Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Nuveen Churchill Direct Lending Corp. | form8-kq12020earningsprese.htm |

Nuveen Churchill BDC Inc. Investor Presentation Quarter Ended March 31, 2020 May 19, 2020

Disclaimer This presentation is for informational purposes only. It does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any securities of Nuveen Churchill BDC Inc. (the “Company,” “we,” “us” or “our”). Any such offering can be made only at the time a qualified offeree receives a confidential private placement memorandum and other operative documents which contain significant details with respect to risks and should be carefully read. In addition, the information in this presentation is qualified in its entirety by reference to all of the information in the Company’s confidential private placement memorandum and the Company’s public filings with the Securities and Exchange Commission (the “SEC”), including without limitation, the risk factors. Nothing in this presentation constitutes investment advice. The Company’s securities have not been registered under the Securities Act of 1933 or listed on any securities exchange. You or your clients may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objectives. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Prospective investors should also seek advice from their own independent tax, accounting, financial, investment and legal advisors to properly assess the merits and risks associated with an investment in the Company in light of their own financial condition and other circumstances. These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s confidential private placement memorandum and public filings with the SEC. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objective will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his, her or its investment. The Company may not provide periodic valuation information to investors, and there may be delays in distributing important tax information. The Company’s fees and expenses may be considered high and, as a result, such fees and expenses may offset the Company’s profits. For a summary of certain of these and other risks, please see the Company’s confidential private placement memorandum and public filings with the SEC. There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. This presentation contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that are outlined in the Company’s confidential private placement memorandum and public filings with the SEC, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. The Company is providing the information as of this date (unless otherwise specified) and assumes no obligations to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, our actual results and financial condition may differ materially as a result of the continued impact of the novel coronavirus (“COVID-19”) pandemic, including without limitation: the length and duration of the COVID-19 outbreak in the United States as well as worldwide and the magnitude of the economic impact of that outbreak; the effect of the COVID-19 pandemic on our business prospects and the prospects of our portfolio companies, including our and their ability to achieve our respective objectives; and the effect of the disruptions caused by the COVID-19 pandemic on our ability to continue to effectively manage our business (including on our ability to source and close new investment opportunities) and on the availability of equity and debt capital and our use of borrowed money to finance a portion of our investments. All capitalized terms in the presentation have the same definitions as the Company’s 10-Q for the quarter ended March 31, 2020. Nuveen Churchill BDC Inc. 2

Key highlights • Nuveen Churchill BDC Inc. is a closed-end, externally managed, non-diversified management investment company that has elected to be Company regulated as a business development company under the Investment Company Act of 1940, as amended. Overview • Total current equity commitments of $289.2* million as of May 18, 2020. • Managed by Nuveen Churchill Advisors LLC and sub-advised by Churchill Asset Management LLC (“Churchill”). • Primarily invest in first lien senior secured loans made to private-equity owned U.S. middle market companies with EBITDA in the $10 to Investment $100 million range. Strategy • Opportunistically invest in junior capital opportunities (second-lien loans, subordinated debt, last-out positions and equity-related securities). • 14+ year track record of successfully managing middle senior market senior loan portfolios through several economic cycles; senior Churchill management averages over 25 years of middle market investing experience. Competitive • Affiliated with Nuveen, a wholly-owned subsidiary of TIAA and leading global asset manager with $1 trillion AUM. Advantages • Unique relationship-driven origination model with a $9 billion portfolio of private equity fund commitments driving robust deal flow. • Strong alignment with parent company TIAA investing alongside third party investors on the same terms. • As of March 31, 2020, current portfolio totals $167.2 million** with a high level of diversification (44 investments; average investment size Current of $3.8 million - 2.3% of the portfolio or 0.8% of Committed Capital***): Portfolio & o Weighted average yield on debt and income producing investments at fair value: 6.34%**** Recent o Weighted average risk rating: 4.2 on Churchill’s internal scale (initial rating assigned at origination: 4.0) Investment o 100% of portfolio consists of first lien senior secured loans bearing interest at a floating rate and made to private equity backed Activity companies*****. • No new investments were made during the three month period ended March 31, 2020. • As of March 31, 2020, the Company had total equity commitments of $287.2 million ($100 million from TIAA), $66.2 million has been Capital funded ($221.0 million remains unfunded). • On April 17, 2020, the Company held a subsequent closing for an additional $2 million of equity commitments. Activity • Declared a quarterly dividend of $0.17 per share to shareholders on April 16, 2020, which was paid on April 21, 2020. • On May 7, 2020, the Company issued additional shares with an aggregate value of $20 million ($18.70 per share). * Includes $2 million equity commitment closed on April 17, 2020. ** Total par value of loan commitments is $174.9 million which includes approximately $2.5 million of unfunded delayed draw term loan commitments. *** Committed Capital includes Equity Commitment of $289.2 million as of April 17, 2020 and $175 million from the Financing Facility. **** The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders but, rather, relates to our investment portfolio and is calculated before the payment of all of our and our subsidiaries’ fees and expenses. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount. ***** 26.0% of first lien senior secured loans are unitranche positions. Nuveen Churchill BDC Inc. 3

Portfolio overview Investment portfolio composition by industry and investment type as of March 31, 2020 Moody’s industry diversification Portfolio composition by investment type* ◼ High Tech Industries 25.7% ◼ First Lien Term Loan (including DDTLs)** Banking, Finance, Insurance, ◼ 10.1% Real Estate ◼ Services: Business 8.0% ◼ Telecommunications 7.6% ◼ Consumer Goods: Non-durable 7.4% ◼ Consumer Goods: Durable 7.3% ◼ Containers, Packaging & Glass 5.5% ◼ Retail 5.3% ◼ Automotive 4.1% ◼ Capital Equipment 2.7% ◼ Construction & Building 2.6% ◼ Aerospace & Defense 2.4% ◼ Transportation: Cargo 2.4% ◼ Healthcare & Pharmaceuticals 2.3% ◼ Beverage, Food & Tobacco 1.8% ◼ Chemicals, Plastics, & Rubber 1.5% 100.0% ◼ Services: Consumer 1.5% ◼ Road and Rail 1.3% ◼ Energy: Electricity 0.5% Total Investment Portfolio at Fair Value as of March 31, 2020 = $167.2 million | Number of Investments = 44 Average Investment Size = $3.8 million (2.3% of the Portfolio or 0.8% of Committed Capital***) * Investment Type reflects classification at issuance. ** 26.0% of first lien term loans are unitranche positions. *** Committed Capital include Equity Commitments of $289.2 million as of April 17, 2020, and $175 million from the Financing Facility. Nuveen Churchill BDC Inc. 4

Capital activity as of March 31, 2020 Capital summary Financing Facility summary Equity Commitments* $289.2* million Lender Wells Fargo Bank, N.A. Total Financing Facility** $175.0 million Financing Facility Amount $175 million Total Committed Capital $464.2 million Stated Maturity Date October 28, 2022 Total Equity Funded $66.2 million Applicable Margin (one-month LIBOR) 2.25% Financing Facility Drawn $107.9 million Average Debt Financing Interest Rate 4.10% Total Funded & Drawn $174.0 million Percentage of Floating Rate Debt Financing 100.0% Asset Coverage Ratio 158.2% Net Asset Value (NAV) Unfunded Equity Commitments $220.9 million Net Asset Value $62.8 million Financing Facility Available*** $65.2 million Shares Outstanding 3,310,590 Total Capital Available $349.7 million Net Asset Value per Share $18.96 * Includes $2 million equity commitment closed on April 17, 2020. ** Represents current Financing Facility amount. *** Available for borrowing based on the computation of collateral to support the borrowings and subject to compliance with applicable covenants and financial ratios. Nuveen Churchill BDC Inc. 5

Credit quality of investments Investment portfolio has a weighted average risk rating of 4.2 on Churchill’s internal risk rating scale (4.0 being the initial rating assigned to investments at origination); nearly 93% of portfolio investments are rated 5 or better Portfolio risk ratings ($ millions) March 31, 2020 December 31, 2019 Number of Portfolio Number of Portfolio Fair Value % of Portfolio Companies Fair Value % of Portfolio Companies 1 $ — — % — $ — — % — 2 — — — — — — 3 — — — — — — 4 142,814 85.4 38 178,780 100.0 46 5 12,212 7.3 3 — — — 6 12,153 7.3 3 — — — 7 — — — — — — 8 — — — — — — 9 — — — — — — 10 — — — — — — Total $ 167,179 100.0 % 44 $ 178,780 100.0 % 46 Rating Definition Rating Definition 1 Performing – Superior 6 Watch List – Low Maintenance 2 Performing – High 7 Watch List – Medium Maintenance 3 Performing – Low Risk 8 Watch List – High Maintenance 4 Performing – Stable Risk 9 Watch List – Possible Loss 5 Performing – Management Notice 10 Watch List – Probable Loss Nuveen Churchill BDC Inc. 6

Share issuance and distribution activity As of May 7, 2020, the Company has 4,380,112 shares outstanding Share issuance Issuance Date Share Issuance Aggregate Offering Price Issuance Price per Share May 7, 2020 1,069,522 $20,000,000 $18.70 December 31, 2019 3,310,540* $66,210,800 $20.00 December 19, 2019 50* $1,000 $20.00 Dividend distribution Date Declared Record Date Payment Date Dividend per Share April 16, 2020 April 16, 2020 April 21, 2020 $0.17 * Shares held by an affiliate of the Company, TIAA. Nuveen Churchill BDC Inc. 7

Investment portfolio as of March 31, 2020 Portfolio has a weighted average spread of 4.80% and weighted average yield of 6.34% at fair value*** Interest Investment Moody’s Industry Type Par Amount* Amortized Cost Fair Value Spread Rate** MAG DS Corp Aerospace & Defense First Lien TL $4.0 $3.9 $4.0 4.75% 7.00% PAI HoldCo Inc Automotive First Lien TL $3.4 $3.4 $3.3 4.25% 5.51% Tailwind Randy's LLC Automotive First Lien TL**** $3.3 $3.3 $3.3 5.50% 6.95% Tailwind Randy's LLC (Delayed Draw) Automotive First Lien DDTL**** $0.7 $0.2 $0.2 5.50% 6.95% Bankruptcy Management Solutions Inc Banking, Finance, Insurance, Real Estate First Lien TL $4.0 $4.0 $3.9 4.50% 5.49% Minotaur Acquisition Inc Banking, Finance, Insurance, Real Estate First Lien TL $5.0 $4.9 $4.9 5.00% 5.99% Northern Star Industries Inc Banking, Finance, Insurance, Real Estate First Lien TL $2.3 $2.3 $2.2 4.50% 5.57% Payment Alliance International Inc Banking, Finance, Insurance, Real Estate First Lien TL $6.7 $6.7 $6.1 5.25% 6.32% KSLB Holdings LLC Beverage, Food & Tobacco First Lien TL $3.0 $2.9 $2.9 4.50% 5.50% Blackbird Purchaser Inc Capital Equipment First Lien TL $3.8 $3.8 $3.7 4.50% 5.95% Blackbird Purchaser Inc (Delayed Draw) Capital Equipment First Lien DDTL $0.1 $0.0 $0.0 4.50% 5.95% MSHC Inc Capital Equipment First Lien TL $0.9 $0.9 $0.9 4.25% 5.25% Boulder Scientific Company LLC Chemicals, Plastics, & Rubber First Lien TL $2.4 $2.4 $2.4 4.25% 6.28% SPI LLC Construction & Building First Lien TL $4.3 $4.4 $4.3 5.00% 6.00% Eagletree-Carbide Acquisition Corp Consumer Goods: Durable First Lien TL $2.9 $2.9 $2.9 4.25% 5.70% Fetch Acquisition LLC Consumer Goods: Durable First Lien TL**** $3.9 $3.9 $3.9 4.50% 5.95% Halo Buyer Inc Consumer Goods: Durable First Lien TL $5.9 $5.8 $5.5 4.50% 5.50% Badger Sportswear Acquisition Inc Consumer goods: Non-durable First Lien TL $3.9 $3.8 $3.5 5.00% 6.25% Kramer Laboratories Inc Consumer Goods: Non-durable First Lien TL $3.0 $2.9 $2.9 5.50% 6.57% North Haven Spartan US Holdco LLC Consumer goods: Non-durable First Lien TL $2.6 $2.6 $2.4 5.00% 6.00% North Haven Spartan US Holdco LLC (Delayed Draw) Consumer goods: Non-durable First Lien DDTL $1.4 $0.1 $0.0 5.00% 6.00% OneWorld Fitness Consumer Goods: Non-durable First Lien TL $4.0 $4.0 $3.5 4.75% 6.20% Brook & Whittle Holding Corp Containers, Packaging & Glass First Lien TL**** $2.7 $2.7 $2.7 5.25% 6.99% Good2Grow LLC Containers, Packaging & Glass First Lien TL $3.6 $3.6 $3.6 4.25% 5.32% Resource Label Group LLC Containers, Packaging & Glass First Lien TL $3.0 $2.9 $2.9 4.50% 6.41% Brave Parent Holdings Inc Energy: Electricity First Lien TL**** $0.9 $0.9 $0.9 4.00% 5.78% Unified Physician Management LLC Healthcare & Pharmaceuticals First Lien TL $1.3 $1.3 $1.2 4.50% 5.50% Unified Physician Management LLC (Delayed Draw) Healthcare & Pharmaceuticals First Lien DDTL $2.7 $2.7 $2.6 4.50% 5.50% * Represents current investments of the BDC. Volume includes unfunded delayed draw term loan commitments. ** The majority of the investments bear interest at a rate that may be determined by reference to London Interbank Offered Rate (“LIBOR” or "L") which reset monthly or quarterly. For each such investment, the Fund has provided the spread over LIBOR and the current contractual interest rate in effect at March 31, 2020. As of March 31, 2020, rates for 1M L, 2M L, 3M L and 6M L are 0.99%, 1.26%, 1.45%, and 1.18% respectively. *** The weighted average spread and weighted average yield of our debt and income producing securities are not the same as a return on investment for our shareholders but, rather, relate to our investment portfolio and are calculated before the payment of all of our and our subsidiaries’ fees and expenses. The weighted average spread was computed using the spread as of March 31, 2020, based on fair value of the investments. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount, based on fair value of the investments. **** Investment is a unitranche position. Nuveen Churchill BDC Inc. 8

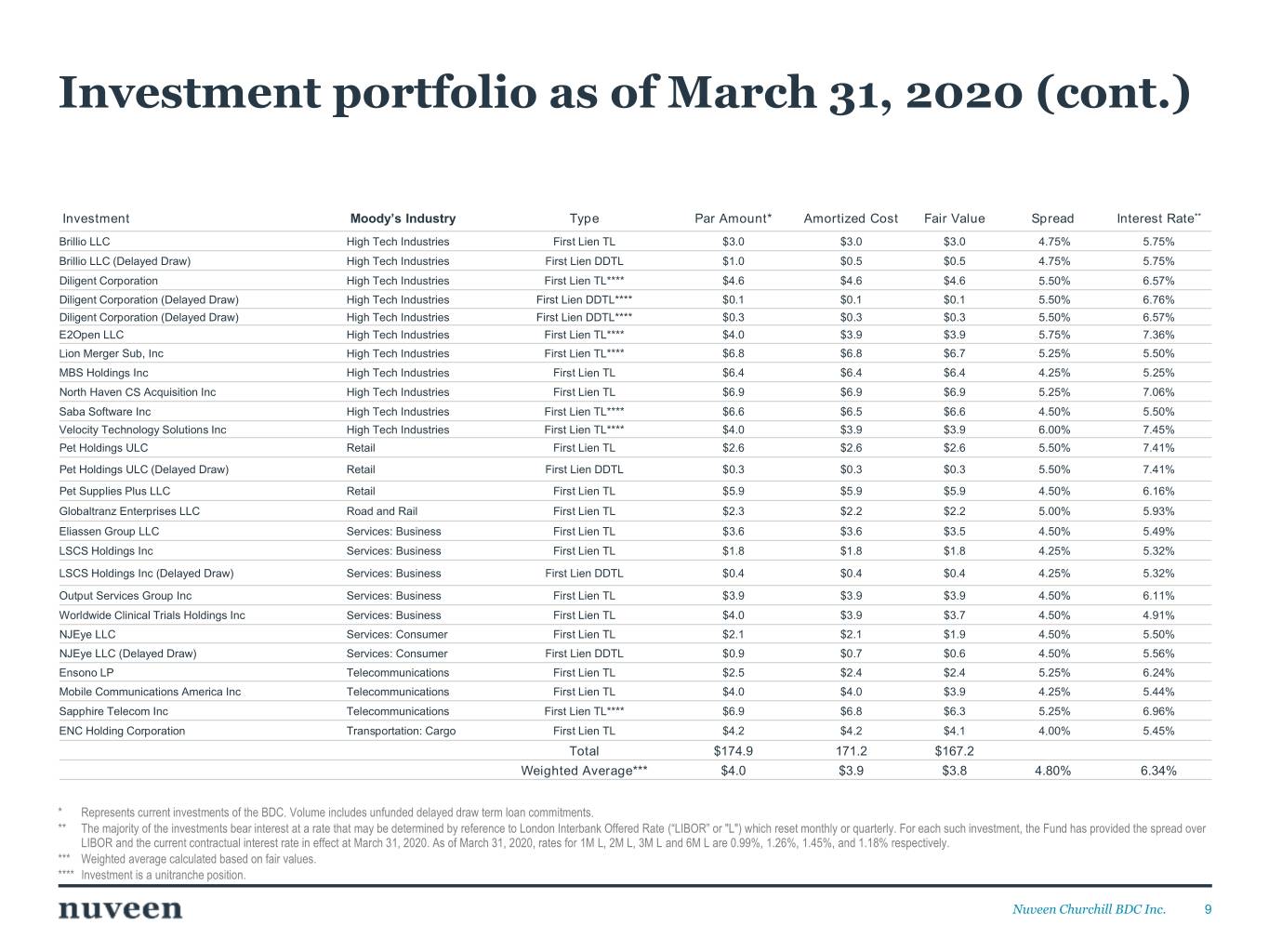

Investment portfolio as of March 31, 2020 (cont.) Investment Moody’s Industry Type Par Amount* Amortized Cost Fair Value Spread Interest Rate** Brillio LLC High Tech Industries First Lien TL $3.0 $3.0 $3.0 4.75% 5.75% Brillio LLC (Delayed Draw) High Tech Industries First Lien DDTL $1.0 $0.5 $0.5 4.75% 5.75% Diligent Corporation High Tech Industries First Lien TL**** $4.6 $4.6 $4.6 5.50% 6.57% Diligent Corporation (Delayed Draw) High Tech Industries First Lien DDTL**** $0.1 $0.1 $0.1 5.50% 6.76% Diligent Corporation (Delayed Draw) High Tech Industries First Lien DDTL**** $0.3 $0.3 $0.3 5.50% 6.57% E2Open LLC High Tech Industries First Lien TL**** $4.0 $3.9 $3.9 5.75% 7.36% Lion Merger Sub, Inc High Tech Industries First Lien TL**** $6.8 $6.8 $6.7 5.25% 5.50% MBS Holdings Inc High Tech Industries First Lien TL $6.4 $6.4 $6.4 4.25% 5.25% North Haven CS Acquisition Inc High Tech Industries First Lien TL $6.9 $6.9 $6.9 5.25% 7.06% Saba Software Inc High Tech Industries First Lien TL**** $6.6 $6.5 $6.6 4.50% 5.50% Velocity Technology Solutions Inc High Tech Industries First Lien TL**** $4.0 $3.9 $3.9 6.00% 7.45% Pet Holdings ULC Retail First Lien TL $2.6 $2.6 $2.6 5.50% 7.41% Pet Holdings ULC (Delayed Draw) Retail First Lien DDTL $0.3 $0.3 $0.3 5.50% 7.41% Pet Supplies Plus LLC Retail First Lien TL $5.9 $5.9 $5.9 4.50% 6.16% Globaltranz Enterprises LLC Road and Rail First Lien TL $2.3 $2.2 $2.2 5.00% 5.93% Eliassen Group LLC Services: Business First Lien TL $3.6 $3.6 $3.5 4.50% 5.49% LSCS Holdings Inc Services: Business First Lien TL $1.8 $1.8 $1.8 4.25% 5.32% LSCS Holdings Inc (Delayed Draw) Services: Business First Lien DDTL $0.4 $0.4 $0.4 4.25% 5.32% Output Services Group Inc Services: Business First Lien TL $3.9 $3.9 $3.9 4.50% 6.11% Worldwide Clinical Trials Holdings Inc Services: Business First Lien TL $4.0 $3.9 $3.7 4.50% 4.91% NJEye LLC Services: Consumer First Lien TL $2.1 $2.1 $1.9 4.50% 5.50% NJEye LLC (Delayed Draw) Services: Consumer First Lien DDTL $0.9 $0.7 $0.6 4.50% 5.56% Ensono LP Telecommunications First Lien TL $2.5 $2.4 $2.4 5.25% 6.24% Mobile Communications America Inc Telecommunications First Lien TL $4.0 $4.0 $3.9 4.25% 5.44% Sapphire Telecom Inc Telecommunications First Lien TL**** $6.9 $6.8 $6.3 5.25% 6.96% ENC Holding Corporation Transportation: Cargo First Lien TL $4.2 $4.2 $4.1 4.00% 5.45% Total $174.9 171.2 $167.2 Weighted Average*** $4.0 $3.9 $3.8 4.80% 6.34% * Represents current investments of the BDC. Volume includes unfunded delayed draw term loan commitments. ** The majority of the investments bear interest at a rate that may be determined by reference to London Interbank Offered Rate (“LIBOR” or "L") which reset monthly or quarterly. For each such investment, the Fund has provided the spread over LIBOR and the current contractual interest rate in effect at March 31, 2020. As of March 31, 2020, rates for 1M L, 2M L, 3M L and 6M L are 0.99%, 1.26%, 1.45%, and 1.18% respectively. *** Weighted average calculated based on fair values. **** Investment is a unitranche position. Nuveen Churchill BDC Inc. 9

Contact us Investor Relations NCBDCInvestorRelations@churchillam.com SEC filings www.churchillam.com/nuveen-churchill-bdc/ Nuveen Churchill BDC Inc. 10