Table of Contents

As filed with the U.S. Securities and Exchange Commission on May 8, 2020

Registration No. 333-237992

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

KALEYRA, INC.

(Exact name of registrant as specified in our charter)

| Delaware | 7374 | 82-3027430 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Via Marco D’Aviano, 2

Milano MI, Italy 20131

+39 02 288 5841

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dario Calogero

Chief Executive Officer and President

Kaleyra, Inc.

Via Marco D’Aviano, 2

Milano MI, Italy 20131

+39 02 288 5841

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Jeffrey C. Selman, Esq.

Crowell & Moring LLP

3 Embarcadero Center, 26th Floor

San Francisco, CA 94111

(415) 365-7442

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Table of Contents

Calculation of Registration Fee

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Offering Price Per Security |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common stock, $0.0001 par value per share |

19,288,478 |

$6.67(2) | $128,654,149 | $16,700 | ||||

| Warrants to purchase common stock |

373,691 | $— (3) | — (3) | — (3) | ||||

| Common stock, $0.0001 par value per share, underlying Warrants |

11,154,938 |

$11.50(4) | $128,281,787 | $16,651 | ||||

| Total |

$256,935,936 | $33,351(5) | ||||||

|

| ||||||||

|

| ||||||||

| (1) | In the event of a stock split, stock dividend or other similar transaction involving the registrant’s common stock, in order to prevent dilution, the number of shares of common stock registered hereby shall be automatically increased to cover the additional common shares in accordance with Rule 416(a) under the Securities Act. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low prices of the Registrant’s common stock on May 1, 2020, as reported on the NYSE American LLC. |

| (3) | No separate fee due in accordance with Rule 457(i). |

| (4) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(g) under the Securities Act. The price per share is based upon the exercise price of the warrants. |

| (5) | The Registrant previously paid $33,351 in connection with the initial filing of this Registration Statement. |

This Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to Section 8(a) of the Securities Act of 1933, as amended, may determine.

Table of Contents

PRELIMINARY PROSPECTUS

30,443,416 Shares of Common Stock

373,691 Warrants to Purchase Common Stock

The selling securityholders named in this prospectus may offer and sell from time to time up to 19,622,169 shares of our common stock, par value $0.0001 per share, and warrants to purchase up to 373,691 shares of common stock, consisting of:

| • | up to 4,027,006 shares of common stock (the “Founder Shares”) initially issued in private placements to GigAcquisitions, LLC (the “Sponsor”), Cowen Investments LLC (“Cowen Investments”), Cowen Investments II LLC (“Cowen Investments II”) and two individuals who are affiliates of Cowen Investments, Irwin Silverberg and Jeffrey Bernstein (collectively, together with GigFounders, LLC, the “Founders”); |

| • | up to 49,827 shares of common stock (the “Private Rights Shares”) issued to the Founders upon consummation of our business combination with Kaleyra, S.p.A. on November 25, 2019 (the “Business Combination”) in exchange for private placement rights. |

| • | up to 60,000 shares of common stock (the “Insider Shares”) issued in private placements to certain insiders, solely in consideration of future services; |

| • | up to 10,687,106 shares of common stock (the “Closing Shares”), issued to the holders of capital stock of Kaleyra S.p.A. in connection with the consummation of our Business Combination with Kaleyra S.p.A; |

| • | up to 3,527,272 shares of common stock (the “Earnout Shares”), of which 1,763,633 have been issued to the former holders of capital stock of Kaleyra S.p.A. upon the achievement of certain financial milestones for the 2019 fiscal year, and the former holders of capital stock of Kaleyra, S.p.A. have the contingent right to receive the remaining 1,763,639 Earnout Shares upon the achievement of certain financial milestones for the 2020 fiscal year; |

| • | up to 373,691 warrants to purchase shares of common stock issued in a private placement to the Founders (the “Placement Warrants”); |

| • | up to 373,691 shares of common stock that are issuable by us upon exercise of the Placement Warrants; |

| • | up to 140,000 shares of common stock issued to Northland Securities, Inc. (“Northland”) as partial consideration for financial advisory services provided by Northland to Kaleyra S.p.A. in connection with the Business Combination (the “Northland Shares”); and |

| • | up to 440,595 shares of common stock issued to Cowen Investments II and Chardan Capital Markets, LLC (“Chardan”) as partial consideration for financial advisory services provided by an affiliate of Cowen Investments II, Cowen and Company (“Cowen”) and Chardan to Kaleyra in connection with the Business Commination (the “Cowen/Chardan Shares”); and |

| • | up to 356,672 shares of common stock that are issuable by us upon conversion of convertible notes (the “Convertible Notes”) issued to Cowen Investments II and Chardan as partial consideration for financial advisor services provided by Cowen and Chardan to Kaleyra in connection with the Business Combination (the “Notes Shares”). |

In addition, this prospectus relates to the offer and sale of up to 10,781,247 shares of common stock that are issuable by us upon the exercise of outstanding warrants that were previously registered (the “Public Warrants”).

The selling securityholders may offer, sell or distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of the shares of common stock or warrants, except with respect to amounts received by us upon the exercise of the warrants. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard to compliance with state securities or “blue sky” laws. The selling stockholders will bear all commissions and discounts, if any, attributable to their sale of shares of common stock or warrants. See “Plan of Distribution” beginning on page 106 of this prospectus.

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and are subject to reduced public company reporting requirements. This prospectus complies with the requirements that apply to an issuer that is an emerging growth company.

Our common stock and warrants are listed on the NYSE American LLC (the “NYSE American”) under the symbols “KLR” and “KLR WS”, respectively. On May 1, 2020, the last reported sales price of our common stock was $6.57 per share and the last reported sales price of our warrants was $1.00 per warrant.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 3 of this prospectus, and under similar headings in any amendment or supplements to this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

May 8, 2020

Table of Contents

| Page | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 3 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 | |||

| 59 | ||||

| 70 | ||||

| 76 | ||||

| 82 | ||||

| 88 | ||||

| 90 | ||||

| 97 | ||||

| 103 | ||||

| 106 | ||||

| 108 | ||||

| 108 | ||||

| 109 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus, filed with the Securities and Exchange Commission. Neither we nor the selling stockholders have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The selling stockholders are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the selling securityholders, have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus outside the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the Securities and Exchange Commission before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

i

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements provide our current expectations or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this prospectus include, but are not limited to, statements about our:

| • | ability to grow and retain our client base; |

| • | ability to provide effective client support and induce our clients to renew and upgrade the technology offerings and services we provide for them; |

| • | ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| • | ability to forecast and maintain an adequate rate of revenue growth and appropriately plan our expenses; |

| • | expectations regarding future expenditures; |

| • | future mix of revenue and effect on gross margins; |

| • | attraction and retention of qualified employees and key personnel; |

| • | ability to compete effectively in a competitive industry; |

| • | ability to protect and enhance our corporate reputation and brand; |

| • | expectations concerning our relationships and actions with our technology partners and other third parties; |

| • | market conditions and global and economic factors beyond our control, including the potential adverse effects of the ongoing global coronavirus (COVID-19) pandemic; |

| • | impact from future regulatory, judicial, and legislative changes in our industry; |

| • | ability to locate and acquire complementary technologies or services and integrate those into our business; and |

| • | future arrangements with, or investments in, other entities or associations. |

These forward-looking statements are based on information available as of the date of this prospectus, and current expectations, forecasts and assumptions, and involve a number of risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

In addition, statements that we “believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to such party as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and these statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You should not place undue reliance on these forward-looking statements. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements.

ii

Table of Contents

“Business Combination” means the business combination between Kaleyra, Inc. (“Kaleyra”) (f/k/a GigCapital, Inc. (“GigCapital”)) and Kaleyra S.p.A., consummated on November 25, 2019.

“Closing Shares” means the 10,687,106 shares of common stock issued to the holders of capital stock of Kaleyra S.p.A. in connection with the consummation of the Business Combination;

“Convertible Notes” means the convertible notes issued to Cowen Investments II and Chardan as partial consideration for financial advisor services provided by Cowen and Chardan to Kaleyra in connection with the Business Combination.

“Cowen/Chardan Shares” means the 440,595 shares of common stock issued to Cowen Investments II and Chardan as partial consideration for financial advisory services provided by Cowen and Chardan to Kaleyra in connection with the Business Combination.

“Earnout Shares” means 3,527,272 shares of common stock, of which 1,763,633 have been issued to the former holders of capital stock of Kaleyra S.p.A. upon the achievement of certain financial milestones for the 2019 fiscal year, and the former holders of capital stock of Kaleyra, S.p.A. have the contingent right to receive the remaining 1,763,639 Earnout Shares upon the achievement of certain financial milestones for the 2020 fiscal year;

“Founders” means Sponsor, GigFounders, LLC, Cowen Investments LLC (“Cowen Investments”), Cowen Investments II LLC (“Cowen Investments II”) , Irwin Silverberg and Jeffrey Bernstein.

“Founder Shares” means the 4,027,006 shares of common stock issued in a private placements to the Founders.

“Insider Shares” means up to 60,000 shares of common stock issued in private placements to certain insiders of Kaleyra, solely in consideration of future services.

“IPO” means Kaleyra’s (f/k/a GigCapital) initial public offering.

“Northland Shares” means 140,000 shares of common stock issued to Northland Securities, Inc. (“Northland”) as partial consideration for financial advisory services provided by Northland to Kaleyra S.p.A. in connection with the Business Combination.

“Notes Shares” means the 356,672 shares of common stock issuable upon conversion of the Convertible Notes.

“Stock Purchase Agreement” means that certain Stock Purchase Agreement, dated as of February 22, 2019, as amended, by and among Kaleyra (f/k/a GigCapital), Kaleyra S.p.A., the shareholders of Kaleyra S.p.A.

“Placement Warrants” means the 373,691 warrants to purchase shares of common stock issued in a private placement to the Founders.

“Private Rights Shares” means the 49,827 shares of common stock issued to the Founders upon consummation of the Business Combination in exchange for private placement rights.

“Public Warrants” means the warrants to purchase 10,781,247 shares of common stock originally issued as part of the units sold in our IPO.

“Sponsor” means GigAcquisitions, LLC.

“warrants” means the “Placement Warrants” and the “Public Warrants”.

iii

Table of Contents

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The “Company,” “Kaleyra” “we,” “our,” “us” or similar terms mean Kaleyra, Inc.(f/k/a GigCapital, Inc.) and our consolidated subsidiaries.

General

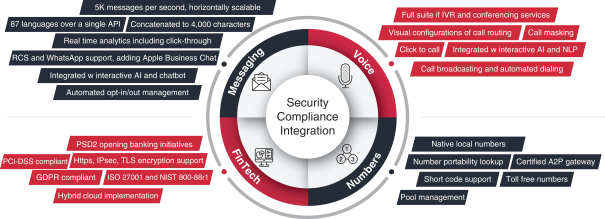

We are a CPaaS company that provides our customers with a trusted cloud communications platform (the “Platform”) that seamlessly integrates software services and applications for business-to-consumer communications between ours customers and their end-user customers and partners on a global basis. The demand for cloud communications is increasingly driven by the growing, and often mandated, need for enterprises to undertake a digital transformation that includes omni-channel, mobile first interactive end-user customer communications. This complements new workflows that our customers have developed which are driven by software and artificial intelligence to automate certain end-user customer-facing processes before, during and after transactions. These communications are increasingly managed through mobile network operators as the gateway to reach end-user consumers’ mobile devices. Our Platform enables these communications by integrating mobile alert notifications and interactive capabilities to reach and engage end user customers.

Our vision is to be the CPaaS provider which best aligns with its customers’ communication requirements, or the most trusted provider, in the world. This requires a combination of security, compliance and integration capabilities that protects the integrity and privacy of our customers’ transactions and includes other key features such as ease of provisioning, reliable network connectivity, high availability for scaling, redundancy, embedded regulatory compliance, configurable monitoring and reporting. We believe the percentage of CPaaS customers that will require high levels of security, compliance and ease of integration will represent an increasingly larger portion of the market, better enabling us to set ourselves apart from our competition.

Corporate Information

We were incorporated in Delaware on October 9, 2017 as a blank check company under the name GigCapital, Inc. Our principal executive offices are located at Via Marco D’Aviano, 2, Milano MI, Italy 20131, and our telephone number is +39 02 288 5841. Our corporate website address is www.kaleyra.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

On November 25, 2019, GigCapital and Kaleyra S.p.A. consummated the transactions contemplated by the Stock Purchase Agreement, as amended, following the approval at the special meeting of the stockholders of GigCapital held on November 22, 2019. In connection with the closing of the Business Combination, we changed our name from GigCapital, Inc. to Kaleyra, Inc.

1

Table of Contents

The Offering

| Securities offered by the selling securityholders |

We are registering the resale by the selling securityholders named in this prospectus, or their permitted transferees, of an aggregate of 19,662,169 shares of common stock and warrants to purchase 373,691 shares of common stock, which includes: |

| • | up to 4,027,006 Founder Shares; |

| • | up to 49,827 Private Rights Shares; |

| • | up to 60,000 Insider Shares; |

| • | up to 10,687,106 Closing Shares; |

| • | up to 3,527,272 Earnout Shares; |

| • | up to 373,691 Placement Warrants; |

| • | up to 373,691 shares of common stock issuable upon exercise of the Placement Warrants; |

| • | up to 140,000 Northland Shares; |

| • | up to 440,595 Cowen/Chardan Shares; and |

| • | up to 356,672 Note Shares. |

| In addition, we are registering 10,781,247 shares of common stock issuable upon exercise of the Public Warrants. |

| Terms of the offering |

The selling securityholders will determine when and how they will dispose of the shares of common stock and warrants registered under this prospectus for resale. |

| Shares outstanding prior to the offering |

As of May 8, 2020, we had 22,173,276 shares of common stock issued and outstanding. |

| Shares outstanding after the offering |

35,448,525 shares of common stock (assuming the exercise for cash of warrants to purchase 11,154,938 shares of common stock, the issuance to selling securityholders of the 1,763,639 Earnout Shares for which there is a contingent right to receive, the issuance of 356,672 Note Shares upon the conversion of the Convertible Notes, and no forfeiture of Founder Shares on the date the registration statement of which this prospectus forms a part is declared effective). |

| Use of proceeds |

We will not receive any of the proceeds from the sale of the warrants or shares of common stock by the selling securityholders. We expect to use the proceeds received from the exercise of the warrants, if any, for working capital and general corporate purposes. |

| NYSE American ticker symbol |

Our common stock and Public Warrants and Placement Warrants are listed on the NYSE American under the symbols “KLR” and “KLR WS”, respectively. |

For additional information concerning the offering, see “Plan of Distribution” beginning on page 106.

2

Table of Contents

An investment in our securities involves a high degree of risk. You should consider carefully all of the risks described below, together with the other information contained in this Annual Report, before making a decision to invest in our securities. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

The market in which Kaleyra participates is highly competitive, and if Kaleyra does not compete effectively, its business, results of operations and financial condition could be harmed.

The market for cloud communications is rapidly evolving, significantly fragmented and highly competitive, with relatively low barriers to entry in some segments. The principal competitive factors in Kaleyra’s market include completeness of offering, credibility with developers, global reach, ease of integration and programmability, product features, platform scalability, reliability, security and performance, brand awareness and reputation, the strength of sales and marketing efforts, customer support, as well as the cost of deploying and using Kaleyra’s services. Kaleyra’s competitors fall into two primary categories:

| • | CPaaS companies that offer a narrower set of software Application Programming Interfaces (“APIs”), less robust customer support and fewer other features while relying on third-party networks and physical infrastructure; and |

| • | Network service providers that offer limited developer functionality on top of their own networks and physical infrastructure. |

Some of Kaleyra’s competitors and potential competitors are larger and have greater name recognition, longer operating histories, more established customer relationships, a larger global reach, larger budgets and significantly greater resources than Kaleyra does. In addition, they have the operating flexibility to bundle competing products and services at little or no incremental cost, including offering them at a lower price as part of a larger sales transaction. As a result, Kaleyra’s competitors may be able to respond more quickly and effectively than Kaleyra can to new or changing opportunities, technologies, standards or customer requirements. In addition, some competitors may offer services that address one or a limited number of functions at lower prices, with greater depth than Kaleyra’s services or in different geographies. Kaleyra’s current and potential competitors may develop and market new services with comparable functionality to Kaleyra’s services, and this could lead to Kaleyra having to decrease prices in order to remain competitive. In addition, some of Kaleyra’s competitors have lower list prices than us, which may be attractive to certain customers even if those services have different or lesser functionality. If Kaleyra is unable to maintain Kaleyra’s current pricing due to the competitive pressures, its margins will be reduced and Kaleyra’s business, results of operations and financial condition would be adversely affected. Customers utilize Kaleyra’s services in many ways and use varying levels of functionality that Kaleyra’s services offer or are capable of supporting or enabling within their applications.

Customers that use many of the features of Kaleyra’s services or use Kaleyra’s services to support or enable core functionality for their applications may have difficulty or find it impractical to replace Kaleyra’s services with a competitor’s services, while customers that use only limited functionality may be able to more easily replace Kaleyra’s services with competitive offerings.

With the introduction of new services and new market entrants, Kaleyra expects competition to intensify in the future. In addition, some of Kaleyra’s customers choose to use Kaleyra’s services and Kaleyra’s competitors’ services at the same time. Moreover, as Kaleyra expands the scope of Kaleyra’s services, Kaleyra may face additional competition. Further, customers and consumers may choose to adopt other forms of electronic communications or alternative communication platforms, including developing necessary networks and

3

Table of Contents

platforms in-house. Furthermore, if Kaleyra’s competitors were to merge such that the combined entity would be able to compete fully with Kaleyra’s service offering, then Kaleyra’s business, results of operations and financial condition may be adversely affected. If one or more of Kaleyra’s competitors were to merge or partner with another of Kaleyra’s competitors, the change in the competitive landscape could also adversely affect Kaleyra’s ability to compete effectively. In addition, pricing pressures and increased competition generally could result in reduced revenue, reduced margins, increased losses or the failure of Kaleyra’s services to achieve or maintain widespread market acceptance.

Kaleyra’s current and potential competitors have developed and may develop in the future product solutions that are available internationally. To the extent that customers seek product solutions that include support and scaling internationally, they may choose to use other service providers to fill their communication service needs. Each of these factors could harm Kaleyra’s business by leading to reduced revenues, slower growth and lower brand name recognition than Kaleyra’s competitors.

If Kaleyra is unable to expand or renew sales to existing clients, or attract new customers, Kaleyra’s growth could be slower than it expects and its business may be harmed.

Kaleyra’s future growth depends upon expanding sales of Kaleyra’s technology offerings and services with existing customers and with new customers. Kaleyra’s customers may not purchase Kaleyra’s technology offerings and services, or Kaleyra’s customers may reduce their purchasing volumes, if Kaleyra does not demonstrate the value proposition for their investment, and Kaleyra may not be able to replace existing customers with new customers. In addition, Kaleyra’s customers may not renew their contracts with Kaleyra on the same terms, or at all, because of dissatisfaction with Kaleyra’s service. If Kaleyra’s customers do not renew their contracts, Kaleyra’s revenue may grow more slowly than expected, may not grow at all, or may decline. Additionally, increasing incremental sales to Kaleyra’s current client base may require increasingly sophisticated and costly sales efforts that are targeted at senior management. Kaleyra plans to continue expanding its sales efforts but it may be unable to hire qualified sales personnel, may be unable to successfully train those sales personnel that Kaleyra is able to hire, and sales personnel may not become fully productive on the timelines that it has projected, or at all. Additionally, although Kaleyra dedicates significant resources to sales and marketing programs, these sales and marketing programs may not have the desired effect and may not expand sales. Kaleyra cannot assure you that its efforts will increase sales to existing customers or additional revenue. If Kaleyra’s efforts to upsell to its customers are not successful, its future growth may be limited.

Kaleyra’s ability to achieve significant growth in revenue in the future will also depend upon its ability to attract new customers. This may be particularly challenging where an organization has already invested substantial personnel and financial resources to integrate competing technology offerings and services into its business, as such organization may be reluctant or unwilling to invest in new technology offerings and services. If Kaleyra fails to attract new customers and maintain and expand those client relationships, its revenue may grow more slowly than expected and its business may be harmed.

Kaleyra currently generates significant revenue from its largest customers, and the loss or decline in revenue from any of these customers could limit Kaleyra’s revenue and results of operations.

In the years ended December 31, 2019 and 2018, Kaleyra’s 10 largest customers generated an aggregate of 50% and 66% of its revenue, respectively. In the event that Kaleyra’s large customers do not continue to use its products, use fewer of its products, or use its products in a more limited capacity, or not at all, Kaleyra’s revenue could be limited and Kaleyra’s business could be harmed.

Kaleyra must increase the network traffic and resulting revenue from the services that it offers to realize its targets for anticipated revenue growth, cash flow and operating performance.

Kaleyra must increase the network traffic and resulting revenue from its inbound and outbound voice calling, text messaging, telephone numbers and related services at acceptable margins to realize Kaleyra’s targets for

4

Table of Contents

anticipated revenue growth, cash flow and operating performance. If Kaleyra does not maintain or improve its current relationships with existing key customers; is not able to expand the available capacity on its network to meet its customers’ demands in a timely manner; does not develop new large enterprise customers; or its customers determine to obtain these services from either their own network or from one of Kaleyra’s competitors, then Kaleyra may be unable to increase or maintain its revenue at acceptable margins.

Kaleyra’s business depends on customers increasing their use of Kaleyra’s services and any loss of customers or decline in their use of Kaleyra’s services could reduce Kaleyra’s profitability.

Kaleyra’s ability to grow and generate incremental revenue depends, in part, on Kaleyra’s ability to maintain and grow its relationships with existing customers and to have them increase their usage of Kaleyra’s Platform. If Kaleyra’s customers do not increase their use of Kaleyra’s services, then Kaleyra’s revenue may decline and Kaleyra’s results of operations may be harmed. Customers generally are charged based on the usage of Kaleyra’s services. Many of Kaleyra’s customers do not have long-term contractual financial commitments to Kaleyra and, therefore, many of Kaleyra’s customers may reduce or cease their use of Kaleyra’s services at any time without penalty or termination charges. Kaleyra cannot accurately predict customers’ usage levels and the loss of customers or reductions in their usage levels of Kaleyra’s services may each have a negative impact on Kaleyra’s business, results of operations and financial condition and may cause Kaleyra’s dollar-based net retention rate to decline in the future if Kaleyra’s customers are not satisfied with Kaleyra’s services. If a significant number of customers cease using, or reduce their usage of, Kaleyra’s services, then Kaleyra may be required to spend significantly more on sales and marketing than Kaleyra’s currently plan to spend in order to maintain or increase revenue from customers. Such additional sales and marketing expenditures could reduce Kaleyra’s profitability and harm its business.

Demand for Kaleyra’s technology offerings and services could be adversely affected by volatile, negative, or uncertain economic conditions and the effects of these conditions on Kaleyra’s customers’ businesses.

Kaleyra’s revenue and profitability depend on the demand for its technology offerings and services, which could be negatively affected by numerous factors, many of which are beyond Kaleyra’s control. Volatile, negative, or uncertain economic conditions affect Kaleyra’s customers’ businesses and the markets Kaleyra serves. Such economic conditions in Kaleyra’s markets have undermined, and could in the future undermine, business confidence in Kaleyra’s markets and cause Kaleyra’s customers to reduce or defer their spending on new technology offerings and services, or may result in customers reducing, delaying or eliminating spending under existing contracts with Kaleyra, which would negatively affect Kaleyra’s business. Growth in the markets Kaleyra serves could be at a slow rate, or could stagnate or contract, in each case for an extended period of time. Ongoing economic volatility and uncertainty and changing demand patterns affect Kaleyra’s business in a number of other ways, including making it more difficult to accurately forecast client demand and effectively build Kaleyra’s revenue and resource plans.

Economic volatility and uncertainty is particularly challenging because it may take some time for the effects and changes in demand patterns resulting from these and other factors to manifest themselves in Kaleyra’s business and results of operations. Changing demand patterns from economic volatility and uncertainty could harm Kaleyra’s business and results of operations.

Kaleyra has limited experience with respect to determining the optimal prices for its products.

Kaleyra charges its customers based on their use of its products. Kaleyra expects that it may need to change its pricing from time to time. In the past Kaleyra has sometimes reduced their prices either for individual customers in connection with long-term agreements or for a particular product. One of the challenges to Kaleyra’s pricing is that the fees that they pay to network service providers over whose networks Kaleyra transmits communications can vary daily or weekly and are affected by volume and other factors that may be outside of Kaleyra’s control and difficult to predict. This can result in Kaleyra incurring increased costs that Kaleyra may be unable or unwilling to pass through to its customers, which could harm Kaleyra’s business.

5

Table of Contents

Further, as competitors introduce new products or services that compete with ours or reduce their prices, Kaleyra may be unable to attract new customers or retain existing customers based on Kaleyra’s historical pricing. As Kaleyra expands internationally, Kaleyra also must determine the appropriate price to enable Kaleyra to compete effectively internationally. Moreover, enterprises, which are a primary focus for Kaleyra’s direct sales efforts, may demand substantial price concessions. In addition, if the mix of products sold changes, including for a shift to Internet protocol (“IP”) based products, then Kaleyra may need to, or choose to, revise its pricing. As a result, in the future Kaleyra may be required or choose to reduce its prices or change its pricing model, which could harm Kaleyra’s business.

Breaches of Kaleyra’s networks or systems, or those of Amazon Web Services (“AWS”) or Kaleyra’s other service providers, could compromise the integrity of its products, platform and data, result in significant data losses and otherwise harm its business.

Kaleyra depends upon its information technology (“IT”) systems to conduct virtually all of its business operations, ranging from Kaleyra’s internal operations and research and development activities to its marketing and sales efforts and communications with Kaleyra’s customers and business partners. Individuals or entities may attempt to penetrate Kaleyra’s network security, or that of its platform, and to cause harm to Kaleyra’s business operations, including by misappropriating its proprietary information or that of its customers, employees and business partners or to cause interruptions of Kaleyra’s products and platform. In particular, cyberattacks and other malicious Internet-based activity continue to increase in frequency and in magnitude generally, and cloud-based companies have been targeted in the past. In addition to threats from traditional computer hackers, malicious code (such as malware, viruses, worms, and ransomware), employee theft or misuse, password spraying, phishing, credential stuffing, and denial-of-service attacks, Kaleyra also faces threats from sophisticated organized crime, nation-state, and nation-state supported actors who engage in attacks (including advanced persistent threat intrusions) that add to the risk to Kaleyra’s systems (including those hosted on AWS or other cloud services), internal networks, its customers’ systems and the information that they store and process. While Kaleyra devotes significant financial and personnel resources to implement and maintain security measures, because the techniques used by such individuals or entities to access, disrupt or sabotage devices, systems and networks change frequently and may not be recognized until launched against a target, Kaleyra may be required to make further investments over time to protect data and infrastructure as cybersecurity threats develop, evolve and grow more complex over time. Kaleyra may also be unable to anticipate these techniques, and Kaleyra may not become aware in a timely manner of such a security breach, which could exacerbate any damage Kaleyra experiences. Additionally, Kaleyra depends upon its employees and contractors to appropriately handle confidential and sensitive data, including customer data, and to deploy Kaleyra’s IT resources in a safe and secure manner that does not expose Kaleyra’s network systems to security breaches or the loss of data. Any data security incidents, including internal malfeasance by its employees or a third party’s fraudulent inducement of Kaleyra’s employees to disclose information, unauthorized access or usage, virus or similar breach or disruption of Kaleyra’s or its service providers, such as AWS or service providers, could result in loss of confidential information, damage to Kaleyra’s reputation, erosion of customer trust, loss of customers, litigation, regulatory investigations, fines, penalties and other liabilities. Accordingly, if Kaleyra’s cybersecurity measures or those of AWS or Kaleyra’s service providers, fail to protect against unauthorized access, attacks (which may include sophisticated cyberattacks), compromise or the mishandling of data by Kaleyra’s employees and contractors, then Kaleyra’s reputation, customer trust, business, results of operations and financial condition could be adversely affected. While Kaleyra maintains errors, omissions, and cyber liability insurance policies covering certain security and privacy damages, Kaleyra cannot be certain that its existing insurance coverage will continue to be available on acceptable terms or will be available in sufficient amounts to cover the potentially significant losses that may result from a security incident or breach or that the insurer will not deny coverage as to any future claim.

6

Table of Contents

To deliver Kaleyra’s products, Kaleyra relies on network service providers and Internet service providers for its network service and connectivity.

Kaleyra currently interconnects with network service providers around the world to enable the use by Kaleyra’s customers of its products over their networks. Kaleyra expects that it will continue to rely heavily on network service providers for these services going forward. Kaleyra’s reliance on network service providers has reduced Kaleyra’s operating flexibility, ability to make timely service changes and control quality of service. In addition, the fees that Kaleyra is charged by network service providers may change daily or weekly, while Kaleyra does not typically change its customers’ pricing as rapidly.

At times, some network service providers have instituted additional fees due to regulatory, competitive or other industry related changes that increase Kaleyra network costs. For example, in 2018, Kaleyra was subject to a pricing increase of more than 10% from certain mobile network service providers for delivered messages. While Kaleyra has historically responded to these types of fee increases through a combination of further negotiating efforts with Kaleyra’s network service providers, absorbing the increased costs or changing Kaleyra’s prices to customers, here Kaleyra identified a unique strategy that allowed it to change its customers prices without effecting Kaleyra’s business. There is no guarantee that Kaleyra will continue to be able to use the same strategy in the future without a material negative impact to Kaleyra business. Additionally, Kaleyra’s ability to respond to any new fees may be constrained if all network service providers in a particular market impose equivalent fee structures, if the magnitude of the fees is disproportionately large when compared to the underlying prices paid by Kaleyra customers, or if the market conditions limit Kaleyra ability to increase the price Kaleyra charges its customers.

Furthermore, some of these network service providers do not have long-term committed contracts with Kaleyra and may terminate their agreements with Kaleyra without notice or restriction. If a significant portion of Kaleyra’s network service providers stop providing Kaleyra with access to their infrastructure, fail to provide these services to Kaleyra on a cost-effective basis, cease operations, or otherwise terminate these services, the delay caused by qualifying and switching to other network service providers could be time consuming and costly and could adversely affect Kaleyra’s business, results of operations and financial condition. Further, if problems occur with Kaleyra’s network service providers, it may cause errors or poor-quality communications with Kaleyra’s products, and it could encounter difficulty identifying the source of the problem. The occurrence of errors or poor-quality communications on Kaleyra’s products, whether caused by Kaleyra’s platform or a network service provider, may result in the loss of Kaleyra’s existing customers or the delay of adoption of Kaleyra’s products by potential customers and may adversely affect its business, results of operations and financial condition.

Kaleyra also interconnects with Internet service providers around the world to enable the use of Kaleyra’s communication products by its customers, and Kaleyra expects that it will continue to rely heavily on Internet service providers for network connectivity going forward. Kaleyra’s reliance on Internet service providers reduces Kaleyra’s control over quality of service and exposes Kaleyra to potential service outages and rate fluctuations. If a significant portion of Kaleyra’s Internet service providers stop providing Kaleyra with access to their network infrastructure, fail to provide access on a cost-effective basis, cease operations, or otherwise terminate access, the delay caused by qualifying and switching to other Internet service providers could be time consuming and costly and could harm Kaleyra’s business and operations.

If Kaleyra is unable to expand its relationships with existing technology partner customers and add new technology partner customers, Kaleyra’s business could be harmed.

Kaleyra believes that the continued growth of its business depends in part upon developing and expanding strategic relationships with technology partner customers. Technology partner customers embed Kaleyra software products in their solutions, such as software applications for contact centers and sales force and marketing automation, and then sell such solutions to other businesses. When potential customers do not have the

7

Table of Contents

available developer resources to build their own applications, Kaleyra refers them to either its technology partners who embed Kaleyra’s products in the solutions that they sell to other businesses or Kaleyra’s consulting partners who provide consulting and development services for organizations that have limited software development expertise to build Kaleyra’s platform into their software applications.

As part of Kaleyra’s growth strategy, it intends to expand Kaleyra’s relationships with existing technology partner customers and add new technology partner customers. If Kaleyra fails to expand its relationships with existing technology partner customers or establish relationships with new technology partner customers in a timely and cost-effective manner, or at all, then Kaleyra’s business, results of operations and financial condition could be adversely affected. Additionally, even if Kaleyra is successful at building these relationships but there are problems or issues with integrating Kaleyra’s products into the solutions of these customers, Kaleyra’s reputation and ability to grow its business may be harmed.

Kaleyra’s investments in new services and technologies may not be successful.

Kaleyra continues to invest in new services and technologies. The complexity of these solutions, Kaleyra’s learning curve in developing and supporting them, and significant competition in the markets for these solutions could make it difficult for Kaleyra to market and implement these solutions successfully. Additionally, there is a risk that Kaleyra’s customers may not adopt these solutions widely, which would prevent Kaleyra from realizing expected returns on these investments. Even if these solutions are successful in the market, they still rely on third-party hardware and software and Kaleyra’s ability to meet stringent service levels. If Kaleyra is unable to deploy these solutions successfully or profitably, it could adversely impact its business.

If Kaleyra fails to adapt and respond effectively to rapidly changing technology, evolving industry standards, changing regulations, and changing customer needs, requirements or preferences, Kaleyra’s products may become less competitive.

The market for communications in general, and cloud communications in particular, is subject to rapid technological change, evolving industry standards, changing regulations, as well as changing customer needs, requirements and preferences. The success of Kaleyra’s business will depend, in part, on Kaleyra’s ability to adapt and respond effectively to these changes on a timely basis. If Kaleyra is unable to develop new products that satisfy Kaleyra customers and provide enhancements and new features for Kaleyra’s existing products that keep pace with rapid technological and industry change, Kaleyra business, results of operations and financial condition could be adversely affected. If new technologies emerge that are able to deliver competitive products and services at lower prices, more efficiently, more conveniently or more securely, such technologies could adversely impact Kaleyra’s ability to compete effectively.

If Kaleyra loses any of its key personnel or is unable to attract and retain the talent required for its business, Kaleyra’s business could be disrupted and its financial performance could suffer.

Kaleyra’s success is heavily dependent upon its ability to attract, develop, engage, and retain key personnel to manage and grow its business, including Kaleyra’s key executive, management, sales, services, and technical personnel. Kaleyra’s future success will depend to a significant extent on the efforts of Kaleyra’s executive team including the leadership of Kaleyra’s Chief Executive Officer, Dario Calogero, as well as the continued service and support of other key employees. Kaleyra’s future success also will depend on its ability to attract and retain highly skilled technology specialists, engineers, and consultants, for whom the market is extremely competitive. All of Kaleyra’s officers and key employees are at-will employees, meaning that they can terminate their employment with Kaleyra at any time. Kaleyra’s inability to attract, develop, and retain key personnel could have an adverse effect on its relationships with its technology partners and customers and adversely affect Kaleyra’s ability to expand its offerings of technology offerings and services. Moreover, Kaleyra’s inability to train its sales, services, and technical personnel effectively to meet the rapidly changing technology needs of its customers could cause a decrease in the overall quality and efficiency of such personnel. Such consequences could harm Kaleyra’s business.

8

Table of Contents

Kaleyra’s ability to attract and retain business and personnel may depend on its reputation in the marketplace.

Kaleyra believes its brand name and its reputation in the marketplace are important corporate assets that help distinguish Kaleyra’s technology offerings and services from those of competitors and also contribute to Kaleyra’s ability to recruit and retain talented personnel, in particular its engineers and consulting professionals. However, Kaleyra’s corporate reputation is potentially susceptible to material damage by events such as disputes with customers, cybersecurity breaches, service outages, internal control deficiencies, delivery failures, or compliance violations. Similarly, Kaleyra’s reputation could be damaged by actions or statements of current or former customers, directors, employees, competitors, vendors, partners, Kaleyra’s joint ventures or joint venture partners, adversaries in legal proceedings, legislators, or government regulators, as well as members of the investment community or the media. There is a risk that negative information about Kaleyra, even if based on rumor or misunderstanding, could adversely affect its business. Damage to Kaleyra’s reputation could be difficult, expensive and time-consuming to repair, could make potential or existing customers reluctant to select Kaleyra for new engagements, resulting in a loss of business, and could adversely affect Kaleyra’s recruitment and retention efforts. Damage to Kaleyra’s reputation could also reduce the value and effectiveness of Kaleyra’s brand name and could reduce investor confidence in Kaleyra, adversely affecting its share price.

Kaleyra has experienced rapid internal growth as well as growth through acquisitions in recent periods. If Kaleyra fails to manage its growth effectively, or its business does not grow as expected, Kaleyra’s operating results may suffer.

Kaleyra’s headcount and operations have grown substantially. Kaleyra had approximately 267 employees as of December 31, 2019, as compared with 235 employees as of December 31, 2018. This growth has placed, and will continue to place, a significant strain on Kaleyra’s operational, financial, and management infrastructure. Kaleyra anticipates further increases in headcount will be required to support increases in its technology offerings and continued expansion. To manage this growth effectively, Kaleyra must continue to improve its operational, financial, and management systems and controls by, among other things:

| • | effectively attracting, training, and integrating a large number of new employees, particularly technical personnel and members of Kaleyra’s management and sales teams; |

| • | further improving Kaleyra’s key business systems, processes, and information technology infrastructure to support Kaleyra’s business needs; |

| • | enhancing Kaleyra’s information and communication systems to ensure that Kaleyra’s employees are well-coordinated and can effectively communicate with each other and Kaleyra’s customers; and |

| • | improving Kaleyra’s internal control over financial reporting and disclosure controls and procedures to ensure timely and accurate reporting of Kaleyra’s operational and financial results. |

If Kaleyra fails to manage its expansion or implement Kaleyra’s new systems, or if Kaleyra fails to implement improvements or maintain effective internal controls and procedures, Kaleyra’s costs and expenses may increase more than expected and Kaleyra may not expand its client base, increase existing customer volumes and renewal rates, enhance its existing applications, develop new applications, satisfy its customers, respond to competitive pressures, or otherwise execute its business plan. If Kaleyra is unable to manage its growth, Kaleyra’s operating results likely will be harmed.

Future acquisitions could disrupt Kaleyra’s business and may divert management’s attention, and if unsuccessful, harm Kaleyra’s business.

Kaleyra may choose to expand by making additional acquisitions that could be material to its business. Acquisitions involve many risks, including the following:

| • | an acquisition may negatively affect Kaleyra’s results of operations and financial condition because it may require Kaleyra to incur charges or assume substantial debt or other liabilities, may cause adverse |

9

Table of Contents

| tax consequences or unfavorable accounting treatment, may expose Kaleyra to claims and disputes by third parties, including intellectual property claims and disputes, or may not generate sufficient financial return to offset additional costs and expenses related to the Business Combination; |

| • | Kaleyra may encounter difficulties or unforeseen expenditures in integrating the business, technologies, products, personnel, or operations of any company that it acquires, particularly if key personnel of the acquired company decide not to work for Kaleyra; |

| • | an acquisition may disrupt its ongoing business, divert resources, increase Kaleyra’s expenses, or distract its management; |

| • | an acquisition may result in a delay or reduction of client purchases for both Kaleyra and the company it acquired due to client uncertainty about continuity and effectiveness of service from either company; |

| • | Kaleyra may encounter difficulties in, or may be unable to, successfully sell any acquired technology offerings or services; |

| • | an acquisition may involve the entry into geographic or business markets in which Kaleyra has little or no prior experience or where competitors have stronger market positions; |

| • | the challenges inherent in effectively managing an increased number of employees in diverse locations; |

| • | the potential strain on its financial and managerial controls and reporting systems and procedures; |

| • | the potential known and unknown liabilities associated with an acquired company; |

| • | Kaleyra’s use of cash to pay for acquisitions would limit other potential uses for its cash; |

| • | if Kaleyra incurs additional debt to fund such acquisitions, such debt may subject Kaleyra to additional material restrictions on its ability to conduct its business as well as additional financial maintenance covenants; |

| • | the risk of impairment charges related to potential write-downs of acquired assets or goodwill in future acquisitions; |

| • | to the extent that Kaleyra issues a significant amount of equity or equity-linked securities in connection with future acquisitions, existing stockholders may be diluted and earnings per share may decrease; and |

| • | managing the varying intellectual property protection strategies and other activities of an acquired company. |

Kaleyra may not succeed in addressing these or other risks or any other problems encountered in connection with the integration of any acquired business. The inability to integrate successfully the business, technologies, products, personnel, or operations of any acquired business, or any significant delay in achieving integration, could harm its business and results of operations.

Kaleyra may experience quarterly fluctuations in its operating results due to a number of factors, which makes its future results difficult to predict and could cause its operating results to fall below expectations.

Kaleyra’s quarterly operating results have fluctuated in the past and Kaleyra expects them to fluctuate in the future due to a variety of factors, many of which are outside of Kaleyra’s control. As a result, Kaleyra’s past results may not be indicative of its future performance and comparing Kaleyra’s operating results on a period-to-period basis may not be meaningful. In addition to the other risks described in this prospectus, factors that may affect Kaleyra’s quarterly operating results include:

| • | changes in spending on collaboration and technology offerings and services by Kaleyra’s current or prospective customers; |

| • | pricing Kaleyra’s technology offerings and services effectively so that Kaleyra is able to attract and retain customers without compromising its operating results; |

10

Table of Contents

| • | attracting new customers and increasing Kaleyra’s existing customers’ use of Kaleyra’s technology offerings and services; |

| • | the mix between wholesale and retail maintenance new contracts and renewals; |

| • | client renewal rates and the amounts for which agreements are renewed; |

| • | seasonality and its effect on client demand; |

| • | awareness of Kaleyra’s brand; |

| • | changes in the competitive dynamics of Kaleyra’s market, including consolidation among competitors or customers and the introduction of new technologies and technology enhancements; |

| • | changes to the commission plans, quotas, and other compensation-related metrics for Kaleyra’s sales representatives; |

| • | the amount and timing of payment for operating expenses, particularly sales and marketing expense; |

| • | Kaleyra’s ability to manage its existing business and future growth, domestically and internationally; |

| • | unforeseen costs and expenses related to the expansion of Kaleyra’s business, operations, and infrastructure, including disruptions in Kaleyra’s hosting network infrastructure and privacy and data security; and |

| • | general economic and political conditions in Kaleyra’s domestic and international markets. |

Kaleyra may not be able to accurately forecast the amount and mix of future technology offerings and services, size or duration of contracts, revenue, and expenses and, as a result, Kaleyra’s operating results may fall below its estimates. Risks related to confidentiality and security provisions or privacy laws will increase as Kaleyra continues to grow its cloud-based offerings and services and store and process increasingly large amounts of Kaleyra’s customers’ confidential information and data and host or manage parts of Kaleyra’s customers’ businesses, especially in industries involving particularly sensitive data such as the financial services industry and the healthcare industry. The loss or unauthorized disclosure of sensitive or confidential client or employee data, including personal data, whether through breach of computer systems, systems failure, employee negligence, fraud or misappropriation, or otherwise, could damage Kaleyra’s reputation and cause it to lose customers. Similarly, unauthorized access to or through Kaleyra’s information systems and networks or those Kaleyra develops or manages for its customers, whether by Kaleyra’s employees or third parties, could result in negative publicity, legal liability, and damage to Kaleyra’s reputation, which could in turn harm Kaleyra’s business and results of operations.

If Kaleyra causes disruptions in its customers’ businesses or provides inadequate service, Kaleyra’s customers may have claims for substantial damages against Kaleyra, which could cause Kaleyra to lose customers, have a negative effect on Kaleyra’s reputation, and adversely affect its results of operations.

If Kaleyra makes errors in the course of delivering services for its customers or business partners, or fails to consistently meet its service level obligations or other service requirements of Kaleyra’s customers, these errors or failures could disrupt Kaleyra’s client’s business, which could result in a reduction in its revenue or a claim for substantial damages against Kaleyra. In addition, a failure or inability by Kaleyra to meet a contractual requirement could subject Kaleyra to penalties, cause Kaleyra to lose customers or damage Kaleyra’s brand or corporate reputation, and limit Kaleyra’s ability to attract new business.

The services Kaleyra provides are often critical to Kaleyra’s customers’ businesses. Certain of Kaleyra’s client contracts require Kaleyra to comply with security obligations including maintaining network security and backup data, ensuring Kaleyra’s network is virus-free, maintaining business continuity planning procedures, and verifying the integrity of employees that work with Kaleyra’s customers by conducting background checks. Any failure in a client’s system, failure of Kaleyra’s data center, cloud or other offerings, or breach of security

11

Table of Contents

relating to the services Kaleyra provides to the client could damage Kaleyra’s reputation or result in a claim for substantial damages against Kaleyra. Any significant failure of Kaleyra’s equipment or systems, or any major disruption to basic infrastructure in the locations in which Kaleyra operates, such as power and telecommunications, could impede Kaleyra’s ability to provide services to Kaleyra’s customers, have a negative impact on Kaleyra’s reputation, cause Kaleyra to lose customers, and adversely affect its results of operations.

Under Kaleyra’s client contracts, Kaleyra’s liability for breach of its obligations is in some cases limited pursuant to the terms of the contract. Such limitations may be unenforceable or otherwise may not protect it from liability for damages. In addition, certain liabilities, such as claims of third parties for which Kaleyra may be required to indemnify its customers, are generally not limited under Kaleyra’s contracts. The successful assertion of one or more large claims against Kaleyra in amounts greater than those covered by Kaleyra’s current insurance policies could harm Kaleyra’s financial condition. Even if such assertions against it are unsuccessful, Kaleyra may incur reputational harm and substantial legal fees.

The length and unpredictability of the sales cycle for Kaleyra’s technology offerings and services could delay new sales and cause Kaleyra’s revenue and cash flows for any given quarter to fail to meet Kaleyra’s projections or market expectations.

The sales cycle between Kaleyra’s initial contact with a potential client and the signing of a contract to provide technology offerings and services varies. As a result of the variability and length of the sales cycle, Kaleyra has a limited ability to forecast the timing of sales. A delay in or failure to complete transactions could harm Kaleyra’s business and financial results, and could cause Kaleyra’s financial results to vary significantly from quarter to quarter. Kaleyra’s sales cycle varies widely, reflecting differences in Kaleyra’s potential customers’ decision-making processes, procurement requirements, and budget cycles, and is subject to significant risks over which Kaleyra has little or no control, including:

| • | Kaleyra’s customers’ budgetary constraints and priorities; |

| • | the timing of Kaleyra’s customers’ budget cycles; and |

| • | the length and timing of customers’ approval processes. |

Kaleyra’s technology offerings and services could infringe upon the intellectual property rights of others or Kaleyra might lose its ability to utilize the intellectual property of others.

Kaleyra cannot be sure that its brand, technology offerings, and services, including, for example, the software solutions of others that Kaleyra offers to its customers, do not infringe on the intellectual property rights of third parties, and these third parties could claim that Kaleyra or its customers are infringing upon their intellectual property rights. These claims could harm Kaleyra’s reputation, cause Kaleyra to incur substantial costs or prevent Kaleyra from offering some services or solutions in the future or require Kaleyra to rebrand. Any related proceedings could require Kaleyra to expend significant resources over an extended period of time. In most of Kaleyra’s contracts, Kaleyra agrees to indemnify its customers for expenses and liabilities resulting from claimed infringements of the intellectual property rights of third parties. Any claims or litigation in this area, regardless of merit, could be time-consuming and costly, damage Kaleyra’s reputation, and/or require Kaleyra to incur additional costs to obtain the right to continue to offer a service or solution to its customers. If Kaleyra cannot secure this right at all or on reasonable terms, or, alternatively, substitute a non-infringing technology, Kaleyra’s business, results of operations, or financial condition could be harmed. Similarly, if Kaleyra is unsuccessful in defending a trademark claim, Kaleyra could be forced to re-brand, which could harm its business, results of operations, or financial condition. Additionally, in recent years, individuals and firms have purchased intellectual property assets where their sole or primary purpose is to assert claims of infringement against technology providers and customers that use such technology. Any such action naming Kaleyra or its customers could be costly to defend or lead to an expensive settlement or judgment against Kaleyra Moreover, such an action could result in an injunction being ordered against Kaleyra’s client or Kaleyra’s own services or operations, causing further damages.

12

Table of Contents

If Kaleyra is unable to protect its intellectual property rights from unauthorized use or infringement by third parties, its business could be adversely affected.

Kaleyra’s success depends, in part, upon its ability to protect its proprietary methodologies and other intellectual property. Existing laws offer only limited protection of Kaleyra’s intellectual property rights, and the protection in some countries in which Kaleyra operates or may operate in the future may be very limited. Kaleyra relies upon a combination of confidentiality policies, nondisclosure and other contractual arrangements, and trade secret, copyright, and trademark laws to protect its intellectual property rights. These laws are subject to change at any time and could further limit its ability to protect its intellectual property. There is uncertainty concerning the scope of available intellectual property protection for software and business methods, which are fields in which Kaleyra relies on intellectual property laws to protect its rights. The validity and enforceability of any intellectual property right Kaleyra obtains may be challenged by others and, to the extent it has enforceable intellectual property rights, those intellectual property rights may not prevent competitors from reverse engineering its proprietary information or independently developing technology offerings and services similar to or duplicative of Kaleyra. Further, the steps Kaleyra takes in this regard might not be adequate to prevent or deter infringement or other misappropriation of its intellectual property by competitors, former employees or other third parties, and Kaleyra might not be able to detect unauthorized use of, or take appropriate and timely steps to enforce, its intellectual property rights. Enforcing Kaleyra’s rights might also require considerable time, money, and oversight, and Kaleyra may not be successful in enforcing its rights.

Kaleyra’s use of open source software could negatively affect its ability to sell Kaleyra’s products and subject Kaleyra to possible litigation.

Kaleyra’s products and Platform incorporate open source software, and Kaleyra expects to continue to incorporate open source software in its products and Platform in the future. Few of the licenses applicable to open source software have been interpreted by courts, and there is a risk that these licenses could be construed in a manner that could impose unanticipated conditions or restrictions on Kaleyra’s ability to commercialize its products and Platform. Moreover, although Kaleyra has implemented policies to regulate the use and incorporation of open source software into Kaleyra’s products and Platform, Kaleyra cannot be certain that it has not incorporated open source software in Kaleyra products or Platform in a manner that is inconsistent with such policies. If Kaleyra fail to comply with open source licenses, Kaleyra may be subject to certain requirements, including requirements that it offer Kaleyra’s products that incorporate the open source software for no cost, that Kaleyra make available source code for modifications or derivative works Kaleyra creates based upon, incorporating or using the open source software and that it license such modifications or derivative works under the terms of applicable open source licenses. If an author or other third party that distributes such open source software were to allege that Kaleyra has not complied with the conditions of one or more of these licenses, Kaleyra could be required to incur significant legal expenses defending against such allegations and could be subject to significant damages, enjoined from generating revenue from customers using products that contained the open source software and required to comply with onerous conditions or restrictions on these products. In any of these events, Kaleyra and its customers could be required to seek licenses from third parties in order to continue offering Kaleyra’s products and Platform and to re-engineer Kaleyra’s products or Platform or discontinue offering its products to customers in the event re-engineering cannot be accomplished on a timely basis. Any of the foregoing could require Kaleyra to devote additional research and development resources to re-engineer Kaleyra’s products or Platform, which could result in customer dissatisfaction and could harm Kaleyra’s business.

If Kaleyra is unable to collect its receivables from, or bill its unbilled services to its customers, its business and results of operations could be adversely affected.

Kaleyra’s business depends on its ability to successfully obtain payment from its customers of the amounts they owe Kaleyra for technology offerings sold or services performed. Kaleyra typically evaluates the financial condition of its customers and usually bills and collects on relatively short cycles. Kaleyra maintains allowances

13

Table of Contents

against receivables and unbilled services. Actual losses on client balances could differ from those that Kaleyra currently anticipate and, as a result, Kaleyra might need to adjust its allowances. There is no guarantee that Kaleyra will accurately assess the creditworthiness of its customers. Macroeconomic conditions could also result in financial difficulties for Kaleyra’s customers, including limited access to the credit markets, insolvency, or bankruptcy, and, as a result, could cause customers to delay payments to Kaleyra, request modifications to their payment arrangements that could increase Kaleyra’s receivables balance, or default on their payment obligations to Kaleyra. Timely collection of client balances also depends on Kaleyra’s ability to complete its contractual commitments and bill and collect its contracted revenue. If Kaleyra is unable to meet its contractual requirements, it might experience delays in collection of and/or be unable to collect its client balances. In addition, if Kaleyra experiences an increase in the time to bill and to collect for its services, Kaleyra’s cash flows could be negatively impacted.

The market for Kaleyra’s products and platform is new and unproven, may decline or experience limited growth and is dependent in part on developers continuing to adopt its platform and use its products.