Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Funko, Inc. | ex-9915720.htm |

| 8-K - 8-K - Funko, Inc. | fnko-20200507.htm |

First Quarter 2020 Earnings May 7, 2020

Cautionary Notes This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our future results of operations and financial position, industry dynamics, our mission, growth opportunities, business strategy and plans and our objectives for future operations, including expanding into new product categories, broadening our retailer network and increasing internationalsales, the underlying trends in our business, the anticipated impact of COVID-19 on our business, and our expected liquidity are forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this presentation are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including without limitation our ability to execute our business strategy; risks related to the impact of COVID-19 on our business, financial results and financial condition; our ability to maintain and realize the full value of our license agreements; the ongoing level of popularity of our products with consumers; changes in the retail industry and markets for our consumer products; our ability to maintain our relationships with retail customers and distributors; our ability to compete effectively; fluctuations in our gross margin; our dependence on content development and creation by third parties; our ability to manage our inventories; our ability to develop and introduce products in a timely and cost-effective manner; increases in tariffs, trade restrictions or taxes; risks related to Brexit; counterfeit product risks; risks relating to intellectual property; our ability to attract and retain qualified employees and maintain our corporate culture; our use of third-party manufacturing; risks associated with our international operations; risks related to the recent coronavirus outbreak; changes in effective tax rates; foreign currency exchange rate exposure; economic downturns; our dependence on vendors and outsourcers; risks relating to government regulation; risks relating to litigation; any failure to successfully integrate or realize the anticipated benefits of acquisitions or investments; reputational risk resulting from our e-commerce business and social media presence; risks relating to our indebtedness and our ability to secure additional financing; the potential for our electronic data or the electronic data of our customers to be compromised, risks relating to our organizational structure; risks associated with our internal control over financial reporting; and the important factors discussed under the caption “Risk Factors” in our Form 10-Q for the quarter ended March 31, 2020 and our other filings with the Securities and Exchange Commission. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date hereof, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. You should read this presentation with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this presentation, and except as otherwise required by law, we do not plan to publicly update or revise any forward-looking statements contained in this presentation, whether as a result of any new information, future events or otherwise. Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by us. 2

is built on the principle that everyone is a fan of something… 3

…and Funko has something for every fan Funko is like an “index fund” for pop culture 4 NOTE: Represents a sampling of our current portfolio of properties as of January 2020.

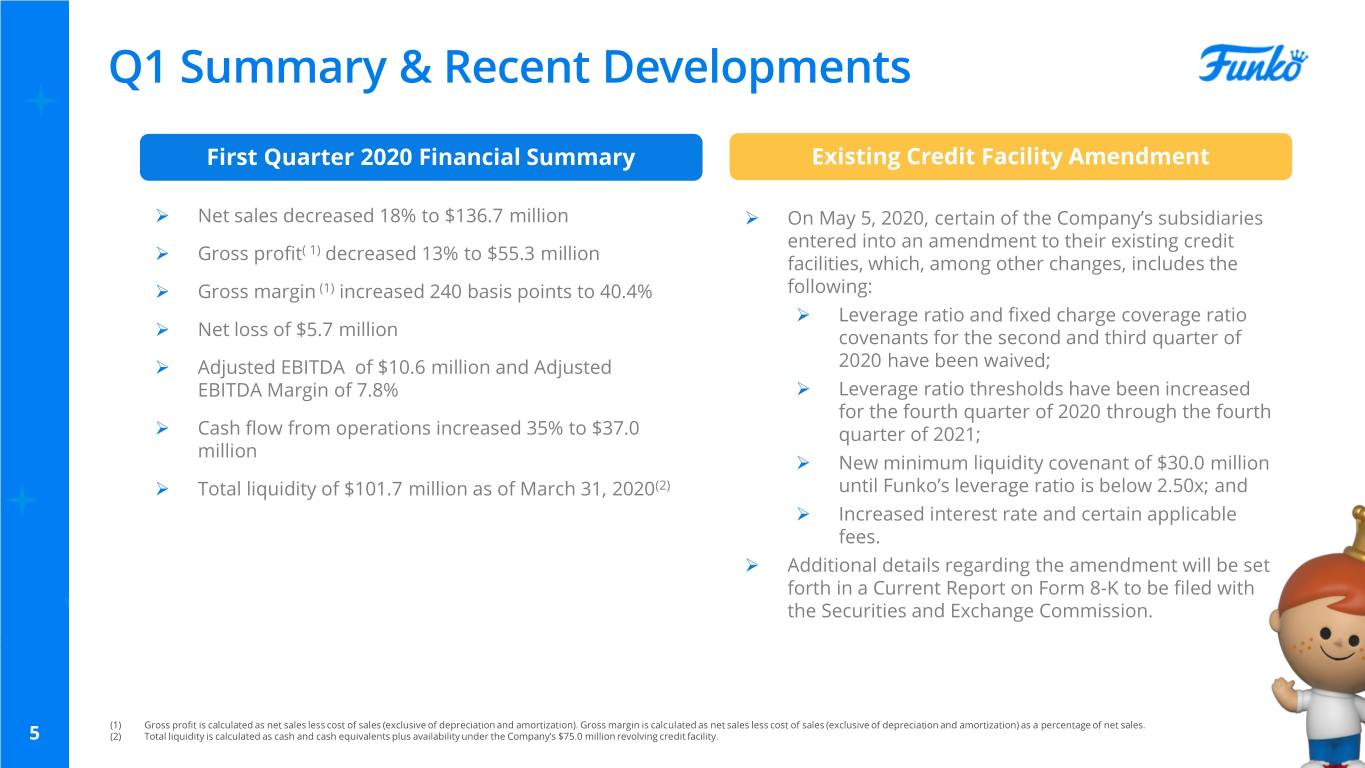

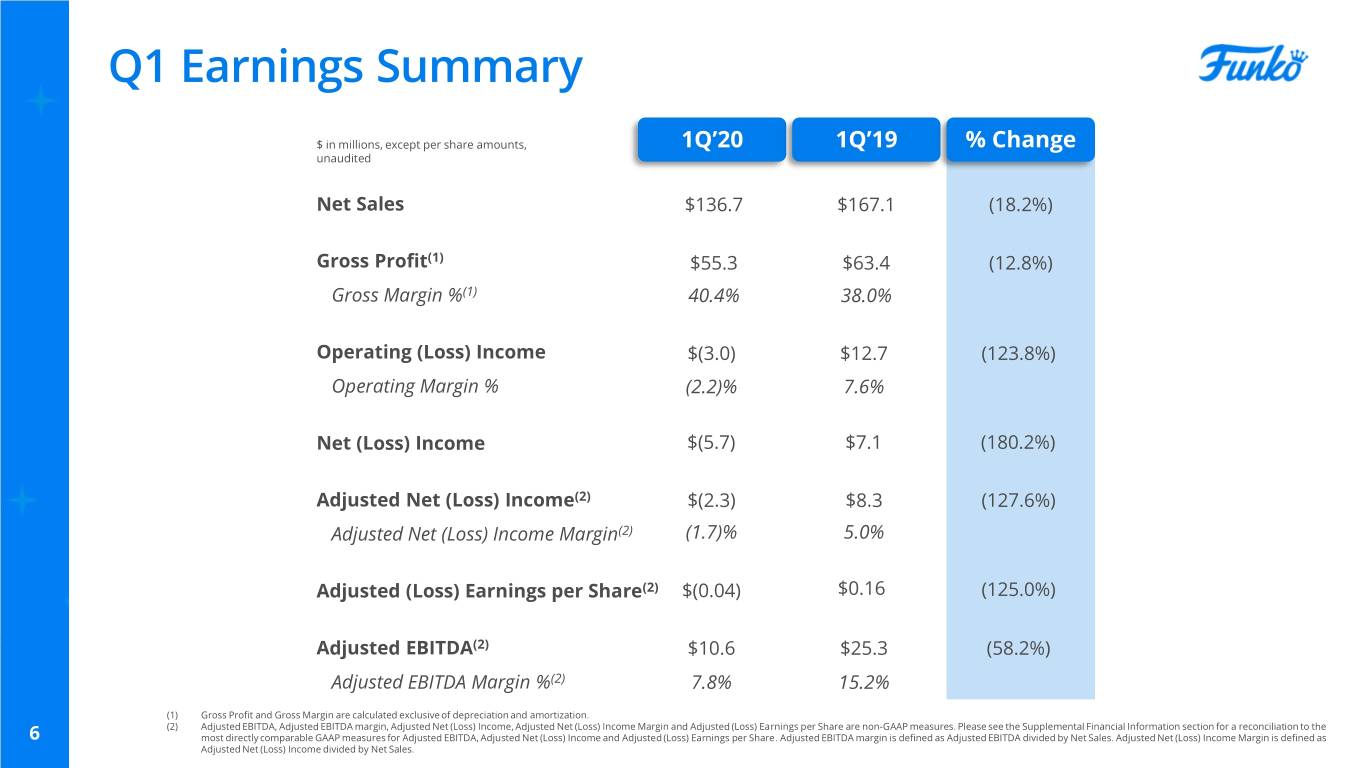

Q1 Summary & Recent Developments First Quarter 2020 Financial Summary Existing Credit Facility Amendment Net sales decreased 18% to $136.7 million On May 5, 2020, certain of the Company’s subsidiaries entered into an amendment to their existing credit Gross profit( 1) decreased 13% to $55.3 million facilities, which, among other changes, includes the Gross margin (1) increased 240 basis points to 40.4% following: Leverage ratio and fixed charge coverage ratio Net loss of $5.7 million covenants for the second and third quarter of Adjusted EBITDA of $10.6 million and Adjusted 2020 have been waived; EBITDA Margin of 7.8% Leverage ratio thresholds have been increased for the fourth quarter of 2020 through the fourth Cash flow from operations increased 35% to $37.0 quarter of 2021; million New minimum liquidity covenant of $30.0 million Total liquidity of $101.7 million as of March 31, 2020(2) until Funko’s leverage ratio is below 2.50x; and Increased interest rate and certain applicable fees. Additional details regarding the amendment will be set forth in a Current Report on Form 8-K to be filed with the Securities and Exchange Commission. (1) Gross profit is calculated as net sales less cost of sales (exclusive of depreciation and amortization). Gross margin is calculated as net sales less cost of sales (exclusive of depreciation and amortization) as a percentage of net sales. 5 (2) Total liquidity is calculated as cash and cash equivalents plus availability under the Company’s $75.0 million revolving credit facility.

Q1 Earnings Summary $ in millions, except per share amounts, 1Q’20 1Q’19 % Change unaudited Net Sales $136.7 $167.1 (18.2%) Gross Profit(1) $55.3 $63.4 (12.8%) Gross Margin %(1) 40.4% 38.0% Operating (Loss) Income $(3.0) $12.7 (123.8%) Operating Margin % (2.2)% 7.6% Net (Loss) Income $(5.7) $7.1 (180.2%) Adjusted Net (Loss) Income(2) $(2.3) $8.3 (127.6%) Adjusted Net (Loss) Income Margin(2) (1.7)% 5.0% Adjusted (Loss) Earnings per Share(2) $(0.04) $0.16 (125.0%) Adjusted EBITDA(2) $10.6 $25.3 (58.2%) Adjusted EBITDA Margin %(2) 7.8% 15.2% (1) Gross Profit and Gross Margin are calculated exclusive of depreciation and amortization. (2) Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net (Loss) Income, Adjusted Net (Loss) Income Margin and Adjusted (Loss) Earnings per Share are non-GAAP measures. Please see the Supplemental Financial Information section for a reconciliation to the 6 most directly comparable GAAP measures for Adjusted EBITDA, Adjusted Net (Loss) Income and Adjusted (Loss) Earnings per Share. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by Net Sales. Adjusted Net (Loss) Income Margin is defined as Adjusted Net (Loss) Income divided by Net Sales.

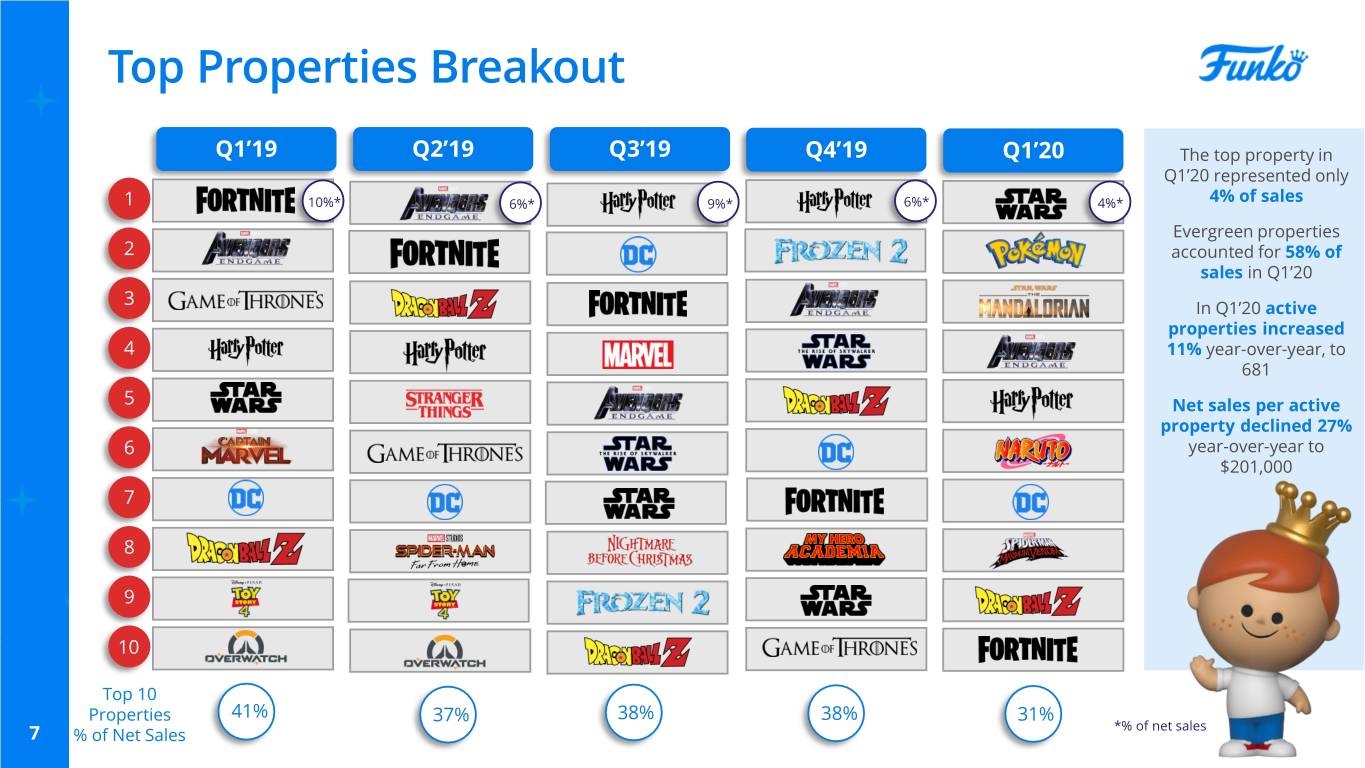

Top Properties Breakout Q1’19 Q2’19 Q3’19 Q4’19 Q1’20 The top property in Q1’20 represented only 1 10%* 6%* 9%* 6%* 4%* 4% of sales Evergreen properties 2 accounted for 58% of sales in Q1’20 3 In Q1’20 active properties increased 4 11% year-over-year, to 681 5 Net sales per active property declined 27% 6 year-over-year to $201,000 7 8 9 10 Top 10 Properties 41% 37% 38% 38% 31% *% of net sales 7 % of Net Sales

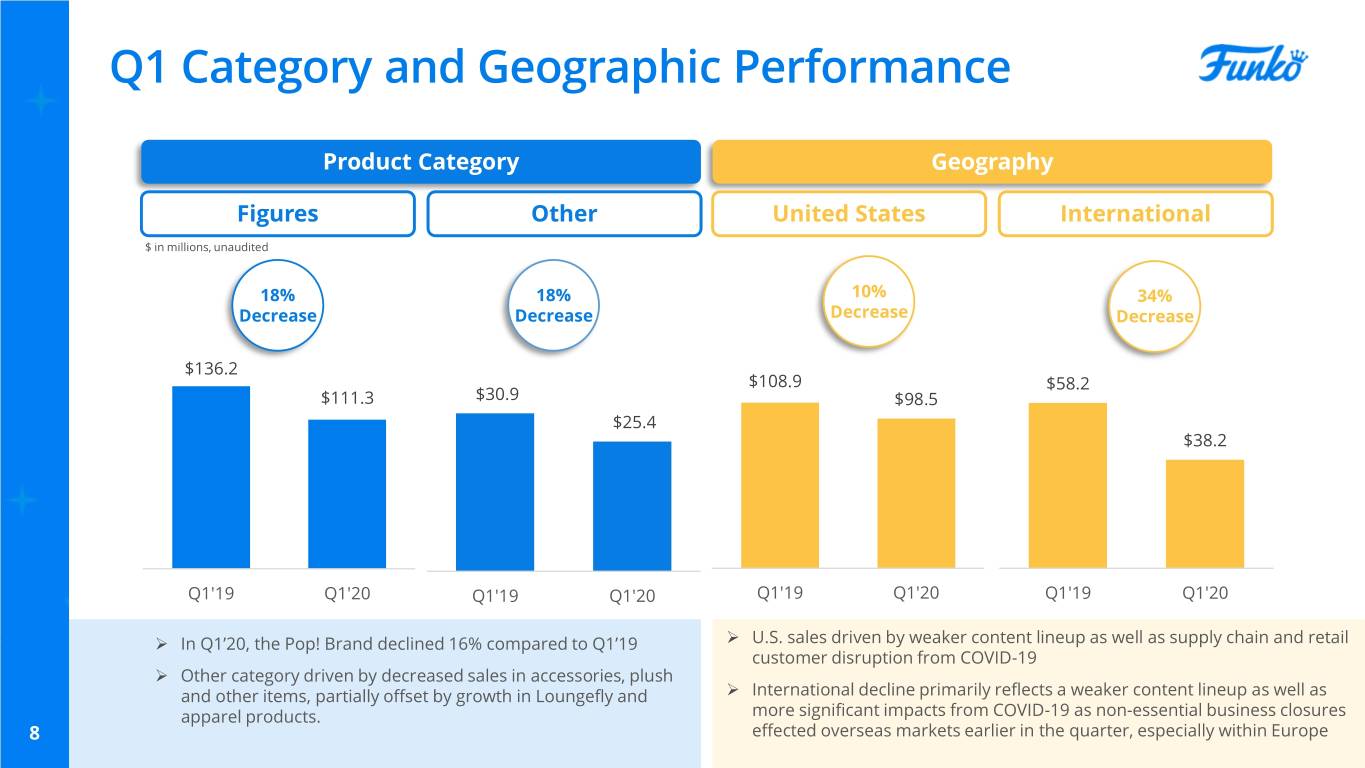

Q1 Category and Geographic Performance Product Category Geography Figures Other United States International $ in millions, unaudited 18% 18% 10% 34% Decrease Decrease Decrease Decrease $136.2 $108.9 $58.2 $111.3 $30.9 $98.5 $25.4 $38.2 Q1'19 Q1'20 Q1'19 Q1'20 Q1'19 Q1'20 Q1'19 Q1'20 In Q1’20, the Pop! Brand declined 16% compared to Q1’19 U.S. sales driven by weaker content lineup as well as supply chain and retail customer disruption from COVID-19 Other category driven by decreased sales in accessories, plush and other items, partially offset by growth in Loungefly and International decline primarily reflects a weaker content lineup as well as apparel products. more significant impacts from COVID-19 as non-essential business closures 8 effected overseas markets earlier in the quarter, especially within Europe

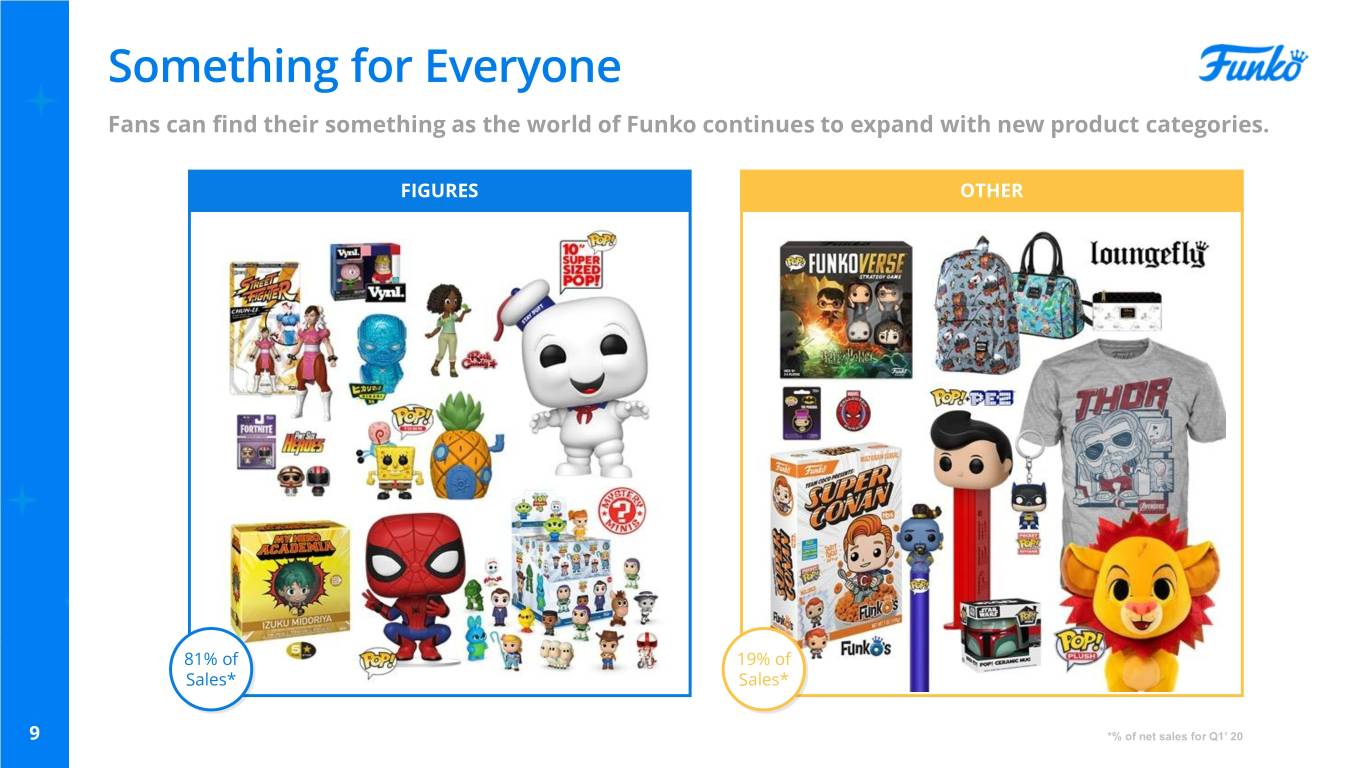

Something for Everyone Fans can find their something as the world of Funko continues to expand with new product categories. FIGURES OTHER 81% of 19% of Sales* Sales* 9 *% of net sales for Q1’ 20

Q1 Non-GAAP Financial Metrics(1) Adjusted Net (Loss) Income Adjusted EBITDA $ in millions, unaudited $ in millions, unaudited $8.3 $25.3 $10.6 ($2.3) Q1'19 Q1'20 Q1'19 Q1'20 Adjusted Adjusted Net (Loss) 5.0% (1.7%) EBITDA 15.2% 7.8% Income Margin Margin % Decline in Adjusted Net (Loss) Income and Adjusted EBITDA is primarily due to the decrease in net sales and increase in SG&A expenses in the quarter 10 (1) See Supplemental Financial Information section for a reconciliation of Adjusted Net (Loss) Income and Adjusted EBITDA, which are non-GAAP measures, to each most directly comparable GAAP measure. Adjusted Net (Loss) Income Margin is defined as Adjusted Net (Loss) Income divided by net sales. Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net sales.

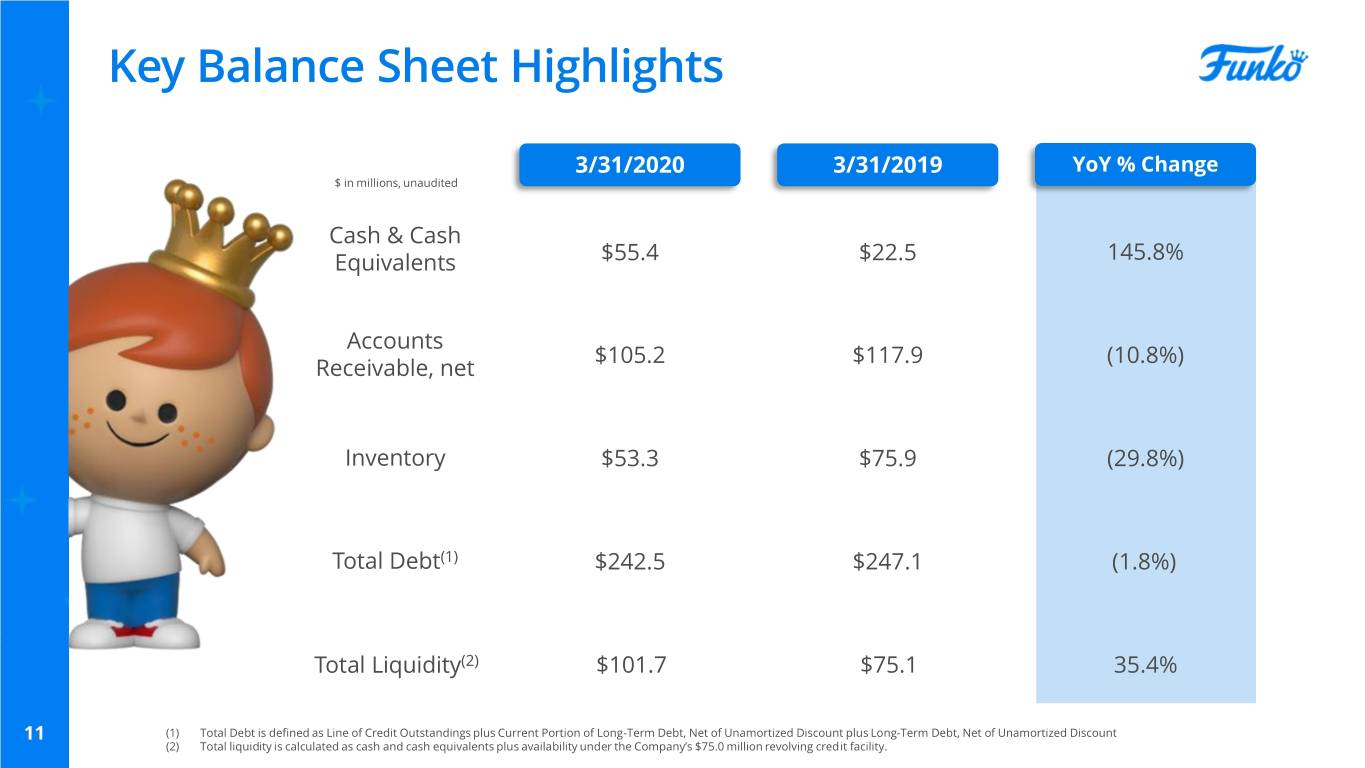

Key Balance Sheet Highlights 3/31/2020 3/31/2019 YoY % Change $ in millions, unaudited Cash & Cash Equivalents $55.4 $22.5 145.8% Accounts $105.2 $117.9 (10.8%) Receivable, net Inventory $53.3 $75.9 (29.8%) Total Debt(1) $242.5 $247.1 (1.8%) Total Liquidity(2) $101.7 $75.1 35.4% 11 (1) Total Debt is defined as Line of Credit Outstandings plus Current Portion of Long-Term Debt, Net of Unamortized Discount plus Long-Term Debt, Net of Unamortized Discount (2) Total liquidity is calculated as cash and cash equivalents plus availability under the Company’s $75.0 million revolving credit facility.

Supplemental Financial Information

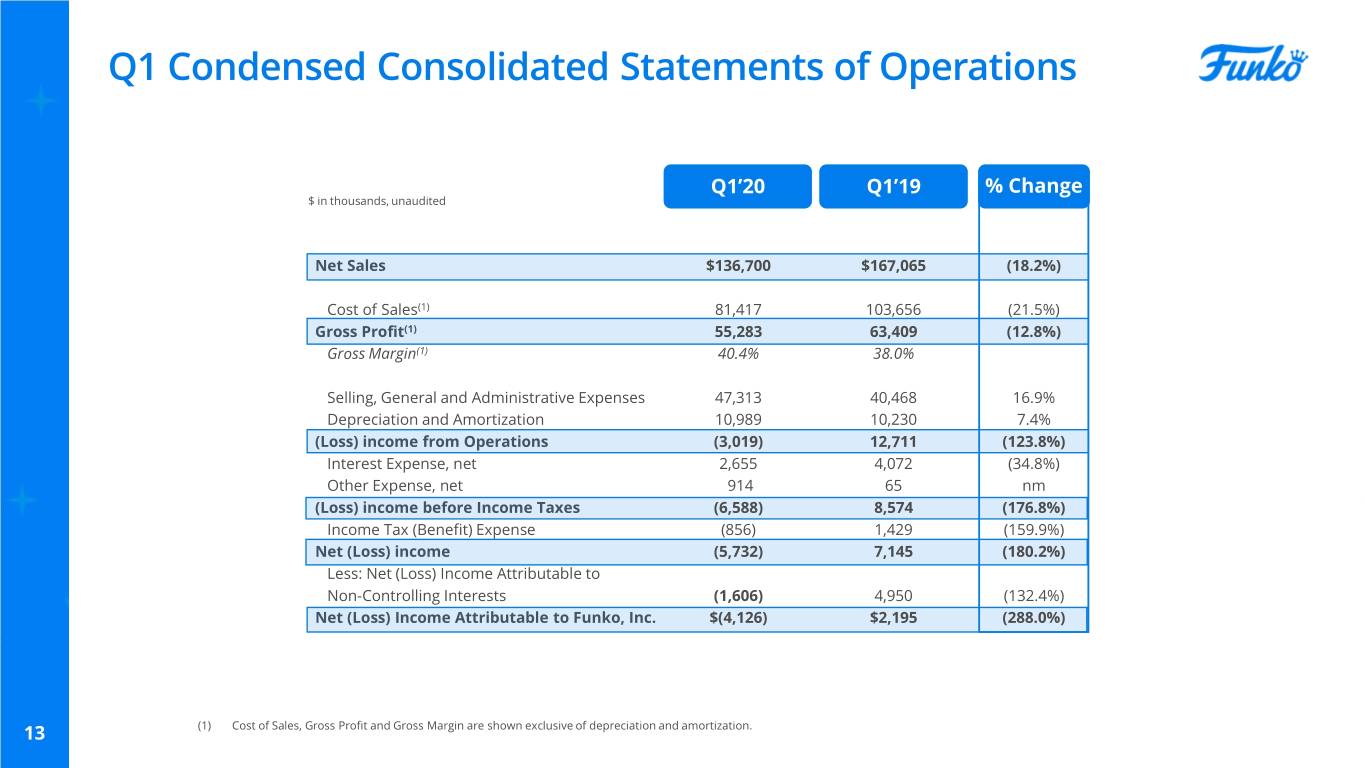

Q1 Condensed Consolidated Statements of Operations Q1’20 Q1’19 % Change $ in thousands, unaudited Net Sales $136,700 $167,065 (18.2%) Cost of Sales(1) 81,417 103,656 (21.5%) Gross Profit(1) 55,283 63,409 (12.8%) Gross Margin(1) 40.4% 38.0% Selling, General and Administrative Expenses 47,313 40,468 16.9% Depreciation and Amortization 10,989 10,230 7.4% (Loss) income from Operations (3,019) 12,711 (123.8%) Interest Expense, net 2,655 4,072 (34.8%) Other Expense, net 914 65 nm (Loss) income before Income Taxes (6,588) 8,574 (176.8%) Income Tax (Benefit) Expense (856) 1,429 (159.9%) Net (Loss) income (5,732) 7,145 (180.2%) Less: Net (Loss) Income Attributable to Non-Controlling Interests (1,606) 4,950 (132.4%) Net (Loss) Income Attributable to Funko, Inc. $(4,126) $2,195 (288.0%) 13 (1) Cost of Sales, Gross Profit and Gross Margin are shown exclusive of depreciation and amortization.

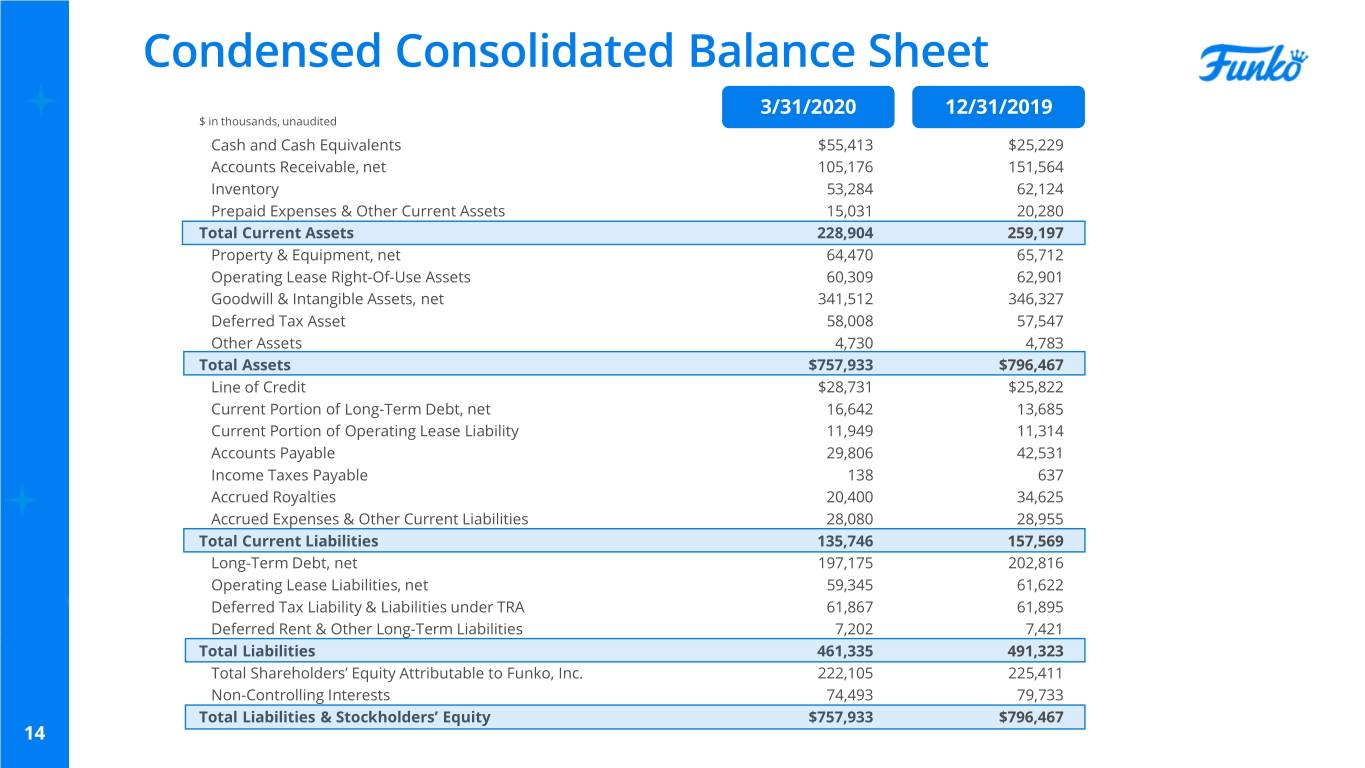

Condensed Consolidated Balance Sheet 3/31/2020 12/31/2019 $ in thousands, unaudited Cash and Cash Equivalents $55,413 $25,229 Accounts Receivable, net 105,176 151,564 Inventory 53,284 62,124 Prepaid Expenses & Other Current Assets 15,031 20,280 Total Current Assets 228,904 259,197 Property & Equipment, net 64,470 65,712 Operating Lease Right-Of-Use Assets 60,309 62,901 Goodwill & Intangible Assets, net 341,512 346,327 Deferred Tax Asset 58,008 57,547 Other Assets 4,730 4,783 Total Assets $757,933 $796,467 Line of Credit $28,731 $25,822 Current Portion of Long-Term Debt, net 16,642 13,685 Current Portion of Operating Lease Liability 11,949 11,314 Accounts Payable 29,806 42,531 Income Taxes Payable 138 637 Accrued Royalties 20,400 34,625 Accrued Expenses & Other Current Liabilities 28,080 28,955 Total Current Liabilities 135,746 157,569 Long-Term Debt, net 197,175 202,816 Operating Lease Liabilities, net 59,345 61,622 Deferred Tax Liability & Liabilities under TRA 61,867 61,895 Deferred Rent & Other Long-Term Liabilities 7,202 7,421 Total Liabilities 461,335 491,323 Total Shareholders’ Equity Attributable to Funko, Inc. 222,105 225,411 Non-Controlling Interests 74,493 79,733 Total Liabilities & Stockholders’ Equity $757,933 $796,467 14

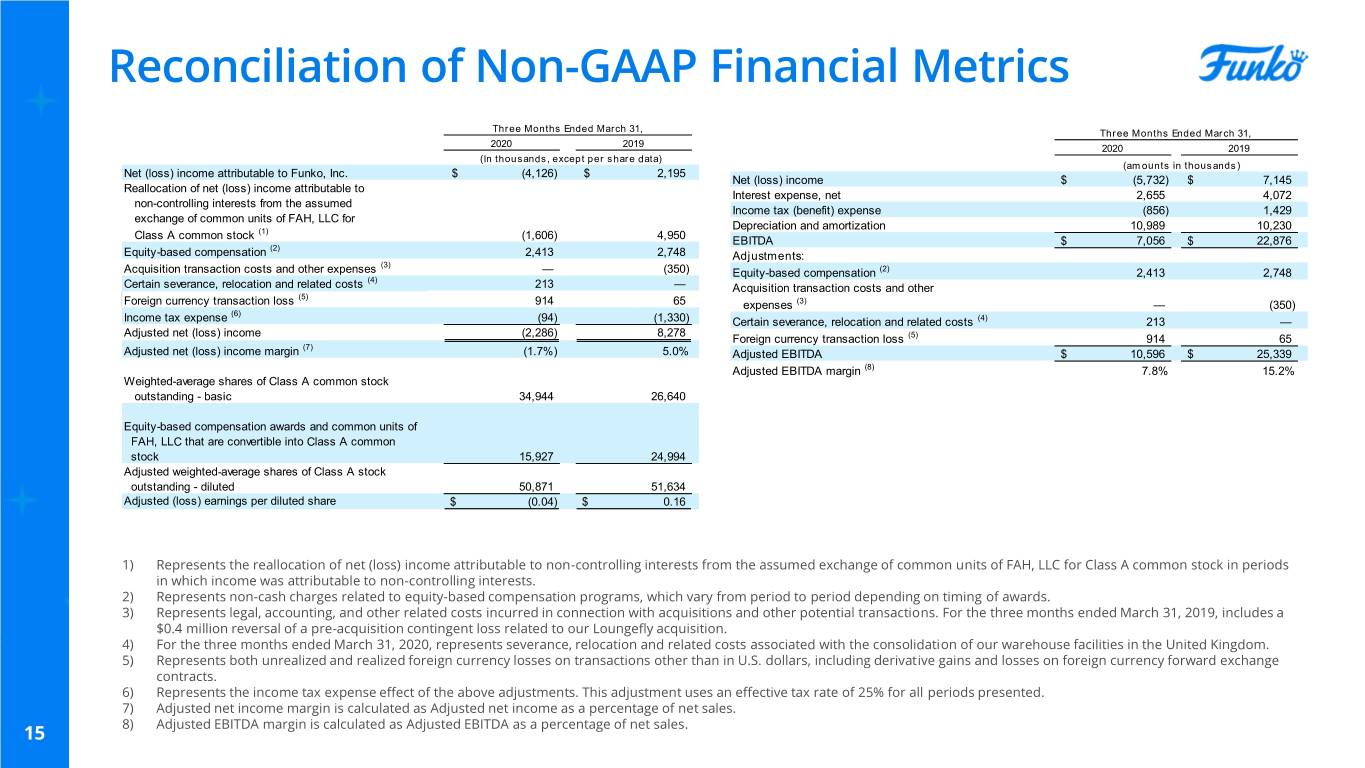

Reconciliation of Non-GAAP Financial Metrics Three Months Ended March 31, Three Months Ended March 31, 2020 2019 2020 2019 (In thousands, except per share data) (amounts in thousands) Net (loss) income attributable to Funko, Inc. $ (4,126) $ 2,195 Net (loss) income $ (5,732) $ 7,145 Reallocation of net (loss) income attributable to Interest expense, net 2,655 4,072 non-controlling interests from the assumed Income tax (benefit) expense (856) 1,429 exchange of common units of FAH, LLC for (1) Depreciation and amortization 10,989 10,230 Class A common stock (1,606) 4,950 EBITDA $ 7,056 $ 22,876 (2) Equity-based compensation 2,413 2,748 Adjustments: (3) Acquisition transaction costs and other expenses — (350) Equity-based compensation (2) 2,413 2,748 (4) Certain severance, relocation and related costs 213 — Acquisition transaction costs and other (5) Foreign currency transaction loss 914 65 expenses (3) — (350) (6) Income tax expense (94) (1,330) Certain severance, relocation and related costs (4) 213 — Adjusted net (loss) income (2,286) 8,278 Foreign currency transaction loss (5) 914 65 (7) Adjusted net (loss) income margin (1.7%) 5.0% Adjusted EBITDA $ 10,596 $ 25,339 Adjusted EBITDA margin (8) 7.8% 15.2% Weighted-average shares of Class A common stock outstanding - basic 34,944 26,640 Equity-based compensation awards and common units of FAH, LLC that are convertible into Class A common stock 15,927 24,994 Adjusted weighted-average shares of Class A stock outstanding - diluted 50,871 51,634 Adjusted (loss) earnings per diluted share $ (0.04) $ 0.16 1) Represents the reallocation of net (loss) income attributable to non-controlling interests from the assumed exchange of common units of FAH, LLC for Class A common stock in periods in which income was attributable to non-controlling interests. 2) Represents non-cash charges related to equity-based compensation programs, which vary from period to period depending on timing of awards. 3) Represents legal, accounting, and other related costs incurred in connection with acquisitions and other potential transactions. For the three months ended March 31, 2019, includes a $0.4 million reversal of a pre-acquisition contingent loss related to our Loungefly acquisition. 4) For the three months ended March 31, 2020, represents severance, relocation and related costs associated with the consolidation of our warehouse facilities in the United Kingdom. 5) Represents both unrealized and realized foreign currency losses on transactions other than in U.S. dollars, including derivative gains and losses on foreign currency forward exchange contracts. 6) Represents the income tax expense effect of the above adjustments. This adjustment uses an effective tax rate of 25% for all periods presented. 7) Adjusted net income margin is calculated as Adjusted net income as a percentage of net sales. 15 8) Adjusted EBITDA margin is calculated as Adjusted EBITDA as a percentage of net sales.