Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Soliton, Inc. | exhibit991-1qfy20earni.htm |

| 8-K - 8-K - Soliton, Inc. | form8-kxannouncementof.htm |

Rapid Acoustic Pulse Technology (Nasdaq: SOLY) FOR INTERNAL USE ONLY. Do not distribute without permission.

Legal Disclaimer All statements contained herein other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors, including those discussed under Item 1A. “Risk Factors” in our most recently filed Form 10-K filed with the Securities and Exchange Commission (“SEC”) and updated from time to time in our Form 10-Q filings and in our other public filings with the SEC. Any forward-looking statements contained in this release speak only as of its date. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward looking statements. More detailed information about Soliton is set forth in our filings with the Securities and Exchange Commission. Security holders are urged to read these documents free of charge on the SEC’s web site at http://www.sec.gov. 2

Overview Summary Breakthrough acoustic shockwave device using novel and proprietary Rapid Acoustic Pulse (RAP) technology § Induces mechanical disruption to targeted cellular level structures and vacuoles § No cavitation, heat or collateral tissue damage or pain Platform technology § Tattoo removal in as little as 1/3 the number office visits compared to standard of care § Cellulite reduction (Pivotal clinical results) § Keloids/other fibrotic disorders, accelerated fat reduction in clinical development > $10 billion in global market § Global market for tattoo removal is projected to be > $4 billion by 2023 § Global cellulite reduction market estimated to be ~ $4.0 billion by 2025 § Global keloid scar treatment market estimated to be ~ $10 billion by 2025 Images provided by Industrial Design firm; actual product may differ somewhat when the product is launched. There is no guarantee of a successful outcome of this revenue strategy. See disclosures at the end. 3

Management and Directors All life science veterans Multiple device clearances Multiple national and international aesthetic device launches 5

Science Advisory Board High profile Key Opinion Leaders Strong podium presence Respected, published researchers Also members of Allergan’s CoolSculpting Medical Advisory Board 6

Device and Revenue Strategy “razor and blade” recurring revenue model Sell or lease Hand piece contains Replaceable consumable consoles replaceable cartridge cartridge for one patient visit Images provided by Industrial Design firm; actual product may differ somewhat when the product is launched. There is no guarantee of a successful outcome of this revenue strategy. See disclosures at the end. 7

Electrode Cartridge § Electro-hydraulics (arc plasma in saline) utilizes 3000 volts at 3000 amps; creates shockwaves from .25 to 12 MPa @ 100 Hz § 8 patent § Electronic wave shaping enables very high families filed repetition rate; reduces unwanted frequencies that cause heat and pain § Worldwide exclusive license from § Custom designed reflector eliminates MD Anderson cavitation, heat, pain; non-focused, § 60601 Electrical Safety slightly diverging waves certified; 2 MOPP/MOOP § Different cartridges enable different § IRB “non-significant risk” therapies: tattoo removal and, if approved, established cellulite reduction and keloid scars. 8

Soliton’s Rapid Acoustic Pulse § Repetition rate and very short rise time provide microscopic mechanical disruption to targeted cellular level structures and vacuoles § High peak pressure and fast repetition rate exploit viscoelastic nature of tissue § Compressed pulses from electronic filtering and reflector shape eliminate cavitation, heat and pain Physical Effects § ECM/Fibrous Septa disruption (Acoustic subcision) § Non-cavitation/non-thermal physical effects Biological Effects (from Mechanotransduction) Hydrophone measurements using an Onda Corporation AIMS III (Acoustic § Collagenesis § Lymphangiogenesis Intensity Measurement System), using HNR-1000 Hydrophone; Z-Wave setup: § Angiogenesis § Inflammation inhibition Z-WavePro set to maximum output (185 mJ), using Z-Wave Handpiece 2.2 9

OPT A Acoustic ECM Disruption—Breakthrough Septa Disruption—Time Dose Response (Source: Control—Tx#26, Pig202 (68659); Test—Tx#63, Day O, Pig 210a. R1-R3 (68659 vs 91940 vs 91939 vs 91900); Head: Omega set at higher power 2800v, 100HZ, 70ms) CONTROL – 20X 1 MIN – 20X 2 MIN – 20X 3 MIN – 20X 10

Potential Fibrosis Treatment: Long-Term Importance What causes Fibrosis? Stiff Extracellular Fibrotic Fibroblast Matrix (“ECM”) Fibroblast Fibrosis RAP Treatment for Fibrosis Multiple Aesthetic Indications RAP Fibrotic Preventative Stiff Non-Stiff or Tissue Fibroblast ECM ECM Therapeutic Disruption Apoptosis Treatment Significant Medical Indications 11

Soliton’s Pipeline FDA Commercial GLOBAL MARKET Indication Pre-Clinical Human POC Pivotal Clearance Launch OPPORTUNITY Tattoo Removal $4.0B Cellulite Reduction $4.0B Keloid and Hypertrophic Scar Reduction $10.0B Skin Laxity Reduction $6.3B 13

Targeted Indications Pathway Cleared In Clinic Future Tattoo Removal Tattoo Removal Cellulite Skin Rejuvenation: Abdomen Cellulite: Skin Rejuvenation Skin Rejuvenation: General Skin Rejuv.: Knees/Elbows Fibrotic Scars Post-Surgical Keloid: Radiation Induced Fibrotic Scars Radiation Induced (Preventative) Burn Induced Capsular Contracture Reduction Breast Implants: Capsular Contracture Prevention Capsular Contraction 14

Tattoo Removal: First Indication

63%* are considering tattoo removal 44 million Americans 70 23% are want some form of MILLION “regretters”** tattoo removal 44 So, why isn’t this already MILLION a billion dollar business? US prospects 29% have at 240 least one tattoo MILLION *As demonstrated in our own proprietary market research conducted by iResearch in Total US Population conjunction with The Phillips Agency. ** The Harris Poll of 2,225 U.S. adults surveyed online from October 14-19, 2015. See disclosures at the beginning. 16

Laser Removal (current standard of care) presents huge barriers Complete tattoo removal means repeating visits >10 times over 1 - 2 years* Timeline reduction changes industry approach *December 2012 Archives of Dermatology There is no guarantee of any outcome. Patients' individual experiences may vary. 17

Statistically Significant Clinical Results § Soliton RAP delivered 75% or greater fading in 100% of patients* after 3 office visits § Outperformed “laser-only” 100%* of the time *Results presented from the Company’s 2017 clinical trial. Fading percentages were determined by a panel of unaffiliated doctors who reviewed the patient results and graded fading. There is no guarantee of any successful outcome for any clinical trial. 18

Complete removal of Before treated ink after 3 treatments After 3 Treatments Individual results will vary. For illustrative purposes only. 19

Cellulite Treatment: Second Potential Indication FOR INTERNAL USE ONLY. Do not distribute without permission.

95 54 million US MILLION Total US women want to Women Population improve their cellulite (Age 15-54) $4B market by 2025.* 81 80-90% suffer MILLION 5% market share = from cellulite $200M revenue. 67%** want to do something 54 about it MILLION US prospects *Is indicated in Medical News Today November 30, 2017. ** Per Cellfina.co.us/hcp-lets-talk-about-cellulite/ See disclosures at the beginning. 21

Competitive Landscape in Cellulite Long-term Side Patient Company Technology Noninvasive Avg Cost # Trmts Duration Effects Satisfaction Syneron Candela RF $1,600 4+ L 60% Cynosure RF & massage 6 L Solta RF $2,475 1 H 67% BTL RF & targeted pressure energy $3,100 4 L 90% Venus Concept RF & pulsed EM fields $2,050 6+ L 62% NOT Allergan Cryotherapy $2,425 1 M EFFECTIVE ON CELLULITE Soliton Rapid Acoustic Pulse $2,500 1 L 92% Merz Surgical Procedure $4,250 1 H 94% Cynosure Laser used under skin $5,775 1 H 92.5% $3,500 Endo Injected Drug 3 H 62.9% per vial

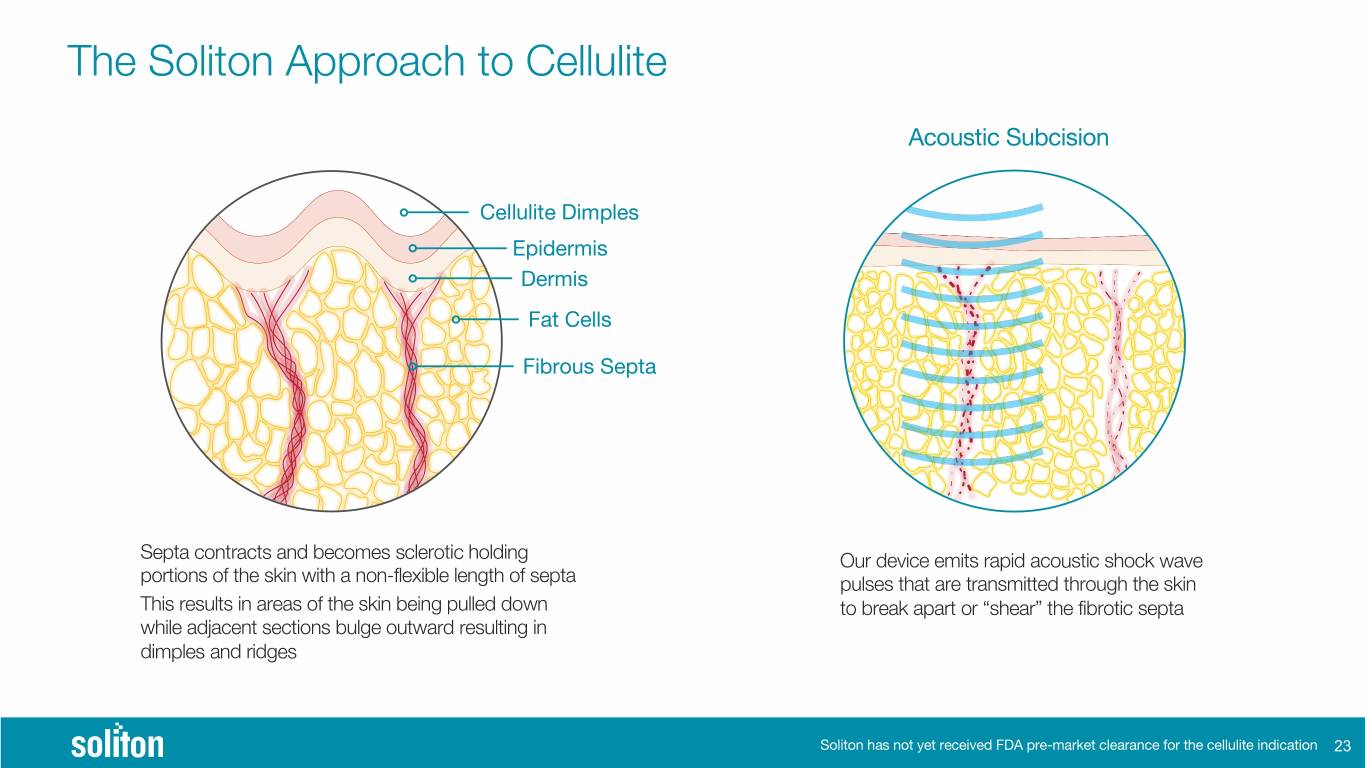

The Soliton Approach to Cellulite Acoustic Subcision Cellulite Dimples Epidermis Dermis Fat Cells Fibrous Septa Septa contracts and becomes sclerotic holding Our device emits rapid acoustic shock wave portions of the skin with a non-flexible length of septa pulses that are transmitted through the skin This results in areas of the skin being pulled down to break apart or “shear” the fibrotic septa while adjacent sections bulge outward resulting in dimples and ridges Soliton has not yet received FDA pre-market clearance for the cellulite indication 23

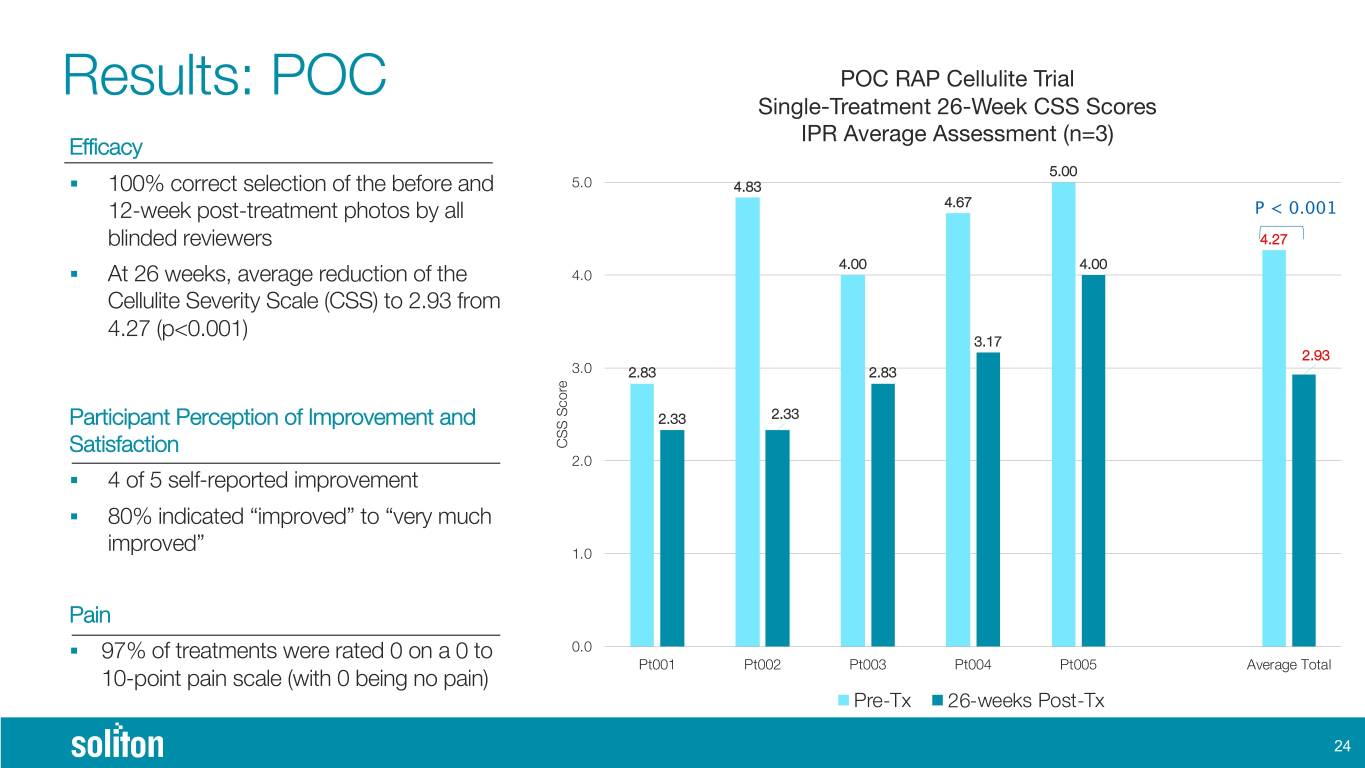

Results: POC POC RAP Cellulite Trial Single-Treatment 26-Week CSS Scores IPR Average Assessment (n=3) Efficacy 5.00 § 100% correct selection of the before and 5.0 4.83 12-week post-treatment photos by all 4.67 P < 0.001 blinded reviewers 4.27 4.00 4.00 § At 26 weeks, average reduction of the 4.0 Cellulite Severity Scale (CSS) to 2.93 from 4.27 (p<0.001) 3.17 2.93 3.0 2.83 2.83 Participant Perception of Improvement and 2.33 2.33 Satisfaction CSS Score 2.0 § 4 of 5 self-reported improvement § 80% indicated “improved” to “very much improved” 1.0 Pain § 97% of treatments were rated 0 on a 0 to 0.0 Pt001 Pt002 Pt003 Pt004 Pt005 Average Total 10-point pain scale (with 0 being no pain) Pre-Tx 26-weeks Post-Tx 24

POC Trial Patient after Single RAP Treatment Before 12-WK 26-WK

Keloid and Hypertrophic Scar Treatment: Third Potential Indication (and Support for Other Fibrotic Disease Targets) FOR INTERNAL USE ONLY. Do not distribute without permission.

Fibrotic Scar POC Trial Results Change in Keloid Volume Average Scar Volume Change at 6 and 12 weeks RAP V. Cryo+TAC Post Single 6 minute RAP Treatment 40 200 35 190.9 180 30 25 % Vol Change - RAP 160 20 % Vol Change - 4x Cryo+TAC VOLUME 29.6% RAP Treatment 140 15 Cryo+TAC Treatments 138.4 % Decrease in Volume 134.4 10 120 5 0 100 0 6 12 0 4 8 12 16 WEEKS NOTE: Head to head trial not conducted. Clinical results shown versus separate, independent study. Treatment Safety Toleration 10 patients (11 keloids); No unexpected adverse events; mild All patients (100%) stated RAP treatment was tolerable; average single 6-minute RAP treatment erythema; occasional pinpoint bleeding overall pain score during procedure: 2.2 on a 0-10 pain scale 27

COVID-19 IMPACT Significant economic impact on the aesthetic marketplace with majority of cosmetic dermatologists shuttering their practice during stay-at-home orders Revised commercial launch timeline appropriate in this environment; plan modified to incorporate cellulite technology into initial launch, if cleared by FDA, and advance cost down design of cartridges Impact on financial markets influencing Company’s financing strategy and driving decisions to defer commercialization spending and increase cash runway There is no guarantee of any successful outcome for any clinical trial. Projected numbers are estimates, are subject to change without notice and there is no guarantee such projections will be met. See disclosures at the end. 28

Post Covid-19 Tentative Commercialization Pathway 2020 2021 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 COVID-!9 IMPACT Brand Development FDA – Device Upgrades Staffing Additions COVID-!9 IMPACT Commercial Launch Sales Force Build Cellulite FDA Clearance This schedule portrays a possible path to commercialization. The remaining impact of COVID-19 on the aesthetic and financial markets continue to create uncertainty around the timing of launch for the Company. 29

Key Milestones MILESTONE ANTICIPATED TIMING FDA Clearance for Tattoo Removal May 2019 Cellulite POC study– 26-week time point May 2019 Cellulite POC 26-week Data Release in Las Vegas Aesthetics Show July 2019 Initiate Cellulite Pivotal Trial Mid 2019 Keloid Scarring POC Trial Mid 2019 FDA Clearance for Gen II RAP Device upgrades Q1 2020 Announce Pivotal Cellulite Results Q2 2020 File FDA Application for Cellulite Q2 2020 Cellulite FDA clearance Q420-Q121 Commercial Launch for Tattoo Impacted by COVID-19 2H 2020, if not impacted POC Study – Fourth indication by COVID-19 Keloid POC2 – DOSING to be initiated 2H 2020, if not impacted by COVID-19 30

Thank you Rapid Acoustic Pulse Technology (Nasdaq: SOLY) FOR INTERNAL USE ONLY. Do not distribute without permission.