Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Corteva, Inc. | q120earningspresentation.htm |

| EX-99.2 - EX-99.2 - Corteva, Inc. | a33120enr.htm |

| 8-K - 8-K - Corteva, Inc. | a331208kenr.htm |

News Release 1Q 2020 Corteva Reports First Quarter 2020 Results Company Delivers Double-Digit Sales and Earnings Increases Over Prior Year – Implements Initiatives to Ensure Business Continuity and Employee Safety WILMINGTON, Del., May 6, 2020 – Corteva, Inc. (NYSE: CTVA) (“Corteva” or the “Company”) today reported financial results for the quarter ended March 31, 2020. 1Q 2020 Results Overview Income from Cont. Net Sales EPS Ops. (After Tax) GAAP $4.0 B $0.36 $281 M vs. 1Q 20192 +16% +157% +151% Organic Sales1 Operating EPS1 Operating EBITDA1 NON-GAAP $4.1 B $0.59 $794 M vs. 1Q 20192 +20% +79% +53% • First quarter 2020 reported net sales were $4.0 billion, • Operating EPS was $0.59, up 79% and operating up 16% versus the year-ago period, with double-digit EBITDA was $794 million, up 53% versus the same organic sales1 growth in every region. quarter last year, as volume and price gains and • Seed sales rose 25% on a reported basis and 27% on ongoing cost-improvement actions more than offset an organic1 basis primarily due to increased corn exchange losses and currency headwinds. deliveries in North America3, coupled with strong • Merger cost synergies for the three months ended sunflower and corn sales in Europe. March 31, 2020 totaled approximately $70 million, • Crop Protection sales improved 5% on a reported basis reflecting continued progress on productivity initiatives. and 10% on an organic basis1 due to increased demand • The Company continues to monitor near-term for new products globally, including ArylexTM and operating conditions with a focus on business continuity EnlistTM herbicides. – and maintains strong liquidity via commercial paper • GAAP earnings per share (EPS) from continuing markets and $8 billion in credit facilities, cash and cash operations were $0.36, up 157% as compared with the equivalents. same quarter last year. • Management suspends full-year 2020 guidance in light • GAAP income from continuing operations after taxes of the COVID-19 crisis and the uncertainty it is creating was $281 million, up 151% versus the prior-year period. across global markets, including currency and commodity markets. “Driven by our purpose, Corteva has come together with industry, government, and society during this challenging global economic and health crisis to proactively drive solutions and to serve farmers and communities when they need us most. We quickly mobilized to ensure the safety of our employees and continued support for our customers – and worked collaboratively across industry and government lines to shape effective policies to avoid disruptions in our supply chain, helping to mitigate impacts to food security more broadly. This level of collaborative coordination is essential as Corteva is a global citizen with an operational footprint that spans over 140 countries and includes a global workforce that serves over 10 million customers each year. Our global diversity, collaborative approach, and dedicated team produced solid financial and operating results in the quarter, despite a difficult environment – and while more uncertainty lies ahead, we are committed to working transparently with our stakeholders as we navigate this historic time for our industry and our world.” – James C. Collins, Jr., Corteva Chief Executive Officer 1. Organic sales, Organic Growth (including by segment and region), Operating EPS, Pro Forma Operating EPS, Operating EBITDA, and Pro Forma Operating EBITDA are non -GAAP measures. See page 6 of this release for further discussion. 2. First Quarter 2019 GAAP information is on a pro forma basis and was determined in accordance with Article 11 of Regulation S-X. Non-GAAP measures for this period are reconciled to the GAAP pro forma measure. 3. North America is defined as U.S. and Canada. EMEA is defined as Europe, Middle East and Africa.

News Release 1Q 2020 Company Update: Delivering on Product Pipeline Delivering for Stakeholders and Executing Corteva recently announced the first registration of Inatreq™ with Strength and Resilience Amidst active in Europe – the latest in a series of early registrations for products with favorable environmental profiles. In Seed, COVID-19 ® increased adoption of new technology, including Qrome and PowerCore® ULTRA, enabled Corteva to gain Ensuring Employee Safety momentum in North America and Latin America despite a Corteva has taken a proactive approach to ensure competitive and challenging environment – an example of employee safety. The Company implemented travel the value the Seed pipeline delivers for farmers. restrictions early and transitioned more than 50% of employees to work from home, while taking advanced Demonstrating Supply Chain Resilience safety measures for all personnel onsite. The Company has designed its Crop Protection and Seed supply chains with reliability, flexibility and long-term competitive advantages in mind. In Crop Protection, greater Prioritizing Customer Service & Support than 80% of Corteva’s global supply chain has sourcing The Company continued to deliver for customers through flexibility with more than 65% coming from U.S. sources – increased use of digital capabilities and implementation and inventory along the value chain for added agility. In of robust safety practices, executing product deliveries, Seed, the Company produces products regionally, as well as providing agronomic services and technical partnering with a diverse network of local growers around the product support for new product launches via new tools. world to maximize the flexibility and resilience of its supply. Serving Local Communities, Globally Progressing Cost and Productivity Initiatives The Company is supporting local food banks, food Corteva continues to drive strong execution through ongoing pantries, and meal delivery and packaging services to progress on merger-related cost synergies and productivity fight global food insecurity – while also donating hand commitments. Specifically in Seed, recent actions reflect a sanitizer and personal protective equipment and continued focus on internal efficiencies through seed field providing COVID-19 testing to support local hospitals. productivity, inventory management, and asset footprint optimization. Summary of First Quarter 2020 and portfolio represented headwinds of 3% and 1%, For the first quarter ended March 31, 2020, reported net respectively. sales increased 16% versus the same quarter last year, with organic sales1 increases of 20%. GAAP income from continuing operations after income taxes was $281 million for the first quarter. Operating Volumes increased 17% versus the prior-year period. EBITDA1 was $794 million, a $276 million improvement Gains were driven by strong early demand for corn seed versus the same period last year on a pro forma basis2. in North America attributable to favorable weather conditions in anticipation of higher planted area. Strong Seed Operating EBITDA improvement reflects volume execution globally, particularly in EMEA3 from robust gains from increased seed deliveries, primarily in North early demand due to perceived supply concerns from America, pricing gains from improved mix, and continued COVID-19, further drove year-over-year volume gains. productivity actions. Crop Protection operating EBITDA Crop Protection volume growth was due to increased improvement reflects merger-related cost synergies and sales of new products, including ArylexTM and EnlistTM ongoing productivity. herbicides and IsoclastTM insecticide. The Company reported GAAP EPS from continuing Local price increased 3% versus the prior-year period, operations of $0.36 and operating EPS1 of $0.59 for the with higher prices on improved mix from new seed first quarter 2020. products in North America and Latin America. Currency ($ in millions, 1Q 1Q % % except where noted) 2020 2019 Change Organic Change1 Net Sales $3,956 $3,396 16% 20% North America $1,765 $1,392 27% 28% EMEA $1,467 $1,364 8% 11% Latin America $434 $365 19% 30% Asia Pacific $290 $275 5% 10% 2

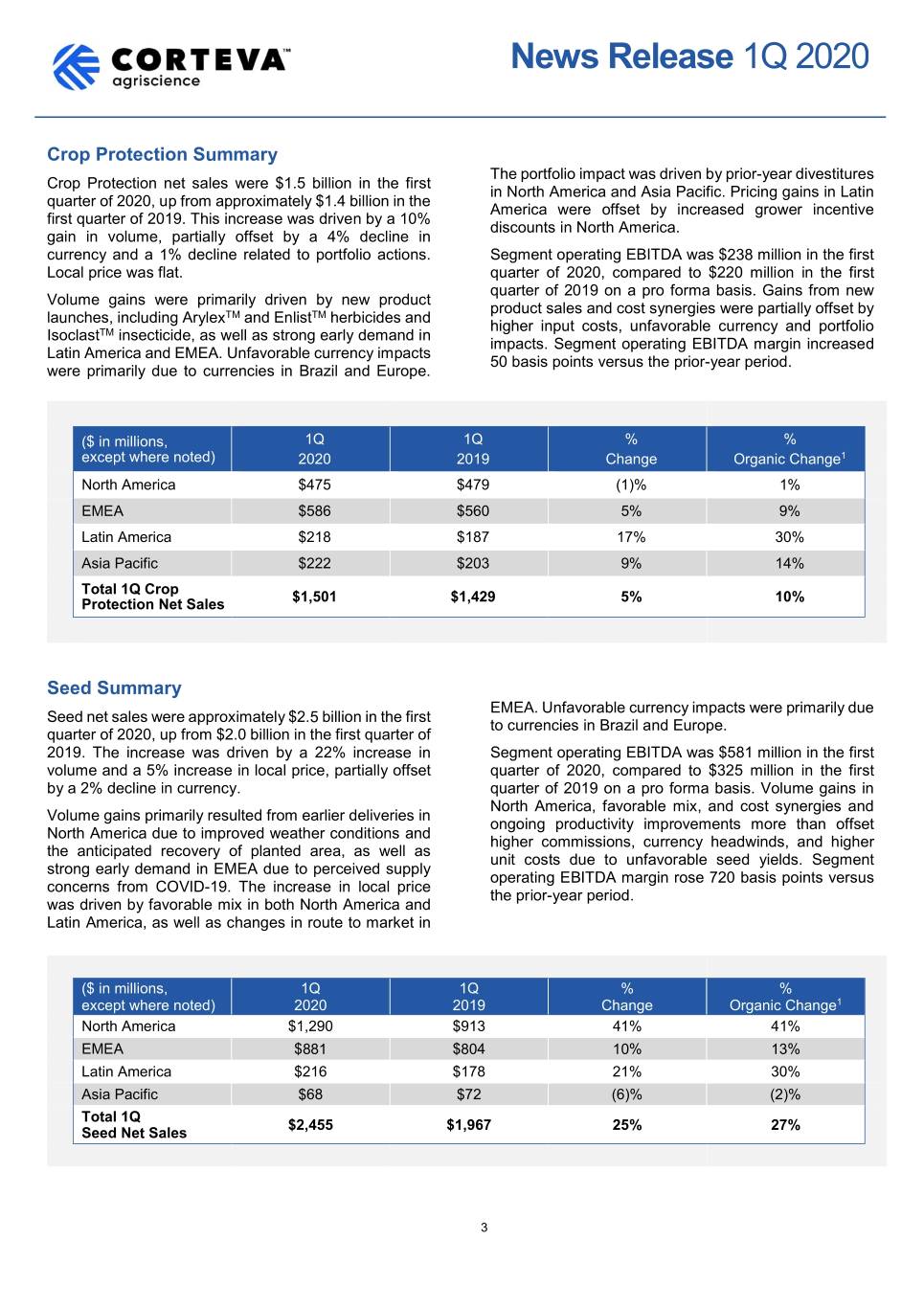

News Release 1Q 2020 Crop Protection Summary The portfolio impact was driven by prior-year divestitures Crop Protection net sales were $1.5 billion in the first in North America and Asia Pacific. Pricing gains in Latin quarter of 2020, up from approximately $1.4 billion in the America were offset by increased grower incentive first quarter of 2019. This increase was driven by a 10% discounts in North America. gain in volume, partially offset by a 4% decline in currency and a 1% decline related to portfolio actions. Segment operating EBITDA was $238 million in the first Local price was flat. quarter of 2020, compared to $220 million in the first quarter of 2019 on a pro forma basis. Gains from new Volume gains were primarily driven by new product product sales and cost synergies were partially offset by launches, including ArylexTM and EnlistTM herbicides and higher input costs, unfavorable currency and portfolio IsoclastTM insecticide, as well as strong early demand in impacts. Segment operating EBITDA margin increased Latin America and EMEA. Unfavorable currency impacts 50 basis points versus the prior-year period. were primarily due to currencies in Brazil and Europe. ($ in millions, 1Q 1Q % % except where noted) 2020 2019 Change Organic Change1 North America $475 $479 (1)% 1% EMEA $586 $560 5% 9% Latin America $218 $187 17% 30% Asia Pacific $222 $203 9% 14% Total 1Q Crop $1,501 $1,429 5% 10% Protection Net Sales Seed Summary EMEA. Unfavorable currency impacts were primarily due Seed net sales were approximately $2.5 billion in the first to currencies in Brazil and Europe. quarter of 2020, up from $2.0 billion in the first quarter of 2019. The increase was driven by a 22% increase in Segment operating EBITDA was $581 million in the first volume and a 5% increase in local price, partially offset quarter of 2020, compared to $325 million in the first by a 2% decline in currency. quarter of 2019 on a pro forma basis. Volume gains in North America, favorable mix, and cost synergies and Volume gains primarily resulted from earlier deliveries in ongoing productivity improvements more than offset North America due to improved weather conditions and higher commissions, currency headwinds, and higher the anticipated recovery of planted area, as well as unit costs due to unfavorable seed yields. Segment strong early demand in EMEA due to perceived supply operating EBITDA margin rose 720 basis points versus concerns from COVID-19. The increase in local price the prior-year period. was driven by favorable mix in both North America and Latin America, as well as changes in route to market in ($ in millions, 1Q 1Q % % except where noted) 2020 2019 Change Organic Change1 North America $1,290 $913 41% 41% EMEA $881 $804 10% 13% Latin America $216 $178 21% 30% Asia Pacific $68 $72 (6)% (2)% Total 1Q $2,455 $1,967 25% 27% Seed Net Sales 3

News Release 1Q 2020 Comments on Balance Sheet paper resulting from the unstable market conditions The Company maintains a strong balance sheet and caused by COVID-19. Corteva operates with access to flexible financing tools which enable it to approximately $8 billion in liquidity through cash, cash effectively operate its customer-focused business equivalents and revolving credit facilities. Management model. Corteva relies heavily on commercial paper for is focused on accelerating working capital productivity, working capital needs. The Company drew down $500 optimizing capital expenditures, and driving cost million from its $6 billion in available credit facilities, due measures to ensure it maintains its strong balance sheet to volatility and increased borrowing costs of commercial position. Outlook Management has decided to suspend full-year 2020 As conditions evolve, Corteva remains committed to guidance in light of the COVID-19 crisis. This decision providing further transparency on its actions in response acknowledges the uncertainty in global markets, to the COVID-19 crisis. specifically currency and key commodity markets, such The Company believes it continues to be well-positioned as ethanol, that can impact demand for our products. to navigate this uncertainty with its solid cash position The Company continues to monitor near-term operating and strong access to liquidity. Looking forward, conditions to ensure business continuity. Global teams management will continue to implement cost-synergy remain focused on tracking changes in production and actions and accelerate productivity initiatives, while at supply, demand dynamics, and impacts from the same time driving new product launches and government actions – while working closely with ramping up new technologies. Corteva will continue to customers and stakeholders. evaluate its plans as conditions require. First Quarter Conference Call The Company will host a live webcast of its first quarter conference call is posted on the Company’s Investor earnings conference call with investors to discuss its Events and Presentations page. A replay of the webcast results and outlook tomorrow, May 7, 2020, at 9:00 a.m. will also be available on the Investor Events and ET. The slide presentation that accompanies the Presentations page. 4

News Release 1Q 2020 About Corteva Agriscience Corteva, Inc. (NYSE: CTVA) is a publicly traded, global pure-play agriculture company that provides farmers around the world with the most complete portfolio in the industry – including a balanced and diverse mix of seed, crop protection and digital solutions focused on maximizing productivity to enhance yield and profitability. With some of the most recognized brands in agriculture and an industry-leading product and technology pipeline well positioned to drive growth, the Company is committed to working with stakeholders throughout the food system as it fulfils its promise to enrich the lives of those who produce and those who consume, ensuring progress for generations to come. Corteva became an independent public company on June 1, 2019, and was previously the Agriculture Division of DowDuPont. More information can be found at www.corteva.com. Follow Corteva on Facebook, Instagram, LinkedIn, Twitter and YouTube. Cautionary Statement About Forward-Looking Statements This communication contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, which are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and may be identified by their use of words like “guidance”, "plans," "expects," "will," "anticipates," "believes," "intends," "projects," "estimates" or other words of similar meaning. All statements that address expectations or projections about the future, including statements about Corteva's strategy for growth, product development, regulatory approval, market position, anticipated benefits of recent acquisitions, timing of anticipated benefits from restructuring actions, outcome of contingencies, such as litigation and environmental matters, expenditures, and financial results, as well as expected benefits from, the separation of Corteva from DowDuPont, are forward-looking statements. Forward-looking statements are based on certain assumptions and expectations of future events which may not be accurate or realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond Corteva's control. While the list of factors presented below is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Corteva's business, results of operations and financial condition. Some of the important factors that could cause Corteva's actual results to differ materially from those projected in any such forward-looking statements include: (i) failure to successfully develop and commercialize Corteva's pipeline; (ii) effect of competition and consolidation in Corteva's industry; (iii) failure to obtain or maintain the necessary regulatory approvals for some Corteva's products; (iv) failure to enforce Corteva's intellectual property rights or defend against intellectual property claims asserted by others; (v) effect of competition from manufacturers of generic products; (vi) impact of Corteva's dependence on third parties with respect to certain of its raw materials or licenses and commercialization; (vii) costs of complying with evolving regulatory requirements and the effect of actual or alleged violations of environmental laws or permit requirements; (viii) effect of the degree of public understanding and acceptance or perceived public acceptance of Corteva's biotechnology and other agricultural products; (ix) effect of changes in agricultural and related policies of governments and international organizations; (x) effect of industrial espionage and other disruptions to Corteva's supply chain, information technology or network systems; (xi) competitor's establishment of an intermediary platform for distribution of Corteva's products; (xii) effect of volatility in Corteva's input costs; (xiii) failure to raise capital through the capital markets or short-term borrowings on terms acceptable to Corteva; (xiv) failure of Corteva's customers to pay their debts to Corteva, including customer financing programs; (xv) failure to realize the anticipated benefits of the internal reorganizations taken by DowDuPont in connection with the spin-off of Corteva, including failure to benefit from significant cost synergies; (xvi) risks related to the indemnification obligations of legacy EID liabilities in connection with the separation of Corteva; (xvii) increases in pension and other post-employment benefit plan funding obligations; (xviii) effect of compliance with environmental laws and requirements and adverse judgments on litigation; (xix) risks related to Corteva's global operations; (xx) effect of climate change and unpredictable seasonal and weather factors; (xxi) effect of counterfeit products; (xxii) failure to effectively manage acquisitions, divestitures, alliances and other portfolio actions; (xxiii) risks related to non-cash charges from impairment of goodwill or intangibles assets; (xxiv) risks related to COVID-19; (xxv) risks related to oil and commodity markets; and (xxvi) other risks related to the Separation from DowDuPont. Additionally, there may be other risks and uncertainties that Corteva is unable to currently identify or that Corteva does not currently expect to have a material impact on its business. Where, in any forward-looking statement, an expectation or belief as to future results or events is expressed, such expectation or belief is based on the current plans and expectations of Corteva's management and expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the expectation or belief will result or be achieved or accomplished. Corteva disclaims and does not undertake any obligation to update or revise any forward-looking statement, except as required by applicable law. A detailed discussion of some of the significant risks and uncertainties which may cause results and events to differ materially from such forward-looking statements or other estimates is included in the “Risk Factors” section of Corteva’s Annual Report on Form 10-K, as modified by subsequent Quarterly Reports on Forms 10-Q and Current Reports on Form 8-K. Corteva Unaudited Pro Forma Financial Information In order to provide the most meaningful comparison of results of operations, supplemental unaudited pro forma financial information for the first quarter of 2019 has been included in this presentation. This presentation presents the pro forma results of Corteva, after giving effect to events that are (1) directly attributable to the merger of DuPont and Dow, debt retirement transactions related to paying off or retiring portions of Historical DuPont’s existing debt liabilities, and the separation and distribution to DowDuPont stockholders of all the outstanding shares of Corteva common stock; (2) factually supportable and (3) with respect to the pro forma statements of income, expected to have a continuing impact on the consolidated results. Refer to Corteva’s Form 10 registration statement filed on May 6, 2019, which can be found on the investors section of the Corteva website, for further details on the above transactions. The pro forma financial statements were prepared in accordance with Article 11 of Regulation S-X, and are presented for informational purposes only, and do not purport to represent what the results of operations would have been had the above actually occurred on the dates indicated, nor do they purport to project the results of operations for any future period or as of any future date. 5

News Release 1Q 2020 Regulation G (Non-GAAP Financial Measures) This earnings release includes information that does not conform to U.S. GAAP and are considered non-GAAP measures. These measures may include organic sales, organic growth (including by segment and region), operating EBITDA, pro forma operating EBITDA, operating EBITDA margin, pro forma operating EBITDA margin, operating earnings per share, pro forma operating earnings per share, base tax rate, and pro forma base tax rate. Management believes that these non-GAAP measures best reflect the ongoing performance of the Company during the periods presented and provide more relevant and meaningful information to investors as they provide insight with respect to ongoing operating results of the Company and a more useful comparison of year over year results. These non-GAAP measures supplement the Company's U.S. GAAP disclosures and should not be viewed as an alternative to U.S. GAAP measures of performance. Furthermore, such non-GAAP measures may not be consistent with similar measures provided or used by other companies. Reconciliations for these non-GAAP measures to U.S. GAAP are provided in the Selected Financial Information and Non-GAAP Measures starting on page A-6 of the Financial Statement Schedules. For first quarter and prior year, these non-GAAP measures are being reconciled to a pro forma GAAP financial measure prepared and presented in accordance with Article 11 of Regulation S-X. See Article 11 Pro Forma Combined Statements of Operations starting on page A-13 of the Financial Statement Schedules. Organic sales is defined as price and volume and excludes currency and portfolio impacts. Operating EBITDA is defined as earnings (i.e., income from continuing operations before income taxes) before interest, depreciation, amortization, non-operating benefits , net and foreign exchange gains (losses), excluding the impact of significant items (including goodwill impairment charges). Non-operating benefits, net consists of non-operating pension and other post-employment benefit (OPEB) credits, tax indemnification adjustments, environmental remediation and legal costs associated with legacy businesses and sites of Historical DuPont. Tax indemnification adjustments relate to changes in indemnification balances, as a result of the application of the terms of the Tax Matters Agreement, between Corteva and Dow and/or DuPont that are recorded by the company as pre-tax income or expense. Operating EBITDA margin is defined as Operating EBITDA as a percentage of net sales. Operating earnings per share are defined as "Earnings per common share from continuing operations - diluted" excluding the after-tax impact of significant items (including goodwill impairment charges), the after-tax impact of non-operating benefits, net, and the after-tax impact of amortization expense associated with intangible assets existing as of the Separation from DowDuPont. Although amortization of the Company's intangible assets is excluded from these non-GAAP measures, management believes it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in amortization of additional intangible assets. Base tax rate is defined as the effective tax rate excluding the impacts of foreign exchange gains (losses), non-operating benefits, net, amortization of intangibles as of the Separation from DowDuPont, and significant items (including goodwill impairment charges). The first quarter of 2019 is on a pro forma basis as discussed above in the paragraph ‘Corteva Unaudited Pro Forma Financial Information’. ® TM SM Trademarks and service marks of Dow AgroSciences, DuPont or Pioneer, and their affiliated companies or their respective owners. # # # 05/06/20 Media Contact: Gregg M. Schmidt +1 302-485-3260 gregg.m.schmidt@corteva.com Investor Contact: Megan Britt +1 302-485-3279 megan.britt@corteva.com 6