Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Trinseo S.A. | tse-20200506xex99d1.htm |

| 8-K - 8-K - Trinseo S.A. | tse-20200506x8k.htm |

Exhibit 99.2

| 1 ™ Trademark of Trinseo S.A. or its affiliates ™ Trademark of Trinseo S.A. or its affiliates May 6, 2020 First Quarter 2020 Financial Results |

| 2 Disclosure Rules Cautionary Note on Forward-Looking Statements. This presentation contains forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts or guarantees or assurances of future performance. Forward-looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “see,” “tend,” “assume,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding the impact from the Covid-19 pandemic, our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Factors that might cause such a difference include, but are not limited to, those discussed in our Annual Report on Form 10-K, under Part I, Item 1A — “Risk Factors” and elsewhere in our other reports filed with the U.S. Securities and Exchange Commission. As a result of these or other factors, our actual results may differ materially from those contemplated by the forward-looking statements. Therefore, we caution you against relying on any of these forward-looking statements. The forward-looking statements included in this presentation are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. This presentation contains financial measures that are not in accordance with generally accepted accounting principles in the US (“GAAP”) including EBITDA, Adjusted EBITDA, Adjusted Net Income, Adjusted EPS and Free Cash Flow. We believe these measures provide relevant and meaningful information to investors and lenders about the ongoing operating results of the Company. Such measures when referenced herein should not be viewed as an alternative to GAAP measures of performance or liquidity, as applicable. We have provided a reconciliation of these measures to the most comparable GAAP metric alongside of the respective measure or otherwise in the Appendix section of this presentation. Introductions • Frank Bozich, President & CEO • David Stasse, Executive Vice President & CFO • Andy Myers, Director of Investor Relations Introductions & Disclosure Rules |

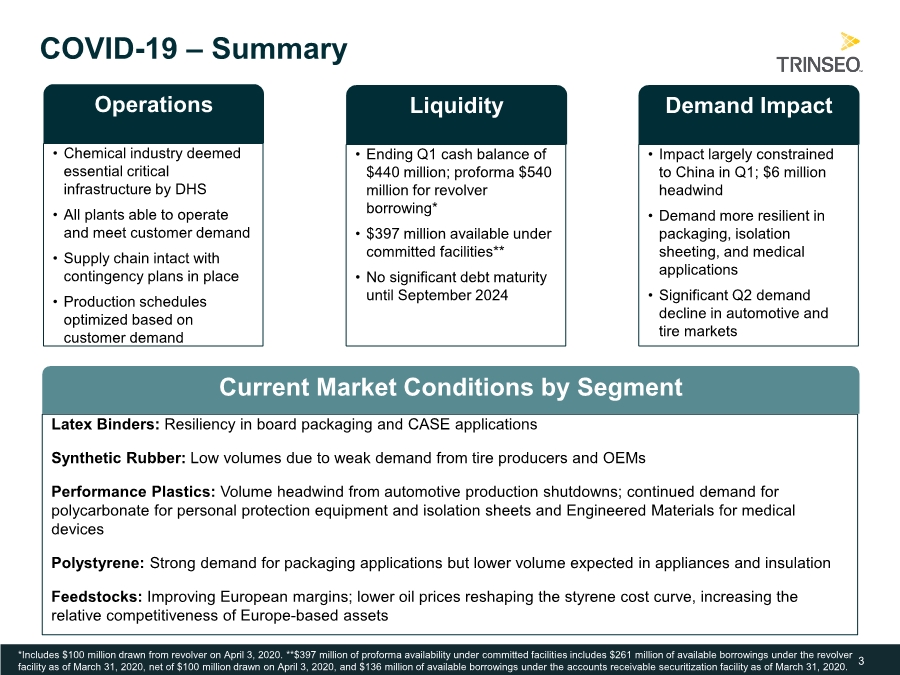

| 3 COVID-19 – Summary Operations • Chemical industry deemed essential critical infrastructure by DHS • All plants able to operate and meet customer demand • Supply chain intact with contingency plans in place • Production schedules optimized based on customer demand Liquidity • Ending Q1 cash balance of $440 million; proforma $540 million for revolver borrowing* • $397 million available under committed facilities** • No significant debt maturity until September 2024 Demand Impact • Impact largely constrained to China in Q1; $6 million headwind • Demand more resilient in packaging, isolation sheeting, and medical applications • Significant Q2 demand decline in automotive and tire markets Current Market Conditions by Segment Latex Binders: Resiliency in board packaging and CASE applications Synthetic Rubber: Low volumes due to weak demand from tire producers and OEMs Performance Plastics: Volume headwind from automotive production shutdowns; continued demand for polycarbonate for personal protection equipment and isolation sheets and Engineered Materials for medical devices Polystyrene: Strong demand for packaging applications but lower volume expected in appliances and insulation Feedstocks: Improving European margins; lower oil prices reshaping the styrene cost curve, increasing the relative competitiveness of Europe-based assets *Includes $100 million drawn from revolver on April 3, 2020. **$397 million of proforma availability under committed facilities includes $261 million of available borrowings under the revolver facility as of March 31, 2020, net of $100 million drawn on April 3, 2020, and $136 million of available borrowings under the accounts receivable securitization facility as of March 31, 2020. |

| 4 Trinseo Contributions to COVID-19 Response Trinseo Materials Essential in the Fight Against COVID-19 Trinseo’s CALIBRE™ PC Resins Essential in Helping to Curb Spread of COVID-19 U.S. Department of Homeland Security Deemed Chemical Industry as Essential Critical Infrastructure Trinseo in the Community: Hong Kong, Taiwan & China Sites Donate Hand Sanitizer and Protective Materials Trinseo’s materials support plastic & paper board food packaging applications to keep foods fresher, longer. |

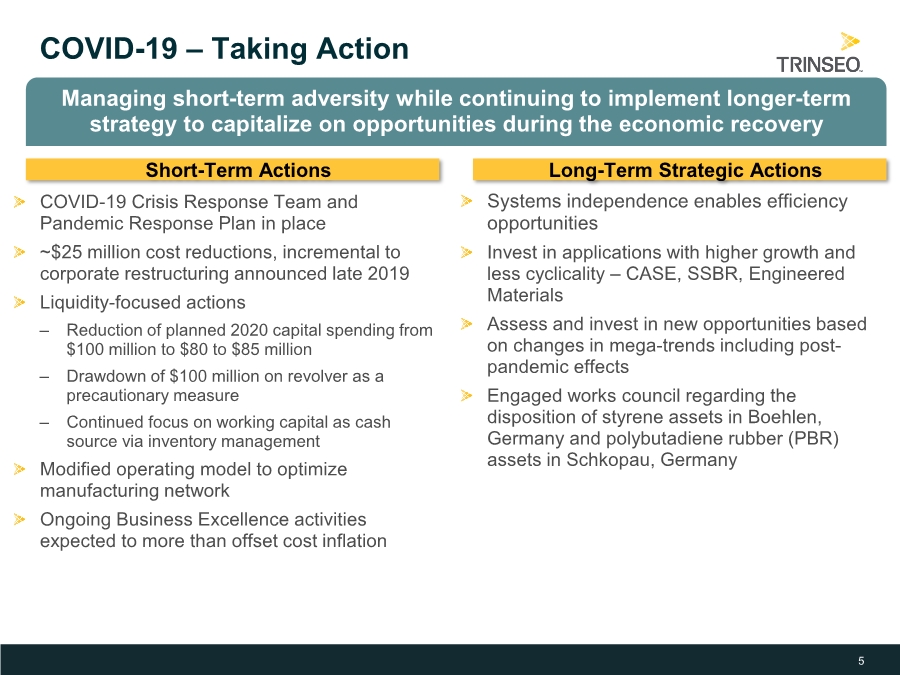

| 5 COVID-19 – Taking Action COVID-19 Crisis Response Team and Pandemic Response Plan in place ~$25 million cost reductions, incremental to corporate restructuring announced late 2019 Liquidity-focused actions – Reduction of planned 2020 capital spending from $100 million to $80 to $85 million – Drawdown of $100 million on revolver as a precautionary measure – Continued focus on working capital as cash source via inventory management Modified operating model to optimize manufacturing network Ongoing Business Excellence activities expected to more than offset cost inflation Managing short-term adversity while continuing to implement longer-term strategy to capitalize on opportunities during the economic recovery Short-Term Actions Systems independence enables efficiency opportunities Invest in applications with higher growth and less cyclicality – CASE, SSBR, Engineered Materials Assess and invest in new opportunities based on changes in mega-trends including post- pandemic effects Engaged works council regarding the disposition of styrene assets in Boehlen, Germany and polybutadiene rubber (PBR) assets in Schkopau, Germany Long-Term Strategic Actions |

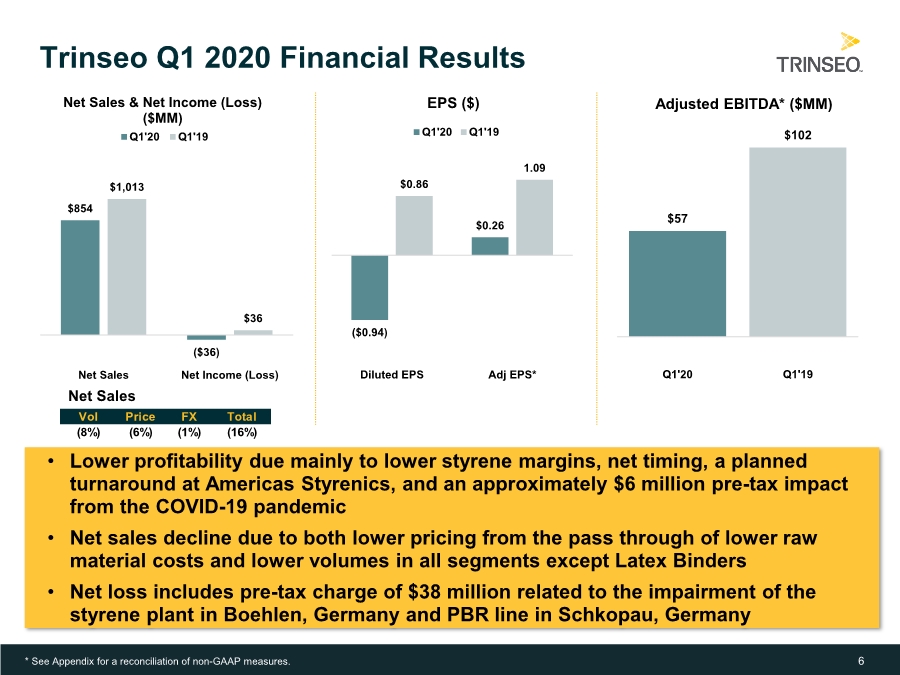

| 6 • Lower profitability due mainly to lower styrene margins, net timing, a planned turnaround at Americas Styrenics, and an approximately $6 million pre-tax impact from the COVID-19 pandemic • Net sales decline due to both lower pricing from the pass through of lower raw material costs and lower volumes in all segments except Latex Binders • Net loss includes pre-tax charge of $38 million related to the impairment of the styrene plant in Boehlen, Germany and PBR line in Schkopau, Germany Trinseo Q1 2020 Financial Results ($0.94) $0.26 $0.86 1.09 Diluted EPS Adj EPS* EPS ($) Q1'20 Q1'19 $854 ($36) $1,013 $36 Net Sales Net Income (Loss) Net Sales & Net Income (Loss) ($MM) Q1'20 Q1'19 $57 $102 Q1'20 Q1'19 Adjusted EBITDA* ($MM) * See Appendix for a reconciliation of non-GAAP measures. Net Sales Vol Price FX Total (8%) (6%) (1%) (16%) |

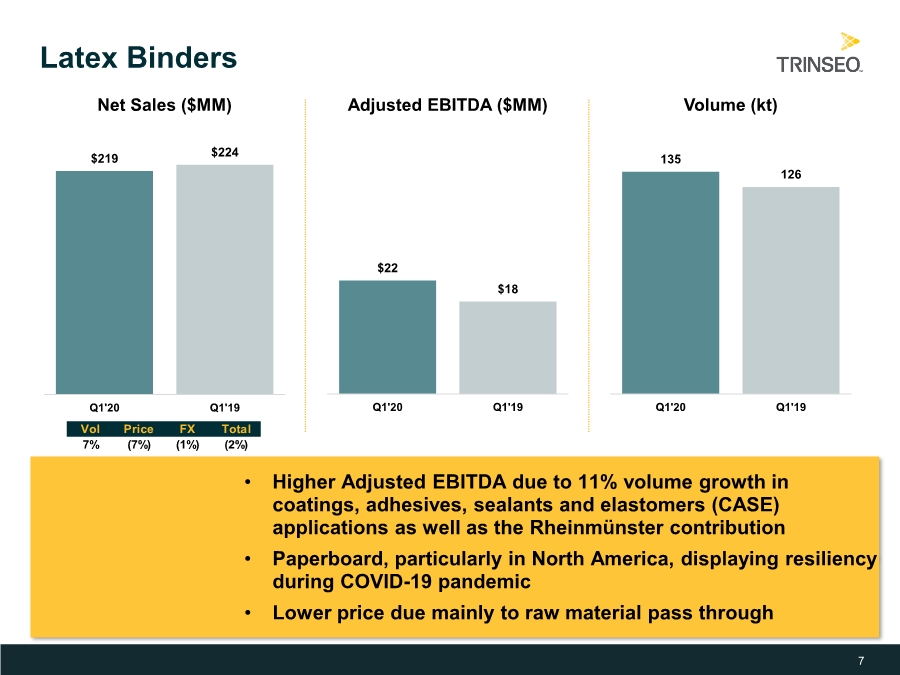

| 7 • Higher Adjusted EBITDA due to 11% volume growth in coatings, adhesives, sealants and elastomers (CASE) applications as well as the Rheinmünster contribution • Paperboard, particularly in North America, displaying resiliency during COVID-19 pandemic • Lower price due mainly to raw material pass through Latex Binders $219 $224 Q1'20 Q1'19 Net Sales ($MM) $22 $18 Q1'20 Q1'19 Adjusted EBITDA ($MM) 135 126 Q1'20 Q1'19 Volume (kt) Vol Price FX Total 7% (7%) (1%) (2%) |

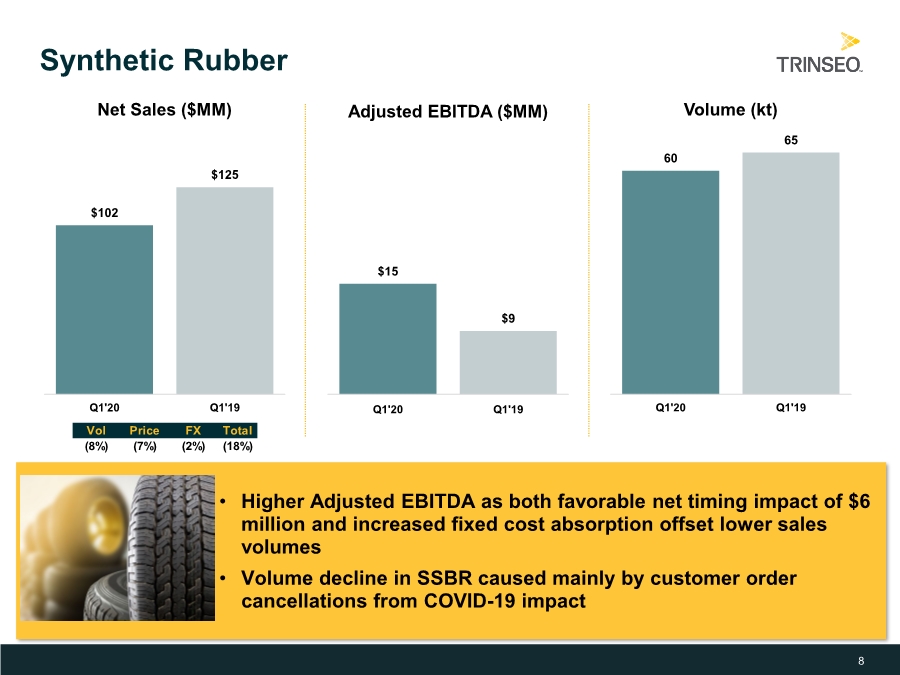

| 8 • Higher Adjusted EBITDA as both favorable net timing impact of $6 million and increased fixed cost absorption offset lower sales volumes • Volume decline in SSBR caused mainly by customer order cancellations from COVID-19 impact Synthetic Rubber $102 $125 Q1'20 Q1'19 Net Sales ($MM) $15 $9 Q1'20 Q1'19 Adjusted EBITDA ($MM) 60 65 Q1'20 Q1'19 Volume (kt) Vol Price FX Total (8%) (7%) (2%) (18%) |

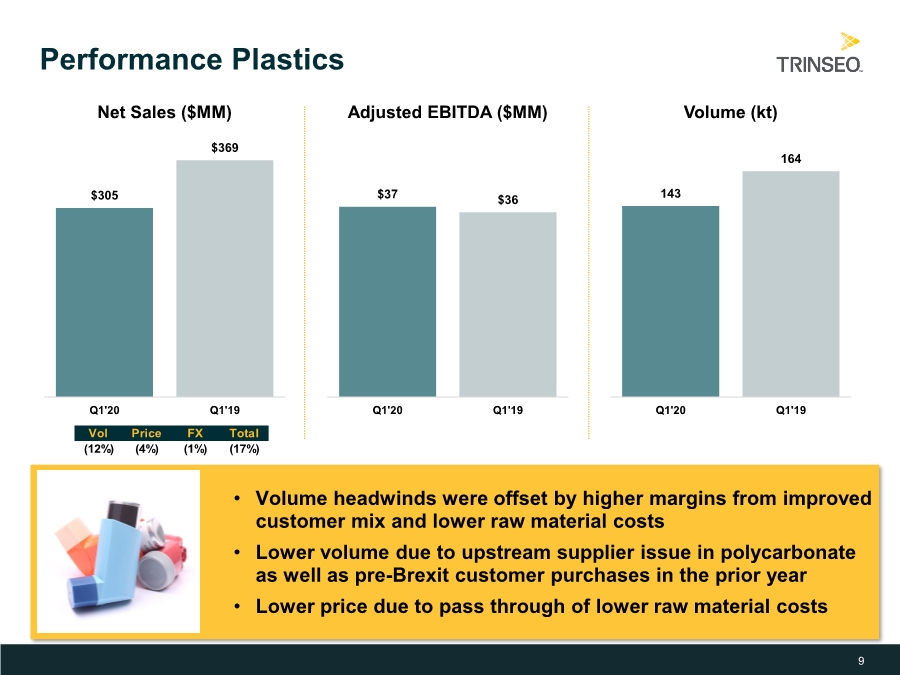

| 9 • Volume headwinds were offset by higher margins from improved customer mix and lower raw material costs • Lower volume due to upstream supplier issue in polycarbonate as well as pre-Brexit customer purchases in the prior year • Lower price due to pass through of lower raw material costs Performance Plastics $305 $369 Q1'20 Q1'19 Net Sales ($MM) $37 $36 Q1'20 Q1'19 Adjusted EBITDA ($MM) 143 164 Q1'20 Q1'19 Volume (kt) Vol Price FX Total (12%) (4%) (1%) (17%) |

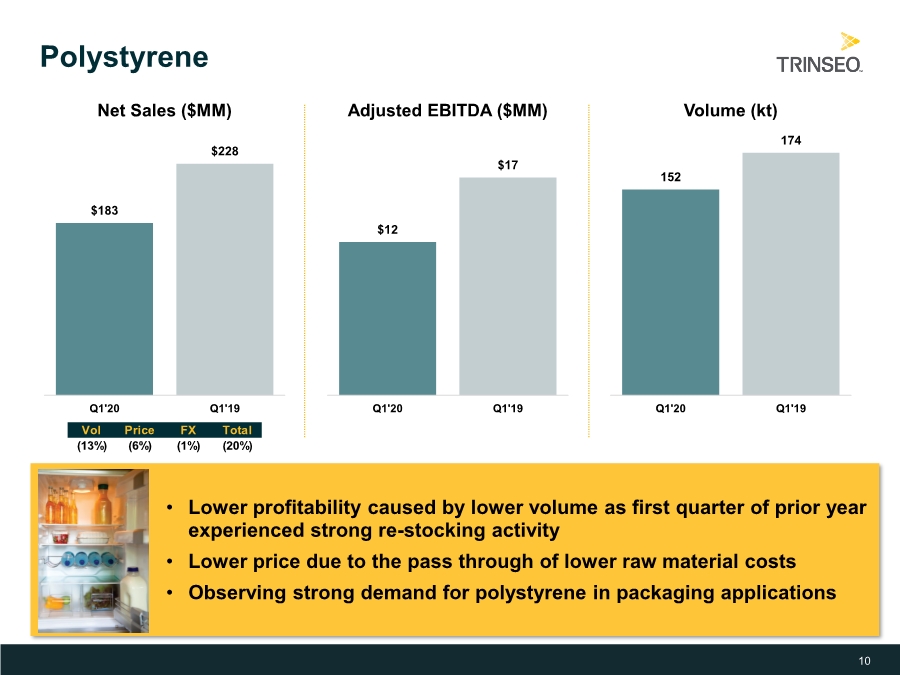

| 10 • Lower profitability caused by lower volume as first quarter of prior year experienced strong re-stocking activity • Lower price due to the pass through of lower raw material costs • Observing strong demand for polystyrene in packaging applications Polystyrene $183 $228 Q1'20 Q1'19 Net Sales ($MM) $12 $17 Q1'20 Q1'19 Adjusted EBITDA ($MM) 152 174 Q1'20 Q1'19 Volume (kt) Vol Price FX Total (13%) (6%) (1%) (20%) |

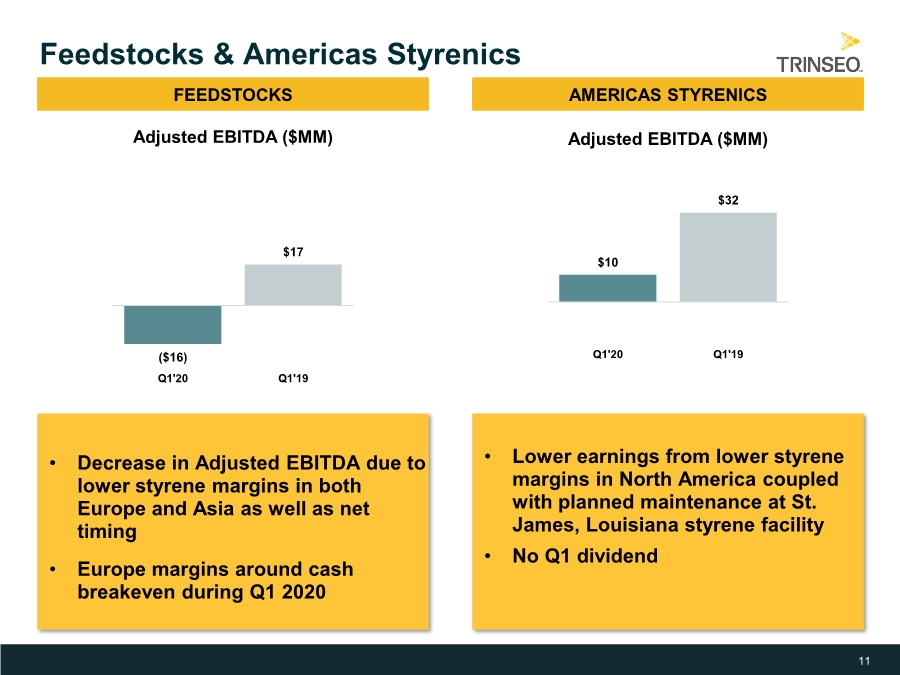

| 11 • Decrease in Adjusted EBITDA due to lower styrene margins in both Europe and Asia as well as net timing • Europe margins around cash breakeven during Q1 2020 Feedstocks & Americas Styrenics ($16) $17 Q1'20 Q1'19 Adjusted EBITDA ($MM) FEEDSTOCKS • Lower earnings from lower styrene margins in North America coupled with planned maintenance at St. James, Louisiana styrene facility • No Q1 dividend AMERICAS STYRENICS $10 $32 Q1'20 Q1'19 Adjusted EBITDA ($MM) |

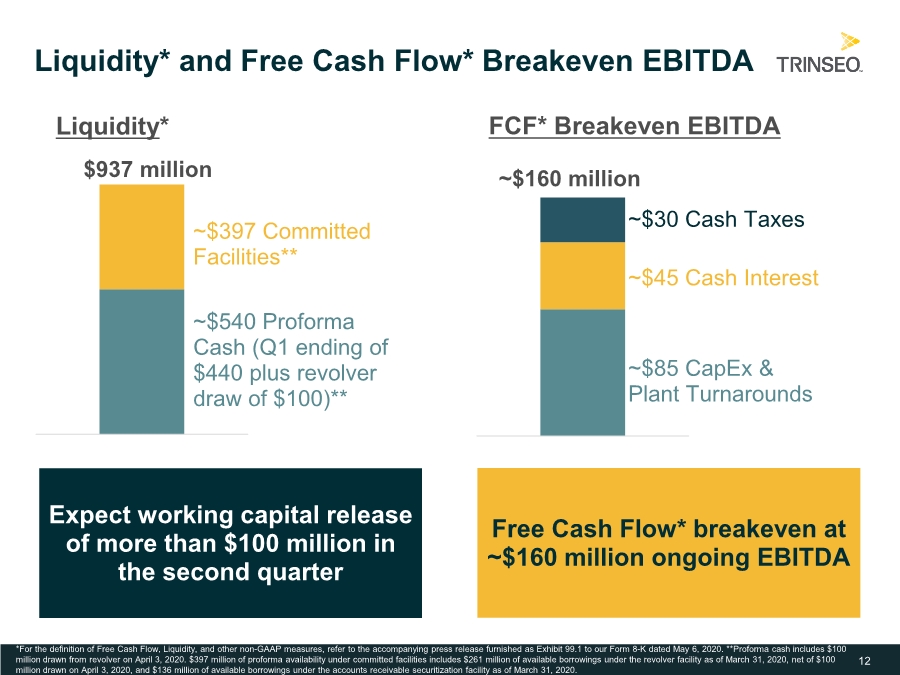

| 12 Liquidity* and Free Cash Flow* Breakeven EBITDA FCF* Breakeven EBITDA ~$160 million ~$30 Cash Taxes ~$45 Cash Interest ~$85 CapEx & Plant Turnarounds Expect working capital release of more than $100 million in the second quarter Free Cash Flow* breakeven at ~$160 million ongoing EBITDA ~$540 Proforma Cash (Q1 ending of $440 plus revolver draw of $100)** ~$397 Committed Facilities** $937 million Liquidity* *For the definition of Free Cash Flow, Liquidity, and other non-GAAP measures, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated May 6, 2020. **Proforma cash includes $100 million drawn from revolver on April 3, 2020. $397 million of proforma availability under committed facilities includes $261 million of available borrowings under the revolver facility as of March 31, 2020, net of $100 million drawn on April 3, 2020, and $136 million of available borrowings under the accounts receivable securitization facility as of March 31, 2020. |

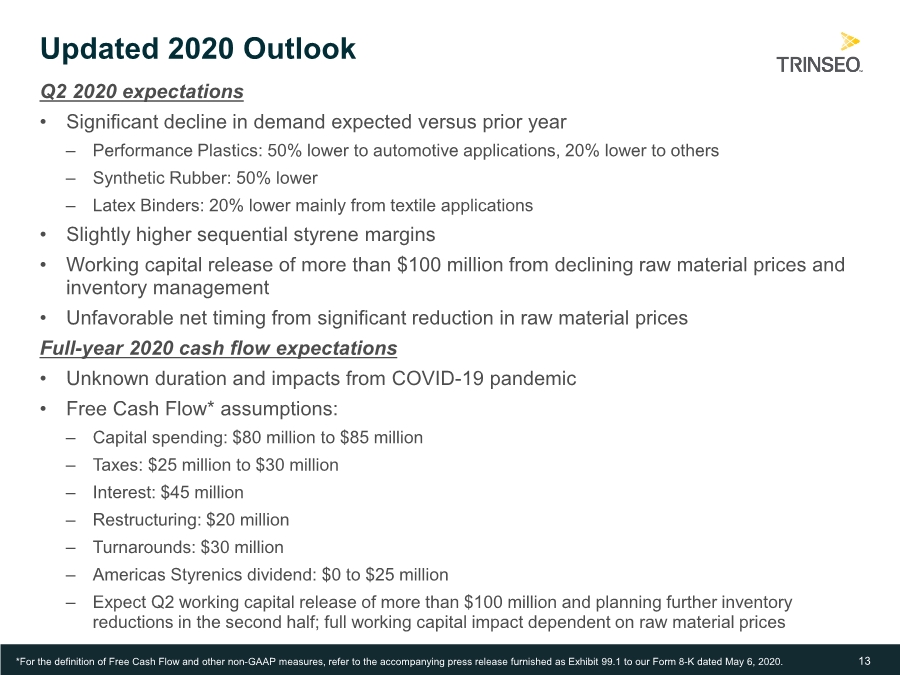

| 13 Updated 2020 Outlook Q2 2020 expectations • Significant decline in demand expected versus prior year – Performance Plastics: 50% lower to automotive applications, 20% lower to others – Synthetic Rubber: 50% lower – Latex Binders: 20% lower mainly from textile applications • Slightly higher sequential styrene margins • Working capital release of more than $100 million from declining raw material prices and inventory management • Unfavorable net timing from significant reduction in raw material prices Full-year 2020 cash flow expectations • Unknown duration and impacts from COVID-19 pandemic • Free Cash Flow* assumptions: – Capital spending: $80 million to $85 million – Taxes: $25 million to $30 million – Interest: $45 million – Restructuring: $20 million – Turnarounds: $30 million – Americas Styrenics dividend: $0 to $25 million – Expect Q2 working capital release of more than $100 million and planning further inventory reductions in the second half; full working capital impact dependent on raw material prices *For the definition of Free Cash Flow and other non-GAAP measures, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated May 6, 2020. |

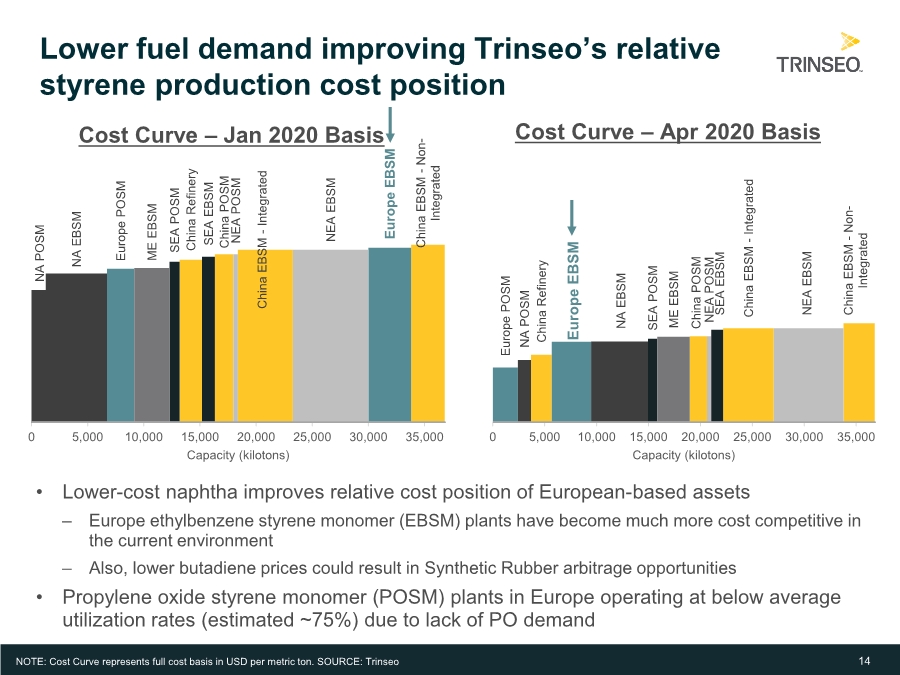

| 14 Lower fuel demand improving Trinseo’s relative styrene production cost position • Lower-cost naphtha improves relative cost position of European-based assets – Europe ethylbenzene styrene monomer (EBSM) plants have become much more cost competitive in the current environment – Also, lower butadiene prices could result in Synthetic Rubber arbitrage opportunities • Propylene oxide styrene monomer (POSM) plants in Europe operating at below average utilization rates (estimated ~75%) due to lack of PO demand Cost Curve – Apr 2020 Basis Cost Curve – Jan 2020 Basis NA POSM NA EBSM Europe POSM ME EBSM SEA POSM China Refinery SEA EBSM China POSM NEA POSM China EBSM - Integrated NEA EBSM Europe EBSM China EBSM - Non- Integrated 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 Capacity (kilotons) Europe POSM NA POSM China Refinery Europe EBSM NA EBSM SEA POSM ME EBSM China POSM NEA POSM SEA EBSM China EBSM - Integrated NEA EBSM China EBSM - Non- Integrated 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 Capacity (kilotons) NOTE: Cost Curve represents full cost basis in USD per metric ton. SOURCE: Trinseo |

| 15 15 Appendix |

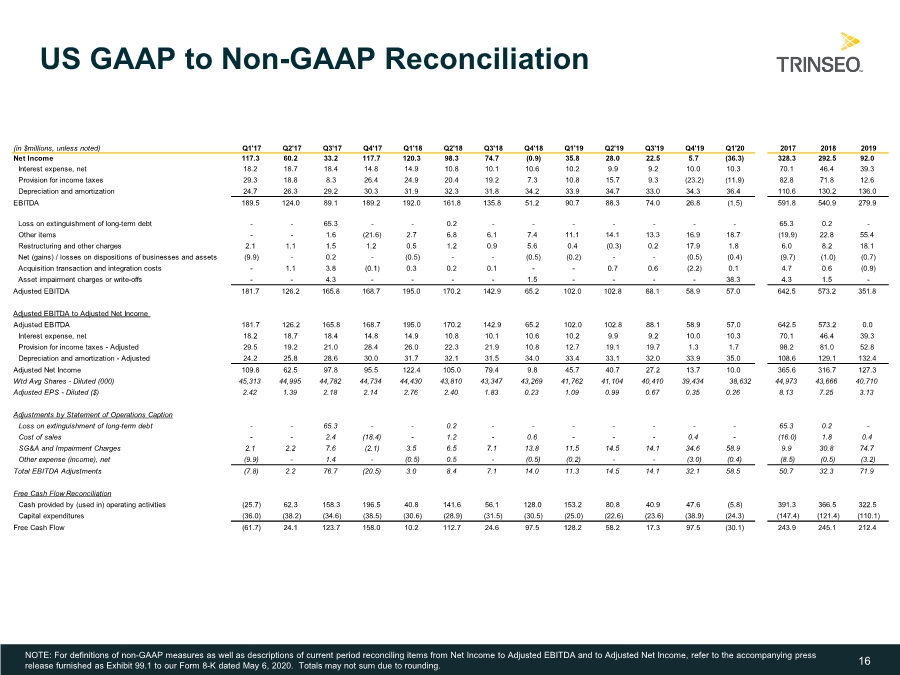

| 16 US GAAP to Non-GAAP Reconciliation NOTE: For definitions of non-GAAP measures as well as descriptions of current period reconciling items from Net Income to Adjusted EBITDA and to Adjusted Net Income, refer to the accompanying press release furnished as Exhibit 99.1 to our Form 8-K dated May 6, 2020. Totals may not sum due to rounding. (in $millions, unless noted) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 2017 2018 2019 Net Income 117.3 60.2 33.2 117.7 120.3 98.3 74.7 (0.9) 35.8 28.0 22.5 5.7 (36.3) 328.3 292.5 92.0 Interest expense, net 18.2 18.7 18.4 14.8 14.9 10.8 10.1 10.6 10.2 9.9 9.2 10.0 10.3 70.1 46.4 39.3 Provision for income taxes 29.3 18.8 8.3 26.4 24.9 20.4 19.2 7.3 10.8 15.7 9.3 (23.2) (11.9) 82.8 71.8 12.6 Depreciation and amortization 24.7 26.3 29.2 30.3 31.9 32.3 31.8 34.2 33.9 34.7 33.0 34.3 36.4 110.6 130.2 136.0 EBITDA 189.5 124.0 89.1 189.2 192.0 161.8 135.8 51.2 90.7 88.3 74.0 26.8 (1.5) 591.8 540.9 279.9 Loss on extinguishment of long-term debt - - 65.3 - - 0.2 - - - - - - - 65.3 0.2 - Other items - - 1.6 (21.6) 2.7 6.8 6.1 7.4 11.1 14.1 13.3 16.9 18.7 (19.9) 22.8 55.4 Restructuring and other charges 2.1 1.1 1.5 1.2 0.5 1.2 0.9 5.6 0.4 (0.3) 0.2 17.9 1.8 6.0 8.2 18.1 Net (gains) / losses on dispositions of businesses and assets (9.9) - 0.2 - (0.5) - - (0.5) (0.2) - - (0.5) (0.4) (9.7) (1.0) (0.7) Acquisition transaction and integration costs - 1.1 3.8 (0.1) 0.3 0.2 0.1 - - 0.7 0.6 (2.2) 0.1 4.7 0.6 (0.9) Asset impairment charges or write-offs - - 4.3 - - - - 1.5 - - - - 38.3 4.3 1.5 - Adjusted EBITDA 181.7 126.2 165.8 168.7 195.0 170.2 142.9 65.2 102.0 102.8 88.1 58.9 57.0 642.5 573.2 351.8 Adjusted EBITDA to Adjusted Net Income Adjusted EBITDA 181.7 126.2 165.8 168.7 195.0 170.2 142.9 65.2 102.0 102.8 88.1 58.9 57.0 642.5 573.2 0.0 Interest expense, net 18.2 18.7 18.4 14.8 14.9 10.8 10.1 10.6 10.2 9.9 9.2 10.0 10.3 70.1 46.4 39.3 Provision for income taxes - Adjusted 29.5 19.2 21.0 28.4 26.0 22.3 21.9 10.8 12.7 19.1 19.7 1.3 1.7 98.2 81.0 52.8 Depreciation and amortization - Adjusted 24.2 25.8 28.6 30.0 31.7 32.1 31.5 34.0 33.4 33.1 32.0 33.9 35.0 108.6 129.1 132.4 Adjusted Net Income 109.8 62.5 97.8 95.5 122.4 105.0 79.4 9.8 45.7 40.7 27.2 13.7 10.0 365.6 316.7 127.3 Wtd Avg Shares - Diluted (000) 45,313 44,995 44,782 44,734 44,430 43,810 43,347 43,269 41,762 41,104 40,410 39,434 38,632 44,973 43,666 40,710 Adjusted EPS - Diluted ($) 2.42 1.39 2.18 2.14 2.76 2.40 1.83 0.23 1.09 0.99 0.67 0.35 0.26 8.13 7.25 3.13 Adjustments by Statement of Operations Caption Loss on extinguishment of long-term debt - - 65.3 - - 0.2 - - - - - - - 65.3 0.2 - Cost of sales - - 2.4 (18.4) - 1.2 - 0.6 - - - 0.4 - (16.0) 1.8 0.4 SG&A and Impairment Charges 2.1 2.2 7.6 (2.1) 3.5 6.5 7.1 13.8 11.5 14.5 14.1 34.6 58.9 9.9 30.8 74.7 Other expense (income), net (9.9) - 1.4 - (0.5) 0.5 - (0.5) (0.2) - - (3.0) (0.4) (8.5) (0.5) (3.2) Total EBITDA Adjustments (7.8) 2.2 76.7 (20.5) 3.0 8.4 7.1 14.0 11.3 14.5 14.1 32.1 58.5 50.7 32.3 71.9 Free Cash Flow Reconciliation Cash provided by (used in) operating activities (25.7) 62.3 158.3 196.5 40.8 141.6 56.1 128.0 153.2 80.8 40.9 47.6 (5.8) 391.3 366.5 322.5 Capital expenditures (36.0) (38.2) (34.6) (38.5) (30.6) (28.9) (31.5) (30.5) (25.0) (22.6) (23.6) (38.9) (24.3) (147.4) (121.4) (110.1) Free Cash Flow (61.7) 24.1 123.7 158.0 10.2 112.7 24.6 97.5 128.2 58.2 17.3 97.5 (30.1) 243.9 245.1 212.4 |

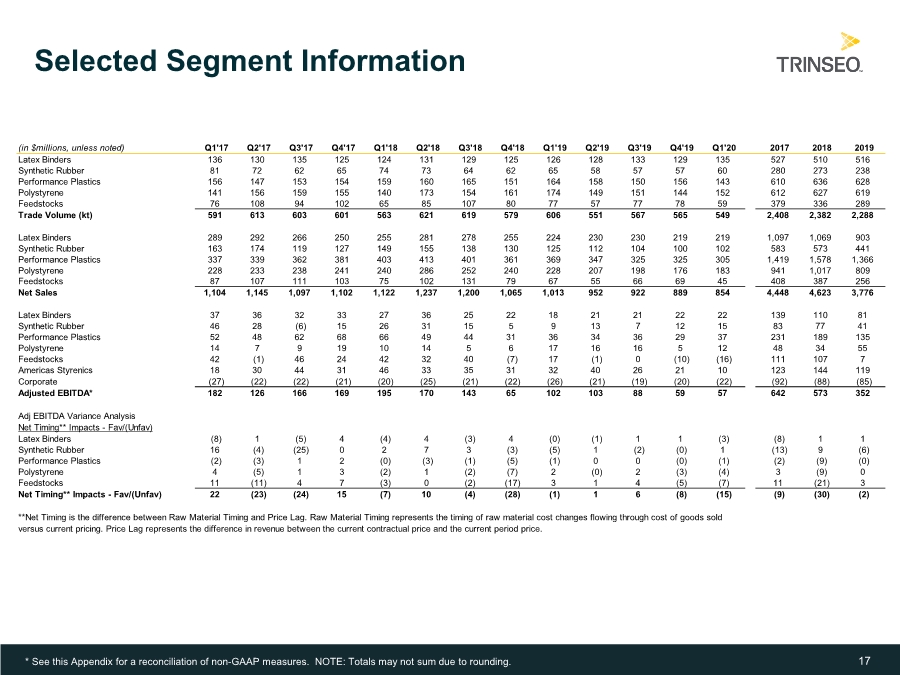

| 17 Selected Segment Information * See this Appendix for a reconciliation of non-GAAP measures. NOTE: Totals may not sum due to rounding. (in $millions, unless noted) Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 2017 2018 2019 Latex Binders 136 130 135 125 124 131 129 125 126 128 133 129 135 527 510 516 Synthetic Rubber 81 72 62 65 74 73 64 62 65 58 57 57 60 280 273 238 Performance Plastics 156 147 153 154 159 160 165 151 164 158 150 156 143 610 636 628 Polystyrene 141 156 159 155 140 173 154 161 174 149 151 144 152 612 627 619 Feedstocks 76 108 94 102 65 85 107 80 77 57 77 78 59 379 336 289 Trade Volume (kt) 591 613 603 601 563 621 619 579 606 551 567 565 549 2,408 2,382 2,288 Latex Binders 289 292 266 250 255 281 278 255 224 230 230 219 219 1,097 1,069 903 Synthetic Rubber 163 174 119 127 149 155 138 130 125 112 104 100 102 583 573 441 Performance Plastics 337 339 362 381 403 413 401 361 369 347 325 325 305 1,419 1,578 1,366 Polystyrene 228 233 238 241 240 286 252 240 228 207 198 176 183 941 1,017 809 Feedstocks 87 107 111 103 75 102 131 79 67 55 66 69 45 408 387 256 Net Sales 1,104 1,145 1,097 1,102 1,122 1,237 1,200 1,065 1,013 952 922 889 854 4,448 4,623 3,776 Latex Binders 37 36 32 33 27 36 25 22 18 21 21 22 22 139 110 81 Synthetic Rubber 46 28 (6) 15 26 31 15 5 9 13 7 12 15 83 77 41 Performance Plastics 52 48 62 68 66 49 44 31 36 34 36 29 37 231 189 135 Polystyrene 14 7 9 19 10 14 5 6 17 16 16 5 12 48 34 55 Feedstocks 42 (1) 46 24 42 32 40 (7) 17 (1) 0 (10) (16) 111 107 7 Americas Styrenics 18 30 44 31 46 33 35 31 32 40 26 21 10 123 144 119 Corporate (27) (22) (22) (21) (20) (25) (21) (22) (26) (21) (19) (20) (22) (92) (88) (85) Adjusted EBITDA* 182 126 166 169 195 170 143 65 102 103 88 59 57 642 573 352 Adj EBITDA Variance Analysis Net Timing** Impacts - Fav/(Unfav) Latex Binders (8) 1 (5) 4 (4) 4 (3) 4 (0) (1) 1 1 (3) (8) 1 1 Synthetic Rubber 16 (4) (25) 0 2 7 3 (3) (5) 1 (2) (0) 1 (13) 9 (6) Performance Plastics (2) (3) 1 2 (0) (3) (1) (5) (1) 0 0 (0) (1) (2) (9) (0) Polystyrene 4 (5) 1 3 (2) 1 (2) (7) 2 (0) 2 (3) (4) 3 (9) 0 Feedstocks 11 (11) 4 7 (3) 0 (2) (17) 3 1 4 (5) (7) 11 (21) 3 Net Timing** Impacts - Fav/(Unfav) 22 (23) (24) 15 (7) 10 (4) (28) (1) 1 6 (8) (15) (9) (30) (2) **Net Timing is the difference between Raw Material Timing and Price Lag. Raw Material Timing represents the timing of raw material cost changes flowing through cost of goods sold versus current pricing. Price Lag represents the difference in revenue between the current contractual price and the current period price. |