Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Trinity Capital Inc. | tm2019542d1_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Trinity Capital Inc. | tm2019542d1_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Trinity Capital Inc. | tm2019542d1_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Trinity Capital Inc. | tm2019542d1_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended March 31, 2020

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-56139

TRINITY CAPITAL INC.

(Exact name of registrant as specified in its charter)

| Maryland | 35-2670395 |

|

(State or other jurisdiction of

incorporation or |

(IRS Employer Identification No.) |

|

3075 West Ray Road |

85226 |

| (Address of principal executive offices) | (Zip Code) |

(480) 374-5350

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

| None | None | None |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | x | Smaller reporting company | ¨ |

| Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell Company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of May 14, 2020, the registrant had 18,049,860 shares of common stock ($0.001 par value per share) outstanding.

TRINITY CAPITAL INC.

FORM 10-Q

TABLE OF CONTENTS

2

Item 1. Consolidated Financial Statements

TRINITY CAPITAL INC.

Consolidated Statements of Assets and Liabilities

(In thousands, except share and per share data)

| March 31, | December 31, | |||||||

| 2020 | 2019 | |||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Investments at fair value: | ||||||||

| Control investments (cost of $28,440 and $0, respectively) | $ | 21,314 | $ | - | ||||

| Affiliate investments (cost of $6,886 and $0, respectively) | 5,380 | - | ||||||

| Non-control / Non-affiliate investments (cost of $387,544 and $0, respectively) | 371,899 | - | ||||||

| Total investments (cost of $422,870 and $0, respectively) | 398,593 | - | ||||||

| Cash and cash equivalents | 62,602 | - | ||||||

| Restricted cash | 16,883 | - | ||||||

| Interest receivable | 3,180 | - | ||||||

| Deferred financing costs | - | 3,525 | ||||||

| Deferred offering costs | - | 2,677 | ||||||

| Prepaid expenses | 122 | - | ||||||

| Other assets | 793 | - | ||||||

| Total assets | $ | 482,173 | $ | 6,202 | ||||

| LIABILITIES | ||||||||

| Credit facility, net of $3,301 and $0, respectively, of unamortized deferred financing cost | $ | 126,699 | $ | - | ||||

| Notes payable, net of $5,309, and $0, respectively, of unamortized deferred financing cost | 119,691 | - | ||||||

| Accounts payable and accrued expenses | 4,823 | 5,668 | ||||||

| Due to related party | - | 1,058 | ||||||

| Other liabilities | 6,397 | - | ||||||

| Total liabilities | 257,610 | 6,726 | ||||||

| Commitments and contingencies (Note 6) | ||||||||

| NET ASSETS | ||||||||

| Common stock, $0.001 par value per share (200,000,000 authorized, 18,049,860 and 10 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively) | 18 | - | ||||||

| Paid-in capital in excess of par | 260,120 | - | ||||||

| Distributable earnings (accumulated loss) | (35,575 | ) | (524 | ) | ||||

| Total net assets | 224,563 | (524 | ) | |||||

| Total liabilities and net assets | $ | 482,173 | $ | 6,202 | ||||

| NET ASSET VALUE PER SHARE | $ | 12.44 | $ | (52,418.20 | ) |

See accompanying notes to consolidated financial statements.

| 3 |

TRINITY CAPITAL INC.

Consolidated Statement of Operations

(In thousands, except share and per share data)

(Unaudited)

| For the Three | ||||

| Months Ended | ||||

| March 31, 2020 | ||||

| INVESTMENT INCOME: | ||||

| Interest income: | ||||

| Control investments | $ | 59 | ||

| Affiliate investments | 116 | |||

| Non-Control / Non-Affiliate investments | 10,685 | |||

| Total investment income | 10,860 | |||

| EXPENSES: | ||||

| Interest expense and other debt financing costs | 4,269 | |||

| Compensation and benefits | 1,378 | |||

| General and administrative | 904 | |||

| Total expenses | 6,551 | |||

| NET INVESTMENT INCOME | 4,309 | |||

| NET REALIZED GAIN/(LOSS) FROM INVESTMENTS: | ||||

| Control investments | - | |||

| Affiliate investments | - | |||

| Non-Control / Non-Affiliate investments | 503 | |||

| Net realized gain from investments | 503 | |||

| NET CHANGE IN UNREALIZED APPRECIATION / (DEPRECIATION) FROM INVESTMENTS: | ||||

| Control investments | (7,128 | ) | ||

| Affiliate investments | (1,507 | ) | ||

| Non-Control / Non-Affiliate investments | (15,642 | ) | ||

| Net change in unrealized appreciation/(depreciation) | ||||

| from investments | (24,277 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS BEFORE FORMATION COSTS | (19,465 | ) | ||

| Costs related to the acquisition of Trinity Capital Holdings and Legacy Funds | (15,586 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (35,051 | ) | |

| NET INVESTMENT INCOME PER SHARE - BASIC AND DILUTED | $ | 0.24 | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS PER SHARE - BASIC AND DILUTED | $ | (1.97 | ) | |

| WEIGHTED AVERAGE SHARES OUTSTANDING - BASIC AND DILUTED | 17,821,790 | |||

See accompanying notes to consolidated financial statements.

| 4 |

TRINITY CAPITAL INC.

Consolidated Statement of Changes in Net Assets

(In thousands, except share and per share data)

(Unaudited)

| Distributable | ||||||||||||||||||||

| Paid In | Earnings | |||||||||||||||||||

| Common Stock | Capital in | (Accumulated | Net | |||||||||||||||||

| Shares | Par Value | Excess of Par | Loss) | Assets | ||||||||||||||||

| Balance as of December 31, 2019 (audited) | 10 | $ | - | $ | - | $ | (524 | ) | $ | (524 | ) | |||||||||

| Issuance of shares related to Formation Transaction (1) | 9,716,517 | 10 | 145,738 | - | 145,748 | |||||||||||||||

| Issuance of common stock, net of issuance costs | 8,333,333 | 8 | 114,382 | - | 114,390 | |||||||||||||||

| Distributions to stockholders | - | - | - | - | - | |||||||||||||||

| Net decrease in net assets resulting from operations | ||||||||||||||||||||

| Net investment income | - | - | - | 4,309 | 4,309 | |||||||||||||||

| Net realized gain (loss) from investments | - | - | - | 503 | 503 | |||||||||||||||

| Net unrealized appreciation (depreciation) from investments | - | - | - | (24,277 | ) | (24,277 | ) | |||||||||||||

| Costs related to the acquisition of Trinity Capital Holdings and Legacy Funds | - | - | - | (15,586 | ) | (15,586 | ) | |||||||||||||

| Balance as of March 31, 2020 (unaudited) | 18,049,860 | $ | 18 | $ | 260,120 | $ | (35,575 | ) | $ | 224,563 | ||||||||||

(1) See “Note 1 - Organization and Basis of Presentation” and “Note 12 - Formation Transactions”.

See accompanying notes to consolidated financial statements.

| 5 |

TRINITY CAPITAL INC.

Consolidated Statement of Cash Flows

(In thousands)

(Unaudited)

| For the Three Months Ended | ||||

| March 31, 2020 | ||||

| Cash flows from operating activities: | ||||

| Net decrease in net assets resulting from operations: | $ | (35,051 | ) | |

| Adjustments to reconcile net decrease in net assets resulting from | ||||

| operations to net cash provided by (used in) operating activities: | ||||

| Purchase of investments | (47,739 | ) | ||

| Proceeds from sales and paydowns of investments | 44,469 | |||

| Net change in unrealized depreciation from investments | 24,277 | |||

| Costs related to the acquisition of Trinity Capital Holdings and Legacy Funds | 15,586 | |||

| Net realized gain from investments | (503 | ) | ||

| Accretion of original issue discounts and exit fees on investments | (2,074 | ) | ||

| Amortization of deferred financing costs | 666 | |||

| Depreciation | 9 | |||

| Change in operating assets and liabilities | ||||

| Increase in interest receivable | (2,054 | ) | ||

| Increase in other assets | (582 | ) | ||

| Increase in accounts payable and accrued liabilities | 3,069 | |||

| Decrease in due to related party | (1,058 | ) | ||

| Increase in other liabilities | 2,093 | |||

| Net cash provided by operating activities | 1,108 | |||

| Cash flows used in investing activities: | ||||

| Formation Transactions of Legacy Funds, net of cash acquired (1) | (89,515 | ) | ||

| Acquisition of Trinity Capital Holdings | (2,211 | ) | ||

| Acquisition of fixed assets | (10 | ) | ||

| Net cash used in investing activities | (91,736 | ) | ||

| Cash flows provided by (used in) financing activities | ||||

| Issuance of common stock | 125,000 | |||

| Common stock issuance costs | (10,610 | ) | ||

| Proceeds from issuance of notes payable | 125,000 | |||

| Financing costs paid related to notes payable | (5,542 | ) | ||

| Borrowings under credit facility | - | |||

| Repayments under credit facility | (60,000 | ) | ||

| Financing costs paid related to credit facility | (3,735 | ) | ||

| Net cash provided by financing activities | 170,113 | |||

| Net increase in cash, cash equivalents and restricted cash | 79,485 | |||

| Cash, beginning of period | - | |||

| Cash, cash equivalents and restricted cash at end of period | $ | 79,485 | ||

| Supplemental and non-cash investing and financing activities: | ||||

| Cash paid for interest | $ | 3,582 | ||

| Shares issued to Trinity Capital Holdings (1) | $ | 8,000 | ||

| Assumption of severance liability (1) | $ | 3,508 | ||

| Shares issued to the Legacy Investors as part of the Formation Transactions (1) | $ | 137,748 | ||

(1) See “Note 1 - Organization and Basis of Presentation” and “Note 12 - Formation Transactions”.

See accompanying notes to consolidated financial statements.

| 6 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Debt Securities | ||||||||||||||||||||

| Administrative and Support and Waste Management and Remediation | ||||||||||||||||||||

| 1-5 Years Maturity | ||||||||||||||||||||

| CleanPlanet Chemical, Inc. | Administrative and Support and Waste Management and Remediation Services | Equipment Financing | January 1, 2022 | Fixed interest rate 9.2%; EOT 9.0% | $ | 2,090 | $ | 2,333 | $ | 2,215 | ||||||||||

| Administrative and Support and Waste Management and Remediation Services | Equipment Financing | May 1, 2022 | Fixed interest rate 9.5%; EOT 9.0% | 489 | 529 | 506 | ||||||||||||||

| Administrative and Support and Waste Management and Remediation Services | Equipment Financing | August 1, 2022 | Fixed interest rate 9.8%; EOT 9.0% | 579 | 616 | 587 | ||||||||||||||

| Administrative and Support and Waste Management and Remediation Services | Equipment Financing | February 1, 2023 | Fixed interest rate 9.8%; EOT 9.0% | 1,112 | 1,123 | 1,123 | ||||||||||||||

| Total CleanPlanet Chemical, Inc. | 4,270 | 4,601 | 4,431 | |||||||||||||||||

| Seaon Environmental, LLC | Administrative and Support and Waste Management and Remediation Services | Equipment Financing | January 1, 2023 | Fixed interest rate 9.0%; EOT 5.0% | $ | 2,840 | $ | 2,913 | $ | 2,696 | ||||||||||

| Sub-total: 1-5 Years Maturity | $ | 7,110 | $ | 7,514 | $ | 7,127 | ||||||||||||||

| Sub-total: Administrative and Support and Waste Management and Remediation (3.2%)* | $ | 7,110 | $ | 7,514 | $ | 7,127 | ||||||||||||||

| Agriculture, Forestry, Fishing and Hunting 1-5 Years Maturity | ||||||||||||||||||||

| Bowery Farming, Inc. | Agriculture, Forestry, Fishing and Hunting | Equipment Financing | January 1, 2023 | Fixed interest rate 8.5%; EOT 8.5% | $ | 3,308 | $ | 3,492 | $ | 3,236 | ||||||||||

| Agriculture, Forestry, Fishing and Hunting | Equipment Financing | February 1, 2023 | Fixed interest rate 8.7%; EOT 8.5% | 3,233 | 3,315 | 3,351 | ||||||||||||||

| Agriculture, Forestry, Fishing and Hunting | Equipment Financing | May 1, 2023 | Fixed interest rate 8.7%; EOT 8.5% | 3,912 | 3,992 | 4,082 | ||||||||||||||

| Total Bowery Farming, Inc. | 10,453 | 10,799 | 10,669 | |||||||||||||||||

| Etagen, Inc. | Agriculture, Forestry, Fishing and Hunting | Secured Loan | August 1, 2023 | Fixed interest rate 11.0%; EOT 3.8% |

$ | 9,500 | $ | 9,549 | 9,298 | |||||||||||

| Sub-total: 1-5 Years Maturity | $ | 19,953 | $ | 20,348 | $ | 19,967 | ||||||||||||||

| Sub-total: Agriculture, Forestry, Fishing and Hunting (8.9%)* | $ | 19,953 | $ | 20,348 | $ | 19,967 | ||||||||||||||

| Construction Less than a Year | ||||||||||||||||||||

| Project Frog, Inc. (8) | Construction | Secured Loan | July 1, 2020 | Fixed interest rate 8.0%; EOT 8.7% | $ | 3,078 | $ | 3,500 | $ | 3,202 | ||||||||||

| Sub-total: Less than a Year | $ | 3,078 | $ | 3,500 | $ | 3,202 | ||||||||||||||

| Sub-total: Construction (1.4%)* | $ | 3,078 | $ | 3,500 | $ | 3,202 | ||||||||||||||

| 7 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Educational Services 1-5 Years Maturity | ||||||||||||||||||||

| Examity, Inc. | Educational Services | Secured Loan | February 1, 2022 | Fixed interest rate 11.5%; EOT 8.0% | $ | 5,541 | $ | 5,968 | $ | 5,901 | ||||||||||

| Educational Services | Secured Loan | February 1, 2022 | Fixed interest rate 11.5%; EOT 4.0% | 2,612 | 2,704 | 2,687 | ||||||||||||||

| Educational Services | Secured Loan | January 1, 2023 | Fixed interest rate 12.3%; EOT 4.0% | 1,134 | 1,163 | 1,145 | ||||||||||||||

| Total Examity, Inc. | 9,287 | 9,835 | 9,733 | |||||||||||||||||

| Qubed, Inc. dba Yellowbrick | Educational Services | Secured Loan | April 1, 2023 | Fixed interest rate 11.5%; EOT 4.0% | 2,000 | 2,012 | 1,999 | |||||||||||||

| Educational Services | Secured Loan | October 1, 2023 | Fixed interest rate 11.5%; EOT 4.0% | 500 | 495 | 496 | ||||||||||||||

| Total Qubed, Inc. dba Yellowbrick | 2,500 | 2,507 | 2,495 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 11,787 | $ | 12,342 | $ | 12,228 | ||||||||||||||

| Sub-total: Educational Services (5.4%)* | $ | 11,787 | $ | 12,342 | $ | 12,228 | ||||||||||||||

| Finance and Insurance Less than a Year | ||||||||||||||||||||

| Handle Financial, Inc. | Finance and Insurance | Secured Loan | January 1, 2021 | Fixed interest rate 12.0%; EOT 8.0% | $ | 4,458 | $ | 5,187 | $ | 5,166 | ||||||||||

| Sub-total: 1-5 Years Maturity | $ | 4,458 | $ | 5,187 | $ | 5,166 | ||||||||||||||

| 1-5 Years Maturity | ||||||||||||||||||||

| Petal Card, Inc. | Finance and Insurance | Secured Loan | December 1, 2023 | Fixed interest rate 11.0%; EOT 3.0% | 10,000 | 9,864 | 9,609 | |||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 10,000 | $ | 9,864 | $ | 9,609 | ||||||||||||||

| Sub-total: Finance and Insurance (6.6%)* | $ | 14,458 | $ | 15,051 | $ | 14,775 | ||||||||||||||

| Health Care and Social Assistance 1-5 Years Maturity | ||||||||||||||||||||

| WorkWell Prevention & Care | Health Care and Social Assistance | Secured Loan | March 1, 2024 | Fixed interest rate 8.0%; EOT 10.0% | $ | 3,370 | $ | 3,558 | $ | 3,244 | ||||||||||

| Health Care and Social Assistance | Secured Loan | March 1, 2024 | Fixed interest rate 8.0%; EOT 10.0% | 700 | 717 | 669 | ||||||||||||||

| Total WorkWell Prevention & Care (7) | 4,070 | 4,275 | 3,913 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 4,070 | $ | 4,275 | $ | 3,913 | ||||||||||||||

| Sub-total: Health Care and Social Assistance (1.7%)* | $ | 4,070 | $ | 4,275 | $ | 3,913 | ||||||||||||||

| Information Less than a Year | ||||||||||||||||||||

| Everalbum, Inc. | Information | Secured Loan | June 1, 2020 | Fixed interest rate 11.25%; EOT 0.0% | $ | 172 | $ | 174 | $ | 192 | ||||||||||

| Hytrust, Inc. | Information | Secured Loan | May 1, 2020 | Fixed interest rate 12.0%; EOT 9.5% | 961 | 1,405 | 1,386 | |||||||||||||

| Smule, Inc. | Information | Equipment Financing | June 1, 2020 | Fixed interest rate 6.3%; EOT 20.0% | 223 | 695 | 685 | |||||||||||||

| Information | Equipment Financing | June 1, 2020 | Fixed interest rate 19.1%; EOT 19.0% | 1 | 3 | 3 | ||||||||||||||

| Total Smule, Inc. | 224 | 698 | 688 | |||||||||||||||||

| Sub-total: Less than a Year | $ | 1,357 | $ | 2,277 | $ | 2,266 | ||||||||||||||

| 1-5 Years Maturity | ||||||||||||||||||||

| EMPYR Inc. | Information | Secured Loan | January 1, 2022 | Fixed interest rate 12.0%; EOT 5.0% | $ | 1,959 | $ | 2,047 | $ | 2,028 | ||||||||||

| Firefly Systems, Inc. | Information | Equipment Financing | February 1, 2023 | Fixed interest rate 9.0%; EOT 10.0% | 5,197 | 4,987 | 4,987 | |||||||||||||

| Gobiquity, Inc. | Information | Equipment Financing | April 1, 2022 | Fixed interest rate 7.5%; EOT 20.0% | 461 | 503 | 507 | |||||||||||||

| Nexus Systems, LLC. | Information | Secured Loan | July 1, 2023 | Fixed interest rate 12.3%; EOT 5.0% | 5,000 | 5,205 | 4,952 | |||||||||||||

| 8 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Oto Analytics, Inc. | Information | Secured Loan | March 1, 2023 | Fixed interest rate 11.5%; EOT 6.0% | 10,000 | 10,237 | 10,107 | |||||||||||||

| RapidMiner, Inc. | Information | Secured Loan | October 1, 2023 | Fixed interest rate 12.0%; EOT 4.0% | 10,000 | 9,910 | 9,534 | |||||||||||||

| STS Media, Inc. (9) | Information | Secured Loan | April 1, 2022 | Fixed interest rate 11.9%; EOT 4.0% | 7,824 | 750 | 250 | |||||||||||||

| Unitas Global, Inc. | Information | Equipment Financing | August 1, 2021 | Fixed interest rate 9.0%; EOT 12.0% | 1,403 | 1,661 | 1,615 | |||||||||||||

| Information | Equipment Financing | April 1, 2021 | Fixed interest rate 7.8%; EOT 6.0% | 204 | 217 | 211 | ||||||||||||||

| Total Unitas Global, Inc. | 1,607 | 1,878 | 1,826 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 42,048 | $ | 35,517 | $ | 34,191 | ||||||||||||||

| Sub-total: Information (16.2%)* | $ | 43,405 | $ | 37,794 | $ | 36,457 | ||||||||||||||

| Manufacturing Less than a Year Maturity | ||||||||||||||||||||

| BHCosmetics, LLC | Manufacturing | Equipment Financing | March 1, 2021 | Fixed interest rate 8.9%; EOT 5.0% | $ | 565 | $ | 605 | $ | 604 | ||||||||||

| Impossible Foods, Inc. | Manufacturing | Secured Loan | April 1, 2020 | Fixed interest rate 11.0%; EOT 9.5% | 146 | 573 | 575 | |||||||||||||

| Manufacturing | Secured Loan | July 1, 2020 | Fixed interest rate 11.0%; EOT 9.5% | 384 | 670 | 671 | ||||||||||||||

| Total Impossible Foods, Inc. | 530 | 1,243 | 1,246 | |||||||||||||||||

| Sub-total: Less than a Year | $ | 1,095 | $ | 1,848 | $ | 1,850 | ||||||||||||||

| 1-5 Years Maturity | ||||||||||||||||||||

| Altierre Corporation | Manufacturing | Secured Loan | September 1, 2022 | Fixed interest rate 12.0%; EOT 6.6% | $ | 12,001 | $ | 12,330 | $ | 10,494 | ||||||||||

| Manufacturing | Secured Loan | June 1, 2023 | Fixed interest rate 12.0%; EOT 0.0% | 1,427 | 1,426 | 1,184 | ||||||||||||||

| Total Altierre Corporation | 13,428 | 13,756 | 11,678 | |||||||||||||||||

| Ay Dee Kay LLC | Manufacturing | Secured Loan | October 1, 2022 | Fixed interest rate 11.3%; EOT 3.0% | 13,205 | 13,353 | 13,213 | |||||||||||||

| BHCosmetics, LLC | Manufacturing | Equipment Financing | April 1, 2021 | Fixed interest rate 8.7%; EOT 5.0% | 615 | 651 | 649 | |||||||||||||

| Exela Pharma Sciences, LLC | Manufacturing | Equipment Financing | October 1, 2021 | Fixed interest rate 11.4%; EOT 11.0% | 3,787 | 4,239 | 4,173 | |||||||||||||

| Manufacturing | Equipment Loan (20) | January 1, 2022 | Fixed interest rate 11.6%; EOT 11.0% | 484 | 643 | 611 | ||||||||||||||

| Total Exela Pharma Sciences, LLC | 4,271 | 4,882 | 4,784 | |||||||||||||||||

| Happiest Baby, Inc. | Manufacturing | Equipment Financing | September 1, 2022 | Fixed interest rate 8.4%; EOT 9.5% | 1,300 | 1,346 | 1,399 | |||||||||||||

| Manufacturing | Equipment Financing | November 1, 2022 | Fixed interest rate 8.6%; EOT 9.5% | 1,022 | 1,047 | 1,106 | ||||||||||||||

| Manufacturing | Equipment Financing | January 1, 2023 | Fixed interest rate 8.6%; EOT 9.5% | 958 | 970 | 1,028 | ||||||||||||||

| Manufacturing | Equipment Financing | June 1, 2023 | Fixed interest rate 8.6%; EOT 9.5% | 1,146 | 1,155 | 1,155 | ||||||||||||||

| Total Happiest Baby, Inc. | 4,426 | 4,518 | 4,688 | |||||||||||||||||

| Health-Ade, LLC | Manufacturing | Equipment Financing | January 1, 2022 | Fixed interest rate 9.4%; EOT 15.0% | 2,226 | 2,609 | 2,567 | |||||||||||||

| Manufacturing | Equipment Financing | April 1, 2022 | Fixed interest rate 8.6%; EOT 15.0% | 1,215 | 1,379 | 1,347 | ||||||||||||||

| Manufacturing | Equipment Financing | July 1, 2022 | Fixed interest rate 9.1%; EOT 15.0% | 2,839 | 3,133 | 3,050 | ||||||||||||||

| 9 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Total Health-Ade, LLC | 6,280 | 7,121 | 6,964 | |||||||||||||||||

| Impossible Foods, Inc. | Manufacturing | Secured Loan | October 1, 2021 | Fixed interest rate 11.0%; EOT 9.5% | 2,445 | 2,758 | 2,928 | |||||||||||||

| Robotany, Inc. | Manufacturing | Equipment Financing | August 1, 2022 | Fixed interest rate 8.0%; EOT 15.0% | 1,900 | 1,993 | 1,824 | |||||||||||||

| Vertical Communications, Inc. | Manufacturing | Secured Loan | March 1, 2022 | Fixed interest rate 12.0%; EOT 6.5% | 8,000 | 8,246 | 8,067 | |||||||||||||

| Manufacturing | Secured Loan | March 1, 2022 | Fixed interest rate 12.0%; EOT 6.5% | 1,000 | 1,074 | 1,044 | ||||||||||||||

| Manufacturing | Secured Loan | March 1, 2022 | Fixed interest rate 12.0%; EOT 6.5% | 500 | 500 | 486 | ||||||||||||||

| Manufacturing | Secured Loan | March 1, 2022 | Fixed interest rate 15.8%; EOT 6.5% | 500 | 500 | 486 | ||||||||||||||

| Manufacturing | Secured Loan | March 1, 2022 | Fixed interest rate 15.8%; EOT 8.5% | 2,000 | 2,000 | 1,944 | ||||||||||||||

| Total Vertical Communications, Inc. (7) | 12,000 | 12,320 | 12,027 | |||||||||||||||||

| Zosano Pharma Corporation | Manufacturing | Equipment Financing | October 1, 2021 | Fixed interest rate 9.4%; EOT 12.0% | 2,676 | 3,025 | 2,863 | |||||||||||||

| Manufacturing | Equipment Financing | January 1, 2022 | Fixed interest rate 9.7%; EOT 12.0% | 1,731 | 1,889 | 1,803 | ||||||||||||||

| Manufacturing | Equipment Financing | July 1, 2022 | Fixed interest rate 9.9%; EOT 12.0% | 1,787 | 1,850 | 1,826 | ||||||||||||||

| Manufacturing | Equipment Financing | October 1, 2022 | Fixed interest rate 9.9%; EOT 12.0% | 1,962 | 1,987 | 1,997 | ||||||||||||||

| Manufacturing | Equipment Financing | December 1, 2022 | Fixed interest rate 10.5%; EOT 12.0% | 1,435 | 1,475 | 1,443 | ||||||||||||||

| Total Zosano | 9,591 | 10,226 | 9,932 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 68,161 | $ | 71,578 | $ | 68,687 | ||||||||||||||

| Sub-total: Manufacturing (31.4%)* | $ | 69,256 | $ | 73,426 | $ | 70,537 | ||||||||||||||

| Professional, Scientific, and Technical Services Less than a Year | ||||||||||||||||||||

| E La Carte, Inc. | Professional, Scientific, and Technical Services | Secured Loan | January 1, 2021 | Fixed interest rate 12.0%; EOT 9.4% | $ | 3,146 | $ | 3,999 | $ | 3,927 | ||||||||||

| Machine Zone, Inc. | Professional, Scientific, and Technical Services | Equipment Financing | August 1, 2019 | Fixed interest rate 6.6%; EOT 20% | - | 357 | 357 | |||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | December 1, 2019 | Fixed interest rate 6.0%; EOT 19.8% | - | 202 | 202 | ||||||||||||||

| Total Machine Zone, Inc. (17) | - | 559 | 559 | |||||||||||||||||

| Sub-total: Less than a Year | $ | 3,146 | $ | 4,558 | $ | 4,486 | ||||||||||||||

| 1-5 Years Maturity | ||||||||||||||||||||

| Augmedix, Inc. | Professional, Scientific, and Technical Services | Secured Loan | April 1, 2023 | Fixed interest rate 12.0%; EOT 6.5% | $ | 9,422 | $ | 9,295 | $ | 9,259 | ||||||||||

| BackBlaze, Inc. | Professional, Scientific, and Technical Services | Equipment Financing | January 1, 2023 | Fixed interest rate 7.2%; EOT 11.5% | 1,215 | 1,297 | 1,299 | |||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | April 1, 2023 | Fixed interest rate 7.4%; EOT 11.5% | 152 | 160 | 160 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | June 1, 2023 | Fixed interest rate 7.4%; EOT 11.5% | 1,154 | 1,203 | 1,201 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | August 1, 2023 | Fixed interest rate 7.5%; EOT 11.5% | 226 | 233 | 233 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | September 1, 2023 | Fixed interest rate 7.7%; EOT 11.5% | 230 | 237 | 236 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | October 1, 2023 | Fixed interest rate 7.5%; EOT 11.5% | 230 | 236 | 234 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | November 1, 2023 | Fixed interest rate 7.2%; EOT 11.5% | 766 | 787 | 779 | ||||||||||||||

| 10 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | December 1, 2023 | Fixed interest rate 7.5%; EOT 11.5% | 1,007 | 1,027 | 1,029 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | January 1, 2024 | Fixed interest rate 7.5%; EOT 11.5% | 873 | 886 | 886 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | January 1, 2024 | Fixed interest rate 7.4%; EOT 11.5% | 886 | 896 | 896 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | February 1, 2024 | Fixed interest rate 7.2%; EOT 11.5% | 767 | 774 | 774 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | April 1, 2024 | Fixed interest rate 7.4%; EOT 11.5% | 232 | 232 | 232 | ||||||||||||||

| Total BackBlaze, Inc. | 7,738 | 7,968 | 7,959 | |||||||||||||||||

| Cuebiq, Inc. | Professional, Scientific, and Technical Services | Secured Loan | April 1, 2024 | Variable interest rate PRIME + 7.25% or Floor rate 12%; EOT 5.0% (19) | 5,000 | 4,957 | 4,957 | |||||||||||||

| Edeniq, Inc. | Professional, Scientific, and Technical Services | Secured Loan | June 1, 2021 | Fixed interest rate 13.0%; EOT 9.5% | 3,817 | 1,880 | 1,463 | |||||||||||||

| Professional, Scientific, and Technical Services | Secured Loan | September 1, 2021 | Fixed interest rate 13.0%; EOT 9.5% | 2,868 | 1,348 | 1,050 | ||||||||||||||

| Total Edeniq, Inc. (7) (9) | 6,685 | 3,228 | 2,513 | |||||||||||||||||

| Footprint, Inc. | Professional, Scientific, and Technical Services | Equipment Financing | March 1, 2024 | Fixed interest rate 10.3%; EOT 8.0% | 17,624 | 17,621 | 17,621 | |||||||||||||

| Hologram Inc. | Professional, Scientific, and Technical Services | Secured Loan | February 1, 2024 | Variable interest rate PRIME + 6.25% or Floor rate 11.25%; EOT 5.0% (19) | 3,000 | 2,948 | 2,948 | |||||||||||||

| iHealth Solutions, LLC | Professional, Scientific, and Technical Services | Secured Loan | April 1, 2022 | Fixed interest rate 12.5%; EOT 5.0% | 4,000 | 4,160 | 4,037 | |||||||||||||

| Incontext Solutions, Inc. | Professional, Scientific, and Technical Services | Secured Loan | October 1, 2022 | Fixed interest rate 11.8%; EOT 5.0% | 6,168 | 6,199 | 5,925 | |||||||||||||

| Matterport, Inc. | Professional, Scientific, and Technical Services | Secured Loan | May 1, 2022 | Fixed interest rate 11.5%; EOT 5.0% | 7,557 | 7,842 | 7,715 | |||||||||||||

| Pendulum Therapeutics, Inc. | Professional, Scientific, and Technical Services | Equipment Financing | May 1, 2023 | Fixed interest rate 7.7%; EOT 5.0% | 447 | 411 | 394 | |||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | September 1, 2023 | Fixed interest rate 7.8%; EOT 5.0% | 2,614 | 2,629 | 2,629 | ||||||||||||||

| Professional, Scientific, and Technical Services | Equipment Financing | November 1, 2023 | Fixed interest rate 7.7%; EOT 5.0% | 763 | 764 | 764 | ||||||||||||||

| Total Pendulum Therapeutics, Inc. | 3,824 | 3,804 | 3,787 | |||||||||||||||||

| SQL Sentry, LLC | Professional, Scientific, and Technical Services | Secured Loan | August 1, 2023 | Fixed interest rate 11.5%; EOT 3.5% | 15,000 | 15,400 | 14,823 | |||||||||||||

| Sun Basket, Inc. | Professional, Scientific, and Technical Services | Secured Loan | May 1, 2022 | Fixed interest rate 11.7%; EOT 5.0% | 11,346 | 11,770 | 11,695 | |||||||||||||

| Utility Associates, Inc. (9) | Professional, Scientific, and Technical Services | Secured Loan | September 30, 2023 | Fixed interest rate 11.0%; EOT 0.0% | 750 | 830 | 558 | |||||||||||||

| Vidsys, Inc. | Professional, Scientific, and Technical Services | Secured Loan | November 1, 2020 | Fixed interest rate 12.0% (8.0% current + 4.0% PIK); EOT 0.0% (18) | 5,223 | 4,920 | 3,418 | |||||||||||||

| Professional, Scientific, and Technical Services | Secured Loan | October 1, 2023 | Fixed interest rate 0.0%; EOT 0.0% | 1,600 | - | - | ||||||||||||||

| Total Vidsys, Inc. | 6,823 | 4,920 | 3,418 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 104,937 | $ | 100,942 | $ | 97,215 | ||||||||||||||

| Sub-total: Professional, Scientific, and Technical Services (45.3%)* | $ | 108,083 | $ | 105,500 | $ | 101,701 | ||||||||||||||

| 11 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Maturity Date | Interest Rate (4) | Principal Amount (5) |

Cost | Fair Value (6) | |||||||||||||

| Real Estate and Rental and Leasing 1-5 Years Maturity | ||||||||||||||||||||

| Knockaway, Inc. | Real Estate and Rental and Leasing | Secured Loan | June 1, 2023 | Fixed interest rate 11.0%; EOT 3.0% | $ | 10,000 | $ | 10,001 | $ | 9,659 | ||||||||||

| Real Estate and Rental and Leasing | Secured Loan | August 1, 2023 | Fixed interest rate 11.0%; EOT 3.0% | 2,500 | 2,493 | 2,451 | ||||||||||||||

| Real Estate and Rental and Leasing | Secured Loan | September 1, 2023 | Fixed interest rate 11.0%; EOT 3.0% | 2,500 | 2,489 | 2,448 | ||||||||||||||

| Total Knockaway, Inc. | 15,000 | 14,983 | 14,558 | |||||||||||||||||

| Wanderjaunt, Inc. | Real Estate and Rental and Leasing | Equipment Financing | June 1, 2023 | Fixed interest rate 10.2%; EOT 12.0% | 489 | 449 | 399 | |||||||||||||

| Real Estate and Rental and Leasing | Equipment Financing | August 1, 2023 | Fixed interest rate 10.2%; EOT 12.0% | 1,499 | 1,520 | 1,520 | ||||||||||||||

| Total Wanderjaunt, Inc. | 1,988 | 1,969 | 1,919 | |||||||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 16,988 | $ | 16,952 | $ | 16,477 | ||||||||||||||

| Sub-total: Real Estate and Rental and Leasing (7.3%)* | $ | 16,988 | $ | 16,952 | $ | 16,477 | ||||||||||||||

| Retail Trade 1-5 Years Maturity | ||||||||||||||||||||

| Birchbox, Inc. | Retail Trade | Secured Loan | April 1, 2023 | Fixed interest rate 9.0% (4.5% current, 4.5% PIK); EOT 5.0% (18) | $ | 20,196 | $ | 20,523 | $ | 19,657 | ||||||||||

| Gobble, Inc. | Retail Trade | Secured Loan | July 1, 2023 | Fixed interest rate 11.3%; EOT 6.0% | 3,962 | 3,974 | 3,814 | |||||||||||||

| Retail Trade | Secured Loan | July 1, 2023 | Fixed interest rate 11.5%; EOT 6.0% | 1,988 | 1,995 | 1,943 | ||||||||||||||

| Total Gobble Inc. | 5,950 | 5,969 | 5,757 | |||||||||||||||||

| Madison Reed, Inc. | Retail Trade | Secured Loan | October 1, 2022 | Fixed interest rate 12.0%; EOT 5.3% | 10,000 | 10,314 | 10,293 | |||||||||||||

| Miyoko's Kitchen | Retail Trade | Equipment Financing | September 1, 2022 | Fixed interest rate 8.8%; EOT 9.0% | 815 | 812 | 812 | |||||||||||||

| UnTuckIt, Inc. | Retail Trade | Secured Loan | June 1, 2023 | Fixed interest rate 12.0%; EOT 5.0% | 20,000 | 21,126 | 19,567 | |||||||||||||

| Sub-total: 1-5 Years Maturity | $ | 56,961 | $ | 58,744 | $ | 56,086 | ||||||||||||||

| Sub-total: Retail Trade (25.0%)* | $ | 56,961 | $ | 58,744 | $ | 56,086 | ||||||||||||||

| Utilities 1-5 Years Maturity | ||||||||||||||||||||

| Invenia, Inc. | Utilities | Secured Loan | January 1, 2023 | Fixed interest rate 11.5%; EOT 5.0% | $ | 8,577 | $ | 9,062 | $ | 8,879 | ||||||||||

| Utilities | Secured Loan | May 1, 2023 | Fixed interest rate 11.5%; EOT 5.0% | 4,000 | 4,216 | 4,188 | ||||||||||||||

| Utilities | Secured Loan | January 1, 2024 | Fixed interest rate 11.5%; EOT 5.0% | 3,000 | 3,014 | 3,121 | ||||||||||||||

| Utilities | Secured Loan | February 1, 2024 | Fixed interest rate 11.5%; EOT 5.0% | 4,000 | 4,052 | 4,052 | ||||||||||||||

| Total Invenia, Inc. (23) | $ | 19,577 | $ | 20,344 | $ | 20,240 | ||||||||||||||

| Dandelion Energy, Inc. | Utilities | Equipment Financing | April 1, 2024 | Fixed interest rate 9.0%; EOT 12.5% | $ | 550 | $ | 531 | $ | 531 | ||||||||||

| Sub-total: 1-5 Years Maturity | $ | 20,127 | $ | 20,875 | $ | 20,771 | ||||||||||||||

| Sub-total: Utilities (9.2%)* | $ | 20,127 | $ | 20,875 | $ | 20,771 | ||||||||||||||

| Wholesale Trade 1-5 Years Maturity | ||||||||||||||||||||

| BaubleBar, Inc. | Wholesale Trade | Secured Loan | April 1, 2021 | Fixed interest rate 11.5%; EOT 7.0% | $ | 6,842 | $ | 7,558 | $ | 7,263 | ||||||||||

| Sub-total: 1-5 Years Maturity | $ | 6,842 | $ | 7,558 | $ | 7,263 | ||||||||||||||

| Sub-total: Wholesale Trade (3.2%) | $ | 6,842 | $ | 7,558 | $ | 7,263 | ||||||||||||||

| Total: Debt Securities (165.0%)* | $ | 382,118 | $ | 383,879 | $ | 370,504 | ||||||||||||||

| 12 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type

of Investment (3) | Expiration Date | Series | Shares | Strike Price | Cost | Fair Value (6) | ||||||||||||||||

| Warrant Investments | ||||||||||||||||||||||||

| Agriculture, Forestry, Fishing and Hunting | ||||||||||||||||||||||||

| Bowery Farming, Inc. | Agriculture, Forestry, Fishing and Hunting | Warrant | June 10, 2029 | Common Stock | 68,863 | $ | 5.08 | $ | 410 | $ | 395 | |||||||||||||

| Etagen, Inc. | Agriculture, Forestry, Fishing and Hunting | Warrant | July 9, 2029 | Common Stock | 140,186 | $ | 1.15 | 283 | 354 | |||||||||||||||

| Sub-Total: Agriculture, Forestry, Fishing and Hunting (0.3%)* | $ | 693 | $ | 749 | ||||||||||||||||||||

| Construction | ||||||||||||||||||||||||

| Project Frog, Inc. (8) | Construction | Warrant | July 26, 2026 | Preferred Series AA | 391,990 | $ | 0.19 | $ | 18 | $ | 9 | |||||||||||||

| Sub-Total: Construction (0.0%)* | $ | 18 | $ | 9 | ||||||||||||||||||||

| Educational Services | ||||||||||||||||||||||||

| Qubed, Inc. dba Yellowbrick | Educational Services | Warrant | September 28, 2028 | Common Stock | 526,316 | $ | 0.38 | $ | 120 | $ | 158 | |||||||||||||

| Sub-Total: Educational Services (0.1%)* | $ | 120 | $ | 158 | ||||||||||||||||||||

| Finance and Insurance | ||||||||||||||||||||||||

| Petal Card, Inc. | Finance and Insurance | Warrant | November 27, 2029 | Preferred Series B | 250,268 | TBD | (22) | $ | 147 | $ | 143 | |||||||||||||

| RM Technologies, Inc. | Finance and Insurance | Warrant | December 18, 2027 | Preferred Series B | 234,421 | $ | 3.88 | 285 | 117 | |||||||||||||||

| Sub-Total: Finance and Insurance (0.1%)* | $ | 432 | $ | 260 | ||||||||||||||||||||

| Health Care and Social Assistance | ||||||||||||||||||||||||

| Galvanize, Inc. (21) | Health Care and Social Assistance | Warrant | May 17, 2026 | Preferred Series B | 1,564,537 | $ | 1.57 | $ | - | $ | - | |||||||||||||

| Sub-Total: Health Care and Social Assistance (0.0%)* | $ | - | $ | - | ||||||||||||||||||||

| Information | ||||||||||||||||||||||||

| Convercent, Inc. | Information | Warrant | November 30, 2025 | Preferred Series 1 | 3,139,579 | $ | 0.16 | $ | 925 | $ | 478 | |||||||||||||

| EMPYR, Inc. (21) | Information | Warrant | March 31, 2028 | Common Stock | 935,198 | $ | 0.07 | - | - | |||||||||||||||

| Everalbum, Inc. | Information | Warrant | July 29, 2026 | Preferred Series A | 851,063 | $ | 0.10 | 25 | 24 | |||||||||||||||

| Firefly, Inc. | Information | Warrant | January 29, 2030 | Common Stock | 133,147 | 282 | 282 | |||||||||||||||||

| Gtxcel, Inc. | Information | Warrant | September 24, 2025 | Preferred Series C | 1,000,000 | $ | 0.21 | 166 | 162 | |||||||||||||||

| Information | Warrant | September 24, 2025 | Preferred Series D | TBD | (22) | TBD | (22) | - | - | |||||||||||||||

| Total Gtxcel, Inc. | 166 | 162 | ||||||||||||||||||||||

| Hytrust, Inc. | Information | Warrant | June 23, 2026 | Preferred Series D2 | 424,808 | $ | 0.82 | 172 | - | |||||||||||||||

| Lucidworks, Inc. | Information | Warrant | June 27, 2026 | Preferred Series D | 619,435 | $ | 0.77 | 806 | 535 | |||||||||||||||

| Market6 | Information | Warrant | November 19, 2020 | Preferred Series B | 53,410 | $ | 1.65 | 29 | - | |||||||||||||||

| Oto Analytics, Inc. | Information | Warrant | August 31, 2028 | Preferred Series B | 1,018,718 | $ | 0.79 | 295 | 232 | |||||||||||||||

| RapidMiner, Inc. | Information | Warrant | March 25, 2029 | Preferred Series C-1 | 11,624 | $ | 60.22 | 528 | 498 | |||||||||||||||

| STS Media, Inc. (21) | Information | Warrant | March 15, 2028 | Preferred Series C | 20,210 | $ | 24.74 | - | - | |||||||||||||||

| Sub-Total: Information (1.0%)* | $ | 3,228 | $ | 2,211 | ||||||||||||||||||||

| Manufacturing | ||||||||||||||||||||||||

| Altierre Corporation | Manufacturing | Warrant | December 30, 2026 | Preferred Series F | 1,200,000 | $ | 0.35 | $ | 24 | $ | - | |||||||||||||

| Manufacturing | Warrant | February 12, 2028 | Preferred Series F | 400,000 | $ | 0.35 | 8 | - | ||||||||||||||||

| Total Altierre Corporation | 32 | - | ||||||||||||||||||||||

| Atieva, Inc. | Manufacturing | Warrant | March 31, 2027 | Preferred Series D | 390,016 | $ | 5.13 | 3,067 | 2,490 | |||||||||||||||

| Manufacturing | Warrant | September 8, 2027 | Preferred Series D | 195,008 | $ | 5.13 | 1,533 | 1,261 | ||||||||||||||||

| Total Atieva, Inc. | 4,600 | 3,751 | ||||||||||||||||||||||

| Ay Dee Kay LLC | Manufacturing | Warrant | March 30, 2028 | Preferred Series G | 6,250 | $ | 35.42 | 23 | - | |||||||||||||||

| Happiest Baby, Inc. | Manufacturing | Warrant | May 16, 2029 | Common Stock | 182,554 | $ | 0.33 | 193 | 157 | |||||||||||||||

| Hexatech, Inc. (21) | Manufacturing | Warrant | April 2, 2022 | Preferred Series A | 226 | $ | 2.77 | - | 4 | |||||||||||||||

| Lensvector, Inc. | Manufacturing | Warrant | December 30, 2021 | Preferred Series C | 85,065 | $ | 1.18 | 32 | - | |||||||||||||||

| Nanotherapeutics, Inc. | Manufacturing | Warrant | November 14, 2021 | Common Stock | 67,961 | $ | 1.03 | 1,122 | 1,171 | |||||||||||||||

| Robotany, Inc. | Manufacturing | Warrant | July 19, 2029 | Common Stock | 23,579 | $ | 1.52 | 129 | - | |||||||||||||||

| SBG Labs, Inc. | Manufacturing | Warrant | June 29, 2023 | Preferred Series A-1 | 42,857 | $ | 0.70 | 13 | 19 | |||||||||||||||

| Manufacturing | Warrant | September 18, 2024 | Preferred Series A-1 | 25,714 | $ | 0.70 | 8 | 5 | ||||||||||||||||

| Manufacturing | Warrant | January 14, 2024 | Preferred Series A-1 | 21,492 | $ | 0.70 | 7 | 10 | ||||||||||||||||

| Manufacturing | Warrant | March 24, 2025 | Preferred Series A-1 | 12,155 | $ | 0.70 | 4 | 5 | ||||||||||||||||

| Manufacturing | Warrant | October 10, 2023 | Preferred Series A-1 | 11,150 | $ | 0.70 | 4 | 3 | ||||||||||||||||

| Manufacturing | Warrant | May 6, 2024 | Preferred Series A-1 | 11,145 | $ | 0.70 | 4 | 11 | ||||||||||||||||

| Manufacturing | Warrant | June 9, 2024 | Preferred Series A-1 | 7,085 | $ | 0.70 | 2 | 5 | ||||||||||||||||

| Manufacturing | Warrant | May 20, 2024 | Preferred Series A-1 | 342,857 | $ | 0.70 | 110 | 153 | ||||||||||||||||

| Manufacturing | Warrant | March 26, 2025 | Preferred Series A-1 | 200,000 | $ | 0.70 | 65 | 89 | ||||||||||||||||

| Total SBG Labs, Inc. | 217 | 300 | ||||||||||||||||||||||

| 13 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Soraa, Inc. | Manufacturing | Warrant | August 21, 2023 | Preferred Series 1 | 192,000 | $ | 5.00 | 498 | 335 | |||||||||||||||

| Manufacturing | Warrant | February 18, 2024 | Preferred Series 2 | 60,000 | $ | 5.00 | 165 | 111 | ||||||||||||||||

| Total Soraa, Inc. | 663 | 446 | ||||||||||||||||||||||

| Vertical Communications, Inc. (7) (21) | Manufacturing | Warrant | July 11, 2026 | Preferred Series A | 828,479 | $ | 1.00 | - | - | |||||||||||||||

| Zosano Pharma Corporation | Manufacturing | Warrant | September 25, 2025 | Common Stock | 75,000 | $ | 3.59 | 69 | 17 | |||||||||||||||

| Sub-Total: Manufacturing (2.6%)* | $ | 7,080 | $ | 5,846 | ||||||||||||||||||||

| Professional, Scientific, and Technical Services | ||||||||||||||||||||||||

| Augmedix, Inc. | Professional, Scientific, and Technical Services | Warrant | September 3, 2029 | Preferred Series B | 1,379,028 | $ | 1.21 | $ | 449 | $ | 364 | |||||||||||||

| Continuity, Inc. | Professional, Scientific, and Technical Services | Warrant | March 29, 2026 | Preferred Series C | 794,403 | $ | 0.25 | 21 | 21 | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant (21) | March 29, 2026 | Preferred Series C | 794,403 | $ | 0.25 | - | - | ||||||||||||||||

| Total Continuity, Inc. | 21 | 21 | ||||||||||||||||||||||

| Crowdtap, Inc. | Professional, Scientific, and Technical Services | Warrant | December 16, 2025 | Preferred Series B | 442,233 | $ | 1.09 | 42 | 41 | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | November 30, 2027 | Preferred Series B | 100,000 | $ | 1.09 | 9 | 9 | ||||||||||||||||

| Total Crowdtap, Inc. | 51 | 50 | ||||||||||||||||||||||

| Dynamics, Inc. | Professional, Scientific, and Technical Services | Warrant | March 10, 2024 | Common Stock | 17,000 | $ | 10.59 | 86 | - | |||||||||||||||

| E La Carte, Inc. | Professional, Scientific, and Technical Services | Warrant | July 28, 2027 | Common Stock | 497,183 | $ | 0.30 | 185 | 130 | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | July 28, 2027 | Preferred Series A | 106,841 | $ | 7.49 | 14 | 11 | ||||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | July 28, 2027 | Preferred Series AA-1 | 104,284 | $ | 7.49 | 14 | 11 | ||||||||||||||||

| Total E La Carte, Inc. | 213 | 152 | ||||||||||||||||||||||

| Edeniq, Inc. | Professional, Scientific, and Technical Services | Warrant | December 23, 2026 | Preferred Series B | 2,685,501 | $ | 0.22 | - | - | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | December 23, 2026 | Preferred Series B | 2,184,672 | $ | 0.01 | - | - | ||||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | March 12, 2028 | Preferred Series C | 5,106,972 | $ | 0.44 | - | - | ||||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | October 15, 2028 | Preferred Series C | 3,850,294 | $ | 0.01 | - | - | ||||||||||||||||

| Total Edeniq, Inc. (7)(21) | - | - | ||||||||||||||||||||||

| Fingerprint Digital, Inc. | Professional, Scientific, and Technical Services | Warrant | April 29, 2026 | Preferred Series B | 48,102 | $ | 10.39 | 165 | 161 | |||||||||||||||

| Footprint, Inc. | Professional, Scientific, and Technical Services | Warrant | February 14, 2030 | Common Stock | 26,852 | $ | 0.31 | 5 | 5 | |||||||||||||||

| Hologram, Inc. | Professional, Scientific, and Technical Services | Warrant | January 27, 2030 | Common Stock | 193,054 | $ | 1.37 | 49 | 49 | |||||||||||||||

| Hospitalists Now, Inc. | Professional, Scientific, and Technical Services | Warrant | March 30, 2026 | Preferred Series D2 | 135,807 | $ | 5.89 | 71 | 57 | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | December 6, 2026 | Preferred Series D2 | 750,000 | $ | 5.89 | 391 | 314 | ||||||||||||||||

| Total Hospitalists Now, Inc. | 462 | 371 | ||||||||||||||||||||||

| Incontext Solutions, Inc. | Professional, Scientific, and Technical Services | Warrant | September 28, 2028 | Preferred Series AA-1 | 332,858 | $ | 1.47 | 34 | - | |||||||||||||||

| Matterport, Inc. | Professional, Scientific, and Technical Services | Warrant | April 20, 2028 | Common Stock | 143,813 | $ | 1.43 | 434 | 407 | |||||||||||||||

| Pendulum Therapeutics, Inc. | Professional, Scientific, and Technical Services | Warrant | October 9, 2029 | Preferred Series D2 | 55,263 | $ | 1.90 | 44 | 43 | |||||||||||||||

| Resilinc, Inc. | Professional, Scientific, and Technical Services | Warrant | December 15, 2025 | Preferred Series A | 589,275 | $ | 0.51 | 40 | 39 | |||||||||||||||

| Reterro, Inc. | Professional, Scientific, and Technical Services | Warrant | October 30, 2025 | Common Stock | 12,841 | $ | 20.00 | - | - | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | October 31, 2026 | Common Stock | 15,579 | $ | 50.00 | - | - | ||||||||||||||||

| Total Reterro, Inc. (21) | - | - | ||||||||||||||||||||||

| Saylent Technologies, Inc. | Professional, Scientific, and Technical Services | Warrant | March 31, 2027 | Preferred Series C | 24,096 | $ | 9.96 | 108 | 106 | |||||||||||||||

| Sun Basket, Inc. | Professional, Scientific, and Technical Services | Warrant | October 5, 2027 | Preferred Series C-2 | 249,306 | $ | 6.02 | 111 | 100 | |||||||||||||||

| Utility Associates, Inc. | Professional, Scientific, and Technical Services | Warrant | June 30, 2025 | Preferred Series A | 92,511 | $ | 4.54 | 55 | 23 | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | May 1, 2026 | Preferred Series A | 60,000 | $ | 4.54 | 36 | 15 | ||||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | May 22, 2027 | Preferred Series A | 200,000 | $ | 4.54 | 120 | 49 | ||||||||||||||||

| Total Utility Associates, Inc. | 211 | 87 | ||||||||||||||||||||||

| Vidsys, Inc. | Professional, Scientific, and Technical Services | Warrant | June 14, 2029 | Preferred Series 1 | 22,507 | $ | 4.91 | - | - | |||||||||||||||

| Professional, Scientific, and Technical Services | Warrant | March 17, 2027 | Common Stock | 3,061 | $ | 4.91 | - | - | ||||||||||||||||

| Total Vidsys, Inc. (21) | - | - | ||||||||||||||||||||||

| Sub-Total: Professional, Scientific, and Technical Services (0.9%)* | $ | 2,483 | $ | 1,955 | ||||||||||||||||||||

| Real Estate and Rental and Leasing | ||||||||||||||||||||||||

| Egomotion Corporation | Real Estate and Rental and Leasing | Warrant | June 29, 2028 | Preferred Series A | 182,357 | $ | 1.32 | $ | 219 | $ | 156 |

| 14 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Knockaway, Inc. | Real Estate and Rental and Leasing | Warrant | May 24, 2029 | Preferred Series B | 87,955 | $ | 8.53 | 209 | 202 | |||||||||||||||

| Sub-Total: Real Estate and Rental and Leasing (0.2%)* | $ | 428 | $ | 358 | ||||||||||||||||||||

| Retail Trade | ||||||||||||||||||||||||

| Birchbox, Inc. | Retail Trade | Warrant | August 14, 2028 | Preferred Series A | 155,845 | $ | 1.25 | $ | 72 | $ | - | |||||||||||||

| Gobble, Inc. | Retail Trade | Warrant | May 9, 2028 | Common Stock | 74,635 | $ | 1.20 | 617 | 416 | |||||||||||||||

| Retail Trade | Warrant | December 27, 2029 | Common Stock | 10,000 | $ | 1.22 | 73 | 56 | ||||||||||||||||

| Total Gobble, Inc. | 690 | 472 | ||||||||||||||||||||||

| Le Tote, Inc. | Retail Trade | Warrant | March 7, 2028 | Common Stock | 216,312 | $ | 1.46 | 490 | 280 | |||||||||||||||

| Madison Reed, Inc. | Retail Trade | Warrant | March 23, 2027 | Preferred Series C | 194,553 | $ | 2.57 | 185 | 226 | |||||||||||||||

| Retail Trade | Warrant | July 18, 2028 | Common Stock | 43,158 | $ | 0.99 | 71 | 92 | ||||||||||||||||

| Retail Trade | Warrant | May 19, 2029 | Common Stock | 36,585 | $ | 1.23 | 56 | 72 | ||||||||||||||||

| Total Madison Reed, Inc. | 312 | 390 | ||||||||||||||||||||||

| Trendly, Inc. | Retail Trade | Warrant | August 10, 2026 | Preferred Series A | 245,506 | $ | 1.14 | 222 | 295 | |||||||||||||||

| Sub-Total: Retail Trade (0.6%)* | $ | 1,786 | $ | 1,437 | ||||||||||||||||||||

| Wholesale Trade | ||||||||||||||||||||||||

| BaubleBar, Inc. | Wholesale Trade | Warrant | March 29, 2027 | Preferred Series C | 531,806 | $ | 1.96 | $ | 640 | $ | 138 | |||||||||||||

| Wholesale Trade | Warrant | April 20, 2028 | Preferred Series C | 60,000 | $ | 1.96 | 72 | 16 | ||||||||||||||||

| Total BaubleBar, Inc. | 712 | 154 | ||||||||||||||||||||||

| Sub-Total: Wholesale Trade (0.1%)* | $ | 712 | $ | 154 | ||||||||||||||||||||

| Total: Warrant Investments (5.9%)* | $ | 16,980 | $ | 13,137 | ||||||||||||||||||||

| 15 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| Portfolio Company (1) | Industry (2) | Type of Investment (3) | Shares | Series | Cost | Fair Value (6) | ||||||||||||

| Equity Investments | ||||||||||||||||||

| Construction | ||||||||||||||||||

| Project Frog, Inc. | Construction | Equity | 8,118,527 | Preferred Series AA-1 | $ | 702 | $ | 380 | ||||||||||

| Construction | Equity | 6,300,134 | Preferred Series BB | 2,667 | 1,789 | |||||||||||||

| Total Project Frog, Inc. (8) | 3,369 | 2,169 | ||||||||||||||||

| Sub-Total: Construction (1.0%)* | $ | 3,369 | $ | 2,169 | ||||||||||||||

| Health Care and Social Assistance | ||||||||||||||||||

| WorkWell Prevention & Care | Health Care and Social Assistance | Equity | 7,000,000 | Common Stock | $ | 51 | $ | - | ||||||||||

| Health Care and Social Assistance | Equity | 3,450 | Preferred Series P | 3,450 | 1,376 | |||||||||||||

| Health Care and Social Assistance | na | Convertible Notes (10)(11) | 1,149 | 1,094 | ||||||||||||||

| Total WorkWell Prevention & Care (7) | 4,650 | 2,470 | ||||||||||||||||

| Sub-Total: Health Care and Social Assistance (1.1%)* | $ | 4,650 | $ | 2,470 | ||||||||||||||

| Manufacturing | ||||||||||||||||||

| Nanotherapeutics, Inc. | Manufacturing | Equity | 382,277 | Common Stock (16) | $ | 6,691 | $ | 6,977 | ||||||||||

| Vertical Communications, Inc. | Manufacturing | Equity (21) | 3,892,485 | Preferred Stock Series 1 | - | - | ||||||||||||

| Manufacturing | Equity | na | Convertible Notes (10)(12) | 3,966 | 391 | |||||||||||||

| Total Vertical Communications, Inc. (7) | 3,966 | 391 | ||||||||||||||||

| Sub-Total: Manufacturing (3.3%)* | $ | 10,657 | $ | 7,368 | ||||||||||||||

| Professional, Scientific, and Technical Services | ||||||||||||||||||

| Dynamics, Inc. | Professional, Scientific, and Technical Services | Equity | 17,726 | Preferred Series A | $ | 390 | $ | - | ||||||||||

| Edeniq, Inc. | Professional, Scientific, and Technical Services | Equity | 7,807,499 | Preferred Series B | - | - | ||||||||||||

| Professional, Scientific, and Technical Services | Equity | 2,441,082 | Preferred Series C | - | - | |||||||||||||

| Professional, Scientific, and Technical Services | Equity | na | Convertible Notes (10)(13) | - | - | |||||||||||||

| Total Edeniq, Inc. (7) | - | - | ||||||||||||||||

| Instart Logic, Inc. (21) | Professional, Scientific, and Technical Services | Equity | na | Convertible Notes (10)(14) | 2,645 | 2,645 | ||||||||||||

| Reterro, Inc. | Professional, Scientific, and Technical Services | Equity | 7,829 | Common Stock | - | - | ||||||||||||

| Vidsys, Inc. | Professional, Scientific, and Technical Services | Equity | na | Convertible Notes (10)(15) | 300 | 300 | ||||||||||||

| Sub-Total: Professional, Scientific, and Technical Services (1.3%)* | $ | 3,335 | $ | 2,945 | ||||||||||||||

| Total: Equity Investments (6.7%)* | $ | 22,011 | $ | 14,952 | ||||||||||||||

| Total Investment in Securities (177.5%)* | $ | 422,870 | $ | 398,593 | ||||||||||||||

| Cash, Cash Equivalents, and Restricted Cash | ||||||||||||||||||

| Goldman Sachs Financial Square Government Institutional Fund | $ | 78,335 | $ | 78,335 | ||||||||||||||

| Other cash accounts | 1,150 | 1,150 | ||||||||||||||||

| Cash, Cash Equivalents, and Restricted Cash (35.4%)* | 79,485 | 79,485 | ||||||||||||||||

| Total Portfolio Investments and Cash and Cash Equivalents (212.9% of net assets) | $ | 502,355 | $ | 478,078 | ||||||||||||||

| * Value as a percent of net assets. | ||||||||||||||||||

| (1) All portfolio companies are located in North America. The Company generally acquires its investments in private transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). These investments are generally subject to certain limitations on resale and may be deemed to be “restricted securities” under the Securities Act. |

| (2) Trinity uses the North American Industry Classification System (NAICS) code for classifying the industry grouping of its portfolio companies. |

| (3) All debt investments are income producing unless otherwise noted. Warrant investments are associated with funded debt and equipment financing instruments. All equity investments are non-income producing unless otherwise noted. Equipment that has been financed relates to operational equipment essential to revenue production for the portfolio company in the industry noted. |

| (4) Interest rate is the fixed rate of the Secured Loan debt investment and does not include any original issue discount, end-of-term (EOT) payment, or any additional fees related to the investments, such as deferred interest, commitment fees, prepayment fees or exit fees. EOT payments are contractual and fixed interest payments due in cash at the maturity date of the loan, including upon prepayment, and are a fixed amount determined at the inception of the loan. At the end of the term of certain equipment leases, the lessee has the option to purchase the underlying assets at fair market value in certain cases subject to a cap, or return the equipment and pay a restocking fee. The fair values of the financed assets have been estimated as a percentage of original cost for purpose of the EOT payment value. The EOT payment is amortized and recognized as non-cash income over the loan or lease prior to its payment. |

| (5) Principal is net of repayments. |

| (6) All investments were valued at fair value using Level 3 significant unobservable inputs as determined in good faith by the Company. |

| (7) This issuer is deemed to be a "Control Investment." Control Investments are defined by the Investment Company Act of 1940 as investments in companies in which the Company owns more than 25% of the voting securities or maintains greater than 50% of the board representation. As defined in the Investment Company Act, Trinity is deemed to be an "Affiliated Person" of this portfolio company. See schedule 12-14 "Investments in and advances to affiliates" in the accompanying notes to the Financial Statements. |

| (8) This issuer is deemed to be a "Affiliate Investment." Affiliate Investments are defined by the Investment Company Act of 1940 as investments in companies in which the Company owns between 5% and 25% of the voting securities. As defined in the Investment Company Act, Trinity is deemed to be an "Affiliated Person" of this portfolio company. See Note 3 in the accompanying notes to the Financial Statements. |

| (9) Debt is on non-accrual status at March 31, 2020, and is therefore considered non-income producing. |

| 16 |

TRINITY CAPITAL INC.

Consolidated Schedule of Investments

March 31, 2020

(In thousands, except share and per share data)

(Unaudited)

| (10) Convertible notes represent investments through which the Company will participate in future equity rounds at preferential rates. There are no principal or interest payments made against the note unless conversion does not take place. |

| (11) Principal balance of $1.1 million at period end. |

| (12) Principal balance of $5.5 million at period end. |

| (13) Principal balance of $1.6 million at period end. |

| (14) Principal balance of $2.6 million at period end. |

| (15) Principal balance of $0.3 million at period end. |

| (16) Certain third-parties have rights to 17,485 shares of Nanotherapeutics at a fair value of approximately $0.4 million as of March 31, 2020. |

| (17) Principal balance represents the balance of the end-of-term payment which was negotiated to be paid in monthly installments over 12 months instead of a one-time lump sum. This asset is considered non-income producing. |

| (18) Interest on this loan includes Paid In Kind. PIK interest income represents income not paid currently in cash. |

| (19) Index based floating interest rate is subject to contractual minimum interest rate. Interest rate PRIME represents 3.25% at March 31, 2020. |

| (20) Investment has an unfunded commitment as of March 31, 2020 (see Note 6). The fair value of the investment includes the impact of the fair value of any unfunded commitments. |

| (21) Investment has zero cost basis as it was purchased at a fair market value of zero as part of the Formation Transaction. |

| (22) Company has been issued warrants with pricing and number of shares dependent upon a future round of equity issuance by the Portfolio Company. |

| (23) Indicates an asset that the Company deems as a "non-qualifying asset” under section 55(a) of 1940 Act. The Company's percentage of non-qualifying assets represents 4.2% of the Company’s total assets. Qualifying assets must represent at least 70% of the Company’s total assets at the time of acquisition of any additional non-qualifying assets. |

| 17 |

TRINITY CAPITAL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

1. Organization and Basis of Presentation

Unless otherwise noted or the context otherwise indicates, the terms "we," "us," "our," the "Company" and "Trinity Capital" refer to Trinity Capital Inc. and its consolidated wholly owned subsidiaries.

Trinity Capital Inc., formed on August 12, 2019 as a Maryland corporation, is a specialty lending company focused on providing debt, including loans and equipment financings, to growth stage companies, including venture-backed companies and companies with institutional equity investors. The Company sources its investments through its principal office located in Chandler, AZ, as well as through its additional office located in San Francisco, CA.

The Company is an internally managed, closed-end, non-diversified management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Company intends to elect to be treated, and intends to qualify annually thereafter, as a regulated investment company (a “RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes.

Management of the Company consists of the Company’s officers and investment and administrative professionals along with the Company’s Board of Directors (the “Board”). The Board consists of five directors, three of whom are not “interested persons” of the Company (as such term is defined in the 1940 Act).

The Company’s investment objective is to maximize the total return to the Company’s stockholders in the form of current income and capital appreciation through investments in growth stage companies, including venture-backed companies and companies with institutional equity investors. The Company targets investments in growth stage companies, which are typically private companies, that have recently issued equity to raise cash to offset potential cash flow needs related to projected growth, have achieved positive cash flow to cover debt service, or have institutional investors committed to additional funding. The Company seeks to achieve its investment objective by making investments consisting primarily of term loans and equipment financings, and, to a lesser extent, working capital loans, equity and equity-related investments. In addition, the Company may obtain warrants or contingent exit fees at funding, providing an additional potential source of investment returns.

On September 27, 2019, the Company was initially capitalized with the sale of 10 shares of its common stock for $150 to its sole stockholder. On January 16, 2020, the Company completed a private equity offering (the “Private Common Stock Offering”) of shares of its common stock pursuant to which it issued and sold 7,000,000 shares for gross proceeds of approximately $105 million. An over-allotment option related to the Private Common Stock Offering was exercised in full and on January 29, 2020, the Company issued and sold an additional 1,333,333 shares of its common stock for gross proceeds of approximately $20 million. As a result, the Company issued and sold 8,333,333 shares of its common stock for total aggregate gross proceeds of approximately $125 million.

On January 16, 2020, concurrent with the completion of the initial closing of the Private Common Stock Offering, the Company completed a private debt offering (the “144A Note Offering” and together with the Private Common Stock Offering, the “Private Offerings”) of $105 million in aggregate principal amount of the Company’s unsecured 7.00% Notes due 2025 (the “Notes”). An over-allotment option related to the 144A Note Offering was exercised in full and on January 29, 2020, the Company issued and sold an additional $20 million in aggregate principal amount of the Notes. As a result, the Company issued and sold $125 million in aggregate principal amount of the Notes. See “Note 5 - Debt,” “Note 7 – Stockholder’s Equity,” and “Note 12 – Formation Transactions.”

| 18 |

On January 16, 2020, immediately following the initial closings of the Private Offerings, the Company used the proceeds from the Private Offerings to complete a series of transactions (the “Formation Transactions”). Through the Formation Transactions, the Company acquired Trinity Capital Investment, LLC (“TCI”), Trinity Capital Fund II, L.P. (“Fund II”), Trinity Capital Fund III, L.P. (“Fund III”), Trinity Capital Fund IV, L.P. (“Fund IV”), and Trinity Sidecar Income Fund, L.P. (“Sidecar Fund”) (collectively the “Legacy Funds”) through mergers of the Legacy Funds with and into the Company. Each member/limited partner of the Legacy Funds was given the option to elect to receive cash and or shares of the Company’s common stock in exchange for its limited partner interests or membership interests, as applicable. The general partners, managers or managing members of the Legacy Funds received only shares in exchange for their interests held in such capacities. In addition, as part of the Formation Transactions, the Company purchased the equity interests of Trinity Capital Holdings, LLC (“Trinity Capital Holdings”) for an aggregate purchase price of $10.0 million, which was comprised of 533,332 shares and $2.0 million in cash, and Trinity Capital Holdings became a wholly owned subsidiary of the Company. In connection with the acquisition of the equity interests of Trinity Capital Holdings, the Company assumed a $3.5 million severance related liability due to a former partner of the Legacy Funds. The Formation Transactions constitute a business acquisition and was accounted for in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification, as amended (“ASC”) ASC 805, Business Combinations (“ASC 805”), and as a result the assets acquired and liabilities assumed were recorded at fair values as of January 16, 2020. Transaction costs related to the acquisition of a business are expensed as incurred and excluded from the fair value of the consideration transferred. See “Note 12 – Formation Transactions.”

On January 16, 2020, in connection with the Formation Transactions, the Company became a party to, and assumed, a $300 million credit agreement (the “Credit Facility”) with Credit Suisse AG (“Credit Suisse”) through the Company’s wholly owned subsidiary, Trinity Funding 1, LLC (“TF1”). TF1 was formed on August 14, 2019 as a Delaware limited liability company with the Company as its sole equity member. TF1 is a special purpose bankruptcy-remote entity and is a separate legal entity from the Company. Any assets conveyed to TF1 are not available to creditors of the Company or any other entity other than TF1’s lenders. TF1 is consolidated for financial reporting purposes and in accordance with generally accepted accounting principles in the United States of America (“GAAP”), and the portfolio investments held by this subsidiary are included in the Company’s consolidated financial statements and recorded at fair value. All intercompany balances and transactions have been eliminated.

The Company commenced operations and filed its election to be regulated as a BDC on January 16, 2020.

Basis of Presentation

The Company’s consolidated financial statements are prepared in accordance with GAAP and pursuant to Regulation S-X. As an investment company, the Company follows accounting and reporting guidance determined by the Financial Account Standards Board (“FASB”), in Topic 946 - Financial Services – Investment Companies (“ASC Topic 946”).

Additionally, the accompanying consolidated financial statements of the Company and related financial information have been prepared pursuant to the requirements for reporting on Form 10-Q and Articles 6 and 10 of Regulation S-X. Accordingly, certain disclosures accompanying annual consolidated financial statements prepared in accordance with GAAP are omitted. In the opinion of management, the unaudited interim financial results included herein contain all adjustments and reclassifications that are necessary for the fair presentation of consolidated financial statements for the period included herein.

Principles of Consolidation

Under FASB Accounting Standards Codification ("ASC") Topic 946, Financial Services - Investment Companies, the Company is precluded from consolidating portfolio company investments, including those in which it has a controlling interest, unless the portfolio company is another investment company. An exception to this general principle occurs if the Company holds a controlling interest in an operating company that provides all or substantially all of its services directly to the Company or to its portfolio companies. None of the portfolio investments made by the Company qualify for this exception. Therefore, the Company's investment portfolio is carried on the Consolidated Statements of Assets and Liabilities at fair value, as discussed further in Note 3 - Investments, with any adjustments to fair value recognized as "Net unrealized appreciation (depreciation) from investments" on the Consolidated Statement of Operations.

2. Summary of Significant Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements.

These estimates and assumptions also affect the reported amounts of revenues, costs and expenses during the reporting period. Management evaluates these estimates and assumptions on a regular basis. Actual results could materially differ from those estimates.

| 19 |

Investment Transactions

Loan originations are recorded on the date of the binding commitment. Realized gains or losses are recorded using the specific identification method as the difference between the net proceeds received and the amortized cost basis of the investment without regard to unrealized gains or losses previously recognized, and include investments written off during the period, net of recoveries. The net change in unrealized gains or losses primarily reflects the change in investment fair values as of the last business day of the reporting period and also includes the reversal of previously recorded unrealized gains or losses with respect to investments realized during the period.

Valuation of Investments

The most significant estimate inherent in the preparation of the Company’s consolidated financial statements is the valuation of investments and the related amounts of unrealized appreciation and depreciation of investments recorded.

The Company’s investments are carried at fair value in accordance with the 1940 Act and ASC Topic 946 and measured in accordance with ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 defines fair value, establishes a framework for measuring fair value, establishes a fair value hierarchy based on the observability of inputs used to measure fair value, and provides disclosure requirements for fair value measurements. ASC 820 requires the Company to assume that each of the portfolio investments is sold in a hypothetical transaction in the principal or, as applicable, most advantageous market using market participant assumptions as of the measurement date. Market participants are defined as buyers and sellers in the principal market that are independent, knowledgeable and willing and able to transact. The Company values its investments at fair value as determined in good faith pursuant to a consistent valuation policy by the Board in accordance with the provisions of ASC Topic 820 and the 1940 Act.

While the Board is ultimately and solely responsible for determining the fair value of the Company’s investments, the Company has engaged an independent valuation firm to provide the Company with valuation assistance with respect to its investments. The Company engages independent valuation firms on a discretionary basis. Specifically, on a quarterly basis, the Company will identify portfolio investments with respect to which an independent valuation firm will assist in valuing. The Company selects these portfolio investments based on a number of factors, including, but not limited to, the potential for material fluctuations in valuation results, size, credit quality and the time lapse since the last valuation of the portfolio investment by an independent valuation firm.

Investments recorded on the Company’s Consolidated Statements of Assets and Liabilities are categorized based on the

inputs to the valuation techniques as follows:

| Level 1 — | Investments whose values are based on unadjusted quoted prices for identical assets in an active market that the Company has the ability to access (examples include investments in active exchange-traded equity securities and investments in most U.S. government and agency securities). |

| Level 2 — | Investments whose values are based on quoted prices in markets that are not active or model inputs that are observable either directly or indirectly for substantially the full term of the investment. |

| Level 3 — | Investments whose values are based on prices or valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement (for example, investments in illiquid securities issued by privately held companies). These inputs reflect management’s own assumptions about the assumptions a market participant would use in pricing the investment. |

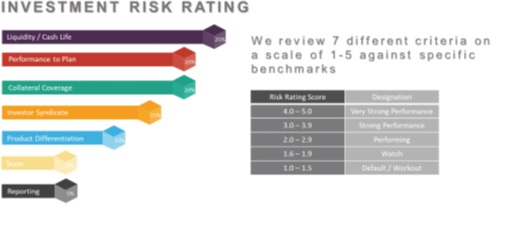

Given the nature of lending to venture capital-backed growth stage companies, substantially all of the Company’s investments in these portfolio companies are considered Level 3 assets under ASC 820 because there is no known or accessible market or market indexes for these investment securities to be traded or exchanges. The Company uses an internally developed portfolio investment rating system in connection with its investment oversight, portfolio management and analysis and investment valuation procedures. This system takes into account both quantitative and qualitative factors of the portfolio companies. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Company’s investments may fluctuate from period to period. Because of the inherent uncertainty of valuation, these estimated values may differ significantly from the values that would have been reported had a ready market for the investments existed, and it is reasonably possible that the difference could be material.

| 20 |

Debt Securities

The debt securities identified on the Consolidated Schedule of Investments are secured loans and equipment financings made to growth stage companies focused in technology, life sciences and other high growth industries which are backed by a select group of leading venture capital investors.

For portfolio investments in debt securities for which Trinity Capital has determined that third-party quotes or other independent pricing are not available, the Company generally estimates the fair value based on the assumptions that hypothetical market participants would use to value the investment in a current hypothetical sale using an income approach.