Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - DIVERSIFIED HEALTHCARE TRUST | a991_dhcx033120xearningsre.htm |

| 8-K - 8-K - DIVERSIFIED HEALTHCARE TRUST | dhc0331208-k.htm |

Exhibit 99.2

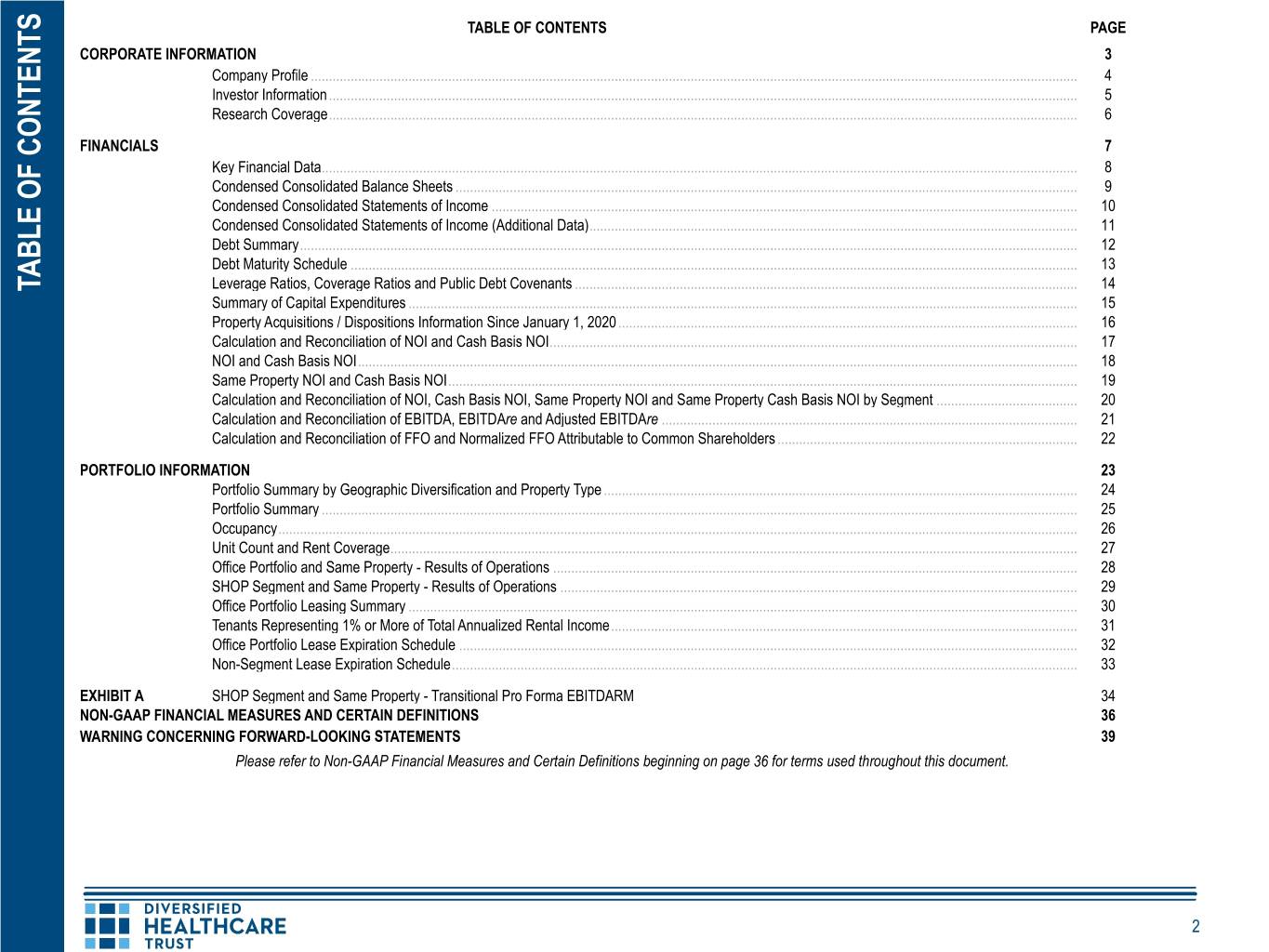

TABLE OF CONTENTS PAGE CORPORATE INFORMATION 3 Company Profile .................................................................................................................................................................................................................... 4 Investor Information............................................................................................................................................................................................................... 5 Research Coverage............................................................................................................................................................................................................... 6 FINANCIALS 7 Key Financial Data................................................................................................................................................................................................................. 8 Condensed Consolidated Balance Sheets ............................................................................................................................................................................ 9 Condensed Consolidated Statements of Income .................................................................................................................................................................. 10 Condensed Consolidated Statements of Income (Additional Data)....................................................................................................................................... 11 Debt Summary....................................................................................................................................................................................................................... 12 Debt Maturity Schedule ......................................................................................................................................................................................................... 13 TABLE OF CONTENTS TABLE Leverage Ratios, Coverage Ratios and Public Debt Covenants ........................................................................................................................................... 14 Summary of Capital Expenditures ......................................................................................................................................................................................... 15 Property Acquisitions / Dispositions Information Since January 1, 2020............................................................................................................................... 16 Calculation and Reconciliation of NOI and Cash Basis NOI.................................................................................................................................................. 17 NOI and Cash Basis NOI....................................................................................................................................................................................................... 18 Same Property NOI and Cash Basis NOI.............................................................................................................................................................................. 19 Calculation and Reconciliation of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI by Segment ....................................... 20 Calculation and Reconciliation of EBITDA, EBITDAre and Adjusted EBITDAre ................................................................................................................... 21 Calculation and Reconciliation of FFO and Normalized FFO Attributable to Common Shareholders................................................................................... 22 PORTFOLIO INFORMATION 23 Portfolio Summary by Geographic Diversification and Property Type................................................................................................................................... 24 Portfolio Summary ................................................................................................................................................................................................................. 25 Occupancy............................................................................................................................................................................................................................. 26 Unit Count and Rent Coverage.............................................................................................................................................................................................. 27 Office Portfolio and Same Property - Results of Operations ................................................................................................................................................. 28 SHOP Segment and Same Property - Results of Operations ............................................................................................................................................... 29 Office Portfolio Leasing Summary ......................................................................................................................................................................................... 30 Tenants Representing 1% or More of Total Annualized Rental Income................................................................................................................................. 31 Office Portfolio Lease Expiration Schedule ........................................................................................................................................................................... 32 Non-Segment Lease Expiration Schedule............................................................................................................................................................................. 33 EXHIBIT A SHOP Segment and Same Property - Transitional Pro Forma EBITDARM 34 NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS 36 WARNING CONCERNING FORWARD-LOOKING STATEMENTS 39 Please refer to Non-GAAP Financial Measures and Certain Definitions beginning on page 36 for terms used throughout this document. 2

3 3

COMPANY PROFILE The Company: Corporate Headquarters: Diversified Healthcare Trust, or DHC, we, our or us, is a real estate investment trust, or REIT, which owns healthcare related properties including medical office and life science buildings, senior living communities and Two Newton Place wellness centers located throughout the U.S. DHC is a component of 61 market indices as of March 31, 255 Washington Street, Suite 300 2020. Among this list, DHC comprises more than 1% of indices such as: BI North America Healthcare REIT Newton, MA 02458-1634 Valuation Peers (BIHLCRNP), Invesco KBW Premium Yield Equity REIT ETF INAV Index (KBWYIV), BI NA (t) (617) 796-8350 Healthcare REIT – Competitive (BIHLCRNC), and the Solactive US Small Cap High Dividend Index (SOLSMHD). COMPANY PROFILE COMPANY Management: Stock Exchange Listing: DHC is managed by The RMR Group LLC, or RMR LLC, the majority owned operating subsidiary of The RMR Group Inc. (Nasdaq: RMR), or RMR Inc. RMR is an alternative asset management company that was Nasdaq founded in 1986 to manage real estate companies and related businesses. RMR primarily provides management services to four publicly traded equity REITs and three real estate related operating businesses. Trading Symbols: In addition to managing DHC, RMR manages Service Properties Trust, a REIT that owns a diverse portfolio of hotels and net lease service and necessity-based retail properties, Industrial Logistics Properties Trust, a Common Shares: DHC REIT that owns industrial and logistics properties, and Office Properties Income Trust, a REIT that owns 5.625% Senior Notes due 2042: DHCNI properties primarily leased to single tenants and those with high credit quality characteristics such as 6.250% Senior Notes due 2046: DHCNL government entities. RMR also provides management services to Five Star Senior Living Inc., or Five Star, a publicly traded operator of senior living communities (including many of the senior living communities that Senior Unsecured Debt Ratings: DHC owns), Sonesta International Hotels Corporation, a privately owned operator and franchisor of hotels and cruise boats, and TravelCenters of America Inc., a publicly traded operator and franchisor of travel centers along the U.S. Interstate Highway System, standalone truck service facilities and restaurants. RMR Moody's: Ba1 also advises the RMR Real Estate Income Fund, which is in the process of converting from a registered S&P Global: BB+ investment company to a publicly traded mortgage REIT, and Tremont Mortgage Trust, a publicly traded mortgage REIT, both of which will focus on originating and investing in floating rate first mortgage whole loans, secured by middle market and transitional commercial real estate, through wholly owned Securities and Exchange Commission, or SEC, registered investment advisory subsidiaries, as well as manages the RMR Office Property Fund LP, a private, open end core plus fund focused on the acquisition, ownership and leasing of a diverse portfolio of multi-tenant office properties throughout the U.S. As of March 31, 2020, RMR had $32.0 billion of real estate assets under management and the combined RMR managed companies had approximately $12 billion of annual revenues, over 2,100 properties and nearly 50,000 employees. We believe that being managed by RMR is a competitive advantage for DHC because of RMR’s depth of management and experience in the real estate industry. We also believe RMR provides management services to us at costs that are lower than we would have to pay for similar quality services if we were self managed. 4

INVESTOR INFORMATION Board of Trustees John L. Harrington Lisa Harris Jones Jeffrey P. Somers Independent Trustee Lead Independent Trustee Independent Trustee Jennifer B. Clark Adam D. Portnoy Managing Trustee Chair of the Board & Managing Trustee INVESTOR INFORMATION INVESTOR Executive Officers Jennifer F. Francis Richard W. Siedel, Jr. President & Chief Operating Officer Chief Financial Officer & Treasurer Contact Information Investor Relations Inquiries Diversified Healthcare Trust Investor and media inquiries should be directed to Two Newton Place Michael Kodesch, Director, Investor Relations, at 255 Washington Street, Suite 300 (617) 796-8234, or mkodesch@dhcreit.com Newton, MA 02458-1634 (t) (617) 796-8350 Financial inquiries should be directed to Richard W. Siedel, Jr. (email) info@dhcreit.com Chief Financial Officer & Treasurer, at (617) 796-8350, (website) www.dhcreit.com or rsiedel@dhcreit.com 5

RESEARCH COVERAGE Equity Research Coverage B. Riley FBR BofA Securities Morgan Stanley Bryan Maher Joshua Dennerlein Vikram Malhotra (646) 885-5423 (646) 855-1681 (212) 761-7064 bmaher@brileyfbr.com joshua.dennerlein@bofa.com vikram.malhotra@morganstanley.com Raymond James RBC Capital Markets Wells Fargo Securities Jonathan Hughes Michael Carroll Todd Stender RESEARCH COVERAGE (727) 567-2438 (440) 715-2649 (212) 214-8067 jonathan.hughes@raymondjames.com michael.carroll@rbccm.com todd.stender@wellsfargo.com Rating Agencies Moody’s Investors Service S & P Global Lori Marks Nicolas Villa (212) 553-1098 (212) 438-1534 lori.marks@moodys.com nicolas.villa@spglobal.com DHC is followed by the equity research analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding DHC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of DHC or its management. DHC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. 6

7

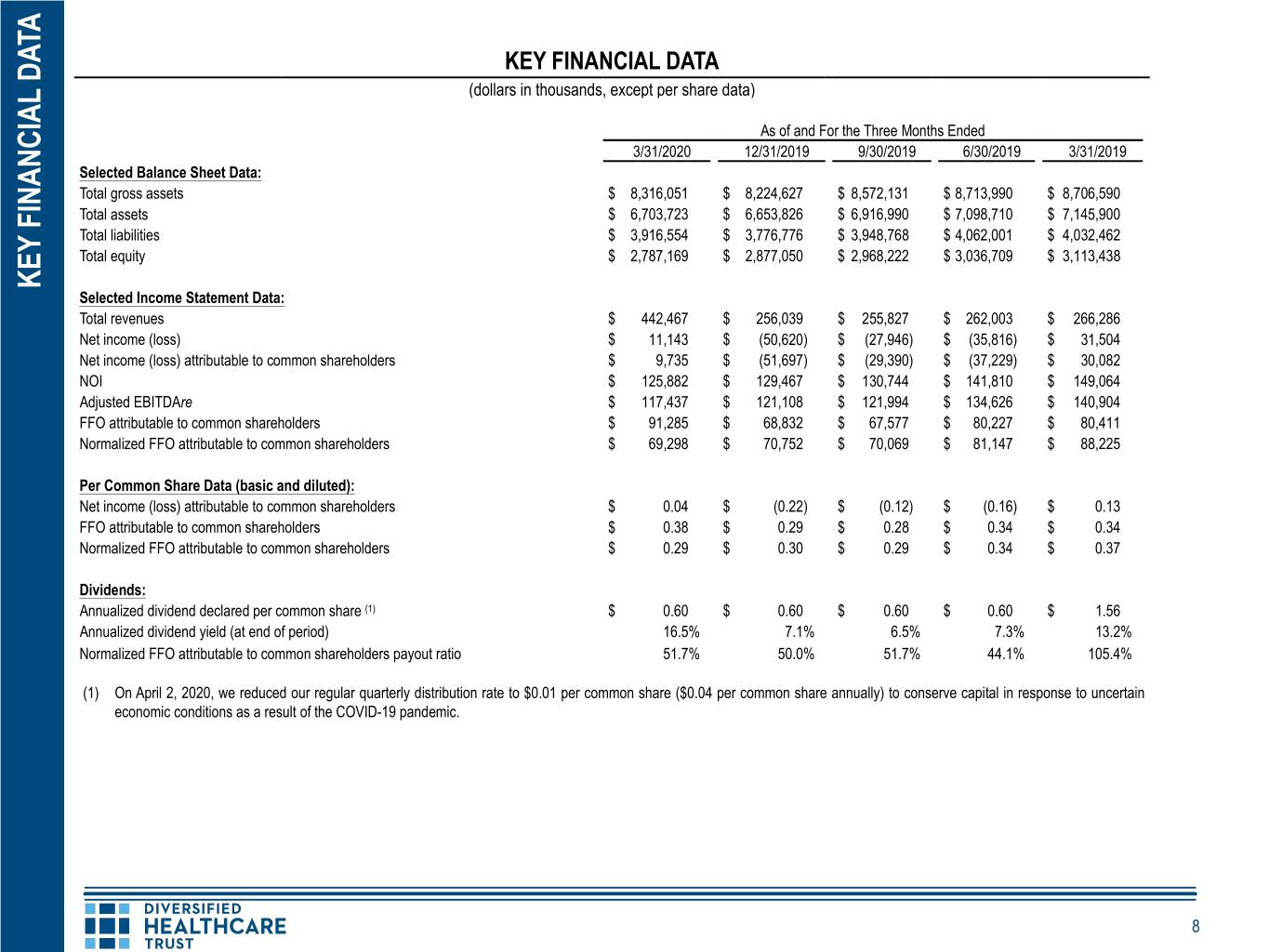

KEY FINANCIAL DATA (dollars in thousands, except per share data) As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Selected Balance Sheet Data: Total gross assets $ 8,316,051 $ 8,224,627 $ 8,572,131 $ 8,713,990 $ 8,706,590 Total assets $ 6,703,723 $ 6,653,826 $ 6,916,990 $ 7,098,710 $ 7,145,900 Total liabilities $ 3,916,554 $ 3,776,776 $ 3,948,768 $ 4,062,001 $ 4,032,462 Total equity $ 2,787,169 $ 2,877,050 $ 2,968,222 $ 3,036,709 $ 3,113,438 KEY FINANCIAL DATA FINANCIAL KEY Selected Income Statement Data: Total revenues $ 442,467 $ 256,039 $ 255,827 $ 262,003 $ 266,286 Net income (loss) $ 11,143 $ (50,620) $ (27,946) $ (35,816) $ 31,504 Net income (loss) attributable to common shareholders $ 9,735 $ (51,697) $ (29,390) $ (37,229) $ 30,082 NOI $ 125,882 $ 129,467 $ 130,744 $ 141,810 $ 149,064 Adjusted EBITDAre $ 117,437 $ 121,108 $ 121,994 $ 134,626 $ 140,904 FFO attributable to common shareholders $ 91,285 $ 68,832 $ 67,577 $ 80,227 $ 80,411 Normalized FFO attributable to common shareholders $ 69,298 $ 70,752 $ 70,069 $ 81,147 $ 88,225 Per Common Share Data (basic and diluted): Net income (loss) attributable to common shareholders $ 0.04 $ (0.22) $ (0.12) $ (0.16) $ 0.13 FFO attributable to common shareholders $ 0.38 $ 0.29 $ 0.28 $ 0.34 $ 0.34 Normalized FFO attributable to common shareholders $ 0.29 $ 0.30 $ 0.29 $ 0.34 $ 0.37 Dividends: Annualized dividend declared per common share (1) $ 0.60 $ 0.60 $ 0.60 $ 0.60 $ 1.56 Annualized dividend yield (at end of period) 16.5% 7.1% 6.5% 7.3% 13.2% Normalized FFO attributable to common shareholders payout ratio 51.7% 50.0% 51.7% 44.1% 105.4% (1) On April 2, 2020, we reduced our regular quarterly distribution rate to $0.01 per common share ($0.04 per common share annually) to conserve capital in response to uncertain economic conditions as a result of the COVID-19 pandemic. 8

CONDENSED CONSOLIDATED BALANCE SHEETS (amounts in thousands, except share data) As of As of March 31, 2020 December 31, 2019 Assets Real estate properties: Land $ 786,242 $ 793,123 Buildings and improvements 6,648,430 6,668,463 Total real estate properties, gross 7,434,672 7,461,586 Accumulated depreciation (1,612,328) (1,570,801) Total real estate properties, net 5,822,344 5,890,785 Assets of properties held for sale 244,881 209,570 Cash and cash equivalents 69,545 37,357 Restricted cash 15,691 14,867 Acquired real estate leases and other intangible assets, net 323,134 337,875 Other assets, net 228,128 163,372 Total assets $ 6,703,723 $ 6,653,826 Liabilities and Equity Unsecured revolving credit facility $ 585,000 $ 537,500 Unsecured term loans, net 449,035 448,741 Senior unsecured notes, net 1,821,560 1,820,681 Secured debt and capital leases, net 693,961 694,739 Liabilities of properties held for sale 8,218 6,758 Accrued interest 29,236 24,060 Assumed real estate lease obligations, net 74,430 76,705 Other liabilities 255,114 167,592 Total liabilities 3,916,554 3,776,776 Commitments and contingencies Equity: CONDENSED CONSOLIDATED BALANCE SHEETS CONDENSED CONSOLIDATED Equity attributable to common shareholders: Common shares of beneficial interest, $.01 par value: 300,000,000 shares authorized, 237,893,725 and 237,897,163 shares issued and outstanding at March 31, 2020 and December 31, 2019, respectively 2,379 2,379 Additional paid in capital 4,612,739 4,612,511 Cumulative net income 2,062,297 2,052,562 Cumulative distributions (4,026,418) (3,930,933) Total equity attributable to common shareholders 2,650,997 2,736,519 Noncontrolling interest: Total equity attributable to noncontrolling interest 136,172 140,531 Total equity 2,787,169 2,877,050 Total liabilities and equity $ 6,703,723 $ 6,653,826 9

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (amounts in thousands, except per share data) For the Three Months Ended March 31, 2020 2019 Revenues: Rental income $ 110,498 $ 158,241 Residents fees and services 331,969 108,045 Total revenues 442,467 266,286 Expenses: Property operating expenses 316,585 117,222 Depreciation and amortization 68,430 72,230 General and administrative 8,832 9,816 Acquisition and certain other transaction related costs 663 7,814 Impairment of assets 11,234 6,206 Total expenses 405,744 213,288 Gain (loss) on sale of properties 2,782 (122) Dividend income — 923 Gains and losses on equity securities, net (9,943) 22,932 Interest and other income 138 114 Interest expense (including net amortization of debt premiums, discounts and issuance costs of $1,509 and $1,652, respectively) (41,650) (45,611) Gain on lease termination 22,896 — Loss on early extinguishment of debt (246) — Income from continuing operations before income tax expense and equity in earnings of an investee 10,700 31,234 Income tax expense 443 (134) Equity in earnings of an investee — 404 Net income 11,143 31,504 Net income attributable to noncontrolling interest (1,408) (1,422) CONDENSED CONSOLIDATED STATEMENTS OF INCOME STATEMENTS CONDENSED CONSOLIDATED Net income attributable to common shareholders $ 9,735 $ 30,082 Weighted average common shares outstanding (basic) 237,669 237,568 Weighted average common shares outstanding (diluted) 237,669 237,600 Per common share data (basic and diluted): Net income attributable to common shareholders $ 0.04 $ 0.13 10

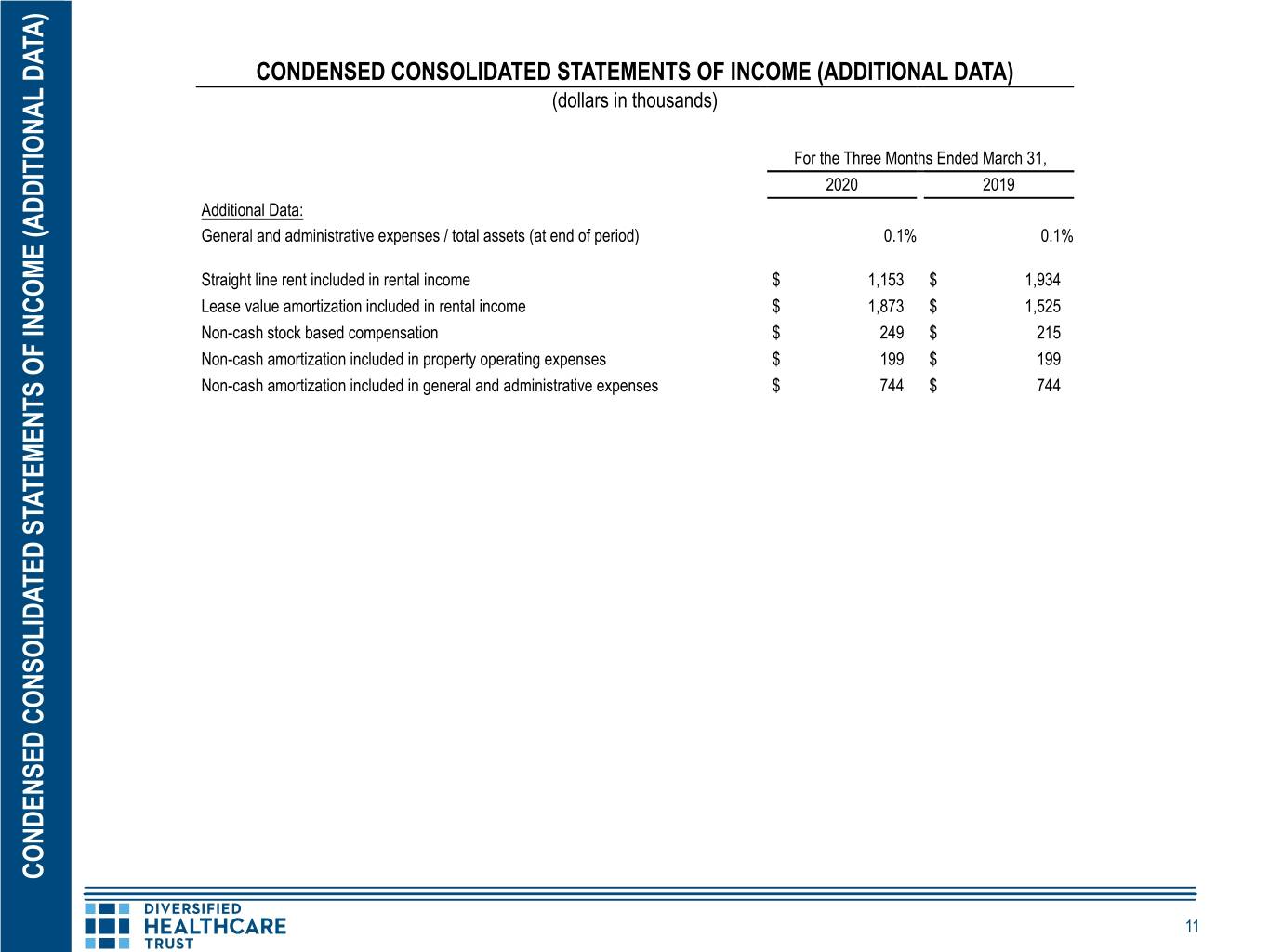

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (ADDITIONAL DATA) (dollars in thousands) For the Three Months Ended March 31, 2020 2019 Additional Data: General and administrative expenses / total assets (at end of period) 0.1% 0.1% Straight line rent included in rental income $ 1,153 $ 1,934 Lease value amortization included in rental income $ 1,873 $ 1,525 Non-cash stock based compensation $ 249 $ 215 Non-cash amortization included in property operating expenses $ 199 $ 199 Non-cash amortization included in general and administrative expenses $ 744 $ 744 CONDENSED CONSOLIDATED STATEMENTS OF INCOME (ADDITIONAL DATA) DATA) OF INCOME (ADDITIONAL STATEMENTS CONDENSED CONSOLIDATED 11

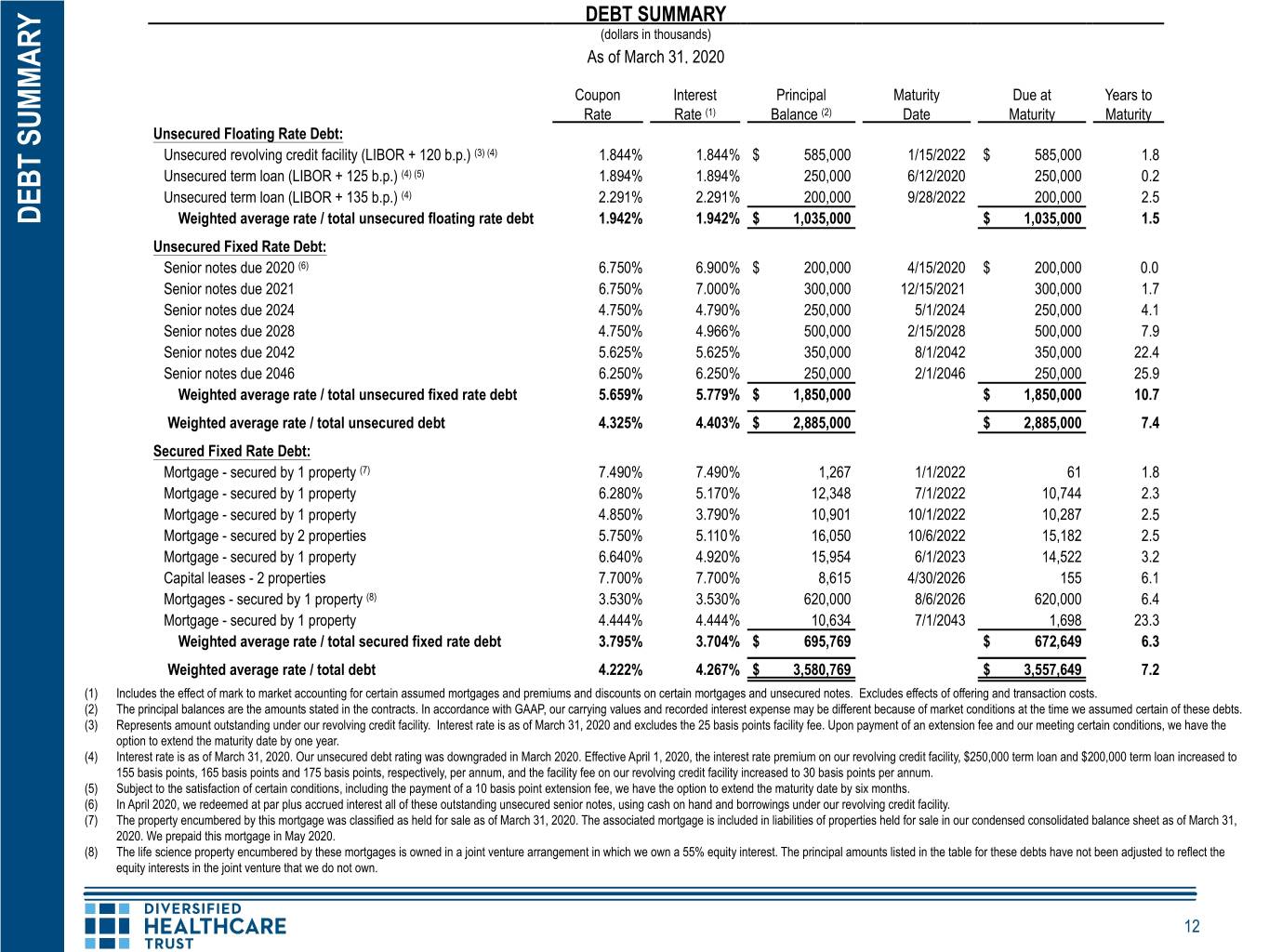

DEBT SUMMARY (dollars in thousands) As of March 31, 2020 Coupon Interest Principal Maturity Due at Years to Rate Rate (1) Balance (2) Date Maturity Maturity Unsecured Floating Rate Debt: Unsecured revolving credit facility (LIBOR + 120 b.p.) (3) (4) 1.844% 1.844% $ 585,000 1/15/2022 $ 585,000 1.8 Unsecured term loan (LIBOR + 125 b.p.) (4) (5) 1.894% 1.894% 250,000 6/12/2020 250,000 0.2 Unsecured term loan (LIBOR + 135 b.p.) (4) 2.291% 2.291% 200,000 9/28/2022 200,000 2.5 DEBT SUMMARY DEBT SUMMARY Weighted average rate / total unsecured floating rate debt 1.942% 1.942% $ 1,035,000 $ 1,035,000 1.5 Unsecured Fixed Rate Debt: Senior notes due 2020 (6) 6.750% 6.900% $ 200,000 4/15/2020 $ 200,000 0.0 Senior notes due 2021 6.750% 7.000% 300,000 12/15/2021 300,000 1.7 Senior notes due 2024 4.750% 4.790% 250,000 5/1/2024 250,000 4.1 Senior notes due 2028 4.750% 4.966% 500,000 2/15/2028 500,000 7.9 Senior notes due 2042 5.625% 5.625% 350,000 8/1/2042 350,000 22.4 Senior notes due 2046 6.250% 6.250% 250,000 2/1/2046 250,000 25.9 Weighted average rate / total unsecured fixed rate debt 5.659% 5.779% $ 1,850,000 $ 1,850,000 10.7 Weighted average rate / total unsecured debt 4.325% 4.403% $ 2,885,000 $ 2,885,000 7.4 Secured Fixed Rate Debt: Mortgage - secured by 1 property (7) 7.490% 7.490% 1,267 1/1/2022 61 1.8 Mortgage - secured by 1 property 6.280% 5.170% 12,348 7/1/2022 10,744 2.3 Mortgage - secured by 1 property 4.850% 3.790% 10,901 10/1/2022 10,287 2.5 Mortgage - secured by 2 properties 5.750% 5.110% 16,050 10/6/2022 15,182 2.5 Mortgage - secured by 1 property 6.640% 4.920% 15,954 6/1/2023 14,522 3.2 Capital leases - 2 properties 7.700% 7.700% 8,615 4/30/2026 155 6.1 Mortgages - secured by 1 property (8) 3.530% 3.530% 620,000 8/6/2026 620,000 6.4 Mortgage - secured by 1 property 4.444% 4.444% 10,634 7/1/2043 1,698 23.3 Weighted average rate / total secured fixed rate debt 3.795% 3.704% $ 695,769 $ 672,649 6.3 Weighted average rate / total debt 4.222% 4.267% $ 3,580,769 $ 3,557,649 7.2 (1) Includes the effect of mark to market accounting for certain assumed mortgages and premiums and discounts on certain mortgages and unsecured notes. Excludes effects of offering and transaction costs. (2) The principal balances are the amounts stated in the contracts. In accordance with GAAP, our carrying values and recorded interest expense may be different because of market conditions at the time we assumed certain of these debts. (3) Represents amount outstanding under our revolving credit facility. Interest rate is as of March 31, 2020 and excludes the 25 basis points facility fee. Upon payment of an extension fee and our meeting certain conditions, we have the option to extend the maturity date by one year. (4) Interest rate is as of March 31, 2020. Our unsecured debt rating was downgraded in March 2020. Effective April 1, 2020, the interest rate premium on our revolving credit facility, $250,000 term loan and $200,000 term loan increased to 155 basis points, 165 basis points and 175 basis points, respectively, per annum, and the facility fee on our revolving credit facility increased to 30 basis points per annum. (5) Subject to the satisfaction of certain conditions, including the payment of a 10 basis point extension fee, we have the option to extend the maturity date by six months. (6) In April 2020, we redeemed at par plus accrued interest all of these outstanding unsecured senior notes, using cash on hand and borrowings under our revolving credit facility. (7) The property encumbered by this mortgage was classified as held for sale as of March 31, 2020. The associated mortgage is included in liabilities of properties held for sale in our condensed consolidated balance sheet as of March 31, 2020. We prepaid this mortgage in May 2020. (8) The life science property encumbered by these mortgages is owned in a joint venture arrangement in which we own a 55% equity interest. The principal amounts listed in the table for these debts have not been adjusted to reflect the equity interests in the joint venture that we do not own. 12

DEBT MATURITY SCHEDULE (dollars in thousands) As of March 31, 2020 Unsecured Unsecured Secured Floating % of Fixed % of Fixed Rate % of % of Year Rate Debt Total Rate Debt Total Debt (1) (2) Total Total Total 2020 $ 250,000 (3) $ 200,000 (4) $ 2,706 $ 452,706 2021 — 300,000 3,867 303,867 2022 785,000 (5) — 39,128 824,128 2023 — — 16,413 16,413 2024 — 250,000 1,834 251,834 2025 — — 2,001 2,001 DEBT MATURITY SCHEDULE DEBT MATURITY 2026 — — 620,904 620,904 2027 — — 302 302 2028 — 500,000 315 500,315 Thereafter — 600,000 8,299 608,299 Principal balance $ 1,035,000 $ 1,850,000 $ 695,769 $ 3,580,769 Unamortized debt issuance costs, premiums and discounts (965) (28,440) (541) (29,946) Total debt, net $ 1,034,035 29.1% $ 1,821,560 51.3% $ 695,228 19.6% $ 3,550,823 100.0% (1) Includes $8,615 of capital lease obligations due through April 2026. (2) Includes $1,267 of principal mortgage obligation for a property classified as held for sale as of March 31, 2020. This mortgage has been included in liabilities of properties held for sale in our condensed consolidated balance sheet as of March 31, 2020. (3) Subject to the satisfaction of certain conditions, including the payment of a 10 basis point extension fee, we have the option to extend the maturity date of our $250,000 term loan by six months to December 2020. (4) In April 2020, we redeemed all $200,000 of our unsecured senior notes due 2020 at par plus accrued interest, using cash on hand and borrowings under our revolving credit facility. (5) Includes $585,000 outstanding under our revolving credit facility at March 31, 2020. Subject to the payment of an extension fee and meeting other conditions, we have the option to extend the maturity date of the facility by an additional year to January 2023. 13

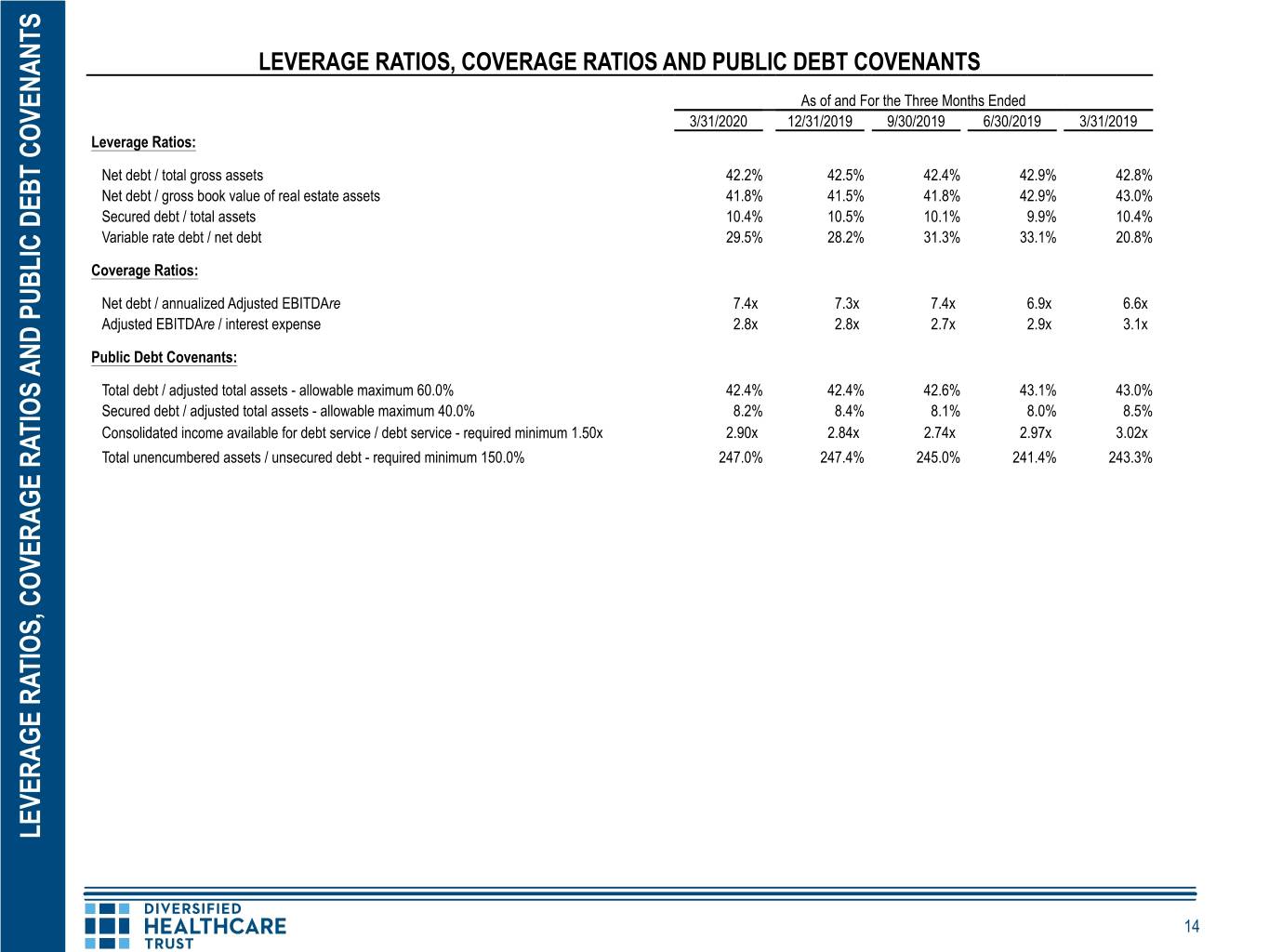

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Leverage Ratios: Net debt / total gross assets 42.2% 42.5% 42.4% 42.9% 42.8% Net debt / gross book value of real estate assets 41.8% 41.5% 41.8% 42.9% 43.0% Secured debt / total assets 10.4% 10.5% 10.1% 9.9% 10.4% Variable rate debt / net debt 29.5% 28.2% 31.3% 33.1% 20.8% Coverage Ratios: Net debt / annualized Adjusted EBITDAre 7.4x 7.3x 7.4x 6.9x 6.6x Adjusted EBITDAre / interest expense 2.8x 2.8x 2.7x 2.9x 3.1x Public Debt Covenants: Total debt / adjusted total assets - allowable maximum 60.0% 42.4% 42.4% 42.6% 43.1% 43.0% Secured debt / adjusted total assets - allowable maximum 40.0% 8.2% 8.4% 8.1% 8.0% 8.5% Consolidated income available for debt service / debt service - required minimum 1.50x 2.90x 2.84x 2.74x 2.97x 3.02x Total unencumbered assets / unsecured debt - required minimum 150.0% 247.0% 247.4% 245.0% 241.4% 243.3% LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS COVERAGE RATIOS LEVERAGE RATIOS, 14

SUMMARY OF CAPITAL EXPENDITURES (dollars and sq. ft. in thousands, except per sq. ft. and unit data) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Office Portfolio lease related costs $ 4,964 $ 9,631 $ 4,622 $ 3,152 $ 9,132 Office Portfolio building improvements 2,665 7,502 5,673 2,929 995 SHOP fixed assets and capital improvements (1) 12,918 5,400 4,997 3,487 3,312 Recurring capital expenditures (2) $ 20,547 $ 22,533 $ 15,292 $ 9,568 $ 13,439 Office Portfolio avg. sq. ft. during period 11,798 12,029 12,276 12,460 12,574 SHOP avg. units managed for our account during period (1) 28,987 10,253 10,126 9,925 9,766 Office Portfolio building improvements per avg. sq. ft. during period $ 0.23 $ 0.62 $ 0.46 $ 0.24 $ 0.08 SHOP fixed assets and capital improvements per avg. unit during period (1) $ 446 $ 527 $ 493 $ 351 $ 339 SUMMARY OF CAPITAL EXPENDITURES OF CAPITAL SUMMARY Development, redevelopment and other activities - Office Portfolio (3) $ 8,214 $ 7,199 $ 8,220 $ 9,285 $ 6,059 Development, redevelopment and other activities - SHOP 8,429 21,091 18,701 73,507 31,658 Total development, redevelopment and other activities (2) $ 16,643 $ 28,290 $ 26,921 $ 82,792 $ 37,717 (1) Data for the three months ended March 31, 2020 includes all senior living communities in our SHOP segment. Prior periods exclude properties leased during those periods. Pursuant to the restructuring of our business arrangements with Five Star, or the Restructuring Transaction, effective January 1, 2020, our previously existing master leases and management and pooling agreements with Five Star were terminated and replaced with new management agreements, or the New Management Agreements, for all of our senior living communities operated by Five Star. (2) From time to time we invest in revenue producing capital improvements at certain of our triple net leased senior living communities. As a result, annual rents payable to us increase pursuant to the terms of the applicable leases. These capital improvements are not included in the table above. (3) In January 2020, we acquired a land parcel adjacent to a property we own in our Office Portfolio in Tempe, Arizona for $2,600, excluding closing costs, in order to reposition this property. This purchase is not included in the table above. 15

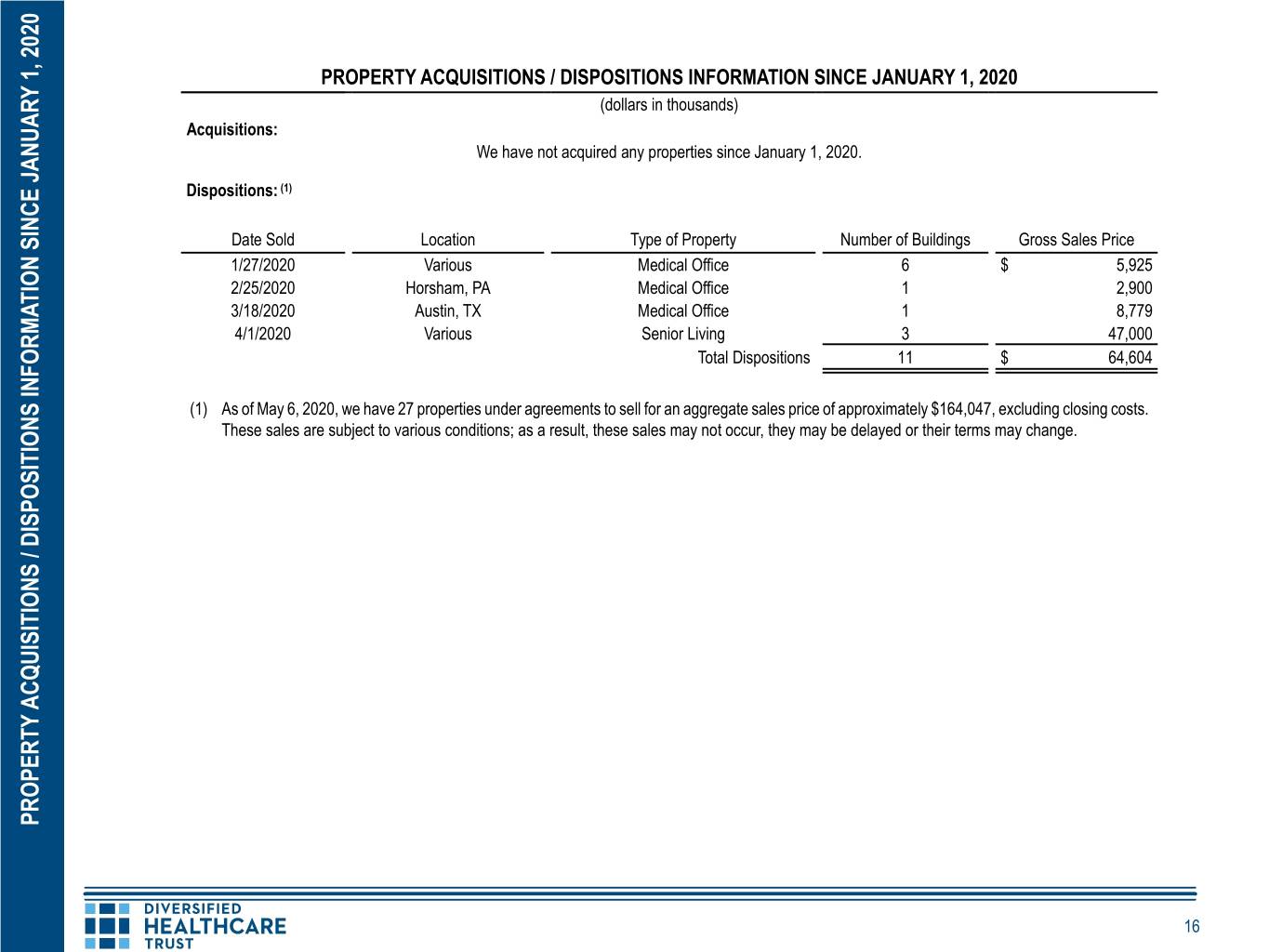

PROPERTY ACQUISITIONS / DISPOSITIONS INFORMATION SINCE JANUARY 1, 2020 (dollars in thousands) Acquisitions: We have not acquired any properties since January 1, 2020. Dispositions: (1) Date Sold Location Type of Property Number of Buildings Gross Sales Price 1/27/2020 Various Medical Office 6 $ 5,925 2/25/2020 Horsham, PA Medical Office 1 2,900 3/18/2020 Austin, TX Medical Office 1 8,779 4/1/2020 Various Senior Living 3 47,000 Total Dispositions 11 $ 64,604 (1) As of May 6, 2020, we have 27 properties under agreements to sell for an aggregate sales price of approximately $164,047, excluding closing costs. These sales are subject to various conditions; as a result, these sales may not occur, they may be delayed or their terms may change. PROPERTY ACQUISITIONS / DISPOSITIONS INFORMATION SINCE JANUARY 1, 2020 SINCE JANUARY ACQUISITIONS / DISPOSITIONS INFORMATION PROPERTY 16

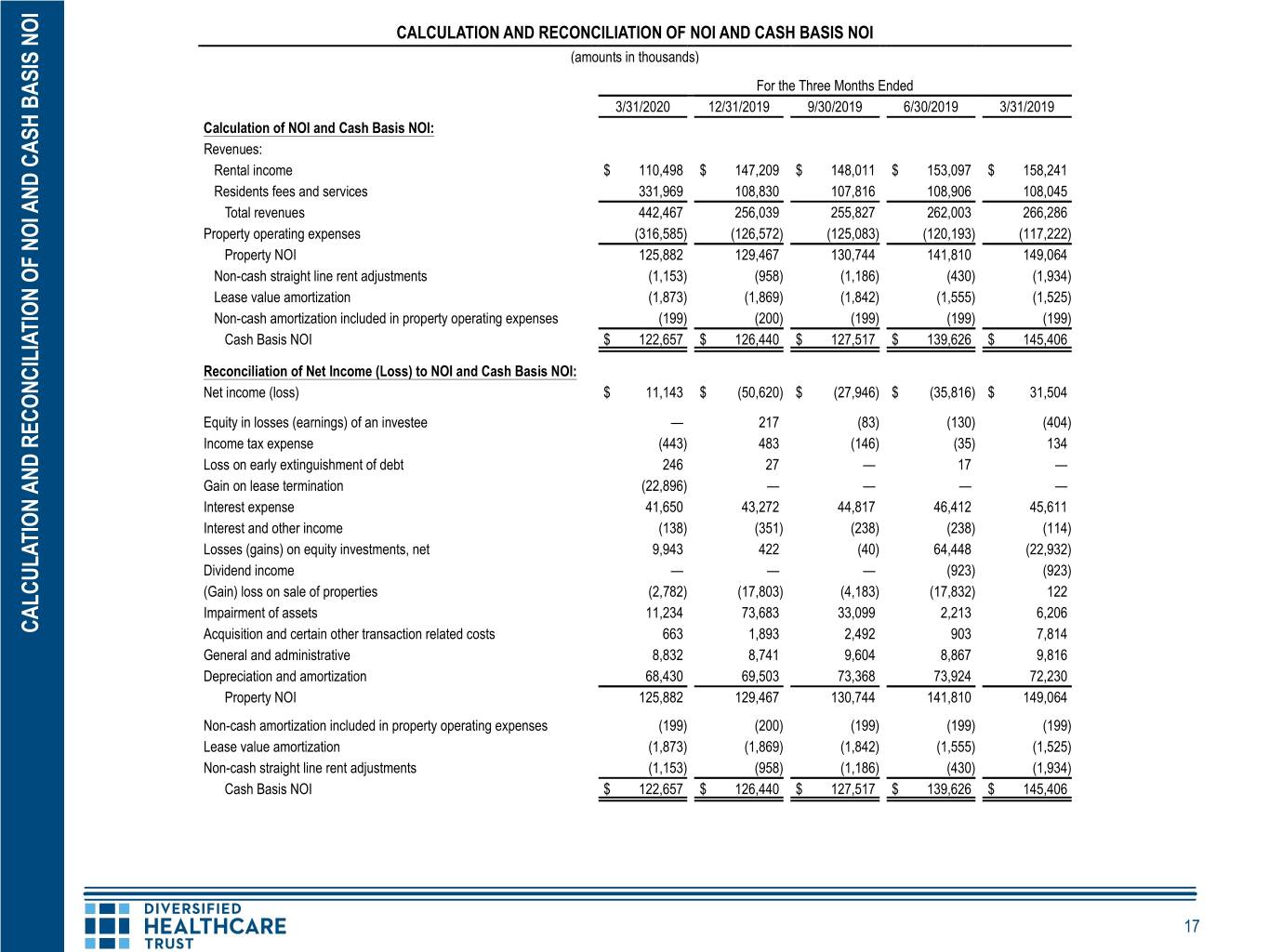

CALCULATION AND RECONCILIATION OF NOI AND CASH BASIS NOI (amounts in thousands) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Calculation of NOI and Cash Basis NOI: Revenues: Rental income $ 110,498 $ 147,209 $ 148,011 $ 153,097 $ 158,241 Residents fees and services 331,969 108,830 107,816 108,906 108,045 Total revenues 442,467 256,039 255,827 262,003 266,286 Property operating expenses (316,585) (126,572) (125,083) (120,193) (117,222) Property NOI 125,882 129,467 130,744 141,810 149,064 Non-cash straight line rent adjustments (1,153) (958) (1,186) (430) (1,934) Lease value amortization (1,873) (1,869) (1,842) (1,555) (1,525) Non-cash amortization included in property operating expenses (199) (200) (199) (199) (199) Cash Basis NOI $ 122,657 $ 126,440 $ 127,517 $ 139,626 $ 145,406 Reconciliation of Net Income (Loss) to NOI and Cash Basis NOI: Net income (loss) $ 11,143 $ (50,620) $ (27,946) $ (35,816) $ 31,504 Equity in losses (earnings) of an investee — 217 (83) (130) (404) Income tax expense (443) 483 (146) (35) 134 Loss on early extinguishment of debt 246 27 — 17 — Gain on lease termination (22,896) — — — — Interest expense 41,650 43,272 44,817 46,412 45,611 Interest and other income (138) (351) (238) (238) (114) Losses (gains) on equity investments, net 9,943 422 (40) 64,448 (22,932) Dividend income — — — (923) (923) (Gain) loss on sale of properties (2,782) (17,803) (4,183) (17,832) 122 Impairment of assets 11,234 73,683 33,099 2,213 6,206 CALCULATION AND RECONCILIATION OF NOI AND CASH BASIS NOI OF NOI AND RECONCILIATION CALCULATION Acquisition and certain other transaction related costs 663 1,893 2,492 903 7,814 General and administrative 8,832 8,741 9,604 8,867 9,816 Depreciation and amortization 68,430 69,503 73,368 73,924 72,230 Property NOI 125,882 129,467 130,744 141,810 149,064 Non-cash amortization included in property operating expenses (199) (200) (199) (199) (199) Lease value amortization (1,873) (1,869) (1,842) (1,555) (1,525) Non-cash straight line rent adjustments (1,153) (958) (1,186) (430) (1,934) Cash Basis NOI $ 122,657 $ 126,440 $ 127,517 $ 139,626 $ 145,406 17

NOI AND CASH BASIS NOI (dollars in thousands) For the Three Months Ended 3/31/2020 3/31/2019 % Change NOI: Life Science $ 34,412 $ 37,016 (7.0)% Medical Office 31,652 34,028 (7.0)% Total Office Portfolio 66,064 71,044 (7.0)% NOI AND CASH BASIS NOI NOI SHOP 48,090 62,313 (22.8)% Non-Segment 11,728 15,707 (25.3)% Total $ 125,882 $ 149,064 (15.6)% Cash Basis NOI: Life Science $ 31,681 $ 34,850 (9.1)% Medical Office 31,292 32,719 (4.4)% Total Office Portfolio 62,973 67,569 (6.8)% SHOP 48,090 62,313 (22.8)% Non-Segment 11,594 15,524 (25.3)% Total $ 122,657 $ 145,406 (15.6)% 18

SAME PROPERTY NOI AND CASH BASIS NOI (dollars in thousands) For the Three Months Ended 3/31/2020 3/31/2019 % Change NOI: Life Science $ 34,590 $ 33,935 1.9 % Medical Office 29,785 29,917 (0.4)% Total Office Portfolio 64,375 63,852 0.8 % SHOP 46,030 58,675 (21.6)% Non-Segment 10,768 10,807 (0.4)% Total $ 121,173 $ 133,334 (9.1)% Cash Basis NOI: Life Science $ 31,867 $ 31,302 1.8 % Medical Office 29,692 28,714 3.4 % Total Office Portfolio 61,559 60,016 2.6 % SAME PROPERTY NOI AND CASH BASIS NOI NOI SAME PROPERTY SHOP 46,030 58,675 (21.6)% Non-Segment 10,618 10,627 (0.1)% Total $ 118,207 $ 129,318 (8.6)% 19

CALCULATION AND RECONCILIATION OF NOI, CASH BASIS NOI, SAME PROPERTY NOI AND SAME PROPERTY CASH BASIS NOI BY SEGMENT 2019 (dollars in thousands) AND For the Three Months Ended March 31, 2020 For the Three Months Ended March 31, 2019 Calculation of NOI and Cash Basis NOI: Office Portfolio SHOP Non-Segment Total Office Portfolio SHOP Non-Segment Total Rental income / residents fees and services $ 98,770 $ 331,969 $ 11,728 $ 442,467 $ 103,221 $ 147,358 $ 15,707 $ 266,286 Property operating expenses (32,706) (283,879) — (316,585) (32,177) (85,045) — (117,222) MARCH 31, 2020 NOI $ 66,064 $ 48,090 $ 11,728 $ 125,882 $ 71,044 $ 62,313 $ 15,707 $ 149,064 NOI change (7.0)% (22.8)% (25.3)% (15.6)% NOI $ 66,064 $ 48,090 $ 11,728 $ 125,882 $ 71,044 $ 62,313 $ 15,707 $ 149,064 Less: Non-cash straight line rent adjustments 1,074 — 79 1,153 1,806 — 128 1,934 Lease value amortization 1,818 — 55 1,873 1,470 — 55 1,525 Non-cash amortization included in property operating expenses 199 — — 199 199 — — 199 Cash Basis NOI $ 62,973 $ 48,090 $ 11,594 $ 122,657 $ 67,569 $ 62,313 $ 15,524 $ 145,406 Cash Basis NOI change (6.8)% (22.8)% (25.3)% (15.6)% Reconciliation of NOI to Same Property NOI: NOI $ 66,064 $ 48,090 $ 11,728 $ 125,882 $ 71,044 $ 62,313 $ 15,707 $ 149,064 Less: NOI not included in same property 1,689 2,060 960 4,709 7,192 3,638 4,900 15,730 Same property NOI $ 64,375 $ 46,030 $ 10,768 $ 121,173 $ 63,852 $ 58,675 $ 10,807 $ 133,334 Same property NOI change 0.8 % (21.6)% (0.4)% (9.1)% Reconciliation of Same Property NOI to Same Property Cash Basis NOI: Same property NOI $ 64,375 $ 46,030 $ 10,768 $ 121,173 $ 63,852 $ 58,675 $ 10,807 $ 133,334 Less: Non-cash straight line rent adjustments 850 — 95 945 2,042 — 125 2,167 Lease value amortization 1,782 — 55 1,837 1,620 — 55 1,675 BASIS NOI BY SEGMENT FOR THE THREE MONTHS ENDED BASIS NOI BY Non-cash amortization included in property operating expenses 184 — — 184 174 — — 174 Same property cash basis NOI $ 61,559 $ 46,030 $ 10,618 $ 118,207 $ 60,016 $ 58,675 $ 10,627 $ 129,318 Same property cash basis NOI change 2.6 % (21.6)% (0.1)% (8.6)% CALCULATION AND RECONCILIATION OF NOI, CASH BASIS NOI, SAME PROPERTY NOI AND SAME PROPERTY CASH AND SAME PROPERTY NOI OF NOI, CASH BASIS SAME PROPERTY AND RECONCILIATION CALCULATION 20

re CALCULATION AND RECONCILIATION OF EBITDA, EBITDAre AND ADJUSTED EBITDAre (amounts in thousands) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Net income (loss) $ 11,143 $ (50,620) $ (27,946) $ (35,816) $ 31,504 AND ADJUSTED EBITDA AND Interest expense 41,650 43,272 44,817 46,412 45,611 re Income tax expense (443) 483 (146) (35) 134 Depreciation and amortization 68,430 69,503 73,368 73,924 72,230 EBITDA 120,780 62,638 90,093 84,485 149,479 (Gain) loss on sale of properties (2,782) (17,803) (4,183) (17,832) 122 Impairment of assets 11,234 73,683 33,099 2,213 6,206 EBITDAre 129,232 118,518 119,009 68,866 155,807 General and administrative expense paid in common shares 249 248 533 392 215 Acquisition and certain other transaction related costs 663 1,893 2,492 903 7,814 Gain on lease termination (22,896) — — — — Loss on early extinguishment of debt 246 27 — 17 — Losses (gains) on equity securities, net 9,943 422 (40) 64,448 (22,932) Adjusted EBITDAre $ 117,437 $ 121,108 $ 121,994 $ 134,626 $ 140,904 CALCULATION AND RECONCILIATION OF EBITDA, EBITDA AND RECONCILIATION CALCULATION 21

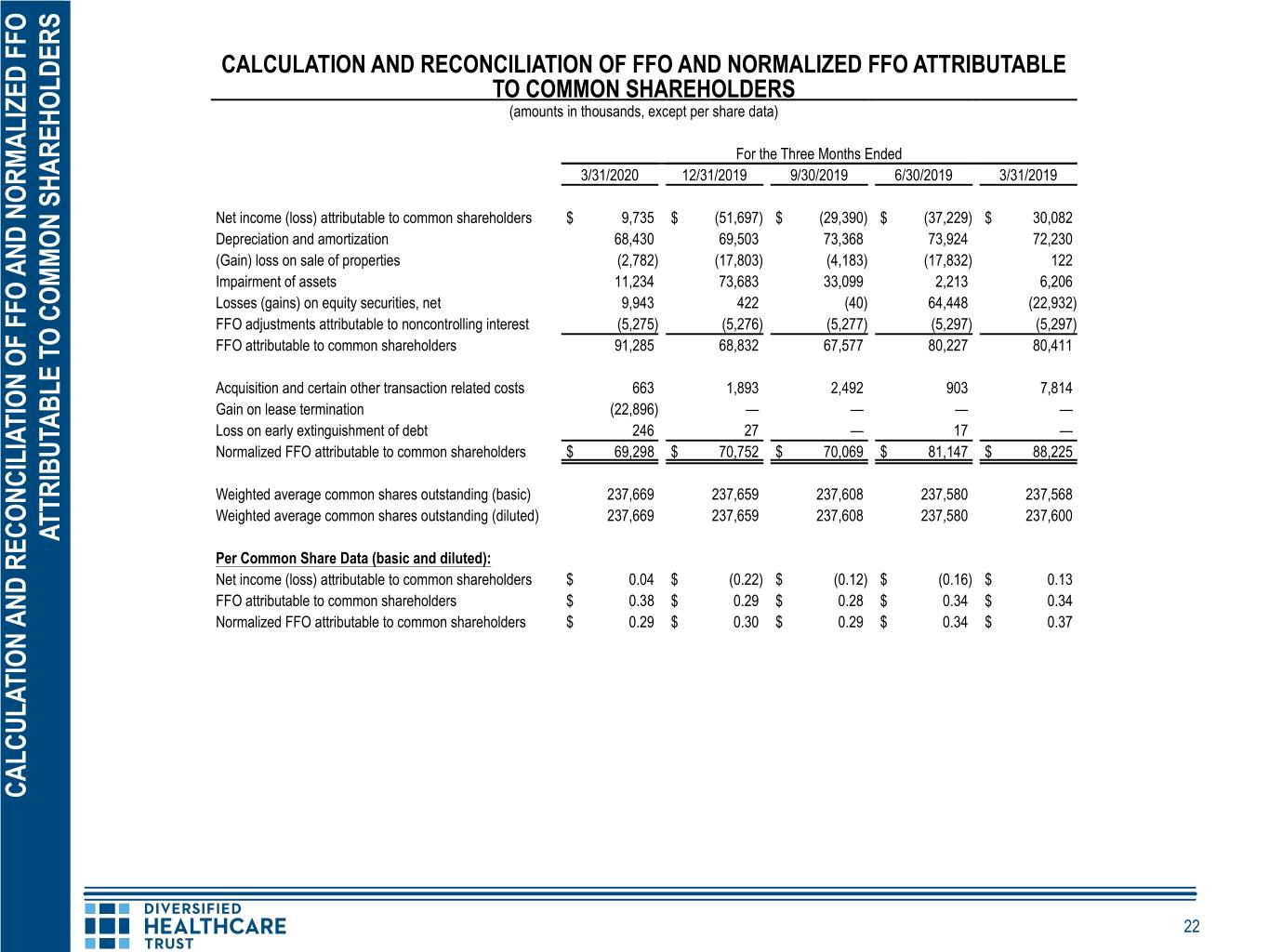

CALCULATION AND RECONCILIATION OF FFO AND NORMALIZED FFO ATTRIBUTABLE TO COMMON SHAREHOLDERS (amounts in thousands, except per share data) For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Net income (loss) attributable to common shareholders $ 9,735 $ (51,697) $ (29,390) $ (37,229) $ 30,082 Depreciation and amortization 68,430 69,503 73,368 73,924 72,230 (Gain) loss on sale of properties (2,782) (17,803) (4,183) (17,832) 122 Impairment of assets 11,234 73,683 33,099 2,213 6,206 Losses (gains) on equity securities, net 9,943 422 (40) 64,448 (22,932) FFO adjustments attributable to noncontrolling interest (5,275) (5,276) (5,277) (5,297) (5,297) FFO attributable to common shareholders 91,285 68,832 67,577 80,227 80,411 Acquisition and certain other transaction related costs 663 1,893 2,492 903 7,814 Gain on lease termination (22,896) — — — — Loss on early extinguishment of debt 246 27 — 17 — Normalized FFO attributable to common shareholders $ 69,298 $ 70,752 $ 70,069 $ 81,147 $ 88,225 Weighted average common shares outstanding (basic) 237,669 237,659 237,608 237,580 237,568 Weighted average common shares outstanding (diluted) 237,669 237,659 237,608 237,580 237,600 ATTRIBUTABLE TO COMMON SHAREHOLDERS TO ATTRIBUTABLE Per Common Share Data (basic and diluted): Net income (loss) attributable to common shareholders $ 0.04 $ (0.22) $ (0.12) $ (0.16) $ 0.13 FFO attributable to common shareholders $ 0.38 $ 0.29 $ 0.28 $ 0.34 $ 0.34 Normalized FFO attributable to common shareholders $ 0.29 $ 0.30 $ 0.29 $ 0.34 $ 0.37 CALCULATION AND RECONCILIATION OF FFO AND NORMALIZED FFO OF FFO AND RECONCILIATION CALCULATION 22

23 23

PORTFOLIO SUMMARY BY GEOGRAPHIC DIVERSIFICATION AND PROPERTY TYPE Geographic Diversification Property Type(1) (2) (based on Gross Book Value of Real Estate Assets as of March 31, 2020) (based on Q1 2020 NOI) IL: 3% VA: 3% Wellness NC: 3% Centers: 4% WI: 4% MD: 4% GA: 5% Independent Living: 24% Medical Office: 25% TX: 8% 28 Other States + D.C.: 35% FL: 9% Assisted Living: 18% Life Science: CA: 10% 28% MA: 16% SNFs: 1% (1) Senior living communities are categorized by the type of living units which constitute a majority of the living units at the community. (2) Memory care communities are classified as assisted living communities. 24 PORTFOLIO SUMMARY BY GEOGRAPHIC DIVERSIFICATION AND PROPERTY TYPE AND PROPERTY GEOGRAPHIC DIVERSIFICATION BY PORTFOLIO SUMMARY

PORTFOLIO SUMMARY (dollars in thousands, except investment per unit or square foot) As of March 31, 2020 % of Total % of % of Square Feet Gross Book Gross Book Investment Per Q1 2020 Q1 2020 Number of or Number of Value of Real Value of Real Square Foot Q1 2020 Total Q1 2020 Total Properties Units Estate Assets (1) Estate Assets or Unit (2) Revenues (3) Revenues NOI (3) NOI Life science 34 4,532,058 $ 1,888,304 22.5% $ 417 $ 46,630 10.5% $ 34,412 27.3% Medical office 96 7,185,559 1,835,715 21.8% $ 255 52,140 11.8% 31,652 25.2% Subtotal Office Portfolio (4) 130 11,717,617 sq. ft. 3,724,019 44.3% $ 318 98,770 22.3% 66,064 52.5% SHOP 244 28,960 units 4,210,867 50.1% $ 145,403 331,969 75.0% 48,090 38.2% Other triple net leased senior living communities 32 2,605 units 295,794 3.5% $ 113,549 7,074 1.6% 7,074 5.6% PORTFOLIO SUMMARY Wellness centers 10 812,000 sq. ft. 178,110 2.1% $ 219 4,654 1.1% 4,654 3.7% Total 416 $ 8,408,790 100.0% $ 442,467 100.0% $ 125,882 100.0% (1) Includes 24 properties with gross book value of real estate assets of $287,397, which are classified as held for sale in our condensed consolidated balance sheet as of March 31, 2020. (2) Represents gross book value of real estate assets divided by number of rentable square feet or living units, as applicable, at March 31, 2020. (3) Includes $333 of revenues and $168 of NOI from properties sold during the three months ended March 31, 2020 and $25,190 of revenues and $4,801 of NOI from properties classified as held for sale in our condensed consolidated balance sheet as of March 31, 2020. (4) Our medical office and life science property leases include some triple net leases where, in addition to paying fixed rents, the tenants assume the obligation to operate and maintain the properties at their expense, and some net and modified gross leases where we are responsible for the operation and maintenance of the properties and we charge tenants for some or all of the property operating costs. A small percentage of our medical office and life science property leases are full-service leases where we receive fixed rent from our tenants and no reimbursement for our property operating costs. 25

OCCUPANCY As of and For the Twelve Months Ended (1) 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Life science 94.2% 94.5% 97.9% 97.8% 99.0% Medical office 91.0% 90.9% 89.1% 91.7% 91.7% OCCUPANCY Weighted average occupancy Office Portfolio (2) 92.2% 92.3% 92.5% 94.0% 94.5% SHOP (3) 84.4% 84.6% 84.0% 83.7% 83.4% Other triple net leased senior living communities (4) 87.3% 87.8% 87.2% 87.6% 87.9% (1) Operating data for the multi-tenant office portfolio is presented as of the end of the period shown; operating data for other tenants is presented for the 12 month period ended on the dates shown, or the most recent prior 12 month period for which tenant and manager operating results are available to us. Excludes data for our wellness centers. (2) Life science and medical office occupancy data is as of quarter end and includes (i) out of service assets undergoing redevelopment, (ii) space which is leased but is not occupied or is being offered for sublease by tenants and (iii) space being fitted out for occupancy. Office Portfolio weighted average occupancy as of March 31, 2020 was 92.6%. (3) Includes senior living communities we owned and that were operated by Five Star during the periods presented. Occupancy for the 12 month period ended or, if shorter, from the date of acquisition through March 31, 2020, was 84.1%. Pursuant to the Restructuring Transaction, effective January 1, 2020, our previously existing master leases and management and pooling agreements with Five Star were terminated and replaced with the New Management Agreements. (4) Excludes data for periods prior to our ownership of certain properties, as well as properties sold or classified as held for sale, or for which there was a transfer of operations during the periods presented. All tenant operating data presented is based upon the operating results provided by our tenants for the indicated periods. We report our operating data one quarter in arrears as this is the most recent prior period for which tenant operating results are available to us from our tenants. We have not independently verified tenant operating data. 26

UNIT COUNT AND RENT COVERAGE SHOP Unit Count as of March 31, 2020 (1): Independent Living and Active Adult units: 10,798: 37.3% Assisted SNF units: Living units: 3,451: 11.9% 11,430: 39.5% Memory Care units: 3,281: 11.3% UNIT COUNT AND RENT COVERAGE UNIT COUNT Rent Coverage (2): As of and For the Twelve Months Ended 12/31/2019 9/30/2019 6/30/2019 3/31/2019 12/31/2018 Other triple net leased senior living communities 1.69x 1.71x 1.76x 1.78x 1.80x Wellness centers 1.82x 1.83x 1.87x 1.93x 1.99x Total 1.75x 1.76x 1.81x 1.84x 1.88x (1) Unit count is by the type of living units at our senior living communities within our SHOP segment. (2) Excludes data for periods prior to our ownership of certain properties, as well as properties sold or classified as held for sale, or for which there was a transfer of operations from one operator to another during the periods presented. All tenant operating data presented is based upon the operating results provided by our tenants for the indicated periods. We report our operating data one quarter in arrears as this is the most recent prior period for which tenant operating results are available to us from our tenants. We have not independently verified tenant operating data. 27

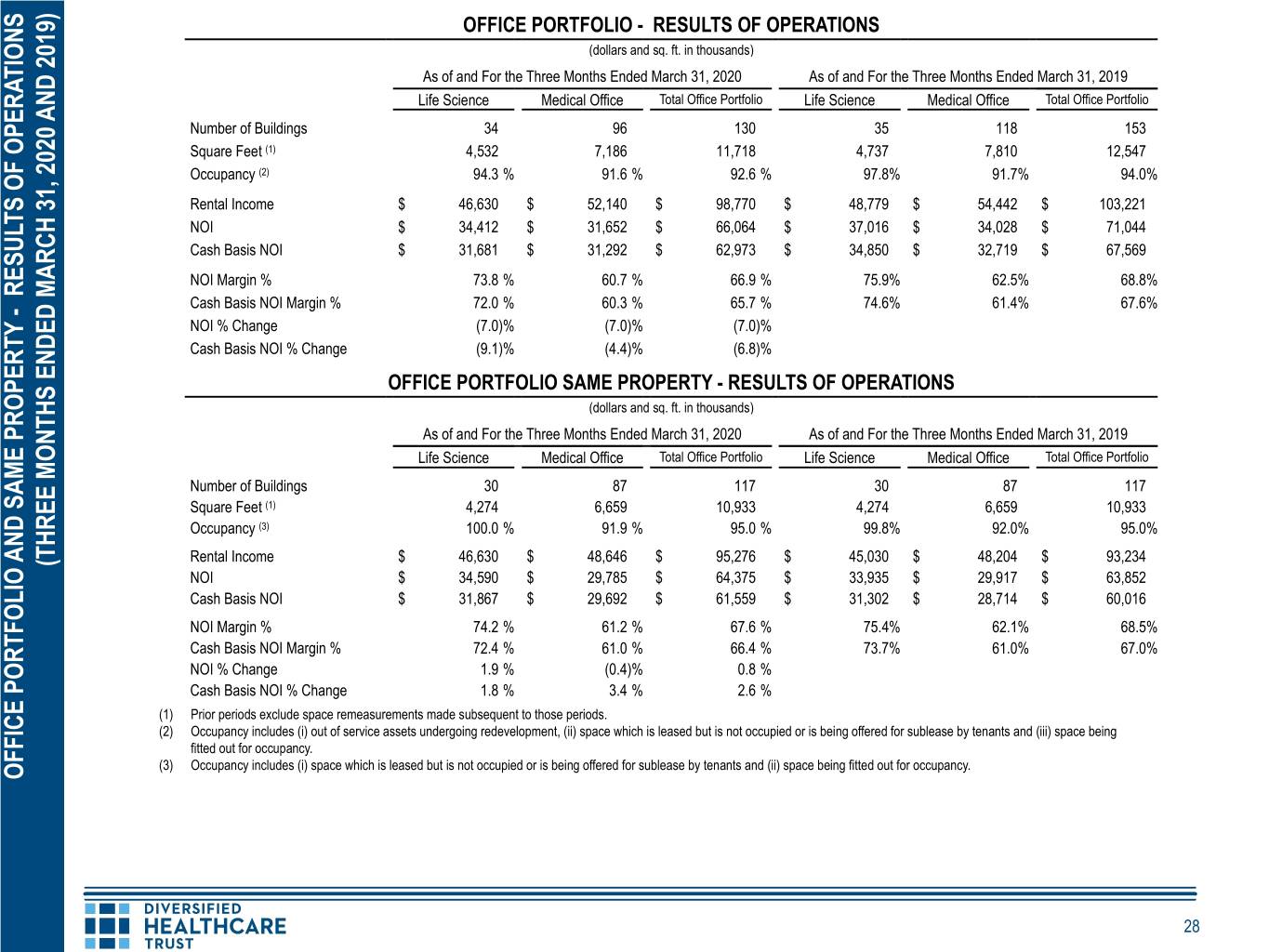

) OFFICE PORTFOLIO - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) 2019 As of and For the Three Months Ended March 31, 2020 As of and For the Three Months Ended March 31, 2019 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio AND Number of Buildings 34 96 130 35 118 153 Square Feet (1) 4,532 7,186 11,718 4,737 7,810 12,547 Occupancy (2) 94.3 % 91.6 % 92.6 % 97.8% 91.7% 94.0% Rental Income $ 46,630 $ 52,140 $ 98,770 $ 48,779 $ 54,442 $ 103,221 NOI $ 34,412 $ 31,652 $ 66,064 $ 37,016 $ 34,028 $ 71,044 Cash Basis NOI $ 31,681 $ 31,292 $ 62,973 $ 34,850 $ 32,719 $ 67,569 NOI Margin % 73.8 % 60.7 % 66.9 % 75.9% 62.5% 68.8% MARCH 31, 2020 Cash Basis NOI Margin % 72.0 % 60.3 % 65.7 % 74.6% 61.4% 67.6% NOI % Change (7.0)% (7.0)% (7.0)% Cash Basis NOI % Change (9.1)% (4.4)% (6.8)% OFFICE PORTFOLIO SAME PROPERTY - RESULTS OF OPERATIONS (dollars and sq. ft. in thousands) As of and For the Three Months Ended March 31, 2020 As of and For the Three Months Ended March 31, 2019 Life Science Medical Office Total Office Portfolio Life Science Medical Office Total Office Portfolio Number of Buildings 30 87 117 30 87 117 Square Feet (1) 4,274 6,659 10,933 4,274 6,659 10,933 Occupancy (3) 100.0 % 91.9 % 95.0 % 99.8% 92.0% 95.0% Rental Income $ 46,630 $ 48,646 $ 95,276 $ 45,030 $ 48,204 $ 93,234 (THREE MONTHS ENDED NOI $ 34,590 $ 29,785 $ 64,375 $ 33,935 $ 29,917 $ 63,852 Cash Basis NOI $ 31,867 $ 29,692 $ 61,559 $ 31,302 $ 28,714 $ 60,016 NOI Margin % 74.2 % 61.2 % 67.6 % 75.4% 62.1% 68.5% Cash Basis NOI Margin % 72.4 % 61.0 % 66.4 % 73.7% 61.0% 67.0% NOI % Change 1.9 % (0.4)% 0.8 % Cash Basis NOI % Change 1.8 % 3.4 % 2.6 % (1) Prior periods exclude space remeasurements made subsequent to those periods. (2) Occupancy includes (i) out of service assets undergoing redevelopment, (ii) space which is leased but is not occupied or is being offered for sublease by tenants and (iii) space being fitted out for occupancy. (3) Occupancy includes (i) space which is leased but is not occupied or is being offered for sublease by tenants and (ii) space being fitted out for occupancy. OFFICE PORTFOLIO AND SAME PROPERTY - RESULTS OF OPERATIONS - RESULTS AND SAME PROPERTY OFFICE PORTFOLIO 28

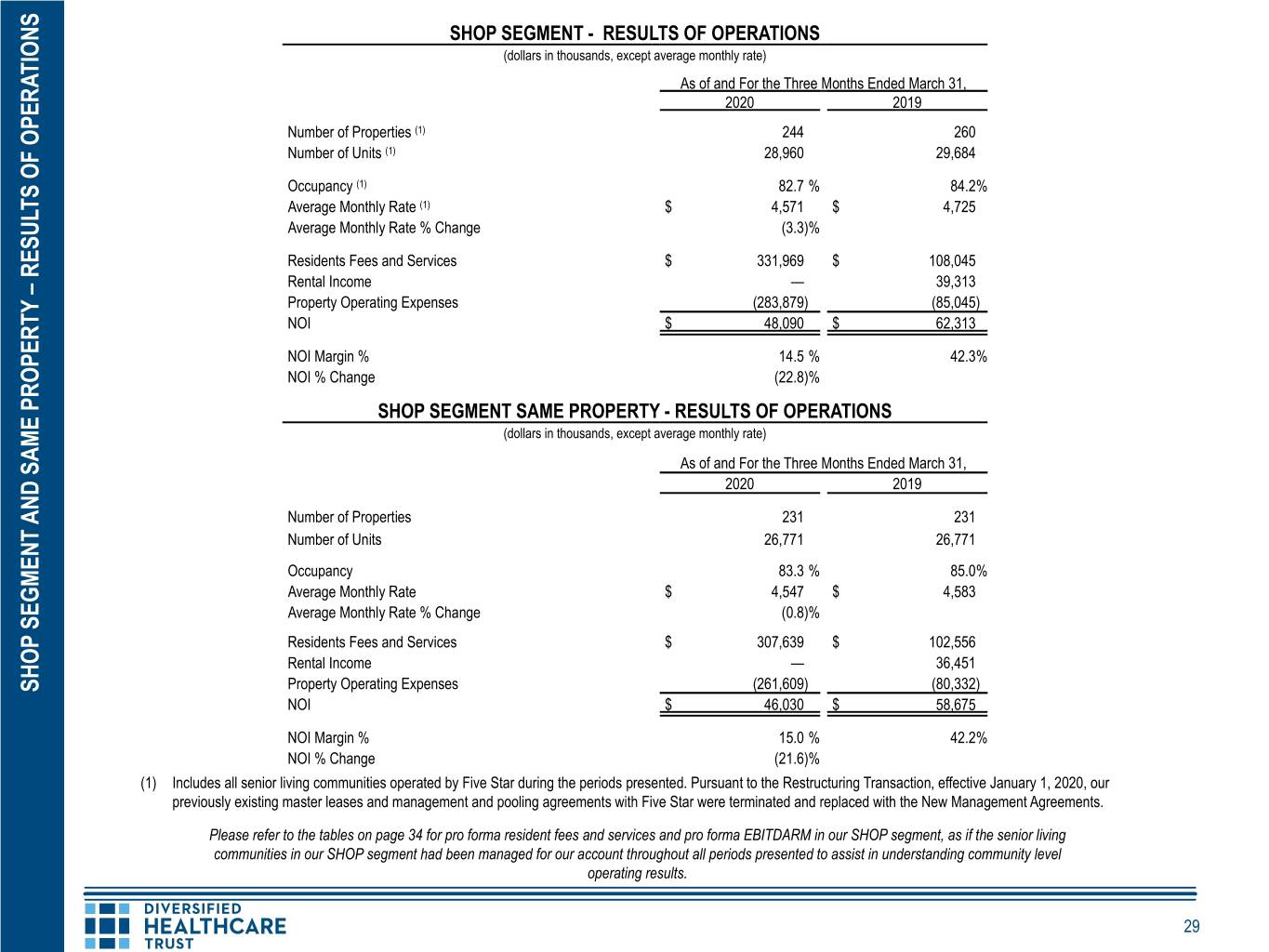

SHOP SEGMENT - RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) As of and For the Three Months Ended March 31, 2020 2019 Number of Properties (1) 244 260 Number of Units (1) 28,960 29,684 Occupancy (1) 82.7 % 84.2% Average Monthly Rate (1) $ 4,571 $ 4,725 Average Monthly Rate % Change (3.3)% Residents Fees and Services $ 331,969 $ 108,045 Rental Income — 39,313 Property Operating Expenses (283,879) (85,045) NOI $ 48,090 $ 62,313 NOI Margin % 14.5 % 42.3% NOI % Change (22.8)% SHOP SEGMENT SAME PROPERTY - RESULTS OF OPERATIONS (dollars in thousands, except average monthly rate) As of and For the Three Months Ended March 31, 2020 2019 Number of Properties 231 231 Number of Units 26,771 26,771 Occupancy 83.3 % 85.0% Average Monthly Rate $ 4,547 $ 4,583 Average Monthly Rate % Change (0.8)% Residents Fees and Services $ 307,639 $ 102,556 Rental Income — 36,451 SHOP SEGMENT AND SAME PROPERTY – RESULTS OF OPERATIONS – RESULTS AND SAME PROPERTY SEGMENT SHOP Property Operating Expenses (261,609) (80,332) NOI $ 46,030 $ 58,675 NOI Margin % 15.0 % 42.2% NOI % Change (21.6)% (1) Includes all senior living communities operated by Five Star during the periods presented. Pursuant to the Restructuring Transaction, effective January 1, 2020, our previously existing master leases and management and pooling agreements with Five Star were terminated and replaced with the New Management Agreements. Please refer to the tables on page 34 for pro forma resident fees and services and pro forma EBITDARM in our SHOP segment, as if the senior living communities in our SHOP segment had been managed for our account throughout all periods presented to assist in understanding community level operating results. 29

OFFICE PORTFOLIO LEASING SUMMARY (dollars and sq. ft. in thousands, except per sq. ft. data) As of and For the Three Months Ended 3/31/2020 12/31/2019 9/30/2019 6/30/2019 3/31/2019 Buildings 130 138 140 145 153 Total sq. ft. (1) 11,718 11,878 12,179 12,372 12,547 Occupancy (2) 92.6% 92.2% 92.3% 92.5% 94.0% Leasing Activity (sq. ft.): New leases 73 126 54 31 51 Renewals 229 268 260 281 447 Total 302 394 314 312 498 Rental Rate on New and Renewed Leases per Sq. Ft.: New leases $ 39.52 $ 26.77 $ 30.07 $ 30.18 $ 24.88 Renewals $ 10.15 $ 28.58 $ 24.50 $ 44.76 $ 25.03 Average net annual rent $ 17.26 $ 28.00 $ 25.45 $ 43.32 $ 25.01 Leasing Costs and Concession Commitments (3): New leases $ 5,805 $ 7,486 $ 3,205 $ 1,496 $ 1,857 Renewals 1,380 5,548 4,416 892 12,518 Total $ 7,185 $ 13,034 $ 7,621 $ 2,388 $ 14,375 Leasing Costs and Concession Commitments per Sq. Ft. (3): New leases $ 79.33 $ 59.17 $ 59.87 $ 48.69 $ 36.28 OFFICE PORTFOLIO LEASING SUMMARY Renewals $ 6.02 $ 20.76 $ 16.97 $ 3.17 $ 28.01 All new and renewed leases $ 23.77 $ 33.10 $ 24.29 $ 7.66 $ 28.86 Weighted Average Lease Term (years) (4): New leases 9.4 9.6 7.8 7.3 5.0 Renewals 5.7 8.8 5.7 15.8 8.9 All new and renewed leases 7.7 9.0 6.1 15.3 8.5 Leasing Costs and Concession Commitments per Sq. Ft. per Year (3): New leases $ 8.48 $ 6.14 $ 7.69 $ 6.68 $ 7.20 Renewals $ 1.05 $ 2.36 $ 2.98 $ 0.20 $ 3.16 All new and renewed leases $ 3.07 $ 3.66 $ 3.97 $ 0.50 $ 3.40 (1) Square feet measurements are subject to modest changes when space is periodically remeasured or reconfigured for new tenants. (2) Occupancy includes (i) out of service assets undergoing redevelopment, (ii) space which is leased but is not occupied or is being offered for sublease by tenants and (iii) space being fitted out for occupancy. (3) Includes commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. (4) Weighted based on annualized rental income pursuant to existing leases as of March 31, 2020. The above leasing summary is based on leases entered into during the periods indicated. 30

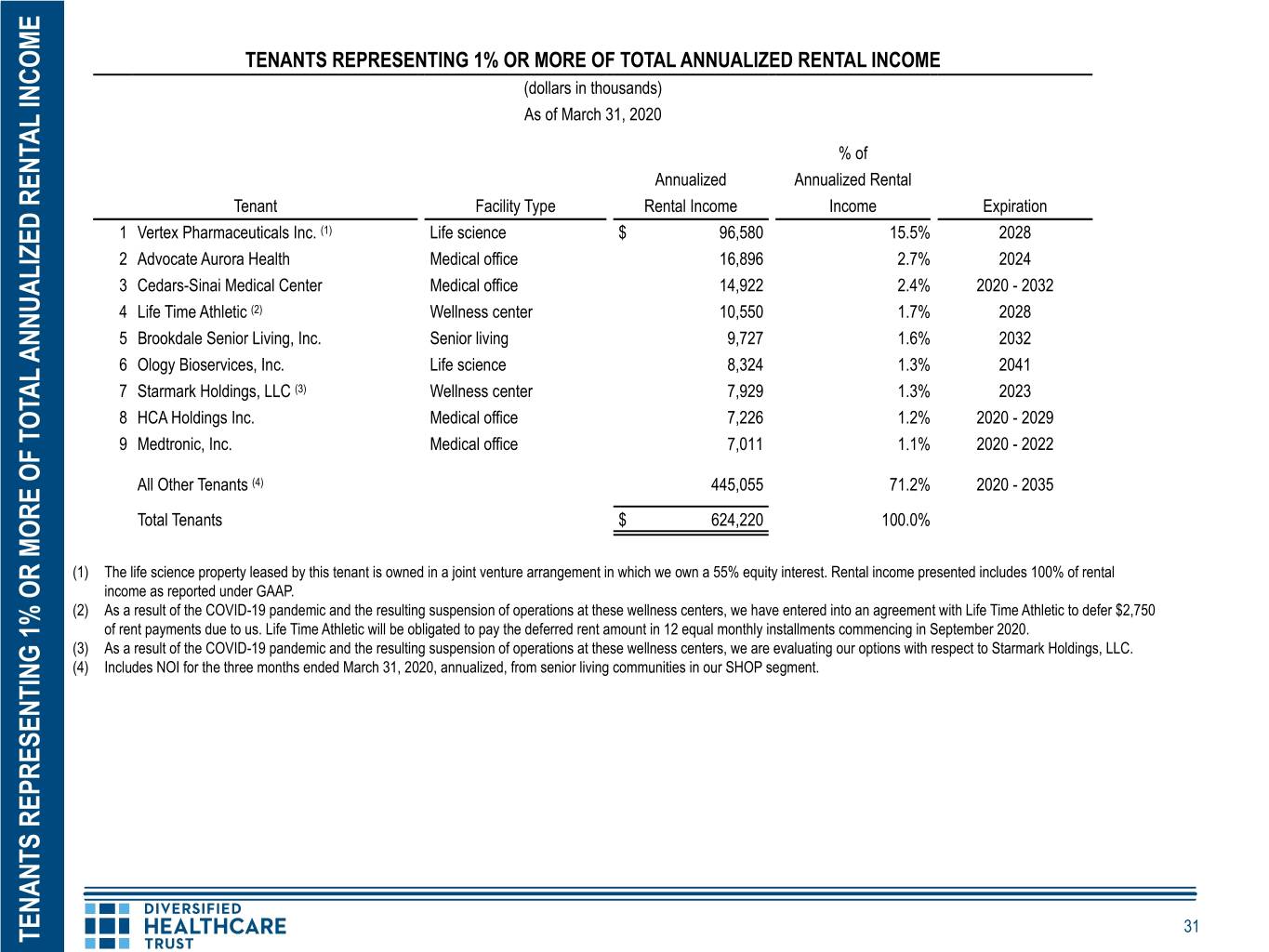

TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL INCOME (dollars in thousands) As of March 31, 2020 % of Annualized Annualized Rental Tenant Facility Type Rental Income Income Expiration 1 Vertex Pharmaceuticals Inc. (1) Life science $ 96,580 15.5% 2028 2 Advocate Aurora Health Medical office 16,896 2.7% 2024 3 Cedars-Sinai Medical Center Medical office 14,922 2.4% 2020 - 2032 4 Life Time Athletic (2) Wellness center 10,550 1.7% 2028 5 Brookdale Senior Living, Inc. Senior living 9,727 1.6% 2032 6 Ology Bioservices, Inc. Life science 8,324 1.3% 2041 7 Starmark Holdings, LLC (3) Wellness center 7,929 1.3% 2023 8 HCA Holdings Inc. Medical office 7,226 1.2% 2020 - 2029 9 Medtronic, Inc. Medical office 7,011 1.1% 2020 - 2022 All Other Tenants (4) 445,055 71.2% 2020 - 2035 Total Tenants $ 624,220 100.0% (1) The life science property leased by this tenant is owned in a joint venture arrangement in which we own a 55% equity interest. Rental income presented includes 100% of rental income as reported under GAAP. (2) As a result of the COVID-19 pandemic and the resulting suspension of operations at these wellness centers, we have entered into an agreement with Life Time Athletic to defer $2,750 of rent payments due to us. Life Time Athletic will be obligated to pay the deferred rent amount in 12 equal monthly installments commencing in September 2020. (3) As a result of the COVID-19 pandemic and the resulting suspension of operations at these wellness centers, we are evaluating our options with respect to Starmark Holdings, LLC. (4) Includes NOI for the three months ended March 31, 2020, annualized, from senior living communities in our SHOP segment. 31 TENANTS REPRESENTING 1% OR MORE OF TOTAL ANNUALIZED RENTAL INCOME ANNUALIZED RENTAL TENANTS REPRESENTING 1% OR MORE OF TOTAL

OFFICE PORTFOLIO LEASE EXPIRATION SCHEDULE (dollars in thousands) As of March 31, 2020 Office Portfolio Annualized Rental Income Expiring Cumulative Percentage of Annualized Rental Percent of Total Annualized Annualized Rental Income Year Income (1) Rental Income Expiring Expiring 2020 $ 26,661 7.0% 7.0% 2021 30,141 7.9% 14.9% 2022 34,950 9.1% 24.0% 2023 20,922 5.5% 29.5% 2024 50,762 13.3% 42.8% 2025 23,958 6.3% 49.1% 2026 21,647 5.7% 54.8% 2027 11,343 3.0% 57.8% 2028 115,197 30.1% 87.9% Thereafter 47,005 12.1% 100.0% Total $ 382,586 100.0% Average remaining lease term for our office portfolio (weighted by annualized rental income): 6.2 years Office Portfolio Square Feet with Leases Expiring Percent of Total Square Cumulative Percentage of Year Square Feet (1) Feet Expiring Total Square Feet Expiring 2020 750,508 6.9% 6.9% 2021 891,590 8.2% 15.1% 2022 1,176,892 10.8% 25.9% 2023 1,040,848 9.6% 35.5% 2024 1,838,297 16.9% 52.4% 2025 1,133,953 10.4% 62.8% 2026 717,723 6.6% 69.4% 2027 466,423 4.3% 73.7% 2028 1,440,951 13.3% 87.0% OFFICE PORTFOLIO LEASE EXPIRATION SCHEDULE OFFICE PORTFOLIO LEASE EXPIRATION Thereafter 1,394,235 13.0% 100.0% Total 10,851,420 100.0% (1) Includes data from our life science property owned in a joint venture arrangement in which we own a 55% equity interest. 32

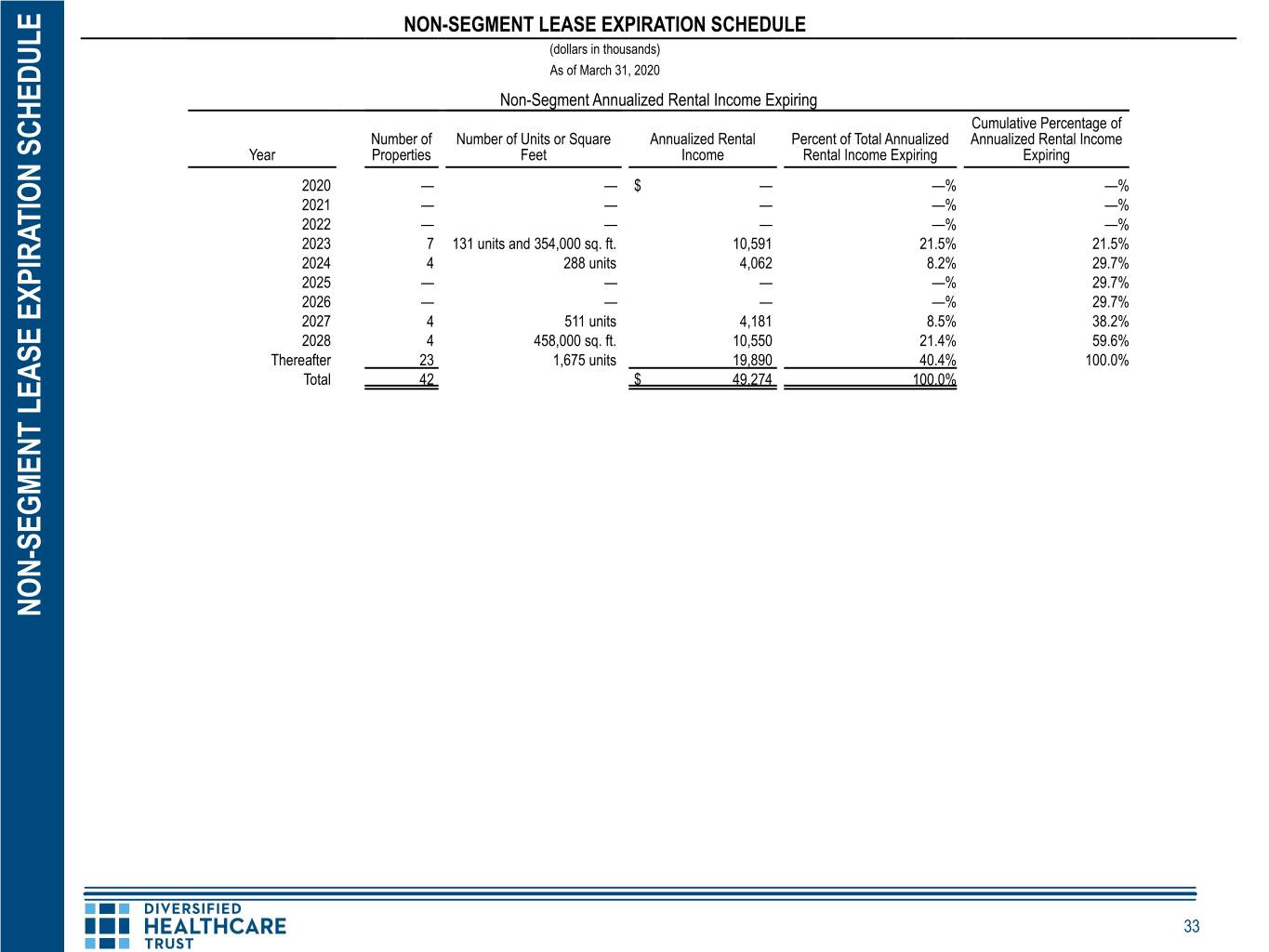

NON-SEGMENT LEASE EXPIRATION SCHEDULE (dollars in thousands) As of March 31, 2020 Non-Segment Annualized Rental Income Expiring Cumulative Percentage of Number of Number of Units or Square Annualized Rental Percent of Total Annualized Annualized Rental Income Year Properties Feet Income Rental Income Expiring Expiring 2020 — — $ — —% —% 2021 — — — —% —% 2022 — — — —% —% 2023 7 131 units and 354,000 sq. ft. 10,591 21.5% 21.5% 2024 4 288 units 4,062 8.2% 29.7% 2025 — — — —% 29.7% 2026 — — — —% 29.7% 2027 4 511 units 4,181 8.5% 38.2% 2028 4 458,000 sq. ft. 10,550 21.4% 59.6% Thereafter 23 1,675 units 19,890 40.4% 100.0% Total 42 $ 49,274 100.0% NON-SEGMENT LEASE EXPIRATION SCHEDULE NON-SEGMENT LEASE EXPIRATION 33

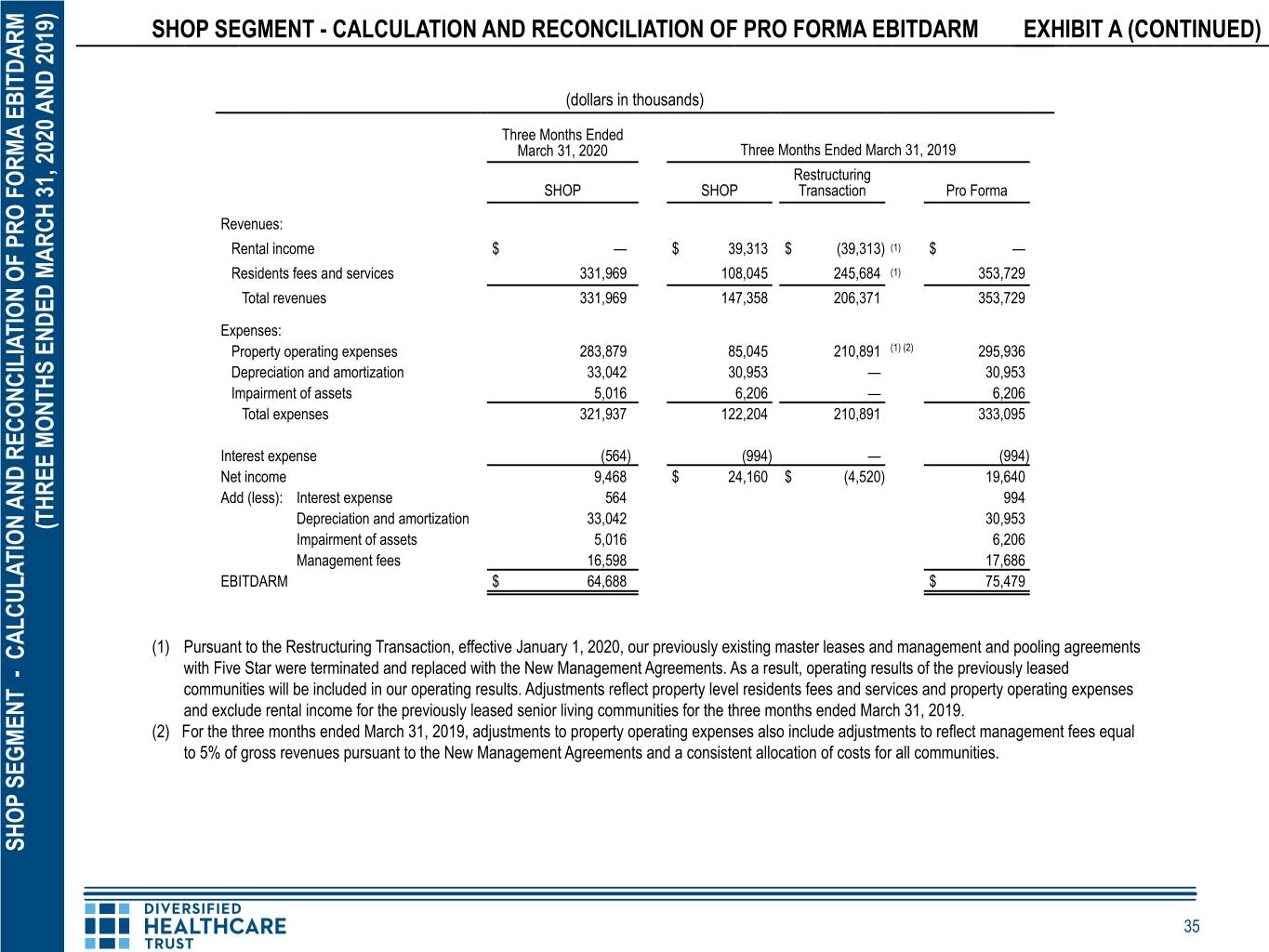

SHOP SEGMENT AND SAME PROPERTY – TRANSITIONAL PRO FORMA EBITDARM EXHIBIT A See page 35 for calculation and reconciliation of Pro Forma EBITDARM and Non-GAAP Financial Measures and Certain Definitions on page 36 for a definition of EBITDARM. SHOP SEGMENT - TRANSITIONAL PRO FORMA EBITDARM (dollars in thousands, except average monthly rate) As of and For the Three Months Ended March 31, 2020 2019 Number of Properties 244 260 Number of Units 28,960 29,684 Occupancy 82.7 % 84.2% Average Monthly Rate $ 4,571 $ 4,725 Average Monthly Rate % Change (3.3)% Residents Fees and Services $ 331,969 $ 353,729 Residents Fees and Services % Change (6.2)% EBITDARM $ 64,688 $ 75,479 EBITDARM % Change (14.3)% SHOP SEGMENT SAME PROPERTY - TRANSITIONAL PRO FORMA EBITDARM (dollars in thousands, except average monthly rate) As of and For the Three Months Ended March 31, 2020 2019 Number of Properties 231 231 Number of Units 26,771 26,771 Occupancy 83.3 % 85.0% Average Monthly Rate $ 4,547 $ 4,583 Average Monthly Rate % Change (0.8)% Residents Fees and Services $ 307,639 $ 312,064 Residents Fees and Services % Change (1.4)% EBITDARM $ 61,163 $ 71,466 EBITDARM % Change (14.4)% SHOP SEGMENT AND SAME PROPERTY – TRANSITIONAL PRO FORMA EBITDARM PRO FORMA – TRANSITIONAL AND SAME PROPERTY SEGMENT SHOP 34

SHOP SEGMENT - CALCULATION AND RECONCILIATION OF PRO FORMA EBITDARM EXHIBIT A (CONTINUED) (dollars in thousands) Three Months Ended March 31, 2020 Three Months Ended March 31, 2019 Restructuring SHOP SHOP Transaction Pro Forma Revenues: Rental income $ — $ 39,313 $ (39,313) (1) $ — Residents fees and services 331,969 108,045 245,684 (1) 353,729 Total revenues 331,969 147,358 206,371 353,729 Expenses: Property operating expenses 283,879 85,045 210,891 (1) (2) 295,936 Depreciation and amortization 33,042 30,953 — 30,953 Impairment of assets 5,016 6,206 — 6,206 Total expenses 321,937 122,204 210,891 333,095 Interest expense (564) (994) — (994) Net income 9,468 $ 24,160 $ (4,520) 19,640 Add (less): Interest expense 564 994 Depreciation and amortization 33,042 30,953 (THREE MONTHS ENDED MARCH 31, 2020 AND 2019) (THREE MONTHS ENDED MARCH 31, 2020 Impairment of assets 5,016 6,206 Management fees 16,598 17,686 EBITDARM $ 64,688 $ 75,479 (1) Pursuant to the Restructuring Transaction, effective January 1, 2020, our previously existing master leases and management and pooling agreements with Five Star were terminated and replaced with the New Management Agreements. As a result, operating results of the previously leased communities will be included in our operating results. Adjustments reflect property level residents fees and services and property operating expenses and exclude rental income for the previously leased senior living communities for the three months ended March 31, 2019. (2) For the three months ended March 31, 2019, adjustments to property operating expenses also include adjustments to reflect management fees equal to 5% of gross revenues pursuant to the New Management Agreements and a consistent allocation of costs for all communities. SHOP SEGMENT - CALCULATION AND RECONCILIATION OF PRO FORMA EBITDARM OF PRO FORMA AND RECONCILIATION SEGMENT - CALCULATION SHOP 35

NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS Non-GAAP Financial Measures We present certain "non-GAAP financial measures" within the meaning of applicable rules of the SEC, including net operating income, or NOI, Cash Basis NOI, same property NOI, same property Cash Basis NOI, earnings before interest, income tax, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, Adjusted EBITDAre, funds from operations attributable to common shareholders, or FFO attributable to common shareholders, and normalized funds from operations attributable to common shareholders, or Normalized FFO attributable to common shareholders. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net income or net income attributable to common shareholders as indicators of our operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income and net income attributable to common shareholders as presented in our condensed consolidated statements of income. We consider these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net income and net income attributable to common shareholders. We believe these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization, they may facilitate a comparison of our operating performance between periods and with other REITs and, in the case of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI, reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of our properties. NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI The calculations of NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI exclude certain components of net income in order to provide results that are more closely related to our property level results of operations. We calculate NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI as shown on pages 17 through 20. We define NOI as income from our real estate less our property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that we record as depreciation and amortization. We define Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fee amortization, if any, and non-cash amortization included in property operating expenses. We calculate same property NOI and same property Cash Basis NOI in the same manner that we calculate the corresponding NOI and Cash Basis NOI amounts, except that we only include same properties in calculating same property NOI and same property Cash Basis NOI. We use NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI to evaluate individual and company wide property level performance. Other real estate companies and REITs may calculate NOI, Cash Basis NOI, same property NOI and same property Cash Basis NOI differently than we do. EBITDA, EBITDAre, Adjusted EBITDAre and EBITDARM We calculate EBITDA, EBITDAre and Adjusted EBITDAre as shown on page 21. EBITDAre is calculated on the basis defined by the National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, as well as certain other adjustments currently not applicable to us. In calculating Adjusted EBITDAre, we adjust for the items shown on page 21 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than we do. Our SHOP segment includes both communities leased to Five Star and operated for our account under management agreements with Five Star as of and during the three months ended March 31, 2019. Pursuant to the Restructuring Transaction, our previously existing master leases and management and pooling agreements with Five Star were terminated and replaced with the New Management Agreements as of January 1, 2020. Under the New Management Agreements, management fees are 5% of resident fees and services revenues. We believe pro forma earnings before interest, taxes, depreciation, amortization, rent and management fees, or EBITDARM, is a meaningful transitional supplemental performance measure as it presents historical community level operating results regardless of the form of contractual arrangements and removes the impact of changes in the agreements (rents and management fees) between us and Five Star during the periods presented. The table on page 34 presents pro forma resident fees and services and pro forma EBITDARM as if the communities had been managed for our account throughout all periods presented to assist in understanding community level operating results. Other real estate companies and REITs may calculate EBITDARM differently than we do. FFO and Normalized FFO Attributable to Common Shareholders We calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders as shown on page 22. FFO attributable to common shareholders is calculated on the basis defined by Nareit, which is net income attributable to common shareholders, calculated in accordance with GAAP, excluding any gain or loss on sale of properties, loss on impairment of real estate assets and gains or losses on equity securities, net, if any, plus real estate depreciation and amortization and minus FFO adjustments attributable to noncontrolling interest, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO attributable to common shareholders, we adjust for the items shown on page 22 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating performance and NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS AND CERTAIN MEASURES FINANCIAL NON-GAAP the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO attributable to common shareholders and Normalized FFO attributable to common shareholders are among the factors considered by our Board of Trustees when determining the amount of distributions to our shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our revolving credit facility and term loan agreements and our public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance, and our expected needs for and availability of cash to pay our obligations. Other real estate companies and REITs may calculate FFO attributable to common shareholders and Normalized FFO attributable to common shareholders differently than we do. 36

NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS (CONTINUED) Adjusted total assets Adjusted total assets is the original cost of real estate assets calculated in accordance with GAAP before depreciation and after impairment write downs, if any, and excludes accounts receivable and intangible assets. Annualized dividend yield Annualized dividend yield is the annualized dividend declared during the applicable period divided by the closing price of DHC's common shares on The Nasdaq Stock Market LLC at the end of the relevant period. (CONTINUED) Annualized rental income Annualized rental income is based on rents pursuant to existing leases as of March 31, 2020. Annualized rental income includes estimated percentage rents, straight line rent adjustments and estimated recurring expense reimbursements for certain net and modified gross leases; excludes lease value amortization at certain of our medical office and life science properties and wellness centers. Annualized rental income amounts for our medical office and life science properties also include 100% of rental income as reported under GAAP from our life science property owned in a joint venture arrangement in which we own a 55% equity interest. Average monthly rate Average monthly rate is calculated by taking the average daily rate, which is defined as total residents fees and services divided by occupied units during the period, and multiplying it by 30 days. Building improvements Building improvements generally include expenditures to replace obsolete building components that extend the useful life of existing assets or cosmetic improvements to increase the marketability of the property. Cash basis NOI margin % Cash basis NOI margin % is defined as cash basis NOI as a percentage of cash basis rental income. Cash basis rental income excludes non-cash straight line rent adjustments, lease value amortization and lease termination fee amortization, if any. Consolidated income available for debt service Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, taxes, loss on asset impairment, gains or losses on equity securities, gains or losses on sales of properties and early extinguishment of debt, determined together with debt service for the applicable period. Development, redevelopment and other activities Development, redevelopment and other activities generally include capital expenditures that reposition a property or result in new sources of revenue. GAAP GAAP is U.S. generally accepted accounting principles. Gross book value of real estate assets Gross book value of real estate assets is real estate assets at cost plus certain acquisition costs, before depreciation and purchase price allocations, less impairment writedowns, if any. Gross purchase price Gross purchase price includes assumed debt, if any, and excludes acquisition costs and purchase price allocation adjustments, if any. Gross sales price Gross sales price excludes closing costs. Lease related costs Lease related costs generally include capital expenditures to improve tenants’ space or amounts paid directly to tenants to improve their space NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS AND CERTAIN MEASURES FINANCIAL NON-GAAP and leasing related costs, such as brokerage commissions and tenant inducements. Net debt Net debt is total debt less cash. 37

NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS (CONTINUED) NOI margin % NOI margin % is defined as NOI as a percentage of rental income. Non-Segment Non-Segment operations consists of triple net leased senior living communities that are leased to third party operators other than Five Star and wellness centers, and any other income or expenses that are not attributable to a specific reporting segment. (CONTINUED) Office Portfolio Office Portfolio consists of medical office properties leased to medical providers and other medical related businesses, as well as life science properties leased to biotech laboratories and other similar tenants. Rent coverage Rent coverage is calculated as operating cash flows from our tenants' facility operations of our properties, before subordinated charges, if any, divided by rent payable to us. Same Property For the three months ended March 31, 2020, same property consists of properties owned, in service and operated by the same operator continuously since January 1, 2019, including our life science property owned in a joint venture arrangement in which we own a 55% equity interest; excludes properties classified as held for sale or in redevelopment, if any. SHOP SHOP, or Senior Housing Operating Portfolio, consists of managed senior living communities that provide short term and long term residential living and in some cases care and other services for residents where we pay fees to the operator to manage the communities for our account. Properties in this segment include independent living communities, assisted living communities, active adult rental communities and SNFs. Pursuant to the Restructuring Transaction, the previously existing master leases and management and pooling agreements between us and Five Star were terminated and replaced with the New Management Agreements as of January 1, 2020. Prior to January 1, 2020, these senior living communities were either managed for our account by Five Star or triple net leased to Five Star. SNF SNF is a skilled nursing facility. Total gross assets Total gross assets is total assets plus accumulated depreciation. Total unencumbered assets Total unencumbered assets is the original cost of real estate assets not encumbered by mortgage debt calculated in accordance with GAAP before depreciation and after impairment write downs, if any, and exclude accounts receivable and intangible assets. Triple net leased senior living communities Triple net leased senior living communities include independent and assisted living communities and SNFs. NON-GAAP FINANCIAL MEASURES AND CERTAIN DEFINITIONS AND CERTAIN MEASURES FINANCIAL NON-GAAP 38

WARNING CONCERNING FORWARD-LOOKING STATEMENTS This presentation of supplemental operating and financial data may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. Whenever we use words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions, we are making forward-looking statements. These forward-looking statements are based upon our present intent, beliefs or expectations, but forward-looking statements are not guaranteed to occur and may not occur. Actual results may differ materially from those contained in or implied by our forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. The information contained in our filings with the SEC, including under “Risk Factors” in our periodic reports, or incorporated therein, identifies important factors that could cause our actual results to differ materially from those stated in or implied by our forward-looking statements. Our filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon forward-looking statements. Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. WARNING CONCERNING FORWARD-LOOKING STATEMENTS CONCERNING FORWARD-LOOKING WARNING 39