Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | zions-20200518.htm |

Investor Update Second Quarter 2020 May 2020

Forward-Looking Statements; Use of Non-GAAP Financial Measures Forward Looking Information These materials include “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expectations regarding future events or determinations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, industry results or regulatory outcomes to differ materially from those expressed or implied by such forward-looking statements. Without limiting the foregoing, the words “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “would,” “targets,” “will” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about future financial and operating results. Actual results and outcomes may differ materially from those presented, either expressed or implied, in the presentation. Important risk factors that may cause such material differences include, but are not limited to, the effects of the spread of the virus commonly referred to as the coronavirus or COVID-19 (and other potentially similar pandemic situations) and associated impacts on general economic conditions on, among other things, our customers’ ability to make timely payments on obligations, fee income revenue due to reduced loan origination activity and card swipe income, operating expense due to alternative approaches to doing business, and so forth; the Bank’s ability to meet operating leverage goals; the rate of change of interest-sensitive assets and liabilities relative to changes in benchmark interest rates; the effects on profitability due to the decline in oil and gas prices, the ability of the Bank to upgrade its core deposit system and implement new digital products in order to remain competitive; risks associated with information security, such as systems breaches and failures; and legislative, regulatory and economic developments. These risks, as well as other factors, are discussed in the Bank’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (SEC) and available at the SEC’s Internet site (https://www.sec.gov/). In addition, you may obtain documents filed with the SEC by the Bank free of charge by contacting: Investor Relations, Zions Bancorporation, N.A., One South Main Street, 11th Floor, Salt Lake City, Utah 84133, (801) 844-7637. Except as required by law, Zions Bancorporation, N.A. specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. Use of Non-GAAP Financial Measures: This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors. Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation. 2

Zions’ Profile: Zions Is A Collection of Community Banks Key Differentiators: Local decision-making and top-notch service, commercial banking focus, granular and low-cost deposit base ▪ Strategic local “ownership” of market opportunities Zions’ Markets Deposits % and challenges Bank Headquarters $Billions of Total Zions Bank Salt Lake City $16 28% Amegy Houston 12 21% ▪ Roughly 2/3 of revenue from commercial customers CB&T San Diego 12 21% NB│AZ Phoenix 5 9% ▪ High quality, granular deposit franchise NSB Las Vegas 5 8% Vectra Denver 3 5% ▪ 41%: Noninterest bearing deposits (avg) to total deposits Commerce Seattle 1 2% Other1 Salt Lake City 3 6% ▪ 0.36%: Cost of deposits consistently among the lowest Zions Bancorporation Salt Lake City $57 100% of peers (ranked second best of peers in 1Q20) Financial Highlights Key Metrics 2020Q1 Listing NASDAQ: ZION Market Capitalization (as of 05/08/20) $4.8B Total Assets $71.5B Total Loans $49.2B Total Deposits $57.5B Common Equity Tier 1 Capital $5.6B Common Equity Tier 1 Capital Ratio 10.0% Zions Bancorp. Rating (S&P/Fitch/Kroll)2 BBB+/BBB+/A- Rating Outlook (S&P/Fitch/Kroll)2 Neg / Neg / Stable Source: SNL Financial/S&P Global. 1 Represents primarily brokered deposits. 2 Represents long-term debt / senior debt issuer rating, as of May 8, 2020. 3

Zions’ Profile: Zions is a Leader in Small Business Lending Zions punches above its weight Commercial Loans Commercial Loans ($ billion) sized $100k - $1M sized $100k - $1M $25 30% as a percent of total commercial loans 25% $20 20% $15 15% $10 10% $5 5% $0 0% C RF C FRC KEY RF CFG ASB FNB USB BAC SNV JPM FHN FITB WFC WAL CMA ZION FRC KEY PBCT CFG ASB FNB BOKF USB BAC SNV JPM FHN FITB WTFC WFC HBAN EWBC WAL CMA ZION PBCT BOKF WTFC HBAN EWBC Five largest U.S. banks Note: Call report data via SNL Financial/S&P Global, as of 1Q20; peer group shown different than typical peer group in order to 4 show the position of the largest U.S. banks. Commercial loans includes both C&I and CRE.

Zions’ Profile: Zions Receives National and Local Recognition for Excellence Affiliates have strong brands in their markets One of only six banks to have averaged 14 Greenwich Excellence Awards since 2009 (survey inception) Top team of women bankers (2015-2019) 1 Voted Best Bank in San Diego and Orange National Bank of Arizona Counties for many years in a row consistently voted #1 Bank in Arizona3 Business Services – Banking Nevada State Bank consistently voted and Community Development #1 Bank in Nevada4 – Large Business 5 1 www.americanbanker.com/news/women-in-banking-top-team-for-2019-zions-bancorp; 2 The San Diego Union-Tribune (annually #1 from 2011-2019) 5 and Orange County Register (annually1. One #1 of from five winning 2014-2019); teams, 3 2015,Fifteen Zions annual Bank; occurrences, 2. exim.gov, April Ranking 24, 2014; Arizona 3.Readers Magazine; of the 4SanLas Diego Vegas Union Review-Tribune,-Journal, Reno Magazine, Elko Daily Free Press August 2015, for 5 years; Orange County Register, for two years in a row; 4.Ranking Arizona, 2015

Zions’ Profile: Zions’ Business Banking Reputation is Highly Ranked Zions compares favorably to key competitors (JPMorgan, Bank of America, US Bank, Wells Fargo) Overall Satisfaction Customer Satisfaction With Our Bankers Customer Satisfaction - Credit Process 90 90 90 80 80 80 Middle Market 70 70 70 60 60 60 Customers 50 50 50 (Revenues $10- 40 40 40 500 million) 30 30 30 20 20 20 10 10 10 0 0 0 % of % "Excellent" Customer Citations Overall Bank You Can Trust Digital Product Satisfaction with Satisfaction with Satisfaction with Willingness to Speed in responding Flexible terms and Satisfaction Capabilities Relationship Cash Management Branch extend credit to a loan request conditions Managers Specialist 90 90 90 80 80 80 70 70 70 Small Business 60 60 60 Customers 50 50 50 (Revenues $1-10 40 40 40 million) 30 30 30 20 20 20 10 10 10 0 0 0 % of % "Excellent" Customer Citations Overall Bank You Can Trust Digital Product Satisfaction with Satisfaction with Satisfaction with Willingness to Speed in responding Flexible terms and Satisfaction Capabilities Relationship Cash Management Branch extend credit to a loan request conditions Managers Specialist Zions Peer Average Source: 2018 Greenwich Associates Market Tracking Program Nationwide. Key Competitors Include: JPMorgan, Bank of America Merrill Lynch, US Bank, Wells Fargo 6 “Excellent” Citations are a "5" on a 5 point scale from "5" excellent to "1" poor.

Zions’ Profile: Digital Capabilities Meaningfully Upgraded Over the Last Several Years COMMERCIAL SMALL BUSINESS AFFLUENT CONSUMER Treasury Internet Banking 2.0 2018-2019 Online and Mobile Banking Replacement 2020-2021 $10B Demand Deposits 625,000 consumer accounts $100MM Fee Income 125,000 business accounts Digital Business Loan Application 2019 Digital Mortgage Loan Application 2019 $2B Loan Balances $2.7B Fundings 4,000 Applications 10,000 Applications Mobile Positive Pay 2019 Small Business and Consumer Digital Account Opening 2016 -2019 Supporting 50% of Treasury Customers Deposit, Credit Card, and Consumer Loans – 9 out of 10 Customer Satisfaction Score Deposit Product Simplification 2018-2019 1.5 Million Accounts - Moving from 500 to 100 Account Types CUSTOMER FIRST AND FIRST CUSTOMER EMPOWERING BANKERS EMPOWERING Relationship Manager Mobile Enablement 2019-2020 Public Website Relaunch 2018-2019 3 million visits per month Customer Data Hub 2019-2021 Master Data Management for Systems of Record Automation Center of Excellence 138 processes Automated CORE FutureCore Release 1 & 2 2017-2019 FutureCore Release 3 Underway DIGITAL TO THE THE TO DIGITAL Consumer, C&I, and CRE Lending Core System Replacement Deposit System Replacement 7

Earnings Trends: Long-time Focus on Expense Control, EPS Impacted in 1Q20 by a Large Provision For Credit Losses Positive operating leverage achieved through revenue growth and expense control Net Revenue Noninterest Expense 160 ZION 160 Indexed: 4Q14 = 100 Indexed: 4Q14 = 100 150 Peer Top Quartile 150 140 140 Peer Bottom Quartile 130 130 120 120 110 110 100 100 90 90 Adjusted Pre-Provision Net Revenue EPS Growth 325 325 Indexed: 4Q14 = 100 300 Indexed: 4Q14 = 100 300 275 275 250 250 225 225 200 200 175 175 150 150 125 125 100 100 75 75 50 50 25 25 0 0 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 Source: SNL Financial/S&P Global. Data adjusted to account for major acquisitions. Zions results adjusted in 1Q19, 2Q19, 3Q18, 2Q18, 1Q18 and 2Q17 to exclude interest 8 income from loan recoveries which were greater than $1 million, a $4 million adjustment in 3Q18 for FDIC true-up and a charitable foundation contribution of $12 million in 4Q17. Results also adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs.

Noninterest Expense Management – a Long-Standing Focus One of the strongest expense control performances among peers… despite significant investments in technology Noninterest Expense Year-over-year % change 15.3% 12.9% 13.6% 11.3% 11.7% 9.6% 8.7% 6.7% Year-over-year Adjusted Noninterest 5.8% Expense for Zions was down 6% 1.3% -1.1% -0.8% -2.1% -1.8% -3.4% -3.1% -5.3% -5.1% RF FRC KEY CFG ASB FNB SNV FHN FITB MTB WAL CMA ZION PBCT BOKF WTFC HBAN EWBC Source: SNL Financial/S&P Global. Zions’ “adjusted” noninterest expense excludes the effect of severance, restructuring, other real estate owned 9 expense, and other items as disclosed in the GAAP-to-Non-GAAP tables at the end of this document.

Profitability Metrics Efficiency and ROA improvement linked to relatively stable noninterest expense and revenue growth. Expense cuts in 4Q19 expected to benefit 2020 financial performance. Efficiency Ratio 80 % Return on Assets 1.8% 1.6% 75 1.4% 70 1.2% 1.0% 65 0.8% 60 0.6% 0.4% 55 0.2% 50 0.0% 1H14 2H14 1H15 2H15 1H16 2H16 1H17 2H17 1H18 2H18 1H19 2H19 1H17 1H14 2H14 1H15 2H15 1H16 2H16 2H17 1H18 2H18 1H19 2H19 1Q20 1Q20 ZION Peer Top Quartile Peer Bottom Quartile ZION Peer Top Quartile Peer Bottom Quartile Source: SNL Financial/S&P Global. Zions efficiency ratio includes adjustments for items such as severance, provision for unfunded lending commitments, securities gains 10 and losses and debt extinguishment costs, as outlined in the GAAP to Non-GAAP Reconciliation in the appendix.

Allowance for Unfunded Lending Commitments, Zions Allowance Zions for Credit Commitments,Loss to Allowance LendingLoan for Ratio Unfunded was 1.56% 1Q20.in Note: capitalRegulatory ratios are Basel III 1Q20;for source: SNL Global. Financial/S&P Total Risk Loss Common equity plus the allowanceequity plusthe Common for strongcredit lossis relativeto peers EWBC 12.4% - BOKF 11.0% AbsorbingCapital WAL 10.0% 10.0% ZION Common Equity Tier 1 Capital Ratio FRC 9.9% CMA 9.5% PBCT 9.5% HBAN 9.5% RF 9.5% CFG 9.4% ASB 9.4% FITB 9.4% MTB 9.2% FNB 9.1% - Basedat Capital Zions for KEY 8.9% WTFC 8.9% SNV 8.7% FHN 8.5% 1Q20 was 13.3%, Zions Including EWBC 12.4% 1.6% BOKF 11.0% 1.0% ZION 10.0% 1.4% 9.5% 1.7% HBAN CET1 Capital Ratio and Allowance for Credit Losses Risk/ Weighted Assets FITB 9.4% 1.7% WAL 10.0% 0.9% RF 9.5% 1.5% CET1Ratio CFG 9.4% 1.5% CMA 9.5% 1.3% ASB 9.4% 1.4% FRC 9.9% 0.7% ACL/RWA MTB 9.2% 1.3% FNB 9.1% 1.3% PBCT 9.5% 0.8% KEY 8.9% 1.0% SNV 8.7% 1.2% FHN 8.5% 1.2% WTFC 8.9% 0.7% 11

Net Interest Income: Significantly Benefitting from a High Quality Deposit Profile High concentration of granular retail and small business deposits; small businesses are net contributors of stable deposits Deposit Composition(1) Noninterest-Bearing Deposits / 40% Percent Total Deposits 3.5 50% 35% 3.0 40% 30% 2.5 25% 30% 2.0 20% 1.5 20% 15% 1.0 10% 10% 0.5 5% 0.0 0% 0% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Consumer Small Commercial Commerical Brokered 2007 Business Real Estate Deposits ZION Peer Top Quartile Peer Bottom Quartile Fed Funds Effective Rate (LHS) Source: SNL Financial/S&P Global, data as of 4Q19. 12 1) Defined by businesses gross annual revenues (GAR): Small Business: <$9.9 million; Commercial: ≥$10 million as of 4Q19

Net Interest Income and Net Interest Margin Changes in interest rates and balance sheet composition impact net interest income performance Net Interest Income Net Interest Margin Net Interest Margin 4Q19 NIM 1Q20 NIM 0.16% -0.08% ($ millions) 3.46% -0.13% Impact of 3.41% $576 Yield on Cost of Noninterest- $569 $567 $559 Earning Interest- bearing $548 Assets bearing Funds Funds 3.68% 3.54% 3.48% 3.46% 3.41% 1Q19 2Q19 3Q19 4Q19 1Q20 13

Net Interest Margin Volatility Actively reducing net interest margin volatility – most recent eight year ranking is considerably better than prior eight 25% Net Interest Margin Net Interest Margin Volatility 20% 5.0(%) Last 15 Years 2004-2011 15% 4.5 9% 10% 5% 4.0 0% RF FRC KEY CFG ASB FNB SNV FHN FITB MTB WAL CMA ZION PBCT BOKF WTFC HBAN EWBC 3.5 25% Net Interest Margin Volatility 20% 2012-2019 3.0 15% 10% 2.5 4% 5% 2004Y 2005Y 2006Y 2007Y 2008Y 2009Y 2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2017Y 2018Y 2019Y 0% ZION Peer Median RF FRC KEY CFG ASB FNB SNV FHN FITB MTB WAL CMA ZION PBCT BOKF WTFC HBAN EWBC Definition: Net interest margin volatility is the 8-year standard deviation of the company’s NIM, expressed as a percentage of the 14 company’s average 8-year NIM. Datasource: S&P Global Market Intelligence, calculations: Zions

Interest Rate Sensitivity Actively managing balance sheet sensitivity Net Interest Income Sensitivity (1) ▪ Interest rate sensitivity reduced through use of interest rate hedges −200 bps −100 bps +100 bps +200 bps ▪ $3.5 billion of loan interest rate swaps as of Q1 2020 1 11% In the down 100 and ▪ At 12/31/19, Zions had $1 billion of fixed-to-floating interest rate down 200 scenarios, 6% swaps on long-term debt (effectively converting the fixed rate debt models assume rates do not fall below zero into floating rate debt). In late March 2020, Zions cancelled the swaps, resulting in a gain that will reduce the cost of the related debt during its remaining life. -6% -6% Loan Reset Profile Total Deposit Betas 52% 1 −200 bps 4% 41% −100 bps 7% 25% 25% +100 bps 21% 18% 10% 11% 13% Assumed +200 bps 24% Percent of Loans of Percent Q1 2020 14% Current Fed Cycle (-225 bps) 13% ≤ 3M 4-12M Libor 1-5 years 5+ years Prior Fed Cycle (+225 bps) Historical 18% Loans After Hedging Source: Company filings and S&P Global Market Intelligence; “Prior Fed Cycle” refers to 3Q15-2Q19, reflecting the lag effect of deposit pricing relative to Fed Funds rates. The “Current Fed Cycle” begins in 3Q19 to present. 15 (1) 12-month simulated impact of an instantaneous and parallel change in interest rates. For more information see the company’s latest Form 10-K.

Decade-Long Risk Profile Improvement Since the recession, Zions has addressed the following: Concern Mitigation Concern Mitigation Negative/Low ✓ Improved ROA to levels approximately in line with peers ✓ Reduced risk through simplified business model and structure, Profitability ✓ Efficiency Ratio improved to 58.8% (YTD 2019) from 73.5% (2014) charter consolidation, merger of holding co. Simplify ✓ Improved mortgage, retail loan and business banking loan processes Processes Energy Losses ✓ Strengthened management information capabilities with enhanced and ✓ Healthy credit metrics due to (1) improved concentration limits and (2) management information systems (e.g. dashboards) More Recent More More Recent More Cloudy Credit less exposure to oilfield services Outlook Board ✓ Six new board members since 2014 Risk ✓ Consolidation of risk and credit functions across the enterprise Engagement ✓ Robust banking and risk management experience Management ✓ Risk Management best practices have permeated the culture for Infrastructure several years Low Capital ✓ Increased CET1 ratio to 10% from <6% Regulatory ✓ Reduced credit losses by more than 90% since 2008 recession, CCAR ✓ No qualitative fails in the CCAR process, ever 1 High Loan sustainable at levels lower than peers Pass/Fail ✓ Post-stress CET1 ratio stronger than CCAR median Losses ✓ Individual loan underwriting not the issue: enhanced concentration Compliance Recent Less risk management ✓ Eliminated CDOs, reduced construction loans, added mortgage loans, government agency MBS High ✓ Reduced total concentration in CRE relative to capital by more than On-Balance ✓ Reduced loan to deposit ratio from more than 100% (pro forma for the Concentration 50% since 2007 Sheet Liquidity Lockhart off-balance sheet vehicle) to the mid- to high 80s percent in CRE, C&D & ✓ Constr. & Land Dev. reduced to less than 0.5x CET1 from 2.7x in 2007; range CDOs Eliminated CDO exposure. 1 Beginning in 2018, Zions was no longer included in CCAR results as published by the Federal Reserve. However, Zions continues to conduct full-scope annual stress 16 testing using scenarios that are generally consistent with the macro stresses experienced in 2008-2010, and the results are published at zionsbancorporation.com

Credit Quality Zions entered the COVID-19 economic downturn with very clean credit quality Key Credit Metrics: Credit Quality Ratios ▪ Classified loans (1.8% of loans) 4.00% 3.50% ▪ NPAs+90(1) (0.56% of loans + OREO) 3.00% ▪ Annualized net loan losses of: ▪ 0.06% in 1Q20 2.50% ▪ 0.09% net charge-offs over the last 12 months 2.00% Allowance for credit losses of: 1.50% ▪ 1.6% of total loans and leases ($777 million) 1.00% ▪ 5.6% oil & gas related of balances ($145 million) 0.50% 0.00% Trailing 12 month net loan charge-offs/loans: 0.09% -0.50% 4Q14 4Q15 4Q16 4Q17 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 NCOs / Loans (ann.) Classified / Loans NPAs +90/ Loans + OREO ACL / Loans (1) Nonperforming assets plus loans that were ≥ 90 days past due. 17 Note: Net Charge-offs/Loans ratio is annualized for all periods shown

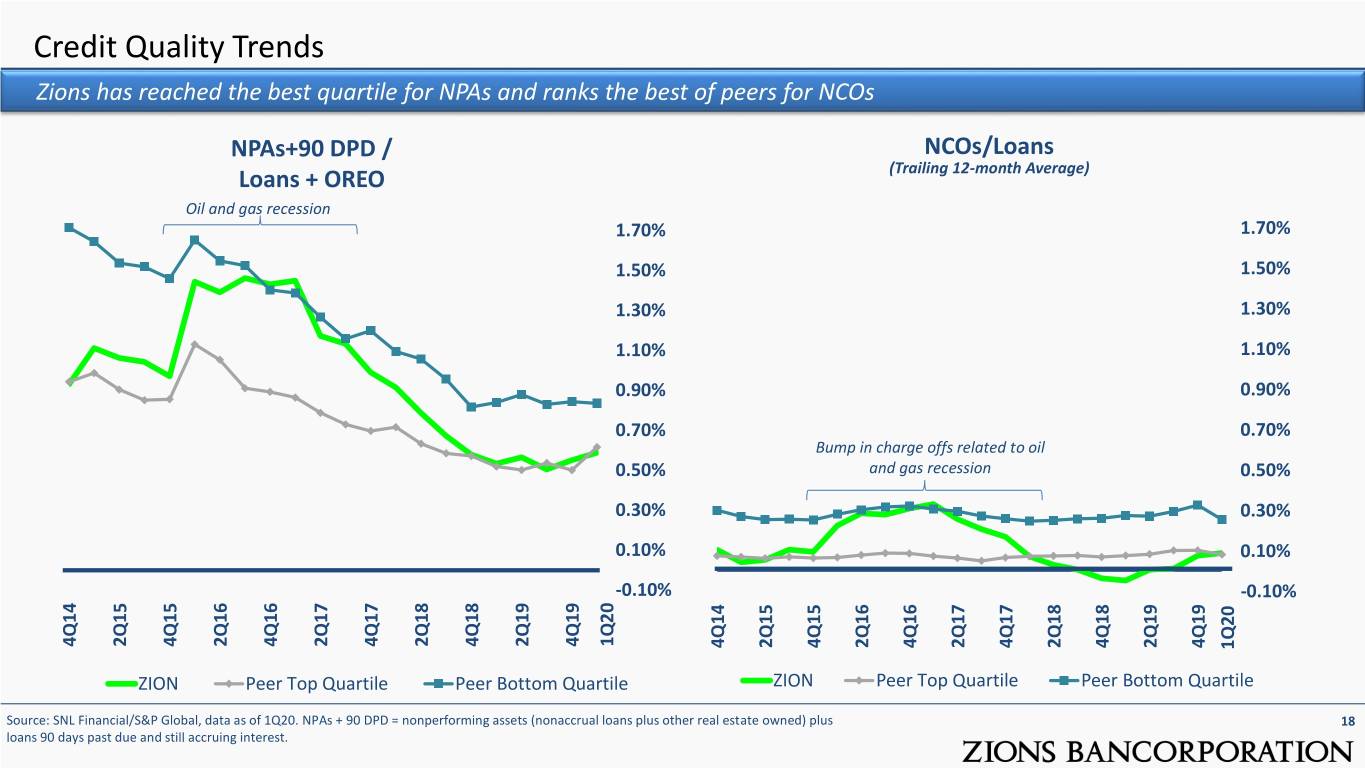

Credit Quality Trends Zions has reached the best quartile for NPAs and ranks the best of peers for NCOs NPAs+90 DPD / NCOs/Loans Loans + OREO (Trailing 12-month Average) Oil and gas recession 1.70% 1.70% 1.50% 1.50% 1.30% 1.30% 1.10% 1.10% 0.90% 0.90% 0.70% 0.70% Bump in charge offs related to oil 0.50% and gas recession 0.50% 0.30% 0.30% 0.10% 0.10% -0.10% -0.10% 1Q20 4Q19 4Q14 2Q15 4Q15 2Q16 4Q16 2Q17 4Q17 2Q18 4Q18 2Q19 4Q14 2Q15 4Q15 2Q16 4Q16 2Q17 4Q17 2Q18 4Q18 2Q19 4Q19 1Q20 ZION Peer Top Quartile Peer Bottom Quartile ZION Peer Top Quartile Peer Bottom Quartile Source: SNL Financial/S&P Global, data as of 1Q20. NPAs + 90 DPD = nonperforming assets (nonaccrual loans plus other real estate owned) plus 18 loans 90 days past due and still accruing interest.

included in Zions’ peer group have been excluded due to to or excludedstatus.theirduemergedbeenfailedpeerhavegroupZions’ in included Source: SNL GlobalFinancial/S&P as 1Q20. of averagetheCalculatedusing Note: of results.annualizedquarterly Survivorship Credit Quality: Nonperforming Assets and Loan Loss Severity Due toDue strong collateral, problemsariseZionsgenerallyexperienceswhen severelesslosses loan FRC 0.16% EWBC 0.37% SNV 0.46% CMA 0.53% NPAs+90DPD / PBCT 0.53% ZION 0.55% Last 12 Months Average WAL 0.61% WTFC 0.69% CFG 0.69% FITB 0.72% FHN 0.75% Loans+OREO HBAN 0.78% ASB 0.81% FNB 0.83% KEY 0.89% RF 0.95% BOKF 0.98% MTB 1.32% Annualized NCOs LoansNonaccrual / FRC 3% WAL 7% Five Year Average (2Q2015 PBCT 11% FHN 12% ZION 13% BOKF 17% bi as: some banksas: some that mayhave been ASB 25% WTFC 28% EWBC 28% CMA 35% SNV 36% – CFG 40% 1Q2020) KEY 44% HBAN 44% RF 47% FNB 53% FITB 70% FRC 7% Annualized NCOs LoansNonaccrual / PBCT 17% BOKF 24% Fifteen Year Average (2Q2005 ASB 29% ZION 31% CFG 37% CMA 39% FHN 42% WTFC 44% FNB 47% WAL 52% SNV 54% RF 55% – KEY 60% 1Q2020) EWBC 65% HBAN 66% FITB 82% 19

Loan Portfolio Risk Assessment – Select Industries Significantly Affected by COVID-19 Select industries believed to be at elevated risk due to COVID-19 pandemic and are being closely managed Industries Impacted by COVID-19: Totaling $5.6 billion of Loan Balances Deferrals as of Mid-May 2020: 11.2% of Loans ▪ Approximately 25% of loan balances in these select industries 5.2% have been booked for a deferral or modification ▪ Total Deferrals: Approximately 6% of total loan balances (excluding SBA-PPP loans) have been booked for a deferral or modification 2.1% Utilization as of mid-May 2020: 1.5% 1.2% % of Loans of % ▪ Revolving line utilization for these select industries was 47.5%, 0.6% 0.4% 0.3% down from 49.0% on March 31, 2020, and up from 43.7% on (3) December 31, 2019 (2) (1) ▪ Total Utilization: On the total portfolio, revolving line utilization Airlines Dentists was 40.6%, down from 42.9% on March 31, 2020, and up from Day Cares Day Restaurants 39.2% on December 31, 2019 Retail Related Retail Hotels & Casinos & Hotels Leisure Related Activities Related Leisure (1) Retail Related includes Retail CRE and Retailers, excluding supermarkets, gas stations and automotive dealerships; (2) Hotels and Casinos includes 20 National Chain Hotels, Not National Chains, and Casinos and Gaming; (3) Leisure Related Activities includes Travel, Tourism & Theme Parks, and Gyms.

Condition of Borrowers Within Select Industries Significantly Affected by COVID-19 Deep dive reviews of certain sub-portfolios have provided key insights regarding loan grading, borrower resiliency Hotels1 (1.5% of loans @ 3/31/20) Retail – CRE2 (3.5% of loans @ 3/31/20) ▪ ▪ Severely impacted – some closed, others have limited Many tenants renegotiating leases ▪ operations Relatively high rate of deferral & modifications ▪ ▪ Hotel occupancy and RevPAR down significantly Low large regional mall exposure ▪ ▪ Relatively high rate of deferral & modifications Relatively higher concentration of grocery-anchored space ▪ ▪ Longer recovery expected relative to other industries Generally low LTVs, generally low teens going-in debt yield ▪ ▪ Generally low LTVs, generally high teens going-in debt yield + Sponsor support/liquidity help mitigate risk sponsor support/liquidity help mitigate risk Dentists (1.2% of loans @ 3/31/20) Restaurants (1.5% of loans @ 3/31/20) ▪ High rate of deferral & modification ▪ High rate of deferral & modifications ▪ Offices re-opening, evidence of pent-up demand ▪ Full service and casual dining restaurants most impacted ▪ Emergency dentistry and oral surgery helped maintain some ▪ Zions’ concentration of quick-service (primarily fast food) is cash flow during general closure period more than 50% ▪ Limited down cycle, recent strength ▪ Franchisor support (1) Hotels are included in the select COVID-19 category entitled “Hotels and Casinos,” which category equaled 2.1% of total loans at March 31, 2020. 21 Retail – CRE is included in the select COVID-19 category entitled “Retail Related,” which category equaled 5.2% of loans at March 31, 2020

Oil & Gas (O&G) Credit Quality Oil and gas loans account for $2.6 billion or 5% of total loans As of March 31, 2020: Oil and Gas ▪ Annualized NCOs equaled 0.2% of loans Key Credit Quality Ratios 35% ▪ Classified loans equaled 3.4% of loans 30% ▪ Allowance for credit losses of $145 million or 5.6% of 25% balances, up from $77 million at December 31, 2019 20% ▪ Approximately 3/5 of 2020 production hedged in the mid- $50s (oil) and high $2s (natural gas) 15% 10% Today vs. 2014-2016 downturn: 5% ▪ Underwriting on energy services has been much stronger ▪ Less leverage 0% ▪ Replaced term loans with revolvers (balances likely to -5% decline, supported by collateral values) 4Q15 4Q16 4Q17 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 ▪ Sponsor support: private equity has dry powder 4Q14 ▪ Fewer junior lien or subordinated debt behind Zions’ loans Net Charge-offs / Loans Classifieds / Loans going into this cycle Nonperforming Assets / Loans Note: Net Charge-offs/Loans ratio is annualized for all periods shown. 22

Oil & Gas Portfolio Significant realignment since downturn ▪ Services, which accounted for bulk of charge offs in the Portfolio Trends 3,500 14 last cycle, account for 18% of the portfolio versus 42% 3,000 12 going into the cycle (Dec 2014) 2,500 10 ▪ Using current mix of loans, if net loss rates were to 2,000 8 remain the same as the 2015-2018 downturn/recovery, 1,500 6 Zions would experience approximately $90 million of 1,000 4 Balance ($Millions) loan losses or 3.6% 500 2 Probability Probability ofDefault Risk Grade ▪ Futures prices are higher than the spot price – two-year - 0 2014Q4 2015Q4 2016Q4 2017Q4 2018Q4 2019Q4 2020Q1 forward price of oil are in the high $30s Balance Weighted Average 1st quartile 3rd Quartile Distribution of Outstanding Balance by Energy Subsector Historical Loss Rates (2015Q1 – 2018Q4) 36% 33% 36% 39% 39% 42% 40% Sector GCOs Recoveries NCOs Services 11.9% 2.5% 9.4% 39% 30% 24% 23% 18% 18% 42% Upstream 6.1% 1.6% 4.6% 28% 31% 35% 34% 24% 33% Other 1.3% 0.8% 0.5% 19% Total 7.6% 1.8% 5.8% 4% 5% 6% 6% 5% 6% 8% 2014Q4 2015Q4 2016Q4 2017Q4 2018Q4 2019Q4 2020Q1 Downstream Midstream Services Upstream “GCO” = Gross Charge-Offs, “NCO” = Net Charge-Offs. Oil & Gas portfolio tracked with internal coding. “Other” 23 energy loans refers primarily to midstream (transportation), but also includes downstream and royalty-based credit. Based on internal data as of 1Q20

Risk Mitigation Strategies: We’re not just “closely monitoring” the areas of risk Active management strategies employed to reduce downgrades and losses Strategies Deployed or In Process of Being Deployed ▪ Implementing temporary policy triage guidelines: ▪ Deferrals ▪ Modifications and restructurings ▪ Covenant adjustments ▪ Implemented new regulatory guidelines around TDRs ▪ Foreclosure moratoriums ▪ Staffing Augmentation ▪ Special Assets Group (“workout” staff) to handle the most challenging situations ▪ Transferring seasoned front-line bankers into SAG / restructuring groups ▪ Emphasis on industry expertise and staffing adequacy ▪ Supplementing with veteran special assets bankers as needed ▪ More simple restructurings to be handled by staff that had recently been on the front line ▪ Front-line bankers actively contacting customers to address current and expected needs ▪ Some Further Refinement to our Long-standing Conservative Underwriting 24

Allowance for Credit Loss Significant 1Q20 increase in qualitative reserve vs. January 1, 2020 due to COVID-19 ▪ The 1Q20 Allowance for Credit Loss reflects expected losses from a severe and prolonged recession ▪ Increase from January 1, 2020 to March 31, 2020 was primarily a qualitative adjustment (1) January 1, 1Q20 % of Wtd Avg 2020 ACL to Loan Segment / 1Q20 Remaining CECL ACL to Loans Security Type Bal Life (years) Loans (CECL) Notes Commercial 53% 2.9 1.17% 1.63% 1.2% ACL excl O&G Commercial Real Increase primarily from 23% 2.1 0.69% 1.29% Estate construction and hospitality Consumer 24% 4.6 1.30% 1.67% Total Loan 100% 3.0 1.08% 1.56% Portfolio HTM Securities 0.03% 0.04% ▪ For regulatory capital treatment, Zions has elected to defer 25% of the change in the ACL balance for the next two years (2) (1) Zions’ quantitative allowance increased moderately from the January 1, 2020 balance; the significant increase to the qualitative 25 component is due to anticipated loan downgrades that have yet to be reflected in customer’s financial statements and delinquencies yet to emerge. (2) After two years of deferral, there is a three year tapering period in which the related capital relief is reduced to zero.

Allowance for Credit Losses: Historical Perspective Today’s loan portfolio consists of higher concentrations of lower risk segments Using the framework of the Global Financial Actual 2009-10 Loss Rates Crisis (recession of 2008-2010) 2009-2010 Applied to 1Q20 Mix Percentage Percentage of Applied Annualized Annualized ▪ Zions experienced an annualized loss rate of 2.5% of loans loans NCOs Loss Rate Loss Rate during its worst nine quarters (12/31/2008) (3/31/2020) ($M) ▪ Zions has since made sweeping changes to the Loan Losses 2.5% 100% 1.8% 100% $890 concentration (mix) of its loan portfolio; First-lien mortgages 1.5% 9% 1.5% 16% 120 Junior lien mortgages Examples include: 1.1% 6% 1.1% 6% 32 and HELOCs ▪ ~95% reduction in land development, which Commercial & Industrial 2.2% 26% 2.2% 27% 297 experienced a 9.2% annualized loss rate Owner-Occupied 1.7% 23% 1.7% 15% 122 ▪ Significant increase in high quality municipal Commercial real estate 2.7% 32% 2.7% 25% 269 lending; Zions’ municipal loans experienced no Term CRE 1.3% 19% 1.3% 19% 120 losses during the GFC Land Development 9.2% 6% 9.2% <1% 12 ▪ Significant increase in first-lien mortgage Vertical Construction 4.7% 7% 4.7% 6% 136 ▪ Adjusted for mix changes only (ignoring Credit card exposures 4.2% <1% 4.2% <1% 7 improvements to underwriting) and assuming a Other consumer 3.3% 1% 3.3% 1% 16 similar, long-term economic recession, Zions’ loss Other loans 0.5% 2% 0.5% 10% 28 rate would be an annualized 1.8%. Approximately one half of “Other” loans are municipal loans, which experienced no loss in the GFC Oil and Gas loans are included in C&I. Percentages may not sum to 100% due to rounding. 26

Allowance for Credit Losses – Comparison to other Banks Zions posted the largest increase in its ACL relative to GSIBs and peers. Relative to the 2019 DFAST modeled “Severely Adverse Scenario,” Zions’ ACL is among the strongest when compared to GSIB commercial banks ACL Increase (1) Global Systemically Important Bank (“GSIB”) ACL Increase (1) Commercial Banks Zions’ Peers 48% 37% 30% 27% 23% 19% 10% ZION JPM WFC BAC C PNC USB Source: S&P Global, Company Reports, federalreserve.gov. (1) the increase is measured from the adoption of CECL on January 1, 2020 to March 31, 2020. 27 For the ACL increase, Zions’ ACL increased to $777M from $526M (Jan 1, 2020 @ CECL adoption).

Small Business Administration – Paycheck Protection Program Loans Significant success with the SBA program, providing more than $7 billion to small businesses More than $7 billion SBA PPP loans processed through Zions and approval obtained ▪ $7.05 billion: Dollar volume of loans processed and approval obtained ▪ More than 40,000: Loans processed and approval obtained ▪ $41,600: Median loan size ▪ Nearly 80% of loans were for less than $150,000 ▪ Approximately 21% of loans processed were for businesses that were not previously Zions Bancorporation customers ▪ Approximately 27% of customers received PPP through Zions ▪ Approximately 22% of all C&I and CRE customers received PPP through Zions ▪ Enabled payroll to be preserved for more than 600,000 workers Net Interest Income effect from SBA PPP loans: ▪ Origination fee for bank processing will be amortized into net interest income (therefore also affecting the net interest margin) over the two year life of the loan ▪ Currently low visibility in rate of PPP loan payoff (or forgiveness) speeds PPP loan data as of May 10, 2020. 28

Warrants Permanent share dilution is dependent upon share price in mid-May ▪ Zions has 29,236,280 warrants (Nasdaq: ZIONW) outstanding ▪ Strike price: $33.3097 ▪ Warrant Multiplier: 1.0997 ▪ Expiration: May 22, 2020 ▪ If exercised, net share settlement method is used to exchange shares for warrants ▪ See prospectus for full, legal description of exercise process Note: For more details, please see Zionsbancorporation.com → Stock Information → Warrant Information, or the prospectus supplement from 29 September 2010, which can be found on the SEC’s website.

Appendix ▪ Company Abbreviation Key ▪ 1Q20 Financial Results ▪ Additional Credit Quality Detail ▪ Loan Growth by Brand and Loan Type ▪ GAAP to Non-GAAP Reconciliation 30

Company Abbreviation (Ticker Symbol) Key ASB: Associated Banc-Corp JPM: JPMorgan Chase & Co. BAC: Bank of America KEY: KeyCorp BOKF: BOK Financial Corporation MTB: M&T Bank Corporation C: Citigroup, Inc. PBCT: People’s United Financial, Inc. CFG: Citizens Financial Group, Inc. RF: Regions Financial Corporation CMA: Comerica Incorporated SNV: Synovus Financial Corp. EWBC: East West Bancorp, Inc. USB: US Bank FHN: First Horizon National Corporation WFC: Wells Fargo & Co. FITB: Fifth Third Bancorp WAL: Western Alliance Bancorporation FNB: FNB Corp WTFC: Wintrust Financial Corp. FRC: First Republic Bank ZION: Zions Bancorporation, N.A. HBAN: Huntington Bancshares Incorporated GREEN TEXT: Included in Zions’ 2H19-1H20 peer group as BLUE TEXT: Not included in Zions’ peer group as listed in the listed in the annual proxy statement; this group is used by annual proxy statement, but may be particularly relevant to Zions’ board in determining management compensation the topic discussed within these slides 31

Financial Results Summary Solid and improving fundamental performance Three Months Ended (Dollar amounts in millions, except per share data) March 31, December 31, September 30, 2020 2019 2019 Earnings Results: Diluted Earnings Per Share $ 0.04 $ 0.97 $ 1.17 Net Earnings Applicable to Common Shareholders 6 174 214 Net Interest Income 548 559 567 Noninterest Income 134 152 146 Noninterest Expense 408 472 415 Pre-Provision Net Revenue - Adjusted (1) 299 275 309 Provision for Credit Losses 258 4 10 Ratios: Return on Assets(2) 0.08 % 1.04 % 1. 25 % Return on Common Equity(3) 0.3 % 10.1 % 12.1 % Return on Tangible Common Equity(3) 0.4 % 11.8 % 14.2 % Net Interest Margin 3.41 % 3.46 % 3.48 % Yield on Loans 4.42 % 4.56 % 4.75 % Yield on Securities 2.34 % 2.33 % 2.37 % Average Cost of Total Deposits(4) 0.36 % 0.44 % 0.50 % Efficiency Ratio (1) 57.7 % 61.3 % 57.3 % Effective Tax Rate 12.5 % 22.1 % 22.9 % Ratio of Nonperforming Assets to Loans, Leases and OREO 0.56 % 0.51 % 0.48 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.06 % 0.18 % 0.01 % Common Equity Tier 1 Capital Ratio 10.0 % 10.2 % 10.4 % (1) Adjusted for items such as severance, provision for unfunded lending commitments, securities gains and losses and debt extinguishment costs. See Appendix for GAAP to non-GAAP reconciliation tables. 32 (2) Net Income before Preferred Dividends or redemption costs used in the numerator (3) Net Income Applicable to Common used in the numerator (4) Includes noninterest-bearing deposits

Credit Quality (Excluding Oil & Gas Portfolio) Excluding oil and gas lending, credit quality remains exceptional ▪ Key Credit Metrics: Key Credit Quality Ratios (Ex-O&G) ▪ Classified loans (1.7% of loans) 1.8% 1.6% ▪ Nonperforming assets (0.54% of loans) 1.4% 1.2% ▪ Annualized net loan losses of: 1.0% ▪ 0.05% in 1Q20 ▪ 0.09% net charge-offs over the last 12 months 0.8% 0.6% ▪ Allowance for credit losses 0.4% ▪ 1.3% of total loans and leases 0.2% 0.0% -0.2% 1Q19 2Q19 3Q19 4Q19 1Q20 Net Charge-offs / Loans Classifieds / Loans Nonperforming Assets / Loans Note: Net Charge-offs/Loans ratio is annualized for all periods shown. 33

Portfolios of Interest – Leveraged Lending Risk primarily related to Oil & Gas ▪ Relationship and middle-market sponsor driven, not the larger syndicated Portfolio Trends leveraged loan market $1.6 10 ▪ Not a focused growth area; balances generally stable-to-declining $1.4 9 $1.2 ▪ 8 Diversified across industries $1.0 7 ▪ Energy O&G (24%) concentration driven by Midstream (characterized $0.8 6 by stable, contracted cash flow) and Upstream (reserve-based $0.6 (WARG) revolvers with asset coverage) $0.4 5 Balance ($ Billions) 4 ▪ Retail (15%) concentration driven by gas stations and quick-service $0.2 3 $0.0 Weighted Average Risk Grade restaurants which tend to have more stable demand drivers and can manage higher leverage levels 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 ▪ Concentration levels set to control perceived areas of risk in the portfolio 2015Q1 Balance WARG Distribution of Outstanding Balance by Industry Problem Loan Trends Health Care & Commercial 30% Pharmaceuticals Services 25% Equipment, 6% 6% Machinery, Parts 20% Mfg. exc. Auto Oil & Gas 7% 24% 15% Entertainmen 10% 10.3% t & 7.7% Recreation Percent Balance of 5% 8% 2.7% 0% 1.1% Other Technology, 21% Telecom and Retail 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 Media 2015Q1 13% 15% Criticized Classified Nonaccrual TTM GCO Leverage Lending here is defined by FDIC in 12 CRF Part 327 – Assessments 34

Portfolios of Interest – Municipal Lending Low risk growth driver Portfolio Trends ▪ Strong growth in municipals loans particularly in the $3.0 10 last three years. $2.5 9 ▪ Growth is focused in core municipal lending exhibiting 8 $2.0 resilient payment sources such as taxes and fees for 7 $1.5 utilities. 6 $1.0 ▪ Growth in high quality assets resulting in an overall 5 (WARG) Balance ($ Billions) $0.5 improvement in the weighted average risk grade from 4 $0.0 3 4 to 3.4 YoY. Weighted Average Risk Grade ▪ Granular - average loan size of $2.7MM 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 Government and Education Other WARG Municipal Lending by Industry Group 2015 Q1 Municipal Lending by Industry Group 2019 Q4 Consumer Consumer Other Services 4% Services Health Care & Real Estate & 5% 1% Pharmaceutical Construction Other s 12% 10% 6% Real Estate & Construction 12% Government & Government & Health Care & Education Education Pharmaceuticals 60% 73% 17% NAICS code used to define industry group 35

Portfolio Overview – Mortgage The portfolio is stable and continues growing at a solid pace with excellent performance metrics Mortgage Portfolio Trends ▪ A majority of the Mortgage loans on the books are in 1st lien $8.0 820 position, with Jr Lien Mortgages only comprising of $19.4 million in $7.0 800 outstandings $6.0 780 ▪ The average current loan amount for Mortgage loans on the books $5.0 760 is $384,000, median of $229,000 $4.0 740 ▪ The overall severely delinquent (90+ DPD) rate for Mortgage loans $3.0 FICO FICO Score is low compared to peers at 0.31% $2.0 720 Balance ($ Billions) ▪ The TTM GCO for Mortgage loans is extremely low, and was near $1.0 700 0% throughout 2019 $0.0 680 2015Q1 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 1st Lien 2nd Lien 25th pctl FICO 75th pctl FICO Distribution of Outstanding Balance by Current Loan Size Problem Loan Trends 0.8% $5,000,000 + 1% 0.6% 0.5% Under 0.4% $1,000,000 - $500,000 0.3% 30% $4,999,999 0.2% 32% Percent of Balance 0.0% 0.0% $500,000 - 2015Q2 2015Q3 2015Q4 2016Q1 2016Q2 2016Q3 2016Q4 2017Q1 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2018Q3 2018Q4 2019Q1 2019Q2 2019Q3 2019Q4 $999,999 2015Q1 37% 30 + Days Past Due 90 + Days Past Due TTM GCO 36

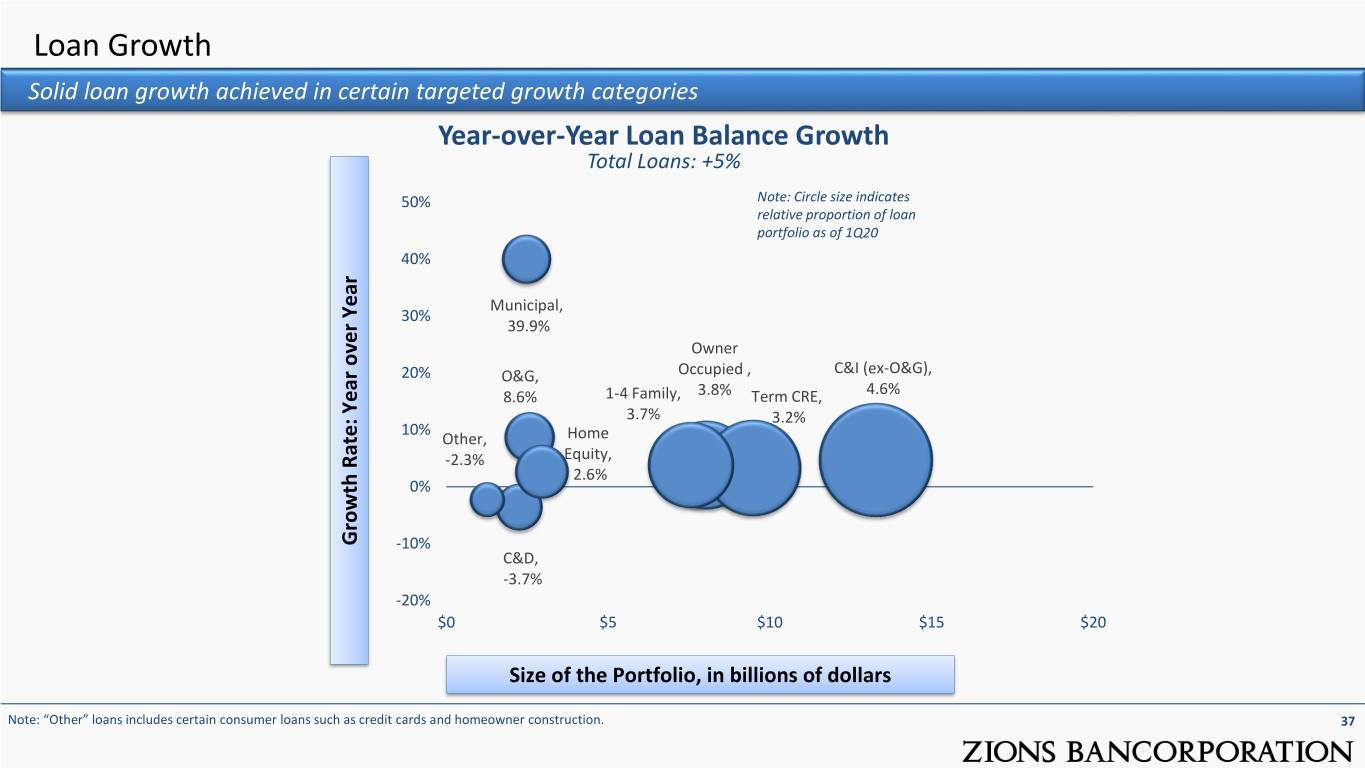

Loan Growth Solid loan growth achieved in certain targeted growth categories Year-over-Year Loan Balance Growth Total Loans: +5% 50% Note: Circle size indicates relative proportion of loan portfolio as of 1Q20 40% Municipal, 30% 39.9% Owner 20% O&G, Occupied , C&I (ex-O&G), 8.6% 1-4 Family, 3.8% Term CRE, 4.6% 3.7% 3.2% 10% Other, Home -2.3% Equity, 2.6% 0% Growth Growth Year Rate:over Year -10% C&D, -3.7% -20% $0 $5 $10 $15 $20 Size of the Portfolio, in billions of dollars Note: “Other” loans includes certain consumer loans such as credit cards and homeowner construction. 37

Loan Growth by Bank Brand and Loan Type Year over Year Loan Growth (4Q19 vs. 4Q18) Zions (in millions) Amegy CB&T NBAZ NSB Vectra CBW Other Total Bank C&I (ex-Oil & Gas) 45 25 571 (206) 85 31 36 - 587 Owner occupied 30 93 30 74 47 (20) 38 - 292 Energy (Oil & Gas) (2) 200 - 1 - 6 - - 205 Municipal 198 98 104 58 64 24 95 68 709 CRE C&D 10 (74) (82) 40 4 78 (62) - (86) CRE Term 79 88 147 (7) 17 (58) 31 - 297 1-4 Family 26 172 42 17 (13) 13 18 (2) 273 Home Equity (36) 41 49 13 1 25 (19) - 74 Other (9) (11) 13 (5) (7) (13) 2 - (30) Total net loans 341 632 874 (15) 198 86 139 66 2,321 Linked Quarter Loan Growth (1Q20 vs. 4Q19) Zions (in millions) Amegy CB&T NBAZ NSB Vectra CBW Other Total Bank C&I (ex-Oil & Gas) (9) 141 514 (6) (8) 15 45 - 692 Owner occupied 11 34 33 44 7 (9) 24 - 144 Energy (Oil & Gas) (6) 93 (7) (2) - - - - 78 Municipal 58 6 18 (4) 3 3 (2) 8 90 CRE C&D (27) 91 (11) 5 (12) 17 (17) - 46 CRE Term 55 36 61 (54) 27 6 9 - 140 1-4 Family (8) 15 10 (1) (3) - 5 (19) (1) Home Equity (10) 15 27 (4) - 17 (4) - 41 Other (9) 11 4 (4) (5) (4) (4) (1) (12) Total net loans 55 442 649 (26) 9 45 56 (12) 1,218 Note: National Real Estate (NRE) is a division of Zions Bank with a focus on small business loans with low LTV 38 ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes municipal and other consumer loan categories. Totals shown above may not foot due to rounding.

GAAP to Non-GAAP Reconciliation (Amounts in millions) 1Q20 4Q19 3Q19 2Q19 1Q19 Efficiency Ratio Noninterest expense (GAAP) (1) (a) $ 408 $ 472 $ 415 $ 424 $ 430 Adjustments: Severance costs - 22 2 1 - Other real estate expense - - (2) - (1) Debt extinguishment cost - - - - - Amortization of core deposit and other intangibles - - - - - Restructuring costs 1 15 - - - Pension termination-related expense - - - - - Total adjustments (b) 1 37 - 1 (1) Adjusted noninterest expense (non-GAAP) (a) - (b) = (c) 407 435 415 423 431 Net Interest Income (GAAP) (d) 548 559 567 569 576 Fully taxable-equivalent adjustments (e) 7 7 7 7 6 Taxable-equivalent net interest income (non-GAAP) (d) + (e) = (f) 555 566 574 576 582 Noninterest income (GAAP) (1) (g) 134 152 146 132 132 Combined income (f) + (g) = (h) 689 718 720 708 714 Adjustments: Fair value and nonhedge derivative income (loss) (11) 6 (6) (6) (3) Equity securities gains (losses), net (6) 2 2 (3) 1 Total adjustments (i) (17) 8 (4) (9) (2) Adjusted taxable-equivalent revenue (non-GAAP) (h) - (i) = (j) 706 710 724 717 716 Pre-provision net revenue (PPNR), as reported (h) – (a) $ 281 $ 246 $ 305 $ 284 $ 284 Adjusted pre-provision net revenue (PPNR) (j) - (c) $ 299 $ 275 $ 309 $ 294 $ 285 Efficiency Ratio (1) (c) / (j) 57.7 % 61.3 % 57.3 % 59.0 % 60.2 % 39

GAAP to Non-GAAP Reconciliation $ In millions except per share amounts 1Q20 4Q19 3Q19 2Q19 1Q19 Pre-Provision Net Revenue (PPNR) (a) Total noninterest expense $408 $472 $415 $424 $430 LESS adjustments: Severance costs - 22 2 1 - Other real estate expense - - (2) - (1) Debt extinguishment cost - - - - - Restructuring costs 1 15 - - - (b) Total adjustments 1 37 - 1 (1) (a-b)=(c) Adjusted noninterest expense 407 435 415 423 431 (d) Net interest income 548 559 567 569 576 (e) Fully taxable-equivalent adjustments 7 7 7 7 6 (d+e)=(f) Taxable-equivalent net interest income (TENII) 555 566 574 576 582 (g) Noninterest Income 134 152 146 132 132 (f+g)=(h) Combined Income $689 $718 $720 $708 $714 LESS adjustments: Fair value and nonhedge derivative income (loss) (11) 6 (6) (6) (3) Securities gains (losses), net (6) 2 2 (3) 1 (i) Total adjustments (17) 8 (4) (9) (2) (h-i)=(j) Adjusted revenue $706 $710 $724 $717 $716 (j-c) Adjusted pre-provision net revenue (PPNR) $299 $275 $309 $294 $285 Net Earnings Applicable to Common Shareholders (NEAC) (k) Net earnings applicable to common 6 174 214 189 205 (l) Diluted Shares 172,998 178,718 181,870 189,089 195,241 GAAP Diluted EPS 0.04 0.97 1.17 0.99 1.04 PLUS Adjustments: Adjustments to noninterest expense 1 37 - 1 (1) Adjustments to revenue 17 (8) 4 9 2 Tax effect for adjustments (4) (11) (1) (2) (1) Preferred stock redemption - - - - - (m) Total adjustments 14 18 3 8 - (k+m)=(n) Adjusted net earnings applicable to common (NEAC) 20 192 217 197 205 (n)/(l) Adjusted EPS 0.12 1.07 1.19 1.04 1.05 (o) Average assets 70,205 69,575 70,252 69,855 68,584 (p) Average tangible common equity 5,910 5,852 5,988 5,974 5,991 Profitability (n)/(o) Adjusted Return on Assets 0.11% 1.09% 1.23% 1.13% 1.21% (n)/(p) Adjusted Return on Tangible Common Equity 1.4% 13.0% 14.4% 13.1% 13.6% (c)/(j) Efficiency Ratio 57.7% 61.3% 57.3% 59.0% 60.2% 40