Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENB Financial Corp | form8k-24143_enbf.htm |

• Welcome • Reading of the Minutes • Certify Voting Activity • Vote on Matters of the Proxy Statement • Discussion of Company Condition – President’s Remarks – Financial Review • Questions & Answers • Voting Results • Adjournment Agenda

Jeffrey S. Stauffer President and CEO – ENB Financial Corp and Ephrata National Bank Barry W. Harting Vice President and Corporate Secretary – ENB Financial Corp Senior Vice President and Chief Risk Officer – Ephrata National Bank Scott E. Lied Treasurer – ENB Financial Corp Senior Vice President and Chief Financial Officer – Ephrata National Bank Presenters

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Meeting Certification

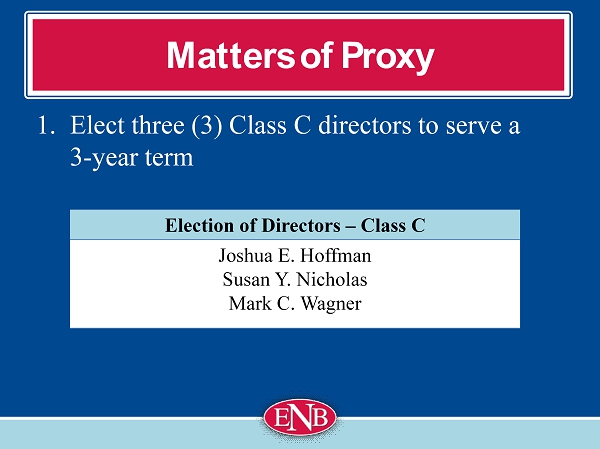

Matters of Proxy 1. Elect three (3) Class C directors to serve a 3 - year term 2. Ratify the selection of S.R. Snodgrass, P.C. 3. Transact other business

1. Elect three (3) Class C directors to serve a 3 - year term Matters of Proxy Election of Directors – Class C Joshua E. Hoffman Susan Y. Nicholas Mark C. Wagner

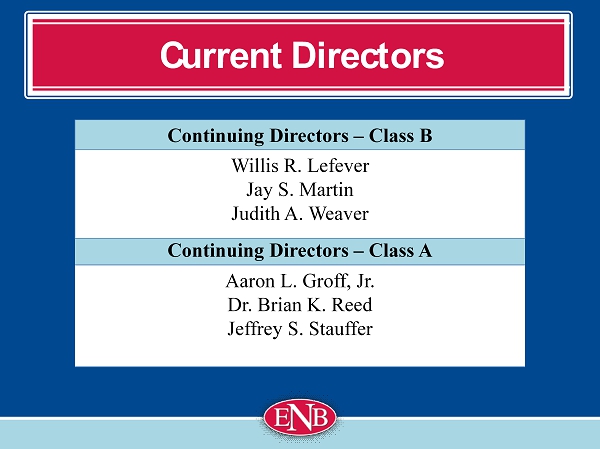

Current Directors Continuing Directors – Class A Aaron L. Groff, Jr. Dr. Brian K. Reed Jeffrey S. Stauffer Continuing Directors – Class B Willis R. Lefever Jay S. Martin Judith A. Weaver

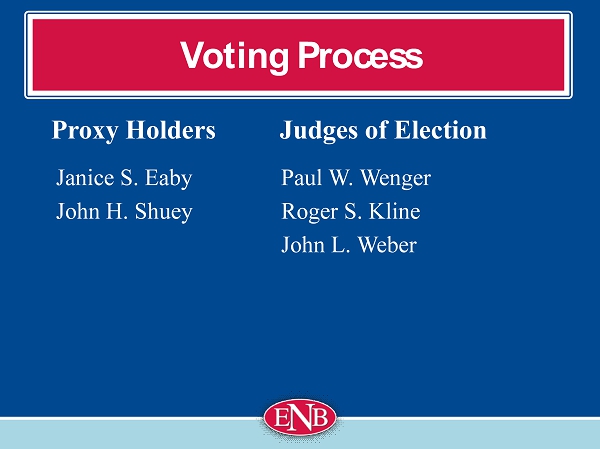

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Process

Voting Process Proxy Holders Janice S. Eaby John H. Shuey Judges of Election Paul W. Wenger Roger S. Kline John L. Weber

Presented by: Jeffrey S. Stauffer President & CEO - ENB Financial Corp President’s Remarks

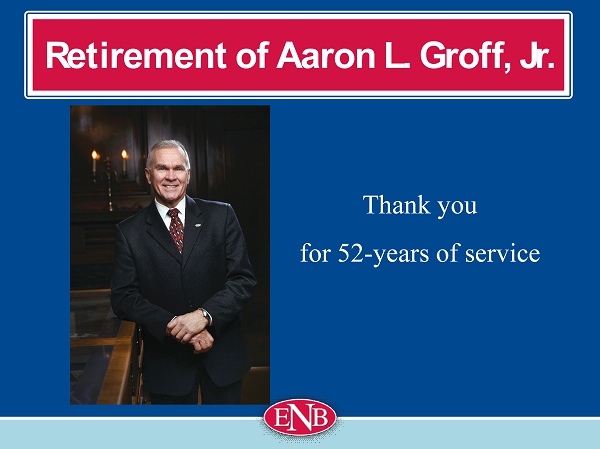

Goodbye to Paul Wenger

Thank you for 52 - years of service Retirement of Aaron L. Groff, Jr.

To remain an independent community bank of undisputed integrity, serving the communities of Lancaster County and beyond. To offer state - of - the - art financial products and services of high quality and value at an affordable price. To provide unsurpassed personal service, delivered by a highly dedicated professional team. Mission Statement

To help clients achieve financial success as defined by them by discovering their goals and dreams in order to provide helpful advice. Vision Statement

A Strategic Path Forward

A Strategic Path Forward Financial Perspective Financial growth and result Key Financial parameters and performance (ROE, ROCE) Higher Profit Margin Improved Cash Flow Lower Bad Loans and Lower Debt Net Interest Margin Reduced Overhead Expense Proper Revenue Mix Learning and Growth Develop Critical Skills and Knowledge Proper Knowledge Management Provide Strategic Information to All Align Personal Goals with Company Goals Employee Growth and Turnover Employee Satisfaction and Retention Customers Increase Customer Satisfaction Increase Customer Loyalty Retention of Key Customers Sales Revenue Per Customer Competitive Pricing and Product Offering High Quality Service Customer Preference Compared to Competitors Internal Business Processes Cross - sell Products Improve Operational Efficiency and Minimize Problems Proper Customer Relationship Management Higher Success Rate in Converting Business Opportunities Fast Business Decisions and Approvals Proper Work Culture and Higher Employee Confidence Balanced Scorecard

A Strategic Path Forward Attracting the Next Generation of Customers

New Markets & Opportunities Mortgage Lending Area Expansion

New Markets & Opportunities ENB Money Management Group Acquired Additional Trust Assets

Maintaining Customer Safety

Commitment to Customer Service

Making a Difference

Employee Engagement

COVID - 19 Response

Presented by: Scott E. Lied Treasurer - ENB Financial Corp Financial Results

Unaudited Financial Information Some of the following slides do present financial information that is unaudited. Therefore, this information is subject to adjustments that could be necessary upon completion of the annual audit. Forward Looking Statements Some of the material and/or language used in this presentation would be considered as a forward looking statement. Management is not obligated to update these forward looking statements. Disclosures

Net Income 0 2,000 4,000 6,000 8,000 10,000 12,000 2015 2016 2017 2018 2019 6,910 7,553 6,344 9,749 11,395 Dollars in Thousands

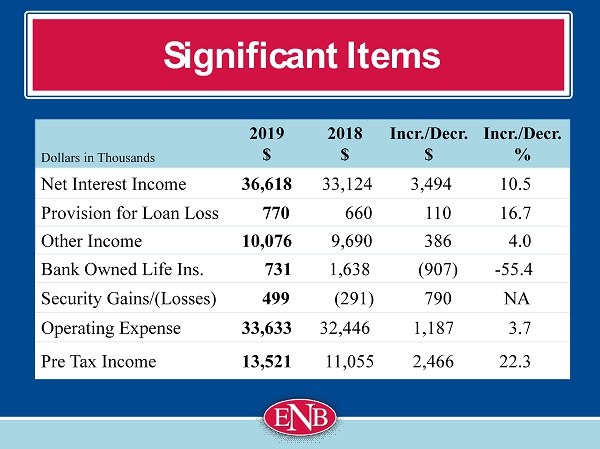

Significant Items Dollars in Thousands 2019 $ 2018 $ Incr./ Decr . $ Incr./ Decr . % Net Interest Income 36,618 33,124 3,494 10.5 Provision for Loan Loss 770 660 110 16.7 Other Income 10,076 9,690 386 4.0 Bank Owned Life Ins. 731 1,638 (907) - 55.4 Security Gains/(Losses) 499 (291) 790 NA Operating Expense 33,633 32,446 1,187 3.7 Pre Tax Income 13,521 11,055 2,466 22.3

2019 Balance Sheet Growth Total Assets up $73.9 million + 6.7% Total Loans up $59.5 million + 8.6% Total Deposits up $54.4 million + 5.9% Total Capital up $13.9 million +13.5%

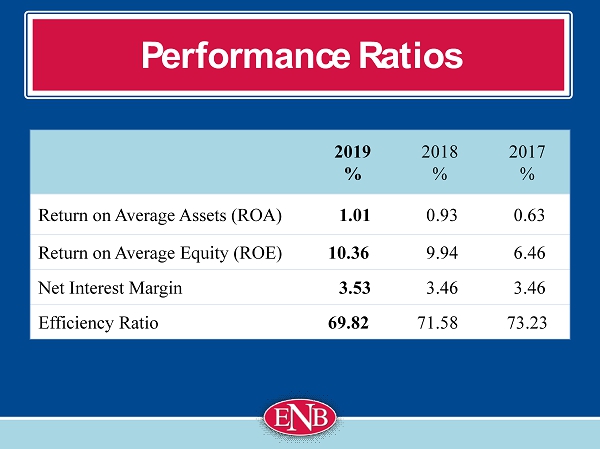

Performance Ratios 2019 % 2018 % 2017 % Return on Average Assets (ROA) 1.01 0.93 0.63 Return on Average Equity (ROE) 10.36 9.94 6.46 Net Interest Margin 3.53 3.46 3.46 Efficiency Ratio 69.82 71.58 73.23

Per Share Data 2019 2018 2017 Earnings Per Share $2.010 $1.710 $1.120 Dividends Per Share $0.620 $0.575 $0.560 Dividend Payout Ratio 30.85% 33.63 % 50.22%

2019 Peer Analysis Measurement ENBP % PA Bank Peer* % Return on Average Assets LTM 1.01 1.01 Core Return on Average Equity 10.36 9.82 Price to Earnings LTM 9.20 9.60 Price to Tangible Book 0.89 0.99 Dividend Yield 3.08 2.73 *Data as of December 31, 2019 from Boenning & Scattergood, Inc., 1 st Qtr. 2020 Mid - Atlantic Regional Bank & Thrift Review consisting of 70 publically traded PA headquartered banks.

2019 Peer Analysis Measurement ENBP % PA Bank Peer* % Tangible Capital to Assets 10.0 9.7 Tier 1 Ratio 13.4 12.8 Total Capital Ratio 14.5 14.5 Efficiency Ratio (Adjusted) 69.8 64.5 Non - Performing Assets/Total Assets 0.34 0.57 Allowance for Loan Losses 1.25 1.04 *Data as of December 31, 2019 from Boenning & Scattergood, Inc., 1 st Qtr. 2020 Mid - Atlantic Regional Bank & Thrift Review consisting of 70 publically traded PA Banks.

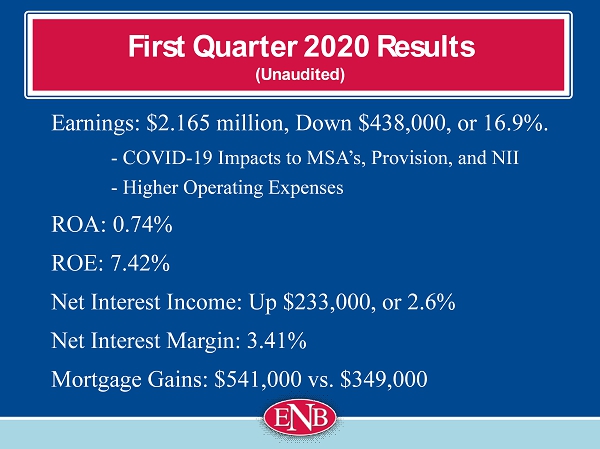

First Quarter 2020 Results (Unaudited) Earnings: $2.165 million, Down $438,000, or 16.9%. - COVID - 19 Impacts to MSA’s, Provision, and NII - Higher Operating Expenses ROA: 0.74% ROE: 7.42% Net Interest Income: Up $233,000, or 2.6% Net Interest Margin: 3.41% Mortgage Gains: $541,000 vs. $ 349,000

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Results

Questions & Answers