Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RGC RESOURCES INC | a8kinvestorpresentation-20.htm |

Investor Presentation May 2020

Forward-Looking Statements The statements in this presentation by RGC Resources, Inc. (the "Company") that are not historical facts constitute “forward- looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the Company's expectations regarding earnings per share, EBITDA, future expansion opportunities, natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of system expansion, general potential for customer growth, relationship of Company with primary regulator, future capital expenditures, current and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") and MVP Southgate milestones, potential of MVP to provide an additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity and potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially from those expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion, regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP, including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk factors described in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is available at www.sec.gov and on the Company’s website at www.rgcresources.com. Additionally, the COVID-19 pandemic creates significant economic uncertainty for the remainder of fiscal 2020 and potentially beyond. The statements made in this presentation are based on information available to the Company as of the first day of the month set forth on the cover of this presentation and the Company undertakes no obligation to update any of the forward- looking statements after the date of this presentation. 1

Agenda Company Overview Financial Profile Growth Strategy Outlook 2

Organizational Structure NASDAQ: RGCO C-Corp formed 1998 Regulated Non-Utility Local Distribution Company Partner in Mountain Valley Pipeline (LDC), located in Roanoke, VA (MVP) Founded in 1883 Partner in proposed MVP Southgate project 3

Roanoke Gas Service Territory Serve over 62,200 natural gas customers Customer Count breakdown: Residential 90% C&I 10% Volume breakdown: Residential 40% C&I 60% Note: Total customers as of March 2020. Volume breakdown per most recent fiscal year end. 4

Roanoke Gas Regulated Utility VA State Corporation Commission (SCC) VA in Top 4 on Forbes “Best States for Business” ranking1 9.44% authorized ROE Highly Stable Alternative Cost Recovery Mechanisms Business Model Weather Normalization Revenue Sharing Infrastructure Riders . SAVE infrastructure replacement rider approved through 2024 System Expansion 1 As of December 2019 5

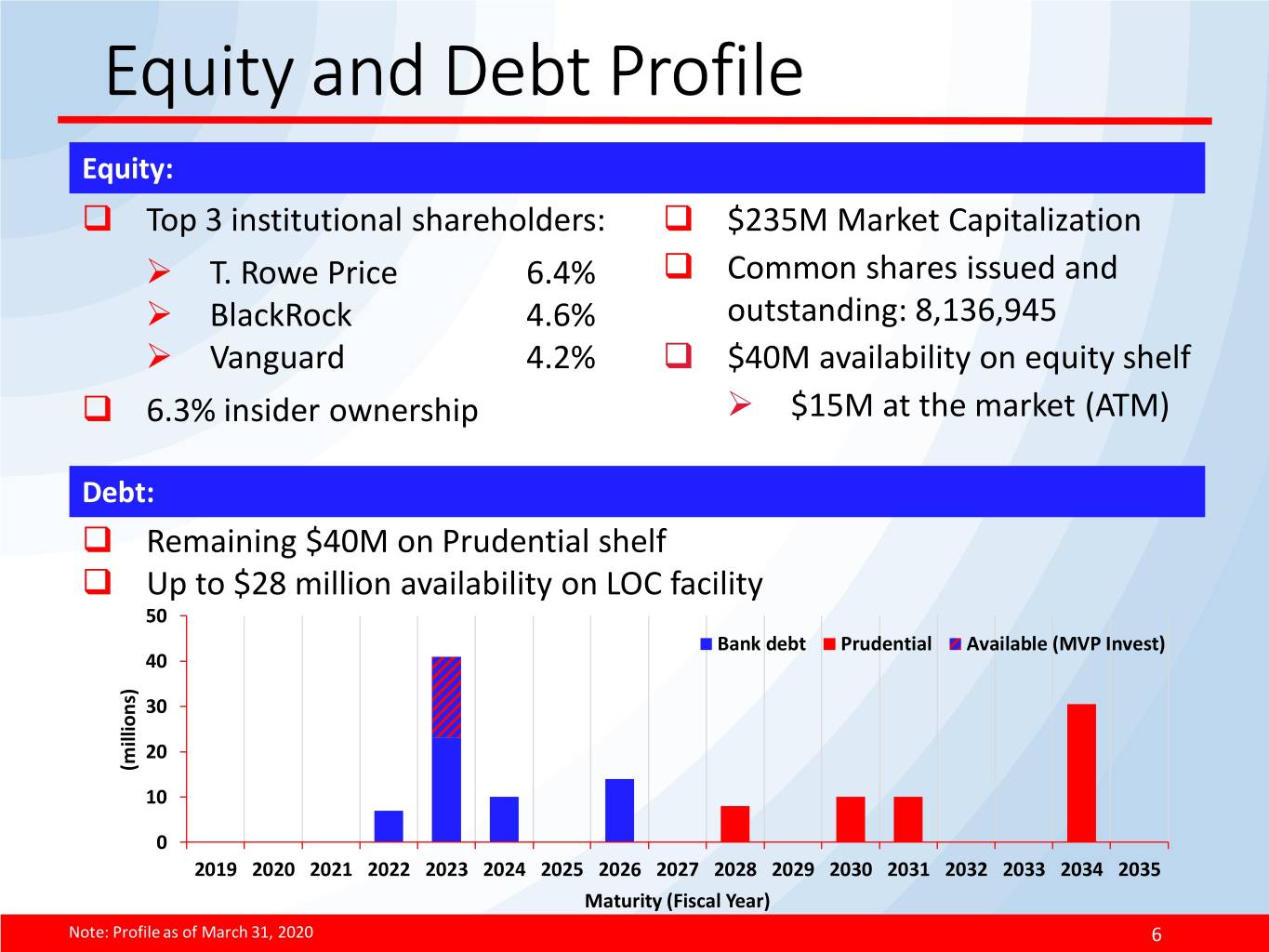

Equity and Debt Profile Equity: Top 3 institutional shareholders: $235M Market Capitalization T. Rowe Price 6.4% Common shares issued and BlackRock 4.6% outstanding: 8,136,945 Vanguard 4.2% $40M availability on equity shelf 6.3% insider ownership $15M at the market (ATM) Debt: Remaining $40M on Prudential shelf Up to $28 million availability on LOC facility 50 Bank debt Prudential Available (MVP Invest) 40 30 20 (millions) 10 0 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Maturity (Fiscal Year) Note: Profile as of March 31, 2020 6

Shareholder Return 76 years dividend payments 16 years dividend increases 5 years record earnings 6.1% dividend increase annual dividend $0.70 (per share) Note: Graph includes stock prices through April 30, 2020. 7

Growth Strategy Regulated Utility Investment CapEx Ongoing Regulated Utility Growth Customer Growth Volumes Delivered Non-Utility Investments MVP 8

Roanoke Gas CapEx Twelve-Months ended March 31: ($000’s) $26,000 $24,000 $24,200 $22,000 $21,200 $21,300 $20,000 $19,400 $18,000 $16,000 $14,000 $12,000 $10,000 2017 2018 2019 2020 9

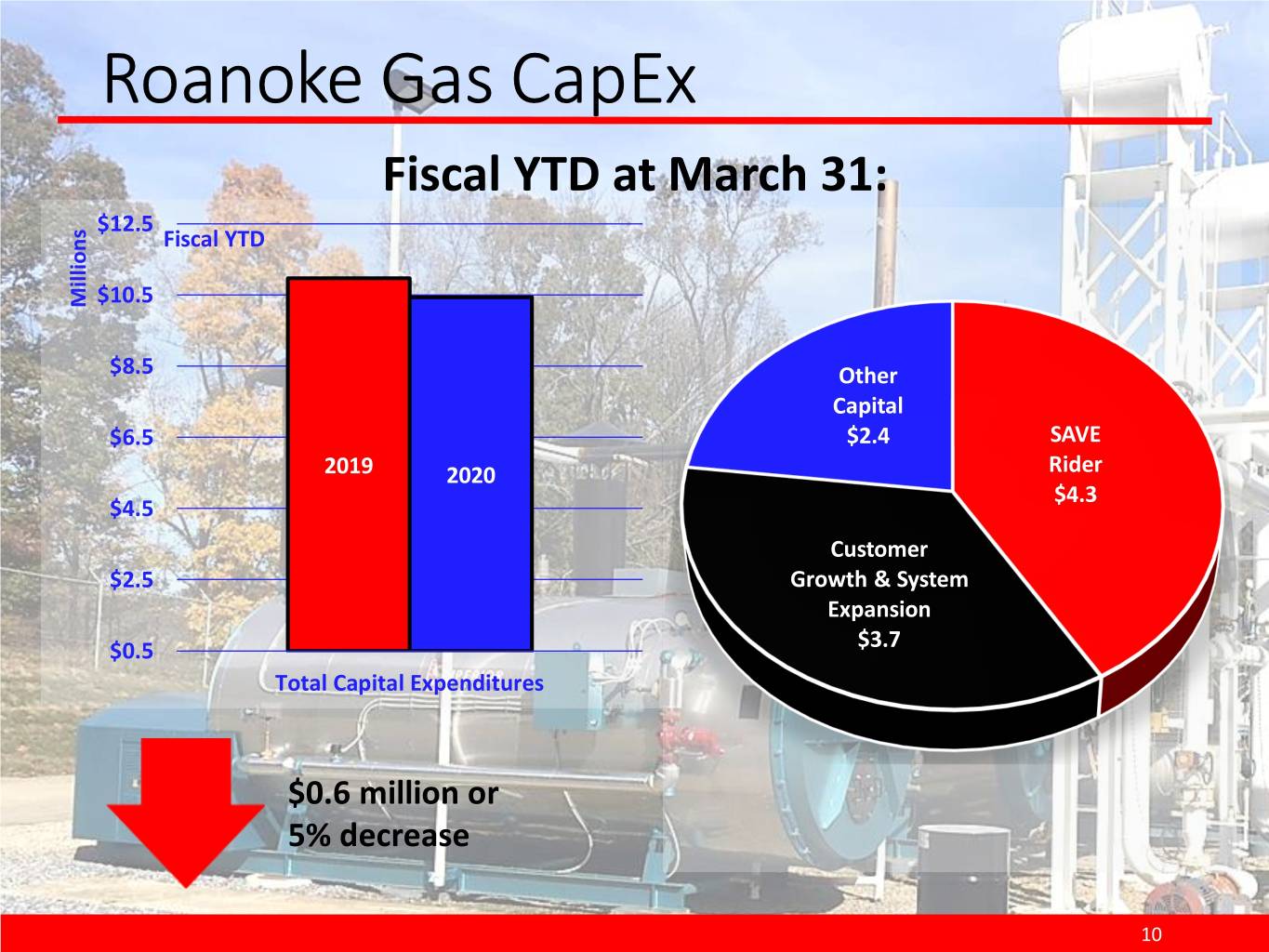

Roanoke Gas CapEx Fiscal YTD at March 31: $12.5 Fiscal YTD Millions $10.5 $8.5 Other Capital $6.5 $2.4 SAVE 2019 2020 Rider $4.3 $4.5 Customer $2.5 Growth & System Expansion $0.5 $3.7 Total Capital Expenditures $0.6 million or 5% decrease 10

Customers 2% growth since 2017 Average Customers (twelve-months ended March 31) 61,500 61,000 60,500 60,000 59,500 2017 2018 2019 2020 New customer additions: YTD Fiscal 2020 322 Fiscal 2019 668 Fiscal 2018 598 Fiscal 2017 628 Fiscal 2016 495 11

Natural Gas Volumes Volumes Delivered (DTH) Fiscal YTD 2019 Fiscal YTD 2020 3,500 3,000 2,500 2,000 Thousands 1,500 1,000 500 - Residential Commercial Industrial 2020 vs 2019 Highlights Total Volumes (7)% Transportation & Interruptible Volumes 15% Heating Degree Days (HDD) (14)% 12

Earnings Per Share $1.35 $1.39 TTM March 31: $1.25 Six-months ended $1.15 March 31: $1.05 $1.10 $0.95 2020 2019 $0.85 Basic: $1.20 $0.89 $0.86 $0.86 $0.75 Diluted: $1.19 $0.88 $0.65 $0.68 $0.64 $0.55 $0.60 $0.56 $0.45 2017 2018 2019 2020 Dividends/Share 13

Return on Equity Twelve-Months ended March 31: 12.0% 11.0% 12.9% 10.0% 10.7% 10.8% 9.0% 9.1% 8.0% 2017 2018 2019 2020 14

Outlook COVID-19 Strategic Opportunities Economic Development 15

COVID-19 Community Company Liquidity Customer Analyses Earnings Guidance 16

Strategic Opportunities Strategic Plan M&A Midstream Opportunities CapEx System Expansion 17

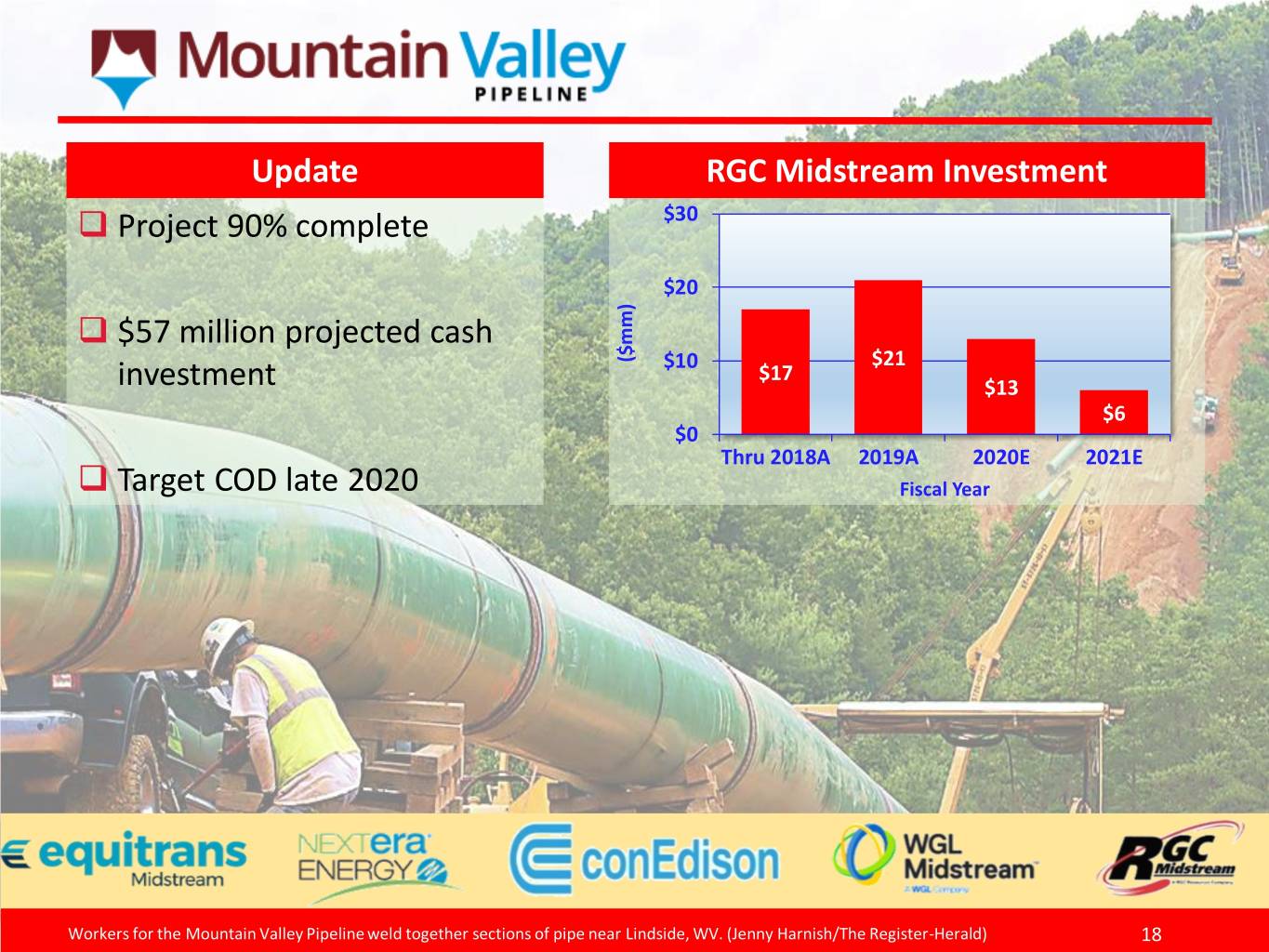

Update RGC Midstream Investment Project 90% complete $30 $20 $57 million projected cash ($mm) $10 $21 $17 investment $13 $6 $0 Thru 2018A 2019A 2020E 2021E Target COD late 2020 Fiscal Year Workers for the Mountain Valley Pipeline weld together sections of pipe near Lindside, WV. (Jenny Harnish/The Register-Herald) 18

Interconnect into Roanoke Gas Distribution System 19

Southgate 70 mile natural gas pipeline system 24 and 16 inch steel underground pipe Starts at TRANSCO 165 and extends into central NC Anchored by firm capacity commitment from PSNC Energy Schedule Nov 2018: Filed application Pending FERC approval Feb 2020: FERC issued final EIS Target 2020: Begin Construction Target 2021: In-service Date 20

Roanoke Gas Capital Budget $25 $21.9 $22.3 $21.0 $20.0 $20.0 $20 $18.0 $15 Millions $10 $5 $0 2019A 2020E 2021E 2022E 2023E 2024E Forecast totals through 2024: SAVE Infrastructure Replacement $43.2 Customer Growth & System Expansion $33.8 Utility Maintenance $24.3 Total $101.3 21

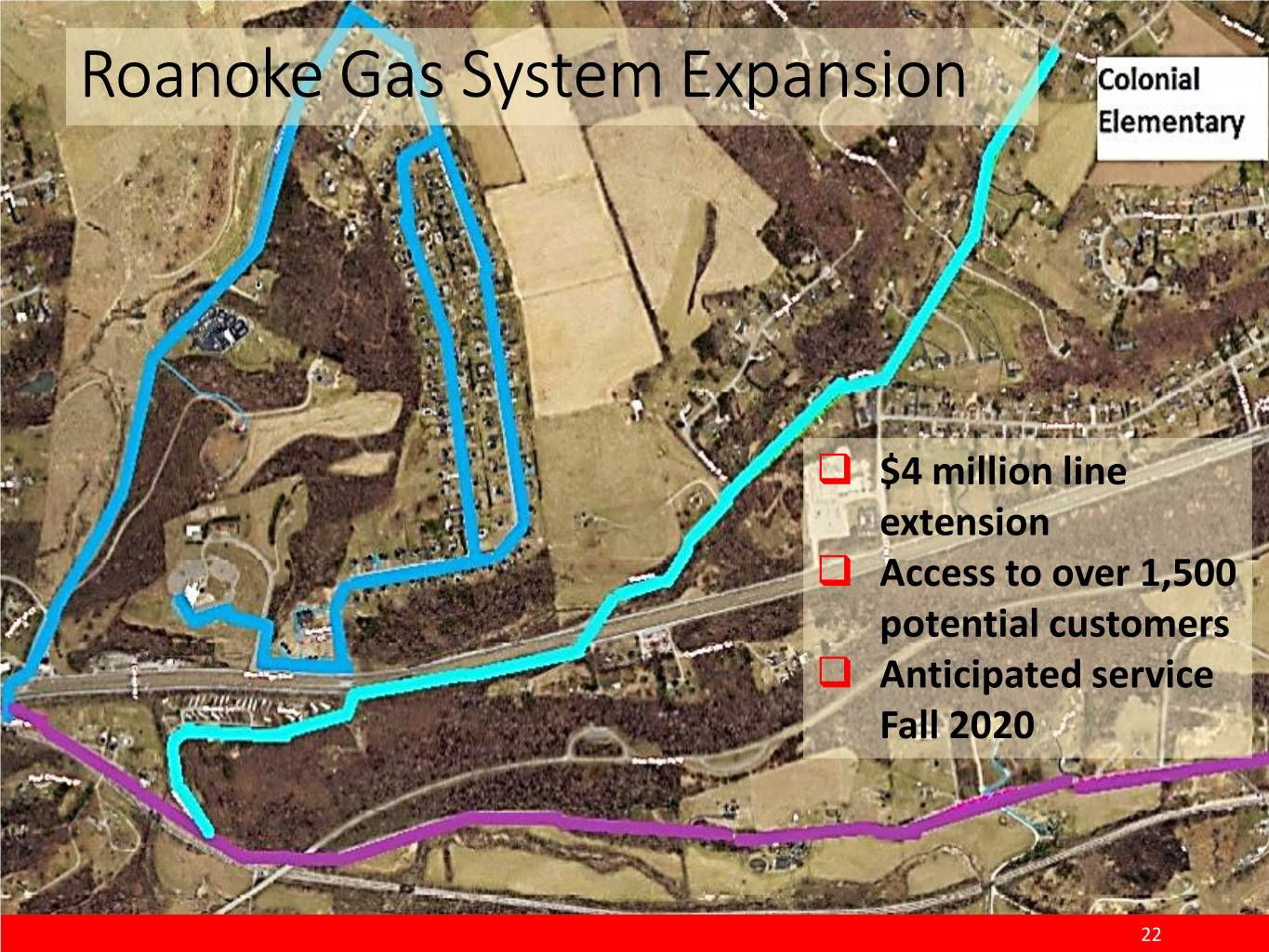

Roanoke Gas System Expansion $4 million line extension Access to over 1,500 potential customers Anticipated service Fall 2020 22

Economic Development Lumber grading facility Mack Trucks (Volvo) will invest $13 adding 4 natural gas- million and hire 250 employees to fired kilns. Capacity to manufacture medium-duty trucks. The Roanoke Times – 1.31.2020 burn additional 210,000 DTH annually. Recycled paper and packaging Company investing over $20 million to finish and expand shell building in Botetourt Automotive solutions provider investing County’s Greenfield Park and $6.4 million to expand Botetourt create 50 new jobs. County operation and create 25 new Roanoke Regional Partnership – 2.26.2019 jobs. TheRoanokeStar.com – 06.19.2019 Service Territory Expansion (supplied by MVP) Tea Company investing $30 Packaging firm plans to million and bringing 60 expand, add 60 new jobs new jobs to Franklin in Franklin County's County’s Summit View Summit View The Roanoke Times – 5.17.2018 WDBJ7.com – 1.21.2020 23

24

Economic Development $300 million expansion to Roanoke Memorial Economists say Carilion Clinic Hospital, including new tower for emergency and heart patients, new psych center and parking garage with connected pedestrian adds over $3.2 Billion to skyway. (Times May 2019) Kicked-off fundraising campaign and unveiled Virginia’s Economy plans for world-class $75 to $100 million The Roanoke Times (Times) Jan 2020 Cancer Center in Roanoke. (Times Nov 2019) VA Tech Carilion (VTC) Partnership Research Institute (VTCRI) will create 828 new jobs and $150 million in additional spending by 2026 School of Medicine and VTCRI will contribute at least $465 million to economy within 8 years. (Times May 2018) VTC Innovation Fund and VTC Seed Fund investing in high growth, seed-stage and early- life companies in Roanoke-Blacksburg region Merger of Radford University and Carilion Jefferson College of Health Sciences expected to double number of nursing students within five years (Times Apr 2019) 25

Questions