Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE FROM THERAPEUTICSMD, INC., DATED MAY 6, 2020 - TherapeuticsMD, Inc. | ex99-1.htm |

| 8-K - CURRENT REPORT - TherapeuticsMD, Inc. | txmd-8k_050620.htm |

Exhibit 99,2

Building the Premier Women’s Health Company 1Q 2020 Earnings May 6, 2020

2 Forward - Looking Statements This presentation by TherapeuticsMD, Inc . (referred to as “we,” “our,” or “the Company”) may contain forward - looking statements . Forward - looking statements may include, but are not limited to, statements relating to our objectives, plans and strategies, as well as statements, other than historical facts, that address activities, events or developments that we intend, expect, project, believe or anticipate will or may occur in the future . These statements are often characterized by terminology such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy” and similar expressions and are based on assumptions and assessments made in light of our managerial experience and perception of historical trends, current conditions, expected future developments and other factors we believe to be appropriate . Forward - looking statements in this presentation are made as of the date of this presentation, and we undertake no duty to update or revise any such statements, whether as a result of new information, future events or otherwise . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties, many of which may be outside of our control . Important factors that could cause actual results, developments and business decisions to differ materially from forward - looking statements are described in the sections titled “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), including our most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q, as well as our current reports on Form 8 - K, and include the following : the company’s ability to protect the intellectual property related to its products ; the effects of the COVID - 19 pandemic ; the company’s ability to maintain or increase sales of its products ; the company’s ability to develop and commercialize IMVEXXY®, ANNOVERA®, BIJUVA® and its hormone therapy drug candidates and obtain additional financing necessary therefor ; whether the company will be able to comply with the covenants and conditions under its term loan facility, including the conditions to draw an additional tranche thereunder and whether the lender will make such tranche available ; the potential of adverse side effects or other safety risks that could adversely affect the commercialization of the company’s current or future approved products or preclude the approval of the company’s future drug candidates ; whether the FDA will approve the efficacy supplement for the lower dose of BIJUVA ; the company’s ability to protect its intellectual property, including with respect to the Paragraph IV notice letters the company received regarding IMVEXXY and BIJUVA ; the length, cost and uncertain results of future clinical trials ; the company’s reliance on third parties to conduct its manufacturing, research and development and clinical trials ; the ability of the company’s licensees to commercialize and distribute the company’s products ; the ability of the company’s marketing contractors to market ANNOVERA ; the availability of reimbursement from government authorities and health insurance companies for the company’s products ; the impact of product liability lawsuits ; the influence of extensive and costly government regulation ; the volatility of the trading price of the company’s common stock and the concentration of power in its stock ownership . This non - promotional presentation is intended for investor audiences only .

3 Our approach is strategic, highly focused and achievable: ▪ Now that we have patient, provider and net revenue data on all 3 of our products, we have developed a path to reduce overall expenses and reallocate our resources that maintains our goal of achieving EBITDA breakeven in 2021 ▪ We believe we are positioned to capitalize on emerging market trends that have been accelerated by COVID - 19 with our retail and online distribution channels ▪ In the short - term, we have adjusted our strategy to be primarily focused on ANNOVERA and IMVEXXY COVID - 19 Strategic Overview

4 ▪ ANNOVERA will remain our primary focus because of the positive market reception and net revenue per unit results that are a full year ahead of our internal expectations ▪ IMVEXXY is our second priority as it has gained traction amongst the prescribing population and is now the fastest growing product in the category ▪ To fund these initiatives, we are pausing the majority of our BIJUVA related promotional activities ▪ We have been able to cut costs considerably and develop a plan that supports our goal of EBITDA breakeven in 2021 Portfolio Strategic Focus

5 • TPG Sixth Street Partners discussions ongoing • We believe ANNOVERA and IMVEXXY are positioned to capitalize on trends accelerating due to COVID - 19 ‒ Expanded access through telehealth ‒ Online and retail home delivery distribution ‒ As a result of job losses due to COVID - 19, we expect unemployment to grow the Medicaid population where we have recently established coverage COVID - 19 Adaptation

1Q20 Accomplishments and Trends

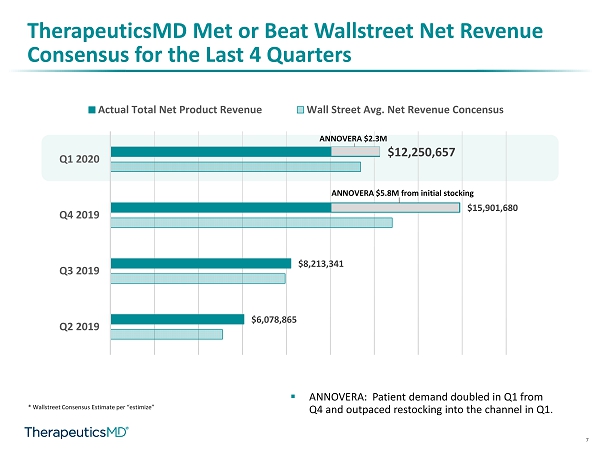

7 TherapeuticsMD Met or Beat Wallstreet Net Revenue Consensus for the Last 4 Quarters * Wallstreet Consensus Estimate per “ estimize ” $6,078,865 $8,213,341 $15,901,680 $12,250,657 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Actual Total Net Product Revenue Wall Street Avg. Net Revenue Concensus ANNOVERA $2.3M ANNOVERA $5.8M from initial stocking ▪ ANNOVERA: Patient demand doubled in Q1 from Q4 and outpaced restocking into the channel in Q1.

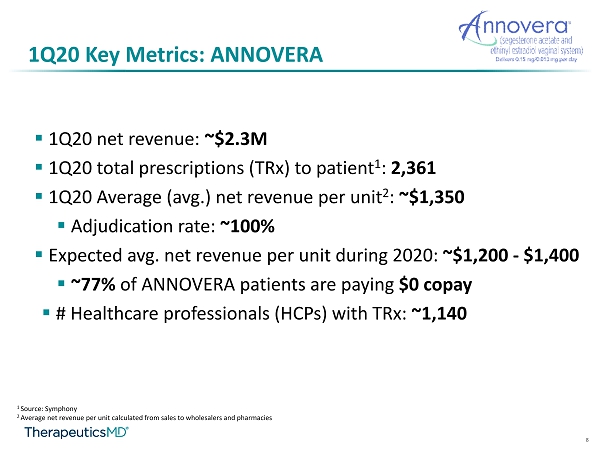

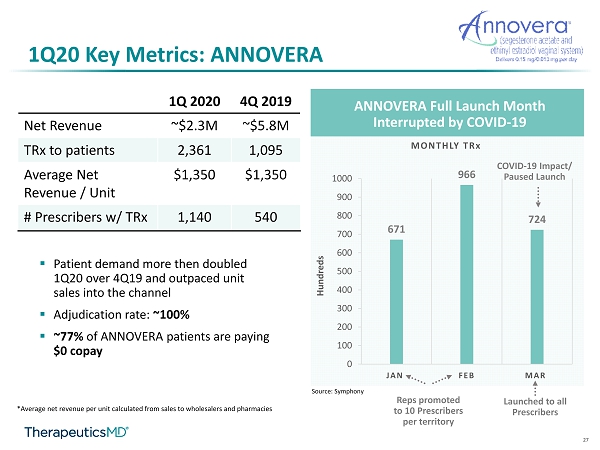

8 1Q20 Key Metrics: ANNOVERA ▪ 1Q20 net revenue: ~$2.3M ▪ 1Q20 total prescriptions ( TRx ) to patient 1 : 2,361 ▪ 1Q20 Average (avg.) net revenue per unit 2 : ~$1,350 ▪ Adjudication rate: ~100% ▪ Expected avg. net revenue per unit during 2020: ~$1,200 - $1,400 ▪ ~77% of ANNOVERA patients are paying $0 copay ▪ # Healthcare professionals (HCPs) with TRx : ~1,140 1 Source: Symphony 2 Average net revenue per unit calculated from sales to wholesalers and pharmacies

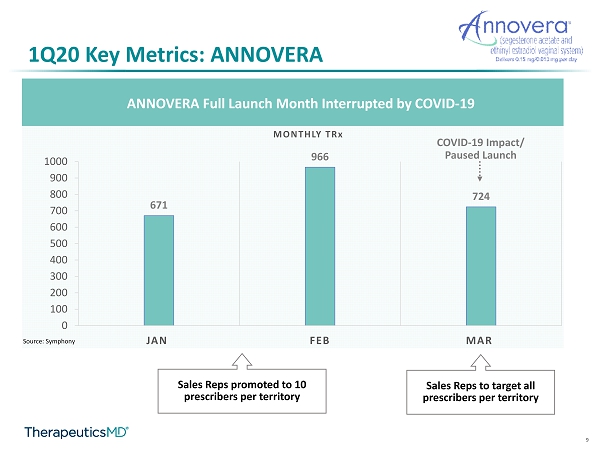

9 1Q20 Key Metrics: ANNOVERA ANNOVERA Full Launch Month Interrupted by COVID - 19 671 966 724 0 100 200 300 400 500 600 700 800 900 1000 JAN FEB MAR MONTHLY TR x COVID - 19 Impact/ Paused Launch Source: Symphony Sales Reps to target all prescribers per territory Sales Reps promoted to 10 prescribers per territory

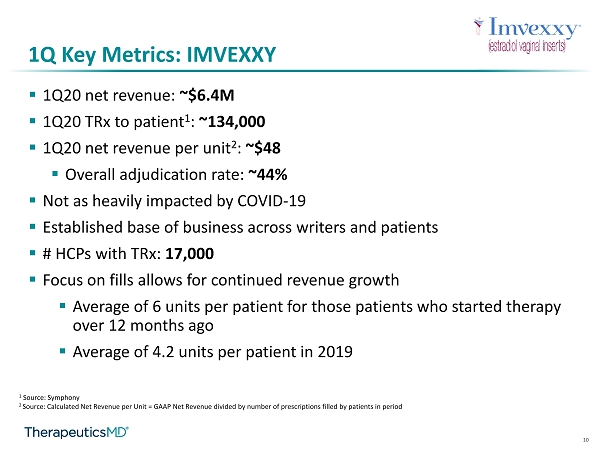

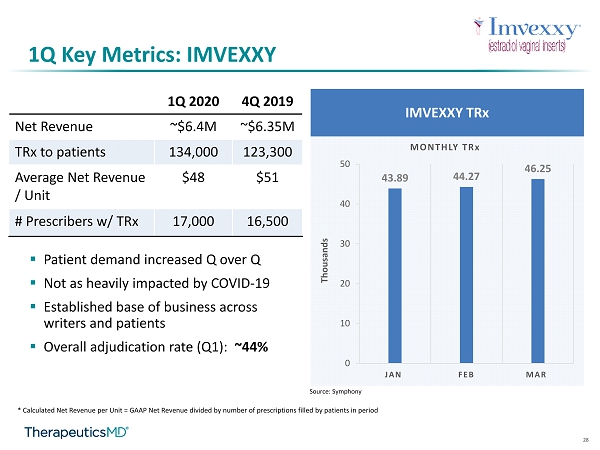

10 1Q Key Metrics: IMVEXXY ▪ 1Q20 net revenue: ~$6.4M ▪ 1Q20 TRx to patient 1 : ~134,000 ▪ 1Q20 net revenue per unit 2 : ~$48 ▪ Overall adjudication rate: ~44% ▪ Not as heavily impacted by COVID - 19 ▪ Established base of business across writers and patients ▪ # HCPs with TRx : 17,000 ▪ Focus on fills allows for continued revenue growth ▪ Average of 6 units per patient for those patients who started therapy over 12 months ago ▪ Average of 4.2 units per patient in 2019 1 Source: Symphony 2 Source: C alculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period

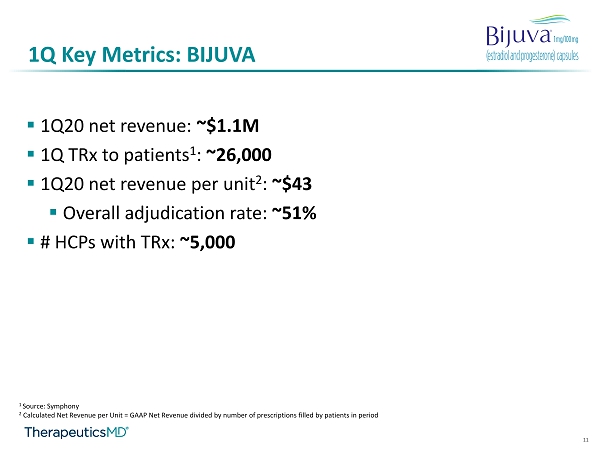

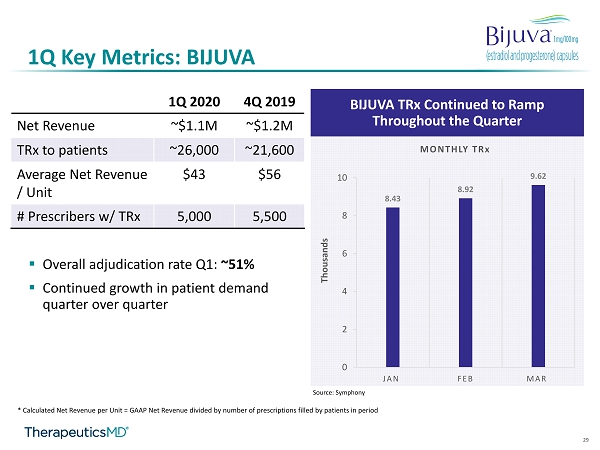

11 1Q Key Metrics: BIJUVA ▪ 1Q20 net revenue: ~$1.1M ▪ 1Q TRx to patients 1 : ~26,000 ▪ 1Q20 net revenue per unit 2 : ~$43 ▪ Overall adjudication rate: ~51% ▪ # HCPs with TRx : ~5,000 1 Source: Symphony 2 Calculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period

PAYOR PROGRESS

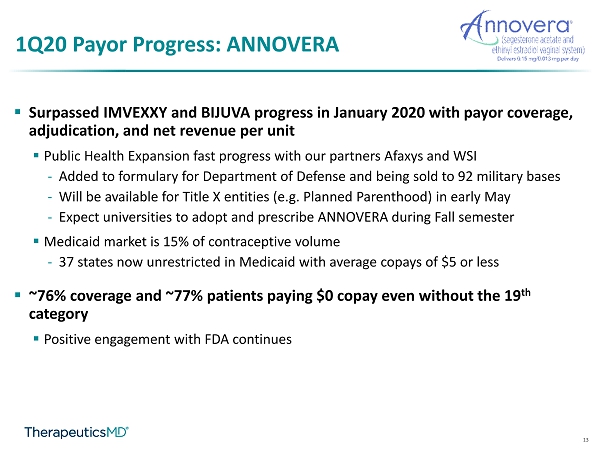

13 1Q20 Payor Progress: ANNOVERA ▪ Surpassed IMVEXXY and BIJUVA progress in January 2020 with payor coverage, adjudication, and net revenue per unit ▪ Public Health Expansion fast progress with our partners Afaxys and WSI - Added to formulary for Department of Defense and being sold to 92 military bases - Will be available for Title X entities (e.g. Planned Parenthood) in early May - Expect universities to adopt and prescribe ANNOVERA during Fall semester ▪ Medicaid market is 15% of contraceptive volume - 37 states now unrestricted in Medicaid with average copays of $5 or less ▪ ~76% coverage and ~77% patients paying $0 copay even without the 19 th category ▪ Positive engagement with FDA continues

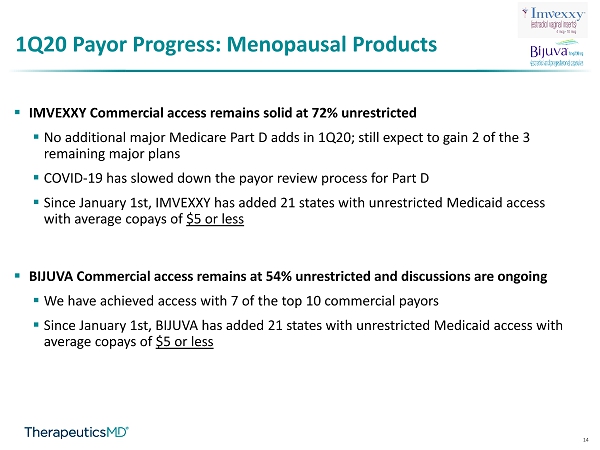

14 1Q20 Payor Progress: Menopausal Products ▪ IMVEXXY Commercial access remains solid at 72% unrestricted ▪ No additional major Medicare Part D adds in 1Q20; still expect to gain 2 of the 3 remaining major plans ▪ COVID - 19 has slowed down the payor review process for Part D ▪ Since January 1st, IMVEXXY has added 21 states with unrestricted Medicaid access with average copays of $5 or less ▪ BIJUVA Commercial access remains at 54% unrestricted and discussions are ongoing ▪ We have achieved access with 7 of the top 10 commercial payors ▪ Since January 1st, BIJUVA has added 21 states with unrestricted Medicaid access with average copays of $5 or less

Strategic Focus and Response to COVID - 19

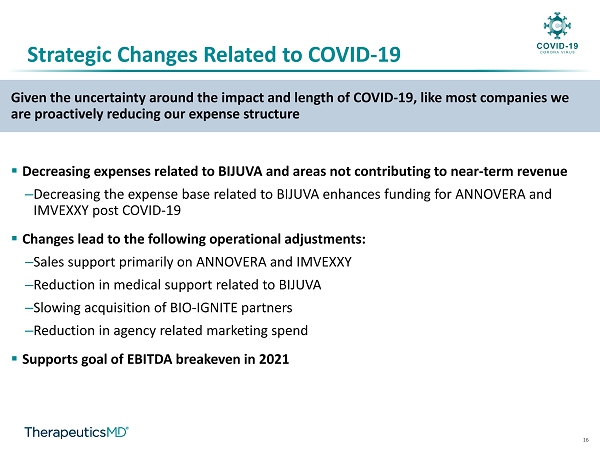

16 Given the uncertainty around the impact and length of COVID - 19, like most companies we are proactively reducing our expense structure ▪ Decreasing expenses related to BIJUVA and areas not contributing to near - term revenue ‒ Decreasing the expense base related to BIJUVA enhances funding for ANNOVERA and IMVEXXY post COVID - 19 ▪ Changes lead to the following operational adjustments: ‒ Sales support primarily on ANNOVERA and IMVEXXY ‒ Reduction in medical support related to BIJUVA ‒ Slowing acquisition of BIO - IGNITE partners ‒ Reduction in agency related marketing spend ▪ Supports goal of EBITDA breakeven in 2021 Strategic Changes Related to COVID - 19

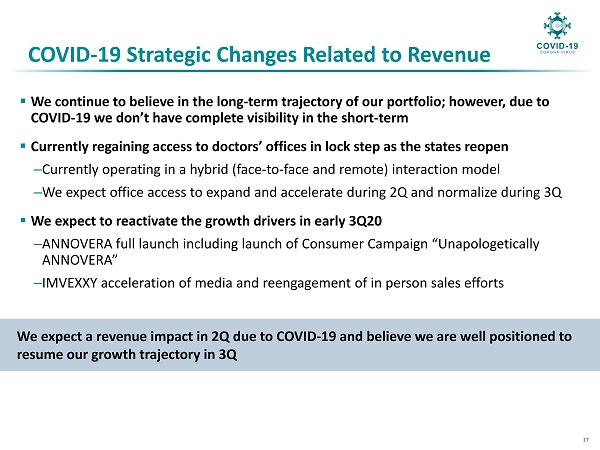

17 COVID - 19 Strategic Changes Related to Revenue ▪ We continue to believe in the long - term trajectory of our portfolio; however, due to COVID - 19 we don’t have complete visibility in the short - term ▪ Currently regaining access to doctors’ offices in lock step as the states reopen ‒ Currently operating in a hybrid (face - to - face and remote) interaction model ‒ We expect office access to expand and accelerate during 2Q and normalize during 3Q ▪ We expect to reactivate the growth drivers in early 3Q20 ‒ ANNOVERA full launch including launch of Consumer Campaign “Unapologetically ANNOVERA” ‒ IMVEXXY acceleration of media and reengagement of in person sales efforts We expect a revenue impact in 2Q due to COVID - 19 and believe we are well positioned to resume our growth trajectory in 3Q

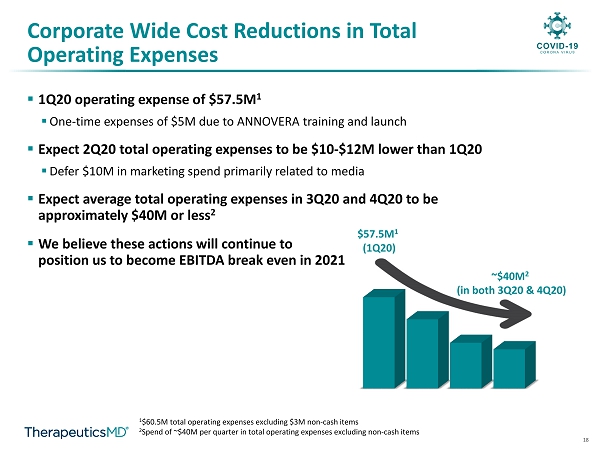

18 Corporate Wide Cost Reductions in Total Operating Expenses 1 $60.5M total operating expenses excluding $3M non - cash items 2 Spend of ~$40M per quarter in total operating expenses excluding non - cash items $57.5M 1 (1Q20) ~$40M 2 (in both 3Q20 & 4Q20) ▪ 1Q20 operating expense of $57.5M 1 ▪ One - time expenses of $5M due to ANNOVERA training and launch ▪ Expect 2Q20 total operating expenses to be $10 - $12M lower than 1Q20 ▪ Defer $10M in marketing spend primarily related to media ▪ Expect average total operating expenses in 3Q20 and 4Q20 to be approximately $40M or less 2 ▪ We believe these actions will continue to position us to become EBITDA break even in 2021

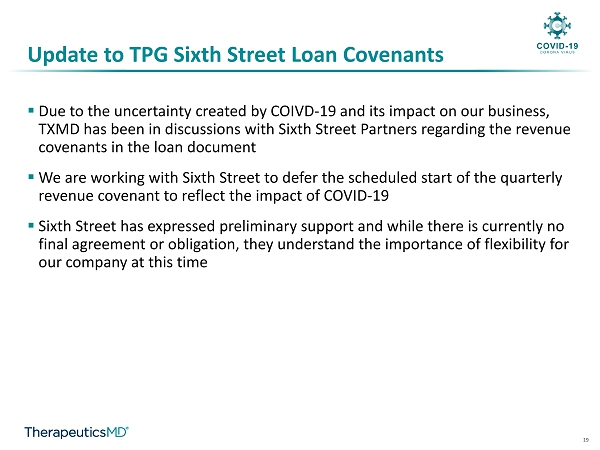

19 ▪ Due to the uncertainty created by COIVD - 19 and its impact on our business, TXMD has been in discussions with Sixth Street Partners regarding the revenue covenants in the loan document ▪ We are working with Sixth Street to defer the scheduled start of the quarterly revenue covenant to reflect the impact of COVID - 19 ▪ Sixth Street has expressed preliminary support and while there is currently no final agreement or obligation, they understand the importance of flexibility for our company at this time Update to TPG Sixth Street Loan Covenants

Plan to Regain Momentum Post - COVID 19

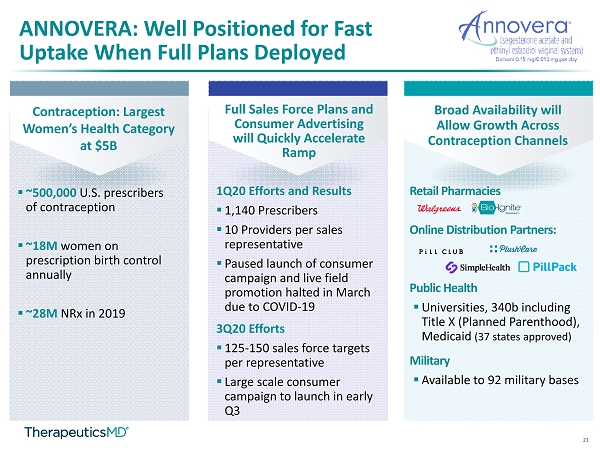

21 ANNOVERA: Well Positioned for Fast Uptake When Full Plans Deployed Contraception: Largest Women’s Health Category at $5B Full Sales Force Plans and Consumer Advertising will Quickly Accelerate Ramp Broad Availability will Allow Growth Across Contraception Channels Retail Pharmacies Online Distribution Partners: Public Health ▪ Universities, 340b including Title X (Planned Parenthood), Medicaid (37 states approved) Military ▪ Available to 92 military bases 1Q20 Efforts and Results ▪ 1,140 Prescribers ▪ 10 Providers per sales representative ▪ Paused launch of consumer campaign and live field promotion halted in March due to COVID - 19 3Q20 Efforts ▪ 125 - 150 sales force targets per representative ▪ Large scale consumer campaign to launch in early Q3 ▪ ~500,000 U.S. prescribers of contraception ▪ ~18M women on prescription birth control annually ▪ ~28M NRx in 2019

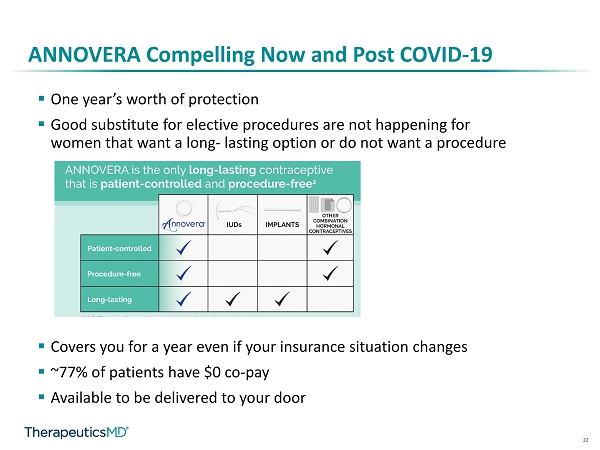

22 ANNOVERA Compelling Now and Post COVID - 19 ▪ One year’s worth of protection ▪ Good substitute for elective procedures are not happening for women that want a long - lasting option or do not want a procedure ▪ Covers you for a year even if your insurance situation changes ▪ ~77% of patients have $0 co - pay ▪ Available to be delivered to your door

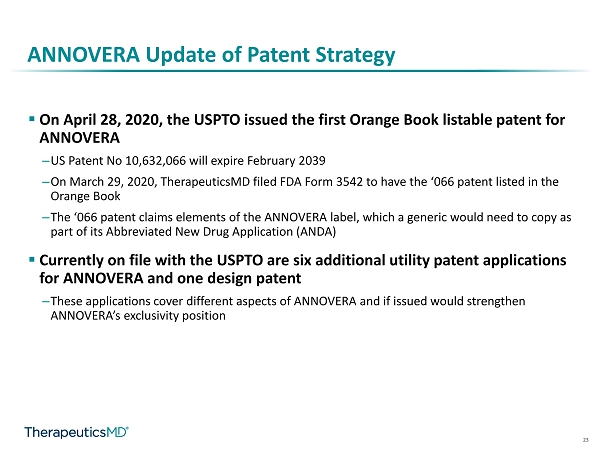

23 ▪ On April 28, 2020, the USPTO issued the first Orange Book listable patent for ANNOVERA ‒ US Patent No 10,632,066 will expire February 2039 ‒ On March 29, 2020, TherapeuticsMD filed FDA Form 3542 to have the ‘066 patent listed in the Orange Book ‒ The ‘066 patent claims elements of the ANNOVERA label, which a generic would need to copy as part of its Abbreviated New Drug Application (ANDA) ▪ Currently on file with the USPTO are six additional utility patent applications for ANNOVERA and one design patent ‒ These applications cover different aspects of ANNOVERA and if issued would strengthen ANNOVERA’s exclusivity position ANNOVERA Update of Patent Strategy

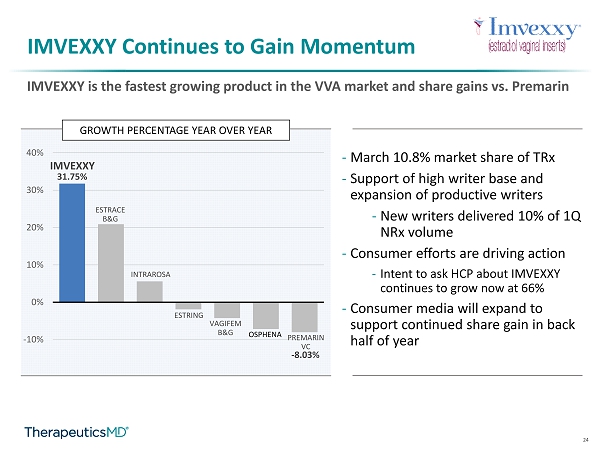

24 IMVEXXY Continues to Gain Momentum IMVEXXY is the fastest growing product in the VVA market and share gains vs. Premarin GROWTH PERCENTAGE YEAR OVER YEAR 31.75% - 8.03% -10% 0% 10% 20% 30% 40% IMVEXXY ESTRACE B&G INTRAROSA ESTRING VAGIFEM B&G OSPHENA PREMARIN VC - March 10.8% market share of TRx - Support of high writer base and expansion of productive writers - New writers delivered 10% of 1Q NRx volume - Consumer efforts are driving action - Intent to ask HCP about IMVEXXY continues to grow now at 66% - Consumer media will expand to support continued share gain in back half of year

25 BIJUVA Targeted Focus Until 0.5/100 Launch is Funded in 2021 ▪ Focus on current writer base through remainder of 2020 ▪ Non - personal promotion ▪ Focus on current Bio - ignite partners ▪ Compounding pharmacists report that they would recommend BIJUVA for 1/3 of their estradiol and progesterone (E+P) patients ▪ Prepare for 0.5/100 launch in 2021 with internal resources, if approved ▪ PDUFA date: November 16, 2020

26 CONTRACEPTION PRENATAL CARE CONTRACEPTION/ FAMILY PLANNING - PERIMENOPAUSE VASOMOTOR SYMPTOMS DYSPAREUNIA (Vulvar & Vaginal Atrophy) REPRODUCTIVE HEALTH MENOPAUSE MANAGEMENT Prenatal Vitamins Q&A

27 1Q20 Key Metrics: ANNOVERA ▪ Patient demand more then doubled 1Q20 over 4Q19 and outpaced unit sales into the channel ▪ Adjudication rate: ~100% ▪ ~77% of ANNOVERA patients are paying $0 copay *Average net revenue per unit calculated from sales to wholesalers and pharmacies ANNOVERA Full Launch Month Interrupted by COVID - 19 671 966 724 0 100 200 300 400 500 600 700 800 900 1000 JAN FEB MAR MONTHLY TR x Hundreds COVID - 19 Impact/ Paused Launch Source: Symphony 1Q 2020 4Q 2019 Net Revenue ~$2.3M ~$5.8M TRx to patients 2,361 1,095 Average Net Revenue / Unit $1,350 $1,350 # Prescribers w/ TRx 1,140 540 Reps promoted to 10 Prescribers per territory Launched to all Prescribers

28 1Q Key Metrics: IMVEXXY IMVEXXY TRx 43.89 44.27 46.25 0 10 20 30 40 50 JAN FEB MAR MONTHLY TRx Thousands Source: Symphony ▪ Patient demand increased Q over Q ▪ Not as heavily impacted by COVID - 19 ▪ Established base of business across writers and patients ▪ Overall adjudication rate (Q1): ~44% * Calculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period 1Q 2020 4Q 2019 Net Revenue ~$6.4M ~$6.35M TRx to patients 134,000 123,300 Average Net Revenue / Unit $48 $51 # Prescribers w/ TRx 17,000 16,500

29 1Q Key Metrics: BIJUVA BIJUVA TRx Continued to Ramp Throughout the Quarter 8.43 8.92 9.62 0 2 4 6 8 10 JAN FEB MAR MONTHLY TRx Thousands Source: Symphony ▪ Overall adjudication rate Q1: ~51% ▪ Continued growth in patient demand quarter over quarter * Calculated Net Revenue per Unit = GAAP Net Revenue divided by number of prescriptions filled by patients in period 1Q 2020 4Q 2019 Net Revenue ~$1.1M ~$1.2M TRx to patients ~26,000 ~21,600 Average Net Revenue / Unit $43 $56 # Prescribers w/ TRx 5,000 5,500

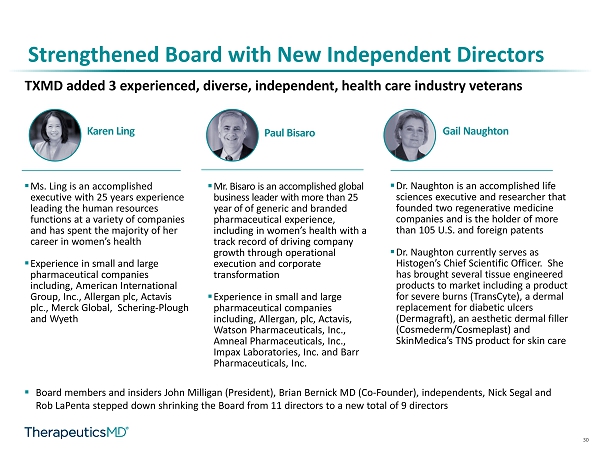

30 TXMD added 3 experienced, diverse, independent, health care industry veterans Gail Naughton Paul Bisaro Karen Ling ▪ Board members and insiders John Milligan (President), Brian Bernick MD (Co - Founder), independents, Nick Segal and Rob LaPenta stepped down shrinking the Board from 11 directors to a new total of 9 directors Strengthened Board with New Independent Directors ▪ Dr. Naughton is an accomplished life sciences executive and researcher that founded two regenerative medicine companies and is the holder of more than 105 U.S. and foreign patents ▪ Dr. Naughton currently serves as Histogen’s Chief Scientific Officer. She has brought several tissue engineered products to market including a product for severe burns ( TransCyte ), a dermal replacement for diabetic ulcers ( Dermagraft ), an aesthetic dermal filler ( Cosmederm / Cosmeplast ) and SkinMedica’s TNS product for skin care ▪ Mr. Bisaro is an accomplished global business leader with more than 25 year of of generic and branded pharmaceutical experience, including in women’s health with a track record of driving company growth through operational execution and corporate transformation ▪ Experience in small and large pharmaceutical companies including, Allergan, plc, Actavis, Watson Pharmaceuticals, Inc., Amneal Pharmaceuticals, Inc., Impax Laboratories, Inc. and Barr Pharmaceuticals, Inc. ▪ Ms. Ling is an accomplished executive with 25 years experience leading the human resources functions at a variety of companies and has spent the majority of her career in women’s health ▪ Experience in small and large pharmaceutical companies including, American International Group, Inc., Allergan plc, Actavis plc., Merck Global, Schering - Plough and Wyeth