Attached files

| file | filename |

|---|---|

| EX-32.2 - Worksport Ltd | ex32-2.htm |

| EX-32.1 - Worksport Ltd | ex32-1.htm |

| EX-31.2 - Worksport Ltd | ex31-2.htm |

| EX-31.1 - Worksport Ltd | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended: December 31, 2019

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 000-27631

Franchise Holdings International, Inc.

(Exact Name of Small Business Issuer as specified in its charter)

| Nevada | 65-0782227 | |

| (State or Other Jurisdiction of | (I.R.S. Employer | |

| Incorporation or Organization) | Identification Number) |

414-3120 Rutherford Rd

Vaughan, Ontario, Canada L4K 0B1

(Address of Principal Executive Offices, Including Zip Code)

Registrant’s Telephone Number, including area code: (888) 554-8789

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 per share par value

Indicate by check mark if registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all Reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter year that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes: [X] No: [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or such shorter year that the registrant was required to submit and post such files. Yes [ ] No [X]

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B is contained in this form and no disclosure will be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K.[X]

Indicate by check mark whether the registrant is a large accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition year for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes [ ] No [X]

As of May 14, 2020, there were the following shares outstanding: Common Stock, $0.0001 par value, 47,037,772. Preferred stock, $0.001 par value, 1,000 preferred shares.

Franchise Holdings International, Inc.

INDEX

FRANCHISE HOLDINGS INTERNATIONAL, INC.

TABLE OF CONTENTS

| Page 2 of 40 |

References in this document to “Franchise Holdings,” “us,” “we,” “our” or “Company” refer to Franchise Holdings International, Inc. unless the context indicates otherwise.

Cautionary Statements under the Private Securities Litigation Reform Act of 1995

Forward-Looking Statements

The following discussion contains forward-looking statements regarding us, our business, prospects and results of operations that are subject to certain risks and uncertainties posed by many factors and events that could cause our actual business, prospects and results of operations to differ materially from those that may be anticipated by such forward-looking statements. Factors that may affect such forward-looking statements include, without limitation: our ability to successfully develop new products and services for new markets; the impact of competition on our revenues, changes in law or regulatory requirements that adversely affect or preclude clients from using us for certain applications; delays our introduction of new products or services; and our failure to keep pace with our competitors. When used in this discussion, words such as “believes”, “anticipates”, “expects”, “intends” and similar expressions are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We undertake no obligation to revise any forward-looking statements in order to reflect events or circumstances that may subsequently arise. Readers are urged to carefully review and consider the various disclosures made by us in this report and other reports filed with the Securities and Exchange Commission that attempt to advise interested parties of the risks and factors that may affect our business.

| Page 3 of 40 |

Narrative Description of the Business

Our History

Franchise Holdings was incorporated in the State of Nevada on April 2, 2003. Franchise Holdings International, Inc. completed a merger with TMAN Global.com Inc. on April 30, 2003. This merger was in the nature of a change in domicile of the Florida corporation to the State of Nevada, as well as the acquisition of a new business. Since the inception of our current business operations, we have been in the business of acquiring franchise, license and distribution rights in new and emerging growth companies.

On December 16, 2014, Franchise Holdings International, Inc. (FNHI) entered into an Agreement (the “Agreement”) to acquire all issued and outstanding shares of Worksport Ltd. (The Company” or Worksport”), an Ontario (Canada) corporation located at 8820 Jane St, Vaughan, Ontario, L4K 2M9 Canada.

Operations

General

Worksport was founded in 2011 to take advantage of the limited innovation provided by existing tonneau cover manufacturers. Tonneau covers have remained much the same in price and design since 2005, with one main company controlling a majority of the tonneau cover market. This dynamic market segment is in need of a new innovative manufacturer of high quality, functional, and aggressively priced tonneau covers. Worksport has developed multiple products for the most prominent pick-up trucks available in North America. Details of each product can be found at www.Worksport.com. Worksport sells its products through wholesalers in Canada and the U.S. and through third-party online retailers. Worksport also manufactures its patented designed covers for other businesses under its private label and OEM manufacturing initiative.

On April 20th, 2018, the board of directors approved special resolutions to the articles of incorporation of Truxmart Ltd, as incorporated in the province on Ontario, Canada. The articles of the Corporation were amended to change the name of the Corporation from Truxmart Ltd. to Worksport Ltd.

Nature of Products and Services

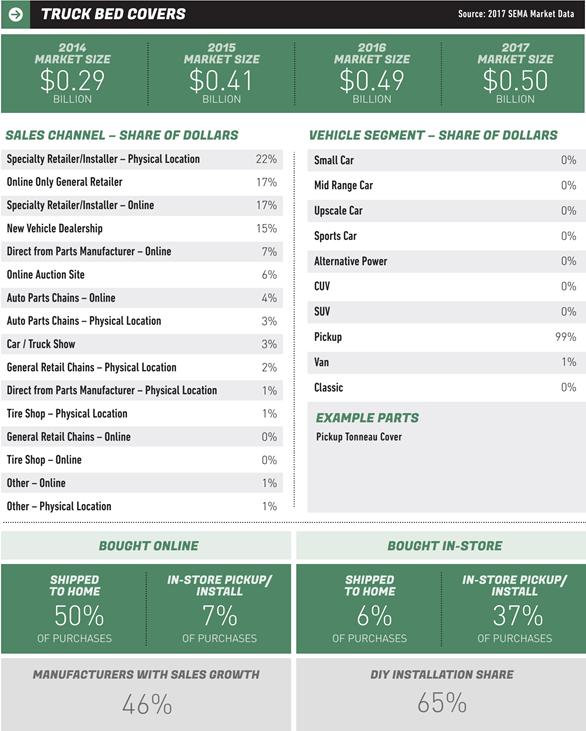

2018 SEMA Report

The 2018 SEMA Report shows the results of the previous year and indicates that 2017 was another good year for the specialty-equipment industry. The overall size of the market grew to $42.92 billion. The 4% growth continues a multiple-year trend. SEMA projects that enter the market will continue to grow through the end of 2018 and bring retail sales close to $45 billion.

This current growth trend is fueled by strong overall economic performance, including an ongoing decline in unemployment and growth in consumer spending. A strong economy paired with rising consumer confidence means that more people are willing to spend money on discretionary items, such as specialty automotive parts. While new vehicle sales have leveled off, they still remain at near-record highs—close to 17 million per year. Recently announced tariffs on imported steel, aluminum, etc. and other policy changes could affect the economy and the industry in 2018, but to this point, demand has been strong.

| Page 4 of 40 |

(excerpt from 2018 SEMA report, relating to the tonneau cover aftermarket in USA / non-oem dealer sales)

| Page 5 of 40 |

2019 Truck Market: Snapshot

Canada New Pickup Truck Sales by Month (All Models)

This sales data table looks at monthly sales performance for the pickup truck segment in Canada on a month to month basis for the entire year so far. It includes all major pickup truck models sold in the Canadian market and you can see that the monthly pickup truck sales trends clearly. Seeing the individual pickup truck model sales performance in this way gives you a good sense of the momentum (good or bad).

| Model | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||||||||||||||||||||||||||||||||||||

| Chevrolet Colorado | 463 | 529 | 796 | 828 | 922 | 696 | 804 | 841 | 891 | 723 | 615 | 423 | ||||||||||||||||||||||||||||||||||||

| Chevrolet Silverado | 3,208 | 3,159 | 4,803 | 4,991 | 5,140 | 208 | 4,080 | 3,867 | 5,216 | 4,429 | 3,766 | 2,970 | ||||||||||||||||||||||||||||||||||||

| Ford F-Series | 8,554 | 8,455 | 13,098 | 13,513 | 15,891 | 15,394 | 13,862 | 14,600 | 13,675 | 10,972 | 11,068 | 6,128 | ||||||||||||||||||||||||||||||||||||

| Ford Ranger | 201 | 173 | 381 | 522 | 589 | 524 | 750 | 756 | 854 | 430 | 428 | 995 | ||||||||||||||||||||||||||||||||||||

| GMC Canyon | 333 | 381 | 574 | 597 | 665 | 502 | 579 | 606 | 312 | 415 | 353 | 219 | ||||||||||||||||||||||||||||||||||||

| GMC Sierra | 2,790 | 3,190 | 4,185 | 4,748 | 4,993 | 3,089 | 3,552 | 4,957 | 5,265 | 4,465 | 3,601 | 4,011 | ||||||||||||||||||||||||||||||||||||

| Honda Ridgeline | 247 | 201 | 284 | 320 | 365 | 310 | 291 | 311 | 252 | 244 | 356 | 224 | ||||||||||||||||||||||||||||||||||||

| Jeep Gladiator | - | 2 | - | 7 | 166 | 278 | 71 | 981 | 375 | 402 | 496 | 272 | ||||||||||||||||||||||||||||||||||||

| Nissan Frontier | 300 | 264 | 395 | 426 | 504 | 277 | 232 | 312 | 314 | 265 | 234 | 200 | ||||||||||||||||||||||||||||||||||||

| Nissan Titan | 292 | 243 | 390 | 260 | 214 | 338 | 222 | 178 | 143 | 142 | 221 | 164 | ||||||||||||||||||||||||||||||||||||

| Ram Pickup | 5,496 | 6,394 | 7,230 | 8,335 | 9,697 | 9,563 | 7,277 | 8,345 | 8,177 | 6,733 | 5,727 | 6,619 | ||||||||||||||||||||||||||||||||||||

| Toyota Tacoma | 852 | 733 | 1,055 | 1,324 | 1,169 | 1,186 | 1,147 | 1,121 | 865 | 1,078 | 1,139 | 867 | ||||||||||||||||||||||||||||||||||||

| Toyota Tundra | 612 | 631 | 909 | 952 | 1,134 | 867 | 882 | 1,139 | 641 | 617 | 907 | 675 | ||||||||||||||||||||||||||||||||||||

https://www.goodcarbadcar.net/2019-canada-pickup-truck-sales-figures-by-model/

| Page 6 of 40 |

USA

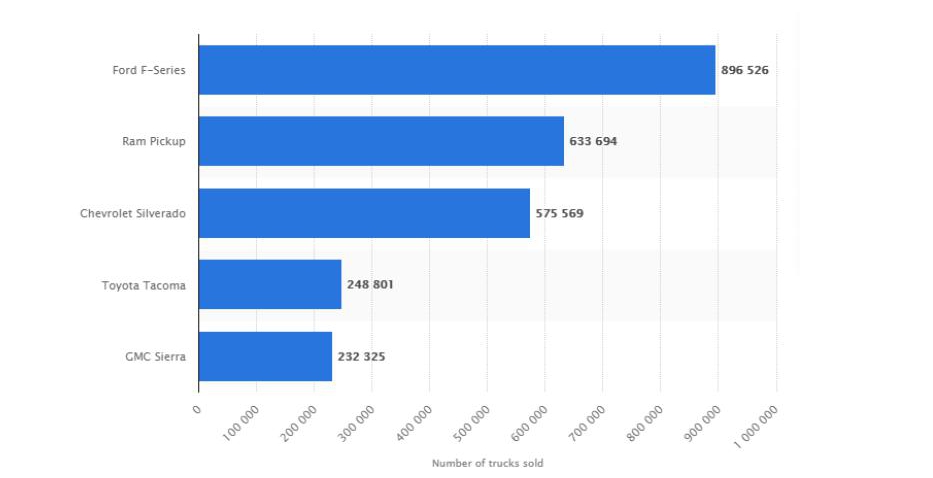

United States - best-selling light trucks – 2019

With year-end sales of almost 900,000 units, the Ford F-Series was the best-selling light truck in the United States. The Ford F-Series is a series of full-size pickup trucks, the most popular variant being the F-150. The 14th generation of this model will be released in 2020.

2019 best-selling light trucks in the United States

After years of recovery in demand for vehicles, U.S. car and light truck sales growth slowed down in 2019, compared with the year before. U.S. light vehicle sales came to around 17 million units in 2019, some 12.2 million of which were light trucks. With the exception of Toyota pickups, light trucks built by U.S.-based automakers continue to be favorites among U.S. vehicle buyers. The Ford F-Series, which has been one of the most popular automobiles with U.S. buyers for years, was ranked as the best-selling light truck in the United States at year-end 2019. The second spot was claimed by Chrysler’s Ram Pickup, followed by GM’s Chevrolet Silverado and the Toyota Tacoma.

https://www.statista.com/statistics/204473/best-selling-trucks-in-the-united-states-from-january-to-october-2011/

Background

For many years, consumers have had very limited options available to them from tonneau cover manufacturers. The leading manufacturers in the North American market have had very few new model developments. The tonneau cover market can be divided into four main styles of covers:

1. Soft Folding & Roll-up covers (Vinyl covers)

2. Hard Folding & Standing Covers (Aluminum and FRP)

3. Solid one piece caps and lids (Plastic & Fiberglass)

4. Retractable Covers (Plastic & Aluminum)

We believe the consumer favors models that are the least cumbersome, most functional, and lowest initial cost. Solid one piece covers and retractable covers are the least desirable because of their limited functionality and overall cost. Therefore, the most popular covers in today’s market are soft and hard folding/rolling tonneau covers.

| Page 7 of 40 |

Market Analysis and Distribution

The Specialty Equipment (aftermarket) consists of three major types of customers which include; master warehouse distributor, dealer/wholesaler, and end retail consumer. Master warehouse distributors will stock and distribute product to their customers, which are usually local dealers and wholesalers. Dealers and wholesalers are local stores which sell product to some businesses and retail consumers in their area and online. Dealers will purchase most of their product from their local distributor who will deliver to them regularly. Retail end consumers are simply the end user of your product. Worksport currently sells its product line through distributors and dealer networks.

The OEM market consists of vehicle manufactures with corporate offices and distribution points globally. Specifically, within North America the OEM market would consist of corporate offices and warehouses in Canada, USA, and Mexico. Target OEM’s for Worksport would be:

Toyota Motor Co.

Ford Motor Co.

Nissan Motor Co.

General Motors

FCA Automotive (RAM Trucks)

In 2017, each vehicle manufacturer above, purchases their OEM brand tonneau covers (tonneau cover installed at the factory) from an independent accessory manufacturer, such as Worksport. No vehicle manufacturer designs and manufacturers their own tonneau covers.

Worksport’s target market includes master warehouse distributors and dealers.

In the Canadian market, Worksport does the majority of its business with warehouse distributors, and select dealer customers. In the US market, Worksport’s customer base is mostly dealers and wholesalers.

Worksport USA is a supplying member of one of the largest after-market buying groups in the USA. American Aftermarket Group (AAG), owned by Line-X coatings, consists of over 700 car and truck accessory stores. Being a supplying member of AAG gives Worksport access to most of the large truck accessory dealers, wholesalers, and online stores in the USA. Our products are sold to AAG members by the sales staff at AAG and all customer service and maintenance is done through phone calls, emails, and infrequent visits.

Worksport Canada sells to only select dealers in Ontario as well as, the largest warehouse distributor in eastern Canada. Robert Thibert in Châteauguay, QC has over 600,000 square feet of warehouse space in three provinces in Canada. Robert Thibert is responsible for stocking and selling our product to their customer base in Canada. Worksport dealer sales in Ontario are to only select dealers who assist with product feedback.

Regular contact is made with our customer base about new product, promotions, updates, and general sales by phone, email, and in person, when possible.

A partial list of our customers includes:

Enterprise Robert Thibert (Québec, Canada)

Trailer Parts Etc. (Florida, USA)

AutoAnything (California)

Turn 5 Distributing

| Page 8 of 40 |

Competition

Companies that compete in this market are Truck Hero Group, Tonno Pro and Rugged Liner however not all companies charge competitive prices:

The Extang (TruckHero) Trifecta retails in the USA for $425. The Tonno Pro Tri Fold retails for $269. The Rugged Liner Tri Fold retails for $329. Whereas the Worksport Tri Fold retails for CAD$259; US$239.

The Extang Solid Fold retails in the USA for $799. The Rugged Liner Hard Fold retails for $689. The Worksport Forte retails at CAD$699; US$689.

Low profile Roll-Up covers are manufactured by many different companies. The two most popular Roll-Up covers are the Truxedo (TruckHero) Low-ProQT, which retails for $499 and the Tonno Pro Low-Roll which retails for $269. The Worksport Roll-Up retails for $CAD299; US$269.

Truck Hero Group is the holding company for Extang Corporation, TruXedo, Inc., BedRug, Inc, UnderCover Inc., Advantage Truck Accessories Inc, Retrax Inc, and BAK Industries, NFAB, RealTruck.Com, Auto Customs, and ARE Truck Caps. They account for the majority of the competing brands in North America.

The area of biggest growth in the tonneau cover market is in the area of aggressively priced hard folding tonneau covers. Currently, the market distribution is shared by three primary participants, with LKQ/Keystone considered the market leader.

Sales, Marketing and Distribution Strategy

Worksport’s sales strategy is constantly changing and dynamic. Sales are made through warehouse distributors, as they typically handle product sales and promotion through their in-house sales department. To fully saturate the market a business must entice the retail consumer to purchase its product by way of a strong internet presence which will consist of YouTube videos and commercials, an interactive website, search engine optimization, social media, etc. The next step is to have strong working relationships and reputations among dealers and wholesalers who purchase Worksport’s product, either directly or through distributors.

Worksport will continue to grow private label sales where Worksport sells products, branded as other companies’ products. Clients who wish to participate in the tonneau cover market, but do not have the ability to navigate the complex manufacturing processes paired with challenging intellectual property rights can utilize Worksports designs, patents, factories, and distribution infrastructure to be able to stock and sell its own unique product without facing any challenges of directly manufacturing.

Worksport hopes to become the leader in the tonneau cover market through innovation. Our main objective is to design and engineer our products to better suit todays new, dynamic, and innovative models of light trucks.

Worksport hopes to become a significant player in our market segment by always maintaining a strong emphasis on customer service, innovation, quality, and a robust global branding.

Worksport’s target market is North, Central, and South America with future plans to expand globally to other market opportunities. Worksport intends to earn revenues from both the automotive specialty equipment market as well as OEM production for vehicle manufactures, globally.

Worksport also plans to gain market share and core value by internally engineering our products to best suit the evolving needs of the consumer as well as a strong intellectual property portfolio (3 Granted Patents, 3 patent applications in Canada and USA – as of 2019)

| Page 9 of 40 |

The Company’s current product lines are as follows:

1. Worksport SC3: Tri Fold (introduced in 2011)

The Worksport Tri Fold is our staple soft folding tonneau cover. The Tri Fold is made with features such as stainless steel hardware, double coated vinyl tarp, and all aluminum and plastic coated front clamps. The Tri Fold is made available to our customer base at an average cost savings of 5% over competing products. Worksport has designed multiple unique variations of this product and is currently manufacturing various versions for Worksport branded sales, as well as private label clients.

2. Worksport SC3Pro: Smart Fold (introduced in 2012)

The Worksport Smart Fold is our second product to market and offers our patented rear Smart Latch system. The Smart Fold is the first innovation in the rear latching system offered on soft folding tonneau covers. The Smart Fold cover comes with all of the same features as the Tri Fold but with a new rear latch system that allows the cover to be opened by simply pulling a release cable which is a new innovation in the soft tri fold segment of our market.

The Company introduced three new products at the Specialty Equipment Manufacturers Association (SEMA) show in Las Vegas in November 2014. These products were the following:

3. Worksport SC4: Quad-Fold (Introduced 2015)

The Worksport Quad-Fold will be the first vinyl wrapped tonneau cover to fold in four sections. This cover will also allow its users full bed access by being foldable upwards towards the rear window of the truck. We chose to make the world’s first quad folding cover so this cover is more compact when standing parallel to the back window of a truck, thus eliminating wind resistance and rear window obstruction.

4. Worksport HC3: Forte (2nd Gen launched in 2016 as Private Label in Canada Only)

Taking valuable information learned from the launch of the first generation Worksport Forte. The all-new redesigned Worksport Forte “GEN2” has been engineered to be easy to install and operate while being offered at an MAP price that fills a much needed void between soft and hard tonneau covers.

The GEN2 Forte cover will now be built using 6MM thick aluminum panels with a robust honeycomb core, coated in a durable matte-black scratch resistant powder coating. The GEN2 Forte cover will be 30% lighter and cost 25-30% less to manufacture. With robust packaging, the lighter weight GEN2 Forte will also save time and money with up to 10% more load quantity in a standard 40’ HC container, therefore maximizing value and product profitability. Notably, the GEN2 Forte will not come with the same cargo-division and tool bags as its predecessor, as cargo division and storage solutions are being closely reviewed and implemented with the Worksport Alpha series of products.

The GEN2 Forte will be manufactured as a Worksport branded product as well as a cornerstone product for private label manufacturing in North, Central, and South American markets.

In addition, we redesigned the Worksport Smart Fold latch system based on consumer feedback. As a consequence, the next generation SC3Pro: Smart Fold covers will be far easier to install and will be available for both domestic and imported light trucks.

Worksport also launched its new Alpha series of tonneau covers at SEMA 2015. The Alpha products are set to be released late 2020, upon successful capital raise for new research and development. The Alpha and TerraVis model covers are anticipated to be very successful in the automotive aftermarket.

| Page 10 of 40 |

Production and Delivery

Worksport products are manufactured to our specifications and design in China. All of our soft (vinyl) covers are made in a factory in Meizhou, China. All future Worksport hard products are manufactured in China. Our soft cover factory is capable of producing 3,000 pieces per month and our hard cover factory is capable of producing 1,500 pieces per month. Production at both factories can be increased within thirty days to facilitate volumes up to ten times the Chinese contract manufacturers’ current output without any stress on their capacity.

Employees

Currently, we employ 1 full-time person. We may hire additional employees in the future to facilitate anticipated growth projections. We reimburse our employee for all necessary and customary business related expenses.

We have no plans or agreements which provide health care, insurance or compensation on the event of termination of employment or change in our control.

Proprietary Information

Intellectual Property Rights

As at the time of filing of this Report, the Corporation has obtained three patents in the US. As disclosed below, the patents are for the company’s “Smart Fold” and “Quad-Fold” tonneau covers and for the “Tool Bag” which s an accessory and part of the “GEN2 Forte” tonneau covers.

In October 2014, the Corporation also filed two provisional patent applications with the US Patent and Trademark ffice which were subsequently granted. Worksport has paid $7,718 since October 2012 for the cost of obtaining US Patent No. 8,814,249 – a system for securing a truck bed cover. This patent is owned by Steven Rossi, previously the sole stockholder of Worksport. Under an exclusive license agreement between the Corporation and Steven Rossi, dated November 26, 2014, Worksport has the right to commercialize this patent. Under this agreement, Worksport is not obligated to pay any royalties to Steven Rossi. Worksport is, however, obligated to pay any expenses incurred to keep the patent in full force and effect.

In 2015, Steven Rossi filed three patent applications and one provisional patent application, all under exclusive license to Worksport, with the US Patent and Trademark Office. As at the date of filing of this Report, the status of the patent applications are as follows:

● Worksport for life of patent is expected to be granted within 2019 and includes the Adjustable/Removable Tool Bag. This feature relates to removable and adjustable bag under tonneau cover and is used on Alpha and GEN 2 Forte. The patent was granted on April 9, 2019.

● Worksport Quattro cover is a full bed access soft folding cover. The patent was granted on March 3, 2019.

● Alpha full-featured tonneau cover system (discussed above) is expected to be branched into two separate patents. The Alpha patent is expected to be granted within 2019.

| Page 11 of 40 |

As at the date of filing of this Report, Worksport also has submitted a US, Canada and China Trademark application for “WORKSPORT” on September 17, 2017. The Corporation expects to be granted trademark ownership rights to the mark “Worksport” within 2019. As of the date hereof, the Corporation has applied for the Worksport logo and word mark in China and is awaiting confirmation through its Chinese trademark agent.

| Applicant’s English name | WORKSPORT, LTD. |

| Proposed Chinese name | 沃可斯堡特有限公司 |

| Applicant’s English address | 414-3120 RUTHERFORD, VAUGHN, ONTARIO, CANADA L4K 0B1 |

| Proposed Chinese address | 加拿大安大略省沃恩市卢瑟福路414-3120号 |

Current Patent Portfolio

The table below contains a record of the patents and trademarks that the Corporation currently owns and holds:

| PATENT # | DESCRIPTION | STATUS | AREA | STATUS | ||||

| 62/823,316 | 3 LATCHES | APPLICATION | WORLD

WIDE | PENDING | ||||

| US20170355251A1 | QUATTRO | GRANTED | US | EXPIRES IN 2035 | ||||

| US10252676B2 | TOOL BAG | GRANTED | US | EXPIRES IN 2035 | ||||

| WO2017070786A1 | ALPHA

(BRANCH OFF TERRAVIS) | WORLDWIDE

PCT APPLICATION | WORLD

WIDE | PENDING | ||||

| US8814249B2 | SMART LATCH | GRANTED | US | EXPIRES IN 2040 | ||||

| 1920142 | WORKSPORT

LOGO MARK | TRADEMARK

APPLICATION IN CANADA | CANADA | GRANTED | ||||

| 1921043 | WORKSPORT

WORD MARK | TRADEMARK

APPLICATION IN CANADA | CANADA | GRANTED | ||||

| 88/120,025 | WORKSPORT

WORK MARK | TRADEMARK

APPLICATION IN US | US | GRANTED | ||||

| 88/120,020 | WORKSPORT

LOGO MARK | TRADEMARK

APPLICATION IN THE US FOR LOGO. | US | GRANTED |

Government Regulation

We believe that governmental regulation will not be significant to us now or in the future.

Research and Development

We will spend for research and development activities on an ongoing basis.

Environmental Compliance

We believe that we are not subject to any material costs for compliance with any environmental laws.

| Page 12 of 40 |

How to Obtain our SEC Filings

We file annual, quarterly, and special reports, proxy statements, and other information with the Securities Exchange Commission (SEC). Reports, proxy statements and other information filed with the SEC can be inspected and copied at the public reference facilities of the SEC at 100 F Street N.E., Washington, DC 20549. Such material may also be accessed electronically by means of the SEC’s website at www.sec.gov.

Our investor relations department can be contacted at our principal executive office at 3120 Rutherford Road, Suite 414, Vaughan, Ontario, Canada L4K 0B2. Our phone number is 1 (888) 554-8789. Our website is www,franchiseholdingsinternational.com

As a “smaller reporting company,” are not required to provide the information required by this Item 1A.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As a “smaller reporting company,” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information in this Item.

We currently occupy office space in Toronto, Ontario. All Worksport product in the USA is stocked by a bonded third party logistics warehouse at an annual rent of approximately $10,000. We have virtually no owned equipment and rely on contracted logistics partners and their equipment to support Worksports supply chain and distribution.

During the year ended December 31, 2019 the Company (defendant) was currently in an ongoing legal proceedings with a supplier (plaintiff). Subsequent to year end on February 6, 2020, the Company reached a legal settlement with the supplier in which the Company is obligated to pay $6,037 per month beginning on March 1, 2020 for four months until the full amount of $24,148 has been repaid in full on June 1, 2020.

ITEM 4. MINE SAFETY DISCLOSURES

None.

| Page 13 of 40 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is quoted on the OTC Markets (“OTCQB”) under the symbol “FNHI.”

The table below sets forth the high and low closing prices of the Company’s Common Stock during the years indicated. The quotations reflect inter-dealer prices without retail mark-up, markdown or commission and may not reflect actual transactions.

| Fiscal Year Ended | Fiscal Year Ended | |||||||||||||||

December 31, 2019 | December 31, 2018 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter | $ | 2.000 | $ | 0.006 | $ | 0.027 | $ | 0.011 | ||||||||

| Second Quarter | $ | 0.300 | $ | 0.055 | $ | 0.019 | $ | 0.008 | ||||||||

| Third Quarter | $ | 0.130 | $ | 0.071 | $ | 0.042 | $ | 0.017 | ||||||||

| Fourth Quarter | $ | 0.115 | $ | 0.044 | $ | 0.042 | $ | 0.017 | ||||||||

The closing sales price of the Company’s common stock as reported on May 14, 2020 was $0.10 per share.

Holders

As of May 14, 2020, there were approximately 120 record holders of our common stock and there are 47,037,772 shares of our common stock outstanding.

Stock Transfer Agent

The stock transfer agent for our securities is Corporate Stock Transfer of Denver, Colorado. Their address is 3200 Cherry Creek Drive South, Suite 430, Denver, Colorado 80209. Their phone number is (303) 282-4800.

Dividend Policy

We have not previously declared or paid any dividends on our common stock and do not anticipate declaring any dividends in the foreseeable future. The payment of dividends on our common stock is within the discretion of our board of directors.

Equity Incentive Plan

We adopted an equity incentive plan on June 5, 2015 (the “Plan”). The Plan provides for the grant of the following types of stock awards: (i) incentive stock options, (ii) non-statutory stock options, (iii) stock appreciation rights, (iv) restricted stock awards, (v) restricted stock unit awards and (vi) other stock awards. The Plan is intended to help the Company secure and retain the services of eligible award recipients, provide incentives for such persons to exert maximum efforts for the success of the Company and any Affiliate and provide a means by which the eligible recipients may benefit from increases in value of the Common Stock. The Board will administer the Plan. Up to 100,000,000 shares may be issued under the Plan. No other stock options or similar instruments have been granted to any of our officers or directors pursuant to the Plan.

| Page 14 of 40 |

Unregistered Sales of Equity Securities

During the year ended December 31, 2019, the Company completed one unregistered sales of equity securities, all pursuant to Rule 506(b) of Regulation D. The company raised $30,000 in exchange for 250,000 post consolidation common shares of the company. This consisted of the following investments:

| Date | Amount | Securities Purchased | ||||||

| Jan-7-2019 | $ | 30,000 | 250,000 | |||||

| TOTAL | $ | 30,000 | 250,000 | |||||

Issuer Purchases of Equity Securities

There were no repurchases of shares of the Company’s common stock during the year ended December 31, 2019.

ITEM 6. SELECTED FINANCIAL DATA

As a “smaller reporting company,” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information in this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following management’s discussion and analysis (“MD&A”) should be read in conjunction with financial statements of FNHI for the years ended December 31, 2019 and 2018, and the notes thereto. Additional information relating to FNHI is available at www.franchiseholdingsinternational.com

Safe Harbor for Forward-Looking Statements

Certain statements included in this MD&A constitute forward-looking statements, including those identified by the expressions anticipate, believe, plan, estimate, expect, intend, and similar expressions to the extent they relate to FNHI or its management. These forward-looking statements are not facts, promises, or guarantees; rather, they reflect current expectations regarding future results or events. These forward-looking statements are subject to risks and uncertainties that could cause actual results, activities, performance, or events to differ materially from current expectations. These include risks related to revenue growth, operating results, industry, products, and litigation, as well as the matters discussed in FNHI’s MD&A under Risk Factors. Readers should not place undue reliance on any such forward-looking statements. FNHI disclaims any obligation to publicly update or to revise any such statements to reflect any change in the Company’s expectations or in events, conditions, or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

The following discussion of our financial condition and results of operations should be read in conjunction with our financial statements and the related notes included in this report.

Results of Operations

Revenue

For the year ended December 31, 2019, revenue from the entire line of Worksport products were $1,926,405, as compared to $481,521 for the year ended, December 31, 2018. The year over year sales increased by approximately 300% as the Company acquired more share of sales of existing customers and increased availability of the Company to fill orders product orders in the USA and Canada.

For the year ended December 31, 2019 revenue generated in Canada was $65,842 compared to $65,190 for the same period in 2018 a increase of 1%. For the year ended December 31, 2019 revenue generated in the United States was $1,860,563 compared to $416,331 for the same period in 2018. This represents an increase in US- source revenue of approximately 347% year-over-year. This increase in the US is primarily attributable the Company’s ability and success to re-enter the US market as of mid-2018, after the allowance of use of the Worksport trademark.

| Page 15 of 40 |

Sales from online retailers of the Worksport products increased from $151,285 in 2018 to $174,793 in 2019, an increase of 16%. Online retailers accounted for 8% of total revenue for the year ended December 31, 2019 compared to 32% for the year ended December 31, 2018. Distributor sales stayed consistent for the year ended December 31, 2019 and 2018 with $64,610 and $64,164 respectively. Private label sales in 2018 were $265,969 and accounted for 56% of total sales. For the year ended December 31, 2019 private label sales were $1,912,401 an increase of 619% or $1,646,432. Worksport expects to continue to grow it’s fields of business as it develops unique and non-competing products to offer to other prospective clients in the US and Canadian markets.

Currently, Worksport works closely with one distributor in Canada, along with its own contracted distribution and inventory facility in Breinigsville, PA and Depew, NY. This does not include multiple independent online retailers.

Although Worksport currently supports a total of 9 dealers and distributors, Worksport will return to a focus on online sales with new inventory being received in the US market for 2020. Worksport continues to believe the trend of increasing sales through online retailers will continue to outpace the traditional distribution business model. Moreover, reputable online retailer’s customers tend to provide larger sales volumes, greater margin of profit as well as greater protection against price erosion.

Cost of Sales

Cost of sales increased by 339% from $384,908 for the year ended December 31, 2018 to $1,687,858 for the year ended December 31, 2019. This increase correlates to the increase in sales for the year ended December 31, 2019. Our cost of sales, as a percentage of sales, was approximately 88% and 80% for the years ended December 31, 2019 and 2018, respectively. The decrease in percentage of sales resulted in a gross margin decrease from 20% for the years ended December 31, 2018 to 12% for the year ended December 31, 2019. This decrease in gross margin is related to the fluctuation in foreign exchange rates used to translate Canadian Dollar sales into United States Dollars for purposes of financial reporting as well as the increased cost for cost of goods sold and cost associated with warehousing inventory, to fulfil just in time sales, in the US market.

Within cost of sales, shipping and freight costs accounted for 3% of cost of sales during the year ended December 31, 2019, whereas in 2018, it accounted for 31% of cost of sales. This decrease is primarily attributed to an increase in volume of sales to a single customer, decreasing shipping and freight cost.

Worksport provides its distributors and online retailers an “all-in” wholesale price. This includes any import duty charges, taxes and shipping charges. Discounts are applied if the distributor or retailer chooses to use their own shipping process. Certain exceptions apply on rare occasions where product is shipped outside the contiguous United Sates or from the United States to Canada. Volume discounts are also offered to certain higher volume customers. Worksport also offers a “dock price” or “pickup program”; where clients are able to pick up product directly from one of Worksport stocking warehouses

Operating Expenses

General and administrative expenses was constant for the year ended December 31, 2019 and 2018. For the year ended December 31, 2019 general and administrative expenses were $238,841 similar to $268,707 for the year ended December 31, 2018. General and administrative expenses consisted of the following changes:

| ● | Sales wages decreased from $113,121 for the year ended December 31, 2018 to $72,081 for the year ended December 31, 2019. | |

| ● | Investor relations decreased by $46,479 or 94% from $49,479 to $3,000 for the year ended December 31, 2019. | |

| ● | Insurance decreased by $9,346 or 49% from $19,070 to $9,724 for the year ended December 31, 2019. | |

| ● | General expenses was $23,922 for December 31, 2018 increasing by $103,474 to $127,396 for the year ended December 31, 2019. The increase was due to the adoption of ASC 842 Lease Accounting, amortization of property and equipment, repairs and maintenance, and general supplies and expenses. | |

| ● | Shipping and freight charges decreased by 58% or $36,475 to $26,641 for the year ended December 31, 2019. The decrease was due to less shipping cost as a result of increase in logistics and bulk shipping. |

Professional fees which include accounting, legal fees, consulting fees, and listing and filing fees, decreased from $864,160 for the year ended December 31, 2018 to $570,852 for the year ended December 31, 2019 – a decrease of 34%. Accounting and audit fees increased by 69% from $102,413 to $173,433. Consulting fees decreased by 69% or $415,119 to $189,881 due to the Company completing previous consulting contracts in early 2019. Legal fees increased by $39,537 from $84,836 to $124,373 for the year ended December 31, 2019.

| Page 16 of 40 |

Other Income and Expenses

During the year ended December 31, 2019, the Company reached a legal settlement agreement (the “unwinding”) with an individual investor to dissolve the Debt Settlement and Mutual Release Agreement entered into on January 12, 2018. In accordance to the settlement agreement, 19,055,551 pre-stock split, reserved shares were released and returned to the Company. In addition, 5,944,449 pre-stock split (990,742 post stock split) shares already issued were returned to the Company’s treasury, and cancelled, reducing the companies issued and outstanding shares accordingly. This transaction resulted in a gain on debt settlement of $250,778. The company closed the unwinding in August 2019.

During the year ended December 31, 2018, there was a settlement of payables which resulted in a loss of $495,944 and the issuance of share subscriptions with a fair market value of $650,000.

Net Loss

Net loss for the year ended December 31, 2019 was $414,607 compared to a net loss of $1,763,038 for the year ended December 31, 2018 which is a of 76% decrease in net loss when compared year over year. This decrease was a result of the following:

| ● | Decrease in operating expenses from $1,307,741 for 2018 to $831,973 for 2019. A decrease of $475,768 or 36%. | |

| ● | Increase in gross profit from $96,614 for 2018 to $238,547 for 2019. An increase of $141,933 or 147%. | |

| ● | The gain on settlement of debt as discussed above. |

Liquidity and Capital Resources

Cash Flow Activities

Cash decreased from $25,323 at December 31, 2018 to $11,993 at December 31, 2019, an decrease of $13,330 or 53%. The decrease was primarily due to the ongoing trade dispute between the United States of America and the People’s Republic of China.

Financing Activities

During fiscal 2019 and 2018, aside from working capital we funded operations through, the issuance of common stock, share subscriptions receivable and the interest bearing loans. Proceeds from financing activities totaled $117,842. Our stock issuances and notes payable contain features that may be dilutive to our shareholders.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements with any party.

Critical Accounting Policies

Our discussion and analysis of results of operations and financial condition are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. We evaluate our estimates on an ongoing basis, including those related to provisions for uncollectible accounts receivable, inventories, valuation of intangible assets and contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The accounting policies that we follow are set forth in Note 3 to our financial statements as included in this annual report. These accounting policies conform to accounting principles generally accepted in the United States, and have been consistently applied in the preparation of the financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As a “smaller reporting company,” as defined by Rule 12b-2 of the Exchange Act, we are not required to provide the information in this Item.

| Page 17 of 40 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

INDEX TO FINANCIAL STATEMENTS

| Page 18 of 40 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Franchise Holdings International, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Franchise Holdings International, Inc. (the Company) as of December 31, 2019 and 2018, and the related statements of operations, comprehensive loss, stockholders’ equity, and cash flows for each of the years in the two-year period ended December 31, 2019, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2019, in conformity with accounting principles generally accepted in the United States of America.

Consideration of the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As more fully described in Note 2 to the financial statements, the Company has incurred net losses and has an accumulated deficit. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2 to the financial statements. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Haynie & Company

Salt Lake City, Utah

May 14, 2020

We have served as the Company’s auditor since 2016.

| Page 19 of 40 |

Franchise Holdings International, Inc.

Consolidated Balance Sheets

December 31, 2019 and 2018

| 2019 | 2018 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 11,993 | $ | 25,323 | ||||

| Accounts receivable net | 67,795 | 61,883 | ||||||

| Inventory (note 4) | 113,156 | 289,516 | ||||||

| Prepaid expenses and deposits | 60,741 | 124,114 | ||||||

| Total Current Assets | 253,685 | 500,835 | ||||||

| Investment (note 18) | 15,658 | - | ||||||

| Property and Equipment, net (note 5) | 94,695 | 43,860 | ||||||

| Right-of-use asset, net (note 19) | 60,125 | - | ||||||

| Intangible Assets, net (note 6) | 57,145 | 12,673 | ||||||

| Total Assets | $ | 481,308 | $ | 557,368 | ||||

| Liabilities and Shareholders’ Deficit | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 969,321 | $ | 401,766 | ||||

| Income taxes payable (note 10) | 36,844 | 82,365 | ||||||

| Related party loan (note 9) | 28,638 | 9,372 | ||||||

| Current portion of notes payable (note 7) | 267,881 | 287,425 | ||||||

| Current lease liability (note 19) | 22,000 | - | ||||||

| Total Current Liabilities | 1,324,684 | 780,928 | ||||||

| Long Term – Lease Liability | 39,185 | - | ||||||

| Total Liabilities | 1,363,869 | 780,928 | ||||||

| Commitments and Contingencies | ||||||||

| Shareholders’ Equity (Deficit) | ||||||||

| Series A Preferred Stock, $0.0001 par value, 1,000,000 shares authorized, 0 and 100,000 shares issued and outstanding, respectively (note 8) | - | 10,000 | ||||||

| Common stock, $0.0001 par value, 43,833,333 shares authorized, 41,906,790 and 24,634,051 shares issued and outstanding, respectively (note 8) | 4,191 | 2,463 | ||||||

| Additional paid-in capital | 8,381,231 | 8,103,934 | ||||||

| Share subscriptions receivable | (1,577 | ) | (1,577 | ) | ||||

| Share subscriptions payable | 1,511,080 | 2,019,532 | ||||||

| Accumulated deficit | (10,768,906 | ) | (10,354,299 | ) | ||||

| Cumulative translation adjustment | (8,580 | ) | (3,613 | ) | ||||

| Total Shareholders’ Deficit | (882,561 | ) | (223,560 | ) | ||||

| Total Liabilities and Shareholders’ Deficit | $ | 481,308 | $ | 557,368 | ||||

The accompanying notes form an integral part of these consolidated financial statements.

| Page 20 of 40 |

Franchise Holdings International, Inc.

Consolidated Statements of Operations and Comprehensive Loss

December 31, 2019 and 2018

| 2019 | 2018 | |||||||

| Net Sales | $ | 1,926,405 | $ | 481,521 | ||||

| Cost of Goods Sold | 1,687,858 | 384,908 | ||||||

| Gross Profit | 238,547 | 96,614 | ||||||

| Operating Expenses | ||||||||

| General and administrative | 238,841 | 268,707 | ||||||

| Sales and marketing | 50,159 | 90,567 | ||||||

| Professional fees | 570,852 | 864,160 | ||||||

| Loss (gain) on foreign exchange | (27,881 | ) | 84,306 | |||||

| Total operating expenses | 831,971 | 1,307,741 | ||||||

| Loss from operations | (593,424 | ) | (1,211,127 | ) | ||||

| Other Income (Expense) | ||||||||

| Interest expense (note 7) | (71,961 | ) | (55,548 | ) | ||||

| Finance charges | - | (418 | ) | |||||

| Gain (loss) on settlement of debt | 250,778 | (495,944 | ) | |||||

| Total other income (expense) | 178,817 | (551,910 | ) | |||||

| Net Loss | (414,607 | ) | (1,763,038 | ) | ||||

| Other Comprehensive Loss | ||||||||

| Foreign currency translation adjustment | (4,967 | ) | 40,770 | |||||

| Comprehensive Loss | $ | (419,574 | ) | $ | (1,722,268 | ) | ||

| Loss per Share (basic and diluted) | $ | (0.01 | ) | $ | (0.08 | ) | ||

| Weighted Average Number of Shares (basic and diluted) | 36,824,519 | 22,348,119 | ||||||

The accompanying notes form an integral part of these consolidated financial statements

| Page 21 of 40 |

Franchise Holdings International, Inc.

Consolidated Statements of Shareholders’ Deficit

December 31, 2019 and 2018

| Preferred Stock | Common Stock | Additional Paid-in | Share Subscriptions | Share Subscription | Accumulated | Cumulative Translation | Total Stockholders’ Equity | |||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Receivable | Payable | Deficit | Adjustment | (Deficit) | |||||||||||||||||||||||||||||||

| Balance at December 31, 2017 | 1,000,000 | $ | 10,000 | 20,387,873 | $ | 2,039 | $ | 7,474,811 | $ | (10,755 | ) | $ | 1,531,080 | $ | (8,591,261 | ) | $ | (44,383 | ) | $ | 371,531 | |||||||||||||||||||

| Issuance for services | - | - | 3,125,001 | 312 | 533,958 | - | (534,270 | ) | - | - | - | |||||||||||||||||||||||||||||

| Issuance for settlement of payables | - | - | 1,121,177 | 112 | 95,166 | - | (95,278 | ) | - | - | - | |||||||||||||||||||||||||||||

| Issuance for cash and subscription payable | - | - | - | - | - | - | 1,118,000 | - | - | 1,118,000 | ||||||||||||||||||||||||||||||

| Uncollectible receivables | - | - | - | - | - | 9,177 | - | - | - | 9,177 | ||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | (1,763,038 | ) | - | (1,763,038 | ) | ||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | - | - | 40,770 | 40,770 | ||||||||||||||||||||||||||||||

| Balance at December 31, 2018 | 1,000,000 | $ | 10,000 | 24,634,051 | $ | 2,463 | $ | 8,103,934 | $ | (1,577 | ) | $ | 2,019,532 | $ | (10,354,299 | ) | $ | (3,613 | ) | $ | (223,560 | ) | ||||||||||||||||||

| Issuance for Services | - | - | 4,680,084 | 469 | 345,834 | - | (290,730 | ) | - | - | 55,573 | |||||||||||||||||||||||||||||

| Return and cancellation of shares | - | - | (990,742 | ) | (99 | ) | (77,179 | ) | - | (247,722 | ) | - | - | (325,000 | ) | |||||||||||||||||||||||||

| Issuance for cash and subscriptions payable | - | - | - | - | - | - | 30,000 | - | - | 30,000 | ||||||||||||||||||||||||||||||

| Conversion of Preferred Stock | (1,000,000 | ) | (10,000 | ) | 13,583,397 | 1,358 | 8,642 | - | - | - | - | - | ||||||||||||||||||||||||||||

| Net Income | - | - | - | - | - | - | - | (414,607 | ) | - | (414,607 | ) | ||||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | - | - | (4,967 | ) | (4,967 | ) | ||||||||||||||||||||||||||||

| Balance at December 31, 2019 | - | - | 41,906,790 | $ | 4,191 | $ | 8,381,231 | $ | (1,577 | ) | $ | 1,511,080 | $ | (10,768,906 | ) | $ | (8,580 | ) | $ | (882,561 | ) | |||||||||||||||||||

The accompanying notes form an integral part of these consolidated financial statements

| Page 22 of 40 |

Franchise Holdings International, Inc.

Consolidated Statements of Cash Flows

December 31, 2019 and 2018

| 2019 | 2018 | |||||||

| Operating Activities | ||||||||

| Net Loss | $ | (414,607 | ) | $ | (1,763,038 | ) | ||

| Adjustments to reconcile net loss to net cash from operating activities: | ||||||||

| Shares issued for services | 55,573 | - | ||||||

| Loss on impairment | 54,292 | - | ||||||

| Depreciation and amortization | 11,439 | 1,516 | ||||||

| Uncollectible Subscription Receivable | - | 9,178 | ||||||

| (Gain) Loss on settlement of debt | (250,778 | ) | 495,944 | |||||

| (544,081 | ) | (1,256,400 | ) | |||||

| Changes in operating assets and liabilities (note 13) | 530,828 | 877,124 | ||||||

| Net cash used in operating activities | (13,253 | ) | (379,276 | ) | ||||

| Cash Flows from Investing Activities | ||||||||

| Purchase of investment (note 18) | (15,658 | ) | - | |||||

| Purchase of property and equipment | (98,353 | ) | (1,874 | ) | ||||

| Net cash used in investing activities | (114,011 | ) | (1,874 | ) | ||||

| Financing Activities | ||||||||

| Proceeds from issuance of stock for cash | 30,000 | 300,000 | ||||||

| Proceeds from loan payable | 88,120 | 22,639 | ||||||

| Shareholder Assumption of Debt | 19,266 | (11,058 | ) | |||||

| Proceeds from shareholder loan | - | (12,839 | ) | |||||

| Payments on notes payable | (19,544 | ) | - | |||||

| Net cash provided by financing activities | 117,842 | 298,742 | ||||||

| Effects of Foreign Currency Translation | (3,908 | ) | 40,770 | |||||

| Change in cash | (13,328 | ) | (41,638 | ) | ||||

| Cash and cash equivalents - beginning of year | 25,323 | 66,961 | ||||||

| Cash and cash equivalents end of year | $ | 11,993 | $ | 25,323 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid | $ | 8,113 | $ | 39,572 | ||||

| Supplemental Disclosure of non-cash investing and financing Activities | ||||||||

| Shares issued for settlement of notes and accounts payable | $ | - | $ | 18,000 | ||||

| Share cancellation | $ | (77,179 | ) | $ | - | |||

| Shares issued to service providers | $ | 55,573 | $ | 150,000 | ||||

| Conversion of Preferred Stock to Common Stock | $ | 8,642 | $ | - | ||||

| Shares issued for share subscriptions payable | $ | 290,540 | $ | 611,548 | ||||

| Write off share subscriptions receivable | $ | - | $ | (9,177 | ) | |||

| Reverse stock split | $ | - | $ | 12,312 | ||||

Recognition of operating lease right of use asset and liability | $ | 68,517 | $ | - | ||||

The accompanying notes form an integral part of these consolidated financial statements.

| Page 23 of 40 |

Franchise Holdings International, Inc.

Notes to the Consolidated Financial Statements

December 31, 2019 and 2018

1. Nature of Operations and Reverse Acquisition Transaction

Franchise Holdings International, Inc. (the “Company”) was incorporated in the State of Nevada on April 2, 2003. During the year ended December 31, 2014, the Company completed a reverse acquisition transaction (the “Reverse Acquisition”) with TruXmart Ltd. (“TruXmart”). On May 2, 2018, Truxmart legally changed its name to Worksport Ltd. (“Worksport”). Worksport designs and distributes truck tonneau covers in Canada and the United States.

2. Basis of Presentation and Going Concern

a) Statement of Compliance

The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) as issued by the Financial Accounting Standards Board (“FASB”).

b) Basis of Measurement

The Company’s financial statements have been prepared on the accrual basis.

c) Consolidation

The Company's consolidated financial statements consolidate the accounts of the Company and its wholly owned subsidiary. All intercompany transactions, balances and unrealized gains or losses from intercompany transactions have been eliminated upon consolidation.

d) Functional and Presentation Currency

These consolidated financial statements are presented in United States Dollars. The functional currency of the Company is the Canadian Dollar. For purposes of preparing these consolidated financial statements, balances denominated in Canadian Dollars outstanding at December 31, 2019 were converted into United States Dollars at a rate of 1.30 Canadian Dollars to one United States Dollar. Balances denominated in Canadian Dollars outstanding at December 31, 2018 were converted into United States Dollars at a rate of 1.36 Canadian Dollars to one United States Dollar. Transactions denominated in Canadian Dollars for the period ended December 31, 2019 and December 31, 2018 were converted into United States Dollars at an average rate of 1.33 and 1.30 Canadian Dollars to one United States Dollar, respectfully.

e) Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

f) Going Concern

These financial statements have been prepared on a going concern basis which assumes that the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. During the year ended December 31, 2019, the Company incurred a net loss of $414,607 and as of that date, the Company’s accumulated deficit was $10,768,906. While the Company has demonstrated the ability to generate revenue, there are no assurances that it will be able to achieve level of revenues adequate to generate sufficient cash flow from operations or obtain additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available we may be forced to discontinue operations, which would cause investors to lose their entire investment. The accompanying consolidated financial statements do not include any adjustments that might result relating to the recoverability and classification of the asset carrying amounts or the amount and classification of liabilities that might result from the outcome of this risk and uncertainty.

g) Reclassification

Certain comparative figures have been re-classified to conform to the current period’s presentation.

| Page 24 of 40 |

3. Significant Accounting Policies

Consolidation - The Company is incorporated in the state of Nevada. The Company has one wholly-owned subsidiary, Worksport Ltd., a company incorporated in the province of Ontario. All intercompany transactions and balances have been eliminated upon consolidation.

Cash and Cash Equivalents - Cash and cash equivalents includes cash on account and demand deposits with maturities of three months or less.

Receivables - Trade accounts receivable are stated at the amount the Company expects to collect. Receivables are reviewed individually for collectability. If the financial condition of the Company’s customers were to deteriorate, adversely affecting their ability to make payments, allowances may be required.

The Company offers credit terms on the sale of the Company’s products to a significant majority of the Company’s customers and requires no collateral from these customers. The Company performs ongoing credit evaluations of customers’ financial condition and maintains an allowance for doubtful accounts receivable based upon the Company’s historical experience and a specific review or accounts receivable at the end of each period. As at December 31, 2019 and 2018, the Company had no allowance for doubtful accounts.

Inventory - Inventory is stated at the lower of cost or net realizable value, with cost being determined by a weighted average basis. Cost includes the cost of materials plus direct labor applied to the product.

Warranties - The Company offers limited warranties against product defects. Customers who are not completely satisfied with their purchase may attempt to be reimbursed for their purchases outside the warranty period. For the years ending December 31, 2019 and 2018, the Company incurred warranty expenses of $2,106 and $3,538.

Revenue Recognition – Beginning after December 15, 2017, for public entities reporting Revenue from Contracts with Customers, ASC 606, a new accounting standard for revenue recognition was issued. An entity must satisfy the following steps under ASC 606 for revenue recognition; identifiable contract, identifiable performance obligation, determinable transaction price, allocating the transaction price and satisfying performance obligations. Sales are recognized when products are shipped, with no right of return, the title and risk of loss has passed to the customers or when they are delivered based on the terms of the sale. Revenue related to shipping and handling costs billed to customers is included in net sales and the related shipping and handling costs are included in cost of products sold. These standards have had no effect on the reported consolidated financial statements.

Property and Equipment - Capital assets are recorded at cost and are amortized using the straight-line method over the following estimated useful lives:

| Furniture and equipment | 5 years | |

| Computers | 3 years | |

| Patents | 25 years | |

| Leasehold improvements | 15 years |

As at December 31, 2019, the Company does not take depreciation for the following items: product moulds, trademarks and the website as the following items are not in service.

Income Taxes - Provisions for income taxes are based on taxes payable or refundable for the current year and deferred taxes on temporary differences between the amount of taxable income and pretax financial income, and between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are included in the consolidated financial statements at currently enacted income tax rates applicable to the period in which the deferred tax assets and liabilities are expected to be realized or settled as prescribed in FASB ASC 740. As changes in tax laws or rates are enacted, deferred tax assets and liabilities are adjusted through the provision for income taxes.

Tax positions initially need to be recognized in the financial statements when it is more-likely-than-not the positions will be sustained upon examination by the tax authorities.

Foreign Currency Translation - Transactions denominated in foreign currencies are initially recorded in the functional currency using exchange rates in effect at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency using exchange rates prevailing at the end of the reporting period. All exchange gains and losses are included in the statement of operations and deficit.

For the purpose of presenting financial statements in United States Dollars, the assets and liabilities are expressed in United States Dollars using exchange rates prevailing at the end of the reporting period. Income and expense items are translated at the average exchange rates for the period, unless exchange rates fluctuated significantly during that period, in which case the exchange rates at the dates of the transactions are used. Exchange differences arising, if any, are recognized in other comprehensive loss and reported as cumulative translation adjustment in shareholder’s equity.

For the purpose of these financial statements, the following exchange rates were used:

| Balance Sheet | Income Statement | |||

| December 31, 2019 | 0.7699 USD/ CAD | 0.7537 USD/ CAD | ||

| December 31, 2018 | 0.7330 USD/ CAD | 0.7721 USD/ CAD |

| Page 25 of 40 |

Financial Instruments - Financial Accounting Standards Board’s (FASB) Accounting Standards Codification (ASC) 825, Disclosures about Fair Value of Financial Instruments, requires disclosures of the fair value of financial instruments. The carrying value of the Company’s current financial instruments, which include cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities and shareholder loan, approximates their fair values because of the short-term maturities of these instruments.

Measurement - The Company initially measures its financial instrument at fair value, except for certain non-arm’s length transactions. The Company subsequently measures all its financial assets and financial liabilities at amortized cost, except for investments in equity instruments that are quoted in an active market, which are measured at fair value. Changes in fair value are recognized in earnings for the period in which they occur.

Financial assets measured at amortized cost include cash and cash equivalents, accounts receivable, related party receivable, other receivables and share subscriptions receivable. Financial liabilities measured at amortized cost include accounts payable and accrued liabilities, and promissory note payable.

Derivative Financial Instruments - The Company has issued and could issue instruments with such terms that require the Company to account for the transactions as derivative financial instruments. The Company is accounting for these transactions in accordance with FASB Accounting Standards Codification (“ASC”) Topic 815, Derivatives and Hedging, which requires that every derivative instrument is recorded on the balance sheet as an asset or liability measured at its fair value as of the reporting date. ASC 815 also requires changes in the derivatives’ fair value to be recognized in earnings for the period.

Related Party Transactions - All transactions with related parties are in the normal course of operations and are measured at the exchange amount.

Intangible Assets and Impairment - Patents and other intangibles are amortized using the straight-line method over their estimated useful lives and are evaluated for impairment at least annually or when events or circumstances arise that indicate the existence of impairment. The Company evaluates the recoverability of identifiable intangible assets whenever events or changes in circumstances indicate that an intangible asset’s carrying amount may not be recoverable. When indicators of impairment exist, the Company measures the carrying amount of the asset against the estimated undiscounted future cash flows associated with it. Should the sum of the expected future cash flows be less than the carrying value of the asset being evaluated, an impairment loss would be recognized. The impairment loss would be calculated as the amount by which the carrying value of the asset exceeds its fair value. The evaluation of asset impairment requires the Company to make assumptions about future cash flows over the life of the asset being evaluated. These assumptions require significant judgment and actual results may differ from assumed and estimated amounts. During the years ended December 31, 2019 and 2018, the Company had no impairment losses related to intangible assets.

Lease Accounting - On January 1, 2019, the Company adopted the new accounting standards ASC 842 that requires lessees to recognize all leases on the balance sheet as right-of-use assets and lease liabilities based on the value of the discounted future lease payments. Expanded disclosures about the nature and terms of lease agreements are required prospectively and are included in Note 19. Upon adoption, the Company also recognized right-of-use assets and lease liabilities of $68,516.

Private Equity Investment - Private equity investments may consist of common stock and preferred stock of privately owned companies. The Company records all private equity investments at the transaction price, excluding transaction costs. The Company assesses annually if there is any objective evidence that its interest in its investments are impaired. If impaired, the carrying value of the Company's share of the underlying assets of the investment is written down to its estimated recoverable amount and charged to the consolidated statement of operations and comprehensive loss.

4. Inventory

Inventory consists of the following at December 31, 2019 and 2018:

| 2019 | 2018 | |||||||

| Finished goods | $ | 104,868 | $ | 282,239 | ||||

| Promotional items | 552 | 700 | ||||||

| Raw materials | 7,737 | 6,577 | ||||||

| $ | 113,156 | $ | 289,516 | |||||

| Prepaid inventory | $ | 50,000 | $ | - | ||||

During the year ended December 31, 2019 the Company recognized a loss on impairment of inventory $54,292.

| Page 26 of 40 |

5. Property and Equipment

Major classes of property and equipment at December 31, 2019 and 2018 are as follows:

| 2019 | ||||||||||||||||||||

| Equipment | Product molds | Computers | Leasehold Improvements | Total | ||||||||||||||||

| Cost | ||||||||||||||||||||

| Balance – January 1, 2019 | $ | 8,850 | $ | 37,243 | $ | 1,162 | $ | - | $ | 47,255 | ||||||||||

| Additions | 1,197 | 28,465 | - | 23,371 | 53,033 | |||||||||||||||

| Balance – December 31, 2019 | $ | 10,047 | $ | 65,708 | $ | 1,162 | $ | 23,371 | 100,288 | |||||||||||

| Accumulated Depreciation | ||||||||||||||||||||

| Balance – January 1, 2019 | $ | (2,254 | ) | $ | - | $ | (1,141 | ) | $ | - | $ | (3,395 | ) | |||||||

| Additions | (1,531 | ) | - | (21 | ) | (646 | ) | (2,198 | ) | |||||||||||

| Balance – December 31, 2019 | $ | (3,785 | ) | $ | - | $ | (1,162 | ) | $ | (646 | ) | $ | (5,593 | ) | ||||||

| Net amount as at December 31, 2019 | $ | 6,262 | $ | 65,708 | $ | - | $ | 22,725 | $ | 94,695 | ||||||||||

| 2018 | ||||||||||||||||||||

| Equipment | Product molds | Computers | Leasehold Improvements | Total | ||||||||||||||||

| Cost | ||||||||||||||||||||

| Balance – January 1, 2018 | $ | 6,976 | $ | 37,243 | $ | 1,162 | $ | - | $ | 45,381 | ||||||||||

| Additions | 1,874 | - | - | - | 1,874 | |||||||||||||||

| Balance – December 31, 2018 | $ | 8,850 | $ | 37,243 | $ | 1,162 | $ | - | $ | 47,255 | ||||||||||

| Accumulated Depreciation | ||||||||||||||||||||

| Balance – January 1, 2018 | $ | (1,181 | ) | $ | - | $ | (1,121 | ) | $ | - | $ | (2,302 | ) | |||||||

| Additions | (1,073 | ) | - | (20 | ) | - | (1,093 | ) | ||||||||||||

| Balance – December 31, 2018 | $ | (2,254 | ) | $ | - | $ | (1,141 | ) | $ | - | $ | (3,395 | ) | |||||||

| Net amount as at December 31, 2018 | $ | 6,596 | $ | 37,243 | $ | 21 | $ | - | $ | 43,860 | ||||||||||

During the years ended December 31, 2019 and 2018, the Company recognized depreciation expense of $2,198 and $1,093, respectively. All current property and equipment, as well as any future purchases of property and equipment have been pledged as security for the notes payable disclosed in Note 7.

6. Intangible Assets

Intangible assets consist of costs incurred to establish the Worksport Tri-Fold and Smart Fold patent technology, Worksport trademarks, as well as the Company’s website. The patent was issued in 2014 and 2019. The patent will be amortized on a straight-line basis over its useful life of 25 years. The Company’s trademark and website are reassessed annually for impairment; the Company has determined that impairment is not necessary for the current year ended December 31, 2019. The change in intangible assets for the years ending December 31, 2019 and 2018 are as follows:

| 2019 | ||||||||||||||||

| Patent | Website | Trademarks | Total | |||||||||||||

| Cost | ||||||||||||||||

| Balance – January 1, 2019 | $ | 10,574 | $ | 3,500 | $ | - | $ | 14,074 | ||||||||

| Additions | 40,676 | - | 4,644 | 45,320 | ||||||||||||

| Balance – December 31, 2019 | $ | 51,250 | $ | 3,500 | $ | 4,644 | $ | 59,394 | ||||||||

| Accumulated Depreciation | ||||||||||||||||

| Balance – January 1, 2019 | $ | (1,401 | ) | $ | - | $ | - | $ | (1,401 | ) | ||||||

| Additions | (848 | ) | - | - | (848 | ) | ||||||||||

| Balance – December 31, 2019 | $ | (2,249 | ) | $ | - | $ | - | $ | (2,249 | ) | ||||||

| Net amount as at December 31, 2019 | $ | 49,001 | $ | 3,500 | $ | 4,643 | $ | 57,145 | ||||||||

| Page 27 of 40 |

| 2018 | ||||||||||||||||

| Patent | Website | Trademarks | Total | |||||||||||||

| Cost | ||||||||||||||||

| Balance – January 1, 2018 | $ | 10,574 | $ | 3,500 | $ | - | $ | 14,074 | ||||||||

| Additions | - | - | - | - | ||||||||||||

| Balance – December 31, 2018 | $ | 10,574 | $ | 3,500 | $ | - | $ | 14,074 | ||||||||

| Accumulated Depreciation | ||||||||||||||||

| Balance – January 1, 2018 | $ | (978 | ) | $ | - | $ | - | $ | (978 | ) | ||||||

| Additions | (423 | ) | - | - | (423 | ) | ||||||||||

| Balance – December 31, 2018 | $ | (1,401 | ) | $ | - | $ | - | $ | (1,401 | ) | ||||||

| Net amount as at December 31, 2018 | $ | 9,173 | $ | 3,500 | $ | - | $ | 12,673 | ||||||||

Amortization of the patent over the next five years and beyond December 31, 2019 is as follows:

| 2020 | $ | 2,050 | ||

| 2021 | $ | 2,050 | ||

| 2022 | $ | 2,050 | ||

| 2023 | $ | 2,050 | ||

| 2024 | $ | 2,050 | ||

| 2025 and later | $ | 46,895 |

7. Notes Payable

The following tables shows the balance of the notes payable as of December 31, 2019 and 2018:

| Balance as at December 31, 2017 | $ | 275,844 | ||

| Additions | 22,639 | |||

| Payment | (11,058 | ) | ||

| Balance as at December 31, 2018 | $ | 287,425 | ||

| Additions | - | |||

| Payments | (19,544 | ) | ||

| Balance as at December 31, 2019 | $ | 267,881 |

2019 Notes Payable