Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Inspire Medical Systems, Inc. | insp-20200505.htm |

Inspire Medical Systems, Inc. May 2020 NYSE: INSP 1

Disclaimer This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expect,’’ ‘‘plan,’’ ‘‘anticipate,’’ ‘‘could,’’ “future,” “outlook,” ‘‘intend,’’ ‘‘target,’’ ‘‘project,’’ ‘‘contemplate,’’ ‘‘believe,’’ ‘‘estimate,’’ ‘‘predict,’’ ‘‘potential,’’ ‘‘continue,’’ or the negative of these terms or other similar expressions, although not all forward-looking statements contain these words. The forward-looking statements in this presentation relate to, among other things, statements regarding the impact of the COVID-19 pandemic on our business, financial results and financial condition, investments in our business, our expectation that a substantial portion of postponed Inspire therapy procedures will be rescheduled, the activity of our commercial team once circumstances allow, full year 2020 financial and operational outlook, future LCDs and positive insurance coverage of Inspire therapy and improvements in market access, clinical data growth, product development, indication expansion, market development, and prior authorization approvals. These forward-looking statements are based on management’s current expectations and involve known and unknown risks and uncertainties that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, estimates regarding the annual total addressable market for our Inspire therapy in the U.S. and our market opportunity outside the U.S.; future results of operations, financial position, research and development costs, capital requirements and our needs for additional financing; commercial success and market acceptance of our Inspire therapy; the impact of the ongoing and global COVID-19 pandemic; general and international economic, political, and other risks, including currency and stock market fluctuations and the uncertain economic environment; our ability to achieve and maintain adequate levels of coverage or reimbursement for our Inspire system or any future products we may seek to commercialize; competitive companies and technologies in our industry; our ability to enhance our Inspire system, expand our indications and develop and commercialize additional products; our business model and strategic plans for our products, technologies and business, including our implementation thereof; our ability to accurately forecast customer demand for our Inspire system and manage our inventory; our dependence on third-party suppliers, contract manufacturers and shipping carriers; consolidation in the healthcare industry; our ability to expand, manage and maintain our direct sales and marketing organization, and to market and sell our Inspire system in markets outside of the U.S.; risks associated with international operations; our ability to manage our growth; our ability to increase the number of active medical centers implanting Inspire therapy; our ability to hire and retain our senior management and other highly qualified personnel; risk of product liability claims; risks related to information technology and cybersecurity; risk of damage to or interruptions at our facilities; our ability to commercialize or obtain regulatory approvals for our Inspire therapy and system, or the effect of delays in commercializing or obtaining regulatory approvals; FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the U.S. and international markets; the timing or likelihood of regulatory filings and approvals; risks related to our debt and capital structure; our ability to establish and maintain intellectual property protection for our Inspire therapy and system or avoid claims of infringement; tax risks; risks that we may be deemed an investment company under the Investment Company Act of 1940; regulatory risks; the volatility of the trading price of our common stock; and our expectations about market trends. Other important factors that could cause actual results, performance or achievements to differ materially from those contemplated in this presentation can be found under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2019, as updated in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 to be filed with the SEC, and as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and the Investors page of our website at www.inspiresleep.com. These and other important factors could cause actual results to differ materially from those indicated by the forward-looking statements made in this presentation. Any such forward-looking statements represent management’s estimates as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, unless required by applicable law, we disclaim any obligation to do so, even if subsequent events cause our views to change. Thus, one should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. This presentation contains trademarks, trade names and service marks of other companies, which are the property of their respective owners. We do not intend our use or display of other parties' trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. 2 © Inspire Medical Systems, Inc. All Rights Reserved

3 © Inspire Medical Systems, Inc. All Rights Reserved

Current Impact of COVID-19 on Inspire Operations . Q1 2020 revenue of $21.3M (31% growth over Q1 2019) was negatively impacted by the COVID-19 pandemic . Substantially all Inspire therapy procedures were postponed beginning the second week of March and numerous other cases, which received prior authorization approval, were not able to be scheduled . We have not had a disruption in supply chain and maintain sufficient levels of inventory . Submitted 929 prior authorization requests in Q1 2020, compared with 722 in Q1 2019 . 761 patients received an approval of their prior authorization submission in Q1 2020, compared with 443 approvals in Q1 2019 . Our response to COVID-19 includes: . Focusing on the safety and well-being of our employees and their families globally by transitioning to remote work environment . Continuing prior authorization process to obtain approvals during current period . Engaging and educating physicians and patients through our online platform using virtual health talks and telemedicine . Continuing to engage patients through our refocused Direct to Consumer marketing strategies (shift from radio and TV in larger markets affected by COVID-19 towards more digital and TV in smaller markets) 4 © Inspire Medical Systems, Inc. All Rights Reserved

Preparations for Post-COVID-19 Pandemic . Site Readiness . Maintain accurate list of all postponed cases and all approved cases . Establish Inspire as a priority procedure when scheduling restarts . OSA is disease state management and Inspire is an outpatient procedure . Surgeon payment increased an average of $450 following Medicare LCD policies . Continue to recruit and train new centers . 28 new centers opened in Q1 2020 . Signed national purchasing agreement for 150-hospital health system . Increase focus on ASCs driven by broadened covered lives and Medicare . Continue recruiting additional Territory Managers . Added 9 TMs in Q1 2020; 82 U.S. TMs at March 31, 2020 . Continue product development programs and expansion initiatives . Completed equity offering in April with $124.7M net proceeds 5 © Inspire Medical Systems, Inc. All Rights Reserved

Significant Business Progress Since IPO: Strong Foundation in Place to Drive Greater Penetration Broader . Continue to Increase Volume by Training and Opening New Centers Commercial . Drive Increased Utilization at Existing Centers Expansion Phase . Continue to Maintain High quality Patient Outcomes Rapid Increase in Covered Lives (mm) 165 Reimbursement Phase 25 2 IPO (May 18) Dec 18 Mar 20 Regulatory Phase . PMA approval from the FDA in 2014 . Clinical evidence in 2,100+1 patients, in 100+ papers . Clinical Effectiveness demonstrated in a real-world setting (ADHERE) Phase . More than 8,200 patients treated with Inspire therapy to date . Medicare coverage in 5 MACs with increase in surgeon fees Expanding commercial efforts to drive continued growth in therapy adoption 6 © Inspire Medical Systems, Inc. All Rights Reserved

Commercial Execution: Opportunity to Accelerate Interest and Conversions Our Direct-to-Patient Strategy Has Proven to Be Successful in Reaching and Educating Patients About Inspire Therapy… 1 Generating Interest 2 Qualifying Interest 3 Driving Conversion Selectively Expanding DTC Matching the Right Patient with Conversion of < 10% of Advertising the Right Physician for the Incoming Calls Right Therapy Inspire Website Visitors (mm) 520k Doctor Searches 2019 2019 ~3k U.S. Implants 4.5 42.5k Phone Calls 2.3 Expanding Adviser Care Strive for Continuous 2020 2020 Program Improvement of Conversion Rates 2018 2019 …And We Are Now Focused on Both Broadening These Efforts and Increasing Our Overall Conversion Rate and Utilization at Existing Centers 7 © Inspire Medical Systems, Inc. All Rights Reserved

Inspire is an Innovative Neurostimulation Solution for Moderate to Severe Obstructive Sleep Apnea (OSA) First and only FDA-approved neurostimulation Our History & Key Milestones technology for OSA 1990s: Medtronic (MDT) begins early work on the development of Inspire More than 8,200 patients treated with Inspire 2001: Initial clinical results published by MDT therapy 2007: Inspire is founded after being spun-out of MDT 2011: Initiated Phase III pivotal STAR trial; CE mark Therapy for the estimated 35–65% of non-CPAP received in Europe compliant patients 2014: STAR results published in the New England Journal of Medicine in January; received PMA ~$10bn annual U.S. market opportunity approval from the FDA 2015: 18-month STAR data published; revenues of Innovative, closed-loop, minimally invasive solution $8.0M 2016: 1,000th implant milestone; revenues of $16.4M Safe, comfortable, and convenient therapy 2017: Launched Inspire IV neurostimulator in U.S.; announced 5-year STAR results; 2,000th implant; Significant body of clinical evidence involving revenues of $28.6M >2,100 patients across 23 studies 2018: Inspire IV CE mark; 5-year STAR results publication; initial public offering on NYSE; Aetna Strong customer base and growing sales team begins covering the Inspire therapy; revenues of $50.6M Growing reimbursement with 165 million U.S. 2019: 7,500th patient receives Inspire therapy; Many BCBS plans and other large insurers write positive covered lives coverage; six Medicare LCD drafts; revenues of $82.1M Proven management team leading 270+ employees 2020: Five final Medicare LCDs; FDA approved expanded age range to include 18-21 year old patients 8 © Inspire Medical Systems, Inc. All Rights Reserved

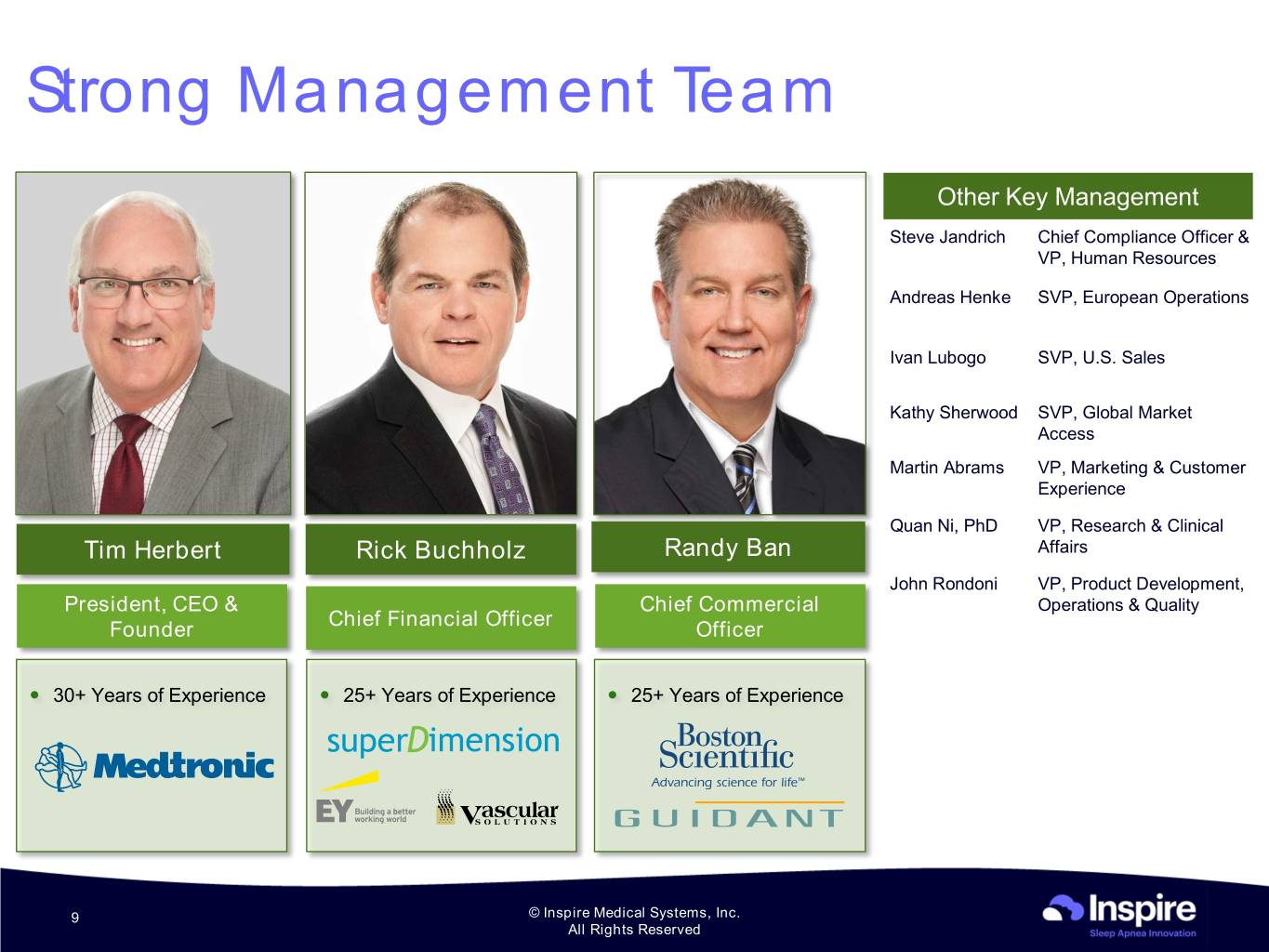

Strong Management Team Other Key Management Steve Jandrich Chief Compliance Officer & VP, Human Resources Andreas Henke SVP, European Operations Ivan Lubogo SVP, U.S. Sales Kathy Sherwood SVP, Global Market Access Martin Abrams VP, Marketing & Customer Experience Quan Ni, PhD VP, Research & Clinical Tim Herbert Rick Buchholz Randy Ban Affairs John Rondoni VP, Product Development, President, CEO & Chief Commercial Operations & Quality Chief Financial Officer Founder Officer 30+ Years of Experience 25+ Years of Experience 25+ Years of Experience 9 © Inspire Medical Systems, Inc. All Rights Reserved

OSA is a Serious and Chronic Disease OSA is Caused by a Blocked or Partially Blocked Airway • Blockage prevents airflow to the lungs • Results in repeated arousals and oxygen de-saturations • Severity of sleep apnea is measured by frequency of apnea or hypopnea events per hour, which is referred to as the Apnea-Hypopnea Index (AHI) Normal range: Moderate sleep apnea: AHI < 5 events per hour 15 ≤ AHI < 30 events per hour Mild sleep apnea: Severe sleep apnea: Airway obstruction 5 ≤ AHI < 15 events per hour AHI ≥ 30 events per hour during breathing Inspire’s Focus Most Patients Are Unaware of Their Condition… …and Untreated OSA Multiplies Serious Health Risks • High risk patients: obese, male or of advanced age Increased Risk of Mortality 5 • Common first indicator: heavy snoring 2x • Other indicators: The risk for stroke1 • Lack of energy • Memory or concentration 2x 2 • Headaches problems The risk for sudden cardiac death • Depression • Excessive daytime 5x % Surviving The risk for cardiovascular mortality3 • Nighttime gasping sleepiness 57% • Dry mouth Increased risk for recurrence of Atrial Fibrillation after ablation4 Years of Follow-up ____________________ Source: Company Website 4. Li et al, Europace 2014. 1. Redline et al, The Sleep Heart Health Study. Am J Res and Crit Care Med 2010. 5. Prospective Study of Obstructive Sleep Apnea and Incident Coronary Heart Disease and Heart Failure from 2. Gami et al, J Am Coll Cardiol 2013. SHHS and Wisconsin Sleep Cohort Study. 3. Young et al, J Sleep 2008. 10 © Inspire Medical Systems, Inc. All Rights Reserved

Current Treatment Options, Such as CPAP and Invasive Surgery, Have Significant Limitations Continuous Positive Airway Pressure (CPAP) is the Leading Therapy for OSA • Delivered through a mask that connects through a Drivers of Non-Compliance hose to a bedside air pump Mask Discomfort • Demonstrated improvements in patient-reported Mask Leakage sleep quality and reductions in daytime sleepiness Pressure Intolerance Ina Skin Irritation • Long-term limitations as a therapeutic option, Nasal Congestion primarily due to low patient compliance Nasal Drying (approximately 35% – 65%) Nosebleeds • Low patient compliance as many patients find the Claustrophobia mask or treatment cumbersome, uncomfortable Lack of Intimacy and loud Invasive Surgery • Several variations of sleep surgery • Success rates vary widely (30% - 60%)1 Ina • Irreversible anatomy alteration • In-patient surgery with extended recovery Uvulopalatopharyngoplasty Maxillomandibular Advancement (UPPP) (MMA) ____________________ 1. Shah, Janki, et al; American Journal of Otolaryngology (2018). Uvulopalatopharyngoplasty vs. CN XII stimulation for treatment of obstructive sleep apnea: A single institution experience. 11 © Inspire Medical Systems, Inc. All Rights Reserved

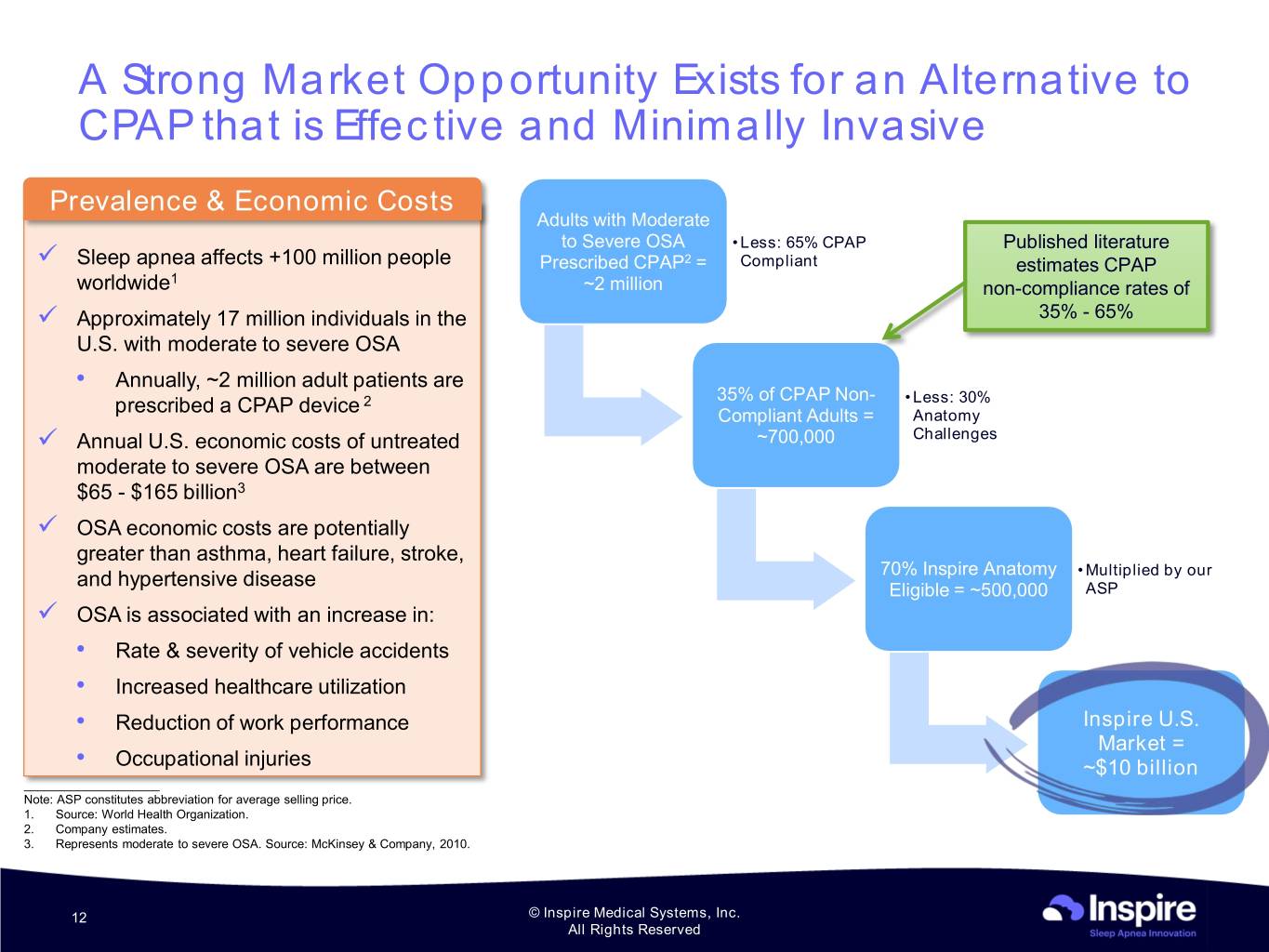

A Strong Market Opportunity Exists for an Alternative to CPAP that is Effective and Minimally Invasive Prevalence & Economic Costs Adults with Moderate to Severe OSA • Less: 65% CPAP Published literature Sleep apnea affects +100 million people Prescribed CPAP2 = Compliant estimates CPAP 1 worldwide ~2 million non-compliance rates of Approximately 17 million individuals in the 35% - 65% U.S. with moderate to severe OSA • Annually, ~2 million adult patients are 35% of CPAP Non- prescribed a CPAP device 2 • Less: 30% Compliant Adults = Anatomy Annual U.S. economic costs of untreated ~700,000 Challenges moderate to severe OSA are between $65 - $165 billion3 OSA economic costs are potentially greater than asthma, heart failure, stroke, and hypertensive disease 70% Inspire Anatomy • Multiplied by our Eligible = ~500,000 ASP OSA is associated with an increase in: • Rate & severity of vehicle accidents • Increased healthcare utilization • Reduction of work performance Inspire U.S. Market = • Occupational injuries ~$10 billion ____________________ Note: ASP constitutes abbreviation for average selling price. 1. Source: World Health Organization. 2. Company estimates. 3. Represents moderate to severe OSA. Source: McKinsey & Company, 2010. 12 © Inspire Medical Systems, Inc. All Rights Reserved

Inspire Therapy is a Proven Solution for Patients with OSA Inspire System Inspire Procedure 3 Stimulation Lead 1 Pressure Sensing Lead Hypoglossal Nerve 2 Neurostimulator Remote control and three implantable components: Approximately a two-hour outpatient procedure Pressure sensing lead: detects when the •1 Requires three small incisions patient is attempting to breathe Patients typically recover quickly and resume •2 Neurostimulator: houses the electronics and normal activities in just a few days battery power for the device System activation occurs 30 days after implantation •3 Stimulation lead: delivers electrical stimulation Patient controls system by turning on the device to the hypoglossal nerve each night with the remote control before going to sleep 13 © Inspire Medical Systems, Inc. All Rights Reserved

Inspire Therapy is a Safe and Effective Solution Mild Stimulation is a Clear Mechanism of Action Inspire Therapy Offers Significant Benefits Strong safety profile Effective and durable treatment Closed-loop system Strong patient compliance High patient satisfaction Minimally invasive outpatient procedure ~11-year battery life (without recharging) Utilizes patient’s natural physiology Short recovery times post surgery Patient controlled therapy Long-term outcomes demonstrate that Inspire therapy addresses the shortfalls of current treatments 14 © Inspire Medical Systems, Inc. All Rights Reserved

Objective Measures Show the Impact of Inspire Therapy on OSA Polysomnogram Before and After Activation of Inspire System Inspire system turned on Airflow Breathing Oxygen Saturation OSA events No OSA events After activating the Inspire system, the patient exhibited a more regular breathing pattern, higher and more consistent blood oxygen levels, and fewer or no transient arousals 15 © Inspire Medical Systems, Inc. All Rights Reserved

Clinical Evidence 16 © Inspire Medical Systems, Inc. All Rights Reserved

Significant Body of Clinical Evidence Evaluating Inspire in more than 2,100 Patients, in 100+ papers Patients Clinical Studies Evaluated Stimulation Therapy for Apnea Reduction (STAR) 126 German Post-Market Study 60 ADHERE Patient Registry 1,017 Company Company Sponsored Pediatric / Down Syndrome 26 Inspire vs. traditional sleep surgery 248 (Cleveland Clinic, Thomas Jefferson, UPenn) Independent Studies in Single Centers 2 150 Independent Studies of Specific Populations 418 Independent German and French Experience 143 (Munich, Lubeck, Bordeaux) Total Patients Evaluated Above 2,188 1. Due to the inclusion of certain patients in multiple studies, some studies are not shown in the table because they do not add any incremental patients to the overall total. 2. Includes Thomas Jefferson University Hospital (TJUH) & University of Pittsburgh Medical Center (UPMC); University Hospitals – Cleveland; Non-Academic Hospital in San Diego; and University of Pennsylvania. 17 © Inspire Medical Systems, Inc. All Rights Reserved

STAR Trial Met Both Primary Endpoints & Showed Statistically Significant Reductions in AHI & ODI Significant Reduction in Severity of OSA Meaningful Levels of Compliance Post-Implantation Apnea-Hypopnea Index (Median) Oxygen Desaturation Index (ODI) (Median) 29.3 25.4 9.0 9.7 7.4 8.6 6.0 6.2 4.8 4.6 Events per Hour Events per Hour Baseline 12 Month 18 Month 3 Year 5 Year Baseline 12 Month 18 Month 3 Year 5 Year N=126 N=124 N=123 N=98 N=71 N=126 N=124 N=123 N=98 N=71 All p values <0.001 vs. baseline All p values <0.001 vs. baseline results in median results in median Withdrawal of Inspire Therapy Resulted in Reversal of Therapeutic Benefit, Further Demonstrating Inspire’s Effectiveness Apnea-Hypopnea Index (Mean) Oxygen Desaturation Index (Mean) 31.3 30.1 26.7 26.8 25.8 23.0 8.9 8.0 7.2 7.6 6.3 6.0 Score (Events/hr) Score (Events/hr) Baseline 1 Year Randomized, Therapy- Baseline 1 Year Randomized, Therapy- withdrawal Trial withdrawal Trial Therapy-maintenance Group (N=23) Therapy-withdrawal Group (N=23) Therapy-maintenance Group (N=23) Therapy-withdrawal Group (N=23) 18 © Inspire Medical Systems, Inc. All Rights Reserved

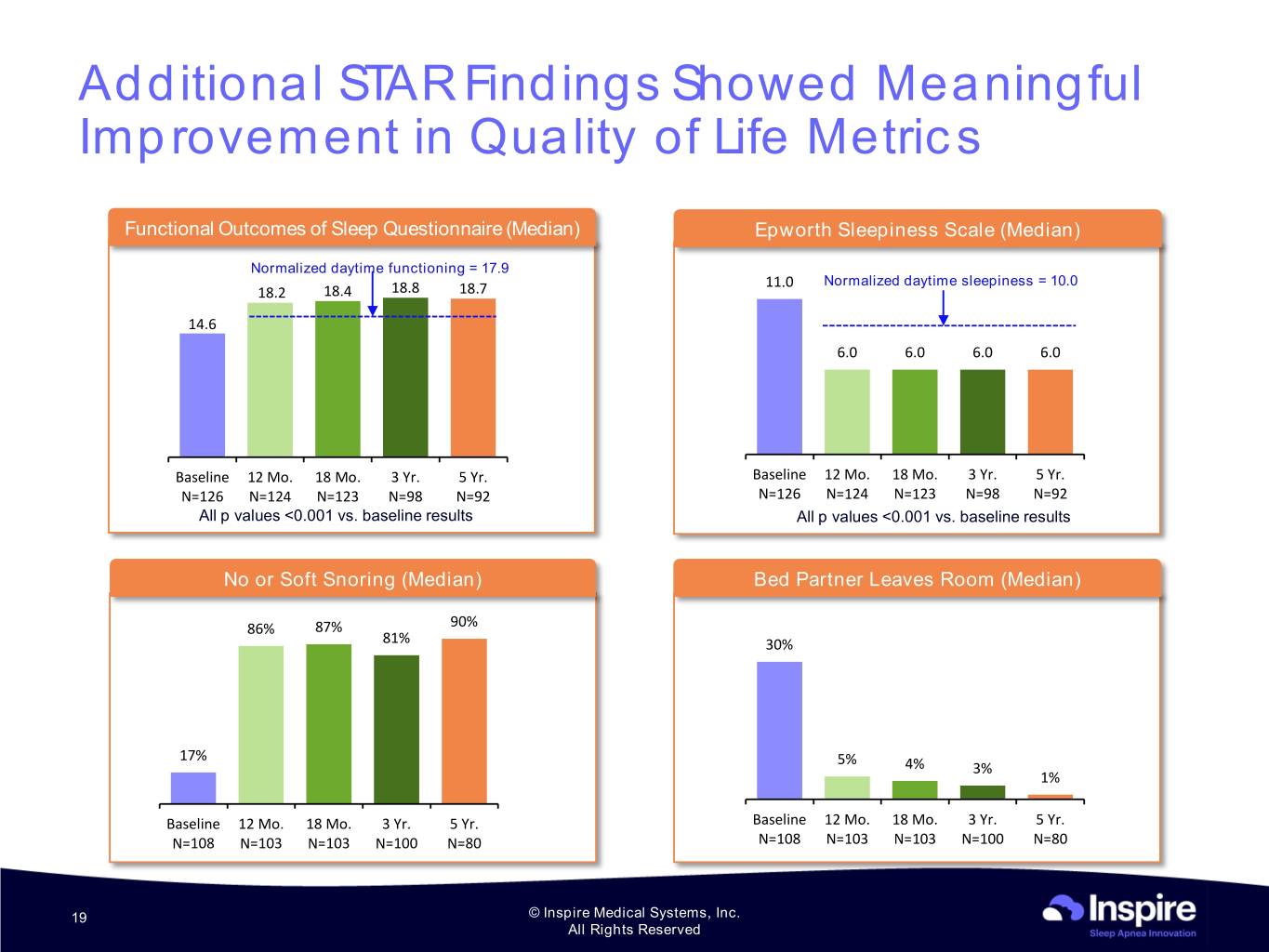

Additional STAR Findings Showed Meaningful Improvement in Quality of Life Metrics Functional Outcomes of Sleep Questionnaire (Median) Epworth Sleepiness Scale (Median) Normalized daytime functioning = 17.9 11.0 Normalized daytime sleepiness = 10.0 18.2 18.4 18.8 18.7 14.6 6.0 6.0 6.0 6.0 Baseline 12 Mo. 18 Mo. 3 Yr. 5 Yr. Baseline 12 Mo. 18 Mo. 3 Yr. 5 Yr. N=126 N=124 N=123 N=98 N=92 N=126 N=124 N=123 N=98 N=92 All p values <0.001 vs. baseline results All p values <0.001 vs. baseline results No or Soft Snoring (Median) Bed Partner Leaves Room (Median) 86% 87% 90% 81% 30% 17% 5% 4% 3% 1% Baseline 12 Mo. 18 Mo. 3 Yr. 5 Yr. Baseline 12 Mo. 18 Mo. 3 Yr. 5 Yr. N=108 N=103 N=103 N=100 N=80 N=108 N=103 N=103 N=100 N=80 19 © Inspire Medical Systems, Inc. All Rights Reserved

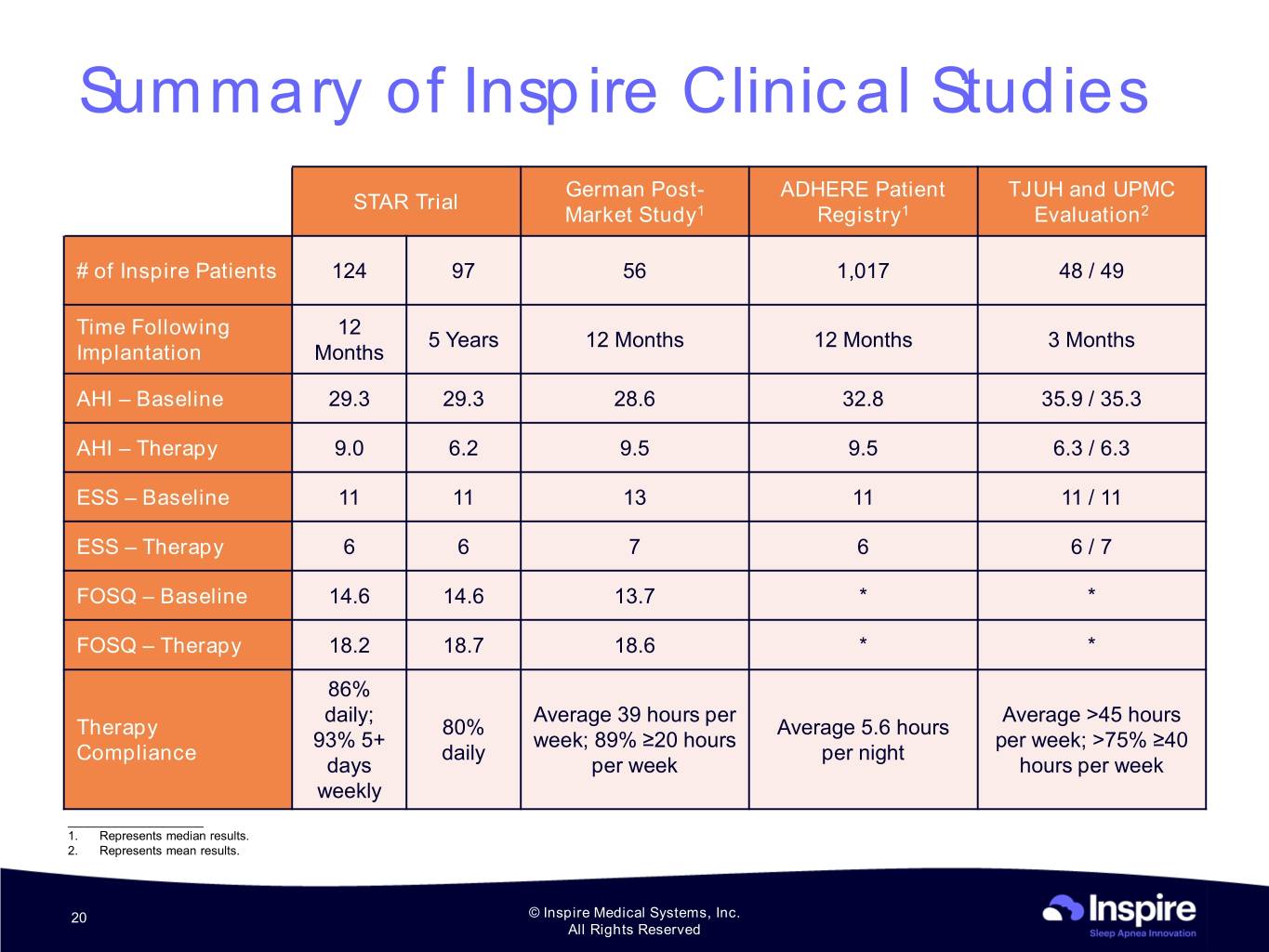

Summary of Inspire Clinical Studies German Post- ADHERE Patient TJUH and UPMC STAR Trial Market Study1 Registry1 Evaluation2 # of Inspire Patients 124 97 56 1,017 48 / 49 Time Following 12 5 Years 12 Months 12 Months 3 Months Implantation Months AHI – Baseline 29.3 29.3 28.6 32.8 35.9 / 35.3 AHI – Therapy 9.0 6.2 9.5 9.5 6.3 / 6.3 ESS – Baseline 11 11 13 11 11 / 11 ESS – Therapy 6 6 7 6 6 / 7 FOSQ – Baseline 14.6 14.6 13.7 * * FOSQ – Therapy 18.2 18.7 18.6 * * 86% daily; Average 39 hours per Average >45 hours Therapy 80% Average 5.6 hours 93% 5+ week; 89% ≥20 hours per week; >75% ≥40 Compliance daily per night days per week hours per week weekly ____________________ 1. Represents median results. 2. Represents mean results. 20 © Inspire Medical Systems, Inc. All Rights Reserved

We Intend to Continue to Build the Depth of Our Clinical Data with Our ADHERE Patient Registry ADHERE Patient Registry Our post-implantation study with the goal of collecting data on a group in excess of 5,000 patients Registry Results from 1,017 Patients Registry study designed to Apnea Hypopnea Index (Median) Epworth Sleepiness Scale (Median) be retrospective and Normalized daytime sleepiness = 10.0 11 P<0.0001 prospective 32.8 P<0.0001 45% Reduction 43 centers are involved in 71% Reduction 6 registry to date 9.5 Registry enrolled >1,700 patients since October Baseline 12 Months Baseline 12 Months 2016 to date N=984 N=382 N=881 N=439 Five peer-reviewed Inspire is Better Would Recommend to Overall Patient Patients would Experience than CPAP Friends / Family manuscripts Satisfaction Choose Inspire Again Adherence Monitoring: Average home device use: 95% 96% 93% 94% 5.6 hours / night Results from the ADHERE registry show Inspire therapy is an effective treatment for OSA in a real-world setting ____________________ Note: Enrollments as of February 2020. Results are from Thaler, Laryngoscope 2019 21 © Inspire Medical Systems, Inc. All Rights Reserved

Product and Indication Expansion 22 © Inspire Medical Systems, Inc. All Rights Reserved

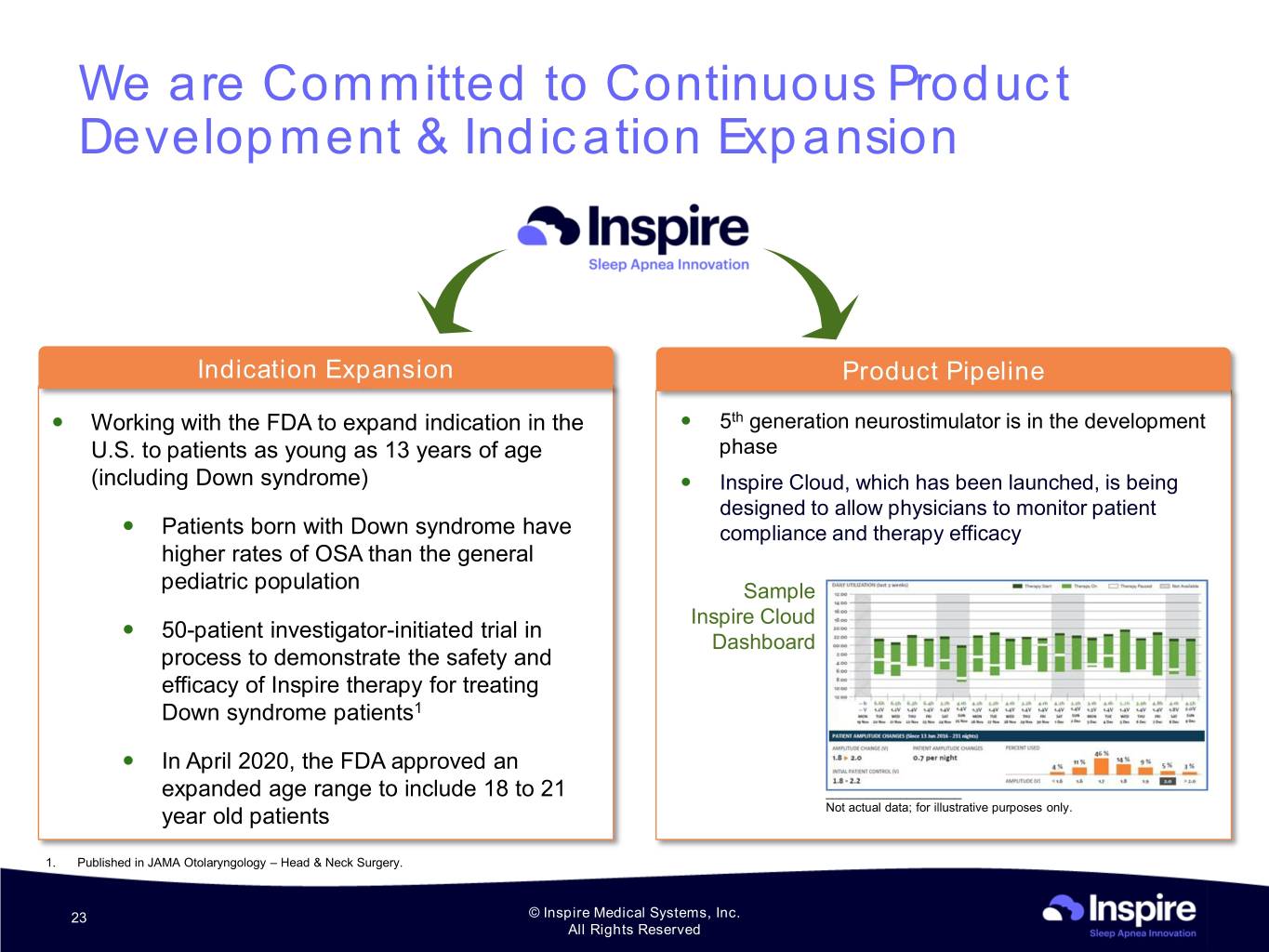

We are Committed to Continuous Product Development & Indication Expansion Indication Expansion Product Pipeline Working with the FDA to expand indication in the 5th generation neurostimulator is in the development U.S. to patients as young as 13 years of age phase (including Down syndrome) Inspire Cloud, which has been launched, is being designed to allow physicians to monitor patient Patients born with Down syndrome have compliance and therapy efficacy higher rates of OSA than the general pediatric population Sample Inspire Cloud 50-patient investigator-initiated trial in Dashboard process to demonstrate the safety and efficacy of Inspire therapy for treating Down syndrome patients1 In April 2020, the FDA approved an expanded age range to include 18 to 21 ____________________ year old patients Not actual data; for illustrative purposes only. 1. Published in JAMA Otolaryngology – Head & Neck Surgery. 23 © Inspire Medical Systems, Inc. All Rights Reserved

Inspire Cloud: Longitudinal Care Longitudinal Care Care Team Inspire cloud Referral Network Inspire Cloud was launched at the AASM (American Academy of Sleep Medicine) annual meeting June 2018 ____________________ Not actual data; for illustrative purposes only. Monitors Adherence Strengthens the Referral Network Generates Complete Patient Therapy Reports Creates Care Coordination Hub Insight into Center-Wide Therapy Outcomes Fits into Existing Sleep Clinic Workflows 24 © Inspire Medical Systems, Inc. All Rights Reserved

Reimbursement 25 © Inspire Medical Systems, Inc. All Rights Reserved

Our Team is Focused on All Aspects of Reimbursement, which Include Coding, Payment, and Coverage Coding Payment Coverage • Physician • Physician • Medicare • Facility • Facility • Commercial • Neurostimulator and stimulation • National Medicare average facility payment: • Over 430 commercial payors in lead: CPT code 64568 for Cranial 2019: ~ $27,700 the U.S. have paid for the Inspire Nerve Stimulator 2020: ~ $29,000 (~5% increase) procedure, mostly through prior authorization • Sensing lead: CPT code 0466T • Covers the cost of the device and the (Category III) procedure for implantation • Medicare payment in most MACs • Physician society working to • In 2020, several MACs assigned a surgeon • Government contract for VA / convert to a Category I code reimbursement of ~$450 to implant pressure Military hospitals sensor (add-on CPT code +0466T) Average U.S. Implant Mix Two-pronged Approach to Reimbursement Part 1: Work with all payers to educate on the therapy 30% during annual and mid-cycle reviews to develop positive Commercial coverage policies (i.e., Aetna was a mid-cycle) 60% Medicare Part 2: Work with physicians and centers to obtain prior VA authorizations from payers as most have negative coverage policies today, yet approve procedures after 10% appeal cycles 26 © Inspire Medical Systems, Inc. All Rights Reserved

Covered Lives Summary Positive BCBS Plans: 73M Total Covered Lives Large Insurance Plans • Wellmark • S. Carolina • Nebraska • Horizon • Idaho • Tennessee • United Healthcare: 41M • N. Carolina • Health Now NY • HCSC (Illinois, • Aetna: 22M • Premera • Federal Employee Plan Texas, etc.) • Regence • Alabama • CareFirst (DC) • *Anthem: 40M • Kansas • Highmark • Capital Blue • *Cigna: 15M • Mississippi • Massachusetts • North Dakota • *Humana: 12M • Louisiana • Excellus • Arkansas • Kansas City • California • Arizona • Independence • Michigan • Rhode Island Small Plans – Positive Coverage Covered Lives Summary • Emblem Health • AVMed • Fallon Health of • Medica • Cleveland Clinic Massachusetts • Medical Mutual • Preferred One • Centene Corp. Total Plans Gained in 2019: 40 • HAP of MI • Ohio State University • GEHA (Gov’t • Ascension • WEA Trust (WI) Employees Health Total Lives Gained in 2019: 136 million • Quartz Health • Priority Health (MI) Assoc.) • Capital District • Health New England • Providence Health Physicians Health • SelectHealth (Utah) Plan Total Positive Policies: 53 Plan (NY) • HealthPartners (MN) • AllWays Health • Geisinger Partners Total US Covered Lives: 165 million * Donates policy in process 27 © Inspire Medical Systems, Inc. All Rights Reserved

Medicare Local Coverage Determination (LCD) Progress – All policy criteria consistent between MACs LCD Final LCD MAC Status Publication Noridian Final March 15, 2020 Novitas Final March 15, 2020 First Coast Final March 15, 2020 (Florida) National Govt. Services Final April 1, 2020 (NGS) Expected final in • BMI criterion = Below 35 Palmetto Draft 2020 • AHI criterion = 15 to 65 events per hour • Other criteria mirrors FDA Indications CGS Final April 1, 2020 • Represents 40 million covered lives Wisconsin • Medicare Advantage is an Phys. Services Draft June 14, 2020 additional 20 million covered lives (WPS) 28 © Inspire Medical Systems, Inc. All Rights Reserved

The Prior Authorization Metrics are Steadfastly Improving with Every New Positive Coverage Policy Case-by-Case Submissions, Reviews & Approvals Process If denied If denied If denied Prepare/Submit an EMR Prepare/Submit an Prepare/Submit a 1st Prepare/Submit a 2nd appeal Prior Authorization level appeal level appeal (External Medical Review) Prior Authorization Approval Track Record Following a Complete Appeal Review Cycle Percentage of Patient Approvals – 2018 Percentage of Patient Approvals – 2019 77% Approved 91% Approved Denied at EMR Denied at EMR Dismissed 1 Dismissed +2,477 2 16% +3,257 6% 7% 2% Overall approval rates are ~59% as many patients do not receive a full review (drop out or are blocked) ~ 78% 1. Indicates number of patient submissions in 2018 in 2019 2. Indicates number of patient submissions in 2019 29 © Inspire Medical Systems, Inc. All Rights Reserved

U.S. Commercial Prior Authorization Submissions • Steady increase in prior authorization submissions fueled Total Submissions by increased capacity, effective patient outreach 2020-Q1: 929 programs and reduction of fatigue/burden of obtaining 2019: 3,257 insurance approvals 2018: 2,477 • With positive policies in-place across most of the U.S., 2017: 1,506 centers will begin to submit authorizations independently 2016: 960 Past Quarter Submissions 1,100 80 988 1,000 929 70 900 812 60 800 722 735 661 700 619 639 50 600 558 488 40 76 500 445 71 400 62 30 303 56 57 268 258 270 48 51 49 Quarterly Total Submissions Total Quarterly 300 209 225 43 20 34 38 200 Quarterly Weekly Average Submissions 21 20 21 23 10 100 16 17 - - Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Qtrly Weekly Average Submissions Qtrly Total Submissions 30 © Inspire Medical Systems, Inc. All Rights Reserved

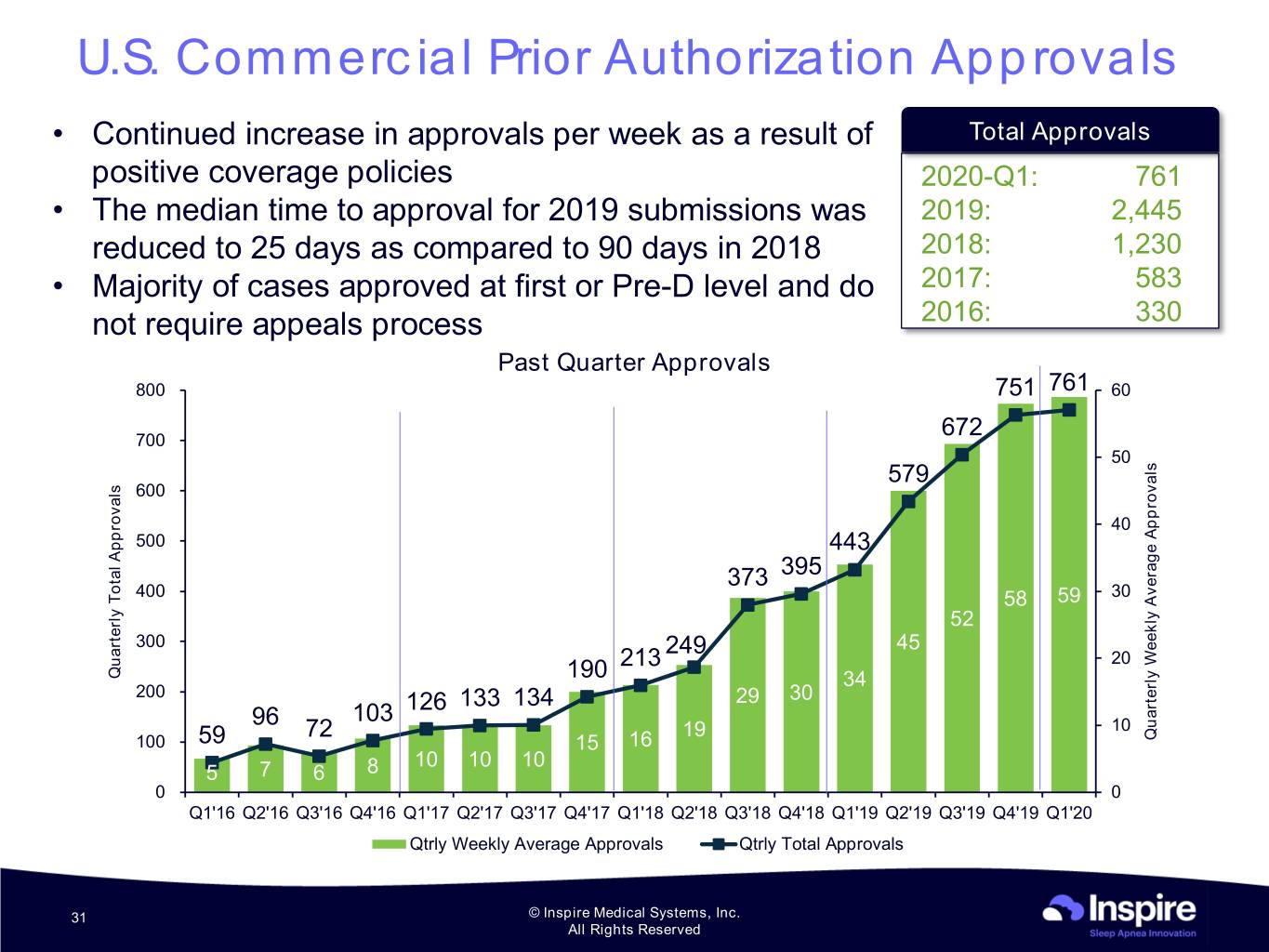

U.S. Commercial Prior Authorization Approvals • Continued increase in approvals per week as a result of Total Approvals positive coverage policies 2020-Q1: 761 • The median time to approval for 2019 submissions was 2019: 2,445 reduced to 25 days as compared to 90 days in 2018 2018: 1,230 • Majority of cases approved at first or Pre-D level and do 2017: 583 not require appeals process 2016: 330 Past Quarter Approvals 800 751 761 60 700 672 50 579 600 40 500 443 373 395 400 58 59 30 52 300 249 45 213 20 Quarterly Approvals Total Quarterly 190 34 200 126 133 134 29 30 96 103 10 72 19 Approvals Average Weekly Quarterly 100 59 15 16 10 10 10 5 7 6 8 0 0 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17 Q1'18 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Qtrly Weekly Average Approvals Qtrly Total Approvals 31 © Inspire Medical Systems, Inc. All Rights Reserved

Commercial Development 32 © Inspire Medical Systems, Inc. All Rights Reserved

We have a Targeted Approach to Market Development and Patient Outreach Market Development Direct-to-Patient Outreach Machine Inspire has built a referral network with physicians across the treatment continuum Company Sponsored Public Relations Differentiated marketing engine capable of generating demand through patient channels Local Local Physician to Patient Direct-to-Patient Channels / Self-Referred Radio TV Physician Word of Mouth Cardiac Dental Practice / Practice EP1 Referrals Referrals 2020-Q1 Website Results Inspire Program Core Team Sleep Sleep Practice Practice Refer and Referrals Manage 1.5M Visitors 92K Doctor 14K Doctor (+69% YoY) Searches* Contacts (-47% YoY) (+48% YoY) ____________________ 1. Electrophysiologists (EP) * Doctor searches decreased YoY due to the addition of a screening question on the website. 33 © Inspire Medical Systems, Inc. All Rights Reserved

Our Sales Strategy Engages All Key Stakeholders Across the OSA Treatment Paradigm Holistic Approach to Engagement Across Key Stakeholders in the OSA Treatment Paradigm U.S. Sales Organization Sleep 82 Territories in U.S. and 8 in Europe Patients Centers Managed by 4 Area Vice-Presidents and 17 Regional Sales Managers Supported by Therapy Awareness Managers and Field Clinical Reps ENT Target for each rep to manage 5 – 7 active Physicians centers per territory Encourage and sponsor additional publications of Focus on building long-lasting physician relationships clinical data Support physicians through all aspects of a case Increase awareness through training and education Identify new regions with high-volume medical centers Continue various direct-to-patient marketing initiatives Continue to build capacity to treat patients by adding centers, hiring Territory Managers, and adding support structure, including Regional Managers and staff to cover implant cases and activations 34 © Inspire Medical Systems, Inc. All Rights Reserved

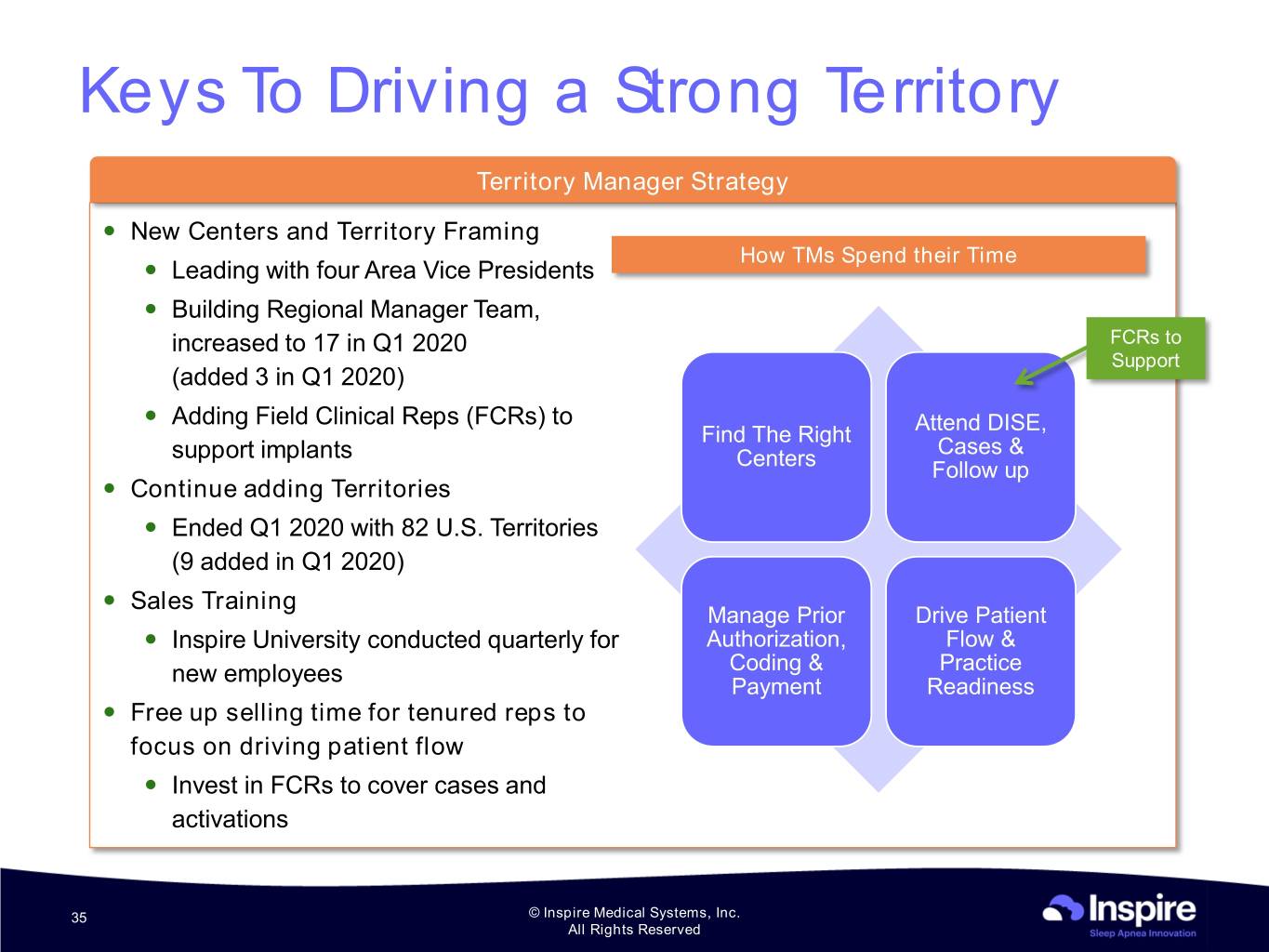

Keys To Driving a Strong Territory Territory Manager Strategy New Centers and Territory Framing How TMs Spend their Time Leading with four Area Vice Presidents Building Regional Manager Team, increased to 17 in Q1 2020 FCRs to Support (added 3 in Q1 2020) Adding Field Clinical Reps (FCRs) to AttendAttend DISE, DISE, Find The Right Find The Cases & support implants Centers Cases & Right Follow up Follow up Continue adding Territories Centers Ended Q1 2020 with 82 U.S. Territories (9 added in Q1 2020) Sales Training Drive Manage Prior Drive Patient Inspire University conducted quarterly for Authorization,Patient Flow & new employees CodingFlow & Practice & PaymentPractice Readiness Free up selling time for tenured reps to Readiness focus on driving patient flow Invest in FCRs to cover cases and activations 35 © Inspire Medical Systems, Inc. All Rights Reserved

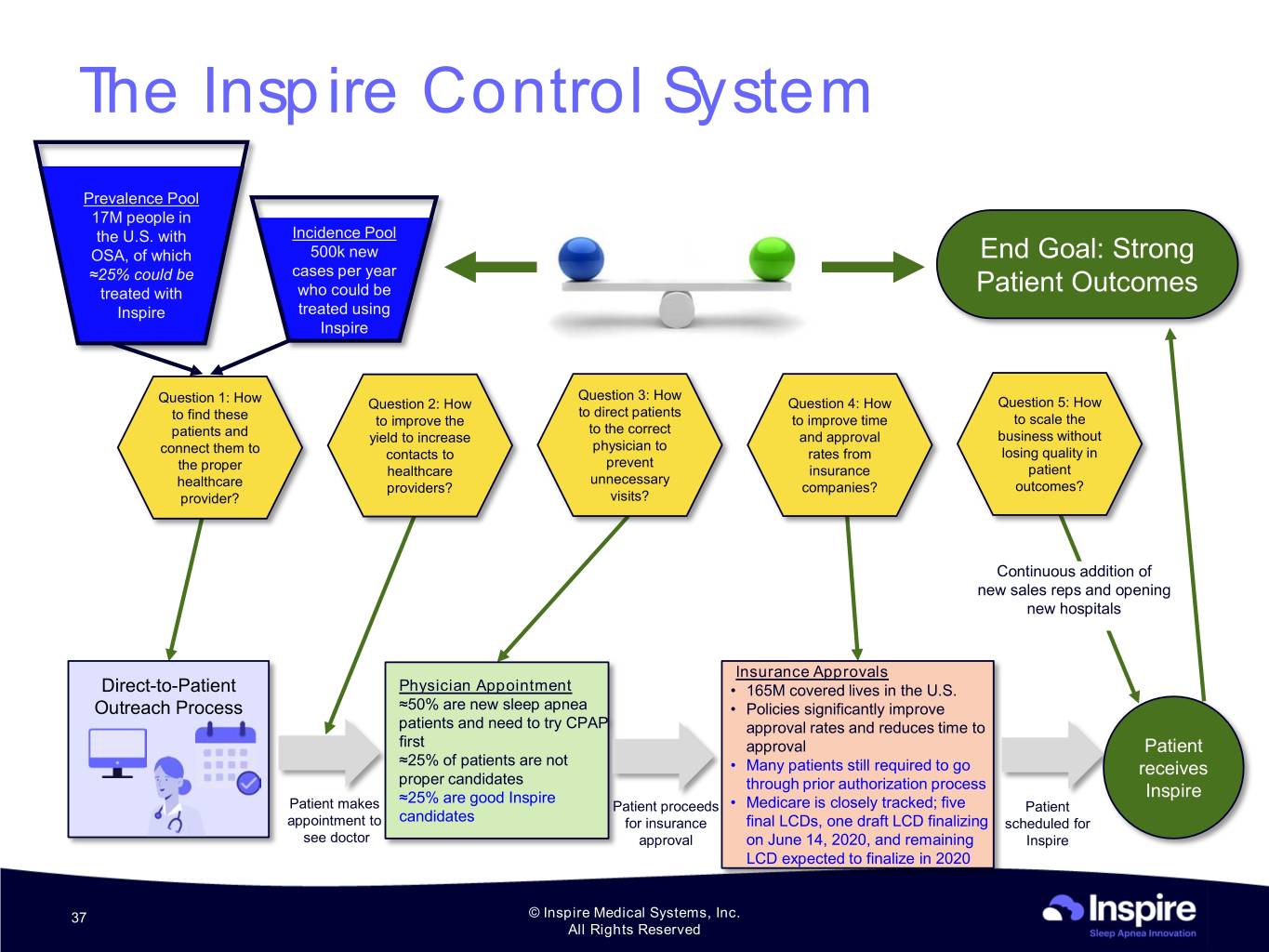

The Great Balancing Act KEEPING CONTROL WHILE GROWING FAST Focus on the rapid scaling of commercialization while ensuring proper training to maintain control of high-quality therapy outcomes 36 © Inspire Medical Systems, Inc. All Rights Reserved

The Inspire Control System Prevalence Pool 17M people in the U.S. with Incidence Pool OSA, of which 500k new End Goal: Strong ≈25% could be cases per year treated with who could be Patient Outcomes Inspire treated using Inspire Question 3: How Question 1: How Question 2: How Question 4: How Question 5: How to direct patients to find these to improve the to improve time to scale the to the correct patients and yield to increase and approval business without physician to connect them to contacts to rates from losing quality in prevent the proper healthcare insurance patient unnecessary healthcare providers? companies? outcomes? provider? visits? Continuous addition of new sales reps and opening new hospitals Insurance Approvals Direct-to-Patient Physician Appointment • 165M covered lives in the U.S. Outreach Process ≈50% are new sleep apnea • Policies significantly improve patients and need to try CPAP approval rates and reduces time to first approval Patient ≈25% of patients are not • Many patients still required to go receives proper candidates through prior authorization process ≈25% are good Inspire Inspire Patient makes Patient proceeds • Medicare is closely tracked; five Patient appointment to candidates for insurance final LCDs, one draft LCD finalizing scheduled for see doctor approval on June 14, 2020, and remaining Inspire LCD expected to finalize in 2020 37 © Inspire Medical Systems, Inc. All Rights Reserved

Financials 38 © Inspire Medical Systems, Inc. All Rights Reserved

Annual Revenue Growth ($ in millions) $82.1 2016 – 2019 CAGR: 71.1% $50.6 $28.6 $16.4 2016 2017 2018 2019 Annual Gross Margin 76.2% 78.9% 80.1% 83.4% 39 © Inspire Medical Systems, Inc. All Rights Reserved

Quarterly Revenue ($ in Millions) $26.9 $20.9 $21.3 $18.0 $16.6 $16.3 $13.1 $10.9 $10.0 $10.0 $7.3 $6.0 $4.7 $5.2 $5.3 $3.0 $3.6 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 79% 69% 56% 91% 90% 81% 80% 66% 62% 65% 60% 62% 31% % YoY Revenue Growth 39 ____________________ © Inspire Medical Systems, Inc. Quarterly amounts are unaudited All Rights Reserved

Q1 2020 Performance YoY Revenue ($ in millions) YoY Gross Margin YoY Growth: 31% YoY Increase: 220bps Territories EQ1 2020: 82 Q1 2020 Revenue Mix EQ1 2019: 53 $21.3 US OUS 84.6% 10% $16.3 90% 82.4% Q1 2019 Revenue Mix US OUS 12% 88% Q1 2019 Q1 2020 Q1 2019 Q1 2020 41 © Inspire Medical Systems, Inc. All Rights Reserved

Our Growth Strategies Ensure strong and consistent patient outcomes globally through planned and controlled expansion and robust physician training Promote awareness among patients, ENT physicians, sleep centers, and referring physicians Expand U.S. sales and marketing organization to drive adoption of our Inspire therapy Leverage the prior authorization model while we work in parallel with payors to develop positive coverage policies Invest in research and development to drive innovation and expand indications Further penetrate existing and expand into new international markets 42 © Inspire Medical Systems, Inc. All Rights Reserved

Our Innovative Inspire Solution has a Significant First Mover Advantage Inspire Therapy is Strongly Positioned FDA PMA approval since 2014 . More than 8,200 patients treated at over 375 medical Compelling Market centers across the U.S. and Europe Opportunity Significant payor experience . 165 million covered lives in the U.S. Large and growing . Leverage highly effective prior authorization model prevalence of OSA . Over 1,500 individual patient submissions in 2017, over 2,450 in 2018, over 3,250 in 2019 Significant economic Evidence of safety and 5-year long-term sustained cost of untreated OSA efficacy . Consistent results across four sponsored and 19 independent clinical studies evaluating ~2,100 patients Urgent clinical need for . Ongoing enrollment of 5,000 patient ADHERE registry an effective alternative (>1,000 patients enrolled thru September 2019) to CPAP Differentiated products built on years of development . Closed loop system that leverages our pressure sensing ~$10bn annual market lead and proprietary algorithm opportunity in the U.S. . Current device represents the 4th generation of our Inspire system, which has an ~11-year battery life and allows for MRI of head and extremities 43 © Inspire Medical Systems, Inc. All Rights Reserved

51