Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Avantor, Inc. | d907406dex992.htm |

| EX-23.1 - EX-23.1 - Avantor, Inc. | d907406dex231.htm |

| 8-K - 8-K - Avantor, Inc. | d907406d8k.htm |

Exhibit 99.1

| VWR CORPORATION |

||||

| 2 | ||||

| Audited Consolidated Financial Statements as of December 31, 2016 and 2015 and for each of the three years in the period ended December 31, 2016 |

| |||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| Consolidated statements of redeemable equity and stockholders’ equity |

7 | |||

| 8 | ||||

| 9 | ||||

1

VWR Corporation

| Description | ||

| Company, we, us, our | VWR Corporation and its consolidated subsidiaries | |

| 2014 Plan | the VWR Corporation 2014 Equity Incentive Plan | |

| Americas | a segment covering North, Central and South America | |

| A/R Facility | an accounts receivable securitization facility due 2018 | |

| AOCI | accumulated other comprehensive income or loss | |

| Annual Report | our Annual Report on Form 10-K filed with the SEC on February 4, 2017 | |

| Avantor | Avantor, Inc., a company with which we are agreed to merge | |

| Biopharma | the combination of the pharmaceutical and biotechnology sectors | |

| Board | the Board of Directors of VWR Corporation | |

| EMEA-APAC | a segment covering Europe, Middle East, Africa and Asia-Pacific | |

| EURIBOR | the applicable interest rate determined by the Banking Federation of the European Union | |

| FASB | the Financial Accounting Standards Board | |

| GAAP | United States generally accepted accounting principles | |

| German, French, and UK Plans | the defined benefit plans in Germany, France and the United Kingdom | |

| IPO | our initial public offering which occurred in 2014 | |

| ITRA | the income tax receivable agreement between us and Varietal | |

| LIBOR | the applicable British Bankers Association London Interbank Offered Rate | |

| LIFO | last-in, first-out inventory method | |

| SEC | the United States Securities and Exchange Commission | |

| SG&A expenses | selling, general and administrative expenses | |

| U.S. Retirement Plan | the defined benefit plan in the United States | |

| Varietal | Varietal Distribution Holdings, LLC, a significant stockholder and affiliate | |

| VWR Funding | VWR Funding, Inc., our wholly-owned subsidiary |

2

Report of Independent Registered Public Accounting Firm

The Board of Directors and Stockholders

VWR Corporation:

We have audited the accompanying consolidated balance sheets of VWR Corporation and subsidiaries as of December 31, 2016 and 2015, and the related consolidated statements of income, comprehensive income or loss, redeemable equity and stockholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2016. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of VWR Corporation and subsidiaries as of December 31, 2016 and 2015, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2016, in conformity with U.S. generally accepted accounting principles.

/s/ KPMG LLP

Philadelphia, Pennsylvania

February 24, 2017

3

VWR Corporation and subsidiaries

Consolidated balance sheets

| December 31, | ||||||||

| (in millions, except per share data) | 2016 | 2015 | ||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 168.7 | $ | 136.3 | ||||

| Trade accounts receivable, net of reserves of $10.5 and $12.0 |

607.2 | 583.2 | ||||||

| Inventories |

483.1 | 424.0 | ||||||

| Other current assets |

93.1 | 89.5 | ||||||

|

|

|

|

|

|||||

| Total current assets |

1,352.1 | 1,233.0 | ||||||

| Property and equipment, net of accumulated depreciation of $248.9 and $216.2 |

253.8 | 228.2 | ||||||

| Goodwill |

1,844.0 | 1,791.4 | ||||||

| Other intangible assets, net |

1,407.8 | 1,455.6 | ||||||

| Other assets |

104.8 | 85.6 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 4,962.5 | $ | 4,793.8 | ||||

|

|

|

|

|

|||||

| Liabilities, redeemable equity and stockholders’ equity |

||||||||

| Current liabilities: |

||||||||

| Current portion of debt |

$ | 250.1 | $ | 92.8 | ||||

| Accounts payable |

476.3 | 474.5 | ||||||

| Employee-related liabilities |

79.3 | 61.4 | ||||||

| Current amount due to Varietal — ITRA |

27.7 | 78.1 | ||||||

| Other current liabilities |

152.7 | 112.3 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

986.1 | 819.1 | ||||||

| Debt, net of current portion |

1,766.9 | 1,896.2 | ||||||

| Amount due to Varietal — ITRA, net of current portion |

57.3 | 85.0 | ||||||

| Deferred income tax liabilities |

477.2 | 459.5 | ||||||

| Other liabilities |

159.4 | 158.8 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

3,446.9 | 3,418.6 | ||||||

| Commitments and contingencies (Note 10) |

||||||||

| Redeemable equity, at redemption value |

21.2 | 38.8 | ||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.01 par value; 50.0 shares authorized, no shares issued or outstanding |

— | — | ||||||

| Common stock, $0.01 par value; 750.0 shares authorized, 131.6 and 131.4 shares issued and outstanding |

1.3 | 1.3 | ||||||

| Additional paid-in capital |

1,766.0 | 1,735.1 | ||||||

| Retained earnings |

154.5 | 6.3 | ||||||

| Accumulated other comprehensive loss |

(427.4 | ) | (406.3 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

1,494.4 | 1,336.4 | ||||||

|

|

|

|

|

|||||

| Total liabilities, redeemable equity and stockholders’ equity |

$ | 4,962.5 | $ | 4,793.8 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

4

VWR Corporation and subsidiaries

Consolidated income statements

| Year ended December 31, | ||||||||||||

| (in millions, except per share data) | 2016 | 2015 | 2014 | |||||||||

| Net sales |

$ | 4,514.2 | $ | 4,318.8 | $ | 4,375.3 | ||||||

| Cost of goods sold |

3,252.4 | 3,121.7 | 3,131.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

1,261.8 | 1,197.1 | 1,243.4 | |||||||||

| Selling, general and administrative expenses |

946.2 | 876.9 | 925.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Operating income |

315.6 | 320.2 | 317.9 | |||||||||

| Interest expense |

(79.7 | ) | (102.8 | ) | (166.3 | ) | ||||||

| Other income (expense), net |

(1.1 | ) | 45.4 | 90.9 | ||||||||

| Loss on extinguishment of debt |

(0.5 | ) | (32.7 | ) | (5.1 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income before income taxes |

234.3 | 230.1 | 237.4 | |||||||||

| Income tax provision |

(86.1 | ) | (75.8 | ) | (84.8 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net income |

148.2 | 154.3 | 152.6 | |||||||||

| Accretion of dividends on redeemable equity |

— | — | (29.4 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income applicable to common stockholders |

$ | 148.2 | $ | 154.3 | $ | 123.2 | ||||||

|

|

|

|

|

|

|

|||||||

| Earnings per share: |

||||||||||||

| Basic |

$ | 1.13 | $ | 1.17 | $ | 2.50 | ||||||

| Diluted |

1.12 | 1.17 | 2.49 | |||||||||

| Weighted average shares outstanding: |

||||||||||||

| Basic |

131.5 | 131.4 | 49.3 | |||||||||

| Diluted |

131.8 | 131.8 | 49.5 | |||||||||

See accompanying notes to consolidated financial statements.

5

VWR Corporation and subsidiaries

Consolidated statements of comprehensive income or loss

| Year ended December 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| Net income |

$ | 148.2 | $ | 154.3 | $ | 152.6 | ||||||

| Other comprehensive loss: |

||||||||||||

| Foreign currency translation: |

||||||||||||

| Net unrealized loss arising during the period |

(22.4 | ) | (174.4 | ) | (204.2 | ) | ||||||

| Reclassification of net loss into earnings |

1.2 | — | — | |||||||||

| Derivative instruments: |

||||||||||||

| Net unrealized gain arising during the period |

9.1 | 3.0 | 0.7 | |||||||||

| Reclassification of net (gain) loss into earnings |

(2.3 | ) | (0.7 | ) | 1.1 | |||||||

| Defined benefit plans: |

||||||||||||

| Net unrealized loss arising during the period |

(9.4 | ) | (7.0 | ) | (27.0 | ) | ||||||

| Reclassification of net loss (gain) into earnings |

2.7 | 2.7 | (3.0 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Other comprehensive loss |

(21.1 | ) | (176.4 | ) | (232.4 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Comprehensive income (loss) |

$ | 127.1 | $ | (22.1 | ) | $ | (79.8 | ) | ||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to consolidated financial statements.

6

VWR Corporation and subsidiaries

Consolidated statements of redeemable equity and stockholders’ equity

| Redeemable equity, at redemption value |

Stockholders’ equity | |||||||||||||||||||||||||||

| Common stock | Additional paid-in capital |

Retained earnings (deficit) |

AOCI | Total | ||||||||||||||||||||||||

| (in millions) | Shares | Par value |

||||||||||||||||||||||||||

| Balance at December 31, 2013 |

$ | 670.6 | 0.1 | $ | — | $ | 723.9 | $ | (300.6 | ) | $ | 2.5 | $ | 425.8 | ||||||||||||||

| Redemption |

(11.5 | ) | — | — | 4.1 | — | — | 4.1 | ||||||||||||||||||||

| Accretion of dividends |

29.4 | — | — | (29.4 | ) | — | — | (29.4 | ) | |||||||||||||||||||

| Recapitalization: |

||||||||||||||||||||||||||||

| Retirement of prior stock |

(650.0 | ) | (0.1 | ) | — | (679.4 | ) | — | — | (679.4 | ) | |||||||||||||||||

| Issuance of new stock |

— | 102.0 | 1.0 | 1,328.4 | 1,329.4 | |||||||||||||||||||||||

| Payment of dividend |

— | — | — | (25.0 | ) | — | — | (25.0 | ) | |||||||||||||||||||

| Recognition of ITRA |

— | — | — | (172.9 | ) | — | — | (172.9 | ) | |||||||||||||||||||

| Issuance of common stock |

— | 29.4 | 0.3 | 582.3 | — | — | 582.6 | |||||||||||||||||||||

| Payment of stock issuance costs |

— | — | — | (4.8 | ) | — | — | (4.8 | ) | |||||||||||||||||||

| Stock-based compensation expense |

— | — | — | 2.0 | — | — | 2.0 | |||||||||||||||||||||

| Reclassifications to state redeemable equity at redemption value |

12.9 | — | — | (12.9 | ) | — | — | (12.9 | ) | |||||||||||||||||||

| Net income |

— | — | — | — | 152.6 | — | 152.6 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | — | — | — | (232.4 | ) | (232.4 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at December 31, 2014 |

51.4 | 131.4 | 1.3 | 1,716.3 | (148.0 | ) | (229.9 | ) | 1,339.7 | |||||||||||||||||||

| Issuance of common stock |

— | — | 1.3 | — | — | 1.3 | ||||||||||||||||||||||

| Stock-based compensation expense |

— | — | — | 4.9 | — | — | 4.9 | |||||||||||||||||||||

| Reclassifications to state redeemable equity at redemption value |

(12.6 | ) | — | — | 12.6 | — | — | 12.6 | ||||||||||||||||||||

| Net income |

— | — | — | — | 154.3 | — | 154.3 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | — | — | — | (176.4 | ) | (176.4 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at December 31, 2015 |

38.8 | 131.4 | 1.3 | 1,735.1 | 6.3 | (406.3 | ) | 1,336.4 | ||||||||||||||||||||

| Issuance of common stock |

— | 0.2 | — | 4.7 | — | — | 4.7 | |||||||||||||||||||||

| Stock-based compensation expense |

— | — | — | 8.6 | — | — | 8.6 | |||||||||||||||||||||

| Reclassifications to state redeemable equity at redemption value |

(17.6 | ) | — | — | 17.6 | — | — | 17.6 | ||||||||||||||||||||

| Net income |

— | — | — | — | 148.2 | — | 148.2 | |||||||||||||||||||||

| Other comprehensive loss |

— | — | — | — | — | (21.1 | ) | (21.1 | ) | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Balance at December 31, 2016 |

$ | 21.2 | 131.6 | $ | 1.3 | $ | 1,766.0 | $ | 154.5 | $ | (427.4 | ) | $ | 1,494.4 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

See accompanying notes to consolidated financial statements.

7

VWR Corporation and subsidiaries

Consolidated statements of cash flows

| Year ended December 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| Cash flows from operating activities: |

||||||||||||

| Net income |

$ | 148.2 | $ | 154.3 | $ | 152.6 | ||||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Depreciation and amortization |

130.1 | 124.5 | 129.3 | |||||||||

| Net foreign currency remeasurement loss (gain) |

2.3 | (45.1 | ) | (95.7 | ) | |||||||

| Deferred income tax provision |

3.4 | 27.3 | 33.9 | |||||||||

| Loss on extinguishment of debt |

0.5 | 32.7 | 5.1 | |||||||||

| Other, net |

23.3 | 17.9 | 13.0 | |||||||||

| Changes in working capital, net of business acquisitions: |

||||||||||||

| Trade accounts receivable |

(25.8 | ) | (30.2 | ) | (30.1 | ) | ||||||

| Inventories |

(63.1 | ) | (43.8 | ) | (41.5 | ) | ||||||

| Accounts payable |

15.0 | 25.1 | 27.5 | |||||||||

| Other assets and liabilities |

32.3 | (37.7 | ) | (3.0 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Net cash provided by operating activities |

266.2 | 225.0 | 191.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash flows from investing activities: |

||||||||||||

| Acquisitions of businesses, net of cash acquired |

(142.8 | ) | (59.1 | ) | (89.9 | ) | ||||||

| Capital expenditures |

(59.9 | ) | (40.9 | ) | (33.6 | ) | ||||||

| Other investing activities |

— | 2.1 | 0.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in investing activities |

(202.7 | ) | (97.9 | ) | (123.0 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Cash flows from financing activities: |

||||||||||||

| Proceeds from issuance of common stock |

4.7 | 1.3 | 582.6 | |||||||||

| Proceeds from debt |

674.4 | 2,767.0 | 742.2 | |||||||||

| Repayment of debt |

(623.8 | ) | (2,810.2 | ) | (1,353.8 | ) | ||||||

| Redemption of redeemable equity |

— | — | (8.9 | ) | ||||||||

| Payment of dividend |

— | — | (25.0 | ) | ||||||||

| Payment to Varietal under ITRA |

(78.1 | ) | (9.8 | ) | — | |||||||

| Payment of debt issuance costs and redemption premium |

(0.9 | ) | (41.9 | ) | (1.1 | ) | ||||||

| Other financing activities |

(3.1 | ) | (2.5 | ) | (7.8 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net cash used in financing activities |

(26.8 | ) | (96.1 | ) | (71.8 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Effect of exchange rate changes on cash |

(4.3 | ) | (12.7 | ) | (13.9 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net increase (decrease) in cash and cash equivalents |

32.4 | 18.3 | (17.6 | ) | ||||||||

| Cash and cash equivalents at beginning of period |

136.3 | 118.0 | 135.6 | |||||||||

|

|

|

|

|

|

|

|||||||

| Cash and cash equivalents at end of period |

$ | 168.7 | $ | 136.3 | $ | 118.0 | ||||||

|

|

|

|

|

|

|

|||||||

| Supplemental disclosures of cash flow information: |

||||||||||||

| Cash paid for interest |

$ | 79.2 | $ | 104.9 | $ | 158.9 | ||||||

| Cash paid for income taxes, net |

78.3 | 48.0 | 39.3 | |||||||||

See accompanying notes to consolidated financial statements.

8

VWR Corporation and subsidiaries

Notes to consolidated financial statements

| 1. | Nature of operations and basis of presentation |

We are a leading global independent provider of product and service solutions to laboratory and production customers. We have significant market positions in Europe and North America. We also have operations in Asia-Pacific and other key emerging markets to support our multinational customers across the globe. We serve a critical role in connecting customer sites with laboratory product suppliers across multiple industries and geographies. We offer a broad portfolio of branded and private label laboratory products, a full range of value-added services and custom manufacturing capabilities to meet our customers’ needs. Services represent a growing but currently small portion of our overall net sales. We offer a wide selection of unique products and have developed an extensive global infrastructure including thousands of sales and service-focused professionals. We deliver value to our customers by improving the costs, efficiency and effectiveness of their research laboratories and production operations. We deliver value to our suppliers by providing them with cost-effective channel access to a global and diverse customer base.

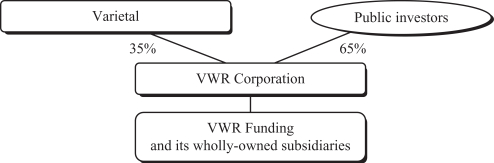

The following describes our corporate organization at December 31, 2016:

| • | Varietal — Following a 2007 merger, Varietal was our only stockholder until our IPO in October 2014 and since then had been our majority stockholder through March 2016. Private equity funds managed by Madison Dearborn Partners hold a controlling interest in Varietal. Our condensed consolidated balance sheets reflect significant amounts of goodwill and other intangible assets as a result of the 2007 merger. |

In April 2016, Varietal completed a sale of our common stock that caused it to no longer hold a majority ownership interest in us. As a result, we experienced a change in control under U.S. federal tax regulations which has impacted (i) the amount and timing of the utilization of our net operating loss carryforwards; (ii) the timing of payments under an ITRA with Varietal (see Note 20); and (iii) the amount of cash taxes we are paying.

| • | VWR Funding and its wholly-owned subsidiaries — VWR Funding is our wholly-owned subsidiary and the sole issuer of our debt. Certain of those debt agreements restrict its ability to make distributions to us. |

Basis of presentation

We report financial results on the basis of two segments organized by geographic region: the Americas and EMEA-APAC.

In 2014, we recapitalized our equity (see Note 12). For all periods presented, the number of shares of common stock outstanding has been adjusted for a stock split. Separately, a conversion of prior equity into newly-issued

9

shares of common stock is presented as a retirement and issuance of shares; share counts for periods prior to that conversion were not adjusted. The consolidated financial statements present the accretion of dividends on redeemable convertible preferred stock for periods prior to the recapitalization. Those dividends were never paid and became available to common stockholders following the recapitalization.

Principles of consolidation

The accompanying consolidated financial statements include the accounts of VWR Corporation and the redeemable equity of Varietal, each after the elimination of intercompany balances and transactions.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue, expense, income and loss during the reporting period. Actual results could differ significantly from those estimates.

Additional disclosures about significant estimates are provided in the following areas: (i) impairment testing, particularly determining whether indicators of impairment were present and whether assets were impaired (see Note 21); (ii) estimating the valuation allowance on deferred tax assets, such as net operating loss carryforwards (see Note 18); (iii) accounting for defined benefit plans, in particular determining key assumptions such as discount rates and the expected return on plan assets (see Note 15); (iv) estimating outcomes of loss contingencies (see Note 10); and (v) estimating fair value, particularly related to measurements based on unobservable inputs (see Note 9).

| 2. | Summary of significant accounting policies |

Cash and cash equivalents

Cash and cash equivalents are comprised of highly liquid investments with original maturities of three months or less, primarily consisting of euro-denominated overnight deposits. Bank overdrafts are classified as current liabilities and presented as a financing activity on our consolidated statements of cash flows.

Trade accounts receivable, net of reserves

Trade accounts receivable are recorded at the invoiced amount and generally do not bear interest. The carrying amount of trade accounts receivable is presented net of a reserve representing our estimate of the amounts that will not be collected and for estimated sales returns and allowances. In addition to reviewing delinquent accounts receivable, we consider many factors in estimating our reserve, including historical data, experience, customer types, creditworthiness and economic trends. From time to time, we may adjust our assumptions for anticipated changes in any of these or other factors expected to affect collectability. Account balances are written off against the allowance when we determine it is probable that the receivable will not be recovered.

Inventories

Our inventories consist primarily of products held for sale. Inventories are valued at the lower of cost or market, cost being primarily determined by the LIFO method for certain of our U.S. subsidiaries and the first-in, first-out method for all other subsidiaries. We regularly review quantities of inventories on hand and compare these amounts to the expected use of each product or product line. We record a charge to cost of goods sold for the amount required to reduce the carrying value of inventory to net realizable value.

At December 31, 2016 and 2015, the percentage of inventories valued using the LIFO method was 36% for both years, and the excess of current cost over LIFO value for those inventories was $24.8 million and $24.6 million, respectively.

10

Property and equipment

Property and equipment are recorded at cost. Depreciation is recognized using the straight-line method over estimated useful lives of 10 to 40 years for buildings and improvements and 3 to 10 years for equipment and computer software. Leasehold improvements are amortized on a straight-line basis over the shorter of the estimated useful lives of the assets or the estimated remaining life of the lease. Costs for repairs and maintenance that do not significantly increase the value or estimated lives of property and equipment are expensed as incurred. Property and equipment held under capital leases were not material for any periods presented.

Impairment of long-lived assets

We evaluate the recoverability of long-lived assets when events or changes in circumstances indicate a possible inability to recover carrying amounts. We assess recoverability by comparing the carrying value of the asset to estimated undiscounted future cash flows expected to be generated by the asset. If an asset is impaired, the loss is measured as the amount by which the asset’s carrying value exceeds its fair value.

Goodwill and other intangible assets

Goodwill represents the excess of purchase price over the fair value of net assets acquired in a business combination. Other intangible assets consist of both amortizable and indefinite-lived intangible assets. Amortizable intangible assets are amortized over their estimated useful lives on a straight-line basis. Indefinite-lived intangible assets are not amortized.

We reevaluate the estimated useful lives of our amortizable intangible assets annually. For indefinite-lived intangible assets, we reevaluate annually whether they continue to have indefinite lives, considering whether they have any legal, regulatory, contractual, competitive or economic limitations and whether they are expected to contribute to the generation of cash flows indefinitely.

Goodwill and other indefinite-lived intangible assets are tested annually for impairment on October 1 of each year. Goodwill impairment testing is performed at the reporting unit level. Our reporting units are the same as our operating segments and reportable segments. All of our intangible assets, including goodwill, are tested for impairment whenever an indication of potential impairment arises. Events or circumstances that might require an interim evaluation include unexpected adverse business conditions, economic factors, unanticipated technological changes or competitive activities, loss of key personnel and acts or anticipated acts by governments and courts. Indefinite-lived intangible assets are tested for impairment prior to testing of goodwill or amortizable intangible assets.

The impairment analysis for goodwill and indefinite-lived intangible assets consists of an optional qualitative assessment potentially followed by a two-step quantitative analysis. If we determine that the carrying value of goodwill or indefinite-lived intangible assets exceeds its fair value, an impairment charge is recorded for the excess. Impairment charges cannot be reversed in subsequent periods.

The impairment analysis for amortizable intangible assets is performed in the same way as for our other long-lived assets, as previously discussed.

Fair value measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at a measurement date. Classification within the fair value hierarchy is based on the lowest of the following levels that is significant to the fair value measurement:

| • | Level 1 — Quoted prices (unadjusted) in active markets for identical assets or liabilities |

11

| • | Level 2 — Inputs that are observable for the asset or liability, either directly or indirectly through market corroboration, for substantially the full term of the asset or liability |

| • | Level 3 — Inputs that are unobservable for the asset or liability based on our evaluation of the assumptions market participants would use in pricing the asset or liability |

We exercise considerable judgment when estimating fair value, particularly when evaluating what assumptions market participants would likely make. The use of different assumptions or estimation methodologies could have a material effect on the estimated fair values.

Commitments and contingencies

Loss contingencies are reflected in the consolidated financial statements based on our assessments of the expected outcome of legal proceedings or the expected resolution of other contingencies. Liabilities for estimated losses are accrued if the potential loss from any claim or legal proceeding is considered probable and the amount can be reasonably estimated. Significant judgment is required to determine probability and whether the amount of an exposure is reasonably estimable. Due to uncertainties related to these matters, accruals are based only on the information available at the time. As additional information becomes available, we reassess potential liabilities related to pending claims and litigation and may revise our previous estimates.

Revenue recognition

We record product revenue on a gross basis when persuasive evidence of an arrangement exists, the price is fixed or determinable, title and risk of loss have been transferred to the customer and collectability of the resulting receivable is reasonably assured. Title and risk of loss is transferred at the time of shipment or upon delivery to customers, depending upon the terms of the arrangement with the customer. Products are delivered without post-sale obligations to the customer. Provisions for discounts, rebates to customers, sales returns and other adjustments are provided for as a reduction of sales in the period the related sales are recorded.

We record shipping and handling charges billed to customers in net sales and record shipping and handling costs in cost of goods sold for all periods presented. Sales taxes, value-added taxes and certain excise taxes collected from customers and remitted to governmental authorities are accounted for on a net basis and therefore are excluded from net sales.

Services represent a growing but currently small portion of our net sales and were not material to our consolidated financial statements.

Classification of expenses

Cost of goods sold includes the cost of the product, vendor rebates, inbound and outbound freight charges, as well as inventory adjustments. SG&A expenses include personnel and facility charges, advertising and promotional charges and other charges related to our global infrastructure operations.

Stock-Based compensation

Stock-based compensation consists primarily of stock options awarded to employees and directors. We measure expense using the grant-date fair value of awards ultimately expected to vest. Awards with service conditions are expensed on a straight-line basis from the date of grant through the end of the requisite service period. We issue new shares of common stock upon the exercise of stock options.

The grant-date fair value of stock options is measured using a closed-form option pricing model, using assumptions based on the terms of each stock option agreement, the expected behavior of grant recipients and

12

peer company data. We have limited historical data about our own awards upon which to base our assumptions. Expected volatility is calculated based on the observed equity volatility for a peer group over a period of time equal to the expected life of the stock options. The risk-free interest rate is based on U.S. Treasury observed market rates continuously compounded over the duration of the expected life. The expected life of stock options is determined using the simplified method, which is calculated as the midpoint of the weighted average vesting period and the contractual term.

We elect to recognize expense based on the number of awards ultimately expected to vest by use of an estimated forfeiture rate. The estimated forfeiture rate is based on historical data for the employee group awarded options and expected employee turnover rates, which management reevaluates each period.

Defined benefit plans

Some of our employees participate in defined benefit plans. The benefits include pension, salary continuance, life insurance and healthcare. Benefits are accrued over the employees’ service periods. We use actuarial methods and assumptions in the valuation of defined benefit obligations and the determination of net periodic pension income or expense. Differences between actual and expected results or changes in the value of defined benefit obligations and plan assets, if any, are not recognized in earnings as they occur but rather systematically over subsequent periods.

Foreign currency translation

Assets and liabilities of our foreign subsidiaries, where the functional currency is the local currency, are translated into U.S. dollars using period-end exchange rates. Revenues, expenses, income and losses are translated using average exchange rates. Resulting translation adjustments are reported in accumulated other comprehensive income or loss. Foreign currency remeasurement gains and losses related to financing activities are reported in other income (expense), net within our consolidated statements of operations, while gains and losses associated with operating activities are reported within the applicable component of operating income.

Income taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the expected net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes and for net operating loss and credit carryforwards. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. We record a valuation allowance to reduce deferred tax assets to the amount that is more likely than not to be realized.

We recognize the effect of income tax positions only if those positions are more likely than not to be sustained. Recognized income tax positions are measured at the largest amount that is more likely than not of being realized. Changes in recognition or measurement are reflected in the period in which a change in judgment occurs, as a result of information that arises or when a tax position is effectively settled. We recognize accrued interest and penalties related to unrecognized tax benefits as a component of income tax expense in our consolidated financial statements.

Due to Varietal — ITRA

We record the estimated amount payable to Varietal under an ITRA, entered into in connection with our IPO, as a noncurrent liability, except for the portion estimated to be payable within one year. The ITRA liability was initially recognized through an adjustment to additional paid-in capital and measured at its expected future value,

13

similar to the underlying deferred tax assets to which it relates. Subsequent changes to the value of the ITRA liability, if any, will be classified as other income (expense), net in the consolidated statements of operations. Cash payments under the ITRA are classified as a financing activity on the consolidated statements of cash flows.

| 3. | New accounting standards |

In March 2016, the FASB issued new guidance to simplify several aspects of accounting and presentation for stock-based compensation. The new guidance is effective for us beginning in the first quarter of 2017, with early adoption permitted. We early adopted the guidance beginning October 1, 2016. The guidance did not have a material impact to us upon adoption.

In February 2016, the FASB issued comprehensive new guidance about leases. Under the new guidance, most leases will be recognized on our consolidated balance sheet as liabilities with corresponding right-of-use assets. The new guidance carries forward a similar method of expense recognition for lessees. The new guidance is effective for us beginning in the first quarter of 2019, with early adoption permitted. The guidance must be adopted using a modified retrospective approach. Although, we are continuing to evaluate its impact, we expect that this new guidance will result in a significant increase to the assets and liabilities we present on our consolidated balance sheet.

In May 2014, the FASB issued comprehensive new revenue recognition guidance. The guidance provides a new model for revenue recognition that supersedes most current guidance and requires more disclosures about revenue including the components of revenue that are communicated to investors. The new guidance is effective for us beginning in the first quarter of 2018 and may be adopted using either a full retrospective or a modified retrospective approach. Although we are continuing to evaluate the impact of the new guidance, we expect that the new recognition model will primarily impact only certain portions of our business, and we expect to provide expanded disclosures and to adopt the new standard using the modified retrospective method.

There were no other new accounting standards that we expect to have a material impact to our financial position or results of operations upon adoption.

| 4. | Earnings per share |

The following table presents information about basic and diluted earnings per share:

| Year ended December 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| Reconciliation of weighted average shares outstanding: |

||||||||||||

| Basic |

131.5 | 131.4 | 49.3 | |||||||||

| Dilutive effect of stock-based instruments |

0.3 | 0.4 | 0.2 | |||||||||

|

|

|

|

|

|

|

|||||||

| Diluted |

131.8 | 131.8 | 49.5 | |||||||||

|

|

|

|

|

|

|

|||||||

| Number of anti-dilutive instruments excluded from dilutive effect |

4.0 | 2.0 | 0.9 | |||||||||

| 5. | Acquisitions |

During the three years ended December 31, 2016, we acquired businesses to broaden our product offerings and strengthen our market positions. Except for their effects on investing cash flow, none of these acquisitions, nor their related costs, were material individually or in the aggregate to our results of operations or financial condition.

14

The following table presents selected information about these acquisitions in the aggregate:

| Year ended December 31, | ||||||||||||

| (dollars in millions) | 2016 | 2015 | 2014 | |||||||||

| Number of businesses acquired |

5 | 4 | 4 | |||||||||

| Components of purchase price: |

||||||||||||

| Cash paid, net of cash acquired |

$ | 142.8 | $ | 59.1 | $ | 89.9 | ||||||

| Estimated fair value of contingent consideration |

13.8 | 13.6 | 8.4 | |||||||||

| Deferred purchase price, net of (settlements) |

3.2 | (3.4 | ) | 3.4 | ||||||||

| Other |

— | — | 13.0 | |||||||||

|

|

|

|

|

|

|

|||||||

| Purchase price |

$ | 159.8 | $ | 69.3 | $ | 114.7 | ||||||

|

|

|

|

|

|

|

|||||||

| Allocation of purchase price: |

||||||||||||

| Net tangible assets |

$ | 31.9 | $ | 9.5 | $ | 15.5 | ||||||

| Identifiable intangible assets |

50.1 | 23.2 | 44.1 | |||||||||

| Goodwill |

77.8 | 36.6 | 55.1 | |||||||||

|

|

|

|

|

|

|

|||||||

| Purchase price |

$ | 159.8 | $ | 69.3 | $ | 114.7 | ||||||

|

|

|

|

|

|

|

|||||||

| Weighted average life of acquired amortizable intangible assets |

9.9 years | 9.7 years | 12.2 years | |||||||||

The purchase price for the acquisitions was higher than the fair value of the acquired identifiable assets, resulting in goodwill, due to the existence of intangible assets not recognizable under GAAP and other market factors. During the years ended December 31, 2016, 2015 and 2014, we recorded goodwill of $65.1 million, $19.6 million and $29.0 million, respectively, that we expect to be deductible for tax purposes. The purchase price allocations for certain acquisitions completed in 2016 are preliminary pending finalization of opening balance sheets and may be adjusted subsequently.

The other component of purchase price represents cash paid to acquire a business that was subsequently rescinded. Since the amount was later refunded in full, we did not include it in the amount paid for acquisitions or the number of businesses acquired.

| 6. | Property and equipment, net |

The following table presents the components of property and equipment, net:

| December 31, | ||||||||

| (in millions) | 2016 | 2015 | ||||||

| Buildings and improvements |

$ | 199.1 | $ | 161.4 | ||||

| Equipment and computer software |

264.5 | 244.2 | ||||||

| Other |

39.1 | 38.8 | ||||||

|

|

|

|

|

|||||

| Property and equipment, gross |

502.7 | 444.4 | ||||||

| Accumulated depreciation |

(248.9 | ) | (216.2 | ) | ||||

|

|

|

|

|

|||||

| Property and equipment, net |

$ | 253.8 | $ | 228.2 | ||||

|

|

|

|

|

|||||

Depreciation expense was $44.7 million, $41.1 million and $40.4 million for the years ended December 31, 2016, 2015 and 2014, respectively.

15

| 7. | Goodwill and other intangible assets, net |

The following tables present information about goodwill by segment:

| (in millions) | Americas | EMEA-APAC | Total | |||||||||

| Balance at December 31, 2014 |

$ | 1,042.3 | $ | 811.3 | $ | 1,853.6 | ||||||

| Acquisitions (Note 5) |

19.7 | 16.9 | 36.6 | |||||||||

| Currency translation |

(15.7 | ) | (82.9 | ) | (98.6 | ) | ||||||

| Other |

— | (0.2 | ) | (0.2 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2015 |

1,046.3 | 745.1 | 1,791.4 | |||||||||

| Acquisitions (Note 5) |

65.1 | 12.7 | 77.8 | |||||||||

| Currency translation |

2.7 | (26.0 | ) | (23.3 | ) | |||||||

| Other |

— | (1.9 | ) | (1.9 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2016 |

$ | 1,114.1 | $ | 729.9 | $ | 1,844.0 | ||||||

|

|

|

|

|

|

|

|||||||

| December 31, 2016 | December 31, 2015 | |||||||||||||||||||||||

| (in millions) | Gross carrying amount |

Accumulated impairment losses |

Net carrying amount |

Gross carrying amount |

Accumulated impairment losses |

Net carrying amount |

||||||||||||||||||

| Americas |

$ | 1,320.7 | $ | 206.6 | $ | 1,114.1 | $ | 1,252.9 | $ | 206.6 | $ | 1,046.3 | ||||||||||||

| EMEA-APAC |

729.9 | — | 729.9 | 745.1 | — | 745.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 2,050.6 | $ | 206.6 | $ | 1,844.0 | $ | 1,998.0 | $ | 206.6 | $ | 1,791.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

The following table presents the components of other intangible assets:

| December 31, 2016 | December 31, 2015 | |||||||||||||||||||||||

| (in millions) | Gross carrying amount |

Accumulated amortization |

Net carrying amount |

Gross carrying amount |

Accumulated amortization |

Net carrying amount |

||||||||||||||||||

| Customer relationships |

$ | 1,413.0 | $ | 651.3 | $ | 761.7 | $ | 1,402.2 | $ | 581.4 | $ | 820.8 | ||||||||||||

| Other |

49.7 | 20.1 | 29.6 | 30.3 | 15.2 | 15.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Amortizable intangible assets |

1,462.7 | 671.4 | 791.3 | 1,432.5 | 596.6 | 835.9 | ||||||||||||||||||

| Indefinite-lived trademarks and tradenames |

616.5 | — | 616.5 | 619.7 | — | 619.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other intangible assets |

$ | 2,079.2 | $ | 671.4 | $ | 1,407.8 | $ | 2,052.2 | $ | 596.6 | $ | 1,455.6 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Amortization expense was $85.4 million, $83.4 million and $88.9 million for the years ended December 31, 2016, 2015 and 2014, respectively.

The following table presents estimated future amortization expense at December 31, 2016:

| (in millions) | ||||

| 2017 |

$ | 85.3 | ||

| 2018 |

83.2 | |||

| 2019 |

81.6 | |||

| 2020 |

80.3 | |||

| 2021 |

76.3 | |||

| Thereafter |

384.6 | |||

|

|

|

|||

| Total |

$ | 791.3 | ||

|

|

|

|||

16

| 8. | Debt |

The following table presents information about debt:

| December 31, 2016 |

December 31, 2015 |

|||||||||||||

| (dollars in millions) | Interest terms |

Rate | Amount | |||||||||||

| Accounts receivable securitization facility |

LIBOR plus 1.15% | 1.89 | % | $ | 163.9 | $ | 38.0 | |||||||

| Senior credit facility: |

||||||||||||||

| Multi-currency revolving loan facility |

EURIBOR plus 2.00% | 2.00 | % | 31.6 | — | |||||||||

| Term A loan, net of discount of $4.8 and $6.1 |

LIBOR plus 2.00% | 2.61 | % | 859.7 | 903.9 | |||||||||

| Term B loan, net of discount of $4.4 and $4.7 |

EURIBOR plus 3.00% | 3.00 | % | 423.8 | 494.8 | |||||||||

| 4.625% senior notes, net of discount of $7.0 and $8.4 |

Fixed rate | 4.63 | % | 524.9 | 538.6 | |||||||||

| Other debt |

|

13.1 | 13.7 | |||||||||||

|

|

|

|

|

|||||||||||

| Total debt |

|

$ | 2,017.0 | $ | 1,989.0 | |||||||||

|

|

|

|

|

|||||||||||

| Classification on consolidated balance sheets: |

| |||||||||||||

| Current portion of debt |

|

$ | 250.1 | $ | 92.8 | |||||||||

| Debt, net of current portion |

|

1,766.9 | 1,896.2 | |||||||||||

|

|

|

|

|

|||||||||||

| Total debt |

|

$ | 2,017.0 | $ | 1,989.0 | |||||||||

|

|

|

|

|

|||||||||||

Other debt includes capital lease obligations and subsidiary loans from local banks. Borrowings under the accounts receivable securitization facility and the multi-currency revolving loan facility are included in the current portion of debt because we frequently borrow from and repay them to satisfy short term cash requirements; we are not required to repay those borrowings until maturity of the instruments.

In 2016, we entered into two interest rate swaps that exchange LIBOR for fixed rates on a portion of our term A loan. See Note 9.

The following table presents availability under credit facilities at December 31, 2016:

| (in millions) | Accounts receivable securitization facility |

Multi- currency revolving loan facility |

Total | |||||||||

| Maximum availability |

$ | 175.0 | $ | 250.0 | $ | 425.0 | ||||||

| Current availability |

$ | 175.0 | $ | 250.0 | $ | 425.0 | ||||||

| Undrawn letters of credit outstanding |

(11.0 | ) | (1.7 | ) | (12.7 | ) | ||||||

| Outstanding borrowings |

(163.9 | ) | (31.6 | ) | (195.5 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Unused availability |

$ | 0.1 | $ | 216.7 | $ | 216.8 | ||||||

|

|

|

|

|

|

|

|||||||

Current availability under the accounts receivable securitization facility depends upon maintaining a sufficient borrowing base of eligible trade accounts receivable. At December 31, 2016, $243.2 million of trade accounts receivable were pledged as collateral under the facility.

17

The following table presents the maturities of debt principal at December 31, 2016:

| (in millions) | 2017 | 2018 | 2019 | 2020 | 2021 | Thereafter | Total | |||||||||||||||||||||

| Accounts receivable securitization facility |

$ | — | $ | 163.9 | $ | — | $ | — | $ | — | $ | — | $ | 163.9 | ||||||||||||||

| Senior credit facility: |

||||||||||||||||||||||||||||

| Multi-currency revolving loan facility |

— | — | — | 31.6 | — | — | 31.6 | |||||||||||||||||||||

| Term A loan |

45.5 | 68.3 | 91.0 | 659.7 | — | — | 864.5 | |||||||||||||||||||||

| Term B loan |

4.3 | 4.3 | 4.3 | 4.3 | 4.3 | 406.7 | 428.2 | |||||||||||||||||||||

| 4.625% senior notes |

— | — | — | — | — | 531.9 | 531.9 | |||||||||||||||||||||

| Other debt |

4.7 | 4.3 | 2.6 | 1.5 | — | — | 13.1 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total debt, excluding discounts |

$ | 54.5 | $ | 240.8 | $ | 97.9 | $ | 697.1 | $ | 4.3 | $ | 938.6 | $ | 2,033.2 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Accounts receivable securitization facility

The accounts receivable securitization facility is for $175.0 million with a commercial bank and matures on May 18, 2018. Borrowings are secured by the trade accounts receivable of certain domestic subsidiaries, which are not available to satisfy the claims of other creditors. We bear the risk of collection on our trade accounts receivable and account for the facility as a secured borrowing.

The accounts receivable securitization facility includes representations and covenants that we consider usual and customary, including that, if our available liquidity falls below a specified amount, the ratio of our adjusted earnings to interest expense cannot exceed a specified amount, each as defined. At December 31, 2016, we were in compliance with those covenants.

Senior credit facility

The senior credit facility is with a syndicate of lenders and includes a $250.0 million multi-currency revolving loan facility due September 28, 2020, a $910.0 million term A loan due September 28, 2020 and a €406.6 million term B loan due January 15, 2022. The term loans require us to make scheduled quarterly principal repayments as shown in the table above. Borrowings under the senior credit facility are secured by substantially all of our assets except for the trade accounts receivable that secure the accounts receivable securitization facility and bear interest at variable rates plus a margin that declines if certain net leverage ratios are achieved. Fees payable under the senior credit facility are not material to interest expense. The senior credit facility includes representations and covenants that we consider usual and customary, including that our first lien net leverage ratio, as defined, cannot exceed a specified amount. At December 31, 2016, we were in compliance with those covenants.

We entered into the senior credit facility in 2015, issuing the term B loan at an original discount of €1.2 million and paying debt issuance costs of $15.4 million, most of which were deferred and are being recognized as interest expense through the maturity date. We used a portion of the proceeds from the senior credit facility and proceeds from the issuance of 4.625% senior notes to repay our prior credit facility and incurred a loss on extinguishment of debt of $7.9 million during 2015.

In 2016, we amended our term B loan for more favorable interest terms. The amendment required us to repay €50.0 million of principal and pay financing costs of $0.9 million, most of which were deferred and are being recognized as interest expense through the maturity date. We also incurred a loss on extinguishment of debt of $0.5 million representing the portion of unamortized deferred costs and original discount related to the principal repaid. In 2014, we amended our prior credit facility to extend maturity dates and obtain more favorable interest terms and paid debt issuance costs of $1.1 million.

Senior notes

We have issued €503.8 million of 4.625% senior notes that mature on April 15, 2022. Interest is payable in arrears on April 15 and October 15 of each year. The notes are redeemable at premiums that begin at 102.3125%

18

plus the present value of interest through April 15, 2018, then decline through April 15, 2020 at which time the notes become redeemable at face value. The notes are also redeemable in part using proceeds from certain equity offerings and in full upon certain changes in control. The indentures covering the notes include representations and covenants that we consider usual and customary. At December 31, 2016, we were in compliance with those covenants.

In 2015, we issued the notes at an original issue discount of €3.8 million and paid debt issuance costs of $5.4 million, which were deferred and are being recognized as interest expense through the maturity date. We also used a portion of the proceeds from the senior credit facility to redeem all of our 7.25% senior notes for a premium of $20.4 million and incurred a loss on extinguishment of debt of $24.8 million. In 2014, we used net proceeds from the IPO to redeem 10.75% subordinated notes at face value and incurred a loss on extinguishment of debt of $5.1 million.

| 9. | Financial instruments and fair value measurements |

Our financial instruments include cash and cash equivalents, trade accounts receivable, accounts payable, debt and an amount due to Varietal under the ITRA. Except for the amount due to Varietal, these financial instruments are held or issued by a number of institutions, which reduces the risk of material non-performance.

Assets and liabilities for which fair value is only disclosed

The carrying amount of cash and cash equivalents is the same as its fair value and is a Level 1 measurement. The carrying amounts for trade accounts receivable and accounts payable approximate fair value due to their short-term nature and are Level 2 measurements.

The following table presents the carrying amounts and fair values of debt instruments:

| December 31, 2016 | December 31, 2015 | |||||||||||||||

| (in millions) | Carrying amount |

Fair value | Carrying amount |

Fair value | ||||||||||||

| Accounts receivable securitization facility |

$ | 163.9 | $ | 163.9 | $ | 38.0 | $ | 38.0 | ||||||||

| Senior credit facility: |

||||||||||||||||

| Multi-currency revolving loan facility |

31.6 | 31.6 | — | — | ||||||||||||

| Term A loan |

859.7 | 856.4 | 903.9 | 901.5 | ||||||||||||

| Term B loan |

423.8 | 431.9 | 494.8 | 500.5 | ||||||||||||

| 4.625% senior notes |

524.9 | 553.9 | 538.6 | 536.5 | ||||||||||||

| Other debt |

13.1 | 13.1 | 13.7 | 13.7 | ||||||||||||

The fair values of debt instruments are based on standard pricing models that take into account the present value of future cash flows, which are Level 2 measurements.

At December 31, 2016 and 2015, the amount due to Varietal under the ITRA (see Note 20) had carrying amounts of $85.0 million and $163.1 million, respectively, and fair values of $82.9 million and $147.6 million, respectively. The fair values were estimated using a combination of observable and unobservable inputs following an income-based approach, a Level 3 measurement.

Recurring fair value measurements with significant unobservable inputs

Certain of the business acquisitions we completed entitle the sellers to contingent consideration if earnings targets are met during a period of time following the acquisition.

19

The following table presents changes to contingent consideration liabilities:

| Year ended December 31, | ||||||||

| (in millions) | 2016 | 2015 | ||||||

| Beginning balance |

$ | 21.0 | $ | 11.6 | ||||

| Acquisitions (Note 5) |

13.8 | 13.6 | ||||||

| Loss (income) from changes to estimated fair value |

4.9 | (1.1 | ) | |||||

| Cash payments |

(4.2 | ) | (2.4 | ) | ||||

| Currency translation |

(0.8 | ) | (0.7 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 34.7 | $ | 21.0 | ||||

|

|

|

|

|

|||||

We estimate the fair value of contingent consideration using the average of probability-weighted potential earn-out payments specified in the purchase agreements, a Level 3 measurement, ranging in the aggregate from approximately $19 million to $38 million for all open earn-outs at December 31, 2016. The significant assumptions used in these calculations include forecasted results and the estimated likelihood for each performance scenario.

Derivative instruments and hedging activities

We engage in hedging activities to reduce our exposure to changes in variable interest rates and foreign currency exchange rates. Our hedging activities are designed to manage specific risks according to our strategies, as summarized below, which may change from time to time. Our hedging activities consist of the following:

| • | Cash flow hedging — We hedge the variable base interest rate of a portion of our term A loan using interest rate swaps; |

| • | Net investment hedging — We hedge a portion of our net investment in euro-denominated foreign operations using our 4.625% senior notes and a portion of our term B loan; |

| • | Economic hedge — We experience opposite foreign currency exchange rate effects related to a euro-denominated intercompany loan and the unhedged portion of our term B loan. The currency effects for these non-derivative instruments are recorded through earnings in the period of change and substantially offset one another; and |

| • | Other hedging activities — Some of our subsidiaries hedge short-term foreign-denominated business transactions and intercompany financing transactions using foreign currency forward contracts. No additional disclosures are provided for these activities because they were not material to our consolidated financial statements. |

Cash flow and net investment hedging

We have entered into two interest rate swaps designated as cash flow hedges of the variable LIBOR rate on $500.0 million of our term A loan. Those swaps exchange the variable LIBOR rate for an approximately 1% fixed rate and mature on September 28, 2020. These hedges have been and are expected to continue to be fully effective. As a result, changes to the fair value of the interest rate swaps, which otherwise would be recognized in earnings, are deferred to AOCI.

We have designated €356.0 million of our term B loan and all €503.8 million of our 4.625% senior notes as hedges to protect a portion of our net investment in foreign operations from the impact of changes in the euro to U.S. dollar exchange rate. As a result of these hedge designations, the foreign currency changes on the debt instruments, which otherwise would be recognized in earnings, are deferred to AOCI and equally offset the foreign currency changes on the hedged portion of our net investment. These hedges have no other impact to our financial position, financial performance or cash flows.

20

The following table presents the balance sheet classification and fair values of these instruments, all of which are Level 2 measurements:

| December 31, | ||||||||||

| (in millions) | Balance sheet classification |

2016 | 2015 | |||||||

| Cash flow hedging: |

||||||||||

| Interest rate swaps |

Other assets | $ | 11.2 | $ | — | |||||

| Net investment hedging: |

||||||||||

| Portion of term B loan |

Debt, net of current portion | 379.2 | 402.6 | |||||||

| 4.625% senior notes |

Debt, net of current portion | 553.9 | 536.5 | |||||||

The following table presents the net unrealized gain (loss) deferred to AOCI for these instruments:

| Year ended December 31, | ||||||||

| (in millions) | 2016 | 2015 | ||||||

| Cash flow hedging: |

||||||||

| Interest rate swaps |

$ | 9.8 | $ | — | ||||

| Net investment hedging: |

||||||||

| Portion of net investment in foreign operations |

(28.6 | ) | (3.7 | ) | ||||

| Portion of term B loan |

13.5 | 12.4 | ||||||

| 4.625% senior notes |

15.1 | (8.7 | ) | |||||

All of these hedges were fully effective for the periods presented. The following table presents the net loss reclassified from AOCI into earnings for these instruments:

| (in millions) |

Income statement classification |

Year ended December 31, | ||||||||

| 2016 | 2015 | |||||||||

| Interest rate swaps |

Interest expense | $ | (1.4 | ) | $ | — | ||||

| 10. | Commitments and contingencies |

Our business involves risk of product liability, patent infringement and other claims in the ordinary course of business arising from the products that we source from various manufacturers or produce ourselves, as well as from the services we provide. Our exposure to such claims may increase as we seek to increase the geographic scope of our sourcing activities and sales of private label products and to the extent that we expand our manufacturing operations or service offerings. We maintain insurance policies, including product liability insurance, and in many cases the manufacturers of the products we distribute have indemnified us against such claims. We cannot assure you that our insurance coverage or indemnification agreements with manufacturers will be available in all pending or any future cases brought against us. Furthermore, our ability to recover under any insurance or indemnification arrangements is subject to the financial viability of our insurers, our manufacturers and our manufacturers’ insurers, as well as legal enforcement under the local laws governing the arrangements. In particular, as we seek to expand our sourcing from manufacturers in the Asia-Pacific region and other developing locations, we expect that we will increase our exposure to potential defaults under the related indemnification arrangements. Insurance coverage in general or coverage for certain types of liabilities, such as product liability or patent infringement in these developing markets may not be readily available for purchase or cost-effective for us to purchase. Furthermore, insurance for liability relating to asbestos, lead and silica exposure is not available, and we do not maintain insurance for product recalls. Accordingly, we could be subject to uninsured and unindemnified future liabilities, and an unfavorable result in a case for which adequate insurance or indemnification is not available could result in a material adverse effect on our business, financial condition and results of operations.

We are also involved in various disputes, litigation and regulatory matters incidental to our business, including employment matters, commercial disputes, government contract compliance matters, disputes regarding

21

environmental clean-up costs, and other matters arising out of the normal conduct of our business. We intend to vigorously defend ourselves in such matters. From time to time, we are named as a defendant in cases as a result of our distribution of laboratory supplies, including litigation resulting from the alleged prior distribution of products containing asbestos by certain of our predecessors or acquired companies. While the impact of these disputes or litigation has historically been immaterial, and we believe the range of reasonably possible loss from current matters continues to be immaterial, there can be no assurance that the impact of the pending and any future claims will not be material to our business, financial condition or results of operations in the future.

Employment agreements

The employment agreements with our executive officers include provisions for the payment of severance and continuing health benefits following termination without cause or resignation for good reason, as those terms are defined in the employment agreements. The aggregate of potential payments for all executive officers under these provisions was $11.1 million at December 31, 2016.

Registration rights agreement

We are party to a registration rights agreement with Varietal that could require us to pay securities registration costs in future periods. Under the registration rights agreement, Varietal is entitled to request that we register (i) any shares of our common stock that it held at October 7, 2014 and (ii) any shares held by Madison Dearborn Partners. Should we register such common stock, we would be required to pay costs related to the registration as well as Varietal’s expenses in connection with its exercise of these rights.

During the years ended December 31, 2016 and 2015, we incurred expenses pursuant to the registration rights agreement. See Note 20.

| 11. | Redeemable equity |

Redeemable equity consists of redeemable equity units of our parent and, prior to July 31, 2014, redeemable convertible preferred stock.

Redeemable equity units of parent

In 2007, Varietal established a plan whereby certain employees were able to purchase a “strip” of preferred and common units. The following describes the accounting for these units:

| • | Issuances — Prior to the recapitalization, Varietal issued these units in exchange for cash. Subsequently, Varietal contributed an equal amount of capital to us in exchange for shares of redeemable convertible preferred stock. None of these units have been issued following the recapitalization. |

| • | Repurchases — Upon termination of the employee unitholders, two redemption options may be triggered, one of which is outside of our control. Prior to the recapitalization, Varietal redeemed the units by providing an equally-valued number of shares of our redeemable convertible preferred stock to the unitholder, which we subsequently redeemed for cash. Following the recapitalization, Varietal redeems units directly with cash. |

| • | Valuation — These units are presented on our consolidated balance sheets at their redemption value. The redemption value is contractually defined, with preferred units valued as the sum of unreturned capital plus a cumulative dividend and common units valued at the enterprise value of Varietal less the redemption value of preferred units. Changes to the redemption value are reclassified to or from additional paid-in capital. |

22

Certain employees also received a special type of common unit that vested based upon continuing service, subject to accelerated vesting upon the occurrence of certain events. Because these units were provided as an incentive to provide services to us, we accounted for them as stock-based compensation. See Note 13.

Redeemable convertible preferred stock

In 2014, in anticipation of our IPO, we completed an internal recapitalization (see Note 12) pursuant to which all shares of our redeemable convertible preferred stock were exchanged for newly-issued shares of common stock. Prior to the recapitalization, the preferred stock was redeemable by Varietal for the sum of unreturned capital plus a cumulative dividend.

| 12. | Stockholders’ equity |

Stockholders’ equity consists of common stock. We are also authorized to issue preferred stock.

Our debt agreements impose restrictions on VWR Funding’s ability to make payments to VWR Corporation, including for the purpose of paying dividends on capital stock. See Note 24.

Recapitalization

In anticipation of our IPO, we completed an internal recapitalization in 2014 pursuant to which all then outstanding equity was exchanged for 102.0 million shares of newly-issued common stock. We also amended and restated our certificate of incorporation and bylaws which resulted in the capitalization shown on our consolidated balance sheet and included a 102-for-1 stock split.

Initial public offering

In 2014, we completed our IPO, which included an additional sale to our underwriters, by issuing 29.4 million common shares at a price of $21.00 per share. After deducting underwriting discounts, the IPO resulted in net proceeds of $582.6 million.

In connection with the IPO, we also: i) paid a $25.0 million dividend to Varietal; ii) terminated a management services agreement with Madison Dearborn Partners and Avista Capital Partners and entered into an ITRA with Varietal (see Note 20); iii) awarded stock options to certain employees and directors under a new stock-based compensation plan (see Note 13); and iv) used the net proceeds from the IPO to repay debt.

| 13. | Stock-based compensation |

The following table presents the components of stock-based compensation expense, a component of SG&A expenses:

| Year ended December 31, | ||||||||||||

| (in millions) | 2016 | 2015 | 2014 | |||||||||

| 2014 Plan |

$ | 8.3 | $ | 4.4 | $ | 1.1 | ||||||

| Other immaterial plans |

0.3 | 0.5 | 0.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 8.6 | $ | 4.9 | $ | 2.0 | ||||||

|

|

|

|

|

|

|

|||||||

At December 31, 2016, remaining stock-based compensation expense of $25.9 million related to unvested awards will be recognized over a weighted average period of 3.0 years.

23

2014 Plan

The 2014 Plan authorized up to 11.5 million shares of common stock to be issued in the form of stock options, stock appreciation rights, restricted stock or other stock-based awards. At December 31, 2016, 5.6 million shares were available for future issuance. No award shall be granted pursuant to the 2014 Plan on or after September 9, 2024.

The following table presents information about stock options under the 2014 Plan:

| Year ended December 31, 2016 | ||||||||||||||||

| (in millions, except per option amounts and years) | Number of stock options |

Weighted average exercise price per option |

Aggregate intrinsic value |

Weighted average remaining term |

||||||||||||

| Outstanding at beginning of period |

3.2 | $ | 21.03 | |||||||||||||

| Granted |

2.8 | 24.68 | ||||||||||||||

| Exercised |

(0.1 | ) | 21.00 | |||||||||||||

| Forfeited |

(0.1 | ) | 21.39 | |||||||||||||

|

|

|

|||||||||||||||

| Outstanding at end of period |

5.8 | 22.80 | $ | 13.3 | 5.4 years | |||||||||||

|

|

|

|||||||||||||||

| Expected to vest |

4.5 | 23.26 | 8.3 | 5.6 years | ||||||||||||

| Exercisable |

1.2 | 21.02 | 4.8 | 4.8 years | ||||||||||||

Granted

In 2016, we granted stock options to management that vest 25% on the first anniversary of the date of grant and 6.25% quarterly thereafter through the fourth anniversary of the date of grant and have a seven-year term.

In 2014, we granted stock options to management that vest 40% on the second anniversary of the date of grant and 5.00% quarterly thereafter through the fifth anniversary of the date of grant and have a seven-year term.

The following table presents information about their fair value:

| Year ended December 31, | ||||||||

| 2016 | 2014 | |||||||

| Weighted average grant date fair value |

$ | 6.69 | $ | 6.67 | ||||

| Expected stock price volatility |

30 | % | 33 | % | ||||

| Risk free interest rate |

1.16 | % | 1.76 | % | ||||

| Expected dividend rate |

nil | nil | ||||||

| Expected life of options |

4.6 years | 4.9 years | ||||||

Vested and exercised

Beginning in 2016, options vested and were exercised. The total fair value of options vested during the year was $8.2 million. Options exercised had intrinsic value of $0.6 million, caused us to realize a tax benefit of $0.2 million and resulted in cash contributions of $2.0 million.

| 14. | Restructuring |

In the fourth quarter of 2016, we initiated a restructuring program designed to achieve additional efficiencies in our operating model and reduce operating expenses. The program involves selectively realigning personnel, closures of several smaller operations accompanied by consolidation of their operating activities in other business units, and closure or divestiture of certain non-strategic businesses units. The program is expected to be completed by early 2018 when operating activity relocations are scheduled to be completed.

24

The following table presents information about restructuring charges under the 2016 program, which are included in SG&A expenses:

| (in millions) | Year ended December 31, 2016 |

December 31, 2016 | ||||||||||||||

| Cumulative charges incurred |

Expected remaining charges |

Total expected charges |

||||||||||||||

| Employee severance |

$ | 12.9 | $ | 12.9 | $ | 5.4 | $ | 18.3 | ||||||||

| Facility closure |

0.4 | 0.4 | 3.9 | 4.3 | ||||||||||||

| Other |

7.0 | 7.0 | 5.4 | 12.4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 20.3 | $ | 20.3 | $ | 14.7 | $ | 35.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Americas |

$ | 1.8 | $ | 1.8 | $ | 1.7 | $ | 3.5 | ||||||||

| EMEA-APAC |

18.5 | 18.5 | 13.0 | 31.5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 20.3 | $ | 20.3 | $ | 14.7 | $ | 35.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Other charges are to write-down the carrying value of net assets of businesses that we plan to close or sell under the program.

The following table presents changes to accrued restructuring charges:

| (in millions) | Employee severance |

Facility closure |

Total | |||||||||

| Balance at December 31, 2015 |

$ | — | $ | — | $ | — | ||||||

| Restructuring charges |

12.9 | 0.4 | 13.3 | |||||||||

| Cash payments |

(2.2 | ) | — | (2.2 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Balance at December 31, 2016 |

$ | 10.7 | $ | 0.4 | $ | 11.1 | ||||||

|

|

|

|

|

|

|

|||||||

| 15. | Benefit plans |

We sponsor a number of defined benefit plans for our employees worldwide. We present these plans as follows due to their differing geographies, characteristics and actuarial assumptions:

| • | The U.S. Retirement Plan is a funded and tax-qualified defined benefit retirement plan providing two types of benefits based on: (i) service for substantially all full-time U.S. employees who completed a year of service by May 31, 2005, with benefits frozen on that date; and (ii) beginning in 2016, an annual contribution we make for substantially all full-time U.S. employees that grows at a defined rate. We generally fund the minimum amount required by applicable laws and regulations. We use a December 31 measurement date for the U.S. Retirement Plan. |

| • | The German, French and UK Plans are presented in the aggregate. Our German subsidiaries have unfunded defined benefit pension plans for certain employees and retirees that are closed to new participants. Our French subsidiary has a funded defined benefit pension plan for a certain group of employees that is closed to new participants. Our UK subsidiary has funded defined benefit plans that are closed to new participants and frozen with respect to future accrual of benefits. We use a December 31 measurement date for the German, French and UK Plans. |