Attached files

| file | filename |

|---|---|

| EX-10.23 - CITRINE GLOBAL, CORP. | ex10-23.htm |

| EX-32.2 - CITRINE GLOBAL, CORP. | ex32-2.htm |

| EX-32.1 - CITRINE GLOBAL, CORP. | ex32-1.htm |

| EX-31.2 - CITRINE GLOBAL, CORP. | ex31-2.htm |

| EX-31.1 - CITRINE GLOBAL, CORP. | ex31-1.htm |

| EX-23.1 - CITRINE GLOBAL, CORP. | ex23-1.htm |

| EX-10.22 - CITRINE GLOBAL, CORP. | ex10-22.htm |

| EX-10.19 - CITRINE GLOBAL, CORP. | ex10-19.htm |

| EX-10.18 - CITRINE GLOBAL, CORP. | ex10-18.htm |

| EX-10.17 - CITRINE GLOBAL, CORP. | ex10-17.htm |

| EX-10.15 - CITRINE GLOBAL, CORP. | ex10-15.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

or

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________________ to ________________

Commission file number 000-55680

TECHCARE

CORP.

(Exact Name of Registrant As Specified In Its Charter)

| Delaware | 68-0080601 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

| 3 Hamelacha, Tel Aviv, Israel | 6721503 | |

| (Address of Principal Executive Offices) | (Area Code) |

Registrant’s Telephone Number, Including Area Code: + (972) 73 7600341

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). [X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” or “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [X] | Smaller reporting company | [X] | |

| Emerging growth company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. [ ]

Indicate whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) [ ] Yes [X] No

On May 7, 2020, the aggregate market value of the common stock held by non-affiliates of the registrant was approximately $97.5 million based on the closing price of $0.197 per share of the Registrant’s common stock on May 7, 2020.

The registrant had 494,721,815 shares of common stock outstanding as of May 7, 2020.

The registrant is relying on the Securities and Exchange Commission’s Order under Section 36 of the Securities Exchange Act of 1934 Modifying Exemptions from the Reporting and Proxy Delivery Requirements for Public Companies (Securities and Exchange Commission Release No. 34-88465 dated March 25, 2020), which concerns exemptions from certain filing deadlines in light of coronavirus disease 2019 (COVID-19). The registrant could not file this Annual Report on Form 10-K for the fiscal year ended December 31, 2019 on a timely basis because the outbreak of COVID-19 in Israel and attendant restrictions on life in Israel, which included, among others, our team and advisors being required to work from home, combined with the additional workload involved in completing the transactions reported by the Registrant during the first quarter of this year for the issuance and sale of shares in the Registrant and the sale of shares in its subsidiary Novomic Ltd, caused delays in completing the required work.

TABLE OF CONTENTS

| 2 |

Cautionary Statement regarding Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, or the Exchange Act. These forward-looking statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the forward-looking statements are made, and we undertake no obligation to update forward-looking statements should these beliefs, estimates, and opinions or other circumstances change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these forward-looking statements to actual results.

Our financial statements are stated in United States dollars, or US$, and are prepared in accordance with United States generally accepted accounting principles, or GAAP. In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common stock” refer to the shares of our common stock. As used in this Annual Report, the terms “we,” “us,” “our,” “TechCare,” the “Company” and the “Registrant” mean TechCare Corp. and its subsidiaries unless the context clearly requires otherwise.

| 3 |

Recent Developments and Corporate Background

Prior to the Company’s quarterly report for the period ended September 30, 2019 the Company’s Board of Directors was exploring strategic alternatives to enhance stockholder value, which the Company reported in the quarterly report might include future acquisitions, a merger with another company, a potential sale of certain assets, including the Company’s wholly owned subsidiary Novomic Ltd., a private company organized under the laws of the State of Israel (“Novomic”), or the sale of the Company as a public shell company.

Until December 31, 2019, the Company had incurred accumulated losses of approximately $10.6 million, and based on the projected cash flows and Company’s cash balance, the Company’s management was of the opinion that without further fundraising it would not have sufficient resources to enable it to continue advancing its activities including the development, manufacturing, and marketing of its products. The Company’s management had plans including the continued commercialization of the Company’s products, to continue taking cost reduction steps and securing sufficient financing, however, it was also exploring strategic alternatives as detailed above.

During 2019 Company made various efforts to increase sales of its product Novokid® in Europe and Israel, and to receive U.S. Food and Drug Administration (“FDA”) approval to sell in the USA. However, the Company’s sales efforts, including in Israel through Super Pharm, and in the Netherlands, and through Amazon UK, did not yield the forecasted outcomes. The Company’s USA OEM agreement failed to result in FDA approval or USA sales. The Company failed to enter into additional engagements with distributors in Europe and Latin America. The Company also failed to launch its product Shine. In January 2019 the Company entered into a joint venture agreement with a Chinese partner for the formation of a Chinese joint venture intended to focus on the development of a comprehensive and broad range of health, wellness, beauty and home products for customers by utilizing its patented technology of vaporization of natural and plant-based compounds. While a Chinese entity was established in accordance with the joint venture agreement, only part of the amount envisaged to be invested in the Company by ICB Biotechnology Investments Ltd in connection with the joint venture was invested and on September 19, 2019 its nominated director Ningzhou Zhang resigned from the board of directors of the Company.

On November 21, 2019, in light of the above, and absence of any improvement in the situation, and after the board of directors of the Company reached the conclusion that the Company would not be able to successfully commercialize any products or secure sufficient financing, the Company entered into a Memorandum of Understanding with Citrine S A L Investment & Holdings Ltd (“the buyer”) which provided for the issuance and sale of a number of shares of common stock of the Company which after the transaction would result in the buyer holding 95% of the fully diluted capital stock of the Company, and the sale by the Company of 90% of its shares in Novomic.

On January 6, 2020, definitive agreements were executed for the sale of 90% of the shares in Novomic to Traistman Radziejewski Fundacja Ltd, which is expected to be completed during May 2020 (the “Novomic Divestment”), and for the issuance and sale of a number of shares equal after the issuance to 95% of the fully diluted capital stock of the Company to Citrine S A L Investment & Holdings Ltd and a group of related persons and entities (the “TechCare Transaction”). Citrine S A L Investment & Holdings Ltd carried out extensive due diligence appropriate for the acquisition of a public company divesting its activities, and obtained from the Company’s sellers detailed representations and warranties. Traistman Radziejewski Fundacja Ltd is controlled by Oren Traistman, who was a director of the Company until February 27, 2020.

On February 23, 2020, the Company entered into an agreement amending and restating the January 6, 2020 agreement concerning the TechCare Transaction, which provided for the issuance and sale of the shares in stages. Pursuant to this agreement, on February 27, 2020 a number of shares was issued to Citrine S A L Investment & Holdings Ltd which was insufficient to cause a change in control of the Company - which would at that time have invalidated the Company’s Directors and Officers insurance – but which did cause to come into effect the resignation of the board of directors of the Company and the appointment of a new board nominated by Citrine S A L Investment & Holdings Ltd. The board of the directors of the Company has accordingly since February 27, 2020 been composed of three nominees of Citrine S A L Investment & Holdings Ltd, namely Ora Meir Soffer, Ilan Ben-Ishay and Ilanit Halperin. Zviel Gedalihou was appointed as Chief Financial Officer of the Company on March 17, 2020, and Ora Meir Soffer was appointed Chief Executive Officer of the Company on May 7, 2020. The Company has no payroll liabilities at present. On March 5, 2020, additional shares were issued, causing Citrine S A L Investment & Holdings Ltd and its group of related persons and entities to become owners of 90.6% of the fully diluted capital stock of the Company, and resulting in a change of control of the Company. The Company is working to complete the issuance and sale of a number of shares equal after the issuance to up to 95% of the fully diluted capital stock of the Company by amending its Certificate of Incorporation to increase its authorized share capital and then issuing additional shares.

The Company continues to sell the Novokid® product both through online and physical sales channels, including through its own website, Amazon.uk, and Super Pharm’s physical outlets, with its principal markets being the United Kingdom, Europe and and Israel.

| 4 |

At the time of the publication of this annual report, Novomic was a technology company engaged in the design, development and commercialization of a unique delivery platform utilizing vaporization of various natural compounds for multiple health, beauty and wellness applications. Its delivery platform was proprietary and patented. Its product offering included Novokid® - an innovative home use device which vaporizes a natural, plant-based, pesticides, and silicone-free compound that effectively treats head lice and eggs. Following its soft launch of Novokid® in the Netherlands, the Company expanded its distribution network and launched Novokid in Israel during late May 2018 through Super Pharm, Israel’s largest and leading drugstore chain. The launch was accompanied by a radio and digital brand awareness and marketing campaign and supported by Meditrend, its Israeli distributor, specializing in health and wellness products while representing leading brands. The Company showcased Novokid® and met potential additional distributors and partners at CPhI Worldwide, a renowned and leading pharma tradeshow held in Madrid during October 2018.

On February 8, 2016, the Company signed a Merger Agreement (the “Merger Agreement”) with Novomic and a Shareholders’ Agreement with the Novomic’s shareholders (the “Shareholders’ Agreement”). The Merger Agreement was by and between the Company, on the one hand, and Novomic together with YMY Industry Ltd., or YMY, and Microdel Ltd. or Microdel, the latter two of which are hereinafter referred to as the “Novomic Founders,” on the other hand. On August 9, 2016, the Company consummated the merger under the Merger Agreement (the “Merger”) and Novomic became a wholly-owned subsidiary of the Company. Upon closing of the Merger, the former Novomic shareholders owned approximately 73.52% of the Company’s capital stock and TechCare stockholders retained approximately 26.48% of the combined company, on a fully diluted basis. Accordingly, while TechCare was the legal acquirer, Novomic was treated as the acquiring company in the Merger for accounting purposes, and the Merger was accounted for as a reverse merger. In connection with the closing of the Merger Agreement, the Company (i) changed its name from BreedIT Corp. to TechCare Corp.; (ii) subjected the 149,219,173 outstanding shares of the Company’s common stock to a reverse split on a one-for-thirty (1:30) basis, resulting in 4,973,972 outstanding shares of common stock; and (iii) authorized ten million (10,000,000) shares of preferred stock, par value $0.0001, which may be issued in one or more classes or series, having such designations, preferences, privileges and rights as our board of directors may determine.

Novomic was incorporated as a private limited liability Company in Israel in 2009. Since inception, Novomic has been a technology company engaged in the design, development and commercialization of a platform that vaporizes liquids from a contained capsule into a treatment area, utilizing its proprietary intellectual property rights.

Novomic’s Treatment Solutions

Novokid® – Natural, Plant-based and Effective Lice Treatment

Parents and children exposed to head lice are now forced to use standard over-the-counter, or OTC, treatments that are toxic, often ineffective, time consuming and expensive. According to the Journal of Medical Entomology, 98% of lice have developed resistance to existing treatments in the US and they are now referred to as “super-lice”. Most current treatments contain pesticides, alcohol or silicone, which are all associated with a wide variety of hazardous side effects. Novokid® was a non-pesticide, natural, plant-based and eco-friendly solution that eliminated lice and super lice with a 10 minute dry treatment. This compares with current treatments that require 20-40 minutes of shampooing and combing. At the time of publication of this report, Novomic’s treatment was fast, dry, clean, and easily administered at home or on the go. Novokid® could also be used as a maintenance treatment if used regularly. The Company’s products were all based on its proprietary and patented vaporization platform, which was developed over a period of seven years.

Shine – Natural Haircare rejuvenation

Shine used a patented vaporization process and formulation to clean, treat and improve the appearance of the hair and scalp. In addition to removing the residue, the treatments balanced the hair’s pH levels, added body and shine, defined curls, and strengthened and protected hair from further damage. The Company believed that the Shine treatment was user friendly, requiring the user to connect the Shine capsule to a designated tube, place the attached cap on their head and sit for a 10-minute treatment. There was no need to rinse or shampoo following the treatment. The treatment was expected to cleanse the scalp and leave the hair shiny and manageable. According to a report published by Mordor Intelligence, the global hair care was valued at $95.45 billion in 2018 and was expected to reach $116 billion by 2024, registering a compound annual growth rate (CAGR) of 3.35%. The Company’s products were all based on its proprietary and patented vaporization platform, which was developed over a period of seven years.

| 5 |

Sales and Marketing

While the vaporizer for Novokid® was designed to be a one-time purchase, the head cap and the capsules were designed to be sold separately based on the “razor-blade” business model (the initial sale of the introductory kit accompanied by the recurring sales of the capsules and head cap). However, the Company nevertheless failed to meet its sales forecasts.

Production

The Company manufactured its products through third party manufacturers in Israel and China. The Novokid® vaporizer was manufactured in China by a local manufacturer, which also handled assembly, integration and quality assurance for the vaporizer and manufactured the cap and the ancillary components of the Novokid® kit. The Novokid® treatment capsules were manufactured and filled in Israel by third party contractors. The Company’s board of directors decided during 2019 to suspend all all production.

Research and Development

The Company incurred $404 thousand on research and development during the past two years, $115 thousand in 2019 and $289 thousand in 2018. The Company’s board of directors decided during 2019 to suspend all research and development activity.

Intellectual Property

Below is the list of patents registered to Novomic:

| Patents | Jurisdiction | Each patent’s relevance to the program | Date and status of registration | |||

| EP 2 438 830 B1 | EU | Treating lice with gaseous compounds in airtight space. | Approved on July 16, 2014 | |||

| US 9/307820 B2 | U.S. | Treating lice with gaseous compounds in airtight space. | Approved on April 12, 2016 | |||

| US 15/438842 | U.S. | Treating an object with gaseous compounds in an airtight space. | February 22, 2017 * | |||

| US 62661868 | U.S. | A capsule for the vaporization of liquid | April 24, 2018 * |

* Under approval process.

Government Regulation

The Company’s head lice treatment was subject to regulation by and approval from CE (which approval was obtained) and the FDA (which approval was not obtained). The Company failed to obtain FDA approval for its Novokid® product.

Employees

As of December 31, 2019, Novomic engaged 3 employees on a part-time (50%) basis, one of them being Novomic’s Chief Financial Officer Tali Dinar, and and two service providers, one of them being Idan Traistman in the role of Chief Executive Officer, and one being Shlomi Arbel in the role of legal advisor.

Novomic was subject to Israeli labor laws and regulations with respect to its employees located in Israel. These laws and regulations principally concerned matters such as pensions, paid annual vacation, paid sick days, length of the workday and workweek, minimum wages, overtime pay, insurance for work-related accidents, severance pay and other conditions of employment. Novomic’s employees were not represented by a labor union. Novomic considered its relationship with its employees to be good. At the time of the Novomic Divestment, Novomic had not experienced any work stoppages.

| 6 |

The Company has newly appointed directors, Chief Executive Officer and Chief Financial Officer.

Website

The Company’s website address is http://www.techcareltd.com/. It is expected that this will be updated in the near future to www.citrine-global.com.

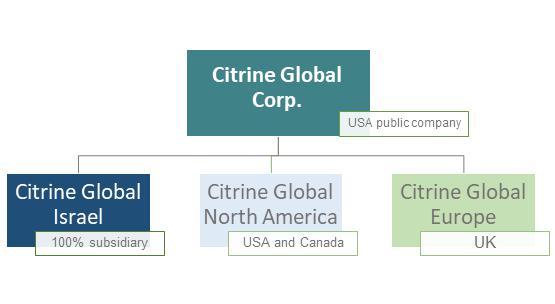

Description of the New Business – Citrine Global, Corp.

Following the recent change of control over the Company, we started a new business. Our vision is to be a powerhouse for high-growth technology companies via our business and financial expertise. To better align our name with the new business, we decided to change the name of the Company to Citrine Global, Corp. We filed a preliminary Schedule 14(C) in connection with the name change and expect the name change to take effect on or about May 28, 2020. On or about the same time, we expect to also start trading under a new ticker symbol. We will file a current report on Form 8-K once the new name and new ticker symbol become effective.

We are focused on creating value and implementing expansion strategies for growth-stage technology companies.

We aim to support local and global expansion of our client companies. We plan to bolster high-growth technology companies via an array of services, with the ability to customize them to each company’s needs - from assistance with strategic business planning to solving real estate-related and finance issues.

We offer multi-strategy solutions combining strategic marketing, business development, real estate and asset management services and financing solutions. Such wide spectrum of services is targeted at helping create an integrated strategy that supports our client companies in achieving their local and global expansion ambitions.

We seek to work proactively and collaboratively with our clients in order to allow them to scale quickly and achieve their milestones.

We believe the health, wellness and food tech fields are demonstrating high growth potential and are therefore primarily focused on these sectors. We plan on empowering innovative companies to become global leaders and improve the health and quality of life of as many people as possible worldwide.

| 7 |

Strategy

Multi-Strategy Solutions:

We offer a mix of business development services, asset and real estate support and financing solutions to help our client companies achieve their growth potential.

Potential client companies we review will receive financing after successful completion of due diligence and evaluation of legal, IP, financial, technological, business, equity/collateral secured loans, shares, sales, assets and real estate aspects in order to minimize risk.

The Company seeks to work proactively and collaboratively to achieve the best possible results. Through our offices and partners around the world, we believe we have the platform to achieve our goals. Our global network of partners and advisers has vast experience in working with start-ups and growth-stage companies helping them create strategic growth plans and present unique, strategic partnership options using a global professional network.

The Company’s partners and managers are all experienced investors and top-level managers that held high level positions in leading companies. They place at the Company’s disposal their network, experience and expertise and offer deep industry know-how in emerging technology markets, to achieve the growth goals and global success our client companies strive for.

The Company’s services range from assistance with strategic business planning to operational execution and financing, customized for the needs of each client company.

Business Development and Consulting:

Business development, creating synergistic partnerships, assisting managements build a strategy and set milestones, assist in finding M&A targets and in paving the way for a public offering.

We assist our client companies with:

● The Business – assisting the company management in building strategic analysis, business modelling, sales strategies, brand positioning, process development, and milestones for global success.

● Optimize Product Strategy - we bring marketing and industry experts to perfect product strategies.

● Ramp up Sales Force - having scaled businesses globally, our team assists in further sales ramp-up.

● Expand Globally - assisting the company management in building strategy and milestones for global success.

● Preparation for Investment - support with financial valuations, preliminary negotiations for investment, mergers, IPO and more.

● Local and International Networking - market development with the support of our partners and business network, we help our companies access international markets.

● The Board - provide board advisory support and assist in finding the right team.

● The Team - our extensive network allows us to find the right team and recruit top talent.

● Capital Raising - public and private capital raising.

● Public Capital - as a publicly traded company we help with solutions adapted to public trade.

● Streamline Operations - with a strong operational background, we assist in improving operations.

● Scale Infrastructure - we want our businesses to be references in terms of their infrastructure.

● Asset and Real Estate - provide solutions for companies’ real estate and assets to support their local and global expansion.

Real Estate:

Provide solutions for companies’ real estate-related needs, whether it is an office space, a lab or a greenhouse, we will assist the company in finding the right real estate at the right place and provide ongoing management services to these assets - all with the aim to enable our client companies to focus on the core aspects of their business and create value to their shareholders.

Financing:

Assist client companies in finding potential sources of financing for their businesses, whether by connecting them to third party investors or making an investment ourselves, or both.

| 8 |

Selection Criteria and Process:

Growth stage technology companies in the fields of healthcare and wellness with high growth potential.

Selection Criteria:

● The companies’ technology and IP

● The management team

● Financial model, market strategy and growth potential

● Addressable global market, competition and potential for international partnerships, mergers, and strategic investments

● Capability for providing collateral

● Substantial equity and revenue base

● Public companies – an advantage

The Company intends to initially focus on Israeli companies through its Israeli arm, which is being incorporated these days.

Key Target Markets

We primarily target growth-stage technology companies focused on health and wellness solutions.

Health and Wellness Market – Overview:

The health and wellness industry is growing consistently and rapidly on a global scale, consisting of over 10% of the global GDP. Health and wellbeing tops consumer agendas creating addressable target markets of trillions of dollars.1 The digital health market is projected to reach over $500 billion at a CAGR of nearly 30% by 2025, the biotech market is expected to reach $775 billion by 2024, and the wellness market is estimated at $4,500 billion.2

The healthcare industry, and specifically the biotech sector, seeks to solve many of the world’s medical problems.

The wellness industry is defined as products and solutions that enable people to incorporate wellness activities and lifestyles into their daily life.

The industry is divided into the following main categories:

● therapeutics

● pharmaceuticals

● biologics

● botanicals

Improvements in health technology and scientific breakthrough innovations are changing treatment paradigms towards directions of:

● preventative

● diagnostic

● holistic patient care

Democratized knowledge is driving demand for innovative health and wellness products and services across all demographics and geographies.

1 https://www.who.int/health_financing/documents/health-expenditure-report-2019.pdf?ua=1

https://www2.deloitte.com/global/en/pages/life-sciences-and-healthcare/articles/global-health-care-sector-outlook.html

2 https://www.gminsights.com/industry-analysis/digital-health-market

https://globalwellnessinstitute.org/industry-research/2018-global-wellness-economy-monitor/

https://www.grandviewresearch.com/industry-analysis/corporate-wellness-market

| 9 |

Changing consumer behavior and disruptive technologies are enabling the rapid consumerization and personalization of healthcare.

There is an evolution from prescription drugs, doctor-administered diagnostics and medical treatments to a new marketplace centered around the well-being of people as individuals not patients, enabling and improving ‘quality of life’ in ways which can be seamlessly integrated into their daily routines.

For these reasons we decided to place our focus on personalized health and wellness.

Many of these innovations are being driven by a new generation of venture-backed, more consumer-orientated companies, often underserved by the traditional medical and pharma VC marketplace. There are also pronounced market asymmetries between the sources of some of the most important wellness innovations in parts of Europe and Israel and the large consumer-driven marketplaces for these innovations globally.

Health and Wellness Markets - Fields:

Medical Food:

● Vitamins and minerals

● Nutritional supplements

● Food allergies

● Personalized nutrition and functional foods

● Digestion and gut health

● Weight management

● Cannabis edibles

● Plant based alternatives

● Neutronics and personalized nutrition

Medical Cannabis:

● Cannabis plant genetics

● Pharmacological cannabis effects

● Cannabis cultivation methods

● Cannabis-infused edibles

● Cannabis-based medications

● Cannabis products development

● Cannabis wellness solutions development

● Cannabis personalized medicine solutions

Physical and Mental Wellbeing:

● Cognitive/brain wellbeing

● Physical therapies

● Injury prevention

● Relaxation management and meditation

● Brain health and neurosciences

● Mood and stress detection and management

● Hypertension

● Anxiety and depression

Anti-Aging and Improved Longevity:

● Skin health/repair

● Bone/joint health

● Personalized fitness and physical mobility

● Lifestyle management

● Fatigue abatement

● Sleep quality

● Pain management

● Mental alertness and dementia abatement

| 10 |

Consumer/Digital Healthcare:

● Preventive and personalized fitness tracking

● Continuous health monitoring and biofeedback

● Point of care testing and screening devices

● Personalized big data and e-health analytics

● Unregulated or minimally regulated wearables, implants

● Post hospital/surgery monitoring

Health and Wellness Markets - Trends and Drivers:

● Health and wellness industry drivers/trends turned into investment opportunities.

● Deregulation of healthcare industry: devolution from hospitals-to-clinics-to-self.

● Technical innovation driving change: consumerization, digitization and democratization of wellbeing.

● Increased awareness of food and nutrition: new generation of functional and personalized foods.

● Cognitive health just as important as physical health: alternative remedies and improved awareness.

● Increased lifespan places huge demands on current systems: anti-aging, lifestyle management, quality of life.

● New consumers’ preferences and behavior: non-surgical, nonprescription, self-administered, self-testing.

● New business models and connected ways of making payments: insurance coverage includes more wellbeing.

● New regulations allowing cannabis infused medications, products and edibles.

● Recent COVID-19 pandemic has brought attention and budgets to developing solutions answering market needs for treatment, prevention and every-day life in this new situation.

Geographies

The Company opens opportunities with an insider’s entree into fast-growing industries with access to strategic investment opportunities. All this under a credible institutional quality platform.

The Company provides solutions to companies from Israel, USA, Canada, Europe and around the world through subsidiaries and local teams and professionals in each region.

The Company’s network of business partners permits access to industry pioneers and leaders allowing for more efficient avenues to create, discover, and assess opportunities.

| 11 |

● Israel is truly a ’start-up nation’ and has global leaders in almost any category of technology-driven innovation covered by the Company. 3

● Europe has very active health and wellness innovation clusters in the Netherlands, UK, France, Nordic regions and Germany in particular.

● North America: - the USA is the market leader in health and wellness innovations and leads the world in M&A activity in this area for mature companies with proven revenues.

In December 2019, a strain of novel coronavirus (COVID-19) causing respiratory illness emerged in the city of Wuhan in the Hubei province of China, and in January 2020, the World Health Organization declared the COVID-19 outbreak a public health emergency. The COVID-19 has spread to many countries and is impacting the markets globally. Many countries, states and municipalities have enacted quarantining regulations which severely limit the ability of people to move and travel, and require non-essential businesses and organizations to close their physical offices. The situation created by COVID-19 worldwide has made it difficult and even impossible to meet with different investors, parties and partners. The company managed to adapt to the situation and built an alternative plan in a short time. Since it was difficult and even impossible to travel specifically to New York and Europe, and since the company directors and executives are based in Israel, Citrine Global took the decision to focus on Israel as first step, via its fully-owned subsidiary Citrine Global Israel Ltd.

Citrine Global Israel Ltd

Citrine Global Israel targets Israeli startups and technology companies, and in particular public companies, in the fields of healthcare, wellness, foodtech and medical cannabis.

About Israel - the “Startup Nation” 4:

● Israel has earned the nickname “Startup Nation” for a very good reason: with a population of around 8.5 million, it has the largest number of startups per capita in the world, around one startup per 1,400 people. This phenomenon has caught the eyes of companies with global reach and global aspirations.

● The hi-tech ecosystem in Israel is currently focusing its attention on research and development in the areas of healthcare and biotech, including solutions for COVID-19 and the medical cannabis plant for medical purposes.

● Israel is known for its academic research yielding world renown innovations and Nobel prize winners.

● In addition, the government recognizes the role of the high-tech industry as a main economic catalyst and supports innovations via funding and other models.

● Israel, as small as it may be, has attracted the interest of the world’s major technology companies, which have set up R&D centres in Israel.

Citrine Global Israel Ltd – Strategy:

Citrine Global Israel offers a unique, independent strategy that covers the whole spectrum of services and financing options to ensure the success of its chosen client companies, combining working capital financing, business escort, technological consulting services, real estate and infrastructure services for companies and a global network of experts and business contacts in the relevant fields.

Citrine Global Israel Ltd – Professional Ecosystem:

Citrine Global Israel has a team of serial entrepreneurs and leading business people and a network of top scientists, researchers and industry leaders, targeting to create an eco-system to promote its client companies towards success.

Citrine Global Israel leverages the knowledge and experience of Citrine S A L High Tech and Citrine Biotech investment funds that have been operating for years in the Israeli start up market and have long term experience in investing in and promoting many startup companies.

3 https://apex.aero/2019/05/22/startup-nation-israel-become-silicon-valley

4 ibid.

| 12 |

Citrine Global Israel also leverages the knowledge and experience of WealthStone Group, which specializes in real estate and hedge funds, and Neto Group, which specializes in insurance and financial planning consultancy.

Citrine Global Israel Ltd - Target Market: Medical Foods:

The medical foods market covers fields including: vitamins and minerals; nutritional supplements; food allergies; personalized nutrition and functional foods; digestion and gut health; weight management; cannabis edibles; plant based alternatives; neutronics and personalized nutrition.

The global medical foods market is expected to be worth $30.4 billion by 2027, growing from $18.4 billion in 2019 at a CAGR of 6.3%. 5

Medical food market drivers include:

● Rise in geriatric population

● Growing incidences of chronic diseases

● Increasing awareness regarding clinical nutrition amongst patients and healthcare professionals

In the past, meal replacements were mainly consumed by the elderly or the ill, frequently suffering from nutritional deficiencies. This has changed in recent years, with the marketing of meal replacements increasingly targeting healthy adults.

In addition, we see the emergence of cannabis-enhanced health edibles and drinks, that is expected to continuously grow by more than 250% by 2021. 6

Citrine Global Israel Target Market: Regulated Medical Cannabis:

The medical cannabis market covers fields including: cannabis plant genetics; pharmacological cannabis effects; cannabis cultivation methods; cannabis-infused edibles; cannabis-based medications; cannabis products development; cannabis wellness solutions development; cannabis personalized medicine solutions.

Medical cannabis solutions have been approved for medical use in many countries and have been shown to benefit more than 40 serious medical conditions, including:

● Cancer

● Multiple sclerosis

● Parkinsons

● Epilepsy

● Chronic pain

● Post trauma

● Chronic digestive problems, Crohn’s Disease

● Anxiety and sleep disorders

● Concentration and memory problems

● Tourette Syndrome

Medical cannabis in Israel:

● The State of Israel is currently focusing its attention on research and development on the cannabis plant for medical purposes.

● Research into the cannabis plant began in Israel in the 1960s, when Prof. Rafael Meshulam first discovered the main components of the cannabis plant, a discovery that was a world breakthrough in the study of the plant at the time.

● Research into the cannabis plant in Israel has continued ever since, in academic and research institutions. In recent years, many studies have been conducted in the field of medical cannabis in Israel. Israel is considered a world center in the field of cannabis research and treatment.

5 https://www.grandviewresearch.com/industry-analysis/medical-foods-market

6 https://www.grandviewresearch.com/industry-analysis/medical-foods-market

https://www.grandviewresearch.com/press-release/global-medical-foods-mark

| 13 |

● The cannabis plant is still not permitted for research in the USA, is still restricted under US federal law, and is only recently increasingly studied in European countries.

● As a result, Israel has an advantage in the field, relative to the rest of the world, and in academic knowledge on the medical potential of the cannabis plant in treating diseases such as cancer, epilepsy, and childhood autism.

● The world’s major drug companies have already begun to express an interest in Israeli research, as well as the big challenge involved in registering patents and intellectual property for drugs using the cannabis plant, which is a complex plant with hundreds of active ingredients.

● Around 100 cannabis–related startups are currently operating in Israel.

Medical Cannabis Global Market Size:

● In the world, there are over 40 countries that allow legal use of medical cannabis and the medical cannabis industry is also expanding to the wellness and medical foods sectors with cannabis incorporated into a variety of edibles, pills, spray products, transdermal patches, supplements, salves, ointments and lotions.

● Legal medical cannabis products sales grew 45.7% to $14.9 billion in 2019. This worldwide growth estimate reflects the highest annual growth rate to date. As a result of expected growth ArcView Group has updated their 2024 forecast to $42.7 billion in worldwide legal cannabis sales. 7

● In addition, we see the emergence of the cannabis-enhanced health edibles and drinks market, that is expected to continuously grow by more than 250% by 2021. 8

Asset and real estate services for the health and medical cannabis industry:

● The healthcare and medical cannabis industry creates attractive opportunities to invest in the industrial real estate sector with a focus on regulated medical-use cannabis facilities.

● Healthcare and medical cannabis companies specifically need infrastructure and assets that are licensed and guarded according to various regulations, involve long-term rentals, and more.

● Citrine has built a model adapted to these companies’ needs, covering innovation centers, laboratories, pharmacies, and clinics.

The Company at this time intends to carry out its cannabis-related activity through its Israeli subsidiary only, and not the US parent company, and to be involved, and engage with client companies that are involved, in cannabis-related activities only in countries where the activity has been authorised under all appliable laws. The Company does not at this time intend to be involved, either directly or indirectly, in cannabis-related activity in the United States, in light of the federal-level restrictions in place at this time.

Citrine Global, Corp.’s primary shareholders

7 https://www.businesswire.com/news/home/20200130005274/en/Global-Cannabis-Market-Hit-42.7-Billion-2024

8 https://www.grandviewresearch.com/industry-analysis/medical-foods-market

https://www.grandviewresearch.com/press-release/global-medical-foods-mark

| 14 |

WealthStone Group

WealthStone Group specializes in alternative investments and operates in various fields with extensive financial knowledge and experience. WealthStone Group has real estate funds, hedge funds and technology investments funds and manages more than half a billion US dollars in investments in Israel.

Wealthstone introduces private investors to a world of investments which until now was reserved to an exclusive group, to allow investors to benefit from diversified alternative investments, with strong collateral and attractive returns.

Wealthstone has a variety of products with a wide range of investment periods, risk and security levels, so that each investor is matched with the most suitable investment.

The world of alternative investments is multi-faceted, with a wide range of investment opportunities that tend to be quite confusing for those who are unfamiliar with the field.

The management team and the funds’ GP partners specialize in each fund’s area, covering real estate, technologies, hedge funds and financing, and they are supported by top professional consultants in the respective fields, among them, appraisers, engineering companies, legal advisers, and other experts in each sector.

Wealthstone Real Estate:

Wealthstone Real Estate deals with financing and lending for projects in the real estate sector, urban renewal, removal-construction, and projects requiring equity and senior debt financing. It is one of the largest companies in Israel for financing renewal projects through limited partnerships in which it serves as a general partner. It is ranked by DUN’S 100 among the leading 100 companies in Israel’s real estate sector. DUN’S 100 is a professional, objective, and reliable guide based on fixed, defined, and measurable criteria according to various market sectors.

Citrine S A L technology investment funds

Citrine S A L technology investment funds is part of Wealthstone’s private equity activity for investments in the high-tech and biotech sectors.

Citrine S A L technology funds invest in high potential Israeli startup companies that own transformational technologies, leading a unique, independent investment strategy with a professional team and a global network of first-class partners and advisors.

Citrine S A L operates through limited partnerships, including Citrine S A L High Tech Ltd and Citrine S A L Biotech Ltd, offering a wide array of investment opportunities to private investors, for a range of investment periods.

The funds operate in various fields of technology investment including:

● Partnerships for investing in high-tech companies.

● Partnerships for investing in biotech companies.

● Partnerships for investing in companies designed for an IPO.

● Along with the financial investment, Citrine S A L provides assistance in building strategies, finding business partners, giving support in financial processes, mergers and acquisitions.

Citrine S AL funds have already invested in several promising Israeli companies including: Nicast, NanoMedic, WellBe, Biocep, Improdia, Intelicanna, IBOT, Cannbit, Novomic, Dario, BSP Medical, ICB Israel-China Fund and more.

The Citrine S A L - ICB Israel-China Fund partnership targets strategic international and Chinese partners interested in investment and commercial cooperation with technology companies. The collaboration covers investment in medical and biomedical companies in order to bring them to China as part of joint ventures.

| 15 |

Additionally, Citrine has models and investments in partnerships that are designed for institutional investors, foreign investors and designated investment groups.

Neto Financial Planning

Neto Financial Planning was founded over 27 years ago and is one of the largest companies in the Israeli private and business financial planning and insurance industry.

Neto has thousands of loyal customers, which it has been accompanying for many years, providing financial advisory services in respects of products with a market worth of over $3 billion.

Neto Financial Planning (Neto) is Israel’s largest financial planning private company. DUN’S 100 has ranked Neto among the leading 100 companies in Israel’s financial planning sector each year since 2018. Neto is the only Israeli broker included in the DUN’S 100 rankings. Neto provides holistic (comprehensive) financial planning for thousands of clients across Israel, through a network which includes financial planners who are licensed pension advisors and an administrative and professional support team.

Neto’s significant scale and experience enable its clients to benefit from a wide variety of investment opportunities, income tax planning and reduction, handling retirees, wills, medical committees, loans, mortgages, review and analysis of their insurance files, elementary insurance, lower costs and access to current and comprehensive knowledge and technologies, in the management of their entire financial lives.

Neto financial planning encompasses the full range of financial needs of every household in Israel including Neto - Financial Planning, Neto - Financial Protection, Neto - Savings and Investment Portfolios for Retirement Planning and Neto -Alternative Investments.

Neto - Alternative Investments: Neto offers its clients a variety of alternative investments that are not directly sensitive to capital markets swings in Israel and globally. The operations in this area are conducted through Wealthstone group (which is owned 50% by Neto), which serves as Neto’s alternative investments arm.

Revenues

We plan on generating revenues from consulting fees, brokering fees, leasing and management services for real-estates assets we own, taking advantage of favorable market conditions to sell real-estate assets, company value appreciation, interest income, investments and more.

Competition

We compete with other more established consulting firms, investment bankers, brokers, real-estate funds, investment firms, online lending sites and tech incubators.

Our business competes primarily in Israel, Europe and North America. We mainly target clients with whom we have existing relationships, either directly or via our partners.

We believe that the experience and contacts of our shareholders, directors and officers and the fact that we offer a wide range of services under one roof will contribute to our competitiveness.

Regulatory Environment

We may need to obtain various regulatory approvals and licenses for real-estate assets we acquire, which may be used by companies engaged in businesses that require certain approvals and licenses for the premises in which they operate (such as laboratories).

| 16 |

Coronavirus Disease 2019 (COVID-19)

In December 2019, a strain of novel coronavirus (COVID-19) causing respiratory illness emerged in the city of Wuhan in the Hubei province of China, and in January 2020, the World Health Organization declared the COVID-19 outbreak a public health emergency. COVID-19 has spread to many countries and is impacting the markets globally. Many countries, states and municipalities have enacted quarantining regulations which severely limit the ability of people to move and travel, and require non-essential businesses and organizations to close their physical offices. We are actively monitoring the situation and we have and will continue to monitor and take actions to abide with all regulatory requirements. We will continue to closely track developments and may take further actions based on regulatory mandates, or that we determine are in the best interests of our team, partners and shareholders. COVID-19 is contributing to a general slowdown in the global economy and may affect our business, results of operations, financial condition and our future strategic plans. Neither the duration nor the spread of the COVID-19 virus can be predicted. At this time, the extent to which the COVID-19 may impact our financial condition or results of operations is uncertain.

Future deterioration or prolonged difficulty in economic conditions could have a material adverse impact on our business, financial position and liquidity.

Future deterioration or prolonged difficulty in economic conditions, as a result of COVID-19 or otherwise, could have a material adverse impact on our business, financial position and liquidity. For example, it could adversely affect our ability to access the liquidity that is necessary to fund operations on terms that are acceptable to us or at all, and could reduce our ability to finance future projects. Financial or other difficulties at our affiliates and partners could negatively affect availability of credit to us in the future.

The Company’s bylaws provide for indemnification of its directors and officers and the purchase of directors and officers insurance at the Company’s expense. This will limit the potential liability of the Company’s directors and officers at a major cost to the Company and hurt the interests of its stockholders.

The Company’s bylaws include provisions that eliminate the personal liability of the directors and officers of the Company for monetary damages to the fullest extent possible under the laws of the State of Delaware or other applicable law. These provisions eliminate the liability of directors and officers to the Company and its stockholders for monetary damages arising out of any violation of a director or officer of his fiduciary duty of due care. Under Delaware law, however, such provisions do not eliminate the personal liability of a director or officer for (i) breach of the director’s or officer’s duty of loyalty, (ii) acts or omissions not in good faith or involving intentional misconduct or knowing violation of law, (iii) payment of dividends or repurchases of stock other than from lawfully available funds, or (iv) any transaction from which the director or officer derived an improper benefit. These provisions do not affect a director’s and officer’s liabilities under the federal securities laws or the recovery of damages by third parties.

| 17 |

Failure in the Company’s information technology systems, including by cybersecurity attacks or other data security incidents, could significantly disrupt its operations.

The Company’s operations depend, in part, on the continued performance of its information technology systems. Its information technology systems are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptions. Failure of its information technology systems could adversely affect its business, profitability and financial condition. Although the Company has information technology security systems, a successful cybersecurity attack or other data security incident could result in the misappropriation and/or loss of confidential or personal information, create system interruptions, or deploy malicious software that attacks the Company’s systems. It is possible that a cybersecurity attack might not be noticed for some period of time. The occurrence of a cybersecurity attack or incident could result in business interruptions from the disruption of the Company’s information technology systems, or negative publicity resulting in reputational damage with its shareholders and other stakeholders and/or increased costs to prevent, respond to or mitigate cybersecurity events. In addition, the unauthorized dissemination of sensitive personal information or proprietary or confidential information could expose the Company or other third-parties to regulatory fines or penalties, litigation and potential liability, or otherwise harm its business.

A certain group of the Company’s stockholders may exert significant influence over its affairs, including the outcome of matters requiring stockholder approval.

As of the date of this Annual Report, a certain group of stockholders, including Ora Meir Soffer (directly and through Beezz Home Technologies Ltd and Citrine S A L Investment & Holdings Ltd) and Yaron Pitaru (directly and through WealthStone Private Equity Ltd and Citrine S A L Investment & Holdings Ltd) and others, collectively own a majority of the issued and outstanding shares of the Company. As a result, such individuals will have the ability, acting together, to control the election of the Company’s directors and the outcome of corporate actions requiring stockholder approval, such as: (i) a merger or a sale of the Company, (ii) a sale of all or substantially all of its assets, and (iii) amendments to its certificate of incorporation and bylaws. This concentration of voting power and control could have a significant effect in delaying, deferring or preventing an action that might otherwise be beneficial to the Company’s other stockholders and be disadvantageous to the Company’s stockholders with interests different from those individuals. Certain of these individuals also have significant control over the Company’s business, policies and affairs as officers or directors of the Company. Therefore, you should not invest in reliance on your ability to have any control over the Company.

Shares eligible for future sale may adversely affect the market.

From time to time, certain of the Company’s stockholders may be eligible to sell all or some of their shares of common stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144 promulgated under the Securities Act, subject to certain limitations. In general, pursuant to Rule 144, non-affiliate stockholders may sell freely after six months subject only to the current public information requirement. Affiliates may sell after six months subject to the Rule 144 volume, manner of sale (for equity securities), and current public information and notice requirements. Any substantial sales of the Company’s common stock pursuant to Rule 144 may have a material adverse effect on the market price of its common stock.

Delaware law contains provisions that could discourage, delay or prevent a change in control of the Company, prevent attempts to replace or remove current management and reduce the market price of its common stock.

Provisions in the Company’s certificate of incorporation and bylaws may discourage, delay or prevent a merger or acquisition involving the Company that its stockholders may consider favorable. For example, the Company’s certificate of incorporation authorizes its board of directors to issue up to fifty million shares of “blank check” preferred stock. As a result, without further stockholder approval, the board of directors has the authority to attach special rights, including voting and dividend rights, to this preferred stock. With these rights, preferred stockholders could make it more difficult for a third party to acquire the Company. The Company is also subject to the anti-takeover provisions of the Delaware General Corporation Law (“DGCL”). Under these provisions, if anyone becomes an “interested stockholder,” the Company may not enter into a “business combination” with that person for three years without special approval, which could discourage a third party from making a takeover offer and could delay or prevent a change in control of the Company. An “interested stockholder” is, generally, a stockholder who owns 15% or more of the Company’s outstanding voting stock or an affiliate of the Company who has owned 15% or more of the Company’s outstanding voting stock during the past three years, subject to certain exceptions as described in the DGCL.

| 18 |

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

Novomic leases from an unaffiliated third party at a monthly rental of approximately $1,600, office space located at 23 Hamelacha Street, Park Afek, Rosh Ha’ain, Israel. The offices consist of approximately 1,300 square feet. Novomic entered a new lease for a period of one year ending on November 30, 2020, for an office space of approximately 500 square feet and monthly rental of approximately $700, with the option to terminate with 90 days’ prior notice. Since the change of control of the Company, its headquarters have been at 3 HaMelacha Street, Tel Aviv, 6721503, Israel. The address of the Company’s registered office in the State of Delaware is c/o Business Filings Incorporated, 108 West 13th St., City of Wilmington, County of Newcastle, Delaware 19801.

The Company knows of no active or pending legal proceedings against the Company, nor of any proceedings that a governmental authority is contemplating against the Company.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 19 |

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Company’s common stock is traded in the United States on the OTCQB market under the ticker symbol “TECR.” Any over-the-counter market quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

Holders of our Common Stock

As of May 7, 2020, the Company had 107 registered stockholders holding 494,721,815 shares of common stock.

Dividends

Since the Company’s inception, it has not declared nor paid any cash dividends on its capital stock and the Company does not anticipate paying any cash dividends in the foreseeable future. Its current policy is to retain any earnings in order to finance its operations. Its Board of directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions it deems relevant and in accordance with applicable corporate law.

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides certain aggregate information with respect to the Company’s shares of common stock that as of December 31, 2019 were issuable under its equity compensation plans in effect as of December 31, 2019. During the first quarter of 2020, in connection with the Techcare Transaction, all options to purchase shares of the Company were waived and cancelled except for options to purchase 311,544 shares of common stock.

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (1) | Weighted-average exercise price of outstanding options, warrants and rights (2) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in first column) (3) | |||||||||

| Equity compensation plans approved by security holders | ___ | ___ | ___ | |||||||||

| Equity compensation plans not approved by security holders | 2,363,712 | $ | 0.0001 | |||||||||

| Total | 2,363,712 | $ | 0.0001 | 3,636,288 | ||||||||

| (1) | Represents shares of common stock issuable under our 2017 Employee Incentive Plan and upon exercise of outstanding options to purchase 2,363,712 shares of common stock. |

| (2) | The weighted average remaining term for the expiration of remaining stock options is 2 years. |

| (3) | Represents shares of common stock available for future issuance under equity compensation plans. “Equity Compensation Plan” under Item 11 hereof contains a description of the material features of the 2017 Employee Incentive Plan and the 2018 Stock Incentive Plan. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

None.

| 20 |

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Liquidity and Capital Resources

The Company’s balance sheet as of December 31, 2019, reflects total assets of approximately $257 thousand consisting mainly of cash and cash equivalents in the amount of approximately $18 thousand, inventory in the amount of approximately $35 thousand, other receivables in the amount of approximately $19 thousand and property and equipment net, in the amount of approximately $156 thousand. As of December 31, 2018, the balance sheet reflects total assets of approximately $1,158 thousand consisting mainly of cash and cash equivalents in the amount of approximately $475 thousand, inventory in the amount of approximately $249 thousand, other receivables in the amount of approximately $177 thousand and property and equipment net, in the amount of approximately $161 thousand. The decrease is related mainly to the decrease in the inventory balance by approximately $214 thousand and the decrease in the cash and cash equivalents balance by approximately $457 thousand.

As of December 31, 2019, the Company had total current liabilities of approximately $360 thousand consisting of accounts payable and accrued expenses in the amount of approximately $224 thousand, and notes payable in the amount of approximately $123 thousand. As of December 31, 2018, the Company had total current liabilities of approximately $385 thousand consisting of approximately $231 thousand in accounts payable and accrued expenses and notes payable in the amount of approximately $80 thousand.

As of December 31, 2019, the Company had negative working capital in the amount of approximately $278 thousand, compared to positive working capital in the amount of approximately $573 thousand at December 31, 2018.

The Company’s total liabilities as of December 31, 2019 and 2018 were approximately $368 thousand and $417 thousand respectively.

During the twelve months ended December 31, 2019, the Company used approximately $1,226 thousand in its operating activities. This resulted in an overall net loss of approximately $1,874 thousand.

During the twelve months ended December 31, 2018, the Company used approximately $2,386 thousand in its operating activities. This resulted in an overall net loss of approximately $2,157 thousand.

During the year ended December 31, 2019, the Company’s investing activities required approximately $11 thousand due to the purchase of property, plant and equipment, approximately $30 thousand for a severance pay fund and approximately $8 thousand in long-term deposit. This compared to approximately $98 thousand due to the purchase of property and approximately $15 thousand for a severance fund during the year ended December 31, 2018.

During the twelve months ended December 31, 2019, the Company’s financing activities provided it with approximately $757 thousand through the issuance of common stock, as compared to approximately $2,372 thousand in the prior year provided through the issuance of common stock.

| 21 |

Results of Operations

Year ended December 31, 2019 as compared to the year ended December 31, 2018

During the twelve months ended December 31, 2019, the Company generated $149 thousand in revenues, compared to $251 thousand in 2018.

The Company’s research and development expenses decreased to $115 thousand comprised of ongoing research and development expenses during the twelve months ended December 31, 2019, compared to approximately $289 thousand during the prior year.

The Company’s marketing, general and administrative expenses during the year ended December 31, 2019, were $1,536 thousand compared to $2,004 thousand during the prior year. The decrease was mainly due to decrease in payroll and consulting.

During the twelve months ended December 31, 2019, the Company incurred financial expenses of $38 thousand, as compared to financial expenses of $30 thousand during the prior year. The increase in financial expenses was mainly due to exchange rates.

As a result of the above, the Company incurred a net loss of approximately $1,874 thousand during the twelve months ended December 31, 2019 as compared to a net loss of approximately $2,157 thousand in 2018.

Year ended December 31, 2018 as compared to the year ended December 31, 2017

During the twelve months ended December 31, 2018, the Company generated $251 thousand in revenues, compared to no revenues in 2017. Revenues were recorded for the first time from the sales of its product, Novokid®.

The Company’s research and development expenses increased to $289 thousand comprised of ongoing research and development expenses during the twelve months ended December 31, 2018, compared to approximately $282 thousand during the prior year, an increase of approximately $6 thousand or 2%.

The Company’s marketing, general and administrative expenses during the year ended December 31, 2018, were $2,003 thousand compared to $2,463 thousand during the prior year. The decrease was mainly due to decrease in payroll and consulting.

During the twelve months ended December 31, 2018, the Company incurred financial expenses of $30 thousand, as compared to financial income of $19 thousand during the prior year. The increase in financial expenses was mainly due to exchange rates.

As a result of the above, the Company incurred a net loss of approximately $2,157 thousand during the twelve months ended December 31, 2018 as compared to a net loss of approximately $2,858 thousand in 2017.

Off-Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

Tabular disclosure of contractual obligations

Not applicable.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

| 22 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

TECHCARE CORP.

CONSOLIDATED FINANCIAL STATEMENTS

| Report of Independent Registered Public Accounting Firm | 24 |

| Consolidated Financial Statements for the Years Ended December 31, 2019 and 2018 | |

| Consolidated Balance Sheets | 25 |

| Consolidated Statements of Operations and Comprehensive Loss | 26 |

| Consolidated Statements of redeemable convertible preferred stock and Stockholders’ Equity (capital deficiency) | 27 |

| Consolidated Statements of Cash Flows | 28 |

| Notes to Consolidated Financial Statements | 29-45 |

| 23 |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders of TechCare Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of TechCare Corp. and its subsidiary (the “Company”), as of December 31, 2019 and 2018, and the related consolidated statements of operations and comprehensive loss, of redeemable convertible preferred stock and stockholders’ equity (capital deficiency) and of cash flows for the years then ended, including the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these consolidated financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Subsequent Event

As discussed in Note 1 to the consolidated financial statements, the Company has entered into an agreement to sell 90% of its subsidiary’s shares to one of the Company’s existing shareholders.

| /s/ Kesselman & Kesselman | |

| Certified Public Accountants (Isr.) | |

| A member firm of PricewaterhouseCoopers International Limited | |

| Tel Aviv, Israel | |

| May 11, 2020 |

We have served as the Company’s auditor since 2020.

| 24 |

Consolidated Balance Sheets

As of December 31, 2019, and 2018

| December 31, 2019 | December 31, 2018 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 17,636 | $ | 474,715 | ||||

| Inventory | 34,513 | 248,912 | ||||||

| Accounts receivable | 9,141 | 13,462 | ||||||

| Inventory subject to refund | 2,159 | 44,529 | ||||||

| Other receivables | 18,522 | 176,583 | ||||||

| Total current assets | 81,971 | 958,201 | ||||||

| Non-current assets: | ||||||||

| Severance pay fund | - | 27,258 | ||||||

| Right of use asset | 14,502 | - | ||||||

| Long-term deposits | 4,699 | 11,366 | ||||||

| Property and equipment, net | 155,655 | 161,401 | ||||||

| Total non-current assets | 174,856 | 200,025 | ||||||

| Total assets | $ | 256,827 | $ | 1,158,226 | ||||

| Liabilities and Stockholders’ Equity (capital deficiency) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 223,841 | $ | 231,311 | ||||

| Notes payable | 123,494 | 80,026 | ||||||

| Refund liability | 4,998 | 73,464 | ||||||

| Current maturities of long-term lease liability | 7,295 | - | ||||||

| Total current liabilities | 359,628 | 384,801 | ||||||

| Non-current liability: | ||||||||

| Lease liability | 7,962 | - | ||||||

| Liability for severance pay | - | 31,971 | ||||||

| Total liabilities | 367,590 | 416,772 | ||||||

| Redeemable convertible preferred stock: | ||||||||

| Redeemable convertible Series A preferred stock, par value $0.0001 per share 12,413,794 shares authorized; 10,344,828 and 0 issued and outstanding at December 31, 2019 and December 31, 2018, respectively | 300,000 | - | ||||||

| Stockholders’ Equity (capital deficiency): | ||||||||

| Common stock, par value $0.0001 per share, 500,000,000 shares authorized; 35,449,398 and 33,212,036 shares issued and outstanding at December 31, 2019 and 2018, respectively | 3,545 | 3,322 | ||||||

| Additional paid-in capital | 10,042,496 | 9,329,419 | ||||||

| Stock to be issued | 30,000 | 30,000 | ||||||

| Preferred stock (excluding redeemable Series A preferred stock), par value $0.0001 per share, 37,586,206 shares authorized at December 31, 2019 and 10,000,000 at December 31, 2018; none issued and outstanding at December 31, 2019 and 2018 | - | - | ||||||

| Accumulated deficit | (10,602,292 | ) | (8,728,157 | ) | ||||

| Accumulated other comprehensive income | 115,488 | 106,870 | ||||||

| Total stockholders’ equity (capital deficiency) | (410,763 | ) | 741,454 | |||||

| Total liabilities and stockholders’ equity (capital deficiency) | $ | 256,827 | $ | 1,158,226 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| 25 |

Consolidated Statements of Operations and Comprehensive Loss

For the Years ended December 31, 2019 and 2018

| For the years ended | ||||||||

| December 31, 2019 | December 31, 2018 | |||||||

| Revenues | 149,085 | 251,417 | ||||||

| Cost of revenues | 158,514 | 218,639 | ||||||

| Provision for slow moving inventory | 176,183 | - | ||||||

| Gross profit (loss) | (185,612 | ) | 32,778 | |||||

| Research and development expenses | 114,560 | 288,813 | ||||||

| Marketing, general and administrative expenses | 1,535,576 | 2,003,709 | ||||||

| Change in fair value of option liability | - | (132,470 | ) | |||||

| Operating loss | 1,835,748 | 2,127,274 | ||||||

| Financial expenses ,net | 38,387 | 29,800 | ||||||

| Loss before income taxes | 1,874,135 | 2,157,074 | ||||||

| Net loss | 1,874,135 | 2,157,074 | ||||||

| Accretion of redeemable convertible preferred shares for Beneficial Conversion Feature | 300,000 | - | ||||||

| Net loss attributable to common stockholders | 2,174,135 | 2,157,074 | ||||||

| Net loss per common stock: | ||||||||

| Basic | $ | (0.06 | ) | $ | (0.07 | ) | ||

| Diluted | $ | (0.06 | ) | $ | (0.07 | ) | ||

| Weighted average number of common stock outstanding: | ||||||||

| Basic | 37,473,278 | 32,476,194 | ||||||

| Diluted | 37,473,278 | 32,607,583 | ||||||

| Comprehensive loss: | ||||||||

| Net loss | 1,874,135 | 2,157,074 | ||||||

| Other comprehensive income attributable to foreign currency translation | (8,618 | ) | (2,093 | ) | ||||

| Comprehensive loss | 1,865,517 | 2,154,981 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

| 26 |

Consolidated Statements of redeemable convertible preferred stock and Stockholders’ Equity (capital deficiency)

Years ended December 31, 2019 and 2018

Redeemable | Accumulated | |||||||||||||||||||||||||||||||||||