Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Envirotech Vehicles, Inc. | adom-8k_20200506.htm |

2020 Annual Stockholders Meeting May 6, 2020 www.ADOMANIelectric.com OTCQB: ADOM “Providing healthier air for all while reducing dependency on fossil fuels.” Exhibit 99.1

This presentation has been prepared by ADOMANI, Inc. (the “Company”) for discussion purposes only and should not be considered as an offer or invitation to subscribe for or purchase any securities in the Company or as an inducement to make an offer or invitation with respect to those securities. No agreement to subscribe for securities in the Company will be entered into on the basis of this presentation or any information, opinions, or conclusions expressed in the course of this presentation. This presentation is not a prospectus or other offering document under U.S. law or under any other law. This presentation contains general summary information and does not take into account the investment objectives, financial situation, and particular needs of any individual investor. This presentation contains, in addition to historical information, certain forward-looking statements that are based the Company's current assumptions, expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and expectations and objectives of management constitute forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical facts and generally contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates,” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters. Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made and reflect the best judgment of the Company's management, forward-looking statements inherently involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Any forward looking statements made in this presentation speak only as of the date on which it is made. The Company is under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations. For historical information relating to the Company, you should consider the information contained in our filings with the U.S. Securities and Exchange Commission, (“SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2019, and particularly in the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors,” as well as the Company's subsequent filings with the SEC. Other unknown or unpredictable factors also could have material adverse effects on the Company's future results, performance or achievements. This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other data about the Company's industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of the Company's future performance and the future performance of the markets in which the Company operates are necessarily subject to a high degree of uncertainty and risk. By attending or receiving this presentation you acknowledge that you will be solely responsible for your own assessment of the market and the Company's market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of the Company's business. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the Company's capital stock in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Disclaimer OTCQB: ADOM

OTCQB: ADOM ADOMANI, like many companies in this time of forced shut down and restricted access, has been forced to respond and adapt to the unexpected legal and regulatory changes resulting from the ongoing COVID-19 pandemic, and continues to suffer from our inability to interact and meet with our customers and prospective customers in order to take additional orders, conduct vehicle demonstrations, and to reinforce other marketing efforts. We are making hundreds of customer calls per week, but a large percentage of the contacts are not at work and cannot be reached. Because of this impact on our business and with no means to accurately predict how long this environment will persist, we have applied for an Economic Injury Disaster Loan and a Paycheck Protection Program loan under the SBA – administered loan programs authorized by the CARES Act. The status of our applications is unknown at this time. Introduction

OTCQB: ADOM Contacts Made and Other Events ADOMANI and the Zeem team met with the HVIP department of CARB to revisit funding for vehicles. Lack of HVIP funding has curtailed orders for trucks and vans. Exhausted HVIP funds are expected to be renewed in Q3 of 2020. Current funding stands at $202M, however we do not have access to this funding at this date. ADOMANI hired a Sacramento lobbyist with strong contacts in the state’s transportation industry to go after all available funds through the HVIP and other state-sponsored programs. Our drivetrain agreement with Blue Bird entitled us to receive payment on orders placed between June 1, 2019 and September 30, 2019. Our projections were that we would receive $195,000 for orders placed during these dates. We have been paid for $120,000 of the $195,000 through 4/7/20 and expect the balance by early June 2020. A PO was received from Santa Clara County for an additional 2 Low Top logistic Vans. This order will use HVIP funding and can be delivered as soon as funding becomes available. This brings our current orders from Santa Clara to 6 Low-Top Logistic Vans and one (1) Prison Bus conversation from diesel to all-electric. Consulting agreement with Neel Sawant re: India has not progressed for various reasons, but Covid-19 is the main one. As we previously announced, the Pittsburg co-op bid was approved and ratified in December 2019. We expect this will generate orders of between 36-50 vehicles in 2020, depending on HVIP funding availability . Implemented permanent cost reductions to save $360,000 from February to December in 2020; also deferred salaries and rent that saved $77,500 through June 30, 2020. GerWeiss delivered the first 10 e-trikes to customers in early Q4 of 2019. The next 50 e-trikes are in production and expected to be delivered in Q2 of 2020. We are seeing supply chain delays and customs delays in the Philippines but production is moving slowly along. JFP Holdings, Ltd is working on several vehicle types for Ukraine, Mexico, Brazil, which include NEV’s, MTU 4 as well as vans, trucks, buses and complete drivetrains. Q1 – 2020 Review CARGO VAN CLASS 4 TRUCK

OTCQB: ADOM Contacts Made and Other Events One of our Chinese partners, a top-tier manufacturer, has informed us that the passenger van we have been working on since Q4 of 2019 is scheduled to be completed soon, will ship to the US in May, and should be here by the end of May for testing and demos. The same partner is finalizing design and engineering costs for a Class 5 Cab & Chassis vehicle. Expectations are we will see the first article ready for homologation in Q3 of 2020. We continued to showcase our all-electric commercial trucks and vans in selected markets with interested customers, but this has been limited to a couple of demos per month with few customers attending. We fully expect this to increase as soon as the lock-down is lifted. We have, however, been able to demo the vehicles in Ohio and Vermont as well as a few demos in California. Q1 – 2020 Review (continued) CARGO VAN CLASS 4 TRUCK

OTCQB: ADOM Operational Update A major supplier and a new vendor for ADOMANI can provide multiple drivetrain packages for trucks and buses at a good entry level price for US and surrounding markets. We have fully moved into our Corona Operations facility and have subleased 40% of the property to Masters Transportation, which has reduced direct lease cost by 45%. The agreement is executed and Masters moved in February 4th. We have also hired a full time EV technician that will work out of this facility and can make repairs to existing EV units as well as build drivetrains for sale. We have also worked out an arrangement to perform all prep and add-on work for Masters along with vehicle warranty work. We will also market our service to local fleets that need EV and hybrid repairs along with wheelchair lift inspections and service to non-emergency transport vehicles. We are looking to secure PMI work for KinderCare locations as well. ADOMANI has signed a non-binding Letter of Intent (“LOI”) for the purchase of 120 FireFly ESV 3-wheeled vehicles from Boston-based ev Transportation Sources, Inc. (“evTS”). The agreement, subject to the parties entering into definitive agreements, appoints ADOMANI the California dealer and calls for ADOMANI to provide sales and marketing efforts and to perform final assembly, testing and warranty work, which will utilize some of the Corona facility’s capacity. Q1 – 2020 Review (continued) CARGO VAN CLASS 4 TRUCK

Utilities Construction Delivery Agriculture Farming Target Industries and Market Segments Service & Delivery Fleets Passenger, Last-Mile Logistic Fleets Utility, Flatbed, Shuttle Services Public & Private Schools State, City, and Counties Public Transportation Existing Fleets Medium Duty Trucks, Cargo Vans & Shuttles Vans Work Trucks School Buses City Bus E-Trikes Conversions OTCQB: ADOM FireFly ESV Essential Services Applications

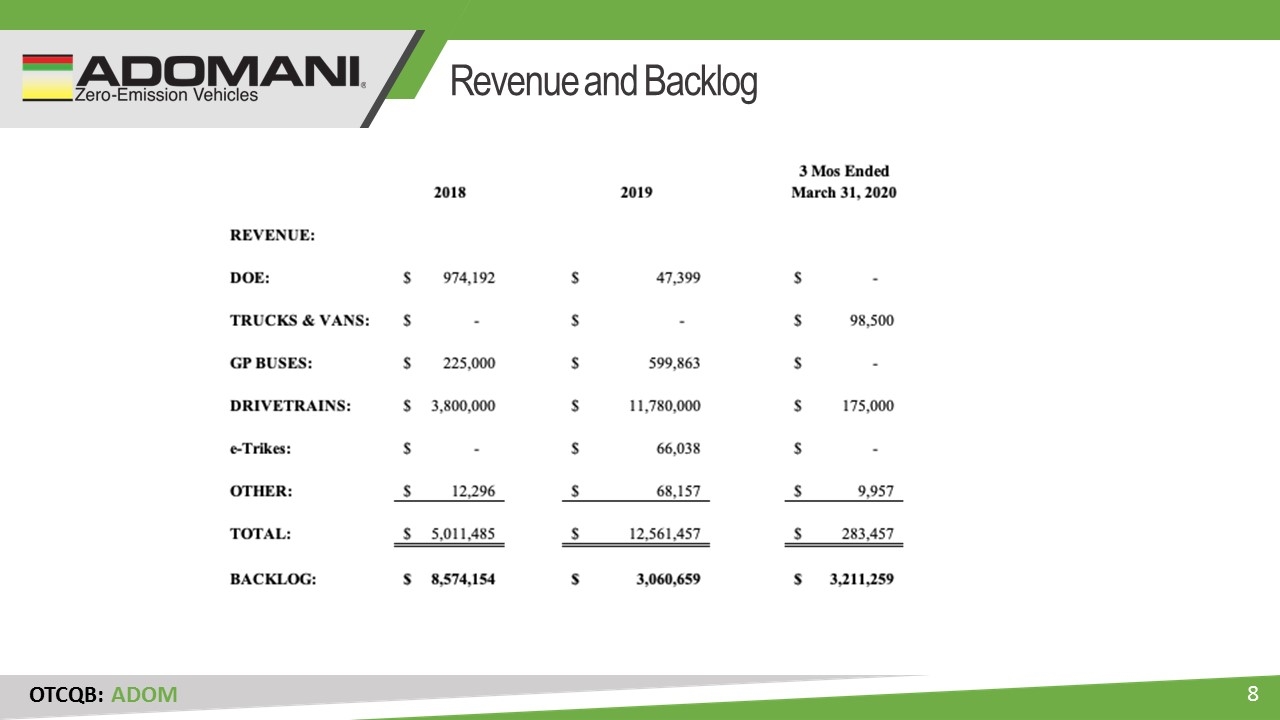

OTCQB: ADOM Revenue and Backlog

Approximately 2.9 million Class 3-5 trucks in US Market (A) Approximately 1.5 million Class 6-7 trucks in US Market (A) Class 3 truck sales were approximately 301,000 units in US & Canada Market in 2018 (B)(C) Class 4-7 truck sales were approximately 237,000 units in US & Canada Market in 2018 (B)(C) Segment Advantages – Light Duty Trucks (A) (B) (C) http://cv.informa.com/wp-content/uploads/Fleet-Owner-Solutions-Guide-2017.pdf https://www.statista.com/statistics/261416/class-3-8-truck-sales-in-the-united-states/ https://cta.ornl.gov/vtmarketreport/pdf/chapter_4_heavy_trucks.pdf https://www.trailer-bodybuilders.com/market-stats/december-bump-caps-2018-truck-sales-boom/gallery?slide=1 (D) OTCQB: ADOM

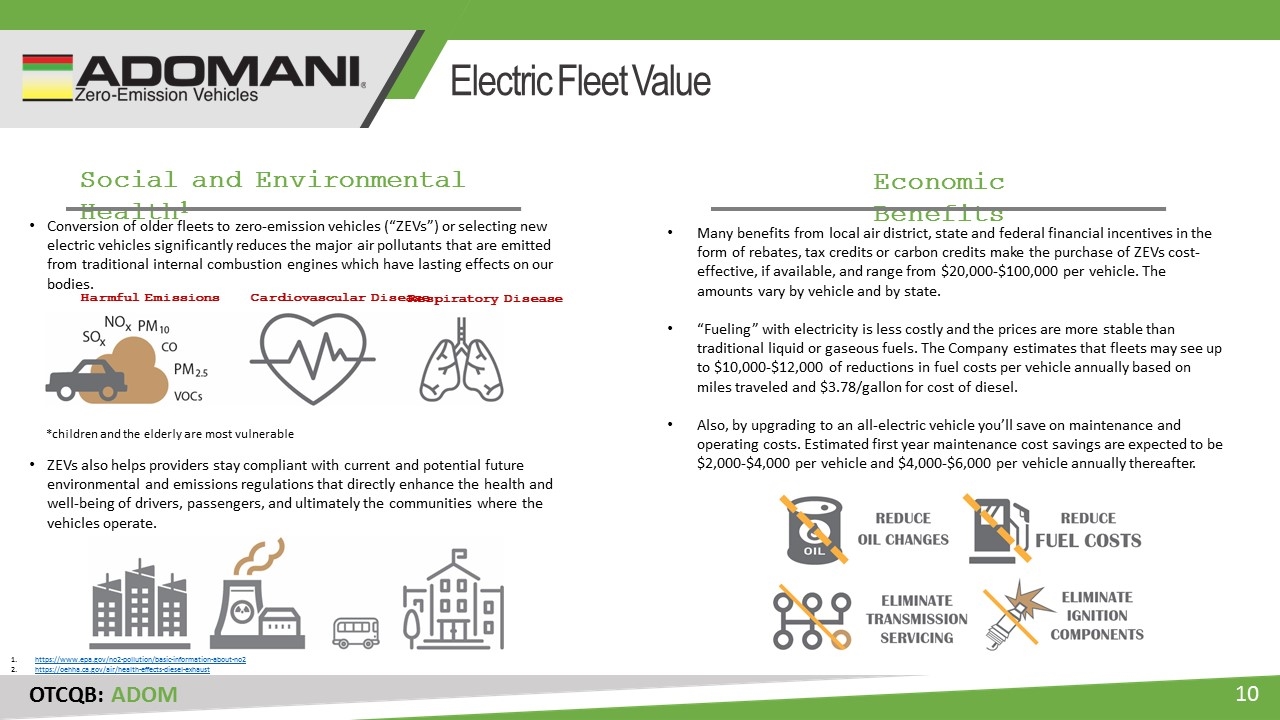

OTCQB: ADOM Electric Fleet Value Social and Environmental Health1 Conversion of older fleets to zero-emission vehicles (“ZEVs”) or selecting new electric vehicles significantly reduces the major air pollutants that are emitted from traditional internal combustion engines which have lasting effects on our bodies. ZEVs also helps providers stay compliant with current and potential future environmental and emissions regulations that directly enhance the health and well-being of drivers, passengers, and ultimately the communities where the vehicles operate. Harmful Emissions Cardiovascular Disease Respiratory Disease *children and the elderly are most vulnerable Many benefits from local air district, state and federal financial incentives in the form of rebates, tax credits or carbon credits make the purchase of ZEVs cost-effective, if available, and range from $20,000-$100,000 per vehicle. The amounts vary by vehicle and by state. “Fueling” with electricity is less costly and the prices are more stable than traditional liquid or gaseous fuels. The Company estimates that fleets may see up to $10,000-$12,000 of reductions in fuel costs per vehicle annually based on miles traveled and $3.78/gallon for cost of diesel. Also, by upgrading to an all-electric vehicle you’ll save on maintenance and operating costs. Estimated first year maintenance cost savings are expected to be $2,000-$4,000 per vehicle and $4,000-$6,000 per vehicle annually thereafter. Economic Benefits https://www.epa.gov/no2-pollution/basic-information-about-no2 https://oehha.ca.gov/air/health-effects-diesel-exhaust

OTCQB: ADOM Current Product Lineup Cargo Van Class 3-5 Trucks E-Trike

OTCQB: ADOM Expected To Be Available in 2020 Class 4-6 Trucks Passenger Van

Mike Menerey CFO – Financial Overview

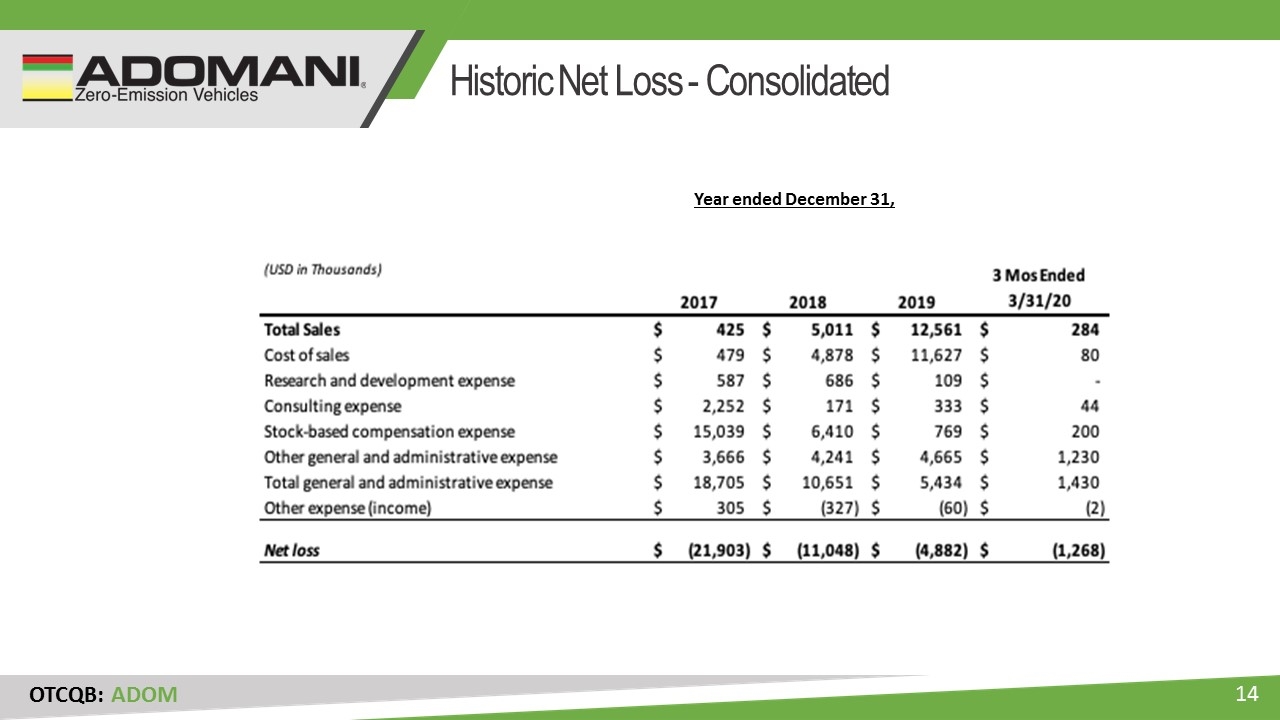

OTCQB: ADOM Historic Net Loss - Consolidated Year ended December 31,

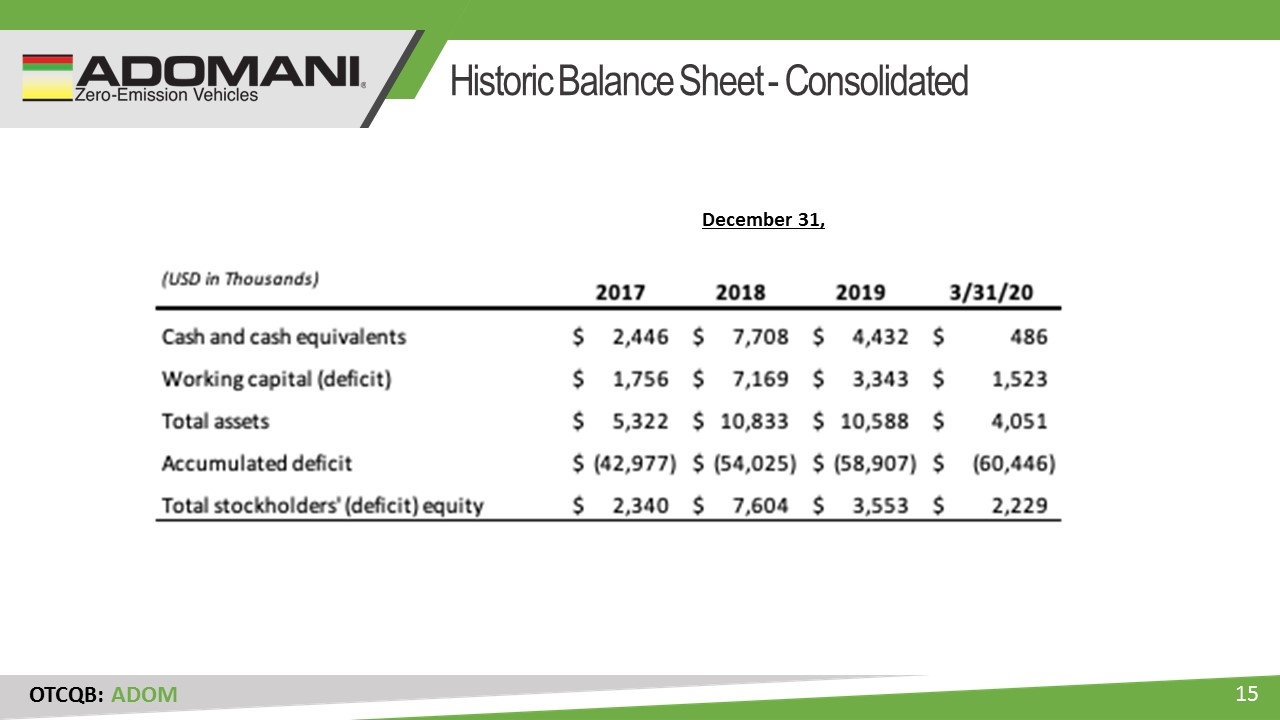

OTCQB: ADOM Historic Balance Sheet - Consolidated December 31,

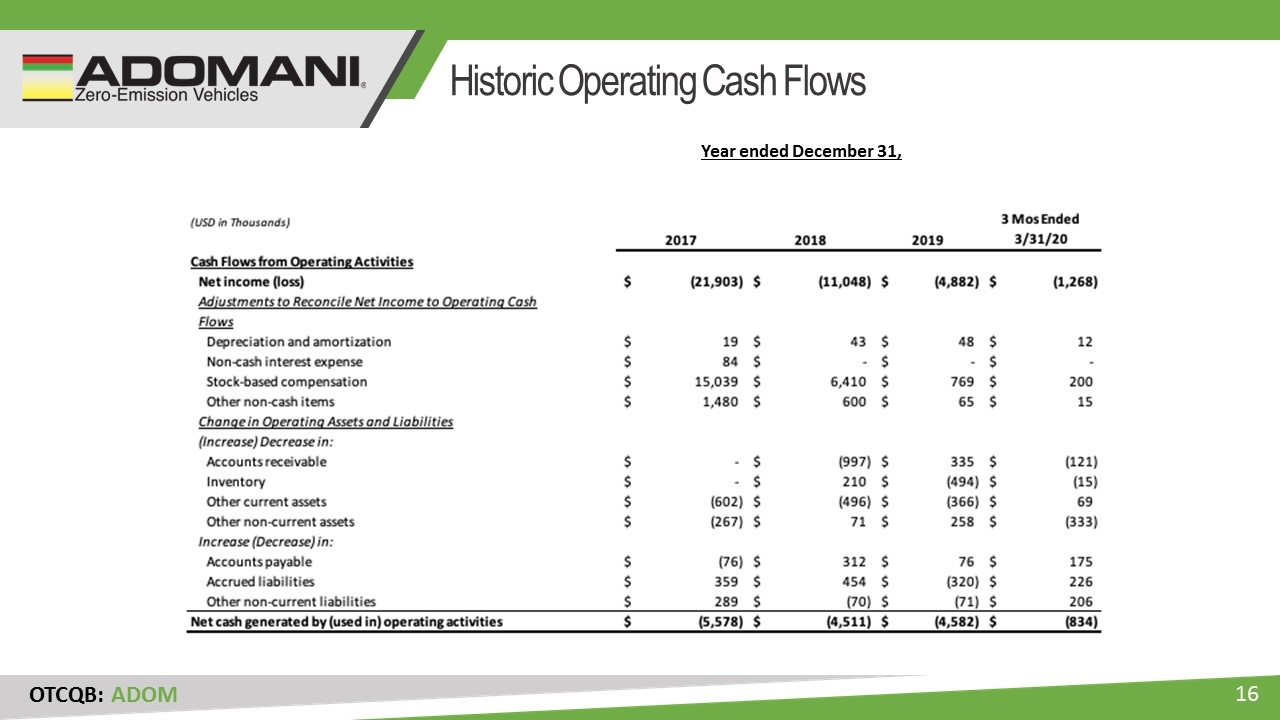

OTCQB: ADOM Historic Operating Cash Flows Year ended December 31,

OTCQB: ADOM Thank you for your interest and participation.