Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL AGRICULTURAL MORTGAGE CORP | agm-20200511.htm |

| EX-99.1 - EX-99.1 - FEDERAL AGRICULTURAL MORTGAGE CORP | a2020q1pressrelease.htm |

First Quarter 2020 Equity Investor Presentation

FARM ER M AC Forward-Looking Statements In addition to historical information, this presentation includes forward- NO OFFER OR SOLICITATION OF SECURITIES looking statements that reflect management’s current expectations for This presentation does not constitute an offer to sell or a solicitation of Farmer Mac’s future financial results, business prospects, and business an offer to buy any Farmer Mac security. Farmer Mac securities are developments. Forward-looking statements include, without limitation, offered only in jurisdictions where permissible by offering documents any statement that may predict, forecast, indicate, or imply future available through qualified securities dealers. Any investor who is results, performance, or achievements. Management’s expectations for considering purchasing a Farmer Mac security should consult the Farmer Mac’s future necessarily involve assumptions, estimates, and applicable offering documents for the security and their own financial the evaluation of risks and uncertainties. Various factors or events, both and legal advisors for information about and analysis of the security, the known and unknown, could cause Farmer Mac’s actual results to differ risks associated with the security, and the suitability of the investment materially from the expectations as expressed or implied by the forward- for the investor’s particular circumstances. looking statements. Some of these factors are identified and discussed in Farmer Mac’s Annual Report on Form 10-K for the year ended Copyright © 2020 by Farmer Mac. No part of this document may be December 31, 2019, filed with the U.S. Securities and Exchange duplicated, reproduced, distributed, or displayed in public in any manner Commission (“SEC”) on February 25, 2020 and Farmer Mac’s Quarterly or by any means without the written permission of Farmer Mac. Report on Form 10-Q for the quarter ended March 31,2020, filed with the SEC on May 11, 2020. These reports are also available on Farmer Mac’s website (www.farmermac.com). Considering these potential risks and uncertainties, no undue reliance should be placed on any forward- looking statements expressed in this presentation. Any forward-looking statements made in this presentation are current only as of March 31, 2020, except as otherwise indicated. Farmer Mac undertakes no obligation to release publicly the results of revisions to any such forward-looking statements that may be made to reflect new information or any future events or circumstances, except as otherwise mandated by the SEC. The information in this presentation is not necessarily indicative of future results. 02

FARM ER M AC Use of Non-GAAP Financial Measures This presentation is for general informational purposes only, is current Core earnings and core earnings per share also differ from net income only as of March 31, 2020, and should be read in conjunction with attributable to common stockholders and earnings per common share, Farmer Mac’s Annual Report on Form 10-K filed with the SEC on respectively, by excluding specified infrequent or unusual transactions February 25, 2020. In the accompanying analysis of its financial that Farmer Mac believes are not indicative of future operating results and information, Farmer Mac uses the following non-GAAP financial that may not reflect the trends and economic financial performance of measures: core earnings, core earnings per share, and net effective Farmer Mac's core business. spread. Farmer Mac uses these non-GAAP measures to measure Farmer Mac uses net effective spread to measure the net spread Farmer corporate economic performance and develop financial plans because, Mac earns between its interest-earning assets and the related net funding in management's view, they are useful alternative measures in costs of these assets. Net effective spread differs from net interest understanding Farmer Mac's economic performance, transaction income and net interest yield because it excludes: (1) the amortization of economics, and business trends. The non-GAAP financial measures premiums and discounts on assets consolidated at fair value that are that Farmer Mac uses may not be comparable to similarly labeled non- amortized as adjustments to yield in interest income over the contractual GAAP financial measures disclosed by other companies. Farmer Mac's or estimated remaining lives of the underlying assets; (2) interest income disclosure of these non-GAAP financial measures is intended to be and interest expense related to consolidated trusts with beneficial supplemental in nature and is not meant to be considered in isolation interests owned by third parties, which are presented on Farmer Mac's from, as a substitute for, or as more important than, the related financial consolidated balance sheets as “Loans held for investment in information prepared in accordance with GAAP. consolidated trusts, at amortized cost;” and (3) beginning January 1, Core earnings and core earnings per share principally differ from net 2018, the fair value changes of financial derivatives and the corresponding income attributable to common stockholders and earnings per assets and liabilities designated in a fair value hedge relationship. Net common share, respectively, by excluding the effects of fair value effective spread also principally differs from net interest income and net fluctuations. These fluctuations are not expected to have a cumulative interest yield because it includes: (1) the accrual of income and expense net impact on Farmer Mac's financial condition or results of operations related to the contractual amounts due on financial derivatives that are not reported in accordance with GAAP if the related financial instruments designated in hedge relationships; and (2) effective in fourth quarter 2017, are held to maturity, as is expected. the net effects of terminations or net settlements on financial derivatives. 03

FARM ER M AC Investment Highlights •90-Day delinquencies of only 0.37% across all lines of business Quality Assets •Cumulative Farm & Ranch lifetime losses of only 0.12% •Issue at narrow, GSE spreads to U.S. Treasuries Funding Advantage •E.g., 10-year U.S. Treasury +1.02% •Ag productivity must double to meet expected global demand Growth Prospects •6.5% share of an ~$245 billion and growing U.S. ag mortgage market •Overhead / outstanding business volume ~20 bps Operational Efficiency •~$900,000 earnings per employee in 2019 Quality, Recurring •99% of total revenues is recurring net effective spread and fees Earnings •Outstanding business volume CAGR of 10.6% (2000 to 2019) Strong Returns, •Core earnings ROE ~17% in 2019 Responsible Growth •Double-digit annual core earnings growth (2016-2019) 04

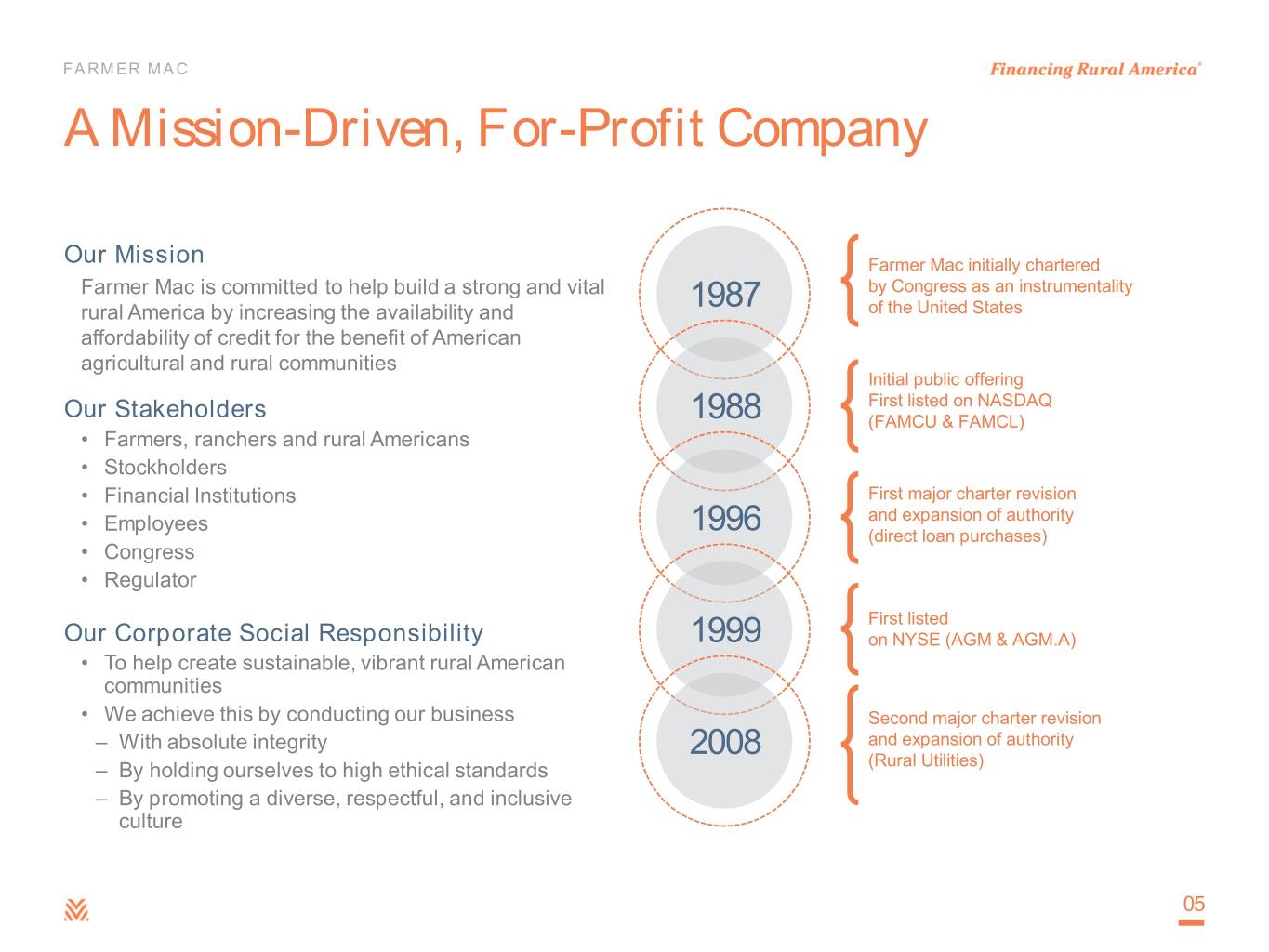

FARM ER M AC A Mission-Driven, For-Profit Company Our Mission Farmer Mac initially chartered Farmer Mac is committed to help build a strong and vital by Congress as an instrumentality rural America by increasing the availability and 1987 of the United States affordability of credit for the benefit of American agricultural and rural communities Initial public offering Our Stakeholders First listed on NASDAQ 1988 (FAMCU & FAMCL) • Farmers, ranchers and rural Americans • Stockholders • Financial Institutions First major charter revision • Employees and expansion of authority 1996 (direct loan purchases) • Congress • Regulator First listed Our Corporate Social Responsibility 1999 on NYSE (AGM & AGM.A) • To help create sustainable, vibrant rural American communities • We achieve this by conducting our business Second major charter revision – With absolute integrity 2008 and expansion of authority – By holding ourselves to high ethical standards (Rural Utilities) – By promoting a diverse, respectful, and inclusive culture 05

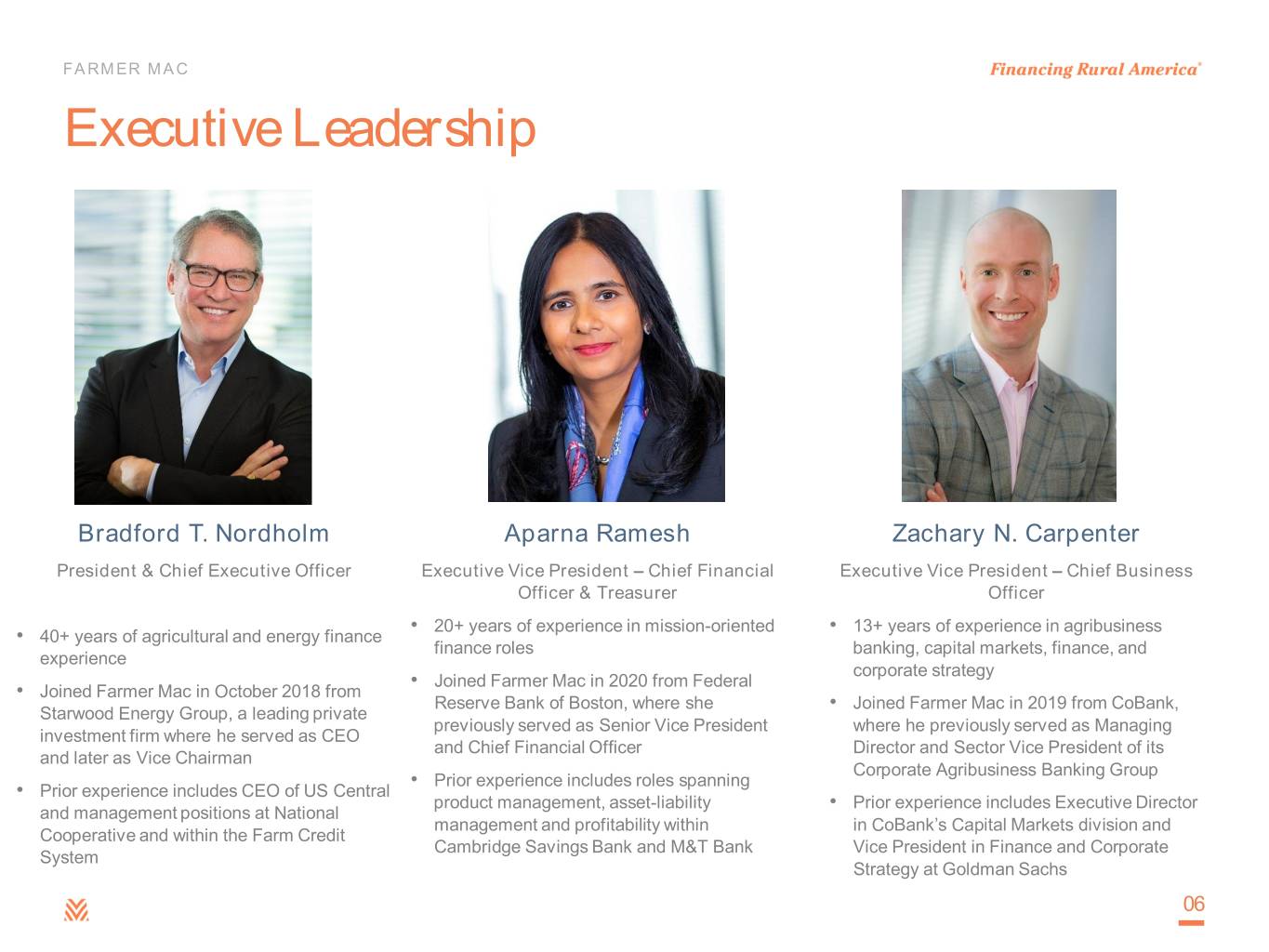

FARM ER M AC Executive Leadership Bradford T. Nordholm Aparna Ramesh Zachary N. Carpenter President & Chief Executive Officer Executive Vice President – Chief Financial Executive Vice President – Chief Business Officer & Treasurer Officer • 20+ years of experience in mission-oriented • 13+ years of experience in agribusiness • 40+ years of agricultural and energy finance finance roles banking, capital markets, finance, and experience corporate strategy • Joined Farmer Mac in 2020 from Federal • Joined Farmer Mac in October 2018 from Reserve Bank of Boston, where she • Joined Farmer Mac in 2019 from CoBank, Starwood Energy Group, a leading private previously served as Senior Vice President where he previously served as Managing investment firm where he served as CEO and Chief Financial Officer Director and Sector Vice President of its and later as Vice Chairman Corporate Agribusiness Banking Group • Prior experience includes roles spanning • Prior experience includes CEO of US Central product management, asset-liability • Prior experience includes Executive Director and management positions at National management and profitability within in CoBank’s Capital Markets division and Cooperative and within the Farm Credit Cambridge Savings Bank and M&T Bank Vice President in Finance and Corporate System Strategy at Goldman Sachs 06

FARM ER M AC U.S. Agricultural Balance Sheet (1) $ IN THOUSANDS $3,026,678,330 $3,000,000,000 Machinery & Vehicles, $270,982,438 $2,500,000,000 $2,000,000,000 Ag Real Estate Debt-to-Asset Ratio: Real Estate 9.8% $1,500,000,000 $2,510,163,458 $ in thousands $ in $1,000,000,000 Farmer Mac Market Share: 6.5% $500,000,000 $401,992,481 Non-Real Estate, $156,329,378 Inventories, $172,948,969 Real Estate, $245,663,103 $16,072,039 $0 Investments, $72,583,465 (2) Farm Sector Assets Farm Sector Debt Farmer Mac 07

FARM ER M AC Central to a Large Addressable Ag Mortgage Market (3) (4) (FCS Secondary Market GSE) $16.1 Billion (6.5% Market Share) Loan Purchase Wholesale Funding Credit Protection Farm Credit System Non-FCS Ag (FCS) Lenders (Cooperative GSE) BANKS AG Addressable • Insurance$61B Companies • Four FCS Banks Agriculture Mortgage Mortgage Market Mortgage • Ag Banks Financing Financing • 68 Retail Agricultural $246 Billion(4) Credit Associations • Non-Bank Lenders NON {Farmers & Ranchers} LENDERS $13B - BANK 08

FARM ER M AC Growth Opportunities Broaden Farmer Mac’s Market = Relative Size Evaluating opportunities not of Volume Opportunity currently being pursued by Farmer Renewable Mac Energy Project Finance • New lines of business = Broaden • New products Securitization Deepen Farmer Mac’s Market Syndications = Deepen Improving processes and operating practices • Customer interaction = Both • Transaction processes Loan • Existing loan features and pricing Process Rural Improvement Broadband Broaden Broaden Mac’s Farmer Market Timber Borrower Retention Deepen Farmer Mac’s Market 09

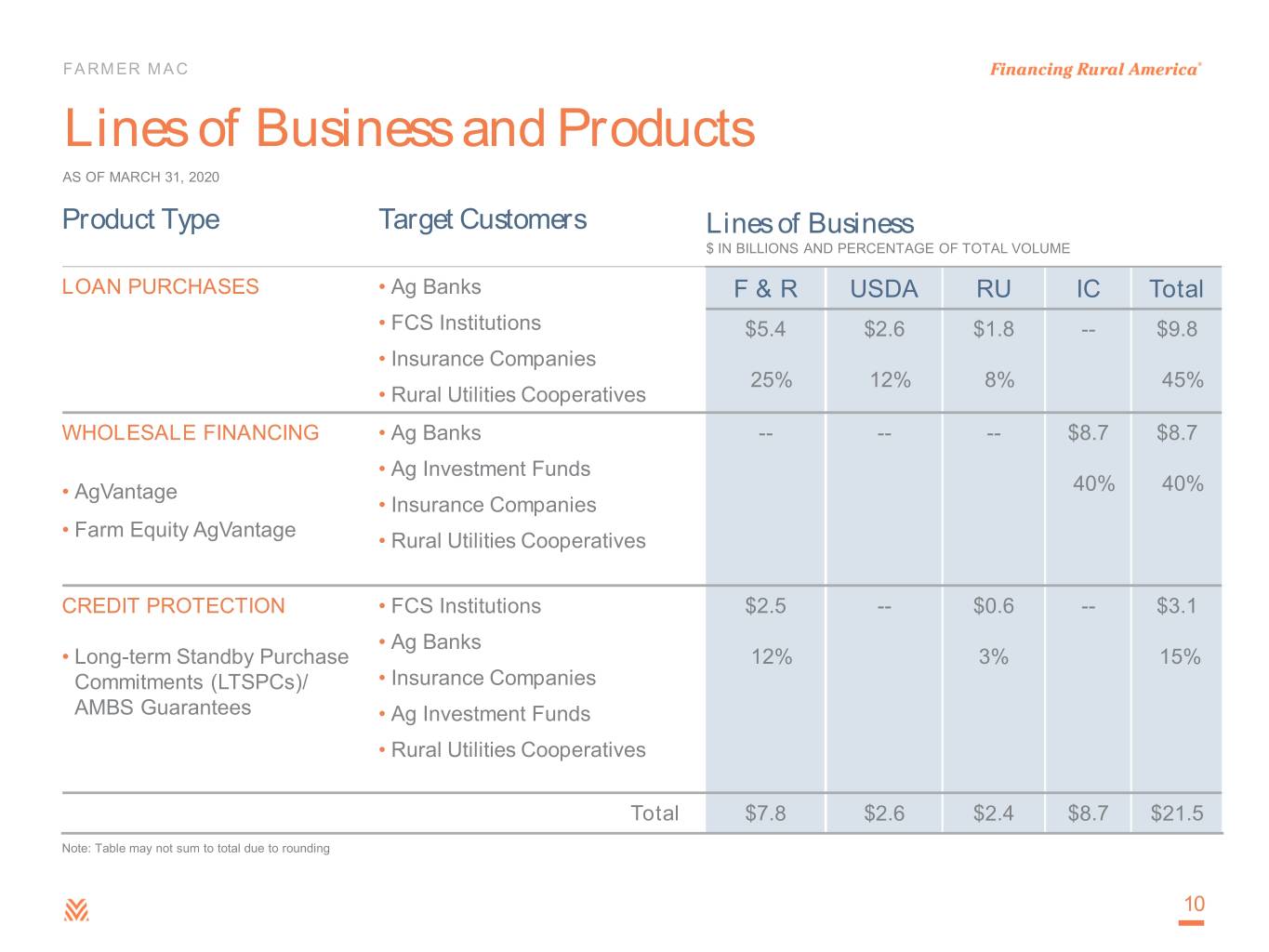

FARM ER M AC Lines of Business and Products AS OF MARCH 31, 2020 Product Type Target Customers Lines of Business $ IN BILLIONS AND PERCENTAGE OF TOTAL VOLUME LOAN PURCHASES • Ag Banks F & R USDA RU IC Total • FCS Institutions $5.4 $2.6 $1.8 -- $9.8 • Insurance Companies 25% 12% 8% 45% • Rural Utilities Cooperatives WHOLESALE FINANCING • Ag Banks -- -- -- $8.7 $8.7 • Ag Investment Funds • AgVantage 40% 40% • Insurance Companies • Farm Equity AgVantage • Rural Utilities Cooperatives CREDIT PROTECTION • FCS Institutions $2.5 -- $0.6 -- $3.1 • Ag Banks • Long-term Standby Purchase 12% 3% 15% Commitments (LTSPCs)/ • Insurance Companies AMBS Guarantees • Ag Investment Funds • Rural Utilities Cooperatives Total $7.8 $2.6 $2.4 $8.7 $21.5 Note: Table may not sum to total due to rounding 10

FARM ER M AC Growing, Recurring, High-Quality Earnings Outstanding Business Volume $20.0 $15.0 6.7% CAGR (2016-2019) $10.0 $ $ BILLIONS IN $5.0 $17.4 $19.0 $19.7 $21.1 $21.5 $0.0 2016 2017 2018 2019 1Q20 Outstanding Business Volume Net Effective Spread & Core Earnings 11.1% CAGR 20.6% CAGR $180.0 (2016-2019) (2016-2019) $100.0 $160.0 EARNINGS CORE $140.0 $80.0 IN MILLIONS$ $120.0 $100.0 $60.0 $80.0 $40.0 $60.0 $ $ MILLIONS IN $40.0 $20.0 $20.0 $123.1 $53.5 $141.3 $65.6 $151.2 $84.0 $168.6 $93.7 $44.2 $20.1 NETEFFECTIVE SPREAD $0.0 $0.0 2016 2017 2018 2019 1Q20 Net Effective Spread Core Earnings Core earnings and net effective spread are non-GAAP measures. For more information on the use of these non-GAAP measures, please see page 3. 11 For a reconciliation of core earnings to GAAP net income attributable to common stockholders and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 23-24 of the Appendix.

FARM ER M AC Proven, Rigorous Underwriting Industry-leading Credits are less Losses less likely credit requirements likely to default even in default – Total debt coverage ratio – Focus on repayment – Average LTV of 45% as of at least 1.25x capacity through of March 31, 2020 stressed inputs – LTVs average 40% to – Land values need to 45% on mortgages – Not a “lender of last decline >49% to purchased resort” generate losses – Minimum borrower net – Farm Credit – “Stress scenario” losses equity of 50% Administration is our of 17% to 48% safety and soundness regulator – 1980s crisis saw land value declines of ~23% (5) 12

FARM ER M AC Credit Consistently Outperforms 90-Day Delinquencies 2.50% 2.00% 1.50% 1.12% 1.02% 1.00% 0.37% 0.50% 0.00% FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 1Q20 Industry 90-Day Delinquencies(6) Farmer Mac 90-Day Delinquencies (Farm & Ranch Portfolio Only) (7) Farmer Mac 90-Day Delinquences (Total Portfolio) Agricultural Lender Charge-off Rates 0.60% Banks 0.50% Average 0.19% All Commercial Banks (8) 0.40% Loans and Leases Farm Credit System Average 0.96% Average 0.11% 0.30% Farmer Mac 0.20% Average 0.02% OFFS AS OF % ASSETS - 0.10% CHARGE 0.00% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 -0.10% 13 Banks(8) (9) Farm Credit System(10) Farmer Mac(11)

FARM ER M AC Historical Credit Losses Ag Storage & Processing Crops Permanent Plantings Livestock Part-Time Farm / Rural Housing $12 $10 $8 $6 $ $ MILLIONS IN NET LOSS / (GAIN) $4 $2 $0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 -$2 & Prior BY YEAR OF ORIGINATION Farm & Ranch line of business has historical cumulative losses of 0.13%, or less than 1bp per year • Cumulative F&R losses of $33 million on $27 billion of cumulative F&R historical business volume Farmer Mac’s Rural Utilities, USDA Guarantees, and Institutional Credit lines of business have not had any credit losses to date 14

FARM ER M AC Strong and Growing Equity Capital Base $815 $815 25.0% $800 $728 $197 $166 $657 20.0% $610 $183 $600 $137 $143 13.4% 15.0% 12.9% 12.6% $400 12.7% 12.6% $ $ MILLIONS IN CORE CAPITAL 10.0% TIER 1 TIER1 CAPITAL RATIO(%) $200 5.0% $467 $520 $545 $619 $649 $0 0.0% 2016 2017 2018 2019 1Q20 Statutory Minimum Core Capital Core Capital Amount Above Statutory Minimum Capital Tier 1 Capital Ratio Statutory Minimum Core Capital defined as total stockholders’ equity less accumulated other comprehensive income. 15

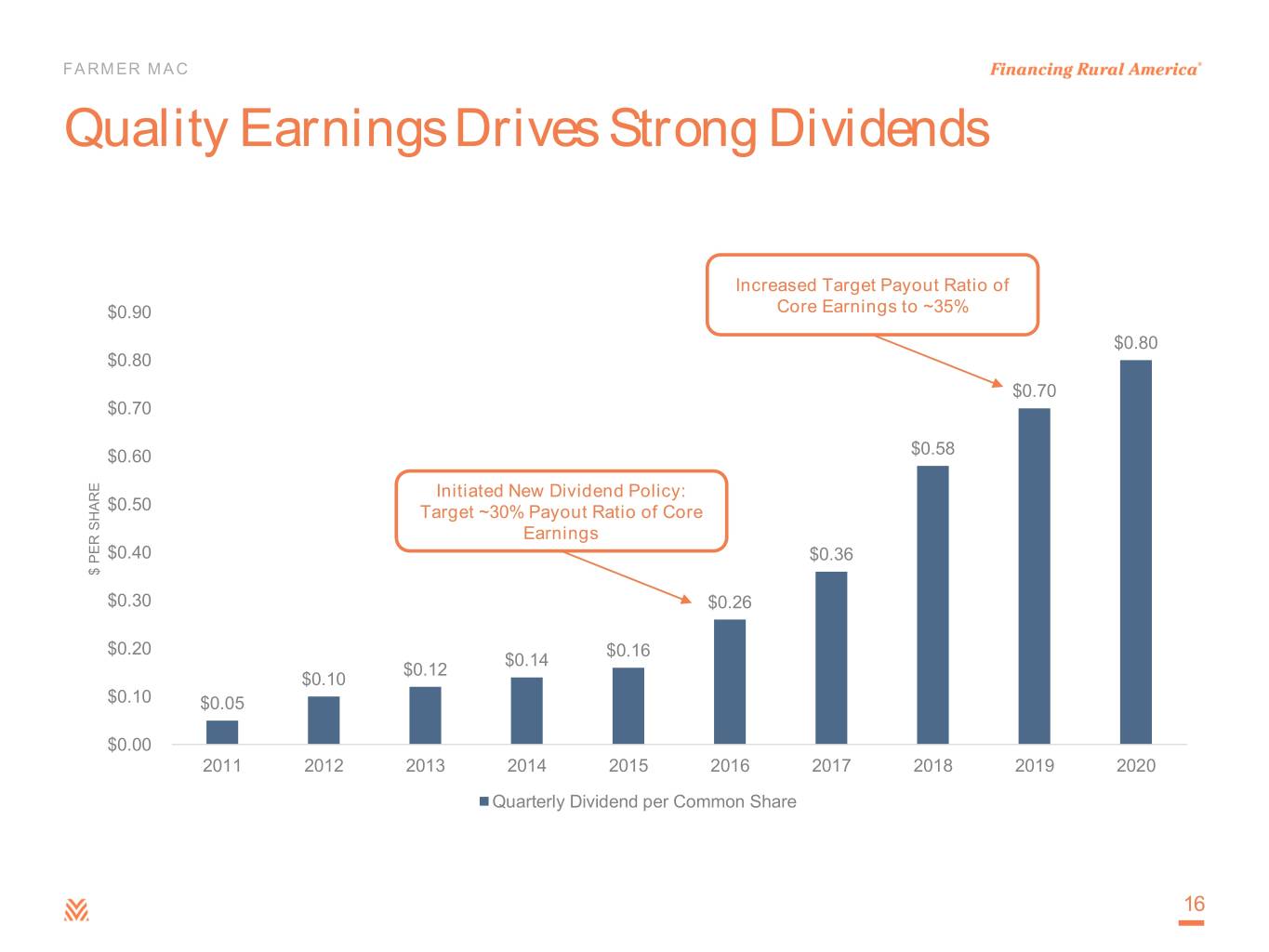

FARM ER M AC Quality Earnings Drives Strong Dividends Increased Target Payout Ratio of $0.90 Core Earnings to ~35% $0.80 $0.80 $0.70 $0.70 $0.60 $0.58 Initiated New Dividend Policy: $0.50 Target ~30% Payout Ratio of Core Earnings $0.40 $0.36 $ $ PER SHARE $0.30 $0.26 $0.20 $0.16 $0.14 $0.12 $0.10 $0.10 $0.05 $0.00 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Quarterly Dividend per Common Share 16

FARM ER M AC Investment Highlights •90-Day delinquencies of only 0.37% across all lines of business Quality Assets •Cumulative Farm & Ranch lifetime losses of only 0.12% •Issue at narrow, GSE spreads to U.S. Treasuries Funding Advantage •E.g., 10-year U.S. Treasury +1.02% as of March 31, 2020 •Ag productivity must double to meet expected global demand Growth Prospects •6.5% share of an ~$245 billion and growing U.S. ag mortgage market •Overhead / outstanding business volume ~20 bps Operational Efficiency •~$900,000 earnings per employee in 2019 Quality, Recurring •99% of total revenues is recurring net effective spread and fees Earnings •Outstanding business volume CAGR of 10.6% (2000 to 2019) Strong Returns, •Core earnings ROE ~17% in 2019 Responsible Growth •Double-digit annual core earnings growth (2016-2019) 17

Appendix

FARM ER M AC Key Company Metrics ($ in thousands, except per share amounts) 1Q20 2019 2018 2017 2016 Core Earnings $20,143 $93,742 $84,047 $65,631 $53,481 Core Earnings per Diluted Share $1.87 $8.70 $7.82 $6.08 $4.98 Net Effective Spread ($) $44,163 $168,608 $151,195 $141,303 $123,072 Net Effective Spread (%) 0.89% 0.91% 0.91% 0.91% 0.84% Guarantee & Commitment Fees $4,896 $21,335 $20,733 $20,350 $19,170 Core Capital Above Statutory Minimum $165,800 $196,700 $182,600 $136,800 $143,200 Common Stock Dividends per Share $0.80 $2.80 $2.32 $1.44 $1.04 Outstanding Business Volume $21,539,312 $21,117,942 $19,724,525 $19,007,311 $17,399,475 90-Day Delinquencies 0.37% 0.29% 0.14% 0.25% 0.12% Charge-Offs $0 $67 $17 $327 $130 Book Value per Share $54.71 $54.80 $49.01 $42.59 $38.42 Core Earnings Return on Equity 14% 17% 17% 15% 13% • Core earnings, core earnings per share, and net effective spread are non-GAAP measures. For more information on the use of these non- GAAP measures, please see page 3. For a reconciliation of core earnings to GAAP net income attributable to common stockholders and core earnings per share to earnings per common share, and a reconciliation of net effective spread to GAAP net interest income, please refer to pages 23-24 of the Appendix. • Periods prior to fourth quarter 2017 have been recast to reflect the revised methodology for calculating net effective spread that became effective in fourth quarter 2017, as further described on page 3. • Book Value per Share excludes accumulated other comprehensive income. 19

FARM ER M AC Equity Capital Structure NYSE Dividend Shares Ticker Yield Outstanding CLASS A VOTING COMMON STOCK AGM.A 6.67% 1.0 million • Ownership restricted to non-Farm Credit System financial institutions STOCK CLASS B VOTING COMMON STOCK -- -- 0.5 million • Ownership restricted to Farm Credit System institutions CLASS C NON-VOTING COMMON STOCK AGM 5.75% 9.2 million • No ownership restrictions COMMON SERIES A NON-CUMULATIVE PREFERRED STOCK AGM.PR.A 5.875% 2.4 million • Option to redeem at any time on or after January 17, 2018 • Redemption Value: $25 per share STOCK SERIES C FIXED-TO-FLOATING RATE NON-CUMULATIVE AGM.PR.C 6.000% 3.0 million PREFERRED STOCK • Option to redeem at any time on or after July 18, 2024 • Redemption Value: $25 per share SERIES D NON-CUMULATIVE PREFERRED STOCK AGM.PR.D 5.700% 4.0 million PREFERRED • Option to redeem at any time on or after July 17, 2024 • Redemption Value: $25 per share • Common stock dividend annualized divided by quarter-end closing price 20 • Par value of annual dividend for preferred stock

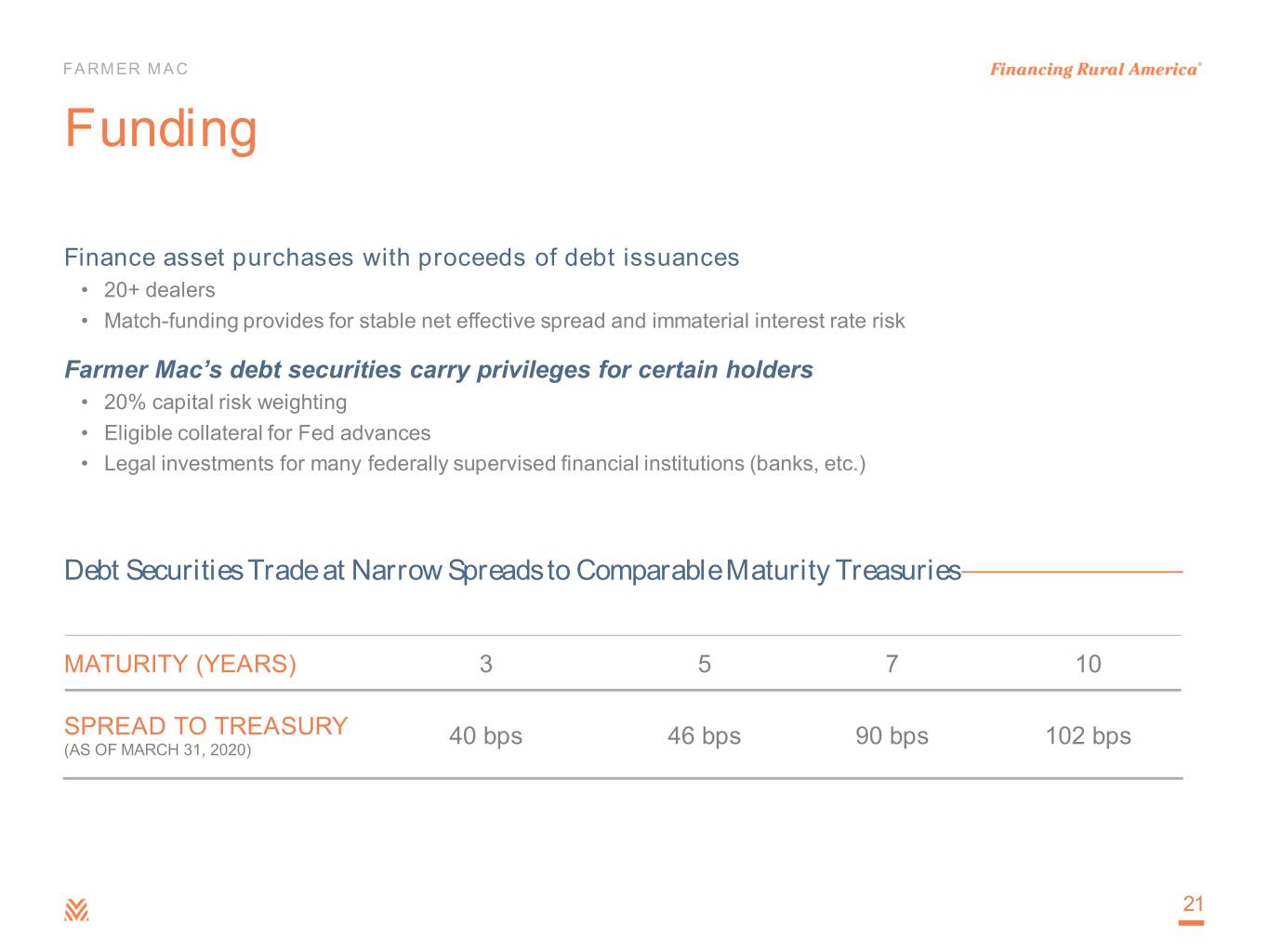

FARM ER M AC Funding Finance asset purchases with proceeds of debt issuances • 20+ dealers • Match-funding provides for stable net effective spread and immaterial interest rate risk Farmer Mac’s debt securities carry privileges for certain holders • 20% capital risk weighting • Eligible collateral for Fed advances • Legal investments for many federally supervised financial institutions (banks, etc.) Debt Securities Trade at Narrow Spreads to Comparable Maturity Treasuries MATURITY (YEARS) 3 5 7 10 SPREAD TO TREASURY 40 bps 46 bps 90 bps 102 bps (AS OF MARCH 31, 2020) 21

FARM ER M AC “Demand Pull” Provides Sustained Growth Opportunity(12) (13) 12.0 0.50 0.43 0.45 CAPITA PER LAND ARABLE 10.0 0.40 person)peruse in (hectare 8.0 0.35 0.30 6.0 0.25 0.18 (in (in billions) 0.20 4.0 0.15 WORLDPOPULATION 2.0 0.10 3.0 9.8 0.05 0.0 0.00 1960 1970 1980 1990 2000 2010 2020 2030 2040 2050 World Population Arable Land per capita World population is expected to grow to 9.8 billion by 2050 • Arable land per person is expected to decline over 40% from 2005 to 2050 USDA projects a 75% increase in total production and consumption of major field crops in the same period • 43% increase in world population • Higher protein diets as incomes in developing countries increase Productivity would need to nearly double by 2050 to feed the world 22

FARM ER M AC Reconciliation of Net Income to Core Earnings Core Earnings by Period Ended (in thousands) 1Q20 2019 2018 2017 2016 Net income attributable to common stockholders $ 9,399 $ 93,650 $ 94,898 $ 71,300 $ 64,152 Less reconciling items: (Losses)/gains on undesignated financial derivatives due to fair value changes (6,484) 10,077 7,959 10,218 8,585 (Losses)/gains on hedging activities due to fair value changes (5,925) (9,010) 4,449 (719) 5,043 Unrealized gains/(losses) on trading assets 106 326 81 (24) 1,460 Amortization of premiums/discounts and deferred gains on assets consolidated at fair value 3 (122) (461) (1,327) (849) Net effects of terminations or net settlements on financial derivatives and hedging activities (1,300) 1,089 1,708 2,674 2,178 Issuance costs on retirement of preferred stock - (1,956) - - - Re-measurement of net deferred tax asset due to enactment of new tax legislation - - - (1,365) - Income tax effect related to reconciling items 2,856 (496) (2,885) (3,788) (5,746) Sub-total (10,744) (92) 10,851 5,669 10,671 Core earnings $ 20,143 $ 93,742 $ 84,047 $ 65,631 $ 53,481 • Periods prior to 2017 have been recast to reflect the revised methodology for calculating net effective spread that became effective in fourth quarter 2017, as further described on page 3. • Issuance costs on retirement of preferred stock relates to the write-off of deferred issuance costs as a result of the retirement of Series B Preferred Stock and Farmer Mac II LLC Preferred Stock. 23

FARM ER M AC Reconciliation of Net Interest Income to Net Effective Spread For the Year Ended December 31, 1Q20 2019 2018 2017 2016 $ in thousands Dollars Yield Dollars Yield Dollars Yield Dollars Yield Dollars Yield Net interest income/yield $ 41,312 0.78% $ 173,135 0.87% $ 174,436 0.96% $ 157,647 0.94% $ 140,274 0.90% Net effects of consolidated trusts (1,700) 0.02% (7,669) 0.03% (6,757) 0.04% (6,236) 0.04% $ (4,302) 0.03% Expense related to undesignated financial derivatives (1,190) -0.02% (5,095) -0.03% (11,685) -0.07% (10,261) -0.07% (11,480) -0.07% Amortization of premiums/discounts on assets consolidated at fair value 11 0.00% 398 0.00% 417 0.01% 1,191 0.01% 610 0.00% Amortization of losses due to terminations or net settlements on financial derivatives and hedging activities 49 0.00% (68) 0.00% (275) 0.00% (1,038) -0.01% (2,030) -0.02% Fair Value Changes on fair value hedge relationships 5,681 0.11% 7,907 0.04% (4,941) -0.03% 0 0.00% 0 0.00% Net Effective Spread $ 44,163 0.89% $ 168,608 0.91% $ 151,195 0.91% $ 141,303 0.91% $ 123,072 0.84% 24

FARM ER M AC Resources Footnote 1: USDA Economic Research Service year end 2018 balance sheet as of September 9, 2019. Footnote 2: Farmer’s Mac’s total excludes loan purchases, LTSPCs, and AgVantage business with rural utilities customers. Market share represents Farmer Mac’s percentage of only Farm Sector Real Estate Debt outstanding. Footnote 3: Eligible ag real estate mortgage market structure shown includes the forecast for outstanding unpaid principal balance of first lien ag mortgage assets as of December 31, 2018. Footnote 4: USDA, Economic Research Service forecast for remaining non-bank lenders for year-end 2018 on a prorated basis. Footnote 5: USDA, National Agricultural Statistics Service (as of August 2015). Historic values are not necessarily predictive of future results or outcomes. Footnote 6: FDIC Call Report Data & Farm Credit Funding Corp Annual Information Statements – Non-accrual real estate loans and accruing loans that are 90 days or more past due made by commercial and Farm Credit System banks (as of June 2019). Footnote 7: Delinquencies include loans held and loans underlying off-balance sheet Farm & Ranch Guaranteed Securities and LTSPCs that are 90 days or more past due, in foreclosure, or in bankruptcy with at least one missed payment, excluding loans performing under either their original loan terms or a court-approved bankruptcy plan. Footnote 8: Board of Governors of the Federal Reserve System charge-off rates - https://www.federalreserve.gov/releases/chargeoff/. Footnote 9: Banks’ charge-off rate is a percentage of agricultural loan assets. Footnote 10: Farm Credit Banks Funding Corporation Annual Information Statements; Farm Credit System’s charge-off rate is the percentage of total loans and guarantees. Footnote 11: Farmer Mac’s charge-off rate is the percentage of total loans and guarantees. Footnote 12: USDA, Economic Research Service Global Drivers of Agricultural Demand and Supply, September 2014. Footnote 13: Food and Agriculture Organization of the United Nations, “World Agriculture Towards 2030/2050,” June 2012. 25