Attached files

| file | filename |

|---|---|

| EX-99.1 - PERFICIENT, INC. PRESS RELEASE - PERFICIENT INC | prfpressreleaseq12020.htm |

| 8-K - 8-K - PERFICIENT INC | prft-20200507.htm |

Q1 2020 Financial Results May 7, 2020

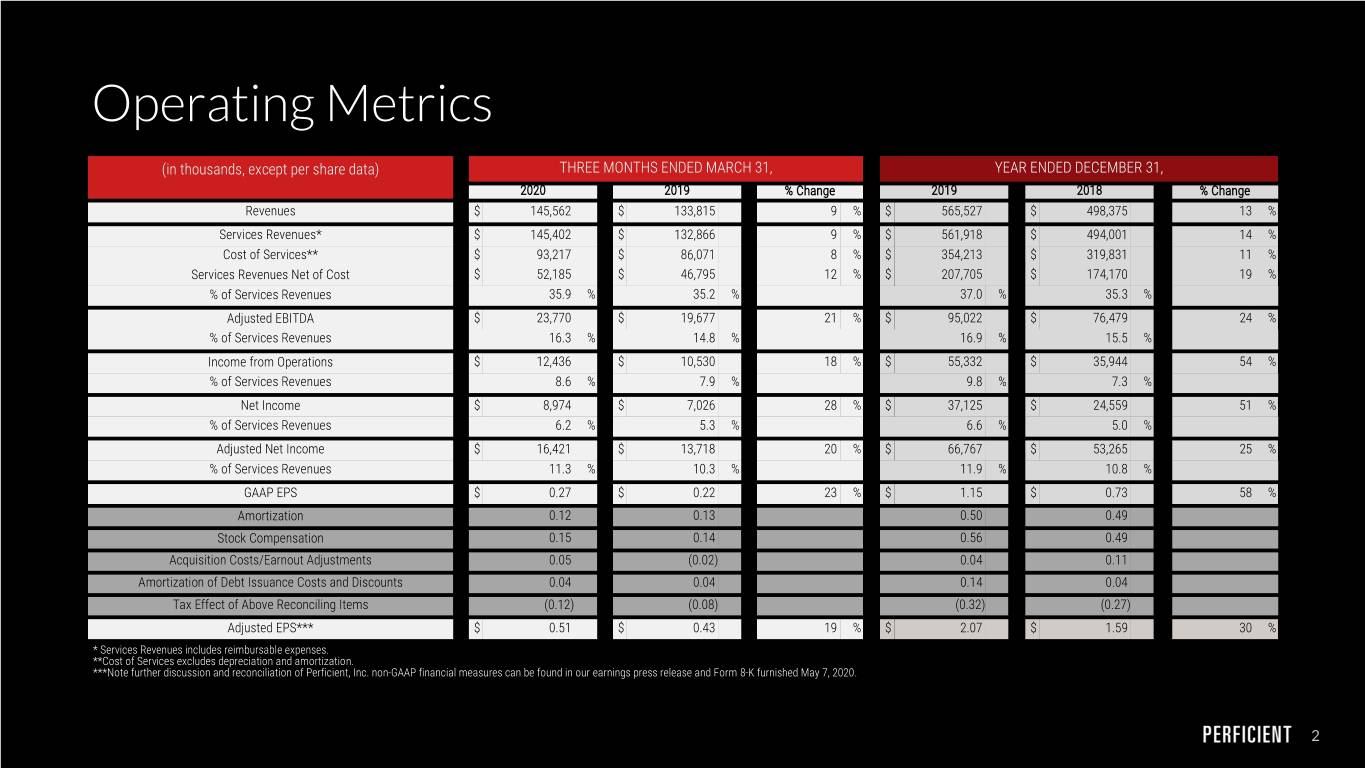

Operating Metrics (in thousands, except per share data) THREE MONTHS ENDED MARCH 31, YEAR ENDED DECEMBER 31, 2020 2019 % Change 2019 2018 % Change Revenues $ 145,562 $ 133,815 9 % $ 565,527 $ 498,375 13 % Services Revenues* $ 145,402 $ 132,866 9 % $ 561,918 $ 494,001 14 % Cost of Services** $ 93,217 $ 86,071 8 % $ 354,213 $ 319,831 11 % Services Revenues Net of Cost $ 52,185 $ 46,795 12 % $ 207,705 $ 174,170 19 % % of Services Revenues 35.9 % 35.2 % 37.0 % 35.3 % Adjusted EBITDA $ 23,770 $ 19,677 21 % $ 95,022 $ 76,479 24 % % of Services Revenues 16.3 % 14.8 % 16.9 % 15.5 % Income from Operations $ 12,436 $ 10,530 18 % $ 55,332 $ 35,944 54 % % of Services Revenues 8.6 % 7.9 % 9.8 % 7.3 % Net Income $ 8,974 $ 7,026 28 % $ 37,125 $ 24,559 51 % % of Services Revenues 6.2 % 5.3 % 6.6 % 5.0 % Adjusted Net Income $ 16,421 $ 13,718 20 % $ 66,767 $ 53,265 25 % % of Services Revenues 11.3 % 10.3 % 11.9 % 10.8 % GAAP EPS $ 0.27 $ 0.22 23 % $ 1.15 $ 0.73 58 % Amortization 0.12 0.13 0.50 0.49 Stock Compensation 0.15 0.14 0.56 0.49 Acquisition Costs/Earnout Adjustments 0.05 (0.02) 0.04 0.11 Amortization of Debt Issuance Costs and Discounts 0.04 0.04 0.14 0.04 Tax Effect of Above Reconciling Items (0.12) (0.08) (0.32) (0.27) Adjusted EPS*** $ 0.51 $ 0.43 19 % $ 2.07 $ 1.59 30 % * Services Revenues includes reimbursable expenses. **Cost of Services excludes depreciation and amortization. ***Note further discussion and reconciliation of Perficient, Inc. non-GAAP financial measures can be found in our earnings press release and Form 8-K furnished May 7, 2020. 2

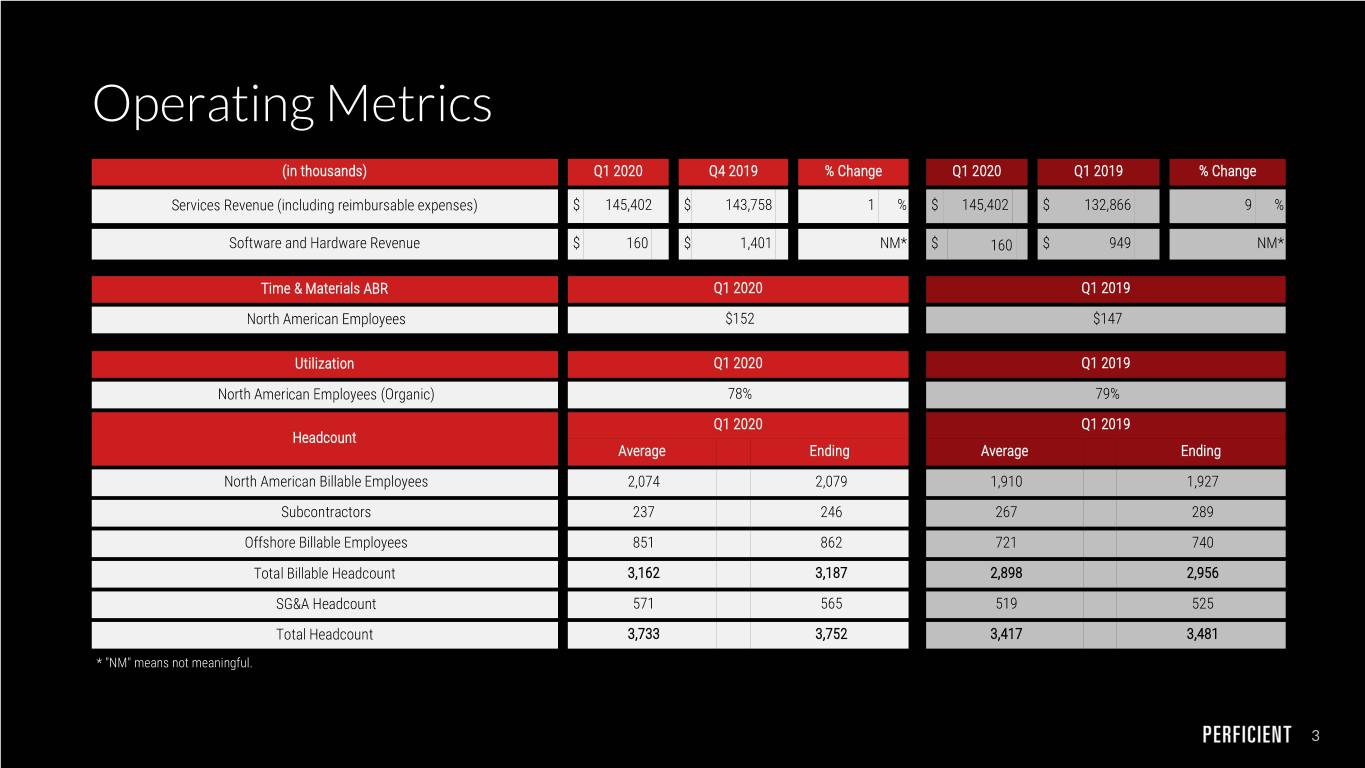

Operating Metrics (in thousands) Q1 2020 Q4 2019 % Change Q1 2020 Q1 2019 % Change Services Revenue (including reimbursable expenses) $ 145,402 $ 143,758 1 % $ 145,402 $ 132,866 9 % Software and Hardware Revenue $ 160 $ 1,401 NM* $ 160 $ 949 NM* Time & Materials ABR Q1 2020 Q1 2019 North American Employees $152 $147 Utilization Q1 2020 Q1 2019 North American Employees (Organic) 78% 79% Q1 2020 Q1 2019 Headcount Average Ending Average Ending North American Billable Employees 2,074 2,079 1,910 1,927 Subcontractors 237 246 267 289 Offshore Billable Employees 851 862 721 740 Total Billable Headcount 3,162 3,187 2,898 2,956 SG&A Headcount 571 565 519 525 Total Headcount 3,733 3,752 3,417 3,481 * "NM" means not meaningful. 3

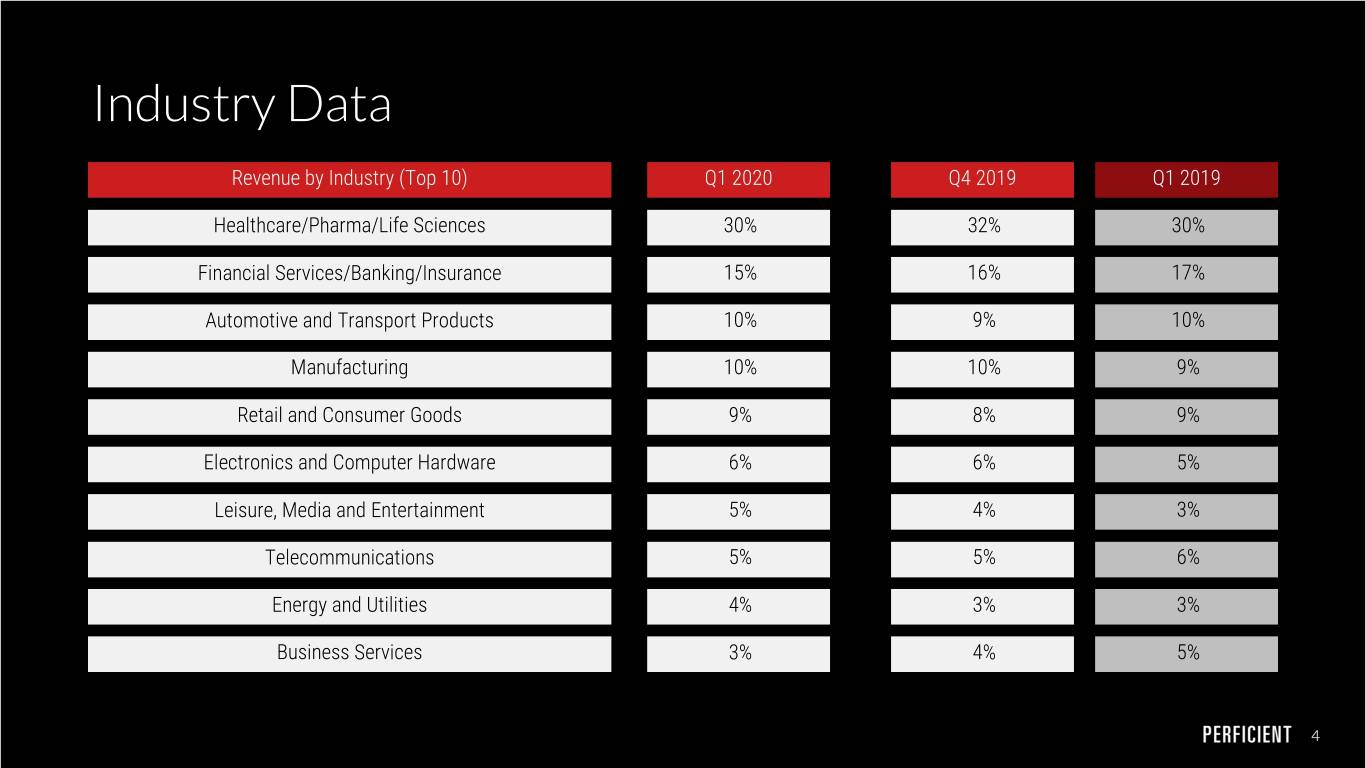

Industry Data Revenue by Industry (Top 10) Q1 2020 Q4 2019 Q1 2019 Healthcare/Pharma/Life Sciences 30% 32% 30% Financial Services/Banking/Insurance 15% 16% 17% Automotive and Transport Products 10% 9% 10% Manufacturing 10% 10% 9% Retail and Consumer Goods 9% 8% 9% Electronics and Computer Hardware 6% 6% 5% Leisure, Media and Entertainment 5% 4% 3% Telecommunications 5% 5% 6% Energy and Utilities 4% 3% 3% Business Services 3% 4% 5% 4