Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Amcor plc | amcor3q2020exhibit991-.htm |

| 8-K - 8-K - Amcor plc | amcor3q2020form8-kxmar.htm |

Exhibit 99.2 Fiscal 2020 year to date results (nine months ended March 31, 2020) Ron Delia CEO Michael Casamento CFO May 11, 2020 US May 12, 2020 Australia NYSE: AMCR | ASX: AMC

Disclaimers Cautionary Statement Regarding Forward-Looking Statements This presentation contains certain statements that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like “believe,” “expect,”, “target”, “project”, “may,” “could,” “would,” “approximately,” “possible,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook” or “continue,” the negative of these words, other terms of similar meaning or the use of future dates. Such statements are based on the current expectations of the management of Amcor and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. None of Amcor or any of its respective directors, executive officers or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur. Risks and uncertainties that could cause actual results to differ from expectations include, but are not limited to: the continued financial and operational impacts of the COVID-19 pandemic on Amcor and its customers, suppliers, employees and the geographic markets in which it and its customers operate; fluctuations in consumer demand patterns; the loss of key customers or a reduction in production requirements of key customers; significant competition in the industries and regions in which Amcor operates; failure to realize the anticipated benefits of the acquisition of Bemis Company, Inc. (“Bemis”), and the cost synergies related thereto; failure to successfully integrate Bemis’ business and operations in the expected time frame or at all; integration costs related to the acquisition of Bemis; failure by Amcor to expand its business; the potential loss of intellectual property rights; various risks that could affect our business operations and financial results due to the international operations; price fluctuations or shortages in the availability of raw materials, energy and other inputs; disruptions to production, supply and commercial risks, including counterparty credit risks, which may be exacerbated in times of economic downturn; the possibility of labor disputes; fluctuations in our credit ratings; disruptions to the financial or capital markets; and other risks and uncertainties identified from time to time in Amcor’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including without limitation, those described under Item 1A. “Risk Factors” of Amcor’s annual report on Form 10-K for the fiscal year ended June 30, 2019 as supplemented by the risk factor contained in Amcor’s Current Report on Form 8-K filed on March 9, 2020. You can obtain copies of Amcor’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements included herein are made only as of the date hereof and Amcor does not undertake any obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as expressly required by law. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. Basis of Preparation of Supplemental Unaudited Combined Financial Information The fiscal 2018 unaudited combined financial information presented in the release gives effect to Amcor's acquisition of Bemis as if the combination had been consummated on July 1, 2018. The Supplemental Unaudited Combined Financial Information includes adjustments for (1) accounting policy alignment, (2) elimination of the effect of events that are directly attributable to the combination (e.g., one-time transaction costs), (3) elimination of the effect of consummated and identifiable divestitures agreed to with certain regulatory agencies as a condition of approval for the transaction, and (4) items which management considers are not representative of ongoing operations. The Supplemental Unaudited Combined Financial Information does not include the preliminary purchase accounting impact, which has not been finalized at the date of the release and does not reflect any cost or growth synergies that Amcor may achieve as a result of the transaction, future costs to combine the operations of Amcor and Bemis or the costs necessary to achieve any cost or growth synergies. The Supplemental Unaudited Combined Financial Information has been presented for informational purposes only and is not necessarily indicative of what Amcor’s results of operations actually would have been had the combination been completed as of July 1, 2018, nor is it indicative of the future operating results of Amcor. The Supplemental Unaudited Combined Financial Information should be read in conjunction with the separate historical financial statements and accompanying notes contained in each of the Amcor and Bemis periodic reports, as available. For avoidance of doubt, the Supplemental Unaudited Combined Financial Information is not intended to be, and was not, prepared on a basis consistent with the unaudited condensed combined financial information in Amcor’s Registration Statement on Form S-4 filed March 25, 2019 with the SEC (the “S-4 Pro Forma Statements”), which provides the pro forma financial information required by Article 11 of Regulation S-X. For instance, the Supplemental Unaudited Combined Financial Information does not give effect to the combination under the acquisition method of accounting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 805, Business Combinations (“ASC Topic 805”), with Amcor treated as the legal and accounting acquirer. The Supplemental Unaudited Combined Financial Information has not been adjusted to give effect to pro forma events that are (1) directly attributable to the combination, (2) factually supportable, or (3) expected to have a continuing impact on the combined results of Amcor and Bemis. More specifically, other than excluding Amcor’s divested plants and one-time transaction costs, the Supplemental Unaudited Combined Financial Information does not reflect the types of pro forma adjustments set forth in S-4 Pro Forma Statements. Consequently, the Supplemental Unaudited Combined Financial Information is intentionally different from, but does not supersede, the pro forma financial information set forth in S-4 Pro Forma Statements. Reconciliations of non-GAAP combined measures to their most comparable GAAP measures and reconciliations of pro forma net income in accordance with Article 11 of Regulation S-X to combined net income is included in the "Reconciliation of Non-GAAP Measures" section of this release. Presentation of non-GAAP financial information Included in this release are measures of financial performance that are not calculated in accordance with U.S. GAAP. These measures include adjusted EBIT (calculated as earnings before interest and tax), adjusted net income, adjusted earnings per share, adjusted free cash flow before dividends, adjusted cash flow after dividends, net debt and the Supplemental Unaudited Combined Financial Information including adjusted earnings before interest, tax, amortization and depreciation, adjusted earnings before interest and tax, and adjusted earnings per share and any ratios related thereto. In arriving at these non-GAAP measures, we exclude items that either have a non-recurring impact on the income statement or which, in the judgment of our management, are items that, either as a result of their nature or size, could, were they not singled out, potentially cause investors to extrapolate future performance from an improper base. While not all inclusive, examples of these items include: • material restructuring programs, including associated costs such as employee severance, pension and related benefits, impairment of property and equipment and other assets, accelerated depreciation, termination payments for contracts and leases, contractual obligations and any other qualifying costs related to the restructuring plan; • earnings from discontinued operations and any associated profit on sale of businesses or subsidiaries; • consummated and identifiable divestitures agreed to with certain regulatory agencies as a condition of approval for Amcor’s acquisition of Bemis; • impairments in goodwill and equity method investments; • material acquisition compensation and transaction costs such as due diligence expenses, professional and legal fees and integration costs; • material purchase accounting adjustments for inventory; • amortization of acquired intangible assets from business combinations; • impact of economic net investment hedging activities not qualifying for hedge accounting; • payments or settlements related to legal claims; and • impacts from hyperinflation accounting. Management has used and uses these measures internally for planning, forecasting and evaluating the performance of the company’s reporting segments and certain of the measures are used as a component of Amcor’s board of directors’ measurement of Amcor’s performance for incentive compensation purposes. Amcor also evaluates performance on a constant currency basis, which measures financial results assuming constant foreign currency exchange rates used for translation based on the rates in effect for the comparable prior-year period. In order to compute constant currency results, we multiply or divide, as appropriate, current-year U.S. dollar results by the current-year average foreign exchange rates and then multiply or divide, as appropriate, those amounts by the prior-year average foreign exchange rates. Amcor believes that these non-GAAP measures are useful to enable investors to perform comparisons of current and historical performance of the company. For each of these non-GAAP financial measures, a reconciliation to the most directly comparable U.S. GAAP financial measure has been provided herein. These non-GAAP financial measures should not be construed as an alternative to results determined in accordance with U.S. GAAP. The company provides guidance on a non-GAAP basis as we are unable to predict with reasonable certainty the ultimate outcome and timing of certain significant items without unreasonable effort. These items include but are not limited to the impact of foreign exchange translation, restructuring program costs, asset impairments, possible gains and losses on the sale of assets and certain tax related events. These items are uncertain, depend on various factors and could have a material impact on U.S. GAAP earnings and cash flow measures for the guidance period. 2

Safety Committed to our goal of ‘no injuries’ Recordable-case frequency rate 4.5 4.1 4.0 4 Acquisition impacts 3.5 3.4 3.3 • 54% of sites injury free for >12 months 2.9 3 2.6 2.6 • 8% reduction in number of injuries 2.5 2.4 2.0 2.1 2 2.0 2.0 • Continuing to align safety practices 1.5 1 0.5 0 Notes: Recordable cases per 1,000,000 hours worked. All data shown for a 12 month period ended June 30, unless otherwise indicated 2010 to 2012 data includes the demerged Orora business. Total rates for 2015 to 2018 include acquired businesses from the first day of ownership. The Bemis acquisition is excluded for all periods prior to and including 2019. Bemis acquisition is included for 3 YTD19 and YTD20. *The increase in the frequency rate between 2016 and 2018 reflects the inclusion of the Alusa and Sonoco acquisitions and the increase between 2019 and YTD19 reflects the inclusion of the Bemis acquisition.

Key messages for today To our employees around the world: “Thank You!” 1. COVID-19: Well positioned and demonstrating resilience 2. Strong YTD result and increased FY20 outlook 3. Bemis acquisition ahead of Year One expectations 4. Clear visibility to near term shareholder returns 5. Substantial opportunities to create value over the long term 4

COVID-19: Guiding Principles Keeping our employees Contributing to relief Keeping our operations healthy efforts in our communities running Today more than ever, we are reminded that what we do matters 5

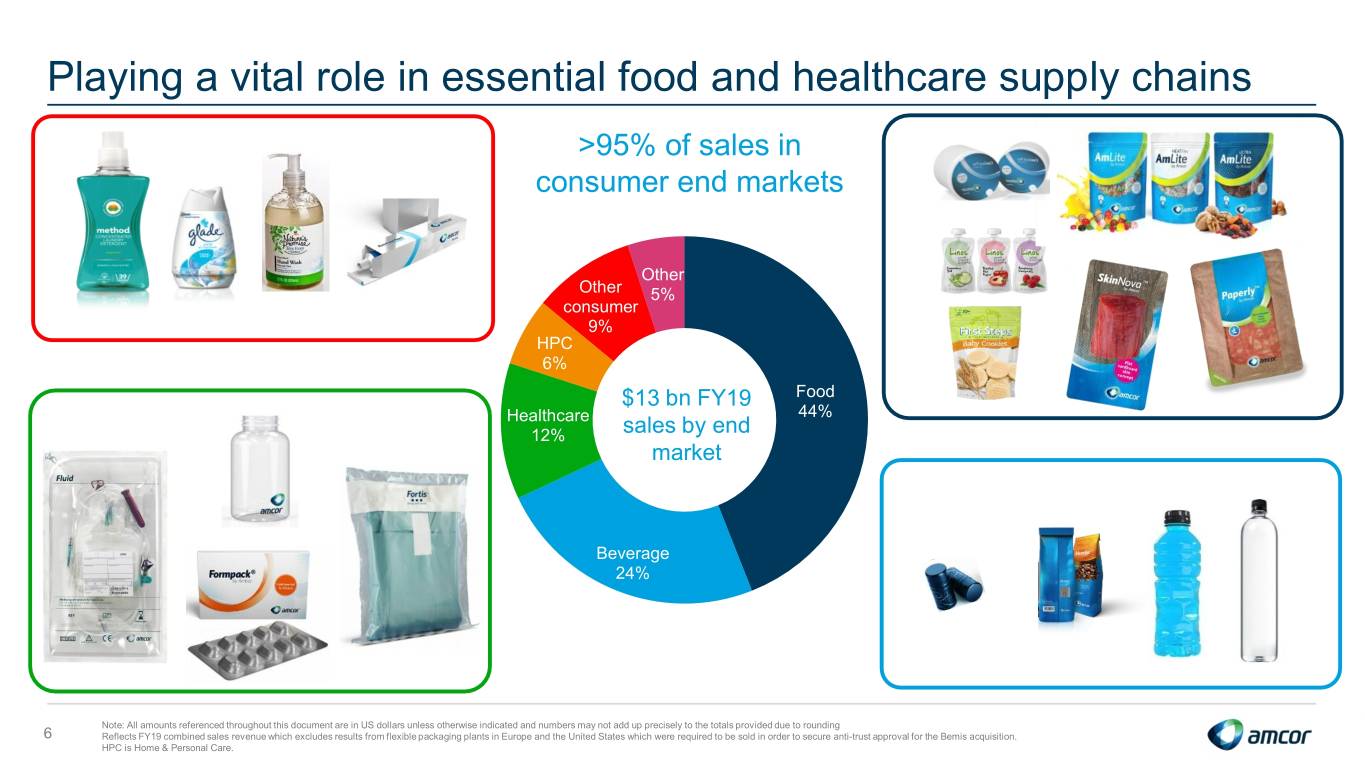

Playing a vital role in essential food and healthcare supply chains >95% of sales in consumer end markets Other Other 5% consumer 9% HPC 6% $13 bn FY19 Food Healthcare 44% 12% sales by end market Beverage 24% Note: All amounts referenced throughout this document are in US dollars unless otherwise indicated and numbers may not add up precisely to the totals provided due to rounding 6 Reflects FY19 combined sales revenue which excludes results from flexible packaging plants in Europe and the United States which were required to be sold in order to secure anti-trust approval for the Bemis acquisition. HPC is Home & Personal Care.

Role of food and healthcare packaging has never been clearer Preserve food and healthcare products…Protect consumers…Promote brands Hygiene Convenience Automation Increased focus on critical needs 7

Reduced volatility from scale and geographic diversification 250 sites in more than 40 countries North America $13 bn FY19 Western Europe sales by region Australia NZ Asia Latam Eastern Europe ~$3 bn FY19 EM sales Presence in >25 emerging market countries 8 Notes: Reflects FY19 combined sales revenue which excludes results from flexible packaging plants in Europe and the United States which were required to be sold in order to secure anti-trust approval for the Bemis acquisition.

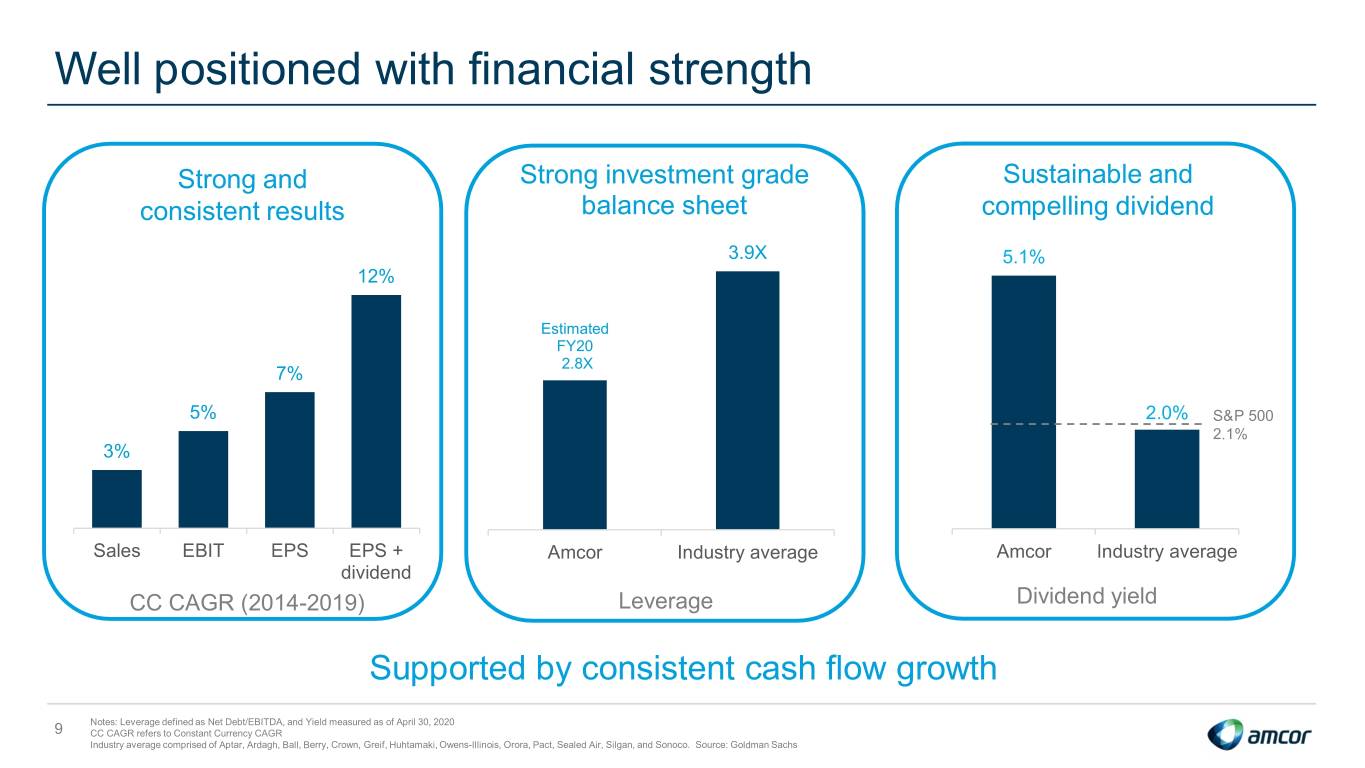

Well positioned with financial strength Strong and Strong investment grade Sustainable and consistent results balance sheet compelling dividend 3.9X 5.1% 12% Estimated FY20 2.8X 7% 5% 2.0% S&P 500 2.1% 3% Sales EBIT EPS EPS + Amcor Industry average Amcor Industry average dividend CC CAGR (2014-2019) Leverage Dividend yield Supported by consistent cash flow growth Notes: Leverage defined as Net Debt/EBITDA, and Yield measured as of April 30, 2020 9 CC CAGR refers to Constant Currency CAGR Industry average comprised of Aptar, Ardagh, Ball, Berry, Crown, Greif, Huhtamaki, Owens-Illinois, Orora, Pact, Sealed Air, Silgan, and Sonoco. Source: Goldman Sachs

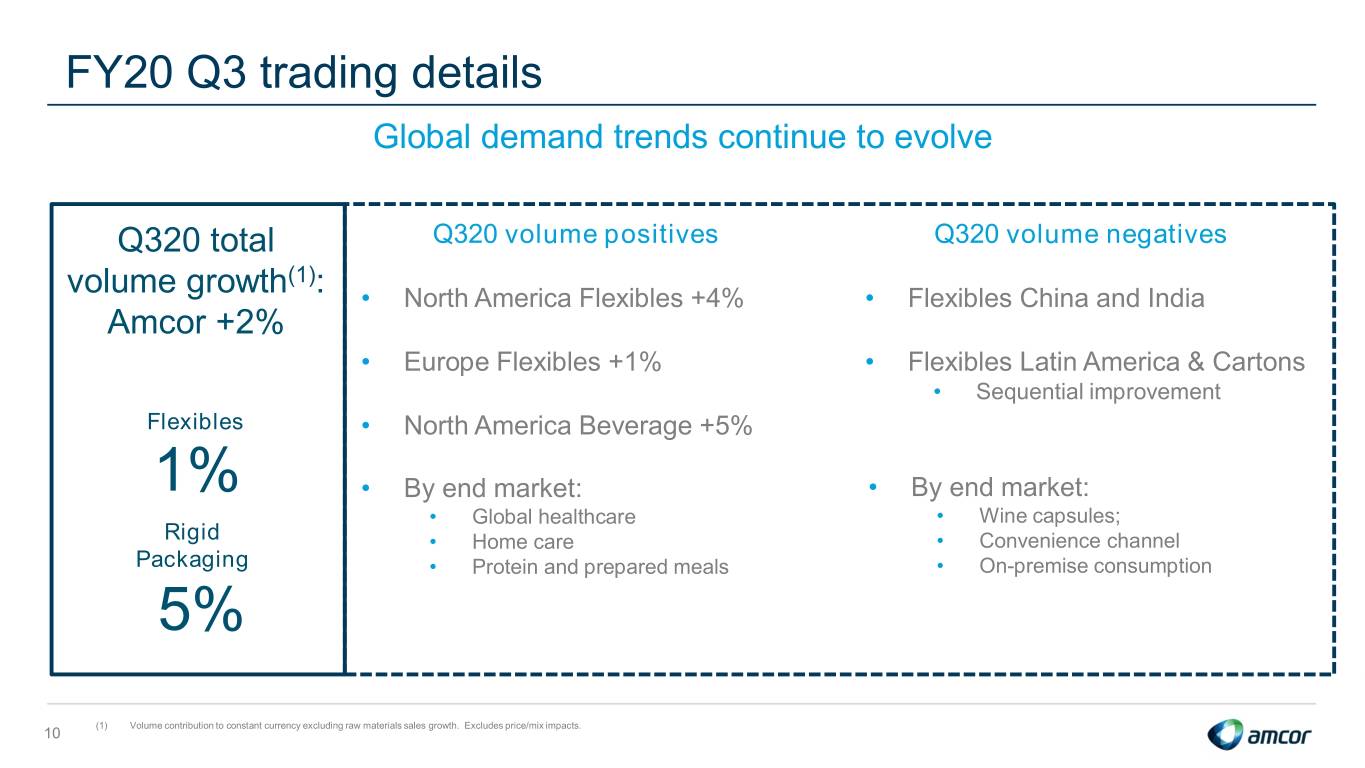

FY20 Q3 trading details Global demand trends continue to evolve Q320 total Q320 volume positives Q320 volume negatives (1) volume growth : • North America Flexibles +4% • Flexibles China and India Amcor +2% • Europe Flexibles +1% • Flexibles Latin America & Cartons • Sequential improvement Flexibles • North America Beverage +5% 1% • By end market: • By end market: • Global healthcare • Wine capsules; Rigid • Home care • Convenience channel Packaging • Protein and prepared meals • On-premise consumption 5% (1) Volume contribution to constant currency excluding raw materials sales growth. Excludes price/mix impacts. 10

Fiscal 2020 year to date financial results (nine months ended March 31, 2020)

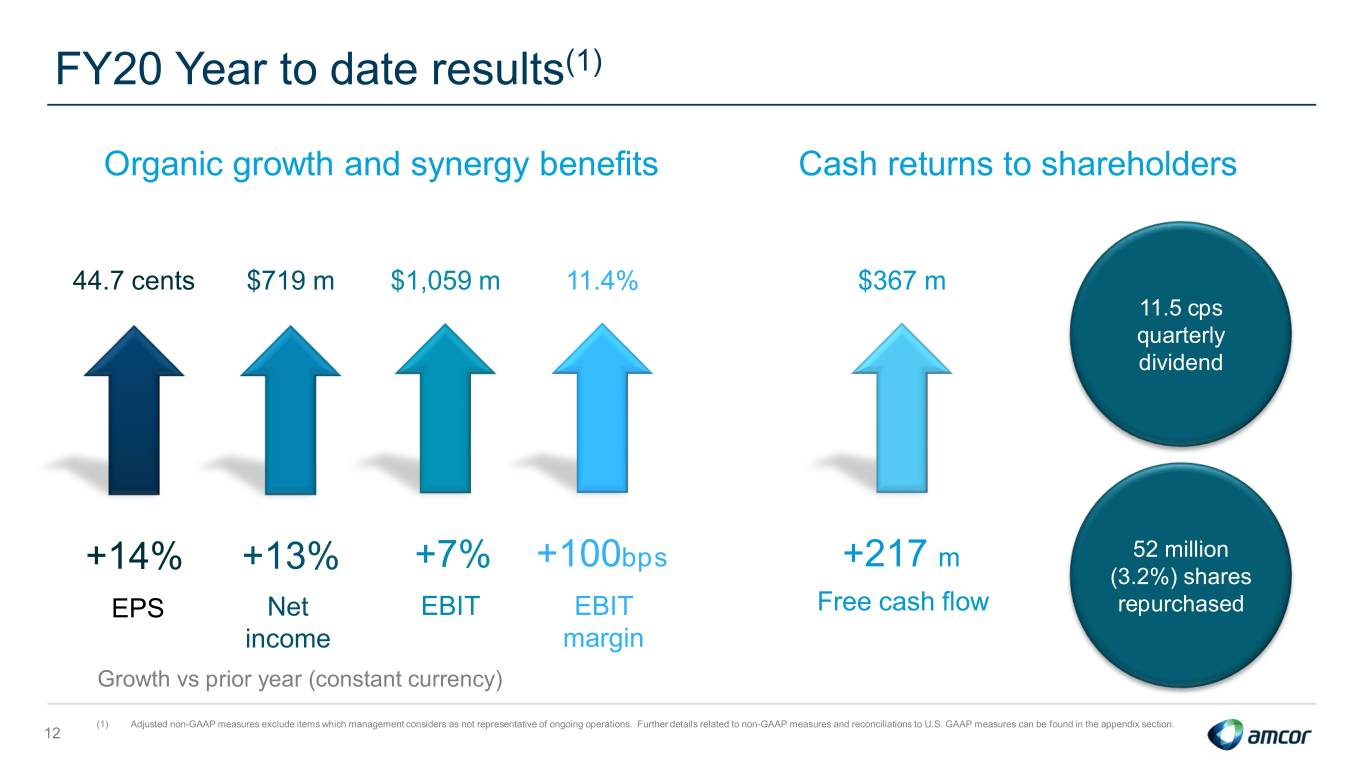

FY20 Year to date results(1) Organic growth and synergy benefits Cash returns to shareholders 44.7 cents $719 m $1,059 m 11.4% $367 m 11.5 cps quarterly dividend +14% +13% +7% +100bps +217 m 52 million (3.2%) shares EPS Net EBIT EBIT Free cash flow repurchased income margin Growth vs prior year (constant currency) (1) Adjusted non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section. 12

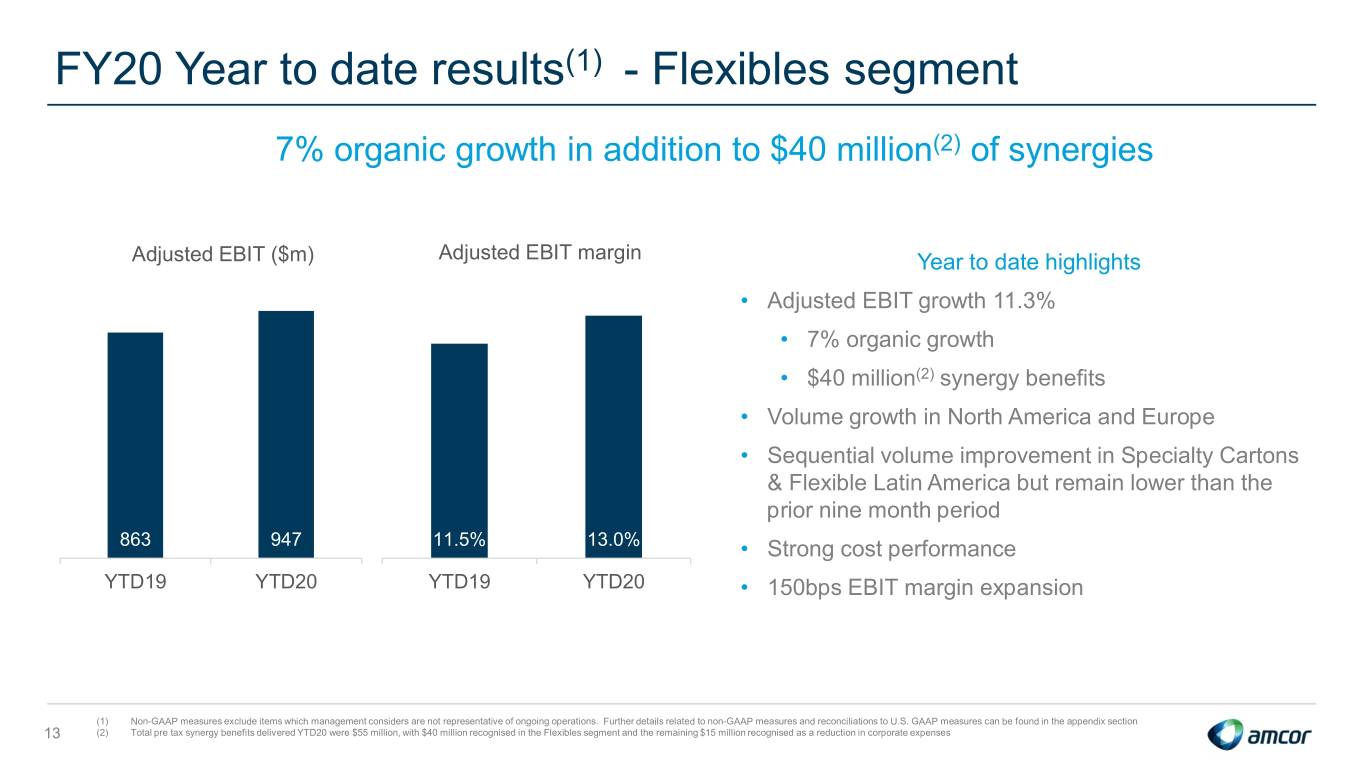

FY20 Year to date results(1) - Flexibles segment 7% organic growth in addition to $40 million(2) of synergies Adjusted EBIT ($m) Adjusted EBIT margin Year to date highlights • Adjusted EBIT growth 11.3% • 7% organic growth • $40 million(2) synergy benefits • Volume growth in North America and Europe • Sequential volume improvement in Specialty Cartons & Flexible Latin America but remain lower than the prior nine month period 863 947 11.5% 13.0% • Strong cost performance YTD19 YTD20 YTD19 YTD20 • 150bps EBIT margin expansion (1) Non-GAAP measures exclude items which management considers are not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section 13 (2) Total pre tax synergy benefits delivered YTD20 were $55 million, with $40 million recognised in the Flexibles segment and the remaining $15 million recognised as a reduction in corporate expenses

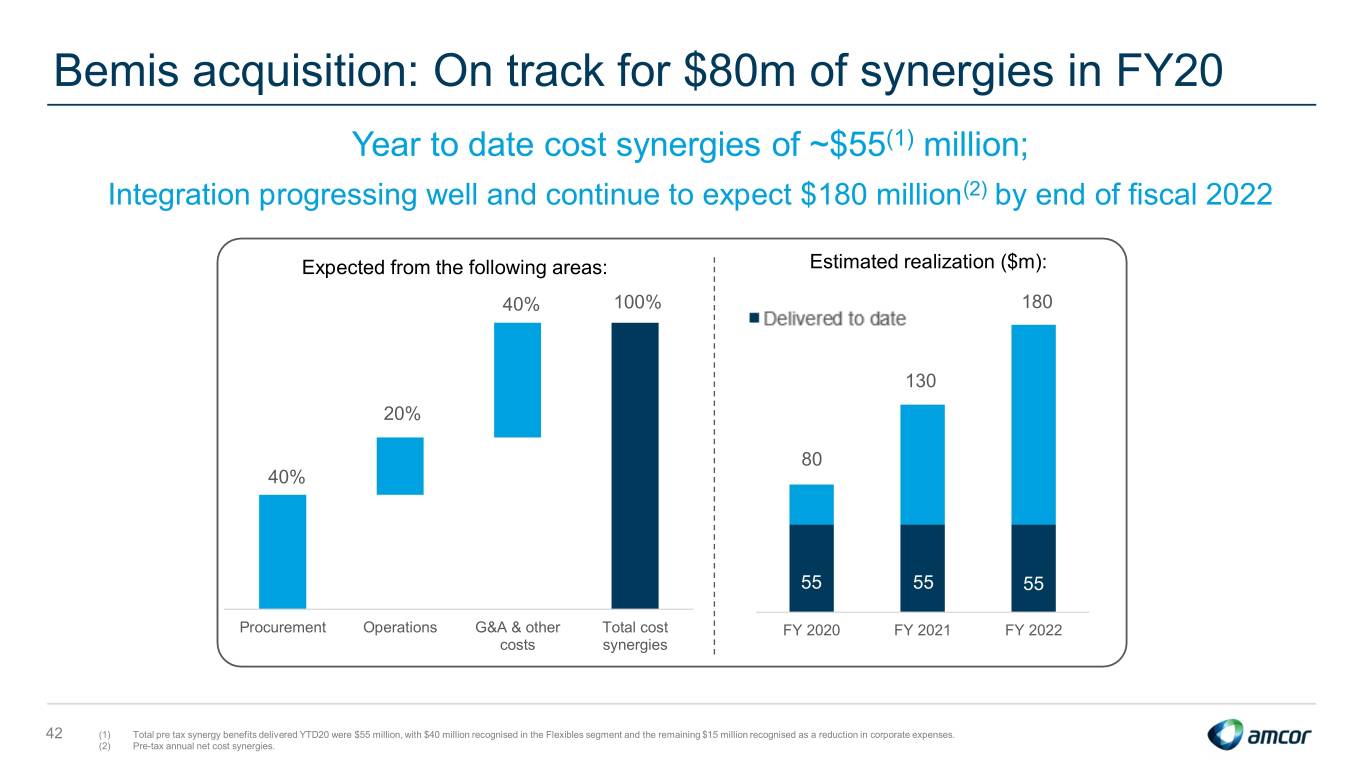

Bemis acquisition ahead of expectations Strategic rationale • Momentum in acquired base business • Integration mostly complete • Timing of first year synergy benefits Global footprint Greater scale Best-in-class ahead of expectations capabilities • $55m YTD(1); $80m FY20; $180m by FY22 • Delivering against strategic rationale Attractive end Commitment to Management talent markets environmental sustainability (1) Total pre tax synergy benefits delivered YTD were $55 million, with $40 million recognised in the Flexibles segment and the remaining $15 million recognised as a reduction in corporate expenses 14

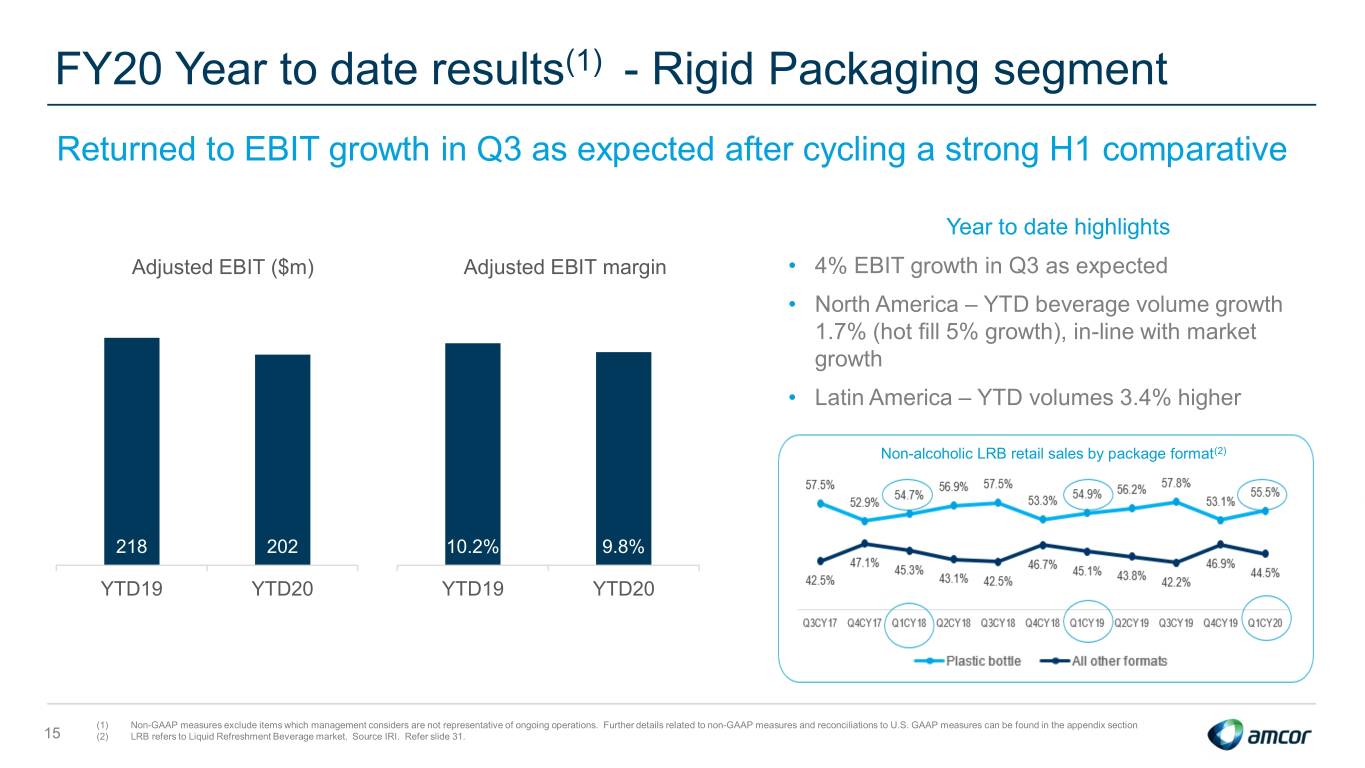

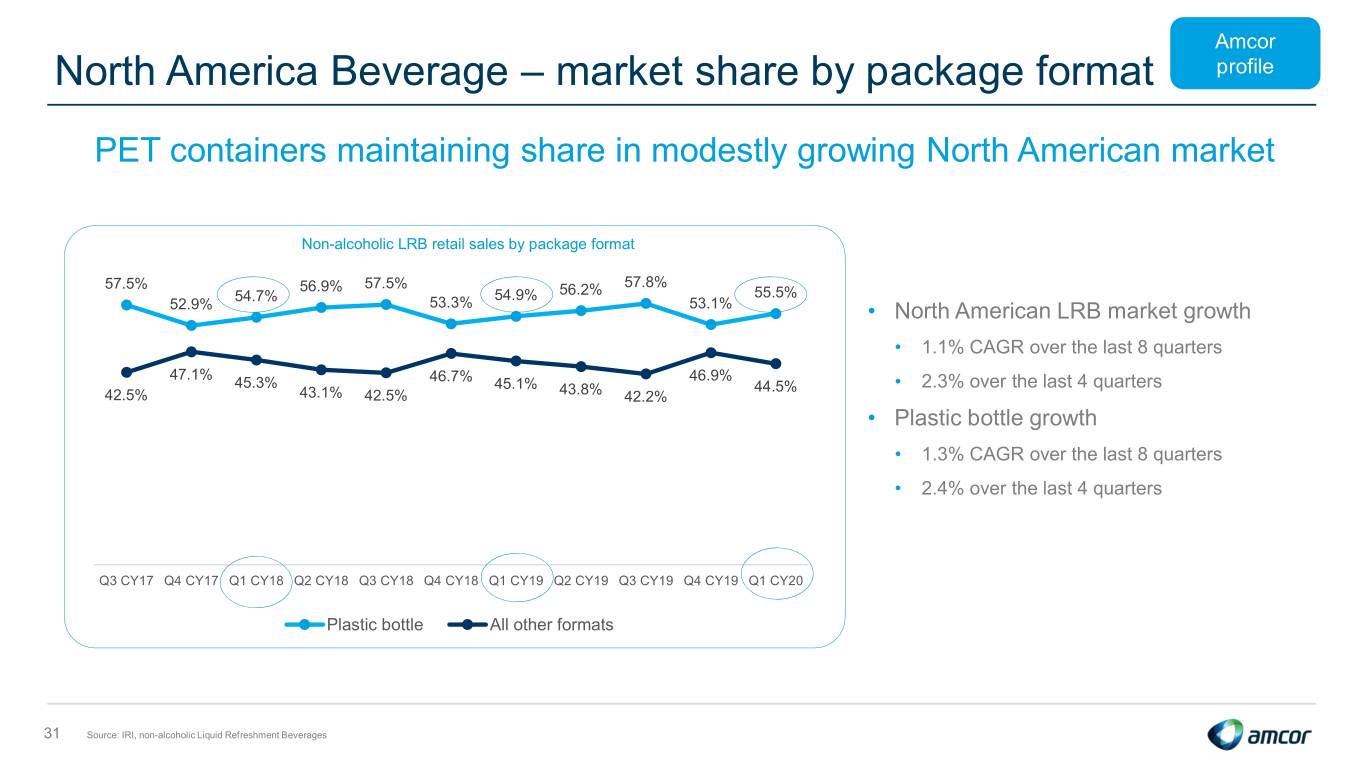

FY20 Year to date results(1) - Rigid Packaging segment Returned to EBIT growth in Q3 as expected after cycling a strong H1 comparative Year to date highlights Adjusted EBIT ($m) Adjusted EBIT margin • 4% EBIT growth in Q3 as expected • North America – YTD beverage volume growth 1.7% (hot fill 5% growth), in-line with market growth • Latin America – YTD volumes 3.4% higher Non-alcoholic LRB retail sales by package format(2) 218 202 10.2% 9.8% YTD19 YTD20 YTD19 YTD20 (1) Non-GAAP measures exclude items which management considers are not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section 15 (2) LRB refers to Liquid Refreshment Beverage market. Source IRI. Refer slide 31.

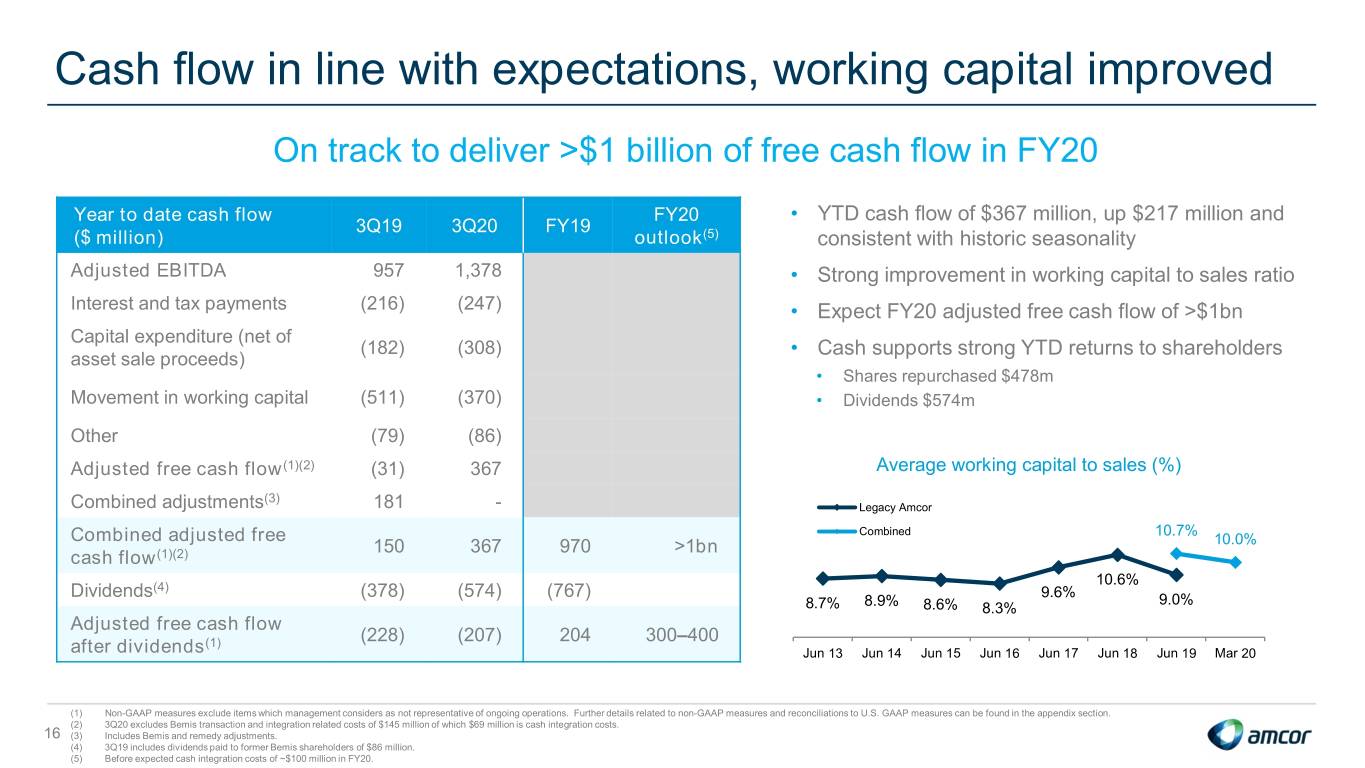

Cash flow in line with expectations, working capital improved On track to deliver >$1 billion of free cash flow in FY20 Year to date cash flow FY20 • YTD cash flow of $367 million, up $217 million and 3Q19 3Q20 FY19 ($ million) outlook(5) consistent with historic seasonality Adjusted EBITDA 957 1,378 • Strong improvement in working capital to sales ratio Interest and tax payments (216) (247) • Expect FY20 adjusted free cash flow of >$1bn Capital expenditure (net of (182) (308) • Cash supports strong YTD returns to shareholders asset sale proceeds) • Shares repurchased $478m Movement in working capital (511) (370) • Dividends $574m Other (79) (86) Adjusted free cash flow(1)(2) (31) 367 Average working capital to sales (%) (3) Combined adjustments 181 - Legacy Amcor Combined adjusted free Combined 10.7% 150 367 970 >1bn 10.0% cash flow(1)(2) (4) 10.6% Dividends (378) (574) (767) 9.6% 9.0% 8.7% 8.9% 8.6% 8.3% Adjusted free cash flow (1) (228) (207) 204 300–400 after dividends Jun 13 Jun 14 Jun 15 Jun 16 Jun 17 Jun 18 Jun 19 Mar 20 (1) Non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section. (2) 3Q20 excludes Bemis transaction and integration related costs of $145 million of which $69 million is cash integration costs. 16 (3) Includes Bemis and remedy adjustments. (4) 3Q19 includes dividends paid to former Bemis shareholders of $86 million. (5) Before expected cash integration costs of ~$100 million in FY20.

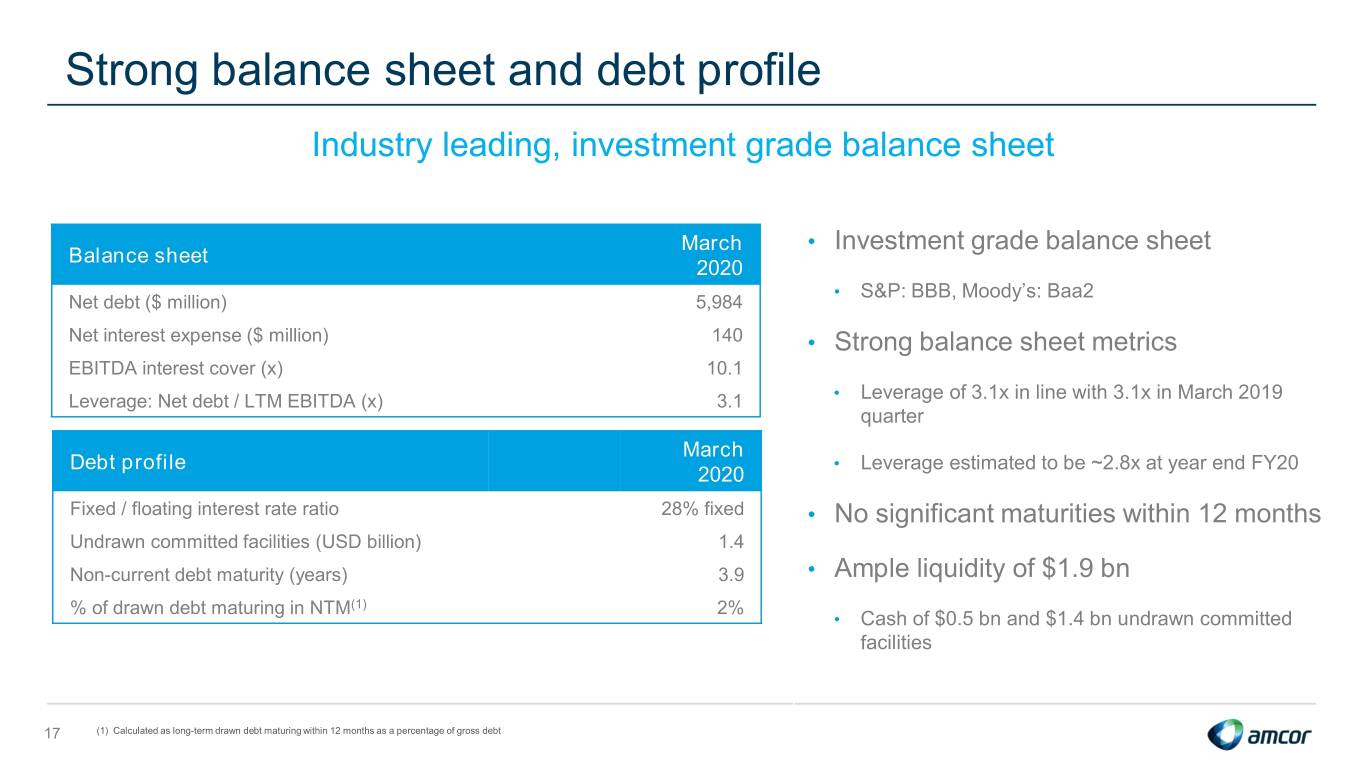

Strong balance sheet and debt profile Industry leading, investment grade balance sheet March • Investment grade balance sheet Balance sheet 2020 • S&P: BBB, Moody’s: Baa2 Net debt ($ million) 5,984 Net interest expense ($ million) 140 • Strong balance sheet metrics EBITDA interest cover (x) 10.1 Leverage: Net debt / LTM EBITDA (x) 3.1 • Leverage of 3.1x in line with 3.1x in March 2019 quarter March Debt profile • Leverage estimated to be ~2.8x at year end FY20 2020 Fixed / floating interest rate ratio 28% fixed • No significant maturities within 12 months Undrawn committed facilities (USD billion) 1.4 Non-current debt maturity (years) 3.9 • Ample liquidity of $1.9 bn % of drawn debt maturing in NTM(1) 2% • Cash of $0.5 bn and $1.4 bn undrawn committed facilities 17 (1) Calculated as long-term drawn debt maturing within 12 months as a percentage of gross debt

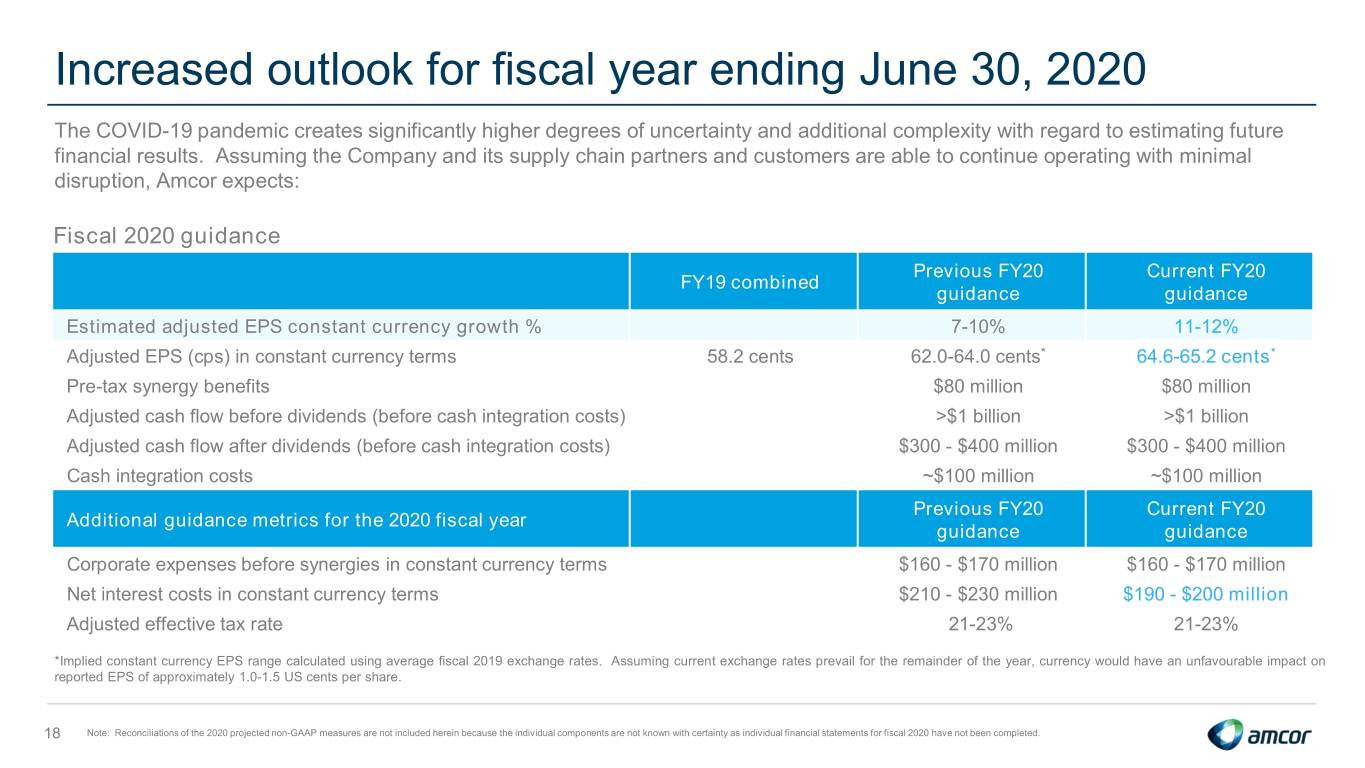

Increased outlook for fiscal year ending June 30, 2020 The COVID-19 pandemic creates significantly higher degrees of uncertainty and additional complexity with regard to estimating future financial results. Assuming the Company and its supply chain partners and customers are able to continue operating with minimal disruption, Amcor expects: Fiscal 2020 guidance Previous FY20 Current FY20 FY19 combined guidance guidance Estimated adjusted EPS constant currency growth % 7-10% 11-12% Adjusted EPS (cps) in constant currency terms 58.2 cents 62.0-64.0 cents* 64.6-65.2 cents* Pre-tax synergy benefits $80 million $80 million Adjusted cash flow before dividends (before cash integration costs) >$1 billion >$1 billion Adjusted cash flow after dividends (before cash integration costs) $300 - $400 million $300 - $400 million Cash integration costs ~$100 million ~$100 million Previous FY20 Current FY20 Additional guidance metrics for the 2020 fiscal year guidance guidance Corporate expenses before synergies in constant currency terms $160 - $170 million $160 - $170 million Net interest costs in constant currency terms $210 - $230 million $190 - $200 million Adjusted effective tax rate 21-23% 21-23% *Implied constant currency EPS range calculated using average fiscal 2019 exchange rates. Assuming current exchange rates prevail for the remainder of the year, currency would have an unfavourable impact on reported EPS of approximately 1.0-1.5 US cents per share. 18 Note: Reconciliations of the 2020 projected non-GAAP measures are not included herein because the individual components are not known with certainty as individual financial statements for fiscal 2020 have not been completed.

Near and long term drivers of shareholder value

Consistent shareholder returns Near term: controllable drivers of shareholder returns • Defensive organic growth • Sustainable, compelling dividend • $180m synergy benefits • $500m buy-back Longer term: unchanged Shareholder Value Creation Model 20

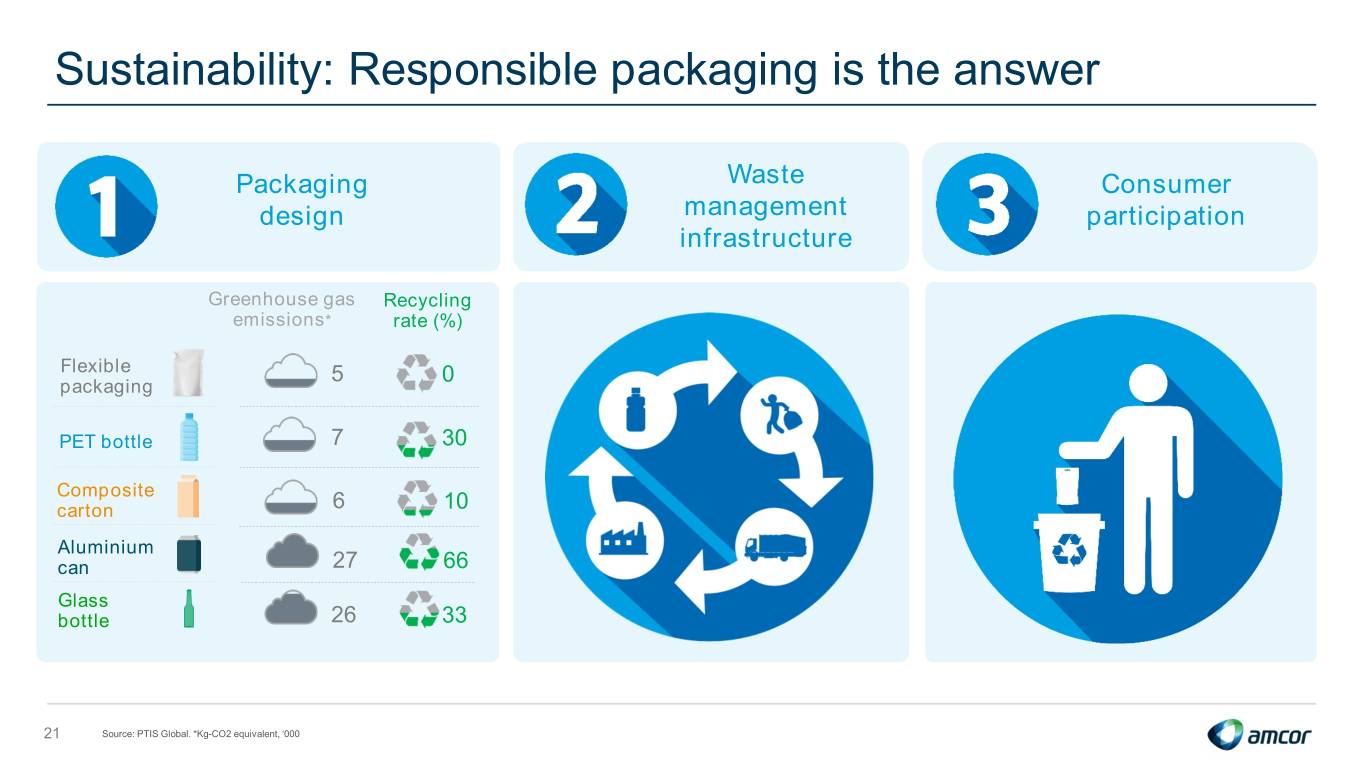

Sustainability: Responsible packaging is the answer Packaging Waste Consumer design management participation infrastructure Greenhouse gas Recycling emissions* rate (%) Flexible 5 0 packaging PET bottle 7 30 Composite carton 6 10 Aluminium can 27 66 Glass bottle 26 33 21 Source: PTIS Global. *Kg-CO2 equivalent, ‘000

Uniquely positioned, fully committed, continuing to invest 2025 Pledge announced Jan 2018 Targeted investment: Develop all our Increase use of Collaborate to increase $50 million packaging to be post-consumer recycling rates R&D infrastructure, recyclable or recycled content worldwide manufacturing equipment and reusable by 2025 partnerships 22

Summary To our employees around the world: “Thank You!” 1. COVID-19: Well positioned and demonstrating resilience 2. Strong YTD result and increased FY20 outlook 3. Bemis acquisition ahead of Year One expectations 4. Clear visibility to near term shareholder returns 5. Substantial opportunities to create value over the long term 23

Appendix slides Amcor profile

Amcor Amcor Strategy profile Our businesses FOCUSED PORTFOLIO: Flexible Packaging Rigid Packaging Specialty Cartons Closures Our differentiated capabilities THE AMCOR WAY: Our winning aspiration Significant growth opportunities WINNING FOR CUSTOMERS, EMPLOYEES, THE leading global packaging company INVESTORS AND THE ENVIRONMENT: 25

Amcor Global leader in primary consumer packaging profile • Founded in Australia in 1860 - NYSE (AMCR) and ASX (AMC) listed • $13 bn sales with ~250 plants, ~50,000 employees, 40+ countries • Global leader in flexible and rigid consumer packaging Global Scale Innovation Sustainability Strong Reach Player Leader Focus Financial Metrics Note: Sales, people and site information presented on a combined basis. 26 Reflects FY19 combined sales revenue which excludes results from flexible packaging plants in Europe and the United States which were required to be sold in order to secure anti-trust approval for the Bemis acquisition.

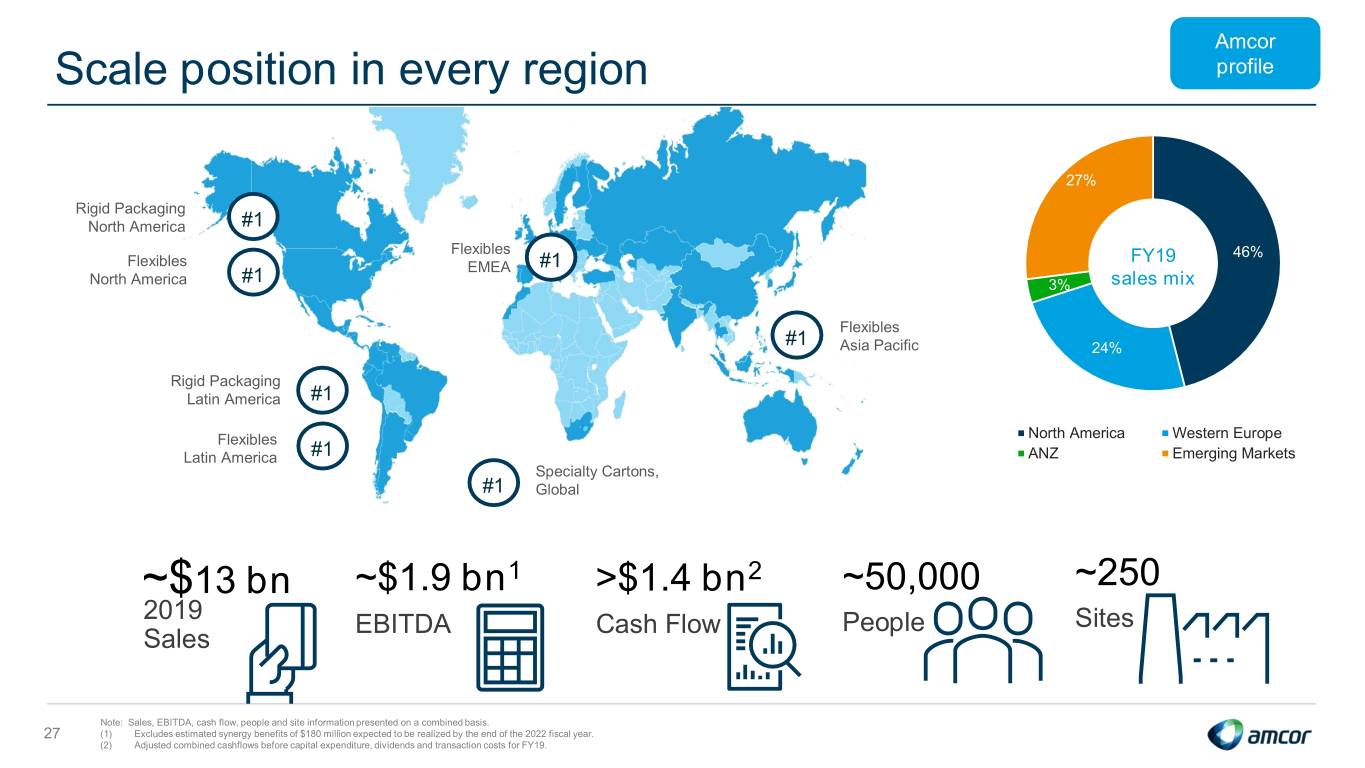

Amcor Scale position in every region profile 27% Rigid Packaging North America #1 Flexibles FY19 46% Flexibles EMEA #1 North America #1 3% sales mix Flexibles #1 Asia Pacific 24% Rigid Packaging Latin America #1 Flexibles North America Western Europe Latin America #1 ANZ Emerging Markets Specialty Cartons, #1 Global ~$13 bn ~$1.9 bn1 >$1.4 bn2 ~50,000 ~250 2019 EBITDA Cash Flow People Sites Sales Note: Sales, EBITDA, cash flow, people and site information presented on a combined basis. 27 (1) Excludes estimated synergy benefits of $180 million expected to be realized by the end of the 2022 fiscal year. (2) Adjusted combined cashflows before capital expenditure, dividends and transaction costs for FY19.

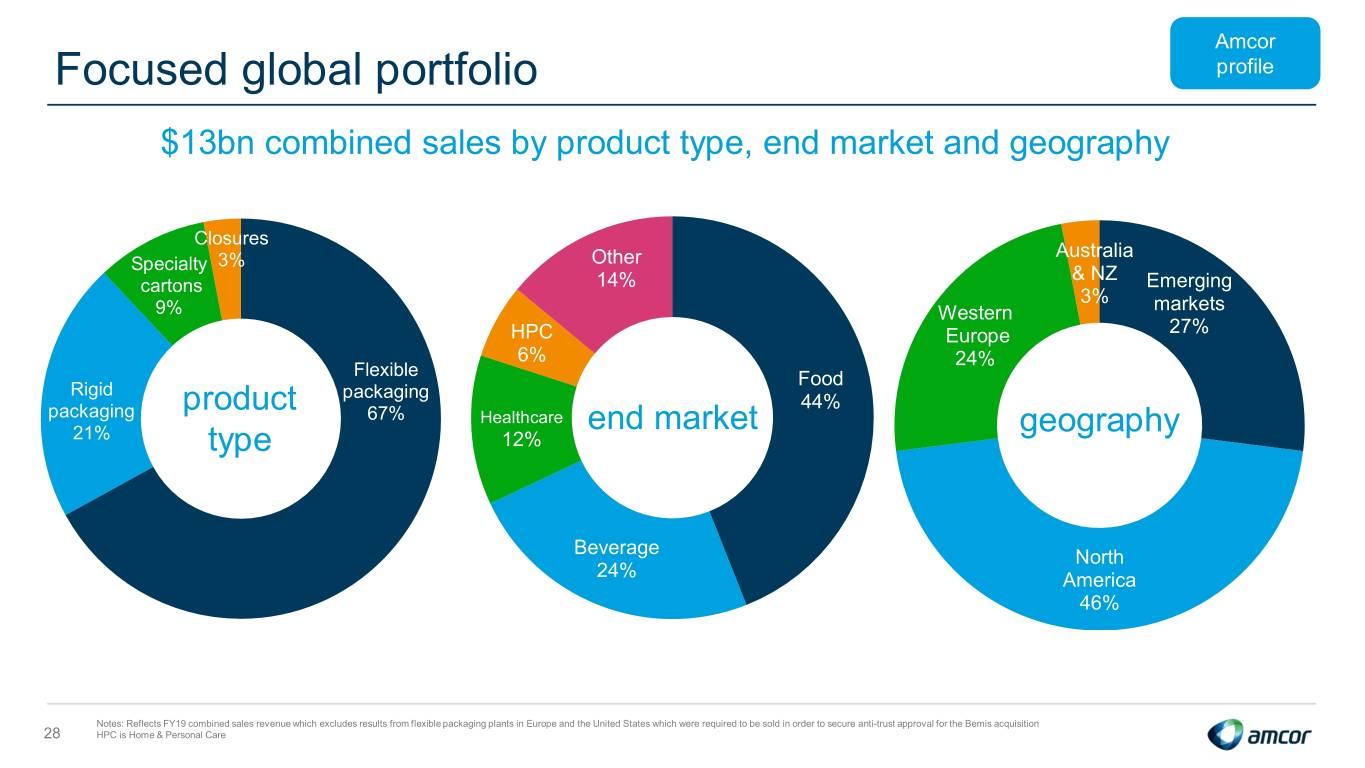

Amcor Focused global portfolio profile $13bn combined sales by product type, end market and geography Closures 3% Other Australia Specialty & NZ cartons 14% Emerging 3% 9% Western markets HPC Europe 27% 6% 24% Flexible Food Rigid packaging product 44% packaging 67% Healthcare end market geography 21% type 12% Beverage North 24% America 46% Notes: Reflects FY19 combined sales revenue which excludes results from flexible packaging plants in Europe and the United States which were required to be sold in order to secure anti-trust approval for the Bemis acquisition 28 HPC is Home & Personal Care

Amcor Amcor Flexibles overview profile Combined sales by Combined sales by region end market Latin America, Other 11% consumer, Europe, 17% Middle East and Home & Africa, Personal 38% care, 6% North Beverage, Food, 54% America, 8% 36% Asia Healthcare Pacific, , 15% 15% Europe, Middle East and Africa Food Healthcare Asia Pacific Beverage North America Home & Personal care Latin America Other consumer 2019 combined 2019 combined Plants Countries Employees sales Adjusted EBIT $10.1 bn $1.2 bn ~190 38 ~43,000 Notes: Reflects FY19 combined sales revenue which excludes results from flexible packaging plants in Europe and the United States which were required to be sold in order to secure anti-trust approval for the Bemis acquisition. Non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found 29 in the appendix section.

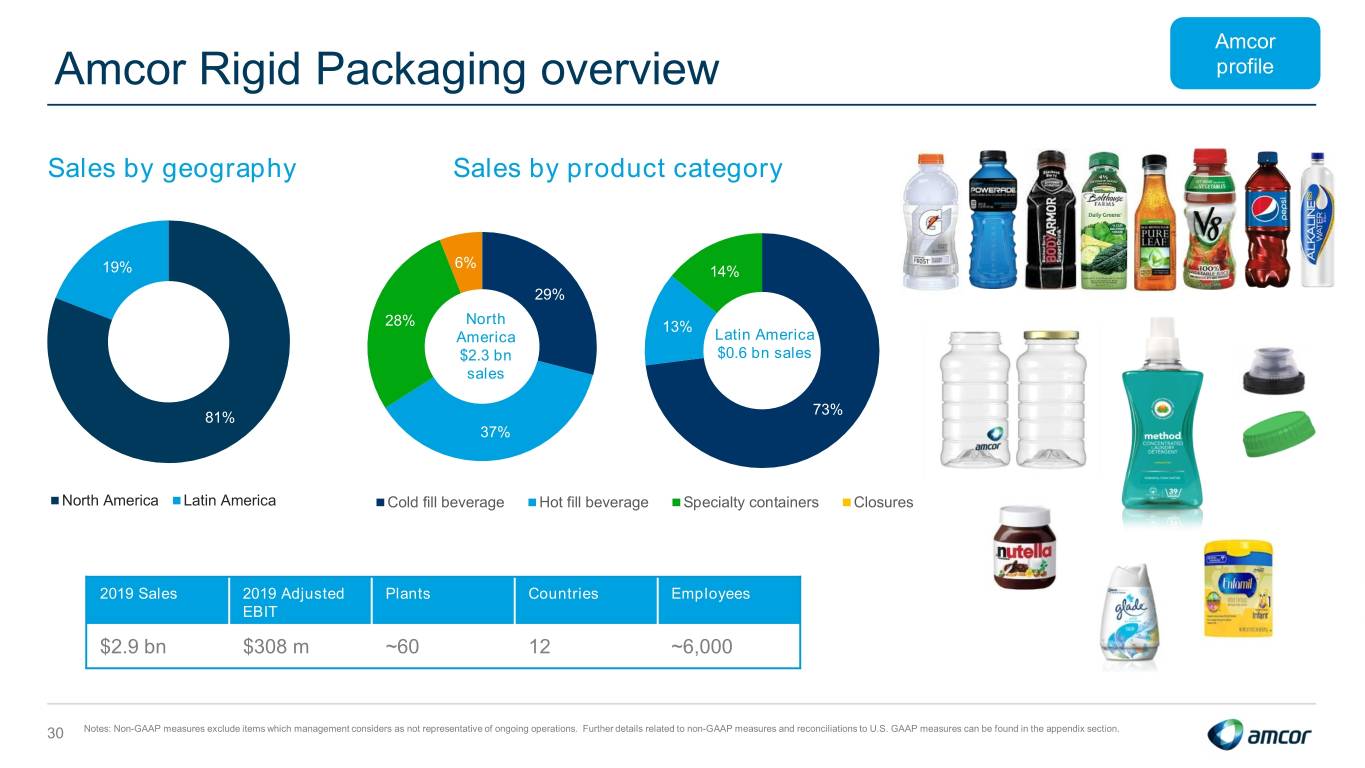

Amcor Amcor Rigid Packaging overview profile Sales by geography Sales by product category 6% 19% 14% 29% North 28% 13% America Latin America $2.3 bn $0.6 bn sales sales 73% 81% 37% North America Latin America Cold fill beverage Hot fill beverage Specialty containers Closures 2019 Sales 2019 Adjusted Plants Countries Employees EBIT $2.9 bn $308 m ~60 12 ~6,000 30 Notes: Non-GAAP measures exclude items which management considers as not representative of ongoing operations. Further details related to non-GAAP measures and reconciliations to U.S. GAAP measures can be found in the appendix section.

Amcor North America Beverage – market share by package format profile PET containers maintaining share in modestly growing North American market Non-alcoholic LRB retail sales by package format 57.5% 56.9% 57.5% 57.8% 54.7% 54.9% 56.2% 55.5% 52.9% 53.3% 53.1% • North American LRB market growth • 1.1% CAGR over the last 8 quarters 47.1% 46.7% 46.9% 45.3% 45.1% 44.5% • 2.3% over the last 4 quarters 42.5% 43.1% 42.5% 43.8% 42.2% • Plastic bottle growth • 1.3% CAGR over the last 8 quarters • 2.4% over the last 4 quarters Q3 CY17 Q4 CY17 Q1 CY18 Q2 CY18 Q3 CY18 Q4 CY18 Q1 CY19 Q2 CY19 Q3 CY19 Q4 CY19 Q1 CY20 Plastic bottle All other formats 31 Source: IRI, non-alcoholic Liquid Refreshment Beverages

Appendix slides Sustainability

Our Sustainability “Point of View” Sustainability There will always be a Requirements of packaging are Responsible packaging Amcor is uniquely role for packaging increasing: end of life solutions / is the answer positioned and taking waste reduction are critical action to lead the way Consumers want Achieving less To Preserve food To innovate and packaging to be: waste takes: and healthcare develop new products • Cost effective 1. Packaging Design products • Convenient To Protect • Easy to use 2. Waste Management To collaborate consumers • Great looking Infrastructure with stakeholders AND To Promote 3. Consumer To inform the brands Sustainable, leading Participation debate to LESS WASTE 33

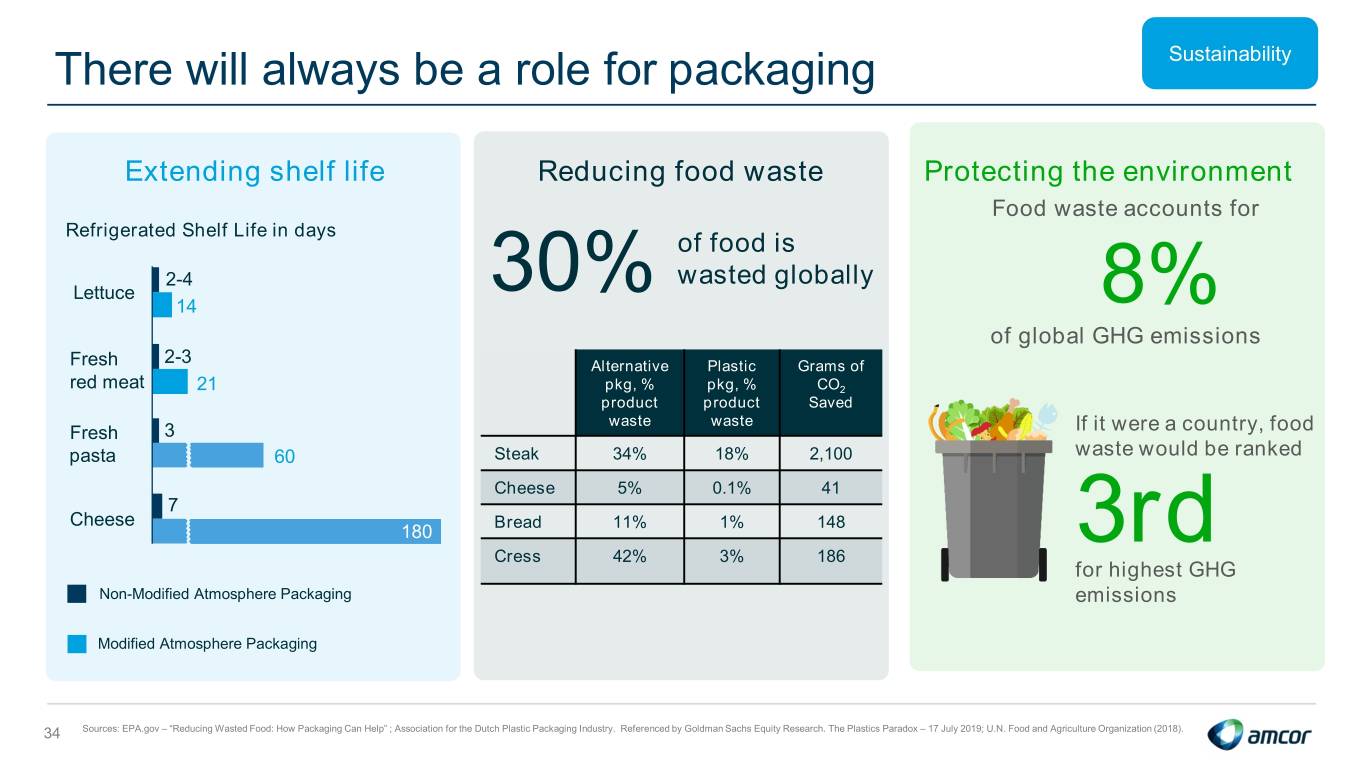

There will always be a role for packaging Sustainability Extending shelf life Reducing food waste Protecting the environment Food waste accounts for Refrigerated Shelf Life in days of food is 2-4 wasted globally Lettuce 30% 14 8% of global GHG emissions Fresh 2-3 Alternative Plastic Grams of red meat 21 pkg, % pkg, % CO2 product product Saved waste waste Fresh 3 If it were a country, food pasta 60 Steak 34% 18% 2,100 waste would be ranked Cheese 5% 0.1% 41 7 Cheese Bread 11% 1% 148 180 3rd Cress 42% 3% 186 for highest GHG Non-Modified Atmosphere Packaging emissions Modified Atmosphere Packaging 34 Sources: EPA.gov – “Reducing Wasted Food: How Packaging Can Help” ; Association for the Dutch Plastic Packaging Industry. Referenced by Goldman Sachs Equity Research. The Plastics Paradox – 17 July 2019; U.N. Food and Agriculture Organization (2018).

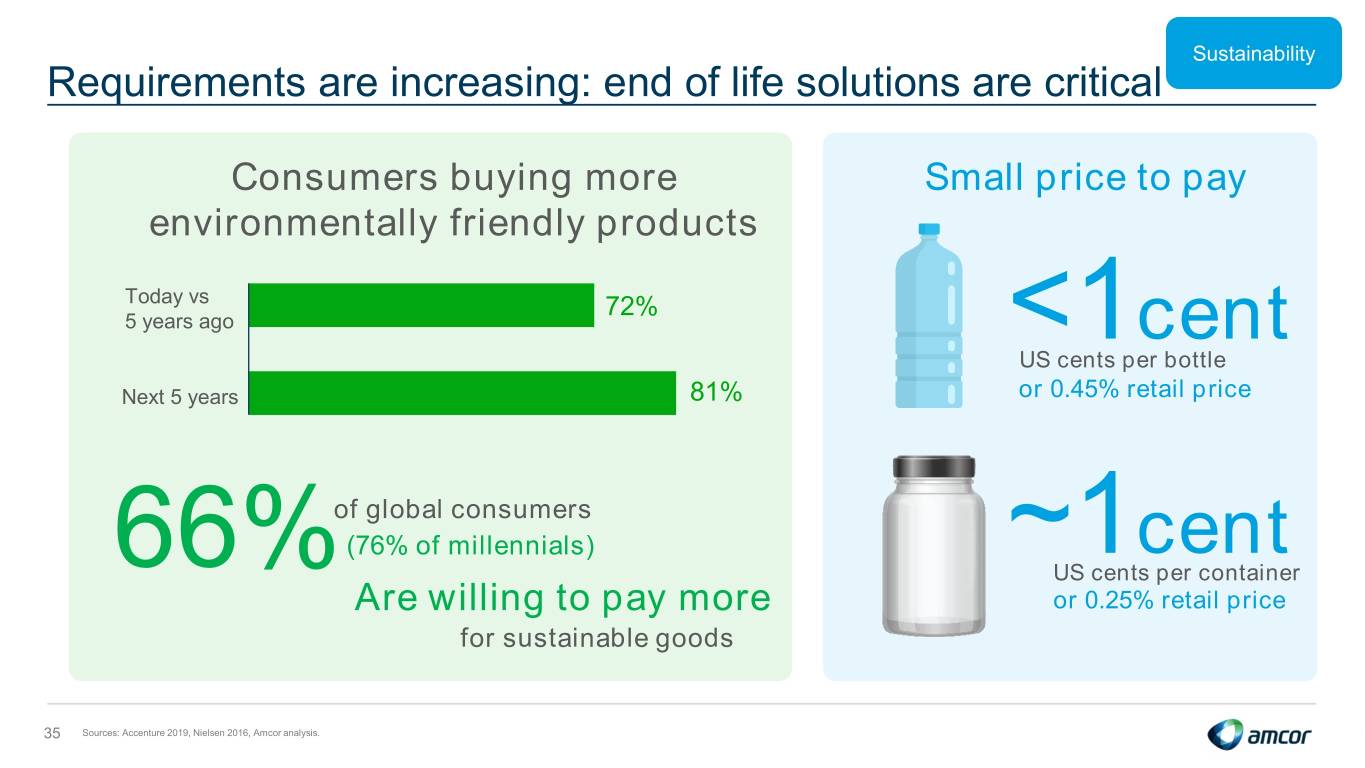

Sustainability Requirements are increasing: end of life solutions are critical Consumers buying more Small price to pay environmentally friendly products Today vs 72% 5 years ago <1cent US cents per bottle Next 5 years 81% or 0.45% retail price of global consumers (76% of millennials) ~1cent 66% US cents per container Are willing to pay more or 0.25% retail price for sustainable goods 35 Sources: Accenture 2019, Nielsen 2016, Amcor analysis.

Responsible packaging is the answer Packaging Waste Consumer design management participation infrastructure Greenhouse gas Recycling emissions* rate (%) Flexible 5 0 packaging PET bottle 7 30 Composite carton 6 10 Aluminium can 27 66 Glass bottle 26 33 36 Source: PTIS Global. *Kg-CO2 equivalent, ‘000

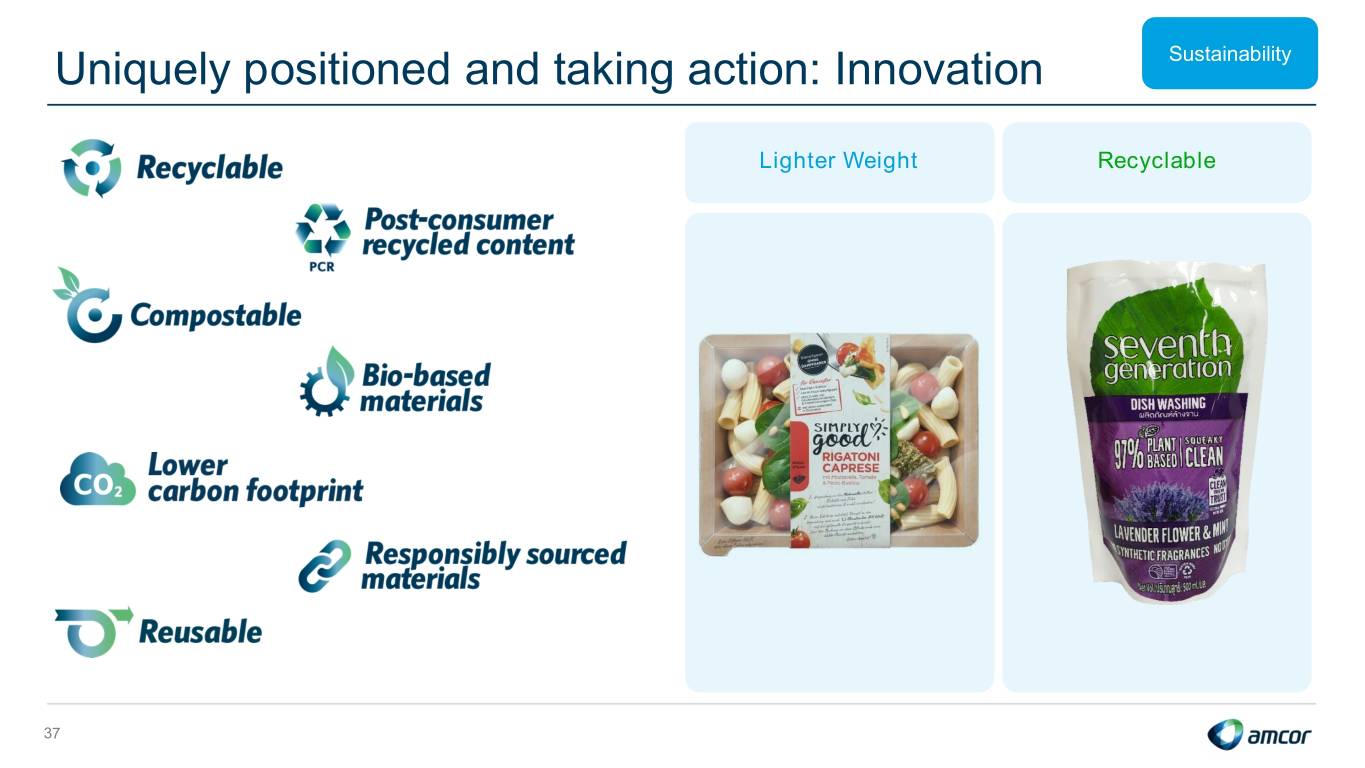

Uniquely positioned and taking action: Innovation Sustainability Lighter Weight Recyclable 37

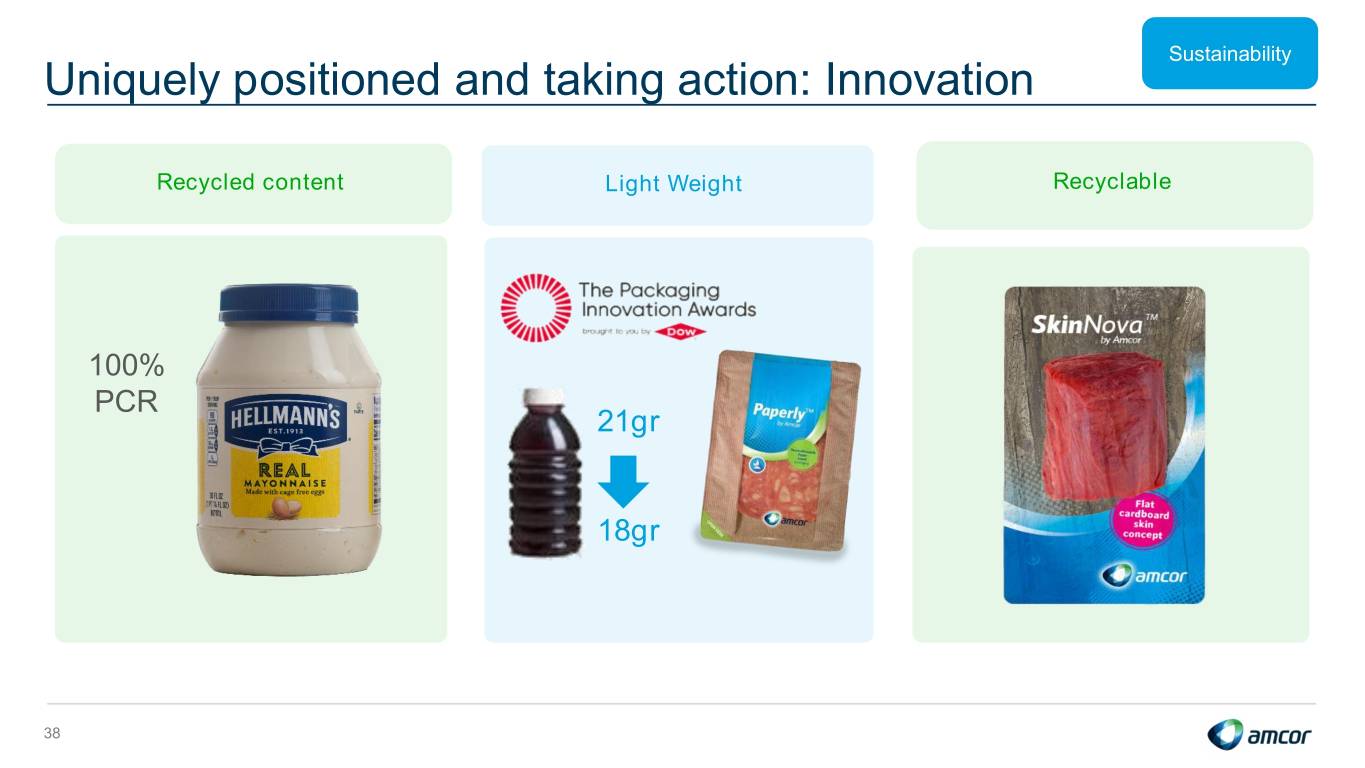

Sustainability Uniquely positioned and taking action: Innovation Recycled content Light Weight Recyclable 100% PCR 21gr 18gr 38

Uniquely positioned and taking action: Innovation Sustainability Existing product Conversion from Brand relaunch in now 100% recycled glass to 100% PET PET recycled PET Continued innovation: >200k tonnes less virgin resin used p.a. by 2025 Effective markets: >1 million tonnes recycled resin demand created through 2025 39

Uniquely positioned and taking action: Collaborating and informing Sustainability Bilateral top-to-top customer summits 40

Appendix slides Fiscal 2020 YTD results – supplementary schedules and reconciliations

Bemis acquisition: On track for $80m of synergies in FY20 Year to date cost synergies of ~$55(1) million; Integration progressing well and continue to expect $180 million(2) by end of fiscal 2022 Expected from the following areas: Estimated realization ($m): 40% 100% 180 130 20% 80 40% 55 55 55 Procurement Operations G&A & other Total cost FY 2020 FY 2021 FY 2022 costs synergies 42 (1) Total pre tax synergy benefits delivered YTD20 were $55 million, with $40 million recognised in the Flexibles segment and the remaining $15 million recognised as a reduction in corporate expenses. (2) Pre-tax annual net cost synergies.

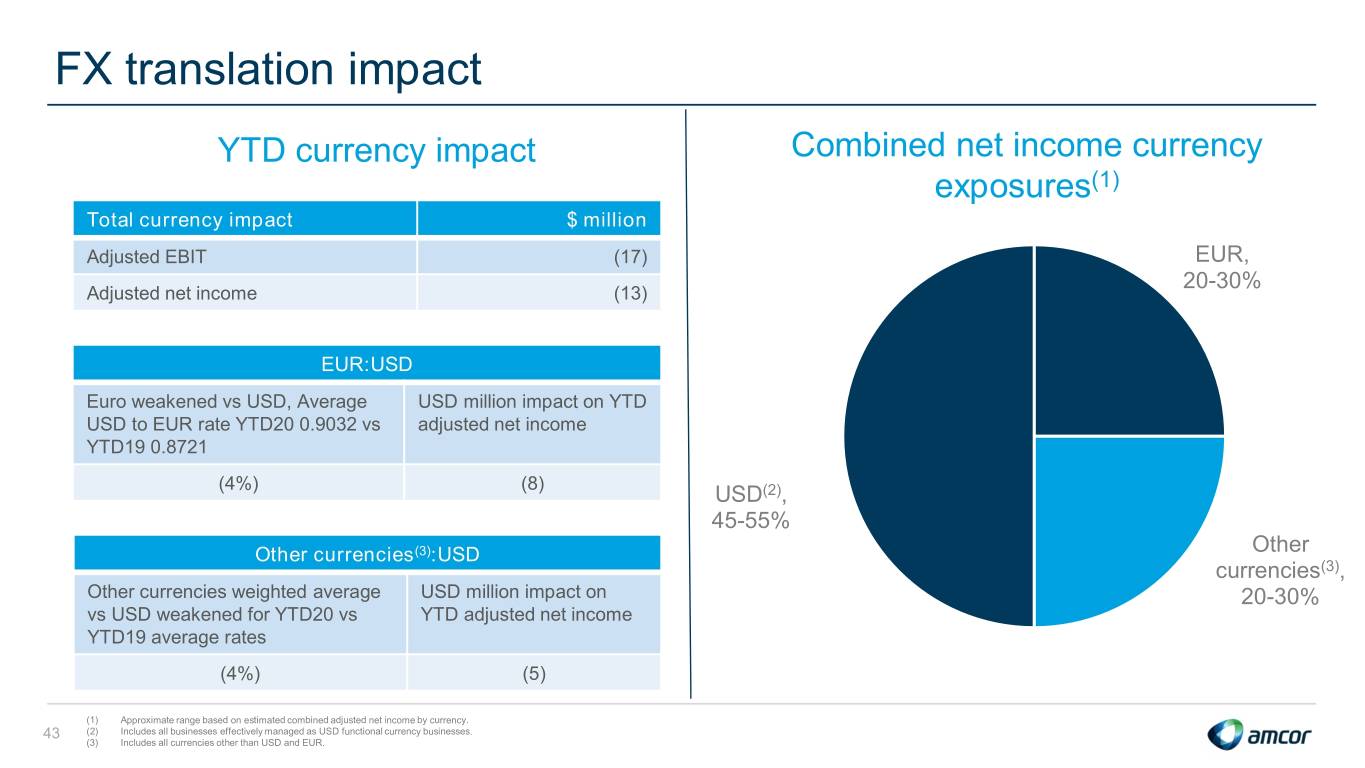

FX translation impact YTD currency impact Combined net income currency exposures(1) Total currency impact $ million Adjusted EBIT (17) EUR, 20-30% Adjusted net income (13) EUR:USD Euro weakened vs USD, Average USD million impact on YTD USD to EUR rate YTD20 0.9032 vs adjusted net income YTD19 0.8721 (4%) (8) USD(2), 45-55% Other currencies(3):USD Other currencies(3), Other currencies weighted average USD million impact on 20-30% vs USD weakened for YTD20 vs YTD adjusted net income YTD19 average rates (4%) (5) (1) Approximate range based on estimated combined adjusted net income by currency. 43 (2) Includes all businesses effectively managed as USD functional currency businesses. (3) Includes all currencies other than USD and EUR.

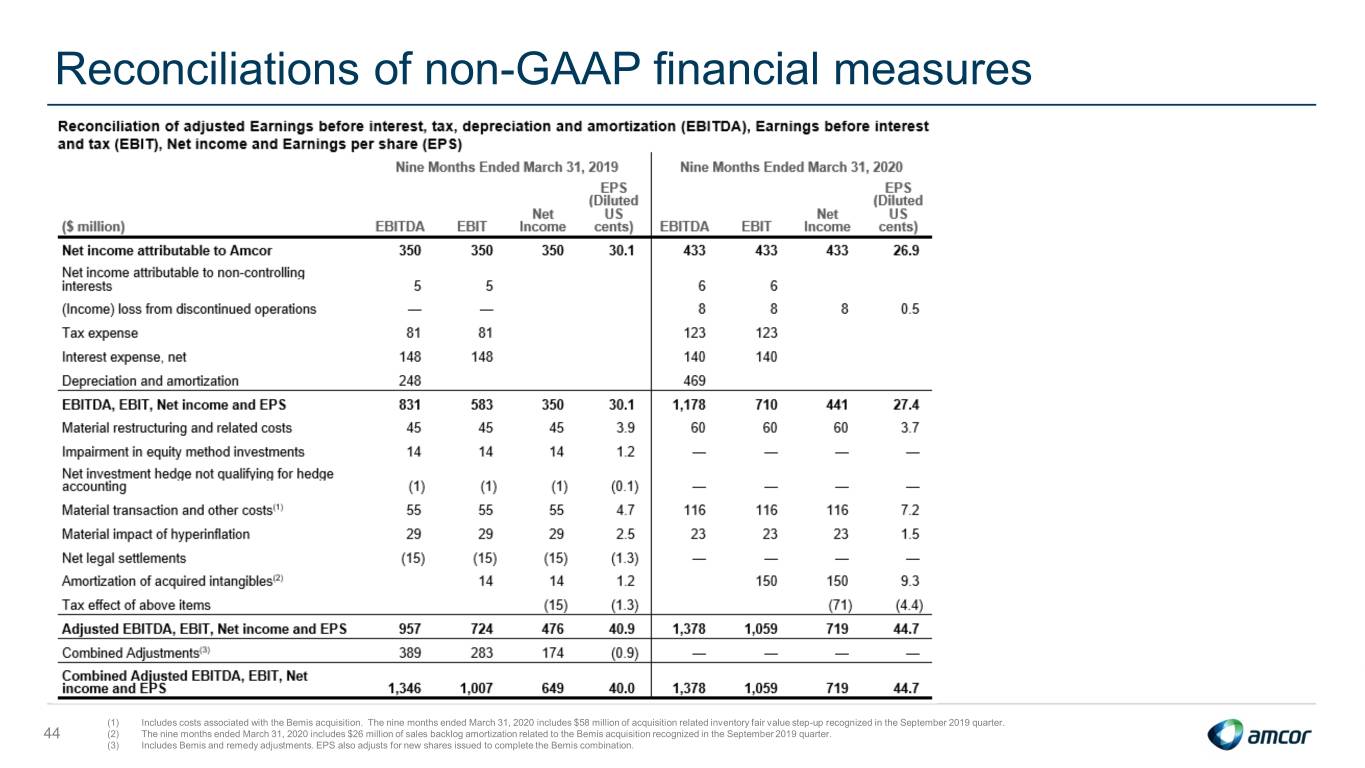

Reconciliations of non-GAAP financial measures (1) Includes costs associated with the Bemis acquisition. The nine months ended March 31, 2020 includes $58 million of acquisition related inventory fair value step-up recognized in the September 2019 quarter. 44 (2) The nine months ended March 31, 2020 includes $26 million of sales backlog amortization related to the Bemis acquisition recognized in the September 2019 quarter. (3) Includes Bemis and remedy adjustments. EPS also adjusts for new shares issued to complete the Bemis combination.

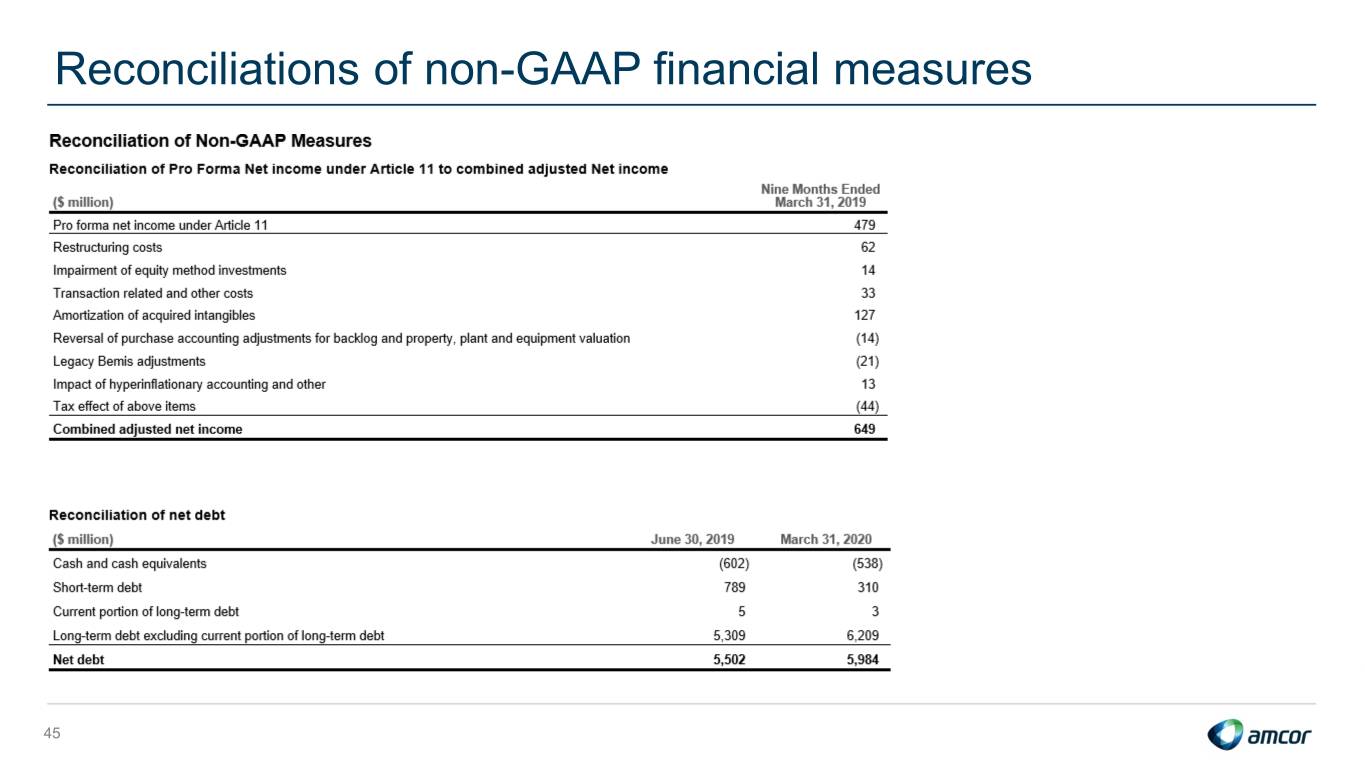

Reconciliations of non-GAAP financial measures 45

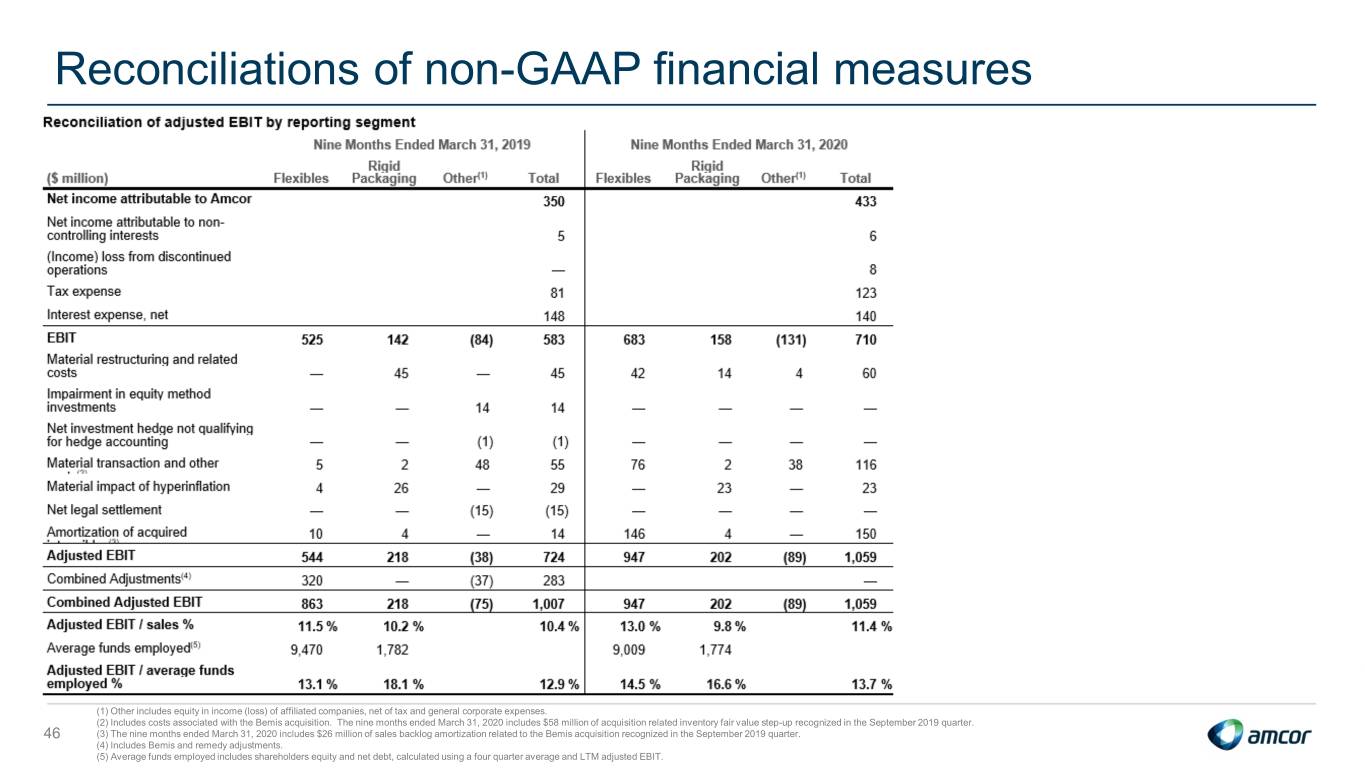

Reconciliations of non-GAAP financial measures (1) Other includes equity in income (loss) of affiliated companies, net of tax and general corporate expenses. (2) Includes costs associated with the Bemis acquisition. The nine months ended March 31, 2020 includes $58 million of acquisition related inventory fair value step-up recognized in the September 2019 quarter. 46 (3) The nine months ended March 31, 2020 includes $26 million of sales backlog amortization related to the Bemis acquisition recognized in the September 2019 quarter. (4) Includes Bemis and remedy adjustments. (5) Average funds employed includes shareholders equity and net debt, calculated using a four quarter average and LTM adjusted EBIT.

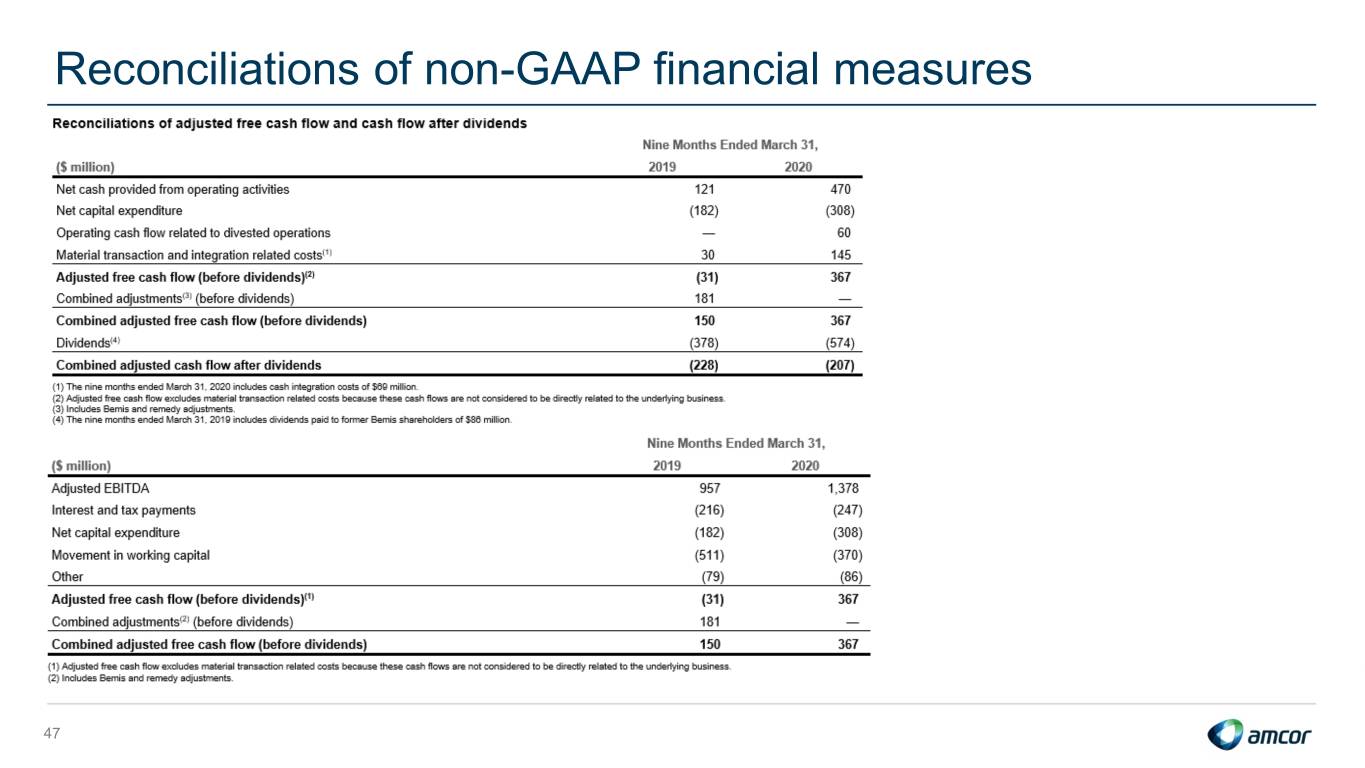

Reconciliations of non-GAAP financial measures 47