Attached files

| file | filename |

|---|---|

| EX-99.2 - MAY 7, 2020 CONFERENCE CALL TRANSCRIPT. - LEXINGTON REALTY TRUST | n2193_ex99-2.htm |

| 8-K - FORM 8-K - LEXINGTON REALTY TRUST | n2193_x5-8k.htm |

Exhibit 99.1

LEXINGTON REALTY TRUST

QUARTERLY SUPPLEMENTAL INFORMATION

March 31, 2020

Table of Contents

|

Section |

|

Page |

|

|

|

|

|

|

||

|

|

|

|

|

Portfolio Data |

|

|

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

This Quarterly Earnings Press Release and Quarterly Supplemental Information contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under the control of Lexington Realty Trust (“Lexington”), which may cause actual results, performance or achievements of Lexington and its subsidiaries to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Lexington’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, risks related to: (1) the potential adverse impact on Lexington or its tenants from the novel coronavirus (COVID-19), (2) the authorization of Lexington’s Board of Trustees of future dividend declarations, (3) Lexington’s ability to achieve its estimates of net income attributable to common shareholders and Adjusted Company FFO available to all equity holders and unitholders – diluted for the year ending March 31,2020, (4) the successful consummation of any lease, acquisition, build-to-suit, development project, disposition, financing or other transaction on the terms described herein or at all, (5) the failure to continue to qualify as a real estate investment trust, (6) changes in general business and economic conditions, including the impact of any new legislation, (7) competition, (8) increases in real estate construction costs, (9) changes in interest rates, (10) changes in accessibility of debt and equity capital markets, and (11) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington’s web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington’s future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects,” may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to revise those forward-looking statements to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington’s expectations will be realized.

|

|

Lexington Realty Trust |

|

|

TRADED: NYSE: LXP |

|

|

One Penn Plaza, Suite 4015 |

|

|

New York, NY 10119-4015 |

FOR IMMEDIATE RELEASE

LEXINGTON REALTY TRUST REPORTS FIRST QUARTER 2020 RESULTS

New York, NY - May 7, 2020 - Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate investment trust focused on single-tenant industrial real estate investments, today announced results for the first quarter ended March 31, 2020.

First Quarter 2020 Highlights

|

|

● |

Recorded Net Income attributable to common shareholders of $16.5 million, or $0.06 per diluted common share. |

|

|

● |

Generated Adjusted Company Funds From Operations available to all equityholders and unitholders - diluted (“Adjusted Company FFO”) of $49.3 million, or $0.19 per diluted common share. |

|

|

● |

Acquired four industrial properties for an aggregate cost of $195.5 million. |

|

|

● |

Disposed of two office properties for an aggregate gross price of $29.6 million. |

|

|

● |

Raised net proceeds of $17.3 million by issuing approximately 1.6 million common shares through the ATM program at an average price of $11.24 per share. |

|

|

● |

Repurchased 1.3 million common shares at an average price of $8.28 per share. |

|

|

● |

Completed 337 thousand square feet of new lease and lease extensions. |

|

|

● |

Increased industrial portfolio to 83.2% of gross real estate assets. |

Subsequent Events

|

|

● |

Collected 99.8% of April 2020 Cash Base Rents. |

|

|

● |

Raised net proceeds of $37.1 million by issuing approximately 3.8 million common shares through the ATM program. |

|

|

● |

Acquired one industrial asset for a cost of approximately $34.7 million. |

|

|

● |

Sold one office property for a gross sales price of $10.7 million. |

Adjusted Company FFO is a non-GAAP financial measure. It and certain other non-GAAP financial measures are defined and reconciled later in this press release.

T. Wilson Eglin, Chairman and Chief Executive Officer of Lexington Realty Trust, commented, “Our portfolio has performed well during the Covid-19 pandemic, demonstrating resilience that is a hallmark of our investment strategy. In this environment, we believe investment opportunities are likely to be more favorable than they have been in the recent past and we plan to use disposition proceeds, retained cash flow, our balance sheet flexibility and access to capital to grow our industrial portfolio. Furthermore, the pandemic has accelerated e-commerce growth, demonstrated the value of more resilient supply chains, and increased the possibility of greater domestic production of goods going forward. These trends bode well for our industrial growth strategy.”

3

COVID-19 RENT UPDATE

As of May 6, 2020, 99.8% of April Cash Base Rents have been paid. Information regarding historical collections should not be considered an indication of expected future collections.

Lexington has received rent relief requests from certain tenants. The amount of rent relief requests Lexington has received represented 5.5% of its 2019 annual Cash Base rents. Lexington estimates the portion of tenants warranting relief represented less than 1% of its 2019 annual Cash Base Rents. Lexington is currently evaluating these requests, but, absent material tenant defaults, Lexington does not expect any material impact to its rental revenues resulting from rent relief requests. However, Lexington can give no assurances on the outcomes of the negotiation of rent relief requests, the success of any tenant’s financial prospects or the amount of relief requests that it will ultimately receive or grant.

FINANCIAL RESULTS

Revenues

For the quarter ended March 31, 2020, total gross revenues were $80.8 million, compared with total gross revenues of $81.2 million for the quarter ended March 31, 2019. The decrease is primarily attributable to sales, partially offset by property acquisitions and higher fee income.

Net Income Attributable to Common Shareholders

For the quarter ended March 31, 2020, net income attributable to common shareholders was $16.5 million, or $0.06 per diluted share, compared with net income attributable to common shareholders for the quarter ended March 31, 2019 of $26.4 million, or $0.11 per diluted share.

Adjusted Company FFO

For the quarter ended March 31, 2020, Lexington generated Adjusted Company FFO of $49.3 million, or $0.19 per diluted share, compared to Adjusted Company FFO for the quarter ended March 31, 2019 of $47.2 million, or $0.20 per diluted share.

Dividends/Distributions

As previously announced, during the first quarter of 2020, Lexington declared a regular quarterly common share/unit dividend/distribution for the quarter ended March 31, 2020 of $0.1050 per common share/unit, which was paid on April 15, 2020 to common shareholders/unitholders of record as of March 31, 2020. Lexington also declared a cash dividend of $0.8125 per share on its Series C Cumulative Convertible Preferred Stock (“Series C Preferred”) for the quarter ended March 31, 2020, which is expected to be paid on May 15, 2020 to Series C Preferred Shareholders of record as of April 30, 2020.

4

TRANSACTION ACTIVITY

ACQUISITION TRANSACTIONS

|

Property Type |

|

Market |

|

Sq. Ft. |

|

Initial Basis |

|

Approximate Lease Term (Yrs) |

|||

|

Industrial-warehouse/distribution |

|

Chicago, IL |

|

705,661 |

|

|

$ |

53,642 |

|

|

10 |

|

Industrial-warehouse/distribution |

|

Phoenix, AZ |

|

160,140 |

|

|

19,164 |

|

|

6 |

|

|

Industrial-warehouse/distribution |

|

Chicago, IL |

|

473,280 |

|

|

39,153 |

|

|

10 |

|

|

Industrial-warehouse/distribution |

|

Dallas, TX |

|

1,214,526 |

|

|

83,495 |

|

|

10 |

|

|

|

|

|

|

2,553,607 |

|

|

$ |

195,454 |

|

|

|

The above properties were acquired at aggregate weighted-average GAAP and cash capitalization rates of 5.3% and 4.8%, respectively.

DEVELOPMENT PROJECTS

|

Project (% owned) |

|

Market |

|

Property |

|

Estimated |

|

Estimated |

|

|

GAAP |

|

|

Lexington |

|

|

Estimated Completion |

|||

|

Consolidated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Fairburn (90%) |

|

Atlanta, GA |

|

Industrial |

|

910,000 |

|

$ |

53,812 |

|

|

$ |

14,641 |

|

|

$ |

11,474 |

|

|

4Q 20 |

|

Rickenbacker (100%) |

|

Columbus, OH |

|

Industrial |

|

320,000 |

|

20,300 |

|

|

3,657 |

|

|

3,421 |

|

|

1Q 21 |

|||

|

|

|

|

|

|

|

|

|

$ |

74,112 |

|

|

$ |

18,298 |

|

|

$ |

14,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Non-consolidated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

ETNA Park 90 (90%)(2) |

|

Columbus, OH |

|

Industrial |

|

TBD |

|

TBD |

|

$ |

8,670 |

|

|

$ |

8,984 |

|

|

TBD |

||

|

ETNA Park 70 East (90%)(2) |

|

Columbus, OH |

|

Industrial |

|

TBD |

|

TBD |

|

5,058 |

|

|

5,089 |

|

|

TBD |

||||

|

|

|

|

|

|

|

|

|

|

|

$ |

13,728 |

|

|

$ |

14,073 |

|

|

|

||

|

|

1. |

GAAP investment balance is in real estate under construction for consolidated projects and investments in non-consolidated entities for non-consolidated projects. |

|

|

2. |

Plans and specifications have not been completed and the estimated square footage, project cost and completion date cannot be determined. |

PROPERTY DISPOSITIONS(1)

|

Primary Tenant |

|

Location |

|

Property Type |

|

Gross |

|

Annualized Net Income(2) ($000) |

|

|

Annualized NOI(2) |

|

|

Month of Disposition |

|

% Leased |

|||||

|

Multi-Tenant (3) |

|

Charleston, SC |

|

Office |

|

$ |

6,830 |

|

|

$ |

(1,142) |

|

|

$ |

17 |

|

|

March |

|

23 |

% |

|

Burns & McDonnell Engineering |

|

Kansas City, MO |

|

Office |

|

22,775 |

|

|

1,277 |

|

|

1,589 |

|

|

March |

|

100 |

% |

|||

|

|

|

|

|

|

|

$ |

29,605 |

|

|

$ |

135 |

|

|

$ |

1,606 |

|

|

|

|

|

|

|

1. |

In addition, a joint venture, in which Lexington has a 20% interest, disposed of one office property for $16.9 million and satisfied $13.0 million of non-recourse debt. |

|

2. |

Quarterly period prior to sale, annualized. |

| 3. | Sold in a foreclosure sale. Disposition price reflects non-recourse debt balance. |

The consolidated 2020 property dispositions resulted in weighted-average GAAP and Cash capitalization rates of 5.9% and 5.4%, respectively.

5

LEASING

|

|

LEASE EXTENSIONS |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

Primary Tenant(1) |

Prior

|

|

Lease

|

|

Sq. Ft. |

||

|

|

Office |

|

|

|

|

|

|

|

|

|

1 |

|

Wall |

NJ |

|

NJ Natural Gas |

|

06/2021 |

|

06/2037 |

|

157,511 |

2 |

|

Baton Rouge |

LA |

|

New Cingular Wireless(2) |

|

10/2022 |

|

11/2023 |

|

23,750 |

2 |

|

Total office lease extensions |

|

|

|

|

|

|

|

181,261 |

|

|

|

NEW LEASES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location |

|

|

|

|

|

Lease Expiration Date |

|

Sq. Ft. |

|

|

|

Industrial |

|

|

|

|

|

|

|

|

|

1 |

|

Moody |

AL |

|

Wal-Mart |

|

|

|

02/2023 |

|

155,766 |

1 |

|

Total industrial leases |

|

|

|

|

|

|

|

155,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

TOTAL NEW AND EXTENDED LEASES |

|

|

|

|

|

|

|

337,027 |

|

(1) Leases greater than 10,000 square feet.

(2) Effective November 7, 2020, the square footage leased by the tenant will be reduced from 70,100 square feet to 23,750 square feet.

As of March 31, 2020, Lexington’s portfolio was 97.2% leased.

BALANCE SHEET/CAPITAL MARKETS

During the first quarter of 2020, Lexington issued 1.6 million common shares under its ATM program raising net proceeds of $17.3 million. During the second quarter of 2020, Lexington issued an additional 3.8 million common shares under its ATM program raising net proceeds of $37.1 million.

In the first quarter of 2020, Lexington repurchased 1.3 million common shares at an average price of $8.28 per share under its share repurchase authorization. As of March 31, 2020, there were approximately 9.0 million common shares remaining to be repurchased under the authorization.

Year to date, Lexington has issued approximately 4.0 million common shares, net, at an average price of $11.06 per share.

During the first quarter, Lexington borrowed $130.0 million on its unsecured revolving credit facility. As of the date of this earnings release, Lexington has $470.0 million of availability under its unsecured revolving credit facility subject to covenant compliance.

2020 EARNINGS GUIDANCE

Lexington now estimates that its net income attributable to common shareholders for the year ended December 31, 2020 will be within an expected range of $0.77 to $0.80 per diluted common share.

Additionally, Lexington is reaffirming that its Adjusted Company FFO for the year ended December 31, 2020 is expected to be within a range of $0.74 to $0.77 per diluted common share. This guidance is forward looking, excludes the impact of certain items and is based on current expectations.

6

FIRST QUARTER 2020 CONFERENCE CALL

Lexington will host a conference call today, May 7, 2020, at 8:30 a.m. Eastern Time, to discuss its results for the quarter ended March 31, 2020. Interested parties may participate in this conference call by dialing 1-844-825-9783 (U.S.), 1-412-317-5163 (International) or 1-855-669-9657 (Canada). A replay of the call will be available through August 7, 2020, at 1-877-344-7529 (U.S.), 1-412-317-0088 (International) or 1-855-669-9658 (Canada), pin code for all replay numbers is 10142063. A link to a live webcast of the conference call is available at www.lxp.com within the Investors section.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust (NYSE: LXP) is a publicly traded real estate investment trust (REIT) that owns a diversified portfolio of real estate assets consisting primarily of equity investments in single-tenant net-leased commercial properties across the United States. Lexington seeks to expand its industrial portfolio through build-to-suit transactions, sale-leaseback transactions and other transactions, including acquisitions. For more information, including Lexington’s Quarterly Supplemental Information package, or to follow Lexington on social media, visit www.lxp.com.

Contact:

Investor or Media Inquiries for Lexington Realty Trust:

Heather Gentry, Senior Vice President of Investor Relations

Lexington Realty Trust

Phone: (212) 692-7200 E-mail: hgentry@lxp.com

This release contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under Lexington’s control which may cause actual results, performance or achievements of Lexington to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Lexington’s periodic reports filed with the Securities and Exchange Commission, including risks related to: (1) the potential adverse impact on Lexington or its tenants from the novel coronavirus (COVID-19); (2) the authorization by Lexington’s Board of Trustees of future dividend declarations, (3) Lexington’s ability to achieve its estimates of net income attributable to common shareholders and Adjusted Company FFO for the year ending December 31, 2020, (4) the successful consummation of any lease, acquisition, build-to-suit, disposition, financing or other transaction, (5) the failure to continue to qualify as a real estate investment trust, (6) changes in general business and economic conditions, including the impact of any legislation, (7) competition, (8) increases in real estate construction costs, (9) changes in interest rates, (10) changes in accessibility of debt and equity capital markets, and (11) future impairment charges. Copies of the periodic reports Lexington files with the Securities and Exchange Commission are available on Lexington’s web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions and describe Lexington’s future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, Lexington undertakes no obligation to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that Lexington’s expectations will be realized.

References to Lexington refer to Lexington Realty Trust and its consolidated subsidiaries. All interests in properties and loans are held, and all property operating activities are conducted, through special purpose entities, which are separate and distinct legal entities that maintain separate books and records, but in some instances are consolidated for financial statement purposes and/or disregarded for income tax purposes. The assets and credit of each special purpose entity with a property subject to a mortgage loan are not available to creditors to satisfy the debt and other obligations of any other person, including any other special purpose entity or affiliate. Consolidated entities that are not property owner subsidiaries do not directly own any of the assets of a property owner subsidiary (or the general partner, member of managing member of such property owner subsidiary), but merely hold partnership, membership or beneficial interests therein which interests are subordinate to the claims of the property owner subsidiary’s (or its general partner’s, member’s or managing member’s) creditors.

7

Non-GAAP Financial Measures - Definitions

Lexington has used non-GAAP financial measures as defined by the Securities and Exchange Commission Regulation G in this Quarterly Earnings Release and in other public disclosures.

Lexington believes that the measures defined below are helpful to investors in measuring our performance or that of an individual investment. Since these measures exclude certain items which are included in their respective most comparable measures under generally accepted accounting principles (“GAAP”), reliance on the measures has limitations; management compensates for these limitations by using the measures simply as supplemental measures that are weighed in balance with other GAAP measures. These measures are not necessarily indications of our cash flow available to fund cash needs. Additionally, they should not be used as an alternative to the respective most comparable GAAP measures when evaluating Lexington’s financial performance or cash flow from operating, investing or financing activities or liquidity.

Cash Base Rent: Cash Base Rent is calculated by making adjustments to GAAP rental revenue to remove the impact of GAAP required adjustments to rental income such as adjustments for straight-line rents related to free rent periods and contractual rent increases. Cash Base Rent excludes billed tenant reimbursements and lease termination income and includes ancillary income. Lexington believes Cash Base Rent provides a meaningful indication of an investments ability to fund cash needs.

Company Funds Available for Distribution (“FAD”): FAD is calculated by making adjustments to Adjusted Company FFO (see below) for (1) straight-line adjustments, (2) lease incentive amortization, (3) amortization of above/below market leases, (4) lease termination payments, net, (5) non-cash interest, net, (6) non-cash charges, net, (7) cash paid for tenant improvements, and (8) cash paid for lease costs. Although FAD may not be comparable to that of other real estate investment trusts (“REITs”), Lexington believes it provides a meaningful indication of its ability to fund cash needs. FAD is a non-GAAP financial measure and should not be viewed as an alternative measurement of operating performance to net income, as an alternative to net cash flows from operating activities or as a measure of liquidity.

Funds from Operations (“FFO”) and Adjusted Company FFO: Lexington believes that Funds from Operations, or FFO, which is a non-GAAP measure, is a widely recognized and appropriate measure of the performance of an equity REIT. Lexington believes FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. As a result, FFO provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities, interest costs and other matters without the inclusion of depreciation and amortization, providing perspective that may not necessarily be apparent from net income.

The National Association of Real Estate Investment Trusts, or NAREIT, defines FFO as “net income (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sales of certain real estate assets, gains and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in value of depreciable real estate held by the entity. The reconciling items include amounts to adjust earnings from consolidated partially-owned entities and equity in earnings of unconsolidated affiliates to FFO.” FFO does not represent cash generated from operating activities in accordance with GAAP and is not indicative of cash available to fund cash needs.

Lexington presents FFO available to common shareholders and unitholders - basic and also presents FFO available to all equityholders and unitholders - diluted on a company-wide basis as if all securities that are convertible, at the holder’s option, into Lexington’s common shares, are converted at the beginning of the period. Lexington also presents Adjusted Company FFO available to all equityholders and unitholders - diluted which adjusts FFO available to all equityholders and unitholders - diluted for certain items which we believe are not indicative of the operating results of Lexington’s real estate portfolio. Lexington believes this is an appropriate presentation as it is frequently requested by security analysts, investors and other interested parties. Since others do not calculate these measures in a similar fashion, these measures may not be comparable to similarly titled measures as reported by others. These measures should not be considered as an alternative to net income as an indicator of Lexington’s operating performance or as an alternative to cash flow as a measure of liquidity.

GAAP and Cash Yield or Capitalization Rate: GAAP and cash yields or capitalization rates are measures of operating performance used to evaluate the individual performance of an investment. These measures are estimates and are not presented or intended to be viewed as a liquidity or performance measure that present a numerical measure of Lexington’s historical or future financial performance, financial position or cash flows. The yield or capitalization rate is calculated by dividing the annualized NOI (as defined below, except GAAP rent adjustments are added back to rental income to calculate GAAP yield or capitalization rate) the investment is expected to generate (or has generated) divided by the acquisition/completion cost (or sale) price.

Net Operating Income (“NOI”): NOI is a measure of operating performance used to evaluate the individual performance of an investment. This measure is not presented or intended to be viewed as a liquidity or performance measure that presents a numerical measure of Lexington’s historical or future financial performance, financial position or cash flows. Lexington defines NOI as operating revenues (rental income (less GAAP rent adjustments and lease termination income), and other property income) less property operating expenses. Other REITs may use different methodologies for calculating NOI, and accordingly, Lexington’s NOI may not be comparable to other companies. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, acquisition-related expenses, other nonproperty income and losses, and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. Lexington believes that net income is the most directly comparable GAAP measure to NOI.

# # #

8

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited and in thousands, except share and per share data)

|

|

|

Three months ended March 31, |

|

|||||

|

|

|

2020 |

|

|

2019 |

|

||

|

Gross revenues: |

|

|

|

|

|

|

|

|

|

Rental revenue |

|

$ |

78,735 |

|

|

$ |

79,975 |

|

|

Other revenue |

|

|

2,092 |

|

|

|

1,273 |

|

|

Total gross revenues |

|

|

80,827 |

|

|

|

81,248 |

|

|

Expense applicable to revenues: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

(40,509 |

) |

|

|

(37,595 |

) |

|

Property operating |

|

|

(10,276 |

) |

|

|

(10,567 |

) |

|

General and administrative |

|

|

(7,825 |

) |

|

|

(8,527 |

) |

|

Non-operating income |

|

|

190 |

|

|

|

481 |

|

|

Interest and amortization expense |

|

|

(14,795 |

) |

|

|

(17,208 |

) |

|

Debt satisfaction gains (charges), net |

|

|

1,393 |

|

|

|

(103 |

) |

|

Impairment charges |

|

|

— |

|

|

|

(588 |

) |

|

Gains on sales of properties |

|

|

9,805 |

|

|

|

20,957 |

|

|

Income before provision for income taxes and equity in earnings of non-consolidated entities |

|

|

18,810 |

|

|

|

28,098 |

|

|

Provision for income taxes |

|

|

(653 |

) |

|

|

(437 |

) |

|

Equity in earnings of non-consolidated entities |

|

|

263 |

|

|

|

619 |

|

|

Net income |

|

|

18,420 |

|

|

|

28,280 |

|

|

Less net income attributable to noncontrolling interests |

|

|

(266 |

) |

|

|

(253 |

) |

|

Net income attributable to Lexington Realty Trust shareholders |

|

|

18,154 |

|

|

|

28,027 |

|

|

Dividends attributable to preferred shares – Series C |

|

|

(1,572 |

) |

|

|

(1,572 |

) |

|

Allocation to participating securities |

|

|

(46 |

) |

|

|

(50 |

) |

|

Net income attributable to common shareholders |

|

$ |

16,536 |

|

|

$ |

26,405 |

|

|

Net income attributable to common shareholders - per common share basic |

|

$ |

0.07 |

|

|

$ |

0.11 |

|

|

Weighted-average common shares outstanding – basic |

|

|

253,038,161 |

|

|

|

232,538,495 |

|

|

Net income attributable to common shareholders - per common share diluted |

|

$ |

0.06 |

|

|

$ |

0.11 |

|

|

Weighted-average common shares outstanding – diluted |

|

|

257,347,277 |

|

|

|

236,142,143 |

|

9

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| March 31, 2020 | December 31, 2019 | |||||||

| (unaudited) | ||||||||

| Assets: | ||||||||

| Real estate, at cost | $ | 3,473,384 | $ | 3,320,574 | ||||

| Real estate - intangible assets | 420,843 | 409,756 | ||||||

| Investments in real estate under construction | 18,298 | 13,313 | ||||||

| Real estate, gross | 3,912,525 | 3,743,643 | ||||||

| Less: accumulated depreciation and amortization | 914,600 | 887,629 | ||||||

| Real estate, net | 2,997,925 | 2,856,014 | ||||||

| Assets held for sale | 7,873 | — | ||||||

| Operating lease right-of-use assets, net | 37,201 | 38,133 | ||||||

| Cash and cash equivalents | 83,525 | 122,666 | ||||||

| Restricted cash | 6,533 | 6,644 | ||||||

| Investment in non-consolidated entities | 57,210 | 57,168 | ||||||

| Deferred expenses, net | 19,749 | 18,404 | ||||||

| Rent receivable – current | 3,646 | 3,229 | ||||||

| Rent receivable – deferred | 67,205 | 66,294 | ||||||

| Other assets | 12,585 | 11,708 | ||||||

| Total assets | $ | 3,293,452 | $ | 3,180,260 | ||||

| Liabilities and Equity: | ||||||||

| Liabilities: | ||||||||

| Mortgages and notes payable, net | $ | 377,703 | $ | 390,272 | ||||

| Revolving credit facility borrowings | 130,000 | — | ||||||

| Term loan payable, net | 297,565 | 297,439 | ||||||

| Senior notes payable, net | 497,079 | 496,870 | ||||||

| Trust preferred securities, net | 127,421 | 127,396 | ||||||

| Dividends payable | 31,720 | 32,432 | ||||||

| Liabilities held for sale | 18 | — | ||||||

| Operating lease liabilities | 38,293 | 39,442 | ||||||

| Accounts payable and other liabilities | 42,479 | 29,925 | ||||||

| Accrued interest payable | 13,992 | 7,897 | ||||||

| Deferred revenue - including below market leases, net | 19,446 | 20,350 | ||||||

| Prepaid rent | 15,066 | 13,518 | ||||||

| Total liabilities | 1,590,782 | 1,455,541 | ||||||

| Commitments and contingencies | ||||||||

| Equity: | ||||||||

| Preferred shares, par value $0.0001 per share; authorized 100,000,000 shares: | ||||||||

| Series C Cumulative Convertible Preferred, liquidation preference $96,770; 1,935,400 shares issued and outstanding | 94,016 | 94,016 | ||||||

| Common shares, par value $0.0001 per share; authorized 400,000,000 shares, 255,232,130 and 254,770,719 shares issued and outstanding in 2020 and 2019, respectively | 26 | 25 | ||||||

| Additional paid-in-capital | 2,982,363 | 2,976,670 | ||||||

| Accumulated distributions in excess of net income | (1,374,286 | ) | (1,363,676 | ) | ||||

| Accumulated other comprehensive loss | (18,924 | ) | (1,928 | ) | ||||

| Total shareholders’ equity | 1,683,195 | 1,705,107 | ||||||

| Noncontrolling interests | 19,475 | 19,612 | ||||||

| Total equity | 1,702,670 | 1,724,719 | ||||||

| Total liabilities and equity | $ | 3,293,452 | $ | 3,180,260 | ||||

10

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

EARNINGS PER SHARE

(Unaudited and in thousands, except share and per share data)

| Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| EARNINGS PER SHARE: | ||||||||

| Basic: | ||||||||

| Net income attributable to common shareholders | $ | 16,536 | $ | 26,405 | ||||

| Weighted-average number of common shares outstanding - basic | 253,038,161 | 232,538,495 | ||||||

| Net income attributable to common shareholders - per common share basic | $ | 0.07 | $ | 0.11 | ||||

| Diluted: | ||||||||

| Net income attributable to common shareholders - basic | $ | 16,536 | $ | 26,405 | ||||

| Impact of assumed conversions | 107 | 1 | ||||||

| Net income attributable to common shareholders | $ | 16,643 | $ | 26,406 | ||||

| Weighted-average common shares outstanding - basic | 253,038,161 | 232,538,495 | ||||||

| Effect of dilutive securities: | ||||||||

| Unvested share-based payment awards and options | 1,160,994 | 53,274 | ||||||

| Operating partnership units | 3,148,122 | 3,550,374 | ||||||

| Weighted-average common shares outstanding - diluted | 257,347,277 | 236,142,143 | ||||||

| Net income attributable to common shareholders - per common share diluted | $ | 0.06 | $ | 0.11 | ||||

11

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

ADJUSTED COMPANY FUNDS FROM OPERATIONS & COMPANY FUNDS AVAILABLE FOR DISTRIBUTION

(Unaudited and in thousands, except share and per share data)

| Three Months Ended | ||||||||

| March 31, | ||||||||

| 2020 | 2019 | |||||||

| FUNDS FROM OPERATIONS: | ||||||||

| Basic and Diluted: | ||||||||

| Net income attributable to common shareholders | $ | 16,536 | $ | 26,405 | ||||

| Adjustments: | ||||||||

| Depreciation and amortization | 39,717 | 36,867 | ||||||

| Impairment charges - real estate | — | 588 | ||||||

| Noncontrolling interests - OP units | 107 | 1 | ||||||

| Amortization of leasing commissions | 792 | 728 | ||||||

| Joint venture and noncontrolling interest adjustment | 2,214 | 2,533 | ||||||

| Gains on sales of properties, including non-consolidated entities | (10,354 | ) | (21,605 | ) | ||||

| FFO available to common shareholders and unitholders - basic | 49,012 | 45,517 | ||||||

| Preferred dividends | 1,572 | 1,572 | ||||||

| Amount allocated to participating securities | 46 | 50 | ||||||

| FFO available to all equityholders and unitholders - diluted | 50,630 | 47,139 | ||||||

| Transaction costs | 21 | — | ||||||

| Debt satisfaction (gains) charges, net, including non-consolidated entities | (1,372 | ) | 103 | |||||

| Adjusted Company FFO available to all equityholders and unitholders - diluted | 49,279 | 47,242 | ||||||

| FUNDS AVAILABLE FOR DISTRIBUTION: | ||||||||

| Adjustments: | ||||||||

| Straight-line adjustments | (1,419 | ) | (2,330 | ) | ||||

| Lease incentives | 269 | 273 | ||||||

| Amortization of above/below market leases | (295 | ) | (6 | ) | ||||

| Lease termination payments, net | 492 | (744 | ) | |||||

| Non-cash interest, net | 428 | 806 | ||||||

| Non-cash charges, net | 1,658 | 1,727 | ||||||

| Tenant improvements | (1,492 | ) | (995 | ) | ||||

| Lease costs | (3,951 | ) | (1,124 | ) | ||||

| Joint venture and noncontrolling interest adjustment | (111 | ) | (176 | ) | ||||

| Company Funds Available for Distribution | $ | 44,858 | $ | 44,673 | ||||

| Per Common Share and Unit Amounts | ||||||||

| Basic: | ||||||||

| FFO | $ | 0.19 | $ | 0.19 | ||||

| Diluted: | ||||||||

| FFO | $ | 0.19 | $ | 0.20 | ||||

| Adjusted Company FFO | $ | 0.19 | $ | 0.20 | ||||

| Basic: | ||||||||

| Weighted-average common shares outstanding - basic EPS | 253,038,161 | 232,538,495 | ||||||

| Operating partnership units(1) | 3,148,122 | 3,550,374 | ||||||

| Weighted-average common shares outstanding - basic FFO | 256,186,283 | 236,088,869 | ||||||

| Diluted: | ||||||||

| Weighted-average common shares outstanding - diluted EPS | 257,347,277 | 236,142,143 | ||||||

| Unvested share-based payment awards and options | 24,799 | 16,499 | ||||||

| Preferred shares - Series C | 4,710,570 | 4,710,570 | ||||||

| Weighted-average common shares outstanding - diluted FFO | 262,082,646 | 240,869,212 | ||||||

(1) Includes OP units other than OP units held by Lexington.

12

LEXINGTON REALTY TRUST AND CONSOLIDATED SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES

2020 EARNINGS GUIDANCE

| Twelve Months Ended December 31, 2020 | ||||||||

| Range | ||||||||

| Estimated: | ||||||||

| Net income attributable to common shareholders per diluted common share(1) | $ | 0.77 | $ | 0.80 | ||||

| Depreciation and amortization | 0.62 | 0.62 | ||||||

| Impact of capital transactions | (0.65 | ) | (0.65 | ) | ||||

| Estimated Adjusted Company FFO per diluted common share | $ | 0.74 | $ | 0.77 | ||||

(1) Assumes all convertible securities are dilutive.

13

LEXINGTON REALTY TRUST

2020 First Quarter Investments / Capital Recycling Summary

PROPERTY INVESTMENTS

| Property Type | Market | Square Feet | Initial Basis ($000) | Month Closed | Primary Lease Expiration | |||||||||||||||

| 1 | Industrial - Warehouse/distribution | Chicago | IL | 705,661 | $ | 53,642 | January | 11/2029 | ||||||||||||

| 2 | Industrial - Warehouse/distribution | Phoenix | AZ | 160,140 | 19,164 | January | 12/2025 | |||||||||||||

| 3 | Industrial - Warehouse/distribution | Chicago | IL | 473,280 | 39,153 | January | 12/2029 | |||||||||||||

| 4 | Industrial - Warehouse/distribution | Dallas | TX | 1,214,526 | 83,495 | February | 08/2029 | |||||||||||||

| 4 | TOTAL PROPERTY INVESTMENTS | 2,553,607 | $ | 195,454 | ||||||||||||||||

CAPITAL RECYCLING

CONSOLIDATED PROPERTY DISPOSITIONS

| Primary Tenant | Location | Property Type | Gross Disposition Price ($000) | Annualized Net Income ($000) (1) | Annualized NOI ($000)(1)(2) | Month of Disposition | % Leased | Gross Disposition Price PSF | ||||||||||||||||||

| 1 | Multi-Tenant (3) | Charleston | SC | Office | $ | 6,830 | $ | (1,142 | ) | $ | 17 | March | 23% | $ | 135.93 | |||||||||||

| 2 | Burns & McDonnell Engineering | Kansas City | MO | Office | 22,775 | 1,277 | 1,589 | March | 100% | 146.07 | ||||||||||||||||

| 2 | TOTAL PROPERTY DISPOSITIONS | $ | 29,605 | $ | 135 | $ | 1,606 | |||||||||||||||||||

NON-CONSOLIDATED PROPERTY DISPOSITIONS (4)

| Primary Tenant | Location | Property Type | Gross Disposition Price ($000) | Annualized Net Income ($000) (1) | Annualized NOI ($000)(1)(2) | Month of Disposition | % Leased | Gross Disposition Price PSF | ||||||||||||||||||

| 1 | Amazon | Huntington | WV | Office | $ | 16,852 | $ | 483 | $ | 1,158 | March | 100% | $ | 245.32 | ||||||||||||

| Footnotes |

| (1) | Quarterly period prior to sale annualized. |

| (2) | See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (3) | Sold in foreclosure sale. Disposition price reflects non-recourse debt balance. |

| (4) | Lexington has a 20% interest in the joint venture that disposed of this property. |

14

LEXINGTON

REALTY TRUST

DEVELOPMENT PROJECTS

3/31/2020

DEVELOPMENT PROJECTS

| Project (% owned) |

Market | Property Type |

Estimated Sq. Ft. |

Estimated Project Cost ($000) |

GAAP Investment Balance as of 3/31/2020 ($000) (1) |

Lexington Amount Funded as of 3/31/2020 ($000) |

Estimated Completion Date | ||||||||||||

| Consolidated | |||||||||||||||||||

| 1 | Fairburn (90%) | Atlanta, GA | Industrial | 910,000 | $ | 53,812 | $ | 14,641 | $ | 11,474 | 4Q 2020 | ||||||||

| 2 | Rickenbacker (100%) | Columbus, OH | Industrial | 320,000 | 20,300 | 3,657 | 3,421 | 1Q 2021 | |||||||||||

| 2 | Total Consolidated Development | $ | 74,112 | $ | 18,298 | $ | 14,895 | ||||||||||||

| Non - Consolidated | |||||||||||||||||||

| 1 | Etna Park 70 (90%) (2) | Columbus, OH | Industrial | TBD | TBD | $ | 8,670 | $ | 8,984 | TBD | |||||||||

| 2 | Etna Park 70 East (90%) (2) | Columbus, OH | Industrial | TBD | TBD | 5,058 | 5,089 | TBD | |||||||||||

| 2 | Total Non-Consolidated Development | $ | 13,728 | $ | 14,073 | ||||||||||||||

| 4 | Total Development Projects | $ | 32,026 | $ | 28,968 | ||||||||||||||

| Footnotes | |

| (1) | GAAP investment balance is in real estate under construction for consolidated projects and in investments in non-consolidated entities for non-consolidated projects. |

| (2) | Plans and specifications for completion have not been completed and the estimated square footage, project cost and completion date cannot be determined. |

15

LEXINGTON

REALTY TRUST

2020 First Quarter Financing Summary

DEBT RETIRED

| Location | Tenant | Property Type | Face

/ Satisfaction ($000) | Rate | Maturity Date | ||||||||||

| Consolidated Mortgage Debt (1) | |||||||||||||||

| Charleston, SC | Multi-Tenant | Office | $ | 6,830 | 5.850% | 02/2021 | |||||||||

| Non-Consolidated Mortgage Debt (2) | |||||||||||||||

| Huntington, WV | Amazon | Office | $ | 12,960 | LIBOR + 200 bps | 09/2021 | |||||||||

CORPORATE LEVEL FINANCING (3)

| Type | Amount ($000) | Current Interest Rate | Maturity Date | |||||||

| Revolving Credit Facility | $ | 130,000 | LIBOR + 90 bps | 02/2023 | ||||||

| Footnotes |

| (1) | Satisfied in foreclosure sale. |

| (2) | Lexington has a 20% interest in the joint venture that disposed of this property. Satisfaction reflects release amount of the joint venture's cross-collateralized debt. |

| (3) | Also, a 20% owned joint venture incurred an additional $3.7 million of secured debt. |

16

LEXINGTON

REALTY TRUST

2020 First Quarter Leasing Summary

LEASE EXTENSIONS

| Tenant (1) | Location | Prior

Term | Lease Expiration Date | Sq. Ft. | New Base Rent Per Annum ($000)(2)(3) | Prior Base Rent Per Annum ($000) | New Cash Base Rent Per Annum ($000)(2)(3) | Prior Cash Base Rent Per Annum ($000)(3) | |||||||||||||||||

| Office | |||||||||||||||||||||||||

| 1 | NJ Natural Gas | Wall | NJ | 06/2021 | 06/2037 | 157,511 | $ | 3,491 | $ | 4,234 | $ | 3,068 | $ | 4,234 | |||||||||||

| 2 | New Cingular Wireless (4) | Baton Rouge | LA | 10/2022 | 11/2023 | 23,750 | 413 | 395 | 420 | 411 | |||||||||||||||

| 2 | Total office lease extensions | 181,261 | $ | 3,904 | $ | 4,629 | $ | 3,488 | $ | 4,645 | |||||||||||||||

| 2 | TOTAL EXTENDED LEASES | 181,261 | $ | 3,904 | $ | 4,629 | $ | 3,488 | $ | 4,645 | |||||||||||||||

NEW LEASES

| Tenant (1) | Location | Lease

Expiration Date | Sq. Ft. | New Base Rent Per Annum ($000)(2)(3) | New

Cash Base Rent Per Annum ($000)(2)(3) | |||||||||||||

| Industrial | ||||||||||||||||||

| 1 | Wal-Mart | Moody | AL | 02/2023 | 155,766 | $ | 746 | $ | 746 | |||||||||

| 1 | Total Industrial New Leases | 155,766 | $ | 746 | $ | 746 | ||||||||||||

| 1 | TOTAL NEW LEASES | 155,766 | $ | 746 | $ | 746 | ||||||||||||

| 3 | TOTAL NEW AND EXTENDED LEASES | 337,027 | $ | 4,650 | $ | 4,234 | ||||||||||||

17

LEXINGTON

REALTY TRUST

2020 First Quarter Leasing Summary

NEW VACANCY (5)

| Prior Lease | 2019 | 2019 | ||||||||||||||||

| Expiration | Base Rent | Cash Rent | ||||||||||||||||

| Former Tenant | Location | Date | Sq. Ft. | ($000)(3) | ($000)(3) | |||||||||||||

| Office | ||||||||||||||||||

| Oce - USA Holding (6) | Boca Raton | FL | 02/2020 | 143,290 | $ | 2,244 | $ | 2,500 | ||||||||||

| Footnotes |

| (1) | Leases greater than 10,000 square feet. |

| (2) | Assumes twelve months rent from the later of 4/1/20 or lease commencement/extension, excluding free rent periods as applicable. |

| (3) | See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (4) | Effective 11/7/2020, the square footage leased by tenant is reduced from 70,100 sqft to 23,750. |

| (5) | Excludes multi-tenant properties, disposed properties and non-consolidated investments. |

| (6) | In receivership. |

18

LEXINGTON REALTY TRUST

03/31/2020

($000)

Other Revenue Data

| Base Rent | ||||||||||||

| Asset Class | Three months ended | |||||||||||

| 3/31/2020(1) | 3/31/2020 Percentage | 3/31/2019 Percentage | ||||||||||

| Industrial | $ | 57,280 | 79.3 | % | 68.2 | % | ||||||

| Office/Other | 14,915 | 20.7 | % | 31.8 | % | |||||||

| $ | 72,195 | 100.0 | % | 100.0 | % | |||||||

|

|

|

|

Base Rent |

| ||||||||

Credit Ratings (2) |

|

|

Three months ended |

| ||||||||

|

|

|

3/31/2020(1) |

|

|

3/31/2020 |

|

|

|

3/31/2019 |

| |

|

Investment Grade |

|

$ |

37,274 |

|

|

|

51.6 |

% |

|

|

40.8 |

% |

|

Non-Investment Grade |

|

|

15,959 |

|

|

|

22.1 |

% |

|

|

19.5 |

% |

|

Unrated |

|

|

18,962 |

|

|

|

26.3 |

% |

|

|

39.7 |

% |

|

|

|

$ |

72,195 |

|

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average Lease Term - Cash Basis |

|

|

|

|

|

|

As of 3/31/2020 |

|

|

|

As of 3/31/2019 |

|

|

|

|

|

|

|

|

|

8.3 years |

|

|

|

9.0 years |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rent Estimates for Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

|

Base Rent (3) |

|

|

Cash Base Rent (3) |

|

|

|

Difference |

| |

|

2020 - remaining |

|

$ |

215,553 |

|

|

$ |

203,921 |

|

|

$ |

(11,632 |

) |

|

2021 |

|

|

269,259 |

|

|

|

258,603 |

|

|

|

(10,656 |

) |

Footnotes

| (1) | Three months ended 3/31/2020 Base Rent recognized for consolidated properties owned as of 3/31/2020. |

| (2) | Credit ratings are based upon either tenant, guarantor or parent/ultimate parent. Historical comparison was not adjusted for subsequent tenant entity changes and multi-tenant was generally reflected as unrated. |

| (3) | Amounts assume (1) lease terms for non-cancellable periods only, (2) no new or renegotiated leases are entered into after 3/31/2020, and (3) no properties are sold or acquired after 3/31/2020. |

19

LEXINGTON REALTY TRUST

Other Revenue Data (Continued)

03/31/2020

($000)

Same-Store NOI (1)

| Three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Total Cash Base Rent | $ | 58,108 | $ | 58,179 | ||||

| Tenant Reimbursements | 6,121 | 6,113 | ||||||

| Property Operating Expenses | (7,692 | ) | (7,616 | ) | ||||

| Same-Store NOI | $ | 56,537 | $ | 56,676 | ||||

Change in Same-Store NOI (2) | (0.2 | %) | ||||||

Same-Store Percent Leased (3) | As of 3/31/2020 | As of 3/31/2019 | ||||||

| 97.4 | % | 98.5 | % | |||||

Lease Escalation Data (4) | ||||||||

Footnotes

| (1) | NOI is on a consolidated cash basis excluding properties acquired and sold in 2020 and 2019 and properties subject to mortgage loans in default at March 31, 2020. |

| See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

| (2) | Change in Same-Store NOI was 0.5% excluding single-tenant property vacancies. |

| (3) | Excludes properties acquired or sold in 2020 and 2019 and properties subject to mortgage loans in default at March 31, 2020. |

| (4) | Based on three months consolidated Cash Base Rents for single-tenant leases (properties greater than 50% leased to a single tenant) owned as of March 31, 2020. Excludes parking operations and rents from prior tenants. |

20

LEXINGTON REALTY TRUST

Portfolio Detail By Asset Class

03/31/2020

($000, except square footage)

| Asset Class | YE 2017 (1) |

| YE 2018 (1)(2) |

| YE 2019 | Q1 2020 | ||||||||||

| Industrial | ||||||||||||||||

% of Cost (3) | 49.3 | % | 71.2 | % | 81.5 | % | 83.2 | % | ||||||||

% of ABR (4) | 44.3 | % | 65.4 | % | 75.5 | % | 79.3 | % | ||||||||

| % Leased | 99.9 | % | 96.3 | % | 97.9 | % | 98.3 | % | ||||||||

Wtd. Avg. Lease Term (5) | 10.5 | 9.7 | 8.3 | 8.0 | ||||||||||||

| Mortgage Debt | $ | 193,529 | $ | 206,006 | $ | 109,939 | $ | 108,825 | ||||||||

% Investment Grade (4) | 28.4 | % | 31.6 | % | 45.9 | % | 49.7 | % | ||||||||

| Square Feet | 36,071,422 | 41,447,962 | 48,742,014 | 51,295,621 | ||||||||||||

| Office/Other | ||||||||||||||||

% of Cost (3) | 50.7 | % | 28.8 | % | 18.5 | % | 16.8 | % | ||||||||

% of ABR (4)(6) | 55.7 | % | 34.6 | % | 24.5 | % | 20.7 | % | ||||||||

| % Leased | 96.0 | % | 87.1 | % | 85.8 | % | 82.1 | % | ||||||||

Wtd. Avg. Lease Term (5) | 7.9 | 7.2 | 8.5 | 9.6 | ||||||||||||

| Mortgage Debt | $ | 503,539 | $ | 369,508 | $ | 283,933 | $ | 272,368 | ||||||||

% Investment Grade (4) | 49.4 | % | 53.2 | % | 57.3 | % | 59.0 | % | ||||||||

| Square Feet | 12,542,640 | 6,111,588 | 3,876,294 | 3,670,123 | ||||||||||||

Construction in progress (7) | $ | 4,219 | $ | 1,840 | $ | 15,208 | $ | 24,424 | ||||||||

Footnotes

| (1) | Office and Other properties combined. |

| (2) | Pataskala, Ohio property reclassed to Industrial from Office/Other. |

| (3) | Based on gross book value of real estate assets; excludes held for sale assets. |

| (4) | Percentage of Base Rent, for consolidated properties owned as of each respective period. |

| (5) | Cash basis. |

| (6) | YE 2018 excludes the acceleration of below-market lease intangible accretion on one Kmart asset. |

| (7) | Includes development classified as real estate under construction on a consolidated basis. |

21

LEXINGTON REALTY TRUST

03/31/2020

As a Percent of Gross Book Value (1)

Portfolio Composition (2)

Footnotes

| (1) | Based on gross book value of real estate assets as of 3/31/2020, exclude held for sale assets. |

| (2) | Based on gross book value of real estate assets as of 3/31/2020, 12/31/2019, 12/31/2018 and 12/31/2017, as applicable and excludes held for sale assets. |

22

LEXINGTON REALTY TRUST

3/31/2020

($000)

The purpose of providing the following information is to enable readers to derive their own estimates of net asset value. This information is not intended to be an asset-by-asset or enterprise valuation.

|

Consolidated properties three month net operating income (NOI) (1) |

|

|

|

|

|

Industrial |

|

$ |

52,364 |

|

|

Office/Other |

|

|

13,148 |

|

|

Total Net Operating Income |

|

$ |

65,512 |

|

|

|

|

|

|

|

|

Lexington’s share of non-consolidated three month NOI (1) |

|

|

|

|

|

NNN OFFICE JV |

|

|

|

|

|

Office |

|

$ |

2,543 |

|

|

OTHER JV |

|

|

|

|

|

Other |

|

$ |

379 |

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

|

Advisory fees |

|

$ |

931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In service assets not fairly valued by capitalized NOI method (1) |

|

|

|

|

|

Wholly-owned assets acquired in 2020 |

|

$ |

194,036 |

|

|

Wholly-owned assets less than 70% leased |

|

$ |

50,835 |

|

|

|

|

|

|

|

|

Add other assets: |

|

|

|

|

|

Assets held for sale - consolidated |

|

$ |

7,873 |

|

|

Construction in progress |

|

|

6,126 |

|

|

Developable land |

|

|

14,073 |

|

|

Development investment at cost incurred |

|

|

14,895 |

|

|

Cash and cash equivalents |

|

|

83,525 |

|

|

Restricted cash |

|

|

6,533 |

|

|

Accounts receivable |

|

|

3,646 |

|

|

Other assets |

|

|

12,585 |

|

|

Total other assets |

|

$ |

149,256 |

|

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

|

Corporate level debt (face amount) |

|

$ |

1,059,120 |

|

|

Mortgages and notes payable (face amount) |

|

|

381,193 |

|

|

Dividends payable |

|

|

31,720 |

|

|

Liabilities held for sale - consolidated |

|

|

18 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

|

71,537 |

|

|

Preferred stock, at liquidation value |

|

|

96,770 |

|

|

Lexington’s share of non-consolidated mortgages (face amount) |

|

|

87,505 |

|

|

Total deductions |

|

$ |

1,727,863 |

|

|

|

|

|

|

|

|

Common shares & OP units at 3/31/2020 |

|

|

258,328,452 |

|

Footnotes

|

(1) |

NOI for the existing property portfolio at March 31, 2020, excludes NOI related to assets undervalued by a capitalized NOI method and assets held for sale. Assets undervalued by a capitalized NOI method are identified generally by occupancies under 70% and assets acquired in 2020. For assets in this category an NOI capitalization approach is not appropriate, and accordingly, Lexington’s net book value has been used. See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. |

23

LEXINGTON REALTY TRUST

Consolidated Portfolio Concentration

3/31/2020

|

|

|

Markets (1) |

|

Percent of Base Rent as of 3/31/2020 (2) |

|

|

|

1 |

|

Houston, TX |

|

|

10.2 |

% |

|

2 |

|

Memphis, TN |

|

|

6.9 |

% |

|

3 |

|

Greenville/Spartanburg, SC |

|

|

5.7 |

% |

|

4 |

|

Atlanta, GA |

|

|

5.1 |

% |

|

5 |

|

Cincinnati/Dayton, OH |

|

|

4.3 |

% |

|

6 |

|

Chicago, IL |

|

|

4.2 |

% |

|

7 |

|

Dallas/Fort Worth, TX |

|

|

4.0 |

% |

|

8 |

|

Nashville, TN |

|

|

4.0 |

% |

|

9 |

|

Phoenix, AZ |

|

|

3.9 |

% |

|

10 |

|

Charlotte, NC |

|

|

3.9 |

% |

|

11 |

|

New York/New Jersey |

|

|

3.7 |

% |

|

12 |

|

Detroit, MI |

|

|

3.5 |

% |

|

13 |

|

DC/Baltimore, MD |

|

|

2.6 |

% |

|

14 |

|

Philadelphia, PA |

|

|

2.6 |

% |

|

15 |

|

South Bay/San Jose, CA |

|

|

2.3 |

% |

|

16 |

|

Jackson, MS |

|

|

2.1 |

% |

|

17 |

|

St. Louis, MO |

|

|

2.1 |

% |

|

18 |

|

Cleveland, OH |

|

|

1.7 |

% |

|

19 |

|

Columbus, OH |

|

|

1.7 |

% |

|

20 |

|

Champaign-Urbana, IL |

|

|

1.5 |

% |

|

|

|

Total Consolidated Portfolio Concentration (3) |

|

|

76.0 |

% |

Footnotes

|

|

(1) |

Markets are based on geographic boundaries defined by CoStar.com. They serve to delineate core areas that are competitive with each other and constitute a generally accepted primary competitive set of areas. Markets are building-type specific, and are non-overlapping contiguous geographic designations. |

|

|

(2) |

Three months ended 3/31/2020 Base Rent recognized for consolidated properties owned as of 3/31/2020. |

|

|

(3) |

Total shown may differ from detailed amounts due to rounding. |

24

LEXINGTON REALTY TRUST

Portfolio Concentration - Industrial

3/31/2020

|

|

|

Markets (1) |

|

Percent of Base Rent as of 3/31/2020 (2) |

|

|

|

1 |

|

Memphis, TN |

|

|

8.7 |

% |

|

2 |

|

Greenville/Spartanburg, SC |

|

|

7.1 |

% |

|

3 |

|

Houston, TX |

|

|

6.3 |

% |

|

4 |

|

Atlanta, GA |

|

|

6.0 |

% |

|

5 |

|

Cincinnati/Dayton, OH |

|

|

5.4 |

% |

|

6 |

|

Chicago, IL |

|

|

5.3 |

% |

|

7 |

|

Nashville, TN |

|

|

5.0 |

% |

|

8 |

|

Detroit, MI |

|

|

4.5 |

% |

|

9 |

|

Phoenix, AZ |

|

|

3.7 |

% |

|

10 |

|

Dallas/Fort Worth, TX |

|

|

3.3 |

% |

|

11 |

|

Charlotte, NC |

|

|

3.1 |

% |

|

12 |

|

Jackson, MS |

|

|

2.7 |

% |

|

13 |

|

St. Louis, MO |

|

|

2.7 |

% |

|

14 |

|

New York/New Jersey |

|

|

2.2 |

% |

|

15 |

|

Cleveland, OH |

|

|

2.2 |

% |

|

16 |

|

Columbus, OH |

|

|

2.1 |

% |

|

17 |

|

Champaign-Urbana, IL |

|

|

1.8 |

% |

|

18 |

|

Jackson, TN |

|

|

1.7 |

% |

|

19 |

|

Richmond, VA |

|

|

1.7 |

% |

|

20 |

|

DC/Baltimore, MD |

|

|

1.7 |

% |

|

|

|

Total Industrial Portfolio Concentration (3) |

|

|

77.3 |

% |

Footnotes

|

|

(1) |

Markets are based on geographic boundaries defined by CoStar.com. They serve to delineate core areas that are competitive with each other and constitute a generally accepted primary competitive set of areas. Markets are building-type specific, and are non-overlapping contiguous geographic designations. |

|

|

(2) |

Three months ended 3/31/2020 Base Rent recognized for consolidated industrial properties owned as of 3/31/2020. |

|

|

(3) |

Total shown may differ from detailed amounts due to rounding. |

25

LEXINGTON REALTY TRUST

Portfolio Concentration - Office/Other

3/31/2020

|

|

|

Markets (1) |

|

Percent of Base Rent as of 3/31/2020 (2) |

|

|

|

1 |

|

Houston, TX |

|

|

24.9 |

% |

|

2 |

|

South Bay/San Jose, CA |

|

|

11.1 |

% |

|

3 |

|

Philadelphia, PA |

|

|

10.7 |

% |

|

4 |

|

New York/New Jersey |

|

|

9.5 |

% |

|

5 |

|

Charlotte, NC |

|

|

6.9 |

% |

|

6 |

|

Dallas/Fort Worth, TX |

|

|

6.8 |

% |

|

7 |

|

DC/Baltimore, MD |

|

|

6.3 |

% |

|

8 |

|

Phoenix, AZ |

|

|

4.9 |

% |

|

9 |

|

Tampa/St. Petersburg, FL |

|

|

3.2 |

% |

|

10 |

|

Baton Rouge, LA |

|

|

1.9 |

% |

|

11 |

|

South Florida |

|

|

1.9 |

% |

|

12 |

|

McAllen/Edinburg/Pharr,TX |

|

|

1.7 |

% |

|

13 |

|

Kansas City, MO |

|

|

1.7 |

% |

|

14 |

|

Oakland, ME |

|

|

1.5 |

% |

|

15 |

|

Orlando, FL |

|

|

1.5 |

% |

|

16 |

|

Knoxville, TN |

|

|

1.5 |

% |

|

17 |

|

Atlanta, GA |

|

|

1.4 |

% |

|

18 |

|

Florence, SC |

|

|

1.0 |

% |

|

19 |

|

Tucson, AZ |

|

|

0.9 |

% |

|

20 |

|

Hawaii |

|

|

0.9 |

% |

|

|

|

Total Office/Other Portfolio Concentration (3) |

|

|

100.0 |

% |

Footnotes

|

|

(1) |

Markets are based on geographic boundaries defined by CoStar.com. They serve to delineate core areas that are competitive with each other and constitute a generally accepted primary competitive set of areas. Markets are building-type specific, and are non-overlapping contiguous geographic designations. |

|

|

(2) |

Three months ended 3/31/2020 Base Rent recognized for consolidated office/other properties owned as of 3/31/2020. |

|

|

(3) |

Total shown may differ from detailed amounts due to rounding. |

26

LEXINGTON REALTY TRUST

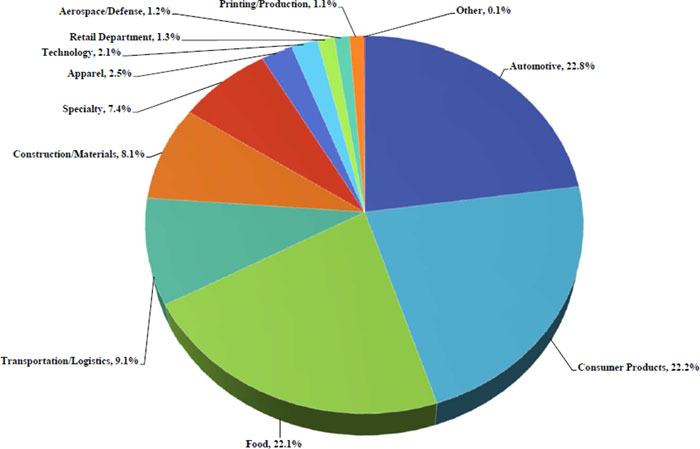

Tenant Industry Diversification - Industrial Assets (1)

3/31/2020

Footnotes

|

|

(1) |

Three months ended 3/31/2020 Base Rent recognized for consolidated properties owned as of 3/31/2020. |

27

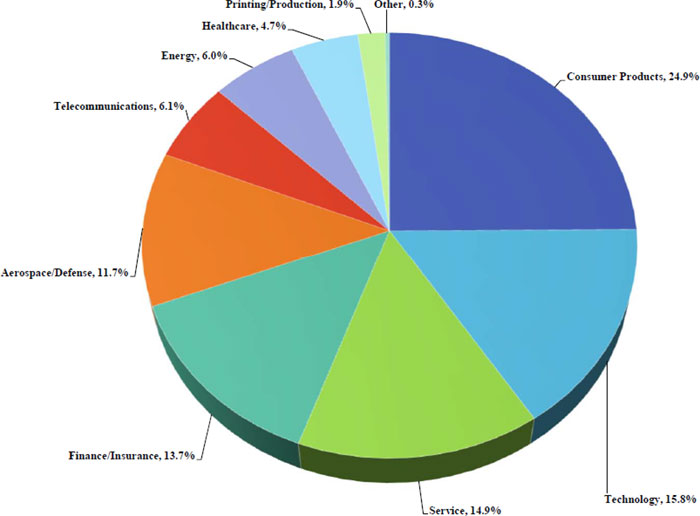

LEXINGTON REALTY TRUST

Tenant Industry Diversification - Office/Other Assets (1)

3/31/2020

Footnotes

|

|

(1) |

Three months ended 3/31/2020 Base Rent recognized for consolidated properties owned as of 3/31/2020. |

28

| LEXINGTON REALTY TRUST |

| Top 15 Tenants |

| 03/31/2020 |

| Top 15 Tenants |

| Tenants (1) | Property Type | Lease Expirations | Number of Leases | Sq. Ft. Leased | Sq. Ft. Leased as a Percent of Consolidated Portfolio (2)(3) | Base Rent as of 3/31/2020 ($000) | Percent of Base Rent as of 3/31/2020 ($000) (2)(4) | |||||||||||||||||

| Dow | Office | 2036 | 1 | 664,100 | 1.2 | % | $ | 3,712 | 5.2 | % | ||||||||||||||

| Nissan | Industrial | 2027 | 2 | 2,971,000 | 5.6 | % | 3,190 | 4.4 | % | |||||||||||||||

| Dana | Industrial | 2021-2026 | 7 | 2,053,359 | 3.8 | % | 2,485 | 3.5 | % | |||||||||||||||

| Kellogg | Industrial | 2027-2029 | 3 | 2,801,916 | 5.2 | % | 2,426 | 3.4 | % | |||||||||||||||

| Amazon | Industrial | 2026-2030 | 3 | 2,515,492 | 4.7 | % | 2,363 | 3.3 | % | |||||||||||||||

| Undisclosed (5) | Industrial | 2031-2035 | 3 | 1,090,383 | 2.0 | % | 1,785 | 2.5 | % | |||||||||||||||

| Watco | Industrial | 2038 | 1 | 132,449 | 0.2 | % | 1,693 | 2.4 | % | |||||||||||||||

| Xerox | Office | 2023 | 1 | 202,000 | 0.4 | % | 1,660 | 2.3 | % | |||||||||||||||

| Wal-Mart | Industrial | 2023-2027 | 3 | 1,491,439 | 2.8 | % | 1,466 | 2.0 | % | |||||||||||||||

| FedEx | Industrial | 2023 & 2028 | 2 | 292,021 | 0.5 | % | 1,430 | 2.0 | % | |||||||||||||||

| Morgan Lewis (6) | Office | 2024 | 1 | 289,432 | 0.5 | % | 1,414 | 2.0 | % | |||||||||||||||

| Undisclosed (5) | Industrial | 2034 | 1 | 1,318,680 | 2.5 | % | 1,386 | 1.9 | % | |||||||||||||||

| Mars Wrigley | Industrial | 2025 | 1 | 604,852 | 1.1 | % | 1,101 | 1.5 | % | |||||||||||||||

| Asics | Industrial | 2030 | 1 | 855,878 | 1.6 | % | 1,097 | 1.5 | % | |||||||||||||||

| Spitzer | Industrial | 2035 | 2 | 449,895 | 0.8 | % | 1,087 | 1.5 | % | |||||||||||||||

| 32 | 17,732,896 | 33.2 | % | $ | 28,295 | 39.5 | % | |||||||||||||||||

Footnotes

| (1) | Tenant, guarantor or parent. |

| (2) | Total shown may differ from detailed amounts due to rounding. |

| (3) | Excludes vacant square feet. |

| (4) | Three months ended 3/31/2020 Base Rent recognized for consolidated properties owned as of 3/31/2020, excluding rent from prior tenants. |

| (5) | Lease restricts certain disclosures. |

| (6) | Includes parking operations. |

29

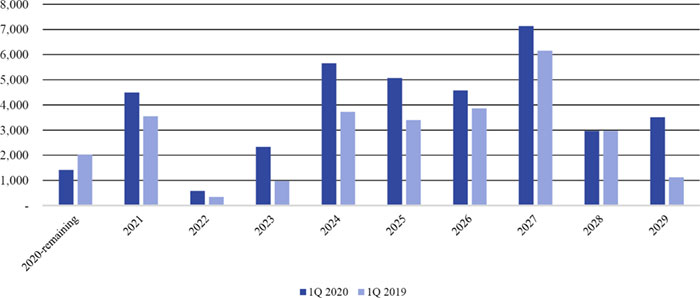

| LEXINGTON REALTY TRUST |

| Lease Rollover Schedule - Consolidated Industrial Properties |

| 03/31/2020 |

| ($000) |

| Year | Number of Leases Expiring | Base Rent as of 3/31/2020 | Percent of Base Rent as of 3/31/2020 | Percent of Base Rent as of 3/31/2019 | ||||||||||||

| 2020 - remaining | 9 | $ | 1,411 | 2.5 | % | 4.1 | % | |||||||||

| 2021 | 13 | 4,488 | 7.9 | % | 7.2 | % | ||||||||||

| 2022 | 2 | 578 | 1.0 | % | 0.7 | % | ||||||||||

| 2023 | 9 | 2,328 | 4.1 | % | 2.0 | % | ||||||||||

| 2024 | 16 | 5,656 | 9.9 | % | 7.6 | % | ||||||||||

| 2025 | 14 | 5,062 | 8.9 | % | 6.9 | % | ||||||||||

| 2026 | 10 | 4,573 | 8.0 | % | 7.9 | % | ||||||||||

| 2027 | 9 | 7,135 | 12.5 | % | 12.5 | % | ||||||||||

| 2028 | 4 | 2,963 | 5.2 | % | 6.0 | % | ||||||||||

| 2029 | 6 | 3,510 | 6.1 | % | 2.3 | % | ||||||||||

| Thereafter | 25 | 19,377 | 33.9 | % | 38.8 | % | ||||||||||

| Total (1) | 117 | $ | 57,081 | 100.0 | % | |||||||||||

Footnotes

| (1) | Total shown may differ from detailed amounts due to rounding. |

30

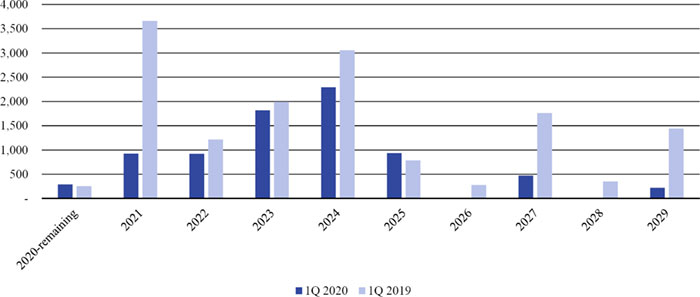

| LEXINGTON REALTY TRUST |

| Lease Rollover Schedule - Consolidated Office/Other Properties |

| 03/31/2020 |

| ($000) |

| Year | Number of Leases Expiring | Base Rent as of 3/31/2020 | Percent of Base Rent as of 3/31/2020 | Percent of Base Rent as of 3/31/2019 | ||||||||||||

| 2020 - remaining | 30 | $ | 290 | 2.0 | % | 1.1 | % | |||||||||

| 2021 | 8 | 924 | 6.5 | % | 16.4 | % | ||||||||||

| 2022 | 2 | 920 | 6.5 | % | 5.4 | % | ||||||||||

| 2023 | 3 | 1,818 | 12.8 | % | 8.9 | % | ||||||||||

| 2024 | 5 | 2,289 | 16.1 | % | 13.7 | % | ||||||||||

| 2025 | 5 | 935 | 6.6 | % | 3.5 | % | ||||||||||

| 2026 | 0 | - | 0.0 | % | 1.3 | % | ||||||||||

| 2027 | 3 | 474 | 3.3 | % | 7.9 | % | ||||||||||

| 2028 | 0 | - | 0.0 | % | 1.6 | % | ||||||||||

| 2029 | 1 | 220 | 1.5 | % | 6.5 | % | ||||||||||

| Thereafter | 8 | 6,387 | 44.8 | % | 24.0 | % | ||||||||||

| Total (1) | 65 | $ | 14,257 | 100.0 | % | |||||||||||

Footnotes

| (1) Total shown may differ from detailed amounts due to rounding and does not include parking operations. |

31

LEXINGTON REALTY TRUST

Property Leases and Vacancies - Consolidated Portfolio - 3/31/2020

| Year of Lease Expiration | Date

of Lease Expiration | Property Location | City | State | Note | Primary Tenant, Guarantor, or Parent | Sq.

Ft. Leased or Available (1) | Base

Rent as of 3/31/2020 ($000) (2) | Cash

Base Rent as of 3/31/2020 ($000) (2) | 3/31/2020 Debt Balance ($000) | Debt

Maturity | |||||||||||||||||||||

| INDUSTRIAL PROPERTIES | ||||||||||||||||||||||||||||||||

| Single-tenant | ||||||||||||||||||||||||||||||||

| 2020 | 6/30/2020 | 1650-1654 Williams Rd. | Columbus | OH | -- | ODW Logistics | 772,450 | 337 | 336 | - | - | |||||||||||||||||||||

| 12/19/2020 | 1901 Ragu Dr. | Owensboro | KY | 5 | Unilever | 443,380 | 373 | 322 | - | - | ||||||||||||||||||||||

| 12/31/2020 | 2203 Sherrill Dr. | Statesville | NC | -- | Geodis America | 639,800 | 623 | 653 | - | - | ||||||||||||||||||||||

| 2021 | 1/31/2021 | 101 Michelin Dr. | Laurens | SC | 18 | Michelin | 1,164,000 | 895 | 895 | - | - | |||||||||||||||||||||

| 3/31/2021 | 2455 Premier Row | Orlando | FL | -- | Walgreen Co. | 205,016 | 196 | 127 | - | - | ||||||||||||||||||||||

| 5/31/2021 | 291 Park Center Dr. | Winchester | VA | -- | Kraft Heinz | 344,700 | 355 | 366 | - | - | ||||||||||||||||||||||

| 6/30/2021 | 11624 S. Distribution Cv. | Olive Branch | MS | -- | Hamilton Beach | 1,170,218 | 947 | 819 | - | - | ||||||||||||||||||||||

| 9/30/2021 | 3820 Micro Dr. | Millington | TN | -- | Ingram Micro | 701,819 | 453 | 468 | - | - | ||||||||||||||||||||||

| 10/25/2021 | 6938 Elm Valley Dr. | Kalamazoo | MI | -- | Dana | 150,945 | 437 | 507 | - | - | ||||||||||||||||||||||

| 11/30/2021 | 2880 Kenny Biggs Rd. | Lumberton | NC | -- | Quickie Manufacturing | 423,280 | 339 | 370 | - | - | ||||||||||||||||||||||

| 12/31/2021 | 191 Arrowhead Dr. | Hebron | OH | -- | Owens Corning | 250,410 | 145 | 145 | - | - | ||||||||||||||||||||||

| 200 Arrowhead Dr. | Hebron | OH | -- | Owens Corning | 400,522 | 231 | 231 | - | - | |||||||||||||||||||||||

| 3686 South Central Ave. | Rockford | IL | -- | Pierce Packaging | 93,000 | 81 | 81 | - | - | |||||||||||||||||||||||

| 2022 | 3/31/2022 | 5417 Campus Dr. | Shreveport | LA | -- | Tire Rack | 257,849 | 336 | 351 | - | - | |||||||||||||||||||||

| 8/31/2022 | 50 Tyger River Dr. | Duncan | SC | -- | Plastic Omnium | 221,833 | 242 | 252 | - | - | ||||||||||||||||||||||

| 2023 | 2/28/2023 | 3102 Queen Palm Dr. | Tampa | FL | -- | RC Moore | 229,605 | 288 | 97 | - | - | |||||||||||||||||||||

| 7670 Hacks Cross Rd. | Olive Branch | MS | -- | MAHLE Industries | 268,104 | 226 | 227 | - | - | |||||||||||||||||||||||

| 5/31/2023 | 6495 Polk Ln. | Olive Branch | MS | 13 | Undisclosed | 151,691 | 146 | 141 | - | - | ||||||||||||||||||||||

| 8/31/2023 | 10535 Red Bluff Rd. | Pasadena | TX | -- | Unis | 257,835 | 308 | 300 | - | - | ||||||||||||||||||||||

| 3737 Duncanville Rd. | Dallas | TX | -- | Owens Corning | 510,440 | 428 | 416 | - | - | |||||||||||||||||||||||

| 10/31/2023 | 493 Westridge Pkwy. | McDonough | GA | -- | Carlstar | 676,000 | 508 | 494 | - | - | ||||||||||||||||||||||

| 12/31/2023 | 120 Southeast Pkwy. Dr. | Franklin | TN | -- | United Technologies | 289,330 | 184 | 184 | - | - | ||||||||||||||||||||||

| 675 Gateway Blvd. | Monroe | OH | -- | Blue Buffalo | 143,664 | 178 | 172 | - | - | |||||||||||||||||||||||

| 2024 | 1/31/2024 | 1285 W. State Road 32 | Lebanon | IN | -- | Continental Tire | 741,880 | 570 | 603 | - | - | |||||||||||||||||||||

| 6495 Polk Ln. | Olive Branch | MS | 13 | Undisclosed | 118,211 | 124 | 120 | - | - | |||||||||||||||||||||||