Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LUMINEX CORP | lmnx-20200514.htm |

INVESTOR PRESENTATION MAY 2020 Homi Shamir, President and CEO

SAFE HARBOR STATEMENT This presentation is being made exclusively to investors that are both institutional accredited investors (within the meaning of Rule 501 promulgated under the Securities Act of 1933, as amended (the “Securities Act”)) (“IAIs”) and qualified institutional buyers (“QIBs”) as defined in Rule 144A (“Rule 144A”) under the Securities Act. The securities described herein have not been and will not be registered under the Securities Act and may not be offered or sold in the United States except to investors that are both IAIs and QIBs in reliance on Section 4(a)(2) of the Securities Act or pursuant to another exemption from, or transaction not subject to, the registration requirements of the Securities Act. This document does not constitute an offer to sell, or a solicitation of an offer to purchase, any securities in any jurisdiction where such offer or sale is not permitted. Any purchaser of such securities will be deemed to have made certain representations and acknowledgments, including, without limitation, that the purchaser is both an IAI and a QIB. Certain statements made during the course of this presentation may not be purely historical and consequently may be forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements made regarding: our Licensed Technologies Group model and the ability of our licensees and installed base to drive future growth; the ability of our technology to enhance productivity and efficiency; our financial position and long-term revenue growth; our ability to integrate our acquisition of the MilliporeSigma flow cytometry business; our molecular diagnostic business model, the markets we are targeting, market segmentation, expected growth of such markets, and the ability of our products to address those markets; sales of our products, their technical capabilities, and the anticipated market size and acceptance, demand and regulatory environment and approvals therefor; our direct sales efforts; our system placements; our system and assay product pipeline and anticipated timelines for regulatory approvals and market releases, including for ARIES® and VERIGENE® instrumentation and assays, and our flow cytometry product lines; market opportunity for ARIES®, VERIGENE®, and our flow cytometry products; functionality and benefits of ARIES®, VERIGENE®, and the flow cytometry products and competitive position; reimbursement trends; our ability to drive growth through investment in R&D and next generation systems and focus on operating leverage and managing operating costs; our long-term financial targets; our key steps and strategies for growth; our strategic outlook and growth plan for our business for 2020 and beyond; operational trends, including those related to sales of systems, assays, consumables, and royalty revenues; competitive threats and products offered by other companies; our business outlook, financial targets and projections about revenues, cash flows, system shipments, expenses and market conditions, and their anticipated impact on Luminex for 2020 and beyond; and, any statements of the plans, strategies and objectives of management for future operations. These forward-looking statements speak only as of the date hereof and are based on our current beliefs and expectations and are subject to known or unknown risks and uncertainties, some of which are beyond our control, that could cause actual results or plans to differ materially and adversely from those anticipated in the forward-looking statements. Factors that could cause or contribute to such differences are detailed in our annual, quarterly, or other filings with the Securities and Exchange Commission. We undertake no obligation to update these forward-looking statements. Also, certain non-GAAP financial measures, as defined by SEC Regulation G, may be covered in this presentation. To the extent that any non-GAAP financial measures are covered, a presentation of and reconciliation to the most directly comparable GAAP financial measures will be included in this presentation and may be available on our website at luminexcorp.com in accordance with Regulation G. complexity simplified. 2

OVERVIEW MOLECULAR LIFE SCIENCE & DIAGNOSTICS CLINICAL TOOLS (MDx) (Tools) LICENSED FLOW TECHNOLOGIES AUTOMATED NON-AUTOMATED CYTOMETRY GROUP (LTG) complexity simplified. Recurring revenue items 3

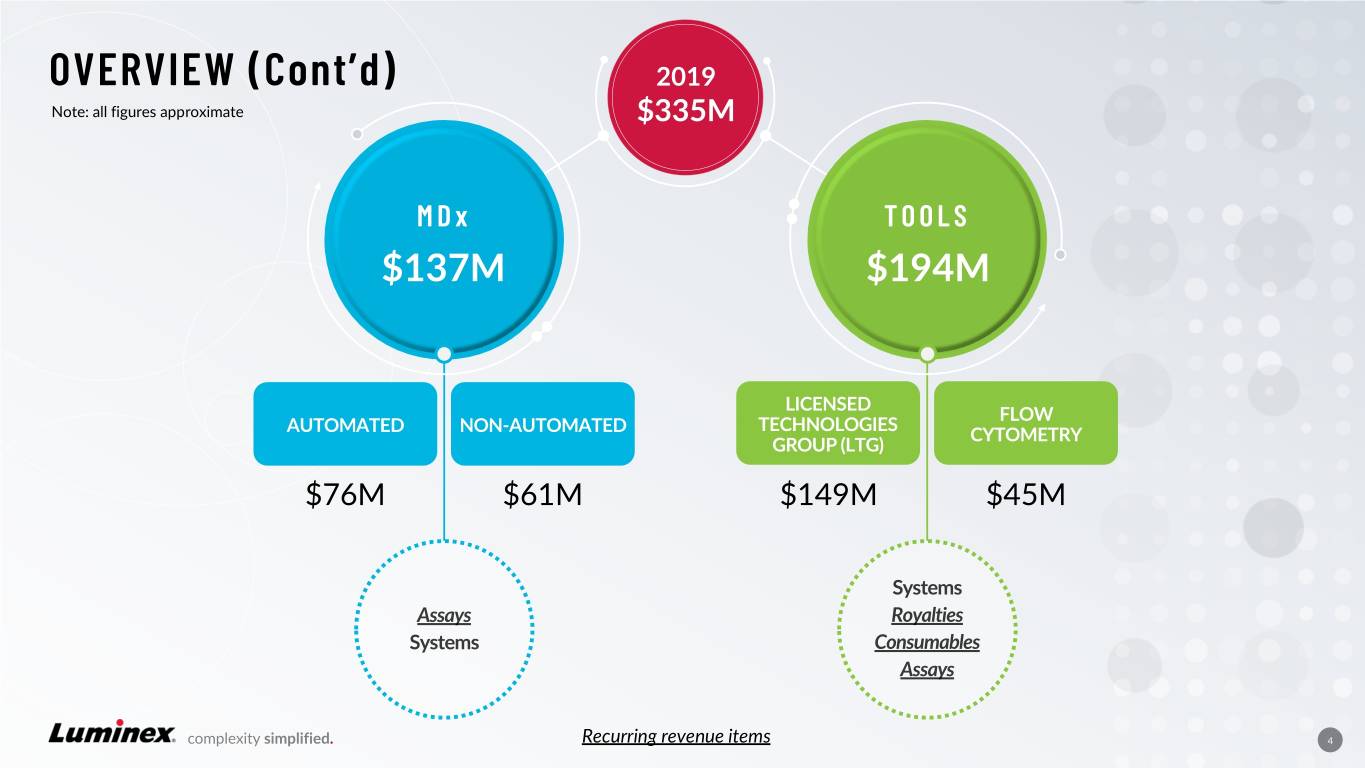

OVERVIEW (Cont’d) 2019 Note: all figures approximate $335M M Dx TOOLS $137M $194M LICENSED FLOW TECHNOLOGIES AUTOMATED NON-AUTOMATED CYTOMETRY GROUP (LTG) $76M $61M $149M $45M complexity simplified. Recurring revenue items 4

OVERVIEW (Cont’d) Q1 2020 Note: all figures approximate $90.4M +$8.0M/+10% M Dx vs. Q1 2019 TOOLS $45.2M $43.3M +$9.9M/+28% -$2.9M/-6% vs. Q1 2019 vs. Q1 2019 LICENSED FLOW TECHNOLOGIES AUTOMATED NON-AUTOMATED CYTOMETRY GROUP (LTG) $26.3M $18.9M $36.8M $6.5M +$7.3M/+38% +$2.6M/+16% +$1.9M/+5% -$4.9M/-43% vs. Q1 2019 vs. Q1 2019 vs. Q1 2019 vs. Q1 2019 complexity simplified. Recurring revenue items 5

OUR RECENT 5-YEAR JOURNEY SIGNIFICANT REVENUE INCREASE: $227M TO $335M FROM 2014 TO 2019, 8% REVENUE CAGR 12% REVENUE CAGR (Ex-LabCorp) VERIGENE® II GI FDA ARIES® Submission 7 FDA Clearances Flow Cytometry Acquisition Nanosphere Acquisition Homi Shamir Joins Luminex NOV as CEO 2019 2015- 2019 JAN JUN 2019 OCT 2016 2014 complexity simplified. 6

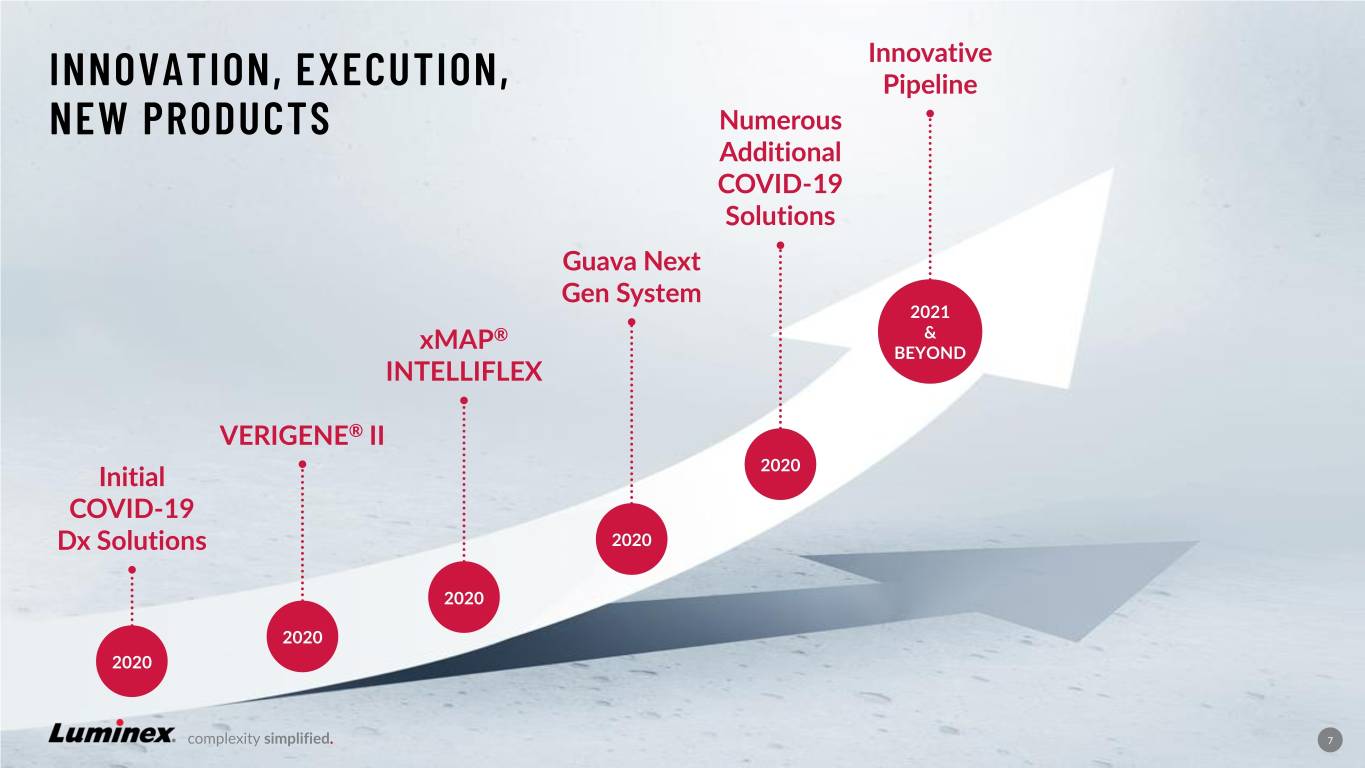

Innovative INNOVATION, EXECUTION, Pipeline NEW PRODUCTS Numerous Additional COVID-19 Solutions Guava Next Gen System 2021 ® & xMAP BEYOND INTELLIFLEX VERIGENE® II Initial 2020 COVID-19 Dx Solutions 2020 2020 2020 2020 complexity simplified. 7

RECENT HIGHLIGHTS/ NEW PRODUCTS 8

COVID-19 SOLUTIONS PCR-BASED TESTS look for the virus’s genetic material in saliva or mucus Currently, there are three types of samples to diagnose people who commercially available tests: are currently infected with the PCR-based, antigen and antibody. novel coronavirus. Luminex’s multiplexed PCR-based ANTIGEN TESTS tests, which have already received EUA clearances, use our NxTAG® and are designed to detect viral ® proteins, which in the case of ARIES Systems. In addition, in Q3 we COVID-19, come from the spikes plan to submit multiplex panels which that coat the surface of the virus include SARS-CoV-2 targets on that trigger an immune response VERIGENE® I, II and NxTAG Systems. in the body. Finally, we plan to submit several serology tests in the near future. ANTIBODY TESTS use blood samples to find signs of prior viral infection. complexity simplified. 9 9

MULTIPLE COVID-19 SOLUTIONS FOR THE LONG-RUN ARIES® • Targeted, sample-to-answer diagnostic testing Molecular VERIGENE® • Syndromic, sample-to-answer diagnostics and surveillance Testing • Syndromic, high-throughput, cost-effective diagnostic testing ® MAGPIX • SARS-CoV-2 serology testing for immunity monitoring, vaccine development Serology Testing LX 200/ • High-throughput, multiplex serology, Vaccines/ FM3D cytokine & proteomic research Therapeutics/ Cell Research xMAP® • High-throughput, multiplex serology research INTELLIFLEX • Vaccine, therapeutic, cytokine & proteomic research SHORT/MID-TERM: DIAGNOSTICS AND SEROLOGY LONG-TERM: RESEARCH, THERAPEUTICS AND HELP FLATTEN THE CURVE VACCINES HELP LOWER THE CURVE complexity simplified. 10

LUMINEX’S PORTFOLIO IS IDEALLY SUITED FOR ALL PHASES OF COVID -19 xMAP® Guava® ARIES® VERIGENE® VERIGENE® II MAGPIX® LX200/FM3D INTELLIFLEX easyCyte™ ImageStream® Description Molecular Dx MDx / Serology Serology Life Science Research Instruments Summer 2020 Test Kits In Dev. In Dev. In Dev. Acute Dx EUA / LDT In Dev. In Dev. EUA Syndromic Dx In Dev. In Dev. Immunity Status EUA / In Dev. In Dev. Convalescent Serum In Dev. In Dev. Planned 19 INDICATIONS 19 Tx / Vaccine Dev. RUO RUO Planned RUO RUO - Surveillance RUO RUO RUO Planned COVID Research RUO RUO RUO RUO RUO Kits Available On Market Q3 2020 Q3 2020 On Mkt / May ‘20 June 2020 Summer 2020 On Market On Market Complexity Moderate High Moderate High High N/A N/A N/A S2A / LDT S2A / Value / Plex / High-Powered S2A Plex Easy to Use Value Proposition Capability Syndromic High Throughput Dual Reporter Imaging Primary Market: U.S. Global complexity simplified. 11

NEW AND TRANSFORMATIVE ERA FOR LUMINEX ANTICIPATED PLANNED LAUNCH OF 3 NEW PLATFORMS IN 2020 1 VERIGENE® II* ‒ Designed to offer flexibility like never before ‒ Launch expected in mid-2020, if cleared 2 xMAP® INTELLIFLEX ‒ Designed to provide modern enhancements for the gold standard multiplexing platform ‒ Launch expected in mid-2020 3 NEXT GEN GUAVA easyCYTE™ SYSTEM ‒ Designed to offer flexible, intuitive and affordable cytometry ‒ Launch expected in mid-2020 complexity simplified. *510(k) applications currently under review by FDA; launch is subject to FDA clearance 12 12

SCALING UP MOLECULAR TEST CAPACITY TO ADDRESS COVID-19 SHIPMENTS CAPACITY Q4 2019 EOQ1 Run Rate EOQ2 Run Rate By EOY 2020 ® RPP Panel: COVIDP -19 EUA: COVID-19 EUA: COVID-19 EUA: NxTAG 93,500 Tests/mo. 380,000 Tests/mo. 760,000 Tests/mo. 760,000 Tests/mo. ® Flu Panel: COVID-19 ASR: COVID-19 EUA: COVID-19 EUA: ARIES 47,000 Tests/mo. 115,000 Tests/mo. 192,000 Tests/mo. 345,000 Tests/mo. EUA Submission EUA Submission RP Flex Panel: RP Flex Panel: ® for COVID-19: for COVID-19: VERIGENE I 81,000 Tests/mo. 100,000 Tests/mo. 100,000 Tests/mo. 100,000 Tests/mo. EUA Submission VERIGENE® II for COVID-19: 40,000 Tests/mo. complexity simplified. 13

FINANCIAL OVERVIEW 14

Q1 2020A REVENUE $ in thousands PY Variance: Q1 2020 Q1 2019 $ % TOTAL MDx 45,237 35,291 9,946 28% System Revenue 6,266 6,046 220 4% Consumable Revenue 12,360 10,258 2,102 20% Royalty Revenue 13,078 13,972 (894) -6% Other Partner | Life Science 5,048 4,625 423 9% PARTNERS | LIFE SCIENCE 36,752 34,901 1,851 5% FLOW | LIFE SCIENCE 6,537 11,355 (4,818) -42% OTHER 1,898 861 1,037 120% TOTAL REVENUE $ 90,424 $ 82,408 $ 8,016 10% Multiplexing Systems 223 210 13 6% S2A Systems 23 8 15 188% Amnis Systems 6 21 (15) -71% Guava/Muse Systems 48 66 (18) -27% TOTAL CAPITAL SALES 300 305 (5) -2% complexity simplified. 15

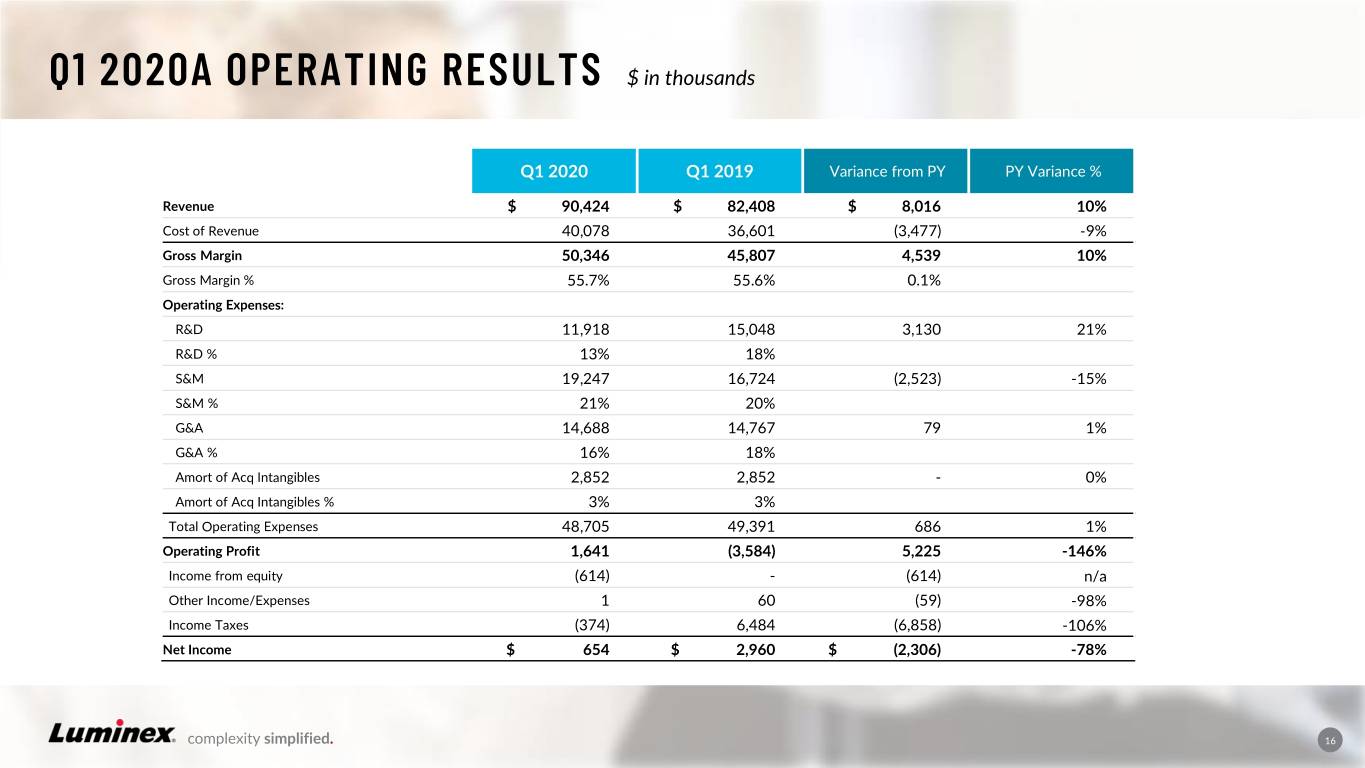

Q1 2020A OPERATING RESULTS $ in thousands Q1 2020 Q1 2019 Variance from PY PY Variance % Revenue $ 90,424 $ 82,408 $ 8,016 10% Cost of Revenue 40,078 36,601 (3,477) -9% Gross Margin 50,346 45,807 4,539 10% Gross Margin % 55.7% 55.6% 0.1% Operating Expenses: R&D 11,918 15,048 3,130 21% R&D % 13% 18% S&M 19,247 16,724 (2,523) -15% S&M % 21% 20% G&A 14,688 14,767 79 1% G&A % 16% 18% Amort of Acq Intangibles 2,852 2,852 - 0% Amort of Acq Intangibles % 3% 3% Total Operating Expenses 48,705 49,391 686 1% Operating Profit 1,641 (3,584) 5,225 -146% Income from equity (614) - (614) n/a Other Income/Expenses 1 60 (59) -98% Income Taxes (374) 6,484 (6,858) -106% Net Income $ 654 $ 2,960 $ (2,306) -78% complexity simplified. 16

GUIDANCE • Expecting Q2 2020 revenue to equal or exceed $105M • COVID-19 activity driving increased molecular diagnostic sales • Expecting potential doubling of total sample-to-answer revenue in Q2 2020 vs. Q2 2019 (~$18M in Q2 2019) • Experiencing very strong demand for our NxTAG® Respiratory Pathogen Panel • Anticipating Flow Cytometry to be down in Q2 2020 vs. Q2 2019, but the percentage decline will be smaller than in Q1 • Expecting LTG revenue for Q2 2020 to be ~flat vs. Q2 2019 • Overall, forecasting FY 2020 revenue to exceed top end of previous guidance range of $362M complexity simplified. 17

SUMMARY OF THE CONVERTIBLE NOTES OFFERING KEY TRANSACTION TERMS Offering size: $260M Maturity: May 15, 2025 (5 year) Coupon: 3% Conversion premium: 25% (up 100% with call spread) Call features: ~$220M after call spread & fees Investor puts: None Ranking: Senior unsecured Offering format: 4(a)(2) private placement Settlement: Option to settle in cash, stock, or any combination Timing: After market close, Thursday, May 7, 2020 Use of proceeds: Net proceeds from the offering will be used to purchase the call spread and for general corporate purposes. Luminex may also use a portion of the net proceeds from the offering to acquire or invest in complementary businesses, assets or technologies, although we have no present commitments or agreements to do so. complexity simplified. 18

LUMINEX INVESTMENT HIGHLIGHTS DIVERSIFIED PRODUCT SERVING MULTI-BILLION OFFERINGS DOLLAR MARKETS • Automated & Flexible Targeted & • Life Science Research Syndromic MDx Solutions • Clinical Diagnostics • Non-Automated MDx Solutions • Life Science and Clinical Tools EXCITING NEW PRODUCT PIPELINE RAZOR/RAZORBLADE ® MODEL • COVID-19 NxTAG EUA Entering a New & • COVID-19 ARIES® EUA • Expanding Installed Base Across Transformative Era • 2 COVID-19 Serology Solutions Multiple Channels • 3 New Platform Launches with Strong Organic • Recurring (Annuity) Revenue Planned in 2020 Comprises over 75% of Total Growth, Profitability • 3 Additional COVID-19 Solutions and Cash Flow • VERIGENE® I SARS-CoV-2 STRONG BALANCE SHEET • VERIGENE® II SARS–CoV-2 ® • Cash Balance of ~$275M • NxTAG RPP+SARS-CoV-2 • Quarterly Cash Dividend • Robust Selection of Additional New Platforms & Opportunities complexity simplified. 19

THANK YOU 20