Attached files

| file | filename |

|---|---|

| EX-32.2 - VBI Vaccines Inc/BC | ex32-2.htm |

| EX-32.1 - VBI Vaccines Inc/BC | ex32-1.htm |

| EX-31.2 - VBI Vaccines Inc/BC | ex31-2.htm |

| EX-31.1 - VBI Vaccines Inc/BC | ex31-1.htm |

| EX-10.4 - VBI Vaccines Inc/BC | ex10-4.htm |

| EX-10.3 - VBI Vaccines Inc/BC | ex10-3.htm |

| EX-10.1 - VBI Vaccines Inc/BC | ex10-1.htm |

| 10-Q - VBI Vaccines Inc/BC | form10q.htm |

Exhibit 10.2

SEVENTH AMENDMENT TO LEASE

This SEVENTH AMENDMENT TO LEASE (this “Amendment”), is made as of the 30th day of April, 2020 (“Effective Date”) by and between AMERICAN TWINE OWNER LLC, a Delaware limited liability company (“Landlord”) and VARIATION BIOTECHNOLOGIES (US), INC., a Delaware corporation (“Tenant”).

WITNESSETH:

Reference is hereby made to the following facts:

A. Landlord (as successor-in-interest to American Twine Limited Partnership) and Tenant are parties to that certain lease agreement dated May 31, 2012, as amended by a First Amendment to Lease dated as of June 28, 2013, a Second Amendment to Lease dated as of October 2, 2013, a Third Amendment to Lease dated as of January, 2014, a Fourth Amendment to Lease dated as of August 7, 2014 (“Fourth Amendment”), a Fifth Amendment to Lease dated as of May 9, 2017 (“Fifth Amendment”), and a Sixth Amendment to Lease dated as of March 23, 2018 (“Sixth Amendment”) (collectively, the “Existing Lease”) for premises consisting, in the aggregate, of 3,475 rentable square feet, comprised of 1,116 rentable square feet, known as Suite 2240 and 2,359 rentable square feet, known as Suite 2241 (“Suite 2241”), located on the second (2nd) floor (collectively the “Premises”) of that certain building having an address of 222 Third Street, Cambridge, Massachusetts (as more particularly described in the Lease, the “Building”). All capitalized words and phrases not otherwise defined herein shall have the meanings ascribed to them in the Existing Lease. The Existing Lease, as modified and amended by this Amendment, is referred to herein as the “Lease”.

B. The Term of the Lease is scheduled to expire on April 30, 2020.

C. Landlord and Tenant have agreed to extend the Term of the Lease and modify and amend the Existing Lease, all in the manner hereinafter set forth.

NOW THEREFORE, in consideration of Ten Dollars ($10.00) and other good and valuable consideration, the receipt, sufficiency and delivery of which are hereby acknowledged, the parties agree that the Existing Lease is hereby amended as follows:

1. Extension of Term of Lease. The Term of the Lease is hereby extended to expire on April 30, 2023 (“Expiration Date”). The period of time commencing as of May 1, 2020 (“Extension Term Commencement Date”) and continuing through the Expiration Date is referred to in this Amendment as the “Extension Term.” Without limitation, all references in the Lease to the “Term” shall be deemed to include the Extension Term in all respects. Tenant has no further rights or options to extend the Term of the Lease. The demise and use of the Premises for the Extension Term shall be upon and subject to all of the terms and conditions of the Existing Lease (including, without limitation, Tenant’s obligation to pay Tenant’s Pro Rata Share of the Property’s electric costs pursuant to Sections 4.2.8 and 4.3 of the Lease), except as expressly set forth in this Amendment.

2. Annual Fixed Rent for the Extension Term. For and with respect to the Extension Term, Tenant shall pay Annual Fixed Rent as follows:

| Time Period | Annual Fixed Rent | Monthly Fixed Rent | ||||||

| 5/1/20-4/30/21: | $ | 295,375.00 | $ | 24,614.58 | ||||

| 5/1/21-4/30/22: | $ | 304,236.25 | $ | 25,353.02 | ||||

| 5/1/22-4/30/23: | $ | 313,375.50 | $ | 26,114.63 | ||||

All such Annual Fixed Rent shall be paid in the manner and at the times set forth in Article IV of the Lease.

3. Real Estate Taxes and Expenses for the Extension Term. For and with respect to the Extension Term, Tenant shall pay, in accordance with Section 4.2 of the Lease, Tenant’s Pro Rata Share of the amount, if any, by which the real estate taxes exceed the real estate taxes for the Tax Base and Tenant’s Pro Rata Share of the amount, if any, by which Operating Expenses exceed the Operating Base (adjusted in accordance with Section 4.2.8 of the Lease); provided, however, during such period:

| (a) | The Tax Base shall mean the fiscal year 2021 (i.e., July 1, 2020 through June 30, 2021), the parties hereby acknowledging and agreeing that, for and with respect to the Extension Term, the Tax Base shall be based on a fiscal year and not a calendar year; and | |

| (b) | The Operating Base shall mean calendar year 2020. |

4. As-Is Condition. Tenant acknowledges that from and after approximately July 1, 2012 for Suite 2241, and from and after April 1, 2018 for Suite 2240, through and including the Effective Date of this Amendment, the Premises have been under its control, subject to and in accordance with the terms and conditions of the Lease. Tenant has had a full and complete opportunity to review and inspect all aspects of the Premises and the condition thereof. Notwithstanding any provision contained in the Lease to the contrary, except for Landlord’s Work, as hereinafter defined, and Landlord’s ongoing repair and maintenance obligations pursuant to Section 5.3 of the Lease, Tenant shall lease the Premises for the Extension Term “as- is”, “where is”, and in all respects in the condition in which the Premises are in as of the Effective Date (provided that all Building systems serving the Premises shall be in good working order), without any obligation on the part of Landlord to prepare or construct the Premises for Tenant’s occupancy, or to provide any allowances or inducements, or to construct any additional work or improvements therein or in the Building and without any representation or warranty (express or implied) on the part of Landlord as to the condition of the Premises. Tenant shall, at its own cost and expense, in accordance with and subject to the terms and provisions of the Lease (including, without limitation, Section 5.2.3 thereof), perform or cause to be performed any and all work and improvements in the Premises during the Extension Term, except to the extent of Landlord’s obligations required by Section 5.3.2 of the Lease. All of such work and improvements shall be considered to be alterations or additions in accordance with the Lease, and shall be performed in accordance with the applicable terms and conditions of the Lease.

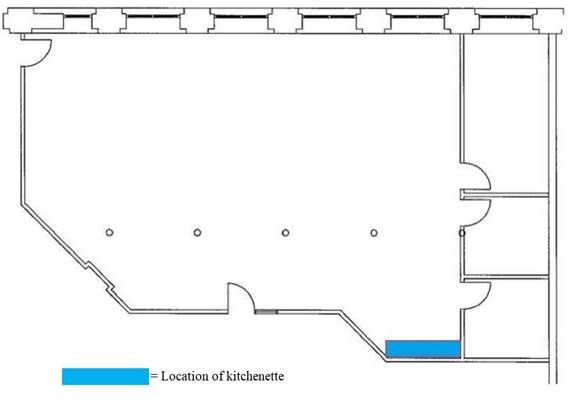

5. Landlord’s Work. Landlord shall, at Landlord’s cost and expense, install, in Suite 2241, a kitchenette and related plumbing using Building standard materials and finishes in the location shown on the plan attached hereto as Exhibit A (“Landlord’s Work”). Landlord shall perform Landlord’s Work as soon as practicable following the Effective Date, subject to delays caused by the action or inaction of Tenant and causes beyond Landlord’s reasonable control, as more particularly set forth in Section 9.4 of the Lease. Landlord shall, during the performance of Landlord’s Work, use reasonable efforts to minimize, to the extent practicable, any interference with Tenant’s use of the Premises. Tenant agrees to cooperate with Landlord and Landlord’s contractor and to follow all reasonable directions given by Landlord in connection with the performance of Landlord’s Work. Tenant shall not be entitled to any diminution in rental value on account of the performance of Landlord’s Work and any delay in the completion of Landlord’s Work shall not delay the Extension Term Commencement Date. In no event shall Landlord have any liability to Tenant based upon the performance of Landlord’s Work, except that obligations of Landlord as set forth in Section 3.2 of the Lease shall apply to Landlord’s Work for a period of one (1) year from substantial completion of Landlord’s Work.

6. Security Deposit. The parties hereby acknowledge that Landlord is currently holding a Security Deposit, in the amount of $19,184.00 pursuant to Article 1 of the Lease and Section 9.10 of the Lease, as amended by Section 11 of the Sixth Amendment. The parties hereby further acknowledge that Tenant shall, at the time that Tenant executes and delivers this Amendment to Landlord, provide an additional Security Deposit to Landlord in the amount of $5,430.58, thereby increasing the Security Deposit to $24,614.58. Landlord shall continue to hold said Security Deposit during the Extension Term in accordance with said Section 9.10 of the Lease.

7. Parking. During the Extension Term, Tenant shall continue to have the right to two (2) reserved parking spaces (“Reserved Parking Spaces”) pursuant to Section 9.9 of the Lease, as amended by Section 9 of the Sixth Amendment. In addition, during the Extension Term, Landlord shall use reasonable efforts to provide to Tenant two (2) “at will” parking passes (“At-Will Building Parking Spaces”) in the Parking Lot designated for tenants and invitees of the Building (the “Parking Area”) for use by Tenant and its employees, business invitees and agents on the following terms and conditions. If Landlord has such At-Will Building Parking Spaces available, Landlord will provide the same to Tenant, provided however, that, if such At- Will Building Parking Spaces are not available, Landlord shall have no obligation to provide said At-Will Building Parking Spaces to Tenant; provided, however, Landlord’s failure to provide the At-Will Building Parking Spaces to Tenant in the Parking Area shall not be a default by Landlord, and Tenant shall have no claim against Landlord, and Landlord shall have no liability to Tenant, by reason thereof. Said At-Will Building Parking Spaces shall be subject to the rules and regulations from time to time in force. Either party may terminate Tenant’s right to use the At-Will Building Parking Spaces, from time to time, by giving the other party at least thirty (30) days’ prior written notice. During the Extension Term, the charge for all of such Reserved Parking Spaces and At-Will Building Parking Spaces shall be at the current market rate.

8. Landlord Termination Right. Landlord shall have the right, at any time after June 30, 2021, upon nine (9) months’ written notice to Tenant (“Landlord’s Termination Notice”), to terminate the Term of the Lease, effective as of the date set forth in Landlord’s Termination Notice (“Effective Termination Date”), and by paying to Tenant a Termination Fee (as hereinafter defined) on the Effective Termination Date. For the avoidance of doubt, Landlord shall have the right to deliver the Landlord Termination Notice to Tenant at any time during the Term, but the Effective Terminate Date may not occur prior to June 30, 2021. Upon the timely giving of such notice, the Term of the Lease shall terminate as of said Effective Termination Date as if such date were the Expiration Date, and Annual Fixed Rent, Additional Rent and other charges due under the Lease shall be pro-rated as of said Effective Termination Date. On the Effective Termination Date, Tenant shall yield up and surrender the Premises in accordance with the requirements of the Lease. The “Termination Fee” shall be $50,000.00 if the Effective Termination Date is earlier than October 1, 2021. The Termination Fee shall be reduced by $86.66 per day for each day for the period from October 1, 2021 to the Effective Termination Date.

9. Tenant Termination Right. (a) Subject to the full and complete satisfaction of the Termination Conditions Precedent (as hereinafter defined), in accordance with the provisions of this Section 9, Tenant shall have the one-time irrevocable option to terminate the Lease (“Tenant Termination”). The conditions precedent (the “Termination Conditions Precedent”) to the effectiveness of any such Tenant Termination shall be as follows: (i) the effective date of any such Tenant Termination shall be April 30, 2022 (“Tenant Termination Date”); (ii) Tenant shall deliver written notice (“Tenant Termination Notice”) of such Tenant Termination to Landlord by not later than July 31, 2021; (iii) concurrent with the delivery of the Tenant Termination Notice, Tenant shall pay to Landlord, without deduction or offset, a non-refundable cash Termination Fee (as hereinafter defined); and (iv) on the Tenant Termination Date, no default of Tenant shall have occurred under the Lease. Said Termination Fee shall be Additional Rent under the Lease and shall be in addition to, and not in lieu of, any other payments due under the Lease. The “Termination Fee” shall be an amount equal to the sum of: (i) the Unamortized Portion (as hereinafter defined) as of the Tenant Termination Date of all costs and expenses incurred by Landlord in connection with this Amendment (the “Transaction Costs”), including the out-of-pocket costs associated with performing Landlord’s Work, all brokerage commissions paid by Landlord in connection with this Amendment, and all legal fees, in an amount not to exceed $5,000.00, paid by Landlord in connection with this Amendment, and (ii) $50,721.49 (i.e., two times the average of the monthly Fixed Rent payable over the Term of the Lease). The “Unamortized Portion” shall mean the unamortized portion of the Transaction Costs, amortized on a straight-line basis over the Extension Term, together with interest thereon at the rate of six percent (6%) per annum. Upon request by Tenant, Landlord shall provide Tenant, with a determination of the foregoing costs, along with Landlord’s calculation of the Unamortized Portion of the costs as of the Tenant Termination Date.

(b) Provided that all of the Termination Conditions Precedent have been fully and completely satisfied, then effective as of the Tenant Termination Date, the Lease, and the rights of the Tenant with respect to the Premises, shall terminate and expire with the same force and effect as if such Tenant Termination Date had originally been specified as the Expiration Date. Prior to the later of (such later date, the “Surrender Date”) (i) the Tenant Termination Date, and (ii) the date on which Tenant actually surrenders and yields-up the Premises, Tenant shall comply with all of the terms and provisions of the Lease and shall perform all of its obligations hereunder, including, without limitation, the obligation to pay when due all Annual Fixed Rent, Additional Rent and other charges due under the Lease. By not later than the Tenant Termination Date, Tenant shall surrender and yield-up the Premises in good and broom-clean order, repair and condition, free of all tenants and occupants, and otherwise in the condition in which the Premises are required to be surrendered pursuant to the Lease at the expiration of the Term of the Lease, including, without limitation, Section 5.1.9 thereof. All property and alterations of any kind, nature or description remaining in the Premises after the Surrender Date shall be and become the property of Landlord and may be disposed of by Landlord, without payment from Landlord and without the necessity to account therefor to Tenant.

(c) Effective as of the Tenant Termination Date, Landlord shall be released from any and all obligations and liabilities thereafter accruing under the Lease. Nothing contained herein shall constitute a waiver, limitation, amendment, or modification of any of the liabilities and obligations of Landlord under the Lease which accrue or arise prior to the Tenant Termination Date. Effective as of the Surrender Date, Tenant shall be released from any and all liabilities and obligations thereafter accruing under the Lease. Nothing contained herein shall constitute a waiver, limitation, amendment, or modification of any of the liabilities and obligations of Tenant under the Lease which accrue or arise prior to the Surrender Date.

(d) The foregoing provisions shall be self-operative; provided, however, on the request of either party Landlord and Tenant will enter into a mutually satisfactory amendment to the Lease evidencing such Tenant Termination of the Lease.

(e) Time is of the essence of this Section 9.

10. Relocation Right. (a) Landlord shall have the right, at any time and from time- to-time during the Term of the Lease, but not earlier than April 30, 2021, upon not less than six (6) months’ prior written notice to Tenant (a “Relocation Notice”), to provide and furnish Tenant with replacement premises elsewhere in the Building, with such replacement premises to be the same or greater size, and substantially the same buildout and visibility, as determined by Landlord in its reasonable discretion (the “Substitute Premises”), and to relocate Tenant from the Premises to the Substitute Premises. If Landlord relocates Tenant to the Substitute Premises, then on the date specified on the Relocation Notice Tenant shall move its equipment, personal property and personnel to the Substitute Premises and shall reinstall and reconstruct such improvements, equipment and personal property in the Substitute Premises in a manner and fashion reasonably comparable to the Premises. Landlord shall, at its sole cost and expense, prior to relocation of Tenant to the Substitute Premises and as a condition of such relocation, improve the Substitute Premises in a manner substantially comparable to the Premises immediately preceding such relocation. Upon receipt of invoices and evidence of payment thereof by Tenant, Landlord shall, within thirty (30) days of receipt of such invoices, reimburse Tenant for the reasonable costs and expenses incurred by Tenant in connection with the removal and relocation of said personnel, equipment and personal property and the reinstallation thereof in the Substitute Premises, together with the reasonable costs incurred in hiring a cleaning service to render the Premises in good order. Upon the exercise by Landlord of the foregoing relocation right, the Lease and each of the terms, covenants and conditions hereof shall remain in full force and effect and be applicable to the Substitute Premises. In such event, effective as of the date specified in the Relocation Notice, Tenant shall vacate and surrender the original Premises in accordance with the terms and conditions of the Lease, and the Substitute Premises shall thereafter be deemed to be substituted for the original Premises and Tenant shall have no further rights or interests in or to the original Premises. After delivery of a Relocation Notice, the provisions of this Section 10 shall be self-operative; however, at either party’s request, Landlord and Tenant shall enter into an amendment of the Lease confirming the relocation of the Premises.

(b) If Landlord provides Tenant with a Relocation Notice which is not acceptable to Tenant, acting reasonably, Tenant shall have the right to terminate the Lease by giving written notice of termination (a “Tenant’s Relocation Termination Notice”) to Landlord within twenty (20) days after delivery of the Relocation Notice, time being of the essence. Such termination shall be effective upon the date the Landlord intended to relocate the Tenant as defined in the Relocation Notice, provided that Landlord, within ten (10) days after receipt of Tenant’s Relocation Termination Notice, shall have the right to withdraw the Relocation Notice. In such event, the Lease shall continue in full force and effect as if Landlord had never provided Tenant with a Relocation Notice.

(c) Landlord shall have no right, pursuant to this Section 10, to relocate Tenant during the period commencing as of May 1, 2022 and ending on April 30, 2023.

11. Assignment/Subletting. The following is added at the end of Section 5.2.1 of the Lease:

“If Tenant desires to assign this Lease or sublet all or any portion of the Premises, then Tenant shall give notice thereof to Landlord, which notice shall be accompanied by (i) the date Tenant desires the assignment or sublease to be effective, (ii) the material business terms on which Tenant would assign or sublet such premises, (iii) a description of the portion of the Premises to be sublet, if applicable, (iv) a true and complete statement reasonably detailing the identity of the proposed assignee or subtenant, the nature of its business, and its proposed use of the Premises, (v) current financial information with respect to the proposed assignee or subtenant, including, without limitation, its most recent financial statements, and (vi) such other information Landlord may reasonably request. Such notice shall be deemed an offer from Tenant to Landlord whereby Landlord (or Landlord’s designee) shall be granted the right, at Landlord’s option (x) with respect to a proposed assignment, to terminate this Lease, upon the terms and conditions hereinafter set forth; and (y) with respect to a sublease, to terminate this Lease with respect to the portion of the Premises proposed to be sublet, upon the terms and conditions hereinafter set forth. If Landlord exercises its option to terminate this Lease (in whole or in part) pursuant to the foregoing provisions, then (a) this Lease (or that part of the Lease relating to the part of the Premises proposed to be sublet, as applicable) shall end and expire on the date that such assignment or sublease was to commence (as if such date were the expiration date of the term hereof), (b) Rent shall be pro-rated and paid or refunded as of such date, (c) Tenant, upon Landlord’s request, shall enter into an agreement confirming such termination, and (d) Landlord shall be free to lease the Premises or applicable part thereof, to any person or persons, including, without limitation, to Tenant’s prospective assignee or subtenant.

In no event shall Landlord be considered to have withheld its consent unreasonably to any proposed assignment or subletting if (it being understood that this is not an all-inclusive list):

1) the proposed assignee or subtenant is not a reputable person or entity of good character with sufficient financial means to perform all of its obligations under this Lease or the sublease, as the case may be, and/or Landlord has not been furnished with reasonable proof thereof;

2) the proposed assignee or sublessee may, in Landlord’s reasonable determination, use the Premises for (a) a use which does not comply with the conditions and restrictions set forth in this Lease, or (b) a use which could overburden the Premises, the Building, the parking areas or other common areas on the Property, or (c) a use which could cause an increase in the insurance premiums payable with respect to the Property or in the Operating Expenses;

3) the proposed assignee or subtenant (or an affiliate thereof) is then an occupant of the Building;

4) the aggregate consideration to be paid by the proposed assignee or subtenant under the terms of the proposed assignment or sublease is less than seventy-five percent (75%) of the fixed rent at which Landlord is then offering to lease other space in the Building;

5) the proposed assignee or subtenant is a person or entity (or affiliate of a person or entity) with whom Landlord or Landlord’s agent is then or has been within the prior six (6) months negotiating in connection with the rental of space in the Building;

6) the form of the proposed sublease or instrument of assignment is not reasonably satisfactory to Landlord;

7) there shall be more than two (2) subtenants of the Premises;

8) the proposed subtenant or assignee shall be entitled, directly or indirectly, to diplomatic or sovereign immunity, regardless of whether the proposed assignee or subtenant agrees to waive such diplomatic or sovereign immunity, and/or shall not be subject to the service of process in, and the jurisdiction of the courts of, the Commonwealth of Massachusetts; or

9) any mortgagee whose consent to such assignment or sublease is required fails to consent thereto.

If a default of Tenant shall occur at any time prior to the effective date of such assignment or subletting, then Landlord’s consent thereto, if previously granted, shall be immediately deemed revoked without further notice to Tenant, and such consent shall be void and without force and effect, and such assignment or subletting shall constitute a further default of Tenant hereunder.”

12. Inapplicable and Deleted Lease Provisions.

(a) Sections 3.1 and 3.3 of the Lease (Improvements), and Exhibit C to the Lease (Landlord’s Work) shall have no applicability with respect to this Amendment.

(b) Section 2.2 of the Lease, as amended by Section 3 of the Fifth Amendment (Extended Terms), and Section 3 of the Fourth Amendment (Termination Right) are hereby deleted and are of no further force or effect.

13. Brokerage. Tenant hereby represents to Landlord that it has dealt only with JLL and Colliers International (collectively, the “Brokers”) in connection with this Amendment. Landlord hereby represents to Tenant that it has dealt only with the Brokers in connection with this Amendment. Each of Tenant and Landlord shall indemnify and hold harmless the other from and against any and all loss, cost and expense (including attorneys’ fees) arising out of or resulting from any breach of said warranty and representation by the indemnifying party, including any claims for a brokerage commission, finder’s fee or similar compensation made by any person arising out of or in connection with this Amendment, other than the Brokers. Landlord shall be responsible for paying a brokerage commission to the Brokers, pursuant to separate agreements between Landlord and each of the Brokers.

14. Landlord’s Notice Addresses and Addresses for Payment of Rent. Landlord’s addresses for notices set forth in Sections 1.1 and 9.1 of the Lease are hereby deleted and the following addresses are substituted therefor:

American Twine Owner LLC c/o

New England Development 75 Park Plaza

Boston, Massachusetts 02116

With a copy to: Goulston & Storrs

PC 400 Atlantic Avenue

Boston, Massachusetts 02110-3333

Attn: NED American Twine

Addresses for payment of Rent:

For U.S. Mail:

American Twine Owner LLC

P.O. Box 842142 Boston, MA 02284-2142

For Overnight Courier:

American Twine Owner LLC 20 Commerce Way

Suite 800

Woburn, MA 01801-1057

Lockbox # 842142

15. REIT and UBTI Matters.

(a) Tenant recognizes and acknowledges that Landlord (and/or direct or indirect owners of Landlord) is or may from time to time seek to qualify as real estate investment trusts (each, a “REIT”) pursuant to Sections 856 et seq. of the Internal Revenue Code of 1986, as amended (the “Code”) or be subject to tax on unrelated business taxable income as defined in the Code. Tenant agrees to promptly provide such information in its possession or reasonably available to it as Landlord reasonably requests in order to determine whether Landlord’s receipt of any income derived or to be derived under any provision of the Lease may not constitute “rents from real property” as defined for purposes of Section 856(d) of the Code or for purposes of Section 512(b) of the Code, or otherwise adversely affect the status of Landlord or its direct or indirect owners under the real estate investment trust or unrelated business taxable income provisions of the Code (each an “Adverse Event”). If Landlord determines in good faith that the Lease or any document contemplated hereby presents an undue risk of an Adverse Event, Tenant agrees upon written notice from Landlord to reasonably cooperate with Landlord in avoiding such Adverse Event, including but not limited to entering into an amendment or modification of the Lease and entering into such other agreements (including with Landlord’s designees) as Landlord in good faith deems necessary to avoid or minimize the effect of an Adverse Event. Provided that provided that the Adverse Event does not arise due to the Tenant knowingly failing to fulfill its obligations under this Section 15, Landlord shall reimburse Tenant for its reasonable, out-of-pocket costs in connection with such amendments, modifications or other agreements, including the reasonable costs of its legal counsel and accountants. Except as provided in Section 15(c) below, any such cooperation shall be structured so that equivalent payments (in economic terms) are paid by Tenant and so that Tenant does not, to more than a de minimis extent, have materially greater obligations or receive materially diminished services, or services of a materially lesser quality, than it was entitled to receive under the Lease without such cooperation.

(b) Without limiting Landlord’s rights under Section 5.2.1 of the Lease, (i) Tenant expressly covenants and agrees not to enter into any sublease or assignment of the Premises which provides for rental or other payment for such use, occupancy, or utilization based in whole or in part on the net income or profits derived by any person from the property leased, used, occupied, or utilized (other than an amount based on a fixed percentage or percentages of receipts or sales), and that any such purported sublease or assignment shall be absolutely void and ineffective as a conveyance of any right or interest in the possession, use, occupancy, or utilization of any part of the Premises, (ii) Landlord may waive the receipt of any amount in subsection (b)(i) above payable to Landlord under the Lease and such waiver shall constitute an amendment or modification of the Lease with respect to such payment, and (iii) if Landlord determines that either Tenant has not fulfilled its obligations under this Section 15 or that avoiding an Adverse Event is not commercially feasible or reasonable, then Landlord shall have the option to terminate the Lease upon ninety (90) days’ prior written notice to Tenant. If such notice shall be given, then the Lease shall terminate on the ninetieth (90th) day after the date of such notice, all with the same force and effect as if such date had been the Expiration Date specified in the Lease. The parties agree to execute such further instrument as may reasonably be required by Landlord in order to give effect to the foregoing provisions of this Section 15(b).

(c) To the maximum extent permitted by law, Tenant shall indemnify and save harmless Landlord and its direct and indirect members, managers, partners, directors, officers, agents, and employees, against and from all claims, expenses, or liabilities of whatever nature actually incurred by Landlord arising directly or indirectly from (i) any breach of subsection 15(b)(i) of this Section 15 or (ii) the inaccuracy of any written information provided to Landlord in connection with any requirement for Landlord’s consent under this Lease for a proposed assignment of this Lease or a sublease of all or any portion of the Premises. The indemnification set forth in this Section 15 shall survive the expiration or termination of the Lease for a period of one (1) year.

16. OFAC Compliance.

(a) Tenant represents and warrants that (a) Tenant and each person or entity owning an interest in Tenant is (i) not currently identified on the Specially Designated Nationals and Blocked Persons List maintained by the Office of Foreign Assets Control, Department of the Treasury (“OFAC”) and/or on any other similar list maintained by OFAC pursuant to any authorizing statute, executive order or regulation (collectively, the “List”), and (ii) not a person or entity with whom a citizen of the United States is prohibited to engage in transactions by any trade embargo, economic sanction, or other prohibition of United States law, regulation, or Executive Order of the President of the United States, (b) none of the funds or other assets of Tenant constitute property of, or are beneficially owned, directly or indirectly, by any Embargoed Person (as hereinafter defined), (c) no Embargoed Person has any interest of any nature whatsoever in Tenant, (d) none of the funds of Tenant have been derived from any unlawful activity with the result that the investment in Tenant is prohibited by law or that the Lease is in violation of law, and (e) Tenant has implemented procedures, and will consistently apply those procedures, to ensure the foregoing representations and warranties remain true and correct at all times. The term “Embargoed Person” means any person, entity or government subject to trade restrictions under U.S. law, including but not limited to, the International Emergency Economic Powers Act, 50 U.S.C. §1701 et seq., The Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated thereunder with the result that the investment in Tenant is prohibited by law or Tenant is in violation of law.

(b) Tenant covenants and agrees (a) to comply with all requirements of law relating to money laundering, anti-terrorism, trade embargos and economic sanctions, now or hereafter in effect, (b) to immediately notify Landlord in writing if any of the representations, warranties or covenants set forth in this paragraph or the preceding paragraph are no longer true or have been breached or if Tenant has a reasonable basis to believe that they may no longer be true or have been breached, (c) not to use funds from any “Prohibited Person” (as such term is defined in the September 24, 2001 Executive Order Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism) to make any payment due to Landlord under the Lease and (d) at the request of Landlord, to provide such information as may reasonably be requested by Landlord to determine Tenant’s compliance with the terms hereof.

(c) Tenant hereby acknowledges and agrees that Tenant’s inclusion on the List at any time during the Term shall be a material default of the Lease. Notwithstanding anything herein to the contrary, Tenant shall not knowingly permit the Premises or any portion thereof to be used or occupied by any person or entity on the List or by any Embargoed Person (on a permanent, temporary or transient basis), and that knowingly permitting such use or occupancy of the Premises by any such person or entity shall be a material default of the Lease.

17. Miscellaneous. Tenant hereby represents and warrants to Landlord as follows: (i) the execution and delivery of this Amendment by Tenant has been duly authorized by all requisite corporate action, (ii) neither the Lease nor the interest of Tenant therein has been assigned, sublet, encumbered or otherwise transferred; (iii) there are no defenses or counterclaims to the enforcement of the Lease or the liabilities and obligations of Tenant thereunder; (iv) Tenant is not in breach or default of any of its respective obligations under the Lease; (v) Landlord has made no representations or warranties, except as expressly and specifically set forth in the Lease and this Amendment. To Tenant’s knowledge, Landlord is not in breach or default of any of its respective obligations under the Lease. Except for Landlord’s Work as defined in Section 5 above, Landlord has performed all work and constructed all improvements required to be performed or constructed by Landlord pursuant to the Lease. The submission of drafts of this document for examination and negotiation does not constitute an offer, or a reservation of or option for, the Extension Term or any of the other terms and conditions set forth in this Amendment, and this Amendment shall not be binding upon Landlord or Tenant unless and until each party hereto has executed and delivered a fully executed copy of this Amendment to the other party. Except as expressly and specifically set forth in this Amendment, the Lease is hereby ratified and confirmed, and all of the terms, covenants, agreements and provisions of the Lease shall remain unaltered and unmodified and in full force and effect throughout the balance of the Term of the Lease, as extended hereby.

18. Counterparts. This Amendment may be executed in two (2) counterparts, which counterparts taken together shall constitute one and the same instrument. This Amendment may be executed by electronic signature, which shall be considered as an original signature for all purposes and shall have the same force and effect as an original signature. Without limitation, in addition to electronically produced signatures, “electronic signature” shall include electronically scanned and transmitted versions (e.g., via pdf) of an original signature.

[Signature Page Follows]

EXECUTED as of the Effective Date.

| LANDLORD: | ||

| AMERICAN TWINE OWNER LLC, | ||

| a Delaware limited liability company | ||

| By: | /s/ Steven F. Fischman | |

| Name: | Steven F. Fischman | |

| Title: | Manager | |

| TENANT: | ||

| VARIATION BIOTECHNOLOGIES (US), INC., | ||

| a Delaware corporation | ||

| By: | /s/ Jeff Baxter | |

| Name: | Jeff Baxter | |

| Title: | President and CEO | |

EXHIBIT A

PLAN AND SCOPE OF LANDLORD’S WORK

222 THIRD STREET - SUITE 2241

Landlord shall, as part of Landlord’s Work, perform the following:

| ● | Provide and install new 22” x 25” stainless steel sink and faucet in existing cabinet and counter | |

| ● | Provide and install new sewage ejector pump in adjacent storage/IT closet | |

| ● | Provide and install new 1.5-gallon under-counter electric water heater | |

| ● | Provide and install all necessary plumbing connections, waste, water and vents | |

| ● | Equipment has standard 120 volt plug connections, existing outlets to be utilized |