Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST UNITED CORP/MD/ | tm2020197d1_8k.htm |

Exhibit 99.1

Investor Presentation Supplement May 2020

2 2 Important additional information F irst United, its directors and certain of its executive officers will be deemed to be participants in the solicitation of proxies from First United's shareholders in connection with the 2020 annual meeting of shareholders. First United has filed a definitive proxy statement and a BLUE proxy card with the SEC in connection with any such solicitation of proxies from First United shareholders. SHAREHOLDERS OF FIRST UNITED ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING BLUE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, are set forth in the definitive proxy statement and other materials filed with the SEC in connection with the 2020 annual meeting of shareholders. Shareholders can obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by First United with the SEC at no charge at the SEC's website www.sec.gov. Copies are also available at no charge at First United's website at http://investors.mybank.com /.

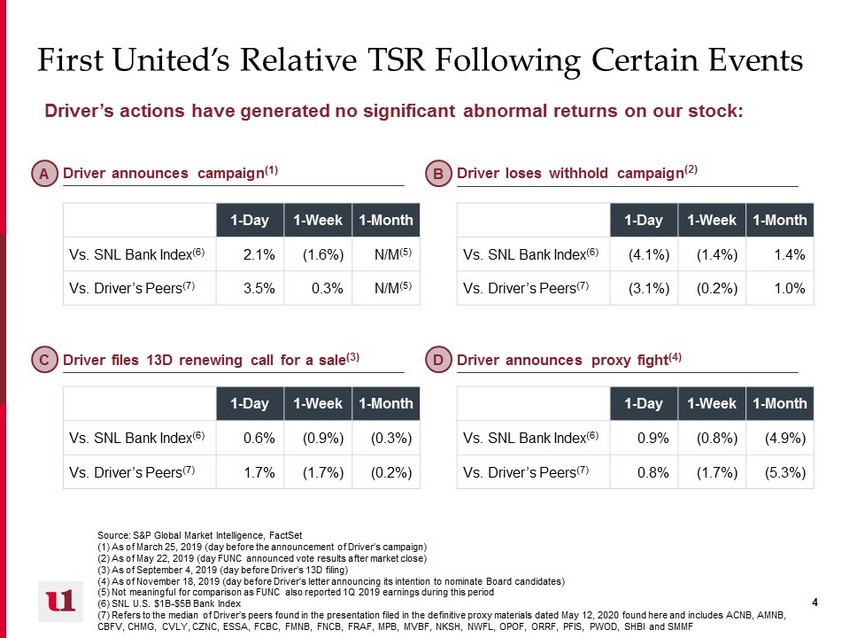

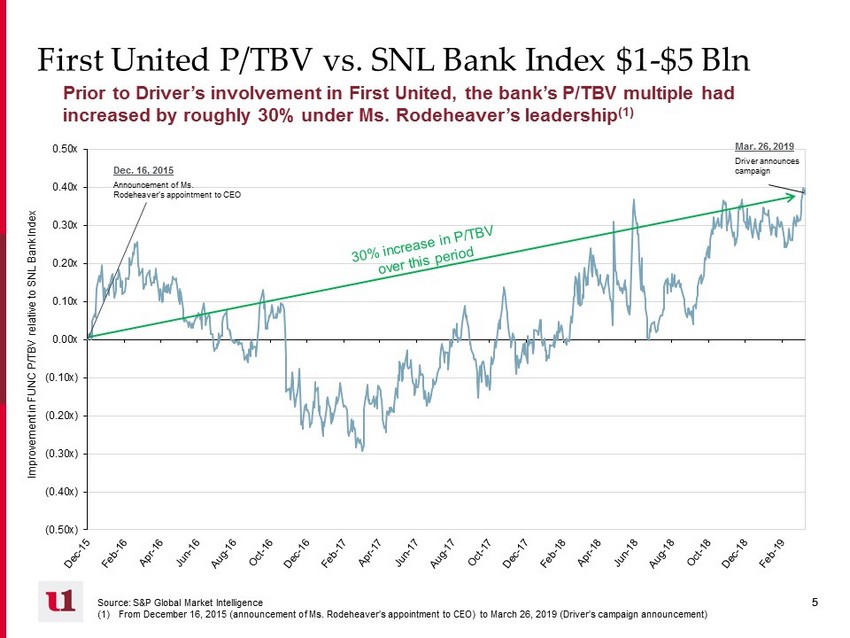

3 3 ▪ Driver’s Campaign has generated NO abnormal returns for First United’s shareholders or caused any meaningful improvement in the bank’s relative valuation – At all four of the key inflection points of Driver’s campaign, First United experienced NO significant returns relative to the SNL Bank Index $1 - $5 billion or Driver’s own peer group (pg. 4) – For years prior to Driver’s arrival, First United had already been growing its price to tangible book value multiple (“P/TBV”) relative to other banks its size, under a new management team and strategy delivering steady, profitable growth (pg. 5) – In 2019, the bank culminated several years of improved profitability, efficiency, asset quality, etc. as well as several quarters of a reinstated, and later dramatically increased, dividend – As those metrics have improved relative to peers, relative valuation has improved, not surprisingly, as well – First United also expanded its shareholder communication and market outreach in 2019 – As Driver first called for a sale last year, First United experienced NO relative expansion of its P/TBV multiple during Driver’s unsuccessful withhold campaign, or even weeks after (pg. 6) – When Driver filed its 13D months later, renewing its call for a sale, and later launched a costly and disruptive proxy fight, First United’s relative P/TBV multiple actually deteriorated, only recovering as the bank continued to deliver strong financial and operating results TSR and Valuation Relative to Peers

4 4 First United’s Relative TSR Following Certain Events Source: S&P Global Market Intelligence, FactSet (1) As of March 25, 2019 ( day before the announcement of Driver’s campaign) (2) As of May 22, 2019 ( day FUNC announced vote results after market close) (3) As of September 4, 2019 ( day before Driver’s 13D filing) (4) As of November 18, 2019 (day before Driver’s letter announcing its intention to nominate Board candidates) (5) Not meaningful for comparison as FUNC also reported 1Q 2019 earnings during this period (6) SNL U.S. $1B - $5B Bank Index (7) Refers to the median of Driver’s peers found in the presentation filed in the definitive proxy materials dated May 12, 2020 found here and includes ACNB, AMNB, CBFV, CHMG, CVLY, CZNC, ESSA, FCBC, FMNB, FNCB, FRAF, MPB, MVBF, NKSH, NWFL, OPOF, ORRF, PFIS, PWOD, SHBI and SMMF Driver announces campaign (1) Driver files 13D renewing call for a sale (3) Driver announces proxy fight (4) Driver loses withhold campaign (2) 1 - Day 1 - Week 1 - Month Vs. SNL Bank Index (6) 2.1% (1.6%) N/M (5) Vs. Driver’s Peers (7) 3.5% 0.3% N/M (5) 1 - Day 1 - Week 1 - Month Vs. SNL Bank Index (6) 0.6% (0.9%) (0.3%) Vs. Driver’s Peers (7) 1.7% (1.7%) (0.2%) 1 - Day 1 - Week 1 - Month Vs. SNL Bank Index (6) (4.1%) (1.4%) 1.4% Vs. Driver’s Peers (7) (3.1%) (0.2%) 1.0% 1 - Day 1 - Week 1 - Month Vs. SNL Bank Index (6) 0.9% (0.8%) (4.9%) Vs. Driver’s Peers (7) 0.8% (1.7%) (5.3%) Driver’s actions have generated no significant abnormal returns on our stock: A B C D

5 5 (0.50x) (0.40x) (0.30x) (0.20x) (0.10x) 0.00x 0.10x 0.20x 0.30x 0.40x 0.50x Source: S&P Global Market Intelligence (1) From December 16, 2015 (announcement of Ms. Rodeheaver’s appointment to CEO) to March 26, 2019 (Driver’s campaign announcement) First United P/TBV vs. SNL Bank Index $1 - $5 Bln Prior to Driver’s involvement in First United, the bank’s P/TBV multiple had increased by roughly 30% under Ms . Rodeheaver’s leadership (1) Mar. 26, 2019 Driver announces campaign Dec. 16, 2015 Announcement of Ms . Rodeheaver’s appointment to CEO Improvement in FUNC P/TBV relative to SNL Bank Index

6 6 (0.10x) 0.00x 0.10x 0.20x 0.30x 0.40x 0.50x Source: S&P Global Market Intelligence (1) March 26, 2019 (Driver’s campaign announcement) to present Since March of last year, First United’s P/TBV multiple has only meaningfully expanded during the most dormant period of Driver’s campaign (1) A B C D May 16, 2019 FUNC annual meeting; Driver loses withhold campaign with support of less than 15% of FUNC shares Sep. 5, 2019 Driver files 13D renewing call for a sale Mar. 26, 2019 Driver announces campaign Nov. 19, 2019 Driver nominates Board candidates Apr. 2, 2019 Driver last public statement until 13D filing in Sep. First United P/TBV vs. SNL Bank Index $1 - $5 Bln Jan. 29, 2020 FUNC announces FY 2019 results Apr. 29, 2020 FUNC announces Q1 2020 earnings (first results announced post - COVID - 19 onset) • During no active time period of Driver's campaign, has there been a significant increase in FUNC's P/TBV multiple relative to peers • In July/August 2019, FUNC’s P/TBV did increase by roughly 10 % • However, this was months after Driver’s most recent public shareholder communication , over a month after Driver lost its withhold campaign, and before Driver filed its 13D renewing its call for a sale and later launching a proxy fight • During all of those times, FUNC’s P/TBV remained unchanged or decreased relative to its peers Jul. 15, 2019 FUNC announces 3Q 2019 earnings Improvement in FUNC P/TBV relative to SNL Bank Index

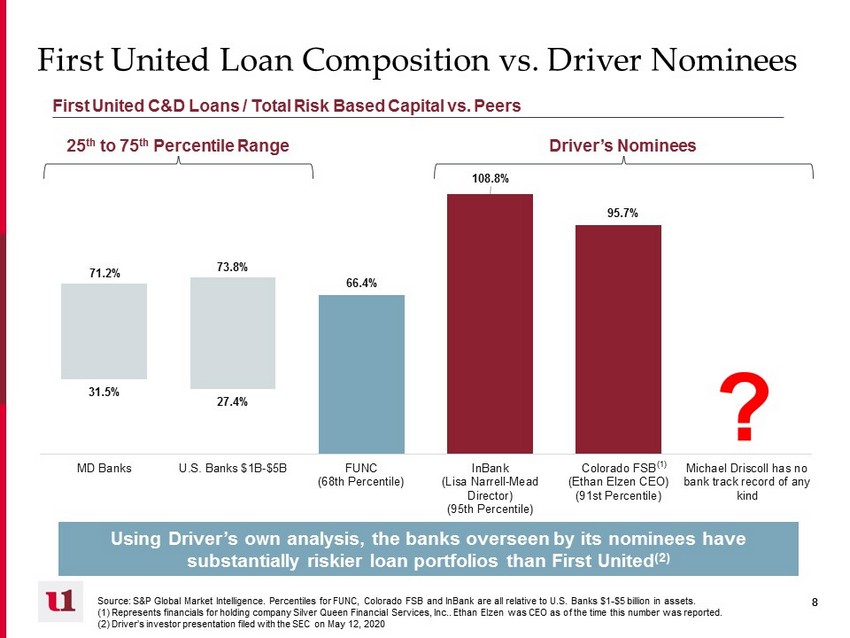

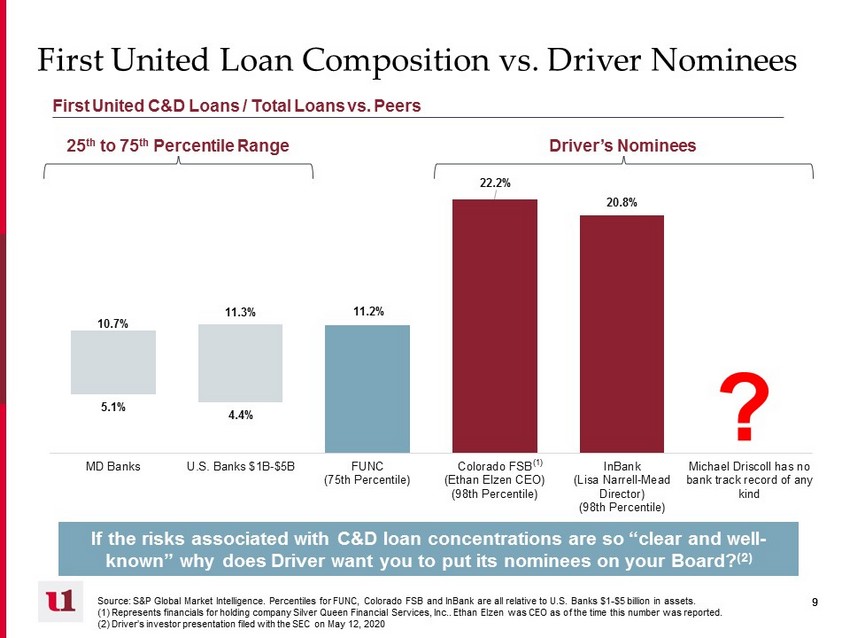

7 7 ▪ Driver’s criticism of First United’s construction and development (“C&D”) loan portfolio underscores the hypocrisy and inaccuracies of its campaign – First United’s level of C&D loans is within the range of most banks its size and in its region, whether measured as a percent of total risk based capital (pg. 8) or of total loans (pg. 9) – First United has dramatically decreased its level of C&D exposure in recent years, cutting it in half – First United has also undertaken enhanced risk mitigation protocols in terms of geographic diversification and enhanced underwriting guidelines and risk management framework – More importantly , the banks that Driver’s nominees are associated with both have nearly TWICE First United’s concentration of C&D loans as a percent of total loans, a level higher than almost any other banks nationally – This does not include Driver’s nominee Michael Driscoll , who has not worked for, managed or served on the board of a bank before Loan Portfolio Management

8 8 31.5% 27.4% 66.4% 108.8% 95.7% 71.2% 73.8% MD Banks U.S. Banks $1B-$5B FUNC (68th Percentile) InBank (Lisa Narrell-Mead Director) (95th Percentile) Colorado FSB (Ethan Elzen CEO) (91st Percentile) Michael Driscoll has no bank track record of any kind First United Loan Composition vs. Driver Nominees First United C&D Loans / Total Risk Based Capital vs . Peers 25 th to 75 th Percentile Range Driver’s Nominees ? (1) Using Driver’s own analysis, the banks overseen by its nominees have substantially riskier loan portfolios than First United (2) Source: S&P Global Market Intelligence. Percentiles for FUNC, Colorado FSB and InBank are all relative to U.S. Banks $1 - $5 billion in assets. (1) Represents financials for holding company Silver Queen Financial Services, Inc .. Ethan Elzen was CEO as of the time this number was reported. (2) Driver’s investor presentation filed with the SEC on May 12, 2020

9 9 5.1% 4.4% 11.2% 22.2% 20.8% 10.7% 11.3% MD Banks U.S. Banks $1B-$5B FUNC (75th Percentile) Colorado FSB (Ethan Elzen CEO) (98th Percentile) InBank (Lisa Narrell-Mead Director) (98th Percentile) Michael Driscoll has no bank track record of any kind First United Loan Composition vs. Driver Nominees First United C&D Loans / Total Loans vs . Peers Source: S&P Global Market Intelligence. Percentiles for FUNC, Colorado FSB and InBank are all relative to U.S. Banks $1 - $5 billion in assets. (1) Represents financials for holding company Silver Queen Financial Services, Inc .. Ethan Elzen was CEO as of the time this number was reported. (2) Driver’s investor presentation filed with the SEC on May 12, 2020 25 th to 75 th Percentile Range Driver’s Nominees ? (1) If the risks associated with C&D loan concentrations are so “clear and well - known” why does Driver want you to put its nominees on your Board ? (2)