Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - i3 Verticals, Inc. | iiiv2q20earningsrelease.htm |

| 8-K - 8-K - i3 Verticals, Inc. | i3verticalsform8k2q2020.htm |

Q2 Fiscal 2020 Supplemental Segment Information

Q2 Fiscal 2020 Segment Performance(1) ($ in thousands) Three months ended March 31, Period over period 2020 2019 growth Adjusted Net Revenue(2) Merchant Services, excluding Purchased Portfolios $ 23,984 $ 22,213 8% Purchased Portfolios 1,034 1,541 (33)% Merchant Services 25,018 23,754 5% Proprietary Software and Payments 14,824 7,694 93% Other (531) — nm Total $ 39,311 $ 31,448 25% Adjusted EBITDA(2) Merchant Services $ 7,255 $ 7,826 (7)% Proprietary Software and Payments 5,919 3,555 66% Other (3,209) (2,634) (22)% Total $ 9,965 $ 8,747 14% Adjusted EBITDA as a percentage of Net Revenue 25.3 % 27.8 % Volume Merchant Services $ 3,393,710 $ 2,794,120 21% Proprietary Software and Payments 184,025 148,688 24% Total $ 3,577,735 $ 2,942,808 22% 1. i3 Verticals has two segments, “Merchant Services,” which includes Purchased Portfolios (a subset of merchant contracts purchased in 2014 and 2017) and "Proprietary Software and Payments." i3 Verticals also has an “Other” category, which includes corporate overhead. 2. Adjusted Net Revenue and Adjusted EBITDA are non-GAAP financial measures. Refer to the following slides for the reconciliation of non-GAAP 2 financial measures.

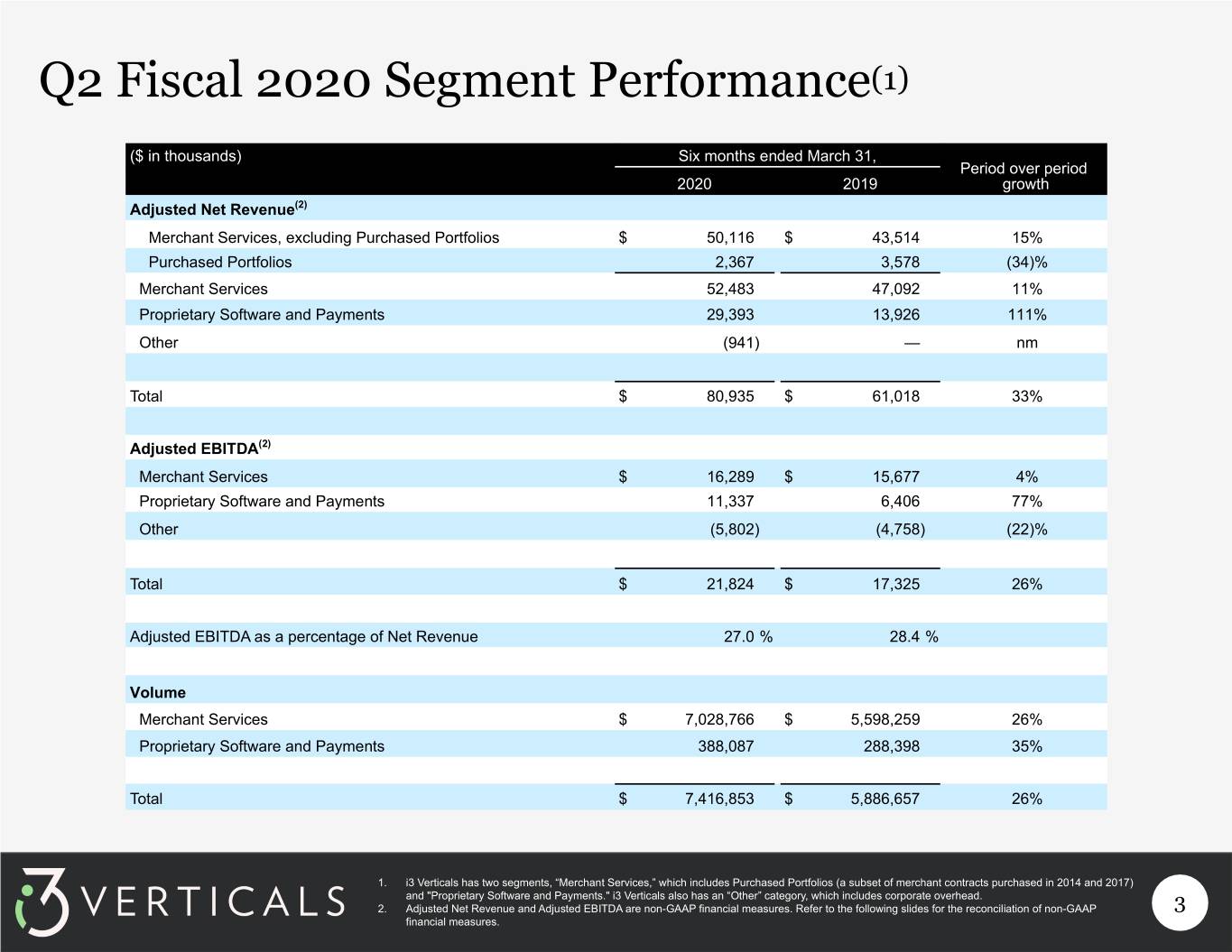

Q2 Fiscal 2020 Segment Performance(1) ($ in thousands) Six months ended March 31, Period over period 2020 2019 growth Adjusted Net Revenue(2) Merchant Services, excluding Purchased Portfolios $ 50,116 $ 43,514 15% Purchased Portfolios 2,367 3,578 (34)% Merchant Services 52,483 47,092 11% Proprietary Software and Payments 29,393 13,926 111% Other (941) — nm Total $ 80,935 $ 61,018 33% Adjusted EBITDA(2) Merchant Services $ 16,289 $ 15,677 4% Proprietary Software and Payments 11,337 6,406 77% Other (5,802) (4,758) (22)% Total $ 21,824 $ 17,325 26% Adjusted EBITDA as a percentage of Net Revenue 27.0 % 28.4 % Volume Merchant Services $ 7,028,766 $ 5,598,259 26% Proprietary Software and Payments 388,087 288,398 35% Total $ 7,416,853 $ 5,886,657 26% 1. i3 Verticals has two segments, “Merchant Services,” which includes Purchased Portfolios (a subset of merchant contracts purchased in 2014 and 2017) and "Proprietary Software and Payments." i3 Verticals also has an “Other” category, which includes corporate overhead. 2. Adjusted Net Revenue and Adjusted EBITDA are non-GAAP financial measures. Refer to the following slides for the reconciliation of non-GAAP 3 financial measures.

Reconciliation of Non-GAAP Financial Measures The reconciliation of our revenue to non-GAAP adjusted net revenue is as follows: ($ in thousands) Three months ended March 31, 2020 Proprietary Software Merchant Services(2) and Payments Other Total Revenue $ 25,018 $ 14,691 $ (531) $ 39,178 Acquisition revenue adjustments(1) — 133 — 133 Adjusted Net Revenue $ 25,018 $ 14,824 $ (531) $ 39,311 ($ in thousands) Three months ended March 31, 2019 Proprietary Software Merchant Services(3) and Payments Other Total Revenue $ 76,875 $ 8,519 $ — $ 85,394 Acquisition revenue adjustments(1) — 739 — 739 Interchange and nework fees (53,121) (1,564) — (54,685) Adjusted Net Revenue $ 23,754 $ 7,694 $ — $ 31,448 1. Under GAAP, companies must adjust, as necessary, beginning balances of acquired deferred revenue to fair value as part of acquisition accounting as defined by GAAP. Acquisition revenue adjustments remove the effect of these adjustments to acquisition date fair value from acquisitions that have closed as of the date of the earnings release. 2. Merchant Services includes purchased portfolios which had revenue of $1,034 and acquisition revenue adjustments of $0 for the three months ended March 31, 2020. 4 3. Merchant Services includes purchased portfolios which had revenue of $3,031, acquisition revenue adjustments of $0 and interchange and network fees of $1,490 for the three months ended March 31, 2019.

Reconciliation of Non-GAAP Financial Measures The reconciliation of our revenue to non-GAAP adjusted net revenue is as follows: ($ in thousands) Six months ended March 31, 2020 Proprietary Software Merchant Services(2) and Payments Other Total Revenue $ 52,483 $ 28,747 $ (941) $ 80,289 Acquisition revenue adjustments(1) — 646 — 646 Adjusted Net Revenue $ 52,483 $ 29,393 $ (941) $ 80,935 ($ in thousands) Six months ended March 31, 2019 Proprietary Software Merchant Services(3) and Payments Other Total Revenue $ 154,577 $ 15,685 $ — $ 170,262 Acquisition revenue adjustments(1) — 1,270 — 1,270 Interchange and nework fees (107,485) (3,029) — (110,514) Adjusted Net Revenue $ 47,092 $ 13,926 $ — $ 61,018 1. Under GAAP, companies must adjust, as necessary, beginning balances of acquired deferred revenue to fair value as part of acquisition accounting as defined by GAAP. Acquisition revenue adjustments remove the effect of these adjustments to acquisition date fair value from acquisitions that have closed as of the date of the earnings release. 2. Merchant Services includes purchased portfolios which had revenue of $2,367 and acquisition revenue adjustments of $0 for the six months ended March 31, 2020. 5 3. Merchant Services includes purchased portfolios which had revenue of $6,877, acquisition revenue adjustments of $0 and interchange and network fees of $3,299 for the six months ended March 31, 2019.

Reconciliation of Non-GAAP Financial Measures The reconciliation of our income (loss) from operations to non-GAAP pro forma adjusted net income and non-GAAP adjusted EBITDA is as follows: ($ in thousands) Three months ended March 31, 2020 Three months ended March 31, 2019 Proprietary Proprietary Merchant Software and Merchant Software and Services Payments Other Total Services Payments Other Total Income (loss) from operations $ 4,791 $ 4,030 $ (6,780) $ 2,041 $ 5,276 $ (922) $ (4,557) $ (203) Interest expense, net — — 2,184 2,184 289 — 866 1,155 (Benefit from) provision for income taxes — — (2,062) (2,062) 188 — (324) (136) Net income (loss) 4,791 4,030 (6,902) 1,919 4,799 (922) (5,099) (1,222) Non-GAAP Adjustments: (Benefit from) provision for income taxes — — (2,062) (2,062) 188 — (324) (136) Offering-related expenses(1) — — 221 221 — — — — Non-cash change in fair value of contingent consideration(2) (400) 258 — (142) (390) 2,892 — 2,502 Equity-based compensation(3) — — 2,510 2,510 — — 1,363 1,363 Acquisition revenue adjustments(4) — 133 — 133 — 739 — 739 Acquisition-related expenses(5) — — 583 583 — — 261 261 Acquisition intangible amortization(6) 2,634 966 — 3,600 2,764 440 1 3,205 Non-cash interest(7) — — 879 879 — — 232 232 Other taxes(8) 3 — 78 81 23 4 160 187 Non-GAAP adjusted income (loss) before taxes 7,028 5,387 (4,693) 7,722 7,384 3,153 (3,406) 7,131 Pro forma taxes at effective tax rate(9) (1,757) (1,347) 1,173 (1,931) (1,846) (788) 851 (1,783) Pro forma adjusted net income (loss)(10) 5,271 4,040 (3,520) 5,791 5,538 2,365 (2,555) 5,348 Plus: Cash interest expense, net(11) — — 1,305 1,305 289 — 634 923 Pro forma taxes at effective tax rate(9) 1,757 1,347 (1,173) 1,931 1,846 788 (851) 1,783 Depreciation, non-acquired intangible asset amortization and internally developed software amortization(12) 227 532 179 938 153 402 138 693 Adjusted EBITDA $ 7,255 $ 5,919 $ (3,209) $ 9,965 $ 7,826 $ 3,555 $ (2,634) $ 8,747 See footnotes continued on the next slide. 6

Reconciliation of Non-GAAP Financial Measures 1. Offering-related expenses includes expenses directly related to certain transactions of an offering. 2. Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition. 3. Equity-based compensation expense consisted of $2,510 and $1,363 related to stock options issued under the Company's 2018 Equity Incentive Plan during the three months ended March 31, 2020 and 2019, respectively. 4. Under GAAP, companies must adjust, as necessary, beginning balances of acquired deferred revenue to fair value as part of acquisition accounting as defined by GAAP. Acquisition revenue adjustments remove the effect of these adjustments to acquisition date fair value from acquisitions that have closed as of the date of the earnings release. 5. Acquisition-related expenses are the professional service and related costs directly related to our acquisitions and are not part of our core performance. 6. Acquisition intangible amortization reflects amortization of intangible assets and software acquired through business combinations, acquired customer portfolios, acquired referral agreements and related asset acquisitions. 7. Non-cash interest expense reflects amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 8. Other taxes consist of franchise taxes, commercial activity taxes and other non-income based taxes. Taxes related to salaries or employment are not included. 9. Pro forma corporate income tax expense is based on Non-GAAP adjusted income before taxes and is calculated using a tax rate of 25.0% for both 2020 and 2019, based on blended federal and state tax rates, considering the Tax Reform Act for 2018. 10.Pro forma adjusted net income assumes that all net income during the period is available to the holders of the Company’s Class A common stock. 11.Cash interest expense, net represents all interest expense recorded on the Company's statement of operations other than non- cash interest expense, which represents amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 12.Depreciation, non-acquired intangible asset amortization and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software. 7

Reconciliation of Non-GAAP Financial Measures The reconciliation of our income (loss) from operations to non-GAAP pro forma adjusted net income and non-GAAP adjusted EBITDA is as follows: ($ in thousands) Six months ended March 31, 2020 Six months ended March 31, 2019 Proprietary Proprietary Merchant Software and Merchant Software and Services Payments Other Total Services Payments Other Total Income (loss) from operations $ 12,080 $ 6,036 $ (11,978) $ 6,138 $ 10,664 $ 767 $ (8,104) $ 3,327 Interest expense, net — — 4,198 4,198 578 — 1,491 2,069 (Benefit from) provision for income taxes — — (1,913) (1,913) 435 — (306) 129 Net income (loss) 12,080 6,036 (14,263) 3,853 9,651 767 (9,289) 1,129 Non-GAAP Adjustments: (Benefit from) provision for income taxes — — (1,913) (1,913) 435 — (306) 129 Offering-related expenses(1) — — 221 221 — — — — Non-cash change in fair value of contingent consideration(2) (1,606) 1,618 — 12 (709) 2,862 — 2,153 Equity-based compensation(3) — — 4,634 4,634 — — 2,314 2,314 Acquisition revenue adjustments(4) — 646 — 646 — 1,270 — 1,270 Acquisition-related expenses(5) — — 845 845 — — 621 621 Acquisition intangible amortization(6) 5,380 1,941 — 7,321 5,387 722 1 6,110 Non-cash interest(7) — — 979 979 — — 465 465 Other taxes(8) 7 — 128 135 23 4 163 190 Non-GAAP adjusted income (loss) before taxes 15,861 10,241 (9,369) 16,733 14,787 5,625 (6,031) 14,381 Pro forma taxes at effective tax rate(9) (3,965) (2,560) 2,342 (4,183) (3,696) (1,406) 1,507 (3,595) Pro forma adjusted net income (loss)(10) 11,896 7,681 (7,027) 12,550 11,091 4,219 (4,524) 10,786 Plus: Cash interest expense, net(11) — — 3,219 3,219 578 — 1,026 1,604 Pro forma taxes at effective tax rate(9) 3,965 2,560 (2,342) 4,183 3,696 1,406 (1,507) 3,595 Depreciation, non-acquired intangible asset amortization and internally developed software amortization(12) 428 1,096 348 1,872 312 781 247 1,340 Adjusted EBITDA $ 16,289 $ 11,337 $ (5,802) $ 21,824 $ 15,677 $ 6,406 $ (4,758) $ 17,325 See footnotes continued on the next slide. 8

Reconciliation of Non-GAAP Financial Measures 1. Offering-related expenses includes expenses directly related to certain transactions of an offering. 2. Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition. 3. Equity-based compensation expense consisted of $4,634 and $2,314 related to stock options issued under the Company's 2018 Equity Incentive Plan during the six months ended March 31, 2020 and 2019, respectively. 4. Under GAAP, companies must adjust, as necessary, beginning balances of acquired deferred revenue to fair value as part of acquisition accounting as defined by GAAP. Acquisition revenue adjustments remove the effect of these adjustments to acquisition date fair value from acquisitions that have closed as of the date of the earnings release. 5. Acquisition-related expenses are the professional service and related costs directly related to our acquisitions and are not part of our core performance. 6. Acquisition intangible amortization reflects amortization of intangible assets and software acquired through business combinations, acquired customer portfolios, acquired referral agreements and related asset acquisitions. 7. Non-cash interest expense reflects amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 8. Other taxes consist of franchise taxes, commercial activity taxes and other non-income based taxes. Taxes related to salaries or employment are not included. 9. Pro forma corporate income tax expense is based on Non-GAAP adjusted income before taxes and is calculated using a tax rate of 25.0% for both 2020 and 2019, based on blended federal and state tax rates. 10.Pro forma adjusted net income assumes that all net income during the period is available to the holders of the Company’s Class A common stock. 11.Cash interest expense, net represents all interest expense recorded on the Company's statement of operations other than non- cash interest expense, which represents amortization of debt discount and debt issuance costs and any write-offs of debt issuance costs. 12.Depreciation, non-acquired intangible asset amortization and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software. 9