Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Phillips Edison & Company, Inc. | peco_20200331-ex991.htm |

| EX-32.2 - EXHIBIT 32.2 - Phillips Edison & Company, Inc. | peco_20200331-ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Phillips Edison & Company, Inc. | peco_20200331-ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Phillips Edison & Company, Inc. | peco_20200331-ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Phillips Edison & Company, Inc. | peco_20200331-ex311.htm |

| EX-10.1 - EXHIBIT 10.1 - Phillips Edison & Company, Inc. | peco_20200331-ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

þ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2020

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 000-54691

PHILLIPS EDISON & COMPANY, INC.

(Exact Name of Registrant as Specified in Its Charter)

Maryland | 27-1106076 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11501 Northlake Drive Cincinnati, Ohio | 45249 |

(Address of principal executive offices) | (Zip Code) |

(513) 554-1110

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

None | None | None | ||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | þ | Smaller reporting company | ¨ |

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of May 1, 2020, there were 290.5 million outstanding shares of common stock of the Registrant.

PHILLIPS EDISON & COMPANY, INC.

FORM 10-Q

TABLE OF CONTENTS

PART I. FINANCIAL INFORMATION | ||

ITEM 1. | ||

ITEM 2. | ||

ITEM 3. | ||

ITEM 4. | ||

PART II. OTHER INFORMATION | ||

ITEM 1. | ||

ITEM 1A. | ||

ITEM 2. | ||

ITEM 5. | ||

ITEM 6. | ||

1

w PART I FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

AS OF MARCH 31, 2020 AND DECEMBER 31, 2019

(Condensed and Unaudited)

(In thousands, except per share amounts)

March 31, 2020 | December 31, 2019 | ||||||

ASSETS | |||||||

Investment in real estate: | |||||||

Land and improvements | $ | 1,547,542 | $ | 1,552,562 | |||

Building and improvements | 3,201,552 | 3,196,762 | |||||

In-place lease assets | 441,492 | 442,729 | |||||

Above-market lease assets | 65,946 | 65,946 | |||||

Total investment in real estate assets | 5,256,532 | 5,257,999 | |||||

Accumulated depreciation and amortization | (786,328 | ) | (731,560 | ) | |||

Net investment in real estate assets | 4,470,204 | 4,526,439 | |||||

Investment in unconsolidated joint ventures | 41,904 | 42,854 | |||||

Total investment in real estate assets, net | 4,512,108 | 4,569,293 | |||||

Cash and cash equivalents | 36,532 | 17,820 | |||||

Restricted cash | 48,043 | 77,288 | |||||

Goodwill | 29,066 | 29,066 | |||||

Other assets, net | 141,263 | 128,690 | |||||

Real estate investment and other assets held for sale | — | 6,038 | |||||

Total assets | $ | 4,767,012 | $ | 4,828,195 | |||

LIABILITIES AND EQUITY | |||||||

Liabilities: | |||||||

Debt obligations, net | $ | 2,356,401 | $ | 2,354,099 | |||

Below-market lease liabilities, net | 108,998 | 112,319 | |||||

Earn-out liability | 22,000 | 32,000 | |||||

Derivative liability | 62,756 | 20,974 | |||||

Deferred income | 13,841 | 15,955 | |||||

Accounts payable and other liabilities | 109,210 | 124,054 | |||||

Total liabilities | 2,673,206 | 2,659,401 | |||||

Commitments and contingencies (Note 8) | — | — | |||||

Equity: | |||||||

Preferred stock, $0.01 par value per share, 10,000 shares authorized, zero shares issued and | |||||||

outstanding at March 31, 2020 and December 31, 2019 | — | — | |||||

Common stock, $0.01 par value per share, 1,000,000 shares authorized, 290,416 and 289,047 | |||||||

shares issued and outstanding at March 31, 2020 and December 31, 2019, respectively | 2,903 | 2,890 | |||||

Additional paid-in capital | 2,793,803 | 2,779,130 | |||||

Accumulated other comprehensive loss (“AOCI”) | (58,552 | ) | (20,762 | ) | |||

Accumulated deficit | (986,292 | ) | (947,252 | ) | |||

Total stockholders’ equity | 1,751,862 | 1,814,006 | |||||

Noncontrolling interests | 341,944 | 354,788 | |||||

Total equity | 2,093,806 | 2,168,794 | |||||

Total liabilities and equity | $ | 4,767,012 | $ | 4,828,195 | |||

See notes to consolidated financial statements.

2

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019

(Condensed and Unaudited)

(In thousands, except per share amounts)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Revenues: | |||||||

Rental income | $ | 128,466 | $ | 128,860 | |||

Fees and management income | 2,165 | 3,261 | |||||

Other property income | 892 | 648 | |||||

Total revenues | 131,523 | 132,769 | |||||

Operating Expenses: | |||||||

Property operating | 21,762 | 22,866 | |||||

Real estate taxes | 17,112 | 17,348 | |||||

General and administrative | 10,740 | 13,285 | |||||

Depreciation and amortization | 56,227 | 60,989 | |||||

Impairment of real estate assets | — | 13,717 | |||||

Total operating expenses | 105,841 | 128,205 | |||||

Other: | |||||||

Interest expense, net | (22,775 | ) | (25,009 | ) | |||

(Loss) gain on disposal of property, net | (1,577 | ) | 7,121 | ||||

Other income, net | 9,869 | 7,536 | |||||

Net income (loss) | 11,199 | (5,788 | ) | ||||

Net (income) loss attributable to noncontrolling interests | (1,430 | ) | 593 | ||||

Net income (loss) attributable to stockholders | $ | 9,769 | $ | (5,195 | ) | ||

Earnings per common share: | |||||||

Net income (loss) per share attributable to stockholders - basic and diluted (See Note 10) | $ | 0.03 | $ | (0.02 | ) | ||

Comprehensive loss: | |||||||

Net income (loss) | $ | 11,199 | $ | (5,788 | ) | ||

Other comprehensive loss: | |||||||

Change in unrealized value on interest rate swaps | (43,364 | ) | (14,361 | ) | |||

Comprehensive loss | (32,165 | ) | (20,149 | ) | |||

Net (income) loss attributable to noncontrolling interests | (1,430 | ) | 593 | ||||

Other comprehensive loss attributable to noncontrolling interests | 5,574 | 1,938 | |||||

Comprehensive loss attributable to stockholders | $ | (28,021 | ) | $ | (17,618 | ) | |

See notes to consolidated financial statements.

3

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019

(Condensed and Unaudited)

(In thousands, except per share amounts)

Common Stock | Additional Paid-In Capital | AOCI | Accumulated Deficit | Total Stockholders’ Equity | Noncontrolling Interests | Total Equity | ||||||||||||||||||||||||

Shares | Amount | |||||||||||||||||||||||||||||

Balance at January 1, 2019 | 279,803 | $ | 2,798 | $ | 2,674,871 | $ | 12,362 | $ | (692,573 | ) | $ | 1,997,458 | $ | 414,911 | $ | 2,412,369 | ||||||||||||||

Dividend reinvestment plan (“DRIP”) | 1,603 | 16 | 17,702 | — | — | 17,718 | — | 17,718 | ||||||||||||||||||||||

Share repurchases | (605 | ) | (6 | ) | (6,674 | ) | — | — | (6,680 | ) | — | (6,680 | ) | |||||||||||||||||

Change in unrealized value on interest rate swaps | — | — | — | (12,423 | ) | — | (12,423 | ) | (1,938 | ) | (14,361 | ) | ||||||||||||||||||

Common distributions declared, $0.17 per share | — | — | — | — | (47,972 | ) | (47,972 | ) | — | (47,972 | ) | |||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | (7,167 | ) | (7,167 | ) | ||||||||||||||||||||

Share-based compensation | 40 | — | 227 | — | — | 227 | 839 | 1,066 | ||||||||||||||||||||||

Conversion of noncontrolling interests | 708 | 7 | 7,820 | — | — | 7,827 | (7,827 | ) | — | |||||||||||||||||||||

Net loss | — | — | — | — | (5,195 | ) | (5,195 | ) | (593 | ) | (5,788 | ) | ||||||||||||||||||

Balance at March 31, 2019 | 281,549 | $ | 2,815 | $ | 2,693,946 | $ | (61 | ) | $ | (745,740 | ) | $ | 1,950,960 | $ | 398,225 | $ | 2,349,185 | |||||||||||||

Balance at January 1, 2020 | 289,047 | $ | 2,890 | $ | 2,779,130 | $ | (20,762 | ) | $ | (947,252 | ) | $ | 1,814,006 | $ | 354,788 | $ | 2,168,794 | |||||||||||||

DRIP | 1,436 | 14 | 15,926 | — | — | 15,940 | — | $ | 15,940 | |||||||||||||||||||||

Share repurchases | (288 | ) | (3 | ) | (2,697 | ) | — | — | (2,700 | ) | — | (2,700 | ) | |||||||||||||||||

Change in unrealized value on interest rate swaps | — | — | — | (37,790 | ) | — | (37,790 | ) | (5,574 | ) | (43,364 | ) | ||||||||||||||||||

Common distributions declared, $0.17 per share | — | — | — | — | (48,809 | ) | (48,809 | ) | — | (48,809 | ) | |||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | (7,105 | ) | (7,105 | ) | ||||||||||||||||||||

Share-based compensation | 103 | 1 | 140 | — | — | 141 | (290 | ) | (149 | ) | ||||||||||||||||||||

Conversion of noncontrolling interests | 118 | 1 | 1,304 | — | — | 1,305 | (1,305 | ) | — | |||||||||||||||||||||

Net income | — | — | — | — | 9,769 | 9,769 | 1,430 | 11,199 | ||||||||||||||||||||||

Balance at March 31, 2020 | 290,416 | $ | 2,903 | $ | 2,793,803 | $ | (58,552 | ) | $ | (986,292 | ) | $ | 1,751,862 | $ | 341,944 | $ | 2,093,806 | |||||||||||||

See notes to consolidated financial statements.

4

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019

(Condensed and Unaudited)

(In thousands)

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||

Net income (loss) | $ | 11,199 | $ | (5,788 | ) | ||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||

Depreciation and amortization of real estate assets | 54,817 | 59,342 | |||||

Impairment of real estate assets | — | 13,717 | |||||

Depreciation and amortization of corporate assets | 1,410 | 1,647 | |||||

Net amortization of above- and below-market leases | (788 | ) | (1,133 | ) | |||

Amortization of deferred financing expenses | 1,251 | 1,297 | |||||

Amortization of debt and derivative adjustments | 1,061 | 2,227 | |||||

Loss (gain) on disposal of property, net | 1,577 | (7,121 | ) | ||||

Change in fair value of earn-out liability | (10,000 | ) | (7,500 | ) | |||

Straight-line rent | (2,288 | ) | (1,713 | ) | |||

Share-based compensation | (149 | ) | 1,272 | ||||

Other | 707 | 995 | |||||

Changes in operating assets and liabilities: | |||||||

Other assets, net | (14,871 | ) | 1,923 | ||||

Accounts payable and other liabilities | (8,313 | ) | (17,921 | ) | |||

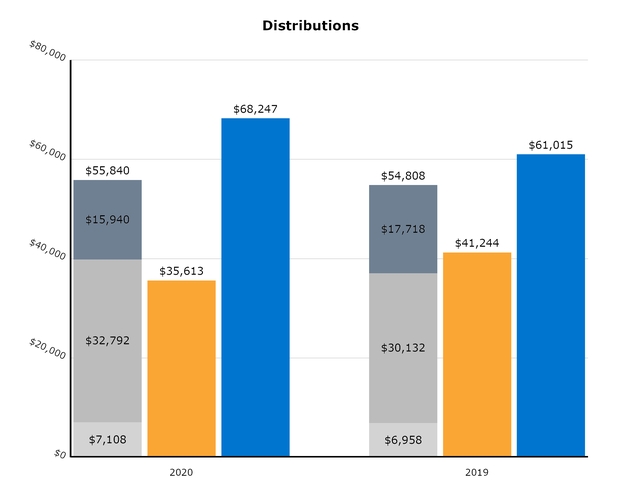

Net cash provided by operating activities | 35,613 | 41,244 | |||||

CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||

Real estate acquisitions | (4,319 | ) | — | ||||

Capital expenditures | (15,965 | ) | (8,574 | ) | |||

Proceeds from sale of real estate | 17,447 | 35,755 | |||||

Return of investment in unconsolidated joint ventures | 424 | 1,197 | |||||

Net cash (used in) provided by investing activities | (2,413 | ) | 28,378 | ||||

CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||

Net change in credit facility | 34,000 | (22,000 | ) | ||||

Payments on mortgages and loans payable | (32,657 | ) | (2,428 | ) | |||

Distributions paid, net of DRIP | (32,792 | ) | (30,132 | ) | |||

Distributions to noncontrolling interests | (7,108 | ) | (6,958 | ) | |||

Repurchases of common stock | (5,176 | ) | (5,444 | ) | |||

Other | — | (206 | ) | ||||

Net cash used in financing activities | (43,733 | ) | (67,168 | ) | |||

NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (10,533 | ) | 2,454 | ||||

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH: | |||||||

Beginning of period | 95,108 | 84,304 | |||||

End of period | $ | 84,575 | $ | 86,758 | |||

RECONCILIATION TO CONSOLIDATED BALANCE SHEETS: | |||||||

Cash and cash equivalents | $ | 36,532 | $ | 12,684 | |||

Restricted cash | 48,043 | 74,074 | |||||

Cash, cash equivalents, and restricted cash at end of period | $ | 84,575 | $ | 86,758 | |||

5

PHILLIPS EDISON & COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019

(Unaudited)

(In thousands)

2020 | 2019 | ||||||

SUPPLEMENTAL CASH FLOW DISCLOSURE, INCLUDING NON-CASH INVESTING AND FINANCING ACTIVITIES: | |||||||

Cash paid for interest | $ | 20,329 | $ | 21,679 | |||

Right-of-use (“ROU”) assets obtained in exchange for new lease liabilities | 551 | 36 | |||||

Accrued capital expenditures | 3,392 | 2,095 | |||||

Change in distributions payable | 77 | 122 | |||||

Change in distributions payable - noncontrolling interests | (3 | ) | 209 | ||||

Change in accrued share repurchase obligation | (2,476 | ) | 1,236 | ||||

Distributions reinvested | 15,940 | 17,718 | |||||

See notes to consolidated financial statements.

6

Phillips Edison & Company, Inc.

Notes to Consolidated Financial Statements

(Condensed and Unaudited)

1. ORGANIZATION |

Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) was formed as a Maryland corporation in October 2009. Substantially all of our business is conducted through Phillips Edison Grocery Center Operating Partnership I, L.P., (the “Operating Partnership”), a Delaware limited partnership formed in December 2009. We are a limited partner of the Operating Partnership, and our wholly owned subsidiary, Phillips Edison Grocery Center OP GP I LLC, is the sole general partner of the Operating Partnership.

We are a real estate investment trust (“REIT”) that invests primarily in well-occupied, grocery-anchored, neighborhood and community shopping centers that have a mix of creditworthy national, regional, and local retailers that sell necessity-based goods and services in strong demographic markets throughout the United States. In addition to managing our own shopping centers, our third-party investment management business provides comprehensive real estate and asset management services to three institutional joint ventures, in which we have a partial ownership interest, and one private fund (collectively, the “Managed Funds”).

As of March 31, 2020, we wholly-owned 285 real estate properties. Additionally, we owned a 20% equity interest in Necessity Retail Partners (“NRP”), a joint venture that owned seven properties; a 15% interest in Grocery Retail Partners I LLC (“GRP I”), a joint venture that owned 17 properties; and a 10% interest in Grocery Retail Partners II LLC (“GRP II”), a joint venture that owned three properties.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

Set forth below is a summary of the significant accounting estimates and policies that management believes are important to the preparation of our consolidated interim financial statements. Certain of our accounting estimates are particularly important for an understanding of our financial position and results of operations and require the application of significant judgment by management. For example, significant estimates and assumptions have been made with respect to the useful lives of assets, recoverable amounts of receivables, and other fair value measurement assessments required for the preparation of the consolidated financial statements. As a result, these estimates are subject to a degree of uncertainty.

During the first quarter of 2020, a novel coronavirus (“COVID-19”) began spreading globally, with the outbreak being classified as a pandemic by the World Health Organization on March 11, 2020. Because of the adverse economic conditions that exist as a result of the impacts of the COVID-19 pandemic, it is possible that the estimates and assumptions that have been utilized in the preparation of the consolidated financial statements could change significantly. Specifically as it relates to our business, the current economic situation has resulted in temporary tenant closures at our shopping centers, often as a result of “stay-at-home” government mandates which limit travel and movement of the general public to essential activities only and require all non-essential businesses to close. These mandates could result in increased permanent retail store closings nationally if the duration of the closures is prolonged. This could reduce the demand for leasing space in our shopping centers and result in a decline in occupancy and rental revenues in our real estate portfolio. All of this activity impacts our estimates around the collectability of revenue and valuation of real estate assets, goodwill and other intangible assets, and certain liabilities, among others.

There were no changes to our significant accounting policies during the three months ended March 31, 2020. For a full summary of our accounting policies, refer to our 2019 Annual Report on Form 10-K filed with the SEC on March 11, 2020.

Basis of Presentation and Principles of Consolidation—The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and with instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. Readers of this Quarterly Report on Form 10-Q should refer to our audited consolidated financial statements for the year ended December 31, 2019, which are included in our 2019 Annual Report on Form 10-K. In the opinion of management, all normal and recurring adjustments necessary for the fair presentation of the unaudited consolidated financial statements for the periods presented have been included in this Quarterly Report. Our results of operations for the three months ended March 31, 2020 are not necessarily indicative of the operating results expected for the full year.

The accompanying consolidated financial statements include our accounts and those of our majority-owned subsidiaries. All intercompany balances and transactions are eliminated upon consolidation.

Income Taxes—Our consolidated financial statements include the operations of wholly owned subsidiaries that have jointly elected to be treated as Taxable REIT Subsidiaries (“TRS”) and are subject to U.S. federal, state, and local income taxes at regular corporate tax rates. During the three months ended March 31, 2020, an immaterial amount of federal income tax benefit was reported, and we recorded a full valuation allowance for our net deferred tax asset. We recorded no income tax expense or benefit for the three months ended March 31, 2019. We recognized an immaterial amount of state and local income tax expense for the three months ended March 31, 2020 and 2019, which is included in Other Income, Net on the consolidated statements of operations and comprehensive loss (“consolidated statements of operations”).

7

Recently Issued and Newly Adopted Accounting Pronouncements—The following table provides a brief description of newly adopted accounting pronouncements and their effect on our consolidated financial statements:

Standard | Description | Date of Adoption | Effect on the Financial Statements or Other Significant Matters | |||

Accounting Standards Update (“ASU”) 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments ASU 2018-19, Financial Instruments - Credit Losses (Topic 326): Codification Improvements ASU 2019-05, Financial Instruments - Credit Losses (Topic 326): Targeted Transition Relief ASU 2019-11, Codification Improvements to Topic 326, Financial Instruments - Credit Losses ASU 2020-02, Financial Instruments - Credit Losses (Topic 326) and Leases (Topic 842) | The amendments in this update replaced the incurred loss impairment methodology in current GAAP with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. It clarified that receivables arising from operating leases are not within the scope of Accounting Standards Codification (“ASC”) Topic 326. Instead, impairment of receivables arising from operating leases will be accounted for in accordance with Topic 842. It also allowed election of the fair value option on certain financial instruments. | January 1, 2020 | The adoption of this standard did not have a material impact on our consolidated financial statements. The majority of our financial instruments result from operating lease transactions, which are not within the scope of this standard. | |||

ASU 2018-17, Consolidation (Topic 810): Targeted Improvements to Related Party Guidance for Variable Interest Entities | This ASU amended two aspects of the related-party guidance in Topic 810: (1) added an elective private-company scope exception to the variable interest entity guidance for entities under common control and (2) indirect interests held through related parties in common control arrangements will be considered on a proportional basis for determining whether fees paid to decision makers and service providers are variable interests. | January 1, 2020 | The adoption of this standard did not have a material impact on our consolidated financial statements. | |||

ASU 2019-04, Codification Improvements to Topic 326, Financial Instruments—Credit Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments | This ASU amended a variety of topics, improving certain aspects of previously issued ASUs, including ASU 2016-01, Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, and ASU 2017-12, Derivatives and Hedging (Topic 815): Targeted Improvements to Accounting for Hedging Activities. | January 1, 2020 | The adoption of this standard did not have a material impact on our consolidated financial statements. | |||

ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting | This ASU contains practical expedients for reference rate reform related activities that impact debt, leases, derivatives and other contracts. The guidance in ASU 2020-04 is optional and may be elected over time as reference rate reform activities occur. | March 12, 2020 | We have elected to apply the hedge accounting expedients related to probability and the assessments of effectiveness for future LIBOR-indexed cash flows to assume that the index upon which future hedged transactions will be based matches the index on the corresponding derivatives. Application of these expedients preserves the presentation of derivatives consistent with past presentation. We continue to evaluate the impact of the guidance and may apply other elections as applicable as additional changes in the market occur. | |||

In response to the COVID-19 pandemic, the FASB issued interpretive guidance addressing the accounting treatment of lease concessions stemming from the pandemic. Under this guidance, entities may make an election to account for lease concessions granted in conjunction with the pandemic consistent with how those concessions would be accounted for under ASC Topic 842, Leases (“ASC 842”) if those enforceable rights and obligations for those concessions already existed within the lease agreement. This accounting treatment may be applied regardless of whether enforceable rights and obligations for those concessions are explicitly outlined within the lease. As a result, entities that make this election will not have to analyze each lease to determine whether enforceable rights and obligations for concessions exist within the contract, and may elect not to account for these concessions as lease modifications within the scope of ASC 842. We will continue to assess the potential impact of this accounting treatment. As of May 11, 2020, we had not yet made any such concessions.

8

Reclassifications—The following line item on our consolidated balance sheets as of December 31, 2019 was reclassified to conform to current year presentation:

• | Corporate Intangible Assets, Net was included in Other Assets, Net. |

The following line items on our consolidated statements of cash flows for the three months ended March 31, 2019 were reclassified to conform to current year presentation:

• | Amortization of Debt and Derivative Adjustments was listed on a separate line from Other Cash Flows from Operating Activities; and |

• | Equity in Net Loss of Unconsolidated Joint Ventures was combined with Other Cash Flows from Operating Activities. |

3. LEASES |

Lessor—The majority of our leases are largely similar in that the leased asset is retail space within our properties, and the lease agreements generally contain similar provisions and features, without substantial variations. All of our leases are currently classified as operating leases. Lease income related to our operating leases was as follows for the three months ended March 31, 2020 and 2019 (dollars in thousands):

March 31, 2020 | March 31, 2019 | ||||||

Rental income related to fixed lease payments | $ | 98,335 | $ | 97,586 | |||

Rental income related to variable lease payments | 31,838 | 30,527 | |||||

Other(1) | (1,707 | ) | 747 | ||||

Total rental income | $ | 128,466 | $ | 128,860 | |||

(1) | Amounts consist of amortization of above- and below-market lease intangibles, lease inducements, revenue adjustments related to changes in collectability, settlement income, and lease buyout income. |

Approximate future fixed contractual lease payments to be received under non-cancelable operating leases in effect as of March 31, 2020, assuming no new or renegotiated leases or option extensions on lease agreements, are as follows (in thousands):

Year | Amount | ||

Remaining 2020 | $ | 281,778 | |

2021 | 341,849 | ||

2022 | 305,829 | ||

2023 | 257,200 | ||

2024 | 201,367 | ||

Thereafter | 537,322 | ||

Total | $ | 1,925,345 | |

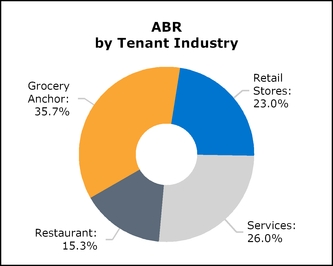

No single tenant comprised 10% or more of our aggregate annualized base rent (“ABR”) as of March 31, 2020. As of March 31, 2020, our real estate investments in Florida and California represented 12.3% and 10.5% of our ABR, respectively. As a result, the geographic concentration of our portfolio makes it particularly susceptible to adverse weather or economic events, including the impact of the COVID-19 pandemic, in the Florida and California real estate markets. As of May 11, 2020, there were approximately 210 and 170 tenant spaces temporarily closed as a result of the COVID-19 pandemic in Florida and California, respectively.

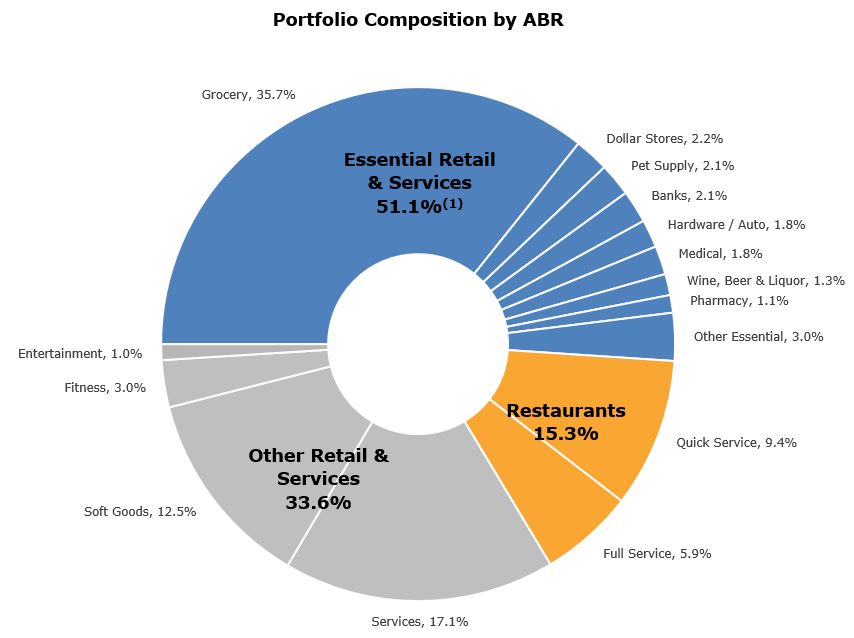

States have issued “stay-at-home” orders that have resulted in temporary business closures but have exempted businesses providing essential goods and services from these mandatory closures. While the definition of what constitutes an essential business and related guidelines vary between different states and municipalities, as it pertains to our portfolio, we believe this generally includes grocers and supermarkets, healthcare providers and pharmacies, banks, gas stations, automotive repair shops, pet stores, laundromats, and other businesses offering goods and services that would similarly be considered critical for a functional society and life-sustaining activities. Even among those that are considered to be essential, many businesses have seen sharp decreases in foot traffic and customer patronage as a result of “stay-at-home” mandates and social distancing guidelines. State mandates have continued to evolve from the initial closures in late March, with certain states implementing “stay-at-home” orders in April, and other states beginning to ease restrictions in late April and early May. As of March 31, 2020, we believe tenants comprising approximately 51% of our portfolio’s ABR are considered essential retail businesses and services. In addition to these essential retail businesses and services, restaurants, comprising approximately 15% of our ABR, are also characterized as essential in many states and municipalities, and may remain open for takeout and delivery.

9

Lessee—Lease assets and liabilities, grouped by balance sheet line where they are recorded, consisted of the following as of March 31, 2020 and December 31, 2019 (in thousands):

Balance Sheet Information | Balance Sheet Location | March 31, 2020 | December 31, 2019 | |||||

ROU assets, net - operating leases(1) | Investment in Real Estate | $ | 3,952 | $ | 7,613 | |||

ROU assets, net - operating and finance leases | Other Assets, Net | 2,396 | 2,111 | |||||

Operating lease liability | Accounts Payable and Other Liabilities | 6,168 | 9,453 | |||||

Finance lease liability | Debt Obligations, Net | 384 | 443 | |||||

(1) | During the three months ended March 31, 2020, one of our acquisitions was land upon which one of our shopping centers is situated that was previously subject to a ground lease in which the lessor controlled an option requiring us to purchase the land subject to the lease. Our valuation of the ROU asset and lease liability as of December 31, 2019 for this ground lease reflected the assumption that the lessor would exercise this option and that we would purchase the underlying land asset. |

4. REAL ESTATE ACTIVITY |

Property Sales—The following table summarizes our real estate disposition activity (dollars in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Number of properties sold(1) | 3 | 3 | |||||

Proceeds from sale of real estate | $ | 17,447 | $ | 35,755 | |||

(Loss) gain on sale of properties, net(2) | (826 | ) | 7,399 | ||||

(1) | We retained certain outparcels of land associated with one of our property dispositions during the three months ended March 31, 2020, and as a result, this property is still included in our total property count. |

(2) | The (loss) gain on sale of properties, net does not include miscellaneous write-off activity, which is also recorded in (Loss) Gain on Disposal of Property, Net on the consolidated statements of operations. |

Impairment of Real Estate Assets—During the three months ended March 31, 2020, we did not recognize any impairment charges. During the three months ended March 31, 2019, we recognized impairment charges totaling $13.7 million. The impairments were associated with certain anticipated property dispositions where the net book value exceeded the estimated fair value. Our estimated fair value was based upon the contracted price to sell or the marketed price for disposition, less estimated costs to sell. We have applied reasonable estimates and judgments in determining the amount of impairment recognized.

Acquisitions—During the three months ended March 31, 2020, we acquired two parcels of land for a total of $4.3 million, both of which are either underneath or adjacent to shopping centers that we own.

There were no acquisitions during the three months ended March 31, 2019.

10

5. OTHER ASSETS, NET |

The following is a summary of Other Assets, Net outstanding as of March 31, 2020 and December 31, 2019, excluding amounts related to assets classified as held for sale (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Other assets, net: | |||||||

Deferred leasing commissions and costs | $ | 39,667 | $ | 38,738 | |||

Deferred financing expenses | 13,971 | 13,971 | |||||

Office equipment, ROU assets, and other | 20,612 | 19,430 | |||||

Corporate intangible assets | 4,883 | 4,883 | |||||

Total depreciable and amortizable assets | 79,133 | 77,022 | |||||

Accumulated depreciation and amortization | (37,880 | ) | (35,055 | ) | |||

Net depreciable and amortizable assets | 41,253 | 41,967 | |||||

Accounts receivable, net(1) | 52,854 | 46,125 | |||||

Accounts receivable - affiliates | 972 | 728 | |||||

Deferred rent receivable, net | 31,572 | 29,291 | |||||

Derivative asset | 18 | 2,728 | |||||

Prepaid expenses and other | 14,594 | 7,851 | |||||

Total other assets, net | $ | 141,263 | $ | 128,690 | |||

(1) | Net of $6.2 million and $6.9 million of reserves for uncollectible amounts. |

6. DEBT OBLIGATIONS |

The following is a summary of the outstanding principal balances and interest rates, which include the effect of derivative financial instruments, for our debt obligations as of March 31, 2020 and December 31, 2019 (dollars in thousands):

Interest Rate(1) | March 31, 2020 | December 31, 2019 | |||||||

Revolving credit facility(2) | LIBOR + 1.4% | $ | 34,000 | $ | — | ||||

Term loans(3) | 2.01% - 4.59% | 1,622,500 | 1,652,500 | ||||||

Secured loan facilities | 3.35% - 3.52% | 395,000 | 395,000 | ||||||

Mortgages | 3.45% - 7.91% | 322,127 | 324,578 | ||||||

Finance lease liability | 384 | 443 | |||||||

Assumed market debt adjustments, net | (1,285 | ) | (1,218 | ) | |||||

Deferred financing expenses, net | (16,325 | ) | (17,204 | ) | |||||

Total | $ | 2,356,401 | $ | 2,354,099 | |||||

(1) | Interest rates are as of March 31, 2020. |

(2) | The gross borrowings and payments under our revolving credit facility were $55.0 million and $21.0 million, respectively, during the three months ended March 31, 2020. The gross borrowings and payments under our revolving credit facility were $64.0 million and $86.0 million, respectively, during the three months ended March 31, 2019. |

(3) | Our term loans carry an interest rate of LIBOR plus a spread. While most of the rates are fixed through the use of swaps, there is still a portion of these loans that is not fixed through a swap, and thus is still indexed to LIBOR. |

In January 2020, we made the final $30 million payment on our term loan maturing in 2021. Following this payment, the next term loan maturity is in April 2022.

In March 2020, we borrowed $34 million on our $500 million revolving credit facility in order to satisfy general operating needs. In April 2020, we borrowed an additional $200 million on our revolving credit facility to meet our operating needs for a sustained period due to the COVID-19 pandemic. As of May 11, 2020, total availability on our revolving credit facility, net of any letters of credit, was $254.7 million. Our debt is subject to certain covenants, and as of March 31, 2020, we were in compliance with the restrictive covenants of our outstanding debt obligations.

11

The allocation of total debt between fixed-rate and variable-rate as well as between secured and unsecured, excluding market debt adjustments and deferred financing expenses, net, as of March 31, 2020 and December 31, 2019, is summarized below (in thousands):

March 31, 2020 | December 31, 2019 | ||||||

As to interest rate:(1) | |||||||

Fixed-rate debt | $ | 1,944,511 | $ | 2,122,021 | |||

Variable-rate debt | 429,500 | 250,500 | |||||

Total | $ | 2,374,011 | $ | 2,372,521 | |||

As to collateralization: | |||||||

Unsecured debt | $ | 1,656,500 | $ | 1,652,500 | |||

Secured debt | 717,511 | 720,021 | |||||

Total | $ | 2,374,011 | $ | 2,372,521 | |||

Weighed-average interest rate(1) | 3.3 | % | 3.4 | % | |||

(1) | Includes the effects of derivative financial instruments (see Notes 7 and 12). |

7. DERIVATIVES AND HEDGING ACTIVITIES |

Risk Management Objective of Using Derivatives—We are exposed to certain risks arising from both our business operations and economic conditions. We principally manage our exposure to a wide variety of business and operational risks through management of our core business activities. We manage economic risks, including interest rate, liquidity, and credit risk, primarily by managing the amount, sources, and duration of our debt funding, and through the use of derivative financial instruments. Specifically, we enter into interest rate swaps to manage exposures that arise from business activities that result in the receipt or payment of future known and uncertain cash amounts, the value of which are determined by interest rates. Our derivative financial instruments are used to manage differences in the amount, timing, and duration of our known or expected cash receipts and our known or expected cash payments principally related to our investments and borrowings.

Cash Flow Hedges of Interest Rate Risk—Interest rate swaps designated as cash flow hedges involve the receipt of variable amounts from a counterparty in exchange for our making fixed-rate payments over the life of the agreements without exchange of the underlying notional amount.

The changes in the fair value of derivatives designated, and that qualify, as cash flow hedges are recorded in AOCI and are subsequently reclassified into earnings in the period that the hedged forecasted transaction affects earnings. During the three months ended March 31, 2020 and 2019, such derivatives were used to hedge the variable cash flows associated with certain variable-rate debt. Amounts reported in AOCI related to these derivatives will be reclassified to Interest Expense, Net as interest payments are made on the variable-rate debt. During the next twelve months, we estimate that an additional $18.7 million will be reclassified from AOCI as an increase to Interest Expense, Net.

The following is a summary of our interest rate swaps that were designated as cash flow hedges of interest rate risk as of March 31, 2020 and December 31, 2019 (notional amounts in thousands):

March 31, 2020 | December 31, 2019 | ||||||

Count | 8 | 9 | |||||

Notional amount | $ | 1,227,000 | $ | 1,402,000 | |||

Fixed LIBOR | 0.8% - 2.9% | 0.8% - 2.9% | |||||

Maturity date | 2020 - 2025 | 2020 - 2025 | |||||

The table below details the nature of the gain or loss recognized on interest rate derivatives designated as cash flow hedges in the consolidated statements of operations (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Amount of (loss) recognized in other comprehensive income on derivatives | $ | (44,916 | ) | $ | (12,857 | ) | |

Amount of loss (gain) reclassified from AOCI into interest expense | 1,552 | (1,504 | ) | ||||

Credit-risk-related Contingent Features—We have agreements with our derivative counterparties that contain provisions where, if we default, or are capable of being declared in default, on any of our indebtedness, we could also be declared to be in default on our derivative obligations. As of March 31, 2020, the fair value of our derivatives in a net liability position, which included accrued interest but excluded any adjustment for nonperformance risk related to these agreements, was approximately $62.8 million. As of March 31, 2020, we had not posted any collateral related to these agreements and were not in breach of any agreement provisions. If we had breached any of these provisions, we could have been required to settle our obligations under the agreements at their termination value of $62.8 million.

12

8. COMMITMENTS AND CONTINGENCIES |

Litigation—We are involved in various claims and litigation matters arising in the ordinary course of business, some of which involve claims for damages. Many of these matters are covered by insurance, although they may nevertheless be subject to deductibles or retentions. Although the ultimate liability for these matters cannot be determined, based upon information currently available, we believe the resolution of such claims and litigation will not have a material adverse effect on our consolidated financial statements.

Environmental Matters—In connection with the ownership and operation of real estate, we may potentially be liable for costs and damages related to environmental matters. In addition, we may own or acquire certain properties that are subject to environmental remediation. Depending on the nature of the environmental matter, the seller of the property, a tenant of the property, and/or another third party may be responsible for environmental remediation costs related to a property. Additionally, in connection with the purchase of certain properties, the respective sellers and/or tenants may agree to indemnify us against future remediation costs. We also carry environmental liability insurance on our properties that provides limited coverage for any remediation liability and/or pollution liability for third-party bodily injury and/or property damage claims for which we may be liable. We are not aware of any environmental matters which we believe are reasonably likely to have a material effect on our consolidated financial statements.

Captive Insurance—Our captive insurance company, Silver Rock Insurance, Inc. (“Silver Rock”) provides general liability insurance, wind, reinsurance, and other coverage to us and our related-party joint ventures. We capitalize Silver Rock in accordance with applicable regulatory requirements.

Silver Rock established annual premiums based on the past loss experience of the insured properties. An independent third party was engaged to perform an actuarial estimate of projected future claims, related deductibles, and projected future expenses necessary to fund associated risk management programs. Premiums paid to Silver Rock may be adjusted based on these estimates, and such premiums may be reimbursed by tenants pursuant to specific lease terms.

As of March 31, 2020, we had four cash collateralized letters of credit outstanding totaling approximately $9.7 million to provide security for our obligations under Silver Rock’s insurance and reinsurance contracts.

COVID-19—As of March 31, 2020, we were not aware of any significant liabilities or obligations to waive rent that we have incurred under force majeure or co-tenancy clauses in tenant leases.

9. EQUITY |

General—The holders of common stock are entitled to one vote per share on all matters voted on by stockholders, including one vote per nominee in the election of our board of directors (“Board”). Our charter does not provide for cumulative voting in the election of directors.

On May 6, 2020, our Board decreased the estimated value per share (“EVPS”) of our common stock to $8.75 based substantially on the estimated market value of our portfolio of real estate properties and our third-party investment management business as of March 31, 2020. The decrease was primarily driven by the negative impact of the COVID-19 pandemic on PECO’s non-grocery tenants resulting from social distancing and stay-at-home guidelines and the uncertainty of the duration and full effect on the overall economy. We engaged a third-party valuation firm to provide a calculation of the range in EVPS of our common stock as of March 31, 2020, which reflected certain balance sheet assets and liabilities as of that date. Previously, our EVPS was $11.10, based substantially on the estimated market value of our portfolio of real estate properties and our third-party investment management business as of March 31, 2019.

Shares of our common stock were issued under the DRIP, as discussed below, at the same price as the EVPS in effect at the time of issuance.

Dividend Reinvestment Plan—The DRIP allows stockholders to invest distributions in additional shares of our common stock, subject to certain limits. Stockholders who elect to participate in the DRIP may choose to invest all or a portion of their cash distributions in shares of our common stock at a price equal to our most recent EVPS.

Stockholders who elect to participate in the DRIP, and who are subject to U.S. federal income taxation laws, will incur a tax liability on an amount equal to the fair value on the relevant distribution date of the shares of our common stock purchased with reinvested distributions, even though such stockholders have elected not to receive the distributions in cash.

On March 27, 2020, the DRIP was temporarily suspended. The March 2020 distribution was paid all in cash on April 1, 2020.

Distributions—On March 27, 2020, our Board temporarily suspended stockholder distributions, effective after the payment of the March 2020 dividend on April 1, 2020 as a result of the uncertainty surrounding the COVID-19 pandemic, including the impact that the pandemic and the measures taken by governmental agencies and tenants in response to the pandemic are expected to continue to have on our shopping centers and our financial condition, liquidity sources, and capital needs.

Distributions paid entirely in cash to stockholders and OP unit holders of record subsequent to March 31, 2020 were as follows (in thousands, except distribution rate):

Month | Date of Record | Distribution Rate | Date Distribution Paid | Amount of Distribution Paid | |||||

March 2020 | 3/16/2020 | $0.05583344 | 4/1/2020 | $ | 18,541 | ||||

13

Share Repurchase Program (“SRP”)—Our SRP provides an opportunity for stockholders to have shares of common stock repurchased, subject to certain restrictions and limitations. The Board reserves the right, in its sole discretion, at any time and from time to time, to reject any request for repurchase.

On August 7, 2019, the Board suspended the SRP with respect to standard repurchases. Our SRP for death, qualifying disability, or determination of incompetence was temporarily suspended effective March 27, 2020.

Convertible Noncontrolling Interests—Under the terms of the Fourth Amended and Restated Agreement of Limited Partnership (the “Partnership Agreement”), Operating Partnership unit (“OP unit”) holders may elect to exchange OP units. The Operating Partnership controls the form of the redemption, and may elect to exchange OP units for shares of our common stock, provided that the OP units have been outstanding for at least one year, or for cash. As the form of redemption for OP units is within our control, the OP units outstanding as of March 31, 2020 and December 31, 2019 are classified as Noncontrolling Interests within permanent equity on our consolidated balance sheets. The distributions that have been paid on OP units are included in Distributions to Noncontrolling Interests on the consolidated statements of equity. During the three months ended March 31, 2020 and 2019, 0.1 million and 0.7 million OP units were converted into shares of our common stock at a 1:1 ratio, respectively. There were approximately 42.7 million OP units outstanding as of March 31, 2020 and December 31, 2019. Additionally, certain of our outstanding time- and performance-based equity awards will result in the issuance of shares or OP units upon vesting in future periods.

10. EARNINGS PER SHARE |

We use the two-class method of computing earnings per share (“EPS”), which is an earnings allocation formula that determines EPS for common stock and any participating securities according to dividends declared (whether paid or unpaid). Under the two-class method, basic EPS is computed by dividing Net Income (Loss) Attributable to Stockholders by the weighted-average number of shares of common stock outstanding for the period. Diluted EPS reflects the potential dilution that could occur from share equivalent activity.

OP units held by limited partners other than us are considered to be participating securities because they contain non-forfeitable rights to dividends or dividend equivalents, and have the potential to be exchanged for an equal number of shares of our common stock in accordance with the terms of the the Partnership Agreement.

In previous periods, we issued certain share-based awards to employees which are tied to the value of our EVPS, but that are paid in cash upon vesting. We have a small number of these awards that remain outstanding, however, they are not considered to be participating securities as they are not convertible into common stock, and as such are not included as a component of our basic or diluted EPS calculation.

The impact of outstanding OP units on basic and diluted EPS has been calculated using the two-class method whereby earnings are allocated to the OP units based on dividends declared and the OP units’ participation rights in undistributed earnings. The effects of the two-class method on basic and diluted EPS were immaterial to the consolidated financial statements as of March 31, 2020 and 2019.

The following table provides a reconciliation of the numerator and denominator of the earnings per share calculations (in thousands, except per share amounts):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Numerator: | |||||||

Net income (loss) attributable to stockholders - basic | $ | 9,769 | $ | (5,195 | ) | ||

Net income (loss) attributable to convertible OP units(1) | 1,430 | (783 | ) | ||||

Net income (loss) - diluted | $ | 11,199 | $ | (5,978 | ) | ||

Denominator: | |||||||

Weighted-average shares - basic | 289,955 | 281,263 | |||||

OP units(1) | 42,848 | 43,996 | |||||

Dilutive restricted stock awards | 425 | — | |||||

Adjusted weighted-average shares - diluted | 333,228 | 325,259 | |||||

Earnings per common share: | |||||||

Basic and diluted | $ | 0.03 | $ | (0.02 | ) | ||

(1) OP units include units that are convertible into common stock or cash, at the Operating Partnership’s option. The Operating Partnership income or loss attributable to these OP units, which is included as a component of Net (Income) Loss Attributable to Noncontrolling Interests on the consolidated statements of operations, has been added back in the numerator as these OP units were included in the denominator for all years presented.

Approximately 2.6 million unvested time- and performance-based stock awards were outstanding as of March 31, 2019. These securities were anti-dilutive for the three months ended March 31, 2019, and, as a result, their impact was excluded from the weighted-average common shares used to calculate diluted EPS for that period.

14

11. REVENUE RECOGNITION AND RELATED PARTY TRANSACTIONS |

Revenue—Summarized below are amounts included in Fees and Management Income. The revenue includes the fees and reimbursements earned by us from the Managed Funds, and other revenues that are not in the scope of ASC Topic 606, Revenue from Contracts with Customers, but that are included in this table for the purpose of disclosing all related party revenues (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Recurring fees(1) | $ | 1,216 | $ | 1,582 | |||

Transactional revenue and reimbursements(2) | 430 | 1,222 | |||||

Insurance premiums(3) | 519 | 457 | |||||

Total fees and management income | $ | 2,165 | $ | 3,261 | |||

(1) | Recurring fees include asset management fees and property management fees. |

(2) | Transactional revenue includes items such as leasing commissions, construction management fees, and acquisition fees. |

(3) | Insurance premium income from other parties includes amounts from third parties not affiliated with us. |

Certain related party accounts receivable and organization and offering costs payable that were outstanding as of March 31, 2019 related to Phillips Edison Grocery Center REIT III, Inc. (“REIT III”) and were settled when we merged with REIT III in October 2019.

Other Related Party Matters—We are the limited guarantor for up to $190 million, capped at $50 million in most instances, of debt for our NRP joint venture. We are also the limited guarantor of a $175 million mortgage loan for GRP I. Our guaranty in both cases is limited to being the non-recourse carveout guarantor and the environmental indemnitor. We are also party to a separate agreement with our joint venture partner in which any potential liability under our guaranty for GRP I will be apportioned between us and our joint venture partner based on our respective ownership percentages in GRP I. We have no liability recorded on our consolidated balance sheets for either guaranty as of March 31, 2020 and December 31, 2019.

12. FAIR VALUE MEASUREMENTS |

The following describes the methods we use to estimate the fair value of our financial and nonfinancial assets and liabilities:

Cash and Cash Equivalents, Restricted Cash, Accounts Receivable, and Accounts Payable—We consider the carrying values of these financial instruments to approximate fair value because of the short period of time between origination of the instruments and their expected realization.

Real Estate Investments—The purchase prices of the investment properties, including related lease intangible assets and liabilities, were allocated at estimated fair value based on Level 3 inputs, such as discount rates, capitalization rates, comparable sales, replacement costs, income and expense growth rates, and current market rents and allowances as determined by management.

Debt Obligations—We estimate the fair value of our debt by discounting the future cash flows of each instrument at rates currently offered for similar debt instruments of comparable maturities by our lenders using Level 3 inputs. The discount rates used approximate current lending rates for loans or groups of loans with similar maturities and credit quality, assuming the debt is outstanding through maturity and considering the debt’s collateral (if applicable). We have utilized market information, as available, or present value techniques to estimate the amounts required to be disclosed.

The following is a summary of borrowings as of March 31, 2020 and December 31, 2019 (in thousands):

March 31, 2020 | December 31, 2019 | ||||||||||||||

Recorded Principal Balance(1) | Fair Value | Recorded Principal Balance(1) | Fair Value | ||||||||||||

Revolving credit facility | $ | 34,000 | 33,767 | $ | — | $ | — | ||||||||

Term loans | 1,607,464 | 1,594,503 | 1,636,470 | 1,656,765 | |||||||||||

Secured portfolio loan facilities | 390,769 | 384,068 | 390,780 | 399,054 | |||||||||||

Mortgages(2) | 324,168 | 325,219 | 326,849 | 337,614 | |||||||||||

Total | $ | 2,356,401 | $ | 2,337,557 | $ | 2,354,099 | $ | 2,393,433 | |||||||

(1) | Recorded principal balances include net deferred financing expenses of $16.3 million and $17.2 million as of March 31, 2020 and December 31, 2019, respectively. Recorded principal balances also include assumed market debt adjustments of $1.3 million and $1.2 million as of March 31, 2020 and December 31, 2019, respectively. There are deferred financing expenses related to our revolving credit facility that are in an asset position and thus are not included in these balances. |

(2) | Our finance lease liability is included in the mortgages line item, as presented. |

15

Recurring and Nonrecurring Fair Value Measurements—Our earn-out liability and interest rate swaps are measured and recognized at fair value on a recurring basis, while certain real estate assets and liabilities are measured and recognized at fair value as needed. Fair value measurements that occurred as of and during the three months ended March 31, 2020 and the year ended December 31, 2019, were as follows (in thousands):

March 31, 2020 | December 31, 2019 | ||||||||||||||||||

Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | ||||||||||||||

Recurring | |||||||||||||||||||

Derivative assets(1) | $ | — | $ | 18 | $ | — | $ | — | $ | 2,728 | $ | — | |||||||

Derivative liability(1) | — | (62,756 | ) | — | — | (20,974 | ) | — | |||||||||||

Earn-out liability | — | — | (22,000 | ) | — | — | (32,000 | ) | |||||||||||

Nonrecurring | |||||||||||||||||||

Impaired real estate assets, net(2) | — | — | — | — | 280,593 | — | |||||||||||||

Impaired corporate intangible asset, net(3) | — | — | — | — | — | 4,401 | |||||||||||||

(1) | We record derivative assets in Other Assets, Net and derivative liabilities in Derivative Liability on our consolidated balance sheets. |

(2) | The carrying value of impaired real estate assets may have subsequently increased or decreased after the measurement date due to capital improvements, depreciation, or sale. |

(3) | The carrying value of our impaired corporate intangible asset, net, which consists of in-place management contracts, subsequently decreased after the measurement date due to amortization as well as through derecognition as part of the merger with REIT III. |

Derivative Instruments—As of March 31, 2020 and December 31, 2019, we had interest rate swaps that fixed LIBOR on portions of our unsecured term loan facilities.

All interest rate swap agreements are measured at fair value on a recurring basis. The valuation of these instruments is determined using widely accepted valuation techniques, including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The fair values of interest rate swaps are determined using the market standard methodology of netting the discounted future fixed cash receipts (or payments) and the discounted expected variable cash payments (or receipts). The variable cash payments (or receipts) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves.

To comply with the provisions of ASC Topic 820, Fair Value Measurement, we incorporate credit valuation adjustments to appropriately reflect both our own nonperformance risk and the respective counterparty’s nonperformance risk in the fair value measurements. In adjusting the fair value of our derivative contracts for the effect of nonperformance risk, we have considered the impact of netting and any applicable credit enhancements, such as collateral postings, thresholds, mutual puts, and guarantees.

Although we determined that the significant inputs used to value our derivatives fell within Level 2 of the fair value hierarchy, the credit valuation adjustments associated with our counterparties and our own credit risk utilize Level 3 inputs, such as estimates of current credit spreads, to evaluate the likelihood of default by us and our counterparties. However, as of March 31, 2020 and December 31, 2019, we have assessed the significance of the impact of the credit valuation adjustments on the overall valuation of our derivative positions and have determined that the credit valuation adjustments are not significant to the overall valuation of our derivatives. As a result, we have determined that our derivative valuations in their entirety are classified in Level 2 of the fair value hierarchy.

Earn-out—As part of our acquisition of Phillips Edison Limited Partnership (“PELP”), an earn-out structure was established which gave PELP the opportunity to earn additional OP units based upon the potential achievement of certain performance targets subsequent to the acquisition. After the expiration of certain provisions in 2019, PELP is now eligible to earn up to five million OP units based on the timing and valuation of a liquidity event for PECO, which can occur no later than December 31, 2021 in order for the performance targets to be achieved per the terms of the agreement.

We estimate the fair value of this liability on a quarterly basis using the Monte Carlo method. This method requires us to make assumptions about future dividend yields, volatility, and timing and pricing of liquidity events, which are unobservable and are considered Level 3 inputs in the fair value hierarchy. A change in these inputs to a different amount might result in a significantly higher or lower fair value measurement at the reporting date. In calculating the fair value of this liability, we have determined that the most likely range of potential outcomes includes a possibility of no additional OP units issued as well as up to a maximum of five million units being issued.

Changes in the fair value of the earn-out liability have been and will continue to be recognized in earnings. The following table presents a reconciliation of the change in the earn-out liability measured at fair value on a recurring basis using Level 3 inputs and recognized as Other Income, Net in the consolidated statements of operations (in thousands):

Earn-Out Liability | |||

Balance at December 31, 2019 | $ | 32,000 | |

Change in fair value recognized in Other Income, Net | (10,000 | ) | |

Balance at March 31, 2020 | $ | 22,000 | |

Real Estate Asset Impairment—Our real estate assets are measured and recognized at fair value less costs to sell on a nonrecurring basis dependent upon when we determine an impairment has occurred. During the three months ended March 31, 2019, we impaired assets that were under contract or actively marketed for sale at a disposition price that was less

16

than carrying value, or that had other operational impairment indicators. The valuation technique used for the fair value of all impaired real estate assets was the expected net sales proceeds, which we consider to be a Level 2 input in the fair value hierarchy. We did not impair any assets during the three months ended March 31, 2020.

On a quarterly basis, we employ a multi-step approach to assess our real estate assets for possible impairment and record any impairment charges identified. The first step is the identification of potential triggering events, such as significant decreases in occupancy or the presence of large dark or vacant spaces. If we observe any of these indicators for a shopping center, we then perform an additional screen test consisting of a years-to-recover analysis to determine if we will recover the net book value of the property over its remaining economic life based upon net operating income as forecasted for the current year. In the event that the results of this first step indicate a triggering event for a center, we proceed to the second step, utilizing an undiscounted cash flow model for the center to identify potential impairment. If the undiscounted cash flows are less than the net book value of the center as of the balance sheet date, we proceed to the third step. In performing the third step, we utilize market data such as capitalization rates and sales price per square foot on comparable recent real estate transactions to estimate fair value of the real estate assets. We also utilize expected net sales proceeds to estimate the fair value of any centers that are actively being marketed for sale. If the estimated fair value of the property is less than the recorded net book value at the balance sheet date, we record an impairment charge.

In addition to these procedures, we also review undeveloped or unimproved land parcels that we own for evidence of impairment and record any impairment charges as necessary. Primary impairment triggers for these land parcels are changes to our plans or intentions with regards to such properties, or planned dispositions at prices that are less than the current carrying values.

Our quarterly impairment procedures have not been altered by the COVID-19 pandemic, as we believe key impairment indicators such as temporary store closings and large dark or vacant spaces will continue to be identified in our review. We have utilized forecasts that incorporate estimated decreases in net operating income (“NOI”) and cash flows as a result of the COVID-19 pandemic in performing our review procedures for the three months ended March 31, 2020. However, it is possible that we could experience unanticipated changes in assumptions that are employed in our impairment review which could impact our cash flows and fair value conclusions. Such unanticipated changes relative to our expectations include but are not limited to: increases or decreases in the duration or permanence of tenant closures, increases or decreases in collectability reserves and write-offs, additional capital required to fill vacancies, extended lease-up periods, future closings of large tenants, changes in macroeconomic assumptions such as rate of inflation and capitalization rates, and changes to the estimated timing of disposition of the properties under review.

We recorded the following expense upon impairment of real estate assets (in thousands):

Three Months Ended March 31, | |||||||

2020 | 2019 | ||||||

Impairment of real estate assets | $ | — | $ | 13,717 | |||

13. SUBSEQUENT EVENTS |

In preparing the condensed and unaudited consolidated financial statements, we have evaluated subsequent events through the filing of this report on Form 10-Q for recognition and/or disclosure purposes. Based on this evaluation, we have determined that there were no events that have occurred that require recognition or disclosure, other than certain events and transactions that have been disclosed elsewhere in these consolidated financial statements.

17

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

All references to “Notes” throughout this document refer to the footnotes to the consolidated financial statements in Part I, Item 1. Financial Statements.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this Quarterly Report on Form 10-Q (this “Report”) of Phillips Edison & Company, Inc. (“we,” the “Company,” “our,” or “us”) other than historical facts may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. We intend for all such forward-looking statements to be covered by the applicable safe harbor provisions for forward-looking statements contained in those Acts. Such forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” “possible,” “initiatives,” “focus,” “seek,” “objective,” “goal,” “strategy,” “plan,” “potential,” “potentially,” “preparing,” “projected,” “future,” “long-term,” “once,” “should,” “could,” “would,” “might,” “uncertainty,” or other similar words. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this report is filed with the U.S. Securities and Exchange Commission (“SEC”). Such statements include, but are not limited to, statements about our focus, plans, strategies, initiatives, and prospects; statements about the global pandemic of a novel coronavirus (“COVID-19”), including its duration and potential or expected impact on our tenants, our business, and our estimated value per share; statements about our estimated value per share and when it may be updated; statements about the duration or extent of the suspension of our distributions, share repurchase program, and dividend reinvestment program; and statements about our future results of operations, capital expenditures, and liquidity. Such statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those projected or anticipated, including, without limitation, (i) changes in national, regional, or local economic climates; (ii) local market conditions, including an oversupply of space in, or a reduction in demand for, properties similar to those in our portfolio; (iii) vacancies, changes in market rental rates, and the need to periodically repair, renovate, and re-let space; (iv) changes in interest rates and the availability of permanent mortgage financing; (v) competition from other available properties and the attractiveness of properties in our portfolio to our tenants; (vi) the financial stability of tenants, including the ability of tenants to pay rent; (vii) changes in tax, real estate, environmental, and zoning laws; (viii) the concentration of our portfolio in a limited number of industries, geographies, or investments; (ix) the effects of the COVID-19 pandemic, including on the demand for consumer goods and services and levels of consumer confidence in the safety of visiting shopping centers as a result of the COVID-19 pandemic; (x) the measures taken by federal, state, and local government agencies and tenants in response to the COVID-19 pandemic, including mandatory business shutdowns, stay-at-home orders and social distancing guidelines; (xi) the impact of the COVID-19 pandemic on our tenants and their ability to pay rent on time or at all, or to renew their leases and, in the case of non-renewal, our ability to re-lease the space at the same or more favorable terms or at all; (xii) the length and severity of the COVID-19 pandemic in the United States; (xiii) the pace of recovery following the COVID-19 pandemic given the current severe economic contraction and increase in unemployment rates; (xiv) our ability to implement cost containment strategies; (xv) our and our tenants’ ability to obtain loans under the CARES Act or similar state programs; (xvi) our ability to pay down, refinance, restructure, or extend our indebtedness as it becomes due; (xvii) to the extent we were seeking to dispose of properties in the near term, significantly greater uncertainty regarding our ability to do so at attractive prices; (xviii) the impact of the COVID-19 pandemic on our business, results of operations, financial condition, and liquidity; and (xix) supply chain disruptions due to the COVID-19 pandemic. Additional important factors that could cause actual results to differ are described in the filings made from time to time by the Company with the SEC and include the risk factors and other risks and uncertainties described in our 2019 Annual Report on Form 10-K, filed with the SEC on March 11, 2020, and those included in this Report, in each case as updated from time to time in our periodic and/or current reports filed with the SEC, which are accessible on the SEC’s website at www.sec.gov.

Except as required by law, we do not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Overview

We are an internally-managed REIT and one of the nation’s largest owners and operators of grocery-anchored shopping centers. The majority of our revenue is lease revenue derived from our real estate investments. Additionally, we operate an investment management business providing property management and advisory services to approximately $570 million of third-party assets. This business provides comprehensive real estate and asset management services to the Managed Funds.

During the first quarter of 2020, the COVID-19 pandemic began spreading globally, with the outbreak being classified as a pandemic by the World Health Organization on March 11, 2020. We began preparing for the effects of the COVID-19 pandemic on our business as well as the economic climate as a whole. Our employees are almost entirely working remotely to help combat the spread of the virus, while also allowing us to be as productive as possible during this time. Some of our initiatives to respond to the ongoing pandemic are:

• | We temporarily suspended stockholder distributions (see Note 9 for more detail); |

• | We temporarily suspended the SRP for death, qualifying disability, or determination of incompetence, while our standard SRP remains suspended; |

• | Our Compensation Committee approved a temporary 25% reduction to the base salary of our chief executive officer; a temporary 10% reduction to the base salaries of our president, chief operating officer, chief financial officer, and general counsel; and a 10% reduction to board members’ base compensation for the 2020-2021 term; |

18

• | We have implemented expense reductions at the property and corporate levels, including the temporary reductions in executive salaries and director compensation, and workforce reductions; |

• | We are delaying capital projects to the extent possible; and |

• | We have borrowed $200 million on our revolving credit facility to ensure that we are able to meet our operating needs for a sustained period. |

As a result of the pandemic, many state governments have issued “stay-at-home” mandates that generally limit travel and movement of the general public to essential activities only and require all non-essential businesses to close. The impact these measures are having on our portfolio has evolved since March 31, 2020 and will continue to do so. Our wholly-owned properties and those owned through our joint ventures contained approximately 5,550 tenant spaces as of May 11, 2020. The following statistics are related to our wholly-owned properties and those owned through our joint ventures as of May 11, 2020 (all statistics are approximate; ABR, GLA, and rent include the prorated portion attributable to properties owned through our joint ventures):

• | 30% of all tenant spaces, totaling 21% of our ABR and 16% of our GLA, remained temporarily closed |

• | Temporary closures include 7% of tenant spaces that we believe are considered to be essential retail and service businesses, totaling 3% of the ABR and 2% of the GLA associated with all essential retail and service businesses; even though they are generally exempted from “stay-at-home” mandates, some essential businesses have temporarily closed due to sharp decreases in foot traffic and customer patronage as a result of these mandates and social distancing guidelines |

• | Received 2,120 rent relief requests from tenant spaces representing 29% of our ABR, all of which are still being evaluated |

• | Collected 77% of rent and recoveries billed for April 2020 and 74% of rent and recoveries billed for the month of May |

We believe substantially all tenants, including those that have been deemed non-essential businesses, are contractually obligated to continue with their rent payments as documented in our lease agreements with them. The Coronavirus Aid, Relief, and Economic Security Act, including the Paycheck Protection Program and Health Care Enhancement Act (collectively, the “CARES Act”), is intended to provide economic relief and stimulus to taxpayers and businesses in order to mitigate the economic impact of the pandemic, and provides an estimated $2.7 trillion to combat the COVID-19 pandemic and stimulate the economy through the provision of government loans and grants to affected individuals and businesses. We have begun working directly with our tenants to inform them of the benefits available through the CARES Act and other small business programs. We have created a resource page on our website to assist in these information efforts.

Portfolio and Leasing Statistics—Below are statistical highlights of our wholly-owned portfolio:

March 31, 2020 | ||

Number of properties | 285 | |

Number of states | 31 | |

Total square feet (in thousands) | 31,862 | |

Leased % of rentable square feet | 95.6 | % |

Average remaining lease term (in years)(1) | 4.6 | |

% ABR from grocery-anchored properties | 97.0 | % |

(1) | The average remaining lease term in years excludes future options to extend the term of the lease. |

The following table details information for our joint ventures, which is the basis for determining the prorated information included in the subsequent tables as of March 31, 2020 (dollars and square feet in thousands):

March 31, 2020 | ||||||||||

Joint Venture | Ownership Percentage | Number of Properties | ABR(1) | GLA(2) | ||||||

Necessity Retail Partners | 20% | 7 | $ | 11,933 | 851 | |||||

Grocery Retail Partners I | 15% | 17 | 24,462 | 1,909 | ||||||

Grocery Retail Partners II | 10% | 3 | 3,840 | 312 | ||||||

(1) | We calculate ABR as monthly contractual rent as of March 31, 2020, multiplied by 12 months. |

(2) | Gross leasable area (“GLA”) is defined as the portion of the total square feet of a building that is available for tenant leasing. |