Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Medicine Man Technologies, Inc. | medman_8k.htm |

Exhibit 99.1

O T C Q X : S H W Z B u s i n e s s O v e r v i e w P r e s e n t a t i o n M a y 2 0 2 0

S A F E H A R B O R S T A T E M E N T 2 This presentation contains "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements can be identified by words such as "believes," "plans," "expects," "anticipates," "will," "should, " "positioned" and words of similar import . Examples of forward - looking statements include, among others, statements regarding Medicine Man Technologies, Inc . dba Schwazze (“the Company") operations, financial performance, business or financial strategies, or achievements . Forward - looking statements are neither historical facts nor assurances of future results or performance . Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of the Company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the Company’s control . Actual outcomes and results and the Company’s financial performance and condition may differ materially from those indicated in the forward - looking statements . Therefore, you should not rely on any of these forward - looking statements . Important factors that could cause actual results and financial condition to differ materially from those indicated in the forward - looking statements include, among others, the following : the Company's ability to raise capital to finance any of its proposed acquisitions ; the Company's ability to close on any of its proposed acquisitions ; the Company's ability to successfully integrate and achieve its objectives with respect to any of its proposed acquisitions ; the Company’s ability to successfully execute its business, financial and growth strategy ; the Company’s ability to expand into additional states ; the Company’s ability to successfully offer new products, services and other offerings ; the Company’s ability to successfully implement its revenue growth strategy, generate cash flow from operations and achieve positive shareholder returns . Any forward - looking statement in this presentation is based only on information currently available to the Company and speaks only as of the date of this presentation . The Company disclaims any obligation to update any forward - looking statement or to announce publicly the results of any revisions to any forward - looking statement to reflect future events or developments except as required by law . The unaudited preliminary pro forma results and other financial information discussed in this presentation consists of estimates derived from the Company’s internal books and records and has been prepared by, and are the responsibility of, the Company’s management . The preliminary financial data are subject to the completion of financial closing procedures, final adjustments and other developments that may arise between now and the time the financial results for the fourth quarter ended December 31 , 2019 are finalized . Therefore, actual results may differ materially from these preliminary financial data and all of these preliminary financial data are subject to change .

I . E x e c u t i v e S u m m a r y 3

E X E C U T I V E S U M M A R Y ▪ Justin Dye, former Albertsons Companies executive and Cerberus Capital operating executive, leads a best - in - class management team bringing Fortune 500 backgrounds and M&A / integration expertise – The management team is primed to buy, integrate and synergize the portfolio of assets with a deep bench of cannabis entrepreneurs ▪ During the past year, the Company has entered into agreements to acquire 10 companies , which when closed will result in a scalable, vertically integrated Colorado operator – All of the targets have a proven track record and are well positioned in their respective markets – The Company has completed one acquisition of 4 dispensaries under the Mesa Organics banner and one manufacturer / extractor, Purplebee’s, which supplies some of the largest infusion companies in Colorado ▪ By establishing optimized operating procedures across the platform, the Company expects to extract significant benefits – The retail strategy will implement product mix optimization, digital engagement technologies, targeted loyalty marketing and other sophisticated operating strategies ▪ For FYE 2019, the Company estimates pro forma revenue and EBITDA margins of $129MM (1) and ~20% - 30%, respectively Note: These figures are unaudited and represent the Company’s current estimates not adjusted for effects due to COVID - 19. These figures are subject to adjustment and change upon completion of the audits for each of the entities included therein (1) Revenue after elimination of $23MM of intercompany payments. PCAOB / Quality of Earnings audits currently underway (2) Avg. revenue by dispensary based on FYE 2019 retail revenue / total expected retail stores post Colorado Roll - up From Seed to Sale Medicine Man Technologies, Inc. dba Schwazze (OTC Ticker: SHWZ) is aggregating a premier portfolio of Colorado cannabis companies, positioning SHWZ as one of the largest vertically - integrated operators in the state and a platform to lead consolidation and growth of cannabis in the U.S. Overview Vertically Integrated Operations Medicine Man Technologies, Inc. dba Schwazze (“Schwazze” or “the Company”) provides an established platform to facilitate the acquisition of companies under the leadership of CEO Justin Dye and his seasoned team ▪ Since 2014 and headquartered in Denver, CO, the Company has historically provided consulting services, nutrients and supplies – Upon legislation allowing outside investors into Colorado, the Company instituted a plant touching strategy backed by Dye Capital By the Numbers 30 D i s p e n s a ri es 58K Retail Sq. Ft. $3MM Avg. Revenue by Dispensary (2) 12 Cultivation Sites 4 M a nuf a c t u ri ng Facilities 1.9MM Cultivation Sq. Ft. 23K Manufacturing Sq. Ft. 87 , 000 Lbs / Year >100 Products 1 Consulting Practice 9 Success Nutrients TM Product Lines 22 States with Strong Consulting Relationships 4

The Company closed on its acquisition of Mesa Organics / Purplebee’s on April 20 th , 2020, thus becoming the first publicly traded company to own a plant - touching operation in Colorado’s history M E S A OR G A N I CS / P U R P L E B E E ’ S A CQ U I S I T I ON Introduction Mesa Organics Dispensaries Purplebee’s Products Synergies and Growth Initiatives ▪ Purplebee’s / Mesa Organics (“PBS”) brings $7.8M in acquired FY’19 Revenues ($1.2M Retail and $6.6M Wholesale) ▪ PBS operates 4 dispensaries (2 opened 4Q’19 and 1 opened 1Q’20) and 1 MIP ▪ PBS supplies some of the largest MIPs in Colorado with bulk distillate and oil which is used to make edibles, vapes, topicals, etc. and is one of the largest pure CO2 extractors in the country ▪ PBS products vape cartridges, full spectrum extracts, oils, lotions / salves, and moonrocks. PBS also white - labels vape production for leading CO brands ▪ Mesa Organics’ 4 dispensaries support southern Colorado ▪ MIPs facility operates at ~50% utilization. PBS recently invested in new ethanol production capabilities to further improve extraction times Increase Average Basket ▪ Begin sales training program with budtenders ▪ Implement repeatable and measurable Dispensary Operational Playbook ▪ Install digital consumer engagement tools ▪ Improve merchandising and store branding Margin Expansion ▪ Centralize buying for both Wholesale and Dispensary ▪ Refine in - store product assortment and mix ▪ Enhance staffing schedules to match store traffic for additional upsell and cross - sell opportunities MIP Operations ▪ Increase store penetration and Wholesale supply channels ▪ Develop new products and innovations 5

$32 $295 $77 $161 $152 $152 $122 $96 $65 $64 $53 $28 ($24) $209 ($19) ($189) ($76) ($125) ($83) ($83) ($153) ($51) ($69) ($200) ($150) ($100) ($50) – $50 $100 $150 Medicine Man Curaleaf Holdings, Trulieve Cannabis Green Thumb MedMen Cresco Labs Inc. TILT Holdings Inc. Harvest Health & Columbia Care Acreage Holdings, iAnthus Green Growth Inc. Corp. Industries Inc. Enterprises Inc. Recreation Inc. Inc. Inc. Brands Inc. ▪ Aggregated significant capital at unsustainable multiples ▪ Deployed capital intensive multi - state strategies ▪ Inefficient operating structures with limited profitability ▪ Management teams with limited operating experience S IG N IF IC A N T O PE R A T O R W IT H K E Y D IF F E R E N T IA T IO N Following successful closings of its announced acquisitions, SHWZ will be the 6 th largest U.S. vertically integrated cannabis operator in the nation by revenue, with positive EBITDA – a key differentiator versus the industry ($USD in millions) $300 $250 $200 Legacy Cannabis The SHWZ Difference Last Twelve Months Revenue and EBITDA (1) ▪ Very attractive entry points ▪ Single mature state maximizes economies of scale ▪ Aggregating assets with a track record of revenue growth and profitability ▪ Current team has a track record of success working together Revenue EBITDA Note: Company figures are unaudited and represent the Company’s current estimates not adjusted for effects due to COVID - 19. These figures are subject to adjustment and change upon completion of the audits for each of the entities included therein Source: Public company filings (1) Pro forma for publicly announced deals | (2) Revenue after elimination of $23MM of intercompany payments. PCAOB / Quality of Earnings audits currently underway| (3) EBITDA based on mid point of Company’s 20% - 30% EBITDA margin guidance ( 3) ( 2) $129 C o m p e t i t o r A 6 C o m p e t i t o r B C o m p e t i t o r C C o m p e t i t o r D C o m p e t i t o r E C o m p e t i t o r F C o m p e t i t o r G C o m p e t i t o r H C o m p e t i t o r I C o m p e t i t o r J C o m p e t i t o r K

Pro forma organization includes 30 dispensaries, 12 cultivations, 4 manufacturing facilities (MIPs) and 1 consulting business unit. Pro forma combination generates FY’19 estimates of ~$129MM of revenue (1) Schwazze Benefits from Several Factors of the Colorado Market P R O F OR M A COM P A N Y S N A P S H O T Governor Polis embraces the industry and focused on pushing a customer - centric approach to regulation Clear Regulatory Structure Conducive to Business Modest sales tax regime compared to other states High Customer Adoption Rate Coloradoans participate at nearly twice the rate of other states (3) Large, Highly Fragmented Market At an estimated 25% of total cannabis sales, the illicit market is quite low compared to other states (3) Medicine Man Technologies - - - S ta r buds 13 1 - - Medicine Man Denver 4 1 - - Project X - 2 - - Medically Correct - - 1 - Los Sueños - 4 - Roots Rx 6 2 - - Colorado Harvest Company 3 2 - - P u r p l ebee ’ s 4 - 1 - C an y on - - 1 - D abb l e E x t r a c t s - - 1 - Total Locations 30 12 4 2 Total Sq. Ft. (000's) 58 1,850 23 19 Company Retail Wholesale Cultivation Manufacturing Other Note: These figures are unaudited and represent the Company’s current estimates. These figures are subject to adjustment and change upon completion of the audits for each of the entities included therein (1) Revenue after elimination of $23MM of intercompany payments. PCAOB / Quality of Earnings audits currently underway (2) Inclusive of corporate headquarters which hosts the Consulting and Big Tomato businesses and Success Nutrients TM (3) Wall Street research ( 2) 2 7

CULTIVATION S C H W A ZZE G ROW S P OT E N T , HIG H - Y I E L DI N G C A N N A B I S S U I T A B L E F O R F L OW E R C ON S UM P T ION OR IN F US E D P R OD UC T S ▪ 1 2 O P ER AT I O N A L F ACI L I T I E S ▪ I M P L E M E N T T H R E E A L I G H T ™ P R OC E D U R E S T O B OOS T F L OWE R Q U A L I T Y A N D Y I EL D S F A R A B O V E T H E I N D U S T R Y A V ER A G E MANUFACTURING B R A N D B UIL D IN G E X P E RT IS E C O M B I N E D W I TH STA TE O F TH E A RT C A P A B I L I TI E S P R O V I D E S OP P OR T UN IT Y F OR W HOL E S A L E A N D P RIV A T E L A B E L G ROW T H ▪ 4 O P ER A T I O N AL F A CI L I T I ES ▪ CO N S O L I D AT E B ES T P R A CT I CE S T H R O U G H O U T AL L M A N U F A C T U R I N G F A CI L I T I E S RETAIL C U S T O MER - C EN T R I C R ET A I L STRA TE G Y SU P P O RTE D B Y A V A R IE T Y OF B A N N E R S T HA T HA V E S T RON G L OC A L T IE S A N D T A IL ORE D M E RC HA N D IS I N G ▪ 3 0 T O T A L L I CEN S ED D I S P E N S A R I E S ▪ CO L O R A D O L EG I S L A T I O N EX P ECT E D T O A L L O W E C O M M E R C E I N Q 1 2 0 2 1 CONSULTING E X TE N SI V E C O N SU L TI N G B A C K G R OUN D IN T HE IN D US T R Y W I T H L O N G S T A N D I N G RE L A TI O N SH I P S TO SU P P O R T OP E RA T ION A L IM P R OV E M E N T A N D MU L T I - STA TE G RO W TH ▪ CO N S U L T I N G I N 2 2 S T AT ES ▪ L E V E R A G E E X P E R T I S E A N D N ET W O R K F O R P O T EN T I A L P A R T N ER S H I P S A N D I N O R G A N I C G R OWT H OP P OR T U N I T I E S F U L L V E R T IC A L IN T E G RA T IO N Schwazze is designed to be vertically integrated, allowing it to control the product at every level, ensuring quality and distribution and allowing it to maximize profits and the consumer experience Comprehensive Support Across Supply Chain 8

S CH W A Z Z E ’ S V I S I ON Schwazze’s vision is to build the most admired cannabis company in the world by devoting its resources to recognize the full potential of cannabis and provide high - quality products to improve the human condition ▪ Continue to build best - in - class management team with deep bench of future leaders ▪ Install Phase I of our Blueprint: Playbook & Processes ▪ Identify investment / growth pipeline while closing CO roll - up transactions ▪ Set KPIs for monitoring performance Build path to healthy free cash flow to reinvest in our assets, customers and people 2 ▪ ERP technology and integration rollout schedule defined ▪ Build digital war chest, including personalized loyalty platform ▪ eCommerce Create industry leadership within scalable digital technologies, omnichannel commerce and innovation 3 ▪ Leadership philosophy and values: Relentless pursuit to get better every single day ▪ High performing organizational structure and design ▪ University System for continuing education, training, communication and career advancement ▪ Skunk Works Innovation Lab and capabilities Foster a culture of getting better everyday while being known as a fun, innovative and inspiring place to work 5 ▪ Build strong brands – new corporate name and messaging are expected to come online in the first half of 2020 ▪ Drive compliance to earn the right to connect with our customers everyday ▪ Customer - facing initiatives linked to sustainable business practices Foster a purpose - driven value system which supports the health and well being of our customers 1 ▪ Internal and third - party data providers and teams onboarded to drive data driven decision making ▪ Marketing / merchandising / operating playbooks start with the customer and work backward ▪ Test, Learn, Implement: customer data and participation to define our new product roadmap direction Customer - centric thinking with data driven decision making is at the core of everything we do 4 9

I I . I n v e s tm e n t H i g h l i g h ts 10

K E Y IN V E S T M E N T H IG H L IG H T S Schwazze is a unique opportunity in the cannabis space – combining best - in - class operations with a management team that has scaled companies before Great Expertise in Retail, Manufacturing, Brand Development and Product Development This Team Has Done This Before – Buying, Integrating and Synergizing Assets to Deliver Outsized Shareholder Returns World - Class Leadership with Best - in - Class Operational Techniques A Market - Leading Position in Colorado, Poised for National Success in a Hypergrowth Industry 1 2 3 4 11

Bob DeGabrielle , Chief Operating Officer: Among the trailblazers in the national and regional legal cannabis space, Bob is a founding member of the Cannabis Trade Association and owner and operator of Los Sueños Farms, one of the largest outdoor sustainable cultivations in the U.S. Dan Pabon, General Counsel and Government Relations: Experienced former Colorado State Representative who was instrumental in the passing and writing of cannabis laws in Colorado. Dan has 15+ years of expertise in emerging regulatory systems, legal research and legislative relations. Justin Dye, Chief Executive Officer and Chairman: 25+ years of experience in private equity, general management, operations, corporate finance and M&A. He led the growth of Albertsons from ~$10Bn to over ~$60Bn in sales with over 2,300 stores and 285,000 employees, creating one of the largest privately held companies in the U.S. Rob Holmes, SVP Real Estate: Founder of Roots Rx in 2014, a seed - to - sale cannabis operator in Colorado’s resort region, he brings 35+ years of experience in finance, risk management and real estate at Salomon Brothers, Lehman Brothers and Greenwich Capital. Steve Miller, SVP Real Estate: Consultant to Roots Rx since 2014. Brings 35+ years of experience at Credit Suisse and Greenwich Capital where he focused on mortgage securities and asset backed products. Steve’s expertise also lies in small entrepreneurial firms with both public and private investments. Shane Sampson, Chief Marketing and Merchandising Officer: 35+ years experience building iconic brands and leading innovative marketing and merchandising programs; expertise spans operations, product merchandising and procurement, eCommerce and branding. He has scaled and led a $12Bn private label products company. Nirup Krishnamurthy , Chief Integration and Information Officer: Dye Capital Partner carrying 25+ years of experience in innovation, technology, restructuring and M&A in Fortune 500 companies, holding executive roles at United Airlines, Northern Trust Bank and A&P Supermarkets. Nirup holds a PhD in Industrial Engineering from SUNY. Nancy Huber, Chief Financial Officer: Successful track record with 30+ years of experience managing public enterprises and overseeing multifunctional management. As CFO of Forward Foods, she oversaw improvements in revenue, margins and EBITDA. Nancy received her MBA from Kellogg School of Management. 1 . 0 E X P E R I E N C E D M A N A G E M E N T T E A M Schwazze has a best - in - class management team with premier operational practices, combining cannabis expertise with large - cap Fortune 500 executives, positioning the Company for revenue enhancements, increased profitability and immediate actionable growth 12

Joshua Haupt, Chief Cultivation Officer: Joshua Haupt, known as the “Steve Jobs of cannabis cultivation,” has been recognized for his innovative growing technique and entrepreneurship in the Cannabis industry. Josh serves as the Chief Cultivation Officer at Schwazze, author of Three A Light TM , founder of Success Nutrients TM and owner of Super Farm. Brian Ruden, Board of Directors: Since 2010, Brian Ruden has owned and operated cannabis businesses under the Starbuds brand. Under his leadership, Starbuds has become one of the most recognized and successful retail cannabis operations in North America. Brian received his law degree from the University of Denver, Sturm College of Law. Lee A. Dayton, Jr, Chief Investment Officer: 25 years of experience in investment banking and corporate development. More recently, he served as VP of Corporate Development and Strategy at Albertsons, focused on high growth customer - focused technologies. Prior to that, Lee worked as an investment banker at UBS, Morgan Stanley and Citigroup. Leonardo Riera, Board of Directors: Leonardo (Leo) Riera has over 30 years of experience in investment banking and fund management. He served as a consultant with McKinsey & Co. and Head of Mergers & Acquisitions for Citicorp Investment Bank. Leo has provided critical support in the negotiation of SHWZ’s acquisitions. Shelle Cleveland, Chief Human Resources Officer: 25 years of experience in leading and creating meaningful change in high performance organizations. Shelle has collaborated with leaders across a wide spectrum at General Electric. From CEOs and C - suite executives to mid - level and future leaders, Shelle uses her diverse background to instill change. Jim Parco, SVP of Manufacturing: In 2014, Jim Parco founded Mesa Organics and Purplebee’s. Mesa Organics operates four dispensary locations in Colorado and Purplebee’s is a leading extractor and manufacturer of cannabis products. Prior to that, Jim served two decades of active duty in the Air Force and was a tenured full professor of economics and business at Colorado College. Todd Williams, Chief Strategy Officer: 24 years of consulting, strategy, asset valuation and M&A experience. In his most recent role at Albertsons, he managed the acquisition of over 1,600 operating grocery stores with ~$40Bn in sales and $10Bn in transaction value and was also responsible for divesting 168 stores with over $3Bn in sales. 1 . 0 E X P E R I E N C E D M A N A G E M E N T T E A M ( C O N T . ) Schwazze has a best - in - class management team with premier operational practices, combining cannabis expertise with large - cap Fortune 500 executives, positioning the Company for revenue enhancements, increased profitability and immediate actionable growth 13

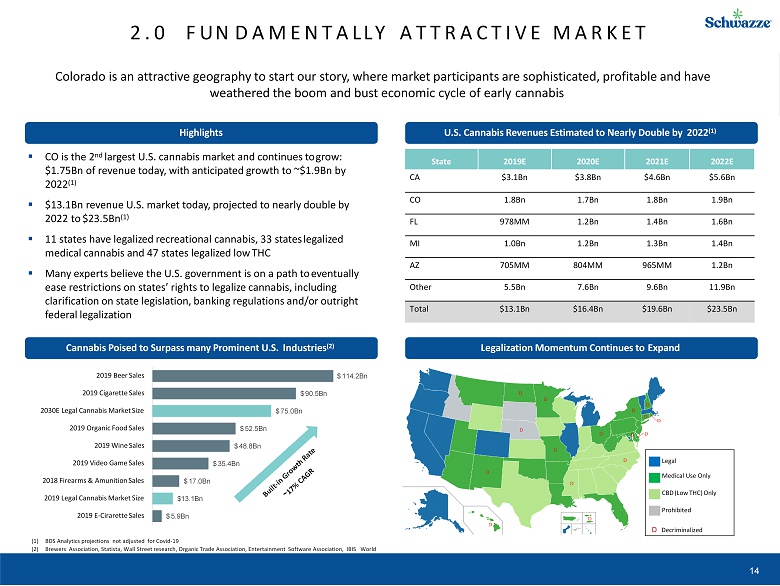

2 . 0 F UN D A M E N T A LLY A T T R A C T I V E M A R K E T Colorado is an attractive geography to start our story, where market participants are sophisticated, profitable and have weathered the boom and bust economic cycle of early cannabis (1) BDS Analytics projections not adjusted for Covid - 19 (2) Brewers Association, Statista, Wall Street research, Organic Trade Association, Entertainment Software Association, IBIS World ▪ CO is the 2 nd largest U.S. cannabis market and continues to grow: $1.75Bn of revenue today, with anticipated growth to ~$1.9Bn by 2022 (1) ▪ $13.1Bn revenue U.S. market today, projected to nearly double by 2022 to $23.5Bn (1) ▪ 11 states have legalized recreational cannabis, 33 states legalized medical cannabis and 47 states legalized low THC ▪ Many experts believe the U.S. government is on a path to eventually ease restrictions on states’ rights to legalize cannabis, including clarification on state legislation, banking regulations and/or outright federal legalization Legal Medical Use Only CBD (Low THC) Only Prohibited D Decriminalized Highlights U.S. Cannabis Revenues Estimated to Nearly Double by 2022 (1) Cannabis Poised to Surpass many Prominent U.S. Industries (2) Legalization Momentum Continues to Expand State 2019E 2020E 2021E 2022E CA $3.1Bn $3.8Bn $4.6Bn $5.6Bn CO 1.8Bn 1.7Bn 1.8Bn 1.9Bn FL 978MM 1.2Bn 1.4Bn 1.6Bn MI 1.0Bn 1.2Bn 1.3Bn 1.4Bn AZ 705MM 804MM 965MM 1.2Bn Other 5.5Bn 7.6Bn 9.6Bn 11.9Bn Total $13.1Bn $16.4Bn $19.6Bn $23.5Bn $ 5.9Bn $13 . 1 Bn $ 17.0Bn $ 35.4Bn $ 48.8Bn $ 52.5Bn $ 75.0Bn $ 90.5Bn $ 114.2Bn 2019 E - Cirarette Sales 2019 Legal Cannabis Market Size 2018 Firearms & Amunition Sales 2019 Video Game Sales 2019 Wine Sales 2019 Organic Food Sales 2030E Legal Cannabis Market Size 2019 Cigarette Sales 2019 Beer Sales 14

12 7 5 4 4 649 Consolidated Company Competitor 1 Competitor 2 Competitor 3 Competitor 4 O t h er 4 2 2 1 1 275 Consolidated Company Competitor 1 Competitor 2 Competitor 3 Competitor 4 O t h er 2 . 0 M A R K E T L E A D IN G PO S IT IO N The current fragmented state of the Colorado cannabis market creates a ripe opportunity for consolidation Schwazze will have a leading position in the Colorado market throughout its operations with significant enhancement and optimization opportunities ▪ Expertise across each of its key operating areas to maximize efficiencies ▪ Customer data to take advantage of market trends ▪ Broad retail and product brand portfolio to compliment merchandising strategy ▪ Control over shelf space allowing for positioning of in - house brands Re ta i l ( D i s p e n sa ri es b y C o m p a n y ) W h o l e s a le (MI PS b y C o m p a n y ) ( C u l t . S i t es b y C o m p a n y ) 30 22 21 14 14 467 Consolidated Company The Green Solution Native Roots Green Dragon LivWell O t h er # 1 # 1 # 1 Note: These figures are unaudited and represent the Company’s current estimates. These figures are subject to adjustment and change upon completion of the audits for each of the entities included therein (1) Colorado Marijuana Enforcement Division 12/02/2019. Charts not to scale, shown for illustrative purposes only Leading, Scalable Cannabis Platform Benefits Vertically Integrated Leader (1) 15

(1) Estimated Company reach based on population in counties near to dispensaries. Population statistics based on U.S. Census M I P 4 Legend S y m bo l T yp e S i t es Dispensary 30 Cultivation 12 Colorado Greater Denver The post consolidated platform will be able to reach an estimated 75% of the mature Colorado cannabis market (1) 16 2 . 0 E X P A N S I V E P OS T CON S OL I D A T I O N F OO T P R I N T

Schwazze’s DNA is a purpose - driven value system which supports the health, well being and happiness of its customers. Data driven customer - centric thinking drives company operations and innovation. SHWZ will deliver what the customers want – where, when and how they want it. 3 . 0 C U S T O M E R - C E N T RIC R E T A IL IN G Legend Products and Brands That Match Customers Demands Retail Analytics & Consumer Engagement Tools Accessories / Apparel Concentrates Edibles Flower and Pre - Rolls Grow Supplies Sublinguals Topicals Shake / Trim SHWZ eCommerce M a r k e t p l a c e e C o m m e r c e Drive Up and Go Same Day Delivery Next Day Delivery Subscription Om n i ch a nn e l ( W h e n , W h e r e a n d Ho w ) S t o r e Fo r m a t s T h a t F i t C u s t o m e r s ’ L i f e s t y l e s Premium ( D es t i n a t io n ) Mainstream ( C o n v e n i e n c e) Value (Price Conscious) Adventurous ( E x p e r i e n t i a l) Consumption Lounge C o n s um e r Data Point of Sale C o m p e t i t iv e Intelligence Sales Force / HRMS Business Intelligence M a r k e t i n g Agency Website / App Coordination Personalized Loyalty Existing C a pa b i lity In Development Non - Users Indies Outsiders Idealists 17

3 . 0 C A N N A B IS E X PE RIE NT IA L R E T A IL Combining best - in - class retail practices with industry leading cannabis expertise, SHWZ will lead innovation in the development of product and retail trends CANNABIS RETAIL 2.0 Interactive Digital Experiences 18 Tasting Lounge Consumption & Event Venue Premium Experiential Branding eCommerce Concierge (click & collect, subscription) Store Within A Store Concepts

R E T A IL NEW STORES ▪ Fill - In Acquisitions ▪ Distressed Asset Acquisitions ▪ New Geographies with Legislative Changes ▪ New Formats and Lounges MERCHANDISING ▪ New Products ▪ Data - Driven Category Management ▪ Pricing and Promotion ▪ Placement and Presentation OPERATING CONDITION ▪ Out of Stocks ▪ Suggestive Sales Methodology and Training ▪ Inventory Management ▪ Full Merchandising, Fresh Looking Products, Friendly Staff, Clean Facilities eCOMM WHOLESALE LEVERAGE BEST PRACTICES ▪ Upgrade Sales Organization ▪ Account Convergence and Management ▪ Sales Incentive Practices ▪ Cross - Sell Products into Underpenetrated Accounts SIMPLIFY VENDOR MANAGEMENT ▪ One Point of Contact for Dispensary Customers ▪ Rigorous Coordination between Sales Staff, Marketing and Supply Chain NEW PRODUCTS ▪ B2B: Grow Flower, Trim and Oil ▪ New Product Roadmap to Meet Future Customers’ Wants and Needs ▪ Grow Medical Cultivation Capacity SERVICES NEW CHANNELS ▪ Success Nutrients TM (plant nutrient line) ▪ Big Tomato (grow supplies) ▪ Three - A - Light TM (cultivation IP) NEW STATES ▪ Target Key States for Consulting Services Unit Tied to Partnerships and Acquisition Pipeline NEW OFFERINGS ▪ Add Manufacturing Suite ▪ Add New Pricing Tiers to Suite of Services ▪ Facility and Equipment Design ▪ Mechanical, Electrical and Plumbing Engineering Services and Procurement 4 . 0 R E P L I CA B L E OR G A N I C G R OW T H P L A Y B OOK 19 Business model is transferable and enables roll out for multistate expansion

…With History of Outperforming Announced Synergy Targets Executive Former Roles Current Role at SHWZ Justin Dye ▪ COO and CAO ▪ Head of Integration ▪ Chairman and CEO Shane Sampson ▪ CMMO ▪ Head of Revenue Synergies ▪ CMMO ▪ Head of Revenue Synergies Todd Williams ▪ VP, Corporate Development ▪ M&A Leader ▪ Chief Strategy Officer ▪ M&A and Capital Committee Leader Nirup Krishnamurthy ▪ CIO ▪ CSO ▪ Chief Integration and Information Officer This Team Has Done This Before… Source: Albertsons Investor Presentation dated May 15, 2018 Synergies Planned At A nn o un c e m e n t : $800MM 2018 Run - Rate: $823MM 4 . 0 P R O V E N M & A A N D I N T E G R A T I O N E X P E R T I S E Led by Justin Dye and critical members of the previous Albertsons’ management team, Schwazze is uniquely positioned with world - class management and acquisition capabilities to grow the Company to become a global cannabis leader ▪ Dye and his team transformed Albertsons into the leader in the U.S. supermarket industry – Pursuing a highly successful acquisition strategy – Instituting best - in - class operating procedures in a low margin business – Achieving unprecedented company growth ▪ Scaling the company from ~$10Bn to ~$60Bn revenue over a three - year period ▪ SHWZ plans to implement a similar growth strategy through acquisitions in the cannabis industry ▪ SHWZ’s team has done this before: buying, integrating and synergizing assets, which delivered outsized shareholder returns 20

K E Y IN V E S T M E N T H IG H L IG H T S Schwazze is a unique opportunity in the cannabis space – combining best - in - class operations with a management team that has scaled companies before Great Expertise in Retail, Manufacturing, Brand Development and Product Development This Team Has Done This Before – Buying, Integrating and Synergizing Assets to Deliver Outsized Shareholder Returns World - Class Leadership with Best - in - Class Operational Techniques A Market - Leading Position in Colorado, Poised for National Success in a Hypergrowth Industry 1 2 3 4 21

Thank you! 22 Investor Contact Information: Medicine Man Technologies, Inc. dba Schwazze 4880 Havana Street, Suite 201 Denver, CO 80239 I R @ S c h w azze . c o m