Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Magnolia Oil & Gas Corp | mgy-20200511xex99d1.htm |

| 8-K - 8-K - Magnolia Oil & Gas Corp | mgy-20200511x8k.htm |

Exhibit 99.2

| First Quarter 2020 Earnings Presentation May 11, 2020 Stephen I. Chazen – Chairman, President & CEO Christopher Stavros – Executive Vice President & CFO Brian Corales – Vice President, Investor Relations |

| Disclaimer 2 FORWARD LOOKING STATEMENTS The information in this presentation and the oral statements made in connection therewith include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this presentation, regarding Magnolia Oil & Gas Corporation’s (“Magnolia,” “we,” “us,” “our” or the “Company”) financial and production guidance, strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this presentation, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events. Except as otherwise required by applicable law, Magnolia disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Magnolia cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Magnolia, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids. In addition, Magnolia cautions you that the forward looking statements contained in this press release are subject to the following factors: (i) the length, scope and severity of the recent coronavirus disease 2019 (“COVID-19”) pandemic, and the impacts of the competition between Russia and Saudi Arabia for crude oil market share, including the effects of related public health concerns and the impact of actions taken by governmental authorities and other third parties in response to the pandemic and its impact on commodity prices, supply and demand considerations, and storage capacity; (ii) the outcome of any legal proceedings that may be instituted against Magnolia; (iii) Magnolia’s ability to realize the anticipated benefits of its business combination, which may be affected by, among other things, competition and the ability of Magnolia to grow and manage growth profitably; (iv) changes in applicable laws or regulations; and (v) the possibility that Magnolia may be adversely affected by other economic, business, and/or competitive factors. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Magnolia's operations and projections can be found in its filings with the Securities and Exchange Commission (the "SEC"), its Annual Report on Form 10-K for the fiscal year ended December 31, 2019 filed with the SEC on February 26, 2020. Magnolia’s SEC filings are available publicly on the SEC’s website at www.sec.gov. NON-GAAP FINANCIAL MEASURES This presentation includes non-GAAP financial measures, including free cash flow, EBITDAX, adjusted EBITDAX, cash operating margin, adjusted net income (loss), and adjusted earnings (loss). Magnolia believes these metrics are useful because they allow Magnolia to more effectively evaluate its operating performance and compare the results of its operations from period to period and against its peers without regard to financing methods or capital structure. Magnolia does not consider these non-GAAP measures in isolation or as an alternative to similar financial measures determined in accordance with GAAP. The computations of these non-GAAP measures may not be comparable to other similarly titled measures of other companies. Magnolia excludes certain items from net income in arriving at cash operating margin, adjusted net income (loss) and adjusted earnings (loss) because these amounts can vary substantially from company to company within its industry depending upon accounting methods, book values of assets and the method by which the assets were acquired. Adjusted EBITDAX, cash operating margin, adjusted net income (loss) and adjusted earnings (loss) should not be considered as alternatives to, or more meaningful than, net income (loss) as determined in accordance with GAAP. Certain items excluded from adjusted EBITDAX, cash operating margin, adjusted net income (loss), and adjusted earnings (loss) are significant components in understanding and assessing a company’s financial performance, and should not be construed as an inference that its results will be unaffected by unusual or non-recurring terms. As performance measures, cash operating margin, adjusted EBITDAX and adjusted net income (loss) may be useful to investors in facilitating comparisons to others in the Company’s industry because certain items can vary substantially in the oil and gas industry from company to company depending upon accounting methods, book value of assets, and capital structure, among other factors. Management believes excluding these items facilitates investors and analysts in evaluating and comparing the underlying operating and financial performance of our business from period to period by eliminating differences caused by the existence and timing of certain expense and income items that would not otherwise be apparent on a GAAP basis. As liquidity measures, management believes free cash flow and cash flows from operations before changes in operating assets and liabilities are useful for investors and widely accepted by those following the oil and gas industry as financial indicators of a company’s ability to generate cash to internally fund drilling and completion activities, fund acquisitions, and service debt. Our presentation of free cash flow, cash operating margin, adjusted net income (loss), and adjusted EBITDAX may not be comparable to similar measures of other companies in our industry. A free cash flow reconciliation is shown on page 12, a cash operating margin reconciliation is shown on page 6 of the presentation, an adjusted EBITDAX reconciliation is shown on page 13 of the presentation, adjusted net Income (loss) reconciliation is shown on page 15 and adjusted earnings (loss) reconciliation is shown on page 16. INDUSTRY AND MARKET DATA This presentation has been prepared by Magnolia and includes market data and other statistical information from sources believed by Magnolia to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Magnolia, which are derived from its review of internal sources as well as the independent sources described above. Although Magnolia believes these sources are reliable, it has not independently verified the information and cannot guarantee its accuracy and completeness. |

| Magnolia Oil & Gas – First Quarter 2020 Highlights 3 • Generated $134.9 million net cash flow from operating activities and $23.3 million of free cash flow in 1Q20. • Ended the first quarter of 2020 with $146.5 million of cash on the balance sheet and an undrawn $450 million revolver providing MGY with ~$600 million of liquidity. • MGY has enough cash on hand today to more than pay for the remaining Capex, overhead and interest expense at least through the remainder of 2020, before considering the revenue from production. • Magnolia has identified cash cost savings during 2020 of ~$55 million compared to the original budget. The reduction is generated from operating costs and general and administrative expenses. • Increased total production 10% and oil production 15% compared to 1Q19. Oil production made up 55% of total company volumes. • Further de-risked our Giddings asset, brought 4 new wells online during the quarter with an average 60-day oil rate of 800 barrels of oil per day. Lowered Giddings wells costs 20% to ~$7 million. • Total cash operating costs including G&A were $9.42/boe, a 14% decline compared to $11.00/boe in the first quarter of 2019. |

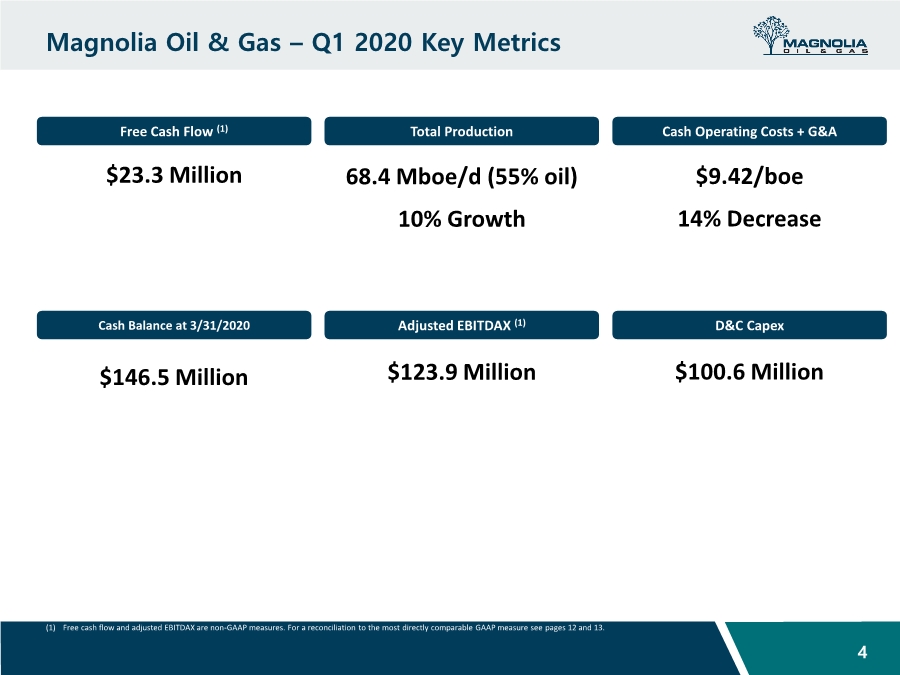

| Magnolia Oil & Gas – Q1 2020 Key Metrics 4 Free Cash Flow (1) Total Production 68.4 Mboe/d (55% oil) 10% Growth Cash Balance at 3/31/2020 $146.5 Million Adjusted EBITDAX (1) $123.9 Million D&C Capex $100.6 Million Cash Operating Costs + G&A $9.42/boe 14% Decrease (1) Free cash flow and adjusted EBITDAX are non-GAAP measures. For a reconciliation to the most directly comparable GAAP measure see pages 12 and 13. $23.3 Million |

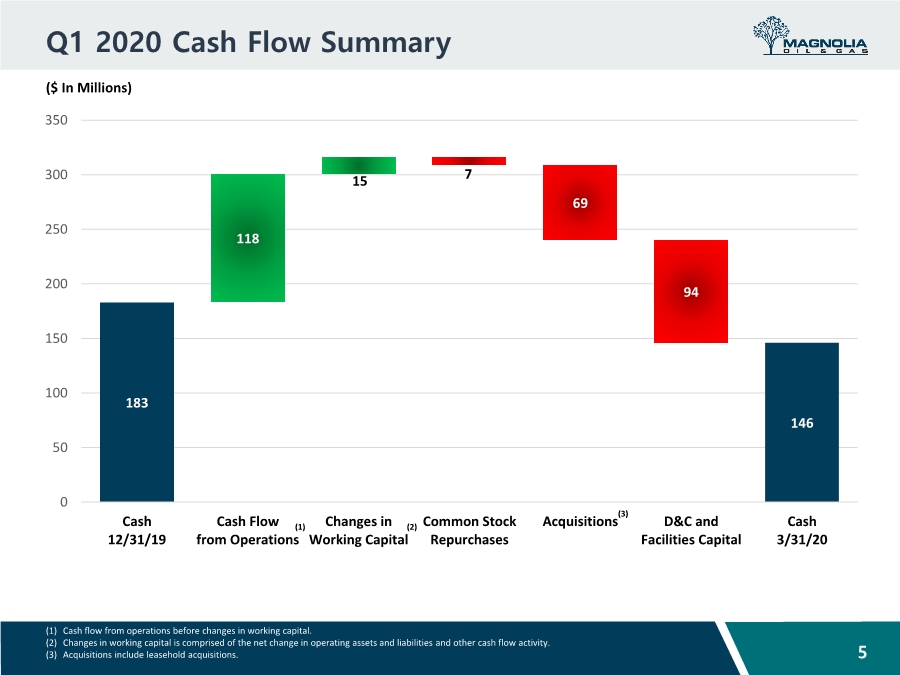

| Q1 2020 Cash Flow Summary 183 118 15 7 69 94 146 0 50 100 150 200 250 300 350 Cash 12/31/19 Cash Flow from Operations Changes in Working Capital Common Stock Repurchases Acquisitions D&C and Facilities Capital Cash 3/31/20 (1) (3) (2) 5 ($ In Millions) (1) Cash flow from operations before changes in working capital. (2) Changes in working capital is comprised of the net change in operating assets and liabilities and other cash flow activity. (3) Acquisitions include leasehold acquisitions. |

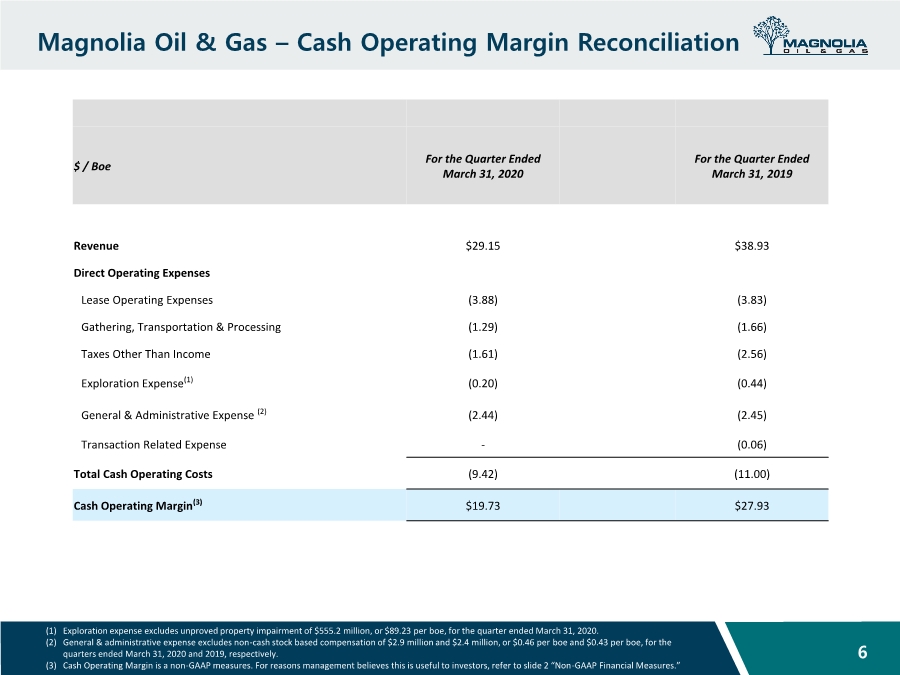

| Magnolia Oil & Gas – Cash Operating Margin Reconciliation 6 (1) Exploration expense excludes unproved property impairment of $555.2 million, or $89.23 per boe, for the quarter ended March 31, 2020. (2) General & administrative expense excludes non-cash stock based compensation of $2.9 million and $2.4 million, or $0.46 per boe and $0.43 per boe, for the quarters ended March 31, 2020 and 2019, respectively. (3) Cash Operating Margin is a non-GAAP measures. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” $ / Boe For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 Revenue $29.15 $38.93 Direct Operating Expenses Lease Operating Expenses (3.88) (3.83) Gathering, Transportation & Processing (1.29) (1.66) Taxes Other Than Income (1.61) (2.56) Exploration Expense(1) (0.20) (0.44) General & Administrative Expense (2) (2.44) (2.45) Transaction Related Expense -(0.06) Total Cash Operating Costs (9.42) (11.00) Cash Operating Margin(3) $19.73 $27.93 |

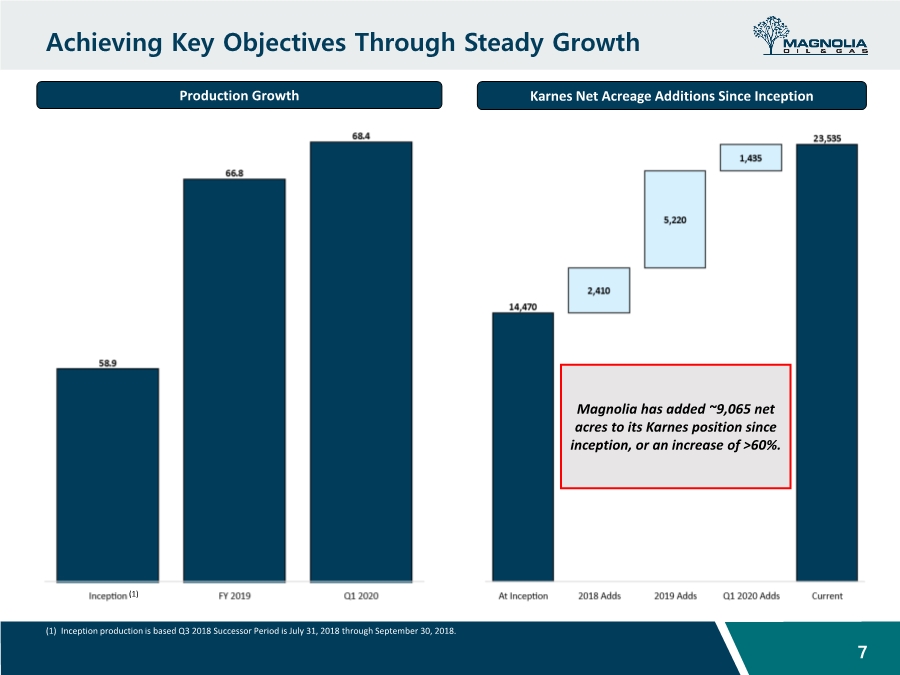

| 7 Karnes Net Acreage Additions Since Inception Magnolia has added ~9,065 net acres to its Karnes position since inception, or an increase of >60%. Achieving Key Objectives Through Steady Growth Production Growth (1) Inception production is based Q3 2018 Successor Period is July 31, 2018 through September 30, 2018. (1) |

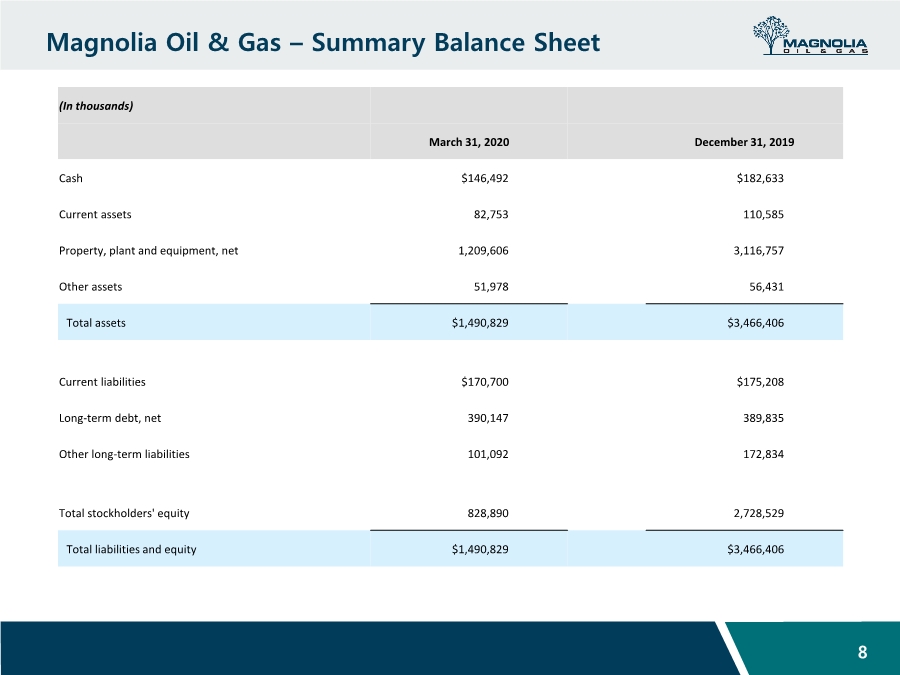

| Magnolia Oil & Gas – Summary Balance Sheet 8 (In thousands) March 31, 2020 December 31, 2019 Cash $146,492 $182,633 Current assets 82,753 110,585 Property, plant and equipment, net 1,209,606 3,116,757 Other assets 51,978 56,431 Total assets $1,490,829 $3,466,406 Current liabilities $170,700 $175,208 Long-term debt, net 390,147 389,835 Other long-term liabilities 101,092 172,834 Total stockholders' equity 828,890 2,728,529 Total liabilities and equity $1,490,829 $3,466,406 |

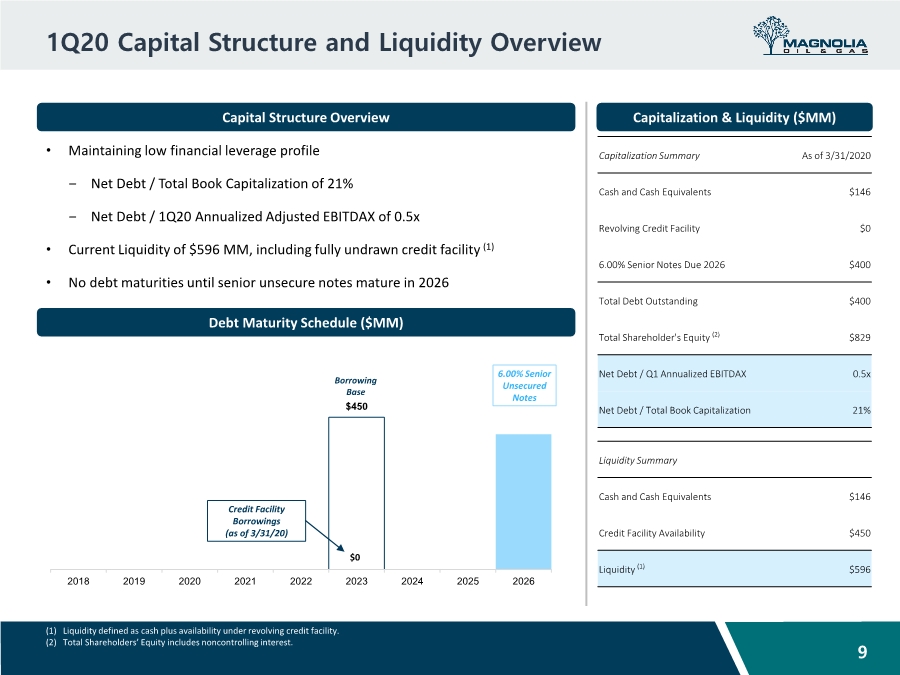

| 1Q20 Capital Structure and Liquidity Overview 9 Capital Structure Overview • Maintaining low financial leverage profile ‒ Net Debt / Total Book Capitalization of 21% ‒ Net Debt / 1Q20 Annualized Adjusted EBITDAX of 0.5x • Current Liquidity of $596 MM, including fully undrawn credit facility (1) • No debt maturities until senior unsecure notes mature in 2026 Debt Maturity Schedule ($MM) Borrowing Base Credit Facility Borrowings (as of 3/31/20) $0 $450 2018 2019 2020 2021 2022 2023 2024 2025 2026 6.00% Senior Unsecured Notes (1) Liquidity defined as cash plus availability under revolving credit facility. (2) Total Shareholders’ Equity includes noncontrolling interest. Capitalization & Liquidity ($MM) Capitalization Summary As of 3/31/2020 Cash and Cash Equivalents $146 Revolving Credit Facility $0 6.00% Senior Notes Due 2026 $400 Total Debt Outstanding $400 Total Shareholder's Equity (2) $829 Net Debt / Q1 Annualized EBITDAX 0.5x Net Debt / Total Book Capitalization 21% Liquidity Summary Cash and Cash Equivalents $146 Credit Facility Availability $450 Liquidity (1) $596 |

| Appendix |

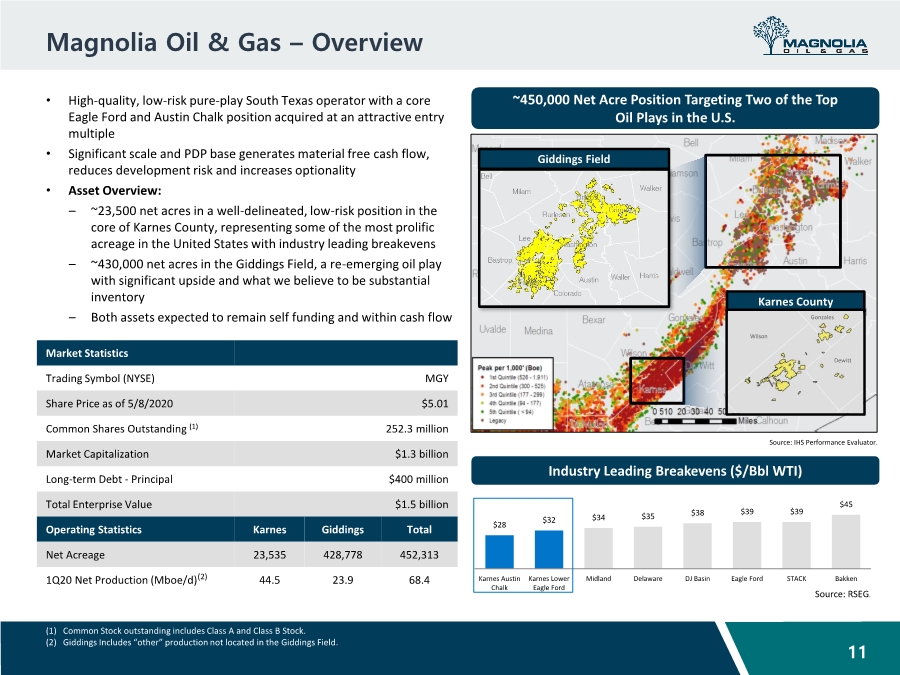

| Magnolia Oil & Gas – Overview • High-quality, low-risk pure-play South Texas operator with a core Eagle Ford and Austin Chalk position acquired at an attractive entry multiple • Significant scale and PDP base generates material free cash flow, reduces development risk and increases optionality • Asset Overview: – ~23,500 net acres in a well-delineated, low-risk position in the core of Karnes County, representing some of the most prolific acreage in the United States with industry leading breakevens – ~430,000 net acres in the Giddings Field, a re-emerging oil play with significant upside and what we believe to be substantial inventory – Both assets expected to remain self funding and within cash flow 11 Karnes County Giddings Field ~450,000 Net Acre Position Targeting Two of the Top Oil Plays in the U.S. Market Statistics Trading Symbol (NYSE) MGY Share Price as of 5/8/2020 $5.01 Common Shares Outstanding (1) 252.3 million Market Capitalization $1.3 billion Long-term Debt - Principal $400 million Total Enterprise Value $1.5 billion Operating Statistics Karnes Giddings Total Net Acreage 23,535 428,778 452,313 1Q20 Net Production (Mboe/d) 44.5 23.9 68.4 Industry Leading Breakevens ($/Bbl WTI) Source: IHS Performance Evaluator. $28 $32 $34 $35 $38 $39 $39 $45 Karnes Austin Chalk Karnes Lower Eagle Ford Midland Delaware DJ Basin Eagle Ford STACK Bakken Source: RSEG. Wilson Dewitt Gonzales (1) Common Stock outstanding includes Class A and Class B Stock. (2) Giddings Includes “other” production not located in the Giddings Field. (2) |

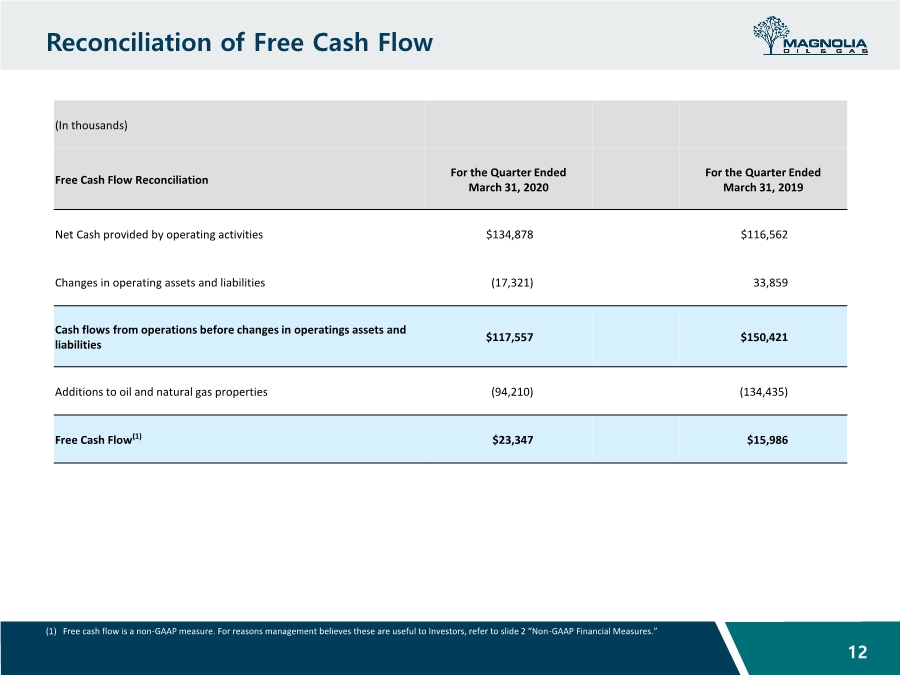

| Reconciliation of Free Cash Flow 12 (1) Free cash flow is a non-GAAP measure. For reasons management believes these are useful to Investors, refer to slide 2 “Non-GAAP Financial Measures.” (In thousands) Free Cash Flow Reconciliation For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 Net Cash provided by operating activities $134,878 $116,562 Changes in operating assets and liabilities (17,321) 33,859 Cash flows from operations before changes in operatings assets and liabilities $117,557 $150,421 Additions to oil and natural gas properties (94,210) (134,435) Free Cash Flow(1) $23,347 $15,986 |

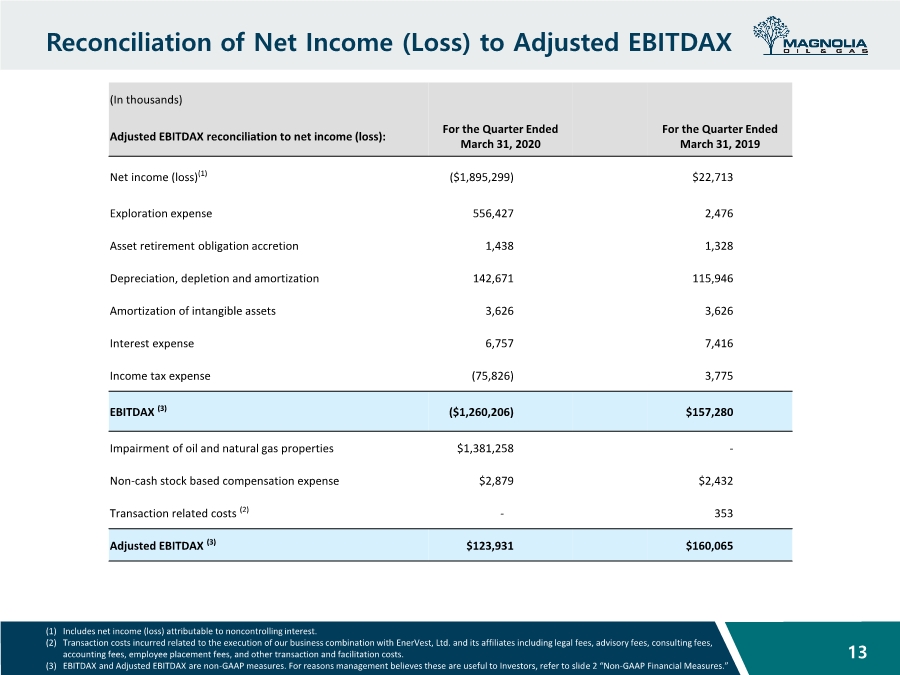

| Reconciliation of Net Income (Loss) to Adjusted EBITDAX 13 (1) Includes net income (loss) attributable to noncontrolling interest. (2) Transaction costs incurred related to the execution of our business combination with EnerVest, Ltd. and its affiliates including legal fees, advisory fees, consulting fees, accounting fees, employee placement fees, and other transaction and facilitation costs. (3) EBITDAX and Adjusted EBITDAX are non-GAAP measures. For reasons management believes these are useful to Investors, refer to slide 2 “Non-GAAP Financial Measures.” (In thousands) Adjusted EBITDAX reconciliation to net income (loss): For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 Net income (loss)(1) ($1,895,299) $22,713 Exploration expense 556,427 2,476 Asset retirement obligation accretion 1,438 1,328 Depreciation, depletion and amortization 142,671 115,946 Amortization of intangible assets 3,626 3,626 Interest expense 6,757 7,416 Income tax expense (75,826) 3,775 EBITDAX (3) ($1,260,206) $157,280 Impairment of oil and natural gas properties $1,381,258 - Non-cash stock based compensation expense $2,879 $2,432 Transaction related costs (2) - 353 Adjusted EBITDAX (3) $123,931 $160,065 |

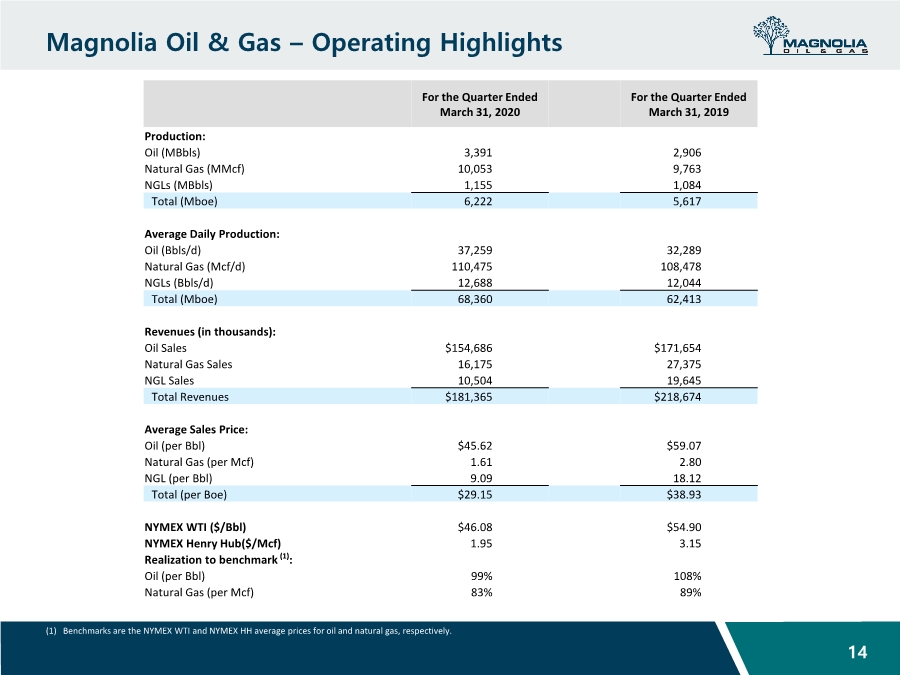

| Magnolia Oil & Gas – Operating Highlights 14 (1) Benchmarks are the NYMEX WTI and NYMEX HH average prices for oil and natural gas, respectively. For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 Production: Oil (MBbls) 3,391 2,906 Natural Gas (MMcf) 10,053 9,763 NGLs (MBbls) 1,155 1,084 Total (Mboe) 6,222 5,617 Average Daily Production: Oil (Bbls/d) 37,259 32,289 Natural Gas (Mcf/d) 110,475 108,478 NGLs (Bbls/d) 12,688 12,044 Total (Mboe) 68,360 62,413 Revenues (in thousands): Oil Sales $154,686 $171,654 Natural Gas Sales 16,175 27,375 NGL Sales 10,504 19,645 Total Revenues $181,365 $218,674 Average Sales Price: Oil (per Bbl) $45.62 $59.07 Natural Gas (per Mcf) 1.61 2.80 NGL (per Bbl) 9.09 18.12 Total (per Boe) $29.15 $38.93 NYMEX WTI ($/Bbl) $46.08 $54.90 NYMEX Henry Hub($/Mcf) 1.95 3.15 Realization to benchmark (1): Oil (per Bbl) 99% 108% Natural Gas (per Mcf) 83% 89% |

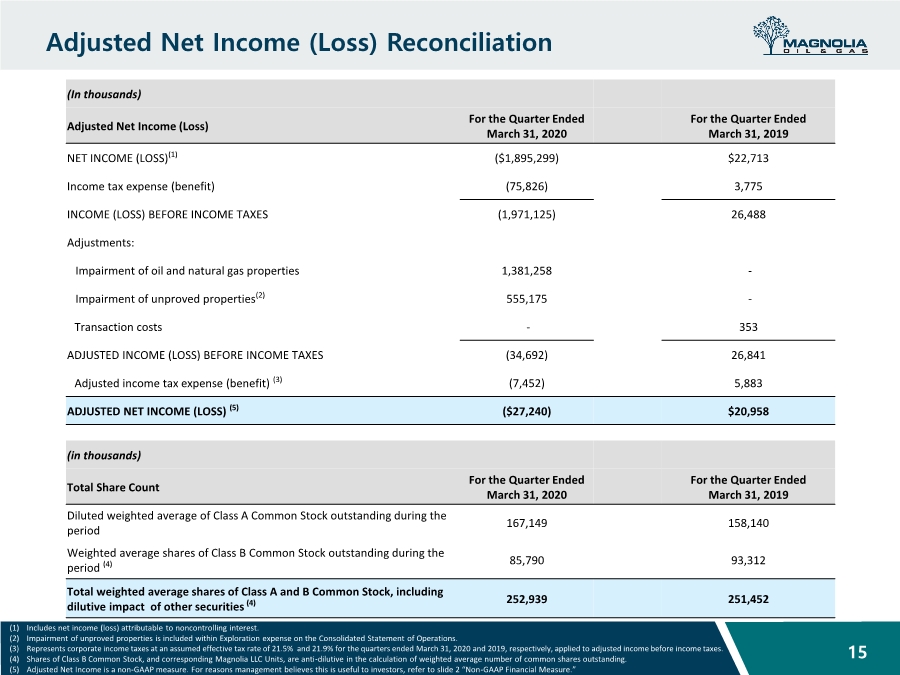

| Adjusted Net Income (Loss) Reconciliation 15 (1) Includes net income (loss) attributable to noncontrolling interest. (2) Impairment of unproved properties is included within Exploration expense on the Consolidated Statement of Operations. (3) Represents corporate income taxes at an assumed effective tax rate of 21.5% and 21.9% for the quarters ended March 31, 2020 and 2019, respectively, applied to adjusted income before income taxes. (4) Shares of Class B Common Stock, and corresponding Magnolia LLC Units, are anti-dilutive in the calculation of weighted average number of common shares outstanding. (5) Adjusted Net Income is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measure.” (In thousands) Adjusted Net Income (Loss) For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 NET INCOME (LOSS)(1) ($1,895,299) $22,713 Income tax expense (benefit) (75,826) 3,775 INCOME (LOSS) BEFORE INCOME TAXES (1,971,125) 26,488 Adjustments: Impairment of oil and natural gas properties 1,381,258 - Impairment of unproved properties(2) 555,175 - Transaction costs - 353 ADJUSTED INCOME (LOSS) BEFORE INCOME TAXES (34,692) 26,841 Adjusted income tax expense (benefit) (3) (7,452) 5,883 ADJUSTED NET INCOME (LOSS) (5) ($27,240) $20,958 (in thousands) Total Share Count For the Quarter Ended March 31, 2020 For the Quarter Ended March 31, 2019 Diluted weighted average of Class A Common Stock outstanding during the period 167,149 158,140 Weighted average shares of Class B Common Stock outstanding during the period (4) 85,790 93,312 Total weighted average shares of Class A and B Common Stock, including dilutive impact of other securities (4) 252,939 251,452 |

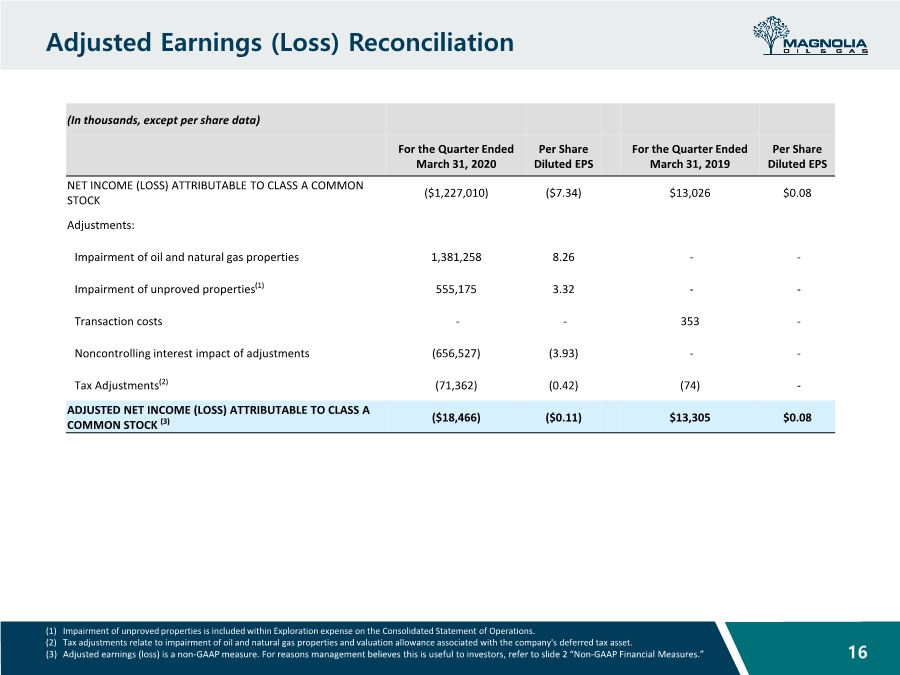

| Adjusted Earnings (Loss) Reconciliation 16 (1) Impairment of unproved properties is included within Exploration expense on the Consolidated Statement of Operations. (2) Tax adjustments relate to impairment of oil and natural gas properties and valuation allowance associated with the company's deferred tax asset. (3) Adjusted earnings (loss) is a non-GAAP measure. For reasons management believes this is useful to investors, refer to slide 2 “Non-GAAP Financial Measures.” (In thousands, except per share data) For the Quarter Ended March 31, 2020 Per Share Diluted EPS For the Quarter Ended March 31, 2019 Per Share Diluted EPS NET INCOME (LOSS) ATTRIBUTABLE TO CLASS A COMMON STOCK ($1,227,010) ($7.34) $13,026 $0.08 Adjustments: Impairment of oil and natural gas properties 1,381,258 8.26 -- Impairment of unproved properties(1) 555,175 3.32 -- Transaction costs -- 353 - Noncontrolling interest impact of adjustments (656,527) (3.93) -- Tax Adjustments(2) (71,362) (0.42) (74) - ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO CLASS A COMMON STOCK (3) ($18,466) ($0.11) $13,305 $0.08 |

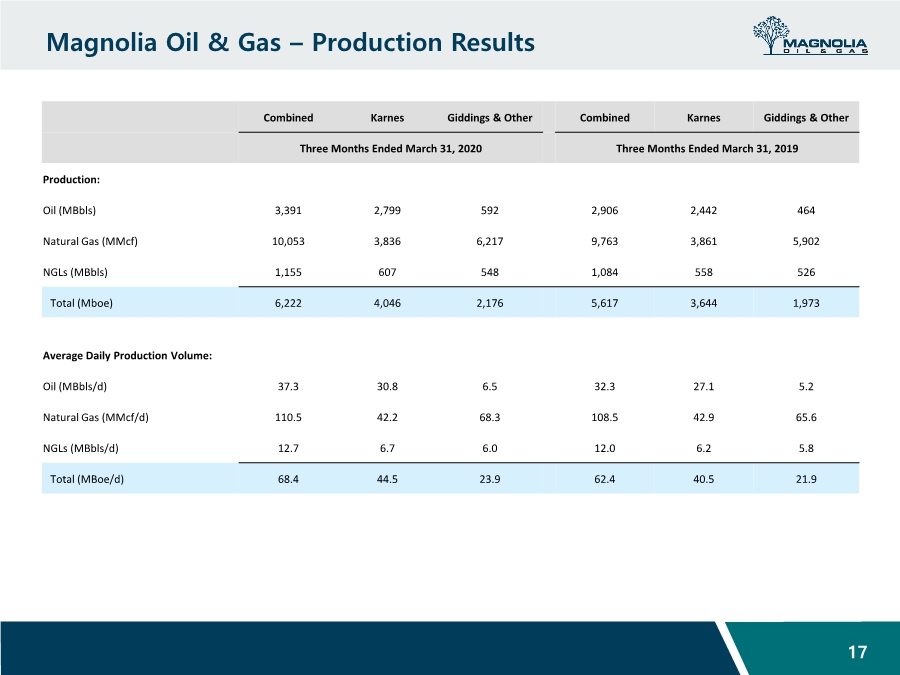

| Magnolia Oil & Gas – Production Results 17 Combined Karnes Giddings & Other Combined Karnes Giddings & Other Three Months Ended March 31, 2020 Three Months Ended March 31, 2019 Production: Oil (MBbls) 3,391 2,799 592 2,906 2,442 464 Natural Gas (MMcf) 10,053 3,836 6,217 9,763 3,861 5,902 NGLs (MBbls) 1,155 607 548 1,084 558 526 Total (Mboe) 6,222 4,046 2,176 5,617 3,644 1,973 Average Daily Production Volume: Oil (MBbls/d) 37.3 30.8 6.5 32.3 27.1 5.2 Natural Gas (MMcf/d) 110.5 42.2 68.3 108.5 42.9 65.6 NGLs (MBbls/d) 12.7 6.7 6.0 12.0 6.2 5.8 Total (MBoe/d) 68.4 44.5 23.9 62.4 40.5 21.9 |