Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CENTERPOINT ENERGY INC | q12020earningsreleasep.htm |

| 8-K - 8-K - CENTERPOINT ENERGY INC | q120208-kearningsrelea.htm |

1ST QUARTER 2020 EARNINGS CALL MAY 7, 2020

CAUTIONARY STATEMENT This presentation and the oral statements made in connection herewith contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this presentation and the oral statements made in connection herewith are forward-looking statements made in good faith by CenterPoint Energy, Inc. (“CenterPoint Energy” or the “Company”) and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995, including statements concerning CenterPoint Energy’s expectations, beliefs, plans, objectives, goals, strategies, future operations, events, financial position, earnings, growth, impact of COVID-19, costs, prospects, capital investments or performance or underlying assumptions (including future regulatory filings and recovery, liquidity, capital resources, balance sheet, cash flow, capital investments and management, financing costs and rate base or customer growth) and other statements that are not historical facts. You should not place undue reliance on forward-looking statements. Actual results may differ materially from those expressed or implied by these statements. You can generally identify our forward-looking statements by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “target,” “will,” or other similar words. The absence of these words, however, does not mean that the statements are not forward-looking. Examples of forward-looking statements in this presentation include statements about the impacts of COVID-19 on our business (including impacts on customer demand and growth, capital expenditures and projects, bad debt expense, supply chain and expectations regarding plans to return to normal operations), our growth and guidance (including earnings and customer, utility and rate base growth (CAGR) expectations, taking into account assumptions related to COVID-19), operation and maintenance expense management initiatives, our equity issuances and anticipated needs, the creation of the Business Review and Evaluation Committee of our Board of Directors and the anticipated benefits therefrom, our proposed sale of CES, including the expected timing and benefits therefrom, the performance of Enable Midstream Partners, LP (“Enable”), including anticipated distributions received on its common units, capital resources and expenditures and production and drilling expectations, our regulatory filings and projections (including the Integrated Resources Plan in Indiana), our credit quality and balance sheet expectations, among other statements. We have based our forward-looking statements on our management’s beliefs and assumptions based on information currently available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions, and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Some of the factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of future regulatory, legislative and IRS decisions, financial market conditions, future market conditions, economic and employment conditions, impact of COVID-19, customer growth, Enable’s performance and ability to pay distributions and other factors described in CenterPoint Energy’s Form 10-Q for the quarter ended March 31, 2020 under “Risk Factors”, in CenterPoint Energy’s Form 10-K for the year ended December 31, 2019 under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Certain Factors Affecting Future Earnings” and in other filings with the Securities and Exchange Commission’s (“SEC”) by the Company, which can be found at www.centerpointenergy.com on the Investor Relations page or on the SEC website at www.sec.gov. A portion of slide 13 is derived from Enable’s investor presentation as presented during its Q1 2020 earnings presentation dated May 6, 2020. The information in this slide is included for informational purposes only. The content has not been verified by us, and we assume no liability for the same. You should consider Enable’s investor materials in the context of its SEC filings and its entire investor presentation, which is available at http://investors.enablemidstream.com. This presentation contains time sensitive information that is accurate as of the date hereof (unless otherwise specified as accurate as of another date). Some of the information in this presentation is unaudited and may be subject to change. We undertake no obligation to update the information presented herein except as required by law. Investors and others should note that we may announce material information using SEC filings, press releases, public conference calls, webcasts and the Investor Relations page of our website. In the future, we will continue to use these channels to distribute material information about the Company and to communicate important information about the Company, key personnel, corporate initiatives, regulatory updates and other matters. Information that we post on our website could be deemed material; therefore, we encourage investors, the media, our customers, business partners and others interested in our Company to review the information we post on our website. 2

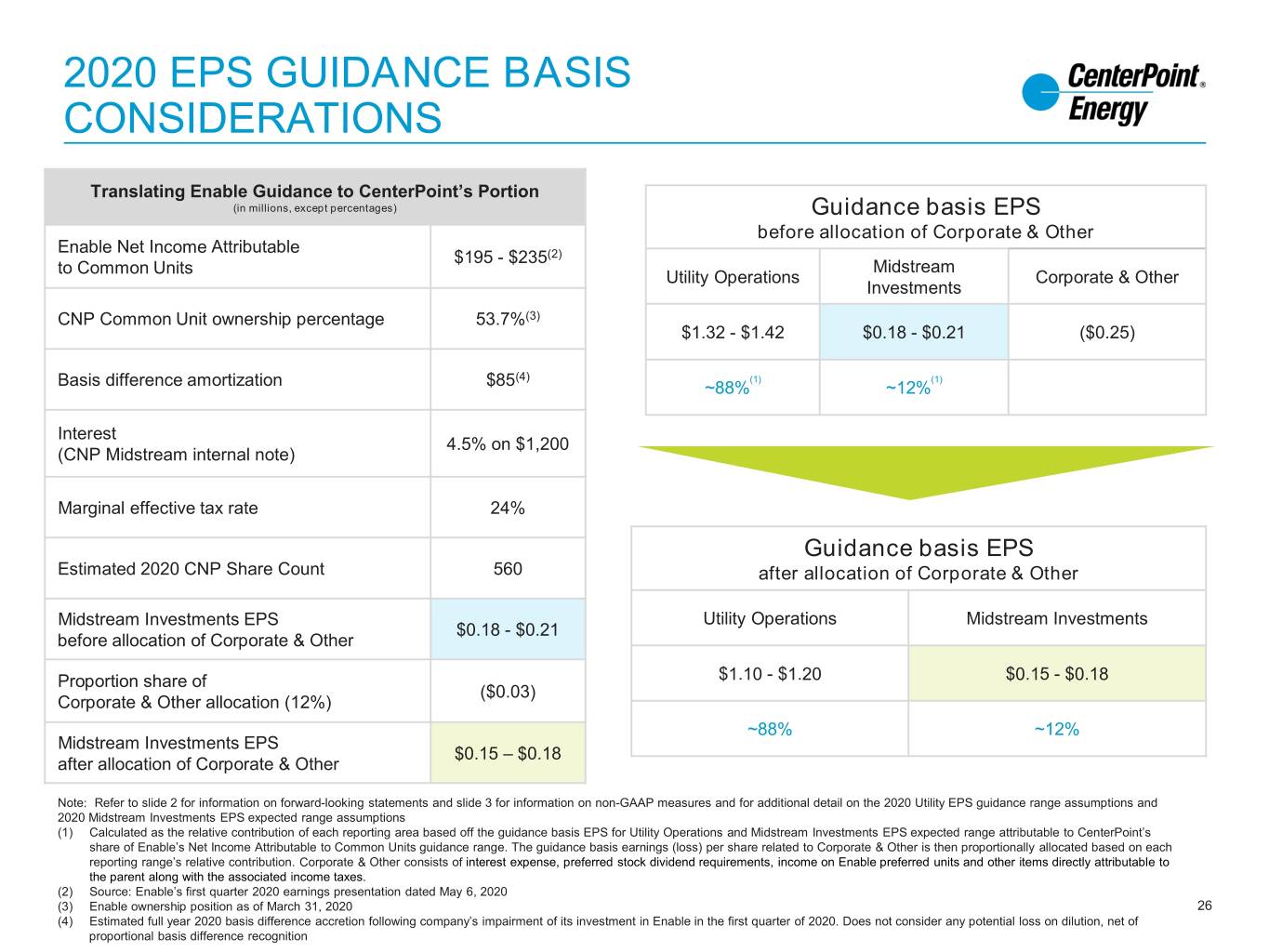

ADDITIONAL INFORMATION Use of Non-GAAP Financial Measures In addition to presenting its financial results in accordance with generally accepted accounting principles (GAAP), including presentation of income (loss) available to common shareholders and diluted earnings (loss) per share, CenterPoint Energy also provides guidance based on adjusted income, adjusted diluted earnings per share and adjusted funds from operations (“FFO”), which are non-GAAP financial measures. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance that excludes or includes amounts that are not normally excluded or included in the most directly comparable GAAP financial measure. To provide greater transparency on utility earnings, CenterPoint Energy’s 2020 guidance will be presented in two components, a guidance basis Utility EPS range and a Midstream Investments EPS expected range. Refer to slide 26 for further detail. The 2020 Utility EPS guidance range includes net income from Houston Electric, Indiana Electric and Natural Gas Distribution business segments, as well as after tax operating income from the Corporate and Other business segment. The 2020 Utility EPS guidance range considers operations performance to date and assumptions for certain significant variables that may impact earnings, such as customer growth (approximately 2% for electric operations and 1% for natural gas distribution) and usage including normal weather, throughput, recovery of capital invested through rate cases and other rate filings, effective tax rates, financing activities and related interest rates, regulatory and judicial proceedings, anticipated cost savings as a result of the merger and reflects dilution and earnings as if the newly issued preferred stock were issued as common stock. In addition, the Utility EPS guidance range incorporates a COVID-19 scenario range of $0.05 - $0.08 which assumes reduced demand levels with April as the peak and reflects anticipated deferral and recovery of incremental expenses, including bad debt. The COVID-19 scenario also assumes a gradual re-opening of the economy in CenterPoint Energy's service territories, leading to diminishing levels of demand reduction, which would continue through August. To the extent actual recovery deviates from these COVID-19 scenario assumptions, the 2020 Utility EPS guidance range may not be met and our projected full-year guidance range may change. The Utility EPS guidance range also assumes an allocation of corporate overhead based upon its relative earnings contribution. Corporate overhead consists of interest expense, preferred stock dividend requirements, income on Enable preferred units and other items directly attributable to the parent along with the associated income taxes. Utility EPS guidance excludes (a) certain integration and transaction-related fees and expenses associated with the merger, (b) severance costs, (c) Midstream Investments and associated allocation of corporate overhead, (d) results related to Infrastructure Services and Energy Services, including anticipated costs and impairment resulting from the sale of those businesses, and (e) earnings or losses from the change in value of ZENS and related securities. In providing this guidance, CenterPoint Energy uses a non-GAAP measure of adjusted diluted earnings per share that does not consider other potential impacts, such as changes in accounting standards or unusual items, which could have a material impact on GAAP reported results for the applicable guidance period. CenterPoint Energy is unable to present a quantitative reconciliation of forward looking adjusted diluted earnings per share because changes in the value of ZENS and related securities are not estimable as they are highly variable and difficult to predict due to various factors outside of management’s control. The 2020 Midstream Investments EPS expected range assumes a 53.7 percent limited partner ownership interest in Enable and includes the amortization of the Company’s basis differential in Enable and assumes an allocation of CenterPoint Energy corporate overhead based upon Midstream Investments relative earnings contribution. The Midstream Investments EPS expected range reflects dilution and earnings as if the CenterPoint Energy newly issued preferred stock were issued as common stock. The Midstream Investments EPS expected range takes into account such factors as Enable’s most recent public outlook for 2020 dated May 6, 2020, and effective tax rates. The company does not include other potential impacts such as any changes in accounting standards, impairments or Enable’s unusual items A reconciliation of income (loss) available to common shareholders and diluted earnings (loss) per share to the basis used in providing guidance is provided in this presentation on slides 27 and 28. The Company is unable to present a quantitative reconciliation of forward-looking adjusted income and adjusted diluted earnings per share used in providing earnings guidance because changes in the value of ZENS and related securities are not estimable as they are highly variable and difficult to predict due to various factors outside of management’s control. These excluded items, including unusual items, could have a material impact on GAAP-reported results for the applicable guidance period. A reconciliation of net cash from operating activities to adjusted FFO is provided in this presentation on slides 29 and 30. Management evaluates the company’s financial performance in part based on adjusted income, adjusted diluted earnings per share and adjusted FFO. Management believes that presenting these non-GAAP financial measures enhances an investor’s understanding of CenterPoint Energy’s overall financial performance by providing them with an additional meaningful and relevant comparison of current and anticipated future results across periods. The adjustments made in these non-GAAP financial measures exclude items that Management believes does not most accurately reflect the Company’s fundamental business performance. These excluded items are reflected in the reconciliation tables, where applicable. CenterPoint Energy’s adjusted income, adjusted diluted earnings (loss) per share and adjusted FFO non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, income (loss) available to common shareholders, diluted earnings per share and net cash from operating activities, which respectively are the most directly comparable GAAP financial measures. These non-GAAP financial measures also may be different than non-GAAP financial measures used by other companies. 3

THANK YOU EMPLOYEES During these unprecedented times, we are proud of the tremendous efforts our employees are making every day to continue providing safe and reliable electricity and natural gas to our customers. We would like to extend a special thank you to our operations personnel who are on the front lines keeping the electricity on and the natural gas flowing during a time when our customers need them most. 4

KEY TAKEAWAYS Strong First Quarter Utility guidance basis EPS of $0.50(1), over 20% Q-o-Q increase Mitigating COVID-19 Impact Constructive regulatory mechanisms Transformative Equity Capital Raise $1.4 billion of new equity capital to reduce debt and eliminate anticipated equity needs through 2022 Strong Investment Grade Balance Sheet Equity issuance improves estimated 2020 FFO to debt by ~ 60 bps(2) Two New Directors and New Board Committee New Business Review and Evaluation Committee to support value enhancement for all stakeholders Reiterating Utility EPS Guidance 2020 Utility EPS of $1.10 - 1.20 and 5-7% Utility EPS CAGR, including COVID impact Notes: Refer to slide 2 for information on forward-looking statements and slide 3 for information on non-GAAP measures, full year 2020 COVID-19 guidance assumptions and other guidance assumptions 5 (1) Excluding non-cash impairments. Refer to slides 27 and 28 for a reconciliation of diluted EPS on a GAAP basis to diluted EPS on a guidance basis (2) Versus prior equity guidance. Dependent on equity treatment from Moody’s and Fitch

SIGNIFICANT EQUITY INVESTMENT REMOVED ANTICIPATED EQUITY NEEDS THROUGH 2022 Significant $1.4 billion equity investment from highly credible investors with a record of value creation $1.4 billion equity investment comprised of: Transaction Led by Long-Term • $725 million mandatory convertible preferred stock Oriented, Highly Credible Investors • $675 million common stock “We are pleased that these sophisticated and experienced investors have chosen to Transaction Furthers Several Key Goals invest with CenterPoint. All of the investors • Strengthens investment grade credit profile with 2020E FFO in this transaction have a proven ability in to debt above prior guidance of low- to mid-14% collaborating to drive substantial value enhancement and bring strong, long-term • Eliminates all anticipated equity needs through 2022, with credibility in the U.S. utility industry. With no total 2020 to 2022 equity issuance below midpoint of prior further anticipated equity needs through guidance 2022, these equity investments provide a transformational opportunity for the • Funds robust $13 billion investment program driving Company to operate from a position of forecasted 7.5% long-term rate base growth heightened strength and flexibility while remaining focused on providing safe, • Supports 50-55% utility dividend payout while maintaining reliable, affordable and sustainable service favorable credit metrics to our customers and executing on the wide range of long-term opportunities across our • Drives forecasted 5-7% utility EPS CAGR over long-term utility businesses.” guidance range John W. Somerhalder II • Benefits all stakeholders through a stronger balance sheet and Interim president and CEO no impact on customer rates CenterPoint Energy 6 Notes: Refer to slide 2 for information on forward-looking statements and slide 3 for information on non-GAAP measures, full year 2020 COVID-19 guidance assumptions and other guidance assumptions

NEW BUSINESS REVIEW AND EVALUATION COMMITTEE FORMED BY THE BOARD Includes 2 new Board members and will complete a 5-month comprehensive review ✓ New Board Members: David Lesar (former CEO of Halliburton) and Barry Smitherman (former chairman of PUCT and Railroad Commission of Texas) will join the Board ✓ Comprehensive Mandate: Provide advice and recommendations to the Board on potential value maximizing strategic business actions to further enhance the Company’s financial strength, positioning and value proposition, including configuration and alignment of current portfolio ✓ Transparent Outcomes: Investor Day by early 2021 to update stakeholders on strategic business plan Committee Membership John Somerhalder Martin Nesbitt Phillip Smith David Lesar (Chair) Barry Smitherman • Director Since 2016 • Director Since 2018 • Director Since 2014 • New Director • New Director • Outstanding energy • Financial, strategic and • Over 40 years of • Enhanced • Former Chairman of industry executive with operational experience business, financial shareholder value as the PUCT and the vast utility experience as CEO and founder of and accounting CEO of Halliburton for Railroad Commission and the skills various companies experience 17 years of Texas New Directors 7

Q1 2020 COVID-19 PANDEMIC UPDATE OPERATIONS • Safety and well-being of CenterPoint’s customers, employees, contractors and the communities we serve are top priorities – Committed to being “Always There” for our customers by enacting temporary suspension of DNP(1) – Implementation of Pandemic Preparedness and Corporate Response Plans ensuring business continuity – $1.5 million COVID-19 Relief Fund via CenterPoint Energy Foundation • No material impact on field operations or customer service; minimal confirmed cases among workforce • Supply chain – no material impacts experienced or anticipated at this time • Capital projects – implemented safety precautions with no significant construction impacts or delays experienced or anticipated as a result of the pandemic • Indiana Electric IRP – no material delays expected, filing remains on target for Q2 as previously disclosed • Management currently preparing for gradual and safe return to normal operations 8 Note: Refer to slide 2 for information on forward-looking statements; IRP – Integrated Resource Plan; DNP – Disconnect for non-pay (1) DNP moratorium program for Houston Electric is applicable for qualified residential customers, subject to third party verification, as permitted by the Texas Public Utility Commission

FIRST QUARTER 2020 EARNINGS SUMMARY First quarter 2020 loss of $2.44 per diluted Reiterate 2020 Utility Guidance share, which included non-cash impairment Basis EPS Range charges and losses on assets held for sale $1.10 - $1.20(1) totaling $3.12 per diluted share, compared and with earnings of $0.28 per diluted share for 5-7% Utility EPS CAGR the first quarter of 2019 through 2024 Guidance Basis (Non-GAAP) Diluted EPS(1) Q-o-Q Utility Guidance Basis Diluted (1) $0.10 EPS Primary Drivers: $0.05 Rate relief D&A Additional month of Usage $0.50 earnings from jurisdictions (driven by weather) $0.41 acquired through Feb. Interest Expense 2019 Vectren merger Equity Return(2) O&M Customer growth Q1 2019 Q1 2020 Taxes Utility Operations (1) Midstream Investments(1) Notes: Refer to slide 3 for information on non-GAAP measures, full year 2020 COVID-19 guidance assumptions and other guidance assumptions. Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS 9 (1) Refer to slides 27 and 28 for a reconciliation of diluted EPS on a GAAP basis to diluted EPS on a guidance basis (2) Primarily due to the annual true-up of transition charges

COVID-19 PANDEMIC UPDATE COVID-19 EXPENSES, INCLUDING BAD DEBT • Collaboration with various PUCs across COVID-19 expense deferral available in nearly 70% of jurisdictions CenterPoint’s regulated footprint to address recovery of COVID-19 Rate base by jurisdiction(1) expenses MS LA 1% 1% • Nearly 70% of CenterPoint’s regulated AR footprint has addressed recovery of OK 5% 1% TX OH (Gas) COVID-19 expenses 6% 10% – Allowing deferral of incremental expenses MN associated with COVID-19, which includes 8% bad debt expense – Potential recovery through annual IN TX (Gas) (Electric) mechanisms or other rate proceedings 13% 44% IN • Bad debt expense not anticipated to be (Electric) materially different than planned with 11% regulatory mechanisms in place COVID-19 mechanisms in place Existing favorable bad debt mechanism Note: Refer to slides 23 – 25 for full detail on regulatory filings; PUC – Public Utility Commission In progress 10 (1) Total projected rate base for the year ended December 31, 2019 and not just the amount that has been reflected in rates. Amounts may differ from regulatory filings

COVID-19 PANDEMIC UPDATE Q2 DEMAND SENSITIVITIES & FY GUIDANCE ASSUMPTIONS Early Q2 Estimated Impacts April 2020 Estimated Demand Impact(1) • “Stay-at-home” practices estimated to yield modest negative Houston Indiana Natural Gas demand impacts associated with electric commercial and small Electric Electric Distribution industrial customer classes Residential 4 – 6% 10 – 11% Flat • Negative C&I electric demand impacts anticipated to be partially offset by increased residential electric usage with more Commercial 15 – 20% 11 – 12% 10 – 25% individuals working from home (2) Industrial 10 – 15% 10 – 11% 10 – 25% • Natural gas C&I demand reduction influenced primarily by restaurant, retail and manufacturing closures; demand for construction, agriculture and some electric energy production is Modest demand impacts with estimated normal April utility EPS reduced by $0.01 - $0.02 • Warmer than normal weather conditions experienced for April under COVID-19 guidance assumptions across all utilities • While long-term pandemic impacts continue to unfold, anticipate April to be the demand decline peak with conditions to gradually reverse over the summer Full Year 2020 COVID-19 Guidance Assumptions ― Gradual re-opening of economy ― Reflects anticipated deferral and recovery of incremental expenses including bad debt ― Anticipate April to be peak of reduced demand levels ― Assumes normal weather conditions ― Anticipate reduced demand levels to diminish over summer months through August ― Estimated full year utility EPS impact of $0.05 - $0.08 Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on 2020 Utility EPS guidance assumptions and non-GAAP measures ; C&I – Commercial and Industrial (1) Represents estimated impacts based upon data available as of the date of this presentation. Decline in demand not completely indicative of lost revenues due to fixed charges and minimum volume 11 commitments which help to support revenues. See slide 22 for further detail on fixed charges as a function of rates (2) Small industrial only. The majority of the Houston Electric sensitivity shown on slide 22 is related to small industrial

SALE OF INFRASTRUCTURE SERVICES & ENERGY SERVICES FOR $1.25B Transaction Details Strategic Rationale ✓ Infrastructure Services(1) ✓ Improves Business Risk Profile(3) ― Sale closed April 9, 2020 ✓ Strengthens Balance Sheet and ― Sales price $850 million; net-after tax Credit Quality(4) proceeds ~$670 million ― Proceeds repaid outstanding debt ✓ Increases Earnings Contribution from Core Utility • Energy Services(2) ― Expected closing Q2 2020 ✓ Reduces Earnings Volatility ― Sales price $400 million; estimated net- after tax proceeds ~$385 million ✓ Focuses on Robust Utility Capital ― Proceeds expected to repay outstanding Investment Program debt Note: Refer to slide 2 for information on forward-looking statements (1) For additional detail, refer to press release and Form 8-K filed on February 3, 2020 and April 9, 2020 (2) For additional detail, refer to press release and Form 8-K filed on February 24, 2020 (3) As determined by rating agencies 12 (4) Specifically CenterPoint Energy and CERC

ENABLE UPDATE • Market Update – Enable expects some amount of volume curtailment in the Anadarko and Williston Basins – Most producer drilling and completion activity for the balance of 2020 is expected to be focused in the Haynesville Shale • Enable Positioning – Recently announced actions expected to increase retained cash flow on an annualized basis by approximately $450 million, improving financial flexibility and positioning Enable to fully fund its expansion capital program and reduce total debt in 2020 – Limited capital spending to contracted, long-term transportation and storage projects and contracted, capital-efficient gathering and processing projects – Committed to making further capital and cost reductions, as appropriate, should challenging market conditions persist • Other Key Business Updates – Recently received FERC approval of MRT’s rate case settlements, establishing rates for services on the MRT system that provide a return on MRT’s historical investments, recovery of the pipeline’s ongoing operating costs and rate certainty for customers – Gulf Run Pipeline project is proceeding on schedule with certificate applications filed Feb. 28, 2020 13 Note: All information is per Enable’s first quarter 2020 earnings presentation dated May 6, 2020; MRT – Enable-Mississippi River Transmission, LLC

ACHIEVING OUR 5-7% UTILITY GROWTH TARGET Top Quartile Customer Growth Lower-risk T&D and Gas LDC and Low Customer Rates ◼ 96%(1) of rate base from lower-risk Gas ◼ Electric customer growth of 2.0%(2) and LDC and electric T&D utility asset bases gas of 1.2%(3), both above the national ◼ Premium utilities earning at or near their average allowed ROEs ◼ Electric T&D(2) and natural gas distribution customer rates below peers Scale Utility Operations Disciplined O&M Control (1) ◼ Total rate base: $15B ◼ Focus on O&M creates rate headroom ◼ Serve over 7M(4) customers and drives earnings growth and shareholder value creation ◼ Diversified across 8 states Investment Grade Credit 7.5%(5) Rate Base CAGR Metrics (6) ◼ $13B regulated capital investment plan ◼ Continued focus on strengthening the ◼ Utility investments supported by attractive balance sheet and maintaining capital recycling from Enable cash flow investment-grade credit quality across our utilities Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on full year 2020 COVID-19 guidance assumptions and other guidance assumptions (1) Based on 2019E Electric T&D, Electric Generation and Natural Gas Distribution rate base as calculated by the individual jurisdictions (2) Houston Electric service territory customer growth rate from 2019 versus 2018 (3) Exclusive of jurisdictions acquired through the merger, customer growth rate from 2019 versus 2018 14 (4) As of December 31, 2019 (5) Based off 2019E through 2024E Electric T&D, Electric Generation and Natural Gas Distribution rate base as calculated by the individual jurisdictions (6) For the period 2020E through 2024E

FIRST QUARTER 2020 HIGHLIGHTS UTILITY OPERATIONS Customer growth and capital Disciplined O&M management Optimize regulatory outcomes • Approximately $600 million • On target to achieve estimated • Rate relief filings increasing utility capital deployed across 2020 $40 million(2) incremental incremental annual revenue by approximately $40 million(3) growing service territories on O&M savings by YE • MN interim rates into effect – Load growth • Sustained O&M management January 1, 2020 – System modernization supports EPS growth and • Houston Electric rate case final maintaining investment-grade – Pipeline replacement order, new rates into effect April credit metrics • Approximately 2.3% electric(1) 23, 2020 and 1.0% gas Y-o-Y customer growth Note: TCOS – Transmission Cost of Service (1) Representative of Houston Electric 15 (2) Inclusive of Houston Electric, Indiana Electric Integrated and Natural Gas Distribution business segments. Excluding utility costs to achieve and amounts with revenue offsets (3) Related to regulatory proceedings filed in the first quarter of 2020, exclusive of TCJA impacts

FIRST QUARTER 2020 NON-CASH IMPAIRMENTS (CONTINUING OPERATIONS) Impairment charges are non-cash AND do not impact: ✓ Liquidity ✓ Cash flow ✓ Compliance with debt covenants Midstream Investments Indiana Electric • $1,177 million after-tax non-cash impairment charge • $185 million non-cash impairment charge related to goodwill – $1,166 million related to investment in Enable – $11 million related to company’s share of impairment • Impairment charge is result of BV = FV at Vectren charges recorded by Enable for goodwill and long-lived merger close (February 1, 2019) and no cushion to assets absorb current market conditions • Reduces equity investment from $2.4 billion to $848 • Resulting BV represents FV per market participants, million however not indicative of management’s view on the long-term value of business due to continued • Annualized basis difference accretion to increase significant capital investment opportunity supporting from approximately $47 million to $100 million growth and replacement of rate base assets 16 Note: Refer to slide 2 for information on forward-looking statements; BV – Book Value; FV – Fair Value

Q1 2020 V Q1 2019 GUIDANCE BASIS (NON-GAAP) EPS(1) DRIVERS FOR CONTINUING OPERATIONS (2) Utility Operations $0.05 $0.01 $0.10 $0.07 Midstream Investments $0.01 $0.05 $0.00 Midstream Investments Primary Drivers Primary Drivers Primary Drivers Primary Drivers $0.02 O&M $0.01 Additional $0.06 Rate Relief $0.03 Income Management month of earnings $0.04 Additional Taxes $0.01 Customer resulting from month of earnings $0.02 Other Growth Feb. 2019 merger resulting from Income $0.02 $0.01 Rate Relief Feb. 2019 merger $0.02 Preferred Depreciation and $0.01 Usage $0.01 O&M Dividends Amortization and Management $0.01 Net $0.50 Other Taxes $0.01 Customer interest expense Utility $0.01 Equity Growth Operations $0.41 Return $0.02 Usage Utility $0.02 Operations Depreciation and Amortization and Other Taxes $0.01 Interest Expense Q1 2019 Consolidated Houston Indiana Electric Natural Gas Corporate & Other Midstream Q1 2020 Consolidated Guidance Basis EPS(1) Electric Integrated Distribution Allocation Investments(3) Guidance Basis EPS(1) Note: All bars exclude certain integration and transaction-related fees and expenses associated with the merger, severance costs and non-cash impairment charges. Quarterly 2019 Utility EPS on a guidance basis is as follows: Q1 2019 - $0.41; Q2 - $0.23; Q3 - $0.39; Q4 - $0.28 (1) Refer to slide 3 for information on non-GAAP measures and slide 27 and 28 for reconciliation to GAAP measures (2) Includes Houston Electric – T&D, Indiana Electric – Integrated and Natural Gas Distribution and the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 26 for details 17 (3) Reference Enable’s Q1 2020 Form 10-Q and first quarter 2020 earnings materials dated May 6, 2020. Includes the associated allocation of Corporate & Other based upon relative earnings contribution. See slide 26 for details

DISCIPLINED O&M MANAGEMENT Utility O&M Management(1) Key O&M Management Initiatives ($40) ➢ Approximately half of targeted 2020 O&M reductions anticipated to be derived from support functions $1,500(2) ➢ Align work activities and organizational $1,460 $ in millions in $ approaches with our utility-focused strategy ➢ Assess operational practices and 2020E Utility O&M Incremental O&M Revised 2020E per Q4'19 earnings call reduction in 2020 Utility O&M optimize to drive O&M savings Earnings growth, Disciplined O&M management shareholder value and customer rate headroom Note: Refer to slide 2 for information on forward-looking statements (1) Inclusive of Houston Electric, Indiana Electric Integrated and Natural Gas Distribution business segments. Excluding certain merger costs, utility costs to achieve, severance and amounts with revenue 18 offsets

FINANCING OUTLOOK UPDATE COMMITTED TO INVESTMENT-GRADE CREDIT • Execution of $1.4 billion equity transaction Consolidated Adjusted FFO/Debt o $725 million Mandatory Convertible Preferred Stock Target ~14 - 14.5% o $675 million Common Stock 13.6%(1) o Delevers balance sheet, strengthens investment-grade credit metrics and overall credit profile o Anticipate no further equity needs through 2022 • Remain committed to maintaining solid, investment-grade credit quality 2019 2020E - 2024E o Balance sheet strength provides base to capture the robust capital investment opportunity in our regulated utility portfolio o Improved business risk profile from sale of Infrastructure Services and pending sale of Energy Services seen as credit Ample Liquidity Capacity positive by rating agencies (in billions) o Proceeds from sale of Infrastructure Services and pending sale (2) of Energy Services to pay down debt Total credit facility capacity $5.1 (3) o Rigorous capital allocation process and on-going disciplined Total utilized (2.0) O&M management Available liquidity as of May 1, 2020 $3.1 • Ample liquidity to withstand expected COVID-19 pandemic impact Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on non-GAAP measures (1) Reference slides 29 and 30 for reconciliation 19 (2) Includes all credit facilities at both parent and subsidiary levels. For additional detail, refer to CenterPoint Energy’s first quarter 2020 Form 10-Q (3) Represents outstanding loans, letters of credit and commercial paper. For additional detail, refer to CenterPoint Energy’s first quarter 2020 Form 10-Q

REITERATE 2020 – 2024 UTILITY GUIDANCE BASIS EPS OUTLOOK Robust regulated utility growth plan drives 5-7% utility growth 5 – 7% Utility EPS ➢ $13 billion 5-year capital investment plan CAGR through 2024 ➢ 7.5% rate base CAGR from 2019 – 2024 $1.10 – $1.20(1) ➢ Top quartile customer growth ➢ Electric(2) and gas rates below peer average ➢ Continued disciplined O&M management ➢ Premium utility portfolio targeting allowed ROEs 2020 Guidance range considerations: 2020 Utility Guidance Basis EPS Range Strong Q1 Results Full-year 2020 estimated Constructive COVID-19 COVID -19 impact Regulatory Treatment Pull-Forward of Future Equity Targeted reduced O&M Dilution to 2020 Deleveraging Additional Corporate and Tax benefit from CARES Act Other Allocation(1) Note: Refer to slide 3 for information on 2020 Utility EPS guidance assumptions and non-GAAP measures. Full-year 2020 COVID-19 guidance impact assumptions consider the following: a gradual re- opening of economy in Company’s service territories; anticipate April to be peak of reduced demand levels; anticipate reduced demand levels to diminish over summer months through August; reflects anticipated deferral and recovery of incremental expenses including bad debt; assumes normal weather conditions; and other assumptions as described on slide 3 20 (1) Refer to slide 26 for additional detail (2) Houston Electric service territory

APPENDIX 21

UTILITY DEMAND SENSITIVITIES Estimated Margins by Customer Class Houston Electric Indiana Electric Natural Gas Distribution 10% 11% 25% 44% 18% 30% 60% 71% 31% Residential Commercial Industrial Residential Commercial Industrial Residential C&I Transportation Estimated Annual Sensitivity to +/- 2% Change in Demand Rates: Percent Fixed +Trued Up (including decoupling)(3) Revenue Impact Estimated EPS Impact (in millions) (in millions) Electric Houston Electric Residential(1) $10 - $15 $0.02 Houston Electric 55% (4) Houston Electric Commercial(1) $6 - $8 $0.01 Indiana Electric 22% Natural Gas Distribution(4) Houston Electric Industrial(1) (2) $1 - $3 $0.01 Indiana 80% Indiana Electric $5 - $6 $0.01 Texas 81% Natural Gas Distribution $8 - $10 $0.01 Minnesota 88% Ohio 72% Note: Amounts presented above are estimates and meant to provide general guides and/or principles. (5) Refer to slide 2 for information on forward-looking statements; C&I - Commercial and Industrial Other 43% (1) Incorporates new rate structure in effect as of April 2020 (2) Based on both current and previous year demand (3) Representative of blended percentage across all customer classes 22 (4) Does not include fuel and purchased power and gas cost (5) Consists of Arkansas, Louisiana, Mississippi and Oklahoma

ELECTRIC OPERATIONS Q1 2020 REGULATORY UPDATE Annual Increase Filing Effective Approval Mechanism (Decrease) (1) Additional Information Date Date Date (in millions) CenterPoint Energy and Houston Electric (PUCT) For full disclosure on Houston Electric rate case, refer to "Regulatory Matters" in Item 2 Rate Case (1) $13 Apr-19 Apr-20 Mar-20 of CenterPoint Energy’s First Quarter 2020 Form 10-Q. TCOS (1) 17 Mar-20 TBD TBD Requested an increase of $204 million to rate base. CenterPoint Energy - Indiana Electric (IURC) Requested an increase of $34 million to rate base, which reflects a $4 million annual increase in current revenues. 80% of revenue requirement is included in requested TDSIC (1) 4 Feb-20 May-20 TBD rate increase and 20% is deferred until next rate case. The mechanism also includes a change in (over)/under-recovery variance of $2 million annually. Note: Please see slides posted under regulatory information for additional detail (http://investors.centerpointenergy.com/regulatory-information) TCOS – Transmission Cost of Service; TDSIC – Transmission, Distribution, and Storage System Improvement Charge (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet determined. Approved rates could differ materially from proposed rates 23

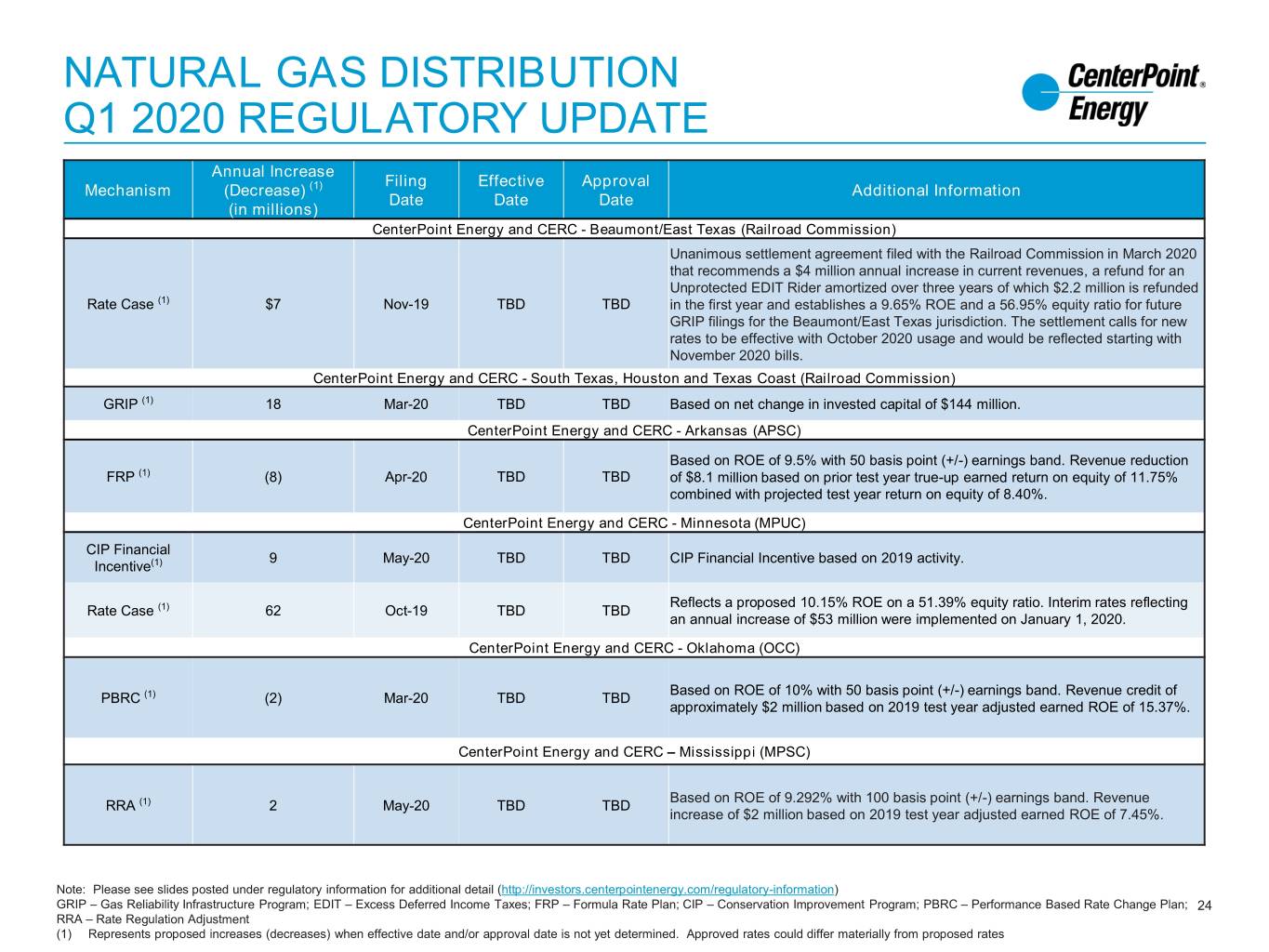

NATURAL GAS DISTRIBUTION Q1 2020 REGULATORY UPDATE Annual Increase Filing Effective Approval Mechanism (Decrease) (1) Additional Information Date Date Date (in millions) CenterPoint Energy and CERC - Beaumont/East Texas (Railroad Commission) Unanimous settlement agreement filed with the Railroad Commission in March 2020 that recommends a $4 million annual increase in current revenues, a refund for an Unprotected EDIT Rider amortized over three years of which $2.2 million is refunded Rate Case (1) $7 Nov-19 TBD TBD in the first year and establishes a 9.65% ROE and a 56.95% equity ratio for future GRIP filings for the Beaumont/East Texas jurisdiction. The settlement calls for new rates to be effective with October 2020 usage and would be reflected starting with November 2020 bills. CenterPoint Energy and CERC - South Texas, Houston and Texas Coast (Railroad Commission) GRIP (1) 18 Mar-20 TBD TBD Based on net change in invested capital of $144 million. CenterPoint Energy and CERC - Arkansas (APSC) Based on ROE of 9.5% with 50 basis point (+/-) earnings band. Revenue reduction FRP (1) (8) Apr-20 TBD TBD of $8.1 million based on prior test year true-up earned return on equity of 11.75% combined with projected test year return on equity of 8.40%. CenterPoint Energy and CERC - Minnesota (MPUC) CIP Financial 9 May-20 TBD TBD CIP Financial Incentive based on 2019 activity. Incentive(1) Reflects a proposed 10.15% ROE on a 51.39% equity ratio. Interim rates reflecting Rate Case (1) 62 Oct-19 TBD TBD an annual increase of $53 million were implemented on January 1, 2020. CenterPoint Energy and CERC - Oklahoma (OCC) Based on ROE of 10% with 50 basis point (+/-) earnings band. Revenue credit of PBRC (1) (2) Mar-20 TBD TBD approximately $2 million based on 2019 test year adjusted earned ROE of 15.37%. CenterPoint Energy and CERC – Mississippi (MPSC) Based on ROE of 9.292% with 100 basis point (+/-) earnings band. Revenue RRA (1) 2 May-20 TBD TBD increase of $2 million based on 2019 test year adjusted earned ROE of 7.45%. Note: Please see slides posted under regulatory information for additional detail (http://investors.centerpointenergy.com/regulatory-information) GRIP – Gas Reliability Infrastructure Program; EDIT – Excess Deferred Income Taxes; FRP – Formula Rate Plan; CIP – Conservation Improvement Program; PBRC – Performance Based Rate Change Plan; 24 RRA – Rate Regulation Adjustment (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet determined. Approved rates could differ materially from proposed rates

NATURAL GAS DISTRIBUTION Q1 2020 REGULATORY UPDATE Annual Increase Filing Effective Approval Mechanism (Decrease) (1) Additional Information Date Date Date (in millions) CenterPoint Energy - Indiana South - Gas (IURC) Requested an increase of $13 million to rate base, which reflects a $1 million annual increase in current revenues. 80% of revenue requirement is included in requested rate increase and 20% is deferred until the next rate case. The CSIA (1) 1 Apr-20 Jul-20 TBD mechanism also includes refunds associated with the TCJA, resulting in no change to the previous credit provided, and a change in the total (over)/under-recovery variance of $1 million annually. CenterPoint Energy - Indiana North - Gas (IURC) Requested an increase of $35 million to rate base, which reflects a $4 million annual increase in current revenues. 80% of revenue requirement is included in requested rate increase and 20% is deferred until the next rate case. The CSIA (1) 4 Apr-20 Jul-20 TBD mechanism also includes refunds associated with the TCJA, resulting in no change to the previous credit provided, and a change in the total (over)/under-recovery variance of $14 million annually. CenterPoint Energy - Ohio (PUCO) Application to flow back to customers certain benefits from the TCJA. Initial impact reflects credits for 2018 of $(10) million and 2019 of $(9) million, and 2020 of $(6) TSCR (1) (N/A) Jan-19 TBD TBD million, with mechanism to begin subsequent to new approval by the PUCO. The order is expected in 2020. Requested an increase of $67 million to rate base for investments made in 2019, DRR 10 May-20 Sep-20 TBD which reflects a $10 million annual increase in current revenues. A change in (over)/under-recovery variance of $2 million annually is also included in rates. Note: Please see slides posted under regulatory information for additional detail (http://investors.centerpointenergy.com/regulatory-information) 25 CSIA – Compliance and System Improvement Adjustment; TSCR – Tax Savings Credit Rider; DRR – Distribution Replacement Rider (1) Represents proposed increases (decreases) when effective date and/or approval date is not yet determined. Approved rates could differ materially from proposed rates

2020 EPS GUIDANCE BASIS CONSIDERATIONS Translating Enable Guidance to CenterPoint’s Portion (in millions, except percentages) Guidance basis EPS before allocation of Corporate & Other Enable Net Income Attributable $195 - $235(2) to Common Units Midstream Utility Operations Corporate & Other Investments CNP Common Unit ownership percentage 53.7%(3) $1.32 - $1.42 $0.18 - $0.21 ($0.25) (4) (1) (1) Basis difference amortization $85 ~88% ~12% Interest 4.5% on $1,200 (CNP Midstream internal note) Marginal effective tax rate 24% Guidance basis EPS Estimated 2020 CNP Share Count 560 after allocation of Corporate & Other Midstream Investments EPS Utility Operations Midstream Investments $0.18 - $0.21 before allocation of Corporate & Other Proportion share of $1.10 - $1.20 $0.15 - $0.18 ($0.03) Corporate & Other allocation (12%) ~88% ~12% Midstream Investments EPS $0.15 – $0.18 after allocation of Corporate & Other Note: Refer to slide 2 for information on forward-looking statements and slide 3 for information on non-GAAP measures and for additional detail on the 2020 Utility EPS guidance range assumptions and 2020 Midstream Investments EPS expected range assumptions (1) Calculated as the relative contribution of each reporting area based off the guidance basis EPS for Utility Operations and Midstream Investments EPS expected range attributable to CenterPoint’s share of Enable’s Net Income Attributable to Common Units guidance range. The guidance basis earnings (loss) per share related to Corporate & Other is then proportionally allocated based on each reporting range’s relative contribution. Corporate & Other consists of interest expense, preferred stock dividend requirements, income on Enable preferred units and other items directly attributable to the parent along with the associated income taxes. (2) Source: Enable’s first quarter 2020 earnings presentation dated May 6, 2020 (3) Enable ownership position as of March 31, 2020 26 (4) Estimated full year 2020 basis difference accretion following company’s impairment of its investment in Enable in the first quarter of 2020. Does not consider any potential loss on dilution, net of proportional basis difference recognition

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO ADJUSTED INCOME AND ADJUSTED DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Quarter Ended March 31, 2020 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 70 $ 0.14 $ (1,127) $ (2.24) $ (25) $ (0.05) $ (146) $ (0.29) $ (1,228) $ (2.44) Timing effects impacting CES (1): Mark-to-market (gains) losses (net of taxes of $11) (4) - - - - - - (35) (0.07) (35) (0.07) ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $30) (4)(5) - - - - 114 0.23 - - 114 0.23 Indexed debt securities (net of taxes of $28) (4) - - - - (107) (0.21) - - (107) (0.21) Impacts associated with the Vectren merger (net of taxes of $1) (4) - - - - 6 0.01 - - 6 0.01 Severance costs (net of taxes of $2, $0) (4) 6 0.01 - - 1 - - - 7 0.01 Impacts associated with the sales of CES (1) and CIS (2) (net of taxes of $28) (4) - - - - - - 206 0.41 206 0.41 Consolidated on a guidance basis 76 0.15 (1,127) (2.24) (11) (0.02) 25 0.05 (1,037) (2.06) Losses on impairment (net of taxes of $0, $379) (4) 185 0.37 1,177 2.34 - - - - 1,362 2.71 Consolidated on a guidance basis, excluding losses on impairment 261 0.52 50 0.10 (11) (0.02) 25 0.05 325 0.65 Corporate and Other Allocation (8) (0.02) (1) - 11 0.02 (2) - - - Consolidated on a guidance basis, excluding losses on impairment and with allocation of Corporate and Other $ 253 $ 0.50 $ 49 $ 0.10 $ - $ - $ 23 $ 0.05 $ 325 $ 0.65 Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense 27 (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other segment plus preferred stock dividend requirements

RECONCILIATION: INCOME (LOSS) AND DILUTED EARNINGS (LOSS) PER SHARE TO ADJUSTED INCOME AND ADJUSTED DILUTED EPS USED IN PROVIDING ANNUAL EARNINGS GUIDANCE Quarter Ended March 31, 2019 Midstream Corporate and CES (1) & CIS (2) Utility Operations Investments Other (6) (Disc. Operations) Consolidated Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted Dollars in Diluted millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) millions EPS (3) Consolidated income available to common shareholders and diluted EPS $ 141 $ 0.28 $ 24 $ 0.05 $ (51) $ (0.10) $ 26 $ 0.05 $ 140 $ 0.28 Timing effects impacting CES (1): Mark-to-market (gains) losses (net of taxes of $5) (4) - - - - - - (14) (0.03) (14) (0.03) ZENS-related mark-to-market (gains) losses: Marketable securities (net of taxes of $17) (4)(5) - - - - (66) (0.13) - - (66) (0.13) Indexed debt securities (net of taxes of $18) (4) - - - - 68 0.13 - - 68 0.13 Consolidated on a guidance basis 141 0.28 24 0.05 (49) (0.10) 12 0.02 128 0.25 Impacts associated with the Vectren merger Merger impacts other than the increase in share count (net of taxes of $13, $11, $0) (4) 70 0.14 - - 22 0.05 2 - 94 0.19 Impact of increased share count on EPS - 0.02 - - - - - - - 0.02 Total merger impacts 70 0.16 - - 22 0.05 2 - 94 0.21 Consolidated on a guidance basis, excluding impacts associated with the Vectren merger 211 0.44 24 0.05 (27) (0.05) 14 0.02 222 0.46 Corporate and Other Allocation (13) (0.03) (1) - 27 0.05 (13) (0.02) - - Consolidated on a guidance basis, excluding impacts associated with the Vectren merger and with allocation of Corporate and Other $ 198 $ 0.41 $ 23 $ 0.05 $ - $ - $ 1 $ - $ 222 $ 0.46 Note: Refer to slide 3 for information on non-GAAP measures (1) Energy Services segment (2) Infrastructure Services segment (3) Quarterly diluted EPS on both a GAAP and guidance basis are based on the weighted average number of shares of common stock outstanding during the quarter, and the sum of the quarters may not equal year-to-date diluted EPS (4) Taxes are computed based on the impact removing such item would have on tax expense 28 (5) Comprised of common stock of AT&T Inc. and Charter Communications, Inc. (6) Corporate and Other segment plus preferred stock dividend requirements

CENTERPOINT ENERGY CONSOLIDATED ADJUSTED CASH FROM OPERATIONS PRE-WORKING CAPITAL Year Ended December 31, 2019 ($ in millions) Net cash provided by operating activities 1,638 Less: Changes in other assets and liabilities Accounts receivable and unbilled revenues, net (226) Inventory 52 Taxes receivable 106 Accounts payable 455 Fuel cost recovery (92) Margin deposits, net 56 Interest and taxes accrued (54) Other current assets 22 Other current liabilities 107 Cash From Operations, Pre-working Capital 2,064 Amounts included in Cash Flows from Investing Activities Distributions from unconsolidated affiliates in excess of cumulative earnings 42 Cash From Operations, Pre-working Capital, including Distributions 2,106 Plus: Other Adjustments Defined Benefit Plan Contribution Less Service Cost 69 Operating Leases Rent Expense 19 Adjusted Cash From Operations Pre-Working Capital 2,194 Note: Refer to slide 3 for information on non-GAAP measures. This slide includes adjusted cash from operations pre-working capital which is net cash provided by operating activities excluding certain changes in other assets and liabilities, and including (i) distributions from unconsolidated affiliates in excess of cumulative earnings included in cash flow from investing activities, as applicable and (ii) other adjustment for defined benefit plans and operating leases. 29

CENTERPOINT ENERGY CONSOLIDATED RATIO OF ADJUSTED CASH FROM OPERATIONS PRE-WORKING CAPITAL/ADJUSTED TOTAL DEBT Year Ended December 31, 2019 ($ in millions) Short-term Debt: Short-term borrowings - Current portion of transition and system restoration bonds 231 Indexed debt (ZENS)** 19 Current portion of other long-term debt 618 Long-term Debt: Transition and system restoration bonds, net* 746 Other, net 13,498 Total Debt, net 15,112 Plus: Other Adjustments 50% of Series A Preferred Stock Aggregate Liquidation Value 400 Benefit obligations 448 Present Value of Operating Lease Liabilities 63 Unamortized debt issuance costs and unamortized discount and premium, net 95 Adjusted Total Debt 16,118 Adjusted Cash From Operations Pre-Working Capital/Adjusted Total Debt (Adjusted FFO/Debt) 13.6% Note: Refer to slide 3 for information on non-GAAP measures and slide 29 for CenterPoint Energy's adjusted cash from operations pre-working capital calculation. This slide includes adjusted cash from operations pre-working capital which is net cash provided by operating activities excluding certain changes in other assets and liabilities, and including (i) distributions from unconsolidated affiliates in excess of cumulative earnings included in cash flow from investing activities, as applicable, (ii) other adjustment for defined benefit plans and operating leases and (iii) multiemployer plans associated with discontinued operations *The transition and system restoration bonds are serviced with dedicated revenue streams, and the bonds are non-recourse to CenterPoint Energy and CenterPoint Energy Houston Electric. **The debt component reflected on the financial statements was $19 million as of December 31, 2019. The principal amount on which 2% interest is paid was $828 million on each of December 31, 2019. The contingent principal amount was $75 million as of December 31, 2019. At maturity or upon redemption, holders of ZENS will receive cash at the higher of the contingent principal amount or 30 the value of the reference shares of AT&T and Charter Communications, Inc.