Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - HESKA CORP | exhibit993-heska8kafinanci.htm |

| EX-23.1 - EXHIBIT 23.1 - HESKA CORP | exhibit231-bdoconsent.htm |

| 8-K/A - 8-K/A - HESKA CORP | heska-8kascilacquisitionfi.htm |

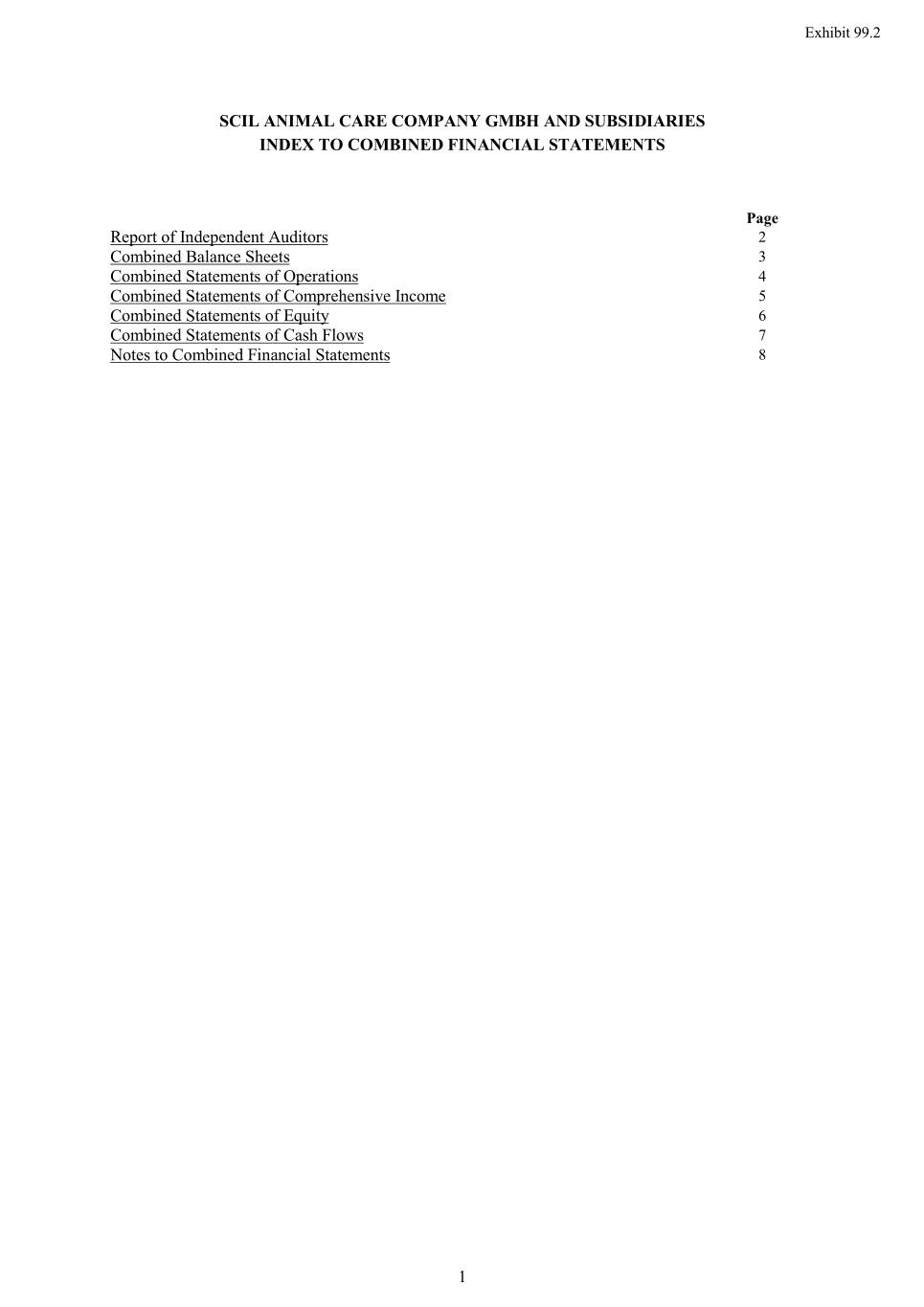

Exhibit 99.2 SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES INDEX TO COMBINED FINANCIAL STATEMENTS Page Report of Independent Auditors 2 Combined Balance Sheets 3 Combined Statements of Operations 4 Combined Statements of Comprehensive Income 5 Combined Statements of Equity 6 Combined Statements of Cash Flows 7 Notes to Combined Financial Statements 8 1

Telefon +49 69 95941-0 Hanauer Landstraße 115 Telefax +49 69 95941-111 60314 Frankfurt/Main frankfurt@bdo.de www.bdo.de Independent Auditor’s Report Board of Directors Scil Animal Care Company GmbH Viernheim, Germany We have audited the accompanying combined financial statements of Scil Animal Care Company GmbH and its subsidiaries, which comprise the combined balance sheets as of December 31, 2019 and 2018 and the related combined statements of operations, comprehensive income, equity, and cash flows for the years then ended, and the related notes to the combined financial statements. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these combined financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these combined financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the combined financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the combined financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the combined financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the combined financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the combined financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Opinion In our opinion, the combined financial statements referred to above present fairly, in all material respects, the financial position of Scil Animal Care Company GmbH and its subsidiaries as of December 31, 2019 and 2018, and the results of their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Emphasis of Matter -COVID-19 As more fully described in Note 16 to the financial statements, the Company may be materially impacted by the outbreak of a novel coronavirus (COVID-19), which was declared a global pandemic by the World Health Organization in March 2020. Our opinion is not modified with respect to this matter. Signed: BDO AG Wirtschaftsprüfungsgesellschaft Frankfurt, Germany March 24, 2020

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES COMBINED BALANCE SHEETS (in EUR thousands) December 31, December 29, 2019 2018 ASSETS Current assets: Cash and cash equivalents 5,758 2,566 Accounts receivable, net of reserves of EUR70 and EUR38 10,168 9,808 Inventories, net 10,379 11,922 Prepaid expenses and other 1,277 2,333 Total current assets 27,582 26,629 Property and equipment, net 14,624 10,835 Goodwill 5,475 5,248 Other intangible assets, net 3,220 4,613 Other non-current assets 1,824 1,091 Total assets 52,725 48,416 LIABILITIES AND EQUITY Current liabilities: Accounts payable 8,465 8,115 Accrued liabilities 2,373 2,334 Other liabilities 4,722 3,649 Total current liabilities 15,560 14,098 Other liabilities 2,586 2,107 Total liabilities 18,146 16,205 Equity: Net Parent Investment 34,671 32,699 Accumulated other comprehensive loss (92) (488) Total equity 34,579 32,211 Total liabilities and equity 52,725 48,416 See accompanying notes to combined financial statements. 3

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES COMBINED STATEMENTS OF OPERATIONS (in EUR thousands) Years Ended December 31, December 29, 2019 2018 Net sales 72,532 70,435 Cost of sales (49,950) (48,281) Gross profit 22,582 22,154 Operating expenses: Selling, general and administrative (22,125) (20,647) Operating income 457 1,507 Other income (expense): Other, net (125) (2) Income before taxes 332 1,505 Income tax benefit 188 1,233 Net income 520 2,738 See accompanying notes to combined financial statements. 4

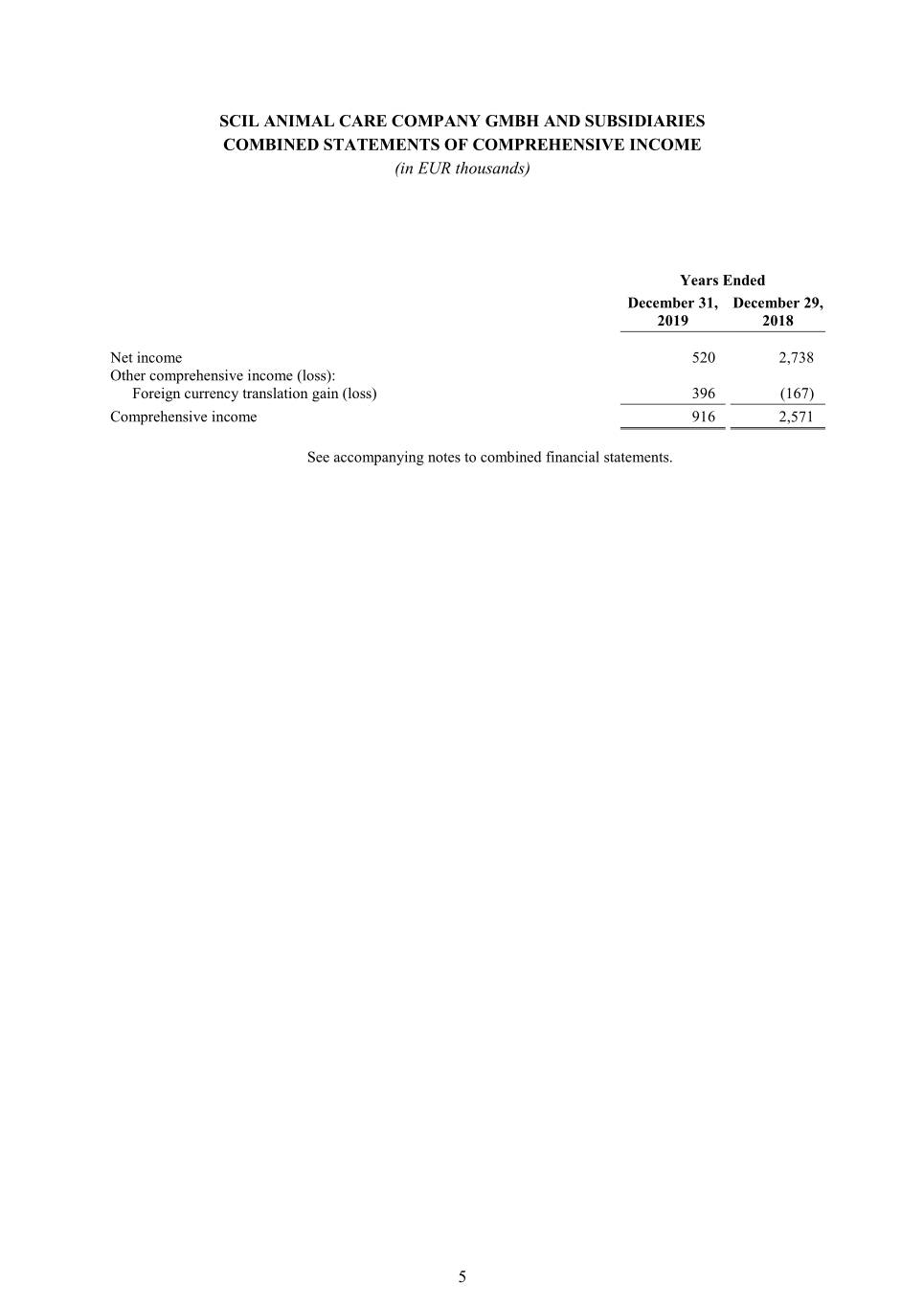

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES COMBINED STATEMENTS OF COMPREHENSIVE INCOME (in EUR thousands) Years Ended December 31, December 29, 2019 2018 Net income 520 2,738 Other comprehensive income (loss): Foreign currency translation gain (loss) 396 (167) Comprehensive income 916 2,571 See accompanying notes to combined financial statements. 5

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES COMBINED STATEMENTS OF EQUITY (in EUR thousands) Accumulated Other Net Parent Comprehensive Investment Income (Loss) Total Equity Balance at December 31, 2017 30,350 (321) 30,029 Net income 2,738 - 2,738 Other comprehensive loss - (167) (167) Net transfers in Parent Investment (389) - (389) Balance at December 29, 2018 32,699 (488) 32,211 Net income 520 - 520 Other comprehensive income - 396 396 Net transfers in Parent Investment 1,452 - 1,452 Balance at December 31, 2019 34,671 (92) 34,579 See accompanying notes to combined financial statements. 6

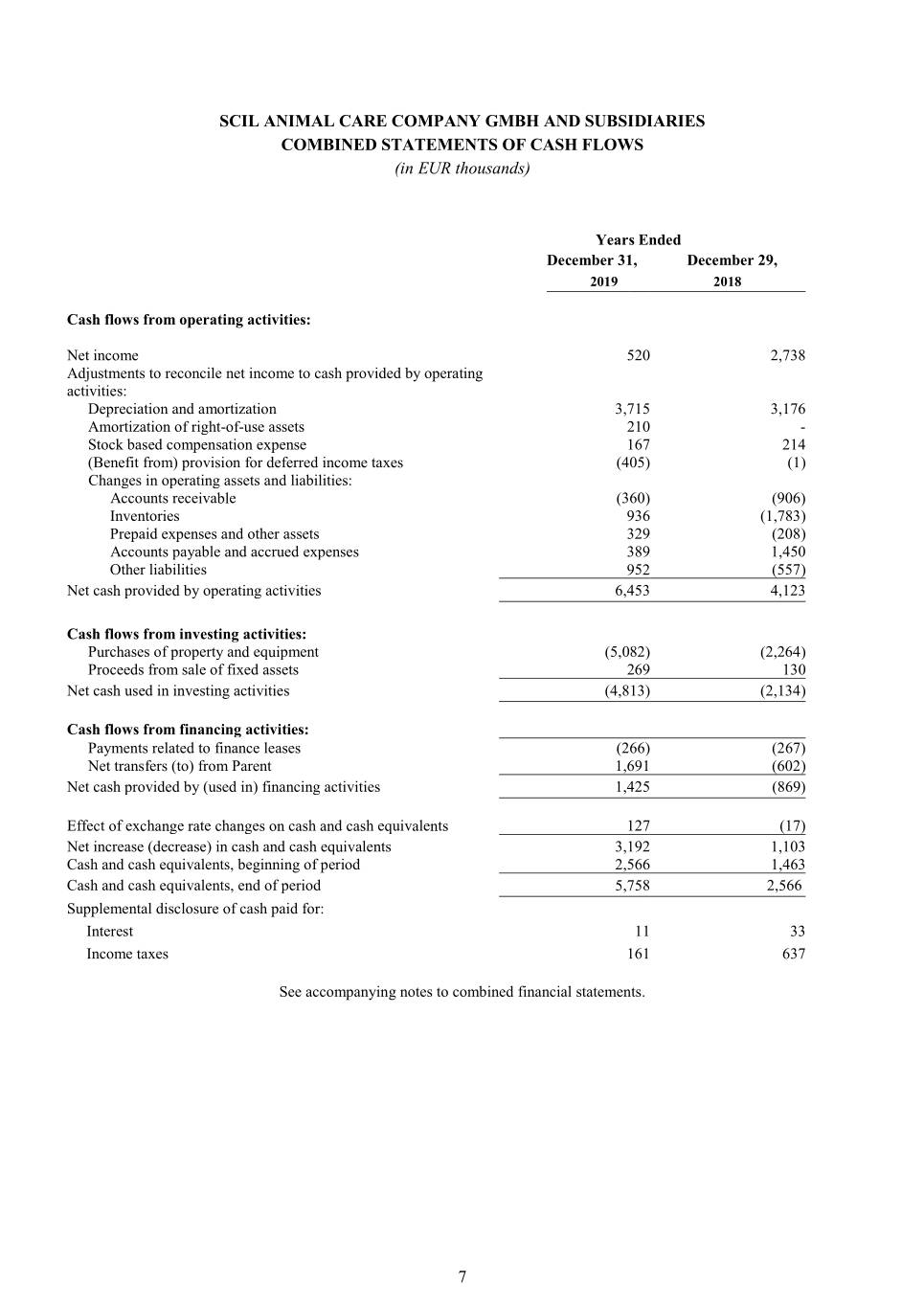

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES COMBINED STATEMENTS OF CASH FLOWS (in EUR thousands) Years Ended December 31, December 29, 2019 2018 Cash flows from operating activities: Net income 520 2,738 Adjustments to reconcile net income to cash provided by operating activities: Depreciation and amortization 3,715 3,176 Amortization of right-of-use assets 210 - Stock based compensation expense 167 214 (Benefit from) provision for deferred income taxes (405) (1) Changes in operating assets and liabilities: Accounts receivable (360) (906) Inventories 936 (1,783) Prepaid expenses and other assets 329 (208) Accounts payable and accrued expenses 389 1,450 Other liabilities 952 (557) Net cash provided by operating activities 6,453 4,123 Cash flows from investing activities: Purchases of property and equipment (5,082) (2,264) Proceeds from sale of fixed assets 269 130 Net cash used in investing activities (4,813) (2,134) Cash flows from financing activities: Payments related to finance leases (266) (267) Net transfers (to) from Parent 1,691 (602) Net cash provided by (used in) financing activities 1,425 (869) Effect of exchange rate changes on cash and cash equivalents 127 (17) Net increase (decrease) in cash and cash equivalents 3,192 1,103 Cash and cash equivalents, beginning of period 2,566 1,463 Cash and cash equivalents, end of period 5,758 2,566 Supplemental disclosure of cash paid for: Interest 11 33 Income taxes 161 637 See accompanying notes to combined financial statements. 7

SCIL ANIMAL CARE COMPANY GMBH AND SUBSIDIARIES NOTES TO COMBINED FINANCIAL STATEMENTS (in EUR thousands, except per share amounts) NOTE 1. DESCRIPTION OF BUSINESS AND BASIS OF PRESENTATION Description of Business scil animal care company GmbH and its subsidiaries (together “scil”, the “scil Group” or the “Company”) is an international organization with headquarters in Germany and subsidiaries located in Europe, Canada and Malaysia. The Company is dedicated to delivering high quality medical devices and solutions to animal health professionals. As a specialist in laboratory medicine and diagnostic imaging in veterinary medicine, the product range primarily includes point of care laboratory systems for clinical chemical blood analysis and hematology as well as ultrasound devices, X-ray systems and computer magnetic resonance imaging (CT / MRT). In addition to diagnostics, the scil Group also serves partial areas of operative veterinary medicine with selected products such as surgical lasers and motor systems. The diagnostic imaging devices are both sold and rented out to customers in the veterinary industry. Basis of Presentation The accompanying combined financial statements of the Company (“Financial Statements”) have been prepared on a stand-alone basis in preparation for filing with the United States Securities and Exchange Commission (SEC) in connection with a proposed acquisition. On February 7, 2019, Henry Schein, Inc. (“Henry Schein” or “Old Parent”) completed a separation, distribution, and subsequent merger of its animal health business (the “Animal Health Business”) into a newly formed entity subsequently named Covetrus (“Covetrus” or “Parent”). The Company was part of the business distributed to Covetrus. Subsequently, the Animal Health Business merged with Direct Vet Marketing, Inc. (d/b/a Vets First Choice, “Vets First Choice”) (the “Merger”). The Merger was accomplished by a series of transactions through Covetrus. The information provided in these stand-alone financial statements has been derived from the combined financial statements and accounting records of the Parent. The Financial Statements reflect the combined historical results of operations, financial position and cash flows of the Company in accordance with U.S. generally accepted accounting principles (“US GAAP”) and are stated in Euro. These combined financial statements include the accounts of scil animal care company GmbH and all of its controlled subsidiaries and its 25% investment in one affiliate company. The investment in the unconsolidated affiliate is accounted for under the equity method. The Financial Statements as of and for the years ended December 31, 2019 and December 29, 2018 are presented on a combined basis. The assets and liabilities in the Financial Statements have been reflected on a historical basis, as included in the historical combined financial statements of the Parent. All intercompany transactions and accounts within the Company have been eliminated. All transactions and amounts between Covetrus (or its consolidated affiliates outside of the Company) and the Company are separately shown as either related-party transactions or as a component of Net Parent Investment. The Parent’s net investment in the Company has been presented as a component of equity in the Financial Statements. Distributions made by the Parent to the Company or to the Parent from the Company are recorded as transfers to and from Parent, and the net amount is presented on the Combined Statements of Cash Flows as “Net transfers (to) from Parent”. The Financial Statements include expense allocations for certain corporate functions historically provided by the Parent, including finance, legal, information services, sales and marketing, administration and communication and similar costs. Since certain of these costs were not historically pushed down to any of the business units, these expenses have been allocated to the Company on the basis of the direct usage when identifiable (also referred to as “specific identification”), with the remainder allocated on a pro rata basis of COGS or other measures of the Company or the Parent. The Company believes the basis on which the expenses have been allocated are a 8

reasonable reflection of the utilization of services provided to, or the benefit received by, the Company during the periods presented. The allocations may not; however, reflect the actual expenses that the Company would have incurred as a stand-alone company for the periods presented. Actual costs that may have been incurred if the Company had been a stand-alone company would depend on several factors, including the chosen organizational structure, what functions were outsourced or performed by employees and strategic decisions made in areas such as information technology and infrastructure. The Financial Statements include certain assets and liabilities that have historically been held at the Parent corporate level but are specifically identifiable or otherwise attributed to the Company. The Parent’s third-party debt has not been allocated to the Company for any of the periods presented as the Company was not the legal obligor of the debt and the Parent’s borrowings were not directly attributable to the Company; therefore, no debt or interest expense for debt has been allocated to the Company. Payments to the local tax authorities are made by the Company. The Company does not maintain taxes payable to/from the Parent. The income tax benefit in the Combined Statements of Operations has been calculated as if the Company filed separate tax returns and was operating as a stand-alone business for the periods presented herein. Fiscal Year The Company historically reported its results of operations and cash flows to the Old Parent on a 52-53 week basis ending on the last Saturday of December. Subsequent to the Merger, the Company reported its results of operations and cash flows to the Parent based on calendar years. Therefore, the year ends for the periods reported are December 31, 2019 and December 29, 2018. The first day of fiscal year 2018 was December 31, 2017. NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Use of Estimates The preparation of Financial Statements in conformity with GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The most significant estimates include the Company’s evaluation of doubtful accounts receivable, evaluation of inventory reserves, evaluation of customer returns, evaluation of goodwill impairment and supplier rebates. Concentration of Credit Risk Financial instruments that potentially subject us to a concentration of credit risk consist of cash and cash equivalents and accounts receivable. The Company maintains the majority of their cash and cash equivalents with financial institutions that management believes are creditworthy in the form of demand deposits. The Company has no off-balance-sheet concentrations of credit risk such as foreign exchange contracts, options contracts or other foreign currency hedging arrangements. The accounts receivable balances are due largely from distribution partners, veterinary clinics and individual veterinarians and other animal health companies. The Company’s receivables did not represent significant concentrations of credit risk as of December 31, 2019 or December 29, 2018 due to the wide variety of customers and markets to which the Company’s products and services are sold. 9

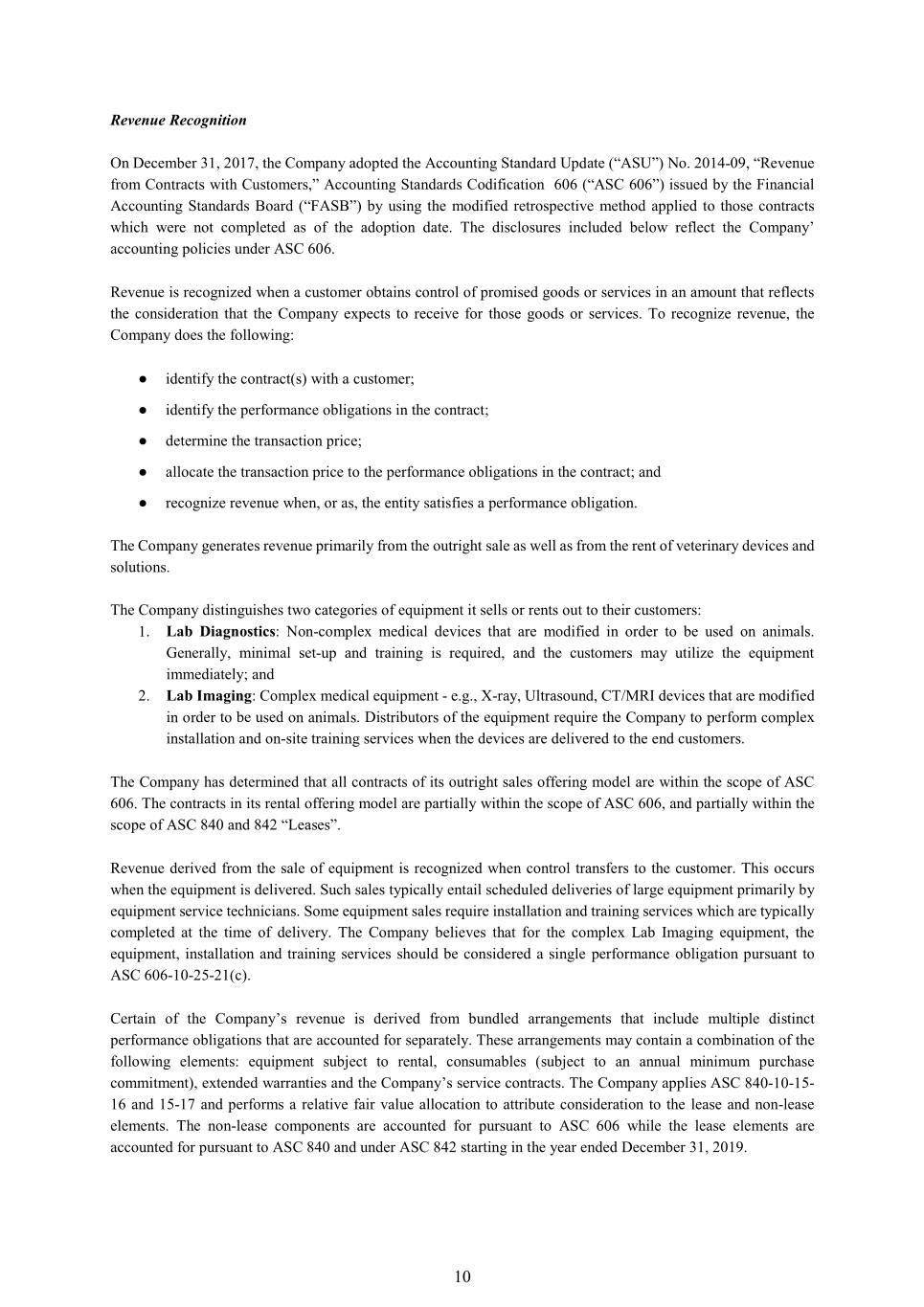

Revenue Recognition On December 31, 2017, the Company adopted the Accounting Standard Update (“ASU”) No. 2014-09, “Revenue from Contracts with Customers,” Accounting Standards Codification 606 (“ASC 606”) issued by the Financial Accounting Standards Board (“FASB”) by using the modified retrospective method applied to those contracts which were not completed as of the adoption date. The disclosures included below reflect the Company’ accounting policies under ASC 606. Revenue is recognized when a customer obtains control of promised goods or services in an amount that reflects the consideration that the Company expects to receive for those goods or services. To recognize revenue, the Company does the following: ● identify the contract(s) with a customer; ● identify the performance obligations in the contract; ● determine the transaction price; ● allocate the transaction price to the performance obligations in the contract; and ● recognize revenue when, or as, the entity satisfies a performance obligation. The Company generates revenue primarily from the outright sale as well as from the rent of veterinary devices and solutions. The Company distinguishes two categories of equipment it sells or rents out to their customers: 1. Lab Diagnostics: Non-complex medical devices that are modified in order to be used on animals. Generally, minimal set-up and training is required, and the customers may utilize the equipment immediately; and 2. Lab Imaging: Complex medical equipment - e.g., X-ray, Ultrasound, CT/MRI devices that are modified in order to be used on animals. Distributors of the equipment require the Company to perform complex installation and on-site training services when the devices are delivered to the end customers. The Company has determined that all contracts of its outright sales offering model are within the scope of ASC 606. The contracts in its rental offering model are partially within the scope of ASC 606, and partially within the scope of ASC 840 and 842 “Leases”. Revenue derived from the sale of equipment is recognized when control transfers to the customer. This occurs when the equipment is delivered. Such sales typically entail scheduled deliveries of large equipment primarily by equipment service technicians. Some equipment sales require installation and training services which are typically completed at the time of delivery. The Company believes that for the complex Lab Imaging equipment, the equipment, installation and training services should be considered a single performance obligation pursuant to ASC 606-10-25-21(c). Certain of the Company’s revenue is derived from bundled arrangements that include multiple distinct performance obligations that are accounted for separately. These arrangements may contain a combination of the following elements: equipment subject to rental, consumables (subject to an annual minimum purchase commitment), extended warranties and the Company’s service contracts. The Company applies ASC 840-10-15- 16 and 15-17 and performs a relative fair value allocation to attribute consideration to the lease and non-lease elements. The non-lease components are accounted for pursuant to ASC 606 while the lease elements are accounted for pursuant to ASC 840 and under ASC 842 starting in the year ended December 31, 2019. 10

The Company sells Lab Imaging extended warranties for which it has determined it is the agent. For all other arrangements the Company considers itself to be the principal in the arrangement for all promises. Revenue derived from other sources, including freight charges and equipment repairs, is recognized when the related product revenue is recognized or when the services are provided. The Company applies the practical expedient to account for shipping and handling activities performed after the customer obtains control as fulfillment activities, rather than a separate performance obligation in the contract. Sales, value-add and other taxes the Company collects concurrently with revenue-producing activities are excluded from revenue. Bundled arrangements that include multiple elements consist primarily of equipment and the related installation service. The Company allocates revenue for such arrangements based on the relative selling prices of the goods or services. If an observable selling price is not available because the Company does not sell the goods or services separately, the Company uses one of the following techniques to estimate the stand-alone selling price: adjusted market approach, cost-plus approach or the residual approach. There is no specific hierarchy for the use of these methods, but the estimated selling price reflects the Company’s best estimate of what the selling prices of each deliverable would be if it were sold regularly on a stand-alone basis, taking into consideration the cost structure of the Company, technical skill required, customer location and other market conditions. Provisions for discounts, rebates to customers, customer returns and other contra revenue adjustments are included in the transaction price at contract inception by estimating the most likely amount based upon historical data and estimates and are provided for in the period in which the related sales are recognized. See Note 3 for additional disclosures of disaggregated net sales. Accounts Receivable The carrying amount of accounts receivable is reduced by a valuation allowance that reflects the Company’s best estimate of the amounts that will not be collected. In addition to reviewing delinquent accounts receivable, the Company considers many factors in estimating its reserve, including historical data, experience, customer types, credit worthiness and economic trends. From time to time, the Company adjusts its assumptions for anticipated changes in any of these or other factors expected to affect collectability. Contract Assets Contract assets include amounts related to any conditional right to consideration for work completed but not billed as of the reporting date and generally represent amounts owed to the Company by customers, but not yet billed. Contract assets are transferred to accounts receivable when the right becomes unconditional. Current contract assets are included in prepaid expenses and other and the non-current contract assets are included in other non- current assets within the Combined Balance Sheets. The contract assets primarily relate to the bundled arrangements for the sale of equipment and consumables and sales of term software licenses. Contract Liabilities Contract liabilities are comprised of advance payments and deferred revenue amounts. Contract liabilities are transferred to revenue once the performance obligation has been satisfied. Current contract liabilities are included in other liabilities within the Combined Balance Sheets. The contract liabilities primarily relate to advance payments from customers and upfront payments for service arrangements provided over time. 11

Deferred Commissions Sales commissions earned by the Company’s sales force that relate to long-term arrangements are capitalized as costs to obtain a contract when the costs incurred are incremental and are expected to be recovered. Deferred sales commissions are amortized over the estimated customer relationship period. The Company applies the practical expedient related to the capitalization of incremental costs of obtaining a contract and recognizes such costs as an expense when incurred if the amortization period of the assets that the Company would have recognized is one year or less. Sales Returns Sales returns are recognized as a reduction of revenue by the amount of expected returns and are recorded as refund liability within current liabilities. The Company estimates the amount of revenue expected to be reversed to calculate the sales return liability based on historical data for specific products, adjusted as necessary for new products. The allowance for returns is presented gross as a refund liability and the Company records an inventory asset (and a corresponding adjustment to cost of sales) for any goods or services that it expects to be returned. Cash and Cash Equivalents Cash consists of cash on hand and held in accounts legally owned by the Company included in the Combined Balance Sheets for each period presented. The Company considers all highly liquid short-term investments with an original maturity of three months or less to be cash equivalents. Due to the short-term maturity of such investments, the carrying amounts are a reasonable estimate of fair value. Inventories Inventories consist primarily of finished goods, other equipment or consumables and are valued at the lower of cost or net realizable value. Costs of consumables are determined by the average cost method or actual cost for large, high-tech equipment. In accordance with the policy for inventory valuation, the Company considers many factors, including the condition and salability of the inventory, historical sales, forecasted sales and market and economic trends. From time to time, the Company adjusts the Company’ assumptions for anticipated changes in any of these or other factors expected to affect the value of inventory. Shipping and Handling Costs Freight and other direct shipping costs are included in cost of sales. Freight and other direct shipping costs were EUR 419 and EUR 313 for the years ended December 31, 2019 and December 29, 2018, respectively. Advertising Advertising costs are charged to operations when incurred as part of selling, general and administrative expenses. Supplier Rebates The Company receives annual performance rebates from suppliers based upon attainment of certain sales and/or purchase goals. Supplier rebates are included as a reduction of cost of sales and are recognized over the period they are earned. The factors considered in estimating supplier rebate accruals include forecasted inventory purchases and sales in conjunction with supplier rebate contract terms, which generally provide for increasing rebates based on either increased purchase or sales volume. 12

Property and Equipment Property and equipment are stated at cost, net of accumulated depreciation or amortization. Depreciation is computed primarily under the straight-line method (see Note 4 – Property and Equipment, Net). Amortization of leasehold improvements is computed using the straight-line method over the lesser of the useful life of the assets or the lease term. Income Taxes The Company accounts for income taxes under an asset and liability approach that requires the recognition of deferred income tax assets and liabilities for the expected future tax consequences of events that have been recognized in the financial statements or tax returns. In estimating future tax consequences, the Company generally considers all expected future events other than enactments of changes in tax laws or rates. The effect on deferred income tax assets and liabilities of a change in tax rates is recognized as income or expense in the period of the enactment date. The Company follows a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken, or expected to be taken, in a tax return. The guidance relates to, among other things, classification, accounting for interest and penalties associated with tax positions, and disclosure requirements. Any interest and penalties accrued related to uncertain tax positions are recorded in tax expense. The Company assesses the realizability of its net deferred tax assets on an annual basis. If, after considering all relevant positive and negative evidence, it is more likely than not that some portion or all of the net deferred tax assets will not be realized, the Company will reduce the net deferred tax assets by a valuation allowance. The realization of net deferred tax assets is dependent on several factors, including the generation of sufficient taxable income prior to the expiration of net operating loss carryforwards. Foreign Currency Translation and Transactions The financial position and results of operations of the Company’ subsidiaries are determined using local currency as the functional currency. Assets and liabilities of these subsidiaries are translated at the exchange rate in effect at each year-end. Statement of operations accounts are translated at the average rate of exchange prevailing during the year. Translation adjustments arising from the use of differing exchange rates from period-to-period are included in accumulated other comprehensive income in equity. Gains and losses resulting from foreign currency transactions are included in earnings. Goodwill Goodwill is not amortized but is subject to impairment analysis at least annually (at the beginning of the fourth quarter) and on an interim basis if events or changes in circumstances indicate that the carrying value may not be recoverable. Goodwill impairment is tested at the Company level. An impairment charge would be recognized for the amount by which the carrying amount exceeds the Company’s fair value; however, the loss recognized should not exceed the total amount of goodwill allocated to the Company. An entity still has the option to perform the qualitative assessment to determine if the quantitative impairment test is necessary. Goodwill impairment testing involves significant judgment and estimates. Some important factors that could trigger an interim impairment review include: ● significant underperformance relative to expected historical or projected future operating results; ● significant changes in the strategy for the Company’s overall business (e.g., decision to divest a business); or 13

● significant negative industry or economic trends. The Company performed this assessment for 2018 and 2019 by evaluating qualitative factors to determine whether goodwill was impaired. There were no indicators for impairment and no impairment charges were recognized during the years ended December 31, 2019 and December 29, 2018. Long-Lived Assets Definite-lived intangible assets consist of trademarks, trade names and customer relationships and are stated at cost, less accumulated amortization. Amortization is computed using the straight-line method over the estimated useful lives of the respective assets, which range from 5 to 10 years. The assets are analyzed for impairment whenever events or changes in circumstances indicate that the related carrying amounts may not be recoverable. There were no indicators for impairment and no impairment charges were recognized during the years ended December 31, 2019 and December 29, 2018. Cost of Sales The primary components of cost of sales include the cost of the product (net of purchase discounts, supplier chargebacks and rebates) and inbound and outbound freight charges. Costs related to purchasing, receiving, inspections, warehousing, internal inventory transfers and other costs of the Company’ distribution network are included in selling, general and administrative expenses along with other operating costs. Comprehensive Income Comprehensive income includes certain gains and losses that, under GAAP, are excluded from net income as such amounts are recorded directly as an adjustment to equity. Comprehensive income is primarily comprised of net income and foreign currency translation gain (loss). Equity-based compensation The Company’s key employees have historically participated in the Old Parent’s equity-based compensation plans which included performance stock units (“PSUs”) and restricted stock units (“RSUs”). Upon closing of the Merger, PSUs and RSUs of the Old Parent were replaced with RSUs of the Parent. Additionally, the Company’s employees were granted equity awards of the Parent in the form of RSUs and non-qualified stock options. The Parent’s RSUs are stock-based awards granted to recipients that vest solely based on the recipient’s continued service over time (primarily four-year cliff vesting). The stock options were issued to purchase Parent’s common stock, shares of restricted stock and restricted stock units under the Parent’s 2019 Omnibus Incentive Compensation Plan (the “Plan”). The Plan provides for the grant of incentive stock options, non-qualified stock options, stock awards, stock units, stock appreciation rights, other stock-based awards and cash awards. Equity-based compensation expense has historically been calculated based on the Old Parent’s or the Parent’s stock price, as applicable, and the expense allocated to the Company has historically been specifically identified based on the awards and the terms of the awards granted to the Company’s employees. In addition, an allocation of equity-based compensation expense related to Parent’s corporate employees has been recorded in the Combined Statements of Operations for the years ended December 31, 2019 and December 29, 2018. Equity-based awards are accounted for in accordance with ASC 718, “Compensation—Stock Compensation” (“ASC 718”). ASC 718 requires that the cost resulting from all share-based payment transactions be recognized in the Financial Statements. ASC 718 establishes fair value as the measurement objective in accounting for share- based payment arrangements and requires all companies to apply a fair-value-based measurement method in accounting for generally all share-based payment transactions with employees. The Company measures stock- based compensation at the grant date, based on the estimated fair value of the award, and recognizes the cost (net 14

of estimated forfeitures) as compensation expense on a straight-line basis over the requisite service period. Stock- based compensation expense for the Company is reflected in selling, general and administrative expenses in its Combined Statements of Operations. Accounting for Investments in Affiliates The Company owns a 25% interest in an unconsolidated affiliate, Lab Technologies Medizintechnik GmbH, Vienna, Austria. The initial investment made was EUR 9. The Company’s share of income or loss has not been material to date. Accounting Pronouncements Adopted ASU No. 2016-02, “Leases (ASC 842)”, introduces the balance sheet recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous guidance. The Company adopted the new lease standard using the transition option issued under the amendments in ASU No. 2018-11, “Leases (ASC 842): Targeted Improvements”, which allowed companies to continue to apply the legacy guidance in ASC 840, “Leases”, in the comparative periods presented in the year of adoption. The Company elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed companies to carry forward the historical lease classification. The Company made an accounting policy election to keep leases with an initial term of 12 months or less off of the balance sheet. The Company recognizes those lease payments in the Combined Statement of Operations on a straight-line basis over the lease term. The impact of the adoption was an increase to assets and liabilities to include operating and capital lease assets and liabilities on January 1, 2019 of EUR 1,259. The initial recognition of the right-of-use asset and lease liability represented a non-cash activity. See Note 13 - Leases. ASU No. 2017-04, “Intangibles-Goodwill and Other (ASC 350): Simplifying the Test for Goodwill Impairment” (“ASU 2017-04”), eliminates step two from the quantitative goodwill impairment test. Under this guidance, annual or interim goodwill impairment testing is performed by comparing the fair value of the reporting units to the carrying value of those units. If the carrying value exceeds the fair value, an impairment charge is recognized, not to exceed the amount of goodwill allocated to each reporting unit. The adoption did not have a material impact on the Company’s Financial Statements and related disclosures. ASU No. 2018-13, “Fair Value Measurement (ASC 820): Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”), removed, modified, and added disclosure requirements for fair value assets and liabilities. The adoption did not have a material impact on the Company’s Financial Statements and related disclosures. Recently Issued Accounting Standards In June 2016, the FASB issued ASU No. 2016-13, “Financial Instruments-Credit Losses (ASC 326): Measurement of Credit Losses on Financial Instruments,” which requires the measurement and recognition of expected credit losses for financial assets held at amortized cost. This ASU is effective for interim and annual reporting periods beginning after December 15, 2020, with early adoption permitted for interim and annual reporting periods beginning after December 15, 2019. This ASU is required to be adopted using the modified retrospective basis, with a cumulative-effect adjustment to Net Parent Investment as of the beginning of the first reporting period in which the guidance of this ASU is effective. The Company does not expect that this ASU will have a material impact on the results of the Financial Statements. ASU 2019-12, “Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes,” removes specific technical exceptions to general principles found in Topic 740, items that often produce information investors have a hard time understanding and simplifies the accounting for income taxes. The standard is effective for fiscal years, 15

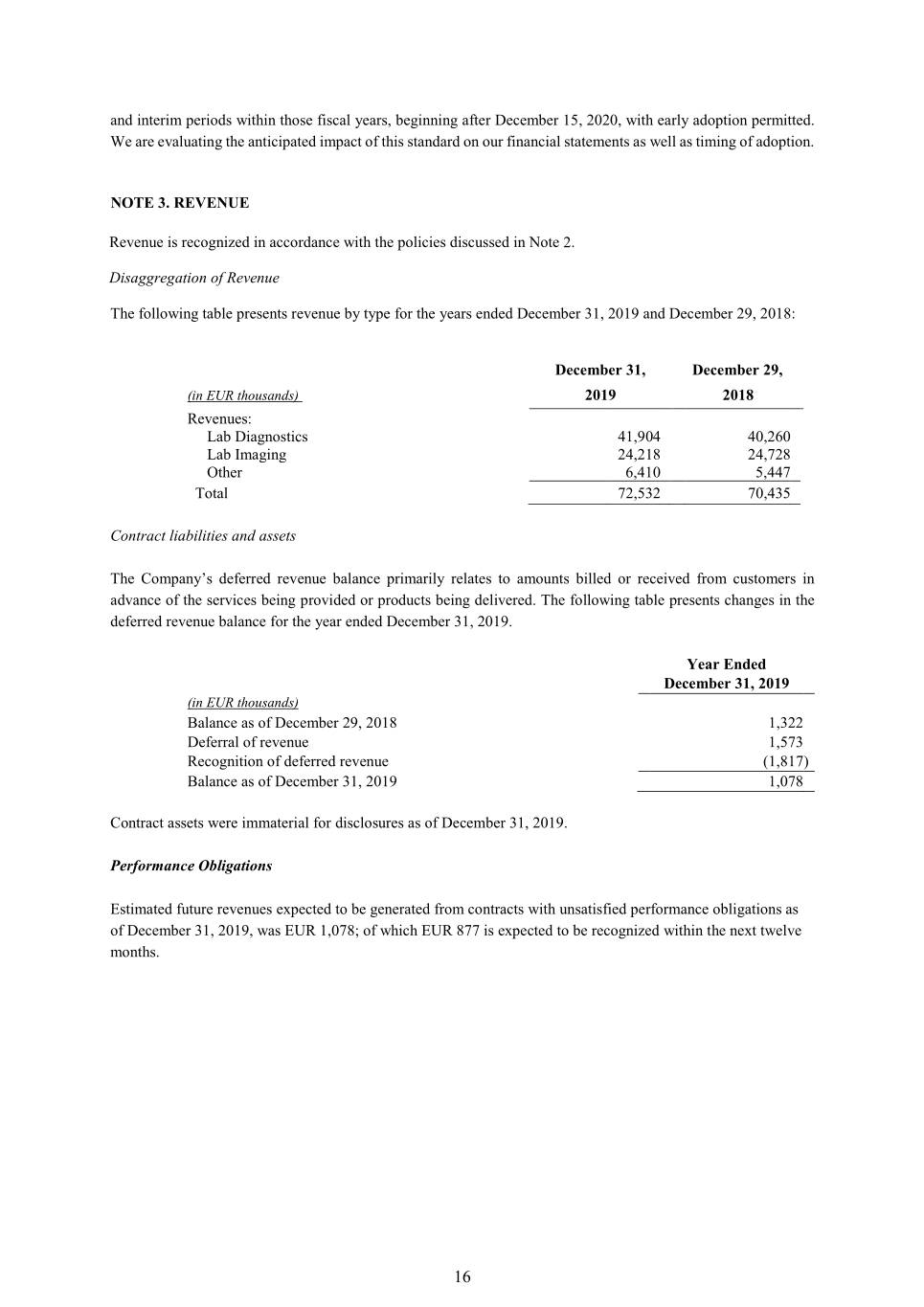

and interim periods within those fiscal years, beginning after December 15, 2020, with early adoption permitted. We are evaluating the anticipated impact of this standard on our financial statements as well as timing of adoption. NOTE 3. REVENUE Revenue is recognized in accordance with the policies discussed in Note 2. Disaggregation of Revenue The following table presents revenue by type for the years ended December 31, 2019 and December 29, 2018: December 31, December 29, (in EUR thousands) 2019 2018 Revenues: Lab Diagnostics 41,904 40,260 Lab Imaging 24,218 24,728 Other 6,410 5,447 Total 72,532 70,435 Contract liabilities and assets The Company’s deferred revenue balance primarily relates to amounts billed or received from customers in advance of the services being provided or products being delivered. The following table presents changes in the deferred revenue balance for the year ended December 31, 2019. Year Ended December 31, 2019 (in EUR thousands) Balance as of December 29, 2018 1,322 Deferral of revenue 1,573 Recognition of deferred revenue (1,817 ) Balance as of December 31, 2019 1,078 Contract assets were immaterial for disclosures as of December 31, 2019. Performance Obligations Estimated future revenues expected to be generated from contracts with unsatisfied performance obligations as of December 31, 2019, was EUR 1,078; of which EUR 877 is expected to be recognized within the next twelve months. 16

NOTE 4. PROPERTY AND EQUIPMENT, NET Property and equipment, including related estimated useful lives, consisted of the following: December 31, December 29, Useful Lives 2019 2018 (in EUR thousands) Land Indefinite 1,272 1,272 Buildings & improvements 25-40 years 8,769 7,420 Machinery and warehouse equipment 4 to 5 years 771 648 Furniture, fixtures and other 5 to 10 years 12,827 8,255 Computer hardware and software 3 to 10 years 2,723 2,681 Leasehold and improvements 3 to 10 years 37 33 Less: accumulated depreciation (11,775) (9,474) Total property and equipment, net 14,624 10,835 Depreciation expense for property and equipment was EUR 2,507 and EUR 1,813 for the years ended December 31, 2019 and December 29, 2018, respectively, and was included within selling, general and administrative expenses in the Combined Statements of Operations. As of December 31, 2019, and December 29, 2018, finance right-of-use assets, net in the amount of EUR 1, 611 and capital lease assets, net, in the amount of EUR 1,433, respectively, are recorded within property and equipment. Amortization of these assets is included in depreciation expense. As of December 31, 2019, operating lease right-of-use assets, net are recorded within Buildings & improvements in the amount of EUR 859. NOTE 5. INTANGIBLE ASSETS Definite-lived intangible assets, net consisted of the following as of: December 31, 2019 Weighted Accumulated Average Useful Cost Net Amortization Life (in EUR thousands) 3,602 (3,422) 180 Trademark / trade name 5 Customer relationships 10 6,127 (3,087) 3,040 Total intangible assets 9,729 (6,509) 3,220 December 29, 2018 Weighted Accumulated Average Useful Cost Net Amortization Life (in EUR thousands) Trademark / trade name 5 3,628 (2,729) 899 Customer relationships 10 6,180 (2,466) 3,714 Total intangible assets 9,808 (5,195) 4,613 17

The trademarks and customer relationships were established at the time the Old Parent acquired the Company in 2015. The values of these assets were pushed down to the Company during the purchase price allocation of the business combination. The Company amortizes intangible assets on a straight-line basis over the estimated useful life. Amortization of intangible assets was EUR 1,418 and EUR 1,363 for the years ended December 31, 2019 and December 29, 2018, respectively, and was included within selling, general and administrative expenses in the Combined Statements of Operations. The estimated future amortization of intangible assets is as follows (in EUR thousands): 2020 830 2021 544 2022 509 2023 375 2024 331 Thereafter 631 Total 3,220 NOTE 6. GOODWILL The changes in the carrying amount of goodwill for the years ended December 31, 2019 and December 29, 2018 were as follows: (in EUR thousands) Balance as of December 31, 2017 5,358 Adjustments to goodwill: Foreign currency translation (110) Balance as of December 29, 2018 5,248 Adjustments to goodwill: Foreign currency translation 227 Balance as of December 31, 2019 5,475 NOTE 7. OTHER NON-CURRENT ASSETS Other non-current assets consisted of the following as of: December 31, December 29, (in EUR thousands) 2019 2018 Sales-type lease assets 947 450 Deferred income tax asset 559 267 Deferred contract costs 98 139 Distribution Agreement 56 84 Other non-current assets 164 151 Total 1,824 1,091 18

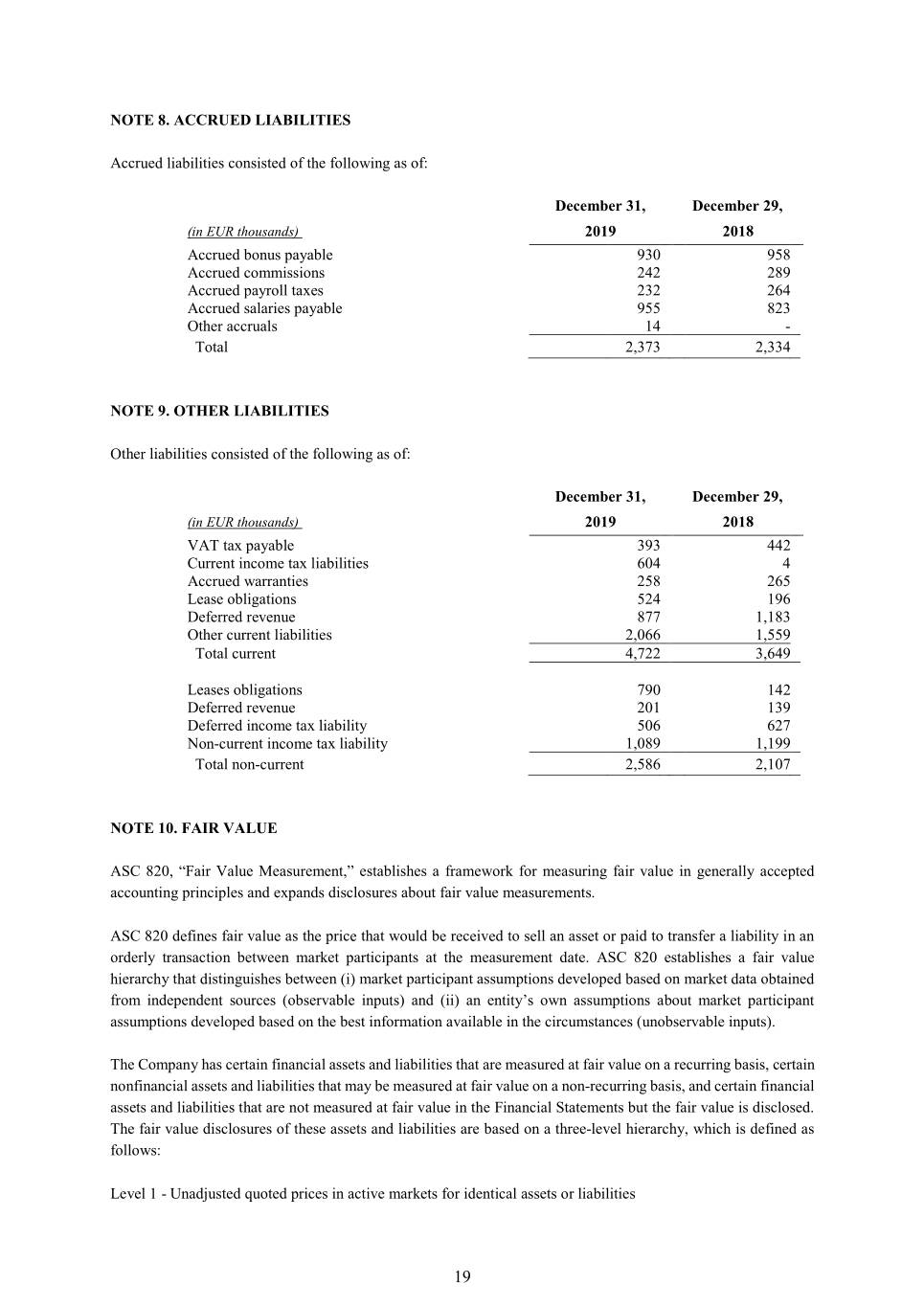

NOTE 8. ACCRUED LIABILITIES Accrued liabilities consisted of the following as of: December 31, December 29, (in EUR thousands) 2019 2018 Accrued bonus payable 930 958 Accrued commissions 242 289 Accrued payroll taxes 232 264 Accrued salaries payable 955 823 Other accruals 14 - Total 2,373 2,334 NOTE 9. OTHER LIABILITIES Other liabilities consisted of the following as of: December 31, December 29, (in EUR thousands) 2019 2018 VAT tax payable 393 442 Current income tax liabilities 604 4 Accrued warranties 258 265 Lease obligations 524 196 Deferred revenue 877 1,183 Other current liabilities 2,066 1,559 Total current 4,722 3,649 Leases obligations 790 142 Deferred revenue 201 139 Deferred income tax liability 506 627 Non-current income tax liability 1,089 1,199 Total non-current 2,586 2,107 NOTE 10. FAIR VALUE ASC 820, “Fair Value Measurement,” establishes a framework for measuring fair value in generally accepted accounting principles and expands disclosures about fair value measurements. ASC 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 establishes a fair value hierarchy that distinguishes between (i) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (ii) an entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The Company has certain financial assets and liabilities that are measured at fair value on a recurring basis, certain nonfinancial assets and liabilities that may be measured at fair value on a non-recurring basis, and certain financial assets and liabilities that are not measured at fair value in the Financial Statements but the fair value is disclosed. The fair value disclosures of these assets and liabilities are based on a three-level hierarchy, which is defined as follows: Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities 19

Level 2 - Unadjusted quoted prices in active markets for similar assets or liabilities, or unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active, or inputs other than quoted prices that are observable for the asset or liability Level 3 - Unobservable inputs for the asset or liability There were no transfers between levels within the fair value hierarchy and no changes in valuation techniques during the years ended December 31, 2019 and December 29, 2018. Assets and Liabilities that are Measured at Fair Value on a Recurring Basis The Company does not have financial instruments measured at fair value on a recurring basis. Assets and Liabilities that are Measured at Fair Value on a Nonrecurring Basis Assets that are measured at fair value on a nonrecurring basis primarily relate to property and equipment, right-of- use assets, intangible assets, and goodwill. The Company does not periodically adjust carrying value to fair value for these assets; rather, the carrying value of the asset is reduced to its fair value when we determine that impairment has occurred. Assets and Liabilities that are not Measured at Fair Value Financial Assets and Liabilities The carrying amounts reported on the Combined Balance Sheets for Cash and cash equivalents, Accounts receivable, Other receivables, Accounts payable, and Accrued expenses approximate their fair value due to the short maturity of those instruments. NOTE 11. COMMITMENTS AND CONTINGENCIES The Company is involved in various legal proceedings that arise in the ordinary course of business. Substantial judgment is required in predicting the outcome of these legal proceedings, many of which take years to adjudicate. The Company accrues estimated costs for a contingency when we believe that a loss is probable and can be reasonably estimated. No material accrued loss contingencies were recorded as of December 31, 2019. 20

NOTE 12. INCOME TAXES The provision for income taxes consists of the following: December 31, December 29, 2019 2018 (in EUR thousands) Current Corporate income tax 244 (666) Trade tax (27) (566) Total current 217 (1,232) Deferred Corporate income tax (300) 1 Trade tax (105) (2) Total deferred (405) (1) Total income tax expense (benefit) (188) (1,233) Current Germany 202 (1,166) Other countries 15 (66) Total current 217 (1,232) Deferred Germany (234) (5) Other countries (171) 4 Total deferred (405) (1) Total income tax expense (benefit) (188) (1,233) The following table summarizes our income before income taxes attributable to Germany and to other countries: December 31, December 29, 2019 2018 (in EUR thousands) Germany 137 731 Other countries 195 774 Income before taxes 332 1,505 The significant components of the Company’s deferred tax assets and deferred tax liabilities were as follows: December 31, December 29, 2019 2018 (in EUR thousands) Deferred income tax asset: Net operating losses 73 84 Current assets1 346 306 Other intangible assets, net 329 231 Property and equipment, net 265 247 Current liabilities2 211 256 Other liabilities (non-current) 245 65 Total deferred income tax asset 1,469 1,189 Valuation allowance for deferred tax assets - (34) Net deferred income tax asset 1,469 1,155 Deferred income tax liability: Current assets1 176 284 Other intangibles assets, net 360 511 Property and equipment, net 300 348 Other non-current assets 494 256 Current liabilities2 86 116 Total deferred tax liability 1,416 1,515 Net deferred income tax asset (liability) 53 (360) 21

1 Current assets include Accounts receivable, net of reserves, Inventories, net, Other receivables and Prepaid expenses and other. 2 Current liabilities include Accounts payable, Accrued liabilities and Other liabilities. The assessment of the amount of value assigned to the deferred tax assets under the applicable accounting rules requires judgment. The Company is required to consider all available positive and negative evidence in evaluating the likelihood that the Company will be able to realize the benefit of the Company’s deferred tax assets in the future. Such evidence includes scheduled reversals of deferred tax liabilities, projected future taxable income, tax planning strategies and the results of recent operations. Since this evaluation requires consideration of events that may occur some years into the future, there is an element of judgment involved. Realization of the Company’s deferred tax assets is dependent on generating sufficient taxable income in future periods. The Company believes that it is more likely than not that future taxable income will be sufficient to allow it to recover substantially all of the value assigned to the deferred tax assets. However, if future events cause the Company to conclude that it is not more likely than not that the Company will be able to recover all of the value assigned to the deferred tax assets, the Company will be required to adjust the valuation allowance accordingly. As of December 31, 2019, the Company had foreign net operating loss carryforwards of EUR 294, which can be utilized against future foreign income for an unlimited amount of time compared to EUR 380 for the prior year period, of which EUR 171 expire in eight years and EUR 52 in nine years. The remaining foreign net operating loss carryforwards as of December 29, 2018, have an indefinite life. For the years ended December 31, 2019, and December 29, 2018, the difference between the effective tax rates of -55% and -82%, respectively, was primarily attributable to the release of the tax reserve for uncertain tax positions and the release of the valuation allowance. As in the previous year, the corporate income tax rate in Germany remained at 15.0% plus the solidarity surcharge of 5.5%. Including the trade tax rate of 12.95%, the total tax rate in 2019 was 28.775% (prior year period: 28.775%). In the financial year 2019, the tax rates for foreign companies ranged between 20.0% and 27.9% (prior year period: between 20% and 27.9%). As of December 31, 2019, the Group have a liability for uncertain tax positions in total of EUR 1,089 compared to EUR 1,199 for the prior year period. The total cumulative amount of undistributed earnings related to investments in certain foreign subsidiaries where the foreign subsidiary has or will invest undistributed earnings indefinitely was EUR 16,422 as of December 31, 2019 compared to EUR 16,130 for the prior year period. As any capital gains on the sale of participations would be 95% exempt under German tax law, only 5% refer to taxable temporary differences (2019: EUR 821 compared to EUR 807 for the prior year period), for which no deferred tax liabilities have been recognized. The Company files corporate income and trade tax returns. The Company is subject to audit by the local income tax authorities. As of December 31, 2019, statute of limitations for tax years 2016 through 2019 remain open to examination by German tax authorities. As of December 31, 2019, there were no tax returns under audit. NOTE 13. LEASES Lessee Activity The Company leases office space, warehouse facilities, vehicles and equipment under non-cancelable operating and finance leases with third parties. The leases have remaining lease terms of one year to eight years. Leases with an initial term of 12 months or less are not recognized on the balance sheet. The Company recognizes lease expense for operating leases on a straight-line basis over the lease term. For purposes of calculating operating lease 22

liabilities, lease terms may be deemed to include options to extend or terminate the lease when it is reasonably certain that the Company will exercise that option. For the years ended December 31, 2019 and December 29, 2018, operating lease expense was approximately EUR 374 and EUR 444, respectively, including immaterial variable and short-term lease costs. Finance leases costs recognized within the Combined Statements of Operations was as follows: December 31, 2019 (in EUR thousands) Amortization of right-of-use assets 210 Interest on lease liabilities 9 The following table presents the lease balances within the Combined Balance Sheet and other supplemental information related to our finance and operating leases as of: December 31, 2019 (in EUR thousands) Finance Leases: Finance lease right-of-use assets, net 1,611 Other liabilities 191 Other non-current liabilities 258 Total finance lease liabilities 449 Operating Leases: Operating lease right-of-use assets, net 859 Other liabilities 333 Other non-current liabilities 532 Total operating lease liabilities 865 Weighted average remaining lease term – finance leases 2.2 Weighted average discount rate – finance leases 2.1% Weighted average remaining lease term – operating leases 4.1 Weighted average discount rate – operating leases 3.5% Supplemental cash flow information related to leases was as follows: December 31, 2019 (in EUR thousands) Cash paid for amounts included in the measurement of 622 operating lease liabilities Right-of-use assets obtained in exchange for new 1,259 operating lease liabilities 23

The following table presents the maturity of the Company's lease liabilities as of December 31, 2019 (in EUR thousands): Operating Leases Finance Leases 2020 355 196 2021 218 156 2022 108 55 2023 65 16 2024 64 10 Thereafter 109 25 Total minimum lease payments 919 458 Less: amount representing interest 54 9 Present value of net minimum lease payments 865 449 Lessor Activity The Company has operating and sales-type leases for Lab Diagnostics and Imaging equipment. Certain of the offerings require the customer to enter into a non-cancellable lease terms for 60 to 72 months, which the Company has determined is equal to the remaining economic life of its leased assets, or contain bargain purchase options where the Company believes the customer would be reasonably certain to exercise the option. These arrangements and are classified as sales-type leases. The revenue and associated cost of revenue of sales-type leases are recognized on a gross basis on the lease commencement date and a net investment in leased assets is recorded on the Consolidated Balance Sheet. We bill the customer monthly over the duration of the rental term. We record the net investment in leases and recognize revenue upon commencement of the lease in the amount of the expected consideration to be received through the monthly payments. Certain of our sales-type lease arrangements are bundled with non-lease elements. We allocate the consideration in the arrangement using the relative standalone price of the components in the contract in order to separate the lease and non-lease components. We are accounting for the non-lease components in accordance with ASC 606. The remainder of leased equipment arrangements are short-term agreements classified as operating leases. Equipment under operating lease is held within Furniture, fixtures and other stated at cost less accumulated depreciation and is classified as Property and equipment, net on the Consolidated Balance Sheets. The components of lease income are as follows (in EUR thousands): December 31, 2019 Classification Sales-type lease revenue Net sales 807 Cost of sales-type lease revenue Cost of sales (495) Gross profit 312 Interest income on the lease receivable Other, net 36 Operating lease income Net sales 1,240 24

The components of our net investment in sales-type leases are as follows (in EUR thousands): December 31, 2019 Gross lease receivables 1,306 Unearned income (98) Net investment in leases 1,208 Reported as: Classification Sales-type lease assets, current Prepaid expenses and other 261 Sales-type lease assets, long-term Other non-current assets 947 Total Sales-type lease assets 1,208 The following table presents the maturity of the Company's sales-type lease receivables as of December 31, 2019 (in EUR thousands): Sales-type leases 2020 325 2021 298 2022 283 2023 243 2024 134 Thereafter 23 Total minimum lease payments 1,306 Less: amount representing interest 98 Present value of net minimum lease payments 1,208 NOTE 14. STOCK-BASED COMPENSATION Stock-based compensation represents the cost related to RSUs, PSUs and non-qualified stock option awards of the Parent granted to the Company’s employees. Stock-based compensation is measured at the grant date, based on the estimated fair value of the awards, and the cost (net of estimated forfeitures) is recognized as compensation expense on a straight-line basis over the requisite service period. The stock-based compensation expense is reflected in selling, general and administrative expenses in the Combined Statements of Operations. The fair value of RSUs and PSUs is based upon the fair market value of the shares underlying the awards on the grant date. The fair value is estimated on the date of grant based on the closing stock price. The Black-Scholes option pricing model is used to determine the fair value of stock options granted. The determination of the fair value of stock-based payment awards utilizing the Black-Scholes model is affected by the stock price of the underlying share and a number of assumptions, including expected volatility, expected life, risk-free interest rate and expected dividends. During the year ended December 29, 2018, the Old Parent granted 815 RSUs and 813 PSUs with a weighted average fair value of USD 65.26 per share to the Company’s employees. Upon closing of the Merger, 8,362 PSUs and RSUs of the Old Parent with a weighted fair value of USD 64.94 were replaced with 13,036 RSUs of the Parent with a weighted fair value of USD 44.54. Share-based compensation expense has been specifically identified to the Company based on the awards and terms previously granted to the Company’s employees by the Old Parent and the Parent. For the years ended December 25

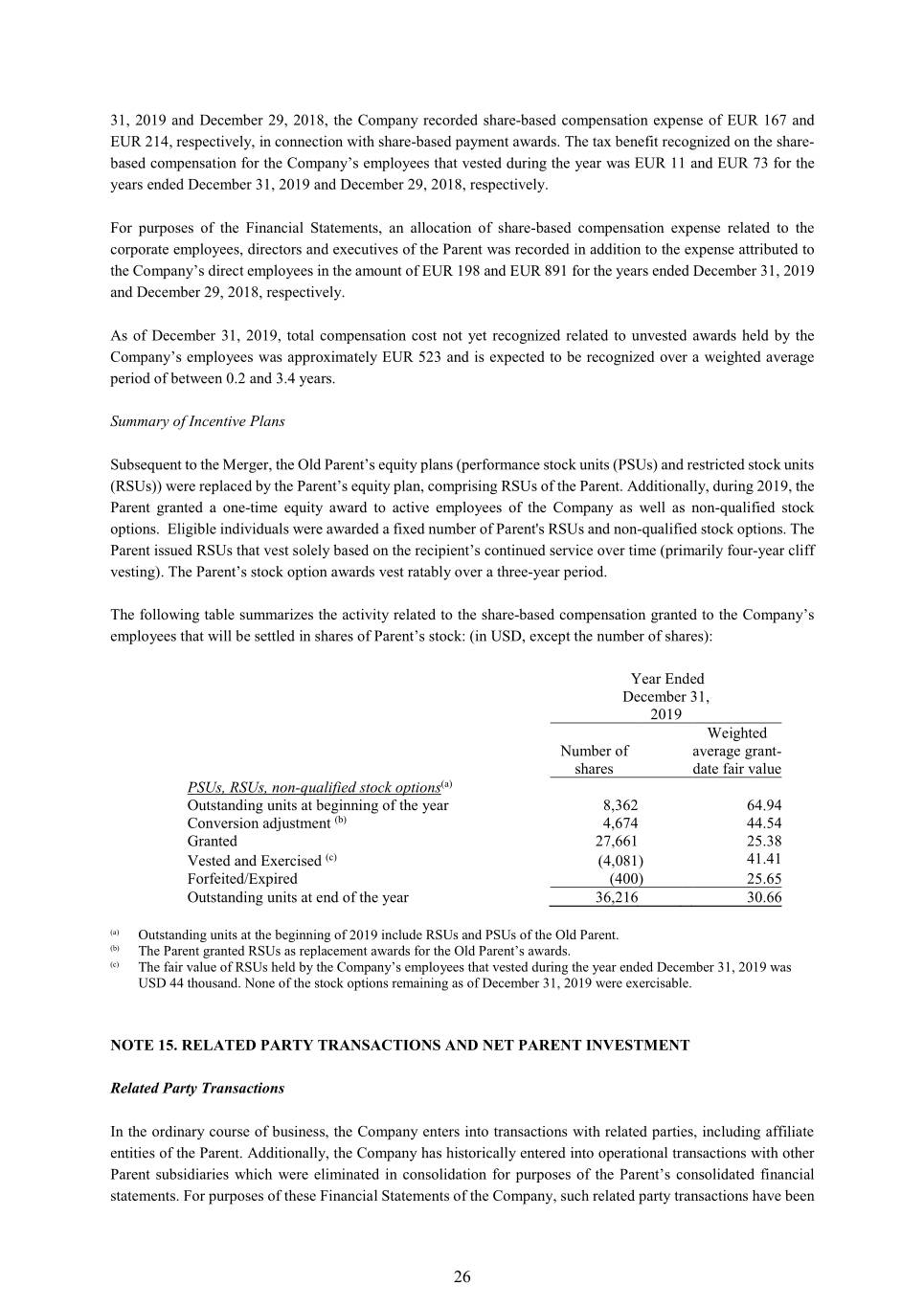

31, 2019 and December 29, 2018, the Company recorded share-based compensation expense of EUR 167 and EUR 214, respectively, in connection with share-based payment awards. The tax benefit recognized on the share- based compensation for the Company’s employees that vested during the year was EUR 11 and EUR 73 for the years ended December 31, 2019 and December 29, 2018, respectively. For purposes of the Financial Statements, an allocation of share-based compensation expense related to the corporate employees, directors and executives of the Parent was recorded in addition to the expense attributed to the Company’s direct employees in the amount of EUR 198 and EUR 891 for the years ended December 31, 2019 and December 29, 2018, respectively. As of December 31, 2019, total compensation cost not yet recognized related to unvested awards held by the Company’s employees was approximately EUR 523 and is expected to be recognized over a weighted average period of between 0.2 and 3.4 years. Summary of Incentive Plans Subsequent to the Merger, the Old Parent’s equity plans (performance stock units (PSUs) and restricted stock units (RSUs)) were replaced by the Parent’s equity plan, comprising RSUs of the Parent. Additionally, during 2019, the Parent granted a one-time equity award to active employees of the Company as well as non-qualified stock options. Eligible individuals were awarded a fixed number of Parent's RSUs and non-qualified stock options. The Parent issued RSUs that vest solely based on the recipient’s continued service over time (primarily four-year cliff vesting). The Parent’s stock option awards vest ratably over a three-year period. The following table summarizes the activity related to the share-based compensation granted to the Company’s employees that will be settled in shares of Parent’s stock: (in USD, except the number of shares): Year Ended December 31, 2019 Weighted Number of average grant- shares date fair value PSUs, RSUs, non-qualified stock options(a) Outstanding units at beginning of the year 8,362 64.94 Conversion adjustment (b) 4,674 44.54 Granted 27,661 25.38 Vested and Exercised (c) (4,081 ) 41.41 Forfeited/Expired (400 ) 25.65 Outstanding units at end of the year 36,216 30.66 (a) Outstanding units at the beginning of 2019 include RSUs and PSUs of the Old Parent. (b) The Parent granted RSUs as replacement awards for the Old Parent’s awards. (c) The fair value of RSUs held by the Company’s employees that vested during the year ended December 31, 2019 was USD 44 thousand. None of the stock options remaining as of December 31, 2019 were exercisable. NOTE 15. RELATED PARTY TRANSACTIONS AND NET PARENT INVESTMENT Related Party Transactions In the ordinary course of business, the Company enters into transactions with related parties, including affiliate entities of the Parent. Additionally, the Company has historically entered into operational transactions with other Parent subsidiaries which were eliminated in consolidation for purposes of the Parent’s consolidated financial statements. For purposes of these Financial Statements of the Company, such related party transactions have been 26

presented and treated as related party in nature. The following table sets forth the composition and amounts of the transactions with related parties, including the Parent and the Parent’s affiliates, reflected in the Combined Statements of Operations: Year ended Year ended December 31, December 29, 2019 2018 (in EUR thousands) Net Sales 3,594 4,660 Operating expenses Selling, general and administrative expenses (a) 1,013 1,718 (a) Selling, general and administrative expenses with related parties primarily includes management fees, employee benefits and legal and professional services. The following table sets forth the amount of receivables due from and payable to related parties outstanding on the Combined Balance Sheets: Years ended December 31, December 29, 2019 2018 (in EUR thousands) Accounts receivables - related parties (a) 719 693 Accounts payable - related parties (b) 47 54 (a) Trade accounts receivable related to Distribution type services (b) Trade accounts payable related to Distribution type services Corporate Allocations and Net Parent Investment The Financial Statements include expense allocations as described in Note 1. The corporate expense allocations made during the years ended December 31, 2019 and December 29, 2018 of EUR 1,544 and EUR 618, respectively, included in the Combined Statements of Operations in Selling, general and administrative expenses and accordingly as a component of Net Parent Investment. In instances where receivables or payables are not cash settled or contractually bound between the Company, Parent or Parent’s affiliates, the amounts were recorded in Net Parent Investment and considered to be effectively settled for cash in these combined financial statements. The total net effect of the settlement of these intercompany transactions is reflected in the Combined Statements of Cash Flows as a financing activity and in the Combined Balance Sheets as Net Parent Investment. The following table summarizes the corporate expense allocation components of the net increase to Net Parent Investment for the years ended December 31, 2019 and December 29, 2018: Years ended December 31, December 29, 2019 2018 (in EUR thousands) Transactions between Company and Parent(a) 1,013 1,718 Corporate allocations 1,544 618 Net increase to Net Parent Investment 1,854 1,788 27

(a) Transactions between Company and Parent primarily includes cumulative intercompany activity with Parent, captive insurance expenses, and stock-based compensation charges and are included in the Combined Statements of Operations in Selling, general and administrative expenses. NOTE 16. SUBSEQUENT EVENTS Acquisition by Heska Corporation Heska Corporation, a US based SEC registered company (“Heska” or “Acquirer”), a provider of advanced veterinary diagnostic and specialty products, announced on January 14, 2020, that they have entered into an agreement to acquire 100% of the capital stock of scil animal care company GmbH and its subsidiaries from Covetrus, Inc. for the agreement provides for a purchase price of $125 million in cash, subject to working capital and other adjustments as set forth in the purchase agreement. The acquisition is expected to close in the next 60 to 90 days, subject to the satisfaction or waiver of closing conditions set forth in the purchase agreement and is not subject to any financing condition. Employee Litigation On February 18, 2020, a former managing director filed a claim disputing the effective date of the termination of his management service agreement and the validity of the Company’s waiver of his two-year post-contractual non- compete obligation. The Company intends to defend itself against the claim. Whether or not this will be successful, depends on complex facts and circumstance. The Company is, based on the advice of its legal advisors, confident that it will be successful in evidencing the effective date of the termination of the management service agreement and as such, no accrual has been recorded for this ongoing litigation. COVID-19 The recent global outbreak of COVID-19 poses the risk that we or our customers, suppliers and other business partners may be disrupted or prevented from conducting business activities for certain periods of time. The durations of potential disruptions are uncertain, and it is not possible at this time to estimate the impact that COVID-19 could have on our business. The impact of COVID-19 on various business activities in affected countries could adversely affect our results of operations and financial condition. 28