Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 PRESS RELEASE - Novelis Inc. | novelisq4fy20results.htm |

| 8-K - 8-K - Novelis Inc. | nvl-form8xkq4fy20.htm |

Exhibit 99.2 NOVELIS Q4 & FULL YEAR FISCAL 2020 EARNINGS CONFERENCE CALL May 7, 2020 Steve Fisher President and Chief Executive Officer Dev Ahuja Senior Vice President and Chief Financial Officer © 2020 Novelis

SAFE HARBOR STATEMENT Forward-looking statements Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward- looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar expressions. Examples of forward looking statements in this news release are statements about our expectation of strategic benefits, including synergies, of the Aleris acquisition, and the possible future risks of the COVID-19 pandemic on our business. Novelis cautions that, by their nature, forward-looking statements involve risk and uncertainty and Novelis' actual results could differ materially from those expressed or implied in such statements. We do not intend, and we disclaim any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum (or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders; fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access financing including in connection with potential acquisitions and investments; risks relating to, and our ability to consummate, pending and future acquisitions, investments or divestitures; changes in the relative values of various currencies and the effectiveness of our currency hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations and negotiations; breakdown of equipment and other events; economic, regulatory and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite materials; changes in general economic conditions including deterioration in the global economy; the risks of pandemics or other public health emergencies, including the continued spread and impact of, and the governmental and third-party responses to, the recent COVID-19 outbreak; changes in government regulations, particularly those affecting taxes, derivative instruments, environmental, health or safety compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other financing agreements; and our ability to generate cash. The above list of factors is not exhaustive. Other important risk factors are included under the caption "Risk Factors" in our upcoming Annual Report on Form 10-K for the fiscal year ended March 31, 2020. © 2020 Novelis 2

FY20 HIGHLIGHTS Annual Shipments . Fourth consecutive year of record (kilotonnes) Adjusted EBITDA 3,300 3,274 3,273 3,188 . Strong underlying market demand 3,200 for lightweight, sustainable 3,123 aluminum FRP 3,100 3,067 . Continue focus on operational 3,000 FY16 FY17 FY18 FY19 FY20 excellence to deliver quality products and unparalleled Annual Adjusted EBITDA customer service ($ millions) $1,500 1,472 . Strong liquidity and balance sheet 1,368 $1,300 1,215 1,085 . Well positioned to navigate near- $1,100 963 term uncertainty and extend $900 industry leadership into our future $700 FY16 FY17 FY18 FY19 FY20 © 2020 Novelis 3

A STRONG FOUNDATION Defend the Core Strengthen our Product Invest in Growth Portfolio Opportunities . Global leader in FRP and . Optimizing our existing . Committed to organic recycling product portfolio expansions in US, China and Brazil . Balanced approach to . Will further diversify with safely delivering addition of high-value . Integrating Aleris into the operational excellence, aerospace and expanded business to drive targeted customer service, quality, Specialties capabilities synergies and value ROCE . Utilizing high levels of recycled content FY20 Novelis Shipment Mix Specialties Auto 15% 19% Can 66% Coil unwind in Guthrie, Kentucky © 2020 Novelis 4

NOVELIS COVID-19 RESPONSE Protecting our Employees Customer Demand Impact . Top priority to help ensure the safety, Beverage can: health and well-being of our . Resilience in North America and Europe employees, facilities and communities . Trade restrictions in Asia limiting ability to export . Reduced tourism, public events, consumer Operational Impact spending to impact South America and Asia . Temporary shutdowns due to reduced demand, government decrees Automotive: . Adjusting plant schedules in line with . US & Europe: Customer shutdowns late March customer demand with expectation to resume operations in May . China: Shutdowns in Jan/Feb; operations slowly resuming with good spot opportunities $ Strengthening our Financial Position . Global recession concerns . Targeting operating fixed cost, SG&A and R&D reductions . Prioritize committed strategic and Specialties: maintenance capex . Temporary customer shutdowns and softening . ABL draw down to increase cash and demand beginning in late March financial flexibility Aerospace: . Lower demand resulting from significantly reduced production and consumer travel © 2020 Novelis 5

COMPLETED ACQUISITION OF ALERIS . On April 14, 2020, Novelis completed its acquisition of Aleris . Strong strategic rationale for transaction . Leverage Novelis’ deep manufacturing and recycling expertise to optimize Aleris’ assets . Diversify product portfolio with addition of high-value aerospace . Enhances sustainability focus with high recycled content B&C business . Enhances and complements Asia operations . Strong pro-forma financial profile, including $150 million of synergies . Next steps . Priority is the safe integration of our new employees and facilities . Continue to work with relevant parties to divest Lewisport and Duffel plants © 2020 Novelis 6

FINANCIAL HIGHLIGHTS © 2020 Novelis

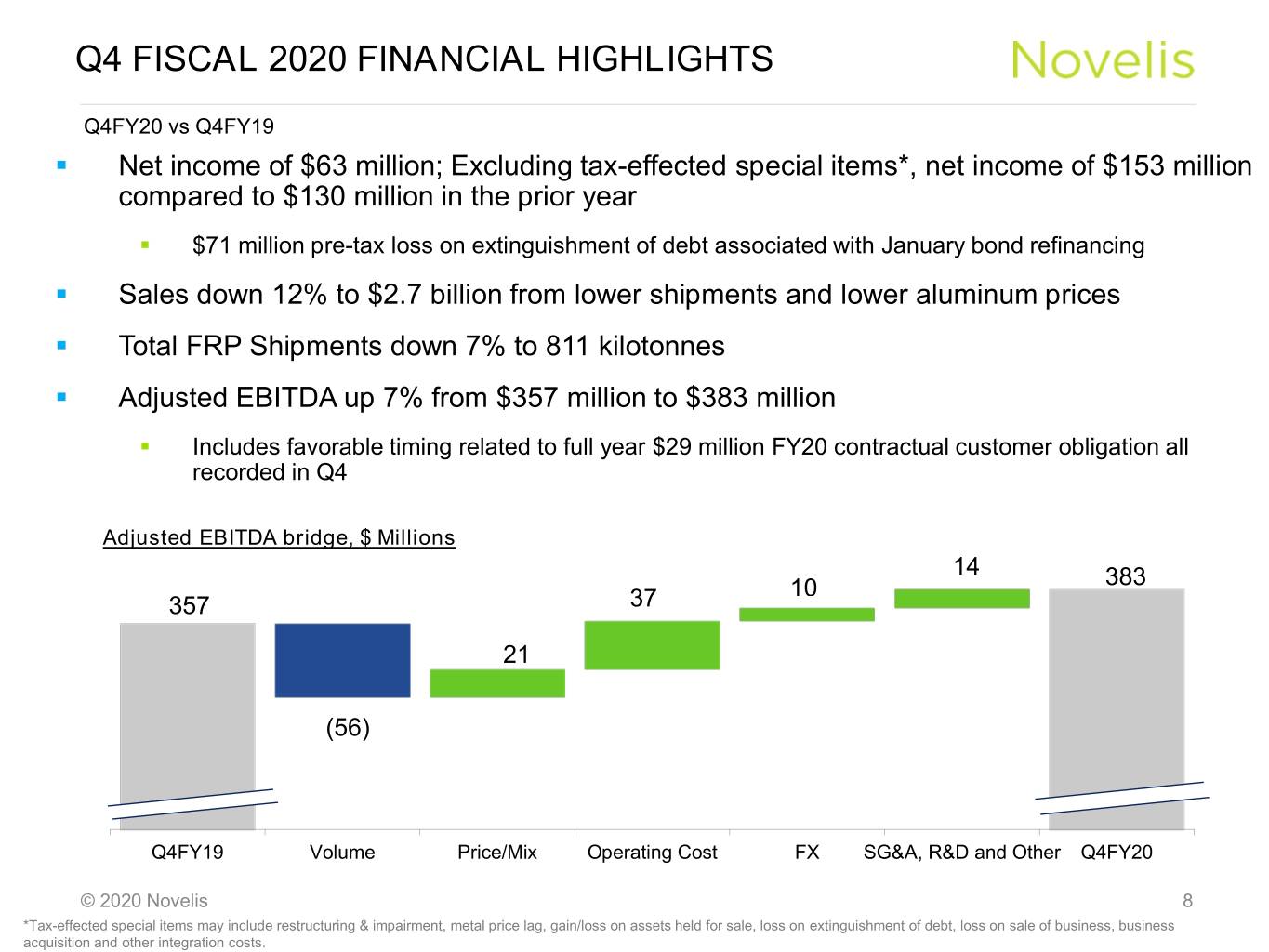

Q4 FISCAL 2020 FINANCIAL HIGHLIGHTS Q4FY20 vs Q4FY19 . Net income of $63 million; Excluding tax-effected special items*, net income of $153 million compared to $130 million in the prior year . $71 million pre-tax loss on extinguishment of debt associated with January bond refinancing . Sales down 12% to $2.7 billion from lower shipments and lower aluminum prices . Total FRP Shipments down 7% to 811 kilotonnes . Adjusted EBITDA up 7% from $357 million to $383 million . Includes favorable timing related to full year $29 million FY20 contractual customer obligation all recorded in Q4 Adjusted EBITDA bridge, $ Millions 14 10 383 357 37 21 (56) Q4FY19 Volume Price/Mix Operating Cost FX SG&A, R&D and Other Q4FY20 © 2020 Novelis 8 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs.

FULL YEAR FISCAL 2020 FINANCIAL HIGHLIGHTS FY20 vs FY19 . Net income of $420 million; Excluding tax-effected special items*, net income of $590 million compared to $468 million in the prior year . Sales down 9% to $11.2 billion on lower average LME aluminum price and local market premiums . Total FRP Shipments flat at 3,273 kilotonnes . Adjusted EBITDA up 7% from $1,368 million to $1,472 million . Adjusted EBITDA per ton $450 Adjusted EBITDA bridge, $ Millions 17 1,472 17 10 64 1,368 (4) FY19 Volume Price/Mix Operating Cost FX SG&A, R&D and Other FY20 © 2020 Novelis 9 *Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business, business acquisition and other integration costs.

FREE CASH FLOW AND NET LEVERAGE $ Millions Net Leverage ratio FY20 FY19 Net debt/TTM Adjusted EBITDA Adjusted EBITDA 1,472 1,368 5.0 Interest paid (224) (248) 4.5 4.0 Taxes paid (182) (159) 3.5 Working capital & other (83) (202) 3.0 Free cash flow before CapEx 983 759 2.5 2.1x Capital expenditures (599) (351) 2.0 Free cash flow 384 408 Prior period is adjusted to conform to current presentation . Free cash flow before capital expenditures increased 30% . FY20 capital expenditures increased 71% primarily to support strategic capacity expansions . Net leverage ratio 2.1x compared to 2.5x FY19 © 2020 Novelis 10

LIQUIDITY UPDATE . March 31, 2020 liquidity position of $2.6 billion . In March, drew down $555 million under our ABL revolver . March 31 position includes $400 million raised in January to partially fund the Aleris acquisition . April 14 Aleris acquisition financing Transaction Financing Approximate Sources and Uses $ billions Uses Sources Equity1 0.8 1-year bridge loan at LIBOR +0.95% 1.1 Estimated net debt 2.0 5-year secured term loan at LIBOR +1.75% 0.8 Total Uses ~$2.8 ABL and cash2 0.9 Total Sources ~$2.8 . Current liquidity end of April 2020 ~$2.0 billion 1) Includes $50 million earn-out payment based upon Aleris meeting specified commercial margin targets outlined in the Merger Agreement 2) Cash includes $400 million proceeds from Novelis senior notes issued in January 2020 © 2020 Novelis 11

SUMMARY © 2020 Novelis

SUMMARY . Well positioned after four consecutive years of record results; FY20 Adjusted EBITDA of $1.5 billion and free cash flow before capital expenditures of nearly $1 billion . Business model durability and comfortable net leverage and liquidity position to sustain operations and critical investments during downturn . Integration of Aleris and completion of organic expansion projects to strengthen our business for the long term . Taking appropriate actions today to manage near-term uncertainty associated with COVID while positioning to respond quickly when demand recovers © 2020 Novelis 13

THANK YOU QUESTIONS? © 2020 Novelis

APPENDIX © 2020 Novelis

NET INCOME RECONCILIATION TO ADJUSTED EBITDA Q1 Q2 Q3 Q4 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 FY20 FY20 FY20 FY20 Net income attributable to our common shareholder 137 116 78 103 434 127 123 107 63 420 - Noncontrolling interests - - - - - - - - - - - Income tax provision 53 64 37 48 202 63 45 49 21 178 - Interest, net 63 66 64 65 258 62 58 57 57 234 - Depreciation and amortization 86 86 88 90 350 88 88 91 94 361 EBITDA 339 332 267 306 1,244 340 314 304 235 1,193 - Unrealized (gain) loss on derivatives 4 (1) 6 1 10 (6) (3) (6) 11 (4) - Realized (gain) loss on derivative instruments not included in - (1) - (1) (2) 2 1 (1) (2) - segment income - Adjustment to reconcile proportional consolidation 16 15 14 13 58 15 14 13 15 13 - (Gain) loss on sale of fixed assets 3 (1) 2 2 6 (1) (1) 1 2 1 - Restructuring and impairment, net 1 - 1 - 2 1 32 3 7 43 - Metal price lag (income) expense (33) (1) 13 25 4 2 5 11 20 38 - Business acquisition and other integration costs 2 8 14 9 33 17 12 17 17 63 - Other, net 2 4 5 2 13 2 - 1 7 10 Adjusted EBITDA $334 $355 $322 $357 $1,368 $372 $374 $343 $383 $1,472 © 2020 Novelis 16

FREE CASH FLOW AND LIQUIDITY Q1 Q2 Q3 Q4 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 FY20 FY20 FY20 FY20 Cash provided by (used in) operating activities 48 162 114 404 728 57 240 167 493 962 Cash provided by (used in) investing activities (52) (291) (91) (123) (557) (149) (127) (124) (175) (575) Plus: Cash used in the acquisition of assets under a - 239 - - 239 - - - - - capital lease Less: (proceeds) outflows from sale of assets, net of - (2) - - (2) (2) (1) - - (3) transaction fees, cash income taxes and hedging Free cash flow $(4) $108 $23 $281 $408 $(94) $112 $43 $318 $384 Capital expenditures 54 60 96 141 351 162 138 122 177 599 “Free cash flow” consists of: (a) “net cash provided by (used in) operating activities,” (b) plus "net cash provided by (used in) investing activities” (c) plus cash used in the “Acquisition of assets under a capital lease”, and (d) less “proceeds from sales of assets and business, net of transaction fees, cash income taxes and hedging”. All prior periods presented conform to the presentation adopted for the current period. Q1 Q2 Q3 Q4 (in $ m) Q1 Q2 Q3 Q4 FY19 FY20 FY20 FY20 FY20 FY20 Cash and cash equivalents 853 829 797 950 950 859 935 1,031 2,392 2,392 Availability under committed credit facilities 1,059 907 884 897 897 870 875 838 186 186 Liquidity $1,912 $1,736 $1,681 $1,847 $1,847 $1,729 $1,810 $1,869 $2,578 $2,578 © 2020 Novelis 17