Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Extended Stay America, Inc. | stay20200331exhibit991.htm |

| 8-K - 8-K - Extended Stay America, Inc. | stay-20200506.htm |

Q1 2020 Earnings Summary May 6, 2020 Extended Stay America, Inc. ESH Hospitality, Inc.

important disclosure information This presentation contains forward-looking statements within the meaning of the federal securities laws. These statements include, but are not limited to, statements related to our expectations regarding our business performance, business strategies, financial results, liquidity and capital resources, capital expenditures, capital returns, distribution policy, plans, goals, beliefs, business trends and future events, as well as the COVID-19 pandemic, its effects on the foregoing, government action taken in response to the pandemic and action that we have or plan to take in response to the pandemic and other non-historical statements, including statements relating to industry RevPAR trends. Forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Extended Stay America, Inc.’s (“ESA”) and ESH Hospitality, Inc.’s (“ESH REIT,” and together with ESA, the “Company”) actual results or performance to differ from those projected in the forward-looking statements, possibly materially. For a description of factors that may cause the Company’s actual results or performance to differ from projected results or performance implied by forward-looking statements, please review the information under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” included in the Company’s combined annual report on Form 10- K filed with the Securities and Exchange Commission (“SEC”) on February 26, 2020 and other documents of the Company on file with or furnished to the SEC, including our combined quarterly report on Form 10-Q to be filed with the SEC on May 6, 2020. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company, its business or operations. Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. We caution you that actual results may differ materially from what is expressed, implied or forecasted by the Company’s forward-looking statements. This presentation includes certain non-GAAP financial measures, including Hotel Operating Profit, Hotel Operating Margin, EBITDA, Adjusted EBITDA, Funds from Operations (“FFO”), Adjusted Funds From Operations (“Adjusted FFO”), Adjusted FFO per diluted Paired Share, Paired Share Income, Adjusted Paired Share Income and Adjusted Paired Share Income per diluted Paired Share. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with U.S. GAAP. Please refer to the Appendix of this presentation for a reconciliation of these non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP, and to the Company’s combined annual report on Form 10-K filed with the SEC on February 26, 2020 for definitions of these non-GAAP measures. This presentation includes certain operating metrics presented on a comparable system-wide basis. The term “Comparable system-wide” refers to hotels operated under the Extended Stay America brand, including those owned, franchised or managed by the Company, for the full three months ended March 31, 2020 and 2019. For franchised or managed hotels, ESA earns certain fees based on a percentage of hotel revenues. 2

Q1 2020 Operating Results and Financial Highlights comparable system-wide revenue per available net income (in millions) room (“RevPAR”) $28.4 $46.67 $43.98 $7.8 Q1 2019 Q1 2020 Q1 2019 Q1 2020 hotel operating margin1 adjusted FFO per diluted Paired Share1 50.1% $0.36 $0.31 45.7% Q1 2019 Q1 2020 Q1 2019 Q1 2020 adjusted EBITDA (in millions)1 adjusted Paired Share income per diluted Paired Share1 $116.3 $0.16 $97.7 $0.07 Q1 2019 Q1 2020 Q1 2019 Q1 2020 1See Appendix for Hotel Operating Margin, Adjusted FFO per diluted Paired Share, Adjusted EBITDA and Adjusted Paired Share Income per diluted Paired Share reconciliations. 3

Outperforming industry, competitive set 3 • STAY’s 2020 RevPAR and occupancy compared to 2019 has held up significantly better than the industry and other mid-priced extended stay hotels in recent weeks1,2 • STAY’s RevPAR Index3 compared to competitive set, already improving before COVID-19, has increased rapidly in recent weeks to over 150 in April 1 Total industry RevPAR numbers per STR, Inc. (“STR”), a CoStar Group Company, as reported at Hotel News Now. Mid-priced extended stay RevPAR per The Highland Group, Inc. (“Highland”). Neither STR nor Highland endorse the Company, nor any other Company, and the data provided by each such company should not be viewed as investment advice or as a recommendation to take a particular course of action. 2 Industry RevPAR #s do not reflect hotel closures; industry revenue decline is steeper than RevPAR. 3 See Appendix for RevPAR Index definition and disclosure. 4

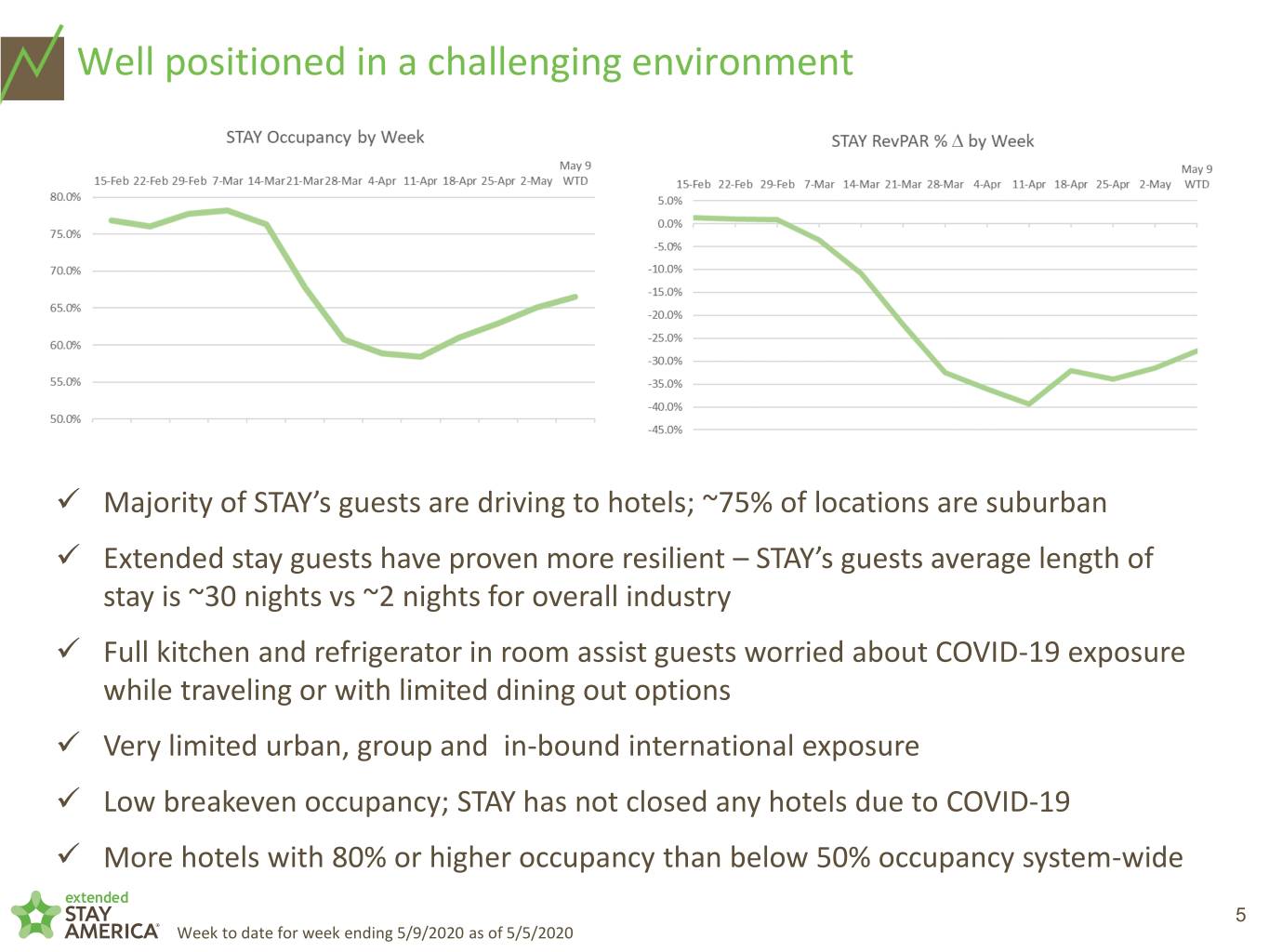

Well positioned in a challenging environment ✓ Majority of STAY’s guests are driving to hotels; ~75% of locations are suburban ✓ Extended stay guests have proven more resilient – STAY’s guests average length of stay is ~30 nights vs ~2 nights for overall industry ✓ Full kitchen and refrigerator in room assist guests worried about COVID-19 exposure while traveling or with limited dining out options ✓ Very limited urban, group and in-bound international exposure ✓ Low breakeven occupancy; STAY has not closed any hotels due to COVID-19 ✓ More hotels with 80% or higher occupancy than below 50% occupancy system-wide 5 Week to date for week ending 5/9/2020 as of 5/5/2020

ESA’s COVID-19 Action and response plans • Provided additional cleaning in our hotels, with a focus on high touch areas in accordance with CDC guidelines. • Purchased and supplied PPE for our associates for their safety. • Reduced interactions between our guests and our associates including temporarily suspending our grab n’ go breakfast and switching to every other week housekeeping from weekly housekeeping. • Increased effort and focus to attract guests staying for a month or longer at a time, which has proven significantly more resilient to date than the broader lodging industry. • Reduced payroll hours due to lower occupancy and longer length of stay guests at a number of our properties. • Drew full $400 million in revolver capacity. Extended Stay America, Inc. has received suspended covenant for four quarters and additional changes. See appendix for more details. • Utilizing the CARES act to reduce our 2020 tax liabilities and other measures. • Suspended Paired Share repurchases and reduced the quarterly distribution. • Due to the uncertain nature of local and state responses as well as macro-economic uncertainty from the COVID-19 pandemic, the Company will not update business performance guidance for 2020. The Company expects depreciation and amortization for the year between $190 and $195 million, net interest expense between $135 and $145 million, and capital expenditures between $160 to $190 million. 6

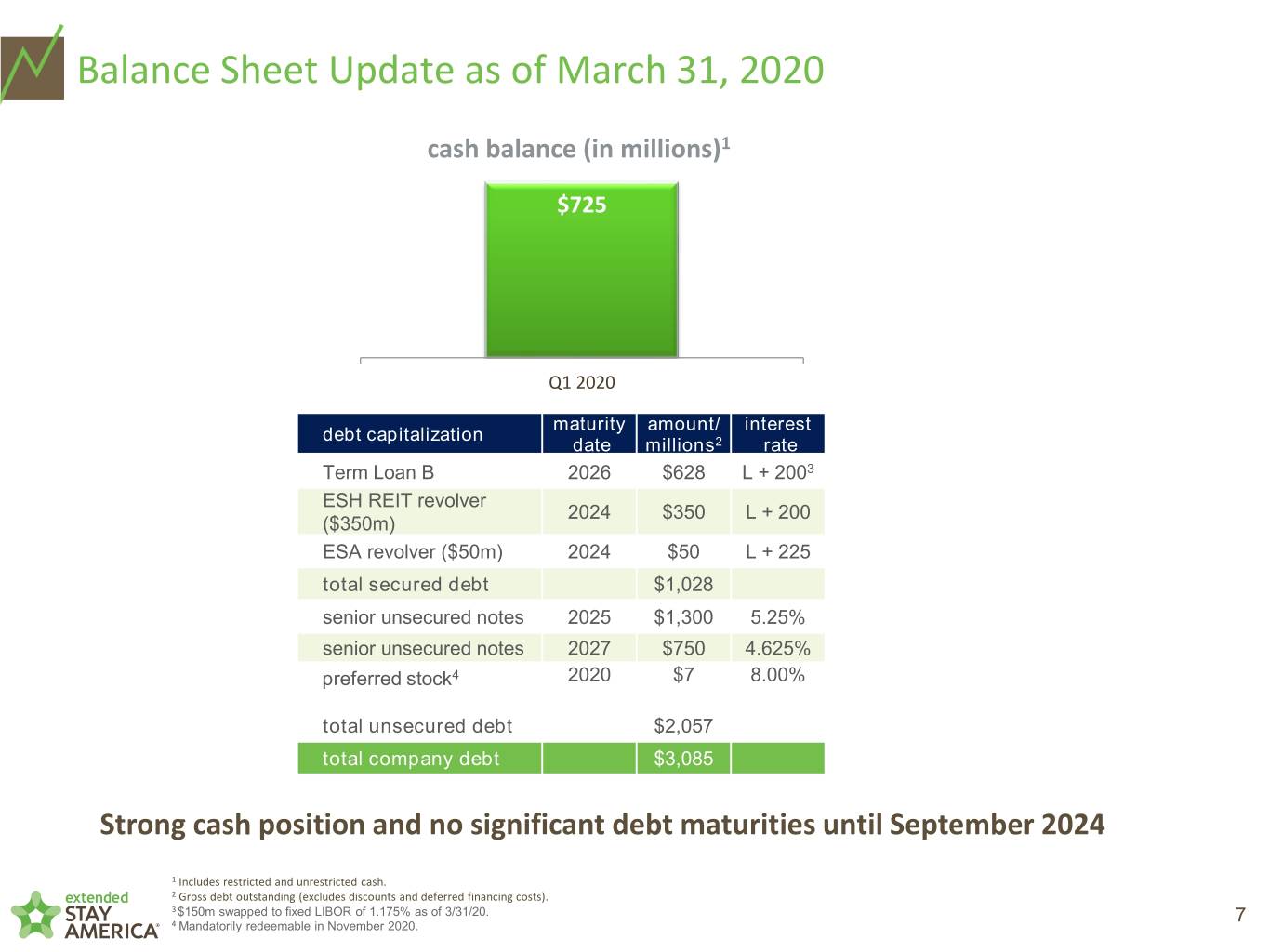

Balance Sheet Update as of March 31, 2020 cash balance (in millions)1 $725 Q1 2020 maturity amount/ interest debt capitalization date millions2 rate Term Loan B 2026 $628 L + 2003 ESH REIT revolver 2024 $350 L + 200 ($350m) ESA revolver ($50m) 2024 $50 L + 225 total secured debt $1,028 senior unsecured notes 2025 $1,300 5.25% senior unsecured notes 2027 $750 4.625% preferred stock4 2020 $7 8.00% total unsecured debt $2,057 total company debt $3,085 Strong cash position and no significant debt maturities until September 2024 1 Includes restricted and unrestricted cash. 2 Gross debt outstanding (excludes discounts and deferred financing costs). 3 $150m swapped to fixed LIBOR of 1.175% as of 3/31/20. 7 4 Mandatorily redeemable in November 2020.

Pipeline Update Company Owned Pipeline & Recently Opened Hotels as of March 31, 2020 Under Option Pre-Development Under Construction Total Pipeline Opened YTD # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms 0 0 4 504 10 1,256 14 1,760 1 120 Third Party Pipeline & Recently Opened Hotels as of March 31, 2020 Commitments Applications Executed Total Pipeline Opened YTD # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms # Hotels # Rooms 27 3,348 5 588 27 3,132 59 7,068 1 113 Definitions Under Option Locations with a signed purchase and sale agreement Pre-Development Land purchased, permitting and/or site work Under Construction Hotel is under construction Commitments Signed commitment or build or convert a certain number of hotels by a third party, generally associated with a prior portfolio sale Applications Third party filed franchise application with deposit Executed Franchise and development application approved, geography identified and deposits paid, various stages of pre-development and/or under construction 8

appendix

REVPAR INDEX RevPAR Index is stated as a percentage and calculated by comparing RevPAR for comparable system-wide hotels to the aggregate RevPAR of a group of competing hotels generally in the same market. As such, the RevPAR Index is only a measure of RevPAR relative to certain competing hotels and not a measure of our absolute RevPAR or profitability. We subscribe to STR, Inc. ("STR"), an independent third-party service, which collects and compiles the data used to calculate RevPAR Index. We select the competing hotels included in the RevPAR Index calculation subject to STR's guidelines. The competing hotels included in STR guidelines will generally include certain hotels that are not considered part of the extended stay lodging segment of the hospitality industry and, instead, fall within the category of short-term stay hotels. STR does not endorse the Company, or any other company, and STR data should not be viewed as investment advice or as a recommendation to take a particular course of action. 10

Corporation Revolver Update The Company executed an amendment to the Corporation Revolving Credit Facility and obtained a suspension of the quarterly tested leverage covenant from the beginning of the second quarter of 2020 through the end of the first quarter of 2021. For the second quarter of 2021 through the fourth quarter of 2021, the leverage covenant calculation has been modified to use annualized EBITDA, as opposed to trailing twelve-month EBITDA. Additionally, the amendment provides for the Corporation to borrow up to $150.0 million from ESH REIT through an intercompany loan facility. During the suspension period, the Company has agreed to maintain minimum liquidity of $150.0 million and to limit share repurchases and dividend payments made by the Corporation. 11

NON-GAAP RECONCILIATION OF NET INCOME TO HOTEL OPERATING PROFIT AND HOTEL OPERATING MARGIN FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019 (In thousands) (Unaudited) Three Months Ended March 31, 2020 2019 Variance Net income $ 7,845 $ 28,404 (72.4)% Income tax expense 1,110 6,123 (81.9)% Interest expense, net 32,685 29,604 10.4% Other non-operating expense (income) 703 (178) (494.9)% Other income (2) (27) (92.6)% Depreciation and amortization 50,520 48,778 3.6% General and administrative expenses 23,938 23,027 4.0% Loss on disposal of assets(1) 3,343 1,376 143.0% Franchise and management fees (1,279) (1,225) 4.4% System services loss, net 417 552 (24.5)% Hotel Operating Profit $ 119,280 $ 136,434 (12.6)% Room revenues $ 254,464 $ 267,046 (4.7)% Other hotel revenues 6,768 5,303 27.6% Total room and other hotel revenues $ 261,232 $ 272,349 (4.1)% Hotel Operating Margin 45.7% 50.1% (440) bps (1) Included in hotel operating expenses in the consolidated statements of operations. 12

NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019 (In thousands) (Unaudited) Three Months Ended March 31, 2020 2019 Net income $ 7,845 $ 28,404 Interest expense, net 32,685 29,604 Income tax expense 1,110 6,123 Depreciation and amortization 50,520 48,778 EBITDA 92,160 112,909 Equity-based compensation 1,126 2,109 System services loss, net(1) 417 - Other expense(2) 4,046 1,293 Adjusted EBITDA $ 97,749 $ 116,311 (1) In light of the growth of our franchise business and in order to enhance comparability, effective January 1, 2020, the Company adopted the practice of other lodging companies with franchise businesses of excluding system services (profit) loss, net from Adjusted EBITDA; no adjustments have been made to prior period results. System services loss, net for the three months ended March 31, 2019, was $0.6 million. (2) Includes loss on disposal of assets, non-operating expense (income), including foreign currency transaction costs, and certain costs associated with dispositions. Loss on disposal of assets totaled $3.3 million and $1.4 million, respectively. 13

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO FUNDS FROM OPERATIONS, ADJUSTED FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS PER DILUTED PAIRED SHARE FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019 (In thousands, except per share and per Paired Share data) (Unaudited) Three Months Ended March 31, 2020 2019 Net income per Extended Stay America, Inc. common share - diluted $ 0.03 $ 0.12 Net income attributable to Extended Stay America, Inc. common shareholders $ 4,554 $ 21,934 Noncontrolling interests attributable to Class B 3,287 6,466 common shares of ESH REIT Real estate depreciation and amortization 48,881 47,433 Tax effect of adjustments to net income attributable to Extended Stay America, Inc. common (1,608) (7,400) shareholders Funds from Operations 55,114 68,433 Adjusted Funds from Operations $ 55,114 $ 68,433 Adjusted Funds from Operations per Paired Share – diluted $ 0.31 $ 0.36 Weighted average Paired Shares outstanding – diluted 178,171 188,576 14

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO PAIRED SHARE INCOME, ADJUSTED PAIRED SHARE INCOME AND ADJUSTED PAIRED SHARE INCOME PER DILUTED PAIRED SHARE FOR THE THREE MONTHS ENDED MARCH 31, 2020 AND 2019 (In thousands, except per share and per Paired Share data) (Unaudited) Three Months Ended March 31, 2020 2019 Net income per Extended Stay America, Inc. common share - diluted $ 0.03 $ 0.12 Net income attributable to Extended Stay America, Inc. common shareholders $ 4,554 $ 21,934 Noncontrolling interests attributable to Class B common shares of ESH REIT 3,287 6,466 Paired Share Income 7,841 28,400 System services loss, net(1) 417 - Other expense(2) 4,046 1,293 Tax effect of adjustments to Paired Share Income (147) (202) Adjusted Paired Share Income $ 12,157 $ 29,491 Adjusted Paired Share Income per Paired Share – diluted $ 0.07 $ 0.16 Weighted average Paired Shares outstanding – diluted 178,171 188,576 (1) In light of the growth of our franchise business and in order to enhance comparability, effective January 1, 2020, the Company adopted the practice of other lodging companies with franchise businesses of excluding system services (profit) loss, net from Adjusted Paired Share Income; no adjustments have been made to prior period results. System services loss, net for the three months ended March 31, 2019, was $0.6 million. (2) Includes loss on disposal of assets, non-operating expense (income), including foreign currency transaction costs, and certain costs associated with dispositions. Loss on disposal of assets totaled $3.3 million and $1.4 million, respectively. 15