Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - SelectQuote, Inc. | d838810dex231.htm |

| EX-5.1 - EX-5.1 - SelectQuote, Inc. | d838810dex51.htm |

| EX-4.5 - EX-4.5 - SelectQuote, Inc. | d838810dex45.htm |

| EX-4.4 - EX-4.4 - SelectQuote, Inc. | d838810dex44.htm |

| EX-4.1 - EX-4.1 - SelectQuote, Inc. | d838810dex41.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 15, 2020.

Registration No. 333-236555

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SelectQuote, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 6411 | 94-3339273 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6800 West 115th Street, Suite 2511

Overland Park, Kansas 66211

(913)-599-9225

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Tim Danker

Chief Executive Officer

SelectQuote, Inc.

6800 West 115th Street, Suite 2511

Overland Park, Kansas 66211

(913)-599-9225

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mark F. Veblen, Esq. Wachtell, Lipton, Rosen & Katz 51 West 52nd Street New York, New York 10019 Telephone: (212) 403-1000 Telecopy: (212) 403-2000 |

Daniel A. Boulware, Esq. SelectQuote, Inc. 6800 West 115th Street, Suite 2511 Overland Park, Kansas 66211 Telephone: (913)-599-9225 Telecopy: (913)-495-5493 |

Jonathan L. Freedman, Esq. Samir A. Gandhi, Esq. Sidley Austin LLP 787 Seventh Avenue New York, New York 10019 Telephone: (212) 839-5300 Telecopy: (212) 839-5599 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Per Share(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.01 per share |

28,750,000 | $ 19.00 | $ 546,250,000 | $ 70,903.25 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes the aggregate amount of additional shares the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act of 1933, as amended. |

| (3) | The registrant previously paid $12,980 in connection with the filling of the Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated May 15, 2020

Preliminary Prospectus

25,000,000 shares

Common Stock

This is an initial public offering of common stock by SelectQuote, Inc. We are offering 18,000,000 shares of our common stock to be sold in the offering. The selling stockholders identified in this prospectus are offering an additional 7,000,000 shares of our common stock. SelectQuote will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Prior to this offering, there has been no public market for our common stock. We currently anticipate that the initial public offering price per share of our common stock will be between $17 and $19 per share.

We intend to apply to list our common stock on the New York Stock Exchange (the “NYSE”) under the symbol “SLQT.”

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, under applicable Securities and Exchange Commission (“SEC”) rules, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to SelectQuote, before expenses |

$ | $ | ||||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting (Conflicts of Interest)” for additional information regarding the underwriting discount and certain expenses payable to the underwriters by us. |

The selling stockholders have granted the underwriters an option for a period of 30 days to purchase up to an additional 3,750,000 shares of our common stock.

At our request, the underwriters have reserved up to 1,250,000 shares of common stock, or up to 5% of the shares of common stock offered by this prospectus for sale by the Company, at the initial public offering price, to certain individuals associated with us. See “Underwriting (Conflicts of Interest)—Directed Share Program.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 22.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2020.

Joint Bookrunners

| Credit Suisse | Morgan Stanley | |

| Evercore ISI | RBC Capital Markets |

| Barclays | Citigroup | Jefferies | ||

Co-Managers

| Cantor | Keefe Bruyette & Woods A Stifel Company |

Piper Sandler | Drexel Hamilton |

, 2020

Table of Contents

-i-

Table of Contents

-ii-

Table of Contents

-iii-

Table of Contents

| 1 | ||||

| 17 | ||||

| Summary Historical Consolidated Financial and Operating Data |

20 | |||

| 22 | ||||

| 49 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 55 | ||||

| Selected Historical Consolidated Financial and Operating Data |

57 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

62 | |||

| 95 | ||||

| 110 | ||||

| 116 | ||||

| 128 | ||||

| 132 | ||||

| 137 | ||||

| 139 | ||||

| 145 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Common Stock |

148 | |||

| 151 | ||||

| 160 | ||||

| 160 | ||||

| 160 | ||||

| F-1 |

-i-

Table of Contents

About this Prospectus

As used in this prospectus, unless the context otherwise indicates, any reference to “SelectQuote,” “our Company,” the “Company,” “we,” “us” and “our” refers to SelectQuote, Inc., the issuer of the shares offered hereby, together with its consolidated subsidiaries.

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus or in any free writing prospectus that we file with the Securities and Exchange Commission. We have not, and the underwriters have not, authorized anyone to provide you with different or additional information. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we, the selling stockholders nor the underwriters have done anything that would permit our initial public offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside of the United States.

Neither this prospectus nor any related free writing prospectus is a prospectus for the purposes of Regulation (EU) 2017/1129 (the “Prospectus Regulation”). This prospectus and any related free writing prospectus and any offer if made subsequently is directed only at persons in Member States of the European Economic Area (the “EEA”) who are “qualified investors” within the meaning of Article 2(e) of the Prospectus Regulation. This prospectus and any related free writing prospectus has been prepared on the basis that any offer of shares of our common stock in any Member State of the EEA will be made pursuant to an exemption under the Prospectus Regulation from the requirement to publish a prospectus for offers of the shares of our common stock. Accordingly any person making or intending to make an offer in that Member State of shares of our common stock which are the subject of the offering contemplated by this prospectus and any related free writing prospectus may only do so in circumstances in which no obligation arises for us or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Regulation in relation to such offer. Neither we nor the underwriters have authorized, nor do we or they authorize, the making of any offer of shares of our common stock in circumstances in which an obligation arises for us or the underwriters to publish a prospectus for such offer.

This prospectus and any related free writing prospectus may not be distributed or circulated to any person in the United Kingdom other than to (i) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”); and (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). This prospectus and any related free writing prospectus is directed only at relevant persons. Other persons should not act on this prospectus and any related free writing prospectus or any of their contents. This prospectus and any related free writing prospectus is confidential and is being supplied to you solely for your information and may not be reproduced, redistributed or passed on to any other person or published, in whole or in part, for any other purpose.

-ii-

Table of Contents

Upon the closing of this offering, each outstanding share of our Series A, B, C and D preferred stock will automatically convert into eight shares of common stock and each outstanding share of our Series E preferred stock will automatically convert into shares of common stock at a fixed discount to the initial offering price. References in this prospectus to the number of shares of our common stock outstanding after this offering are based on 144,650,597 shares of our common stock issued and outstanding as of the date of this prospectus (assuming the automatic conversion of all outstanding shares of our Series A, B, C, D and E preferred stock into an aggregate of 52,404,685 shares of common stock upon completion of this offering, and assuming, for purposes of the conversion of the Series E preferred stock, an initial offering price of $18 per share of common stock, which is the midpoint of the estimated price range set forth on the cover of this prospectus). Unless otherwise noted, these references assume:

| • | the initial offering price of $18 per share of common stock, which is the midpoint of the estimated price range set forth on the cover of this prospectus; |

| • | no exercise of the outstanding options to purchase an aggregate of shares of common stock; |

| • | an eight-for-one forward stock split of our common stock effected on February 28, 2020; and |

| • | the filing and effectiveness of our sixth amended and restated certificate of incorporation and the adoption of our amended and restated bylaws upon the closing of this offering. |

-iii-

Table of Contents

FINANCIAL STATEMENTS AND BASIS OF PRESENTATION

SelectQuote operates on a fiscal year that begins on July 1st of each given calendar year and ends on June 30th of the following calendar year. This prospectus includes audited consolidated balance sheets as of June 30, 2019 and June 30, 2018 and consolidated statements of operations, statements of changes in shareholders’ equity, and statements of cash flows for the years ended June 30, 2019 and June 30, 2018 and an unaudited condensed consolidated balance sheet as of March 31, 2020 and condensed consolidated statements of operations, statements of changes in shareholders’ equity, and statements of cash flows for the nine month periods ended March 31, 2020 and March 31, 2019.

Stock Split

On February 28, 2020, we effected an eight-for-one forward stock split of our issued and outstanding shares of common stock and a proportional adjustment to the existing conversion ratios for our Series A, B, C and D preferred stock, which we refer to as the “stock split.” The par value of our common stock was not adjusted as a result of the stock split. All references to common stock, options to purchase common stock, share data, per share data and related information presented in this prospectus and contained in the financial statements and footnotes have been retrospectively adjusted, where applicable, to reflect the effect of the stock split and the adjustment of the Series A, B, C and D preferred stock conversion ratios. In connection with the stock split, the number of authorized shares of our common stock was increased to 700,000,000. Our shares of treasury stock were not affected by the stock split and were retired on March 30, 2020.

INDUSTRY AND OTHER DATA

Certain industry data and market data included in this prospectus were obtained from independent third-party surveys, market research, publicly available information, reports of governmental agencies and industry publications and surveys. All of management’s estimates presented herein are based upon management’s review of independent third-party surveys and industry publications prepared by a number of sources and other publicly available information. All of the market data used in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We believe that the information from these industry publications and surveys included in this prospectus is reliable. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

TRADEMARKS AND TRADE NAMES

“SelectQuote,” our logo, and other trademarks or trade names of SelectQuote, Inc. appearing in this prospectus are our property. This prospectus also contains trademarks and trade names of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

-iv-

Table of Contents

This summary highlights information appearing elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes appearing at the end of this prospectus, before making any investment decision. In this prospectus, we make certain forward-looking statements, including expectations relating to our future performance. These expectations reflect our management’s view of our prospects and are subject to the risks described under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” Our expectations for our future performance may change after the date of this prospectus and there is no guarantee that such expectations will prove to be accurate. Unless the context otherwise requires, we use the terms “SelectQuote,” the “Company,” “we,” “us” and “our” in this prospectus to refer to SelectQuote, Inc.

Our Company

We are united by our mission to provide solutions that help consumers with their overall financial well-being and protect their most valued assets: their families, their health and their property. Our highly skilled agents strive to deliver a best-in-class consumer experience through a comparison shopping process of leading insurance carriers to provide consumers with greater choice, transparency and value.

We are a leading technology-enabled, direct-to-consumer (“DTC”) distribution platform that provides consumers with a transparent and convenient venue to shop for complex senior health, life and auto & home insurance policies from a curated panel of the nation’s leading insurance carriers. As an insurance distributor, we do not insure the consumer, but rather identify consumers looking to acquire insurance products and place these consumers with insurance carrier partners that provide these products and, in return, earn commissions from our insurance carrier partners for the policies we sell on their behalf. Our proprietary technology allows us to take a broad funnel approach to marketing by analyzing and identifying high quality consumer leads sourced from a wide variety of online and offline marketing channels. Our primary sources of leads include search engine marketing, radio, television, and third-party marketing partners. We monitor our acquisition costs to dynamically allocate our marketing spend to the most attractive channel, benefitting from over thirty years of data accumulated through our proprietary, purpose-built technologies. Our advanced workflow processing system scores each acquired lead in real-time, matching it with an agent whom we determine is best suited to meet the consumer’s need. Our platform then captures and utilizes our experience to further build upon the millions of data points that feed our marketing algorithms, which further enhances our ability to deploy subsequent marketing dollars efficiently and target more high-quality consumer leads.

Our proprietary routing and workflow system is a key competitive advantage and driver of our business performance. Our systems analyze and intelligently route consumer leads to agents and allow us to monitor, segment and enhance our agents’ performance. This technological advantage also allows us to rapidly conduct a needs-based, bespoke analysis for each consumer that maximizes sales, enhances customer retention and ultimately maximizes policyholder lifetime revenues. Although we have the ability to conduct end-to-end enrollments online, our expertise and value add stems from the coupling of our technology with our skilled agents, which provides greater transparency in pricing terms and choice, and an overall better consumer experience. When customers are satisfied, their propensity to switch policies decreases, thereby improving retention rates, increasing policyholder lifetime values and ultimately, optimizing and increasing the visibility of our financial performance.

We generate commission revenue from selling policies on behalf of our insurance carrier partners, the majority of which compensate us through first year and renewal commissions. We have built our business model to maximize commissions collected over the life of an approved policy less the cost of acquiring the business, a metric we refer to as policyholder lifetime value and which is a key component to our overall profitability.

-1-

Table of Contents

For our fiscal year ended June 30, 2019 (“fiscal 2019”), we earned $337.5 million of revenue representing 44% growth over the $233.7 million of revenue that we earned during our fiscal year ended June 30, 2018 (“fiscal 2018”). In fiscal 2019, we generated $72.6 million in net income, an increase of 108% over fiscal 2018 when we generated $34.9 million in net income. In fiscal 2019, we generated $105.3 million in Adjusted EBITDA, an increase of 111% over fiscal 2018 when we generated $49.9 million in Adjusted EBITDA. Our Adjusted EBITDA Margin increased to 31.2% in fiscal 2019 from 21.4% in fiscal 2018.

For the nine month period ended March 31, 2020, we earned $390.1 million of revenue representing 48.3% growth over the $263.1 million of revenue that we earned for the nine month period ended March 31, 2019. Net income increased 2.4% from $59.7 million for the nine month period ended March 31, 2019 to $61.1 million for the nine month period ended March 31, 2020. During the nine month period ended March 31, 2020, we generated $113.9 million in Adjusted EBITDA, an increase of 32.8% over the nine month period ended March 31, 2019, when we generated $85.8 million in Adjusted EBITDA. Our Adjusted EBITDA Margin decreased to 29.2% for the nine month period ended March 31, 2020, from 32.6% for the nine month period ended March 31, 2019.

Adjusted EBITDA and Adjusted EBITDA Margin are Non-GAAP financial measures that we use to measure our operating performance. For a reconciliation of these Non-GAAP financial measures to our GAAP financial measures, please see “Selected Historical Consolidated Financial and Operating Data—Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures (Adjusted EBITDA)” in this prospectus.

Our Business Model

We operate in an attractive segment of the insurance value chain, distributing insurance products on behalf of our insurance carrier partners who, in return, pay us commissions. Accordingly, we do not currently generate revenues directly from the consumers with whom we interact. In addition, because we are not the issuer of the insurance policy to the consumer, we bear no underwriting risks.

Founded over 30 years ago as what we believe was the first DTC term life insurance exchange platform in the U.S., our technology-driven, differentiated model allows consumers to easily compare pricing and policy options from over 50 of the nation’s leading insurance carriers. Working in tandem, our agents and technology systems are the foundational pillars of our franchise. Our highly trained and licensed agents are subject matter experts in the products they sell, and this, in combination with our purpose-built software and business process, differentiates the service we provide to consumers relative to other insurance distributors or “online only” offerings. We believe providing personalized advice and guidance from policy research to enrollment is a key differentiator in the senior health market as consumers tend to prefer or require more personalized attention to navigate increasingly complex and ever-changing coverage options. Our agents on the SelectQuote platform are trained to offer unbiased advice in order to be more aligned to the specific needs of each customer.

As one of the few technology-enabled distributors of scale in our end markets, we believe that we are well-positioned to capitalize on the accelerating trend of digital transformation across the insurance distribution landscape. Under the traditional insurance distribution model, consumers are often unaware of their full range of coverage options and are at risk of receiving opaque, “one size fits all” recommendations primarily intended to maximize agent commissions over their needs. In contrast, the insurance distribution landscape today is one in which consumers of insurance demand greater choice, seek more transparency in pricing and use the internet to self-research their insurance options. Recent technological innovations, including the proliferation of smart mobile devices as a means of consumer purchasing, consumer demand for price transparency and comparison shopping, and the development of machine learning for business applications, continue to transform the insurance distribution landscape. As the composition of the U.S. population gradually shifts to the mobile-first

-2-

Table of Contents

generation, consumers are becoming more tech-savvy and increasingly comfortable shopping online. We believe our ability to offer multiple carriers’ policies, proprietary technology platform, vast datasets and use of machine learning in key aspects of our business puts us in an excellent position to take advantage of these consumer trends.

Direct distribution is becoming an increasingly important part of the overall distribution strategies of insurance carriers as they drive to lower customer acquisition costs. Internet and mobile devices enable distributors to target and reach consumers directly in a highly controlled and efficient manner. Our software allows our agents to have more effective interactions with customers, driving agent productivity and sales volumes and providing an attractive distribution alternative for our insurance carrier partners. While traditional insurance distributors use a time-intensive, in-person purchasing process, consumers are increasingly researching insurance policies for their needs online and ultimately, purchasing through direct channels. Platforms like ours are well-positioned to serve these customers as we allow consumers to compare insurance in a transparent manner, without having to solicit individual quotes from carriers in the market or rely on the options presented by a traditional insurance distributor and to do so from the comfort of their homes.

Our systems allow us to gain valuable insights from the rich sources of consumer information we have gathered over three decades, and we use data analytics and proprietary algorithms to enhance our sales and marketing strategies in an effort to maximize our return on our marketing spend and enhance our agents’ close rates. As we have grown, we have continued to gather valuable data that has allowed us to further enhance our algorithms. Accordingly, we have been able to improve our lead acquisition efficiency and scoring and workflow processing capabilities, which has enabled us to serve customers more efficiently and has improved the value proposition we offer to our insurance carrier partners. As our value proposition has grown, our insurance carrier partners have come to rely more on our distribution capabilities and have collaborated with us more deeply in product design, helping fuel our growth. We expect this virtuous cycle, which we refer to as the SelectQuote “Fly Wheel,” to continue as we execute on our mission.

Our Agents

Our agent force is one of two foundational pillars that support our business. The insurance products we sell are often complicated and each consumer has different needs. We believe the most effective method for matching

-3-

Table of Contents

products with each consumer’s needs requires the attention of highly-trained and skilled agents, and we believe this training and expertise differentiates us from the traditional distribution model. Each of our lines of business has dedicated licensed agents that are subject matter experts in that line which allows them to provide deep expertise and helpful advice that are specific to a client’s needs. We have developed what we believe is a best-in-class talent management system that allows us to recruit from across the U.S. and build and retain top agents. We provide each new agent with up to 10 weeks of proprietary in-house training, which is later supplemented by ongoing training during the agents’ full-time employment. Our training is designed to ensure that every agent is well-equipped with a deep understanding of the products he or she sells and the customer service and sales skills necessary to best service the customer. A goal of ours is that every agent in whom we invest will build a long and rewarding career with us.

Our need for agent capacity is seasonal, peaking during the Annual Election Period (“AEP”) and remaining elevated during the Open Enrollment Period (“OEP”). We hire additional “flex” agents during these periods to address this expected increase in transaction volume and temporarily reassign agents from our Senior business to our Life and Auto & Home businesses during non-AEP/OEP periods. Our flex agents undergo up to 10 weeks of proprietary in-house training, further supplemented by additional training. We continuously assess flex agent performance throughout AEP and OEP. The majority of our flex agents that we regard as high performers during this period move on to become “core” agents or accept other roles with us. This opportunity to assess flex agent performance before offering a permanent role within the Company is an important factor in placing employees in the right roles over the long term, which allows us to maintain our strong agent productivity and helps create a positive career path leading to strong employee engagement as evidenced by multiple awards of “Best Places to Work.” In fact, based on our past experience, average agent productivity increases by approximately 40% in an agent’s second AEP.

Our agents are segmented into multiple levels based on their productivity, with the most productive agents given first access to the highest quality leads. In our Senior segment, level one agents demonstrate higher productivity and higher close rates than similarly situated Senior agents in levels below them. In addition, we experience much lower agent attrition with our top-level agents. Essentially, this process allows us to match a lead with the appropriate agent and to optimize our agent’s most valuable asset: time. Each agent guides the potential customer through tailored policy options and provides education on complex senior health, life and auto & home products, thereby helping consumers select the option that best suits their needs and circumstances. This personalized approach enhances the customer experience and when customers are satisfied, their propensity to switch policies decreases, which extends the renewal revenue stream paid to us by our insurance carrier partners, and enhances the lifetime value of policyholder relationships. Our processes and technologies come together to drive strong economic results, allowing us to reward top agents with market leading pay, which coupled with our corporate culture, drives what we believe to be an industry-leading agent retention rate of over 93% among our level 1, or top performing, agents, and a 70% overall agent retention rate.

As of March 31, 2020, we employed a total of 922 core agents and 73 flex agents across our Senior, Life and Auto & Home segments.

Our Technology

Technology is the second foundational pillar that supports our business. Our proprietary technology permeates our business process, from lead generation to scoring and routing, product selection and eventually to customer conversion, post-sale management, and cross-selling opportunities. Applying information gathered

-4-

Table of Contents

since our founding more than 30 years ago to drive sophisticated attribution modeling, we have continued to optimize our decision-making and advance our goal of maximizing policyholder lifetime value and profitability.

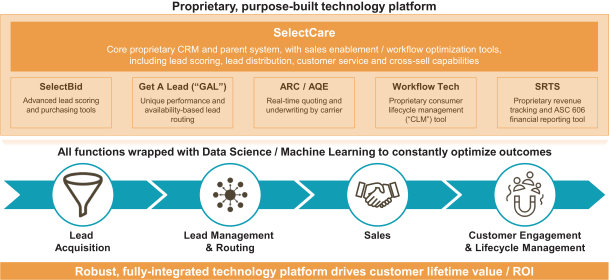

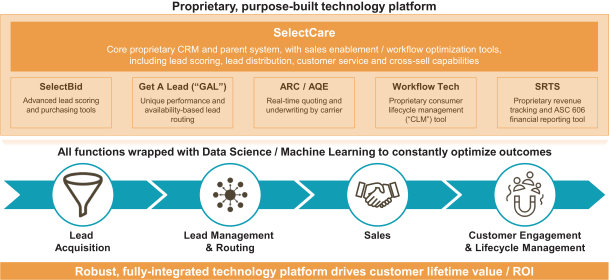

Lead Acquisition: We utilize a broad policyholder acquisition funnel strategy, generating new business leads through a wide variety of online and offline marketing channels, such as search engine, television, radio advertising and third-party marketing partners. Our software continuously monitors the cost of acquiring customers and uses our algorithm to dynamically adjust our bids for specific leads based on our expectation of the lead’s lifetime value. As we continue to operate, these algorithms feed a vast and ever growing pool of millions of data points, which, with the assistance of our team of highly skilled data scientists, enhances our ability to more accurately estimate a new lead’s lifetime value and enables us to make more informed decisions when generating leads. Our data science team creates algorithms that support lead buying, scoring and routing and consumer lifecycle management of closed leads. We believe what sets us apart from our competitors is our more than 30 years of proprietary data that our data scientists use as part of our bidding strategy for purchased leads, grouping phone and web leads by likelihood to purchase specific products, scoring phone and web leads using historical performance of similar leads based on demographics, tiering leads for routing to the corresponding agent levels, and performing predictive analysis of current customers’ retention rates or “persistency”.

Lead Management & Routing: Regardless of how a lead is generated, our proprietary software will score the lead in real-time on a scale of 1 to 10 based on multiple factors, then route the lead to the most appropriate level of agent to maximize expected lifetime policyholder value. This works in tandem with our bespoke, purpose-built lead routing and workflow management technology, Get A Lead (“GAL”). Based on lead score, agent level, and agent availability, GAL uses a “rapid fire approach” to quickly assign these leads to a licensed agent. We believe that our use of proprietary technology to monitor, segment and enhance agent performance, such as through real-time lead routing to the most effective agents, is a key competitive advantage and driver of our business performance.

Sales: Once assigned a lead, our highly skilled, licensed agents utilize their training, experience and our proprietary software and systems to rapidly conduct a bespoke needs-based analysis for each consumer. This coupling of our technology with our skilled agents provides the consumer with greater transparency in pricing terms and choice, and an overall better consumer experience that maximizes sales, enhances customer retention and, ultimately, maximizes our policyholder lifetime revenues.

-5-

Table of Contents

Customer Engagement & Lifecycle Management: We use advanced algorithms informed by over 1 billion consumer and third-party data points to enrich our consumer engagement strategy. Our dedicated retention-focused customer care (“CCA”) team leverages this technology to help consumers successfully onboard and to identify customers we determine to be likely to purchase additional products, thereby improving the likelihood that a consumer retains his or her policy and identifying cross-sell opportunities.

Our Products

The core products we distribute on behalf of our insurance carrier partners are needs-based and critical to the overall financial well-being of consumers and the protection of their most valued assets: their families, their health and their property. Increasing household financial obligations, rising healthcare costs, importance of health and wellbeing, and government and lender mandates for certain insurance coverage drive the need for the insurance products we distribute. These products are underwritten by leading insurance carrier partners that we carefully select across our three business lines: SelectQuote Senior, SelectQuote Life and SelectQuote Auto & Home.

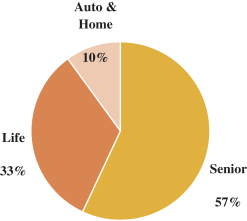

SelectQuote Senior (“Senior”), our fastest growing and largest segment, was launched in 2010 and provides unbiased comparison shopping for Medicare Advantage (“MA”) and Medicare Supplement (“MS”) insurance plans as well as prescription drug plan, dental, vision and hearing and critical illness products. We represent approximately 15 leading, nationally-recognized insurance carrier partners, including Humana, UnitedHealthcare and Aetna. Medicare Advantage and Medicare Supplement plans accounted for 74% of our approved Senior policies during fiscal 2019 and 78% of our approved Senior policies during the nine month period ended March 31, 2020, with ancillary policies including prescription drug, dental, vision and hearing plans, accounting for most of the remainder.

SelectQuote Life (“Life”) is one of the country’s largest and most established DTC insurance distributors for term life insurance, having sold over 1.75 million policies nationwide since our founding in 1985. Our platform provides unbiased comparison shopping for life insurance and ancillary products including term life, guaranteed issue, final expense, accidental death and juvenile insurance. We represent approximately 15 leading, nationally-recognized insurance carrier partners, with many of these relationships exceeding 15 years. Term and permanent life products accounted for 84% of new premium within the Life segment during fiscal 2019 and 76% of new premium within the Life segment during the nine month period ended March 31, 2020, with ancillary products, primarily final expense, accident and juvenile life policies, accounting for the majority of the remainder.

SelectQuote Auto & Home (“Auto & Home”) was founded in 2011 as an unbiased comparison shopping platform for auto, home and specialty insurance lines. We offer insurance products, including homeowners, auto, dwelling fire and other ancillary insurance products, underwritten by 29 leading, nationally-recognized insurance carrier partners. Homeowners and 12-month auto products accounted for 75% of new premium within the Auto & Home segment during fiscal 2019 and 78% of new premium within the Auto & Home segment during the nine month period ended March 31, 2020, with six-month auto, dwelling and other products accounting for the remainder.

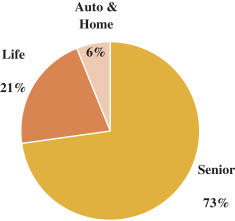

As illustrated below, we have a diverse revenue base from a variety of products and carriers across each business line. We experienced strong revenue, net income and Adjusted EBITDA growth across each of our segments in fiscal 2019 that has continued into fiscal 2020. Revenues from Senior, Life and Auto & Home grew by 88%, 12% and 5%, respectively, in fiscal 2019 compared to fiscal 2018, and have grown by 73%, 10% and 15%, respectively, for the nine month period ended March 31, 2020, compared to the nine month period ended March 31, 2019. Adjusted EBITDA and Adjusted EBITDA Margin are Non-GAAP financial measures that we use to measure our operating performance. For a reconciliation of these Non-GAAP financial measures to our GAAP financial measures, please see “Selected Historical Consolidated Financial and Operating Data—Non-GAAP Financial Measures” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures (Adjusted EBITDA)” in this prospectus.

-6-

Table of Contents

| Revenue for Fiscal 20191

|

Adjusted EBITDA for Fiscal 20192

|

Our Insurance Carrier Partners

We maintain longstanding, deeply integrated relationships with over 50 of the nation’s leading insurance carriers, who have some of the industry’s most widely recognizable brands. Our insurance carrier partners consider us a key strategic partner, as evidenced by our standing as one of the top DTC insurance distributors for a number of our key partners, including carriers owned by Humana, UnitedHealthcare, Aetna and Prudential. These high-quality relationships have resulted in strong insurance carrier retention rates and the fact that we have never been dropped by an insurance carrier partner. We believe carriers see our method of acquiring customers as scalable and efficient and, ultimately, as cost advantageous compared to their own models, and provide us, in some cases, with marketing development funds as additional compensation to deliver policies. Marketing development funds are similar to production bonuses in that they are based on attaining various predetermined target sales levels or other agreed upon objectives for individual insurance carrier partners. Our insurance carrier partners are responsible for paying our commissions and, for these purposes, act as our customers. We do not currently generate revenues directly from the consumers to whom we sell insurance policies on behalf of our insurance carrier partners.

Separate from SelectQuote’s comparison shopping platform, we have established several carrier-specific sales platform arrangements with several of our insurance carrier partners, which we call “pods”. These arrangements give us access to various marketing assets from our insurance carrier partners, such as use of the insurance carrier’s brand, which allows us to target customers for specific insurance carrier partners to give us access to incremental sales volume. Consumers directed to a pod agent come from either leads that are not branded as SelectQuote or come directly from an insurance carrier-affiliated channel. Our software assigns a propensity score to unbranded leads, potentially assigning those with a high propensity to purchase from a specific carrier to that carrier’s pod. The number of insurance carrier partners with which we have pod relationships can vary quarter to quarter depending on the insurance carrier partner and the business line.

Our Market Opportunity

We estimate that the total addressable market for the insurance products we distribute is greater than $180 billion. Further, while these markets are already substantial, they are also growing, in part due to a number of highly attractive demographic trends. We base our market opportunity estimates on third-party demographic

| 1 | Excludes Corporate & Eliminations. |

| 2 | Excludes Corporate & Eliminations. |

-7-

Table of Contents

data, our historical policy revenue experience and customer retention expectations. According to the Kaiser Family Foundation, there are approximately 67.7 million Medicare beneficiaries in 2020. We believe this addressable market, which is the core focus of the products we distribute, presents an annual commission revenue opportunity of approximately $30 billion for our Senior segment. The products marketed by our Life and Auto & Home segments also address large markets that present annual commission revenue opportunities of approximately $105 billion and $47 billion, respectively, which present us with additional opportunities for growth. In each of our three segments, we estimate our market share to be less than 1% and we believe we can benefit from greater market penetration in addition to underlying market growth.

Senior Market

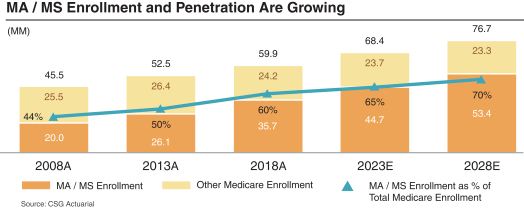

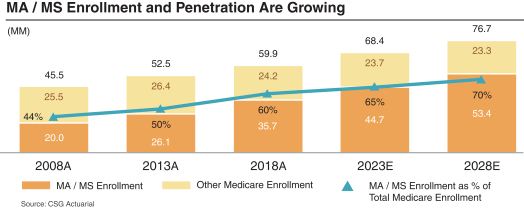

Demand for senior insurance products in the U.S. is underpinned by powerful demographic trends. The number of people reaching retirement each year took a step-change in 2011 as the first wave of the post-war “Baby Boomer” generation turned 65. The proportion of the population that is age 65 or higher increased from 12.9% in 2010 to 15.2% in 2016 and is expected to reach 16.9% by 2020, according to the United States Census Bureau. On average, 10,000 “Baby Boomers” are expected to turn 65 every day, or nearly 4 million per year, for the next 10 years. As a result, Medicare enrollment is growing steadily, with the number of Medicare enrollees expected to grow from 59.9 million in 2018 (up from 45.5 million in 2008 and 52.5 million in 2013), to approximately 68.4 million in 2023 then rising to 76.7 million by 2028, according to CSG Actuarial.

Not only is the population of people age 65 and higher growing, but according to Pew Research Center, internet usage within this group has also risen, with 73% using the internet in 2019 compared to 40% in 2009. This group is also transacting more online, with 55% of people age 65 and higher making online purchases monthly according to SheerID, and accessing online health resources, with 68% doing so according to the Journal of Medical Internet Research.

Within the growing Medicare market, Medicare Advantage plans are gaining prominence, as these private market solutions displace the traditional, government Medicare program. CSG Actuarial estimated that, at the end of 2019, there were approximately 23 million Medicare Advantage enrollees, representing approximately 38% penetration of the Medicare market. According to LEK Consulting, by 2025, the number of Medicare Advantage enrollees is expected to swell to approximately 38 million, representing a 50% penetration rate of the Medicare market. LEK Consulting projects that Medicare Advantage products will reach 60% to 70% penetration between 2030 and 2040, highlighting the pace with which this already large segment of the Medicare market is growing. The chart below illustrates the historical and projected increase in Medicare Advantage and Medicare Supplement enrollment compared to total Medicare enrollment, according to CSG Actuarial.

-8-

Table of Contents

The degree to which we will realize a corresponding increase in revenue will be determined by our ability to continue to successfully place new Medicare policies for this enlarged potential consumer base. Despite our scale, we account for only a fraction of the total market for Medicare Advantage and Medicare Supplement plans, with only 0.3 million of the 35.7 million total enrollment for such plans in 2018, providing ample opportunity for growth. From 2017 to 2018, our Medicare Supplement and Medicare Advantage active policy count grew 37.5%, or 15.6 times the 2.4% growth in total Medicare enrollment over the same time frame, according to CSG Actuarial. Accordingly, we can benefit not only from broad growth in Medicare and the increasing penetration of Medicare Advantage plans, but we can also achieve growth through market share gains in the distribution of Medicare Advantage and Medicare Supplement products. We can also grow through our offering of ancillary and non-insurance products targeting the senior market.

Life Market

DTC sales of life insurance are becoming more prevalent as an increasing proportion of consumers are conducting self-directed online research prior to buying policies. Due to the typically more complex and longer-term nature of life insurance products, we expect agent expertise and consultation to continue as a prominent aspect of the sales process prior to ultimate purchase. Our dedicated, high-touch agents coupled with our user-friendly online platform caters to these evolving consumer preferences, which we believe favorably positions us to capture an increasing share of the overall market. Our approach to consumer engagement provides transparency and, we believe, an overall better experience that generates higher conversion rates than achievable by other forms of distribution, creating a cost advantage for our distribution platform relative to others.

Auto & Home Market

Property & Casualty insurance is a large addressable market in which policyholders often have a government or lender-mandated need for coverage. The DTC channel for sales of these products is well established and growing, driven by continued adoption of online sources for research and quotes. We believe the combination of our technology and agents is an important differentiator that better enables us to help potential policyholders compare and choose between multiple products, and also to give valuable advice on bundled options that provide more holistic coverage across multiple risks. We differentiate ourselves from carrier captive agents and traditional insurance distributors on the basis of choice, convenience and consumer experience.

Our Competitive Strengths

Leading technology-based sales platform. Our primary focus is to provide best-in-class service to bring policyholders value through greater choice and transparency. Since 1985, we have helped over 2 million policyholders save time and money on critical insurance purchases. Since our founding in 1985, we have been pioneers of insurance distribution and, through our technology-driven sales model, we believe we are well placed to support policyholders and insurance carrier partners as consumers continue shifting towards online channels to make purchasing decisions for their insurance needs. We believe that our data and our technology are key competitive advantages and drivers of our business performance. We continue to upgrade and optimize our technology as new opportunities are identified by our Information Technology and Analytics teams. SelectCare is our core overarching proprietary customer relationship management (“CRM”) and parent system with phone bank, sales enablement / workflow optimization and reporting tools. SelectCare is a bespoke system that uses various algorithms to score leads, route them to agents and organize each agent’s work day, with the objective of maximizing return on investment. Operating within SelectCare are the following purpose-built systems:

| • | SelectBid: Advanced, data-enriched lead scoring and purchasing tool that provides real-time feedback to help us determine which consumers and campaigns are generating the most valuable opportunities, allowing us to optimize marketing spend. |

-9-

Table of Contents

| • | Get A Lead (“GAL”): Bespoke, purpose-built lead routing and workflow management technology based on lead quality, agent performance and agent availability. GAL uses a targeted approach to rapidly assign consumers to a licensed agent. |

| • | Automated Rate Calculator (“ARC”) / Automated Quote Engine (“AQE”): Real-time quoting and underwriting applications integrated directly into carrier systems. ARC and AQE allow us to build quotes for potential customers in real time based on specific carrier underwriting requirements and risk tolerances. |

| • | SelectQuote Revenue Tracking System (“SRTS”): Fully integrated, proprietary revenue tracking and financial reporting tool that also supports financial and customer falloff / retention prediction algorithms, allowing for real-time workflow and actions with our customer service teams. |

We currently utilize data science across all of our key business functions and systems, and our sophisticated algorithms benefit from years of data accumulation and analysis, which are continuously enriched with new data and refined by our in-house data science team. Our algorithms are informed by data accumulated through our operating history, which includes approximately 32 million leads and over 1 billion data points in our database. Our focus on data quality ensures our data scientists can draw deep insights as accurately and efficiently as possible. Our complex regression and machine learning models drive marketing spend and lead purchasing, scoring and routing, sales execution and post-sale customer engagement, all to further our goal of maximizing policyholder lifetime value. As we continue to grow, we will naturally acquire more data that will continue to better inform our decision making.

Highly scalable platform with growing network effects. Our structured recruiting, training and agent onboarding program provides flexibility to ramp up agent hiring activity to drive sales volumes. Through significant recent investments we have made to our technological, infrastructure and reporting capabilities, our platform is designed to provide us with ample support for future years of growth with minimal ongoing working capital requirements. We have built our systems to be highly adaptable, providing us with flexibility to seamlessly provide product extensions and enter into other product verticals. We continually evaluate our insurance carrier partnerships, and we have the ability to accommodate new insurance carrier relationships and new products that may further drive growth. As we expand, we expect our appeal to consumers as a one-stop shop and our appeal to carriers as a leading platform with large consumer audiences to continue to grow. These network effects will allow us to accumulate more data and insights, which serve to strengthen our algorithms and the value of our connections, thus accelerating our “Fly Wheel.”

Strong brand awareness. We were founded over 30 years ago as what we believe was the first DTC term life insurance exchange platform in the U.S. Over this time, we have built a highly successful and recognizable household brand. We continue to enhance our visibility with advertisements on nationwide TV networks (including CNN, Fox News and ESPN) and radio outlets, while also maintaining a strong online presence through our market-leading comparison websites, complemented by search engine advertising and a social media presence (Facebook, YouTube, etc.). There is also meaningful potential for us to leverage our strong brand awareness for intragroup cross sales and expansion into adjacent products and markets that further enhance revenue.

Ability to attract and retain productive, career-based agent force. We believe that a technology-enabled agent-based distribution model generates superior return on investment and policyholder lifetime value relative to solely web-based or traditional distribution models. As a result, we have built processes that allow us to attract, train and retain top talent, and to grow our agent force. Our sophisticated recruitment engine is employed across our six major city center locations and nationally with our remote agent capability and involves personality tests, multiple interviews and final approval by a senior manager. Seasonally, we utilize flex agents in our Senior segment for AEP and OEP to capitalize on the heightened activity during these windows. The use of

-10-

Table of Contents

flex agents allows us to identify top performing agents who will ultimately be transitioned to core agents or other roles at the Company following OEP. The fact that we offer our flex agents multiple career paths gives us a strategic advantage in recruiting highly talented individuals. Many of our top producing core agents previously served as flex agents. These recruiting and development processes lead to agent productivity rates that we believe are materially above the industry norm, allowing us to offer competitive compensation packages and attractive career paths, which in turn drives tenured core agent retention levels of over 93% among our most productive agents. This results in a virtuous cycle, that we believe gives SelectQuote a sustainable competitive advantage in the recruitment of new agents.

Diverse product offering. At our inception, we specialized in the distribution of term life insurance products. Since then, in addition to introducing a range of other life insurance products, SelectQuote expanded into the fast growing senior health insurance market (in 2010) and auto & home insurance market (in 2011). Our three product segments are a natural fit with consumer insurance and healthcare needs across different life stages. We believe we are unique among insurance distributors for our diverse product range, which provides us with greater stability as demand for certain products fluctuates over the calendar year, and over longer periods of time. Today we provide consumers with access to over 20 products, sourced from over 50 carriers.

Deep and broad insurance carrier partnerships. We are a key distribution partner for over 50 of the largest and most respected blue-chip insurance carriers. Our strong and long-standing relationships with many of our insurance carrier partners, some of which have been on our platform since our inception, represent a mutual commitment which we believe is difficult to replicate. While we are focused on providing consumers with greater choice, we also strive to be a meaningful component of our insurance carrier partners’ distribution strategy, and are therefore selective when it comes to which carriers we accept on to our platform. Our national presence, scale, broad consumer reach and our sales capability make us a partner of choice and a critical distribution channel for these carriers. We are a leading DTC insurance distributor for a number of insurance carrier partners, which helps us negotiate for attractive economics from our insurance carrier partners. In fiscal 2019, we sold more than 160,000 Senior policies for our Senior insurance carrier partners and produced more than $145.0 million in new premium for our Life and Auto & Home insurance carrier partners. In the nine month period ended March 31, 2020, we sold approximately 235,000 Senior policies for our Senior insurance carrier partners and produced more than $123.0 million in new premium for our Life and Auto & Home insurance carrier partners. Furthermore, our proprietary technology and tech-enabled agent model is focused on maximizing policyholder lifetime value, meaning that our insurance carrier partners enjoy higher quality business from each transaction sourced through us. Our insurance carrier partners also rely on our strong internal compliance function, which records all of our calls and audits a subset of them with our Quality Assurance team to ensure that we are complying with Centers for Medicare & Medicaid Services (“CMS”) rules and regulation, telemarketing regulations, carrier internal requirements and that the agents are meeting certain quality metrics that we deem important. Our compliance record and efficiency have led insurance carriers to partner with us on another key value proposition—our insurance carrier dedicated agent pods. These pods deepen our relationship with these insurance carrier partners and enable us to sell more policies. Pod marketing is specific to each individual pod and is separate from SelectQuote’s comparison shopping platform. This ensures a SelectQuote lead always gets presented with the comparison shopping platform.

Data driven approach to maximization of policyholder lifetime value. We use advanced algorithms informed by over 1 billion consumer data points to enrich our consumer engagement strategy. Our algorithms help agents identify opportunities for cross-sell, such as offering complementary plans at the point of sale. After a sale is made, our algorithms effectively identify customers likely to purchase additional products, thereby improving the likelihood that a policyholder retains his or her policy and generating highly predictable future income. As of March 31, 2020, our dedicated CCA team, which we launched four years ago, was comprised of 127 professionals who aim to improve the consumer experience during the post-sale carrier onboarding process, drive improved retention in the out years and improve cross selling opportunities. A number of the CCA team

-11-

Table of Contents

members are former licensed agents already familiar with the business and the consumer journey. This function allows our core agent force to allocate time towards new business generation. The CCA team leverages our systems to identify opportunities for consumers to purchase additional products and for us to implement tailored retention strategies. Part of the team’s function also involves a data-driven targeted outreach program to Medicare Advantage clients ahead of AEP to gauge potential interest in insurance shopping plans during the upcoming season. In order to make sure that we are making decisions with the best data possible, we partner with leading external industry consultants to review and validate our historical retention experience and projected performance. Our consistent track record of delivering strong customer retention rates creates additional value for our insurance carrier partners, solidifying SelectQuote’s position as a key partner with insurance carriers, which produces a positive reinforcement loop across our business. Our database is the result of more than 30 years of dedicated focus and investment, providing us with unparalleled insights that are difficult for competitors to replicate.

Attractive financial profile. As a distributor of insurance products, we benefit from favorable industry trends. We earn commission revenue on the successful sale and renewal of polices we distribute and, accordingly, our financial model does not reflect the inherent uncertainties associated with underwriting insurance risk. We have a high degree of visibility into the commission we earn at the time of sale, as well as the renewal commissions we would earn should a policyholder renew his or her policy. Our CCA team’s efforts enhance the policyholder experience and thereby improve policyholder retention and our opportunity to generate renewal commissions. Because our agents do not receive a share of renewal commissions, each dollar of renewal revenue directly adds to our income from operations, thereby improving our margins. Our platform is highly scalable, which enables margin expansion as we grow.

Strong company culture developed by an experienced management team. We maintain a unique sales and consumer service-oriented culture. We are a diverse group of women and men who are united in our mission to provide solutions that help consumers with their overall financial well-being and protect their most valued assets. Through our recruiting processes, we are able to identify people who enjoy being a part of, and are motivated by, a performance-based, meritocratic organization. This allows us to assemble a world-class team of people who envision building their careers at SelectQuote. Our company culture is promoted by a highly experienced management team with deep industry experience and a track record of industry innovation. The key members of our management team have over 60 total years of industry experience and several members of our management team have worked together to build our business over the last eight years.

Our Growth Strategy

Maximize policyholder lifetime value. Policyholder lifetime value represents commissions estimated to be collected over the life of an approved policy less the cost of acquiring the business and is a key component of our overall profitability. Our goal is to maximize policyholder lifetime value, and we do so through strategies designed to maximize the revenue opportunity and minimize our customer acquisition cost. Maximizing policyholder lifetime value involves continued investment in:

| • | Our agent experience and customer care team, which together enhance our close rates, commissionable premium, and our ability to earn renewal and cross-sell revenue; |

| • | Carrier relationships, and in particular, negotiation of more favorable terms; |

| • | Pre-AEP outreach to our Senior segment policyholders to better understand emerging trends in consumer decision making; |

| • | Technology, data and analytics to optimize our marketing and lead acquisition spend; and |

| • | Our pod offerings, which offer an opportunity to earn economics on a more favorable basis than our broader comparison shopping platform. |

-12-

Table of Contents

Increase the size and enhance the productivity of our agent force. Agents and their productivity are a key element of our ability to distribute policies and earn commission revenue. We intend to continue to invest in our agent force, widening our recruiting funnel through our new remote agent program as well as selectively expanding our physical offices and growing our agent ranks. We intend to continue to invest in training, technology and widening our product offering, all of which enable our agents to be more productive. In doing so, we believe we will be able to offer more rewarding career opportunities for our agents, which should further enhance our ability to grow our agent force.

Deepen consumer penetration and drive cross-selling opportunities. We are highly focused on the consumer experience and believe that customer satisfaction is a key driver to maximizing cross-sell opportunities and repeat business. We believe there are natural synergies across our portfolio of products, and we are focused on increasing cross-sell across our existing customer base. Our success cross-selling ancillary products (e.g., dental, vision and hearing, prescription drug plans and fixed indemnity) to our clients is improving and we continue to look at ways to broaden our cross-selling opportunities. Within our Auto & Home business, we have been successful in bundling products (selling multiple products to the same customer). For fiscal 2019 and the nine month period ended March 31, 2020, our agents sold policies to over 30,000 and 26,000 customers, respectively, with bundle rates of 47% and 50%, respectively, which we believe are significantly higher than industry averages. A large and relatively untapped opportunity is to deepen cross-sell of products to customers across our three segments, and we are currently employing technology and data designed to enable us to better track the customer life journey to allow us to identify and better execute on this opportunity.

Deepen and broaden our insurance carrier partnerships. We are selective with the carriers that we choose to do business with and seek to maintain a balance between offering consumers choice, while sustaining a meaningful relationship with carriers to ensure we are able to get the best terms for consumers. We continuously evaluate our insurance carrier partner panel and have the ability to quickly accommodate new insurance carrier relationships and new products from existing carriers. Our focus on offering high-quality products has resulted in strong retention rates, increasing the value of our distribution model to insurance carrier partners.

Introduce new products. We have an attractive and scalable platform with strong policyholder acquisition capabilities, backed by flexible systems that can be leveraged to introduce new product offerings to consumers. We also have established relationships with major carriers that are familiar with our business model, providing a natural advantage for sourcing new product opportunities. We currently offer over 20 products on behalf of our insurance carrier partners to consumers and continuously evaluate new product opportunities, including simplified annuities, retirement solutions and other financial services products.

Senior Secured Credit Facilities

On November 5, 2019, the Company entered into a credit agreement (the “Credit Agreement”) with Morgan Stanley Capital Administrators, Inc., as lender and administrative agent, UMB Bank N.A., as lender and revolver agent, and the other lenders party thereto, providing for (i) a $75.0 million senior secured revolving credit facility (the “Revolving Credit Facility”) and (ii) a $425.0 million senior secured term loan (the “Term Loan” and, together with the Revolving Credit Facility, the “Senior Secured Credit Facilities”). Morgan Stanley Capital Administrators, Inc. is an affiliate of Morgan Stanley & Co. LLC, one of the underwriters of this offering.

Proceeds from the Term Loan may be used to pay dividends, purchase shares or otherwise return capital to stockholders in an amount not to exceed $325.0 million and for general corporate purposes. The Revolving Credit Facility is available for general corporate purposes and includes a letter of credit sub-facility of up to $5.0 million. The Senior Secured Credit Facilities also include an uncommitted incremental facility, which, subject to certain conditions, provides for additional term loans or an increase of existing term loans and/or an

-13-

Table of Contents

increase in commitments under the Revolving Credit Facility, in each case, in an aggregate amount of up to $100.0 million. Notwithstanding the foregoing, the aggregate amount of increases in commitments under the Revolving Credit Facility may not exceed $15.0 million.

On November 15, 2019, the Company declared a distribution of $188.7 million on all outstanding common stock and stock options (regardless of vesting status) ($1.96 per share) and $86.3 million on all outstanding Series A, B, C and D preferred stock ($15.66 per share) from a portion of the proceeds of the Term Loan (the “Distribution”). $265.8 million of the Distribution was paid to existing stockholders and $9.2 million was paid to stock option holders.

As of the date of this prospectus, the aggregate principal amount of the Term Loan is $425.0 million and our borrowing capacity under the Revolving Credit Facility is $75.0 million.

Stock Split

On February 28, 2020, we effected an eight-for-one forward stock split of our issued and outstanding shares of common stock and a proportional adjustment to the existing conversion ratios for our Series A, B, C and D preferred stock. The par value of our common stock was not adjusted as a result of the stock split. All references to common stock, options to purchase common stock, share data, per share data and related information presented in this prospectus and contained in the financial statements and footnotes have been retrospectively adjusted, where applicable, to reflect the effect of the stock split and the adjustment of the Series A, B, C and D preferred stock conversion ratios. In connection with the stock split, the number of authorized shares of our common stock was increased to 700,000,000. Our shares of treasury stock were not affected by the stock split and were retired on March 30, 2020.

Private Placement of Series E Preferred Stock

On April 17, 2020 and May 6, 2020, we issued and sold an aggregate of 100,000 shares and 35,000 shares, respectively, of our Series E preferred stock to certain “accredited investors” (as defined in Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities Act”)), at a purchase price of $1,000 per share, for aggregate proceeds of approximately $135.0 million and net proceeds to the Company of approximately $129.0 million, after deducting commissions and expenses. We applied a portion of the net proceeds from the private placement of Series E preferred stock to complete our acquisition of InsideResponse, LLC (“InsideResponse”), an online marketing consulting firm from which we have historically purchased leads, and intend to use the remaining proceeds for general corporate purposes. Upon the closing of this offering, all outstanding shares of Series E preferred stock will automatically convert into shares of common stock at a fixed discount to the initial offering price.

In connection with the sale of shares of our Series E preferred stock, we entered into Investor Rights Letters with the purchasers of our Series E preferred stock (the “Series E Holders”), which grant the Series E Holders certain rights, including but not limited to certain preemptive rights and information rights. Upon the closing of this offering, these rights will terminate. See “Description of Capital Stock—Series E Preferred Stock Rights” and “Recent Sales of Unregistered Securities” for additional information.

Summary of Risk Factors

You should consider carefully the risks described under the “Risk Factors” section beginning on page 22 and elsewhere in this prospectus. These risks could materially and adversely affect our business, financial condition, operating results, cash flow and prospects, which could cause the trading price of our common stock to decline and could result in a partial or total loss of your investment. These risks include, among others, those related to:

| • | Our reliance on a limited number of insurance carrier partners and any potential termination of those relationships; |

-14-

Table of Contents

| • | Existing and future laws and regulations affecting the healthcare and health insurance market; |

| • | Competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; |

| • | Changes and developments in the regulation of the healthcare industry; |

| • | Systemic changes in our insurance carrier partners’ sales strategies; |

| • | Disruptions or failures of our technological infrastructure and platform; |

| • | Potential changes in applicable technology and consumer outreach techniques; |

| • | Our ability to attract, integrate and retain qualified personnel; |

| • | Failure to convert sales leads to actual sales of insurance policies; |

| • | The impact on our operations from the effects of public health crises, including the current COVID-19 outbreak; |

| • | Our existing and future indebtedness; |

| • | Our intellectual property and technology; |

| • | Our being a public company; and |

| • | Our common stock and this offering. |

Corporate Information

We were incorporated in Delaware on August 18, 1999 under the name SelectQuote, Inc. to serve as a holding company for our business subsidiaries, including SelectQuote Insurance Services, our original operating company, which was incorporated in California on August 14, 1984. Our principal executive offices are located at 6800 West 115th Street, Suite 2511, Overland Park, Kansas 66211, and our telephone number at that address is (913) 599-9225. Our website address is www.selectquote.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider information contained on our website to be part of this prospectus or in deciding whether to purchase shares of our common stock.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies, including:

| • | Presenting only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus; |

| • | Reduced disclosure about our executive compensation arrangements; |

| • | Exemption from the requirements to hold non-binding advisory votes on executive compensation and golden parachute payments; and |

| • | Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

-15-

Table of Contents

We may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of this offering or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company earlier if we have more than $1.07 billion in annual revenue, we have more than $700.0 million in market value of our stock held by non-affiliates (and we have been a public company for at least 12 months and have filed one annual report on Form 10-K) or we issue more than $1 billion of non-convertible debt securities over a three-year period. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting obligations in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.