Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Seritage Growth Properties | srg-8k_20200508.htm |

COVID-19 BUSINESS UPDATE May 2020 Exhibit 99.1

Seritage Growth Properties | COVID-19 Business Update 1 SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE Our number one priority is the health and safety of our team, our families, our communities and our partners, including our tenants, contractors, and other stakeholders We are focused on preserving the medium- and long-term value of our assets and platform, balanced with the need to make immediate changes in response to the current environment Click Here for April 2020 shareholder letter and 2019 annual report On the civic front, over 180 of our properties (certain full buildings and many of our parking lots) are available to governmental and community organizations for relief efforts Please visit www.seritage.com/civic or email us at SeritageCares@seritage.com to utilize these facilities at no cost

Near Term Adjustments 2 SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE Until we have more visibility into the duration and extent of the disruption to the economy and on our business, we have taken steps to: Materially reduce or defer operating and corporate expenses to offset potential income reductions or deferrals and manage our cash resources until our tenants start to reopen Reduction in operating expenses at the property and corporate level – each by approximately 20 to 25 percent Limit our capital deployment, providing a period of time to assess further capital allocation, potential changes to the mix of tenants and uses and the scope of certain projects Substantially all of our construction projects placed on hold at the end of March

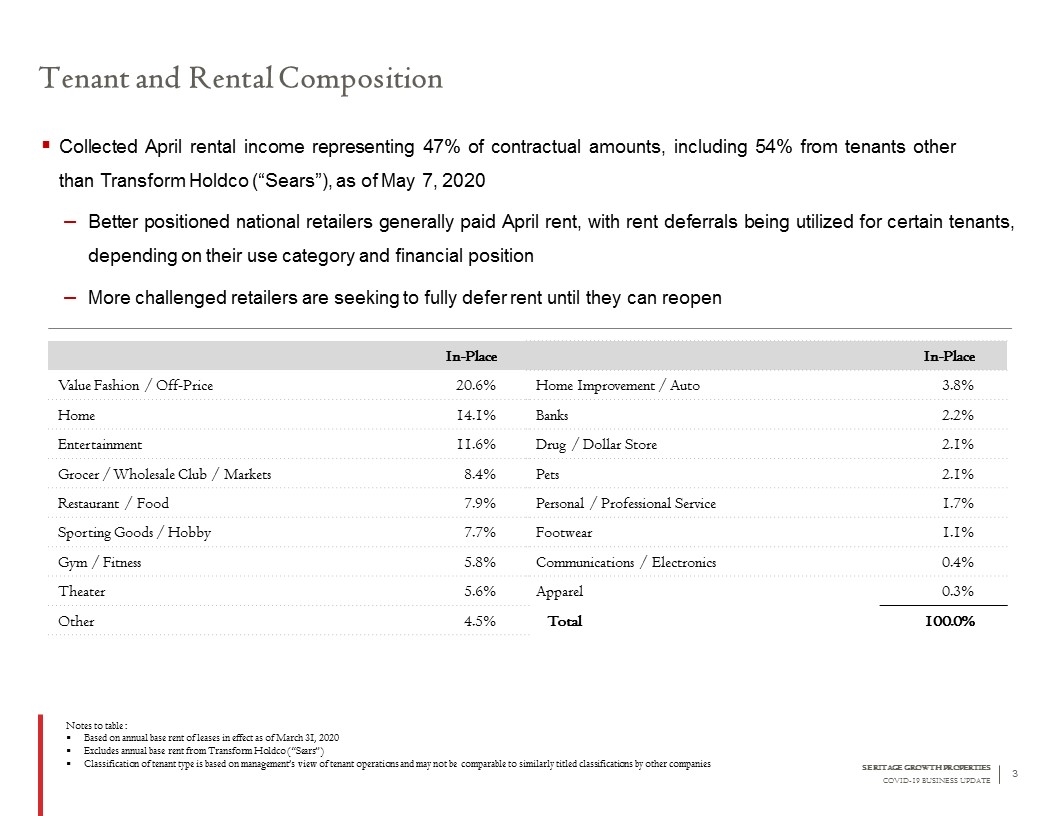

Tenant and Rental Composition SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE Collected April rental income representing 47% of contractual amounts, including 54% from tenants other than Transform Holdco (“Sears”), as of May 7, 2020 Better positioned national retailers generally paid April rent, with rent deferrals being utilized for certain tenants, depending on their use category and financial position More challenged retailers are seeking to fully defer rent until they can reopen Notes to table : Based on annual base rent of leases in effect as of March 31, 2020 Excludes annual base rent from Transform Holdco (“Sears”) Classification of tenant type is based on management’s view of tenant operations and may not be comparable to similarly titled classifications by other companies 3 In-Place Value Fashion / Off-Price 20.6% Home 14.1% Entertainment 11.6% Grocer / Wholesale Club / Markets 8.4% Restaurant / Food 7.9% Sporting Goods / Hobby 7.7% Gym / Fitness 5.8% Theater 5.6% Other 4.5% In-Place Home Improvement / Auto 3.8% Banks 2.2% Drug / Dollar Store 2.1% Pets 2.1% Personal / Professional Service 1.7% Footwear 1.1% Communications / Electronics 0.4% Apparel 0.3% Total 100.0%

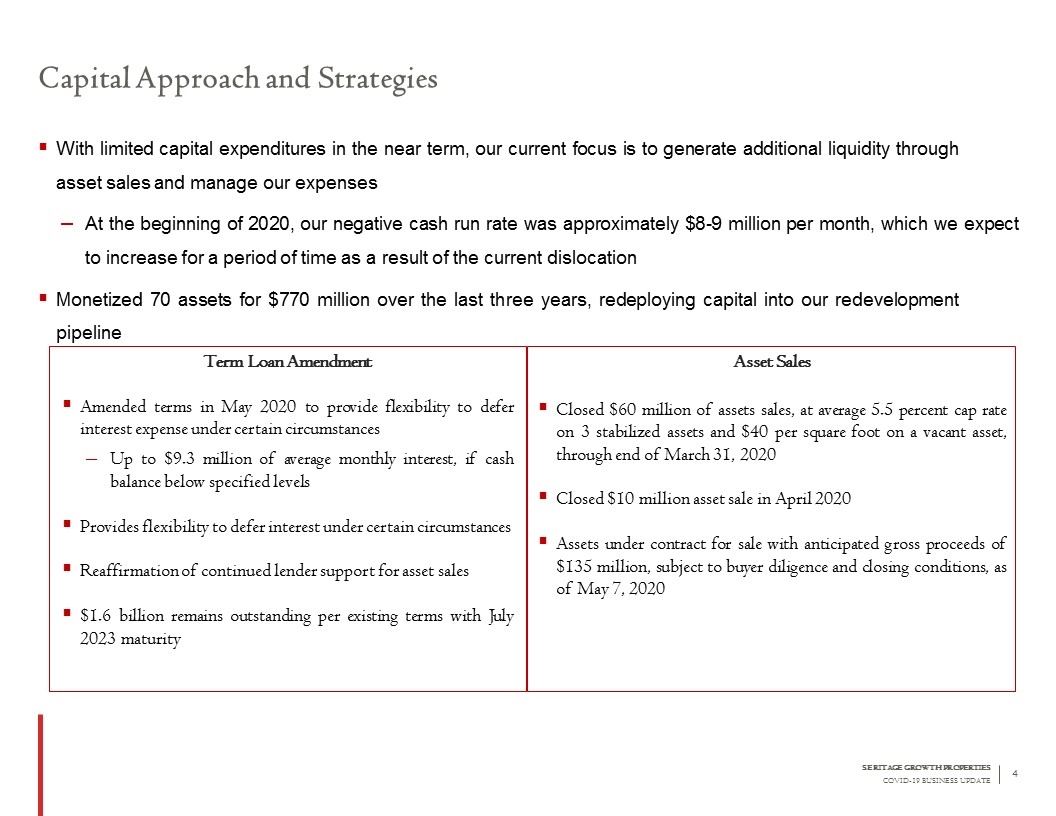

Capital Approach and Strategies 4 SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE With limited capital expenditures in the near term, our current focus is to generate additional liquidity through asset sales and manage our expenses At the beginning of 2020, our negative cash run rate was approximately $8-9 million per month, which we expect to increase for a period of time as a result of the current dislocation Monetized 70 assets for $770 million over the last three years, redeploying capital into our redevelopment pipeline Term Loan Amendment Amended terms in May 2020 to provide flexibility to defer interest expense under certain circumstances Up to $9.3 million of average monthly interest, if cash balance below specified levels Provides flexibility to defer interest under certain circumstances Reaffirmation of continued lender support for asset sales $1.6 billion remains outstanding per existing terms with July 2023 maturity Asset Sales Closed $60 million of assets sales, at average 5.5 percent cap rate on 3 stabilized assets and $40 per square foot on a vacant asset, through end of March 31, 2020 Closed $10 million asset sale in April 2020 Assets under contract for sale with anticipated gross proceeds of $135 million, subject to buyer diligence and closing conditions, as of May 7, 2020

Unlocking Value as We Move Forward 5 SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE We believe that there will be immense need to convert well-located real estate for revitalized uses to serve today’s communities To lead in this transformation, we are focused on: Utilizing the quality and diversity of our asset base to our advantage Leveraging our track record in intensive redevelopment and our extensive relationships with tenants, development partners and capital providers Continuing to expand our opportunity set beyond retail, with a focus on multi-family and mixed-use environments Prioritizing capital for our more differentiated redevelopments, those projects with stronger return metrics, and those redevelopments that we can restart quickly to generate near-term income

Our Culture and Commitment 6 SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE Our core principles will continue to guide how we conduct ourselves and approach the challenges and necessary strategic changes that we may make in the months ahead. Be a culture based on respect Build relationships for the long term Create an environment of constant improvement Be entrepreneurial and proactive Inspire people and communities through our projects Our team, our track record, our extensive relationships with retail and non-retail users, and our partnerships with mixed-use developers and capital providers position us to be a leader in the transformation of real estate that will be necessary as part of the larger economic recovery in our communities. We will get through this together by being proactive and decisive in the short term, while preserving the medium- and long-term value of our assets and platform.

Seritage Growth Properties | Forward Looking Statements SERITAGE GROWTH PROPERTIES COVID-19 BUSINESS UPDATE 7 This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the company’s control, which may cause actual results to differ significantly from those expressed in any forward-looking statement. Factors that could cause or contribute to such differences include, but are not limited to: our historical exposure to Sears Holdings and the effects of its previously announced bankruptcy filing; the litigation filed against us and other defendants in the Sears Holdings adversarial proceeding pending in bankruptcy court; Holdco’s termination and other rights under its master lease with us; competition in the real estate and retail industries; risks relating to our recapture and redevelopment activities; contingencies to the commencement of rent under leases; the terms of our indebtedness; restrictions with which we are required to comply in order to maintain REIT status and other legal requirements to which we are subject; failure to achieve expected occupancy and/or rent levels within the projected time frame or at all; the impact of ongoing negative operating cash flow on our ability to fund operations and ongoing development; our ability to access or obtain sufficient sources of financing to fund our liquidity needs; our relatively limited history as an operating company; and the impact of the COVID-19 pandemic on the business of our tenants and our business, income, cash flow, results of operations, financial condition, liquidity, prospects, ability to service our debt obligations and our ability to pay dividends and other distributions to our shareholders. For additional discussion of these and other applicable risks, assumptions and uncertainties, see the “Risk Factors” and forward-looking statement disclosure contained in our filings with the Securities and Exchange Commission, including the risk factors relating to Sears Holdings and Holdco. While we believe that our forecasts and assumptions are reasonable, we caution that actual results may differ materially. We intend the forward-looking statements to speak only as of the time made and do not undertake to update or revise them as more information becomes available, except as required by law.

500 Fifth Avenue | New York, NY 10110 212-355-7800 | www.seritage.com