Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ANNALY CAPITAL MANAGEMENT INC | a2020may208-kannualmee.htm |

Annual Meeting Presentation May 20, 2020

Important Notices This presentation is iss u ed by A nna ly Capital Management, Inc. ("Annaly"), a publicly traded company t ha t has elected to be taxed as a real estate investment trust for federal income tax purposes and is being furnished in connection with Annaly’s 2020 A nnu a l Meeting. This presentation is provided for inves t ors in Annaly for informational purposes only a nd is not an offerto sell, or a solicitation of an offer to bu y, any s ecu rit y or instrument. Annaly is not a registered investment adviser. A nna ly is managed by A nna ly Management Compa ny LLC ("A MCO "), a registered investment adviser. This presentation is not a communication by AMCO and is not designed to maintain any existing AMCO client or investor or solicit new AMCO clients or investors. Forward-Looking Statements This presentation, other written or oral communications, a nd our public documents to which we refer contain or incorporate by reference certain forwa rd -looking statements which are based on various assumptions (some of which are beyond our control) and may be identified by reference to a futureperiod or periods or by the useof forward-looking terminology, such as “may,” “will,” “believe,” “ ex p ect ,” “anticipate,” “continue,” or similar terms or variations on those terms or the nega t ive of those t erm s . Such statements inclu d e those relating to the Company’s future performance, macro outlook, the interest rate a nd credit environments, tax ref orm , future opportunities and the anticipated Internalization. Actual res u lts could differ materially from those s et f ort h in f orwa rd -looking statements due to a va riet y of factors, including, but not limited to, ris ks a nd uncertainties related to the COVID-19 pandemic, including as related to adverse economic conditions on real estate-related assets and financing conditions; c ha nges in interest ra t es ; c ha nges in the yield curve; c ha nges in prepayment ra t es ; the availability of mort ga ge-ba cked securities (“MBS”) and other securities for p u rc has e; the availability of financing and, if available, the t erm s of any financing; changes in the market va lu e of the Company’s assets; c ha nges in business conditions and the general economy; the Compa ny’s ability to grow our commercial real estate bu siness; the Comp a ny’s ability to grow its res id ent ia l credit business; the Compa ny’s ability to grow it s middle market lending bu siness; credit ris ks related to the Comp a ny’s investments in cred it ris k transfer securities, residential mortgage-backed securities and related residential mort ga ge credit assets, commercial real estate assets a nd corporate debt ; ris ks related to investments in mort ga ge servicing rights; the Company’s ability to consummate any cont em p la t ed investment opportunities; c ha nges in government regulations or policy affecting the Comp a ny’s bu siness; the Comp a ny’s ability to maintain its qualification as a REIT for U.S. federal income tax purposes; the Company’s ability to maintain its ex emp t ion from registration u nd er the Investment Compa ny Act of 1940, as amended; a nd risks and uncertainties associated wit h the Internalization, including but not limited to the occurrence of any event, change or other circumstances t ha t could give rise to the termination of the Internalization Agreement; the outcome of any legal proceedings that may be instituted against the parties to the Internalization Agreement; the inability to complete the Internalization due to the failure to satisfy closing conditions or otherwise; risks t ha t the Internalization d is ru pt s the Company’s current p la ns and operations; the im pa ct , if any, of the announcement or pendency of the Internalization on the Comp a ny’s relationships with third parties; and the am ou nt of the costs, fees, expenses c ha rges related to the Internalization; and the risk that the expected benefits, including long-term cost savings, of the Internalization are not achieved. For a discussion of the risks a nd uncertainties which could cause actual res u lts to differfrom those contained in the forward-looking statements, see “Risk Fa ct ors” in our most recent A nnu a l Rep ort on Form 10-K and any subsequent Quarterly Rep ort s on Form 10-Q. The Compa ny does not undertake, and specifically disclaims any obligation, to publicly release the res u lt of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstancesafter the date of such statements, except as required by law. We routinely post imp ort a nt information for investors on our website, www.annaly.com. We intend to use this webpage as a m ea ns of disclosing materialinformation, for complying with our disclosure obligations under Regu la t ion FD and to post and update investor presentations and similar materials on a regular ba s is . Annaly encou ra ges investors, analysts, the media and others interested in A nna ly to monitor the I nves t ors section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations, webcasts and other information we post from time to t im e on our websit e. To sign-up for email-notifications, please vis it the “Email Alerts” s ect ion of our website, www.annaly.com, under the “Investors” section and enter the required information to enable notifications. The information c ont a ined on, or t ha t may be accessed through, our webpage is not incorporated by reference into, a nd is not a part of, this document. Past performance is no guarantee of future res u lt s . There is no guarantee t ha t any investment strategy referenced herein will work u nd er all m a rket conditions. Prior to making any investment decision, you s hou ld eva lu at e your ability to invest for the long-t erm , especially during periods of downturns in the m a rket . You alone assume the responsibility of evaluating the merits and ris ks associated wit h any potential investment or investment strategy referenced herein. To the extent that t his material c ont a ins reference to any past sp ecif ic investment recommendations or strategies which were or would have been p rof it a ble to any person, it should not be as su m ed that recommendations made in the future will be p rof it able or will equal the performance of such past investment recommendations or strategies. The information c ont a ined herein is not intended to provide, and should not be relied upon for accounting, legal or tax advice or investment recommendations for Annaly or any of its affiliates. Regardless of s ou rc e, information is believed to be reliable for purposes used herein, bu t Annaly m a kes no representation or warrantyas to the accuracy or completeness thereof and does not take any responsibility for information obta ined from sou rces outside of A nna ly. Certain information contained in the presentation discusses general market activity, ind us t ry or sector trends, or other broad-based economic, market or political conditions and should not be construed asresearch or investment advice. 2 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Annaly is a Leading Diversified Capital Manager 93% ~$13 billion 518% of Total Assets Comprised of Permanent Capital(2) Total Shareholder Return Liquid Agency MBS(1) Since IPO(3) 4 Investment Groups Evolved & Evolving $20 billion Agency, Residential Credit, 38 Distinct Investment Common and Preferred Commercial Real Estate & Options & Counting Dividends Declared(4) Middle Market Lending $3 billion ~180 ESG Focus Combined Deal Value of Talented Professionals Robust Corporate Transformational Responsibility Acquisitions(5) & Governance Source: Company filings. Financial data as of March 31, 2020. Employee composition as of December 31, 2019. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 3 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

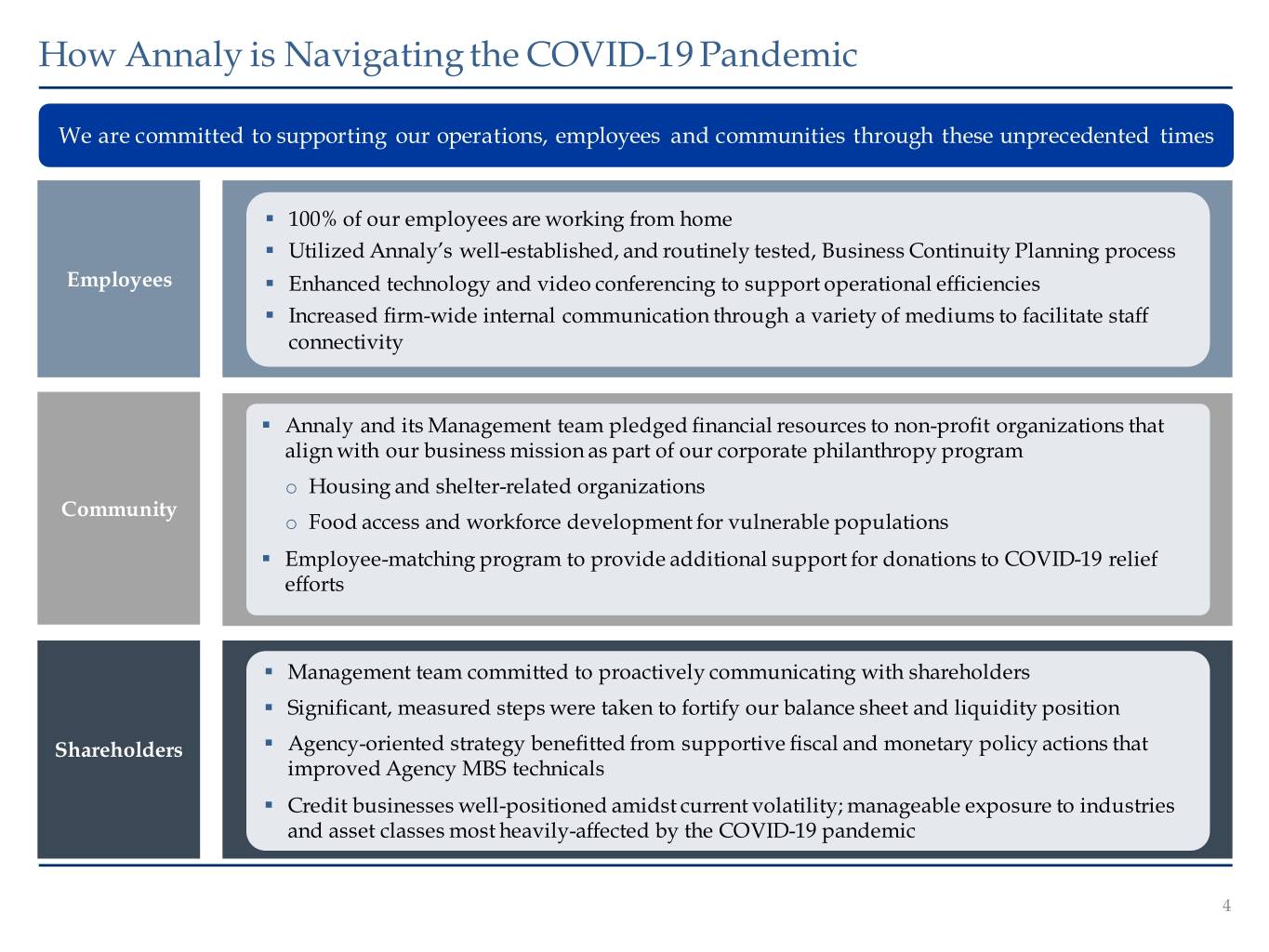

How Annaly is Navigating the COVID-19 Pandemic We are committed to supporting our operations, employees and communities through these unprecedented times . 100% of our employees are working from home . Utilized Annaly’s well-established, and routinely tested, Business Continuity Planning process Employees . Enhanced technology and video conferencing to support operational efficiencies . Increased firm-wide internal communication through a variety of mediums to facilitate staff connectivity . Annaly and its Management team pledged financial resources to non-profit organizations that align with our business mission as part of our corporate philanthropy program o Housing and shelter-related organizations Community o Food access and workforce development for vulnerable populations . Employee-matching program to provide additional support for donations to COVID-19 relief efforts . Management team committed to proactively communicating with shareholders . Significant, measured steps were taken to fortify our balance sheet and liquidity position Shareholders . Agency-oriented strategy benefitted from supportive fiscal and monetary policy actions that improved Agency MBS technicals . Credit businesses well-positioned amidst current volatility; manageable exposure to industries and asset classes most heavily-affected by the COVID-19 pandemic 4 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Progressive Approach, Proven Results Power. The industry leader with a differentiated model composed of four sizeable, diversified investment strategies: Agency, Residential Credit, Commercial Real Estate and Middle Market Lending Proven. Proven over 20+ years to be a stable source of yield for shareholders, we continue to deliver attractive investment returns throughout market cycles People. Our people are our greatest asset and we are committed to promoting our employees' engagement, development and full potential 5 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Power. The combination of the four business strategies is intended to enhance risk-adjusted returns over time through investment optionality and risk management Economic and market perspectives Management incentives aligned with provide lens into residential & shareholders; no forced deployment of commercial sectors capital is a risk mitigant Deep credit focus and expertise shared Complementary characteristics improve across businesses durability – liquidity, cyclicality, leverage Investing across capital structures and Advantaged by liquidity of Agency markets results in best relative value portfolio Diversified financing sources Focus on secured lending 6 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Proven. Since inception, Annaly has delivered $20bn in dividends to shareholders(1) ($mm) $20,000 $16,000 $12,000 $8,000 $4,000 – 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD Prior Cumulative Dividends Declared Dividends Declared During Year Source: Company filings. Financial data as of March 31, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 7 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

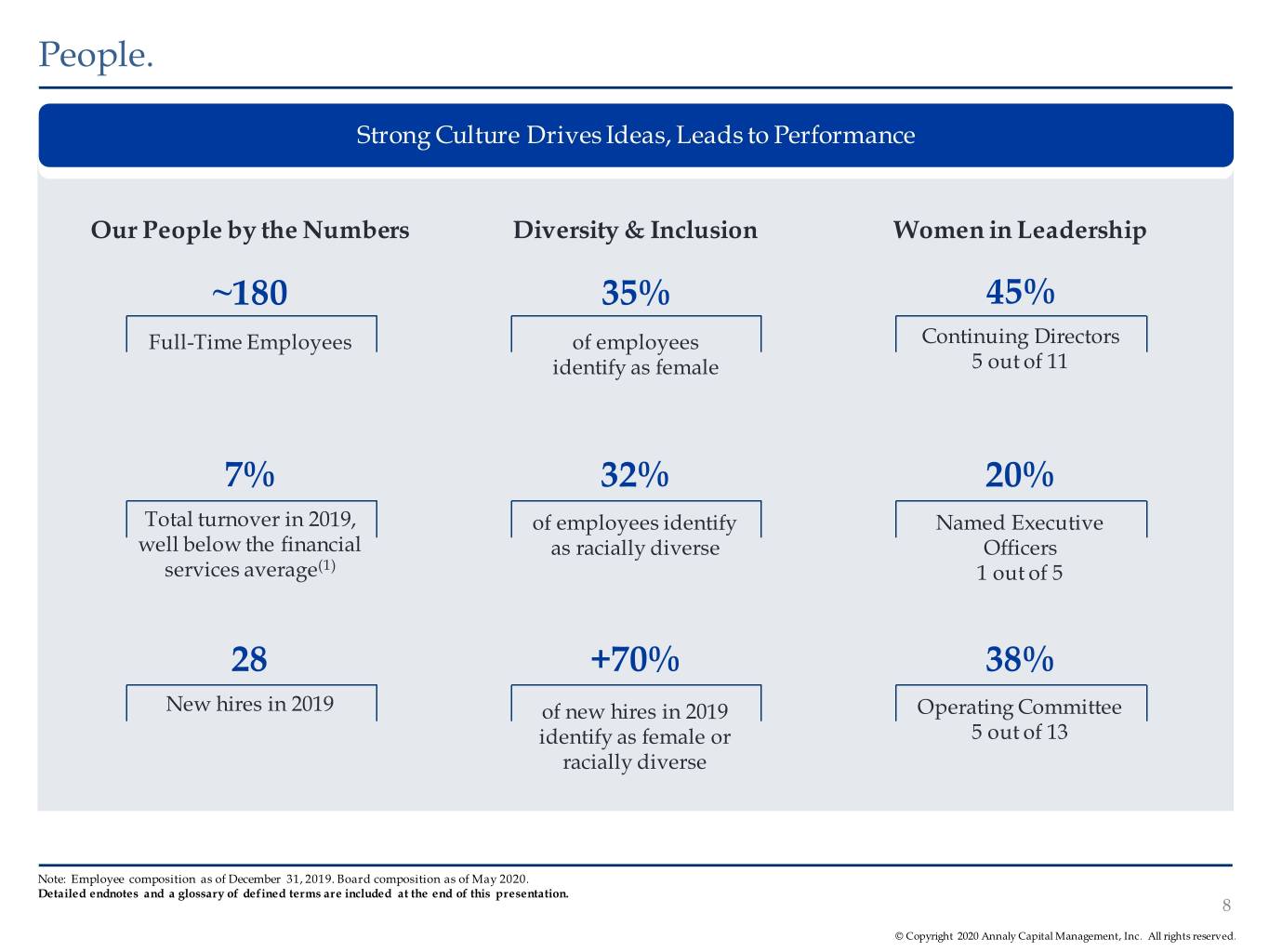

People. Strong Culture Drives Ideas, Leads to Performance Our People by the Numbers Diversity & Inclusion Women in Leadership ~180 35% 45% Full-Time Employees of employees Continuing Directors identify as female 5 out of 11 7% 32% 20% Total turnover in 2019, of employees identify Named Executive well below the financial as racially diverse Officers services average(1) 1 out of 5 28 +70% 38% New hires in 2019 of new hires in 2019 Operating Committee identify as female or 5 out of 13 racially diverse Note: Employee composition as of December 31, 2019. Board composition as of May 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 8 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Mission Annaly combines the power of capital together with sound strategy to best serve our shareholders With a culture that champions diversity and talent, we work relentlessly to optimize risk-adjusted returns. With nearly $13 billion in permanent capital(1), we support two fundamental pillars of the American economy: housing and business Note: Financial data as of March 31, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 9 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Investments We finance housing across the country and support the vitality of local communities and the economy through our investments Support for Housing Support for American Businesses(5) Nearly $95bn Nearly 700K Our investments in middle market businesses and of residential housing American homes financed in through our commercial portfolio help drive economic investments all 50 states(1) growth in the places where Americans live and work: Lower Loan Balance Mortgages Over 200,000 loans totaling over $16 billion to borrowers with lower Health Care Services and $741mm loan balance mortgages, typically financing homes that are less than Equipment half the national house price average(2) Environmentally Friendly $540mm Self-Employed Borrowers Buildings & Businesses Nearly 900 loans totaling nearly $500 million to self-employed, creditworthy borrowers, including small business owners(3) Data and Technology Innovation $593mm & Advancement Credit Risk Transfers (“CRT”) supported through Annaly’s Community Development & Over 2.5 million additional homes $285mm investments in CRT securities(4) Economic Opportunity Note: Financial data as of March 31, 2020, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 10 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Strategy Nearly $13 billion of permanent capital(1) invested across our four, scaled investment strategies Portfolio Overview Equity ESG ARM/HECM 36% 3% 1% Other 6% DUS 2% Annaly AAA CMBS Annaly Agency IO/IIO/ 75% Commercial 1% 8% CMO/MSR of of (2) 30yr Group 1% Dedicated Real Estate Dedicated 91% (4) Whole Capital Group Loan Capital 15yr 21% 2% Credit CMBS 20yr 25% 3% Mezzanine 8% Agency CRT 8% Private Label CRT 2nd Lien 1% 30% Annaly Annaly Middle WL Prime 6% 11% Residential 48% 28% of Market Lending of Credit Group(3) Dedicated Group(5) Dedicated Capital Capital 1st Lien Prime Alt-A 70% Jumbo 3% IO Subprime <1% Prime 5% Jumbo RPL 3% 4% Source: Company filings. Financial data as of March 31, 2020. Percentages may not sum to 100% due to rounding. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 11 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Positioning Investment Strategy Outlook & Positioning Assets(1) $92.0bn Positive tailwinds for investing in Agency MBS Coordinated fiscal and monetary policy support improving Annaly Agency Sector Rank(2) #1/8 interest rate risk outlook, while challenges remain Group Asset reduction in Q1 2020 concentrated in generic pools, Strategy Countercyclical / Defensive resulting in pool portfolio with attractive convexity profiles Assets(1) $2.6bn Conservative portfolio stance cushioned volatility in the portfolio during market dislocation Annaly — Whole loan portfolio 100% first lien with strong credit; Residential Sector Rank(2) #8/14 50% of securities portfolio in investment grade assets Credit Group Ability to transact in either securities or whole loans provides a Strategy Cyclical / Growth benefit relative to peers within new residential credit landscape Assets(1) $2.6bn Portfolio positioned with a focus on strong sponsorship and Annaly best-in-class operating partners Commercial CMBS portfolio comprised of underlying loans secured by Sector Rank(2) #8/17 Real Estate higher quality, stabilized real estate Group Equity portfolio comprised of necessity-based real estate (e.g., Strategy Cyclical / Growth grocery-anchored shopping centers and healthcare) Portfolio comprised of 51 borrowers that are 100% backed by Assets $2.2bn top tier private equity sponsors Annaly Fundamentals of the portfolio have been aided due to the Sector Rank(2) Middle Market #9/45 mission critical nature of underlying borrowers Lending Group — 90% of the portfolio deemed “essential businesses”(3) Strategy Non-Cyclical / Defensive Minimal use of third-party leverage relative to BDC peers Note: Financial data as of March 31, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 12 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Capitalization With the largest capital base in the sector, Annaly’s deep and diverse financing sources across all investment groups provide the Company with unique competitive advantages Total Financing and Capital 3/31/2020: $92.3bn(1) Overview of Select Financing Options Available Financing Options In-House Broker Dealer Street Repo In-House Broker-Dealer (FICC) Our broker dealer provides Secured bilateral financing access to the Fixed Income sourced from a large number of Clearing Corporation (FICC), counterparties with whom which funds Agency MBS Annaly has long term Agency, Non-Agency Street Repo through cleared triparty repo relationships & CMBS Repo $72.2bn Direct Repo FHLB(2) Direct Repo Matches Arcola directly with Access to government-sponsored cash providers such as sovereign bank financing as a member FHLB wealth funds, state pension financial institution provides funds, etc. attractive financing terms FHLB(2) $0.9bn Credit Facilities / Warehouse Financing Credit Facilities / Non-Recourse Term Term Credit Warehouse Financing Financing Facilities $1.3bn Non-Recourse Provide longer-term financing Experience in public rated Term Financing for assets within middle market Non-Recourse securitizations for Residential lending and commercial real (3) loans and have executed a CRE Secured Financing estate businesses; significant Syndication CLO, which provided additional $5.2bn existing financing capacity flexibility and liquidity remains available Preferred Equity $2.0bn Mortgage Financing Mortgage Syndication Financing Capital markets capabilities Preferred Equity Mortgage financing on within businesses provide an Common Equity properties owned by ACREG outlet for managing liquidity $10.7bn provides additional leverage and and achieving desire return liquidity Common Equity through structural leverage Note: Financial data as of March 31, 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 13 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

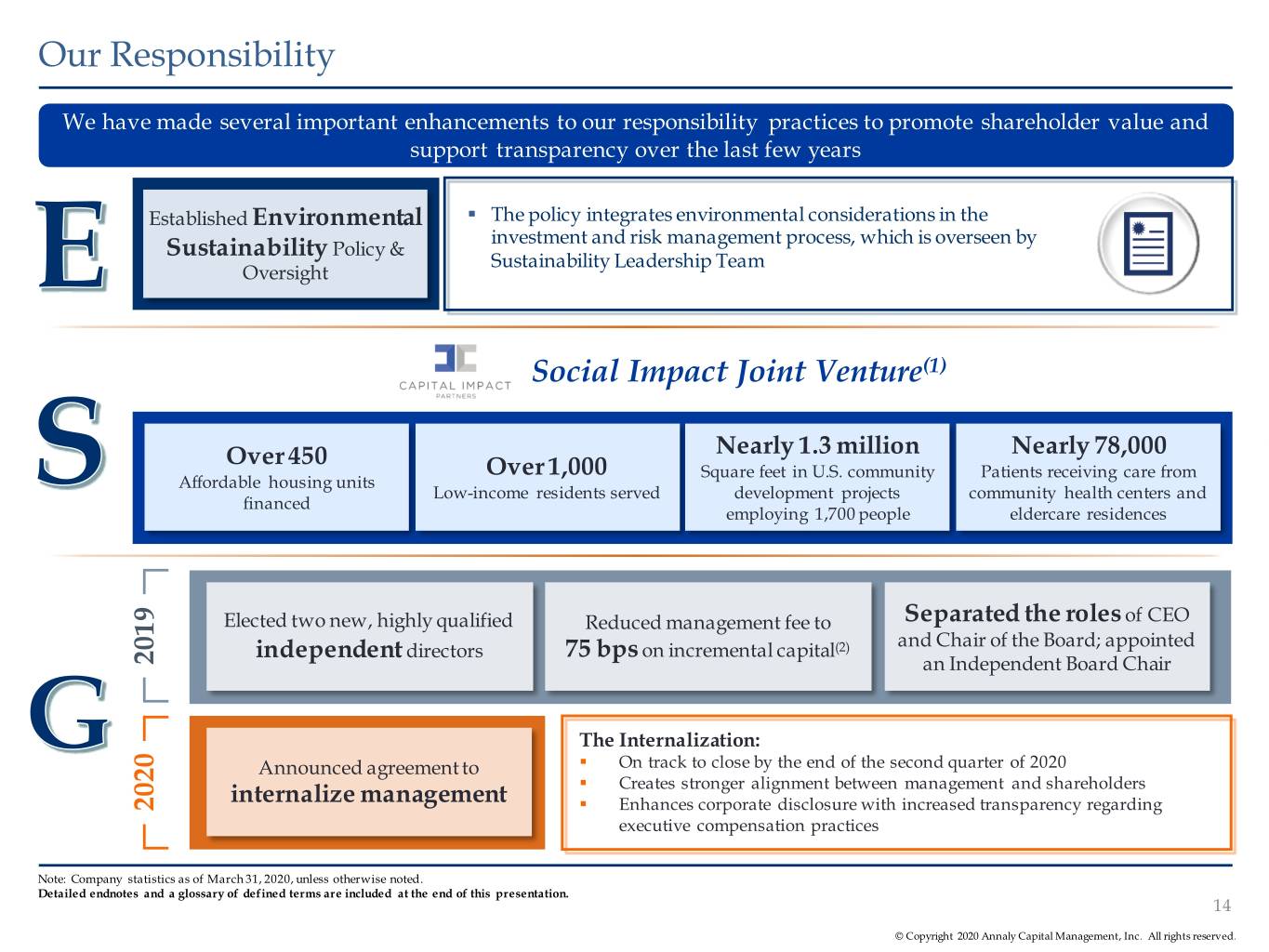

Our Responsibility We have made several important enhancements to our responsibility practices to promote shareholder value and support transparency over the last few years Established Environmental . The policy integrates environmental considerations in the investment and risk management process, which is overseen by Policy & Sustainability Sustainability Leadership Team Oversight Social Impact Joint Venture(1) Over 450 Nearly 1.3 million Nearly 78,000 Over 1,000 Square feet in U.S. community Patients receiving care from Affordable housing units Low-income residents served development projects community health centers and financed employing 1,700 people eldercare residences Elected two new, highly qualified Reduced management fee to Separated the roles of CEO and Chair of the Board; appointed directors on incremental capital(2) 2019 independent 75 bps an Independent Board Chair The Internalization: Announced agreement to . On track to close by the end of the second quarter of 2020 . internalize management Creates stronger alignment between management and shareholders 2020 . Enhances corporate disclosure with increased transparency regarding executive compensation practices Note: Company statistics as of March 31, 2020, unless otherwise noted. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 14 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Our Key Stakeholders We are committed to maintaining strong corporate governance practices that benefit the long-term interests of our investors Board of Directors | 11 Continuing Directors; 5 Standing Committees Age Gender Diversity Tenure 40’s >10 Years 3 Directors 3 Directors 60’s 55 7.1 <5 Years 5 Directors 45% 6 Directors years 50’s 5 to 10 Years years 3 Directors 2 Directors Represents the average tenure of Continuing Represents the average age of Continuing Directors of Continuing Directors are Women Directors 2019–2020 Global Shareholder Engagement Efforts(1) We take pride in our extensive outreach efforts and evolving Outreach included Outreach included approximately our business in response to shareholder feedback. We are committed to transparency, 100% 90% enhanced disclosure and continued engagement of top 100 institutional investors of institutional ownership Note: Board composition as of May 2020. Detailed endnotes and a glossary of defined terms are included at the end of this presentation. 15 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Glossary and Endnotes

Glossary ACREG: Refers to Annaly Commercial Real Estate Group FICC: Refers to Fixed Income Clearing Corporation Agency Peers: Represents companies comprising the Agency sector FHLB: Refers to the Federal Home Loan Bank within the BBREMTG Index*(1) Ginnie Mae: Refers to the Government National Mortgage AMML: Refers to Annaly Middle Market Lending Group Association ARC: Refers to Annaly Residential Credit Group Hybrid Peers: Represents companies comprising the hybrid sector within the BBREMTG Index*(3) BBREMTG: Represents the Bloomberg Mortgage REIT Index*, including Annaly mREITs or mREIT Peers: Represents constituents of the BBREMTG Index*, excluding Annaly Commercial Peers: Represents companies comprising the commercial sector within the BBREMTG Index*(2) SWF: Refers to Sovereign Wealth Fund Continuing Directors: Represents the eleven members of the Board TBA Securities: To-Be-Announced securities following the 2020 Annual Meeting (assuming all nominees are elected) CRE CLO: Refers to Commercial Real Estate Collateralized Loan Obligation CRT: Refers to Credit Risk Transfer Securities Dedicated Capital: Represents the capital allocation for each of the four investment strategies calculated as the difference between each investment strategies’ assets and related financing. This calculation includes TBA purchase contracts and excludes non-portfolio related activity and will vary from total stockholders’ equity ESG: Refers to Environmental, Social and Governance *Represents constituents as of April 15, 2020. 1. Consists of AGNC, AI, ANH, ARR, CMO, EARN and ORC. 2. Consists of ABR, ACRE, ARI, BRMK, BXMT, CLNC, GPMT, HCFT, KREF, LADR, LOAN, RC, SACH, STWD, TRTX and XAN. 17 3. Consists of AJX, CHMI, CIM, DX, IVR, MFA, MITT, NRZ, NYMT, PMT, RWT, TWO and WMC. © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.

Endnotes Page 3 1. Assets represent Annaly’s investments that are on balance sheet, net of securitized debt of consolidated VIEs, as well as investments that are off-balance sheet in which the Company has economic exposure. Assets include TBA purchase contracts (market value) of $13.1bn and CMBX derivatives (market value) of $463.5mm and are shown net of securitized debt of consolidated VIEs of $6.4bn. 2. Permanent capital represents Annaly’s total stockholders’ equity as of March 31, 2020. 3. Total return represents total shareholder return for the period beginning October 7, 1997 through April 15, 2020. 4. Data shown since Annaly’s initial public offering in October 1997 through April 15, 2020 and includes common and preferred dividends declared. 5. Acquisitions include Annaly’s $876mm acquisition of CreXus Investment Corp. (closed May 2013), $1,519mm acquisition of Hatteras Financial Corp. (closed July 2016) and $906mm acquisition of MTGE Investment Corp. (closed September 2018). Page 7 1. Data shown since Annaly’s initial public offering in October 1997 through April 15, 2020 and includes common and preferred dividends declared. Page 8 1. Financial services sector rates of 28% total turnover in 2019 per U.S. Department of Labor, Bureau of Labor Statistics, "Job Openings and Labor Turnover Summary," using December 2018 - November 2019 totals. Page 9 1. Permanent capital represents Annaly’s total stockholders’ equity as of March 31, 2020. Page 10 1. Represents the estimated number of homes financed by Annaly’s holdings of Agency MBS, residential whole loans and securities, as well as multi-family commercial real estate loans, securities and equity investments. The number includes all homes related to securities and loans wholly-owned by Annaly and a pro-rata share of homes in securities or equity investments that are partially owned by Annaly. 2. Represents all of the loans included in low loan balance (<$85,000) and medium loan balance ($85,000-$110,000) Agency MBS pools wholly-owned by Annaly and a pro-rata share of loans in low loan balance and medium loan balance Agency MBS pools partially-owned by Annaly. Based on FHFA’s December 31, 2019 seasonally adjusted House Price Index, which is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. 3. Represents residential whole loans owned by Annaly. 4. CRTs include the loans in the CRT reference pool for CRT securities partially-owned by Annaly. In rare cases, some individual borrowers may be counted multiple times if they are present in Annaly’s holdings of multiple asset types. 5. All figures quoted in this section represent the cumulative commitment value at investment date of Annaly’s commercial investments, including current and prior investments. Page 11 1. Permanent capital represents Annaly’s total stockholders’ equity as of March 31, 2020. 2. Includes TBA purchase contracts and MSRs. 3. Shown exclusive of securitized residential mortgage loans of a consolidated VIE and loans held by a master servicer in an MSR silo that is consolidated by the Company. Prime Jumbo and Prime classifications include the economic interest of certain positions that are classified as Residential Mortgage Loans within our Consolidated Financial Statements. Prime classification includes $75.4mm of Prime IO. 4. Percentages are based on economic interest and exclude the effects of consolidated VIEs and CMBX derivatives. Other reflects limited and general partnership interests in a commercial loan investment fund that is accounted for under the equity method for GAAP. ESG reflects joint venture interests in social impact loan investment funds that are accounted for under the equity method for GAAP. Whole loans includes mezzanine loans for which Annaly Commercial Real Estate is also the corresponding first mortgage lender. 5. Does not include minority equity, which represented 0.2% of the portfolio as of March 31, 2020. Page 12 1. Assets represent Annaly’s investments that are on balance sheet, net of securitized debt of consolidated VIEs, as well as investments that are off-balance sheet in which the Company has economic exposure. Agency assets include TBA purchase contracts (market value) of $13.1bn and are shown net of securitized debt of consolidated VIEs of $1.6bn. Residential Credit assets are shown net of securitized debt of consolidated VIEs of $2.5bn. Commercial Real Estate assets include CMBX derivatives (market value) of $463.5mm and are shown net of securitized debt of consolidated VIEs of $2.2bn. 2. Sector rank compares Annaly dedicated capital in each of its four investment strategies as of March 31, 2020 (adjusted for P/B as of April 15, 2020) to the market capitalization of the companies in each respective comparative sector as of April 15, 2020. The companies in each comparative sectors are selected as follows: for Agency, Commercial Real Estate and Residential Credit sector ranking represent Agency Peers, Commercial Peers and Hybrid Peers, respectively, within the BBREMTG Index as of April 15, 2020 and for Middle Market Lending sector ranking is the S&P BDC Index as of April 15, 2020. 3. Represents businesses deemed essential given critical infrastructure based on CDC guidelines. Page 13 1. Does not include synthetic financing for TBA contracts. 2. Reflects Annaly’s 5-year FHLB financing, which sunsets in February 2021. 3. Excludes securitized debt of investments in Freddie Mac securitizations and securitized debt of a subordinated tranche in a securitization trust, each of which were consolidated upon the Company’s purchase of the controlling interest in such securitizations. Page 14 1. All figures quoted in this section represent the cumulative impact of Annaly's investments, including current and prior investments, with Capital Impact Partners. 2. Incremental capital represents the Company’s stockholders’ equity (as defined in the Management Agreement, “Stockholders’ Equity”) in excess of $17.28bn (which reflects total Stockholders’ Equity calculated in accordance with the Management Agreement as of February 28, 2019). Page 15 1. Representative of outreach during 2019-2020 proxy season and shareholder base as of December 31, 2019. Shareholder data per Ipreo. 18 © Copyright 2020 Annaly Capital Management, Inc. All rights reserved.