Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Sonos Inc | final2q20pressreleaseann.htm |

| 8-K - 8-K - Sonos Inc | a8-kitem20205062020.htm |

Q2 2020 May 6, 2020 Dear Fellow Shareholders, We hope you are managing your way through these challenging times, and that Sonos is bring- ing some joy to your home while you do. Our thoughts go out to all those impacted at this time and we remain focused first and foremost on the health and safety of our people and our broader communities. It has been heartwarming and inspiring to see the way people are coming together across ev- ery part of our lives. The compassion, creativity and truly selfless behavior is reinvigorating our communities and our teams. At Sonos, our teams have contributed to relief efforts by utilizing our 3D printers in Santa Barbara and Boston to help create PPE for frontline workers, and we will continue to provide support through our Soundwaves program to organizations that are navigating this unprecedented time in music education. Any time a crisis hits, it’s critical to step back and take stock. We have spent time over the past month doing just this, and we are confident that we will exit this period of uncertainty stronger, and in a position to seize new opportunities that are certain to arise. Our second quarter was challenging, as we experienced a 17% year-over-year decline in rev- enue. Coming off a strong first quarter, we had expected some softness in the second quarter and we did see challenges primarily from a large retail partner in the US rebalancing inventory as well as some weakness in our German market from inventory rebalancing at our distributor. In March, our total revenue declined 23% year-over-year as the typical replenishment order cycle in the majority of our end markets was disrupted due to the softer global demand envi- ronment and broad-based physical retail closures stemming from the COVID-19 pandemic. Despite this, we continued to gain market share in the streaming home audio category in the U.S. and U.K, which we attribute to the quality of our products and strength of our brand1. 1 Q2 FY2020

We are seeing strong engagement from the more than 10 million homes we are already in, as evidenced by a 32% increase in total listening hours year-over-year for the month of March and an estimated 48% increase in April. With the pandemic-driven closures in physical retail, we have also focused on our direct-to-consumer efforts, and it paid off as we saw a 32% year- over-year increase in our revenue through direct-to-consumer channels, primarily sonos.com, during the second quarter. Our direct-to-consumer channel revenue has accelerated mean- ingfully to approximately 400% year-over-year growth in April following the success of our “At Home with Sonos” marketing campaign, which ran from April 2nd through May 5th. With mil- lions of people working from home, we realized that we had an opportunity to make their lives a little more joyful during this time and get in front of consumers with relevant promotions and messaging. We are also excited to highlight that Sonos Move was one of the top performing products in April, and it did not have a promotional offer associated with it. Overall, April is showing meaningfully better trends as compared to March, and we expect that our total reve- nue in April will decline less than 5% year-over-year despite the closures by most of our physi- cal retail partners. While it is hard to know what the next few months will bring, we believe these trends illustrate that our products and brand are resonating with consumers, and that the focus and investments we made in our direct-to-consumer engine over the past two years are paying off. We believe all of this positions us well to weather this storm and come out stronger on the other side. Continued Innovation and Launch of New Products and Services I am proud to share that we have quickly seen how resilient, adaptable and agile our people are. Our team has risen to the challenge and maintained an incredible level of productivity and teamwork despite the stresses of stay-at-home orders and life in general. This is evidenced by the fact we launched Sonos Radio on April 21st and are announcing three new products today. We have long instilled a “learn and adjust” culture, and that approach is resonating as we cre- atively and quickly solve for the needs of our customers, colleagues and communities. Innovation remains the core of Sonos – both in the products we build and the culture that fuels them. We design products and experiences that are easy to use, deliver brilliant sound, and give users the freedom of choice when it comes to voice and music services. We are excited to introduce several new product innovations today. We remain focused on bringing the best experience to customers and believe our products remain highly relevant and helpful during this current environment where we are seeing people consuming more and more content in their homes. 2 Q2 FY2020

Arc is our premium smart soundbar that delivers our most immersive home theater experience. With smart, adaptable, cinema-quality sound, support for Dolby Atmos, and multiple voice as- sistants, Arc sets a new standard for premium home theater sound. Arc builds on Sonos’ in- novation and leadership in the home theater category - our existing home theater products, Playbar and Beam, have been top ranked soundbars by total dollars in the U.S. The Sonos Arc will be available June 10 for $799 USD MSRP. The Sonos Five is our most powerful speaker, delivering the same studio-quality sound as the beloved Play:5 and bringing increased memory, processing power, and a new wireless radio. It also features a stunning new front grille. Sonos Five will be available June 10 for $499 USD MSRP. We have long held a leading position in the premium speaker category and are excited to bring an even better version of our successful Play:5 to the market. Our new Sub features the same iconic design and bold bass as its predecessor, but upgrades it with increased memory, processing power, and more. Sonos speakers are designed with great bass performance on their own, but Sub is capable of lower frequencies, optimizing the sound for an even richer and more realistic sound. The new Sonos Sub will be available June 10 for $699 USD MSRP. 3 Q2 FY2020

As you saw in late April, we launched Sonos Radio. Inspired by and built for Sonos owners, Sonos Radio is a free, ad-supported radio service available in the Sonos app. Streaming mu- sic, news, sports, and original Sonos programming, Sonos Radio integrates a growing list of 60,000+ radio stations into one place from long-time partners, including TuneIn and many more to come. Sonos Radio features original programming from Sonos for listeners to explore genre stations, artist-curated stations, and our signature station, Sonos Sound System. We will continue to explore the role services play in the future of Sonos and experiment with new business models, like we have done with our IKEA and Sonance partnerships, and pro- grams like Flex and Sonos for Business. Strong Balance Sheet and Preserving Liquidity For the past few years, we have maintained a focus on sustainable, profitable growth and are fortunate to be in a position of strength today as a result of this focus. We have long maintained a view that the cash we have on our balance sheet would enable us to invest in our business even in challenging times. We ended the second quarter with $283 million in cash and cash equivalents and very minimal long-term debt. We also have in place an $80 million undrawn revolving credit facility providing even further flexibility should we need it. We are confident in our liquidity even in the advent of a prolonged weak economy. During the second quarter, we used $83.5 million in cash from operations, largely due to the timing of inventory payables following our holiday quarter. Looking forward, we expect inven- tory levels to normalize in the third quarter. We also repurchased approximately $30 million of our stock early in the quarter. We have approximately $17 million remaining under our current $50 million repurchase authorization. When the pandemic hit, we took immediate action to review our planned investments for the year and make adjustments to preserve liquidity while not compromising on our critical busi- ness needs. We have adjusted our marketing approach and reduced investments. We have also taken steps to manage and tighten our inventory and eliminated many discretionary op- erating expenses. We are focused on having a lower operating expense run rate in the second half of fiscal 2020 as compared to the first half of fiscal 2020. We are confident that these are the right measures to take at this time but will continue to review our investments as we learn more over the coming weeks and months. Withdrawing Fiscal 2020 Outlook We do not know when physical retail will reopen, or how the global economy will recover from the COVID-19 pandemic. While we are working to be nimble and prepared, we do not know what a normal run-rate for our business looks like in this new world. In light of the uncertainty, unpredictability and volatility of the current environment, we are withdrawing our previously issued fiscal 2020 revenue, gross margin, and adjusted EBITDA guidance. Despite the uncertainty, we are excited about what we have seen from our five-week “At Home with Sonos” campaign, the launch of our new products, the strength in our balance sheet that allows us to continue making prudent investments, and the resiliency of our teams as they continue to operate from home. As we look at the engagement and listening hours, we know people who are staying at home value their Sonos products. In closing, I would like to reiterate just how proud I am of the way the Sonos team has come together during this unprecedented period proving just how strong our “learn and adjust” cul- ture truly is. The speed in which decisions are being made and the agility of the team is in- spiring – from the launch of our “At Home with Sonos” marketing program, to adjusting to a 4 Q2 FY2020

work-from-home environment quickly and seamlessly, continuing to forge innovation and bring new products to market, to taking decisive action and preserving our liquidity to better posi- tion the company, all while exemplifying compassion for their teammates, families and broader community. Our commitment to innovation is stronger than ever as evidenced by the launch of Arc, Sonos Five, Sub, and Sonos Radio. We remain focused on bringing the best experience to our custom- ers in any environment and continue to focus on our future product roadmap. We are confident that the actions we are taking today will set us up for long-term success and the continued tremendous opportunity ahead. We will get through this current period of uncertainty together and we will help millions of others get through this by bringing some much-needed joy to their homes through the power of Sonos sound. Stay healthy and safe. Patrick Spence CEO PS: This quarter, we have pulled together a playlist that includes music from many of the amazing artists Sonos has worked with thus far in 2020, including many that are featured on Sonos Radio. 1. The NPD Group, Inc., U.S. Retail Tracking Service, Streaming Audio Speakers, Based on dollar sales, Jan-Mar’20 vs. ‘19; GfK POS, UK, Audio Streaming, Jan’-Mar’20, Dollars 5 Q2 FY2020

Financial Summary Q2 2020 results (three months ended March 28, 2020) Highlights • Q2 revenue of $175.1 million, representing a 17% decline year-over-year and 16% decline on a constant currency basis. • Gross margin decreased 130 basis points year-over-year to 41.7%. Excluding the impact of tariffs, gross margin increased 230 basis points year-over-year to 45.3%. • Net loss of $52.3 million compared to $22.8 million last year. • Adjusted EBITDA loss of $28.4 million, compared to a loss of $2.8 million last year. Excluding the impact of tariffs, adjusted EBITDA was a loss of $22.1 million. Revenue In Q2 FY2020, we sold 680,591 products, representing a 23% decline year-over-year. The decrease in products sold is consistent with the impact on revenue. We generated revenue of $175.1 million, a decrease of 17% compared to the prior year. During the quarter, we did see challenges primarily from a large retail partner in the U.S. rebalancing inventory and we experienced weakness specifically in our German market from inventory re- balancing at our distributor. In addition, there was the impact in March from the softer global demand environment and broad-based physical retail closures stemming from the COVID-19 pandemic impacting replenishment orders in the majority of our end-markets. Despite this, we continued to gain market share in the streaming home audio category in the U.S. and U.K, which we attribute to the quality of our products and strength of our brand1. We saw an increase in online sales that partly offset the impact on physical retail and our di- rect-to-consumer revenue, primarily from sonos.com, increased 32% year-over-year. This channel has had continued momentum as we enter the third quarter driven by our “At Home with Sonos” program in April. In addition to the positive momentum in April, we are excited for the launch of our new products, Arc, Five and Sub. Sonos speaker revenue represented 66% of total revenue during the second quarter and de- creased 27% from the prior year to $116.4 million as we believe this category was more signifi- cantly impacted by inventory rebalancing measures and the effects that COVID-19 has had on consumer demand and retail partner store closures. Sonos system products revenue, which represented 27% of total revenue during the quarter, increased 22% year-over-year to $47.2 million driven by the performance of Sonos AMP and the launch of Sonos Port in late fiscal 2019. Partner products and other revenue increased 4% to $11.5 million driven primarily by our IKEA and Sonance partnerships which launched in the second quarter of fiscal 2019. In Q2 FY2020, Americas decreased revenue by 12% and EMEA decreased 28% (26% on a con- stant currency basis) year-over-year. Revenue in Germany declined 66% year-over-year. APAC increased revenue by 9% primarily due to the recognition of IKEA related revenue in that region. 6 Q2 FY2020

Note: Beginning in the first quarter fiscal 2020, we started reporting our product revenue in the following categories: Sonos speakers (wireless, home theater, etc.), Sonos system products (components, other system products, etc.), and Partner products and other revenue (module revenue, partner revenue, licensing, accessories, etc.) to further align our revenue reporting with the evolving nature of our products, customers’ engagement across multiple categories and how we evaluate our business. Please visit the Quarterly Earnings section of our Investor Relations website for historical prod- uct revenue based on these new categories. Gross Margin Our Q2 FY2020 gross margin of 41.7% was 130 points lower than Q2 FY2019 driven by the introduction of tariffs in September 2019. Excluding the effect of tariffs, gross margin would have increased 230 basis points to 45.3%, driven by volume and mix shifts into higher margin products and channels as well as product and material cost reductions associated with the consolidation of our supplier base and successful cost negotiations. We have not experienced any material impact as it relates to our manufacturing capacity to date due to COVID-19 and we continue to make progress with our efforts to diversify our sup- ply chain into Malaysia. We have submitted a request for exclusion from the August 2019 Sec- tion 301 Tariff Action (List 4A) and are hopeful that it will result in a positive outcome. Operating Expenses Our operating expenses in Q2 FY2020 increased 11% from Q2 FY2019 to $126.2 million, rep- resenting 72% of revenue for the period. Research and development expenses increased 24% from Q2FY2019 to $49.6 million primarily due to higher personnel-related expenses due to an increase in headcount and the addition of the Snips SAS team as well as other product development costs as we continue to invest in new products and features. Sales and mar- keting expenses increased 2% from Q2 FY2019 to $50.5 million driven primarily by marketing campaigns as well as customer experience and technology support tools, offset primarily by a decrease in personnel-related costs. General and administrative expenses increased 9% from Q2 FY2019 to $26.1 million primarily due to an increase in legal fees related to our IP litigation. Excluding the $1.7 million in IP-litigation fees during the quarter, general and administrative expenses increased 2%. Q&A Conference Call Webcast – 5 p.m. EST on May 6, 2020 The Company will host a webcast of its conference call and Q&A related to Q2 results on May 6, 2020 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). Participants may access the live webcast in listen-only mode on the Sonos investor relations website at https://investors.sonos. com/news-and-events/default.aspx. An archived webcast of the conference call will also be available at https://investors.sonos.com/news-and-events/default.aspx following the call. The 7 Q2 FY2020

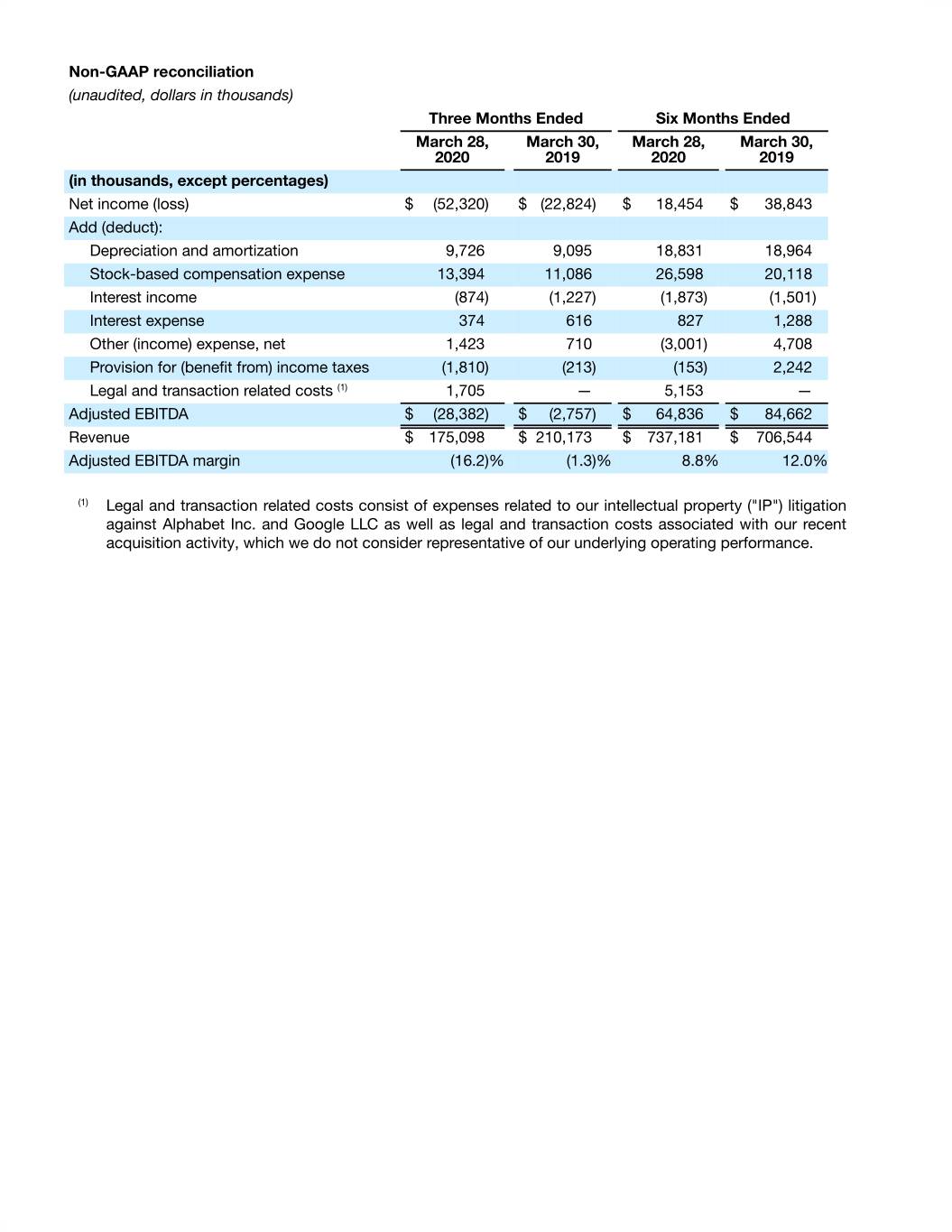

conference call may also be accessed by dialing 877-683-0503 with conference ID 1898508. Participants outside the U.S. can dial 647-689-5442 using the same conference ID. Use of Non-GAAP Measures We have provided in this letter financial information that has not been prepared in accordance with generally accepted accounting principles (“U.S. GAAP”), including adjusted EBITDA, adjust- ed EBITDA margin, free cash flow, gross margin excluding the impact of tariffs, adjusted EBITDA excluding the impact of tariffs and constant currency growth percentages. These non-GAAP financial measures are not based on any standardized methodology prescribed by U.S. GAAP and are not necessarily comparable to similarly titled measures presented by other compa- nies. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in these non-GAAP financial measures. Accordingly, we believe that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall under- standing of our past performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its financial and operational decision-making. Non-GAAP financial measures should not be considered in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. Investors are encouraged to review the reconciliation of these financial measures to their nearest U.S. GAAP financial equivalents provided in the financial statement tables above. We define adjusted EBITDA as net income (loss) adjusted to exclude the impact of depreciation, stock-based compensation expense, interest income, interest expense, other income (expense), income taxes and other items that we do not consider representative of our underlying operating performance. We de- fine adjusted EBITDA margin as adjusted EBITDA divided by revenue. We define free cash flow as defined as net cash from operations less purchases of property and equipment. We cal- culate gross margin excluding the impact of tariffs as gross profit dollars removing the impact of tariffs imposed on goods imported to the U.S. from China divided by revenue. We calculate adjusted EBITDA excluding the impact of tariffs as net income (loss) excluding the impact of tariffs imposed on goods manufactured in China and adjusted to exclude the impact of depre- ciation, stock-based compensation expense, interest income, interest expense, other income (expense), income taxes and other items that we do not consider representative of our under- lying operating performance. We calculate constant currency growth percentages by translat- ing our prior-period financial results using the current period average currency exchange rates and comparing these amounts to our current period reported results. 8 Q2 FY2020

Forward Looking Statements This letter contains forward-looking statements that involve risks and uncertainties. These for- ward-looking statements include statements regarding our long-term focus, financial, growth and business strategies and opportunities, growth metrics and targets, product launches, profitability and gross margins, product feature and technological updates, our planned sup- ply chain diversification efforts, our tariff expense and other factors affecting variability in our financial results. These forward-looking statements are only predictions and may differ ma- terially from actual results due to a variety of factors, including, but not limited to the duration and impact of the COVID-19 pandemic and weak economy and related impact on consumer spending; our ability to successfully introduce new products and maintain the success of our existing products; the success of our financial, growth and business strategies; our ability to integrate acquisitions; our ability to meet growth targets; our ability to reduce costs and to cost-effectively improve our products; the success of our efforts to expand our direct-to-con- sumer channel and improve brand awareness; our expectations of seasonality and other factors causing variability in our financial results; our ability to manage our international ex- pansion; tariffs on imports; our ability to diversify our supply chain; our ability to defend our patents and the continued strength of our patent portfolio; and the other risk factors set forth under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended March 28, 2020 and our other filings filed with the Securities and Exchange Commission (the “SEC”), copies of which are available free of charge at the SEC’s website at www.sec.gov or upon request from our investor relations department. All forward-looking statements herein reflect our opinions only as of the date of this letter, and we undertake no obligation, and ex- pressly disclaim any obligation, to update forward-looking statements herein in light of new information or future events. Sonos and Sonos product names are trademarks or registered trademarks of Sonos, Inc. All other product names and services may be trademarks or service marks of their respective owners. 9 Q2 FY2020

Condensed consolidated statements of operations and comprehensive income (loss) (unaudited, in thousands, except share and per share amounts) Three Months Ended Six Months Ended March 28, March 30, March 28, March 30, 2020 2019 2020 2019 Revenue $ 175,098 $ 210,173 $ 737,181 $ 706,544 Cost of revenue 102,089 119,760 436,552 420,842 Gross profit 73,009 90,413 300,629 285,702 Operating expenses Research and development 49,593 40,080 102,120 77,175 Sales and marketing 50,504 49,371 127,928 115,223 General and administrative 26,119 23,900 56,327 47,724 Total operating expenses 126,216 113,351 286,375 240,122 Operating income (loss) (53,207) (22,938) 14,254 45,580 Other income (expense), net Interest income 874 1,227 1,873 1,501 Interest expense (374) (616) (827) (1,288) Other income (expense), net (1,423) (710) 3,001 (4,708) Total other income (expense), net (923) (99) 4,047 (4,495) Income (loss) before provision for (benefit from) income taxes (54,130) (23,037) 18,301 41,085 Provision for (benefit from) income taxes (1,810) (213) (153) 2,242 Net income (loss) $ (52,320) $ (22,824) $ 18,454 $ 38,843 Net income (loss) attributable to common stockholders Basic $ (52,320) $ (22,824) $ 18,454 $ 38,843 Diluted $ (52,320) $ (22,824) $ 18,454 $ 38,843 Net income (loss) per share attributable to common stockholders Basic $ (0.48) $ (0.22) $ 0.17 $ 0.38 Diluted $ (0.48) $ (0.22) $ 0.16 $ 0.35 Weighted-average shares used in computing net income (loss) per share attributable to common stockholders Basic 109,515,049 102,331,529 109,249,866 101,239,817 Diluted 109,515,049 102,331,529 117,819,569 111,474,057 Total comprehensive income (loss) Net income (loss) $ (52,320) $ (22,824) $ 18,454 $ 38,843 Change in foreign currency translation adjustment (431) 660 (950) 1,169 Comprehensive income (loss) $ (52,751) $ (22,164) $ 17,504 $ 40,012 10 Q2 FY2020

Condensed consolidated balance sheets (unaudited, dollars in thousands, except par values) As of March 28, September 28, 2020 2019 Assets Current assets: Cash and cash equivalents $ 283,250 $ 338,641 Restricted cash 182 179 Accounts receivable, net of allowances 40,172 102,743 Inventories 112,476 219,784 Prepaids and other current assets 27,945 17,762 Total current assets 464,025 679,109 Property and equipment, net 74,910 78,139 Operating lease right-of-use assets 54,213 — Goodwill 15,545 1,005 Intangible assets, net 27,143 13 Deferred tax assets 1,042 1,154 Other noncurrent assets 2,297 2,185 Total assets $ 639,175 $ 761,605 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 82,111 $ 251,941 Accrued expenses 43,041 69,856 Accrued compensation 28,397 41,142 Short-term debt 8,333 8,333 Deferred revenue, current 14,590 13,654 Other current liabilities 36,727 17,548 Total current liabilities 213,199 402,474 Operating lease liabilities, noncurrent 56,198 — Long-term debt 21,545 24,840 Deferred revenue, noncurrent 45,753 42,795 Other noncurrent liabilities 2,676 10,568 Total liabilities 339,371 480,677 Stockholders’ equity: Common stock, $0.001 par value 113 110 Treasury stock (51,310) (13,498) Additional paid-in capital 541,937 502,757 Accumulated deficit (189,922) (208,377) Accumulated other comprehensive loss (1,014) (64) Total stockholders’ equity: 299,804 280,928 Total liabilities and stockholders’ equity: $ 639,175 $ 761,605 11 Q2 FY2020

Condensed consolidated statements of cash flows (unaudited, in thousands) Six Months Ended March 28, March 30, 2020 2019 Cash flows from operating activities Net income $ 18,454 $ 38,843 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 18,831 18,964 Stock-based compensation expense 26,598 20,118 Other 2,989 1,607 Deferred income taxes 74 441 Foreign currency transaction (gain) loss (420) 2,300 Changes in operating assets and liabilities: Accounts receivable, net 63,344 7,933 Inventories 106,245 86,814 Other assets (9,690) (5,433) Accounts payable and accrued expenses (191,070) (111,227) Accrued compensation (14,443) (6,205) Deferred revenue 3,729 4,562 Other liabilities 10,727 6,388 Net cash provided by operating activities 35,368 65,105 Cash flows from investing activities Purchases of property and equipment and intangible assets (25,800) (8,087) Cash paid for acquisition, net of acquired cash (36,289) — Net cash used in investing activities (62,089) (8,087) Cash flows from financing activities Repayments of borrowings (3,333) — Payments for purchase of treasury stock (37,812) (566) Proceeds from exercise of common stock options 12,585 18,947 Payments of offering costs — (585) Net cash provided by (used in) financing activities (28,560) 17,796 Effect of exchange rate changes on cash, cash equivalents and restricted cash (107) (475) Net increase (decrease) in cash, cash equivalents and restricted cash (55,388) 74,339 Cash, cash equivalents and restricted cash Beginning of period 338,820 221,120 End of period $ 283,432 $ 295,459 Supplemental disclosure Cash paid for interest $ 851 $ 1,244 Cash paid for taxes, net of refunds $ 1,025 $ 1,941 Cash paid for amounts included in the measurement of lease liabilities $ 7,346 $ — Supplemental disclosure of non-cash investing and financing activities Purchases of property and equipment in accounts payable and accrued expenses $ 3,270 $ 2,426 Right-of-use assets obtained in exchange for new operating lease liabilities $ 75,642 $ — 12 Q2 FY2020

Non-GAAP reconciliation (unaudited, dollars in thousands) Three Months Ended Six Months Ended March 28, March 30, March 28, March 30, 2020 2019 2020 2019 (in thousands, except percentages) Net income (loss) $ (52,320) $ (22,824) $ 18,454 $ 38,843 Add (deduct): Depreciation and amortization 9,726 9,095 18,831 18,964 Stock-based compensation expense 13,394 11,086 26,598 20,118 Interest income (874) (1,227) (1,873) (1,501) Interest expense 374 616 827 1,288 Other (income) expense, net 1,423 710 (3,001) 4,708 Provision for (benefit from) income taxes (1,810) (213) (153) 2,242 Legal and transaction related costs (1) 1,705 — 5,153 — Adjusted EBITDA $ (28,382) $ (2,757) $ 64,836 $ 84,662 Revenue $ 175,098 $ 210,173 $ 737,181 $ 706,544 Adjusted EBITDA margin (16.2)% (1.3)% 8.8% 12.0% (1) Legal and transaction related costs consist of expenses related to our intellectual property ("IP") litigation against Alphabet Inc. and Google LLC as well as legal and transaction costs associated with our recent acquisition activity, which we do not consider representative of our underlying operating performance. 13 Q2 FY2020

Stock-based compensation (unaudited, in thousands) Three Months Ended Six Months Ended March 28, March 30, March 28, March 30, 2020 2019 2020 2019 Cost of revenue $ 278 $ 218 $ 561 $ 403 Research and development 5,427 4,284 10,543 7,888 Sales and marketing 3,407 3,128 6,948 5,809 General and administrative 4,282 3,456 8,546 6,018 Total stock-based compensation expense $ 13,394 $ 11,086 $ 26,598 $ 20,118 Free cash flow reconciliation (unaudited, in thousands) Six Months Ended March 28, March 30, 2020 2019 Cash flows provided by operating activities $ 35,368 $ 65,105 Less: purchases of property and equipment and intangible assets (25,800) (8,087) Free cash flow $ 9,568 $ 57,018 14 Q2 FY2020