Attached files

| file | filename |

|---|---|

| EX-23.2 - EX-23.2 - Avantor, Inc. | d927374dex232.htm |

| EX-23.1 - EX-23.1 - Avantor, Inc. | d927374dex231.htm |

| EX-5.1 - EX-5.1 - Avantor, Inc. | d927374dex51.htm |

| EX-1.1 - EX-1.1 - Avantor, Inc. | d927374dex11.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 18, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Avantor, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3826 | 82-2758923 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Radnor Corporate Center

Building One, Suite 200

100 Matsonford Road

Radnor, PA 19087

Telephone: (610) 386-1700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Justin M. Miller, Esq.

Executive Vice President, General Counsel

Avantor, Inc.

Radnor Corporate Center

Building One, Suite 200

100 Matsonford Road

Radnor, PA 19087

Telephone: (610) 386-1700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Joseph H. Kaufman, Esq. Ryan Bekkerus, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, New York 10017 (212) 455-2000 |

Patrick O’Brien, Esq. Rachel Phillips, Esq. Ropes & Gray LLP 1211 Avenue of the Americas New York, NY 10036 (617) 951-7000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to Be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Unit(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common stock, par value $0.01 per share |

51,750,000 | $17.31 | $895,792,500 | $116,274 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 6,750,000 shares of common stock to be sold upon exercise of the underwriters’ option to purchase additional shares. See “Underwriting (Conflicts of Interest).” |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(c) of the Securities Act of 1933, as amended. The proposed maximum offering price per share and proposed maximum aggregate offering price shown are based on the average of the high and low prices of the registrant’s common stock on May 14, 2020 as reported on the New York Stock Exchange. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated May 18, 2020.

45,000,000 Shares

Avantor, Inc.

Common Stock

The selling stockholders named in this prospectus are offering 45,000,000 shares of our common stock. We will not receive any proceeds from the sale of the shares being sold by the selling stockholders.

Our common stock is listed on the New York Stock Exchange under the symbol “AVTR.” On May 15, 2020, the closing sales price of our common stock as reported on the New York Stock Exchange was $17.86 per share.

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 6,750,000 shares of common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholders pursuant to any exercise of the underwriters’ option to purchase additional shares.

Investing in shares of our common stock involves significant risks. See “Risk Factors” beginning on page 17 of this prospectus and the risk factors in the documents incorporated by reference in this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds before expenses, to the selling stockholders |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with the offering. See “Underwriting (Conflicts of Interest)” for additional information regarding underwriting compensation. |

We have agreed to pay certain offering expenses for the selling stockholders incurred in connection with the sale.

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 6,750,000 shares of common stock.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2020.

| Goldman Sachs & Co. LLC | J.P. Morgan |

The date of this prospectus is , 2020.

Table of Contents

| Page | ||||

| i | ||||

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 17 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 35 | ||||

| 40 | ||||

| 50 | ||||

| Certain United States Federal Income and Estate Tax Consequences to Non-U.S. Holders |

53 | |||

| 56 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

We, the selling stockholders and the underwriters (and any of our or their affiliates) have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who obtain this prospectus must inform themselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

This prospectus includes or incorporates by reference market and industry data and forecasts that we have derived from independent consultants, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable.

Our internal data and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that such information is reliable, we have not had this information verified by any independent sources. Similarly, our internal research is based upon our understanding of industry conditions, and such information has not been verified by any independent sources. Any estimates underlying such market-derived information and other factors could cause actual results to differ materially from those expressed in the independent parties’ estimates and in our estimates.

| i |

Table of Contents

TRADEMARKS, TRADENAMES AND SERVICE MARKS

We own or have rights to trademarks or trade names that we use in conjunction with the operation of our business and that appear in this prospectus (or in documents we have incorporated by reference). This prospectus (or in documents we have incorporated by reference) also contains trademarks, service marks, trade names and copyrights of other companies which, to our knowledge, are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus (or in documents we have incorporated by reference) may appear without the ® or ™ symbols, but the absence of such symbols does not indicate the registration status of the trademarks and is not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to such trademarks and trade names.

Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “Company,” “we,” “us” and “our” refer to Avantor, Inc. and its consolidated subsidiaries. The following are definitions of certain terms as used in this prospectus, unless otherwise noted or indicated by context.

| • | “Annual Report ” means the annual report on Form 10-K for the fiscal year ended December 31, 2019, filed on February 14, 2020. |

| • | “Dollar Term Loan Facility” means the term loan tranche of the Senior Secured Credit Facilities. |

| • | “Euro Term Loan Facility” means the term loan tranche of the Senior Secured Credit Facilities. |

| • | “NuSil” means NuSil Technology LLC and its subsidiaries. |

| • | “Quarterly Report” means the quarterly report on Form 10-Q for the quarter ended March 31, 2020, filed on April 29, 2020. |

| • | “Revolver” means Avantor Funding’s senior secured revolving credit facility of up to $250.0 million. |

| • | “Senior Secured Credit Facilities” means the Term Loan Facility and the Revolver. |

| • | “Senior Secured Notes” means the (i) $1.5 billion aggregate principal amount of 6.000% Senior First Lien Notes due 2024 and (ii) €500 million aggregate principal amount of 4.750% Senior First Lien Notes due 2024, in each case, issued by Avantor Funding. |

| • | “Senior Unsecured Notes” means the $2 billion aggregate principal amount of 9.000% Senior Notes due 2025, issued by Avantor Funding. |

| • | “Term Loan Facility” means Avantor Funding’s senior secured term loan facility, consisting of the Dollar Term Loan Facility and the Euro Term Loan Facility. |

| • | “VWR” means VWR Corporation. |

| • | “VWR Acquisition” means the acquisition of VWR on November 21, 2017. |

PRESENTATION OF CERTAIN FINANCIAL MEASURES

This prospectus contains, or incorporates by reference, certain financial measures, including Adjusted EBITDA and Adjusted Net Income, that are not recognized under generally accepted accounting principles in the United States (“GAAP”). Adjusted EBITDA and Adjusted Net Income have been presented in this prospectus as supplemental measures of financial performance that are not required by, or presented in accordance with GAAP. These non-GAAP financial measures are included in this prospectus because they are key metrics used by management to assess our financial performance. We use these measures to supplement GAAP measures of

| ii |

Table of Contents

performance in order to evaluate the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against that of other peer companies using similar measures. We believe such measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry and are helpful supplemental measures to provide additional insight in evaluating a company’s core operational performance as they exclude costs that do not relate to the underlying operation of their business and include cost savings that are expected to occur.

Adjusted EBITDA and Adjusted Net Income are non-GAAP measures of our financial performance and should not be considered as alternatives to net income or loss as a measure of financial performance or any other performance measures derived in accordance with GAAP, nor should they be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted Net Income are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect certain cash requirements such as tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future. Adjusted EBITDA and Adjusted Net Income contain certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and/or amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted Net Income. Our presentation of Adjusted EBITDA and Adjusted Net Income is not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

In calculating Adjusted EBITDA and Adjusted Net Income, we make certain adjustments that are based on assumptions and estimates that may prove to have been inaccurate. Accordingly, you should not view our presentation of these adjustments as a projection that we will achieve these benefits but rather only as an indication of our current expectations.

For definitions of Adjusted EBITDA and Adjusted Net Income and reconciliations to the most directly comparable measure under GAAP, see “Summary—Summary Historical Financial and Other Data.”

We, the selling stockholders and the underwriters (and any of our or their affiliates) have not authorized anyone to provide any information or to make any representations other than those contained, or incorporated by reference, in this prospectus or in any free writing prospectuses filed with the Securities and Exchange Commission. We, the selling stockholders and the underwriters (and any of our or their affiliates) take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information contained or incorporated by reference in this prospectus or any free writing prospectus prepared by us or on our behalf is accurate only as of their respective dates or on the date or dates which are specified in such documents, and that any information in documents that we have incorporated by reference is accurate only as of the date of such document incorporated by reference.

Certain monetary amounts, percentages and other figures included or incorporated by reference in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

| iii |

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference herein from our filings with the Securities and Exchange Commission listed under “Incorporation by Reference.” This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should carefully read the entire prospectus and the information incorporated by reference herein, including any free writing prospectus prepared by us or on our behalf, including the information presented under the sections entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” included in this prospectus, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited financial statements and the notes thereto in our Annual Report and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the unaudited condensed consolidated financial statements and related notes thereto in our Quarterly Report, each of which is incorporated by reference herein, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties.

Company Overview

We are a leading global provider of mission critical products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. Our comprehensive offerings, which include materials & consumables, equipment & instrumentation and services & specialty procurement, are relied upon by our customers, often on a recurring basis, because they are frequently specified into their research, development and production processes. These processes are commonly organized into “workflows” that define the activities our customers perform each day. We collaborate closely with our customers to enable them to develop new innovative products, lower their development and production costs, improve product or process performance characteristics, and enhance the safety and reliability of the drugs, devices and other products they produce. In addition to relying on our products, many customers depend upon our services. Some of these services are performed by over 1,300 of our associates that are co-located with certain customers, working side-by-side with their scientists every day. Our local presence combined with our global infrastructure enable and promote successful relationships with our customers and connect us to over 225,000 of their locations in over 180 countries. Our mission is to set science in motion to create a better world.

We have global operations and an extensive product portfolio. We strive to enable customer success through innovation, Current Good Manufacturing Practices (“cGMP”) manufacturing and comprehensive service offerings. The depth and breadth of our portfolio provides our customers a comprehensive range of products and services and allows us to create customized and integrated solutions for our customers. Selected offerings sold to our customers in discovery, research, development and production processes include:

| • | Materials & consumables: Ultra-high purity chemicals and reagents, lab products and supplies, highly specialized formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits and education and microbiology and clinical trial kits. In 2019, 33% of our revenues were from sales of proprietary materials & consumables and 40% of our revenues were from third-party materials & consumables; |

| • | Equipment & instrumentation: Filtration systems, virus inactivation systems, incubators, analytical instruments, evaporators, ultra-low-temperature freezers, biological safety cabinets and critical environment supplies; and |

| • | Services & specialty procurement: Onsite lab and production, clinical, equipment, procurement and sourcing and biopharmaceutical material scale-up and development services. |

We have deep expertise in developing, customizing, manufacturing and supplying products for a wide variety of workflows, allowing us to provide tailored solutions throughout the lifecycle of our customers’

1

Table of Contents

products. In aggregate, we provide approximately six million products, including products we make as well as products from approximately 4,000 core suppliers across the globe. We manufacture products that meet or exceed the demanding requirements of our customers across a number of highly-regulated industries. Our high-purity and ultra-high purity products, such as our J.T.Baker and SeaStar brand chemicals, are trusted by life sciences and electronic materials customers around the world and can be manufactured at purity levels as stringent as one part-per-trillion. Similarly, our NuSil brand of high-purity, customized silicones has been trusted for more than thirty years by leading medical device manufacturers and aerospace companies.

We complement our products with a range of value-added services. Each day, our onsite service associates work side-by-side with our customers to support their workflows. This close proximity to our customers and their workflows allows our associates to develop insights into how to serve them better. In certain cases, customers choose to fully leverage our value-added services and expertise by outsourcing specialized workflows entirely to us, further connecting us to their operations and allowing us to identify new business opportunities. We believe our growing services offering is a competitive advantage that further differentiates us from our competitors, deepens our relationships with current customers and enhances our ability to reach new ones.

We employ a differentiated innovation model that is informed by our embedded relationships with our customers and enables us to anticipate and align our innovation efforts with our customers’ priorities. We engage with our customers early in their product development cycles through our 300-person innovation team to advance our customers’ programs from research and discovery through development and commercialization. At each step of our customers’ workflows, we share our scientific and workflow expertise to help deliver incremental and sustainable improvements to existing customer products and processes. These projects include enhancing product purity and therefore its performance characteristics, improving product packaging and streamlining workflows. Our strategic initiatives include the development of new products in emerging areas of science such as cell and gene therapy. We currently have approximately 1,400 innovation projects with our customers that address process improvements for existing products and potential significant new opportunities for us to support.

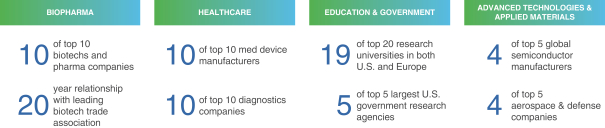

We are a strategic partner to a diverse and sophisticated customer base with stringent quality and regulatory demands. Our ability to customize products and processes at scale while meeting these quality and regulatory requirements and the embedded nature of our business model have made us an integral part of our customers’ development programs and broader supply chain. We are incorporated in approximately 785 of our customers’ master access files (“MAF”) and drug master files (“DMF”) that are registered with regulatory authorities around the world. Additionally, we are able to meet the exacting quality and regulatory requirements of our advanced technologies & applied materials customers, including semiconductor manufacturers, by providing materials at purity levels as stringent as one part-per-trillion. We have developed long-standing relationships with a global customer base, and generated approximately 36% of our net sales for the year ended December 31, 2019 from customers with whom we have 15+ year relationships. In total, in 2019 we believe we served established leaders and emerging innovators across each of the industries we serve:

The combination of our innovation centers and manufacturing facilities empowers us to support our customers from the earliest stages of their product innovation to commercial manufacturing, and provides us

2

Table of Contents

multiple opportunities to serve as a critical partner to them. Our eleven regional innovation centers located in seven different countries (including five currently operating in the Asia, Middle East and Africa (“AMEA”) region), allow us to efficiently support the product development needs of our diverse customer base. In addition, we have 28 manufacturing facilities, 13 of which are cGMP compliant and 12 of which are regulated by the U.S. Food and Drug Administration (“FDA”) or comparable foreign regulatory authorities. Led by our globally recognized VWR brand, we have approximately 150 sales and distribution centers strategically located to promote supply chain efficiency, enabling us to deliver orders virtually anywhere in the world, often within 24 to 48 hours. We employ approximately 3,600 sales and sales support professionals around the world who are focused on serving our customers through a local presence. Our professionals’ comprehensive industry-specific knowledge is supplemented by our leading online customer platform which affords current and potential customers a rich, informative and customized user experience and allows us to better address a global customer base. Many customers choose to directly integrate their ordering activity with our online platform. We have over 2,700 integrated connections with our customers and over 1,300 integrated connections with our suppliers to simplify and expedite their transactions with us. In 2019, approximately 51% of our revenues came from our digital channels.

In 2019, we recorded net sales of $6,040.3 million, net income of $37.8 million, Adjusted EBITDA of $1,031.2 million and Adjusted Net Income of $373.6 million. Approximately 85% of our net sales were from offerings which we consider to be recurring in nature. In addition, for the three months ended March 31, 2020, we have recorded net sales of $1,519.0 million, net income of $47.0 million, Adjusted EBITDA of $262.8 million and Adjusted Net Income of $111.9 million. For the definition of Adjusted EBITDA and Adjusted Net Income and reconciliations of these measures from net income or loss, please see “—Summary Historical Financial and Other Data.”

Our Competitive Strengths

Our customer-centric business model, combined with our deep understanding of our customers’ workflows, allows us to differentiate ourselves in the marketplace and is at the core of our competitive advantage. We believe the following competitive strengths provide the foundation for our position as the partner of choice for mission critical products and services to our customers:

Trusted Partner With Deep Customer Relationships. Our end-to-end integrated workflow platform and our ability to partner at every stage of research, development and commercialization have led to deep, embedded customer relationships. Over 1,300 of our associates are co-located with certain customers, working side-by-side with their scientists every day. We have collaborated with and supported many of our strategic global accounts for decades, and approximately 36% of our net sales for the year ended December 31, 2019 was generated by customers with whom we have maintained relationships for over 15 years. Regardless of company size or development stage, our customers seek a partner with innovative and comprehensive product offerings, superior quality, advanced manufacturing and skilled technical services to support all of their research, development and commercialization needs. Based on our expertise and experience in these areas, we believe we are a critical partner for our customers.

Customized Offerings to Address Our Customers’ Evolving Needs. We work closely with our customers to provide highly customized formulations across a variety of workflows. Our customization capabilities span the entire spectrum of core customer requirements, including purity, composition, blending, kitting, form factor, packaging, lot size and specialized certifications. Our ability to rapidly customize and innovate has led to significant adoption of our products as we and our customers seek to improve productivity and establish new processes. Our highly specialized and customized development, manufacturing and servicing capabilities also allow us to continue to pursue customized solutions in emerging and innovative therapeutic areas such as cell and gene therapies.

Depth And Breadth of Product and Service Offerings. Our comprehensive portfolio of materials & consumables, equipment & instrumentation and services & specialty procurement enables us to serve some

3

Table of Contents

of the most demanding and challenging areas of science. We offer more than six million distinct products that are often required by our customers in many of their most important processes. Our portfolio includes products valued for their exacting purity and performance specifications, some of which we manufacture to purity levels as stringent as one part-per-trillion. In addition, we offer our customers comprehensive value-added services and innovative services needed in the laboratory. We are dedicated to bringing new digital insights and capabilities to our customers as we collaborate to cultivate the “lab of the future”—a lab capable of generating and digesting vast amounts of data with IoT devices.

Quality and Regulatory Expertise Drives Customer Loyalty. We serve industries that are subject to rigorous quality, performance and reliability regulations. Our customers rely on us to navigate these requirements while also facilitating their innovation and manufacturing efforts. We have submitted and maintain approximately 785 MAFs and DMFs with the FDA and comparable local regulatory authorities in nine countries, which simplifies our customers’ medical product approval processes by allowing them to reference our products as part of their own applications. Our 13 cGMP facilities and 19 ISO-certified distribution facilities create a manufacturing and distribution network that is designed to meet stringent quality and regulatory requirements. Our quality expertise is highly valued, including in semiconductor manufacturing, where customer demands for precision frequently exceed those in pharmaceuticals, biologics and medical devices. Our manufacturing expertise allows us to utilize the same manufacturing line for all stages of development and commercialization thus reducing customer regulatory burdens as their products progress from the laboratory to full scale production. This differentiated approach allows our customers to bring their products to market faster and more efficiently, and allows us to typically maintain our position over the life of the product given the regulatory requirements, as well as the costs and risks involved in substituting our products.

Customer-Centric Innovation Framework. We employ a differentiated innovation model that is informed by our embedded relationships with our customers and enables us to anticipate and align our innovation efforts with our customers’ priorities. We take a portfolio approach to our activities and focus on both incremental and breakthrough innovation. We will continue to serve the most successful established and emerging companies through:

| • | Proprietary Product Innovations. We engage with our customers throughout their product lifecycles, including during initial discovery and development activities, to create materials and solutions that meet stringent specifications. We currently have approximately 1,400 innovation projects with our customers that address process improvements for existing products and potential significant new opportunities for us to support. |

| • | Third-Party Product Innovations. We are an important channel for thousands of specialized manufacturers of complex and sophisticated scientific products. Because we are already embedded in key customer workflows and are widely trusted among a broad collection of emerging and established suppliers, we are able to accelerate market acceptance and growth of promising third-party innovations. |

| • | Data and Research Analytics. We are actively engaged in developing advanced, innovative data integration and analytical solutions to support the vast amounts of data being generated by our customers. By relying on our data capabilities and insights, we will allow our customers to continue to focus on their core competencies while also participating in the benefits derived from analyzing and utilizing data. |

Global Scale, Strategic Locations and Specialized Infrastructure. We are strategically located close to our global customers to drive supply chain efficiency, minimize customer lead times and navigate a complex network of regulatory requirements. Our global footprint consists of over 200 facilities located in over 30 countries and allows us to deliver our extensive portfolio of products and services to customers nearly anywhere in the world and generally within 24 to 48 hours. We have the expertise and government

4

Table of Contents

licenses to manage multiple controlled environments globally, enabling us to safely and in a compliant manner handle highly regulated chemicals and other materials.

Attractive Financial Profile and Scalable Operating Platform. We believe we have an attractive business model due to our scale, resilient and recurring revenue base, demonstrated operating leverage, and strong cash flow generation. The cost of our products is often a small percentage of the overall cost of our customers’ workflow, resulting in a resilient business profile. Additionally, for the year ended December 31, 2019, approximately 85% of our sales were from our materials & consumables and services & specialty procurement offerings which we consider to be recurring. By employing the Avantor Business System (“ABS”), a disciplined approach to continuously unlocking operational efficiencies, we have a demonstrated track record of improving profitability and driving cash flow generation. Our platform is further enhanced by a disciplined approach to M&A that, prior to the VWR Acquisition, historically contributed incremental revenue growth to VWR of approximately 1% to 2% per year by targeting businesses that enhance our workflow solutions, increase our technical capabilities and extend our global reach.

World-Class Leadership with Proven Ability to Execute at Scale. Our 12-member senior executive team has extensive experience within the life sciences and advanced technologies & applied materials industries globally, and possesses a wide network of industry relationships. Our management team has a proven track record of delivering stable revenue growth, executing on investment plans, achieving margin expansion and driving continuous improvement of global enterprises. Our management team is supported by approximately 12,000 associates around the world who have extensive scientific and commercial experience and enable us to provide our customers with tailored expertise and service.

Our Growth Strategies

We intend to capitalize on our world-class platform and distinctive competitive strengths as we pursue the following growth strategies:

Increase Integration of Our Products and Services Into Customers’ Workflows. Our extensive and long-term relationships with our customers and our embedded position in their workflows provide us with unique insights into their activities and understanding of additional products and services that we could offer to them. We translate these insights and understanding, together with our focus on workflows, into a convenient one-stop solution for our customers resulting in a growing volume of business.

Develop New Products and Services. We are continuously expanding our portfolio to provide our customers with additional solutions and further expand our addressable markets. Specifically, we are focusing our efforts to expand our portfolio in:

| • | Bioproduction. We are broadening our range of process ingredients, serums, reagents, excipients, chromatography resins and single-use assemblies for use in the fast-growing bioproduction sector. |

| • | Custom Manufactured Products. We are continuing to partner with our customers to create materials and solutions that meet the unique and stringent specifications for their current and future products. We currently have approximately 1,400 customer-directed projects in development at our innovation centers located around the world. |

| • | New Products in High Growth Areas. We are working closely with our sales force and our customers’ R&D teams to understand emerging technologies and regulatory and industry standards that will become critical workflows in high growth industries. This close coordination with customers allows us to make targeted investments in the development of innovative products and solutions, bringing new products and services to market rapidly. |

| • | Service Offerings. We are expanding upon our traditional services, such as specialty procurement, to offer additional innovative, flexible and customized solutions to our global strategic customers. |

5

Table of Contents

| We will continue to expand the scope of our service offerings and increase the complexity, precision and value of our offerings. |

| • | Digital Capabilities. As the volume, velocity and variety of data generated by our customers continue to expand, the ability to organize and analyze this data for actionable insight has become increasingly critical to our customers. Based on the insights we gain as strategic partners, we are building a broad suite of technology-enabled offerings tailored to our customers’ objectives to increase productivity and effectiveness of their research and manufacturing workflows. |

Expand in Geographies Expected to Have Outsized Growth. We are focused on expanding our geographic reach and believe certain emerging economies, including China, Southeast Asia and Eastern Europe, offer a strong opportunity for growth. Local demand for our products and solutions in these regions is being driven by increasingly stringent quality and regulatory requirements, the expansion of our customers’ presence, an inadequate local supplier base and a significant increase in local government investment to support innovation in the industries we serve. We have invested in targeted geographies and intend to capitalize on our local presence and ability to attract new customers and follow existing ones into new geographies.

Continually Enhance Our Global Online Platform. We are continually improving and expanding our multi-lingual online sales platform in order to deliver our complete portfolio of offerings across all workflows. We will focus on enhancing our online platform in order to improve search engine effectiveness, simplify and personalize the user experience though enhancements to our vwr.com website and capture greater wallet share at existing customers and business from new customers. Using advanced analytics, we have also developed digital tools and marketing programs to increase the utility and stickiness of our platform, improve order conversion rates and share better insights with our customers regarding their needs and purchasing behaviors.

Increase Commercial Excellence and Operational Efficiency to Drive Margin Expansion. Operational discipline has been a core business focus at Avantor and VWR historically and continues to be our priority across manufacturing, sales and operational processes. The ABS is fundamental to our operational growth strategy to drive continuous improvement by improving efficiency throughout our supply chain and increasing our overall productivity. This approach will continue to be a key component in our margin expansion plans going forward and will help drive profitability and cash generation.

Pursue Strategic Acquisitions to Expand our Platform. We have a strong track record of successfully identifying, completing and integrating strategic acquisitions. Our broad platform, global infrastructure and diversified customer base allow us to generate growth and operating leverage through such acquisitions. We intend to continue to pursue opportunistic acquisitions in our existing and adjacent customer segments to accelerate our entry into high-growth markets and geographies as well as add capabilities and workflow solutions.

Industry Overview

We operate primarily in the biopharma, healthcare, education & government and advanced technologies & applied materials industries. We estimate our total addressable market within these industries to be approximately $70 billion in the aggregate in 2018. We expect the total addressable market we serve will grow approximately 5% annually from 2018 to 2020. Our customers are sophisticated, science-driven businesses working across highly technical industries that require innovation and adherence to the most demanding technical and regulatory requirements.

6

Table of Contents

The following are some of the market forces affecting our customers and driving growth within our industries:

| • | Favorable Demographic and Epidemiologic Trends. Healthcare demand is increasing rapidly across most of the world, driven principally by aging populations, an increased prevalence of chronic diseases and improved access to healthcare. |

| • | Strong Funding and Externalization of Drug Discovery. Research and development (“R&D”) activities are accelerating with approximately $200 billion of investment in life sciences being deployed each year by a variety of sources as of 2018, including governments, startups and large pharmaceutical companies. We have seen an increasing trend in R&D outsourcing among both small and large pharmaceutical companies, who are focused on driving efficiencies in their processes and aim to focus on their key strengths and value generating activities. |

| • | Proliferation of R&D and Development of New Therapeutic Modalities. The rapid, accelerating pace of scientific innovation in the industries we serve is propelling heightened investment in complex and novel research, including new biologic and therapeutic modalities. |

| • | Emergence of Biosimilars. Biosimilars are rapidly emerging alongside small and large molecule drugs. Based on our evaluation of third-party data, we estimate biosimilar sales will exceed $25 billion by 2020. |

| • | Digital Transformation of Science. The rapid adoption of technologies such as big data and analytics and cloud based solutions represents a meaningful opportunity to automate and optimize mission critical operations and drive competitive differentiation. |

| • | Positive Research and Development Trends in Advanced Technologies & Applied Materials. Continued demand for Internet of Things (“IoT”) devices and groundbreaking technological advancements, including artificial intelligence and autonomous cars, are driving demand for improved chip designs that often have smaller feature sizes. These new chips will increase the need for ultra-high purity materials, in higher volumes, that are used in the semiconductor manufacturing processes. In addition, the aerospace & defense industry continues to utilize new technologies and features, which has driven increased spending in this industry. |

The following is a summary of the industries we serve:

| • | Biopharma. Our offerings are used by biopharmaceutical companies, biotechnology companies, biosimilar companies, generic drug companies and contract manufacturing organizations (“CMOs”) of all sizes to specifically address their development and manufacturing needs during each phase of a drug’s lifecycle, from research and development to commercialization. We are well-positioned to support the emerging needs of science, providing solutions for both traditional small molecule sectors and the growing, more complex large molecule sector. We estimate that our addressable portion of the biopharma industry for 2018 was approximately $30 billion and will grow approximately 7% from 2018 to 2020. |

| • | Healthcare. Healthcare consists of medical implants, drug delivery devices, non-implantable devices (the “medical device industry”) and diagnostic tools and consumables (the “diagnostics industry”). Our offerings include high-purity silicones used in the manufacture of medical implantable devices, including aesthetic and reconstructive implants, pacemakers and cochlear implants. Our high-purity silicones are also frequently specified into non-implantable medical devices, such as medical-grade tubing, balloons and bladders. Also, we provide medical-grade silicones expertise to customize sustained drug-release devices for our pharmaceutical and biologics customers. We estimate that our addressable portion of the healthcare industry for 2018 was approximately $9 billion and will grow approximately 5% from 2018 to 2020. |

7

Table of Contents

| • | Education & Government. The education & government industry consists of government sponsored research across multiple areas of discovery, including basic and applied science. Our offerings are used by academic institutions and government sponsored organizations to address their needs for continued education and testing and research activities that includes areas such as agriculture and environmental. We estimate that our addressable portion of the education & government industry for 2018 was approximately $15 billion and will grow approximately 3% from 2018 to 2020. |

| • | Advanced Technologies & Applied Materials. We have a comprehensive product line of solutions and high-purity acids and solvents used in the manufacture of semiconductors and other high precision electronic applications. We also offer an extensive line of specialty space-grade silicone materials to the aerospace & defense industry. These highly customized materials are used in extreme environments, and include adhesives, sealants, coatings and other inputs for various aircraft, satellite and space applications. We estimate that our addressable portion of the advanced technologies & applied materials industry for 2018 was approximately $15 billion and will grow approximately 4% from 2018 to 2020. |

Risks Related to Our Business and Our Industry, Regulation and Our Offering

Investing in our common stock involves substantial risk, and our ability to successfully operate our business is subject to numerous risks. Some of the more significant challenges and risks related to our business include the following:

| • | the impact of the COVID-19 pandemic on our business, operating results, cash flows and/or financial condition; |

| • | our ability to implement our growth strategy, both domestically and internationally, while maintaining our commercial operations and administrative activities; |

| • | our ability to anticipate and respond to changing industry trends; |

| • | our ability to continue to successfully value and integrate acquired businesses; |

| • | our products’ satisfaction of applicable quality criteria, specifications and performance standards; and |

| • | our leverage, our ability to incur more debt and access additional capital, and our ability to generate cash to service our indebtedness and to fund our other liquidity needs. |

Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our common stock.

Corporate History and Information

Our 115 year legacy began in 1904 with the founding of the J.T. Baker Chemical Company. In 2010, Avantor was acquired by affiliates of New Mountain Capital, LLC (“New Mountain Capital”), our sponsor, from Covidien plc. Since then, we have expanded through a series of large acquisitions across the globe. In 2016, we acquired NuSil, a leading supplier of high-purity silicone products for the medical device industry that was founded in 1985. In 2017, we also acquired VWR, a global manufacturer and distributor of laboratory and production products and services founded in 1852 that now represents the primary ordering platform for our customers. Avantor, Inc. was incorporated in Delaware in May 2017 in anticipation of the VWR Acquisition.

Our principal executive offices are located at the Radnor Corporate Center, Building One, Suite 200, 100 Matsonford Road, Radnor, Pennsylvania 19087 and our telephone number is (610) 386-1700. Our website is www.avantorsciences.com. Information contained on our website or that can be accessed through our website is not part of, and is not incorporated by reference in, this prospectus.

8

Table of Contents

Recent Developments

In December 2019, a novel coronavirus disease (COVID-19) was reported and in January 2020, the World Health Organization (“WHO”) declared COVID-19 a Public Health Emergency of International Concern. On February 28, 2020, the WHO raised its assessment of the COVID-19 threat from high to very high at a global level due to the continued increase in the number of cases and affected countries, and on March 11, 2020, the WHO characterized COVID-19 as a pandemic.

For a discussion of the impact the COVID-19 pandemic had on our business during the three months ended March 31, 2020, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report, which is incorporated by reference herein. We experienced a modest impact from the pandemic during the first quarter of 2020. Following quarter end, we experienced low single-digit declines on our business in April of 2020, representing a modest net negative impact of the pandemic during this period. Such declines are primarily attributable to academic lab closures, curtailment of elective procedures and lower demand in the industrial portion of the advanced technologies and applied materials end market. In addition, we also experienced modest positive impacts on our business from continued strength in the biopharma industry, as well as demand for personal protective equipment and COVID-19-specific solutions. For a discussion of risks related to the COVID-19 pandemic, see “Risk Factors—The scale and scope of the recent COVID-19 outbreak and resulting pandemic is unknown and is expected to adversely impact our business at least for the near term. The overall impact on our business, operating results, cash flows and/or financial condition could be material.”

9

Table of Contents

The Offering

| Common stock offered by the selling stockholders |

45,000,000 shares. |

| Option to purchase additional shares of common stock |

The underwriters have an option for a period of 30 days from the date of this prospectus to purchase up to 6,750,000 additional shares of common stock from the selling stockholders. |

| Common stock outstanding |

574,885,011 shares (as of March 31, 2020). |

| Use of proceeds |

We will not receive any proceeds from the sale of shares of common stock by the selling stockholders named in this prospectus. While we have agreed to pay certain offering expenses for the selling stockholders incurred in connection with the sale, the selling stockholders will bear all commissions and discounts, if any, from the sale of our common stock pursuant to this prospectus. See “Use of Proceeds” and “Principal and Selling Stockholders.” |

| Dividend policy |

We do not currently anticipate paying any dividends on our common stock. We expect to retain all future earnings for use in the operation and expansion of our business. Any decision to declare and pay dividends in the future will be made at the sole discretion of our Board of Directors and will depend on various factors. Our ability to pay dividends on common stock may be restricted by the documents governing our and our subsidiaries’ existing and future outstanding indebtedness. No dividends may be declared or paid on our common stock unless accumulated and unpaid dividends on our 6.250% Series A mandatory convertible preferred stock (the “Mandatory Convertible Preferred Stock”) have been declared and paid, or set aside for payment, on all outstanding shares of the Mandatory Convertible Preferred Stock for all preceding dividend periods. See “Dividend Policy.” |

| Risk factors |

See “Risk Factors” for a discussion of risks you should carefully consider before deciding to invest in our common stock. |

| Conflicts of interest |

Certain affiliates of Goldman Sachs & Co. LLC (i) are selling stockholders in this offering and will receive approximately $ (or %) of the net proceeds, (ii) currently own 72,605,349 shares of our common stock and (iii) currently have one director appointee on our Board, as well as other rights. Therefore, Goldman Sachs & Co. LLC is deemed to have a conflict of interest within the meaning of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“Rule 5121”). Accordingly, this offering is being conducted in accordance with Rule 5121. |

| Certain of the affiliates of Goldman Sachs & Co. LLC that hold our common stock are funds whose limited partners are current and former employees of Goldman Sachs & Co. LLC; these current |

10

Table of Contents

| employees include individuals who are providing services on behalf of Goldman Sachs & Co. LLC in connection with this offering. See “Certain Relationships and Related Party Transactions” and “Underwriting (Conflicts of Interest).” |

| NYSE ticker symbol |

“AVTR.” |

Unless otherwise indicated or the context otherwise requires, all information in this prospectus reflects and assumes no exercise by the underwriters’ option to purchase up to 6,750,000 additional shares of our common stock.

Additionally, the number of shares of our common stock is based on 574,885,011 shares of our common stock outstanding as of March 31, 2020 and does not reflect:

| • | (i) 7,963,445 shares of common stock that may be issued upon the exercise of outstanding options at an average weighted exercise price of $16.26 and (ii) 11,088,951 shares of common stock that may be issued pursuant to future awards, in each case, under our 2019 Equity Incentive Plan (as defined below); |

| • | 10,945,098 shares of common stock that may be issued upon the exercise of outstanding options at an average weighted exercise price of $23.21 issued under the Vail Plan (as defined below); |

| • | 6,063,117 shares of common stock that may be issued upon the exercise of outstanding options at an average weighted exercise price of $4.48 issued under the Legacy Avantor Plan (as defined below); |

| • | 6,204,819 shares of common stock that may be issued upon the vesting of restricted stock units and performance stock units issued under the 2019 Equity Incentive Plan and/or the Legacy Avantor Plan; |

| • | 2,000,000 shares of common stock that may be issued pursuant to our employee stock purchase plan (the “ESPP”); and |

| • | up to 73,927,980 shares of our common stock issuable upon conversion of the Mandatory Convertible Preferred Stock, subject to anti-dilution, make-whole and other adjustments or any shares of our common stock that may be issued in payment of a dividend, fundamental change dividend make-whole amount or accumulated dividend amount. |

11

Table of Contents

Summary Historical Financial and Other Data

The following tables set forth our summary historical consolidated financial data as of the dates and for the periods indicated. The summary historical consolidated financial data as of December 31, 2018 and December 31, 2019 and for the years ended December 31, 2017, December 31, 2018 and December 31, 2019 is derived from our audited consolidated financial statements and related notes thereto incorporated by reference in this prospectus. The summary historical consolidated balance sheet data as of December 31, 2017, is derived from our audited consolidated financial statements and related notes thereto not included in this prospectus. The summary historical condensed consolidated financial data as of March 31, 2020 and for the three months ended March 31, 2019 and 2020 is derived from our unaudited condensed consolidated financial statements and related notes thereto incorporated by reference in this prospectus. The unaudited condensed consolidated financial statements have been prepared on the same basis as our audited consolidated financial statements and, in the opinion of our management, reflect all normal recurring adjustments necessary for the fair presentation of our consolidated results for these periods. The results for any interim period are not necessarily indicative of the results that may be expected for the full year. Additionally, our historical results are not necessarily indicative of the results expected for any future period.

In accordance with GAAP, we have included the financial results of VWR since the VWR Acquisition on November 21, 2017. For more information about this basis of presentation, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 1 to the audited annual financial statements in our Annual Report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 1 to the unaudited condensed consolidated financial statements in our Quarterly Report, each of which is incorporated by reference in this prospectus.

You should read the information contained in this table in conjunction with “Capitalization” included in this prospectus, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and the accompanying notes thereto in our Annual Report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our unaudited condensed consolidated financial statements and related notes thereto in our Quarterly Report, each of which is incorporated by reference in this prospectus.

12

Table of Contents

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions, except per share data) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| Statement of operations data |

||||||||||||||||||||

| Net sales |

$ | 1,247.4 | $ | 5,864.3 | $ | 6,040.3 | 1,480.1 | $ | 1,519.0 | |||||||||||

| Cost of sales |

814.6 | 4,044.5 | 4,119.6 | 1,004.9 | 1,017.1 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

432.8 | 1,819.8 | 1,920.7 | 475.2 | 501.9 | |||||||||||||||

| Selling, general and administrative expenses |

449.7 | 1,405.3 | 1,368.9 | 337.6 | 343.5 | |||||||||||||||

| Fees to New Mountain Capital |

193.5 | 1.0 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating (loss) income |

(210.4 | ) | 413.5 | 551.8 | 137.6 | 158.4 | ||||||||||||||

| Interest expense |

(200.9 | ) | (523.8 | ) | (440.0 | ) | (128.6 | ) | (94.5 | ) | ||||||||||

| Loss on extinguishment of debt |

(56.4 | ) | — | (73.7 | ) | — | — | |||||||||||||

| Other income (expense), net |

7.5 | (3.5 | ) | 2.5 | (5.1 | ) | 0.8 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) income before income taxes |

(460.2 | ) | (113.8 | ) | 40.6 | 3.9 | 64.7 | |||||||||||||

| Income tax benefit (expense) |

314.9 | 26.9 | (2.8 | ) | (10.1 | ) | (17.7 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income |

(145.3 | ) | (86.9 | ) | 37.8 | (6.2 | ) | 47.0 | ||||||||||||

| Net loss attributable to noncontrolling interests |

(32.6 | ) | — | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net (loss) income attributable to Avantor, Inc. |

(112.7 | ) | (86.9 | ) | 37.8 | (6.2 | ) | 47.0 | ||||||||||||

| Accumulation of yield on preferred stock |

(27.8 | ) | (269.5 | ) | (152.5 | ) | (71.8 | ) | (16.1 | ) | ||||||||||

| Adjustment of preferred stock to redemption value |

(274.4 | ) | — | (220.4 | ) | — | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss available to common stockholders of Avantor, Inc. |

$ | (414.9 | ) | $ | (356.4 | ) | $ | (335.1 | ) | $ | (78.0 | ) | $ | 30.9 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (Loss) earnings per share information: |

||||||||||||||||||||

| (Loss) earnings per share, basic and diluted |

$ | (2.75 | ) | $ | (2.69 | ) | $ | (0.84 | ) | (0.59 | ) | 0.05 | ||||||||

| Weighted average shares outstanding, basic |

151.1 | 132.7 | 401.2 | 132.8 | 573.7 | |||||||||||||||

| Weighted average shares outstanding, diluted |

151.1 | 132.7 | 401.2 | 132.8 | 581.3 | |||||||||||||||

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| Balance sheet data (as of period end) |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 185.4 | $ | 184.7 | $ | 186.7 | $ | 346.3 | ||||||||||||

| Total assets |

10,446.5 | 9,911.6 | 9,773.3 | 9,786.2 | ||||||||||||||||

| Total long-term debt, including current portion |

7,117.8 | 6,924.7 | 5,116.5 | 5,054.7 | ||||||||||||||||

| Total liabilities |

9,476.9 | 9,104.0 | 7,311.1 | 7,346.1 | ||||||||||||||||

| Total redeemable equity |

3,589.8 | 3,859.3 | — | — | ||||||||||||||||

| Total stockholders’ (deficit) equity |

(2,620.2 | ) | (3,051.7 | ) | 2,462.2 | 2,440.1 | ||||||||||||||

| Cash flow data |

||||||||||||||||||||

| Net cash (used in) provided by operating activities |

$ | (167.5 | ) | $ | 200.5 | $ | 354.0 | $ | 75.0 | $ | 253.1 | |||||||||

| Net cash used in investing activities |

(6,676.0 | ) | (23.2 | ) | (42.1 | ) | (7.9 | ) | (11.9 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

6,965.0 | (170.3 | ) | (307.8 | ) | (106.1 | ) | (73.1 | ) | |||||||||||

| Other data |

||||||||||||||||||||

| Adjusted EBITDA(1) |

$ | 289.5 | $ | 945.3 | $ | 1,031.2 | $ | 248.0 | $ | 262.8 | ||||||||||

| Adjusted Net Income(1) |

67.4 | 232.9 | 373.6 | 68.2 | 111.9 | |||||||||||||||

| (1) | We define Adjusted EBITDA as net income or loss exclusive of interest expense, income tax expense, depreciation, amortization and certain other adjustments that we do not consider in our evaluation of our |

13

Table of Contents

| ongoing operating performance from period to period as discussed further below. We believe Adjusted EBITDA is frequently used by analysts, investors and other interested parties to evaluate companies in our industry and is a helpful supplemental measure to provide additional insight in evaluating a company’s core operational performance as it excludes costs that do not relate to the underlying operation of their business. Adjusted EBITDA as presented herein does not include adjustments for the run-rate effect of synergies, which is included in calculating Adjusted Net Leverage, a metric that is incorporated by reference into this prospectus. We believe that the actions we have taken in respect of the global value capture program as of March 31, 2020 would generate an additional $20.3 million of projected annualized cost synergies (above and beyond what is already included in our historical results). |

We define Adjusted Net Income as net income or loss exclusive of amortization as further adjusted to eliminate the impact of certain costs related to the IPO, our reorganization and other items that we do not consider in our evaluation of our ongoing operating performance from period to period as discussed further below. We believe Adjusted Net Income is useful to investors as a way to analyze the underlying trends in our core business consistently across the periods inclusive of interest and depreciation.

Adjusted EBITDA and Adjusted Net Income are non-GAAP measures of our financial performance and should not be considered as alternatives to net income or loss as a measure of financial performance, or any other performance measure derived in accordance with GAAP, nor should it be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted Net Income are not intended to be measures of free cash flow for management’s discretionary use, as they do not reflect certain cash requirements such as tax payments, debt service requirements, capital expenditures and certain other cash costs that may recur in the future. Adjusted EBITDA and Adjusted Net Income contain certain other limitations, including the failure to reflect our cash expenditures, cash requirements for working capital needs and cash costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted Net Income. Our presentation of Adjusted EBITDA and Adjusted Net Income is not necessarily comparable to other similarly titled captions of other companies due to different methods of calculation.

The following table sets forth a reconciliation of net income or loss, the most directly comparable GAAP performance measure, to Adjusted EBITDA and Adjusted Net Income, using data derived from our consolidated financial statements, in each case for the periods indicated:

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| Net (loss) income |

$ | (145.3 | ) | $ | (86.9 | ) | $ | 37.8 | $ | (6.2 | ) | $ | 47.0 | |||||||

| Amortization(a) |

65.2 | 321.3 | 312.3 | 78.6 | 77.4 | |||||||||||||||

| Net foreign currency loss from financing activities(b) |

5.5 | 6.5 | 1.9 | 6.2 | 1.6 | |||||||||||||||

| Gain on derivative instruments(c) |

(9.6 | ) | — | — | — | — | ||||||||||||||

| Other stock-based compensation expense (benefit)(d) |

26.6 | (0.7 | ) | 36.8 | — | (1.1 | ) | |||||||||||||

| Loss on extinguishment of debt(e) |

56.4 | — | 73.7 | — | — | |||||||||||||||

| Restructuring and severance charges(f) |

29.6 | 81.2 | 24.3 | 5.5 | 1.2 | |||||||||||||||

| Purchase accounting adjustments(g) |

41.8 | (1.0 | ) | (10.7 | ) | — | — | |||||||||||||

| Transaction fees to New Mountain Capital(h) |

192.5 | — | — | (0.8 | ) | — | ||||||||||||||

| VWR transaction, integration and planning expenses(i) |

73.7 | 36.2 | 22.5 | 6.3 | 3.6 | |||||||||||||||

| Adjustment for U.S. tax reform(j) |

(126.7 | ) | (27.3 | ) | — | — | — | |||||||||||||

| Other(k) |

33.1 | 8.5 | 3.2 | — | 1.8 | |||||||||||||||

14

Table of Contents

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| Income tax benefit applicable to pretax adjustments(1) |

(175.4 | ) | (104.9 | ) | (128.2 | ) | (21.4 | ) | (19.6 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted Net Income |

67.4 | 232.9 | 373.6 | 68.2 | 111.9 | |||||||||||||||

| Interest expense(a) |

200.9 | 523.8 | 440.0 | 128.6 | 94.5 | |||||||||||||||

| Depreciation(a) |

34.0 | 83.3 | 86.6 | 19.7 | 19.1 | |||||||||||||||

| Income tax (benefit) provision applicable to Adjusted Net Income(m) |

(12.8 | ) | 105.3 | 131.0 | 31.5 | 37.3 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 289.5 | $ | 945.3 | $ | 1,031.2 | $ | 248.0 | $ | 262.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (a) | Represents amounts as determined under GAAP. |

| (b) | Represents remeasurement of various foreign-denominated borrowings into functional currencies. Our U.S. subsidiaries carry a significant amount of euro-denominated debt, and many of our subsidiaries borrow and lend with each other in foreign currencies. Through July 11, 2019, the foreign currency losses were primarily caused by unhedged intercompany loans receivable ranging from €190 million and €795 million. |

On July 11, 2019, we completed an intercompany recapitalization that is intended to mitigate substantially all of our net euro financing exposure in future periods. We still expect to record gains and losses related to intercompany borrowings denominated in other currencies. Historically, the remeasurement of borrowings denominated in currencies other than the euro has not been material.

| (c) | Represents the realized gain on foreign currency forward contracts used to partially hedge pre-acquisition changes in the value of VWR’s euro-denominated loans. |

| (d) | Represents expenses primarily related to remeasuring stand alone appreciation rights at fair value on a recurring basis, the vesting of performance stock options with the completion of our IPO and the modification of stock-based awards caused by the legal entity restructuring in November 2017. |

| (e) | Represents the write-off of unamortized deferred financing fees and, additionally in 2017, a $9.6 million payment of a call premium, each incurred as a result of refinancing our outstanding indebtedness or making significant prepayments on our term loans, and which were otherwise classified as interest expense in our prior presentation of Adjusted EBITDA. As a result of a loss on extinguishment of debt of $73.7 million in 2019, we determined it was appropriate to include this as an addition to Adjusted Net Income, and also to include the related 35% tax effect in the income tax benefit applicable to pretax adjustments. While Adjusted Net Income was impacted by this reclassification of adjustments, there was no change to the amount of 2017 Adjusted EBITDA. |

| (f) | The following table presents restructuring and severance charges by plan: |

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| 2017 restructuring |

$ | 17.5 | $ | 78.3 | $ | 23.0 | $ | 5.1 | $ | 1.2 | ||||||||||

| Other |

12.1 | 2.9 | 1.3 | 0.4 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 29.6 | $ | 81.2 | $ | 24.3 | $ | 5.5 | $ | 1.2 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Other includes three smaller plans for VWR, NuSil and legacy Avantor and other non-plan initiatives.

| (g) | Represents reversals of the short-term impact of purchase accounting adjustments on earnings. The most significant adjustment in 2017 was an increase to cost of sales that resulted from valuing VWR’s inventory at fair value in purchase accounting. The most significant adjustment in 2019 was a normalization of expense for prepaid customer rebates that were derecognized in purchase accounting. |

| (h) | Represents transaction fees paid to New Mountain Capital. Pursuant to the terms of their advisory agreement with us, in 2017 New Mountain Capital earned a fee equal to 2% of the value of a debt refinancing and the VWR Acquisition. See “Certain Relationships and Related Party Transactions.” |

15

Table of Contents

| (i) | Represents direct expenses incurred to consummate the VWR Acquisition and other expenses incurred related to the planning and integration of VWR. |

| (j) | Represents the accounting effects of tax reform legislation enacted in the United States. In 2017, we recognized a provisional one-time income tax benefit of $126.7 million, consisting of a $285.5 million benefit caused by the remeasurement of our deferred tax assets and liabilities at the new corporate tax rate, offset in part by a $158.8 million expense caused by the one-time transition tax on our accumulated foreign undistributed earnings and profits. In 2018, we finalized our provisional accounting for U.S. tax reform, which included interpreting new transition tax regulations issued in 2018. In connection with finalizing our provisional accounting, we recognized a further income tax benefit of $27.3 million, consisting of a $48.8 million benefit related to the one-time transition tax, offset in part by an expense of $21.5 million related to deferred tax remeasurement. During the preparation of our third quarter 2019 results, we concluded that it was more appropriate to remove the impact of these one-time benefits from U.S. tax reform in the calculation of Adjusted Net Income, and reclassify such impact as an increase to the income tax benefit provision applicable to Adjusted Net Income. As a result, Adjusted Net Income for 2017 and 2018 was reduced by $126.7 million (offset by adjustments for debt extinguishment net of the related tax effect) and $27.3 million, respectively, but there were no changes to the amounts of 2017 and 2018 Adjusted EBITDA. |

| (k) | The following table presents the components of other: |

| Year ended December 31, | Three months ended March 31, |

|||||||||||||||||||

| (in millions) | 2017 | 2018 | 2019 | 2019 | 2020 | |||||||||||||||

| Unconsummated equity offering |

$ | 19.9 | $ | — | $ | — | $ | — | $ | — | ||||||||||

| NuSil-related integration expenses |

5.1 | — | — | — | — | |||||||||||||||

| Executive departures |

— | 4.5 | — | — | — | |||||||||||||||

| Impairment charges |

5.0 | 2.9 | — | — | — | |||||||||||||||

| Debt refinancing fees |

3.1 | — | — | — | — | |||||||||||||||

| Other transaction expenses |

— | 1.1 | 3.2 | — | 1.8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 33.1 | $ | 8.5 | $ | 3.2 | $ | — | $ | 1.8 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (l) | Represents the income tax benefit associated with the reconciling items between net income or loss and Adjusted Net Income. To determine the aggregate tax effect of the reconciling items, we utilized statutory income tax rates ranging from 0% and 35%, depending upon the applicable jurisdictions of each adjustment. |

| (m) | Represents the difference between income tax expense or benefit as determined under GAAP and the income tax benefit applicable to pretax adjustments. |

16

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information in this prospectus or incorporated by reference herein, including the risks and uncertainties discussed under the section “Summary—Summary Historical Financial and Other Data” included in this prospectus, the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the audited financial statements and the notes thereto in our Annual Report and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the unaudited condensed consolidated financial statements and related notes thereto in our Quarterly Report, each of which is incorporated by reference herein, before investing in our common stock. The scale and scope of the COVID-19 pandemic may heighten the potential adverse effects on our business, operating results, cash flows and/or financial condition described in the risk factors contained in our Annual Report and Quarterly Report. If any of the risks described below actually occur, our business, financial condition, results of operations or prospects could be materially adversely affected. In any such case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to this Offering and Ownership of Our Common Stock