Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - EXICURE, INC. | exicureexhibit311-33120.htm |

| EX-32.1 - EXHIBIT 32.1 - EXICURE, INC. | exicureexhibit321-33120.htm |

| EX-31.2 - EXHIBIT 31.2 - EXICURE, INC. | exicureexhibit312-33120.htm |

| EX-10.1 - EXHIBIT 10.1 - EXICURE, INC. | exicureexhibit1012-3312020.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________

FORM 10-Q

______________________________________

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39011

______________________________________

EXICURE, INC.

(Exact name of registrant as specified in its charter)

_____________________________________

Delaware | 81-5333008 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

8045 Lamon Avenue

Suite 410

Skokie, IL 60077

(Address of principal executive offices)

Registrant’s telephone number, including area code (847) 673-1700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

Common Stock, par value $0.0001 per share | XCUR | The Nasdaq Stock Market LLC | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |

Non-accelerated filer | x | Smaller reporting company | x | |

Emerging growth company | x | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of May 12, 2020, there were 87,150,447 shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

EXICURE, INC.

QUARTERLY REPORT ON FORM 10-Q

TABLE OF CONTENTS

3

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q, or this Quarterly Report, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act. All statements other than statements of historical fact contained in this Quarterly Report are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “could,” “will,” “would,” “should,” “expect,” “plan,”, “anticipate,” “believe,” “estimate,” “intend,” “predict,” “seek,” “contemplate,” “project,” “continue,” “potential,” “ongoing” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these identifying words. These forward-looking statements include, but are not limited to, statements about:

• | our expectations regarding the impact of the ongoing coronavirus 2019, or COVID-19, pandemic including the expected duration of disruption and immediate and long-term delays, interruptions or other adverse effects to clinical trials, delays in regulatory review, preclinical research and development (“R&D”), collaboration and partnership programs, manufacturing and supply chain interruptions, adverse effects on healthcare systems and disruption of the global economy, and the overall impact of the coronavirus pandemic on our business, financial condition and results of operations; |

• | our estimates of expenses, ongoing losses, future revenue and capital requirements, including our expectations relating to our needs for additional financing; |

• | the initiation, timing, progress and results of our current and future preclinical studies, clinical trials, collaboration and partnership programs, including our ongoing clinical trials and any planned clinical trials for AST-008 or any of our product candidates, and the research and development programs we pursue; |

• | our ability to advance our product candidates into, and successfully complete, clinical trials; |

• | the timing and likelihood of regulatory filings for our current and future product candidates including any Investigational New Drug, or IND, application, Investigational Medicinal Product Dossier, or IMPD, Clinical Trial Application, or CTA, New Drug Application, or NDA, or other regulatory submissions; |

• | our ability to obtain and maintain regulatory approval of our product candidates in the indications for which we plan to develop them, and any related restrictions, limitations or warnings in the label of an approved drug or therapy; |

• | the size and growth potential of the markets for our product candidates, if approved, and the rate and degree of market acceptance of our product candidates, including reimbursement that may be received from payors; |

• | the diversion of healthcare resources away from the conduct of clinical trials as a result of the ongoing COVID-19 pandemic, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

• | the interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel, quarantines or social distancing protocols imposed or recommended by federal or state governments, employers and others in connection with the ongoing COVID-19 pandemic; |

• | our dependence on current and future collaborators for advancement of therapeutic candidates pursuant to the terms of such collaborations, including ability to obtain and maintain regulatory approval and commercialization, if approved; |

• | the status of clinical trials, development timelines and discussions with regulatory authorities related to product candidates under development by us and our collaborators; |

• | our receipt and timing of any milestone payments or royalties under any current or future research collaboration and license agreements or arrangements; |

4

• | our ability to identify and develop therapeutic candidates for treatment of additional disease indications; |

• | the rate and degree of market acceptance of any approved therapeutic candidates; |

• | the commercialization of any approved therapeutic candidates; |

• | the implementation of our business model and strategic plans for our business, technologies and therapeutic candidates; |

• | our ability to obtain additional funds for our operations; |

• | our ability to obtain and maintain intellectual property protection for our technologies and therapeutic candidates and our ability to operate our business without infringing the intellectual property rights of others; |

• | our reliance on third parties to conduct our preclinical studies and clinical trials; |

• | our reliance on third party supply and manufacturing partners to supply the materials and components for, and manufacture, our research and development, preclinical and clinical trial supplies; |

• | our expectations regarding our ability to attract and retain qualified key management and technical personnel; |

• | our expectations regarding the time during which we will be an emerging growth company under the Jumpstart Our Business Startups Act of 2012, or JOBS Act; |

• | statements regarding our internal controls; |

• | the impact of government laws and regulations as well as developments relating to our competitors or our industry; and |

• | other factors that may impact our financial results. |

You should refer to the section titled “Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Quarterly Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Quarterly Report.

This Quarterly Report also contains or may contain estimates, projections and other information concerning our industry, our business and the markets for certain therapeutics, including data regarding the estimated size of those markets, their projected growth rates and the incidence of certain medical conditions. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances reflected in this information. Unless otherwise expressly stated, we obtained these industry, business, market and other data from reports, research surveys, studies and similar data prepared by third parties, industry, medical and general publications, government data and similar sources. In some cases, we do not expressly refer to the sources from which these data are derived.

Except where the context otherwise requires, in this Quarterly Report, the “Company,” “Exicure,” “we,” “us” and “our” refers to Exicure, Inc., a Delaware corporation, and, where appropriate, our wholly owned subsidiary, Exicure Operating Company.

5

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

March 31, 2020 | December 31, 2019 | ||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 24,577 | $ | 48,460 | |||

Short-term investments | 74,223 | 62,326 | |||||

Accounts receivable | 27 | 16 | |||||

Unbilled revenue receivable | 11 | 19 | |||||

Prepaid expenses and other assets | 2,906 | 1,955 | |||||

Total current assets | 101,744 | 112,776 | |||||

Property and equipment, net | 2,298 | 2,099 | |||||

Other noncurrent assets | 1,487 | 388 | |||||

Total assets | $ | 105,529 | $ | 115,263 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Current portion of long-term debt | $ | — | $ | 4,965 | |||

Accounts payable | 3,392 | 1,814 | |||||

Accrued expenses and other current liabilities | 1,268 | 2,435 | |||||

Current portion of deferred revenue | 15,713 | 21,873 | |||||

Total current liabilities | 20,373 | 31,087 | |||||

Common stock warrant liability | 42 | 414 | |||||

Deferred revenue non-current | — | 2,956 | |||||

Other noncurrent liabilities | — | 59 | |||||

Total liabilities | $ | 20,415 | $ | 34,516 | |||

Stockholders’ equity: | |||||||

Common stock, $0.0001 par value per share; 200,000,000 shares authorized, 87,150,447 issued and outstanding, March 31, 2020; 86,069,263 issued and outstanding, December 31, 2019 | 9 | 9 | |||||

Additional paid-in capital | 165,269 | 162,062 | |||||

Accumulated other comprehensive loss | (17 | ) | (27 | ) | |||

Accumulated deficit | (80,147 | ) | (81,297 | ) | |||

Total stockholders' equity | 85,114 | 80,747 | |||||

Total liabilities and stockholders’ equity | $ | 105,529 | $ | 115,263 | |||

See accompanying notes to the unaudited condensed consolidated financial statements.

6

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

Three Months Ended, March 31, | |||||||

2020 | 2019 | ||||||

Revenue: | |||||||

Collaboration revenue | $ | 9,183 | $ | 25 | |||

Total revenue | 9,183 | 25 | |||||

Operating expenses: | |||||||

Research and development expense | 6,075 | 3,395 | |||||

General and administrative expense | 2,574 | 2,208 | |||||

Total operating expenses | 8,649 | 5,603 | |||||

Operating income (loss) | 534 | (5,578 | ) | ||||

Other income (expense), net: | |||||||

Dividend income | 39 | 105 | |||||

Interest income | 360 | 1 | |||||

Interest expense | (128 | ) | (183 | ) | |||

Other income (expense), net | 345 | 369 | |||||

Total other income (expense), net | 616 | 292 | |||||

Net income (loss) | $ | 1,150 | $ | (5,286 | ) | ||

Basic earnings (loss) per common share | $ | 0.01 | $ | (0.12 | ) | ||

Diluted earnings (loss) per common share | $ | 0.01 | $ | (0.12 | ) | ||

Weighted-average basic common shares outstanding | 87,079,160 | 44,358,000 | |||||

Weighted-average diluted common shares outstanding | 88,244,632 | 44,358,000 | |||||

See accompanying notes to the unaudited condensed consolidated financial statements.

7

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, except share and per share data)

Three Months Ended, March 31, | |||||||

2020 | 2019 | ||||||

Net income (loss) | $ | 1,150 | $ | (5,286 | ) | ||

Other comprehensive income, net of taxes | |||||||

Unrealized gains on available for sale securities, net of tax | 10 | — | |||||

Other comprehensive income | 10 | — | |||||

Comprehensive income (loss) | $ | 1,160 | $ | (5,286 | ) | ||

See accompanying notes to the unaudited condensed consolidated financial statements.

8

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands, except shares)

Common Stock | ||||||||||||||||||||||

Shares | $ | Additional Paid-in- Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders' Equity | |||||||||||||||||

Balance at December 31, 2019 | 86,069,263 | $ | 9 | $ | 162,062 | $ | (81,297 | ) | $ | (27 | ) | $ | 80,747 | |||||||||

Equity-based compensation | — | — | 441 | — | — | 441 | ||||||||||||||||

Issuance of common stock | 1,081,184 | — | 2,766 | — | — | 2,766 | ||||||||||||||||

Other comprehensive income, net | — | — | — | — | 10 | 10 | ||||||||||||||||

Net income (loss) | — | — | — | 1,150 | — | 1,150 | ||||||||||||||||

Balance at March 31, 2020 | 87,150,447 | $ | 9 | $ | 165,269 | $ | (80,147 | ) | $ | (17 | ) | $ | 85,114 | |||||||||

Common Stock | ||||||||||||||||||||||

Shares | $ | Additional Paid-in- Capital | Accumulated Deficit | Accumulated Other Comprehensive Loss | Total Stockholders’ Equity | |||||||||||||||||

Balance at December 31, 2018 | 44,358,000 | $ | 4 | $ | 75,942 | $ | (54,994 | ) | $ | — | $ | 20,952 | ||||||||||

Equity-based compensation | — | — | 489 | — | — | 489 | ||||||||||||||||

Net income (loss) | — | — | — | (5,286 | ) | — | (5,286 | ) | ||||||||||||||

Balance at March 31, 2019 | 44,358,000 | $ | 4 | $ | 76,431 | $ | (60,280 | ) | $ | — | $ | 16,155 | ||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

9

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Cash flows from operating activities: | |||||||

Net income (loss) | 1,150 | (5,286 | ) | ||||

Adjustments to reconcile net income (loss) to cash used in operating activities: | |||||||

Depreciation and amortization | 148 | 87 | |||||

Equity-based compensation | 441 | 489 | |||||

Amortization of long-term debt issuance costs and fees | 35 | 34 | |||||

Other | 84 | 36 | |||||

Change in fair value of warrant liabilities | (346 | ) | (369 | ) | |||

Changes in operating assets and liabilities: | |||||||

Unbilled revenue receivable and accounts receivable | (2 | ) | — | ||||

Prepaid expenses and other current assets | (911 | ) | (62 | ) | |||

Other noncurrent assets | 30 | (559 | ) | ||||

Accounts payable | 1,807 | 354 | |||||

Accrued expenses and other current liabilities | (1,108 | ) | (52 | ) | |||

Deferred revenue | (9,116 | ) | 975 | ||||

Other noncurrent liabilities | (59 | ) | 341 | ||||

Net cash used in operating activities | (7,847 | ) | (4,012 | ) | |||

Cash flows from investing activities: | |||||||

Purchase of available for sale securities | (21,926 | ) | — | ||||

Proceeds from sale or maturity of available for sale securities | 10,000 | — | |||||

Capital expenditures | (577 | ) | (8 | ) | |||

Net cash used in investing activities | (12,503 | ) | (8 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from common stock offering | 2,973 | — | |||||

Repayment of long-term debt | (4,999 | ) | — | ||||

Payment of long-term debt fees and issuance costs | (100 | ) | (52 | ) | |||

Payment of common stock financing costs | (207 | ) | — | ||||

Net cash used in financing activities | (2,333 | ) | (52 | ) | |||

Net decrease in cash, cash equivalents, and restricted cash | (22,683 | ) | (4,072 | ) | |||

Cash, cash equivalents, and restricted cash - beginning of period | 48,460 | 26,268 | |||||

Cash, cash equivalents, and restricted cash - end of period | $ | 25,777 | $ | 22,196 | |||

10

EXICURE, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(in thousands)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Supplemental disclosure of cash flow information: | |||||||

Non-cash financing activities: | |||||||

Debt fees (accrued expenses) | $ | — | $ | 100 | |||

Non-cash investing activities: | |||||||

Capital expenditures (accounts payable and accrued expenses) | 126 | 8 | |||||

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the unaudited condensed consolidated balance sheets that sum to the total of the amounts shown in the unaudited condensed consolidated statements of cash flows:

March 31, 2020 | December 31, 2019 | ||||||

Cash and cash equivalents | $ | 24,577 | $ | 48,460 | |||

Restricted cash included in other noncurrent assets | 1,200 | — | |||||

Total cash, cash equivalents, and restricted cash shown in the unaudited condensed consolidated statements of cash flows | $ | 25,777 | $ | 48,460 | |||

See accompanying notes to the unaudited condensed consolidated financial statements.

11

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

1. Description of Business and Basis of Presentation

Description of Business

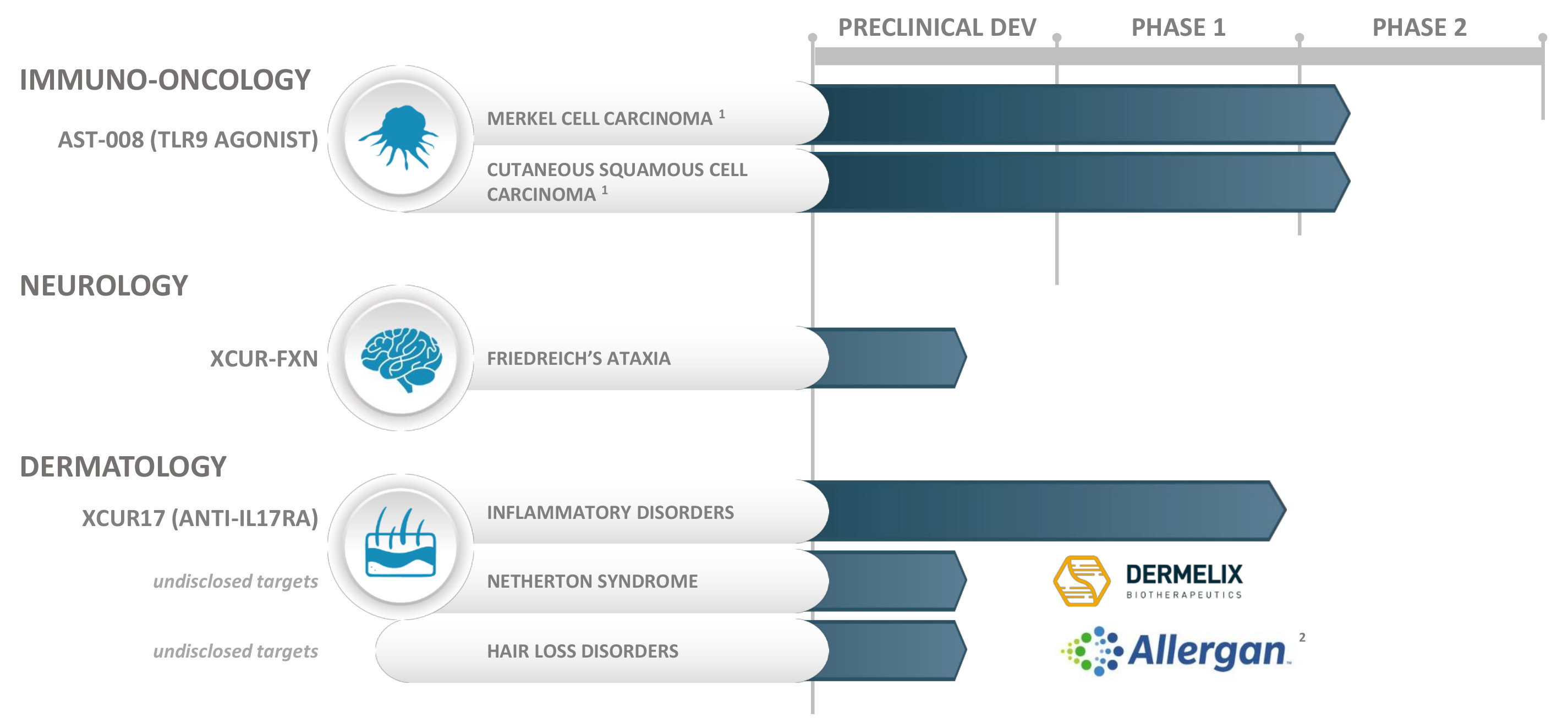

Exicure, Inc. (the “Company”) is a clinical-stage biotechnology company developing therapeutics for immuno-oncology, genetic disorders and other indications based on our proprietary Spherical Nucleic Acid (“SNA”) technology. SNAs are nanoscale constructs consisting of densely packed synthetic nucleic acid sequences that are radially arranged in three dimensions. The Company believes that the design of its SNAs gives rise to distinct chemical and biological properties that may provide advantages over other nucleic acid therapeutics and enable therapeutic activity outside of the liver. The Company is working to advance its SNA therapeutic candidates through multiple clinical trials, including the ongoing Phase 1b/2 trial of AST-008 in cancer patients.

The Company believes that one of the key strengths of its proprietary SNAs is that they have the potential to enter a number of different cells and organs. The Company has shown in preclinical studies that SNAs may have therapeutic potential in neurology, ophthalmology, pulmonology, and gastroenterology. As a consequence, the Company has expanded its pipeline into neurology, and is conducting early stage research activities in ophthalmology, pulmonology, and gastroenterology.

Throughout these unaudited condensed consolidated financial statements, the terms the “Company” and “Exicure” refer to Exicure, Inc. and its wholly owned subsidiary, Exicure Operating Company. Exicure Operating Company holds all material assets and conducts all business activities and operations of Exicure, Inc.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements as of March 31, 2020 and December 31, 2019, and for the three months ended March 31, 2020 and 2019, have been presented in conformity with generally accepted accounting principles in the United States (“GAAP”).

Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements include the accounts of Exicure, Inc. and its wholly owned subsidiary, Exicure Operating Company. All intercompany transactions and accounts are eliminated in consolidation.

Significant Risks and Uncertainties

With the global spread of the ongoing COVID-19 pandemic in the first quarter of 2020, the Company has taken active measures designed to address and mitigate the impact of the COVID-19 pandemic on its business, such as facilitating management’s routine communication to address employee and business concerns and frequent provision of updates to the Board. Under social distancing guidelines for COVID-19, the Company is typically operating with less than 50% of its R&D staff on-site at any one time. The Company is managing laboratory staffing and taking other appropriate managerial actions to maintain progress on its preclinical and collaboration programs. The Company’s office and general and administrative team has been working from home. The Company’s preclinical development program in Friedreich’s ataxia (“FA”) is ongoing and it continues to expect that IND-enabling studies for the Company’s FA drug candidate, XCUR-FXN, will begin in late 2020. The Company also continues to progress its collaborations with Allergan and DERMELIX, LLC, d/b/a Dermelix Biotherapeutics (“Dermelix”). However, if the COVID-19 pandemic continues and persists for an extended period of time, the Company could experience significant disruptions to its preclinical development timelines, which would adversely affect its business, financial condition, results of operations and growth prospects.

The Company anticipates that the COVID-19 pandemic may have an impact on the clinical development timelines for its AST-008 clinical program. The extent to which the COVID-19 pandemic impacts the Company’s

12

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

business, its clinical development and regulatory efforts, its corporate development objectives and the value of and market for its common stock, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time, such as the ultimate duration of the pandemic, travel restrictions, quarantines, social distancing and business closure requirements in the United States and other countries, and the effectiveness of actions taken globally to contain and treat the disease. The global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic could have a material adverse effect on the Company’s business, financial condition, results of operations and growth prospects.

In addition, the Company is subject to other challenges and risks specific to its business and its ability to execute on its business plan and strategy, as well as risks and uncertainties common to companies in the biotechnology industry with research and development operations, including, without limitation, risks and uncertainties associated with: obtaining regulatory approval of its product candidates; delays or problems in obtaining clinical supply, loss of single source suppliers or failure to comply with manufacturing regulations; identifying, acquiring or in-licensing additional products or product candidates; product development and the inherent uncertainty of clinical success; and the challenges of protecting and enhancing its intellectual property rights; and the challenges of complying with applicable regulatory requirements. In addition, to the extent the ongoing COVID-19 pandemic adversely affects the Company’s business and results of operations, it may also have the effect of heightening many of the other risks and uncertainties.

Liquidity Risk

As of March 31, 2020, the Company has generated an accumulated deficit of $98,984 since inception and expects to incur significant expenses and negative cash flows for the foreseeable future. Based on the Company’s current operating plans, it believes that existing working capital at March 31, 2020 is sufficient to fund the Company for at least the next 12 months. Management believes that it will be able to obtain additional working capital through equity financings, partnerships and licensing, or other arrangements, to fund operations. However, there can be no assurance that such additional financing will be available and, if available, can be obtained on terms acceptable to the Company. The Company has historically principally raised capital through the sale of its securities. However, the COVID-19 pandemic continues to rapidly evolve and has already resulted in a significant disruption of global financial markets. The Company believes raising capital in the current market could be very difficult for early stage biotech companies like Exicure. If the disruption persists and deepens, the Company could experience an inability to access additional capital, which could in the future negatively affect its operations.

Unaudited Interim Financial Information

The accompanying interim condensed consolidated balance sheet as of March 31, 2020, the interim condensed consolidated statements of operations for the three months ended March 31, 2020 and 2019, the interim condensed consolidated statements of comprehensive income (loss) for the three months ended March 31, 2020 and 2019, the interim condensed consolidated statements of changes in stockholders’ equity for the three months ended March 31, 2020 and 2019, and the interim condensed consolidated statements of cash flows for the three months ended March 31, 2020 and 2019, are unaudited. The interim unaudited condensed consolidated financial statements have been prepared on the same basis as the annual audited financial statements; and in the opinion of management, reflect all adjustments, which include only normal recurring adjustments necessary for the fair statement of the Company’s financial position as of March 31, 2020, the results of its operations for the three months ended March 31, 2020 and 2019, and the results of its cash flows for the three months ended March 31, 2020 and 2019. The financial data and other information disclosed in these notes related to the three months ended March 31, 2020 and 2019 are unaudited. The results for the three months ended March 31, 2020 are not necessarily indicative of results to be expected for the year ending December 31, 2020, or any other interim periods, or any future year or period.

13

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Use of Estimates

The preparation of the financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Management bases its estimates on certain assumptions which it believes are reasonable in the circumstances and while actual results could differ from those estimates, management does not believe that any change in those assumptions in the near term would have a significant effect on the Company’s financial position, results of operations or cash flows. Actual results in future periods could differ from those estimates.

2. Significant Accounting Policies

The Company’s significant accounting policies are disclosed in the audited consolidated financial statements and the notes thereto, which are included in the in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 10, 2020. Since the date of those audited consolidated financial statements, there have been no material changes to the Company’s significant accounting policies.

Recently Adopted Accounting Pronouncements

None.

Recent Accounting Pronouncements Not Yet Adopted

Financial Instruments - Credit Losses

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) ASU 2016-13, Measurement of Credit Losses on Financial Instruments (“ASU 2016-13). ASU 2016-13 is a new standard intended to improve reporting requirements specific to loans, receivables and other financial instruments. ASU 2016-13 requires that credit losses on financial assets measured at amortized cost be determined using an expected loss model, instead of the current incurred loss model, and requires that credit losses related to available-for-sale debt securities be recorded through an allowance for credit losses and limited to the amount by which carrying value exceeds fair value. ASU 2016-13 also requires enhanced disclosure of credit risk associated with financial assets. The effective date of ASU 2016-13 was deferred by ASU 2019-09, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842)—Effective Dates to the annual period beginning after December 15, 2022 for companies that (i) meet the definition of an SEC filer and (ii) are eligible as “smaller reporting companies” as such term is defined by the SEC, with early adoption permitted. The Company is currently assessing the impact of adoption of ASU 2016-13 to its consolidated financial statements.

14

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

3. Collaborative Research and License Agreements

Allergan Collaboration Agreement

Summary of Agreement

On November 13, 2019 (the “Effective Date”), the Company entered into a Collaboration, Option and License Agreement (the “Allergan Collaboration Agreement”), with a wholly-owned subsidiary of Allergan plc, Allergan Pharmaceuticals International Limited (“Allergan”). On May 8, 2020, Allergan plc, including Allergan, was acquired by AbbVie Inc. (“AbbVie”). Accordingly, all references to “Allergan” in the defined terms including, but not limited to, “Allergan,” “Allergan Collaboration Agreement,” “Allergan R&D Services” and “Allergan JDC Services,” should be read and construed as references to AbbVie. Pursuant to the Allergan Collaboration Agreement, the Company granted to Allergan exclusive access and options to license SNA based therapeutics arising from two collaboration programs related to the treatment of hair loss disorders (each, a “Collaboration Program”). Under each such license (obtained in connection with the exercise of an Option, as defined and discussed further below), the Company would grant to Allergan exclusive, royalty-bearing, sublicenseable, nontransferable, worldwide rights to develop, manufacture, use and commercialize such SNA therapeutics. Under the Allergan Collaboration Agreement, the Company will use commercially reasonable efforts to conduct two Collaboration Programs, each focused on one or more hair loss disorders to discover one or more SNA products that are directed to, bind to or inhibit one or more specific Collaboration Program targets (each, a “Program Target”).

As of the Effective Date, the Company and Allergan have agreed upon a development plan for each Collaboration Program that describes the development activities and timelines required to advance such Collaboration Program through first IND filing (each, a “Development Plan”). The activities described in the Development Plan are conducted under the supervision of the Joint Development Committee (the “JDC”) consisting of three members from each of the Company and Allergan. The Company is primarily responsible for performing early stage discovery and preclinical activities (the “Initial Development Activities”) set forth in the Development Plan for each Collaboration Program and will be solely responsible for all costs and expenses related to the Initial Development Activities. Allergan may elect, in its sole discretion and at its sole cost and expense, to conduct formulation assessment and in vivo testing as set forth in a Development Plan.

Following the completion of all Initial Development Activities, the Company is required to deliver to Allergan a report that describes the results of the Initial Development Activities and identifies at least one SNA-based compound that satisfies certain criteria for such Collaboration Program as determined by the JDC (the “Initial Development Report”). Following the delivery of the Initial Development Report for a Collaboration Program, Allergan will have the ability for a defined period of time (the “Initial Option Exercise Period”) to exercise an option (each an “Option”) to obtain worldwide rights and license to the Company’s SNA technology and the Company’s interest in joint collaboration technology to make, have made, import, use, sell or offer for sale any product (each a “Licensed Product”) that results from such Collaboration Program during the term of the Allergan Collaboration Agreement.

At Allergan’s sole option, Allergan may extend the Initial Option Exercise Period (the “Option Extension”) and require the Company to perform IND-enabling activities described in the Development Plan (the “IND-Enabling Activities”), subject to the payment of additional consideration (“Extension Exercise”). If Allergan exercises the Option Extension, the Company would be responsible for conducting the IND-Enabling Activities and would be solely responsible for all costs and expenses associated with such activities. Upon completion of the IND-Enabling Activities, the Company is required to deliver a report that describes the results of the IND-Enabling Activities (the “IND-Enabling Activities Data Package”) to Allergan. Following the delivery of IND-Enabling Activities Data Package, Allergan will have the ability for a defined period of time (the “Extended Option Exercise Period”) to exercise an Option with respect to such Collaboration Program. After the exercise of an Option with respect to a Collaboration Program, Allergan will be responsible for all development, manufacturing, and commercialization activities, and costs and expense associated with such activities in connection with Licensed Products arising from such Collaboration Program.

15

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

The Company’s obligation to conduct the activities defined in the Development Plan under the Allergan Collaboration Agreement commenced on November 13, 2019 and continues until the earlier of (i) the date Allergan exercises an Option, (ii) the date Allergan abandons a Collaboration Program and foregoes its Option to that Collaboration Program, or (iii) the fifth anniversary of the Effective Date (the “Research Term”). If the Initial Option Exercise Period or Extended Option Exercise Period is still in effect for a Collaboration Program or if the Company has not delivered a complete Initial Development Report or, if Allergan made an Extension Exercise for a Collaboration Program, a complete IND-Enabling Activities Data Package for such Collaboration Program, as determined by the JDC, then the Research Term will automatically extend by one-year increments until such obligation is satisfied, but in no event past the seventh anniversary of the Effective Date.

Under the terms of the Allergan Collaboration Agreement, the Company received a $25,000 upfront, non-refundable, non-creditable cash payment (the “Allergan Upfront Payment”) related to the Company’s research and development costs for conducting the Development Plan for two Collaboration Programs, each focused on one or more targets, and certain options to obtain exclusive, worldwide licenses under certain intellectual property rights owned or controlled by the Company to develop, manufacture and commercialize certain products resulting from each such Collaboration Programs. The option exercise fee during the Initial Option Exercise Period is $10,000 per Collaboration Program. If Allergan elects to extend the Initial Option Exercise Period, Allergan is required to pay an additional fee of $10,000. If Allergan elects to exercise its option during the Extended Option Exercise Period, Allergan must pay the Company the option exercise fee of $15,000.

Following the exercise by Allergan of an Option with respect to a Collaboration Program, Allergan would be required to make certain milestone payments to the Company upon the achievement of specified development, product approval and launch, and commercial events, on a Licensed Product by Licensed Product basis. On a Licensed Product by Licensed Product basis, for the first Licensed Product to achieve the associated milestone event, the Company is eligible to receive up to an aggregate of $55,000 for development milestone payments and $132,500 for product approval and launch milestone payments. The Company is also eligible for up to $175,000 in sales milestone payments on a Collaboration Program by Collaboration Program basis, associated with aggregate worldwide sales. Certain product approval milestones are subject to certain reductions under specified circumstances, including for payments required to be made by Allergan to obtain certain third party intellectual property rights.

In addition, to the extent there is any Licensed Product, the Company would be entitled to receive tiered royalty payments of mid-single digits to the mid-teens percentage on future net worldwide product sales of such Licensed Products, subject to certain reductions under specified circumstances. Royalties are due on a Licensed Product by Licensed Product and country by country basis from the date of the first commercial sale of each Licensed Product in a country until the latest to occur of: (i) the expiration date in such country of the last to expire valid claim within the licensed intellectual property covering the manufacture, use or sale of such Licensed Product in such country, (ii) the tenth anniversary of the first commercial sale of such Licensed Product in such country, and (iii) the expiration of regulatory exclusivity for such Licensed Product in such country.

Allergan may terminate the Allergan Collaboration Agreement for any reason or no reason, either in its entirety or on a Collaboration Program by Collaboration Program basis, at any time on 90 days’ prior written notice to the Company. Unless earlier terminated, the term of the Allergan Collaboration Agreement shall continue until (i) if both Option Exercise Periods expire without Allergan exercising either Option, the expiration of the later to expire Option Exercise Period, and (ii) if either or both Options are exercised on a Licensed Product-by-Licensed Product and country-by-country basis, the expiration of the royalty term for such Licensed Product in such country. Either party may terminate the Allergan Collaboration Agreement if the other party has materially breached or defaulted in the performance of any of its material obligations and such breach or default continues after the specified cure period.

Termination of the Allergan Collaboration Agreement for any reason will not release either party from any liability which, at the time of such termination, has already accrued to the other party or which is attributable to a period prior to such termination. In addition, termination of the Allergan Collaboration Agreement will not preclude either party from pursuing any rights and remedies it may have under the agreement or at law or in equity with

16

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

respect to any breach of the Allergan Collaboration Agreement. If either party terminates the Allergan Collaboration Agreement, the license and rights granted to Allergan with respect to the terminated Collaboration Program or License Product shall terminate.

Accounting Analysis

The Company concluded that Allergan is a customer in this arrangement, and as such the arrangement falls within the scope of the revenue recognition guidance. Under the Allergan Collaboration Agreement, the Company has identified a single performance obligation that includes (i) the research and development activities during the Research Term (the “Allergan R&D Services”), and (ii) Joint Development Committee services during the Research Term (the “Allergan JDC Services”). The Company has concluded that the Allergan R&D Services is not distinct from the Allergan JDC Services during the Research Term. The JDC provides oversight and management of the overall Allergan Collaboration Agreement, and the members of the JDC from the Company have specialized industry knowledge, particularly as it relates to SNA technology. The JDC is meant to facilitate the early stage research being performed and coordinate the activities of both the Company and Allergan. Further, the JDC services are critical to the ongoing evaluation of a Collaboration Program and the drafting and evaluation of the Initial Development Report and the IND-Enabling Data Package. Accordingly, the Company’s participation on the JDC is essential to Allergan receiving value from the Allergan R&D Services and as such, the Allergan JDC Services along with the Allergan R&D Services are considered one performance obligation (the “Collaboration Program Services”). In addition, the Company has concluded that the option to purchase two development and commercialization licenses is considered a marketing offer as the options did not provide any discounts or other rights that would be considered a material right in the arrangement, and thus, not a performance obligation at the onset of the agreement. The consideration for these options will be accounted for when they are exercised.

As of the Effective Date of the Allergan Collaboration Agreement, the total transaction price was determined to be $25,000, consisting solely of the Allergan Upfront Payment. The Company also utilized the most likely amount method to estimate any development and regulatory milestone payments to be received. As of the Effective Date of the Allergan Collaboration Agreement, there were no milestones included in the transaction price. The milestones were fully constrained due to the significant uncertainties surrounding such payments. The Company considered the stage of development and the risks associated with the remaining development required to achieve the milestone, as well as whether the achievement of the milestone is outside the control of the Company or Allergan. The Company has determined that any commercial milestones and sales-based royalties will be recognized when the related sales occur and therefore have also been excluded from the transaction price. The Company will re-evaluate the transaction price at the end of each reporting period and as uncertain events are resolved or other changes in circumstances occur. As of March 31, 2020, the Company determined that any development, regulatory, or commercial milestones continue to be constrained and therefore the related milestone payments continue to be excluded from the transaction price at March 31, 2020.

The Company will recognize revenue related to the Collaboration Program Services as the performance obligation is satisfied using an input method to measure progress. The Company believes the input method that most accurately depicts the measure of progress is the actual hours incurred to date relative to projected hours to complete the research service.

During the three months ended March 31, 2020, the Company recognized revenue under the Allergan Collaboration Agreement of approximately $9,116. As of March 31, 2020, there was $15,713 of deferred revenue related to the Allergan Collaboration Agreement, which is classified as current on the unaudited condensed consolidated balance sheet.

17

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Dermelix Collaboration Agreement

Summary of Agreement

On February 17, 2019, Exicure entered into a License and Development Agreement with Dermelix (the “Dermelix Collaboration Agreement.”) Pursuant to the Dermelix Collaboration Agreement, the Company granted to Dermelix exclusive, worldwide royalty-bearing license rights to, develop, manufacture, have manufactured, use and commercialize the Company’s SNA technology for the treatment of Netherton Syndrome (“NS”) and, at Dermelix’s option, up to five additional specified orphan diseases that are within the dermatology field. Upon written notice to the Company, Dermelix may exercise its option at any time following the effective date of the Dermelix Collaboration Agreement until the date that is six (6) years from the date that the first collaboration SNA therapeutic achieves first dosing in humans in a Phase 1 clinical trial for NS.

Dermelix will initially seek to develop a targeted therapy for the treatment of NS. Under the terms of the Dermelix Collaboration Agreement, the Company will be responsible for conducting the early stage development for each indication up to IND enabling toxicology studies. Dermelix will assume subsequent development, commercial activities and financial responsibility for such indications. Dermelix will pay the costs and expenses of development and commercialization of any licensed products under the Dermelix Collaboration Agreement, including the Company’s expenses incurred in connection with development activities and in accordance with the development budget. Under the terms of the Dermelix Collaboration Agreement, Exicure received an upfront payment of $1,000, to be applied against the initial $1,000 of the Company’s development expenses. If Dermelix exercises any of its option rights for additional indications, Dermelix will pay an option exercise fee equal to $1,000 for each exercised option (each, an “Option Exercise Fee”). Any Option Exercise Fee will be applied against the Company’s development expenses with respect to the particular indication for which the option was exercised.

Pursuant to the Dermelix Collaboration Agreement, the Company shall have the right to pursue the development and commercialization of SNA technology for the treatment of orphan diseases which are neither NS nor one of the additional specified orphan diseases selected by Dermelix pursuant to its option rights. If the Company commences development activities of SNA technology for the treatment of such an orphan disease, the Company will notify Dermelix in writing of such development and Dermelix will have thirty (30) days following receipt of such notice to use one of its remaining option rights on such orphan disease. If Dermelix does not use one of its remaining option rights on such orphan disease, or has no option rights remaining, then the Company will have no further obligations to Dermelix with respect to the development of SNA therapeutics for such orphan disease and shall be free to continue commercialization and development activities with respect thereto.

For each of NS as well as any additional licensed product for which Dermelix exercises one of its options, the Company shall be eligible to receive additional cash payments totaling up to $13,500 upon achievement of certain development and regulatory milestones and up to $152,500 upon achievement of certain sales milestones. The regulatory milestones are payable upon the initiation or completion of clinical trials, and regulatory approval in the United States and outside the United States, per program. The commercial sales milestones are payable upon achievement of specified aggregate annual product sales thresholds. In the event a therapeutic candidate subject to the collaboration results in commercial sales, the Company will receive low double-digit royalties on annual net sales for such licensed products.

Accounting Analysis

The Company concluded that Dermelix is a customer in this arrangement, and as such the arrangement falls within the scope of the revenue recognition guidance. The Company identified performance obligations under the Dermelix Collaboration Agreement for the license of intellectual property for the NS therapeutic candidate and associated research and development services for the NS therapeutic candidate. The Company determined that the performance obligations were not separately identifiable and were not distinct or distinct within the context of the contract due to the specialized nature of the services to be provided by Exicure, specifically with respect to the

18

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Company’s expertise related to SNA technology, and the interdependent relationship between the performance obligations. As such, the Company concluded that there is a single identified performance obligation.

The Company used the most likely amount method to estimate variable consideration and estimated that the most likely amount for each potential development and regulatory milestone, which is considered variable consideration, was zero, as the achievement of those milestones is uncertain and highly susceptible to factors outside of the Company’s control. Accordingly, all such milestones were excluded from the transaction price. Management will re-evaluate the transaction price at the end of each reporting period and as uncertain events are resolved or other changes in circumstances occur and adjust the transaction price as necessary. Sales-based royalties, including commercial sales milestone payments based on the level of sales, were also excluded from the transaction price, as the license is deemed to be the predominant item to which the royalties relate. The Company will recognize such revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied).

Revenue associated with the performance obligation will be recognized as services are provided using a cost-to-cost measure of progress method. The transfer of control occurs over time and, in management’s judgment, this input method is the best measure of progress towards satisfying the performance obligation under the Dermelix Collaboration Agreement and reflects a faithful depiction of the transfer of goods and services.

The Company initially recorded the upfront payment of $1,000 as deferred revenue related to its wholly unsatisfied performance obligation and reduced this balance to zero during 2019 by recognizing revenue as services were provided. The Company recognized $67 of revenue under the Dermelix Collaboration Agreement during the three months ended March 31, 2020, which reflects reimbursement by Dermelix for additional costs incurred by Exicure for early stage development costs beyond the initial $1,000 upfront payment. The Company expects to incur additional early stage development costs and expects to be reimbursed by Dermelix for such costs under the terms of the Dermelix Collaboration Agreement. The Company will recognize both revenue and research and development expense for such costs on a gross basis during the period in which those costs are incurred. The Company recognized $25 of revenue under the Dermelix Collaboration Agreement during the three months ended March 31, 2019 which related to amortization of the above-mentioned deferred revenue related to the upfront payment for services provided during that period.

4. Supplemental Balance Sheet Information

Prepaid expenses and other current assets

March 31, 2020 | December 31, 2019 | ||||||

Prepaid clinical, contract research and manufacturing costs | $ | 1,219 | $ | 481 | |||

Interest receivable | 398 | 236 | |||||

Prepaid insurance | 369 | 533 | |||||

Other | 920 | 705 | |||||

Prepaid expenses and other current assets | $ | 2,906 | $ | 1,955 | |||

19

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Property and equipment, net

March 31, 2020 | December 31, 2019 | ||||||

Scientific equipment | $ | 3,315 | $ | 2,795 | |||

Leasehold improvements | 192 | 192 | |||||

Computers and software | 48 | 32 | |||||

Furniture and fixtures | 41 | 41 | |||||

Construction in process | 168 | 356 | |||||

Property and equipment, gross | 3,764 | 3,416 | |||||

Less: accumulated depreciation | (1,466 | ) | (1,317 | ) | |||

Property and equipment, net | $ | 2,298 | $ | 2,099 | |||

Depreciation and amortization expense was $148 and $87 for the three months ended March 31, 2020 and 2019, respectively.

Other noncurrent assets

March 31, 2020 | December 31, 2019 | ||||||

Restricted cash | $ | 1,200 | $ | — | |||

Operating lease asset | 285 | 356 | |||||

Other | 2 | 32 | |||||

Total other noncurrent assets | $ | 1,487 | $ | 388 | |||

Accrued expenses and other current liabilities

March 31, 2020 | December 31, 2019 | ||||||

Accrued payroll-related expenses | $ | 386 | $ | 920 | |||

Accrued legal expenses | 318 | 254 | |||||

Operating lease liability | 275 | 292 | |||||

Accrued clinical, contract research and manufacturing costs | 152 | 515 | |||||

Accrued other expenses | 137 | 454 | |||||

Accrued expenses and other current liabilities | $ | 1,268 | $ | 2,435 | |||

Other noncurrent liabilities

March 31, 2020 | December 31, 2019 | ||||||

Operating lease liability | $ | — | $ | 59 | |||

Total other noncurrent liabilities | $ | — | $ | 59 | |||

20

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

5. Investments

As of March 31, 2020 and December 31, 2019, the Company primarily invested its excess cash in debt instruments of corporations, the U.S. Treasury, financial institutions, and U.S. government agencies with strong credit ratings and an investment grade rating at or above a long-term rating of Aa3/AA- and a short-term rating of P1/A1. The Company has established guidelines relative to diversification and maturities that maintain safety and liquidity. The Company periodically reviews and modifies these guidelines to maximize trends in yields and interest rates without compromising safety and liquidity.

The following table summarizes the contract maturity of the available-for-sale securities the Company held as of March 31, 2020:

One year or less | 64 | % |

After one year but within two years | 36 | % |

Total | 100 | % |

All of the Company’s available-for-sale securities are available to the Company for use in its current operations. As a result, the Company categorizes all of these securities as current assets even though the stated maturity of some individual securities may be one year or more beyond the balance sheet date.

The amortized cost, gross unrealized holding gains, gross unrealized holding losses and fair value of cash equivalents and available-for-sale securities by type of security at March 31, 2020 and December 31, 2019 were as follows:

March 31, 2020 | |||||||||||||||

Amortized Costs | Gross Unrealized Holding Gains | Gross Unrealized Holding Losses | Fair Value | ||||||||||||

Commercial paper | $ | 10,718 | $ | 3 | $ | (9 | ) | $ | 10,712 | ||||||

Corporate notes/bonds | 49,973 | 44 | (158 | ) | 49,859 | ||||||||||

U.S. Treasuries | 4,510 | 36 | — | 4,546 | |||||||||||

U.S. Government agency securities | 9,039 | 67 | — | 9,106 | |||||||||||

$ | 74,240 | $ | 150 | $ | (167 | ) | $ | 74,223 | |||||||

December 31, 2019 | |||||||||||||||

Amortized Costs | Gross Unrealized Holding Gains | Gross Unrealized Holding Losses | Fair Value | ||||||||||||

Commercial paper | $ | 13,932 | $ | 1 | $ | (2 | ) | $ | 13,931 | ||||||

Corporate notes/bonds | 36,620 | 1 | (24 | ) | 36,597 | ||||||||||

U.S. Treasuries | 4,513 | — | (1 | ) | 4,512 | ||||||||||

U.S. Government agency securities | 9,786 | — | (2 | ) | 9,784 | ||||||||||

$ | 64,851 | $ | 2 | $ | (29 | ) | $ | 64,824 | |||||||

21

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

6. Debt

On March 2, 2020, pursuant to the terms of the loan agreement with Hercules Technology Growth Capital (“Hercules”) and subsequent amendments thereto (the “Hercules Loan Agreement”), the Company repaid all remaining outstanding obligations under the Hercules Loan Agreement as of the maturity date, including the outstanding principal balance of $4,999 and the end of term fee of $100.

The Company paid interest on the Hercules Loan Agreement of $142 and $149 during the three months ended March 31, 2020 and 2019, respectively.

7. Leases

The Company has lease agreements for its facilities in: Skokie, Illinois, which serves as the Company’s principal executive offices and where the Company has laboratory space; Cambridge, Massachusetts, where the Company leases office space; Chicago, Illinois, where the Company leases office and laboratory space; and leases for office equipment (the “Office Equipment Leases”), as further described below. Each of these leases are classified as operating leases.

Skokie Lease – The Company’s lease agreement for office and laboratory space in Skokie, Illinois commenced in March 2012 and expires in February 2021 (the “Skokie Lease”). The Skokie Lease includes a renewal option which the Company is not reasonably certain to exercise. Lease payments for the Skokie Lease include a fixed payment amount as well as variable payments related to a proportionate share of operating and real estate expenses.

Cambridge Lease – The Company’s lease agreement for office space at a multi-tenant facility in Cambridge, Massachusetts commenced in March 2019 and is month-to-month (the “Cambridge Lease”). The Cambridge Lease is cancellable at any time. Due to the nature of the Cambridge Lease, the Company determined that this lease represented a short-term lease with an initial term of less than twelve months and, as such, the Cambridge Lease is not recorded on the balance sheet and related lease costs are recognized in the statement of operations as they are incurred.

Chicago Lease – The Company has approximately thirty-thousand square feet of office and laboratory space in Chicago, Illinois (the “Chicago Lease”). The original term (the “Original Term”) of the Chicago Lease is 10 years, commencing on the date on which the Premises are ready for occupancy under the terms of the Chicago Lease (the "Anticipated Commencement Date"). The Company has options to extend the term of the Chicago Lease for two additional successive periods of five years each (the “Extension Periods”) at the then prevailing effective market rental rate.

The initial annual base rent during the Original Term is $37.00 per square foot per year, or approximately $1,113 for the first 12-month period of the Original Term, payable in monthly installments beginning on the Anticipated Commencement Date. Base rent thereafter is subject to annual increases of 3%, for an aggregate amount of $12,761 over the Original Term. The Company must also pay its proportionate share of certain operating expenses and taxes for each calendar year during the term. During the first 12-month period of the Original Term, the base rent and the Company's proportionate share of operating expenses and taxes are subject to certain abatements.

The Landlord will contribute a maximum of $3,159 toward tenant improvements. In connection with the Chicago Lease, the Company will maintain a letter of credit for the benefit of the Landlord in an initial amount of $1,200, which amount is subject to reduction over time. Upon execution of the Chicago Lease, the Company paid to the Landlord the first installment of base rent and the estimated monthly amount of its pro rata share of taxes and its pro rata share of operating expenses in the aggregate amount of $87 which amount had been adjusted for the abatement as set forth in the lease agreement.

As part of the agreement for the Chicago Lease, the Company is required to maintain a standby letter of credit during the term of the lease, currently in the amount of $1,200, which is secured by a restricted certificate of deposit

22

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

account and presented within other noncurrent assets on the Company’s unaudited condensed consolidated balance sheet at March 31, 2020.

The Chicago Lease has not yet commenced for accounting purposes as of March 31, 2020. As a result, the Company has not yet recognized an operating lease asset or operating lease liability on the unaudited condensed consolidated balance sheet for the Chicago Lease. The Company currently expects the Chicago Lease to commence in June of 2020.

Office Equipment Leases – The Company has also elected to not record the Office Equipment Leases on the balance sheet since related payment amounts and lease costs are insignificant. Lease costs for the Office Equipment Leases are recognized in the statement of operations on a straight-line basis over the lease term.

The following table summarizes the presentation in the Company’s unaudited condensed consolidated balance sheets of its operating leases:

March 31, 2020 | |||

Assets: | |||

Operating lease asset | $ | 285 | |

Liabilities: | |||

Operating lease liability | $ | 275 | |

Because the rate implicit in each lease is not readily determinable, the Company uses its incremental borrowing rate to determine the present value of the lease payments. Information related to the Company's operating lease asset and related operating lease liabilities were as follows:

March 31, 2020 | ||

Remaining lease term (1) | 0.9 years | |

Discount rate | 16.1 | % |

(1) Does not include a renewal term beyond February 28, 2021. Renewal terms are included in the lease term when it is reasonably certain that the Company will exercise the option.

The following table summarizes lease costs in the Company’s unaudited condensed consolidated statement of operations:

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Operating lease costs | $ | 84 | $ | 84 | |||

Short term lease costs | 38 | 6 | |||||

Variable lease costs | 57 | 84 | |||||

Total lease costs | $ | 179 | $ | 174 | |||

During the three months ended March 31, 2020 and 2019, the Company made cash payments of $114 and $277 for operating leases, respectively.

23

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Maturities of the Company’s lease liability as of March 31, 2020 were as follows:

Years Ending December 31, | Operating Leases (1) | |||

2020 (remaining nine months) | $ | 235 | ||

2021 | 59 | |||

Total | $ | 294 | ||

Less: imputed interest | (19 | ) | ||

Total lease liability | $ | 275 | ||

Current operating lease liability | $ | 275 | ||

(1) Excluded from the table above are the lease payments associated with the Chicago Lease that has not commenced as of the end of the period, which is the date the asset is made available to the Company by the lessor.

8. Stockholders’ Equity

Preferred Stock

As of March 31, 2020 and December 31, 2019, the Company had 10,000,000 shares of preferred stock, par value $0.0001 authorized and no shares issued and outstanding.

Common Stock

As of March 31, 2020 and December 31, 2019, the Company had authorized 200,000,000 shares of common stock, par value $0.0001. As of March 31, 2020 and December 31, 2019, the Company had 87,150,447 shares and 86,069,263 shares issued and outstanding, respectively.

The holders of shares of the Company’s common stock are entitled to one vote per share on all matters to be voted upon by the Company’s stockholders and there are no cumulative rights. Subject to preferences that may be applicable to any outstanding preferred stock, the holders of shares of the Company’s common stock are entitled to receive ratably any dividends that may be declared from time to time by the Company’s Board out of funds legally available for that purpose. In the event of the Company’s liquidation, dissolution or winding up, the holders of shares of the Company’s common stock are entitled to share ratably in all assets remaining after payment of liabilities, subject to prior distribution rights of preferred stock then outstanding. The Company’s common stock has no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to the Company’s common stock. The outstanding shares of the Company’s common stock are fully paid and non-assessable.

December 2019 Offering

On December 23, 2019, the Company sold 10,000,000 shares of its common stock at the public offering price of $2.75 per share in an underwritten public offering, for gross proceeds of $27,500 and estimated net proceeds of $25,344 after deducting underwriting discounts and commission and other offering expenses payable by the Company (the “December 2019 Offering”). In addition, the Company granted the underwriters a 30-day option to purchase an additional 1,500,000 shares of common stock offered in the common stock offering. On January 6, 2020, the underwriters partially exercised the option to purchase an additional 1,081,184 shares of common stock at the public offering price of $2.75 per share for additional gross proceeds of $2,973 and net proceeds of $2,766 after deducting underwriting discounts and commission and other offering expenses.

The shares sold in the December 2019 Offering were sold pursuant to a registration statement on Form S-3 that was declared effective by the SEC on July 24, 2019.

24

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

Common Stock Warrants

As of March 31, 2020, warrants to purchase 413,320 shares of common stock at a price of $3.00 per share remain outstanding. The Warrants expire as follows: 163,174 warrants expire on March 27, 2021; 132,884 expire on April 28, 2021; and 117,262 expire on May 3, 2021. The Warrants are classified as a liability which is remeasured each period at fair value. See Note 12, Fair Value Measurements for more information on the fair value of the common stock warrant liability.

Accumulated Other Comprehensive Loss

The following table summarizes the changes in each component of accumulated other comprehensive loss, net of tax, for 2020:

Unrealized gains (losses) on short-term investments | Total | |||||||

Balance at December 31, 2019 | $ | (27 | ) | $ | (27 | ) | ||

Other comprehensive income (loss) before reclassifications | 10 | 10 | ||||||

Net current period other comprehensive loss | 10 | 10 | ||||||

Balance at March 31, 2020 | $ | (17 | ) | $ | (17 | ) | ||

9. Equity-Based Compensation

The number of shares of common stock reserved for issuance under the 2017 Equity Incentive Plan automatically increases on January 1 of each year, beginning on January 1, 2020, by the lesser of (i) 4,600,000 shares, (ii) 5% of the total number of shares of our capital stock outstanding on December 31 of the preceding calendar year, or (iii) a lesser number of shares determined by the Compensation Committee of the Company’s Board. The Compensation Committee made the determination to increase the share reserve for the 2017 Equity Incentive Plan by 4,303,463 shares, effective January 1, 2020.

As of March 31, 2020, the aggregate number of common stock options available for grant under the 2017 Equity Incentive Plan was 3,127,813.

Equity-based compensation expense is classified in the statements of operations as follows:

Three Months Ended March 31, | ||||||||

2020 | 2019 | |||||||

Research and development expense | $ | 157 | $ | 121 | ||||

General and administrative expense | 284 | 368 | ||||||

$ | 441 | $ | 489 | |||||

Unamortized equity-based compensation expense at March 31, 2020 was $3,944, which is expected to be amortized over a weighted-average period of 2.8 years.

The Company utilizes the Black-Scholes option-pricing model to determine the fair value of common stock option grants. The Black-Scholes option-pricing model was developed for use in estimating the fair value of traded options that have no vesting restrictions and are fully transferable. The model also requires the input of highly subjective assumptions. In addition to an assumption on the expected term of the option grants as discussed below,

25

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

application of the Black-Scholes model requires additional inputs for which we have assumed the values described in the table below:

Three Months Ended March 31, | |||||

2020 | 2019 | ||||

Expected term | 5.2 to 6.1 years | 6.0 to 6.1 years | |||

Risk-free interest rate | 1.68% | 2.56% | |||

Expected volatility | 81.0% to 83.1%; weighted avg. 83.0% | 83.2% to 83.4%; weighted avg. 83.4% | |||

Forfeiture rate | 5 | % | 5 | % | |

Expected dividend yield | — | % | — | % | |

The expected term is based upon the “simplified method” as described in Staff Accounting Bulletin Topic 14.D.2. Currently, the Company does not have sufficient experience to provide a reasonable estimate of an expected term of its common stock options. The Company will continue to use the “simplified method” until there is sufficient experience to provide a more reasonable estimate in conformance with ASC 718-10-30-25 through 30-26. The risk-free interest rate assumptions were based on the U.S. Treasury bond rate appropriate for the expected term in effect at the time of grant. The expected volatility is based on calculated enterprise value volatilities for publicly traded companies in the same industry and general stage of development. The estimated forfeiture rates were based on historical experience for similar classes of employees. The dividend yield was based on expected dividends at the time of grant.

The fair value of the underlying common stock and the exercise price for the common stock options granted during the three months ended March 31, 2020 and 2019 are summarized in the table below:

Common Stock Options Granted During Period Ended: | Fair Value of Underlying Common Stock | Exercise Price of Common Stock Option | |

Three months ended March 31, 2020 | $1.19 to $2.80; weighted avg. $1.27 | $1.19 to $2.80; weighted avg. $1.27 | |

Three months ended March 31, 2019 | $2.80 | $2.80 | |

The weighted-average grant date fair value of common stock options granted in the three months ended March 31, 2020 and 2019 was $0.89 and $2.01 per common stock option, respectively.

A summary of common stock option activity as of the periods indicated is as follows:

Options | Weighted-Average Exercise Price | Weighted-Average Remaining Contractual Term (years) | Aggregate Intrinsic Value (thousands) | |||||||||

Outstanding - December 31, 2019 | 5,697,714 | $ | 2.34 | 6.7 | $ | 4,625 | ||||||

Granted | 1,211,704 | 1.27 | ||||||||||

Outstanding - March 31, 2020 | 6,909,418 | $ | 2.15 | 7.1 | $ | 1,492 | ||||||

Exercisable - March 31, 2020 | 4,164,925 | $ | 2.06 | 5.6 | $ | 1,172 | ||||||

Vested and Expected to Vest - March 31, 2020 | 6,693,125 | $ | 2.15 | 7.0 | $ | 1,461 | ||||||

26

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

10. Income Taxes

Pre-tax income was $1,150 for the three months ended March 31, 2020, which consists entirely of income in the United States. and resulted in no provision for income tax expense during the period then ended since it projects a pre-tax loss for the year ending December 31, 2020. Pre-tax loss was $5,286 for the three months ended March 31, 2019, which consists entirely of loss in the United States and resulted in no provision for income tax expense during the period then ended. The effective tax rate is 0% in each of the three months ended March 31, 2020 and 2019 because the Company has generated tax losses and has provided a full valuation allowance against its deferred tax assets.

On March 27, 2020, the President of the United States signed into law the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”). The CARES Act, among other things, allows for a five-year carry back of federal net operating losses generated in 2018 through 2020 and removes the 80% taxable income limitation for net operating loss deductions for tax years ending before 2021. While the Company continues to analyze the relevant provisions of the CARES Act, the provisions of the legislation did not have an impact on the Company’s income taxes.

11. Earnings (Loss) Per Common Share

Basic earnings (loss) per common share is calculated by dividing net income (loss) by the weighted-average number of shares of common stock outstanding during the period. Diluted earnings (loss) per common share is calculated using the treasury share method by giving effect to all potentially dilutive securities that were outstanding. Potentially dilutive options and warrants to purchase common stock that were outstanding during the three months ended March 31, 2019 were excluded from the diluted loss per share calculation for the three months ended March 31, 2019 because such shares had an anti-dilutive effect due to the net loss reported in that period. Therefore, basic and diluted loss per common share is the same for the three months ended March 31, 2019.

The following is the computation of earnings (loss) per common share for the three months ended March 31, 2020 and 2019:

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Net income (loss) | 1,150 | (5,286 | ) | ||||

Weighted-average basic common shares outstanding | 87,079,160 | 44,358,000 | |||||

Dilutive effect of exercise of stock options | 1,165,472 | — | |||||

Weighted-average diluted common shares outstanding | 88,244,632 | 44,358,000 | |||||

Earnings (loss) per basic common share | $ | 0.01 | $ | (0.12 | ) | ||

Earnings (loss) per diluted common share | $ | 0.01 | $ | (0.12 | ) | ||

27

EXICURE, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

The outstanding securities presented below were excluded from the calculation of earnings (loss) per common share for the periods presented, because such securities would have been anti-dilutive due to the Company’s earnings (loss) per share during that period:

As of March 31, | |||||

2020 | 2019 | ||||

Options to purchase common stock | 2,924,355 | 5,125,659 | |||

Warrants to purchase common stock | 413,320 | 413,320 | |||

12. Fair Value Measurements