Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Physicians Realty Trust | a2020q1supplementaldocum.htm |

| EX-99.1 - EXHIBIT 99.1 - Physicians Realty Trust | a2020q1earningspressreleas.htm |

| 8-K - 8-K - Physicians Realty Trust | a8-k2020q1earningslpan.htm |

Exhibit 99.3 COVID-19 Supplemental Presentation May 2020

This document may contain “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements concern and are based upon, among other things, the possible expansion of the company’s portfolio; the sale of properties; the performance of its operators/tenants and properties; its ability to enter into agreements with new viable tenants for vacant space or for properties that the company takes back from financially troubled tenants, if any; its occupancy rates; its ability to acquire, develop and/or manage properties; the ability to successfully manage the risks associated with international expansion and operations; its ability to make distributions to shareholders; its policies and plans regarding investments, financings and other matters; its tax status as a real estate investment trust; its critical accounting policies; its ability to appropriately balance the use of debt and equity; its ability to access capital markets or other sources of funds; its ability to meet its earnings guidance; and its ability to finance and complete, and the effect of, future acquisitions. When the company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties. The company’s expected results may not be achieved, and actual results may differ materially from expectations. This may be a result of various factors, including, but not limited to: the unknown duration and economic, operational, and financial impacts of the global outbreak of the COVID-19 pandemic and the actions taken by governmental authorities in connection with the pandemic on the Company’s business; material differences between actual results and the assumptions, projections and estimates of occupancy rates, rental rates, operating expenses and required capital expenditures; the status of the economy; the status of capital markets, including the availability and cost of capital; issues facing the healthcare industry, including compliance with, and changes to, regulations and payment policies, responding to government investigations and punitive settlements and operators’/tenants’ difficulty in cost-effectively obtaining and maintaining adequate liability and other insurance; changes in financing terms; competition within the healthcare, seniors housing and life science industries; negative developments in the operating results or financial condition of operators/tenants, including, but not limited to, their ability to pay rent and repay loans; the company’s ability to transition or sell facilities with profitable results; the failure to make new investments as and when anticipated; acts of God affecting the company’s properties; the company’s ability to re-lease space at similar rates as vacancies occur; the failure of closings to occur as and when anticipated, including the receipt of third-party approvals and healthcare licenses without unexpected delays or conditions; the company’s ability to timely reinvest sale proceeds at similar rates to assets sold; operator/tenant or joint venture partner bankruptcies or insolvencies; the cooperation of joint venture partners; government regulations affecting Medicare and Medicaid reimbursement rates and operational requirements; regulatory approval and market acceptance of the products and technologies of life science tenants; liability or contract claims by or against operators/tenants; unanticipated difficulties and/or expenditures relating to future acquisitions and the integration of multi-property acquisitions; environmental laws affecting the company’s properties; changes in rules or practices governing the company’s financial reporting; the movement of U.S. and foreign currency exchange rates; and legal and operational matters, including real estate investment trust qualification and key management personnel recruitment and retention. Finally, the company assumes no obligation to update or revise any forward-looking statements or to update the reasons why actual results could differ from those projected in any forward-looking statements. 1

COVID-19 Overview • Collected 94% of April billings (Rent and CAM) as of April 30th, 2020 Rent Collections • Uncollected charges (6% of billings) primarily comprised of Ambulatory Surgery Centers (8%); specialists that rely on ASCs like Orthopaedics (14%), Ophthalmologists (10%), Gastroenterologists (4%), and other surgeons (6%); and lower acuity tenants like Internal Medicine providers (8%) and Dentists (2%) Deferral • Received inquiries for rent deferrals from tenants representing 21% of April billings (Rent and CAM) Requests • DOC has retained two consultants to help tenants navigate SBA and Medicare relief processes • The DOC portfolio is 96% leased as of April 30th, 2020 Portfolio • Overall portfolio utilization was 93% of the pre-COVID baseline as of May 4th Utilization • 3 occupied assets, representing 0.6% of ABR, are below 20% utilization as of May 4th • 97% of April rents related to these assets were paid by the health system occupants • As of May 6th, DOC’s current cash position is $30mm with $622mm available for borrowing under the Company’s Corporate revolving credit facility Liquidity • The Company remains comfortably in compliance with all debt covenants 2

Rent Deferral Decision Flowchart Rent Deferral Request Submitted Active Discussions Waive May Late Fees Will / does tenant Credit Team provide monthly Yes Evidence of Yes reviews financial Financial Distress? financials statements? Yes Does business qualify for EIDL, No No PPP, or Medicare Acceleration? No Is practice No closed or running at Yes significantly lower utilization? Yes Opportunity to alter existing lease with more term, higher escalators, other benefits in return for deferral or partial rent payment? No Denied Request 3

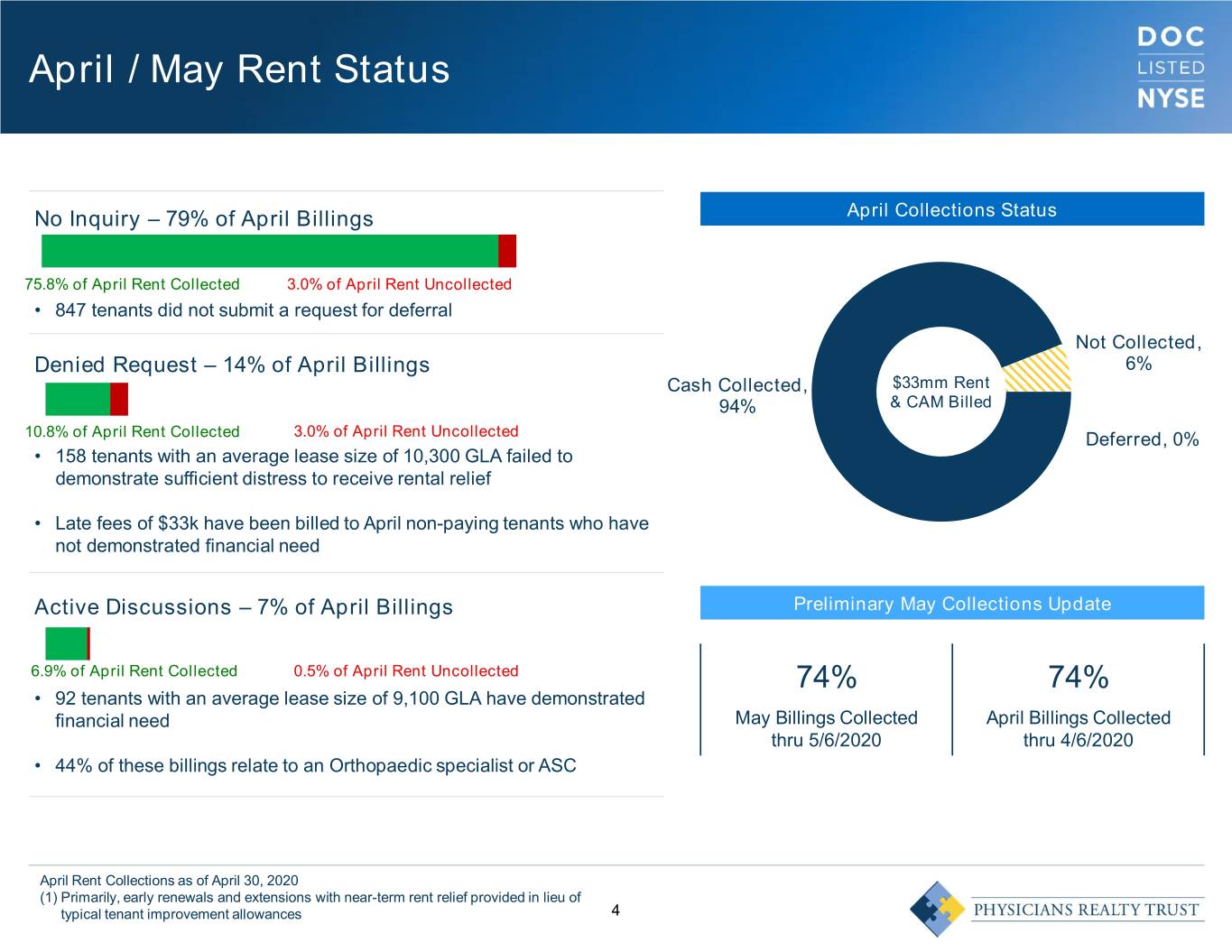

April / May Rent Status No Inquiry – 79% of April Billings April Collections Status 75.8% of April Rent Collected 3.0% of April Rent Uncollected • 847 tenants did not submit a request for deferral Not Collected, Denied Request – 14% of April Billings 6% Cash Collected, $33mm Rent 94% & CAM Billed 10.8% of April Rent Collected 3.0% of April Rent Uncollected Deferred, 0% • 158 tenants with an average lease size of 10,300 GLA failed to demonstrate sufficient distress to receive rental relief • Late fees of $33k have been billed to April non-paying tenants who have not demonstrated financial need Active Discussions – 7% of April Billings Preliminary May Collections Update 6.9% of April Rent Collected 0.5% of April Rent Uncollected 74% 74% • 92 tenants with an average lease size of 9,100 GLA have demonstrated financial need May Billings Collected April Billings Collected thru 5/6/2020 thru 4/6/2020 • 44% of these billings relate to an Orthopaedic specialist or ASC April Rent Collections as of April 30, 2020 (1) Primarily, early renewals and extensions with near-term rent relief provided in lieu of typical tenant improvement allowances 4

April Collection Analytics DOC’s longstanding focus on investment grade health system proved to offer resiliency in April, with 97% of charges related to such tenants being paid in full Collections by Credit Type Portfolio Specialty Distribution Tenant Credit % of April Billings % Collected % Collected Tenant Specialty Type % ABR % IG (April Billings) Investment Grade 60% 97% Oncology / Hematology 11% 69% 100% Non-Investment Grade 40% 89% Internal / Family Medicine 9% 74% 95% Total 100% 94% Surgery Center 9% 58% 94% Orthopaedics 9% 25% 90% Health System Administration 8% 85% 97% Collections by Campus Proximity Imaging Center / Radiology 5% 71% 98% Campus Proximity % of April Billings % Collected Cardiology 4% 81% 91% On-Campus / Adjacent MOB 48% 94% Ophthalmology 4% 8% 78% Off-Campus / Affiliated MOB 37% 95% Specialty Hospital 3% 0% 100% Off-Campus / Unaffiliated MOB 11% 85% Obstetrics / Gynecology 3% 59% 95% Hospital & LTACH 4% 100% All Other 35% 54% 91% Total 100% 94% Total 100% 56% 94% April Rent Collections as of April 30, 2020 5

COVID Impact to Asset Utilization Key Market Utilization Top Five MSAs(1) % GLA % Utilization(2) 1 Atlanta / Sandy Springs / Roswell, GA 7.7% 90% 2 Dallas / Fort Worth / Arlington, TX 7.0% 100% 3 Louisville / Jefferson County, KY / IN 5.4% 98% 4 Phoenix / Mesa / Scottsdale, AZ 5.3% 99% 5 Minneapolis / St. Paul / Bloomington, MN / WI 5.2% 93% Total 30.6% 96% Portfolio Utilization Distribution 78.9% Utilization reflects % of Leased 93% suites closed due to COVID-19 Weighted Average Building Utilization(2) 12.5% 2 2.2% 1.7% 2.0% 1.6% 0.4% 0.1% 0.2% 0.4% Buildings Closed Due to COVID-19 (1) Figures as of March 31, 2020, excluding unconsolidated JV assets (2) Weighted by ABR, as reported by on-site facility personnel as of May 4, 2020 6

State & Healthcare Reactivation 13 of DOC’s 31 states have Stay-At-Home orders expiring 26 of DOC’s 31 states will allow elective surgery or plan to before May 10th, representing 57% of ABR resume before May 10th, representing 89% of ABR Stay-At-Home Orders Resumption of Elective Surgery (% ABR) (% ABR) 50% 47% 60% 55% CO MO CA TN 50% AL MO 40% FL MT IL VA AR MT GA OK MD WA 40% AZ NE 30% AR IN PA ME WI 34% CO NY 25% ND KY TX OH 30% CA OH FL PA CT MN MD 20% NE AL MN 18% GA OK IL TN MI NM AZ MS 20% MS TX IN VA 10% CT NM ND KY WA 10% 10% LA NY 10% LA WI MI ME 1% 0% 0% Note: Stay-At-Home and Elective Surgery Resumption dates as of May 6, 2020 7

Strong Liquidity with Access to Capital DOC maintains an investment-grade balance sheet with near-term liquidity that ‘BBB-’ / ‘Baa3’ $690mm 5.1x far exceeds expected uses, with no Investment Availability Under Consolidated Net Debt to meaningful term debt due until 2023 Grade Ratings Revolving Credit Facility Adjusted EBITDAre(1) Debt Maturity Schedule (As of March 31, 2020) $450 Senior Notes $425 $401 $400 Credit Facility $350 Mortgages $300 $265 $250 Millions $200 $181 $150 $100 $70 $50 $45 $25 $25 $- $7 $- $- $- $- (1) Adjusted EBITDAre is a non-GAAP measure. Refer to slide 13 for a reconciliation of Net Income to Adjusted EBITDAre 8

Industry Leading Tenant Base 96% 7.2 Year Leased Portfolio Wtd. Average Lease Term Remaining DOC’s portfolio provides industry-leading stability, exceeding closest peers in occupancy and remaining lease term 59% 89% Investment Grade Rated Tenancy(1) Tenant Financial Visibility(2) Lease Expiration Schedule (% Consolidated Portfolio Leased GLA as of March 31, 2020) 30% 25.1% 25% 20.3% 20% Less than 5% of the Company’s Portfolio expires in any year prior to 2024 15% 9.9% 9.9% 10% 8.1% 6.2% 4.6% 4.6% 4.4% 5% 4.2% 2.7% 0% (1) Consolidated assets only, % of Leased GLA. Includes parent ratings where appropriate plus tenancy attributable to Northside Hospital (a non-rated entity) (2) Represents ABR from tenants where the entity’s financial performance is known, 9 either through public filings or reporting requirements embedded in leases

Anticipated Sources and Uses DOC’s conservative leverage profile, net lease structure, and industry leading lease term provide liquidity in excess of anticipated cash uses Anticipated Sources and Uses (May 2020 – December 2020) Sources: $228 - $230mm Uses: $166 - $174mm Anticipated Net Sources: $59mm As of May 6th $ 622mm Revolving Credit Facility Availability $ 30mm Cash on Hand $ 202 - 203 $ 26 - 27 $ (12 - 14) $ (28 - 29) $ (18 - 20) $ (13 - 15) $ (95 - 96) + $59mm 1Q Cash NOI Scheduled Development Debt Service CapEx Cash G&A Dividend Net Sources (Annualized) Mezz Loan Commitments (Recurring & Distributions (At Midpoint) Redemptions Non-recurring) Note: Cash NOI presented reflects actual 1Q’20 performance of $25.3mm per month, unchanged for the eight month period presented. Refer to slide 14 for a reconciliation of Net Income to Cash NOI. Dividend distributions represent a continuance of 1Q’20 distributions of $0.23 per share and unit, with 10 no change in shares and units outstanding. Any future dividend distributions are determined by the Board or Trustees in its discretion.

Public Note Covenant Compliance DOC remains comfortably in compliance with all covenant thresholds as of March 31, 2020 Consolidated Leverage Ratio Secured Leverage Ratio 70% 40% 60% 50% 30% 40% 20% 30% 20% 10% 10% 0% 0% DOC Threshold DOC Threshold Consolidated Debt Service Maintenance of Unencumbered Assets 5.00x 5.00x 4.00x 4.00x 3.00x 3.00x 2.00x 2.00x 1.00x 1.00x 0.00x 0.00x DOC Threshold DOC Threshold Note: Covenants as determined by the Company’s March 2017 and December 2017 notes 11

Credit Facility Covenant Compliance DOC remains comfortably in compliance with all covenant thresholds as of March 31, 2020 Consolidated Fixed Charge Coverage Ratio Consolidated Unsecured Leverage Ratio 70% 5.00x 60% 4.00x 50% 40% 3.00x 30% 2.00x 20% 1.00x 10% 0% 0.00x DOC Threshold DOC Threshold Unencumbered Debt Service Coverage Ratio Relevant Definitions 5.00x Unencumbered Asset Pool 4.00x Real Estate Assets meeting numerous requirements, including the performance of tenants subject to material leases 3.00x Unencumbered Pool Property Value 2.00x For any Unencumbered Pool property, the Net Operating Income of the asset multiplied by a determined cap rate (MOB: 6.0%, LTACH: 9.25%) 1.00x 0.00x Revolver Availability Calculated as the larger of: $850mm or the maximum Unsecured Indebtedness permitted by the Consolidated Unsecured Leverage Ratio DOC Threshold Note: Covenants presented above are calculated in accordance with the Company’s Amended and Restated Credit Agreement dated August 7, 2018 and represent a sample 12 of covenants therein

Reconciliation of Non-GAAP Measures Calculation of Consolidated Net Debt March 31, 2020 This presentation includes disclosure of Adjusted EBITDAre, which is a non-GAAP financial measure. We Consolidated Debt $ 1,444,489 define Adjusted EBITDAre as EBITDAre, computed in accordance with standards established by the National Less: Cash and Cash Equivalents (2,612) Association of Real Estate Investment Trusts (“Nareit”), plus non-cash compensation, other non-recurring items, Consolidated Net Debt $ 1,441,877 and the pro forma impact of investment activity. We consider Adjusted EBITDAre an important measure because it provides additional information to allow Calculation of Consolidated Net Debt Quarter Ended management, investors, and our current and potential to Consolidated Adjusted EBITDAre March 31, 2020 creditors to evaluate and compare our core operating results and our ability to service debt. Net Income $ 14,960 For purposes of the Securities and Exchange Depreciation and Amortization Expense 36,747 Commission’s (“SEC”) Regulation G, a non-GAAP financial measure is a numerical measure of a company’s Interest Expense 15,626 historical or future financial performance, financial position Proportionate Share of Unconsolidated JV Adjustments 2,426 or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, EBITDAre $ 69,759 that are included in the most directly comparable financial measure calculated and presented in accordance with Non-Cash Share Compensation Expense 2,996 GAAP in the statements of operations, balance sheets or statements of cash flows (or equivalent statements) of the Net Non-Cash Changes in Fair Value (91) company, or includes amounts, or is subject to adjustments that have the effect of including amounts, that Pro-Forma Adjustments for Investment Activity (35) are excluded from the most directly comparable financial Amounts Attributable to Unconsolidated JV Adjustments (2,426) measure so calculated and presented. Consolidated Adjusted EBITDAre $ 70,203 As used in this presentation, GAAP refers to generally accepted accounting principles in the United States of Annualized $ 280,812 America. Our use of the non-GAAP financial measure terms herein may not be comparable to that of other real estate investment trusts. Pursuant to the requirements of Regulation G, we have provided reconciliations of the Consolidated Net Debt / Consolidated Annualized Adjusted EBITDAre 5.1x non-GAAP financial measures to the most directly comparable GAAP financial measures. 13

Reconciliation of Non-GAAP Measures Quarter Ended This presentation includes disclosure of Cash NOI, which is a non-GAAP Calculation of Cash Net Operating Income (NOI) March 31, 2020 financial measure. We define Cash NOI as net income or loss, computed in accordance with GAAP, generated from our total portfolio of properties Net Income $ 14,960 and other investments before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, General and Administrative Expenses 8,977 interest expense, net change in the fair value of derivative financial instruments, gain or loss on the sale of investment properties, impairment Depreciation and Amortization Expense 36,747 losses, straight-line rent adjustments, amortization of acquired above and below market leases, and other non-cash and normalizing items, Interest Expense 15,626 including our share of all required adjustments from unconsolidated joint ventures. Other non-cash and normalizing items include items such as Net Change in Fair Value of Derivatives (91) the amortization of lease inducements, payments received from seller master leases and rent abatements, and changes in fair value of Straight Line Rent Adjustments (3,731) contingent consideration. We believe that Cash NOI provides an accurate measure of the operating performance of our operating assets because it Amortization of Acquired Above/Below Market Leases and Assumed Debt 905 excludes certain items that are not associated with management of the properties. Our use of the term Cash NOI may not be comparable to that Amortization of Lease Inducements 290 of other real estate companies as such other companies may have different methodologies for computing this amount. Proportionate Share of Unconsolidated Joint Venture Adjustments 2,289 For purposes of the Securities and Exchange Commission’s (“SEC”) Cash NOI $ 75,972 Regulation G, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable financial measure calculated and presented in accordance with GAAP in the statements of operations, balance sheets or statements of cash flows (or equivalent statements) of the company, or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable financial measure so calculated and presented. As used in this presentation, GAAP refers to generally accepted accounting principles in the United States of America. Our use of the non-GAAP financial measure terms herein may not be comparable to that of other real estate investment trusts. Pursuant to the requirements of Regulation G, we have provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures. 14