Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - First Northwest Bancorp | fnwb-050620x8k.htm |

1Q20 INVESTOR PRESENTATION

SAFE HARBOR STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of First Northwest Bancorp’s management and on information available to First Northwest Bancorp as of the date of this presentation. It is important to note that these forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties, including, but not limited to, the ability of First Northwest Bancorp to implement its business strategy. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause First Northwest Bancorp’s actual results to differ materially from those described in the forward-looking statements can be found in First Northwest Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2019, which has been filed with the Securities and Exchange Commission and is available on the Securities and Exchange Commission’s website (www.sec.gov). First Northwest Bancorp does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 2

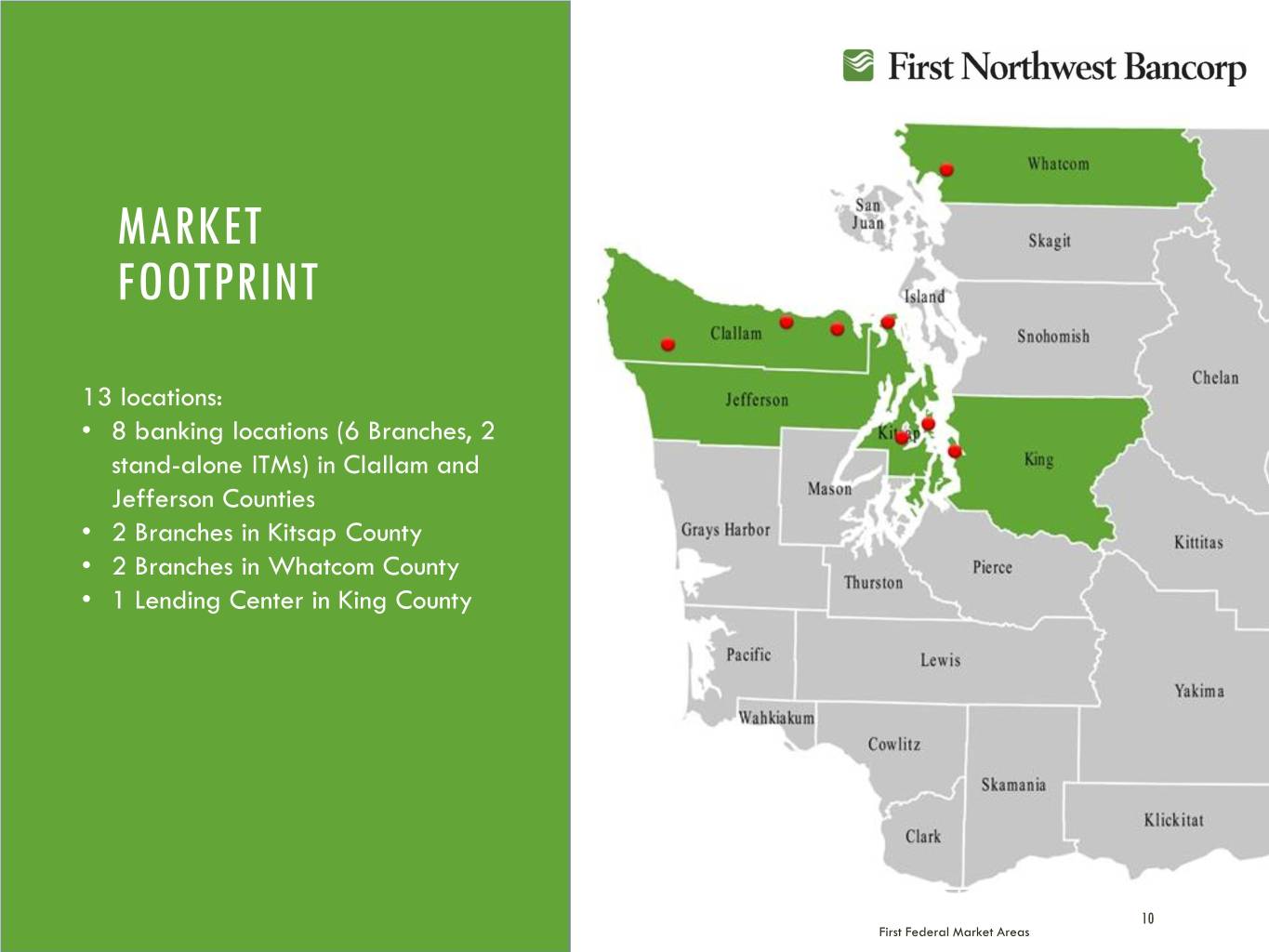

ABOUT FIRST NORTHWEST BANCORP “FNWB” Bank holding company for First Federal, a growing $1.4 billion* asset, state chartered savings bank headquartered in Port Angeles, Washington First Federal is a Washington state-chartered savings bank, founded in 1923 NASDAQ ticker symbol “FNWB” 13 locations strong: 8 banking locations (including 6 Branches, and 2 stand- alone ITMs) in Clallam and Jefferson Counties, 2 Branches in Kitsap County, 2 Branches in Whatcom County, and a Lending Center in King County # 1 in Deposit Market Share in Clallam and Jefferson Counties Full-service community bank offering consumer, mortgage and commercial solutions leveraging digital solutions in our emerging and legacy markets * - All data as of March 31, 2020, unless otherwise specified 3

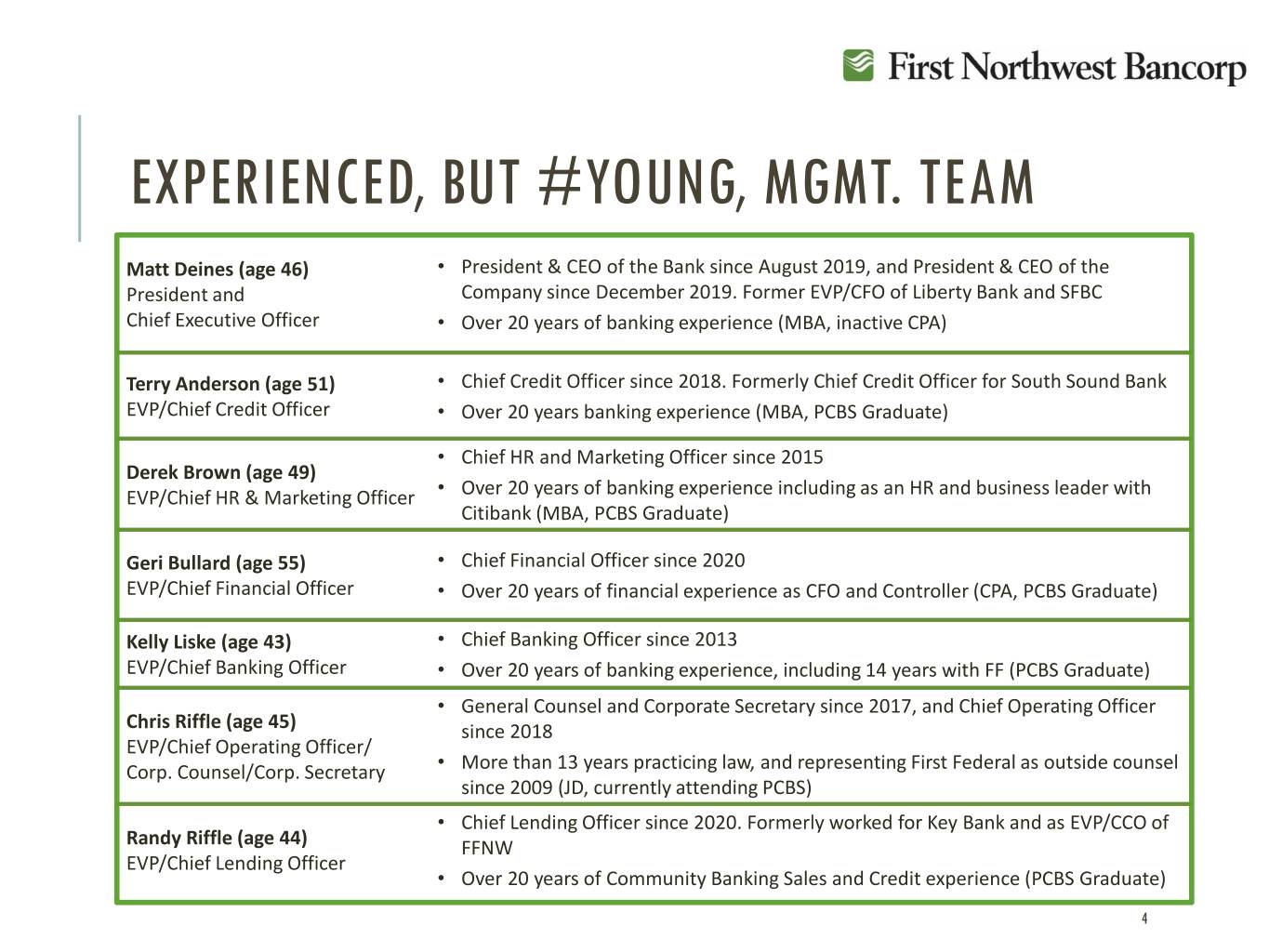

EXPERIENCED, BUT #YOUNG, MGMT. TEAM Matt Deines (age 46) • President & CEO of the Bank since August 2019, and President & CEO of the President and Company since December 2019. Former EVP/CFO of Liberty Bank and SFBC Chief Executive Officer • Over 20 years of banking experience (MBA, inactive CPA) Terry Anderson (age 51) • Chief Credit Officer since 2018. Formerly Chief Credit Officer for South Sound Bank EVP/Chief Credit Officer • Over 20 years banking experience (MBA, PCBS Graduate) • Chief HR and Marketing Officer since 2015 Derek Brown (age 49) • EVP/Chief HR & Marketing Officer Over 20 years of banking experience including as an HR and business leader with Citibank (MBA, PCBS Graduate) Geri Bullard (age 55) • Chief Financial Officer since 2020 EVP/Chief Financial Officer • Over 20 years of financial experience as CFO and Controller (CPA, PCBS Graduate) Kelly Liske (age 43) • Chief Banking Officer since 2013 EVP/Chief Banking Officer • Over 20 years of banking experience, including 14 years with FF (PCBS Graduate) • General Counsel and Corporate Secretary since 2017, and Chief Operating Officer Chris Riffle (age 45) since 2018 EVP/Chief Operating Officer/ • Corp. Counsel/Corp. Secretary More than 13 years practicing law, and representing First Federal as outside counsel since 2009 (JD, currently attending PCBS) • Chief Lending Officer since 2020. Formerly worked for Key Bank and as EVP/CCO of Randy Riffle (age 44) FFNW EVP/Chief Lending Officer • Over 20 years of Community Banking Sales and Credit experience (PCBS Graduate) 4

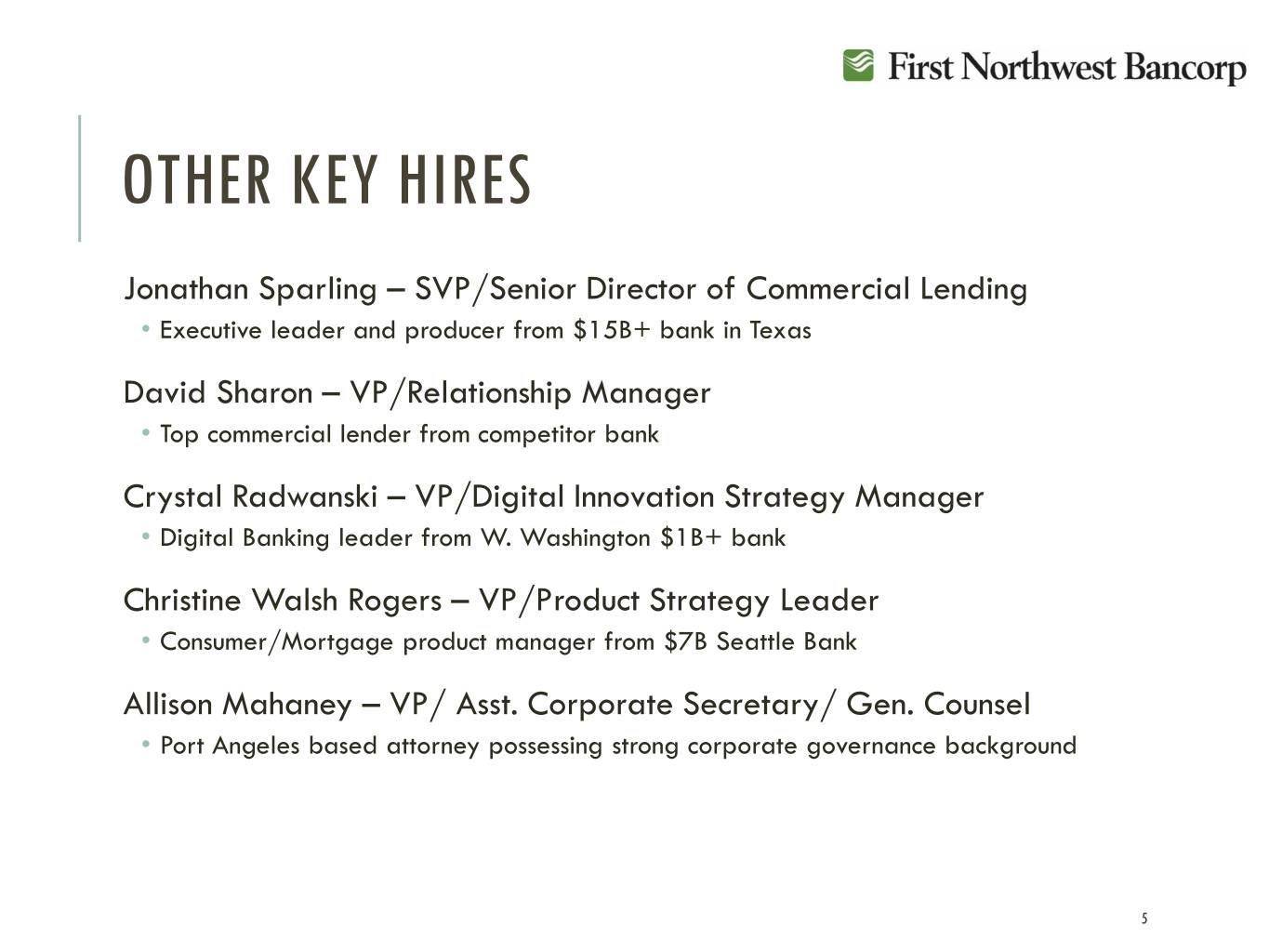

OTHER KEY HIRES Jonathan Sparling – SVP/Senior Director of Commercial Lending • Executive leader and producer from $15B+ bank in Texas David Sharon – VP/Relationship Manager • Top commercial lender from competitor bank Crystal Radwanski – VP/Digital Innovation Strategy Manager • Digital Banking leader from W. Washington $1B+ bank Christine Walsh Rogers – VP/Product Strategy Leader • Consumer/Mortgage product manager from $7B Seattle Bank Allison Mahaney – VP/ Asst. Corporate Secretary/ Gen. Counsel • Port Angeles based attorney possessing strong corporate governance background 5

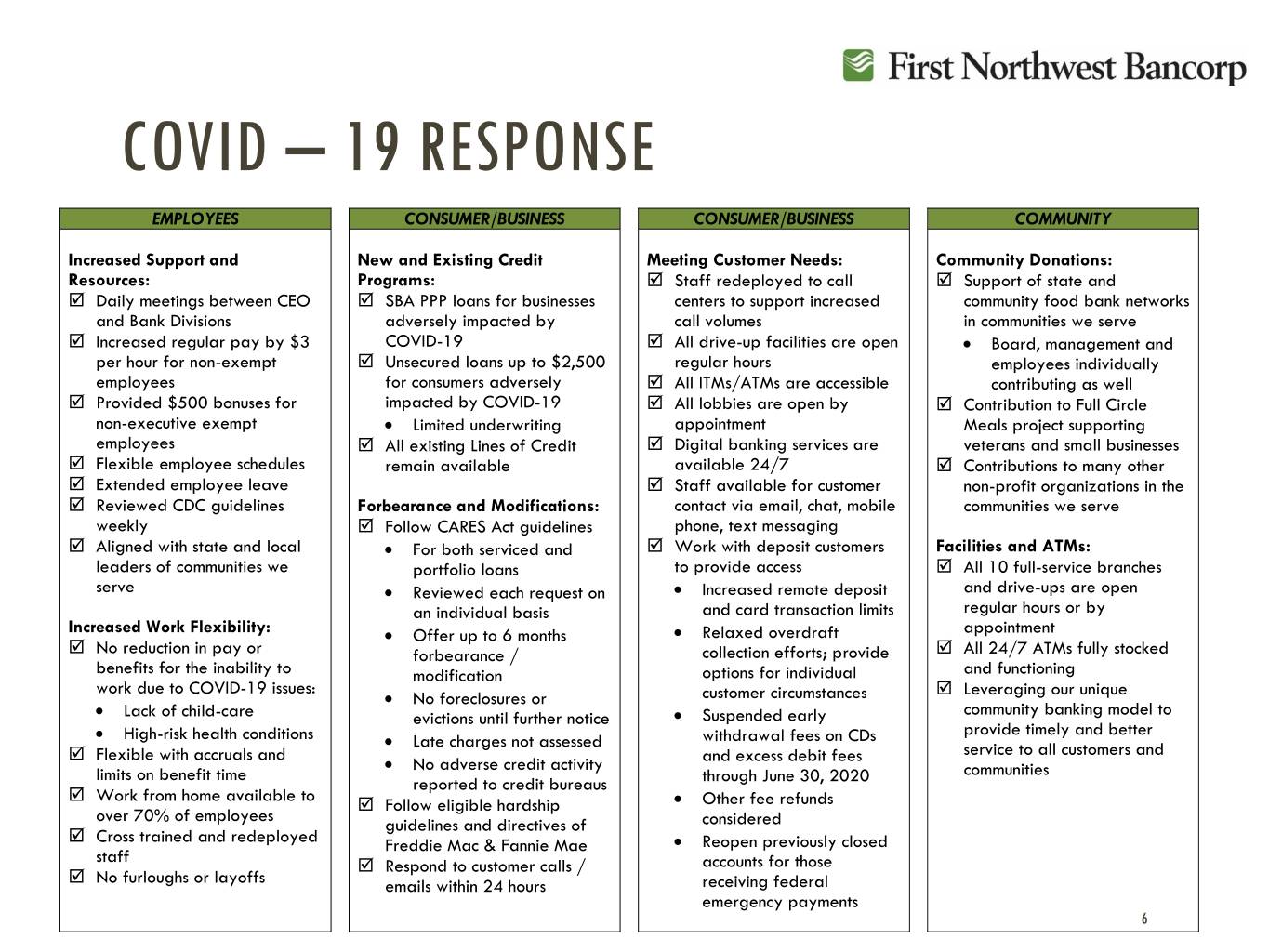

COVID – 19 RESPONSE EMPLOYEES CONSUMER/BUSINESS CONSUMER/BUSINESS COMMUNITY Increased Support and New and Existing Credit Meeting Customer Needs: Community Donations: Resources: Programs: Staff redeployed to call Support of state and Daily meetings between CEO SBA PPP loans for businesses centers to support increased community food bank networks and Bank Divisions adversely impacted by call volumes in communities we serve Increased regular pay by $3 COVID-19 All drive-up facilities are open • Board, management and per hour for non-exempt Unsecured loans up to $2,500 regular hours employees individually employees for consumers adversely All ITMs/ATMs are accessible contributing as well Provided $500 bonuses for impacted by COVID-19 All lobbies are open by Contribution to Full Circle non-executive exempt • Limited underwriting appointment Meals project supporting employees All existing Lines of Credit Digital banking services are veterans and small businesses Flexible employee schedules remain available available 24/7 Contributions to many other Extended employee leave Staff available for customer non-profit organizations in the Reviewed CDC guidelines Forbearance and Modifications: contact via email, chat, mobile communities we serve weekly Follow CARES Act guidelines phone, text messaging Aligned with state and local • For both serviced and Work with deposit customers Facilities and ATMs: leaders of communities we portfolio loans to provide access All 10 full-service branches serve • Reviewed each request on • Increased remote deposit and drive-ups are open an individual basis and card transaction limits regular hours or by Increased Work Flexibility: • Offer up to 6 months • Relaxed overdraft appointment No reduction in pay or forbearance / collection efforts; provide All 24/7 ATMs fully stocked benefits for the inability to modification options for individual and functioning work due to COVID-19 issues: Leveraging our unique • No foreclosures or customer circumstances community banking model to • Lack of child-care evictions until further notice • Suspended early provide timely and better • High-risk health conditions • Late charges not assessed withdrawal fees on CDs Flexible with accruals and service to all customers and • No adverse credit activity and excess debit fees limits on benefit time communities reported to credit bureaus through June 30, 2020 Work from home available to Follow eligible hardship • Other fee refunds over 70% of employees guidelines and directives of considered Cross trained and redeployed Freddie Mac & Fannie Mae • Reopen previously closed staff Respond to customer calls / accounts for those No furloughs or layoffs emails within 24 hours receiving federal emergency payments 6

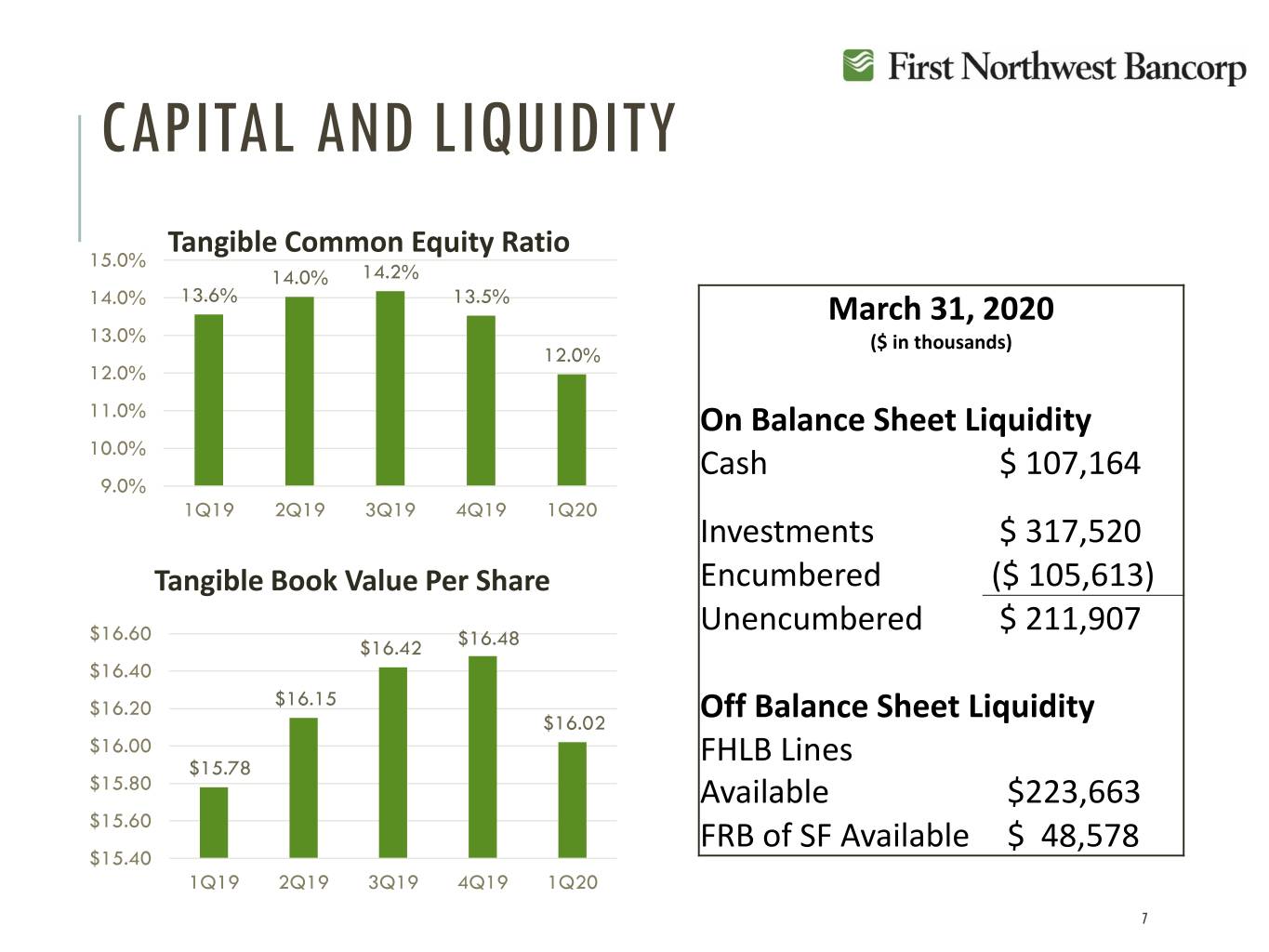

CAPITAL AND LIQUIDITY Tangible Common Equity Ratio 15.0% 14.0% 14.2% 14.0% 13.6% 13.5% March 31, 2020 13.0% ($ in thousands) 12.0% 12.0% 11.0% On Balance Sheet Liquidity 10.0% Cash $ 107,164 9.0% 1Q19 2Q19 3Q19 4Q19 1Q20 Investments $ 317,520 Tangible Book Value Per Share Encumbered ($ 105,613) $16.60 Unencumbered $ 211,907 $16.42 $16.48 $16.40 $16.20 $16.15 $16.02 Off Balance Sheet Liquidity $16.00 $15.78 FHLB Lines $15.80 Available $223,663 $15.60 FRB of SF Available $ 48,578 $15.40 1Q19 2Q19 3Q19 4Q19 1Q20 7

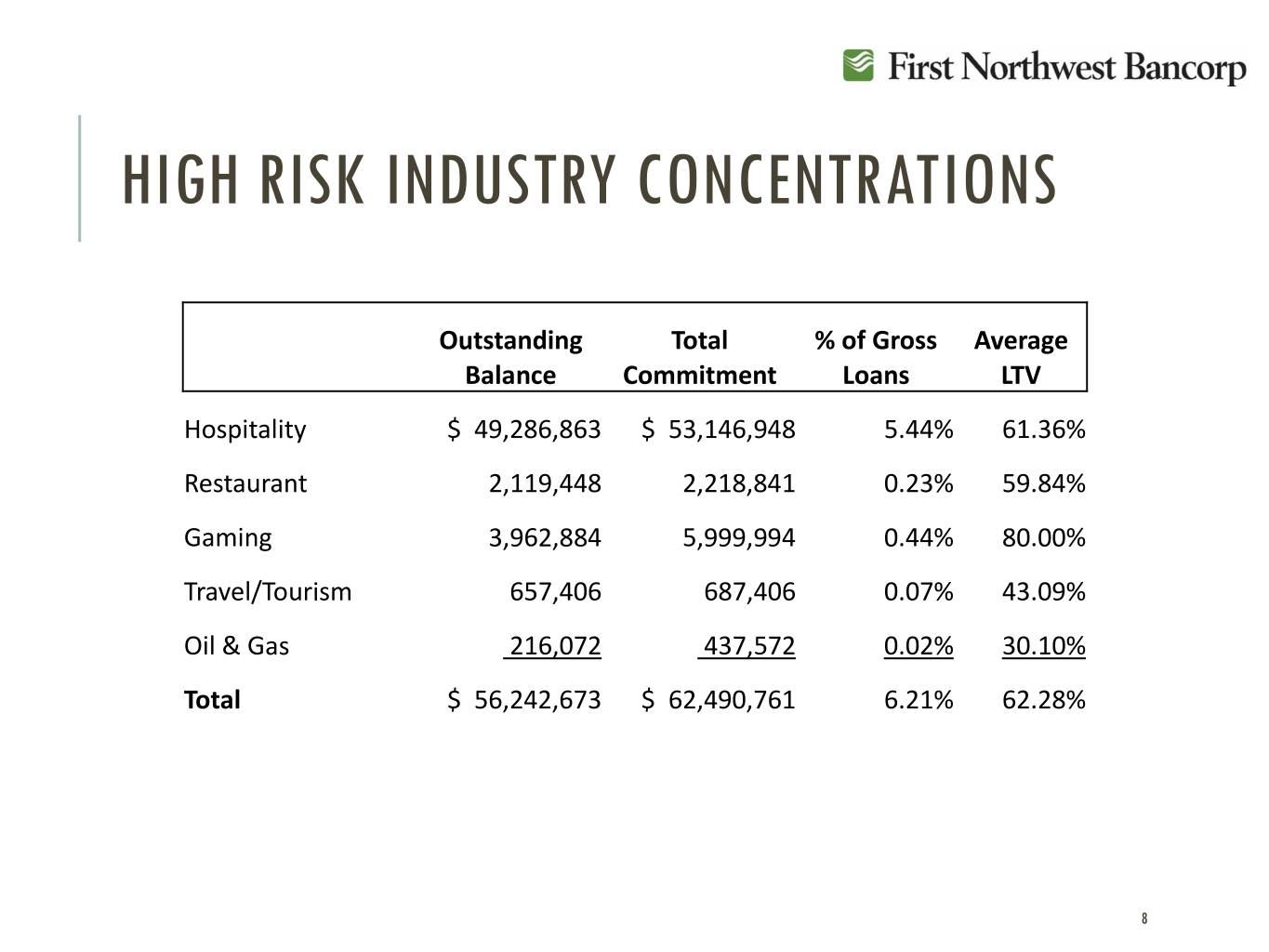

HIGH RISK INDUSTRY CONCENTRATIONS Outstanding Total % of Gross Average Balance Commitment Loans LTV Hospitality $ 49,286,863 $ 53,146,948 5.44% 61.36% Restaurant 2,119,448 2,218,841 0.23% 59.84% Gaming 3,962,884 5,999,994 0.44% 80.00% Travel/Tourism 657,406 687,406 0.07% 43.09% Oil & Gas 216,072 437,572 0.02% 30.10% Total $ 56,242,673 $ 62,490,761 6.21% 62.28% 8

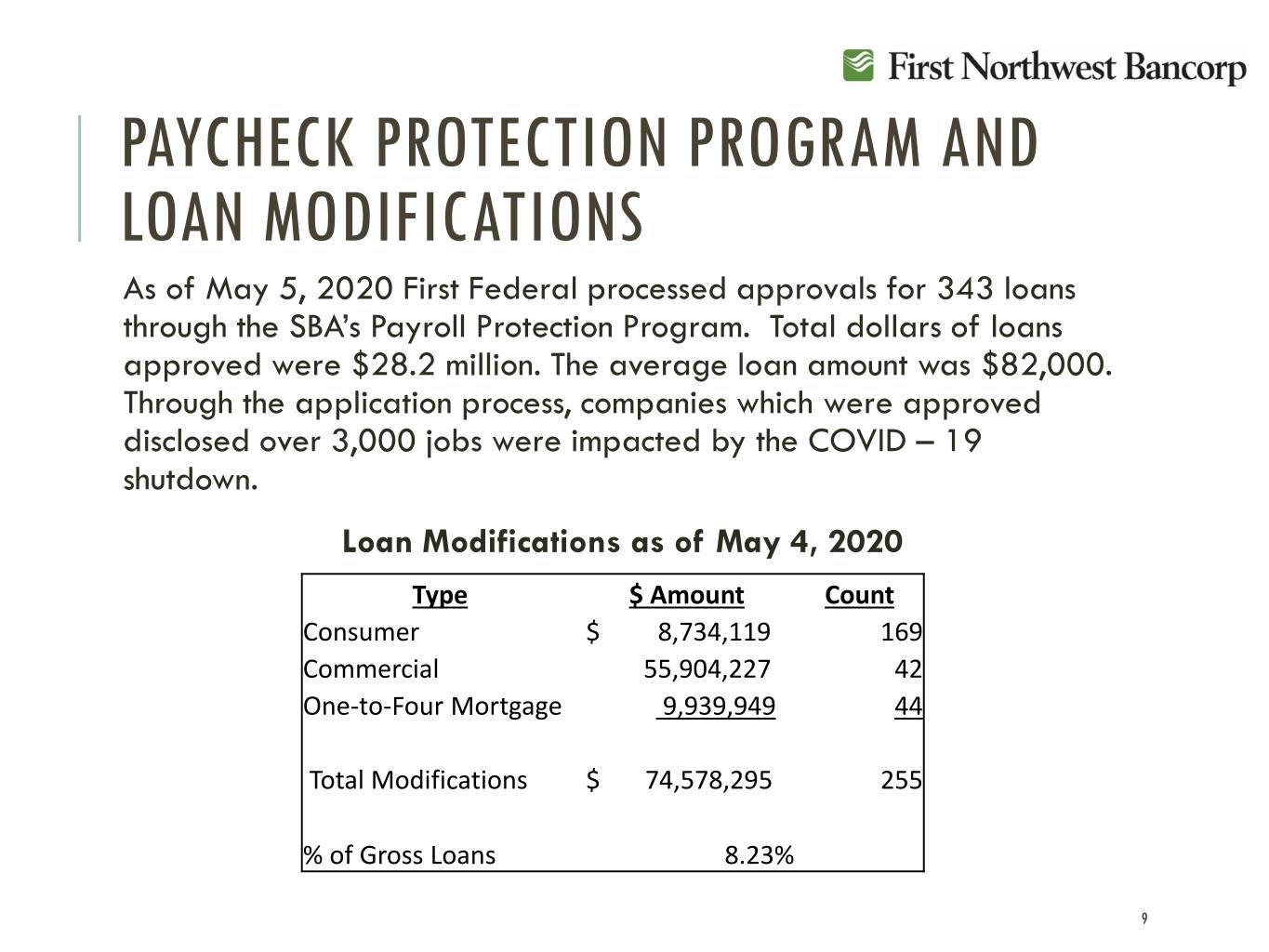

PAYCHECK PROTECTION PROGRAM AND LOAN MODIFICATIONS As of May 5, 2020 First Federal processed approvals for 343 loans through the SBA’s Payroll Protection Program. Total dollars of loans approved were $28.2 million. The average loan amount was $82,000. Through the application process, companies which were approved disclosed over 3,000 jobs were impacted by the COVID – 19 shutdown. Loan Modifications as of May 4, 2020 Type $ Amount Count Consumer $ 8,734,119 169 Commercial 55,904,227 42 One-to-Four Mortgage 9,939,949 44 Total Modifications $ 74,578,295 255 % of Gross Loans 8.23% 9

MARKET BRANCHFOOTPRINT FOOTPRINT 13• 6 locations: branches in Clallam and Jefferson • 8counties banking locations (6 Branches, 2 • stand2 branches-alone in KitsapITMs) Countyin Clallam and • 2 branches in Whatcom county • LendingJefferson center Counties in King county • Total2 Branches of 11 locations in Kitsap County • 2 Branches in Whatcom County • 1 Lending Center in King County 10 10 First Federal Market Areas

STRATEGIES FOR THE BANK TODAY Strategic Goals Financial Goals • Enhance Digital Offerings • Leverage/Scale current fixed costs and excess capital • Expansion in Existing Markets • Generate organic and wholesale • Hire Great Bankers growth to increase NIM and reduce efficiency ratio • Leverage Data to Manage Risk and Drive • Increase Return on Equity and Growth Earnings per Share 11

Will be a 12.0% 86% Loan to three pronged TCE/Assets Deposit ratio approach OPPORTUNITY TO LEVERAGE Relationship Digital Wholesale 12

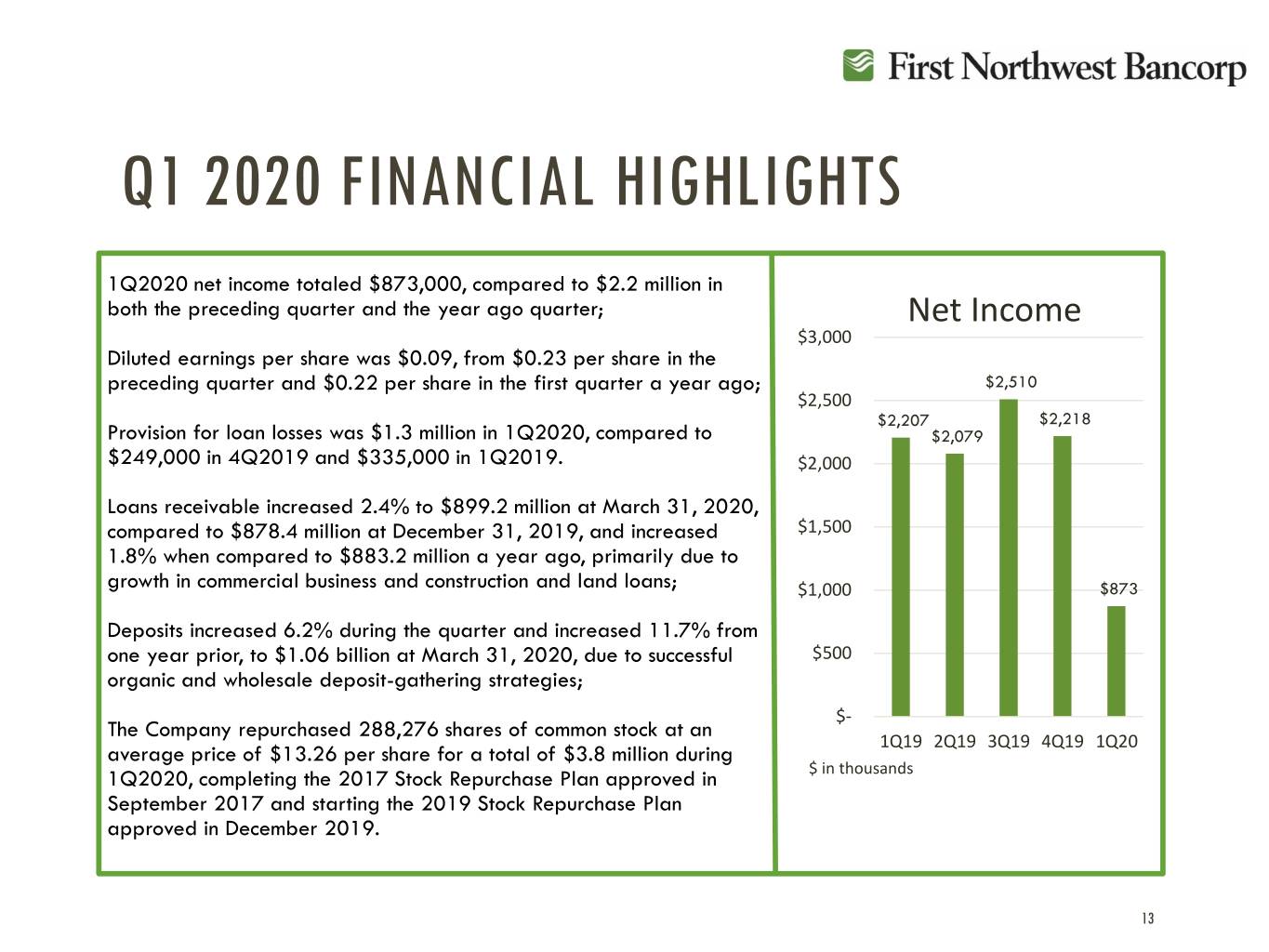

Q1 2020 FINANCIAL HIGHLIGHTS 1Q2020 net income totaled $873,000, compared to $2.2 million in both the preceding quarter and the year ago quarter; Net Income $3,000 Diluted earnings per share was $0.09, from $0.23 per share in the preceding quarter and $0.22 per share in the first quarter a year ago; $2,510 $2,500 $2,207 $2,218 Provision for loan losses was $1.3 million in 1Q2020, compared to $2,079 $249,000 in 4Q2019 and $335,000 in 1Q2019. $2,000 Loans receivable increased 2.4% to $899.2 million at March 31, 2020, compared to $878.4 million at December 31, 2019, and increased $1,500 1.8% when compared to $883.2 million a year ago, primarily due to growth in commercial business and construction and land loans; $1,000 $873 Deposits increased 6.2% during the quarter and increased 11.7% from one year prior, to $1.06 billion at March 31, 2020, due to successful $500 organic and wholesale deposit-gathering strategies; $- The Company repurchased 288,276 shares of common stock at an average price of $13.26 per share for a total of $3.8 million during 1Q19 2Q19 3Q19 4Q19 1Q20 1Q2020, completing the 2017 Stock Repurchase Plan approved in $ in thousands September 2017 and starting the 2019 Stock Repurchase Plan approved in December 2019. 13

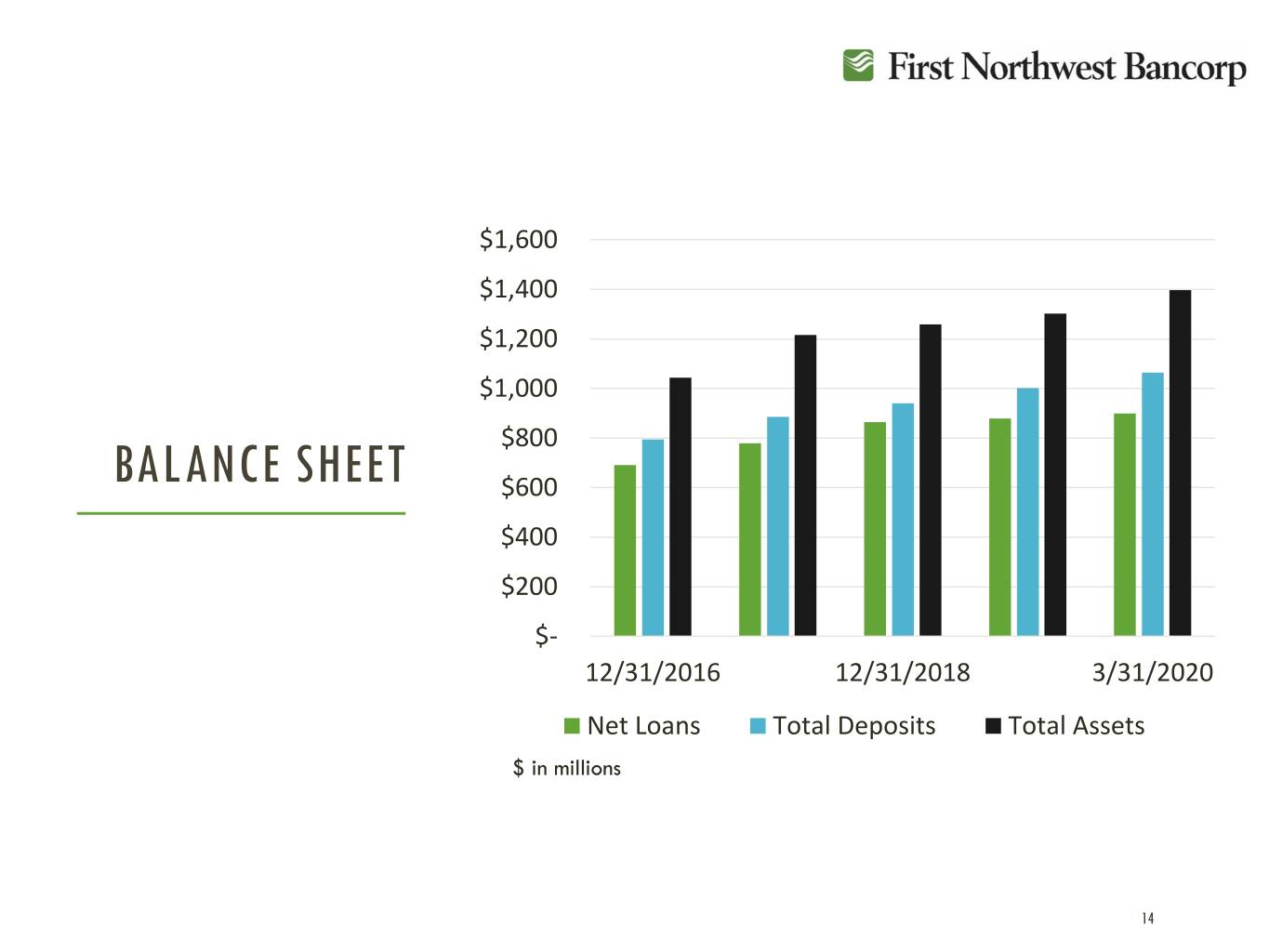

$1,600 $1,400 $1,200 $1,000 $800 BALANCE SHEET $600 $400 $200 $- 12/31/2016 12/31/2018 3/31/2020 Net Loans Total Deposits Total Assets $ in millions 14

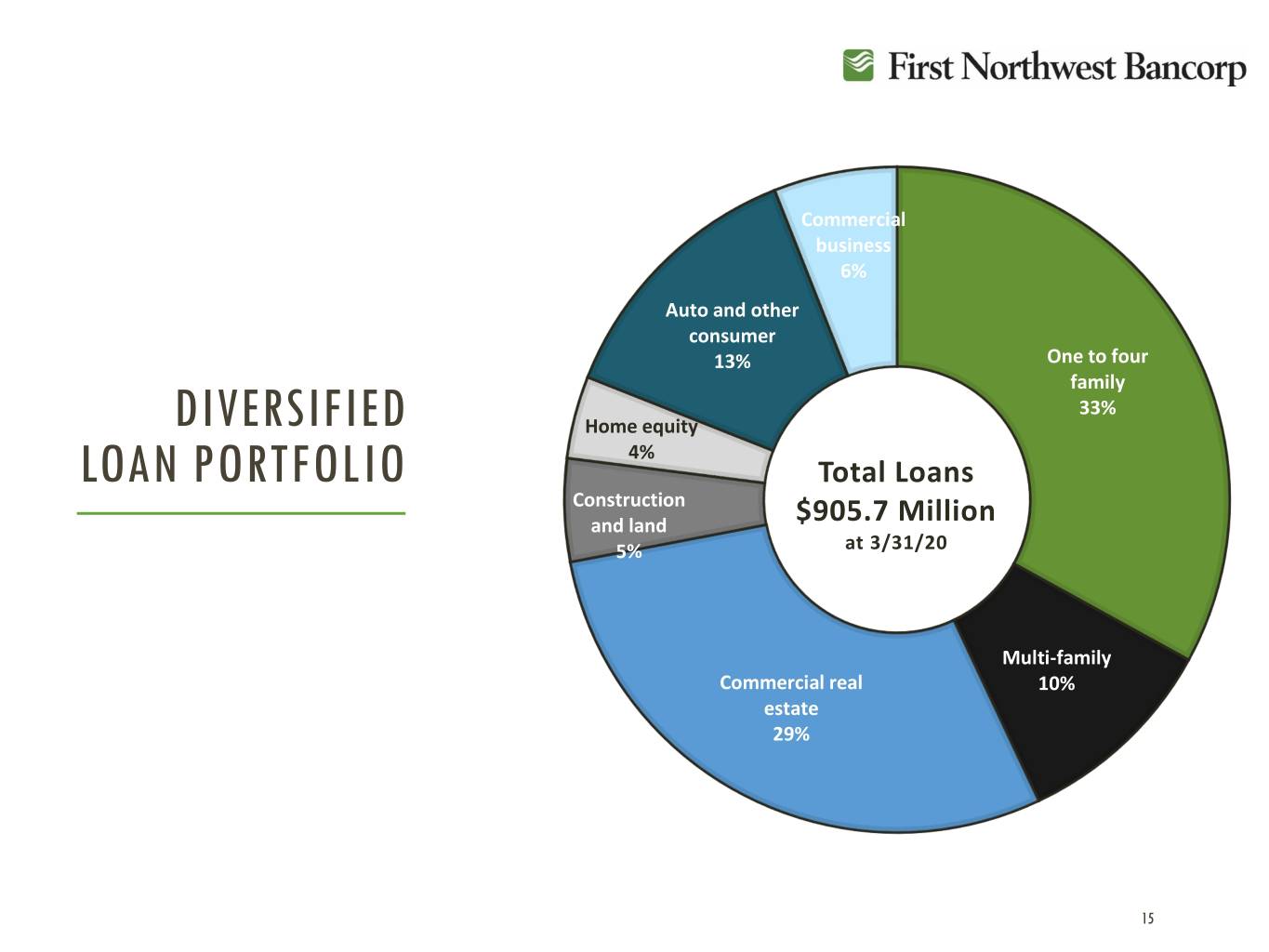

Commercial business 6% Auto and other consumer 13% One to four family 33% DIVERSIFIED Home equity 4% LOAN PORTFOLIO Total Loans Construction and land $905.7 Million 5% at 3/31/20 Multi-family Commercial real 10% estate 29% 15

DEPOSIT PORTFOLIO 12/31/2019 3/31/2020 % of Wtd Avg % of Wtd Avg QTD % Deposit Category Balance Total Cost Balance Total Cost Change Non Int Checking $ 160,420 16.0% 0.00% $ 167,530 15.7% 0.00% 4.43% Int Checking 116,076 11.6% 0.07% 118,753 11.2% 0.04% 2.31% Savings 168,983 16.9% 0.86% 165,747 15.6% 0.72% -1.91% Money Market 248,086 24.8% 0.46% 253,198 23.8% 0.48% 2.06% Certificates of Deposits 308,080 30.8% 1.85% 358,677 33.7% 1.67% 16.42% Total Deposits $ 1,001,645 100.0% 0.84% $ 1,063,905 100.0% 0.81% 6.22% $ in thousands 16

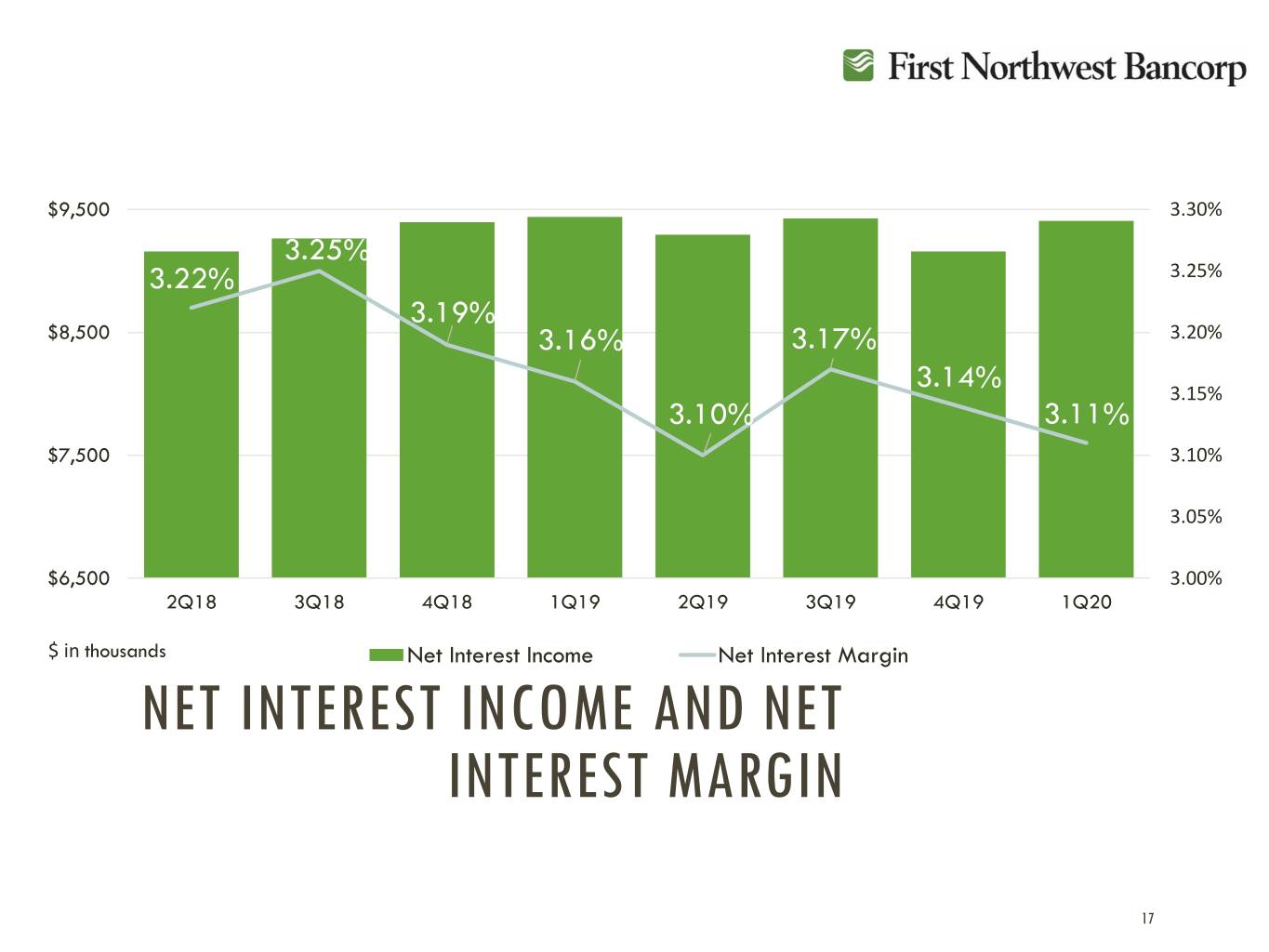

$9,500 3.30% 3.25% 3.22% 3.25% 3.19% $8,500 3.16% 3.17% 3.20% 3.14% 3.15% 3.10% 3.11% $7,500 3.10% 3.05% $6,500 3.00% 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 $ in thousands Net Interest Income Net Interest Margin NET INTEREST INCOME AND NET INTEREST MARGIN 17

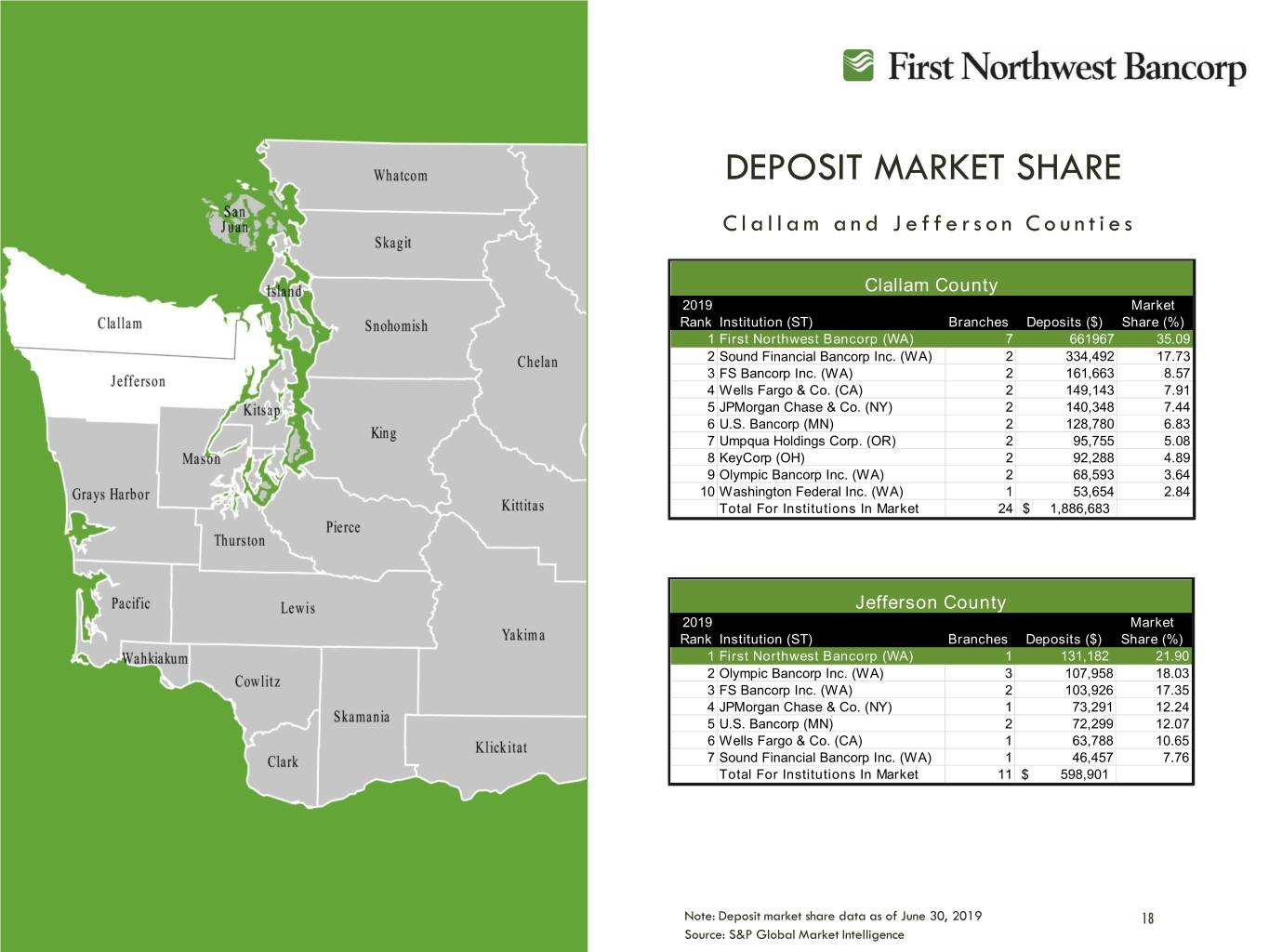

DEPOSIT MARKET SHARE Clallam and Jefferson Counties Clallam County 2019 Market Rank Institution (ST) Branches Deposits ($) Share (%) 1 First Northwest Bancorp (WA) 7 661967 35.09 2 Sound Financial Bancorp Inc. (WA) 2 334,492 17.73 3 FS Bancorp Inc. (WA) 2 161,663 8.57 4 Wells Fargo & Co. (CA) 2 149,143 7.91 5 JPMorgan Chase & Co. (NY) 2 140,348 7.44 6 U.S. Bancorp (MN) 2 128,780 6.83 7 Umpqua Holdings Corp. (OR) 2 95,755 5.08 8 KeyCorp (OH) 2 92,288 4.89 9 Olympic Bancorp Inc. (WA) 2 68,593 3.64 10 Washington Federal Inc. (WA) 1 53,654 2.84 Total For Institutions In Market 24 $ 1,886,683 Jefferson County 2019 Market Rank Institution (ST) Branches Deposits ($) Share (%) 1 First Northwest Bancorp (WA) 1 131,182 21.90 2 Olympic Bancorp Inc. (WA) 3 107,958 18.03 3 FS Bancorp Inc. (WA) 2 103,926 17.35 4 JPMorgan Chase & Co. (NY) 1 73,291 12.24 5 U.S. Bancorp (MN) 2 72,299 12.07 6 Wells Fargo & Co. (CA) 1 63,788 10.65 7 Sound Financial Bancorp Inc. (WA) 1 46,457 7.76 Total For Institutions In Market 11 $ 598,901 Note: Deposit market share data as of June 30, 2019 18 Source: S&P Global Market Intelligence

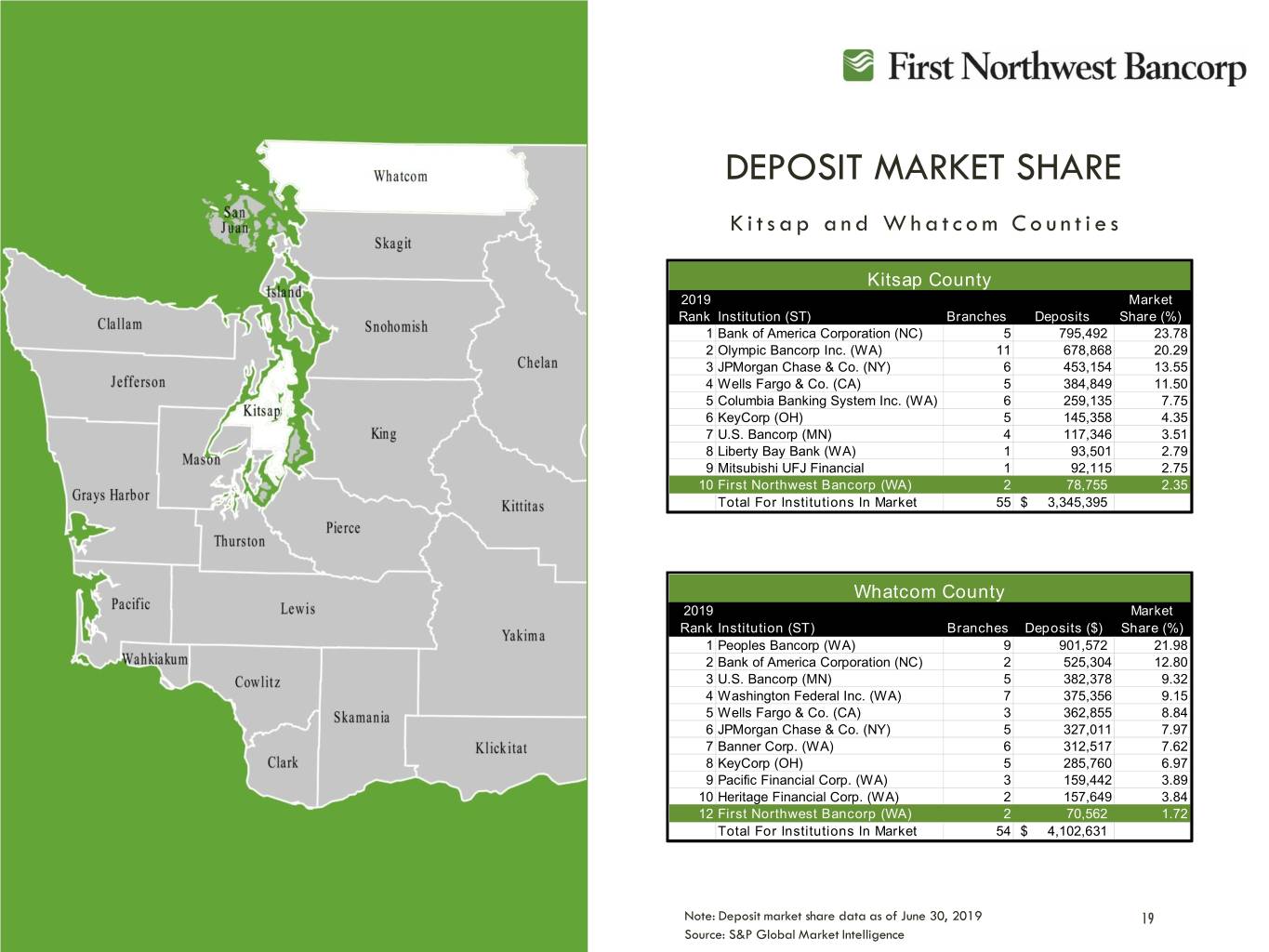

DEPOSIT MARKET SHARE Kitsap and Whatcom Counties Kitsap County 2019 Market Rank Institution (ST) Branches Deposits Share (%) 1 Bank of America Corporation (NC) 5 795,492 23.78 2 Olympic Bancorp Inc. (WA) 11 678,868 20.29 3 JPMorgan Chase & Co. (NY) 6 453,154 13.55 4 Wells Fargo & Co. (CA) 5 384,849 11.50 5 Columbia Banking System Inc. (WA) 6 259,135 7.75 6 KeyCorp (OH) 5 145,358 4.35 7 U.S. Bancorp (MN) 4 117,346 3.51 8 Liberty Bay Bank (WA) 1 93,501 2.79 9 Mitsubishi UFJ Financial 1 92,115 2.75 10 First Northwest Bancorp (WA) 2 78,755 2.35 Total For Institutions In Market 55 $ 3,345,395 Whatcom County 2019 Market Rank Institution (ST) Branches Deposits ($) Share (%) 1 Peoples Bancorp (WA) 9 901,572 21.98 2 Bank of America Corporation (NC) 2 525,304 12.80 3 U.S. Bancorp (MN) 5 382,378 9.32 4 Washington Federal Inc. (WA) 7 375,356 9.15 5 Wells Fargo & Co. (CA) 3 362,855 8.84 6 JPMorgan Chase & Co. (NY) 5 327,011 7.97 7 Banner Corp. (WA) 6 312,517 7.62 8 KeyCorp (OH) 5 285,760 6.97 9 Pacific Financial Corp. (WA) 3 159,442 3.89 10 Heritage Financial Corp. (WA) 2 157,649 3.84 12 First Northwest Bancorp (WA) 2 70,562 1.72 Total For Institutions In Market 54 $ 4,102,631 Note: Deposit market share data as of June 30, 2019 19 Source: S&P Global Market Intelligence

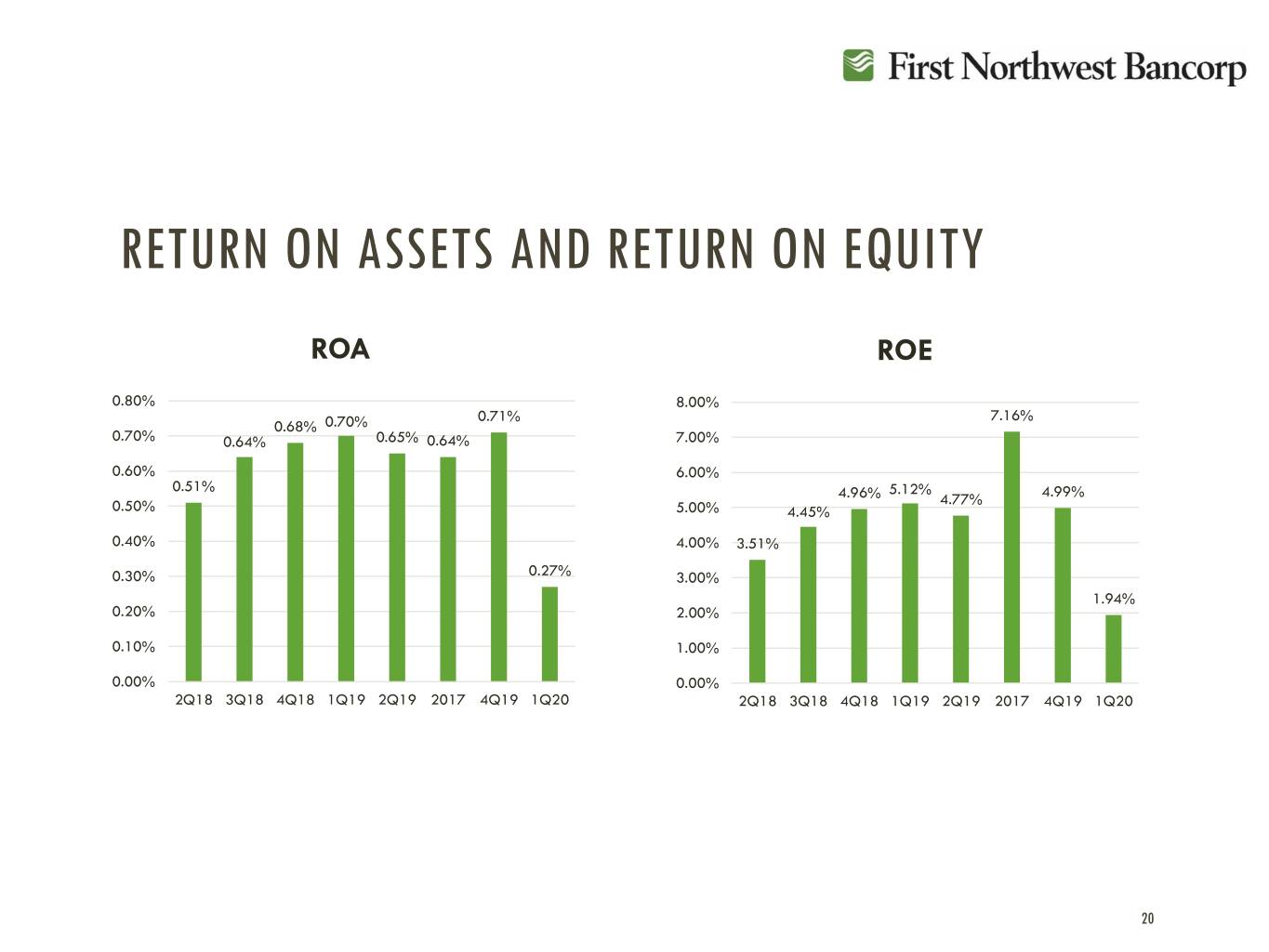

RETURN ON ASSETS AND RETURN ON EQUITY ROA ROE 0.80% 8.00% 0.71% 7.16% 0.68% 0.70% 0.70% 0.64% 0.65% 0.64% 7.00% 0.60% 6.00% 0.51% 5.12% 4.96% 4.77% 4.99% 0.50% 5.00% 4.45% 0.40% 4.00% 3.51% 0.30% 0.27% 3.00% 1.94% 0.20% 2.00% 0.10% 1.00% 0.00% 0.00% 2Q18 3Q18 4Q18 1Q19 2Q19 2017 4Q19 1Q20 2Q18 3Q18 4Q18 1Q19 2Q19 2017 4Q19 1Q20 20

1. Properly leverage equity capital to enhance EPS and ROAE FINANCIAL 2. Grow revenue while maintaining expense GOALS AND discipline to reduce efficiency ratio 3. Maintain market lead in historical markets and OBJECTIVES expand Puget Sound market share 4. Maintain strong credit culture and asset quality 21

SAFE HARBOR STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of First Northwest Bancorp’s management and on information available to First Northwest Bancorp as of the date of this presentation. It is important to note that these forward-looking statements are not guarantees of future performanceQUESTIONS? and are subject to significant risks and uncertainties, including, but not limited to, the ability of First Northwest Bancorp to implement its business strategy. Actual results may differ from those set forth in the forward-looking statements. Factors that could cause First Northwest Bancorp’s actual results to differ materially from those described in the forward-looking statements can be found in First Northwest Bancorp’s Annual Report on Form 10-K for the year ended December#PROUDLYPNW 31, 2018, which has been filed with the Securities and Exchange Commission and is available on the Securities and Exchange Commission’s website (www.sec.gov). First Northwest Bancorp does not undertake to update the forward-looking statements to reflect the impact of circumstances or events that may arise after the date of the forward-looking statements. 22