Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Service Properties Trust | ex991svcq12020er.htm |

| 8-K - 8-K - Service Properties Trust | svcq120208k.htm |

Service Properties Trust Exhibit 99.2 SVC Nasdaq Listed First Quarter 2020 Supplemental Operating and Financial Data Courtyard by Marriott Phoenix, S. Chandler, AZ Operator: Marriott International, Inc. Guest Rooms: 156 All amounts in this report are unaudited.

Table of Contents (1) CORPORATE INFORMATION Company Profile 4 Investor Information 5 Research Coverage 6 FINANCIALS Key Financial Data 8 Condensed Consolidated Balance Sheets 9 Condensed Consolidated Statements of Income 10 Notes to Condensed Consolidated Statements of Income 11 Debt Summary 12 Debt Maturity Schedule 13 Leverage Ratios, Coverage Ratios and Public Debt Covenants 14 Capital Expenditure and Restricted Cash Activity 15 Property Acquisition and Disposition Information Since January 1, 2020 16 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre 17 Calculation of FFO and Normalized FFO 18 PORTFOLIO INFORMATION Portfolio Summary 20 Consolidated Portfolio by Brand Affiliation 21 Consolidated Portfolio Diversification by Industry 22 Hotel Portfolio by Brand 23 Hotel Operating Agreement Information 24, 25, 26 Hotel Operating Statistics by Operating Agreement 27, 28 Hotel Coverage by Operating Agreement 29 Net Lease Portfolio by Brand 30 Net Lease Portfolio by Industry 31 Net Lease Portfolio by Tenant (Top 10) 32 Net Lease Portfolio Expiration Schedule 33 Net Lease Occupancy and Leasing Summary 34 Non-GAAP Financial Measures and Certain Definitions 35, 36 WARNING CONCERNING FORWARD-LOOKING STATEMENTS 37 (1) Please refer to non-GAAP Financial Measures and Certain Definitions for terms used throughout the document. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 2

Corporate Information Towne Place Suites Petro Shopping Centers Renton,WA . 2154 Beltline Boulevard, I-77 Exit 5 Operator: Marriott International, Inc. Columbia, SC Guest Rooms: 137 Operator: TravelCenters of America SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 3

Company Profile The Company: Corporate Headquarters: Service Properties Trust, or SVC, we, our or us, is a real estate investment trust, or REIT, which owns a diverse portfolio of Two Newton Place hotels and net lease service and necessity-based retail properties across the United States and in Puerto Rico and Canada 255 Washington Street, Suite 300 with 148 distinct brands across 23 distinct industries. SVC's properties are primarily operated under long term management or lease agreements. SVC is a component of 83 market indices and it comprises more than 1% of the following indices as of Newton, MA 02458-1634 March 31, 2020: Bloomberg REIT Hotels Index (BBREHOTL) and Invesco KBW Premium Yield Equity REIT ETF INAV Index (t) (617) 964-8389 (KBWYIV). Stock Exchange Listing: Management: SVC is managed by The RMR Group LLC, or RMR LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR), or Nasdaq RMR Inc., RMR LLC is an alternative asset management company that was founded in 1986 to manage real estate Trading Symbol: companies and related businesses. RMR LLC primarily provides management services to four publicly traded equity REITs and three real estate related operating businesses. In addition to managing SVC, RMR LLC manages Industrial Logistics Common Shares: SVC Properties Trust, a REIT that owns industrial and logistics properties, Office Properties Income Trust, a REIT that owns properties primarily leased to single tenants and those with high credit quality characteristics such as government entities, Senior Unsecured Debt Ratings: and Diversified Healthcare Trust, a REIT that primarily owns high-quality, private-pay healthcare properties like medical office Standard & Poor's: BBB- and life science properties, senior living communities and wellness centers. RMR LLC also provides management services to Five Star Senior Living Inc., a publicly traded operator of senior living communities, Sonesta Holdco Corporation and its Moody's: Baa3 subsidiaries, or Sonesta, a privately owned operator and franchisor of hotels (including some of the hotels that SVC owns) Key Data (as of March 31, 2020): and cruise boats, and TravelCenters of America Inc., or TA, a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System (including 179 travel centers that SVC owns), and standalone truck service facilities and (dollars in 000s) restaurants. RMR also advises the RMR Real Estate Income Fund, which is in the process of converting from a registered Total properties: 1,142 investment company to a publicly traded mortgage REIT, and Tremont Mortgage Trust, a publicly traded mortgage REIT, both of which will focus on originating and investing in floating rate first mortgage loans, secured by middle market and Hotels 329 transitional commercial real estate, through wholly owned SEC registered investment advisory subsidiaries, as well as Net lease properties 813 manages the RMR Office Property Fund LP, a private, open end core plus fund focused on the acquisition, ownership and Number of hotel rooms/suites 51,358 leasing of a diverse portfolio of multi-tenant office properties throughout the U.S. As of March 31, 2020, RMR LLC had $31.9 billion of real estate assets under management and the combined RMR LLC managed companies had approximately $12 Total net lease square feet 14,511,567 billion of annual revenues, over 2,100 properties and more than 50,000 employees. We believe that being managed by RMR Q1 2020 total revenues $ 483,776 LLC is a competitive advantage for SVC because of RMR LLC’s depth of management and experience in the real estate Q1 2020 net loss $ (33,650) industry. We also believe RMR LLC provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self managed. Q1 2020 Normalized FFO $ 123,084 SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 4

Investor Information Board of Trustees Laurie B. Burns Robert E. Cramer Donna D. Fraiche Independent Trustee Independent Trustee Independent Trustee John L. Harrington William A. Lamkin John G. Murray Lead Independent Trustee Independent Trustee Managing Trustee Adam D. Portnoy Chair of the Board & Managing Trustee Senior Management John G. Murray Brian E. Donley Ethan S. Bornstein President and Chief Executive Officer Chief Financial Officer and Treasurer Senior Vice President Todd W. Hargreaves Vice President Contact Information Investor Relations Inquiries Service Properties Trust Investor and media inquiries should be directed to Two Newton Place Kristin Brown, Director, Investor Relations at 255 Washington Street, Suite 300 (617) 796-8232, or kbrown@rmrgroup.com. Newton, MA 02458-1634 (t) (617) 964-8389 Financial inquiries should be directed to Brian E. Donley, (email) info@svcreit.com Chief Financial Officer and Treasurer, at (617) 964-8389 (website) www.svcreit.com or bdonley@rmrgroup.com. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 5

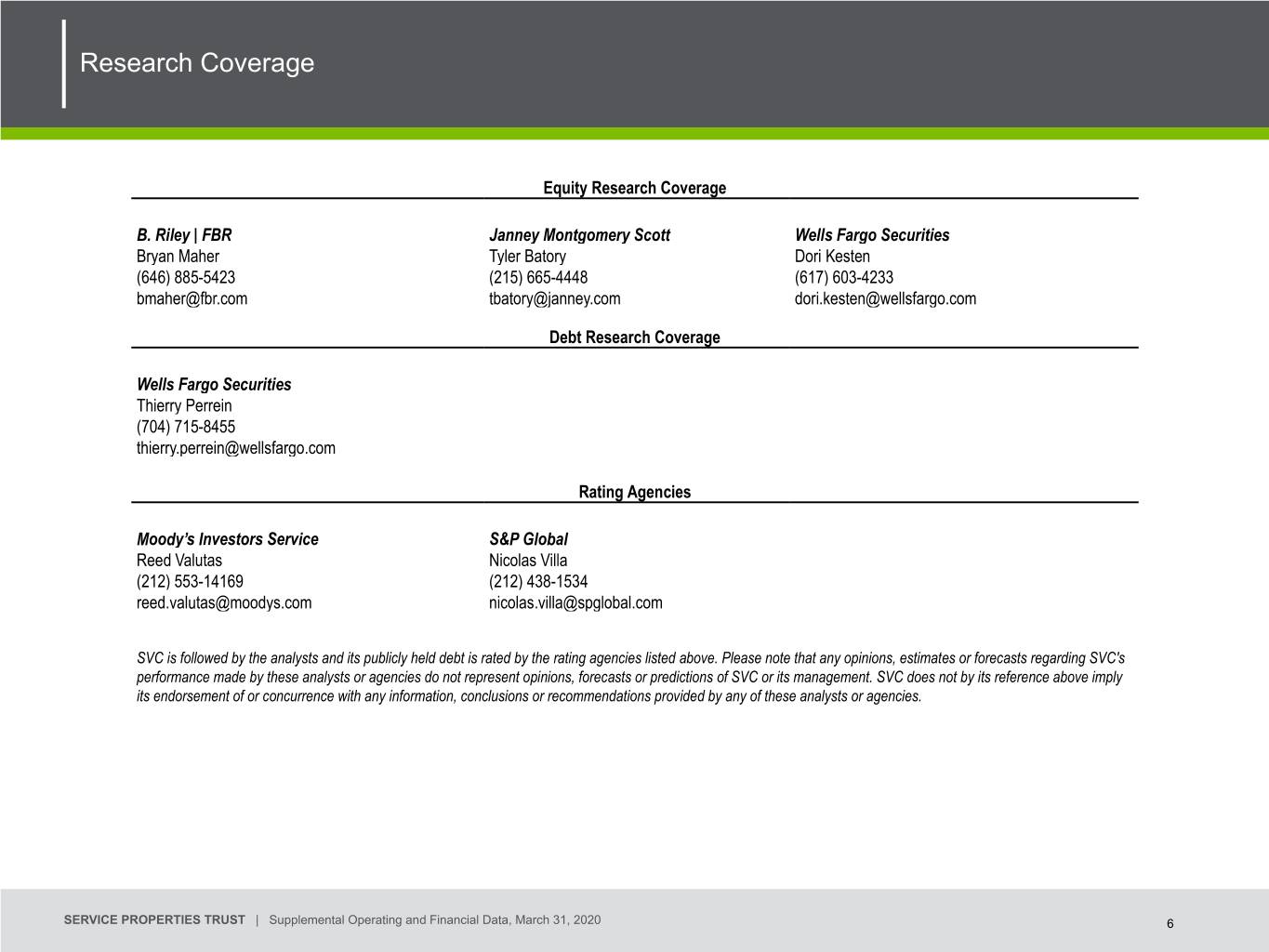

Research Coverage Equity Research Coverage B. Riley | FBR Janney Montgomery Scott Wells Fargo Securities Bryan Maher Tyler Batory Dori Kesten (646) 885-5423 (215) 665-4448 (617) 603-4233 bmaher@fbr.com tbatory@janney.com dori.kesten@wellsfargo.com Debt Research Coverage Wells Fargo Securities Thierry Perrein (704) 715-8455 thierry.perrein@wellsfargo.com Rating Agencies Moody’s Investors Service S&P Global Reed Valutas Nicolas Villa (212) 553-14169 (212) 438-1534 reed.valutas@moodys.com nicolas.villa@spglobal.com SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 6

FINANCIALS Marriott Kauai Resort & Beach Club Kalapaki Beach, HI Operator: Marriott International, Inc. Guest Rooms: 156 SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 7

Key Financial Data (dollars in thousands, except per share data) As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Selected Balance Sheet Data: Total gross assets $ 12,206,842 $ 12,154,728 $ 12,602,187 $ 10,204,219 $ 10,235,599 Total assets $ 8,996,623 $ 9,033,967 $ 9,515,503 $ 7,177,746 $ 7,255,804 Total liabilities $ 6,614,357 $ 6,528,089 $ 6,906,517 $ 4,520,304 $ 4,519,238 Total shareholders' equity $ 2,382,266 $ 2,505,878 $ 2,608,986 $ 2,657,442 $ 2,736,566 Selected Income Statement Data: Total revenues $ 483,776 $ 580,906 $ 599,772 $ 610,562 $ 524,908 Net income (loss) $ (33,650) $ (14,893) $ 40,074 $ 8,782 $ 225,787 Adjusted EBITDAre $ 195,137 $ 227,013 $ 209,545 $ 218,972 $ 195,901 FFO $ 123,084 $ 147,830 $ 147,184 $ 168,766 $ 144,640 Normalized FFO $ 123,084 $ 151,622 $ 155,635 $ 168,766 $ 144,640 Per Common Share Data (basic and diluted): Net income (loss) $ (0.20) $ (0.09) $ 0.24 $ 0.05 $ 1.37 FFO $ 0.75 $ 0.90 $ 0.90 $ 1.03 $ 0.88 Normalized FFO $ 0.75 $ 0.92 $ 0.95 $ 1.03 $ 0.88 Dividend Data: Annualized dividends paid per share during the period (1) $ 2.16 $ 2.16 $ 2.16 $ 2.16 $ 2.12 Annualized dividend yield (at end of period) 40.0% 8.9% 8.4% 8.6% 8.1% Normalized FFO payout ratio 72.0% 58.7% 56.8% 52.4% 60.2% (1) On March 30, 2020, we declared a quarterly dividend of $0.01 per share ($0.04 per year) which we expect to pay on or about May 21, 2020 to shareholders of record on April 21, 2020. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 8

Condensed Consolidated Balance Sheets (dollars in thousands, except per share data) As of March 31, 2020 As of December 31, 2019 ASSETS Real estate properties: Land $ 2,068,645 $ 2,066,602 Buildings, improvements and equipment 9,376,243 9,318,434 Total real estate properties, gross 11,444,888 11,385,036 Accumulated depreciation (3,210,219) (3,120,761) Total real estate properties, net 8,234,669 8,264,275 Acquired real estate leases and other intangibles 364,397 378,218 Assets held for sale 56,688 87,493 Cash and cash equivalents 55,218 27,633 Restricted cash 44,537 53,626 Due from related persons 65,109 68,653 Other assets, net 176,005 154,069 Total assets $ 8,996,623 $ 9,033,967 LIABILITIES AND SHAREHOLDERS' EQUITY Unsecured revolving credit facility $ 457,000 $ 377,000 Unsecured term loan, net 398,038 397,889 Senior unsecured notes, net 5,290,396 5,287,658 Security deposits 47,094 109,403 Accounts payable and other liabilities 402,736 335,696 Due to related persons 17,447 20,443 Dividend payable 1,646 — Total liabilities 6,614,357 6,528,089 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 164,566,397 and 164,563,034 shares issued and outstanding 1,646 1,646 Additional paid in capital 4,548,076 4,547,529 Cumulative net income available for common shareholders 3,457,995 3,491,645 Cumulative common distributions (5,625,451) (5,534,942) Total shareholders' equity 2,382,266 2,505,878 Total liabilities and shareholders' equity $ 8,996,623 $ 9,033,967 SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 9

Condensed Consolidated Statements of Income (dollars in thousands, except per share data) For the Three Months Ended March 31, 2020 2019 Revenues: Hotel operating revenues (1) $ 383,503 $ 454,863 Rental income (2) 100,072 68,673 FF&E reserve income (3) 201 1,372 Total revenues 483,776 524,908 Expenses: Hotel operating expenses (1) 271,148 317,685 Other operating expenses 3,759 1,440 Depreciation and amortization 127,926 99,365 General and administrative (4) 14,024 12,235 Loss on asset impairment (5) 16,740 — Total expenses 433,597 430,725 Gain on sale of real estate (6) (6,911) 159,535 Dividend income — 876 Unrealized gains (losses) on equity securities, net (7) (5,045) 20,977 Interest income 262 637 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $3,288 and $2,570, respectively) (71,075) (49,766) Income (loss) before income taxes and equity in earnings (losses) of an investee (32,590) 226,442 Income tax expense (342) (1,059) Equity in earnings (losses) of an investee (718) 404 Net income (loss) $ (33,650) $ 225,787 Weighted average common shares outstanding (basic) 164,370 164,278 Weighted average common shares outstanding (diluted) 164,370 164,322 Net income (loss) per common share (basic and diluted) $ (0.20) $ 1.37 See Notes to Condensed Consolidated Statements of Income on page 11. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 10

Notes to Condensed Consolidated Statements of Income (dollar amounts in thousands, except share data) (1) As of March 31, 2020, we owned 329 hotels; 328 of these hotels were managed by hotel operating companies and one hotel was leased to a hotel operating company. As of March 31, 2020, we also owned 813 net lease properties. Our condensed consolidated statements of income include hotel operating revenues and expenses of managed hotels and rental income and other operating expenses from our leased hotel and net lease properties. Certain of our managed hotels had net operating results that were, in the aggregate, $118,064 and $42,839 less than the minimum returns due to us for the three months ended March 31, 2020 and 2019, respectively. When managers of these hotels are required to fund the shortfalls under the terms of our management agreements or their guarantees, we reflect such fundings (including security deposit applications) in our condensed consolidated statements of income as a reduction of hotel operating expenses. The reduction to hotel operating expenses was $75,927 and $22,465 for the three months ended March 31, 2020 and 2019, respectively. When we reduce the amounts of the security deposit we hold for any of our operating agreements for payment deficiencies, it does not result in additional cash flows to us of the deficiency amounts, but reduces the refunds due to the respective tenants or managers who have provided us with these deposits upon expiration of the applicable operating agreement. The security deposits are non-interest bearing and are not held in escrow. We had shortfalls at certain of our managed hotel portfolios not funded by the managers of these hotels under the terms of our management agreements of $47,755 and $20,676 for the three months ended March 31, 2020 and 2019, respectively, which represent the unguaranteed portions of our minimum returns from our Sonesta and Wyndham agreements. The net operating results of our managed hotel portfolios did not exceed the minimum returns due to us for either of the three months ended March 31, 2020 or 2019. Certain of our guarantees and our security deposits may be replenished by a share of future cash flows from the applicable hotel operations in excess of the minimum returns due to us, certain fees to the manager, or working capital advances, if any, pursuant to the terms of the applicable agreements. When our guarantees and security deposits are replenished by cash flows from hotel operations, we reflect such replenishments in our condensed consolidated statements of income as an increase to hotel operating expenses. There were no such replenishments for the either of the three months ended March 31, 2020 or 2019. (2) We reduced rental income by $3,543 and $1,132 in the three months ended March 31, 2020 and 2019 respectively, to record scheduled rent changes under certain of our leases, the deferred rent obligations under our leases with TA and the estimated future payments to us under our leases with TA for the cost of removing underground storage tanks on a straight line basis. (3) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. We own all the FF&E reserve escrows for our hotels. We report deposits by our tenants into the escrow accounts under our hotel leases as FF&E reserve income. We do not report the amounts which are escrowed as FF&E reserves for our managed hotels as FF&E reserve income. (4) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in general and administrative expense in our consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we do not include these amounts in the calculation of Normalized FFO or Adjusted EBITDAre until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. No business management incentive fee expense was recorded for the three months ended March 31, 2020 or 2019. (5) We recorded a $16,740 loss on asset impairment during the three months ended March 31, 2020 to reduce the carrying value of two net lease properties to their estimated fair value. (6) We recorded a $6,911 net loss on sale of real estate during the three months ended March 31, 2020 in connection with the sales of six net lease properties and a $159,535 gain on sale of real estate during the three months ended March 31, 2019 in connection with the sales of 20 travel centers. (7) Unrealized gains (losses) on equity securities, net represent the adjustment required to adjust the carrying value of our former investment in RMR Inc. and our investment in TA to their fair value. We sold our RMR Inc. shares in July 2019, SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 11

Debt Summary As of March 31, 2020 (dollars in thousands) Interest Principal Maturity Due at Years to Rate Balance Date Maturity Maturity Unsecured Floating Rate Debt: $1,000,000 unsecured revolving credit facility (1) (2) (5) 1.850% $ 457,000 7/15/22 $ 457,000 2.3 $400,000 unsecured term loan (2) (3) (5) 2.931% 400,000 7/15/23 400,000 3.3 Subtotal / weighted average 2.355% $ 857,000 $ 857,000 2.8 Unsecured Fixed Rate Debt: Senior unsecured notes due 2021 4.250% $ 400,000 2/15/21 $ 400,000 0.9 Senior unsecured notes due 2022 5.000% 500,000 8/15/22 500,000 2.4 Senior unsecured notes due 2023 4.500% 500,000 6/15/23 500,000 3.2 Senior unsecured notes due 2024 4.650% 350,000 3/15/24 350,000 4.0 Senior unsecured notes due 2024 4.350% 825,000 10/1/24 825,000 4.5 Senior unsecured notes due 2025 4.500% 350,000 3/15/25 350,000 5.0 Senior unsecured notes due 2026 5.250% 350,000 2/15/26 350,000 5.9 Senior unsecured notes due 2026 4.750% 450,000 10/1/26 450,000 6.5 Senior unsecured notes due 2027 4.950% 400,000 2/15/27 400,000 6.9 Senior unsecured notes due 2028 3.950% 400,000 1/15/28 400,000 7.8 Senior unsecured notes due 2029 4.950% 425,000 10/1/29 425,000 9.5 Senior unsecured notes due 2030 4.375% 400,000 2/15/30 400,000 9.9 Subtotal / weighted average 4.604% $ 5,350,000 $ 5,350,000 5.4 Total / weighted average (4) 4.293% $ 6,207,000 $ 6,207,000 5.0 (1) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 120 basis points per annum. We also pay a facility fee of 25 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed above is as of March 31, 2020. Subject to the payment of an extension fee and meeting certain other conditions, we may extend the maturity date of our credit facility for two additional six month periods. (2) The maximum borrowing availability under our revolving credit facility and term loan combined may be increased to up to $2,300,000 subject to certain terms and conditions. (3) We are required to pay interest on the amount outstanding under our term loan at a rate of LIBOR plus a premium of 135 basis points per annum, subject to adjustment based on changes to our credit ratings. The interest rate listed above is as of March 31, 2020. Our term loan is prepayable without penalty at any time. (4) The carrying value of our total debt of $6,145,434 as of March 31, 2020 is net of unamortized discounts and premiums and certain issuance costs totaling $61,566. (5) On May 8, 2020, we amended the agreement governing our unsecured revolving credit facility and term loan. Among the changes, the interest rates paid on borrowings under the revolving credit facility and term loan were each increased by 50 basis points per annum and the feature pursuant to which the maximum borrowing availability under the credit agreement may be increased to up to $2,300,000 on a combined basis in certain circumstances may not be utilized during the specified waiver period. In addition, we provided equity pledges on certain of our subsidiaries. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 12

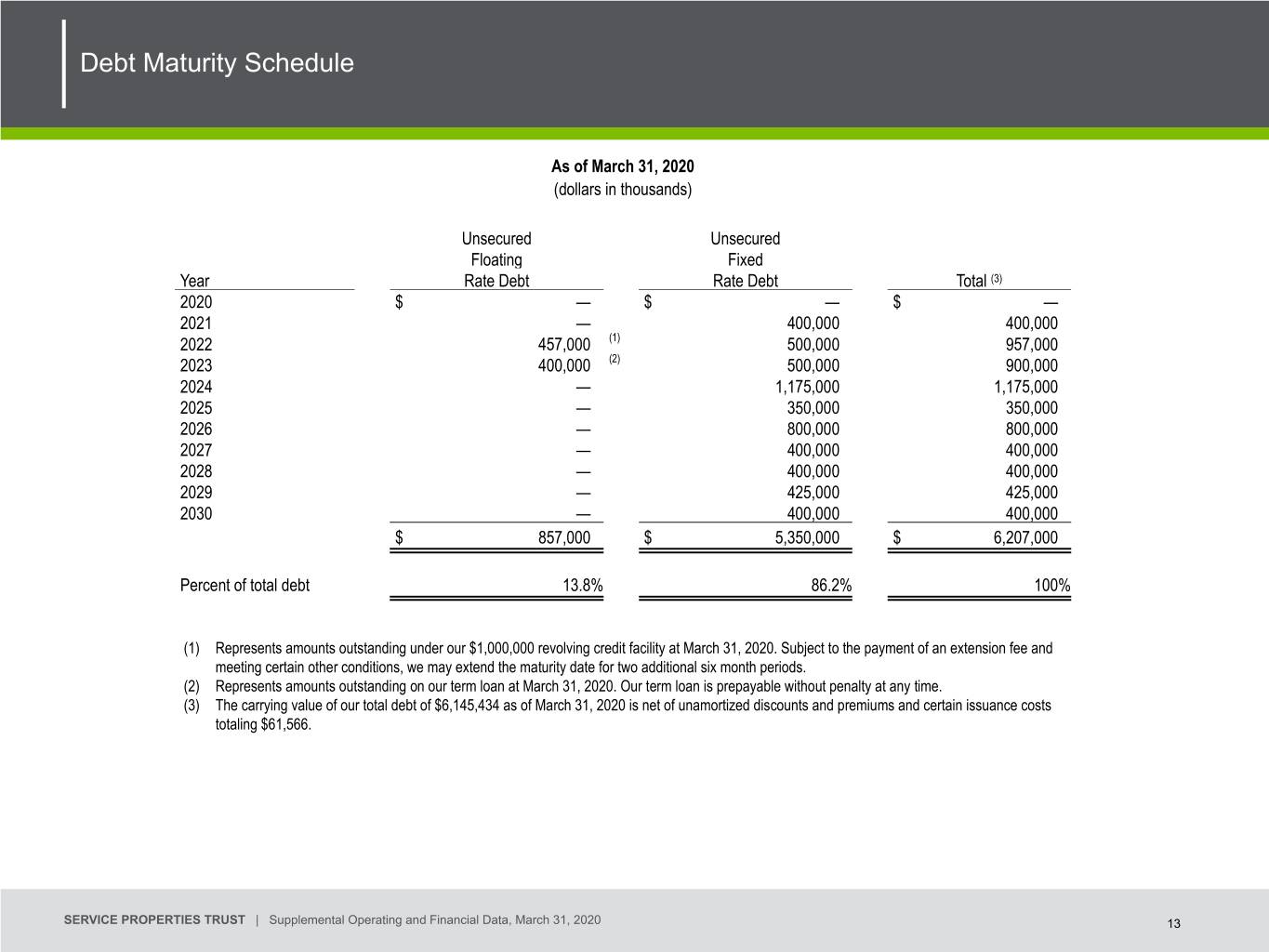

Debt Maturity Schedule As of March 31, 2020 (dollars in thousands) Unsecured Unsecured Floating Fixed Year Rate Debt Rate Debt Total (3) 2020 $ — $ — $ — 2021 — 400,000 400,000 2022 457,000 (1) 500,000 957,000 2023 400,000 (2) 500,000 900,000 2024 — 1,175,000 1,175,000 2025 — 350,000 350,000 2026 — 800,000 800,000 2027 — 400,000 400,000 2028 — 400,000 400,000 2029 — 425,000 425,000 2030 — 400,000 400,000 $ 857,000 $ 5,350,000 $ 6,207,000 Percent of total debt 13.8% 86.2% 100% (1) Represents amounts outstanding under our $1,000,000 revolving credit facility at March 31, 2020. Subject to the payment of an extension fee and meeting certain other conditions, we may extend the maturity date for two additional six month periods. (2) Represents amounts outstanding on our term loan at March 31, 2020. Our term loan is prepayable without penalty at any time. (3) The carrying value of our total debt of $6,145,434 as of March 31, 2020 is net of unamortized discounts and premiums and certain issuance costs totaling $61,566. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 13

Leverage Ratios, Coverage Ratios and Public Debt Covenants As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Leverage Ratios: Net debt / total gross assets 50.4% 50.2% 51.8% 40.4% 40.7% Net debt / gross book value of real estate assets 52.0% 52.0% 56.0% 42.4% 43.0% Secured debt / total assets 0.0% 0.0% 0.0% 0.0% 0.0% Variable rate debt / Net debt 13.9% 12.7% 18.2% 11.9% 13.0% Coverage Ratios: Adjusted EBITDAre / interest expense 2.7x 3.1x 4.0x 4.4x 3.9x Net debt / annualized Adjusted EBITDAre (1) 7.9x 6.7x 6.6x 4.7x 5.3x Public Debt Covenants: Total debt / adjusted total assets - allowable maximum 60.0% 50.0% 49.4% 51.1% 40.4% 40.8% Secured debt / adjusted total assets - allowable maximum 40.0% 0.0% 0.0% 0.0% 0.0% 0.0% Consolidated income available for debt service / debt service - required minimum 1.50x 2.5x 2.95x 3.81x 4.22x 3.77x Total unencumbered assets / unsecured debt - required minimum 150% 202.0% 202.5% 195.8% 247.6% 245.3% (1) We completed the SMTA Transaction on September 20, 2019. For purposes of calculating coverage ratios for the three months ended September 30, 2019, we included our pro forma estimates of the annualized Adjusted EBITDAre we expected to be generated from this portfolio. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 14

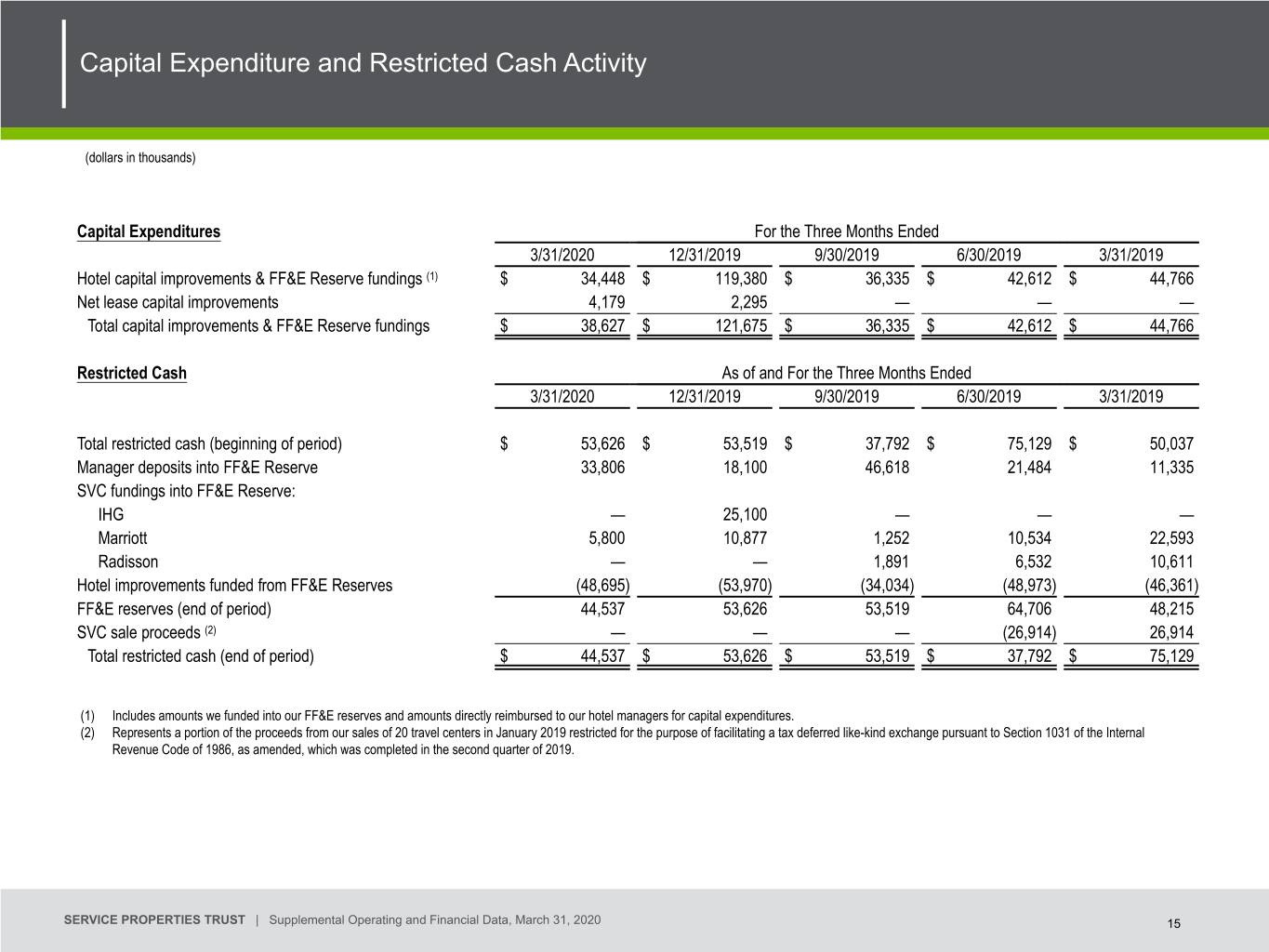

Capital Expenditure and Restricted Cash Activity (dollars in thousands) Capital Expenditures For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Hotel capital improvements & FF&E Reserve fundings (1) $ 34,448 $ 119,380 $ 36,335 $ 42,612 $ 44,766 Net lease capital improvements 4,179 2,295 — — — Total capital improvements & FF&E Reserve fundings $ 38,627 $ 121,675 $ 36,335 $ 42,612 $ 44,766 Restricted Cash As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Total restricted cash (beginning of period) $ 53,626 $ 53,519 $ 37,792 $ 75,129 $ 50,037 Manager deposits into FF&E Reserve 33,806 18,100 46,618 21,484 11,335 SVC fundings into FF&E Reserve: IHG — 25,100 — — — Marriott 5,800 10,877 1,252 10,534 22,593 Radisson — — 1,891 6,532 10,611 Hotel improvements funded from FF&E Reserves (48,695) (53,970) (34,034) (48,973) (46,361) FF&E reserves (end of period) 44,537 53,626 53,519 64,706 48,215 SVC sale proceeds (2) — — — (26,914) 26,914 Total restricted cash (end of period) $ 44,537 $ 53,626 $ 53,519 $ 37,792 $ 75,129 (1) Includes amounts we funded into our FF&E reserves and amounts directly reimbursed to our hotel managers for capital expenditures. (2) Represents a portion of the proceeds from our sales of 20 travel centers in January 2019 restricted for the purpose of facilitating a tax deferred like-kind exchange pursuant to Section 1031 of the Internal Revenue Code of 1986, as amended, which was completed in the second quarter of 2019. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 15

Property Acquisition and Disposition Information Since January 1, 2020 (dollars in thousands except per room and per sq. ft. data) ACQUISITIONS: Number of Rooms or Suite (Hotels) / Average Purchase Square Footage Purchase Price per Room or Date Acquired Properties Brand Location (Net Lease) Operating Agreement Price (1) Suite / Square Foot 3/12/2020 3 Taco Bell Various 6,696 AG Bells LLC $ 7,071 $ 1,056 (1) Represents cash purchase price and excludes acquisition related costs. DISPOSITIONS: Average Sales Former Operating Price per Square Date Disposed Properties Brand Location Square Footage Agreement Sales Price (1) Foot 1/28/2020 1 Vacant Gothenburg, NE 31,978 Vacant $ 585 $ 18 2/6/2020 1 Vacant Rochester, MN 90,503 Vacant 2,600 29 2/13/2020 1 Vacant Ainsworth, NE 32,901 Vacant 775 24 2/14/2020 1 Vacant Dekalb, IL 5,052 Vacant 1,050 208 3/2/2020 1 HOM Furniture, Inc. Eau Claire, MI 98,824 HOM Furniture, Inc.(2) 2,600 26 3/28/2020 1 Vacant Stillwater, OK 33,018 Vacant 400 12 6 292,276 $ 8,010 27 (1) Represents cash sales price and excludes closing related costs. (2) The lease was scheduled to expire on April 30, 2020 and required annual minimum rent of $817. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 16

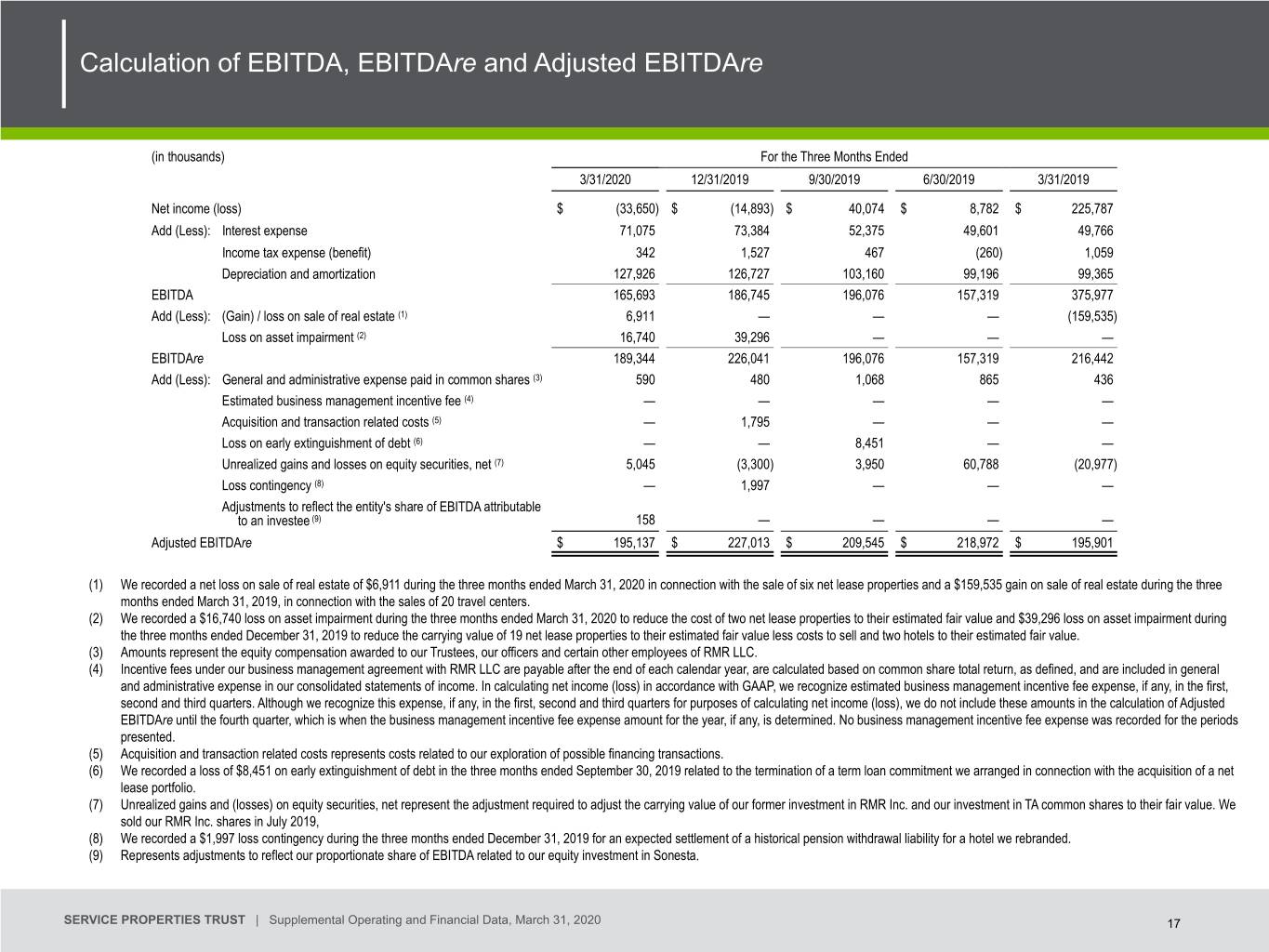

Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (in thousands) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Net income (loss) $ (33,650) $ (14,893) $ 40,074 $ 8,782 $ 225,787 Add (Less): Interest expense 71,075 73,384 52,375 49,601 49,766 Income tax expense (benefit) 342 1,527 467 (260) 1,059 Depreciation and amortization 127,926 126,727 103,160 99,196 99,365 EBITDA 165,693 186,745 196,076 157,319 375,977 Add (Less): (Gain) / loss on sale of real estate (1) 6,911 — — — (159,535) Loss on asset impairment (2) 16,740 39,296 — — — EBITDAre 189,344 226,041 196,076 157,319 216,442 Add (Less): General and administrative expense paid in common shares (3) 590 480 1,068 865 436 Estimated business management incentive fee (4) — — — — — Acquisition and transaction related costs (5) — 1,795 — — — Loss on early extinguishment of debt (6) — — 8,451 — — Unrealized gains and losses on equity securities, net (7) 5,045 (3,300) 3,950 60,788 (20,977) Loss contingency (8) — 1,997 — — — Adjustments to reflect the entity's share of EBITDA attributable to an investee (9) 158 — — — — Adjusted EBITDAre $ 195,137 $ 227,013 $ 209,545 $ 218,972 $ 195,901 (1) We recorded a net loss on sale of real estate of $6,911 during the three months ended March 31, 2020 in connection with the sale of six net lease properties and a $159,535 gain on sale of real estate during the three months ended March 31, 2019, in connection with the sales of 20 travel centers. (2) We recorded a $16,740 loss on asset impairment during the three months ended March 31, 2020 to reduce the cost of two net lease properties to their estimated fair value and $39,296 loss on asset impairment during the three months ended December 31, 2019 to reduce the carrying value of 19 net lease properties to their estimated fair value less costs to sell and two hotels to their estimated fair value. (3) Amounts represent the equity compensation awarded to our Trustees, our officers and certain other employees of RMR LLC. (4) Incentive fees under our business management agreement with RMR LLC are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in general and administrative expense in our consolidated statements of income. In calculating net income (loss) in accordance with GAAP, we recognize estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income (loss), we do not include these amounts in the calculation of Adjusted EBITDAre until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. No business management incentive fee expense was recorded for the periods presented. (5) Acquisition and transaction related costs represents costs related to our exploration of possible financing transactions. (6) We recorded a loss of $8,451 on early extinguishment of debt in the three months ended September 30, 2019 related to the termination of a term loan commitment we arranged in connection with the acquisition of a net lease portfolio. (7) Unrealized gains and (losses) on equity securities, net represent the adjustment required to adjust the carrying value of our former investment in RMR Inc. and our investment in TA common shares to their fair value. We sold our RMR Inc. shares in July 2019, (8) We recorded a $1,997 loss contingency during the three months ended December 31, 2019 for an expected settlement of a historical pension withdrawal liability for a hotel we rebranded. (9) Represents adjustments to reflect our proportionate share of EBITDA related to our equity investment in Sonesta. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 17

Calculation of FFO and Normalized FFO (amounts in thousands, except per share data) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Net income (loss) $ (33,650) $ (14,893) $ 40,074 $ 8,782 $ 225,787 Add (Less): Depreciation and amortization 127,926 126,727 103,160 99,196 99,365 (Gain) / loss on sale of real estate (1) 6,911 — — — (159,535) Loss on asset impairment (2) 16,740 39,296 — — — Unrealized gains and losses on equity securities, net (3) 5,045 (3,300) 3,950 60,788 (20,977) Adjustments to reflect the entity's share of FFO attributable to an investee (4) 112 — — — — FFO 123,084 147,830 147,184 168,766 144,640 Add (Less): Acquisition and transaction related costs (5) — 1,795 — — — Loss on early extinguishment of debt (6) — — 8,451 — — Loss contingency (7) — 1,997 — — — Normalized FFO $ 123,084 $ 151,622 $ 155,635 $ 168,766 $ 144,640 Weighted average shares outstanding (basic) 164,370 164,364 164,321 164,284 164,278 Weighted average shares outstanding (diluted) 164,370 164,364 164,348 164,326 164,322 Basic and diluted per share common share amounts: Net income (loss) $ (0.20) $ (0.09) $ 0.24 $ 0.05 $ 1.37 FFO $ 0.75 $ 0.90 $ 0.90 $ 1.03 $ 0.88 Normalized FFO $ 0.75 $ 0.92 $ 0.95 $ 1.03 $ 0.88 (1) We recorded a net loss on sale of real estate of $6,911 during the three months ended March 31, 2020 in connection with the sale of six net lease properties and a $159,535 gain on sale of real estate during the three months ended March 31, 2019, in connection with the sales of 20 travel centers. (2) We recorded a $16,740 loss on asset impairment during the three months ended March 31, 2020 to reduce the cost of two net lease properties to their estimated fair value and $39,296 loss on asset impairment during the three months ended December 31, 2019 to reduce the carrying value of 19 net lease properties to their estimated fair value less costs to sell and two hotels to their estimated fair value. (3) Unrealized gains and (losses) on equity securities, net represent the adjustment required to adjust the carrying value of our former investment in RMR Inc. and our investment in TA common shares to their fair value. We sold our RMR Inc. shares in July 2019, (4) Represents adjustments to reflect our proportionate share of FFO related to our equity investment in Sonesta. (5) Acquisition and transaction related costs represents costs related to our exploration of possible financing transactions. (6) We recorded a loss of $8,451 on early extinguishment of debt in the three months ended September 30, 2019 related to the termination of a term loan commitment we arranged in connection with our acquisition of a net lease portfolio. (7) We recorded a $1,997 loss contingency during the three months ended December 31, 2019 for an expected settlement of a historical pension withdrawal liability for a hotel we rebranded. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 18

PORTFOLIO INFORMATION Sonesta Resort Hilton Head Island, SC Operator: Sonesta Guest Rooms: 340 SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 19

Portfolio Summary As of March 31, 2020 (dollars in thousands) Portfolio composition (1) Number of Properties Hotel Properties 329 Net Lease Properties 813 Total Properties 1,142 Diversification Facts Net lease: 39.2% Tenants/Operators 193 Brands 148 Hotel: 60.8% Industries 23 States (2) 47 Investments Hotels $ 7,045,016 Net Lease Properties 5,253,149 Geographical Diversification (1) Total Investments $ 12,298,165 Annualized Minimum Return and Rent Hotels $ 587,488 CA 11% Net Lease Properties 379,503 TX 8% Total Annualized Minimum Returns and Rents $ 966,991 Other 46% GA 7% (3) Minimum Return/Rent Coverage (37 States, Hotels 0.73x DC, PR, ON) IL 7% Sonesta Fort Lauderdale Beach Net Lease 2.28x Ft. Lauderdale, FL OH 4% Total Portfolio 1.34x Operator: Sonesta FL 4% (1) Based on the annualized Minimum Returns and Rents. Guest Rooms: 240 AZ NJ PA MA (2) We also own one property in Washington D.C., two in Canada and one in Puerto Rico. 4% 3% 3% (3) Coverage data amounts include data for certain properties for periods prior to when we acquired 3% them. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 20

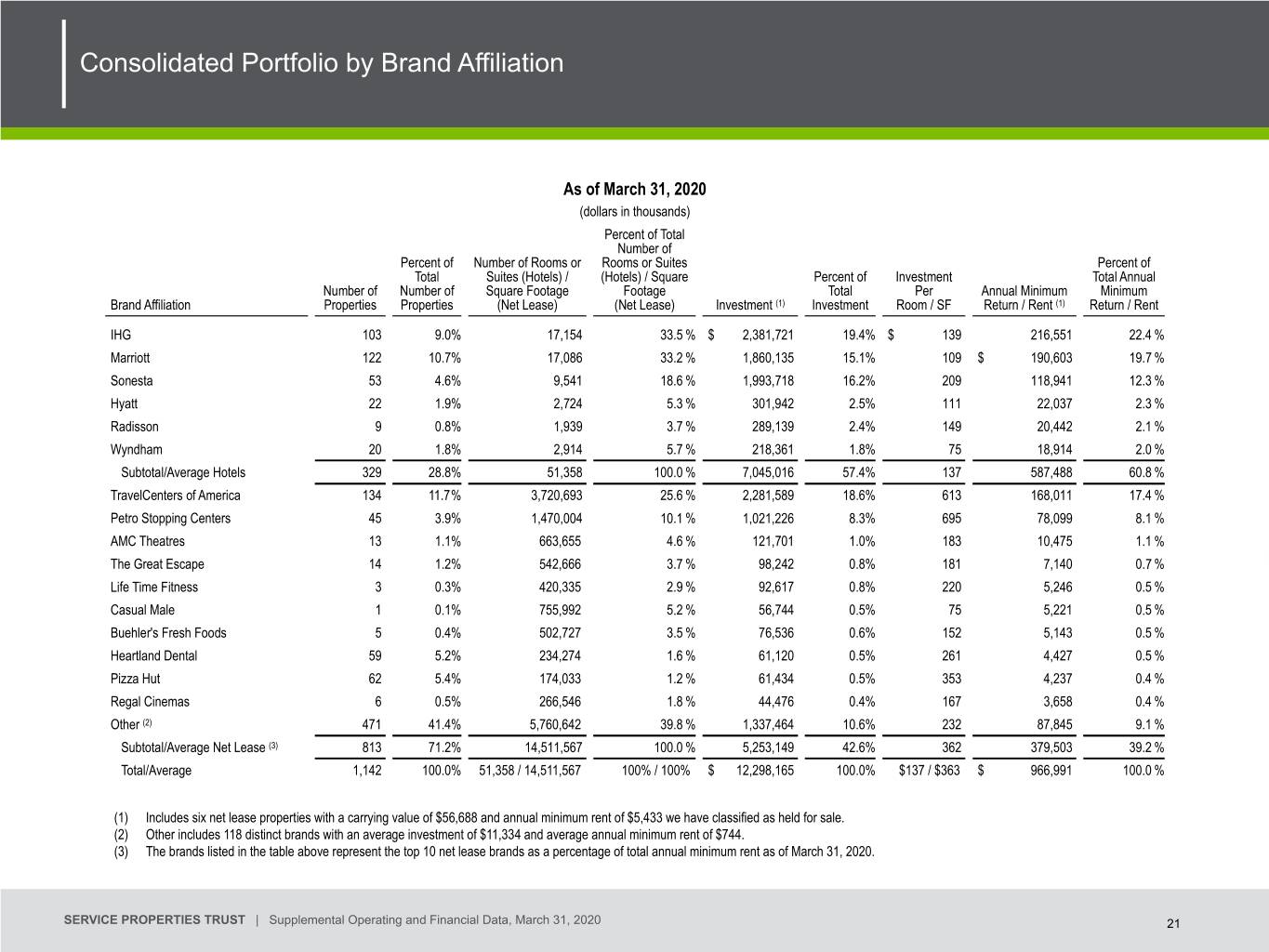

Consolidated Portfolio by Brand Affiliation As of March 31, 2020 (dollars in thousands) Percent of Total Number of Percent of Number of Rooms or Rooms or Suites Percent of Total Suites (Hotels) / (Hotels) / Square Percent of Investment Total Annual Number of Number of Square Footage Footage Total Per Annual Minimum Minimum Brand Affiliation Properties Properties (Net Lease) (Net Lease) Investment (1) Investment Room / SF Return / Rent (1) Return / Rent IHG 103 9.0% 17,154 33.5 % $ 2,381,721 19.4% $ 139 216,551 22.4 % Marriott 122 10.7% 17,086 33.2 % 1,860,135 15.1% 109 $ 190,603 19.7 % Sonesta 53 4.6% 9,541 18.6 % 1,993,718 16.2% 209 118,941 12.3 % Hyatt 22 1.9% 2,724 5.3 % 301,942 2.5% 111 22,037 2.3 % Radisson 9 0.8% 1,939 3.7 % 289,139 2.4% 149 20,442 2.1 % Wyndham 20 1.8% 2,914 5.7 % 218,361 1.8% 75 18,914 2.0 % Subtotal/Average Hotels 329 28.8% 51,358 100.0 % 7,045,016 57.4% 137 587,488 60.8 % TravelCenters of America 134 11.7% 3,720,693 25.6 % 2,281,589 18.6% 613 168,011 17.4 % Petro Stopping Centers 45 3.9% 1,470,004 10.1 % 1,021,226 8.3% 695 78,099 8.1 % AMC Theatres 13 1.1% 663,655 4.6 % 121,701 1.0% 183 10,475 1.1 % The Great Escape 14 1.2% 542,666 3.7 % 98,242 0.8% 181 7,140 0.7 % Life Time Fitness 3 0.3% 420,335 2.9 % 92,617 0.8% 220 5,246 0.5 % Casual Male 1 0.1% 755,992 5.2 % 56,744 0.5% 75 5,221 0.5 % Buehler's Fresh Foods 5 0.4% 502,727 3.5 % 76,536 0.6% 152 5,143 0.5 % Heartland Dental 59 5.2% 234,274 1.6 % 61,120 0.5% 261 4,427 0.5 % Pizza Hut 62 5.4% 174,033 1.2 % 61,434 0.5% 353 4,237 0.4 % Regal Cinemas 6 0.5% 266,546 1.8 % 44,476 0.4% 167 3,658 0.4 % Other (2) 471 41.4% 5,760,642 39.8 % 1,337,464 10.6% 232 87,845 9.1 % Subtotal/Average Net Lease (3) 813 71.2% 14,511,567 100.0 % 5,253,149 42.6% 362 379,503 39.2 % Total/Average 1,142 100.0% 51,358 / 14,511,567 100% / 100% $ 12,298,165 100.0% $137 / $363 $ 966,991 100.0 % (1) Includes six net lease properties with a carrying value of $56,688 and annual minimum rent of $5,433 we have classified as held for sale. (2) Other includes 118 distinct brands with an average investment of $11,334 and average annual minimum rent of $744. (3) The brands listed in the table above represent the top 10 net lease brands as a percentage of total annual minimum rent as of March 31, 2020. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 21

Consolidated Portfolio Diversification by Industry As of March 31, 2020 (dollars in thousands) Percent of Total Annualized No. of Rooms/ Percent of Total Annual Minimum Minimum Industry Properties Square Footage Investments (1) Investment Return/ Rent (1) Return/Rent 1. Hotels 329 51,358 $ 7,045,016 57.3% $ 587,488 62.0% 2. Travel Centers 182 5,238,765 3,344,496 27.2% 249,230 24.9% 3. Restaurants-Quick Service 249 663,436 319,869 2.6% 20,723 2.1% 4. Movie Theaters 24 1,240,533 209,846 1.7% 17,832 1.8% 5. Restaurants-Casual Dining 63 433,938 222,103 1.8% 12,709 1.3% 6. Health and Fitness 13 837,811 184,744 1.5% 10,979 1.1% 7. Miscellaneous Retail 19 598,731 114,433 0.9% 8,866 0.9% 8. Medical/Dental Office 72 409,706 118,098 1.0% 9,099 0.9% 9. Grocery 19 1,020,819 129,219 1.1% 8,598 0.9% 10. Automotive Parts and Service 63 210,152 96,496 0.8% 6,529 0.7% 11. Apparel 2 845,297 67,770 0.6% 5,891 0.6% 12. Automotive Dealers 9 172,251 64,756 0.5% 4,664 0.5% 13. Entertainment 4 199,853 61,436 0.5% 4,238 0.4% 14. Educational Services 9 220,758 55,647 0.5% 3,719 0.4% 15. Sporting Goods 3 331,864 52,022 0.4% 3,489 0.3% 16. Miscellaneous Manufacturing 7 763,312 32,873 0.3% 2,402 0.2% 17. Building Materials 26 424,998 28,987 0.2% 2,402 0.2% 18. Car Washes 5 41,456 28,658 0.2% 2,076 0.2% 19. Drug Stores and Pharmacies 8 82,543 23,970 0.2% 1,646 0.2% 20. Legal Services 5 25,429 11,362 0.1% 1,008 0.1% 21. General Merchandise 3 99,233 7,492 0.1% 555 0.1% 22. Home Furnishings 5 248,448 37,215 0.3% 401 —% 23. Dollar Stores 3 27,593 2,971 —% 186 —% 24. Other 3 126,021 8,872 0.1% 2,261 0.2% 25. Vacant 17 248,619 29,814 0.1% — —% Total 1,142 51,358 / 14,511,567 $ 12,298,165 100.0% $ 966,991 100.0% (1) Includes six net lease properties with a carrying value of $56,688 and annual minimum rent of $5,433 we have classified as held for sale. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 22

Hotel Portfolio by Brand As of March 31, 2020 (dollars in thousands) Percent of Percent of Number of Total Number Percent of Investment Number of Total Number Rooms or of Rooms or Total Hotel Per Room or Brand Manager Hotels of Hotels Suites Suites Investment Investment Suite Courtyard by Marriott® Marriott 71 21.8% 10,265 19.9% $ 1,021,131 14.5% $ 99 Royal Sonesta Hotels® Sonesta 7 2.1% 2,675 5.2% 908,685 12.9% 341 Sonesta ES Suites® Sonesta 39 11.9% 4,731 9.2% 651,234 9.2% 138 Crowne Plaza® IHG 11 3.3% 4,141 8.1% 644,170 9.1% 156 Candlewood Suites® IHG 61 18.5% 7,553 14.7% 605,986 8.6% 80 Residence Inn by Marriott® Marriott 35 10.6% 4,488 8.7% 562,374 8.0% 125 Kimpton® Hotels & Restaurants IHG 5 1.5% 1,421 2.8% 482,474 6.8% 340 Sonesta Hotels & Resorts® Sonesta 7 2.1% 2,135 4.2% 433,799 6.2% 203 Staybridge Suites® IHG 20 6.1% 2,481 4.8% 356,016 5.1% 143 Hyatt Place® Hyatt 22 6.7% 2,724 5.3% 301,942 4.3% 111 Radisson® Hotels & Resorts and Radisson Blu® Radisson 6 1.8% 1,509 2.9% 235,724 3.3% 156 InterContinental Hotels and Resorts® IHG 3 0.9% 804 1.6% 219,106 3.1% 273 Wyndham Hotels and Resorts® and Wyndham Grand® Wyndham 4 1.2% 1,158 2.3% 115,882 1.6% 100 Marriott® Hotel Marriott 2 0.6% 748 1.5% 131,798 1.9% 176 TownePlace Suites by Marriott® Marriott 12 3.6% 1,321 2.6% 118,926 1.7% 90 Hawthorn Suites® Wyndham 16 4.9% 1,756 3.4% 102,479 1.5% 58 Holiday Inn® IHG 3 0.9% 754 1.5% 73,969 1.0% 98 Country Inns & Suites® by Radisson Radisson 3 0.9% 430 0.8% 53,415 0.8% 124 SpringHill Suites by Marriott® Marriott 2 0.6% 264 0.5% 25,906 0.4% 98 Total/Average Hotels 329 100.0% 51,358 100.0% $ 7,045,016 100.0% $ 137 SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 23

Hotel Operating Agreement Information IHG - We lease 102 IHG branded hotels (20 Staybridge Suites®, 61 Candlewood Suites®, two InterContinental®, 11 Crowne Plaza®, three Holiday Inn® and five Kimpton® Hotels & Restaurants) in 30 states in the U.S., the District of Columbia and Ontario, Canada to one of our wholly owned taxable REIT subsidiaries, or TRSs. These 102 hotels are managed by subsidiaries of IHG under a combination management agreement. We lease one additional InterContinental® branded hotel in Puerto Rico to a subsidiary of IHG. The annual minimum return amount presented in the table on slide 22 includes $7,908 of minimum rent related to the leased Puerto Rico hotel. The management agreement and the lease expire in 2036; IHG has two renewal options for 15 years each for all, but not less than all, of the hotels. As of March 31, 2020, we held a security deposit of $42,063 under this agreement to cover payment shortfalls of our minimum return. This security deposit, if utilized, may be replenished and increased up to $100,000 from the hotels' available cash flows in excess of our minimum return, working capital advances and certain management fees. Under this agreement, IHG is required to maintain a minimum security deposit of $37,000. In addition to our minimum return, this management agreement provides for an annual additional return payment to us of $12,067 from the hotels' available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve payment of our minimum return, working capital advances, payment of certain management fees and replenishment and expansion of the security deposit, if any. In addition, the agreement provides for payment to us of 50% of the hotels' available cash flows after payment to us of the annual additional return amount. These additional return amounts are not guaranteed or secured by the security deposit we hold. Our IHG agreement requires 5% of gross revenues from hotel operations be placed in escrow for hotel maintenance and periodic renovations, or an FF&E reserve. As a result of current market conditions, effective March 1, 2020, we and IHG have agreed to suspend contributions to the FF&E reserve under our IHG agreement for the remainder of 2020. Marriott - We lease our 122 Marriott branded hotels (two full service Marriott®, 35 Residence Inn by Marriott®, 71 Courtyard by Marriott®, 12 TownePlace Suites by Marriott® and two SpringHill Suites by Marriott® hotels) in 31 states to certain of our TRSs. The hotels under the Marriott agreement are managed by subsidiaries of Marriott and require aggregate annual minimum returns of $190,603. The Marriott Agreement is scheduled to expire in 2035 and Marriott has two renewal options for 10 years each for all, but not less than all, of the hotels. As of March 31, 2020, we held a security deposit of $4,790 under this agreement to cover payment shortfalls of our minimum return. This security deposit, if utilized, may be replenished and increased up to $64,700 from a share of the hotels’ available cash flows in excess of our minimum return, certain management fees and working capital advances. Marriott has also provided us with a $30,000 limited guaranty to cover payment shortfalls up to 85% of our minimum return after the available security deposit balance has been depleted. This limited guaranty expires in 2026. In addition to our minimum return, this agreement provides for payment to us of 60% of the hotels' available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve, payment of our minimum return, payment of certain management fees, working capital advances and replenishment of the security deposit. This additional return amount is not guaranteed or secured by the security deposit. Our Marriott agreement requires 5.5% to 6.5% of gross revenues from hotel operations be placed in an FF&E reserve. As a result of current market conditions, we and Marriott have agreed to suspend contributions to the FF&E reserve under our Marriott agreement for six months effective March 1, 2020. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 24

Hotel Operating Agreement Information Sonesta - We lease our 53 Sonesta branded hotels (seven Royal Sonesta® Hotels, seven Sonesta Hotels & Resorts® and 39 Sonesta ES Suites® hotels) in 26 states to certain of our TRSs. The hotels are managed by Sonesta under a combination management agreement which expires in 2037; Sonesta has two renewal options for 15 years each for all, but not less than all, of these 53 hotels. We have no security deposit or guaranty from Sonesta. Accordingly, payment by Sonesta of the minimum returns due to us under this management agreement is limited to the hotels' available cash flows after the payment of operating expenses, including certain management fees, and we are financially responsible for operating cash flows deficits, if any. In addition to our minimum returns, this management agreement provides for payment to us of 80% of the hotels' available cash flows after payment of hotel operating expenses, including certain management fees to Sonesta, our minimum return, working capital advances and any required FF&E reserves. Hyatt - We lease our 22 Hyatt Place® branded hotels in 14 states to one of our TRSs. The hotels are managed by a subsidiary of Hyatt Hotel Corporation, or Hyatt, under a combination management agreement that expires in 2030; Hyatt has two renewal options for 15 years each for all, but not less than all, of the hotels. We have a limited guaranty of $50,000 under this agreement to cover payment shortfalls of our minimum return. As of March 31, 2020, the available Hyatt guaranty was $16,026. The guaranty is limited in amount but does not expire in time and may be replenished from a share of the hotels' available cash flows in excess of our minimum return and our working capital advances. In addition to our minimum return, this management agreement provides for payment to us of 50% of the hotels' available cash flows after payment of operating expenses, funding the required FF&E reserve, payment of our minimum return, our working capital advances and reimbursement to Hyatt of working capital and guaranty advances, if any. This additional return is not guaranteed. Our Hyatt agreement requires 5% of gross revenues from hotel operations be placed in an FF&E reserve. As a result of current market conditions, effective March 1, 2020, we and Hyatt have agreed to suspend contributions to the FF&E reserve under our Hyatt agreement for the remainder of 2020. Radisson - We lease our nine Radisson branded hotels (four Radisson® Hotels & Resorts, four Country Inns & Suites® by Radisson and one Radisson Blu® hotel) in six states to one of our TRSs and these hotels are managed by a subsidiary of Radisson under a combination management agreement which expires in 2035 and Radisson has two 15 year renewal options for all, but not less than all, of the hotels. We have a limited guaranty of $47,523 under this agreement to cover payment shortfalls of our minimum return. As of March 31, 2020, the available Radisson guaranty was $36,647. The guaranty is limited in amount but does not expire in time and may be replenished from a share of the hotels' available cash flows in excess of our minimum return and our working capital advances. In addition to our minimum return, this management agreement provides for payment to us of 50% of the hotels' available cash flows after payment of operating expenses, funding the required FF&E reserve, payment of our minimum return, our working capital advances and reimbursement to Radisson of working capital and guaranty advances, if any. This additional return is not guaranteed. Our Radisson agreement requires 5% of gross revenues from hotel operations be placed in an FF&E reserve. As a result of current market conditions, effective April 1, 2020, we and Radisson have agreed to suspend contributions to the FF&E reserve under our Radisson agreement for the remainder of 2020. Wyndham - We lease our 20 Wyndham branded hotels (four Wyndham Hotels and Resorts® and 16 Hawthorn Suites® hotels) in 13 states to one of our TRSs. The hotels are managed by a subsidiary of Wyndham under a combination management agreement which expires in September 2020. We have no guarantee or security deposit from Wyndham. Payment by Wyndham is limited to the available cash flows after payment of operating expenses. Wyndham is not entitled to any base management fees for the remainder of the agreement. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 25

Hotel Operating Statistics by Operating Agreement (Comparable Hotels(1)) For the Three Months Ended March 31, No. of Hotels (1) No. of Rooms or Suites 2020 2019 Change ADR IHG 97 15,714 $ 111.18 $ 118.49 (6.2%) Marriott 122 17,086 138.02 140.21 (1.6%) Sonesta (2) 52 9,169 127.43 135.24 (5.8%) Hyatt 22 2,724 106.95 112.98 (5.3%) Radisson 8 1,773 126.95 130.72 (2.9%) Wyndham 20 2,914 77.19 82.70 (6.7%) All Hotels Total/Average 321 49,380 $ 121.02 $ 126.86 (4.6%) OCCUPANCY IHG 97 15,714 64.7% 72.8% (8.1) pts Marriott 122 17,086 52.9% 65.4% (12.5) pts Sonesta (2) 52 9,169 51.7% 62.4% (10.7) pts Hyatt 22 2,724 59.5% 74.5% (15.0) pts Radisson 8 1,773 56.7% 65.6% (8.9) pts Wyndham 20 2,914 52.8% 60.4% (7.6) pts All Hotels Total/Average 321 49,380 56.9% 67.4% (10.5) pts RevPAR IHG 97 15,714 $ 71.93 $ 86.26 (16.6%) Marriott 122 17,086 73.01 91.70 (20.4%) Sonesta (2) 52 9,169 65.88 84.39 (21.9%) Hyatt 22 2,724 63.64 84.17 (24.4%) Radisson 8 1,773 71.98 85.75 (16.1%) Wyndham 20 2,914 40.76 49.95 (18.4%) All Hotels Total/Average 321 49,380 $ 68.86 $ 85.50 (19.5%) (1) Excludes eight hotels for the three months ended March 31, 2020. (2) Operating data includes data for two hotels for periods prior to when these were managed by Sonesta. "ADR" is average daily rate; "RevPAR" is room revenue per available room. All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 26

Hotel Operating Statistics by Operating Agreement For the Three Months Ended March 31, No. of Hotels No. of Rooms or Suites 2020 2019 Change ADR IHG (1) 103 17,154 $ 114.07 $ 122.70 (7.0%) Marriott 122 17,086 138.02 140.21 (1.6%) Sonesta (2) 53 9,541 134.47 145.97 (7.9%) Hyatt 22 2,724 106.95 112.98 (5.3%) Radisson 9 1,939 125.48 129.66 (3.2%) Wyndham 20 2,914 77.19 82.70 (6.7%) All Hotels Total/Average 329 51,358 $ 123.06 $ 130.04 (5.4%) OCCUPANCY IHG (1) 103 17,154 62.5% 72.3% (9.8) pts Marriott 122 17,086 52.9% 65.4% (12.5) pts Sonesta (2) 53 9,541 50.8% 63.0% (12.2) pts Hyatt 22 2,724 59.5% 74.5% (15.0) pts Radisson 9 1,939 53.2% 63.3% (10.1) pts Wyndham 20 2,914 52.8% 60.4% (7.6) pts All Hotels Total/Average 329 51,358 56.1% 67.4% (11.3) pts RevPAR IHG (1) 103 17,154 $ 71.29 $ 88.71 (19.6%) Marriott 122 17,086 73.01 91.70 (20.4%) Sonesta (2) 53 9,541 68.31 91.96 (25.7%) Hyatt 22 2,724 63.64 84.17 (24.4%) Radisson 9 1,939 66.76 82.07 (18.7%) Wyndham 20 2,914 40.76 49.95 (18.4%) All Hotels Total/Average 329 51,358 $ 69.04 $ 87.65 (21.2%) (1) Operating data includes data for certain hotels for periods prior to when we acquired them. (2) Operating data includes data for two hotels for periods prior to when these were managed by Sonesta. "ADR" is average daily rate; "RevPAR" is room revenue per available room. All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants' operating data. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 27

Hotel Coverage by Operating Agreement (1) Number of For the Twelve Months Ended Operating Agreement Properties 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 IHG 103 0.80x 0.91x 0.89x 0.97x 1.02x Marriott 122 0.92x 1.06x 1.08x 1.10x 1.12x Sonesta 53 0.38x 0.54x 0.59x 0.64x 0.65x Hyatt 22 0.76x 0.90x 0.90x 0.95x 1.00x Radisson 9 0.84x 0.93x 0.95x 0.93x 0.97x Wyndham 20 0.38x 0.50x 0.48x 0.50x 0.51x Total Hotels 329 0.73x 0.86x 0.87x 0.91x 0.95x Number of For the Three Months Ended Operating Agreement Properties 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 IHG 103 0.34x 0.88x 0.89x 1.10x 0.76x Marriott 122 0.39x 0.86x 1.16x 1.29x 0.91x Sonesta 53 (0.22x) 0.31x 0.55x 0.89x 0.39x Hyatt 22 0.38x 0.69x 0.77x 1.20x 0.92x Radisson 9 0.11x 0.76x 1.38x 1.13x 0.45x Wyndham 20 (0.25x) 0.32x 0.70x 0.74x 0.23x Total Hotels 329 0.20x 0.72x 0.90x 1.11x 0.70x (1) Coverage amounts for our IHG, Sonesta and Radisson agreements include data for certain hotels for periods prior to when we acquired them. Coverage amounts for our Sonesta agreement include data for three hotels prior to when these were managed by Sonesta. All operating data presented are based upon the operating results provided by our managers and tenants for the indicated periods. We have not independently verified our managers' or tenants’ operating data. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 28

Net Lease Portfolio by Brand As of March 31, 2020 (dollars in thousands) Percent of Percent of Total Total Annualized Annualized Brand No. of Buildings Investment (1) Investment Minimum Rent (1) Minimum Rent Coverage (2) 1. TravelCenters of America 134 $ 2,281,589 43.4% $ 168,011 44.3% 1.98x 2. Petro Stopping Centers 45 1,021,226 19.4% 78,099 20.6% 1.61x 3. AMC Theatres 13 121,701 2.3% 10,475 2.8% 1.33x 4. The Great Escape 14 98,242 1.9% 7,140 1.9% 4.13x 5. Life Time Fitness 3 92,617 1.8% 5,246 1.4% 3.56x 6. Casual Male 1 56,744 1.1% 5,221 1.4% 1.22x 7. Buehler's Fresh Foods 5 76,536 1.5% 5,143 1.4% 2.09x 8. Heartland Dental 59 61,120 1.2% 4,427 1.2% 3.67x 9. Pizza Hut 62 61,434 1.2% 4,237 1.1% 1.36x 10. Regal Cinemas 6 44,476 0.8% 3,658 1.0% 1.84x 11. Express Oil Change 23 49,724 0.9% 3,379 0.9% 3.44x 12. Flying J Travel Plaza 3 41,681 0.8% 3,120 0.8% 3.49x 13. Norms 10 53,673 1.0% 3,106 0.8% 3.37x 14. B&B Theatres 4 34,369 0.7% 3,100 0.8% 1.24x 15. America's Auto Auction 6 34,314 0.7% 2,672 0.7% 5.20x 16. Church's Chicken 45 35,995 0.7% 2,576 0.7% 1.97x 17. Fleet Farm 1 37,802 0.7% 2,571 0.7% 4.01x 18. Courthouse Athletic Club 4 39,688 0.8% 2,400 0.6% 2.29x 19. Big Al's 2 35,214 0.7% 2,336 0.6% 1.48x 20. Creme de la Creme 4 29,131 0.6% 2,208 0.6% 1.71x 21. Martin's 16 31,144 0.6% 2,080 0.5% 2.21x 22. Mister Car Wash 5 28,658 0.5% 2,076 0.5% 4.78x 23. Hardee's 19 31,844 0.6% 2,069 0.5% 0.89x 24. Burger King 21 34,289 0.7% 2,054 0.5% 2.39x 25. Popeye's Chicken & Biscuits 20 28,434 0.5% 1,889 0.5% 3.49x 26. Other (3) 288 791,504 14.9% 50,210 13.2% 3.81x Total 813 $ 5,253,149 100.0% $ 379,503 100.0% 2.28x (1) Includes six net lease properties with an aggregate carrying value of $56,688 and annual minimum rent of $5,433 we have classified as held for sale. (2) Coverage amounts include data for certain properties for periods prior to when we acquired them. (3) Other includes 103 distinct brands with an average investment of $2,748 per building and average annual minimum rent of $174 per lease. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 29

Net Lease Portfolio by Industry As of March 31, 2020 (dollars in thousands) Percent of Total Percent of Total Annualized Annualized Industry No. of Buildings Investment (1) Investment Minimum Rent (1) Minimum Rent Coverage (2) 1. Travel Centers 182 $ 3,344,496 63.7% $ 249,230 65.6% 1.88x 2. Restaurants-Quick Service 249 319,869 6.1% 20,723 5.5% 2.44x 3. Movie Theaters 24 209,846 4.0% 17,832 4.7% 1.43x 4. Restaurants-Casual Dining 63 222,103 4.2% 12,709 3.3% 2.43x 5. Health and Fitness 13 184,744 3.5% 10,979 2.9% 2.83x 6. Miscellaneous Retail 19 114,433 2.2% 8,866 2.3% 3.43x 7. Medical/Dental Office 72 118,098 2.2% 9,099 2.4% 3.56x 8. Grocery 19 129,219 2.5% 8,598 2.3% 2.72x 9. Automotive Parts and Service 63 96,496 1.8% 6,529 1.7% 2.85x 10. Apparel 2 67,770 1.3% 5,891 1.6% 1.54x 11. Automotive Dealers 9 64,756 1.2% 4,664 1.2% 4.54x 12. Entertainment 4 61,436 1.2% 4,238 1.1% 2.34x 13. Educational Services 9 55,647 1.1% 3,719 1.0% 3.13x 14. Sporting Goods 3 52,022 1.0% 3,489 0.9% 3.44x 15. Miscellaneous Manufacturing 7 32,873 0.6% 2,402 0.6% 25.29x 16. Building Materials 26 28,987 0.6% 2,402 0.6% 3.54x 17. Car Washes 5 28,658 0.5% 2,076 0.5% 4.78x 18. Drug Stores and Pharmacies 8 23,970 0.5% 1,646 0.4% 1.79x 19. Legal Services 5 11,362 0.2% 1,008 0.3% 1.45x 20. General Merchandise 3 7,492 0.1% 555 0.1% 3.27x 21. Home Furnishings 5 37,215 0.7% 401 0.1% 2.53x 22. Dollar Stores 3 2,971 0.1% 186 —% 2.83x 23. Other 3 8,872 0.1% 2,261 0.9% 1.15x 24. Vacant 17 29,814 0.6% — —% — Total 813 $ 5,253,149 100.0% $ 379,503 100.0% 2.28x (1) Includes six net lease properties with an aggregate carrying value of $56,688 and annual minimum rent of $5,433 we have classified as held for sale. (2) Coverage amounts include data for certain properties for periods prior to when we acquired them. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 30

Net Lease Portfolio by Tenant (Top 10) As of March 31, 2020 (dollars in thousands) Percent of Total Percent of Total Annualized Annualized Tenant Brand Affiliation No. of Buildings Investment (1) Investment Minimum Rent (1) Minimum Rent Coverage (2) TravelCenters of America / 1. TravelCenters of America, Inc. Petro Stopping Centers 179 $ 3,302,815 62.9% $ 246,110 64.8% 1.87x (3) (4) 2. Universal Pool Co., Inc. The Great Escape 14 98,242 1.9% 7,140 1.9% 4.13x 3. Healthy Way of Life II, LLC Life Time Fitness 3 92,617 1.8% 5,246 1.4% 3.56x (3) 4. Destination XL Group, Inc. Casual Male 1 56,744 1.1% 5,221 1.4% 1.22x 5. Styx Acquisition, LLC Buehler's Fresh Foods 5 76,536 1.5% 5,143 1.4% 2.09x (3) 6. Professional Resource Development, Inc. Heartland Dental 59 61,120 1.2% 4,427 1.2% 3.67x 7. Carmike Cinemas, LLC AMC Theatres 6 44,621 0.8% 4,068 1.1% 1.72x 8. Regal Cinemas, Inc. Regal Cinemas 6 44,476 0.8% 3,658 1.0% 1.84x 9. Eastwynn Theatres, Inc. AMC Theatres 5 41,771 0.8% 3,541 0.9% 0.87x 10. Express Oil Change, L.L.C. Express Oil Change 23 49,724 0.9% 3,379 0.9% 3.44x Sub-total, Top 10 301 3,868,666 73.7% 287,933 76.0% 1.88x 11. Other (5) Various 512 1,384,483 26.3% 91,570 24.0% 3.25x Total 813 $ 5,253,149 100.0% $ 379,503 100.0% 2.28x (1) Includes six net lease properties with an aggregate carrying value of $56,688 and annual minimum rent of $5,433 that we have classified as held for sale. (2) Coverage amounts include data for certain properties for periods prior to when we acquired them. (3) Leases subject to full or partial guarantee. (4) TA is our largest tenant. As of March 31, 2020, we leased 179 travel centers (134 under the TravelCenters of America brand and 45 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2029, 2031, 2032, 2033 and 2035, respectively. TA has two renewal options for 15 years each for all of the travel centers. In addition to the payment of our minimum rent, these leases provide for payment to us of percentage rent based on increases in total non-fuel revenues over base levels (3.5% of non-fuel revenues above threshold amounts defined in the agreements). TA's remaining deferred rent obligation of $52,843 is due in quarterly installments of $4,404 through January 31, 2023. (5) Other includes 177 tenants with an average investment of $7,822 and average annual minimum rent of $517. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 31

Net Lease Portfolio - Expiration Schedule As of March 31, 2020 (dollars in thousands) Cumulative % of Total Annualized Minimum Rent Percent of Total Annualized Annualized Minimum Rent Year (1) Square Feet Expiring (2) Minimum Rent Expiring Expiring 2020 225,364 $ 4,401 1.2% 1.2% 2021 622,790 7,265 1.9% 3.1% 2022 905,744 10,809 2.8% 5.9% 2023 148,804 2,481 0.7% 6.6% 2024 694,836 9,988 2.6% 9.2% 2025 545,105 12,635 3.3% 12.5% 2026 1,603,671 14,558 3.8% 16.3% 2027 1,146,673 13,086 3.4% 19.7% 2028 412,496 7,436 2.0% 21.7% 2029 1,308,212 47,213 12.4% 34.1% 2030 171,295 3,649 1.0% 35.1% 2031 1,449,918 51,281 13.6% 48.7% 2032 1,125,517 50,438 13.3% 62.0% 2033 1,100,723 53,194 14.0% 76.0% 2034 310,042 9,051 2.4% 78.4% 2035 2,244,214 77,772 20.6% 99.0% 2036 264,727 3,130 0.8% 99.8% 2037 — — — 99.8% 2038 10,183 409 0.1% 99.9% 2039 10,035 556 0.1% 100.0% 2040 33,233 151 0.0% 100.0% Total 14,333,582 $ 379,503 100.0% Weighted Average Lease Term 9.30 11.1 (1) The year of lease expiration is pursuant to contract terms. (2) Includes six net lease properties with an aggregate carrying value of $56,688 and annual minimum rent of $5,433 we have classified as held for sale. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 32

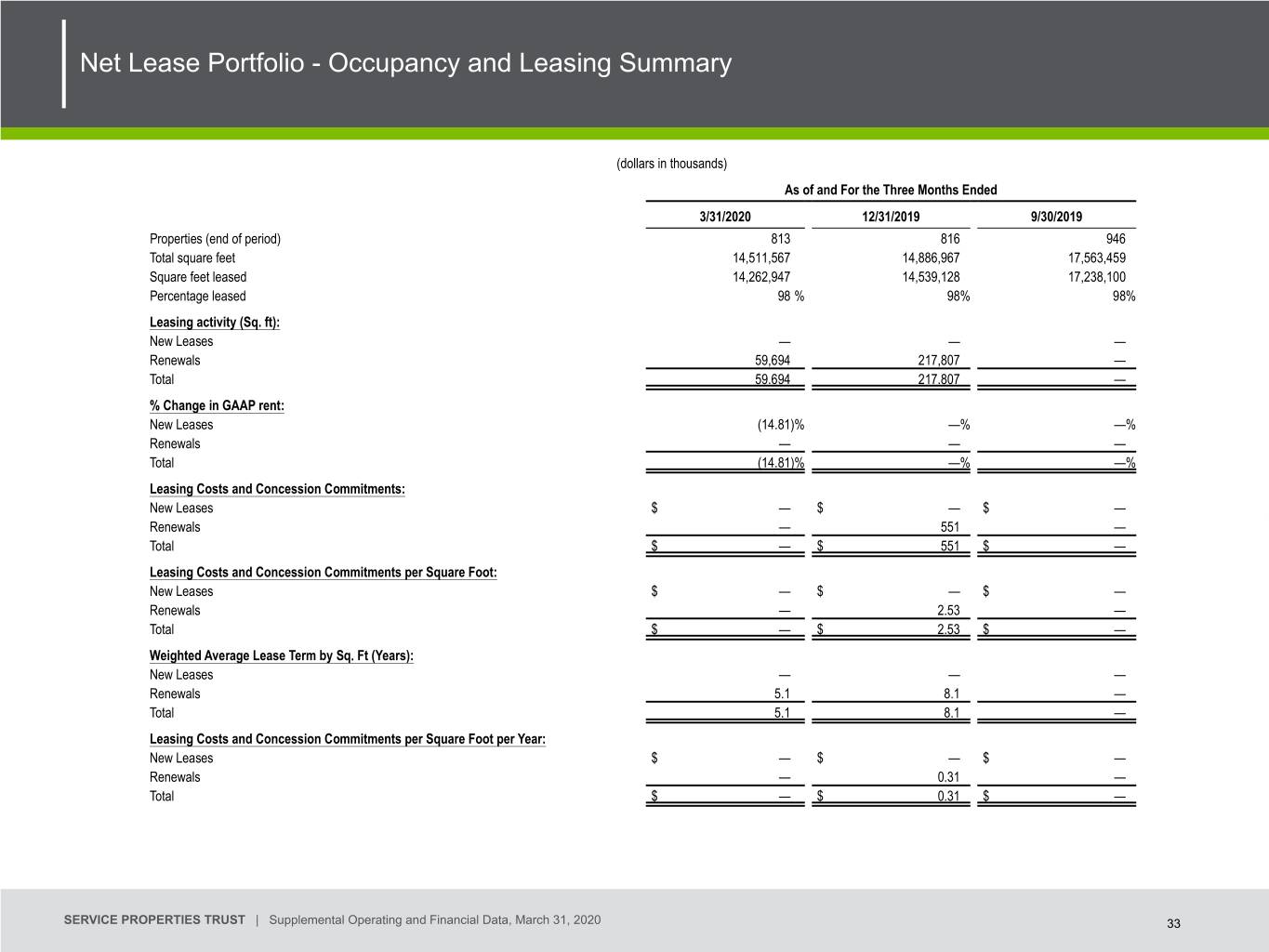

Net Lease Portfolio - Occupancy and Leasing Summary (dollars in thousands) As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 Properties (end of period) 813 816 946 Total square feet 14,511,567 14,886,967 17,563,459 Square feet leased 14,262,947 14,539,128 17,238,100 Percentage leased 98 % 98% 98% Leasing activity (Sq. ft): New Leases — — — Renewals 59,694 217,807 — Total 59.694 217.807 — % Change in GAAP rent: New Leases (14.81)% —% —% Renewals — — — Total (14.81)% —% —% Leasing Costs and Concession Commitments: New Leases $ — $ — $ — Renewals — 551 — Total $ — $ 551 $ — Leasing Costs and Concession Commitments per Square Foot: New Leases $ — $ — $ — Renewals — 2.53 — Total $ — $ 2.53 $ — Weighted Average Lease Term by Sq. Ft (Years): New Leases — — — Renewals 5.1 8.1 — Total 5.1 8.1 — Leasing Costs and Concession Commitments per Square Foot per Year: New Leases $ — $ — $ — Renewals — 0.31 — Total $ — $ 0.31 $ — SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 33

Non-GAAP Financial Measures and Certain Definitions Non-GAAP Financial Measures We present certain “non-GAAP financial measures” within the meaning of applicable Securities and Exchange Commission, or SEC, rules, including EBITDA, EBITDAre, Adjusted EBITDAre, FFO and Normalized FFO. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income (loss) as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income (loss) as presented in our condensed consolidated statements of income. We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income (loss). We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of our operating performance between periods and with other REITs. EBITDA, EBITDAre and Adjusted EBITDAre: We calculate earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 17. EBITDAre is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, as well as certain other adjustments currently not applicable to us. In calculating Adjusted EBITDAre, we adjust for the items shown on page 18 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. FFO and Normalized FFO: We calculate funds from operations, or FFO, and Normalized FFO as shown on page 18. FFO is calculated on the basis defined by Nareit, which is net income (loss), calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any unrealized gains and losses on equity securities, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO, we adjust for the item shown on page 19 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our credit agreement and public debt covenants, the availability to us of debt and equity capital, our distribution rate as a percentage of the trading price of our common shares, or dividend yield, and to the dividend yield of other REITs, our expectation of our future capital requirements and operating performance and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than we do. Other Definitions Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment write-downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period. Comparable Hotels Data: We present RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. We generally define comparable hotels as those that we owned and were open and operating for the entire periods being compared. For the three months ended March 31, 2020 and 2019, we excluded eight hotels from our comparable results. Four of these hotels were not owned for the entire periods and four were closed for major renovations during part of the periods presented. For the years ended March 31, 2020 and 2019, we excluded ten hotels from our comparable results. Six of these hotels were not owned for the entire periods and four were closed for major renovations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 34

Non-GAAP Financial Measures and Certain Definitions (continued) Coverage: We define hotel coverage as total hotel revenues minus all hotel expenses and FF&E reserve escrows that are not subordinated to minimum returns due to SVC divided by the minimum returns or rents due to SVC. We define net lease coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to us weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. EBITDAR amounts used to determine rent coverage are generally for the latest twelve month period reported based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by us. Tenants that do not report operating information are excluded from the coverage calculations. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. FF&E Reserve: Most of our hotel operating agreements require the deposit of a percentage of gross hotel revenues into escrows to fund FF&E reserves. We own all the FF&E reserve escrows for our hotels. Our net lease agreements do not require FF&E escrow deposits; however, certain tenants may request that we fund capital improvements in return for increases in the annual minimum rent. Our tenants are generally not obligated to request and we are not obligated to fund any such improvements. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for our hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such fundings, our contractual annual minimum returns or rents generally increase by a percentage of the amounts we fund. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Investment: We define hotel investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in minimum returns or rents. We define net lease investment as historical cost of our properties plus capital improvements funded by us less impairment write-downs, if any. Minimum Return/Rent: Each of our management agreements or leases with hotel operators provides for payment to us of an annual minimum return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees or security deposits. In addition, certain of our hotel management agreements provide for payment to us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed or secured by deposits. Each of our agreements with our net lease tenants provides for payment to us of minimum rent. Certain of these minimum payment amounts are secured by full or limited guarantees. Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to record scheduled rent changes under certain of our leases, the deferred rent obligations payable to us under our leases with TA and the estimated future payments to us under our TA leases for the cost of removing underground storage tanks at our travel centers on a straight line basis or any reimbursement of expenses paid by us. SMTA Transaction: On September 20, 2019, we acquired 767 net lease properties from Spirit MTA REIT, a Maryland REIT, (NYSE: SMTA), or SMTA, located in 45 states, for an aggregate transaction value of $2.5 billion. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 35

Warning Concerning Forward-looking Statements This supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “will,” “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon our forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. SERVICE PROPERTIES TRUST | Supplemental Operating and Financial Data, March 31, 2020 36