Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Axcella Health Inc. | a2241613zex-23_1.htm |

| EX-5.1 - EX-5.1 - Axcella Health Inc. | a2241613zex-5_1.htm |

| EX-1.1 - EX-1.1 - Axcella Health Inc. | a2241613zex-1_1.htm |

As filed with the Securities and Exchange Commission on May 11, 2020.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AXCELLA HEALTH INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2836 (Primary Standard Industrial Classification Code Number) |

26-3321056 (I.R.S. Employer Identification Number) |

840 Memorial Drive

Cambridge, MA 02139

(857) 320-2200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

William Hinshaw

Chief Executive Officer

840 Memorial Drive

Cambridge, MA 02139

(857) 320-2200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all communications, including communications sent to agent for service, should be sent to: | ||

Kingsley L. Taft Laurie A. Burlingame Goodwin Procter LLP 100 Northern Ave. Boston, MA 02210 (617) 570-1000 |

Peter N. Handrinos Wesley C. Holmes Latham & Watkins LLP 200 Clarendon Street Boston, MA 02116 (617) 948-6000 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer ý |

Smaller Reporting Company ý Emerging Growth Company ý |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

|

||||

| Title of Each Class of Securities To Be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

||

|---|---|---|---|---|

Common Stock, $0.001 par value per share |

$92,724,500 | $12,035.65 | ||

|

||||

- (1)

- Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes offering price of any additional shares of common stock that the underwriters have an option to purchase. Represents an aggregate of 12,650,000 shares of common stock (which includes the additional shares of common stock that the underwriters have an option to purchase) at the assumed public offering price of $7.33 per share, the last reported sale price of the common stock as reported on the Nasdaq Global Market on May 8, 2020.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 11, 2020

PRELIMINARY PROSPECTUS

11,000,000 Shares

Axcella Health Inc.

Common Stock

We are offering 11,000,000 shares of our common stock. Our common stock is listed on the Nasdaq Global Market under the symbol "AXLA." On May 8, 2020, the last reported sale price of our common stock as reported on the Nasdaq Global Market was $7.33 per share. The final public offering price will be determined through negotiation between us and the lead underwriters in the offering and the recent market price used throughout the prospectus may not be indicative of the actual offering price.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 16 of this prospectus and under similar headings in documents incorporated by reference into this prospectus.

We are an "emerging growth company" as defined under U.S. federal securities laws and will be subject to reduced public company reporting requirements. See "Prospectus Summary—Implications of being an emerging growth company."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public Offering Price |

$ | $ | ||

Underwriting Discounts and Commissions(1) |

$ | $ | ||

Proceeds, before expenses, to us |

$ | $ | ||

|

||||

- (1)

- See "Underwriting" beginning on page 35 of this prospectus for additional information regarding total underwriter compensation.

We have granted the underwriters an option for a period of up to 30 days to purchase up to 1,650,000 additional shares of our common stock.

Delivery of the shares of common stock is expected to be made on or about , 2020.

| J.P. MORGAN | SVB LEERINK |

| WEDBUSH PACGROW | ROTH CAPITAL PARTNERS |

Prospectus dated , 2020

TABLE OF CONTENTS

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

i

This summary highlights information contained elsewhere in this prospectus. Before investing in our common stock, you should carefully read this entire prospectus, including our consolidated financial statements and the related footnotes and the other documents incorporated by reference herein. As used in this prospectus, unless the context otherwise requires, references to the "company," "we," "us" and "our" refer to Axcella Health Inc. together with its consolidated subsidiaries.

In this prospectus, we use the following defined terms:

"product candidate" to refer to one of our investigational product candidates.

"development platform" to refer to our proprietary human-focused development platform.

"dose" to refer to the exposure amount of a product candidate in Clinical Trials and Clinical Studies.

"non-drug" to refer to a non-therapeutic use of a product candidate. Such use may be as a food product or dietary supplement.

"Clinical Trial" to refer to a human clinical study of a drug product candidate subject to the requirements for an effective Investigational New Drug application, or an IND.

"Clinical Study" to refer to Institutional Review Board-Approved, or IRB-Approved, clinical studies conducted in humans with our product candidates under U.S. Food and Drug Administration, or the FDA, regulations and guidance supporting research with food outside of an IND (prior to any decision to develop a product candidate as a drug product candidate under an IND or a non-drug product candidate). In these food studies, based on our understanding of FDA regulations and guidance, we evaluate in humans, including individuals with disease, a product candidate for safety, tolerability and effects on the normal structures and functions of the body. These studies are not designed or intended to evaluate a product candidate's ability to diagnose, cure, mitigate, treat or prevent a disease as these would be evaluated in Clinical Trials if we decide to develop a product candidate as a drug or therapeutic.

Overview

We are a clinical-stage biotechnology company focused on leveraging endogenous metabolic modulators, or EMMs, to pioneer a new approach for treating complex diseases and improving health. Our product candidates are comprised of multiple EMMs that are engineered in distinct combinations and ratios with the goal of simultaneously impacting multiple biological pathways. Our pipeline includes lead therapeutic candidates for non-alcoholic steatohepatitis, or NASH, and the reduction in risk of overt hepatic encephalopathy, or OHE, recurrence. Additional muscle- and blood-related programs are in earlier-stage development.

Using our development platform, we have efficiently designed a pipeline of product candidates that are comprised of amino acids and their derivatives, which have a general history of safe use. These orally administered compositions are designed to have multifactorial effects.

Once we design a product candidate, we decide whether to initially evaluate it in (i) a non-investigational new drug application, or non-IND, Institutional Review Board, or IRB, approved Clinical Study under U.S. Food and Drug Administration, or the FDA, regulations and guidance supporting research with food (as noted herein, the term food also includes dietary supplements) or (ii) in a Clinical Trial under an IND. A Clinical Study allows us to evaluate a product candidate's safety, tolerability and permissible secondary endpoints (e.g. impact on normal structures and functions of the body, including metabolic pathways), before we determine the next steps in its development. Our Clinical Studies are conducted at reputable medical centers following Good Clinical Practices, or GCPs, including IRB approval and monitoring, by qualified investigators, including key opinion leaders in their fields. Subsequent development options for a product candidate we initially investigate in a

1

Clinical Study include, but are not limited to, conducting future research in a Clinical Trial for an identified therapeutic indication, continuing research in another Clinical Study, out-licensing the product candidate, or terminating development.

In 2018, we completed three Clinical Studies. In all three studies, our product candidates were found to be generally well tolerated, and we generated structure and function biomarker data suggesting clinically relevant changes in liver and muscle metabolic pathways. We believe our ability to generate these human data at an early stage of development via initial Clinical Studies (i) significantly reduces the translational uncertainty typically seen when transitioning from animal studies to human studies, (ii) enables us to make high-insight, capital-efficient product candidate development decisions and (iii) for product candidates we initially research in Clinical Studies and subsequently decide to investigate for potential therapeutic indications, potentially increases their probability of Clinical Trial success.

In May 2020, we announced positive top-line data from AXA1125-003, our Clinical Study assessing the impact of AXA1125 and AXA1957 on safety, tolerability and effects on structures and functions of the liver, as measured by a comprehensive panel of imaging and soluble biomarkers related to metabolism, inflammation and fibrosis. Given the strength and consistency of data on AXA1125, we are pursuing future development for AXA1125 under an IND-enabled Clinical Trial, subject to FDA allowance, to study its potential to treat both adult and pediatric NASH. As a result of our decision to focus our NASH development efforts on AXA1125, we have decided against reinitiating our AXA1957-002 pediatric study, which had recently been suspended due to COVID-19. See "—Recent Developments—Clinical Study AXA1125-003."

We currently have two Clinical Studies underway:

- •

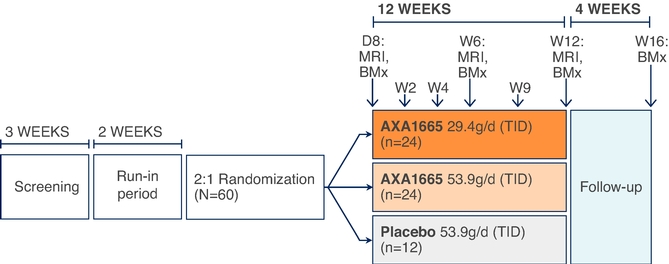

- AXA1665-002: A placebo-controlled, randomized, parallel-arm study assessing the impact of two doses of AXA1665 on safety, tolerability and

structure/function secondary endpoints in approximately 60 subjects with mild and moderate hepatic insufficiency; and

- •

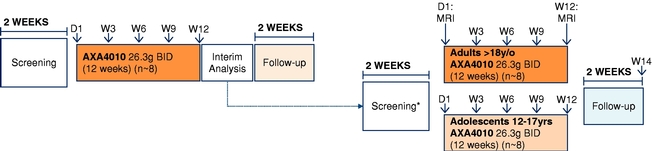

- AXA4010-001: A sequential and staged cohort study assessing the impact of AXA4010 on safety, tolerability and blood structure/function secondary endpoints in up to 24 subjects (up to 16 adults and eight adolescents) with sickle cell disease.

Based in part on our Clinical Study results to date, along with other relevant information, we have decided to pursue future development for AXA1665 under an IND-enabled Clinical Trial to study its potential to modulate key pathogenic pathways associated with OHE, subject to the data readout from our ongoing Clinical Study and FDA allowance of an IND. We have yet to make a development decision for our other product candidates, AXA2678 and AXA4010.

On March 6, 2019, we had a face-to-face pre-IND meeting with the FDA for AXA1665 during which we discussed clinical endpoints, assessment tools and other matters relating to a potential IND-opening Clinical Trial for AXA1665 in patients with the complications of cirrhosis, including hepatic encephalopathy, or HE, and sarcopenia or muscle wasting in cirrhosis. Based on FDA feedback received at this meeting, we believe that additional toxicology work would not be required prior to commencing a Clinical Trial for AXA1665. Assuming supportive data from our ongoing Clinical Study of AXA1665 and subject to FDA feedback and authorization to proceed under an IND, we plan to initiate a potentially registrational Phase 2b/3 Clinical Trial in the fourth quarter of 2020. We recently had a Type C meeting with FDA where we received key input on our planned Clinical Trial for AXA1665 and anticipate interacting with the FDA again in 2020 prior to a formal IND submission for AXA1665.

2

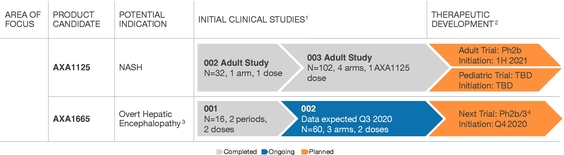

An overview of our current therapeutic product candidates and their current development status is illustrated below.

- (1)

- Initial

Clinical Studies refers to Non-IND Clinical Studies initiated prior to a development path decision.

- (2)

- Planned

Clinical Trial, contingent upon allowance by the FDA. Timing based on current expectations and subject to risks associated with the COVID-19

pandemic.

- (3)

- Indication

expected to be reduction in risk of overt hepatic encephalopathy recurrence.

- (4)

- We believe that this has the potential to serve as a registrational Clinical Trial, subject to final data readout from ongoing Clinical Study and allowance by the FDA.

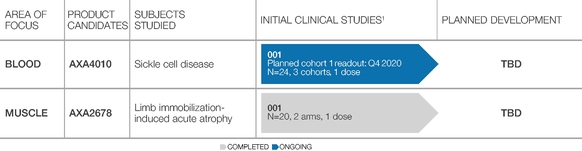

We have yet to make a development decision for our other product candidates, AXA2678 and AXA4010.

- (1)

- Initial Clinical Studies refers to non-IND Clinical Studies initiated prior to a development path decision. Timing of planned cohort 1 readout based on current expectations and subject to risks associated with the COVID-19 pandemic.

About Endogenous Metabolic Modulators (EMMs)

EMMs encompass a broad set of molecular families, including amino acids, bile acids other intermediary substrates and hormones. Together, these molecules can serve as master regulators and signaling agents, driving multiple pathways to elicit multifactorial effects that integrate basic cellular functioning to impact fundamental biologies. Such biologies include cellular bioenergetics (e.g., tricarboxylic acid cycle and electron transport chain), nutrient handling (e.g., de novo lipogenesis, or metabolic formation of fat, gluconeogenesis, or the generation of glucose from certain non-carbohydrate carbon substrates, and proteogenesis, or protein formation), nutrient sensing via master regulators (e.g., via mammalian target of rapamycin, or mTOR, 5' AMP-activated protein kinase, or AMPK, fibroblast growth factor 21, or FGF21, and peroxisome proliferator-activated receptors, or PPARs), immune response and inflammation, reactive oxygen response, vascular function, neurotransmitter signaling, tissue repair, and autophagy.

3

Our EMM Composition Design and Nonclinical Research Approach

Design Approach

Our development platform allows us to efficiently design and test EMM compositions that simultaneously target multiple biologies and metabolic pathways. This platform integrates advanced analytics of metabolic regulation and dysregulation to interrogate data in our proprietary databases, which we refer to as Axcella Database, or AxcellaDB, and Axcella Knowledge Base, or AxcellaKB. Our human primary cell systems also directly test the multiple biologies that are particularly disease-related and/or drive metabolic dysregulation. All of this is supported by what we believe to be the world's leading EMM safety database. The data and learnings generated through this process further inform our design methodology, increasing our development platform's efficiency for the development of subsequent product candidates.

AxcellaDB, our proprietary database, synthesizes a combination of data from published scientific and medical literature, our in vitro models, and our human Clinical Studies. Through advanced analytics, we investigate novel, causal connections among EMMs, biology, health and/or disease. We believe this enables us to take a systems biology approach to product candidate discovery and development. Ultimately, we envision utilizing AxcellaKB and its internal machine learning capabilities to identify EMM compositions, predict their effects on biology and potentially identify new target areas for our platform.

Nonclinical Research

We test EMM compositions and hypothesized synergies in normal and disease-specific human primary cell models. We conduct our model systems in environments that aim to simulate physiological levels of biofluids and nutrients. These models include multiple cell types that we use to deconstruct dysregulated metabolism or disease conditions to isolate effects of EMM compositions on subsets of metabolic pathways. The throughput of these models enables us to test product candidates as well as combinations of the individual constituents to identify and better understand their interactions.

Pharmacokinetic, or PK, literature, experiments and modeling inform our EMM compositions (i.e. amounts and ratios). We are able to evaluate EMM plasma exposure, supra-physiological exposures, windows of exposure administration amounts, the characterization of critical PK behaviors across molecule classes, and the implications of physiological compartmental distribution. We believe these data can be used to refine product candidate designs.

Our Clinical Approach and Development Path Decision Making

Once a product candidate is designed, we then decide whether to evaluate the candidate in a Clinical Study or under a Clinical Trial. To date, we have initially conducted clinical investigations of our product candidates in Clinical Studies. Going forward, we may conduct initial clinical investigations of future product candidates under Clinical Trials.

We conduct our Clinical Studies under the FDA's September 2013 Guidance for Clinical Investigators, Sponsors, and IRBs entitled "Investigational New Drug Applications (INDs)—Determining Whether Human Research Studies Can Be Conducted Without an IND ," which we believe allows for Clinical Studies to be conducted to assess a food product's safety, tolerability and effect on normal structures or functions in humans in healthy and diseased subjects. Our current product candidates comprise amino acids and their derivatives. We select the amounts of the amino acids and derivatives used in our product candidates based upon doses previously found in third-party clinical studies and third-party clinical trials to be tolerable with no significant safety concerns. Therefore, we believe we can study our product candidates in Clinical Studies as food and dietary supplements.

4

Our Clinical Studies include an assessment of safety and tolerability and a substantial number of biomarkers that may inform biologies relevant to the healthy structures and functions of the body but are not designed or intended to evaluate a product candidate's ability to diagnose, cure, mitigate, treat or prevent a disease or other health condition. They are conducted at reputable medical centers following GCPs, including IRB approval and monitoring, by qualified investigators, including key opinion leaders in their fields. Using a combination of data from these Clinical Studies and/or other relevant information, we decide whether to advance the product candidate's development in a therapeutic path under a Clinical Trial, further research the product candidate in another Clinical Study, out-license commercialization rights to the product candidate, or terminate its development. We may decide to partner with other companies in the development or commercialization of our product candidates.

We have determined that our lead compounds, AXA1665 and AXA1125, will be pursued as therapeutic product candidates, meaning that any future assessment of these product candidates will be made in Clinical Trials, subject to FDA allowance of INDs and, for AXA1665, also subject to final data readouts from our ongoing Clinical Study. These IND-enabled Clinical Trials would be designed to evaluate AXA1665's ability to reduce the risk of OHE recurrence and AXA1125's ability to treat patients with NASH.

Recent Developments

Clinical Study AXA1125-003

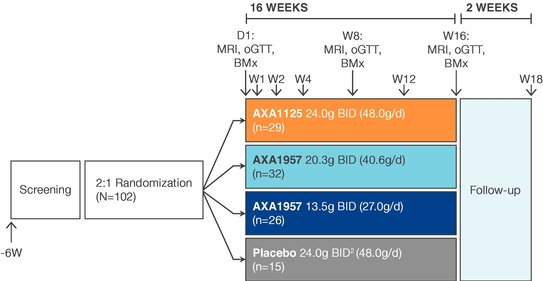

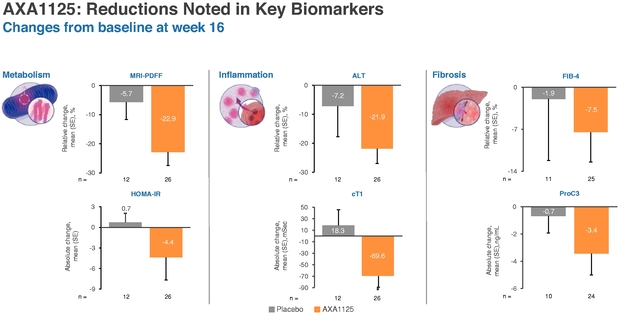

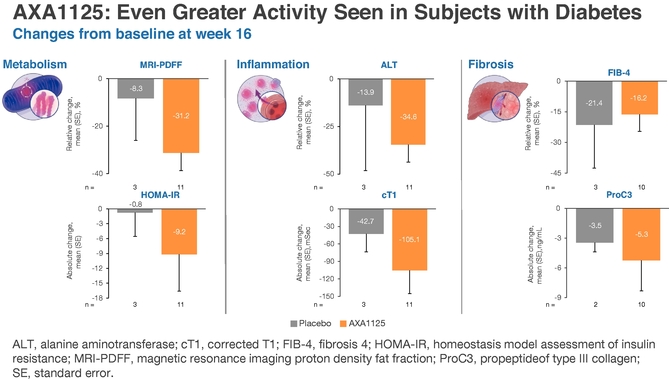

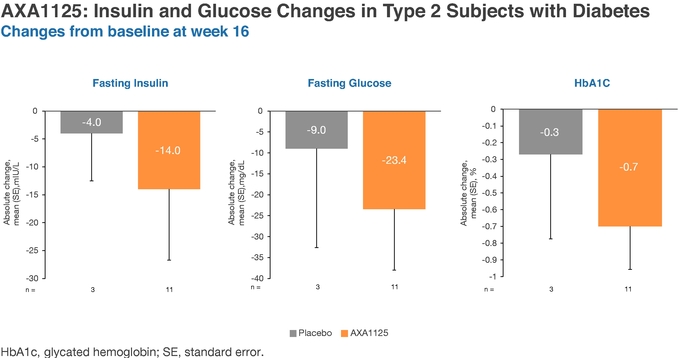

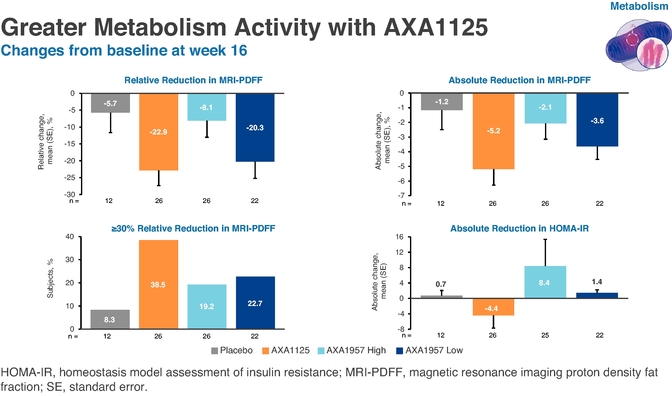

On May 6, 2020, we announced positive top-line data from AXA1125-003, a placebo-controlled, randomized, multi-arm Clinical Study assessing the impact of AXA1125 and AXA1957 on safety, tolerability and effects on structures and functions of the liver, as measured by a comprehensive panel of imaging and soluble biomarkers related to metabolism, inflammation and fibrosis. In this non-IND study, 102 adult non-alcoholic fatty liver disease, or NAFLD, subjects with presumed NASH, based on inclusion criteria, were enrolled and dosed in a 2:2:2:1 ratio to receive AXA1125, one of two AXA1957 doses, or placebo administered twice daily for 16 weeks. Study subjects were stratified based on the presence or absence of type 2 diabetes.

Study design for AXA1125-003. This Clinical Study was initiated prior to determination of AXA1125 as our therapeutic product candidate for NASH.

5

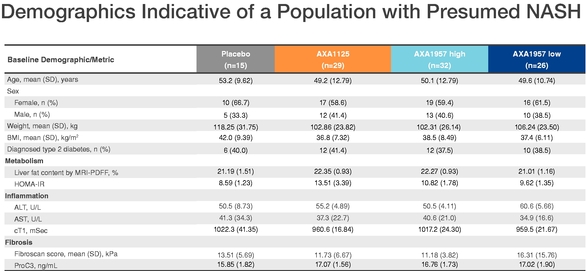

All values are mean (SE) unless otherwise noted.

ALT, alanine aminotransferase; AST, alanine transaminase; BMI, body mass index: cT1, corrected T1; HOMA-IR, homeostasis model assessment of insulin resistance; MRI-PDFF, magnectic resonance imaging proton density fat fraction; ProC3, propeptide of type III collagen; SD, standard deviation; SE, standard error.

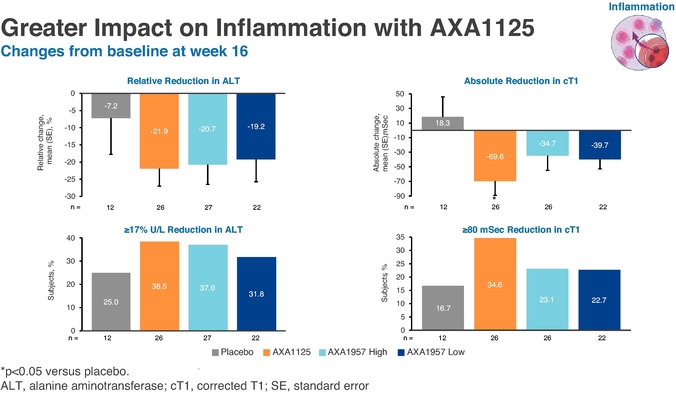

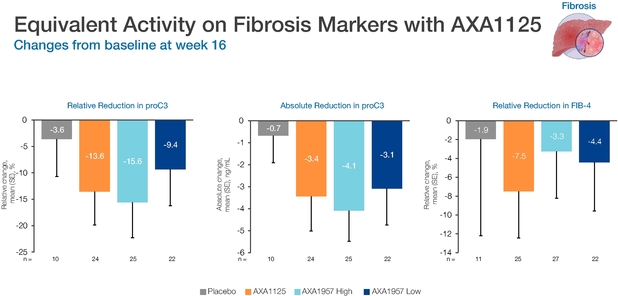

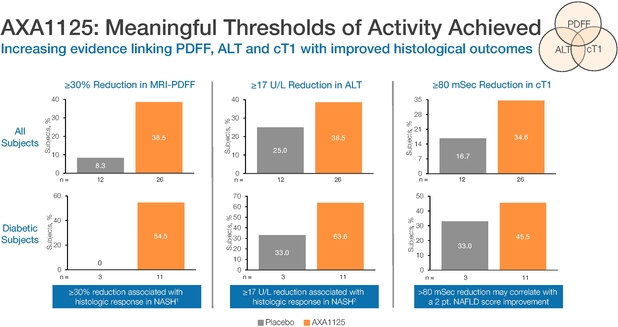

Results from the study showed that AXA1125 and AXA1957 were generally well-tolerated, with sustained reductions noted for both product candidates versus placebo in key biomarkers of metabolism, inflammation and fibrosis over 16 weeks. Overall, as compared to placebo, AXA1125 demonstrated larger and more consistent reductions in clinically relevant biomarkers than AXA1957. Additionally, in a majority of subjects with type 2 diabetes receiving AXA1125, clinically relevant thresholds of activity were observed in non-invasive tests that suggest a higher probability of positive histological outcomes. The results from this study are summarized below:

*p<0.05 versus placebo.

ALT, alanine aminotransferase; cT1, correctedT1; FIB-4, fibrosis 4; HOMA-IR, homeostasis model assessment of insulin resistance; MRI-PDFF, magnetic resonance imaging proton density fat fraction; ProC3, propeptide of type III collagen; SE, standard error.

6

7

8

FIB-4, fibrosis 4; ProC3, propeptide of type III collagen; SE, standard error.

- (1)

- Loomba,

R. et al. Hepatology, January 2020

- (2)

- Loomba, R. et al. Gastroenterology, January 2019

ALT, alanine aminotransferase; cT1, corrected T1; MRI-PDFF, magnetic resonance imaging proton density fat fraction; NASH, nonalcoholic steatohepatitis; NAFID, non-alcoholic fatty liver disease; SE, standard error.

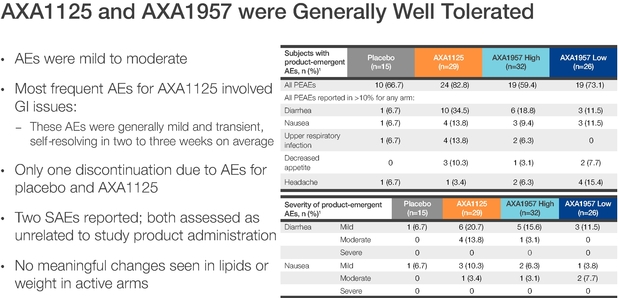

AXA1125 and AXA1957 were both generally well tolerated in the study. The adverse events, or AEs, experienced in ³10% of subjects were gastrointestinal (diarrhea, nausea, reduced appetite) and upper respiratory infection. Gastrointestinal AEs were generally mild and transient, self-resolving in two to three weeks on average. Two serious adverse events were reported, both of which were determined to be unrelated to study product administration.

9

- (1)

- Safety based on what subject received on day 1 of dosing. Subjects counted only once if they had more than one event reported during the product administration period.

AE, adverse event; GI, gastrointestinal; SAE, serious adverse event; PEAEs, product-emergent adverse events

Clinical Study AXA1665-002

AXA1665-002 is an ongoing 12-week (with a four-week follow-up) randomized, placebo-controlled Clinical Study to assess AXA1665's safety, tolerability and impact on normal liver and muscle structures and functions in approximately 60 adult subjects with mild (Child A) and moderate (Child B) hepatic insufficiency.

Study design for AXA1665-002. This Clinical Study was initiated prior to determination of AXA1665 as a therapeutic product candidate.

10

The assessments in AXA1665-002 include:

| Primary | ||

| Safety & tolerability | Clinical AEs, vital signs, ECGs, clinical laboratory parameters, including standard chemistry and hematology panels, plasma ammonia, albumin, total protein and other liver function tests |

| Secondary | ||

| PK of AXA1665 constituents and endogenous amino acid levels | FR* and VPR* | |

Normal Structure |

||

| Physiological assessments | • Body composition via MRI to assess lean and fat mass compartments, including thigh muscle volumes, intramuscular fat |

|

Normal Function |

||

• Physical (LFI*; gait speed) |

||

• Cognitive (Stroop test; PHES; CFF) |

||

• Health-related questionnaires |

- *

- FR, VPR and LFI are believed to have prognostic significance in subjects with cirrhosis and end-stage liver disease based on emerging scientific literature. PHES = psychometric hepatic encephalopathy score; CFF = critical flicker frequency.

Enrollment in AXA1665-002 was completed in February 2020, and AXA1665 continued to be generally well tolerated through week 12. Data from this Clinical Study is anticipated in the third quarter of 2020. This timing is based on our current expectations and is subject to risks associated with the COVID-19 pandemic.

Clinical Study AXA4010-001

AXA4010-001 is an ongoing Clinical Study that is expected to enroll up to 24 subjects ages 12 and older in a staged sequential design of three separate cohorts each for up to 12 weeks (see study design below).

Study design for AXA4010-001

In addition to safety and tolerability, the study will assess the effects of AXA4010 on normal blood structure and function, including hemolysis, inflammation and vascular physiology. The first cohort will consist of eight adult subjects with sickle cell disease, or SCD, to test whether AXA4010 can impact normal blood and vascular function. Subsequently, additional adult subjects as well as adolescent subjects may be enrolled into the study. SCD is a chronic hemolytic anemia that is associated with inflammation and metabolic derangements that include nitric oxide depletion and oxidative stress. As a result, we believe SCD is an appropriate biological model in which to study AXA4010's potential impact on multiple aspects of blood health. We currently anticipate a data readout from Cohort 1 of this study in the fourth quarter of 2020.

11

Corporate history

We were incorporated in August 2008 under the laws of the state of Delaware under the name Newco LS16, Inc. Our name was changed to Axcella Health Inc. in June 2016. Our principal executive offices are located at 840 Memorial Drive, Cambridge, MA 02139, and our phone number is (857) 320-2200. Our website address is https://www.axcellahealth.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus.

We own various U.S. federal trademark applications and unregistered trademarks, including our company name and our logo. All other trademarks or trade names referred to in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the symbols ® and ™, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

Implications of being an emerging growth company

We are an "emerging growth company," as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in April 2012. For so long as we remain an emerging growth company, we are permitted and intend to rely on certain exemptions from various public company reporting requirements, including not being required to have our internal control over financial reporting audited by our independent registered public accounting firm pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and any golden parachute payments not previously approved. In particular, in this prospectus, we have provided only two years of audited financial statements and have not included all of the executive compensation related information that would be required if we were not an emerging growth company. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We will remain an emerging growth company until the earlier to occur of (1) December 31, 2024, (2) the last day of the fiscal year in which we have total annual gross revenues of at least $1.07 billion, (3) the last day of the fiscal year in which we are deemed to be a "large accelerated filer," under the rules of the U.S. Securities and Exchange Commission, or SEC, which means the market value of our equity securities that is held by non-affiliates exceeds $700 million as of the prior June 30th and (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected not to "opt out" of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we will adopt the new or revised standard at the time private companies adopt the new or revised standard and will do so until such time that we either (i) irrevocably elect to "opt out" of such extended transition period or (ii) no longer qualify as an emerging growth company.

12

Common stock offered by us |

11,000,000 shares | |

Common stock to be outstanding immediately after this offering |

34,188,816 shares (or 35,838,816 shares if the underwriters exercise their option to purchase additional shares in full) |

|

Option to purchase additional shares offered by us |

1,650,000 shares |

|

Use of proceeds |

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $75.2 million, or $86.6 million if the underwriters exercise their option to purchase additional shares in full, assuming a public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, to advance our current liver programs, including our planned IND filing for AXA1665 and ensuing initiation of a Clinical Trial and our planned IND filing for AXA1125 in adults and pediatric patients and ensuing initiation of Clinical Trials; to advance our product candidate AXA4010, including the conclusion of our ongoing Clinical Study; to advance our development platform and discovery efforts; and to support organizational growth and for working capital and other general corporate purposes. For a more complete description of our intended use of the proceeds from this offering, see "Use of Proceeds." |

|

Risk factors |

You should carefully read the "Risk Factors" section of this prospectus and under similar headings in documents incorporated by reference into this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock. |

|

Nasdaq Global Market symbol |

"AXLA" |

The number of shares of our common stock to be outstanding after this offering is based on 23,188,816 shares of our common stock outstanding as of March 31, 2020 and excludes:

- •

- 5,443,078 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2020 under our 2010 Stock

Incentive Plan, or our 2010 Plan, and our 2019 Stock Option and Incentive Plan, or our 2019 Plan, with a weighted-average exercise price of $7.09 per share;

- •

- 162,967 shares of common stock reserved for vesting of restricted stock units outstanding as of March 31, 2020 under our 2019 Plan;

- •

- 601,721 shares of common stock available for future issuance as of March 31, 2020 under our 2019 Plan; and

13

- •

- 469,069 shares of our common stock available for future issuance as of March 31, 2020 under our 2019 Employee Stock Purchase Plan, or our 2019 ESPP.

Unless otherwise indicated, all information in this prospectus reflects or assumes the following:

- •

- no exercise of the outstanding options described above; and

- •

- no exercise by the underwriters of their option to purchase additional shares of common stock in this offering.

14

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read the following selected consolidated financial data together with our consolidated financial statements and the related notes and the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2019 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020. We have derived the consolidated statements of operations data for the years ended December 31, 2019 and 2018 and the consolidated balance sheet data as of December 31, 2019 and 2018 from our audited consolidated financial statements incorporated by reference in this prospectus. We have derived the consolidated statements of operations data for the three months ended March 31, 2020 and 2019 and the consolidated balance sheet data as of March 31, 2020 from our unaudited consolidated financial statements incorporated by reference in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

| |

Three Months Ended March 31, |

Year Ended December 31, |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2020 | 2019 | 2019 | 2018 | |||||||||

| |

(in thousands, except share and per share data) |

(in thousands, except share and per share data) |

|||||||||||

Operating expenses: |

|||||||||||||

Research and development |

$ | 10,335 | $ | 7,563 | $ | 41,658 | $ | 25,486 | |||||

General and administrative |

4,125 | 3,468 | 15,781 | 8,410 | |||||||||

| | | | | | | | | | | | | | |

Total operating expenses |

14,460 | 11,031 | 57,439 | 33,896 | |||||||||

| | | | | | | | | | | | | | |

Loss from operations |

(14,460 | ) | (11,031 | ) | (57,439 | ) | (33,896 | ) | |||||

| | | | | | | | | | | | | | |

Other income (expense), net |

(549 | ) | (542 | ) | (1,598 | ) | (2,173 | ) | |||||

| | | | | | | | | | | | | | |

Net loss |

$ | (15,009 | ) | $ | (11,573 | ) | $ | (59,037 | ) | $ | (36,069 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Net loss per share, basic and diluted(1) |

$ | (0.65 | ) | $ | (2.43 | ) | $ | (3.55 | ) | $ | (7.97 | ) | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

Weighted average common shares outstanding, basic and diluted |

23,188,816 | 4,775,828 | 16,624,941 | 4,546,373 | |||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- See Note 11 to our consolidated financial statements incorporated by reference in this prospectus for details on the calculation of basic and diluted net loss per share.

| |

As of March 31, |

As of December 31, |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2020 | 2019 | 2018 | |||||||

| |

(in thousands) |

|||||||||

Balance Sheet Data: |

||||||||||

Cash and cash equivalents |

$ | 75,522 | $ | 92,053 | $ | 79,466 | ||||

Working capital(1) |

69,781 | 85,184 | 73,390 | |||||||

Total assets |

77,582 | 94,359 | 81,844 | |||||||

Long term debt, net of current portion and discount |

22,820 | 24,897 | 24,521 | |||||||

Other liabilities(2) |

908 | 882 | 1,898 | |||||||

Preferred stock warrant liability |

— | — | 425 | |||||||

Redeemable convertible preferred stock |

— | — | 197,842 | |||||||

Total stockholders' equity (deficit) |

46,814 | 60,224 | (149,753 | ) | ||||||

- (1)

- We

define working capital as current assets less current liabilities.

- (2)

- As of December 31, 2018, this includes a $1.2 million success fee relating to our loan and security agreement with Solar, which was paid upon the completion of our IPO in May 2019.

15

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus and the documents incorporated by reference into this prospectus, including the risks identified under "Item 1A. Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, before deciding whether to invest in our common stock. The occurrence of any of the events or developments described therein and below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks related to our common stock and this offering

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the net tangible book value of your shares. In addition, we may issue additional securities in the future, which may result in additional dilution.

The public offering price will be substantially higher than the as adjusted net tangible book value per share of our common stock after this offering. Investors purchasing common stock in this offering will pay a price per share that substantially exceeds the as adjusted net tangible book value per share after this offering. As a result, investors purchasing common stock in this offering will incur immediate dilution of $3.76 per share, based on an assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, representing the difference between our as adjusted net tangible book value per share after giving effect to this offering and the assumed public offering price. To the extent outstanding stock options are exercised, new stock options are issued or we issue additional shares of common stock in the future, including through the sale of equity or convertible debt securities, there will be further dilution to new investors. As a result of the dilution to investors purchasing common stock in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of our liquidation. For a further description of the dilution that you will experience immediately after this offering, see "Dilution."

We have broad discretion in the use of our existing cash, cash equivalents and the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of our existing cash, cash equivalents and the net proceeds from this offering, including for any of the purposes described in the section entitled "Use of Proceeds," and you will not have the right or opportunity as part of your investment decision to assess whether such proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of our existing cash, cash equivalents and the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might not apply our existing cash, cash equivalents and the net proceeds from this offering in ways that ultimately increase the value of your investment. The failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

16

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements that involve risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements other than statements of historical facts contained in this prospectus and the documents incorporated by reference into this prospectus are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expects", "intends", "plans", "anticipates", "believes", "estimates", "predicts", "potential", "continue" or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

- •

- the initiation, success, cost and timing of our product development activities, preclinical studies, Clinical Studies and Clinical Trials,

including statements regarding the timing of initiation and completion of preclinical studies, Clinical Studies or Clinical Trials and related preparatory work, the timing of the availability of the

results of these preclinical studies, Clinical Studies and Clinical Trials and the subject and timing of planned interactions with the FDA or other regulatory agencies, including the timing of IND

application submissions;

- •

- our ability to obtain funding for our operations, including funding necessary to complete further development of our initial product

candidates, and if successful, commercialization of these candidates as drug or non-drug products;

- •

- the potential for our identified research priorities to advance our development platform, development programs or product candidates;

- •

- our ability to obtain and maintain regulatory approval or find alternate regulatory commercialization pathways from the FDA, the European

Medicines Agency, or the EMA, and other comparable regulatory authorities for our product candidates, and any related restrictions, limitations or warnings in the label of an approved product

candidate;

- •

- our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates, development platform

and the type of such protection;

- •

- our ability and the potential to successfully manufacture our product candidates for preclinical studies, Clinical Studies and Clinical Trials

and for commercial use, if approved;

- •

- the size and growth potential of the markets for our product candidates and our ability to serve those markets, either alone or in combination

with others;

- •

- the rate and degree of market acceptance of our product candidates, if approved;

- •

- regulatory developments in the United States and foreign countries;

- •

- our ability to enter into a collaboration, partnership, or other agreement with a third party on reasonable terms or at all to develop one or

more product candidates or commercialize any of our product candidates, if approved;

- •

- our ability to secure sufficient manufacturing and supply chain capacity;

- •

- the success of competing products or therapies that are or may become available;

- •

- our ability to attract and retain key scientific, management or other necessary personnel;

- •

- our estimates regarding expenses for both product development and as a public company, future revenue, capital requirements and needs for

additional financing;

- •

- the potential for faults in our internal controls;

17

- •

- the effect of the COVID-19 outbreak on any of the foregoing; and

- •

- other risks and uncertainties, including those discussed in "Risk Factors" and "Item 1A. Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which is incorporated by reference into this prospectus.

Any forward-looking statements in this prospectus and the documents incorporated by reference into this prospectus reflect our current views with respect to future events and with respect to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those described under "Risk Factors" and "Item 1A. Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, which is incorporated by reference into this prospectus, and elsewhere in this prospectus and the documents incorporated by reference into this prospectus. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

We may from time to time provide estimates, projections and other information concerning our industry, the general business environment, and the markets for certain diseases, including estimates regarding the potential size of those markets and the estimated incidence and prevalence of certain medical conditions. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties, and actual events, circumstances or numbers, including actual disease prevalence rates and market size, may differ materially from the information reflected in this prospectus and the documents incorporated by reference into this prospectus. Unless otherwise expressly stated, we obtained this industry, business information, market data, prevalence information and other data from reports, research surveys, studies and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data, and similar sources, in some cases applying our own assumptions and analysis that may, in the future, prove not to have been accurate.

18

We estimate that we will receive net proceeds from the sale of shares of our common stock in this offering of approximately $75.2 million, or $86.6 million if the underwriters exercise their option to purchase additional shares in full, assuming a public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, would increase (decrease) the net proceeds to us from this offering by approximately $10.3 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same. Similarly, an increase (decrease) of 1,000,000 shares in the number of shares offered by us would increase (decrease) the net proceeds to us from this offering by approximately $6.9 million, assuming that the assumed public offering price remains the same. We do not expect that a change in the public offering price or the number of shares by these amounts would have a material effect on our uses of the proceeds from this offering, although it may accelerate the time at which we will need to seek additional capital.

We currently expect to use the net proceeds from this offering, together with our cash and cash equivalents as of March 31, 2020, to advance our current liver programs, including our planned IND filing for AXA1665 and ensuing initiation of a Clinical Trial and our planned IND filing for AXA1125 in adults and pediatric patients and ensuing initiation of Clinical Trials; to advance our product candidate AXA4010, including the conclusion of our ongoing Clinical Study; to advance our development platform and discovery efforts; and to support organizational growth and for working capital and other general corporate purposes.

As of March 31, 2020, we had $75.5 million of cash and cash equivalents on hand. Based on our current plans, we believe our cash and cash equivalents as of March 31, 2020, together with the net proceeds from this offering, will be sufficient to fund our operating expenses and capital expenditure requirements through the first half of 2023. We have based these estimates on assumptions that may prove to be incorrect, and we could use our available capital resources sooner than we currently expect. We may satisfy our future cash needs through the sale of equity securities, debt financings, working capital lines of credit, corporate collaborations or license agreements, grant funding, interest income earned on invested cash balances, or a combination of one or more of these sources.

We cannot specify with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering. Due to uncertainties inherent in the development process, it is difficult to estimate the exact amounts of the net proceeds that will be used for any particular purpose. We may use our existing cash, cash equivalents and the future payments, if any, generated from any future collaboration agreements to fund our operations, either of which may alter the amount of net proceeds used for a particular purpose. In addition, the amount, allocation and timing of our actual expenditures will depend upon numerous factors, including the results of our research and development efforts, the timing and success of our Clinical Studies and Clinical Trials and the timing of regulatory submissions. Accordingly, we will have broad discretion in using these proceeds.

Pending their uses, we plan to invest the net proceeds of this offering in short-term, interest-bearing, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

19

The following table sets forth our cash and cash equivalents and our capitalization as of March 31, 2020:

- •

- on an actual basis; and

- •

- on an as adjusted basis to give effect to our issuance and sale of 11,000,000 shares of our common stock in this offering at the assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

You should read the information in this table together with our consolidated financial statements and the related notes incorporated by reference in this prospectus and the "Summary Consolidated Financial Data" section of this prospectus.

| |

As of March 31, 2020 | ||||||

|---|---|---|---|---|---|---|---|

| |

Actual | As Adjusted | |||||

| |

(in thousands, except share and per share data) |

||||||

Cash and cash equivalents |

$ | 75,522 | $ | 150,764 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Debt, net of discount |

24,987 | 24,897 | |||||

| | | | | | | | |

Stockholders' equity (deficit): |

|||||||

Preferred stock, $0.001 par value; 10,000,000 shares authorized and no shares issued or outstanding, actual and as adjusted |

— | — | |||||

Common stock, $0.001 par value; 150,000,000 shares authorized, actual and as adjusted; 23,607,797 shares issued and 23,188,816 shares outstanding, actual; 34,607,797 shares issued and 34,188,816 shares outstanding, as adjusted |

24 | 35 | |||||

Additional paid-in capital |

277,885 | 353,116 | |||||

Treasury stock, 418,981 shares at cost |

— | — | |||||

Accumulated deficit |

(231,095 | ) | (231,095 | ) | |||

| | | | | | | | |

Total stockholders' equity (deficit) |

46,814 | 122,056 | |||||

| | | | | | | | |

Total capitalization |

$ | 71,801 | $ | 147,043 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

A $1.00 increase (decrease) in the assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, additional paid-in capital, total stockholders' equity (deficit) and total capitalization by $10.3 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. An increase (decrease) of 1,000,000 shares in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) the as adjusted amount of each of cash and cash equivalents, additional paid-in capital, total stockholders' equity (deficit) and total capitalization by $6.9 million, assuming no change in the assumed public offering price per share and after deducting underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

20

The table above does not include:

- •

- 5,443,078 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2020 under our 2010 Plan and

our 2019 Plan, with a weighted-average exercise price of $7.09 per share;

- •

- 162,967 shares of common stock reserved for vesting of restricted stock units outstanding as of March 31, 2020 under our 2019 Plan;

- •

- 601,721 shares of common stock available for future issuance as of March 31, 2020 under our 2019 Plan; and

- •

- 469,069 shares of our common stock available for future issuance as of March 31, 2020 under our 2019 ESPP.

21

If you invest in our common stock in this offering, your ownership interest will be diluted immediately to the extent of the difference between the public offering price per share of our common stock and the as adjusted net tangible book value per share of our common stock immediately after this offering.

Our historical net tangible book value (deficit) as of March 31, 2020 was $46.8 million, or $2.02 per share of our common stock. Our historical net tangible book value (deficit) is the amount of our total tangible assets less our total liabilities. Historical net tangible book value (deficit) per share represents historical net tangible book value (deficit) divided by the 23,188,816 shares of our common stock outstanding as March 31, 2020.

After giving effect to our issuance and sale of 11,000,000 shares of our common stock in this offering at the assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2020 would have been $122.1 million, or $3.57 per share. This represents an immediate increase in as adjusted net tangible book value per share of $1.55 to existing stockholders and immediate dilution of $3.76 in as adjusted net tangible book value per share to new investors purchasing common stock in this offering. Dilution per share to new investors is determined by subtracting as adjusted net tangible book value per share after this offering from the public offering price per share paid by new investors. The following table illustrates this dilution on a per share basis:

Assumed public offering price per share |

$ | 7.33 | |||||

Historical net tangible book value (deficit) per share as of March 31, 2020 |

$ | 2.02 | |||||

Increase in as adjusted net tangible book value per share attributable to new investors purchasing common stock in this offering |

1.55 | ||||||

| | | | | | | | |

As adjusted net tangible book value per share after this offering |

3.57 | ||||||

| | | | | | | | |

Dilution per share to new investors purchasing common stock in this offering |

$ | 3.76 | |||||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

If the underwriters exercise their option to purchase additional shares in full, our as adjusted net tangible book value per share after this offering would be $3.72, representing an immediate increase in as adjusted net tangible book value per share of $1.70 to existing stockholders and immediate dilution in as adjusted net tangible book value per share of $3.61 to new investors purchasing common stock in this offering, based on the assumed public offering price of $7.33 per share, the last reported trading price of our common stock on the Nasdaq Global Market on May 8, 2020, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

The table and discussion above are based on the number of shares of our common stock outstanding as of March 31, 2020, and exclude:

- •

- 5,443,078 shares of common stock issuable upon the exercise of stock options outstanding as of March 31, 2020 under our 2010 Plan and

our 2019 Plan, with a weighted-average exercise price of $7.09 per share;

- •

- 162,967 shares of common stock reserved for vesting of restricted stock units outstanding as of March 31, 2020 under our 2019 Plan;

- •

- 601,721 shares of common stock available for future issuance as of March 31, 2020 under our 2019 Plan; and

- •

- 469,069 shares of our common stock available for future issuance as of March 31, 2020 under our 2019 ESPP.

22

To the extent that outstanding stock options are exercised, new stock options are issued or we issue additional shares of common stock in the future, there will be further dilution to new investors. In addition, we may choose to raise additional capital because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

23

The following table sets forth information, to the extent known by us or ascertainable from public filings, with respect to the beneficial ownership of our common stock (1) as of March 31, 2020 and (2) as adjusted to reflect the sale of common stock offered by us in this offering, by:

- •

- each of our directors;

- •

- each of our named executive officers;

- •

- all of our directors and executive officers as a group; and

- •

- each person, or group of affiliated persons, who is known by us to beneficially owner of greater-than-5.0% of our common stock.

The percentage ownership information shown in the table prior to this offering is based upon 23,188,816 shares of our common stock outstanding as of March 31, 2020. The percentage ownership information shown in the table after this offering is based upon 23,188,816 shares of common stock outstanding as of March 31, 2020, as adjusted to reflect the sale of 11,000,000 shares of common stock by us in the offering and assuming no exercise of the underwriters' option to purchase additional shares. As of March 31, 2020, we had approximately 39 holders of record.

Beneficial ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to our common stock. Shares of our common stock subject to options that are currently exercisable or exercisable within 60 days of March 31, 2020 are considered outstanding and beneficially owned by the person holding the options for the purpose of calculating the percentage ownership of that person but not for the purpose of calculating the percentage ownership of any other person. Except as otherwise noted, the persons and entities in this table have sole voting and investing power with respect to all of the shares of our common stock beneficially owned by them, subject to community property laws, where applicable. Except as otherwise indicated in the table below, addresses of named beneficial owners are in care of Axcella Health Inc., 840 Memorial Drive, Cambridge, Massachusetts 02139.

| |

Shares beneficially owned prior to the offering |

Shares beneficially owned after the offering |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name and address of beneficial owner

|

Number | Percentage | Number | Percentage | |||||||||

5% Stockholders: |

|||||||||||||

Flagship Pioneering Funds(1) |

8,748,414 | 37.7 | % | 8,748,414 | 25.6 | % | |||||||

FMR LLC(2) |

3,211,922 | 13.9 | % | 3,211,922 | 9.4 | % | |||||||

Nestlé Health Sciences US Holdings, Inc.(3) |

2,368,699 | 10.2 | % | 2,368,699 | 6.9 | % | |||||||

Gurnet Point L.P.(4) |

1,293,891 | 5.6 | % | 1,293,891 | 3.8 | % | |||||||

HarbourVest Partners L.P.(5) |

1,229,034 | 5.3 | % | 1,229,034 | 3.6 | % | |||||||

Named executive officers and directors: |

|||||||||||||

David R. Epstein(6) |

602,455 | 2.5 | % | 602,455 | 1.7 | % | |||||||

William Hinshaw(7) |

484,713 | 2.0 | % | 484,713 | 1.4 | % | |||||||

Manu Chakravarthy, M.D., Ph.D.(8) |

163,337 | * | 163,337 | * | |||||||||

William D. Baird III(9) |

33,324 | * | 33,324 | * | |||||||||

Grégory Behar, M.B.A.(10) |

11,000 | * | 11,000 | * | |||||||||

David A. Berry, M.D., Ph.D.(11) |

771,042 | 3.3 | % | 771,042 | 2.3 | % | |||||||

Shreeram Aradhye, M.D.(12) |

61,074 | * | 61,074 | * | |||||||||

Stephen Hoge, M.D.(13) |

65,288 | * | 65,288 | * | |||||||||

Gary Pisano, Ph.D.(14) |

92,433 | * | 92,433 | * | |||||||||

Cristina M. Rondinone, Ph.D.(15) |

31,185 | * | 31,185 | * | |||||||||

Catherine A. Sohn, PharmD.(16) |

6,499 | * | 6,499 | * | |||||||||

All executive officers and directors as a group (16 persons)(17) |

2,598,734 | 10.4 | % | 2,598,734 | 7.2 | % | |||||||

- *

- Represents beneficial ownership of less than one percent.

24

- (1)

- Based

solely on a Schedule 13D filed with the SEC on May 23, 2019, consists of (i) 2,035,830 shares of common stock held by Flagship VentureLabs

IV, LLC ("VentureLabs IV") (ii) 1,761,029 shares of common stock held by Flagship Ventures Fund 2007, L.P. ("Flagship Fund 2007"), (iii) 3,288,780 shares of common stock

held by Flagship Ventures Fund IV, L.P. ("Flagship Fund IV"), (iv) 676,752 shares of common stock held by Flagship Ventures Fund IV Rx, L.P. ("Flagship Fund IV Rx" and, together

with VentureLabs IV and Flagship Fund IV, the "Flagship IV Funds") and (v) 986,023 shares of common stock held by Flagship Ventures Opportunities Fund I, L.P ("Flagship Opportunities I").

Noubar B. Afeyan, Ph.D. and Edwin M. Kania are the managers of the general partner of Flagship Fund IV and Flagship Fund 2007, and each of these individuals may be deemed to beneficially own the

shares directly held by the Flagship Fund IV Funds and Flagship Fund 2007. While Mr. Kania is retired from Flagship Pioneering, he continues to serve as a manager of Flagship Fund IV GP

and Flagship Fund 2007 GP. Dr. Afeyan, as the sole manager of the general partner of Flagship Opportunities I, may be deemed to beneficially own the shares directly held by Flagship

Opportunities I. The address of each of the entities and individuals listed above is 55 Cambridge Parkway, Suite 800E, Cambridge, MA 02142.

- (2)

- Based

solely on a Schedule 13G/A filed with the SEC on February 7, 2020, FMR LLC has sole voting power with respect to 950,165 shares and sole

dispositive power over 3,211,922 shares and Abigail P. Johnson has sole dispositive power over 3,211,922 shares. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of

FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC,

representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all

Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the

execution of the shareholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to

FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the

Investment Company Act ("Fidelity Funds") advised by Fidelity Management & Research Company ("FMR Co"), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds'

Boards of Trustees. FMR Co carries out the voting of the shares under written guidelines established by the Fidelity Funds' Boards of Trustees. The address of FMR LLC is 245 Summer Street,

Boston, Massachusetts 02210.

- (3)

- Based

solely on a Schedule 13G filed with the SEC on February 13, 2020, (i) Nestlé Health Science US Holdings, Inc.

("NHS"), (ii) NIMCO US, Inc. ("NIMCO"), the parent of NHS, (iii) Nestlé US Holdco, Inc. ("Nestlé US Holdco"), an indirect parent of NHS,

(iv) Société des Produits Nestlé S.A. ("SPN"), an indirect parent of NHS, and (v) Nestlé S.A.

("Nestlé"), the ultimate parent of each of NHS, NIMCO, Nestlé US Holdco and SPN, each has shared voting power and shared dispositive power with respect to 2,368,699

shares. The principal executive office of NHS, NIMCO and Nestlé US Holdco is 1812 North Moore Street, Arlington, VA 22209 and the principal executive office of SPN and

Nestlé is Avenue Nestlé 55, CH-1800, Vevey Switzerland.

- (4)

- Based

solely on a Schedule 13G filed with the SEC on February 7, 2020, Gurnet Point L.P. ("Gurnet Point") and Waypoint

International GP LLC ("Waypoint"), the general partner of Gurnet Point, each has shared voting power and shared dispositive power with respect to 1,293,891 shares. The address of Gurnet

Point and Waypoint is 55 Cambridge Parkway, Suite 401, Cambridge, Massachusetts 02142.

- (5)

- Based solely on a Schedule 13G filed with the SEC on February 5, 2020, consists of 1,229,034 shares common stock owned directly by SMRS-TOPE LLC. HarbourVest Partners, LLC ("HarbourVest") is the General Partner of HarbourVest Partners L.P., which is the Manager of

25

HVST-TOPE LLC, which is the Managing Member of SMRS-TOPE LLC. Each of HarbourVest, HarbourVest Partners L.P. and HVST-TOPE LLC may be deemed to have a beneficial interest in the shares held by SMRS-TOPE LLC. Voting and investment power over the securities owned directly by SMRS-TOPE LLC is exercised by the Investment Committee of HarbourVest. Each of HarbourVest, HarbourVest Partners L.P. and HVST-TOPE LLC and the members of the HarbourVest Investment Committee disclaim beneficial ownership of the shares held directly by SMRS-TOPE LLC. The principal business office of each HarbourVest, HarbourVest Partners L.P., HVST-TOPE LLC and SMRS-TOPE LLC is One Financial Center, Boston, MA 02111.

- (6)

- Consists

of 68,103 shares of common stock and 534,352 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (7)

- Consists

of 484,713 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (8)

- Consists

of 163,337 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (9)

- Consists

of 33,324 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (10)

- Consists

of 11,000 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (11)

- Consists

of 760,042 shares of common stock and 11,000 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

Mr. Berry, who is currently a Class I director, has not been nominated for re-election to the board of directors at the Annual Meeting, and his term will end as of the close of the

Annual Meeting.

- (12)

- Consists

of 61,074 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (13)

- Consists

of 65,288 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (14)

- Consists

of 92,433 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (15)

- Consists

of 31,185 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (16)

- Consists

of 1,000 shares of common stock and 5,499 shares of common stock underlying options exercisable within 60 days of March 31, 2020.

- (17)

- Also includes an aggregate of 3,665 shares of common stock and 272,719 shares of common stock underlying options exercisable within 60 days of March 31, 2020 held by Laurent Chardonnet, Stephen Mitchener, PharmD., Tony Tramontin, Ph.D., Paul Fehlner, J.D., Ph.D., and Heidy King-Jones, J.D., LL.M.

26

The summary of the general terms and provisions of our registered securities set forth below does not purport to be complete. It is subject to and qualified in its entirety by reference to our Restated Certificate of Incorporation, or our Certificate of Incorporation, and our Amended and Restated Bylaws, or our Bylaws, each of which are incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part, and by applicable law. We encourage you to read our Certificate of Incorporation, our Bylaws and the applicable provisions of the Delaware General Corporation Law for additional information.

Authorized Capital Stock

Our authorized capital stock consists of 150,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share, all of which are undesignated preferred stock.

Common Stock

The holders of our common stock are entitled to one vote for each share held on all matters submitted to a vote of the stockholders. The holders of our common stock do not have any cumulative voting rights. Holders of our common stock are entitled to receive ratably any dividends declared by our board of directors out of funds legally available for that purpose, subject to any preferential dividend rights of any outstanding preferred stock. Our common stock has no preemptive rights, conversion rights or other subscription rights, or redemption or sinking fund provisions.

In the event of our liquidation, dissolution or winding up, holders of our common stock will be entitled to share ratably in all assets remaining after payment of all debts and other liabilities and any liquidation preference of any outstanding preferred stock. All outstanding shares are fully paid and nonassessable.

Listing

Our common stock is listed and traded on the Nasdaq Global Market under the symbol "AXLA."

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Trust Company, N.A.

Preferred Stock