Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China United Insurance Service, Inc. | tm2014582d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China United Insurance Service, Inc. | tm2014582d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China United Insurance Service, Inc. | tm2014582d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China United Insurance Service, Inc. | tm2014582d1_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

OR

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

COMMISSION FILE NUMBER: 000-54884

CHINA UNITED INSURANCE SERVICE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 30-0826400 |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

7F, No. 311 Section 3

Nan-King East Road

Taipei City, Taiwan

(Address of principal executive offices)

+8862-87126958

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer x |

| Non-accelerated filer ¨ | Smaller reporting company x |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act.

Yes ¨ No x

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

As of May 6, 2020, there were 29,421,736 shares of common stock issued and outstanding, and 1,000,000 preferred shares issued and outstanding.

TABLE OF CONTENTS

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the factors described under Part 1 Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements represent our estimates and assumptions only as of the date of this report. You should read this report and the documents that we reference in this report, or that we filed as exhibits to this report completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

3

OTHER PERTINENT INFORMATION

References in this quarterly report to “we,” “us,” “our” and the “Company” and words of like import refer to China United Insurance Service, Inc., its subsidiaries and variable interest entities.

References to China or the PRC refer to the People’s Republic of China (excluding Hong Kong, Macao and Taiwan). References to Taiwan refer to Republic of China.

Unless context indicates otherwise, reference to the “Company” in this quarterly report refers to China United Insurance Service, Inc. and its subsidiaries. Reference to “AHFL” refers to the combined operations of Action Holdings Financial Limited and its Taiwan Subsidiaries (as defined below). Reference to “Anhou” refers to the combined operations of Law Anhou Insurance Agency Co., Ltd. and its subsidiaries.

Our business is conducted in Taiwan and China using New Taiwanese Dollars (“NT$” or “NTD”), the currency of Taiwan, Hong Kong Dollars (“HK$” or “HKD”), the currency of Hong Kong, and RMB, the currency of China, respectively, and our financial statements are presented in United States dollars (“USD”, “US$” or “$”). In this quarterly report, we refer to assets, obligations, commitments and liabilities in our financial statements in U.S. dollars. These dollar references are based on the exchange rate of NT$, HK$ and RMB to USD, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars which may result in an increase or decrease in the amount of our obligations (expressed in USD) and the value of our assets, including accounts receivable (expressed in USD).

4

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| March 31, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 12,058,320 | $ | 12,615,008 | ||||

| Time deposits | 42,527,370 | 38,731,658 | ||||||

| Accounts receivable | 14,759,386 | 22,541,558 | ||||||

| Contract assets | 220,665 | - | ||||||

| Marketable securities | 1,144,659 | 290,153 | ||||||

| Other current assets | 2,067,271 | 1,810,962 | ||||||

| Total current assets | 72,777,671 | 75,989,339 | ||||||

| Property, plant and equipment, net | 1,441,283 | 1,402,866 | ||||||

| Operating lease assets | 5,697,468 | 5,522,665 | ||||||

| Intangible assets | 457,040 | 518,264 | ||||||

| Long-term investments | 2,575,494 | 2,693,082 | ||||||

| Restricted cash – noncurrent | 43,141 | 43,492 | ||||||

| Other assets | 3,675,559 | 3,072,714 | ||||||

| TOTAL ASSETS | $ | 86,667,656 | $ | 89,242,422 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Short-term loans | $ | 9,600,000 | $ | 8,100,000 | ||||

| Commission payable to sales professionals | 8,269,902 | 12,545,730 | ||||||

| Income tax payable – current | 3,673,645 | 2,389,304 | ||||||

| Operating lease liabilities – current | 2,482,675 | 2,242,034 | ||||||

| Due to related parties | 535,339 | 462,859 | ||||||

| Other current liabilities | 9,631,104 | 11,657,184 | ||||||

| Total current liabilities | 34,192,665 | 37,397,111 | ||||||

| Operating lease liabilities | 2,938,731 | 3,048,632 | ||||||

| Income tax payable – noncurrent | 815,451 | 815,451 | ||||||

| Other liabilities | 1,993,683 | 2,229,736 | ||||||

| TOTAL LIABILITIES | 39,940,530 | 43,490,930 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| STOCKHOLDERS’ EQUITY | ||||||||

| Preferred stock, par value $0.00001, 10,000,000 authorized, 1,000,000 issued and outstanding | 10 | 10 | ||||||

| Common stock, par value $0.00001, 100,000,000 authorized, 29,421,736 issued and outstanding | 294 | 294 | ||||||

| Additional paid-in capital | 8,190,449 | 8,190,449 | ||||||

| Statutory reserves | 8,228,904 | 8,228,904 | ||||||

| Retained earnings | 8,865,692 | 9,402,294 | ||||||

| Accumulated other comprehensive income | 90,661 | 417,015 | ||||||

| Total stockholders' equity attribute to parent’s shareholders | 25,376,010 | 26,238,966 | ||||||

| Noncontrolling interests | 21,351,116 | 19,512,526 | ||||||

| TOTAL STOCKHOLDERS’ EQUITY | 46,727,126 | 45,751,492 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 86,667,656 | $ | 89,242,422 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-1 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenue | $ | 28,523,210 | $ | 19,426,674 | ||||

| Cost of revenue | 19,499,924 | 11,195,074 | ||||||

| Gross profit | 9,023,286 | 8,231,600 | ||||||

| Operating expenses: | ||||||||

| Selling | 490,030 | 488,620 | ||||||

| General and administrative | 7,558,908 | 3,803,556 | ||||||

| Total operating expense | 8,048,938 | 4,292,176 | ||||||

| Income from operations | 974,348 | 3,939,424 | ||||||

| Other income (expenses): | ||||||||

| Interest income | 110,891 | 88,473 | ||||||

| Interest expenses | (59,282 | ) | (33,582 | ) | ||||

| Other - net | (152,739 | ) | 301,926 | |||||

| Total other income | (101,130 | ) | 356,817 | |||||

| Income before income taxes | 873,218 | 4,296,241 | ||||||

| Income tax expense | (883,633 | ) | (1,077,387 | ) | ||||

| Net (loss) income | (10,415 | ) | 3,218,854 | |||||

| Less: net income attributable to noncontrolling interests | 526,187 | 1,211,849 | ||||||

| Net (loss) income attributable to parent’s shareholders | (536,602 | ) | 2,007,005 | |||||

| Other comprehensive loss items: | ||||||||

| Foreign currency translation loss | (561,123 | ) | (363,320 | ) | ||||

| Other | (57 | ) | - | |||||

| Total other comprehensive loss | (561,180 | ) | (363,320 | ) | ||||

| Comprehensive (loss) income | (571,595 | ) | 2,855,534 | |||||

| Less: comprehensive (loss) income attributable to noncontrolling interests | (291,361 | ) | (1,061,527 | ) | ||||

| Comprehensive (loss) income attributable to parent’s shareholders | $ | (862,956 | ) | $ | 1,794,007 | |||

| Weighted average shares outstanding: | ||||||||

| Basic and diluted | 29,421,736 | 29,452,669 | ||||||

| (Loss) earning per share attributable to common stockholders of parent: | ||||||||

| Basic and diluted | $ | (0.018 | ) | $ | 0.066 | |||

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

| Common Stock |

Amount | Preferred Stock |

Amount | Additional Paid-in Capital |

Statutory Reserves |

Accumulated Other Comprehensive Income |

Retained Earnings |

Total | Noncontrolling Interests |

Total Equity |

||||||||||||||||||||||||||||||||||

| Balance December 31, 2019 | 29,421,736 | $ | 294 | 1,000,000 | $ | 10 | $ | 8,190,449 | $ | 8,228,904 | $ | 417,015 | $ | 9,402,294 | $ | 26,238,966 | $ | 19,512,526 | $ | 45,751,492 | ||||||||||||||||||||||||

| Issuance of preferred shares of subsidiary to noncontrolling interests | - | - | - | - | - | - | - | - | - | 1,547,229 | 1,547,229 | |||||||||||||||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | - | - | (326,316 | ) | - | (326,316 | ) | (234,807 | ) | (561,123 | ) | |||||||||||||||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | (38 | ) | - | (38 | ) | (19 | ) | (57 | ) | |||||||||||||||||||||||||||||

| Net (loss) income | - | - | - | - | - | - | - | (536,602 | ) | (536,602 | ) | 526,187 | (10,415) | |||||||||||||||||||||||||||||||

| Balance March 31, 2020 | 29,421,736 | $ | 294 | 1,000,000 | $ | 10 | $ | 8,190,449 | $ | 8,228,904 | $ | 90,661 | $ | 8,865,692 | $ | 25,376,010 | $ | 21,351,116 | $ | 46,727,126 | ||||||||||||||||||||||||

| Common Stock |

Amount | Preferred Stock |

Amount | Additional Paid-in Capital |

Statutory Reserves |

Accumulated Other Comprehensive Loss |

Retained Earnings |

Total | Noncontrolling Interests |

Total Equity |

||||||||||||||||||||||||||||||||||

| Balance December 31, 2018 | 29,452,669 | $ | 295 | 1,000,000 | $ | 10 | $ | 8,190,449 | $ | 7,299,123 | $ | (171,318 | ) | $ | 7,273,227 | $ | 22,591,786 | $ | 16,351,044 | $ | 38,942,830 | |||||||||||||||||||||||

| Foreign currency translation loss | - | - | - | - | - | - | (212,998 | ) | - | (212,998 | ) | (150,322 | ) | (363,320 | ) | |||||||||||||||||||||||||||||

| Other comprehensive gain | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||

| Net income | - | - | - | - | - | - | - | 2,007,005 | 2,007,005 | 1,211,849 | 3,218,854 | |||||||||||||||||||||||||||||||||

| Balance March 31, 2019 | 29,452,669 | $ | 295 | 1,000,000 | $ | 10 | $ | 8,190,449 | $ | 7,299,123 | $ | (384,316 | ) | $ | 9,280,232 | $ | 24,385,793 | $ | 17,412,571 | $ | 41,798,364 | |||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

CHINA UNITED INSURANCE SERVICE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash flows from operating activities: | ||||||||

| Net (loss) income | $ | (10,415 | ) | $ | 3,218,854 | |||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Compensation cost of the preferred stocks issued to nonemployees | 1,554,289 | - | ||||||

| Depreciation and amortization | 201,522 | 166,061 | ||||||

| Amortization of bond premium | 66 | 65 | ||||||

| Gain (loss) on valuation changes of financial assets | 170,530 | (74,056 | ) | |||||

| Loss on disposal of fixed assets | 7,346 | 10,855 | ||||||

| Deferred income tax | (479,202 | ) | (34,459 | ) | ||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 7,596,492 | 2,055,797 | ||||||

| Contract assets | (221,848 | ) | (1,040,568 | ) | ||||

| Other current assets | (235,848 | ) | 2,184,387 | |||||

| Other assets | (156,709 | ) | (552,165 | ) | ||||

| Income tax payable | 1,306,071 | 1,032,707 | ||||||

| Commission payable | (4,171,583 | ) | (3,004,106 | ) | ||||

| Other current liabilities | (2,004,534 | ) | (901,092 | ) | ||||

| Long-term liabilities | (215,366 | ) | (1,423,100 | ) | ||||

| Net cash provided by operating activities | 3,340,811 | 1,639,180 | ||||||

| Cash flows from investing activities: | ||||||||

| Purchases of time deposits | (22,634,176 | ) | (18,305,382 | ) | ||||

| Proceeds from maturities of time deposits | 18,441,127 | 9,924,948 | ||||||

| Purchases of marketable securities | (940,268 | ) | - | |||||

| Proceeds from disposal of equipment | 2,879 | - | ||||||

| Purchase of equipment | (195,976 | ) | (87,315 | ) | ||||

| Purchase of intangible assets | (9,487 | ) | (21,259 | ) | ||||

| Cash received from issuance of preferred shares by a subsidiary | 319 | - | ||||||

| Net cash used in investing activities | (5,335,582 | ) | (8,489,008 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from short-term loans | 22,800,000 | 9,512,787 | ||||||

| Repayment of short-term loans | (21,300,000 | ) | (8,400,000 | ) | ||||

| Proceeds from related party borrowings | 79,759 | - | ||||||

| Net cash provided by financing activities | 1,579,759 | 1,112,787 | ||||||

| Foreign currency translation | (142,027 | ) | (138,150 | ) | ||||

| Net decrease in cash, cash equivalents and restricted cash | (557,039 | ) | (5,875,191 | ) | ||||

| Cash, cash equivalents and restricted cash, beginning balance | 12,658,500 | 20,639,771 | ||||||

| Cash, cash equivalents and restricted cash, ending balance | $ | 12,101,461 | $ | 14,764,580 | ||||

| SUPPLEMENTARY DISCLOSURE: | ||||||||

| Interest paid | $ | 58,926 | $ | 40,895 | ||||

| Income tax paid | $ | - | $ | 8,176 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| F-4 |

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

China United Insurance Service, Inc. (“China United”, “CUII”, or the “Company”) is a Delaware corporation, organized on June 4, 2010 by Yi-Hsiao Mao, a Taiwan citizen, as a listing vehicle for both ZLI Holdings Limited (“CU Hong Kong”) and Action Holdings Financial Limited (“AHFL,” a company incorporated in the British Virgin Islands). The Company primarily engages in brokerage and insurance agency services by providing two broad categories of insurance products, life insurance products and property and casualty insurance products, and manages its business through aggregating them into three geographic operating segments, Taiwan, PRC, and Hong Kong. The Company’s common stock currently trades over the counter under the ticker symbol “CUII” on the OTC Pink market.

In May 2019, AHFL entered into an agreement to make capital contributions of $485,909 (NTD15,000,000) to AIlife International Investment Co., Limited (“AIlife”, formerly known as “Ilife”). After the transaction, the Company owned 93.75% of AIlife. In July 2019, AHFL acquired the remaining 6.25% shares of AIlife, which became the Company’s wholly owned subsidiary. The business objective of AIlife is to obtain a non-exclusive license covering certain information technology systems from Law Broker and generate revenues from marketing and making the technologies available to insurance intermediary companies.

O June 4, 2019, AIlife entered into an acquisition agreement with the selling shareholder of Uniwill Insurance Broker Co., Ltd (“Uniwill”). Pursuant to the acquisition agreement, AIlife agreed to pay $14,535 (NTD 450,000) in exchange for the insurance brokerage licenses issued to Uniwill by the Taiwanese government, along with right to the Uniwill company name and $6,455 (NTD 200,000) of legal deposits. The Company has no intention of operating the Uniwill existing brokerage business nor retaining any of its sales personnel. Therefore, the acquisition is accounted as an assets purchase.

On November 15, 2019, AIlife, Cyun-Jhan Enterprise Co., Ltd. (“Cyun-Jhan”), and Jian-Zao International Industrial Co., Ltd. (“Jian-Zao” and, collectively with AIlife and Cyun-Jhan, the “Parties”) entered into a Joint Venture Agreement (the “JV Agreement”). Under the terms of the JV Agreement, the Parties agreed to invest funds, labor and technology into Uniwill. Under the terms of the JV Agreement, the paid-in capital of Uniwill should increase to an aggregate amount of $13.3 million (NTD 400 million) by AIlife, provided that the other two parties achieve performance goals no later than December 31, 2021. On August 15, 2019, AIlife increased and completed the capital injections in Uniwill to the amount of $3.3 million. As of March 23, 2020, the Company completed regulatory approvals and amendment of Uniwill’s Article of Incorporation. During the three months ended March 31, 2020, Uniwill issued a total of 9,608 preferred shares to Cyun-Jhan and Jian-Zao for cash and recognized additional market value of $1,554,289 on February 10, 2020. The holders of 9,608 shares of preferred stocks participate in daily operating and entitle to have the rights of share 50% of earnings of Uniwill. Each share of the preferred stock issued has 1,000 votes as compared to one vote per common stock share. The preferred stock’s right of conversion to common stocks upon the achievement of performance goals are set forth in the JV Agreement.

| F-5 |

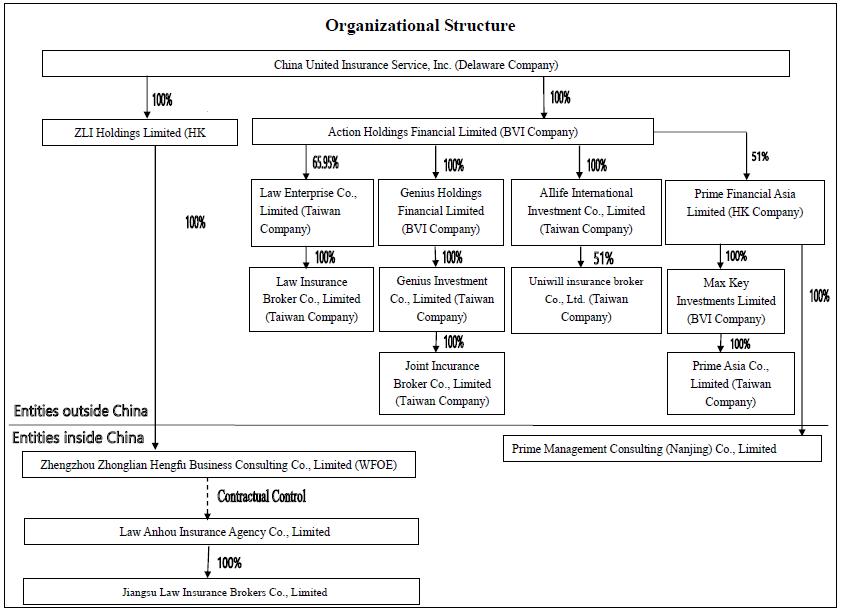

The corporate structure as of March 31, 2020 is as follows:

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The unaudited consolidated financial statements include the accounts of China United, its subsidiaries and variable interest entities as shown in the corporate structure in Note 1. All significant intercompany transactions and balances have been eliminated in the consolidation. Certain reclassifications have been made to the consolidated financial statements for prior year to the current year’s presentation. Such reclassifications have no effect on net income as previously reported.

Basis of Presentation

The unaudited consolidated financial statements presented herein have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, all adjustments, including normal recurring adjustments, considered necessary for a fair statement of the financial statements have been included. Operating results for the three months ended March 31, 2020 are not necessarily indicative of the results that may be expected for the year ending December 31, 2020.

| F-6 |

These unaudited consolidated financial statements and notes thereto should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto for the year ended December 31, 2019, which were included in the Company’s 2019 Annual Report on Form 10-K (“2019 Form 10-K”). The accompanying consolidated balance sheet as of December 31, 2019, has been derived from the Company’s audited consolidated financial statements as of that date.

Use of Estimates

The preparation of the Company’s consolidated financial statements in conformity with GAAP requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Actual results may differ from those estimates and assumptions.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable includes commission receivables stated at net realizable values. The Company reviews its accounts receivable regularly to determine if a bad debt allowance is necessary at each quarter-end. Management reviews the composition of accounts receivable and analyzes the age of receivables outstanding, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the necessity of making such allowance. No allowance was deemed necessary as of March 31, 2020 and December 31, 2019.

Foreign Currency Transactions

The Company’s financial statements are presented in U.S. dollars ($), which is the Company’s reporting and functional currency. The functional currencies of the Company’s subsidiaries are NTD, RMB and HKD. The resulting translation adjustments are reported under other comprehensive income in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 220 (“ASC 220”), “Reporting Comprehensive Income”. Gains and losses resulting from the translation of foreign currency transactions are reflected in the consolidated statements of operations and other comprehensive income (loss). Monetary assets and liabilities denominated in foreign currency are translated at the functional currency using the rate of exchange prevailing at the balance sheet date. Any differences are taken to profit or loss as a gain or loss on foreign currency translation in the consolidated statements of operations and other comprehensive income (loss).

The Company translates the assets and liabilities into U.S. dollars using the rate of exchange prevailing at the balance sheet date and the statements of operations and cash flows are translated at an average rate during the reporting period. Adjustments resulting from the translation from NTD, RMB and HKD into U.S. dollars are recorded in stockholders’ equity as part of accumulated other comprehensive income. The exchange rates used for financial statements are as follows:

| Average Rate for the three months ended March 31, |

||||||||

| 2020 | 2019 | |||||||

| Taiwan dollar (NTD) | NTD | 30.104041 | NTD | 30.815550 | ||||

| China yuan (RMB) | RMB | 6.979847 | RMB | 6.746399 | ||||

| Hong Kong dollar (HKD) | HKD | 7.770461 | HKD | 7.845634 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | ||||

| Exchange Rate at | ||||||||

| March 31, 2020 | December 31, 2019 | |||||||

| Taiwan dollar (NTD) | NTD | 30.247627 | NTD | 29.95314 | ||||

| China yuan (RMB) | RMB | 7.087588 | RMB | 6.96676 | ||||

| Hong Kong dollar (HKD) | HKD | 7.752546 | HKD | 7.78722 | ||||

| United States dollar ($) | $ | 1.000000 | $ | 1.000000 | ||||

Earnings (Loss) Per Share

Basic earnings (loss) per common share (“EPS”) is computed by dividing net income attributable to the common shareholders of the Company by the weighted-average number of common shares outstanding. Diluted EPS is computed in the same manner as basic EPS, except the number of shares includes additional common shares that would have been outstanding if potential common shares with a dilutive effect had been issued.

| F-7 |

As the holders of preferred stock of the Company are entitled to share equally with the holders of common stock, on a per share basis, in such dividends and other distributions of cash, property or shares of stock of the Company as may be declared by the board of directors, the preferred stock is treated as a participating security. When calculating the basic earnings per common share, the two-class method is used to allocate earnings to common stock and participating security as required by FASB ASC Topic 260, “Earnings Per Share.” As of March 31, 2020 and 2019, the Company does not have any potentially dilutive instrument.

Fair Value of Financial Instruments

Fair value accounting establishes a framework for measuring fair value and expands disclosure about fair value measurements. Fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three levels as follows:

| · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

The following table summarize financial assets and liabilities measured at fair value on a recurring basis as of March 31, 2020 and December 31, 2019:

| March 31, 2020 | ||||||||||||||||

| Fair Value | Carrying | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Value | |||||||||||||

| Assets | ||||||||||||||||

| Total time deposits | $ | 42,527,370 | $ | - | $ | - | $ | 42,527,370 | ||||||||

| Marketable securities: | ||||||||||||||||

| Mutual funds | $ | - | $ | 1,144,659 | $ | - | $ | 1,144,659 | ||||||||

| Long-term investments: | ||||||||||||||||

| Government bonds held for available-for-sale | 100,096 | - | - | 100,096 | ||||||||||||

| REITs | 1,204,723 | - | - | 1,204,723 | ||||||||||||

| Total assets measured at fair value | $ | 43,832,189 | $ | 1,144,659 | $ | - | $ | 44,976,848 | ||||||||

| December 31, 2019 | ||||||||||||||||

| Fair Value | Carrying | |||||||||||||||

| Level 1 | Level 2 | Level 3 | Value | |||||||||||||

| Assets | ||||||||||||||||

| Total cash equivalents and time deposits | $ | 40,194,850 | $ | - | $ | - | $ | 40,194,850 | ||||||||

| Marketable securities: | ||||||||||||||||

| Mutual funds | - | 290,153 | - | 290,153 | ||||||||||||

| Long-term investments: | ||||||||||||||||

| Government bonds held for available-for-sale | 101,203 | - | - | 101,203 | ||||||||||||

| REITs | 1,308,711 | - | - | 1,308,711 | ||||||||||||

| Total assets measured at fair value | $ | 41,604,764 | $ | 290,153 | $ | - | $ | 41,894,917 | ||||||||

| F-8 |

The carrying amounts of current financial assets and liabilities in the consolidated balance sheets for cash equivalents, time deposits, and restricted cash equivalents approximate fair value due to the short-term duration of those instruments.

Marketable securities and long-term investments in REITs – The fair values of mutual funds and REITs were valued based on quoted market prices in active markets.

Government bonds – The fair value of government bonds is valued based on theoretical bond price in the Taipei Exchange.

According to Taiwan Regulations Governing Deposit of Bond and Acquirement of Insurance by Insurance Agents, Insurance Brokers and Insurance Surveyors (“RGDBAI”) Article 3 and 4, Law Broker is required to maintain a minimum of NTD 3,000,000 ($99,181 and $100,156 as of March 31, 2020 and December 31, 2019, respectively) restricted balance in a separate account or government bonds issued by the central government in order to maintain its insurance license. The government bonds will mature on March 17, 2021 and the amortized cost of the bonds is $99,436 (NTD 3,007,688) and $100,479 (NTD 3,009,674) as of March 31, 2020 and December 31, 2019, respectively. The Company will purchase a similar investment after the maturity of the bonds to maintain the insurance license.

Concentration of Risk

The Company maintains cash with banks in the USA, People’s Republic of China (“PRC”), Hong Kong, and Taiwan. Should any bank holding cash become insolvent, or if the Company is otherwise unable to withdraw funds, the Company would lose the cash with that bank; however, the Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts. In Taiwan, a depositor has up to NTD3,000,000 insured by Central Deposit Insurance Corporation (“CDIC”). In China, a depositor has up to RMB500,000 insured by the People’s Bank of China Financial Stability Bureau (“FSD”). In Hong Kong, a depositor has up to HKD500,000 insured by Hong Kong Deposit Protection Board (“DPB”). In the United States, the standard insurance amount is $250,000 per depositor in a bank insured by the Federal Deposit Insurance Corporation (“FDIC”).

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and cash equivalents, time deposits, restricted cash, register capital deposit and accounts receivable. As of March 31, 2020 and December 31, 2019, approximately $2,612,00 and $2,293,000 of the Company’s cash and cash equivalents, time deposits, restricted cash equivalents and registered capital deposits held by financial institutions, was insured, and the remaining balance of approximately $52,945,000 and $50,108,000, was not insured. With respect to accounts receivable, the Company generally does not require collateral and does not have an allowance for doubtful accounts.

For the three months ended March 31, 2020 and 2019, the Company’s revenues from sale of insurance policies underwritten by these companies were:

| Three months ended March 31, | ||||||||||||||||

| 2020 | 2019 | |||||||||||||||

| Amount | % of Total Revenue | Amount | % of Total Revenue | |||||||||||||

| Taiwan Life Insurance Co., Ltd. | $ | 5,592,675 | 20 | % | $ | 3,371,243 | 17 | % | ||||||||

| TransGlobe Life Insurance Inc. | 4,995,954 | 18 | % | 2,787,932 | 14 | % | ||||||||||

| Farglory Life Insurance Co., Ltd. | 3,379,091 | 12 | % | $ | 4,420,420 | 23 | % | |||||||||

| Shin Kong Life Insurance Co., Ltd. | 3,062,062 | 11 | % | 1,561,986 | 8 | % | ||||||||||

| F-9 |

As of March 31, 2020 and December 31, 2019, the Company’s accounts receivable from these companies were:

| March 31, 2020 | December 31, 2019 | |||||||||||||||

| Amount | % of Total Accounts Receivable | Amount | % of Total Accounts Receivable | |||||||||||||

| TransGlobe Life Insurance Inc. | $ | 3,301,616 | 22 | % | $ | 4,239,621 | 19 | % | ||||||||

| Taiwan Life Insurance Co., Ltd | 2,875,035 | 20 | % | 4,012,914 | 18 | % | ||||||||||

| Farglory Life Insurance Co., Ltd. | 1,955,082 | 13 | % | 2,664,140 | 12 | % | ||||||||||

| Shin Kong Life Insurance Co., Ltd. | 1,628,219 | 11 | % | 3,586,795 | 16 | % | ||||||||||

| AIA International Limited Taiwan Branch | 1,000,994 | 7 | % | 2,447,051 | 11 | % | ||||||||||

The Company’s operations are in the PRC, Hong Kong and Taiwan. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, foreign currency exchange and legal environments in the PRC, Hong Kong and Taiwan, and by the state of each economy. The Company’s results may be adversely affected by changes in the political and social conditions in the PRC, Hong Kong and Taiwan, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, and rates and methods of taxation, among other things.

Stock-Based Compensation

The Company accounts for equity-based compensation cost in accordance with ASC 718, Compensation-Stock Compensation after adoption of ASC 2018-07, which requires the measurement and recognition of compensation expense related to the fair value of equity-based compensation awards that are ultimately expected to vest. Stock-based compensation expense recognized includes the compensation cost for all share-based compensation payments granted to employees and nonemployees, net of estimated forfeitures, over the employees requisite service period or the non-employee performance period based on the grant date fair value estimated in accordance with the provisions of ASC 718. ASC 718 is also applied to awards modified, repurchased, or cancelled during the periods reported. Compensation costs for awards granted to nonemployees under Uniwill for each of the three months ended March 31, 2020 and 2019 were $1,554,289 and nil, respectively.

Income Taxes

The Company records income tax expense using the asset-and-liability method of accounting for deferred income taxes. Under this method, deferred taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Deferred tax assets are reduced by a valuation allowance if, based on available evidence, it is more likely than not that the deferred tax assets will not be realized.

When tax returns are filed, it is likely some positions taken would be sustained upon examination by the taxing authorities, while others are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The benefit of a tax position is recognized in the financial statements in the period during which, based on all available evidence, management believes it is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes, if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits are classified as interest expense and penalties are classified in selling, general and administrative expenses in the statements of operations and other comprehensive income (loss).

| F-10 |

New Accounting Pronouncements and Other Guidance

Credit Losses

In June 2016, the FASB issued ASU No. 2016-13, (FASB ASC Topic 326), Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments which amends the current accounting guidance and requires the use of the new forward-looking “expected loss” model, rather than the “incurred loss” model, which requires all expected losses to be determined based on historical experience, current conditions and reasonable and supportable forecasts. This guidance amends the accounting for credit losses for most financial assets and certain other instruments including trade and other receivables, held-to-maturity debt securities, loans and other instruments.

In November 2019, the FASB issued ASU No. 2019-10 to postpone the effective date of ASU No. 2016-13 for public business entities eligible to be smaller reporting companies defined by the SEC to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company believes the adoption of ASU No. 2016-13 will not have a material impact on its financial position and results of operations.

The management does not believe that other than disclosed above, accounting pronouncements the recently issued but not yet adopted will have a material impact on its financial position results of operations or cash flows.

NOTE 3 – CASH, CASH EQUIVALENTS AND RESTRICTED CASH

Cash, cash equivalents and restricted cash consisted of the following as of March 31, 2020 and December 31, 2019:

| March 31, 2020 | December 31, 2019 | |||||||

| Cash and cash equivalents: | ||||||||

| Cash on hand and in banks | $ | 12,058,320 | $ | 11,151,816 | ||||

| Time deposits – with original maturities less than three months (see Note 4) | - | 1,463,192 | ||||||

| 12,058,320 | 12,615,008 | |||||||

| Restricted cash – noncurrent | 43,141 | 43,492 | ||||||

| Total cash, cash equivalents and restricted cash shown in the statements of cash flows | $ | 12,101,461 | $ | 12,658,500 | ||||

Noncurrent restricted cash includes a mandatory deposit in the bank in conformity with Provisions of the Supervision and Administration of Specialized Insurance Agencies in PRC, which is not allowed to be withdrawn without the permission of the regulatory commission, and a trust account held for the bonus accrued for Law Broker’s officers.

NOTE 4 – TIME DEPOSITS

| March 31, 2020 | December 31, 2019 | |||||||

| Total time deposits | $ | 42,527,370 | $ | 40,194,850 | ||||

| Less: Time deposits – with original maturities less than three months (see Note 3) | - | (1,463,192 | ) | |||||

| Time deposits – original maturities over three months but less than one year | $ | 42,527,370 | $ | 38,731,658 | ||||

Time Deposits Pledged as Collateral

The Company had time deposits $165,302 (NTD 5 million) pledged as collateral for the Company’s credit card as of Mach 31, 2020. In addition, the Company had time deposits of $11,118,894 and 11,920,632 pledged as collateral for short-term loans, respectively, as of March 31, 2020 and December 31, 2019. See Note 5.

| F-11 |

NOTE 5 – SHORT-TERM LOANS

The Company’s short-term loans consisted of the following as of March 31, 2020 and December 31, 2019:

| March 31, 2020 | December 31, 2019 | |||||||

| Credit facility, O-Bank | $ | 3,100,000 | $ | 2,600,000 | ||||

| Credit facility, FEIB | 2,500,000 | 2,500,000 | ||||||

| Credit facility, CTBC | 1,500,000 | 1,500,000 | ||||||

| Credit facility, KGI | 1,500,000 | 1,500,000 | ||||||

| Credit facility, E. Sun | 1,000,000 | - | ||||||

| Total short-term loans | $ | 9,600,000 | $ | 8,100,000 | ||||

The Company entered into the following credit agreements:

O-Bank Co., Ltd. (“O-Bank”)

CUII has a revolving credit facility in amount of $4,000,000 with O-Bank, which matures on October 22, 2020. Borrowings under the revolving credit facility bear interest at the TAIFX3 rate plus a margin of 0.5%. As of March 31, 2020 and December 31, 2019, the outstanding balance of the revolving credit facility were $3,100,000 with a weighted average interest rate of 2.85% and $2,600,000 with a weighted average interest rate of 2.83%, respectively. As of March 31, 2020 and December 31, 2019, the borrowing is secured by a total amount of $3,570,528 (NTD 108 million) and $3,038,079 (NTD 91 million) of time deposits.

Law Broker entered into a credit agreement with O-Bank, which matures on October 22, 2020, and the agreement provides for a $3.3 million (NTD 100 million) revolving credit facility. Borrowings under this agreement bear interest at the TAIFX3 rate plus a margin of 0.75%. As of March 31, 2020 and December 31, 2019, the outstanding loan under this credit agreement was nil.

Far Eastern International Bank (“FEIB”)

In September 2017, CUII entered into a line of credit agreement with FEIB, which matures on January 8, 2021, and borrowings under the revolving credit facility bear interest at the higher of LIBOR or TAIFX3 rate plus a margin of 0.85%. The outstanding balance of the revolving credit facility were $2,500,000 as of March 31, 2020 and December 31, 2019. The interest rate for the outstanding balance as of March 31, 2020 and December 31, 2019 were 3.65% and 3.05%, respectively. As of March 31, 2020 and December 31, 2019, the borrowing is secured by a total amount of $3,034,949 (NTD 91.8 million) and $3,064,787 (NTD 91.8 million) of time deposits.

Law Broker entered into a credit agreement with FEIB providing for a $2.6 million (NTD 80 million) revolving credit facility, which matures January 8, 2021. As of March 31, 2020 and December 31, 2019, there was no outstanding loan under this credit agreement.

CTBC Bank Co., Ltd. (“CTBC”)

CUII has a revolving credit facility in amount of $1,500,000 with CTBC, which matures on August 31, 2020, and borrowings under the revolving credit facility bear interest at the CTBC’s cost of funds plus a margin of 1%. The outstanding balance of the revolving credit facility were $1,500,000 as of March 31, 2020 and December 31, 2019. The interest rate for the outstanding balance as of March 31, 2020 and December 31, 2019 were 2.95% and 3.20%, respectively. As of March 31, 2020 and December 31, 2019, The borrowing is secured by a total amount of $1,719,143 (NTD 52 million) and $1,736,045 (NTD 52 million) of time deposits. Law Broker is the guarantor of the credit facility.

Law Broker entered into a credit agreement with CTBC providing for a $3.3 million (NTD 100 million) revolving credit facility, which matures on August 31, 2020. As of March 31, 2020 and December 31, 2019, the outstanding loan under this credit agreement was nil.

KGI Commercial Bank Co., Ltd. (“KGI”)

CUII was approved for a line of credit agreement with KGI, which matures on October 2, 2020, pursuant to which CUII has a revolving credit facility of $1,600,000. Borrowings under the agreement bear interest at the LIBOR rate plus a margin of 0.9%. As of March 31, 2020 and December 31, 2019, the Company had the outstanding borrowing of $1,500,000 with a weighted interest rate of 2.80% and $1,500,000 with a weighted interest rate of 3.06%, respectively. The borrowing is secured by a total amount of $1,769,336 (RMB 7.6 million and NTD 20 million) and $2,295,061 (RMB 7.6 million and NTD 36 million) of time deposits.

| F-12 |

Law Broker entered into another credit agreement with KGI providing for a $1.6 million (NTD 50 million), and the agreement matures on October 2, 2020. The borrowing is secured by a total amount of $1,786,660 (RMB 12 million) of time deposits as of December 31, 2019. As of March 31, 2020 and December 31, 2019, there was no outstanding loan under this credit agreement.

E. Sun Bank (“E. Sun”)

CUII was approved for a line of credit agreement with E. Sun, pursuant to which CUII has a revolving credit facility of $1,000,000. Borrowings under the agreement bear interest at the LIBOR rate plus a margin of 0.7%. As of March 31, 2020, the Company had the outstanding borrowing of $1,000,000 with an interest rate of 2.45%. The borrowing is secured by a total amount of $1,024,938 of time deposits. CUII’s revolving credit facility with E. Sun expired on April 2, 2020 and CUII was in the process of extending the term of the credit facility.

Total interest expenses of bank loans incurred were $59,282 and $28,845 for the three months ended March 31, 2020 and 2019, respectively.

NOTE 6 – COMMISSIONS PAYABLE TO SALES PROFESSIONALS

Commissions payable to sales professionals consisted of the following as of March 31, 2020 and December 31, 2019:

| March 31, 2020 |

December 31, 2019 |

|||||||

| Taiwan | $ | 7,966,075 | $ | 12,123,149 | ||||

| PRC | 303,827 | 422,581 | ||||||

| Hong Kong | - | - | ||||||

| Total commissions payable to sales professionals | $ | 8,269,902 | $ | 12,545,730 | ||||

Commissions payable to sales professionals are usually settled within twelve months.

NOTE 7 – OTHER CURRENT LIABILITIES

Other current liabilities were as follows, as of March 31, 2020 and December 31, 2019:

| March 31, 2020 |

December 31, 2019 |

|||||||

| Unearned revenue – AIATW | $ | 1,922,707 | $ | 1,781,975 | ||||

| Accrued business tax and tax withholdings | 1,265,432 | 1,262,570 | ||||||

| Accrued bonus | 3,738,959 | 4,961,323 | ||||||

| Payroll payable and other benefits | 1,170,734 | 1,317,367 | ||||||

| Other accrued liabilities | 1,533,272 | 2,333,949 | ||||||

| Total other current liabilities | $ | 9,631,104 | $ | 11,657,184 | ||||

Unearned Revenue – AIATW

On June 10, 2013, AHFL entered into a Strategic Alliance Agreement (the “Alliance Agreement”) with AIA International Limited Taiwan Branch (“AIATW”), the purpose of which is to promote life insurance products provided by AIATW within Taiwan by insurance agencies or brokerage companies affiliated with AHFL or CUIS. The original term of the Alliance Agreement was from June 1, 2013 to May 31, 2018. Pursuant to the terms of the Alliance Agreement, AIATW paid AHFL an execution fee of approximately $8,326,700 (NTD250,000,000, including the tax of NTD11,904,762, the “Execution Fee”), which is to be recorded as revenue upon fulfilling sales targets and the 13-month persistency ratio, as defined, over the next five years. The Execution Fee may be required to be recalculated if certain performance targets are not met by AHFL.

On September 30, 2014, AHFL entered into a Strategic Alliance Supplemental Agreement (the “First Amendment to the Alliance Agreement”) with AIATW. In the First Amendment to the Alliance Agreement, the performance targets and the provision about refunding the Execution Fee on a pro rata basis when the performance targets are not met were revised.

| F-13 |

On January 6, 2016, AHFL entered into an Amendment No. 2 to the Alliance Agreement (the “Second Amendment to the Alliance Agreement”) with AIATW to further revise certain provisions in the Strategic Alliance Agreement and the previous amendment entered into by and between AHFL and AIATW. To the extent permitted by applicable laws and regulations, AHFL shall assist and encourage any insurance agency company or insurance brokerage company duly approved by the competent government authorities of Taiwan (the “Appointed Broker/Agent”), to cooperate with AIATW for the promotion of life insurance products of AIATW. Pursuant to the Second Amendment to the Alliance Agreement, the expiration date of the Strategic Alliance Agreement was extended from May 31, 2018 to December 31, 2021, and the effect of the Alliance Agreement during the period from October 1, 2014 to December 31, 2015 was suspended. In addition, both AHFL and AIATW agreed to adjust certain terms and conditions set forth in the Alliance Agreement, some of which are as follows: (i) expanding the scope of services to be provided by AHFL to AIATW to include, without limitation, assessment and advice on suitability of cooperative partners, advice on product strategies suitable for promotion channel development, advice on promotion/sales channel improvement, advice on promotion channel marketing and strategic planning, and promotion channel talent training; and (ii) removing certain provisions related to performance milestones and refund of Execution Fees. On March 15, 2016, AHFL issued a promise letter (the “2016 Letter”) to AIATW that AHFL is required to (i) fulfill sales targets and (ii) the 13-month persistency ratio.

On June 14, 2017, with AIATW’s consent, the 2016 Letter was revoked in order to conform with the latest terms and conditions regarding the cooperation between AHFL and AIATW as set forth in an Amendment No. 3 to the Alliance Agreement (the “Third Amendment to the Alliance Agreement”). Pursuant to the Third Amendment to the Alliance Agreement, both AHFL and AIATW agreed to adjust certain terms and conditions set forth this amendment, some of which included (i) except the first contract year (April 15th, 2013 to September 30th, 2014), the sales target of the alliance between the parties shall be changed to (a) value of new business (“VONB”) and (b) the 13-month persistency ratio; and (ii) AIATW will calculate and recognize the VONB and 13-month persistency ratio each contract year and inform the Company the result; and (iii) the Company agrees to return the basic business promotion fees to AIATW within thirty (30) days of receipt of the notice sent by AIATW if the Company fails to meet the targets set forth in the Third Amendment to the Alliance Agreement, AIATW reserves the right to offset such amount against the amount payable by it to the Company; and (iv) upon the termination of the Alliance Agreement and its amendments pursuant to the Section 8.2 of the Alliance Agreement, both parties agreed to calculate the amount to be returned or repaid, as applicable, based on the past and current contract years. The Company shall return the basic business execution fees at NTD50 million for the first contract year, NTD35 million for the second contract year, and NTD33 million for each contract year thereafter within one month after the termination.

| F-14 |

The following table presents the amounts recognized as revenue and refund for each contract year:

| Contract Year | Period | Execution Fees | Revenue Amount | Revenue

VAT Amount | Refund Amount | Refund

VAT Amount | |||||||||||||||||||||||||||||

| First | 04/15/2013

- 09/30/2014 | NTD | 50,000,000 | NTD | 27,137,958 | (1) | NTD | 1,356,898 | NTD | 20,481,090 | (1) | NTD | 1,024,054 | ||||||||||||||||||||||

| Second | 01/01/2016

- 12/31/2016 | NTD | 35,000,000 | NTD | 12,855,000 | (2) | NTD | 642,750 | NTD | 20,478,333 | (2) | NTD | 1,023,917 | ||||||||||||||||||||||

| Third | 01/01/2017

- 12/31/2017 | NTD | 33,000,000 | NTD | 12,628,201 | (3) | NTD | 631,410 | NTD | 18,800,370 | (3) | NTD | 940,019 | ||||||||||||||||||||||

| Fourth | 01/01/2018

- 12/31/2018 | NTD | 33,000,000 | NTD | 11,228,600 | (4) | NTD | 561,429 | NTD | 20,199,971 | (4) | NTD | 1,010,000 | ||||||||||||||||||||||

| Fifth | 01/01/2019

- 12/31/2019 | NTD | 33,000,000 | NTD | 9,481,371 | (5) | NTD | 474,069 | NTD | 21,947,200 | (5) | NTD | 1,097,360 | ||||||||||||||||||||||

| Sixth | 01/01/2020

- 12/31/2020 | NTD | 33,000,000 | NTD | 12,302,394 | NTD | 615,120 | NTD | 19,126,177 | (6) | NTD | 956,309 | |||||||||||||||||||||||

| Seventh | 01/01/2021

- 12/31/2021 | NTD | 33,000,000 | NTD | - | NTD | - | NTD | - | NTD | - | ||||||||||||||||||||||||

| TOTAL | NTD | 250,000,000 | NTD | 85,633,525 | NTD | 4,281,675 | NTD | 121,033,141 | NTD | 6,051,659 | |||||||||||||||||||||||||

| 1) | The revenue recognition for the first contract year is based on the annual first year premium (“AFYP”) set in Alliance Agreement, which is different from other contract years. From the second contract year to the seventh contract year, the revenue calculation is based on VONB. The Company recognized the first contract year’s revenue amount of $892,742 (NTD 27,137,958), net of Value-Added Tax (“VAT”) in 2017 due to uncertainty resolved after Amendment 3 went effective. Besides, on December 3, 2015 and February 23, 2016, the Company refunded the amounts of $160,573 (NTD4,761,905), net of VAT, and $530,056 (NTD15,719,185), net of VAT, to AIATW, respectively, due to the portion of performance sales targets not met during the first contract year based on original agreement and earlier amendments. |

| 2) | For the year ended December 31, 2016, the Company recognized the second contract year’s revenue amount of $422,883 (NTD 12,855,000), net of VAT, and refunded the amount of $690,537 (NTD 20,478,333), net of VAT, due to uncertainty resolved after Amendment 3 went effective. |

| 3) | For the year ended December 31, 2017, the Company recognized the third contract year’s revenue amount of $415,423 (NTD12,628,201), net of VAT, and refund amount of $633,955 (NTD18,800,370), net of VAT, for the same contract period based on the calculation of VONB and 13-month persistency. |

| 4) | For the year ended December 31, 2018, the Company recognized the fourth contract year’s revenue amount of $372,650 (NTD11,228,600), net of VAT, and refund amount of $670,389 (NTD 20,199,971), net of VAT, for the same contract period based on the calculation of VONB and 13-month persistency. |

| 5) | For the year ended December 31, 2019, the Company recognized the fifth contract year’s revenue amount of $314,953 (NTD9,481,371), net of VAT, and refund the amount of $729,045 (NTD 21,947,200), net of VAT, for the same contract period based on the calculation of VONB and 13-month persistency. |

| 6) | The Company estimated VONB and 13-month persistency ratio for the year ending December 31, 2020 and calculated the revenue amount to be $429,096 (NTD12,917,514) for the year. The amount will be reassessed every quarter until receiving AIATW’s notice. |

The Company recognized revenue of $102,166 (NTD3,075,599), net of VAT, and $79,697 (NTD2,455,912), net of VAT for the three months ended March 31, 2020 and 2019 related to this agreement. As of March 31, 2020 and December 31, 2019, the Company had non-current portion of unearned revenue of $779,282 and $1,049,258, respectively, and amounts in current liabilities of $1,922,707 and $1,781,975, respectively, related to the Alliance Agreement.

Accrued Bonus

The Company’s foreign subsidiaries have various bonus plans, which provide cash awards to employees based upon their performance, and had accrued bonus of $2,786,532 and $4,057,515, respectively, related to cash awards to employees as of March 31, 2020 and December 31, 2019.

The Company has other compensation plans solely provided by Law Broker to its officers. The compensation plans eligible to Law Broker’s officers include a surplus bonus based on a percentage of income after tax and other performance bonuses such as retention and non-competition. For the three months ended March 31, 2020 and the year ended December 31, 2019, the bonus expenses incurred by Law Broker’s officers under the compensation plans were $249,939 and $824,213, respectively. As of March 31, 2020 and December 31, 2019, the Company had accrued bonus of $952,427 and $903,808 payable within next 12 months, and noncurrent accrued bonus of $494,426 and $471,466, respectively, related to the compensation plans for Law Broker’s officers. See Note 13 for additional information of appointment and engagement agreements with Law Broker’s officers.

| F-15 |

NOTE 8 – OTHER LIABILITIES

The Company’s other liabilities consisted of the following as of March 31, 2020 and December 31, 2019:

| March 31, 2020 | December 31, 2019 | |||||||

| Unearned revenue – noncurrent (Note 7) | $ | 779,282 | $ | 1,049,258 | ||||

| Due to previous shareholders of AHFL | 495,906 | 500,782 | ||||||

| Accrued bonus - noncurrent (Note 7) | 494,426 | 471,466 | ||||||

| Net defined benefit liability | 224,069 | 208,230 | ||||||

| Total other liabilities | $ | 1,993,683 | $ | 2,229,736 | ||||

Due to Previous Shareholders of AHFL

Due to previous shareholders of AHFL is the entire remaining balance payable of the 2012 acquisition cost. On March 27, 2019, the Company and the selling shareholders of AHFL entered into a sixth amendment to the acquisition agreement, pursuant to which, the Company will make the cash payment in the amount of NTD15 million on or prior to March 31, 2021. The Company is in negotiation with the previous shareholders of AHFL to extend the repayment date. As of March 31, 2020 and December 31, 2019, the amount due to previous shareholders of AHFL were $495,906 and $500,782, respectively. The change in amounts was due to foreign currency translation.

NOTE 9 – REVENUE

The Company’s revenue is derived primarily from insurance agency and brokerage services provided to its customers. The Company, through its subsidiaries and variable interest entities, sells insurance products provided by insurance companies to individuals, and is compensated in the form of commissions from the respective insurance companies, according to the terms of each service agreement made by and between the Company and the insurance companies. The sale of an insurance product by the Company is considered complete when initial insurance premium is paid by an individual and the insurance policy is approved by the respective insurance company. When a policy is effective, the insurance company is obligated to pay the agreed-upon commission to the Company under the terms of its service agreement with the Company and such commission is recognized as revenue.

The Company considers the contracts with insurance companies contain one performance obligation and consideration should be recorded when performance obligation is satisfied at point in time. The amount of revenue to be recognized when the insurance policy is effective includes first year commission and other contingent commission that a significant reversal of revenue would not occur in the subsequent periods. When other contingent commission that could not be determined if a significant reversal of revenue would occur, the Company recognizes the commission after receiving insurance companies’ notice.

For the three months ended March 31, 2020 and 2019, the Company recorded revenue of $28,523,210 and $19,426,674, respectively. Disaggregation information of revenue is disclosed in Note 15.

Contract balance

| March 31, 2020 | December 31, 2019 | |||||||

| Accounts receivable | $ | 14,759,386 | $ | 22,541,558 | ||||

| Contract assets – current | 220,665 | - | ||||||

| Unearned revenue – current (Note 7) | 1,922,707 | 1,781,975 | ||||||

| Unearned revenue – noncurrent (Note 8) | 779,282 | 1,049,258 | ||||||

| F-16 |

Contract assets are the Company’s conditional rights to consideration for completed performance obligation and are in relation to the performance bonus to be rewarded based on the annual performance. The Company recognizes the contingent commission as a contract asset when the performance obligation is fulfilled, and the Company has not had the unconditional rights to the payment.

Unearned revenue relates to advances received prior to performance under the contract. The related contract is the Alliance Agreement with AIATW which is disclosed in Note 7 to the consolidated financial statements.

NOTE 10 – LEASE

The Company adopted ASC 842 as of January 1, 2019 using a modified retrospective transition with no adjustment to its comparative periods in the year of transition. The Company elected the practical expedients, which allow the Company not to reassess prior conclusions with respect to lease identification, lease classification and initial direct costs under ASC 842. The Company did not elect the hindsight practical expedient to determine the lease term or in assessing the likelihood that a lease purchase option will be exercised. The adoption of ASC 842 resulted in the recognition of operating lease right-of-use assets of $4.0 million and corresponding operating lease liabilities of $3.7 million as of January 1, 2019 on the consolidated balance sheet.

The Company has operating leases for its offices with lease terms ranging from one to six years. We determine if an arrangement is a lease at inception of the contract and whether a contract is or contains a lease by determining whether it conveys the right to control the use of the identified asset for a period of time. If the contract provides us the right to substantially all of the economic benefits from the use of the identified asset and the right to direct the use of the identified asset, we consider it to be, or contain, a lease. We record a right-of-use asset and a corresponding lease liability based on the present value of the minimum lease payments. The lease term used in the calculation of right-of-use assets and lease liabilities renewal and termination options that are reasonably certain to be exercised. Leases with an initial term of twelve months or less are not recorded on the consolidated balance sheet and the related lease expense is recognized on a straight-line basis over the lease term. Our leases do not provide an implicit borrowing rate, and we estimate the Company’s incremental borrowing rate to discount the lease payments based on information available at lease commencement.

For the three months ended March 31, 2020 and 2019, the Company recorded operating lease cost of $678,348 and $652,730, respectively.

Operating lease right-of-use assets represent the Company's right to use an underlying asset for the lease term and lease liabilities represent the Company's obligation to make lease payments arising from the lease. As of March 31, 2020, operating lease right-of-use assets and lease liabilities were as follows:

| March 31, 2020 | December 31, 2019 | |||||||

| Operating lease right-of-use assets | $ | 5,697,468 | $ | 5,522,665 | ||||

| Operating lease liabilities – current | 2,482,675 | 2,242,034 | ||||||

| Operating lease liabilities – noncurrent | 2,938,731 | 3,048,632 | ||||||

Lease term and discount rate

| March 31, 2020 | December 31, 2019 | |||||||

| Weighted average remaining lease term | ||||||||

| Operating lease | 2.76 years | 2.91 years | ||||||

| Weighted average discount rate | ||||||||

| Operating lease | 2.91 | % | 2.85 | % | ||||

| F-17 |

Supplemental cash flow information related to leases

| March 31, 2020 | December 31, 2019 | |||||||

| Cash paid for amounts included in the measurement of lease liabilities | ||||||||

| Operating cash flows related to operating leases | $ | 746,122 | $ | 2,655,644 | ||||

The minimum future lease payments as of March 31, 2020 are as follows:

| Amount | ||||

| 2020 (reminder of year) | $ | 2,608,767 | ||

| 2021 | 1,735,596 | |||

| 2022 | 680,963 | |||

| 2023 | 437,803 | |||

| 2024 | 197,045 | |||

| Thereafter | - | |||

| Total minimum lease payments | 5,660,174 | |||

| Less: Interest | (238,768 | ) | ||

| Present value of future minimum lease payments | $ | 5,421,406 | ||

NOTE 11– NONCONTROLLING INTERESTS

Noncontrolling interests consisted of the following as of March 31, 2020 and December 31, 2019:

| Name of Entity | % of Non- controlling Interest |

December 31, 2019 |

Contribution | Net Income (Loss) |

Other Income (Loss) |

March 31, 2020 | ||||||||||||||||||

| Law Enterprise | 34.05 | % | $ | (204,964 | ) | $ | - | $ | (111,705 | ) | $ | (5,795 | ) | $ | (322,464 | ) | ||||||||

| Law Broker | 34.05 | % | 19,536,104 | - | 1,112,834 | (187,703 | ) | 20,461,235 | ||||||||||||||||

| Uniwill | 50.00 | % | - | 1,547,229 | (485,521 | ) | (41,971 | ) | 1,019,737 | |||||||||||||||

| PFAL | 49.00 | % | 351,278 | - | 10,668 | 778 | 362,724 | |||||||||||||||||

| MKI | 49.00 | % | 283 | - | - | - | 283 | |||||||||||||||||

| PA Taiwan | 49.00 | % | (167,531 | ) | - | (88 | ) | (13 | ) | (167,632 | ) | |||||||||||||

| PTC Nanjing | 49.00 | % | (2,644 | ) | - | (1 | ) | (122 | ) | (2,767 | ) | |||||||||||||

| Total | $ | 19,512,526 | $ | 1,547,229 | $ | 526,187 | $ | (234,826 | ) | $ | 21,351,116 | |||||||||||||

| Name of Entity | % of Non- Controlling Interests |

December 31, 2018 |

Net Income (Loss) |

Other Comprehensive Income (Loss) |

Dividends | December 31, 2019 |

||||||||||||||||||

| Law Enterprise | 34.05 | % | $ | (72,557 | ) | $ | (147,948 | ) | $ | 15,541 | $ | - | $ | (204,964 | ) | |||||||||

| Law Broker | 34.05 | % | 16,149,662 | 2,985,723 | 400,719 | - | 19,536,104 | |||||||||||||||||

| PFAL | 49.00 | % | 436,742 | 7,086 | 1,265 | (93,815 | ) | 351,278 | ||||||||||||||||

| MKI | 49.00 | % | (2,630 | ) | 2,913 | - | - | 283 | ||||||||||||||||

| PA Taiwan | 49.00 | % | (157,762 | ) | (9,694 | ) | (75 | ) | - | (167,531 | ) | |||||||||||||

| PTC Nanjing | 49.00 | % | (2,411 | ) | (139 | ) | (94 | ) | - | (2,644 | ) | |||||||||||||

| Total | $ | 16,351,044 | $ | 2,837,941 | $ | 417,356 | $ | (93,815 | ) | $ | 19,512,526 | |||||||||||||

During the three months ended March 31, 2020, Uniwill issued a total of 9,608 preferred shares to Cyun-Jhan and Jian-Zao for cash pursuant to the JV Agreement entered on November 15, 2019 after the performance goals of first stage were achieved on February 10, 2020 (the “Grant Date”). The preferred stocks issued have voting rights at 1 share to 1,000 voting rights of common stock and the right of conversion to common stocks upon the achievement of the performance goals of stage two set forth in the JV Agreement. The holders of 9,608 shares of preferred stocks in aggregate participate in the daily operating of Uniwill and entitle to 49% of equity interest and 50% of earnings of the operating subsidiary.

Based on ASC 718, the Company determined that the fair market value of 9,608 shares of convertible preferred stock was $1,547,229 on the Grant Date valuated by an independent third-party valuation firm using the probability-based recognition approach. $1,554,289 compensation cost is recognized after cash surrendered for the three months ended March 31, 2020 as a result.

| F-18 |

NOTE 12 – INCOME TAX

The following table reconciles the Company’s statutory tax rates to effective tax rates for the three months ended March 31, 2020 and 2019:

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| US statutory rate | 21 | % | 21 | % | ||||

| Tax rate difference | (2 | )% | (1 | )% | ||||

| Tax base difference | 1 | % | 1 | % | ||||

| Income tax on undistributed earnings | 18 | % | 3 | % | ||||

| Loss in subsidiaries | 28 | % | 1 | % | ||||

| Provision for uncertain tax position | 32 | % | - | % | ||||

| Un-deductible and non-taxable items | 3 | % | - | % | ||||

| Effective tax rate | 101 | % | 25 | % | ||||

The Company’s income tax expense is mainly generated by its subsidiaries in Taiwan. The Company’s subsidiaries in Taiwan are subject to the statutory tax rate on income reported in the statutory financial statements after appropriate adjustments at 20% and 5% of the tax on any undistributed earnings according to the Income Tax Law of Taiwan. As of March 31, 2020 and December 31, 2019, the Company had current tax payable of $3,548,277 and $2,230,793 for Taiwan income tax, respectively.

WFOE and the Company’s Consolidated Affiliated Entities (“CAE”) in PRC are governed by the Income Tax Law of PRC concerning private-run enterprises, which are generally subject to tax at 25% on income reported in the statutory financial statements after appropriate adjustments, except for Jiangsu. For Jiangsu province in PRC, according to the requirement of local tax authorities, the tax basis is levied at 10% of total revenue, instead of net income. WFOE and CAE had no income tax expenses for the three months ended March 31, 2020 and years ended December 31, 2019 due to the loss positions.

The Company’s subsidiaries in Hong Kong are governed by the Inland Revenue Ordinance Tax Law of Hong Kong and are generally subject to a profit tax at the rate of 16.5% on the estimated assessable profits. As of March 31, 2020 and December 31, 2019, the Company had current tax payable of $24,046 and $56,993 for Hong Kong income tax, respectively.

The Company is subject to the statutory rate of 21% in the U.S. federal jurisdiction. The Company had no income tax expense for the three months ended March 31, 2020 and years ended December 31, 2019 due to the loss positions and no GILTI tax obligation existed. The Company recognized a one-time transition tax of $1,199,195 in the year of 2018 based on the Company’s total post-1986 earnings and profits (“E&P”) that it previously deferred from U.S. income tax. As of March 31, 2020, and December 31, 2019, the Company had current tax payable of $101,322 and $101,518 and noncurrent tax payable of $815,451 and $815,451 associated with the one-time transition tax.

As of March 31, 2020, the Company recorded an uncertain tax positions approximately of $277,000 related to withholding tax matters in the Taiwan Segment. During the three months ended March 31, 2020, the Company recognized interest and penalties of approximately $178,000, in in selling, general and administrative expenses.

NOTE 13 – RELATED PARTY TRANSACTIONS

Due to related parties

The following summarized the Company’s loans payable related parties as of March 31, 2020 and December 31, 2019:

| March 31, 2020 | December 31, 2019 | |||||||

| Due to Mr. Mao (CEO and Principal shareholder of the Company) | $ | 438,928 | $ | 373,183 | ||||

| Due to Ms. Lu (A shareholder of Anhou) | 83,624 | 85,074 | ||||||

| Others | 12,787 | 4,602 | ||||||

| Total | $ | 535,339 | $ | 462,859 | ||||

| F-19 |

Due to Mr. Mao

Amounts due to Mr. Mao were associated with funding provided by Mr. Mao for the formation of our subsidiaries in China in 2011. As of March 31, 2020 and December 31, 2019, due to Mr. Mao in the respective amounts of $438,928 and $373,183 was non-interesting bearing and payable on demand.

Due to Ms. Lu

Due to Ms. Lu were borrowings from Ms. Lu to support Anhou’s business operation. Due to Ms. Lu in the respective amounts of $83,624 and $85,074 was non-interesting bearing and payable on demand.

NOTE 14 – COMMITMENTS AND CONTINGENCIES

Operating Leases

See future minimum annual lease payments in Note 10.

Time Deposits Pledged as Collateral

See time deposits pledged as collateral in Note 4 and 5.

Legal Proceedings

On December 20, 2018, the Company and one of the Company’s former employees, agreed to settle fraud charges brought by the SEC relating to a scheme to manipulate the Company’s trading volume for the purpose of obtaining a listing on Nasdaq. Neither the Company nor the former employee realized financial gain from the scheme. Both the Company and the former employee agreed to the entry of a final judgment entered on January 18, 2019 that enjoins them from violating the charged provisions of the federal securities laws, orders the Company to comply with its undertaking to retain an independent compliance monitor for a period of not less than one year. The SEC did not seek a monetary penalty against the Company and there is no financial impact to the Company.

On April 10, 2020, the Company submitted a written certification (the “Certification”) to the SEC of its compliance with the undertaking indicated by the Final Judgment entered into on January 18, 2019 in front of the United States District Court for the Southern District of New York (SEC v. China United Ins. Serv., Inc., No. 18 Civ. 12055, Consent of Defendant China United Insurance Service, Inc. (ECF No. 3-1) (S.D.N.Y Dec. 20, 2018)) requiring the Company to retain an independent compliance monitor (“Independent Monitor”) for a period of not less than one year. The Independent Monitor was mandated to review and evaluate the Company’s commitment to and implementation of a revised compliance program and to submit a final report to the SEC with respect to these matters. The Company reviewed the Independent Monitor’s final report submitted to the SEC on December 23, 2019 and confirmed in its Certification that, to the best knowledge of the Company, the factual content of the final report was true and accurate as of the date of such report.

Appointment agreement

On December 21, 2018, Law Broker entered into an appointment agreement with Shu-Fen, Lee (“Ms. Lee”), pursuant to which, she serves as the president of Law Broker from December 21, 2018 to December 20, 2021. Ms. Lee’s primary responsibilities include 1) overall business planning, 2) implementation of resolution of the shareholders' meeting or the board of directors, 3) the appointment and dismissal of the Law Broker’s employees and sales professionals, except for internal auditors, 4) financial management and application, 5) being the representative of Law Broker, 6) other matters assigned by the board of directors. According to the agreement, Ms. Lee’s compensation plan include: 1) base salary, 2) managerial allowance, 3) surplus bonus based on 1.25% of Law Broker’s income after tax, and 4) annual year-end bonus. For the three months ended March 31, 2020 and 2019, the Company has recorded the compensation expense of $50,436 and $0 under the appointment agreement, respectively.

Engagement agreement

On May 10, 2016, Law Broker entered into an engagement agreement with Hui-Hsien Chao (“Ms. Chao”), pursuant to which, she serves as the general manager of Law Broker from December 29, 2015 to December 28, 2018. The engagement agreement with Ms. Chao was renewed in 2019 and her service period has extended to December 20, 2021. Ms. Chao’s primary responsibilities are to assist Law Broker in operating and managing insurance agency business. According to the engagement agreement, Ms. Chao’s Bonus plans include: 1) execution, 2) long-term service fees, 3) pension and 4) non-competition. The payment of such bonuses will only occur upon satisfaction of certain condition and subject to the terms in the engagement agreement. Ms. Chao acts as the general manager or equivalent position of Law Broker for a term of at least three years. For the three months ended March 31, 2020 and 2019, the Company has recorded the compensation expense of $75,772 and $27,043 under the appointment agreement, respectively.

| F-20 |

NOTE 15 – SEGMENT REPORTING

The Company organizes and manages its business as three operating segments by operating geographic areas. The business of WFOE, CU Hong Kong and the CAE in PRC was managed and reviewed as PRC segment. The business of AHFL and its subsidiaries in Taiwan was managed and reviewed as Taiwan segment. The business of PFAL was managed and reviewed as Hong Kong segment. PRC and Taiwan segments retain majority of reported consolidated amounts.

The geographical distributions of the Company’s financial information for the three months ended March 31, 2020 and 2019 were as follows:

| For three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Geographical Areas | ||||||||

| Revenue | ||||||||

| Taiwan | $ | 27,342,936 | $ | 16,971,117 | ||||

| PRC | 1,429,297 | 2,267,316 | ||||||

| Hong Kong | 68,619 | 195,195 | ||||||

| Elimination adjustment | (317,642 | ) | (6,954 | ) | ||||

| Total revenue | $ | 28,523,210 | $ | 19,426,674 | ||||

| Income (loss) from operations | ||||||||

| Taiwan | $ | 928,928 | $ | 3,790,078 | ||||

| PRC | (31,113 | ) | 31,584 | |||||

| Hong Kong | 23,653 | 85,209 | ||||||

| Elimination adjustment | 52,880 | 32,553 | ||||||

| Total income from operations | $ | 974,348 | $ | 3,939,424 | ||||

| Net income (loss) | ||||||||

| Taiwan | $ | (1,434 | ) | $ | 3,125,888 | |||

| PRC | (39,957 | ) | 19,368 | |||||

| Hong Kong | 21,772 | 73,856 | ||||||

| Elimination adjustment | 9,204 | (258 | ) | |||||

| Total net (loss) income | $ | (10,415 | ) | $ | 3,218,854 | |||

| F-21 |

The geographical distribution of the Company’s financial information as of March 31, 2020 and December 31, 2019 were as follows:

| March 31, 2020 |

December 31, 2019 |

|||||||

| Geographical Areas | ||||||||