• preserving important strategic client relationships;

• consolidating corporate and administrative infrastructures and eliminating duplicative operations; and

• coordinating geographically separate organizations.

In addition, even if the operations of an acquisition are integrated successfully, we may not realize the full benefits of such acquisition, including the synergies, cost savings or growth opportunities that it expects. These benefits may not be achieved within the anticipated time frame, or at all.

Further, acquisitions may also cause us to:

• cause our management to expend significant time, effort and resources;

• issue securities that would dilute our current stockholders;

• use a substantial portion of our cash resources;

• increase our interest expense, leverage and debt service requirements if we incur additional debt to pay for an acquisition;

• assume liabilities, including environmental liabilities, for which we do not have indemnification from the former owners or have indemnification that may be subject to dispute or concerns regarding the creditworthiness of the former owners;

• record goodwill and non-amortizable intangible assets that are subject to impairment testing on a regular basis and potential impairment charges;

• experience volatility in earnings due to changes in contingent consideration related to acquisition liability estimates;

• incur amortization expenses related to certain intangible assets;

• lose existing or potential contracts as a result of conflict of interest issues;

• incur large and immediate write-offs; or

• become subject to litigation.

6

Construction and maintenance sites are inherently dangerous workplaces. If we, the owner, or others working at the project site fail to maintain safe work sites, we can be exposed to significant financial losses and reputational harm, as well as civil and criminal liabilities.

Construction and maintenance sites often put our employees and others in proximity with large pieces of mechanized equipment, moving vehicles, chemical and manufacturing processes, and highly regulated materials, in a challenging environment. If we fail to implement safety procedures or if the procedures we implement are ineffective, or if others working at the site fail to implement and follow appropriate safety procedures, our employees and others may become injured, disabled or even lose their lives, the completion or commencement of our projects may be delayed, and we may be exposed to litigation or investigations. Unsafe work sites also have the potential to increase employee turnover, increase the cost of a project to our clients, and raise our operating and insurance costs. Any of the foregoing could result in financial losses or reputational harm, which could have a material adverse impact on our business, financial condition and results of operations.

In addition, our projects can involve the handling of hazardous and other highly regulated materials, which, if improperly handled or disposed of, could subject us to civil and/or criminal liabilities. We are also subject to regulations dealing with occupational health and safety. Although we maintain functional groups whose primary purpose is to ensure we implements effective health, safety and environmental (“HSE”) work procedures throughout our organization, including construction sites and maintenance sites, the failure to comply with such regulations could subject it to liability. In addition, despite the work of our functional groups, we cannot guarantee the safety of our personnel or that there will be no damage to or loss of our work, equipment or supplies.

Our safety record is critical to our reputation. Many of our clients require that we meet certain safety criteria to be eligible to bid for contracts and many contracts provide for automatic termination or forfeiture of some or all of our contract fees or profit in the event we fail to meet certain measures. Accordingly, if we fail to maintain adequate safety standards, we could suffer reduced profitability or the loss of projects or clients, which could have a material adverse impact on our business, financial condition and results of operations.

Demand from clients is cyclical and vulnerable to economic downturns. If the economy weakens or client spending declines, our financial results may be impacted.

Demand for services from our clients is cyclical and vulnerable to economic downturns, which may result in clients delaying, curtailing or canceling proposed and existing projects. Our business traditionally lags the overall recovery in the economy. If the economy weakens or client spending declines, then our revenue, profits and overall financial condition may deteriorate.

In addition, if there is an economic downturn, our existing and potential clients may either postpone entering into new contracts or request price concessions. Difficult financing and economic conditions may cause some of our clients to demand better pricing terms or delay payments for services we perform, thereby increasing the average number of days our receivables are outstanding and the potential of increased credit losses on uncollectible invoices. Further, these conditions may result in the inability of some of our clients to pay us for services that it has already performed. Accordingly, these factors affect our ability to forecast our future revenue and earnings from business areas that may be adversely impacted by market conditions.

Our results of operations depend on the award of new contracts and the timing of the performance of these contracts.

Our revenues are derived from new contract awards. Delays in the timing of the awards or cancellations of such prospects as a result of economic conditions, material and equipment pricing and availability or other factors could impact our long-term projected results. It is particularly difficult to predict whether or when we will receive large-scale projects as these contracts frequently involve a lengthy and complex bidding and selection process, which is affected by several factors, such as market conditions or governmental and environmental approvals. Since a significant portion of our revenues is generated from such projects, our results of operations and cash flows can fluctuate significantly from quarter to quarter depending on the timing of our contract awards and the commencement or progress of work under awarded contracts. Furthermore, many of these contracts are subject to financing contingencies and, as a result, we are subject to the risk that the customer will not be able to secure the necessary financing for the project.

7

In addition, many contracts require us to satisfy specific progress or performance milestones in order to receive payment from the customer. As a result, we may incur significant costs for engineering, materials, components, equipment, labor or subcontractors prior to receipt of payment from a customer.

The uncertainty of contract award timing can also present difficulties in matching workforce size with contract needs. In some cases, we maintain and bear the cost of a ready workforce that is larger than necessary under existing contracts in anticipation of future workforce needs for expected contract awards. If an expected contract award is delayed or not received, we may incur additional costs resulting from reductions in staff or redundancy of facilities, which could have a material adverse effect on our business, financial condition and results of operations.

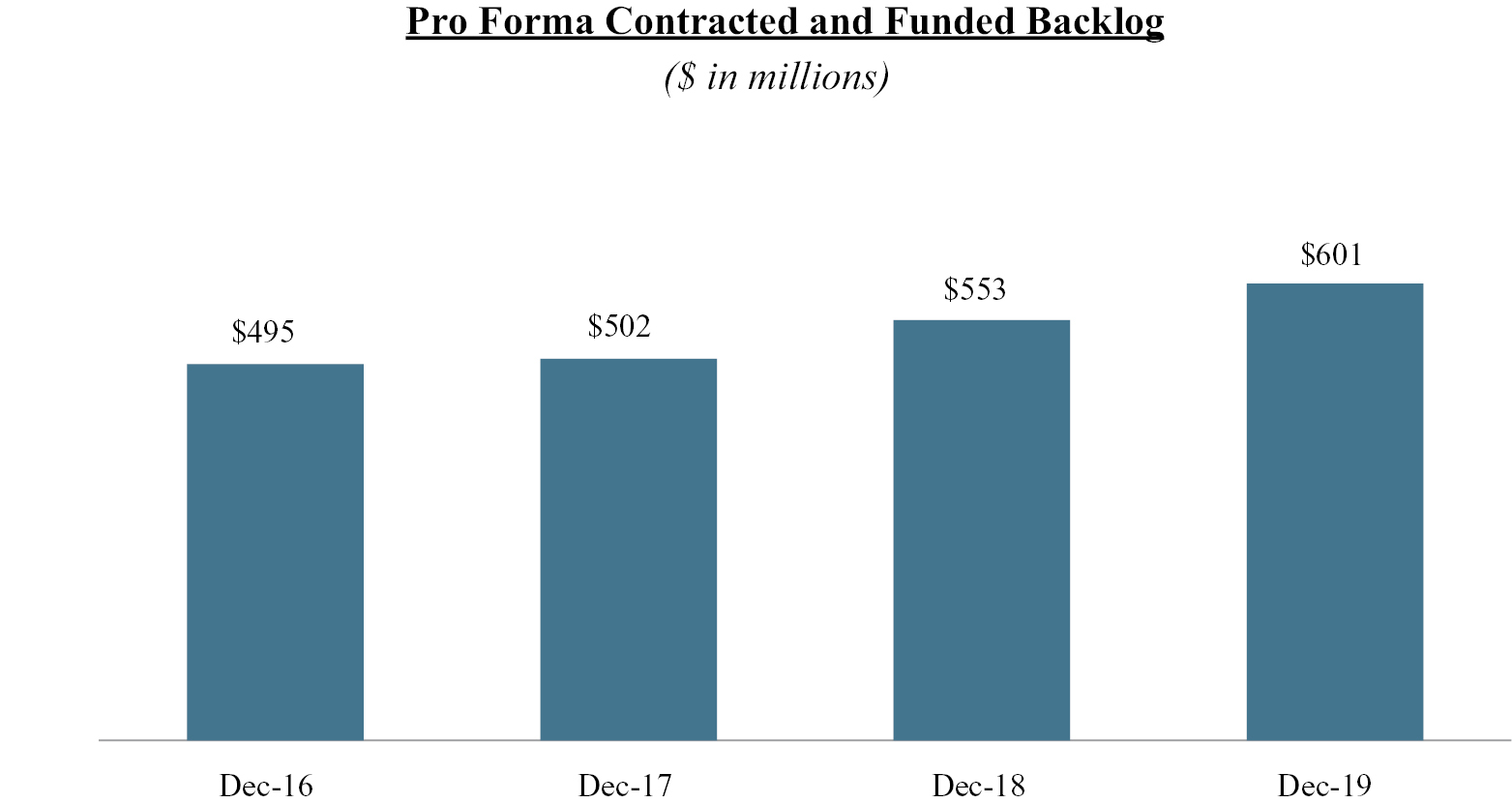

The contracts in our backlog may be adjusted, canceled or suspended by our clients and, therefore, our backlog is not necessarily indicative of our future revenues or earnings. Additionally, even if fully performed, our backlog is not a good indicator of future gross margins.

Backlog represents the total dollar amount of revenues we expect to record in the future as a result of performing work under contracts that have been awarded to it. As of December 31, 2019, our backlog totaled approximately $601 million. There is no assurance that backlog will be realized as revenues in the amounts reported or, if realized, will result in profits. In accordance with industry practice, substantially all of our contracts are subject to cancellation, termination, or suspension at the discretion of the client. In the event of a project cancellation, we would generally have no contractual right to the total revenue reflected in our backlog. Projects can remain in backlog for extended periods of time because of the nature of the project and the timing of the services required by the project. The risk of contracts in backlog being cancelled or suspended generally increases during periods of widespread economic slowdowns or in response to changes in commodity prices.

The contracts in our backlog are subject to changes in the scope of services to be provided as well as adjustments to the costs relating to the contracts. The revenue for certain contracts included in backlog is based on estimates. Additionally, the way we perform on our individual contracts can affect greatly our gross margins and hence, future profitability.

Our services expose us to significant risks of liability, and our insurance policies may not provide adequate coverage.

If we fail to provide our services in accordance with applicable professional standards or contractual requirements, we could be exposed to significant monetary damages or even criminal violations. Our engineering practice, for example, involves professional judgments regarding the planning, design, development, construction, operations and management of industrial facilities and public infrastructure projects. While we do not generally accept liability for consequential damages in our contracts, and although we have adopted a range of insurance, risk management and risk avoidance programs designed to reduce potential liabilities, a catastrophic event at one of our project sites or completed projects resulting from the services we have performed could result in significant professional or product liability, and warranty or other claims against us as well as reputational harm, especially if public safety is impacted. These liabilities could exceed our insurance limits or the fees we generate, may not be covered by insurance at all due to various exclusions in our coverage and self-insured retention amounts, and could impact our ability to obtain insurance in the future. Further, even where coverage applies, the policies have deductibles, which result in our assumption of exposure for certain amounts with respect to any claim filed against us. In addition, clients or subcontractors who have agreed to indemnify us against any such liabilities or losses might refuse or be unable to pay it. An uninsured claim, either in part or in whole, as well as any claim covered by insurance but subject to a high deductible, if successful and of a material magnitude, could have a material adverse impact on our business, financial condition and results of operations.

Unavailability or cancellation of third-party insurance coverage would increase our overall risk exposure as well as disrupt the management of our business operations.

We maintain insurance coverage from third-party insurers as part of our overall risk management strategy and some of our contracts require us to maintain specific insurance coverage limits. If any of our third-party insurers fail, suddenly cancel coverage, or otherwise are unable to provide us with adequate insurance coverage, our overall risk exposure and operational expenses would increase and the management of our business operations would be disrupted. In addition, there can be no assurance that any of our existing insurance coverage will be renewable upon the expiration of the coverage period or that future coverage will be affordable at the required limits.

8

We engage in a highly competitive business. If we are unable to compete effectively, we could lose market share and our business and results of operations could be negatively impacted.

We face intense competition to provide technical, professional and construction services to clients. The markets we serve are highly competitive and we compete against many regional, national and multinational companies.

The extent of our competition varies by industry, geographic area and project type. Our projects are frequently awarded through a competitive bidding process, which is standard in our industry. We are constantly competing for project awards based on pricing, schedule and the breadth and technical sophistication of our services. Competition can place downward pressure on our contract prices and profit margins, and may force us to accept contractual terms and conditions that are less favorable to us, thereby increasing the risk that, among other things, we may not realize profit margins at the same rates as we have seen in the past or may become responsible for costs or other liabilities we have not accepted in the past. If we are unable to compete effectively, we may experience a loss of market share or reduced profitability or both, which, if significant, could have a material adverse impact on our business, financial condition and results of operations.

The nature of our contracts, particularly those that are fixed price, subject us to risks of cost overruns. We may experience reduced profits or, in some cases, losses if costs increase above budgets or estimates or if the project experiences schedule delays.

As of December 31, 2019, approximately 5% of our revenues were earned under fixed price contracts. Fixed price contracts require us to estimate the total cost of the project in advance of its performance. For fixed price contracts, we may benefit from any cost savings, but we bear greater risk of paying some, if not all, of any cost overruns. Fixed price contracts are established in part on partial or incomplete designs, cost and scheduling estimates that are based on several assumptions, including those about future economic conditions, commodity and other materials pricing and availability of labor, equipment and materials, and other exigencies. If the design or the estimates prove inaccurate or if circumstances change due to, among other things, unanticipated technical problems, difficulties in obtaining permits or approvals, changes in local laws or labor conditions, weather or other delays beyond our control, changes in the costs of equipment or raw materials, our vendors’ or subcontractors’ inability or failure to perform, or changes in general economic conditions, then cost overruns may occur and we could experience reduced profits or, in some cases, a loss for that project. These risks are exacerbated for projects with long-term durations because there is an increased risk that the circumstances on which we based our original estimates will change in a manner that increases costs. If the project is significant, or there are one or more issues that impact multiple projects, costs overruns could have a material adverse impact on our business, financial condition and results of operations.

Governmental agencies may modify, curtail or terminate our contracts at any time prior to their completion and, if we do not replace them, we may suffer a decline in revenue.

Most government contracts may be modified, curtailed or terminated by the government either at our discretion or upon the default of the contractor. If the government terminates a contract at its discretion, then we typically can recover only costs incurred or committed, settlement expenses and profit on work completed prior to termination, which could prevent us from recognizing all our potential revenue and profits from that contract. In addition, for some assignments, the U.S. government may attempt to “insource” the services to government employees rather than outsource to a contractor. If a government terminates a contract due to our default, we could be liable for excess costs incurred by the government in obtaining services from another source.

We are dependent on third parties to complete certain of our contracts.

Third-party subcontractors we hire perform certain work under our contracts. We also rely on third-party equipment manufacturers or suppliers to provide equipment and materials used for certain of our projects. If we are unable to hire qualified subcontractors or find qualified equipment manufacturers or suppliers, our ability to successfully complete certain projects could be impaired. If we are not able to locate qualified third-party subcontractors or the amount we are required to pay for subcontractors or equipment and supplies exceeds what we have estimated, especially in a lump sum or a fixed price contract, we may suffer losses on these contracts. If a subcontractor, supplier or manufacturer fails to provide services, supplies or equipment as required under a contract for any reason, we may be required to source these services, equipment or supplies to other third parties on a delayed basis or on less favorable terms, which could impact contract profitability. There is a risk that we may have disputes with our subcontractors relating to, among other

9

things, the quality and timeliness of work performed, customer concerns about a subcontractor or our failure to extend existing task orders or issue new task orders under a contract. In addition, faulty workmanship, equipment or materials could impact the overall project, resulting in claims against us for failure to meet required project specifications.

Third parties may find it difficult to obtain enough financing to help fund their operations. The inability to obtain financing could adversely affect a third party’s ability to provide materials, equipment or services which could have a material adverse impact on our business, financial condition and results of operations. In addition, a failure by a third-party subcontractor, supplier or manufacturer to comply with applicable laws, regulations or client requirements could negatively impact our business and, for government clients, could result in fines, penalties, suspension or even debarment being imposed on us, which could have a material adverse impact on our business, financial condition and results of operations.

We rely on third-party internal and outsourced software to run our critical accounting, project management and financial information systems. As a result, any sudden loss, disruption or unexpected costs to maintain these systems could significantly increase our operational expense and disrupt the management of our business operations.

We rely on third-party software to run our critical accounting, project management and financial information systems. We also depend on our software vendors to provide long-term software maintenance support for our information systems. Software vendors may decide to discontinue further development, integration or long-term software maintenance support for our information systems, in which case we may need to abandon one or more of our current information systems and migrate some or all of our accounting, project management and financial information to other systems, thus increasing our operational expense as well as disrupting the management of our business operations.

Negative conditions in the credit and financial markets and delays in receiving client payments could result in liquidity problems, adversely affecting our cost of borrowing and our business.

Although we finance much of our operations using cash provided by operations, at times we depend on the availability of credit to grow our business and to help fund business acquisitions. Instability in the credit markets in the U.S. or abroad could cause the availability of credit to be relatively difficult or expensive to obtain at competitive rates, on commercially reasonable terms or in sufficient amounts. This situation could make us more difficult or more expensive for us to access funds, refinance our existing indebtedness, enter into agreements for new indebtedness, or obtain funding through the issuance of securities or such additional capital may not be available on terms acceptable to us, or at all. We may also enter into business acquisition agreements that require us to access credit, which if not available at the closing of the acquisition could result in a breach of the acquisition agreement and a resulting claim for damages by the sellers of such business. In addition, market conditions could negatively impact our clients’ ability to fund their projects and, therefore, utilize our services, which could have a material adverse impact on our business, financial condition and results of operations.

Some of our customers, suppliers and subcontractors depend on access to commercial financing and capital markets to fund their operations. Disruptions in the credit or capital markets could adversely affect our clients’ ability to finance projects and could result in contract cancellations or suspensions, project delays and payment delays or defaults by our clients. In addition, clients may be unable to fund new projects, may choose to make fewer capital expenditures or otherwise slow their spending on our services or to seek contract terms more favorable to them. Our government clients may face budget deficits that prohibit them from funding proposed and existing projects or that cause them to exercise their right to terminate our contracts with little or no prior notice. In addition, any financial difficulties suffered by our subcontractors or suppliers could increase our cost or adversely impact project schedules. These disruptions could materially impact our backlog and have a material adverse impact on our business, financial condition and results of operations.

If we fail to comply with federal, state and local governmental requirements, our business may be adversely affected.

We are subject to U.S. federal, state, and local laws and regulations that affect our business. Although we have policies and procedures to comply with U.S. trade laws, the violation of such laws could subject us and our employees to civil or criminal penalties, including substantial monetary fines, or other adverse actions including debarment from participation in U.S. government contracts, and could damage our reputation and our ability to do business.

10

Our business strategy relies in part on acquisitions to sustain our growth. Acquisitions of other companies present certain risks and uncertainties.

Our business strategy involves growth through, among other things, the acquisition of other companies. We try to evaluate companies that we believe will strategically fit into our business and growth objectives, including, for example, our acquisition of ATC Group Services in January 2019 and Long Engineering, Inc. (“LONG”) in February 2020. If we are unable to successfully integrate and develop acquired businesses, we could fail to achieve anticipated synergies and cost savings, including any expected increases in revenues and operating results, which could have a material adverse effect on our financial results.

We may not be able to identify suitable acquisition or strategic investment opportunities or may be unable to obtain the required consent of our lenders and, therefore, may not be able to complete such acquisitions or strategic investments. We may incur expenses associated with sourcing, evaluating and negotiating acquisitions (including those that do not get completed), and we may also pay fees and expenses associated with financing acquisitions to investment banks and other advisors. Any of these amounts may be substantial, and together with the size, timing and number of acquisitions we pursue, may negatively affect and cause significant volatility in our financial results.

In addition, we have assumed, and may in the future assume, liabilities of the company we are acquiring. While we retain third-party advisors to consult on potential liabilities related to these acquisitions, there can be no assurances that all potential liabilities will be identified or known to us. If there are unknown liabilities or other obligations, our business could be materially affected.

Our quarterly results may fluctuate significantly, which could have a material negative effect on the price of our Class A common stock.

Our quarterly operating results may fluctuate due to several factors, including:

• fluctuations in the spending patterns of our customers;

• the number and significance of projects executed during a quarter;

• unanticipated changes in contract performance, particularly with contracts that have funding limits;

• the timing of resolving change orders, requests for equitable adjustments and other contract adjustments;

• project delays;

• changes in prices of commodities or other supplies;

• weather conditions that delay work at project sites;

• the timing of expenses incurred in connection with acquisitions or other corporate initiatives;

• natural disasters or other crises;

• staff levels and utilization rates;

• changes in prices of services offered by our competitors; and

• general economic and political conditions.

If our quarterly operating results fluctuate significantly, causing our operating results to fall below the expectations of securities analysts, the price of our Class A common stock may decrease substantially, which could have a material negative impact on our financial condition and results of operations.

We are an “emerging growth company” and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including not being required to comply with the auditor attestation requirements of Section 404(b) of Sarbanes-Oxley, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy

11

statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. In addition, pursuant to Section 107 of the JOBS Act, as an “emerging growth company” we intend to take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.” We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our initial public offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

An impairment charge on our goodwill could have a material adverse impact on our financial position and results of operations.

Because we have grown in part through acquisitions, goodwill and intangible assets represent a substantial portion of our assets. Under U.S. GAAP, we are required to test goodwill carried in our combined balance sheets for possible impairment on an annual basis based upon a fair value approach. As of December 31, 2019, we have $85,125,000 of goodwill, representing 24% of our total assets of $352,773,000. We also are required to test goodwill for impairment between annual tests if events occur or circumstances change that would more likely than not reduce our enterprise fair value below our book value. These events or circumstances could include a significant change in the business climate, including a significant sustained decline in a reporting unit’s market value, legal factors, operating performance indicators, competition, sale or disposition of a significant portion of our business, potential government actions toward our facilities, and other factors.

If our market capitalization drops significantly below the amount of net equity recorded on our balance sheet, we might indicate a decline in our fair value and would require us to further evaluate whether our goodwill has been impaired. If the fair value of our reporting units is less than their carrying value, we could be required to record an impairment charge. The amount of any impairment could be significant and could have a material adverse impact on our financial position and results of operations for the period in which the charge is taken.

Rising inflation, interest rates, and/or construction costs could reduce the demand for our services as well as decrease our profit on our existing contracts, in particular with respect to our fixed price contracts.

Rising inflation, interest rates, or construction costs could reduce the demand for our services. In addition, we bear all the risk of rising inflation with respect to those contracts that are fixed price. Because a portion of our revenues are earned from fixed price contracts (approximately 5% as of December 31, 2019), the effects of inflation on our financial condition and results of operations over the past few years have been generally minor. However, if we expand our business into markets and geographic areas where fixed price and lump sum work is more prevalent, inflation may have a larger impact on our results of operations in the future. Therefore, increases in inflation, interest rates or construction costs could have a material adverse impact on our business, financial condition and results of operations.

We are subject to professional standards, duties and statutory obligations on professional reports and opinions we issue, which could subject us to monetary damages.

We issue reports and opinions to clients based on our professional engineering expertise as well as our other professional credentials that subject us to professional standards, duties and obligations regulating the performance of our services. If a client or another third party alleges that our report or opinion is incorrect or it is improperly relied upon and we are held responsible, we could be subject to significant liability or claims for damages. In addition, our reports and other work product may need to comply with professional standards, licensing requirements, securities regulations and other laws and rules governing the performance of professional services in the jurisdiction where the services are performed. We could be liable to third parties who use or rely upon our reports and other work product even if we are not contractually bound to those third parties. These events could in turn result in monetary damages and penalties.

12

The outcome of pending and future claims and litigation could have a material adverse impact on our business, financial condition and results of operations.

We are a party to claims and litigation in the normal course of business. Since we engage in engineering and construction activities for large facilities and projects where design, construction or systems failures can result in substantial injury or damage to employees or others, we are exposed to claims and litigation and investigations if there is a failure at any such facility or project. Such claims could relate to, among other things, personal injury, loss of life, business interruption, property damage, pollution and environmental damage and be brought by our clients or third parties, such as those who use or reside near our clients’ projects. We can also be exposed to claims if it agreed that a project will achieve certain performance standards or satisfy certain technical requirements and those standards or requirements are not met. In many of our contracts with clients, subcontractors, and vendors, we agree to retain or assume potential liabilities for damages, penalties, losses and other exposures relating to projects that could result in claims that greatly exceed the anticipated profits relating to those contracts. In addition, while clients and subcontractors may agree to indemnify us against certain liabilities, such third parties may refuse or be unable to pay it.

Outbreaks of communicable diseases could adversely affect our business, financial condition and results of operations.

Global or national health concerns, including the outbreak of pandemic or contagious disease, can negatively impact the global economy and, therefore, demand and pricing for our services. For example, the outbreak of the COVID-19 pandemic (“COVID-19”) and the measures being taken to address and limit the spread of the virus have adversely affected the U.S. economy and financial markets, resulting in an economic downturn that may negatively impact the demand for our services. Furthermore, uncertainty regarding the impact of any outbreak of pandemic or contagious disease, including COVID-19, could lead to increased volatility in the markets in which we operate. The occurrence or continuation of any of these events could lead to decreased revenues and limit our ability to execute on our business plan, which could adversely affect our business, financial condition and results of operations.

Additionally, we have an increased number of employees working remotely. As a result, we may have increased cyber security and data security risks, due to increased use of home Wi-Fi networks and virtual private networks, as well as increased disbursement of physical machines. While we implement IT controls to reduce the risk of a cyber-security and data security breach, there is no guarantee that these measures will be adequate to safeguard all systems with an increased number of employees working remotely.

At this time we are monitoring, and will continue to monitor, the safety of our employees during the COVID-19 pandemic. We are evaluating the impact of COVID-19 on current projects, but the full effects of COVID-19 on our operations are still unknown. The extension of shelter-in-place orders within the cities and municipalities we operate in could further negatively impact future results as well as the re-designation of infrastructure spending to non-essential services. Disruptions to capital markets due to the uncertainty surrounding the length and severity of COVID-19 could delay the timing of our customers’ capital projects. In addition, the timing of payments from our commercial customers may be impacted.

Risks Relating to Our Common Stock and Warrants

We may be required to take write-downs or write-offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and stock price, which could cause you to lose some or all of your investment.

Although we conducted due diligence prior to the Business Combination, we cannot assure you that this diligence revealed all material issues that may be present in our business, that it would be possible to uncover all material issues through a customary amount of due diligence, or that factors outside of our control will not later arise. As a result, the company may be forced to later write-down or write-off assets, restructure our operations, or incur impairment or other charges that could result in losses. Even if the due diligence successfully identified certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with our preliminary risk analysis. Even though these charges may be non-cash items and not have an immediate impact on our liquidity, the fact that the company reports charges of this nature could contribute to negative market perceptions about the company or our securities. In addition, charges of this nature may cause the company to violate net worth or other covenants to which we may be subject. Accordingly, our stockholders could suffer a reduction in the value of their shares. Such stockholders are unlikely to have a remedy for such reduction in value unless they are able to successfully claim

13

that the reduction was due to the breach by our officers or directors of a duty of care or other fiduciary duty owed to them, or if they are able to successfully bring a private claim under securities laws that the proxy solicitation or tender offer materials, as applicable, relating to the Business Combination contained an actionable material misstatement or material omission.

To the extent that any shares of Class A common stock are issued pursuant to the terms of the LLC Agreement or upon exercise of any of the warrants, the number of shares eligible for resale in the public market would increase.

Pursuant to the terms of the LLC Agreement, the Seller and its limited partners (the “Continuing Members”) may redeem any or all of the shares of Class B common stock issued to them along with a corresponding number of Holdings Units, for an equal number of shares of Class A common stock.

Furthermore, we have 20,000,000 outstanding warrants to purchase 20,000,000 shares of Class A common stock at an exercise price of $11.50 per share, which warrants will become exercisable upon the effectiveness if this Registration Statement. In addition, there are 3,750,000 private placement warrants (including the warrants underlying the private placement units) outstanding exercisable for 3,750,000 shares of common stock at an exercise price of $11.50 per share.

To the extent that any shares of Class A common stock are issued pursuant to the terms of the LLC Agreement or upon exercise of any of the warrants to purchase shares of Class A common stock, there will be an increase in the number of shares of Class A common stock eligible for resale in the public market. Sales of a substantial number of such shares in the public market could adversely affect the market price of Class A common stock.

If we raise capital in the future by issuing shares of common or preferred stock or other equity or equity-linked securities, convertible debt or other hybrid equity securities, our then existing stockholders may experience dilution, such new securities may have rights senior to those of our common stock, and the market price of our common stock may be adversely effected.

If we raise capital in the future our then existing stockholders may experience dilution. Our second amended and restated certificate of incorporation (the “Charter”) provides that preferred stock may be issued from time to time in one or more series. Our Board of Directors (the “Board”) is authorized to fix the voting rights, if any, designations, powers, preferences, the relative, participating, optional or other special rights and any qualifications, limitations and restrictions thereof, applicable to the shares of each series. Our Board of directors may, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting power and other rights of the holders of the shares of common stock and could have anti-takeover effects. The ability of our Board to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control of us or the removal of existing management. The issuance of any such securities may have the impact of adversely affecting the market price of our common stock.

We may redeem holders’ unexpired warrants prior to their exercise at a time that is disadvantageous to the holder, thereby making such warrants worthless.

We have the ability to redeem outstanding public warrants at any time after they become exercisable and prior to their expiration, at a price of $0.01 per warrant, provided that the closing price of our Class A common stock equals or exceeds $18.00 per share (as adjusted for share splits, share dividends, reorganizations, recapitalizations and the like) for any 20 trading days within a 30 trading-day period ending on the third trading day prior to proper notice of such redemption. If and when the warrants become redeemable by us, we may exercise our redemption right even if we are unable to register or qualify the underlying securities for sale under all applicable state securities laws. Redemption of the outstanding warrants could force holders (i) to exercise the warrants and pay the exercise price therefor at a time when it may be disadvantageous to do so, (ii) to sell the warrants at the then-current market price when the holder might otherwise wish to hold your warrants or (iii) to accept the nominal redemption price which, at the time the outstanding warrants are called for redemption, is likely to be substantially less than the market value of the warrants. The private placement warrants are not redeemable by us so long as they are held by the Sponsor or its permitted transferees.

14

We are a “controlled company” within the meaning of NASDAQ listing standards and the rules of the SEC. As a result, we qualify for, and may elect to rely on, exemptions from certain corporate governance requirements that would otherwise provide protection to stockholders of other companies.

Bernhard Capital Partners Management LP (“Bernhard Capital Partners”) beneficially owns a majority of the voting power of all outstanding shares of our common stock. Pursuant to NASDAQ listing standards, a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company qualifies as a “controlled company” and may elect not to comply with certain corporate governance requirements. Therefore, for so long as Bernhard Capital Partners beneficially owns a majority of the voting power of all outstanding shares of our common stock, we may elect to not be subject to NASDAQ listing standards that would otherwise require us to have: (i) a board of directors comprised of a majority of independent directors; (ii) compensation of our executive officers determined by a majority of the independent directors or a compensation committee comprised solely of independent directors; (iii) a compensation committee charter which, among other things, provides the compensation committee with the authority and funding to retain compensation consultants and other advisors; and (iv) director nominees selected, or recommended for the Board’s selection, either by a majority of the independent directors or a nominating committee comprised solely of independent directors. Accordingly, if we remain a controlled company and if we elect to rely on the exemption and during any transition period following a time when we have made such election and are no longer a controlled company, our stockholders would not have the same protections afforded to stockholders of companies that are subject to all of the NASDAQ corporate governance requirements.

In addition, on June 20, 2012, the SEC passed final rules implementing provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 pertaining to compensation committee independence and the role and disclosure of compensation consultants and other advisers to the compensation committee. The SEC’s rules direct each of the national securities exchanges (including NASDAQ) to develop listing standards requiring, among other things, that: (i) compensation committees be composed of fully independent directors, as determined pursuant to new independence requirements; (ii) compensation committees be explicitly charged with hiring and overseeing compensation consultants, legal counsel and other committee advisors; and (iii) compensation committees be required to consider, when engaging compensation consultants, legal counsel or other advisors, certain independence factors, including factors that examine the relationship between the consultant or advisor’s employer and us. As a “controlled company,” we are not subject to these compensation committee independence requirements.

If the benefits of the Business Combination do not meet the expectations of investors or securities analysts, the market price of our securities may decline.

If the benefits of the Business Combination do not meet the expectations of investors or securities analysts, the market price of our securities may decline. The market values of our securities may vary significantly from their prices on the date the Purchase Agreement was executed (August 12, 2019), the date of the proxy statement (November 12, 2019), or the date of the Annual Report on Form 10-K (March 16, 2020).