Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Anterix Inc. | d862983d8k.htm |

Exhibit 99.1

May 19, 2020

To our shareholders:

Today’s letter was a long time coming but all the sweeter for that. Many of you reading this can remember years of Anterix investor events where we speculated about an FCC decision that would embrace the core principle that motivated our purchase of 900 MHz spectrum in 2014. With a unanimous vote last week, the FCC delivered that decision, providing all of us the opportunity to flesh out the details of how Anterix will bring to market a rare commodity: 6 MHz of cleared broadband spectrum below 1GHz.1 This is a situation in which the details—lots and lots of details—really matter as we peel back the layers of a nuanced, complex Order to share how we see this opportunity shaping up.

In summary, this landmark Report and Order (“R&O”):

Modernizes the legacy rules covering the 10 MHz of spectrum in the 900 MHz band to allow for 6 MHz of broadband and 4 MHz for narrowband users.

Establishes a well-defined path for Anterix to convert its nationwide narrowband 900 MHz spectrum position, held in every county, into this valuable broadband spectrum.

Responds to numerous industrial enterprises, especially utilities, that filed requests at the FCC in this proceeding, stating their compelling need for this broadband spectrum to build private LTE networks to solve highly critical requirements.

Enables Anterix to launch its commercial business, focused on long-term leasing of this broadband spectrum to utilities and other critical industries like the recent LOI announced with Ameren.

As a starter, in order to understand the R&O, it is important to review four key elements (glossary of relevant terms on p. 12):

1. The role of the county

2. The mechanisms and costs involved in realizing the transition to broadband:

a. Spectrum acquisitions

b. Clearing/retuning costs

c. Anti-windfall payments

3. Voluntary/Mandatory relocation

4. Complex systems

1 Review of the Commission’s Rules Governing the 896-901/935-940 MHz Band, Report and Order, Order of Proposed Modification, and Orders, WT Docket No. 17-200 (FCC 20-67) (rel. May 14, 2020) (“R&O” or “Order”). (The FCC rules cited below will become effective 30 days after publication of the R&O in the Federal Register).

Before we take you through each of these elements step by step, it is important to highlight that Anterix owns approximately 60% of all the licensed spectrum in the 900 MHz band, a dominant position resulting from literal decades of spectrum acquisitions through the highest bids at FCC auctions and scores of private market transactions. Based on the breadth of our spectrum asset on our balance sheet, the R&O is uniquely very meaningful to Anterix.2

The Four Elements

1. The Importance of the County:

For compelling reasons of suitability to the critical infrastructure industry, and with the industry’s strong support, the FCC chose to make counties the “base unit of measure” for calculating whether an entity is eligible to hold a broadband license.3 As a result of this decision and Anterix’s extensive accumulated spectrum holdings, Anterix—and only Anterix—is an essential party in every one of the nation’s 3,233 counties. As we take you through the process by which an applicant becomes eligible for a broadband license, it is important to keep in mind this compelling advantage.

2. The Cost of Acquiring a Broadband License:

Such cost is dependent on three inter-related factors. As described below, Anterix will need to demonstrate that it already holds the majority (50%+) of licensed channels throughout the entire 10 MHz of 900 MHz spectrum in each county (Requirement 1). That test already has been met in most counties nationwide. Anterix will also be required to show that it holds licenses for, or has agreements that will enable it to clear, at least 90% of the licensed channels in the new 6 MHz broadband segment (240 narrowband channels) established by the FCC (Requirement 2). Anterix can “clear” the spectrum by purchasing channels from “covered incumbents” (licensees with channels in that broadband segment) for cash or other consideration, by paying to relocate covered incumbents to replacement channels outside the broadband segment, or by demonstrating that the broadband facilities will be far enough from the covered incumbent’s narrowband system to allow the two types of networks to co-exist. Finally, Anterix will need to return 6 MHz (240 channels) of 900 MHz spectrum from either the broadband or narrowband segments to the FCC in exchange for the 6 MHz broadband license (Requirement 3). If Anterix does not have that many channels in a county, it will be allowed, effectively, to purchase vacant channels from the FCC’s inventory (which it has in almost all but the most populous counties)4 by making an “anti-windfall” payment to the US Treasury based on the 600 MHz incentive auction prices.5

Importantly, the markets where the FCC has channels in inventory and where Anterix may need to “purchase” them are in the smaller urban, suburban and rural markets. Anterix’s spectrum position is greatest in the largest, most populated, and therefore most expensive markets, with a few exceptions as shown in Map 1. Thus, though Anterix will incur “anti-windfall” costs for FCC channels, where available, in order to reach the 240-channel mark, those costs on average will be substantially lower than the nationwide average amount paid in the 600 MHz FCC auction, which is skewed by the higher prices paid in the top markets. Without understanding this phenomenon, it is easy to overestimate the likely anti-windfall payments Anterix will need to make. The difference is substantial as we will demonstrate.

Anterix will need to determine in each county the least expensive way to satisfy these three FCC requirements. For example, it may choose to acquire a channel in a private market transaction rather than from the FCC perhaps through a cash payment or even a spectrum swap, if that is the most economical solution.

2 The great majority of Anterix’s 900 MHz spectrum was purchased by Nextel through the FCC’s auction process. Nextel acquired additional 900 MHz channels from existing licensees. Anterix purchased Sprint’s entire 900 MHz spectrum inventory following Sprint’s acquisition of Nextel and since then has made additional 900 MHz acquisitions.

3 R&O at ¶ 122.

4 R&O at ¶¶ 89-95.

5 In 2016, the FCC incentivized television broadcast licensees to sell their spectrum in the first “incentive” auction in order to repurpose spectrum for licensed wireless networks.

3. The Voluntary Versus Mandatory Retuning of Incumbents:

Over the last few decades, the FCC has established a strong preference on a bi-partisan basis for the voluntary operation of the marketplace rather than the heavier hand of regulation. Consistent with that history, the new rules have a decided preference for voluntary decisions made freely in the marketplace.6 The most vivid example is the “90% rule.” The burden to clear the broadband segment falls squarely on the broadband licensee. Before filing an application, the applicant must first hold or achieve agreements with the holders of at least 90% of licensed channels within the broadband segment on a purely voluntary basis.7 Because of this process, Anterix must continue to approach markets, starting with our own incumbent position, and then using the twin tools of spectrum acquisition or spectrum retuning and negotiate as best it can to get to 90%. Only after that target is reached and the license is issued does the “mandatory” period commence, during which recalcitrant incumbents are required to negotiate in good faith with the broadband applicant, subject to intervention by FCC staff if agreement is not reached.8 In the following material, we have attempted to give you a good feel for how these rules will determine the timing and the pricing of the retuning process.

4. The Complex System Concept:

The R&O exempts “complex systems” from mandatory retuning—even where the applicant meets the 90% test.9 Complex systems are defined as having 45 or more functionally integrated sites and, as discussed below, will be addressed on an individualized basis.

We well understand the path for Anterix to reach the goals it set for itself almost 6 years ago. That path is not easy, nor can we achieve all our objectives without reaching agreements with incumbents both large and small.

“We strongly believe that we have just the right elements to complete this task: the experienced team, well-seasoned market demand, and the balance sheet assets of cash and spectrum.”

With that overview, let’s now look in some detail at the process the FCC sets out for obtaining a broadband license, and what that means for Anterix based upon our holdings, our work so far with incumbents, and the current status of narrowband channels in the broadband segment.

6 R&O at 38-45.

7 Id. at 58-61; 47 C.F.R.27.1503(a)(2).

8 Id. at 63-66.

9 Id. at 79; 47 C.F.R.27.1504(b).

The Rules and Implications for Anterix

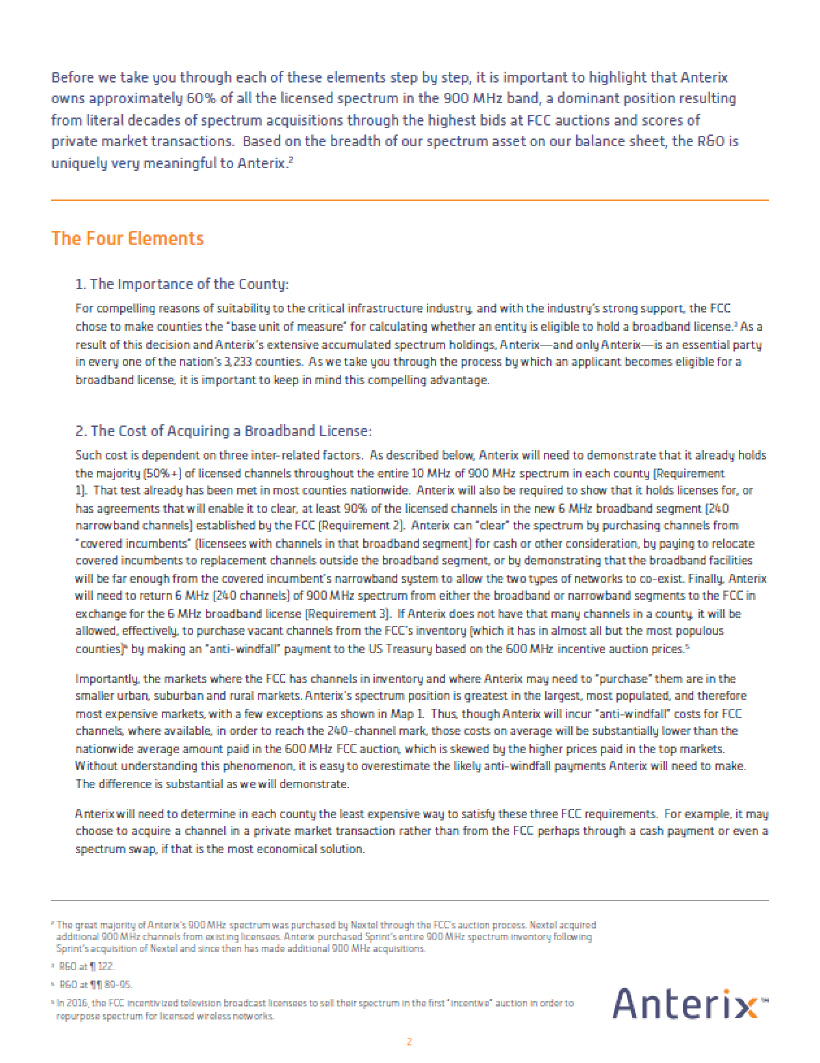

The 900 MHz spectrum configuration after the ruling is a good starting point for our discussion of the criteria for becoming a broadband licensee and the US Treasury payments that may be necessary in certain counties.

In order to demonstrate control of the 240 channels (i.e., any 240 channels out of the total 399 in the band) necessary to become the broadband licensee in a given county, Anterix will need to:

| 1. |

|

Certify it already possesses at least 240 channels; or |

| 2. |

|

Obtain the incremental channels required through |

| a. |

spectrum acquisitions, |

| b. |

the FCC’s inventory, by making an “anti-windfall” payment. |

But before it starts down that path, Anterix will need first to establish its eligibility with two threshold tests in order to be the broadband licensee for that county.

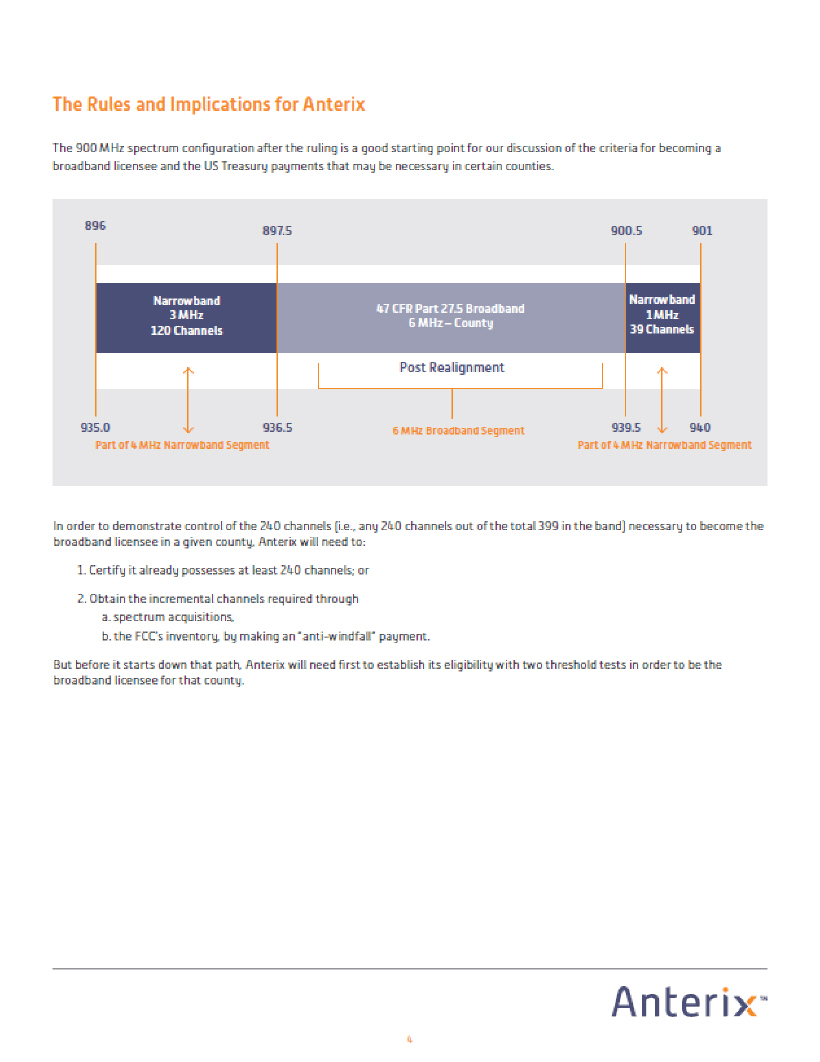

Eligibility Test #1 – 50% of the Licensed Channels in the Entire 10 MHz

Test #1 mandates that a successful applicant must hold licenses for greater than 50% of the channels licensed in a county. To be clear, the 50% threshold is of channels licensed in the entire 10 MHz that constitutes the 900 MHz band, a maximum of 399 channels.10 In most of the country the FCC has licensed fewer than 399 channels, resulting in a smaller denominator to measure the 50%. Anterix currently holds licenses for over 50% of the licensed channels in more than 3,100 counties of the 3,223 counties in the United States (excluding Pacific territories). See Map 1 below.

Eligibility Test #2 – 90% of the Licensed Channels in the Broadband Segment

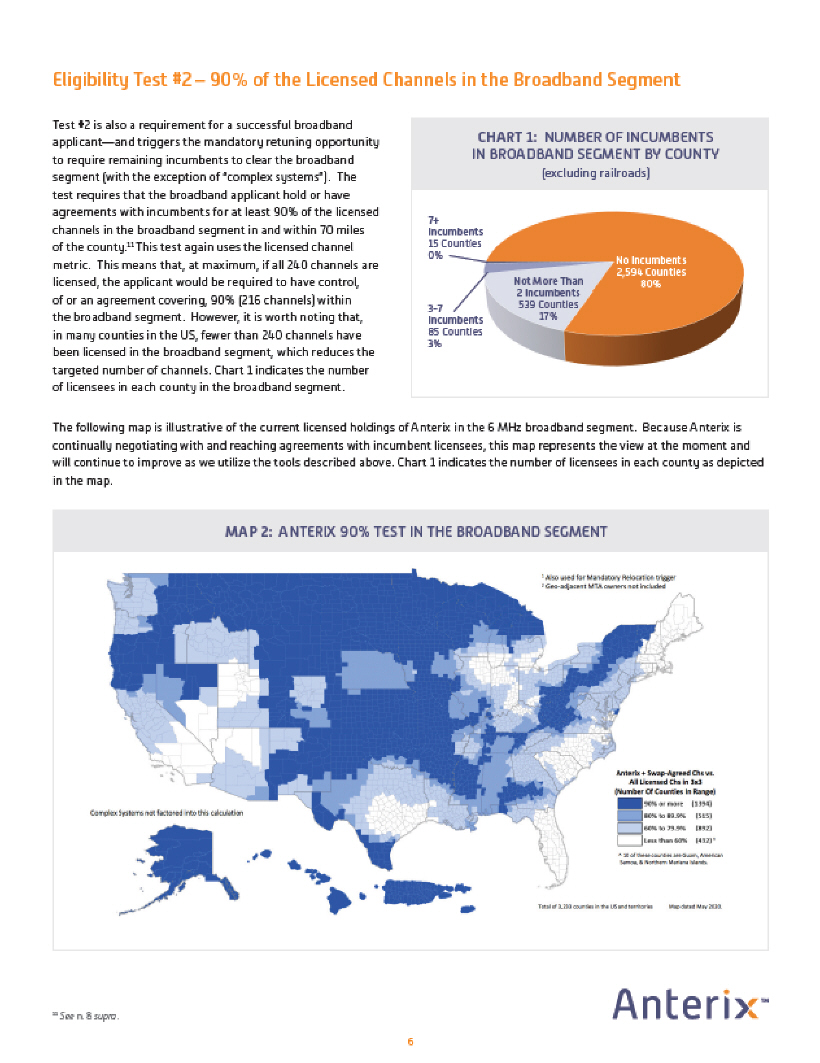

Test #2 is also a requirement for a successful broadband applicant—and triggers the mandatory retuning opportunity to require remaining incumbents to clear the broadband segment (with the exception of “complex systems”). The test requires that the broadband applicant hold or have agreements with incumbents for at least 90% of the licensed channels in the broadband segment in and within 70 miles of the county.11 This test again uses the licensed channel metric. This means that, at maximum, if all 240 channels are licensed, the applicant would be required to have control, of or an agreement covering, 90% (216 channels) within the broadband segment. However, it is worth noting that, in many counties in the US, fewer than 240 channels have been licensed in the broadband segment, which reduces the targeted number of channels. Chart 1 indicates the number of licensees in each county in the broadband segment.

CHART 1: NUMBER OF INCUMBENTS IN BROADBAND SEGMENT BY COUNTRY (excluding raildroads)

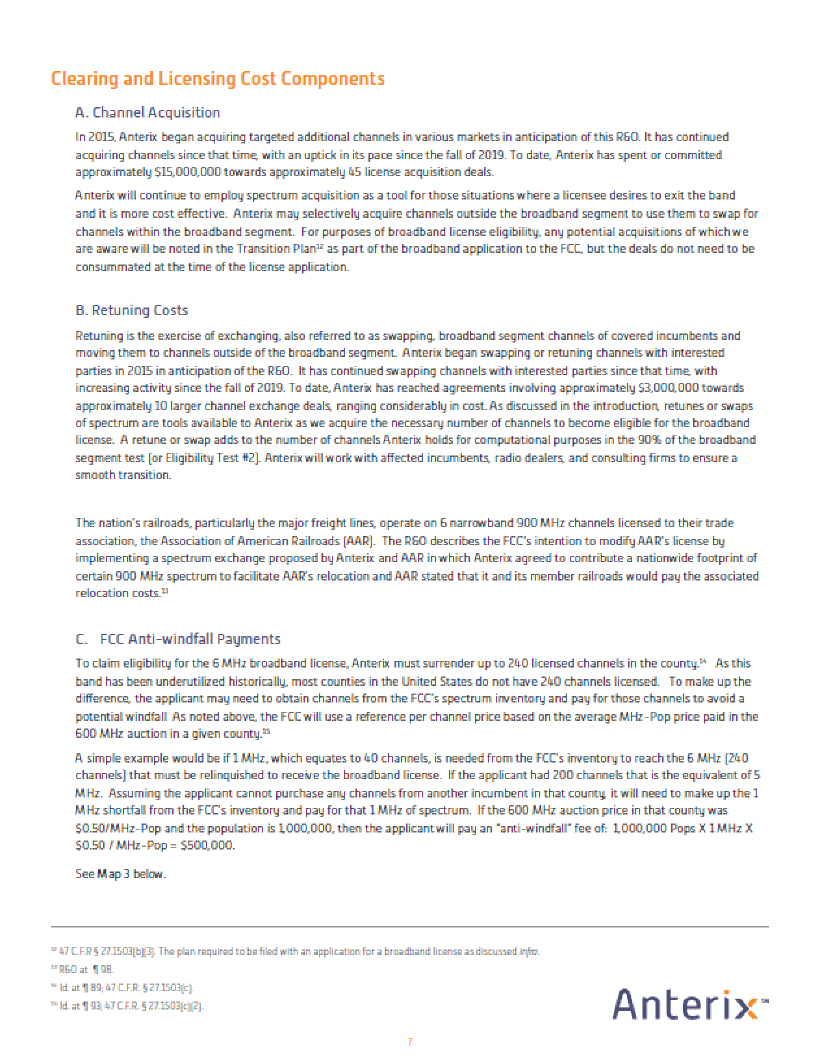

The following map is illustrative of the current licensed holdings of Anterix in the 6 MHz broadband segment. Because Anterix is continually negotiating with and reaching agreements with incumbent licensees, this map represents the view at the moment and will continue to improve as we utilize the tools described above. Chart 1 indicates the number of licensees in each county as depicted in the map.

MAP 2: ANTERIX 90% TEST IN THE BROADBAND SEGMENT

Clearing and Licensing Cost Components

A. Channel Acquisition

In 2015, Anterix began acquiring targeted additional channels in various markets in anticipation of this R&O. It has continued acquiring channels since that time, with an uptick in its pace since the fall of 2019. To date, Anterix has spent or committed approximately $15,000,000 towards approximately 45 license acquisition deals.

Anterix will continue to employ spectrum acquisition as a tool for those situations where a licensee desires to exit the band and it is more cost effective. Anterix may selectively acquire channels outside the broadband segment to use them to swap for channels within the broadband segment. For purposes of broadband license eligibility, any potential acquisitions of which we are aware will be noted in the Transition Plan12 as part of the broadband application to the FCC, but the deals do not need to be consummated at the time of the license application.

B. Retuning Costs

Retuning is the exercise of exchanging, also referred to as swapping, broadband segment channels of covered incumbents and moving them to channels outside of the broadband segment. Anterix began swapping or retuning channels with interested parties in 2015 in anticipation of the R&O. It has continued swapping channels with interested parties since that time, with increasing activity since the fall of 2019. To date, Anterix has reached agreements involving approximately $3,000,000 towards approximately 10 larger channel exchange deals, ranging considerably in cost. As discussed in the introduction, retunes or swaps of spectrum are tools available to Anterix as we acquire the necessary number of channels to become eligible for the broadband license. A retune or swap adds to the number of channels Anterix holds for computational purposes in the 90% of the broadband segment test (or Eligibility Test #2). Anterix will work with affected incumbents, radio dealers, and consulting firms to ensure a smooth transition.

The nation’s railroads, particularly the major freight lines, operate on 6 narrowband 900 MHz channels licensed to their trade association, the Association of American Railroads (AAR). The R&O describes the FCC’s intention to modify AAR’s license by implementing a spectrum exchange proposed by Anterix and AAR in which Anterix agreed to contribute a nationwide footprint of certain 900 MHz spectrum to facilitate AAR’s relocation and AAR stated that it and its member railroads would pay the associated relocation costs.13

C. FCC Anti-windfall Payments

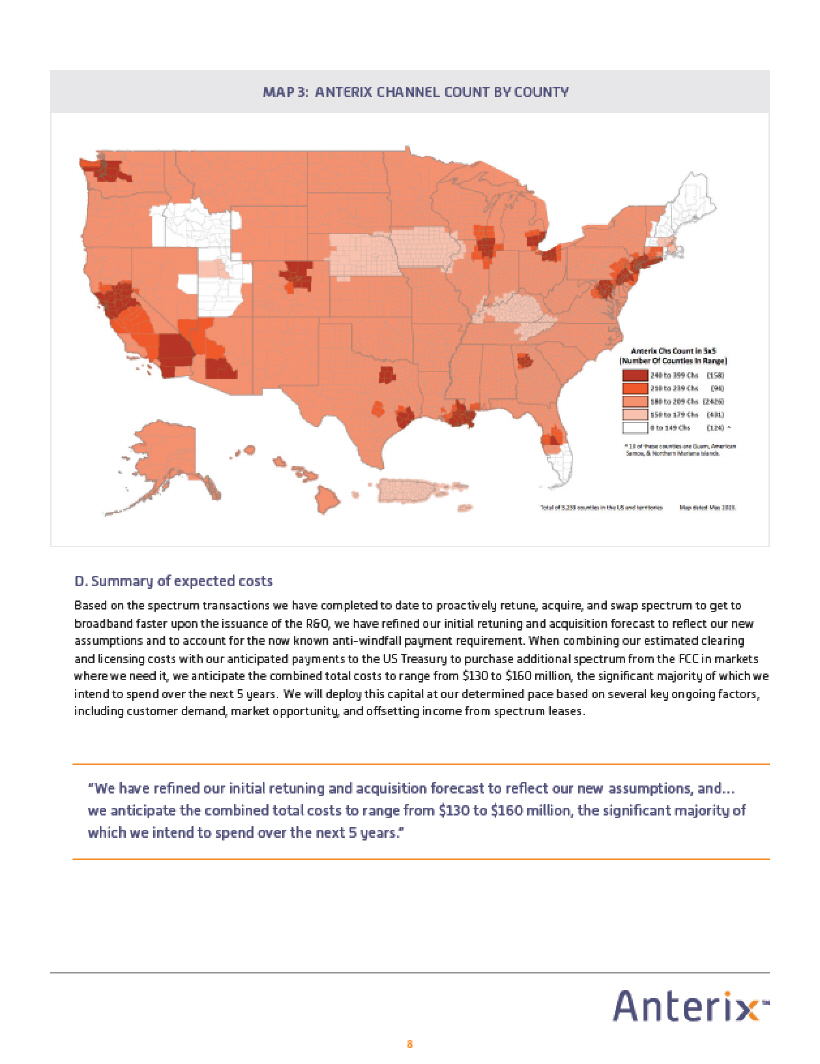

To claim eligibility for the 6 MHz broadband license, Anterix must surrender up to 240 licensed channels in the county.14 As this band has been underutilized historically, most counties in the United States do not have 240 channels licensed.To make up the difference, the applicant may need to obtain channels from the FCC’s spectrum inventory and pay for those channels to avoid a potential windfall As noted above, the FCC will use a reference per channel price based on the average MHz-Pop price paid in the 600 MHz auction in a given county.15

A simple example would be if 1 MHz, which equates to 40 channels, is needed from the FCC’s inventory to reach the 6 MHz (240 channels) that must be relinquished to receive the broadband license. If the applicant had 200 channels that is the equivalent of 5 MHz. Assuming the applicant cannot purchase any channels from another incumbent in that county, it will need to make up the 1 MHz shortfall from the FCC’s inventory and pay for that 1 MHz of spectrum. If the 600 MHz auction price in that county was $0.50/MHz -Pop and the population is 1,000,000, then the applicant will pay an “anti-windfall” fee of: 1,000,000 Pops X 1 MHz X $0.50 / MHz-Pop = $500,000.

See Map 3 below.

12 47 C.F.R § 27.1503(b)(3) . The plan required to be filed with an application for a broadband license as discussed infra.

13 R&O at ¶ 98.

14 Id. at ¶ 89; 47 C.F.R. § 27.1503(c).

15 Id. at ¶ 93; 47 C.F.R. § 27.1503(c)(2).

MAP 3: ANTERIX CHANNEL COUNT BY COUNTY

D.Summary of expected costs

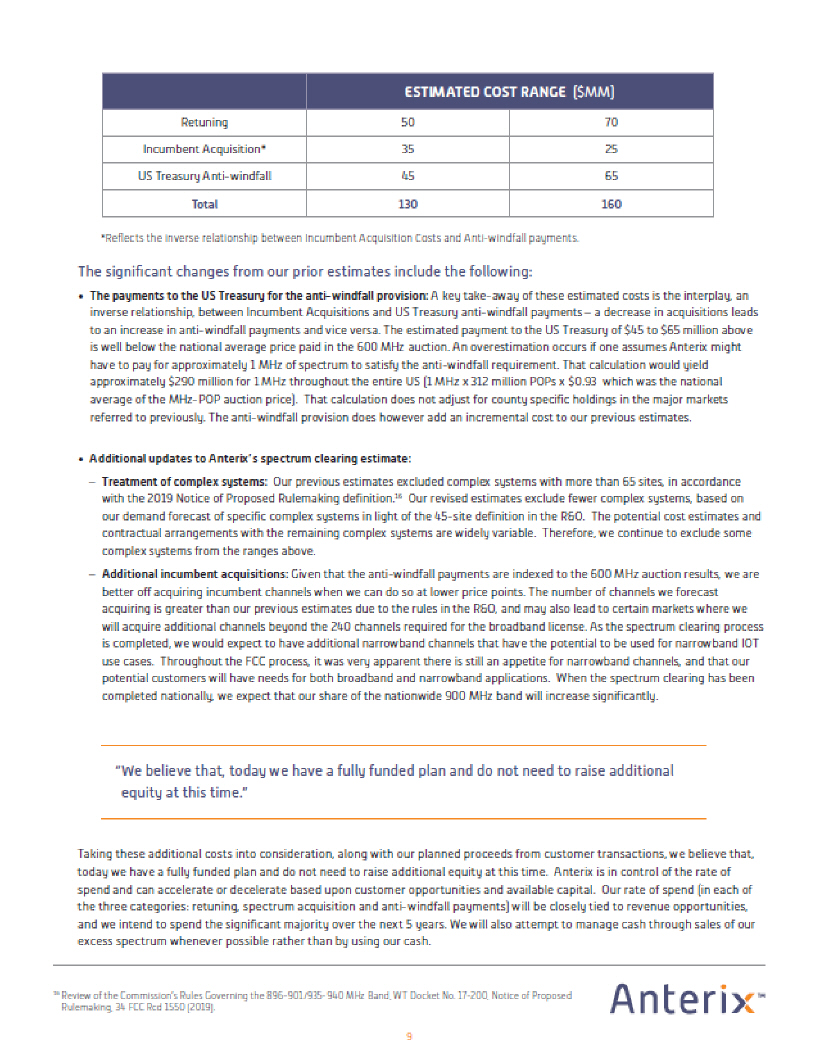

Based on the spectrum transactions we have completed to date to proactively retune, acquire, and swap spectrum to get to broadband faster upon the issuance of the R&O, we have refined our initial retuning and acquisition forecast to reflect our new assumptions and to account for the now known anti-windfall payment requirement. When combining our estimated clearing and licensing costs with our anticipated payments to the US Treasury to purchase additional spectrum from the FCC in markets where we need it, we anticipate the combined total costs to range from $130 to $160 million, the significant majority of which we intend to spend over the next 5 years. We will deploy this capital at our determined pace based on several key ongoing factors, including customer demand, market opportunity, and offsetting income from spectrum leases.

“We have refined our initial retuning and acquisition forecast to reflect our new assumptions, and… we anticipate the combined total costs to range from $130 to $160 million, the significant majority of which we intend to spend over the next 5 years.”

ESTIMATED COST RANGE ($MM)

Retuning 50 70

Incumbent Acquisition* 35 25

US Treasury Anti-windfall 45 65

Total 130 160

*Reflects the inverse relationship between Incumbent Acquisition Costs and Anti-windfall payments.

The significant changes from our prior estimates include the following:

The payments to the US Treasury for the anti-windfall provision: A key take-away of these estimated costs is the interplay, an inverse relationship, between Incumbent Acquisitions and US Treasury anti-windfall payments – a decrease in acquisitions leads to an increase in anti-windfall payments and vice versa. The estimated payment to the US Treasury of $45 to $65 million above is well below the national average price paid in the 600 MHz auction. An overestimation occurs if one assumes Anterix might have to pay for approximately 1 MHz of spectrum to satisfy the anti-windfall requirement. That calculation would yield approximately $290 million for 1 MHz throughout the entire US (1 MHz x 312 million POPs x $0.93 which was the national average of the MHz-POP auction price). That calculation does not adjust for county specific holdings in the major markets referred to previously. The anti-windfall provision does however add an incremental cost to our previous estimates.

Additional updates to Anterix’s spectrum clearing estimate:

Treatment of complex systems: Our previous estimates excluded complex systems with more than 65 sites, in accordance with the 2019 Notice of Proposed Rulemaking definition.16 Our revised estimates exclude fewer complex systems, based on our demand forecast of specific complex systems in light of the 45-site definition in the R&O. The potential cost estimates and contractual arrangements with the remaining complex systems are widely variable. Therefore, we continue to exclude some complex systems from the ranges above.

Additional incumbent acquisitions: Given that the anti-windfall payments are indexed to the 600 MHz auction results, we are better off acquiring incumbent channels when we can do so at lower price points. The number of channels we forecast acquiring is greater than our previous estimates due to the rules in the R&O, and may also lead to certain markets where we will acquire additional channels beyond the 240 channels required for the broadband license. As the spectrum clearing process is completed, we would expect to have additional narrowband channels that have the potential to be used for narrowband IOT use cases. Throughout the FCC process, it was very apparent there is still an appetite for narrowband channels, and that our potential customers will have needs for both broadband and narrowband applications. When the spectrum clearing has been completed nationally, we expect that our share of the nationwide 900 MHz band will increase significantly.

“We believe that, today we have a fully funded plan and do not need to raise additional equity at this time.”

Taking these additional costs into consideration, along with our planned proceeds from customer transactions, we believe that, today we have a fully funded plan and do not need to raise additional equity at this time. Anterix is in control of the rate of spend and can accelerate or decelerate based upon customer opportunities and available capital. Our rate of spend (in each of the three categories: retuning, spectrum acquisition and anti-windfall payments) will be closely tied to revenue opportunities, and we intend to spend the significant majority over the next 5 years. We will also attempt to manage cash through sales of our excess spectrum whenever possible rather than by using our cash.

16 Review of the Commission’s Rules Governing the 896-901/935-940 MHz Band, WT Docket No. 17-200, Notice of Proposed Rulemaking, 34 FCC Rcd 1550 (2019).

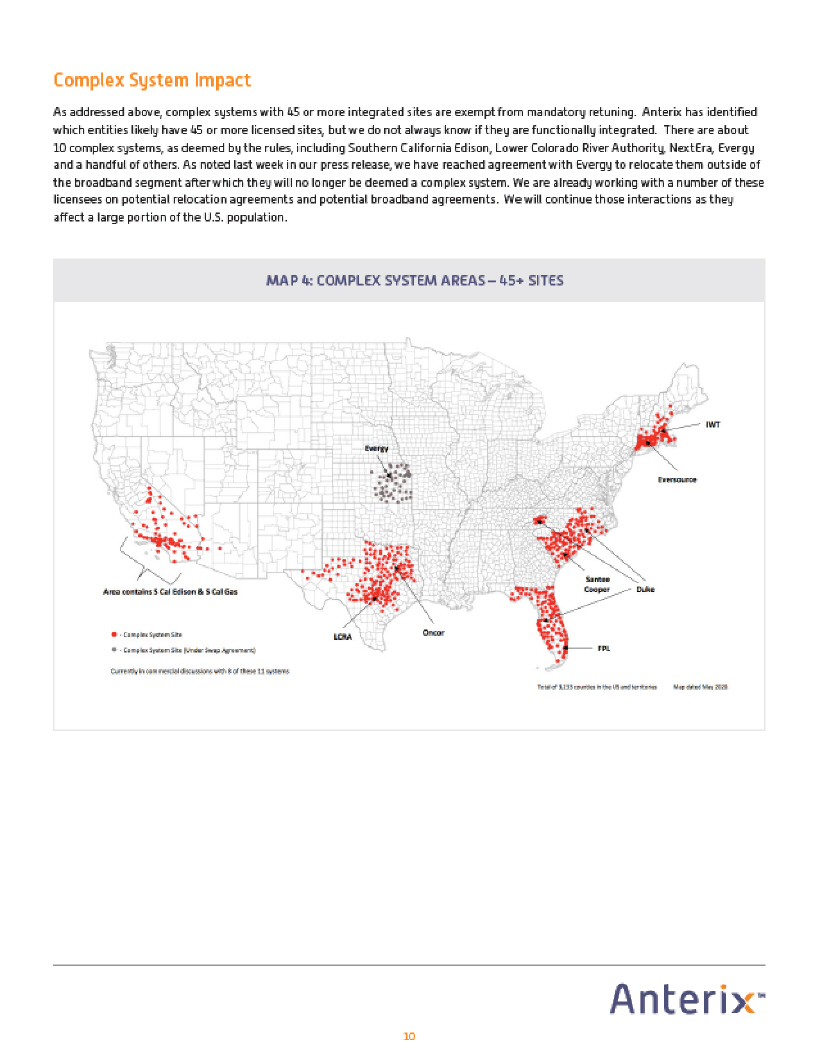

Complex System Impact

As addressed above, complex systems with 45 or more integrated sites are exempt from mandatory retuning. Anterix has identified which entities likely have 45 or more licensed sites, but we do not always know if they are functionally integrated. There are about 10 complex systems, as deemed by the rules, including Southern California Edison, Lower Colorado River Authority, NextEra, Evergy and a handful of others. As noted last week in our press release, we have reached agreement with Evergy to relocate them outside of the broadband segment after which they will no longer be deemed a complex system. We are already working with a number of these licensees on potential relocation agreements and potential broadband agreements. We will continue those interactions as they affect a large portion of the U.S. population.

MAP 4: COMPLEX SYSTEM AREAS – 45+ SITES

Broadband Licensing Process17

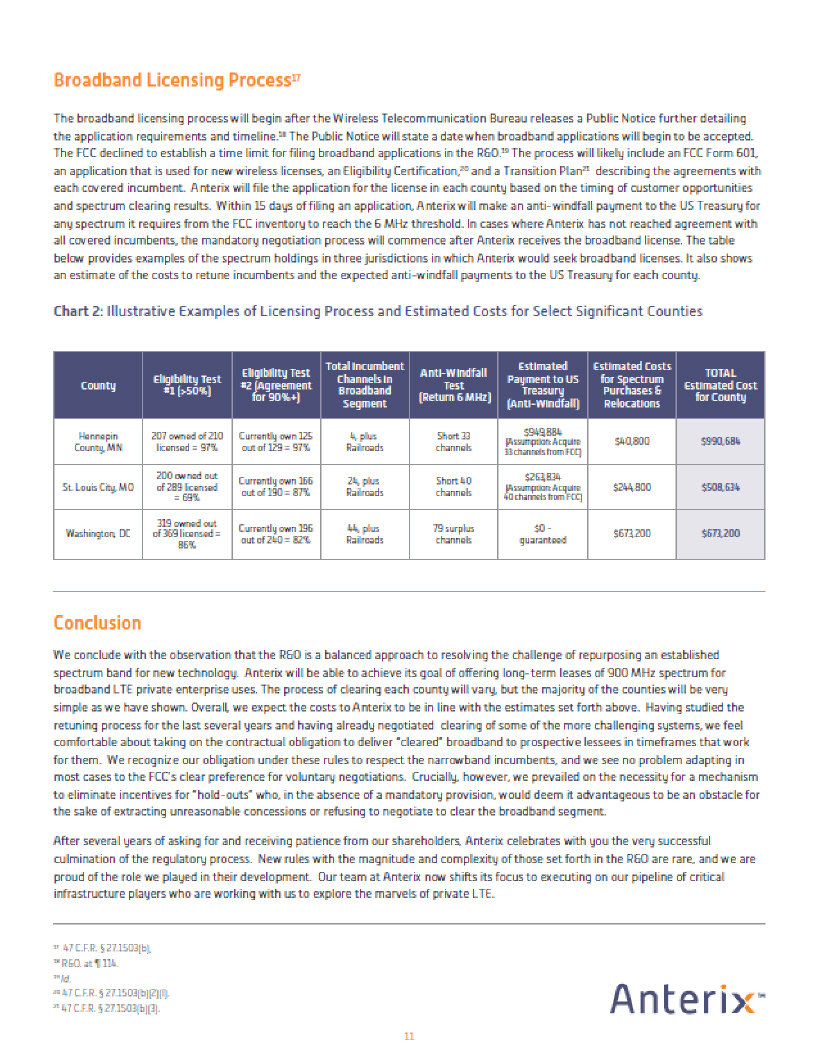

The broadband licensing process will begin after the Wireless Telecommunication Bureau releases a Public Notice further detailing the application requirements and timeline.18 The Public Notice will state a date when broadband applications will begin to be accepted. The FCC declined to establish a time limit for filing broadband applications in the R&O.19 The process will likely include an FCC Form 601, an application that is used for new wireless licenses, an Eligibility Certification,20 and a Transition Plan21 describing the agreements with each covered incumbent. Anterix will file the application for the license in each county based on the timing of customer opportunities and spectrum clearing results. Within 15 days of filing an application, Anterix will make an anti-windfall payment to the US Treasury for any spectrum it requires from the FCC inventory to reach the 6 MHz threshold. In cases where Anterix has not reached agreement with all covered incumbents, the mandatory negotiation process will commence after Anterix receives the broadband license. The table below provides examples of the spectrum holdings in three jurisdictions in which Anterix would seek broadband licenses. It also shows an estimate of the costs to retune incumbents and the expected anti-windfall payments to the US Treasury for each county.

Chart 2: Illustrative Examples of Licensing Process and Estimated Costs for Select Significant Counties

County Eligibility Test #1 (>50%) Eligibility Test#2 (Agreement for 90%+) Total Incumbent Channels in Broadband Segment Anti-Windfall Test (Return 6 MHz) Estimated Payment to US Treasury (Anti-Windfall) Estimated Costs for Spectrum Purchases & Relocations Total Estimated Cost for County

Hennepin County, MN 207 owned of 210 licensed = 97% Currently own 125 out of 129 = 97% 4, plus Railroads Short 33 channels $949,884 (Assumption: Acquire 33 channels from FCC) $40,800 $990,684

St. Louis City, MO 200 owned out of 289 licensed = 69% Currently own 166 out of 190 = 87% 24, plus Railroads Short 40 channels

$263,834 (Assumption: Acquire 40 channels from FCC) $244,800 $508,634

Washington, DC 319 owned out of 369 licensed = 86% Currently own 196 out of 240 = 82% 44, plus Railroads 79 surplus channels $0 – guaranteed $673,200 $673,200

Conclusion

We conclude with the observation that the R&O is a balanced approach to resolving the challenge of repurposing an established spectrum band for new technology. Anterix will be able to achieve its goal of offering long-term leases of 900 MHz spectrum for broadband LTE private enterprise uses. The process of clearing each county will vary, but the majority of the counties will be very simple as we have shown. Overall, we expect the costs to Anterix to be in line with the estimates set forth above. Having studied the retuning process for the last several years and having already negotiated clearing of some of the more challenging systems, we feel comfortable about taking on the contractual obligation to deliver “cleared” broadband to prospective lessees in timeframes that work for them. We recognize our obligation under these rules to respect the narrowband incumbents, and we see no problem adapting in most cases to the FCC’s clear preference for voluntary negotiations. Crucially, however, we prevailed on the necessity for a mechanism to eliminate incentives for “hold-outs” who, in the absence of a mandatory provision, would deem it advantageous to be an obstacle for the sake of extracting unreasonable concessions or refusing to negotiate to clear the broadband segment.

After several years of asking for and receiving patience from our shareholders, Anterix celebrates with you the very successful culmination of the regulatory process. New rules with the magnitude and complexity of those set forth in the R&O are rare, and we are proud of the role we played in their development. Our team at Anterix now shifts its focus to executing on our pipeline of critical infrastructure players who are working with us to explore the marvels of private LTE.

17 47 C.F.R. § 27.1503(b),

18 R&O. at ¶ 114.

19 Id.

20 47 C.F.R. § 27.1503(b)(2)(l) .

21 47 C.F.R. § 27.1503(b)(3) .

Glossary of Key Terms

> 240 Channels: Equals 6 MHz of 900 MHz spectrum whether the individual 25 kHz channels are scattered throughout the

5x5/10 MHz 900 MHz band or are the contiguous 3x3/6 MHz broadband segment.

> 3x3 or 6 MHz: The broadband segment of the 900 MHz band is authorized for a total of 6 MHz of spectrum, with 3 MHz

designated for uplink transmissions and 3 MHz for downlink transmissions.

> 5x5 or 10 MHz: The 900 MHz band is authorized for a total of 10 MHz of spectrum, with 5 MHz designated for uplink

transmissions and 5 MHz for downlink transmissions.

> 600 MHz Auction: The FCC’s 2016 “incentive auction” in which licensees of television broadcast channels were incentivized

to relinquish their spectrum for defined payments so the spectrum could be repurposed for licensed wireless services.

> Anti-Windfall Payment: A payment to the U.S. Treasury from a 900 MHz broadband applicant if the applicant relinquishes

less than six megahertz of spectrum with the amount of the payment based on the per MHz-pop 600 MHz forward auction

prices for the Partial Economic Area in which the county applied for by the broadband applicant is included.

> Channel Size: FCC licenses authorize the use of channels of varying bandwidths. 900 MHz narrowband channels each are

authorized for 25 kHz bandwidth (12.5 kHz each uplink and downlink). The broadband license will be authorized for 6 MHz

bandwidth (3 MHz each uplink and downlink), the equivalent of 240 25 kHz bandwidth channels.

> Complex System: A covered incumbent’s system that consists of 45 or more functionally integrated sites.

> Covered Incumbent: Any 900 MHz site-based licensee in the broadband segment that is required under section 90.621(b)

to be protected by a broadband licensee with a base station at any location within the county, or any 900 MHz geographic-

based SMR licensee in the broadband segment whose license area completely or partially overlaps the county.

> Eligibility Certification: A document filed as part of the broadband application that lists the licenses the applicant holds in

the 900 MHz band to demonstrate that it holds the licenses for more than 50% of the total licensed 900 MHz spectrum for the

relevant county including credit for spectrum included in an application to acquire or relocate any covered incumbents filed on

or after March 14, 2019.

> FCC Form 601: FCC Application used for Wireless Telecommunications Bureau Radio Service Authorizations such as a 900

MHz broadband license.

> Licensed Channel: Any of the 399 25 kHz narrowband 900 MHz channels for which the FCC has issued a license to an entity.

Some channels remain in the FCC inventory.

> Mandatory Retuning: A process by which an eligible broadband applicant can relocate a covered incumbent to channels

outside the broadband segment if the replacement channels provide comparable facilities to the covered incumbent’s existing

system and the broadband applicant pays all reasonable retuning costs.

> MTA: Major Trading Area; service areas based on the Rand McNally 1992 Commercial Atlas & Marketing Guide, that define 900

MHz SMR geographic licenses,

> Narrowband Channel: A 900 MHz 25 kHz bandwidth channel.

> Railroads: The freight railroads that, through the Association of American Railroads, hold an effectively nationwide license for

six non-contiguous 900 MHz channels, three of which are in the broadband segment.

> Retuning: Modifying a covered incumbent’s narrowband system to operate on channels outside the broadband segment.

> Swapping: Exchanging Anterix channels outside the broadband segment for the broadband segment channels held by a covered incumbent.

> Transition Plan: A document filed as part of the broadband application that demonstrates that the applicant holds or has agreements to acquire, relocate or protect at least 90% of the licensed channels of covered incumbents in the county.

Forward-Looking Statements

Any statements contained in this Stockholder Letter that do not describe historical facts are forward-looking statements as defined under the Federal securities laws. These forward-looking statements may include, but are not limited to, statements regarding: (i) Anterix Inc.’s (the “Company’s) ability to qualify for and obtain broadband licenses pursuant to terms of the R&O; (ii) the demand by utilities and critical infrastructure enterprises to enter into long-term lease arrangements for the Company’s spectrum assets and to deploy broadband LTE networks and solutions; and (iii) the Company’s estimated costs and timing to complete the spectrum clearing required to obtain broadband licenses, including spectrum swaps, retuning incumbent systems, acquiring spectrum from incumbents and the FCC and entering agreements with operators of complex systems. Any such forward-looking statements are based on the Company’s current expectations and are subject to a number of risks and uncertainties that could cause its actual future results to differ materially from its current expectations or those implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: (i) the Company may not be able to obtain broadband licenses on a timely basis or on commercially acceptable terms, or at all; (ii) the Company may not be successful in commercializing its spectrum assets to its targeted customers and markets; (iii) the Company may not be able to correctly estimate its operating expenses and revenues, which could lead to cash shortfalls, and require it to secure additional financing sooner than planned; (iv) the ongoing coronavirus pandemic could adversely impact the Company’s business, commercialization efforts and operations; (v) the Company has no operating history with its proposed business plan, which makes it difficult to evaluate its prospects and future financial results; and (vi) the Company may not be able to successfully compete against competitors, including Tier 1 carriers, offering broadband offerings and technologies, products and services to the Company’s target customers. These and other factors that may affect the Company’s future results of operations are identified and described in more detail in its filings with the Securities and Exchange Commission (the “SEC”), including its Current Report on Form 8-K filed, with the SEC on May 18, 2020, its Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2019, filed with the SEC on February 4, 2020 and its subsequent filings. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Stockholder Letter. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.