Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Innovative Payment Solutions, Inc. | ea122067-8k_innovative.htm |

Exhibit 99.1

Inn o vat e . Pay. Sol ve. Innovative Payment

Forward Looking Statements Innovative Payment This presentation includes forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 , as amended about our current expectations and projections about future events . In some cases forward - looking statements can be identified by terminology such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “strategy,” “target,” “will,” “would” and similar expressions or variation . The statements contained in this report that are not purely historical are forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These statements are based on the beliefs and assumptions of our management based on information currently available to management . Such forward - looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward - looking statements . Factors that could cause or contribute to such differences include, but are not limited to, our ability to continue as a going concern ; our ability to raise additional working capital ; our ability to increase product demand and market acceptance for our products ; our ability to use working capital resources effectively and efficiently ; our ability to maintain our listing on the OTC - QB, our ability to attract key personnel ; our ability to maintain and add new relationships and customers and those discussed in our Annual Report on Form 10 - K for the year ended December 31 , 2019 . Furthermore, such forward - looking statements speak only as of the date of this report . Except as required by law, we undertake no obligation to update any forward - looking statements to reflect events or circumstances after the date of such statements . COVID - 19 Considerations The Company’s operations and business have experienced disruption due to the unprecedented conditions surrounding the COVID - 19 pandemic spreading throughout the United States, Mexico and the world . The Company provides an integrated network of kiosks, terminals and payment channels that enable consumers to deposit cash, convert it into a digital form and remit the funds to any merchant in its network quickly and securely . The Company has plans to roll out 50 kiosks in Southern California to provide digital payments for the unbanked and underbanked using self - service kiosks and an E wallet ecosystem . The kiosks are currently located in the Company’s warehouses in Southern California awaiting installation . Due to measures imposed by the local governments in areas affected by COVID - 19 , businesses have been suspended due to quarantine intended to contain this outbreak and many people have been forced to work from home in those areas . As a result, installation of the Company’s network of kiosks, terminals and payment channels in Southern California has been delayed, which has had an adverse impact on the Company’s business and financial condition and has hampered its ability to generate revenue and access usual sources of liquidity on reasonable terms .

$0.042 $5,750,508 136,916,858 common $995,132 Self service kiosk solutions (B2C, B2B), fintech development and integration infrastructure Payments ecosystem for unbanked and underbanked Plans for advanced B2B kiosk rev share solutions, cash remittance, e - wallets, other payment channels IPSI Snapshot Source: OTCMarkets.com as of 5/18/20 and edgar.com IPSI /20) Share Price (5/18 Market Cap Capitalization Debt (3/31/20) Innovative Payment

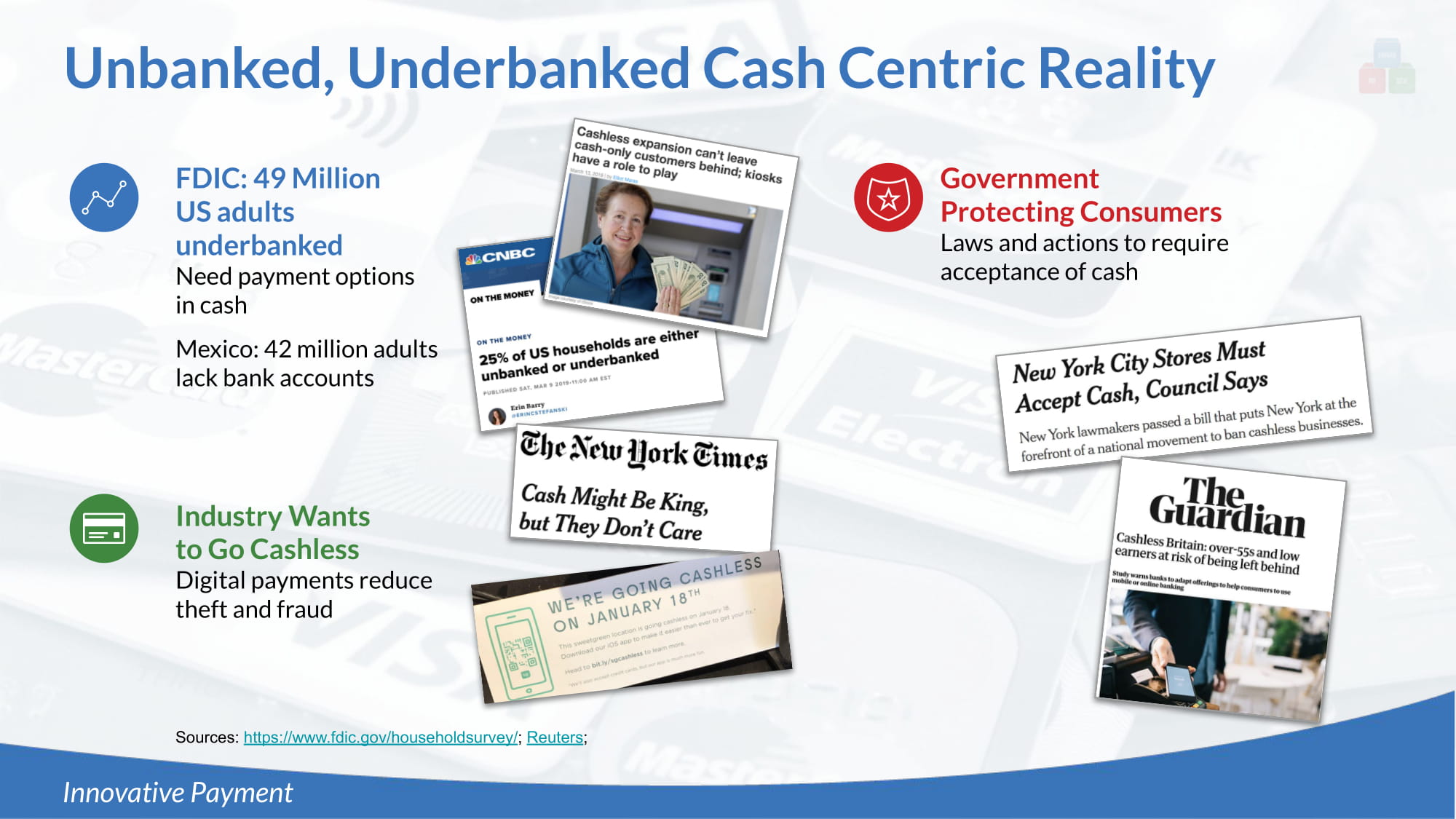

FDIC: 49 Million US adults underbanked Need payment options in cash Mexico: 42 million adults lack bank accounts Unbanked, Underbanked Cash Centric Reality Sources: https://www.fdic.gov/householdsurvey/ ; Reuters ; Government Protecting Consumers Laws and actions to require acceptance of cash Industry Wants to Go Cashless Digital payments reduce theft and fraud Innovative Payment

St r ategy Simple payment solutions and low cost financial services that deliver superior value for consumers and businesses . Remittance, merchant payments, lotto, mobile phone top off, micro loans, additional financial services Provide access to digital payments for the unbanked and underbanked using self service kiosks and an e - wallet ecosystem. Application of internationally proven kiosk payment model to U.S. Innovative Payment

Debt Restructure Underway Total convertible debt as of 9/30/19 $2,160,108 Converted to equity on 12/31/19 $1,330,907 Innovative Payment Balance remaining on 3/31/20 $995,132

Value of Kiosk Channel ● Traffic magnet - new customers ● Low maintenance with remote monitoring and software updates ● Easy to use and requires little or no service from customer representatives ● Low staff training and overhead FOR BUSINESS ● Additional revenue source ● No lines - 24/7 convenient access to bill payment services FOR CONSUMERS ● Easy alternative for cash dependent unbanked and online payment skeptics FOR ADD - ON SERVICES ● Ads (second screen and targeted), payday loans, check deposits, prepaid cards or even checkout services Innovative Payment Innovative Payment

IPSI’s Kiosk Platform Hardware Options Change machine Debit card reader Barcode reader Advanced peripherals Camera biometrics ● Flexible open architecture minimizes costs but allows new applications ● New features and transaction modules easily added ● Cost: $2,000 & up depending upon options Innovative Payment

IPSI Platform 9 Innovative Payment

Kiosk Network History Proven software & hardware Established vendor relationships Cost effective customer capture ● Low upfront cost ● Recurring revenue streams 2 million consumers 2019: 4.5 million transactions $17 million processed while deployed in Mexico Technology Validation Consumer Adoption 10 Innovative Payment

Linked to Mexico’s Largest Service Providers 11 • Over 150 services planned for payment through IPSI Network • Every mobile network, cable operators, home lenders, 12 out of 32 states, bank payments, micro lenders, Innovative Payment

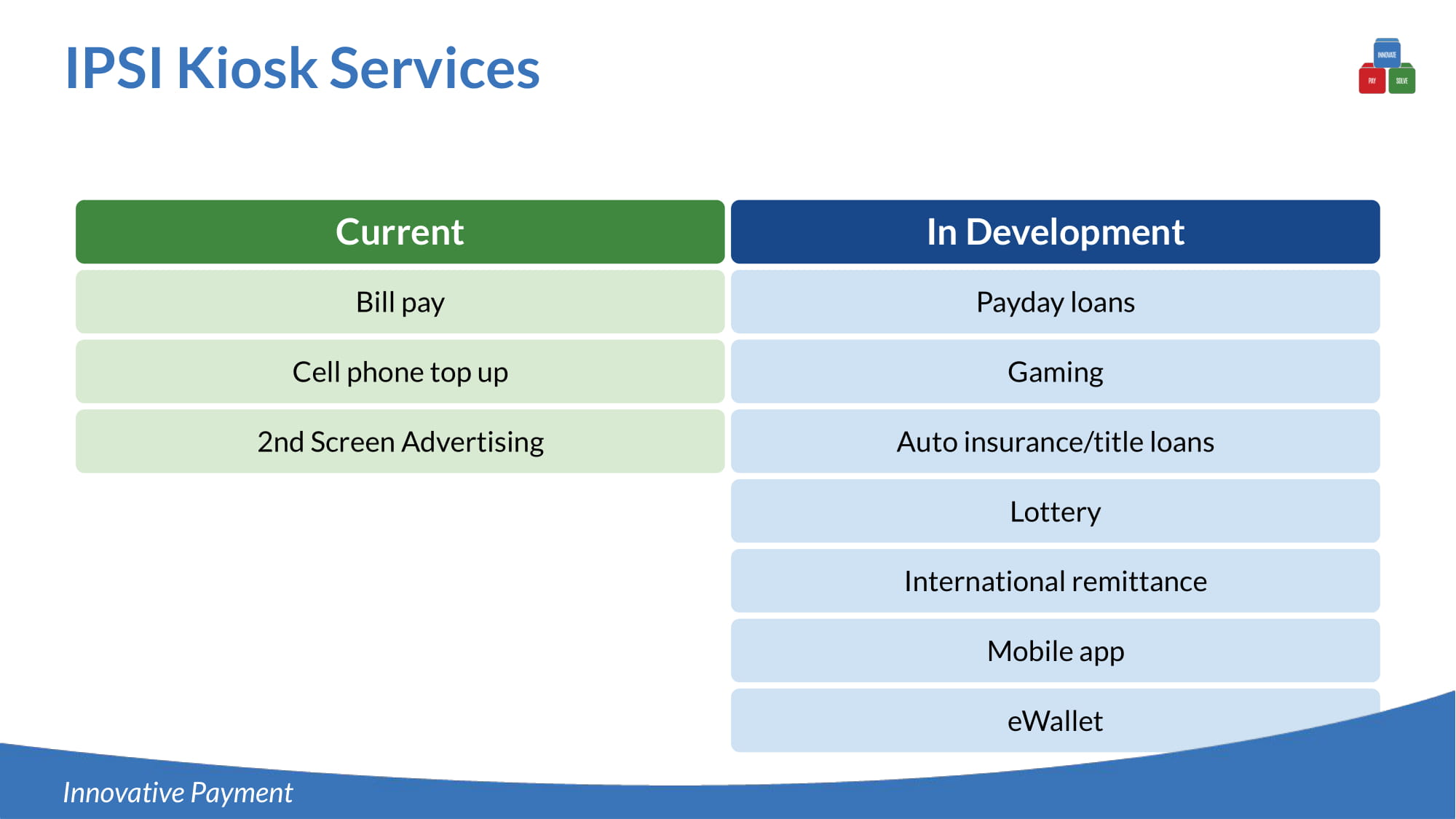

IPSI Kiosk Services Cell phone top up 2nd Screen Advertising Current Bill pay Gaming Auto insurance/title loans In Development Payday loans Lottery International remittance Mobile app eWallet Innovative Payment

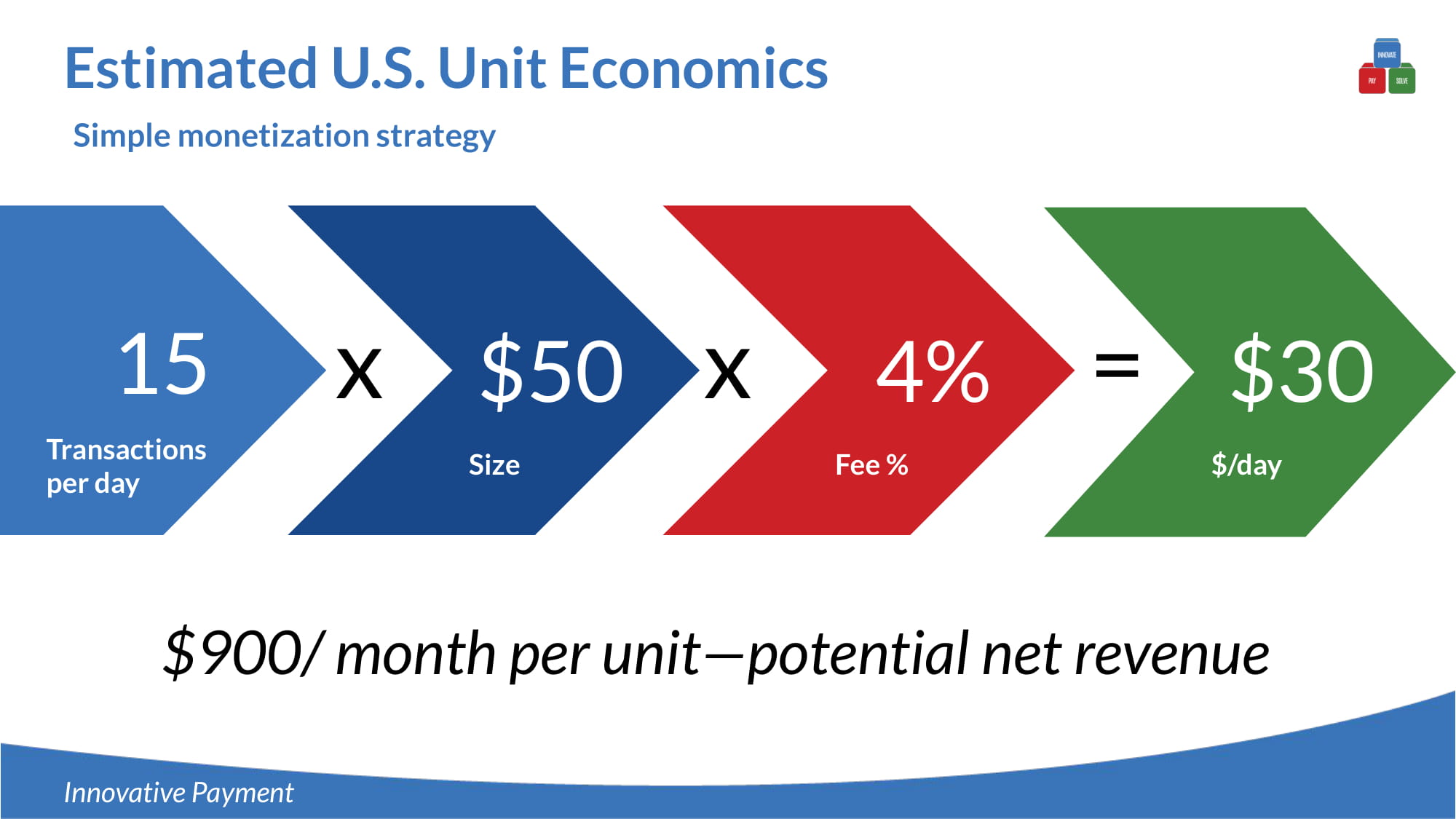

= Innovative Payment x x $900/ month per unit — potential net revenue Estimated U.S. Unit Economics Simple monetization strategy 15 T r ansactions per day $30 $/day 4% Fee % $50 Size

Innovative Payment’s US Pilot Program Rollout Gas Stations Convenience Stores Malls 50 kiosk pilot program planned for Q3, 2020 Revenue share with location partners grows IPSI footprint with low cost Retailer benefits from incremental monetization of foot traffic Innovative Payment

Sept. 2020 US Pilot 3Q20 - 50 Southern California Kiosks May 2020 June 2020 Hone marketing, customer acquisition July 2020 Refurbish existing kiosk inventory Identify locations software Launch Plans to launch with 50 Kiosks in California in 3Q20 Integrate services into Keep CapEx low Prove US Customer economics Placement Strategy April 2020 Collect data & optimize Timeline: Goals: 2021 500 kiosks, Southern California Innovative Payment

Qiwi PLC (Nasdaq: QIWI) $1B mkt cap Internationally Proven Model - QIWI 2018 Results 16 In payments processed Innovative Payment Virtual Wallets Kiosks and terminals In revenue 52M USD in profit 20.8M $16B $441M 144K Source: QIWI SEC Filings

IPSI Timetable Founded November 2013 100 kiosks July 2015 700 kiosks July 2016 2M Customers June 2018 2013 Restructuring Begins Feb 2019 2015 2014 2020 2016 2018 2019 2017 First kiosk installed July 2014 200 kiosks December 2015 Public company May 2016 Sale of Mexican Assets & Name Change Dec 2019 M e xican network expansion 2017 - 18 50 Kiosk Pilot Q3 2020 2021 Innovative Payment

Proven Leadership Board of Directors Innovative Payment Advisory Panel Joe Abrams Founder, MySpace, Software Toolworks Bill Corbett - CEO, Director Former CEO, Digital Power Lending Career investment banker with Bear Stearns, Shemano, and Paulson Group Andrey Novikov - COO, Director Former VP, global business development QIWI, Plc. (Nasdaq:QIWI) Lead role QIWI startups in China, Mexico, India, Brazil, Argentina, Chile, Peru, and others Jim Fuller Former, SVP New York Stock Exchange, SIPC Director

Summary 2 million customer, business model proven in Mexico now shifting to U.S. Proven economics for self service kiosks Solution for unbanked through merge of physical transactions with digital Cost effective model Planning to scale into greater fee capture from IPSI network expansion Innovative Payment

Thank You investors@innovatepaysolve.com (818) 864 - 4004 Innovatepaysolve.com Innovative Payment