Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Century Communities, Inc. | form8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION | MAY 2020

Forward-Looking Statements Certain statements in this Investor Presentation may be regarded as

"forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Certain forward-looking statements discuss the Company’s plans, strategies and intentions, and may be identified by reference

to a future period or periods or by the use of forward-looking terminology, such as “expects,” “may,” “will,” “believes,” “should,” “would,” “could,” “approximately,” “anticipates,” “estimates,” “targets,” “intends,” “likely,” “projects,”

“positioned,” “strategy,” “future,” and “plans.” In addition, these words may use the positive or negative or other variations of those terms. All statements other than statements of historical fact are “forward–looking statements” for purposes

of federal and state securities laws. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. These statements involve known and unknown risks, uncertainties and other factors that may cause our

actual results, levels of activity, performance or achievements to differ from those expressed or implied by the forward-looking statement.These forward-looking statements are based on various assumptions and the current expectations of the

management of the Company, and may not be accurate because of risks and uncertainties surrounding these assumptions and expectations. Certain factors may cause actual results to differ significantly from these forward-looking statements. If any

of the events occur, there is no guarantee what effect they will have on the operations or financial condition of the Company. Major risks, uncertainties and assumptions include, but are not limited to, risks relating to: the Company’s capital

and financing needs and availability; any unforeseen changes to or effects on liabilities, future capital expenditures, revenues, expenses, earnings, synergies, indebtedness, financial condition, losses and future prospects; the Company’s

ability to integrate and operate assets successfully after the closing of an acquisition; demand fluctuations in the housing industry; the effect of general economic conditions, including employment rates, housing starts, interest rate levels,

availability of financing for home mortgages, and the strength of the U.S. dollar; ability to adapt the Company’s business strategy to changing home buying patterns and trends; ability to identify and acquire desirable land; the impact of the

COVID-19 pandemic on the Company’s business operations; and other factors. However, it is not possible to predict or identify all such factors.In addition, the Company has disclosed under the heading “Risk Factors” in its Annual Report on Form

10-K for the fiscal year ended December 31, 2019 (the “Annual Report”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 7, 2020, the risk factors which materially affect its business, financial condition and

operating results. Investors are encouraged to review the Annual Report for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement.

Forward-looking statements included herein are made as of the date hereof, and the Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect future events, developments or otherwise, except as may be

required by applicable law. Non-GAAP Financial InformationThis Investor Presentation includes certain non-GAAP financial measures as defined by SEC rules. Such non-GAAP financial measures are presented as a supplemental financial measurements

in the evaluation of our business. We believe the presentation of these financial measures helps investors to assess our operating performance from period to period and enhances understanding of our financial performance and highlights

operational trends. Non-GAAP financial measures are widely used by investors in the valuation, comparison, rating and investment recommendations of companies. However, such measurements may not be comparable to those of other companies in our

industry, which limits their usefulness as a comparative measures. Such measures are not required by or calculated in accordance with GAAP and should not be considered as a substitutes for net income or any other measure of financial

performance reported in accordance with GAAP or as a measure of operating cash flow or liquidity. Non-SolicitationThe information in this Investor Presentation is for informational purposes only and is neither an offer to sell, nor a

solicitation of an offer to subscribe for or buy any securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Company overview 8,201LTM Q1 2020homes closed $2.5 BILLIONLTM Q1 2020 home sales revenues $1.1

BILLIONStockholders’ equity TOP 10 U.S. HOMEBUILDER1 Premier publicly traded homebuilder 17 CONSECUTIVE YEARS OF PROFITABILITYProfitable through multiple housing cycles 35,831 LOTSAttractive land position Source: Company filingsBased on

2018 closings KEY MARKETSFocused on markets with robust economic, job, and population growth FINANCIAL SERVICESProvides mortgage, title and insurance services generating ancillary income with robust margins

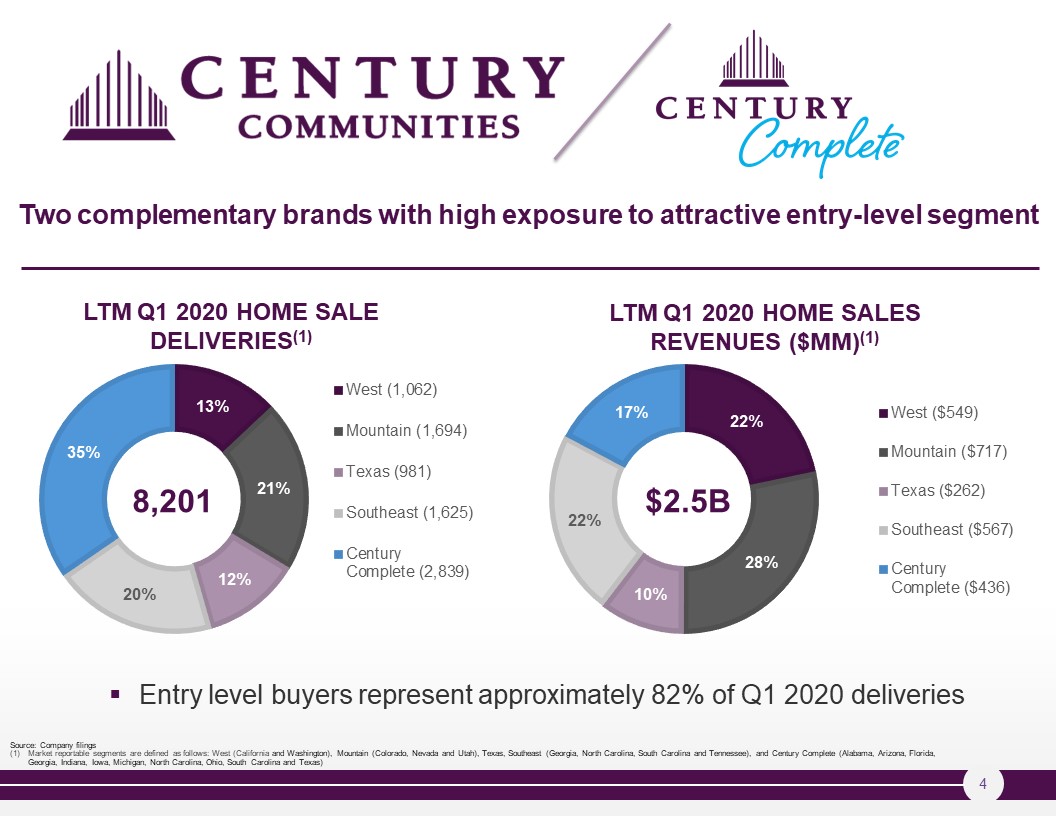

Source: Company filingsMarket reportable segments are defined as follows: West (California and

Washington), Mountain (Colorado, Nevada and Utah), Texas, Southeast (Georgia, North Carolina, South Carolina and Tennessee), and Century Complete (Alabama, Arizona, Florida, Georgia, Indiana, Iowa, Michigan, North Carolina, Ohio, South Carolina

and Texas) LTM Q1 2020 HOME SALES REVENUES ($MM)(1) LTM Q1 2020 HOME SALE DELIVERIES(1) $2.5B 8,201 Entry level buyers represent approximately 82% of Q1 2020 deliveries Two complementary brands with high exposure to attractive

entry-level segment

2Q performance update 2020 April Net Sales essentially the same, down less than 1% from prior

yearGross and Net Sales improved sequentially through AprilCancellations have improved from elevated levels in MarchNow in-line with year-to-date averageRepaid $100M on the line of credit in MayContinue to see states loosen coronavirus-related

restrictions, reopen their economies and begin to lift social-distancing and stay-at-home orders

Key INVESTMENT Highlights Seasoned & Cycle Tested Management TeamSuccessful History of M&A

and IntegrationAttractive Entry Level Buyer FocusGeographically Diverse Top-10 U.S. BuilderStrong Performance Across Financial MetricsConsistent Track Record of Profitable GrowthReturns Focused Business ModelStrong Balance Sheet with Ample

Liquidity

SEASONED & CYCLE TESTED management TEAM DALE FRANCESCONCHAIRMAN AND CO-CHIEF EXECUTIVE

OFFICER Co-Founder of CCS Co-Largest Shareholder 25+ years of homebuilding experience ROBERT FRANCESCONPRESIDENT AND CO-CHIEF EXECUTIVE OFFICERCo-Founder of CCS Co-Largest Shareholder 25+ years of homebuilding experience DAVID MESSENGERCHIEF

FINANCIAL OFFICER CFO of CCS Since 2013 25+ years of real estate and finance experience

Founded in 2002 by Dale and Rob Francescon Aligned with shareholders with ~12.5% ownership of

CCSProfitable every year since founding – 17 consecutive years, including through the most recent economic downturnSuccessfully executed numerous equity and debt capital raises, with a commitment to maintaining a conservative balance sheet

Completed and fully integrated seven acquisitions since 2012 Financial Metrics Operating Metrics 2015 LTM Q1 2020 Experienced management team Seasoned and cycle-tested management team Track record of profitable growth # of

Markets 28 8 # of States 17 4 Owned/Controlled Lots 35,831 13,160 Deliveries 8,201 2,401 ASP ($000s) $309 $302 Total Revenues ($mm) $2,605 $734 Adjusted EBITDA ($mm) $236 $78 Adjusted Pretax Net (Loss) /

Income ($mm) $160 $60 Shareholders’ Equity ($mm) $1,085 $409

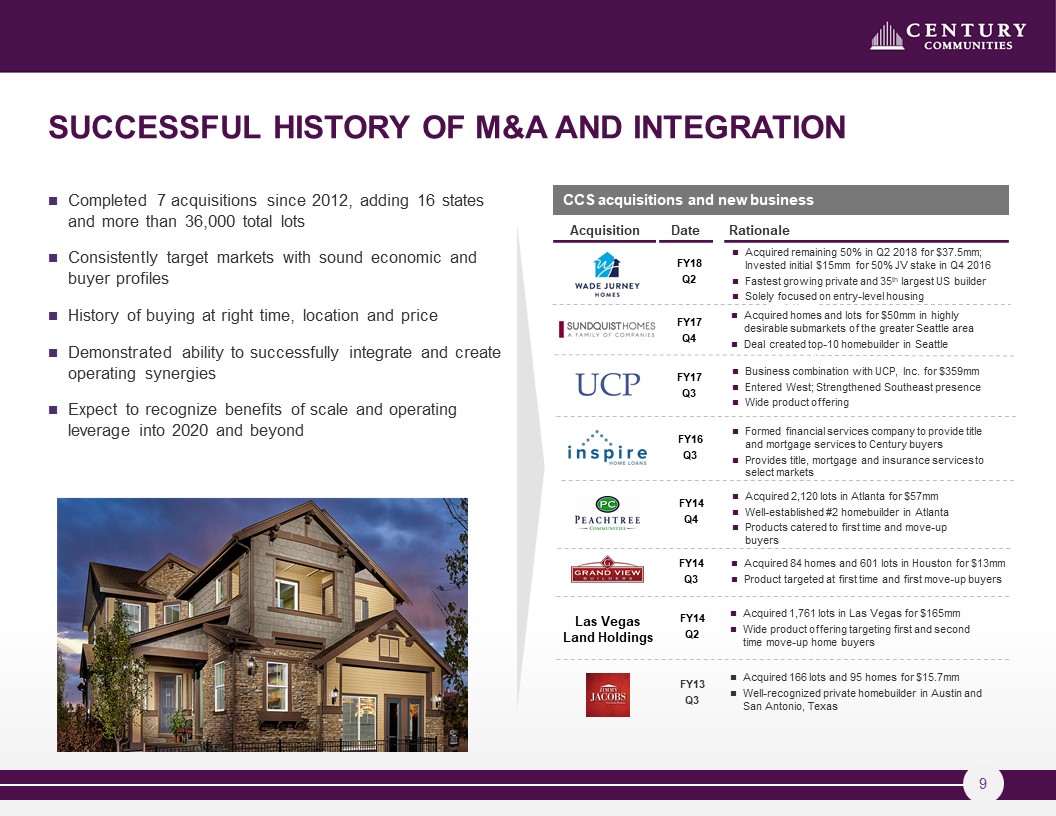

Successful HISTORY of M&A and integration 2014 2015 2014 Completed 7 acquisitions since 2012,

adding 16 states and more than 36,000 total lots Consistently target markets with sound economic and buyer profiles History of buying at right time, location and priceDemonstrated ability to successfully integrate and create operating

synergiesExpect to recognize benefits of scale and operating leverage into 2020 and beyond CCS acquisitions and new business 2016 201 6 Acquisition Date FY14Q4 FY18Q2 FY17Q3 FY17Q4 FY14Q3 FY14Q2 FY13Q3 2013 2017 2013 2017

Rationale Acquired 2,120 lots in Atlanta for $57mmWell-established #2 homebuilder in AtlantaProducts catered to first time and move-up buyers Acquired homes and lots for $50mm in highly desirable submarkets of the greater Seattle area Deal

created top-10 homebuilder in Seattle Business combination with UCP, Inc. for $359mm Entered West; Strengthened Southeast presenceWide product offering Acquired remaining 50% in Q2 2018 for $37.5mm; Invested initial $15mm for 50% JV stake in

Q4 2016Fastest growing private and 35th largest US builderSolely focused on entry-level housing Acquired 84 homes and 601 lots in Houston for $13mmProduct targeted at first time and first move-up buyers Acquired 1,761 lots in Las Vegas for

$165mmWide product offering targeting first and second time move-up home buyers Acquired 166 lots and 95 homes for $15.7mmWell-recognized private homebuilder in Austin and San Antonio, Texas Formed financial services company to provide title

and mortgage services to Century buyers Provides title, mortgage and insurance services to select markets FY16Q3 Las Vegas Land Holdings

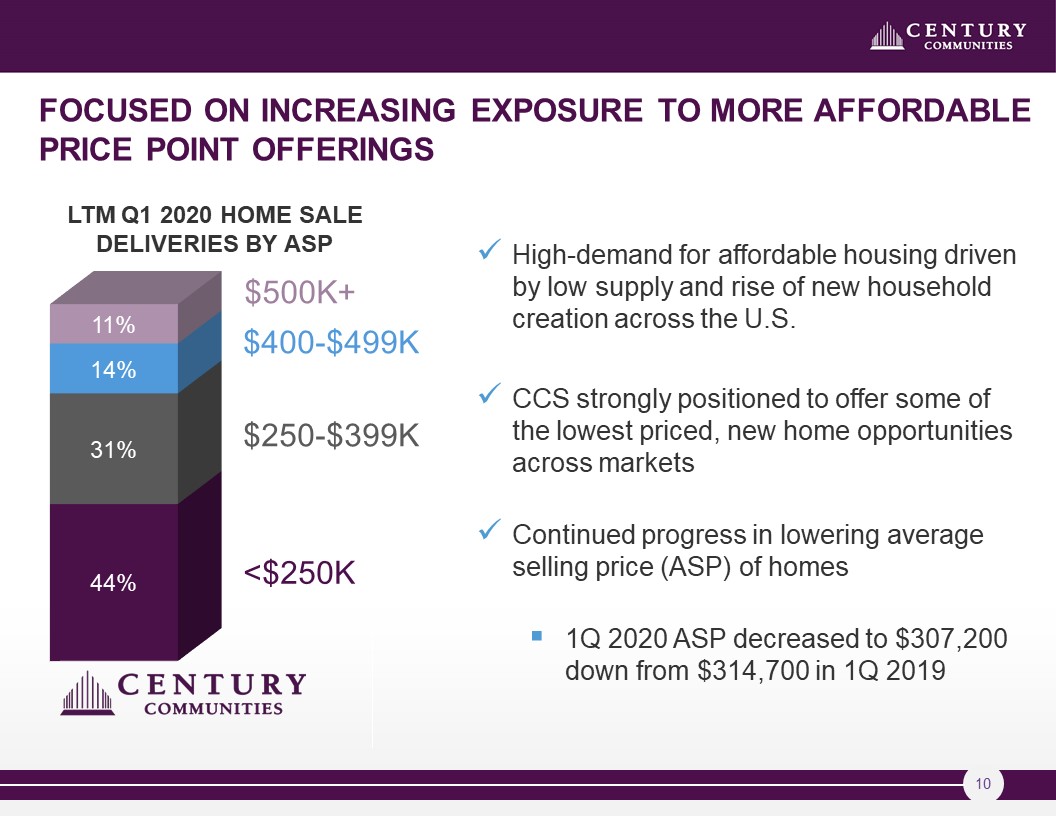

FOCUSED ON INCREASING EXPOSURE TO MORE AFFORDABLE PRICE POINT

OFFERINGS $500K+ $400-$499K $250-$399K <$250K LTM Q1 2020 HOME SALE DELIVERIES BY ASP High-demand for affordable housing driven by low supply and rise of new household creation across the U.S.CCS strongly positioned to offer some of

the lowest priced, new home opportunities across marketsContinued progress in lowering average selling price (ASP) of homes1Q 2020 ASP decreased to $307,200 down from $314,700 in 1Q 2019

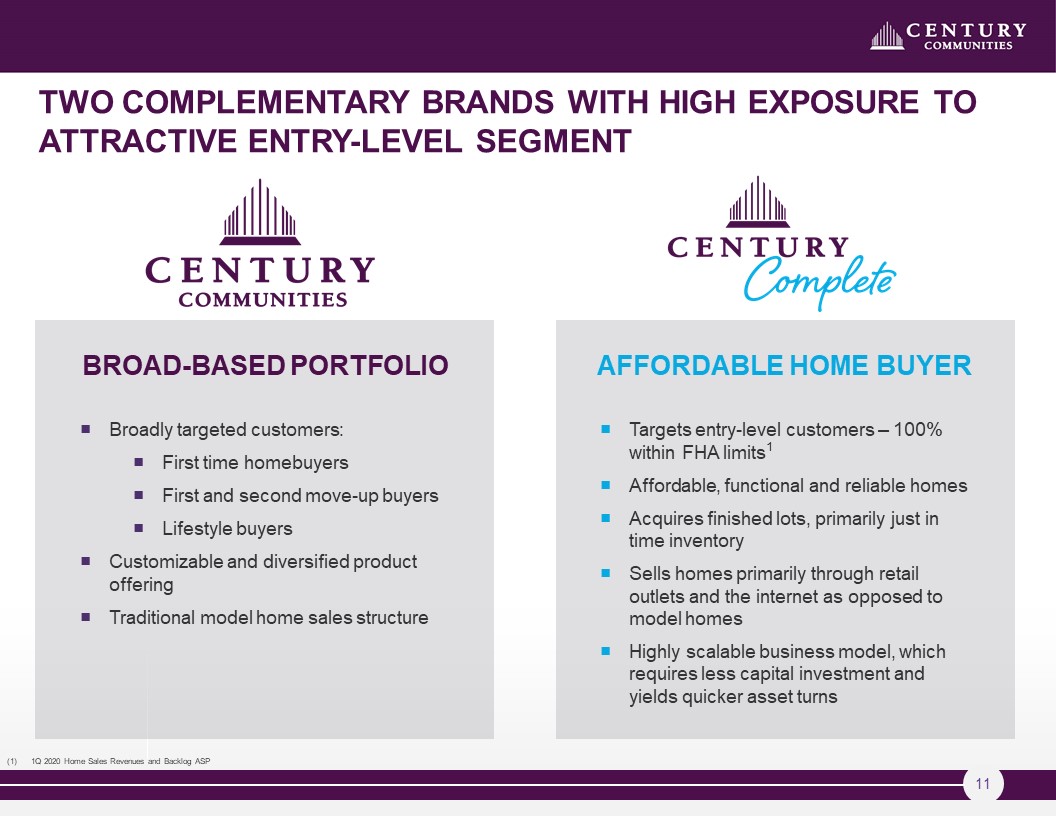

1Q 2020 Home Sales Revenues and Backlog ASP TWO COMPLEMENTARY BRANDS WITH HIGH EXPOSURE TO Attractive

ENTRY-LEVEL SEGMENT Broadly targeted customers: First time homebuyersFirst and second move-up buyers Lifestyle buyersCustomizable and diversified product offering Traditional model home sales structure Targets entry-level customers – 100%

within FHA limits1Affordable, functional and reliable homesAcquires finished lots, primarily just in time inventorySells homes primarily through retail outlets and the internet as opposed to model homesHighly scalable business model, which

requires less capital investment and yields quicker asset turns BROAD-BASED PORTFOLIO AFFORDABLE HOME BUYER

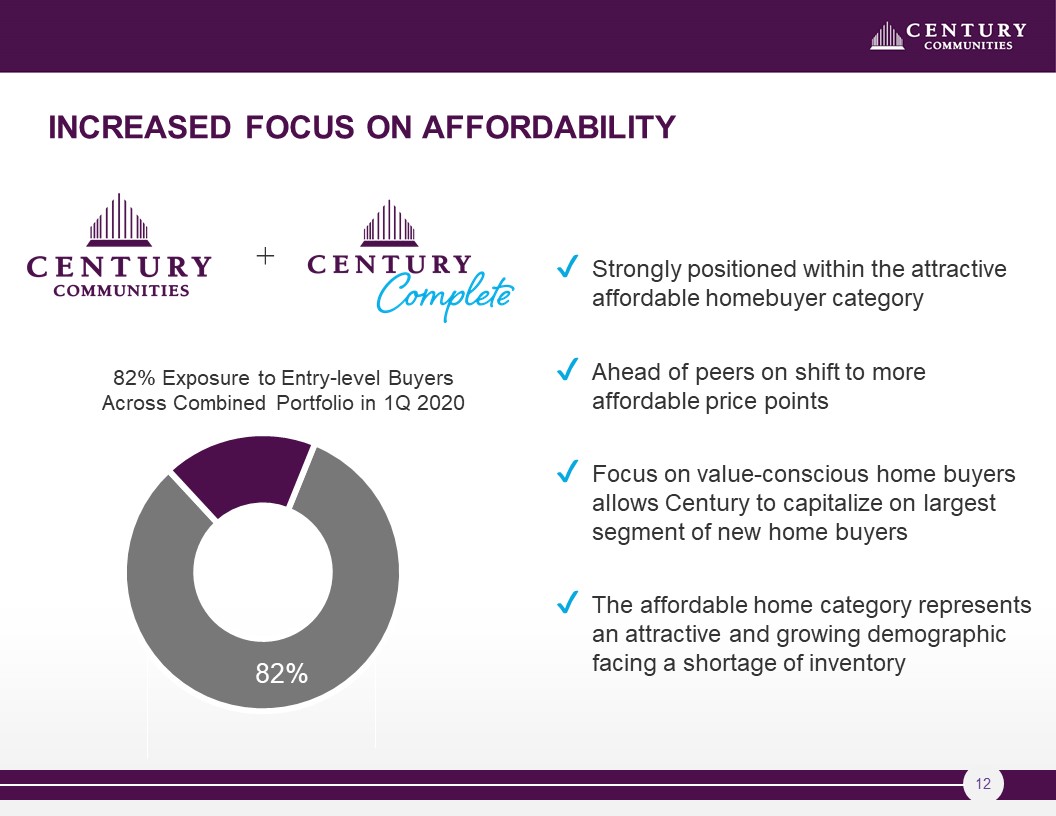

INCREASED FOCUS ON AFFORDABILITY + 82% Exposure to Entry-level Buyers Across Combined Portfolio in 1Q

2020 Strongly positioned within the attractive affordable homebuyer categoryAhead of peers on shift to more affordable price pointsFocus on value-conscious home buyers allows Century to capitalize on largest segment of new home buyersThe

affordable home category represents an attractive and growing demographic facing a shortage of inventory

Increased investment in online homebuying resources ACROSS ENTIRE PORTFOLIO Century’s comprehensive

virtual resources enable homebuyers to:Explore floor plans and quick move-in homes Set up virtual appointments with Onsite Agents through call/chatSchedule video walkthroughs of homes and communitiesSign contracts electronicallyTransfer earnest

money deposits electronicallyUtilize effective, one-stop financing and closing solutions through Century’s mortgage, title and insurance companies

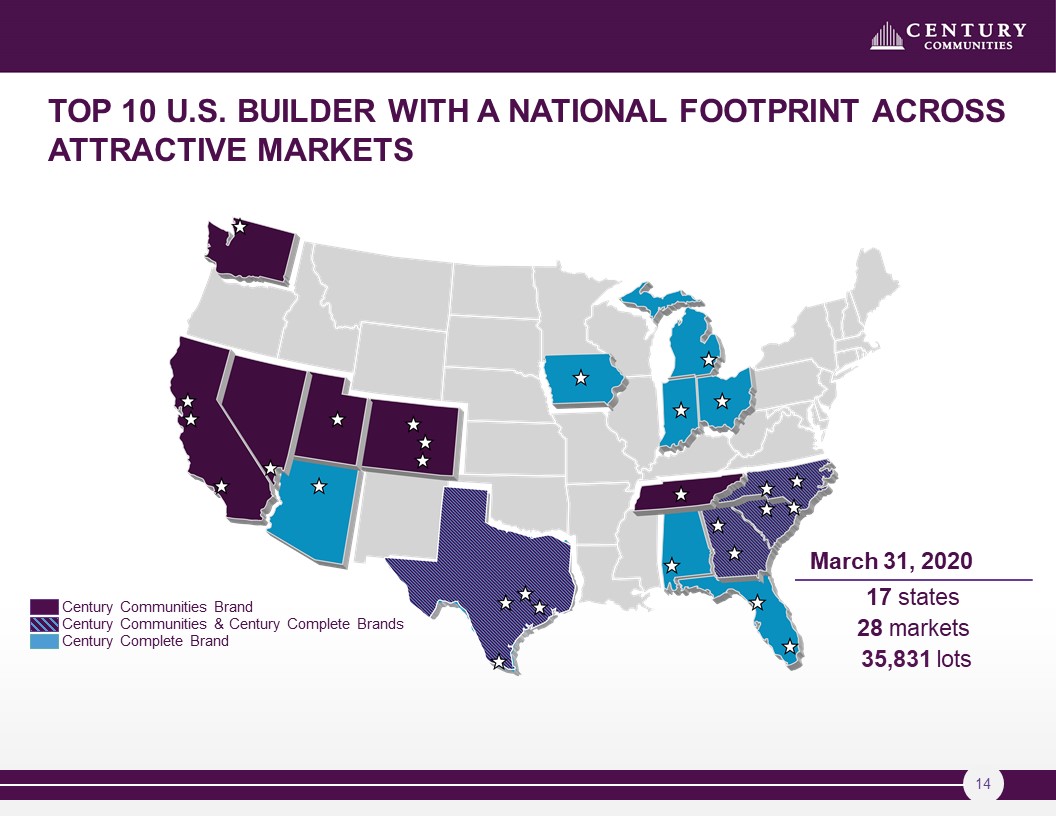

Top 10 U.S. Builder with a national footprint across attractive Markets March 31, 2020 17 states28

markets 35,831 lots Century Communities Brand Century Communities & Century Complete Brands Century Complete Brand

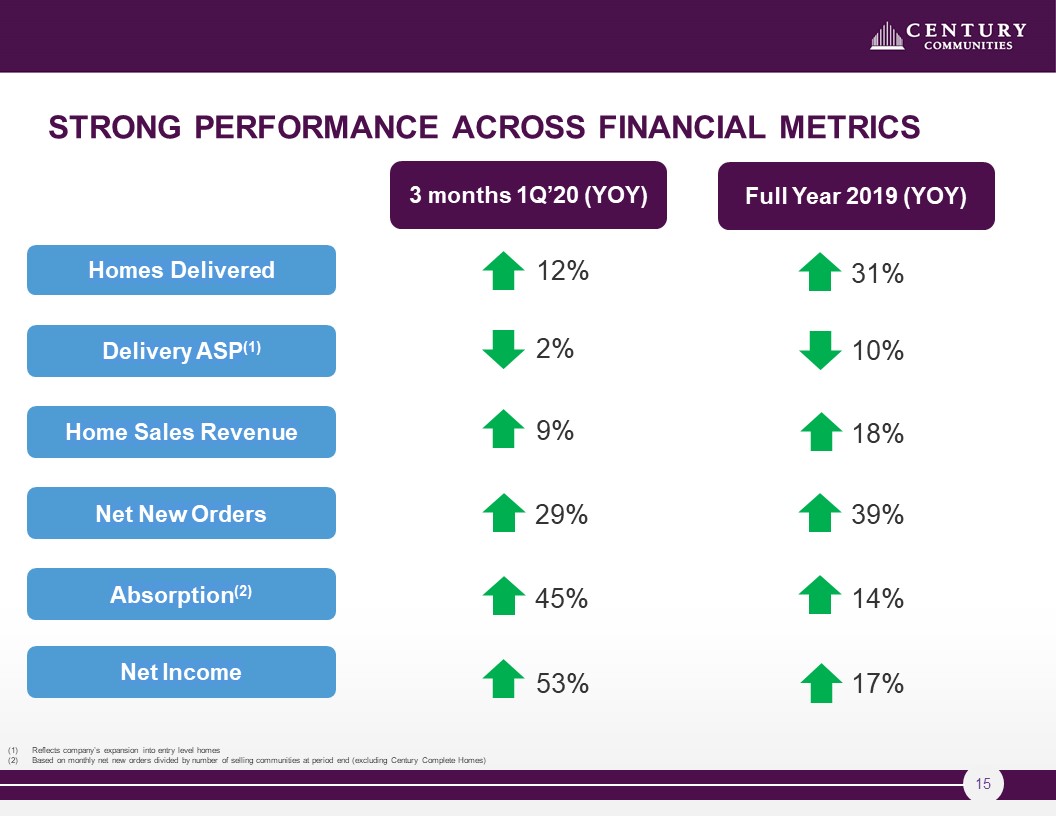

STRONG PERFORMANCE ACROSS FINANCIAL METRICS Home Sales Revenue Homes Delivered Net New

Orders Delivery ASP(1) Absorption(2) Reflects company’s expansion into entry level homesBased on monthly net new orders divided by number of selling communities at period end (excluding Century Complete Homes) Net

Income 53% 17% 45% 14% 29% 39% 9% 18% 2% 10% 12% 31% 3 months 1Q’20 (YOY) Full Year 2019 (YOY)

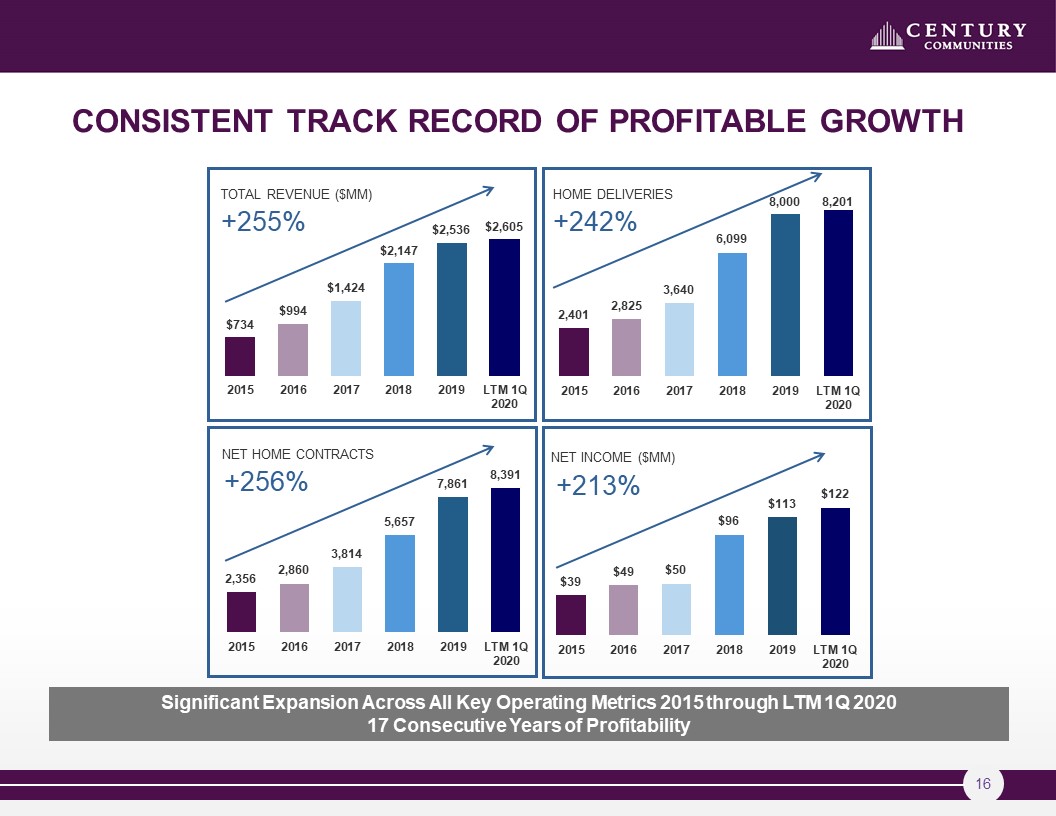

Consistent TRACK Record OF Profitable growth TOTAL REVENUE ($MM) +255% HOME DELIVERIES

+242% NET HOME CONTRACTS +256% Significant Expansion Across All Key Operating Metrics 2015 through LTM 1Q 202017 Consecutive Years of Profitability NET INCOME ($MM) +213%

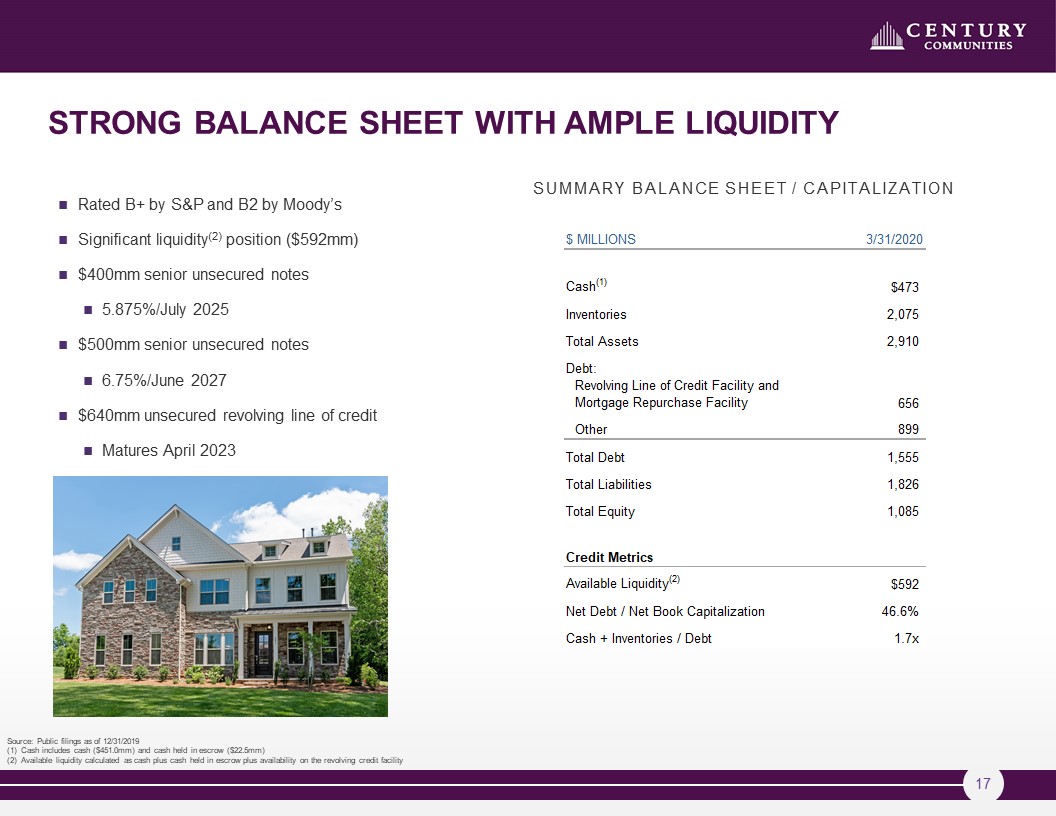

Strong balance sheet with AMPLE LIQUIDITY Rated B+ by S&P and B2 by Moody’sSignificant liquidity(2)

position ($592mm)$400mm senior unsecured notes5.875%/July 2025$500mm senior unsecured notes6.75%/June 2027$640mm unsecured revolving line of creditMatures April 2023 Source: Public filings as of 12/31/2019Cash includes cash ($451.0mm) and

cash held in escrow ($22.5mm) Available liquidity calculated as cash plus cash held in escrow plus availability on the revolving credit facility SUMMARY BALANCE SHEET / CAPITALIZATION

Key INVESTMENT Highlights Seasoned & Cycle Tested Management TeamSuccessful History of M&A and

IntegrationAttractive Entry Level Buyer FocusGeographically Diverse Top-10 U.S. BuilderStrong Performance Across Financial MetricsConsistent Track Record of Profitable GrowthReturns Focused Business ModelStrong Balance Sheet with Ample

Liquidity

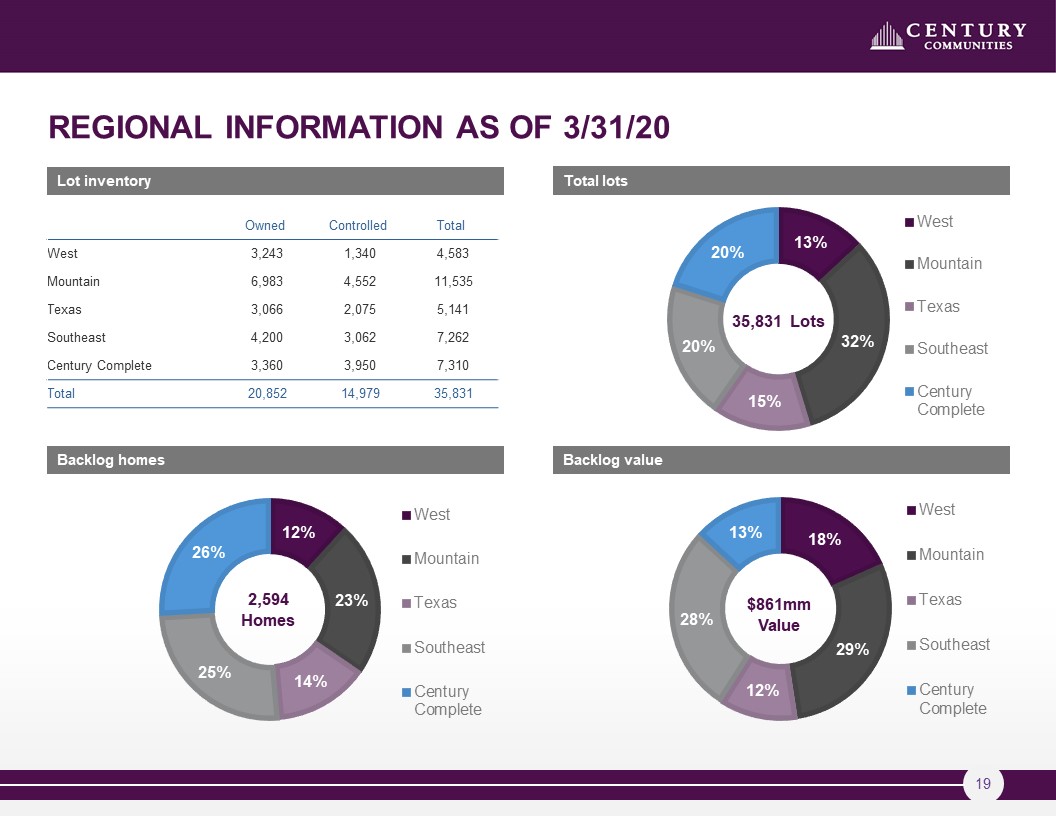

Regional Information As of 3/31/20 2,594Homes 35,831 Lots $861mm Value Total lots Lot

inventory Backlog value Backlog homes Owned Controlled Total West 3,243 1,340 4,583 Mountain 6,983 4,552 11,535 Texas 3,066 2,075 5,141 Southeast 4,200 3,062 7,262 Century Complete 3,360 3,950

7,310 Total 20,852 14,979 35,831

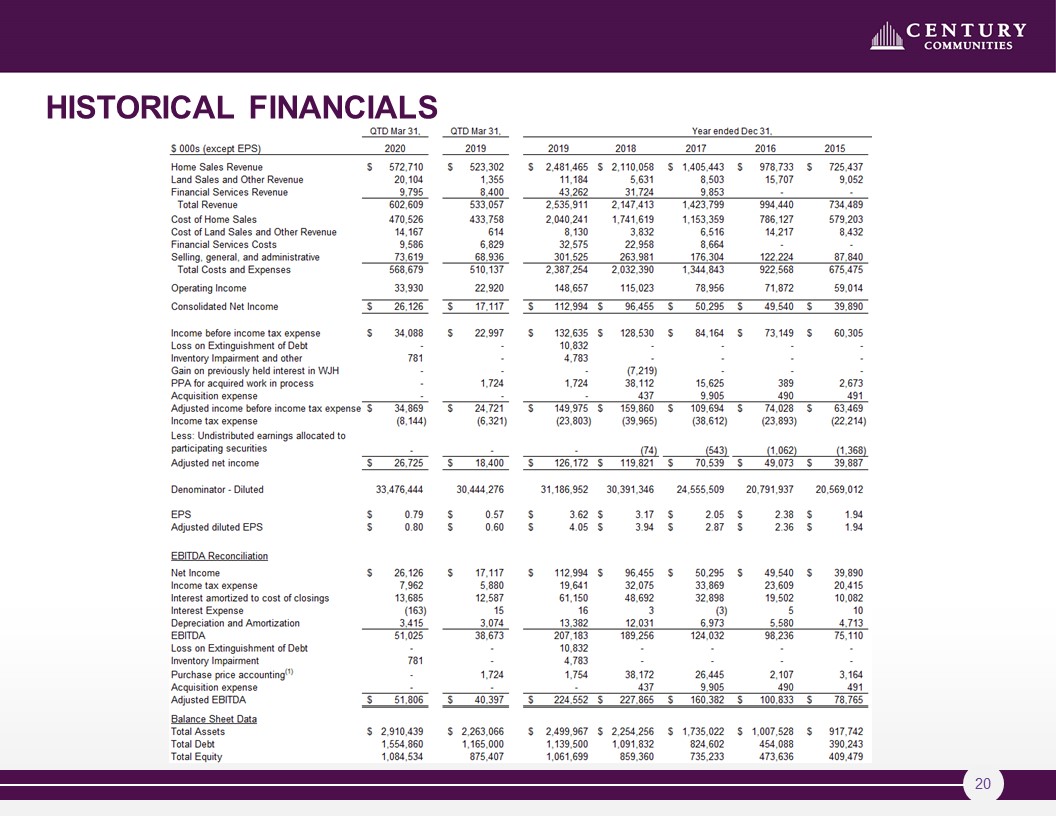

Historical Financials