Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OCEANFIRST FINANCIAL CORP | ocfc8-kinvestorpresent.htm |

. . . Exhibit 99.1 OceanFirst Financial Corp. Investor Presentation May 2020

INVESTOR PRESENTATION . . . Forward Looking Statements In addition to historical information, this presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 which are based on certain assumptions and describe future plans, strategies and expectations of the Company. These forward-looking statements are generally identified by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “will,” “should,” “may,” “view,” “opportunity,” “potential,” or similar expressions or expressions of confidence. The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse effect on the operations of the Company and its subsidiaries include, but are not limited to: changes in interest rates, general economic conditions, public health crises (such as governmental, social and economic effects of the novel coronavirus), levels of unemployment in the Bank’s lending area, real estate market values in the Bank’s lending area, future natural disasters and increases to flood insurance premiums, increased defaults as a result of economic disruptions caused by novel coronavirus, the level of prepayments on loans and mortgage- backed securities, legislative/regulatory changes (particularly with respect to the novel coronavirus), monetary and fiscal policies of the U.S. Government including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System, the quality or composition of the loan or investment portfolios, demand for loan products, deposit flows, competition, demand for financial services in the Company’s market area, accounting principles and guidelines and the Bank’s ability to successfully integrate acquired operations. These risks and uncertainties are further discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, under Item 1A - Risk Factors and elsewhere, and subsequent securities filings and should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. No Offer or Solicitation: The Presentation does not constitute or form part of, and should not be construed as, an offer to sell or issue, or the solicitation of an offer to purchase, subscribe to or acquire, securities of the Company, or an inducement to enter into investment activity in the United States or in any other jurisdiction in which such offer, solicitation, inducement or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of such jurisdiction. No part of this Presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. 2

. . . About OceanFirst Financial Corp. 3

INVESTOR PRESENTATION . . . OceanFirst Financial Corp. • NASDAQ: OCFC • Market Cap: $997million1 • Bank Holding Company with National Bank Subsidiary • Founded in 1902 • Total Assets of $10.5 billion2 • 75 Full-Service Branches in New Jersey and Metropolitan New York City3 Headquarters OceanFirst Bank Branches OceanFirst Bank Loan Offices 1 As of April 30, 2020 4 2 As of March 31, 2020 3 13 branches will be consolidated on May 15, 2020 leaving 62 full-service branches

INVESTOR PRESENTATION . . . Investment Thesis • Organic Growth Including Low-Cost and Durable Deposit Base • Cost of deposits is one of the lowest in the state of New Jersey at 70 basis points • Strength of Assets • Strong and diversified balance sheet underpins flexibility to grow the business • Digital Innovation • Digital products and customer experience on par with national banks and FinTechs, far outpacing regional and community banks • Disciplined and Strategic M&A • Acquired attractive and underappreciated assets in exurban markets at favorable prices • Bench Strength • Deep banking, regulatory, M&A, and integration experience • Conservative Risk Culture • Commitment to management of credit, interest rate and regulatory / compliance risk • Insider Ownership • Substantial insider ownership aligned with shareholder interest 5

INVESTOR PRESENTATION . . . Commitment to Execution Our Recent Accomplishments... …Lead to Our Path Forward • Seven Acquisitions Closed in Less Than • Local to Regional Scale Five Years, Including Two River Bancorp (NASDAQ: TRCB) & Country Bank • Increased Investment in Digital Banking Holding Company Inc. (OTC PINK: CYHC) & Customer Engagement closed effective January 1, 2020 • Maximizing Real Estate to Anticipate the • Consolidated 40 Branches in the Last Evolving Needs of our Employees and Three Years with Nominal Deposit Customers Losses, while Realizing Substantial Cost Savings. An additional 13 Branches to • Further Loan Portfolio Diversification: be Consolidated on May 15, 2020 Sector, Industry, Geography and Vintage • “Digital Culture” Adopted Throughout the Bank 6

. . . Our Business 7

INVESTOR PRESENTATION . . . First Quarter 2020 Highlights Financial Highlights Operational Highlights • Core Net Income of $27.0 million • Acquisitions of Two River and Country • Core Diluted EPS of $0.45 Bank completed on January 1, 2020, with • Net Interest Margin of 3.52% full integration of Two River on target for mid-May completion • Strong Core ROA of 1.05%, and Core ROTE of 12.25% • Branch consolidation • Improved core efficiency ratio to 55.36% • 13 planned in 2020 from 56.73% in the linked quarter, even • Adopted CECL with an increased credit with additional $1.0 million COVID-19 loss expense by $9.6 million from prior operating expense linked quarter • Record loan pipeline of $525.3 million at • COVID-19 initiatives for employees, March 31, 2020 with substantial customers, and community contributions from metropolitan New York City and greater Philadelphia markets 8

INVESTOR PRESENTATION . . . ACL Components In addition to the Allowance for Credit Losses, there is $38 million in net unamortized purchase accounting credit marks. 9

INVESTOR PRESENTATION . . . PPP Application Status $10M 141 2K Loans approved to date have an estimated fee income of approximately $17.1 million that will be realized in future quarters. 10 Data as of May 3, 2020

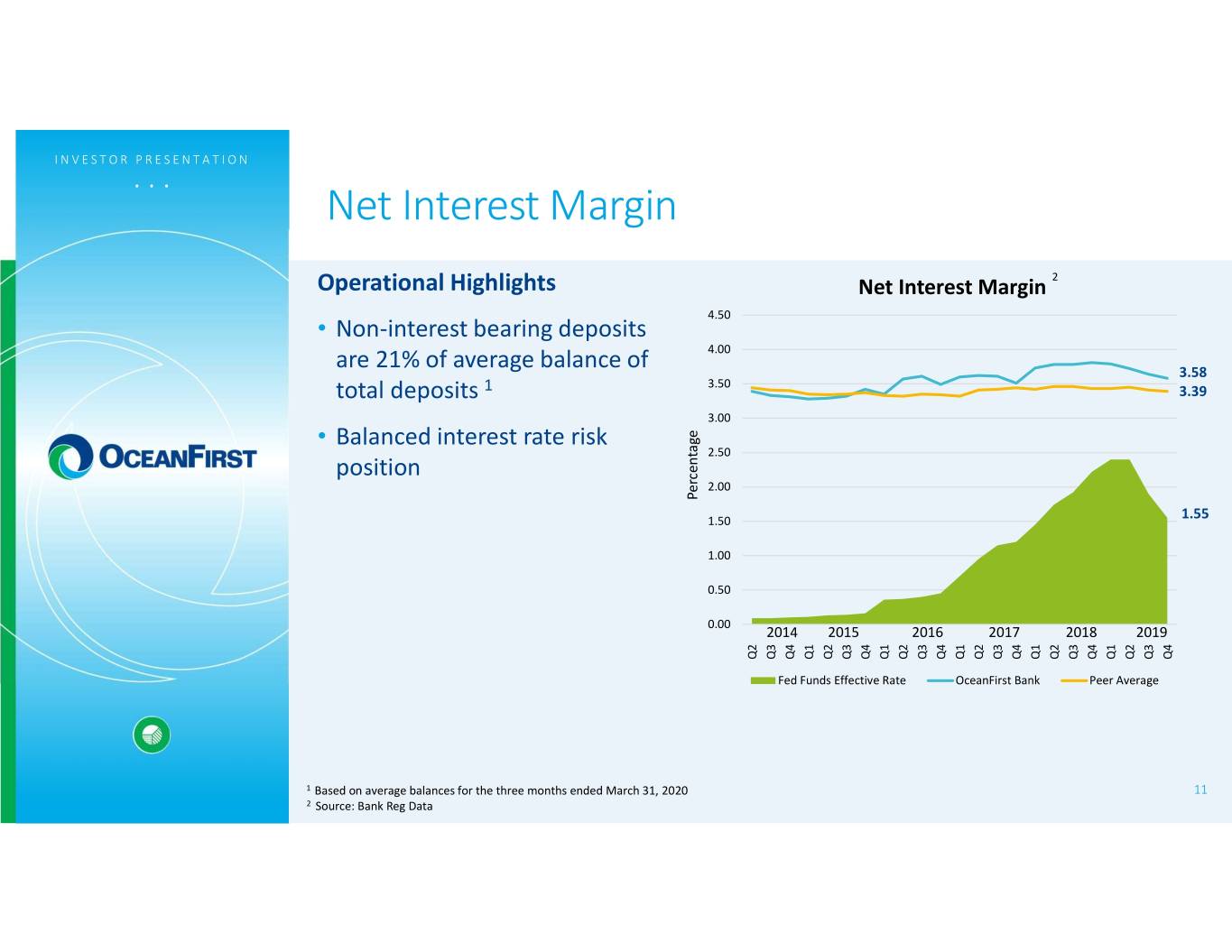

INVESTOR PRESENTATION . . . Net Interest Margin Operational Highlights Net Interest Margin 2 4.50 • Non-interest bearing deposits 4.00 are 21% of average balance of 3.58 3.50 total deposits 1 3.39 3.00 • Balanced interest rate risk 2.50 position 2.00 Percentage 1.50 1.55 1.00 0.50 0.00 2014 2015 2016 2017 2018 2019 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Fed Funds Effective Rate OceanFirst Bank Peer Average 1 Based on average balances for the three months ended March 31, 2020 11 2 Source: Bank Reg Data

INVESTOR PRESENTATION . . . Effective Interest Rate Risk Management Duration 5.0 All asset categories managed with limited duration 4.0 3.0 Years 2.0 1.0 0.0 Securities Mortgage Loans Consumer Loans Commercial Loans Total Assets FHLB Term Time Deposits (Weighted Average) Borrowings Rate Characteristics 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% Mortgage Loans Consumer Loans Commercial Loans Securities Total Assets Borrowings1 Deposits (CRE & C&I) (Weighted Average) Adjustable/Floating Fixed Core Deposits, Administered 12 At March 31, 2020 1 Includes overnight advances

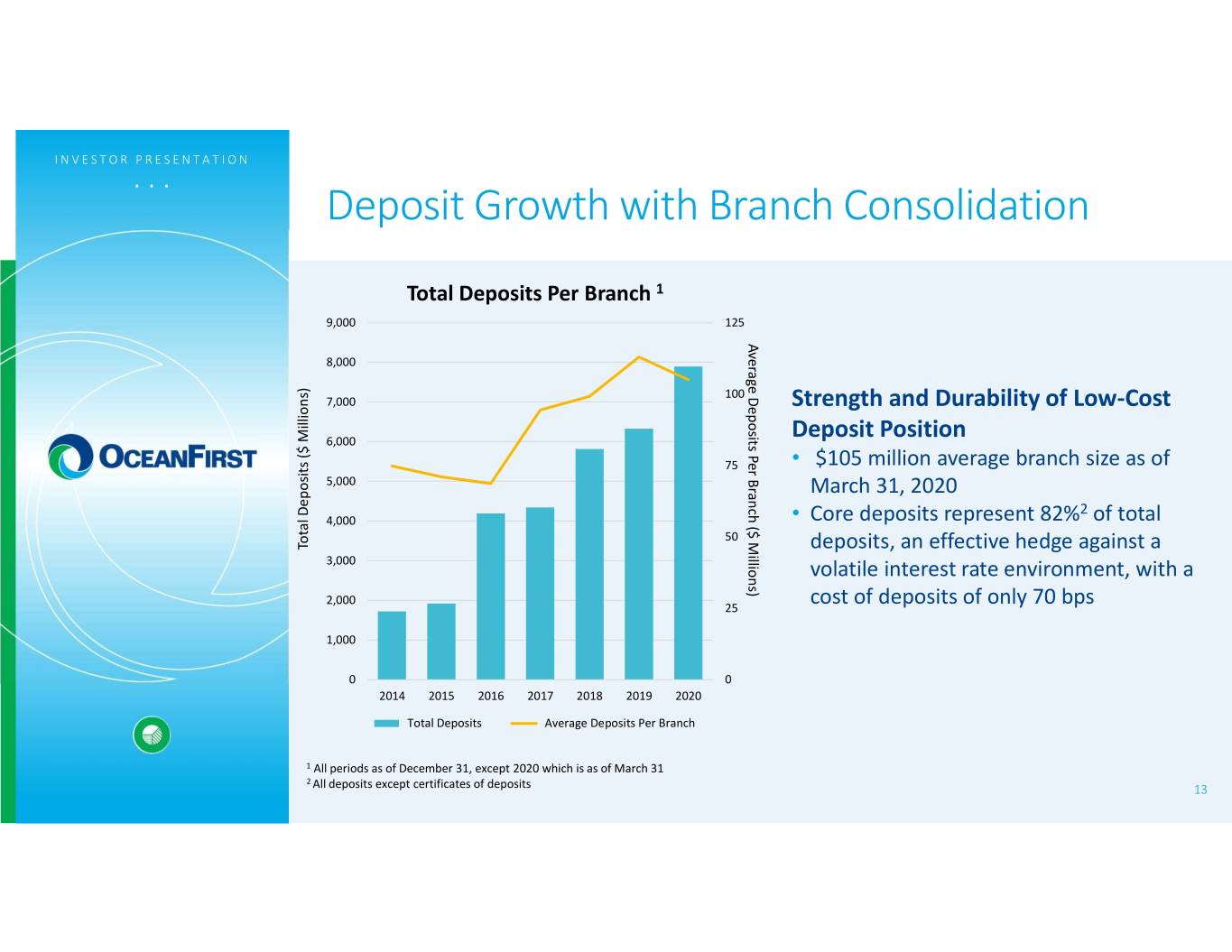

INVESTOR PRESENTATION . . . Deposit Growth with Branch Consolidation Total Deposits Per Branch 1 9,000 125 Average Deposits Per Branch ($ Millions) ($ Branch Deposits Per Average 8,000 100 7,000 Strength and Durability of Low-Cost 6,000 Deposit Position 75 • $105 million average branch size as of 5,000 March 31, 2020 2 4,000 • Core deposits represent 82% of total 50 Total Deposits Millions) ($ deposits, an effective hedge against a 3,000 volatile interest rate environment, with a 2,000 25 cost of deposits of only 70 bps 1,000 0 0 2014 2015 2016 2017 2018 2019 2020 Total Deposits Average Deposits Per Branch 1 All periods as of December 31, except 2020 which is as of March 31 2 All deposits except certificates of deposits 13

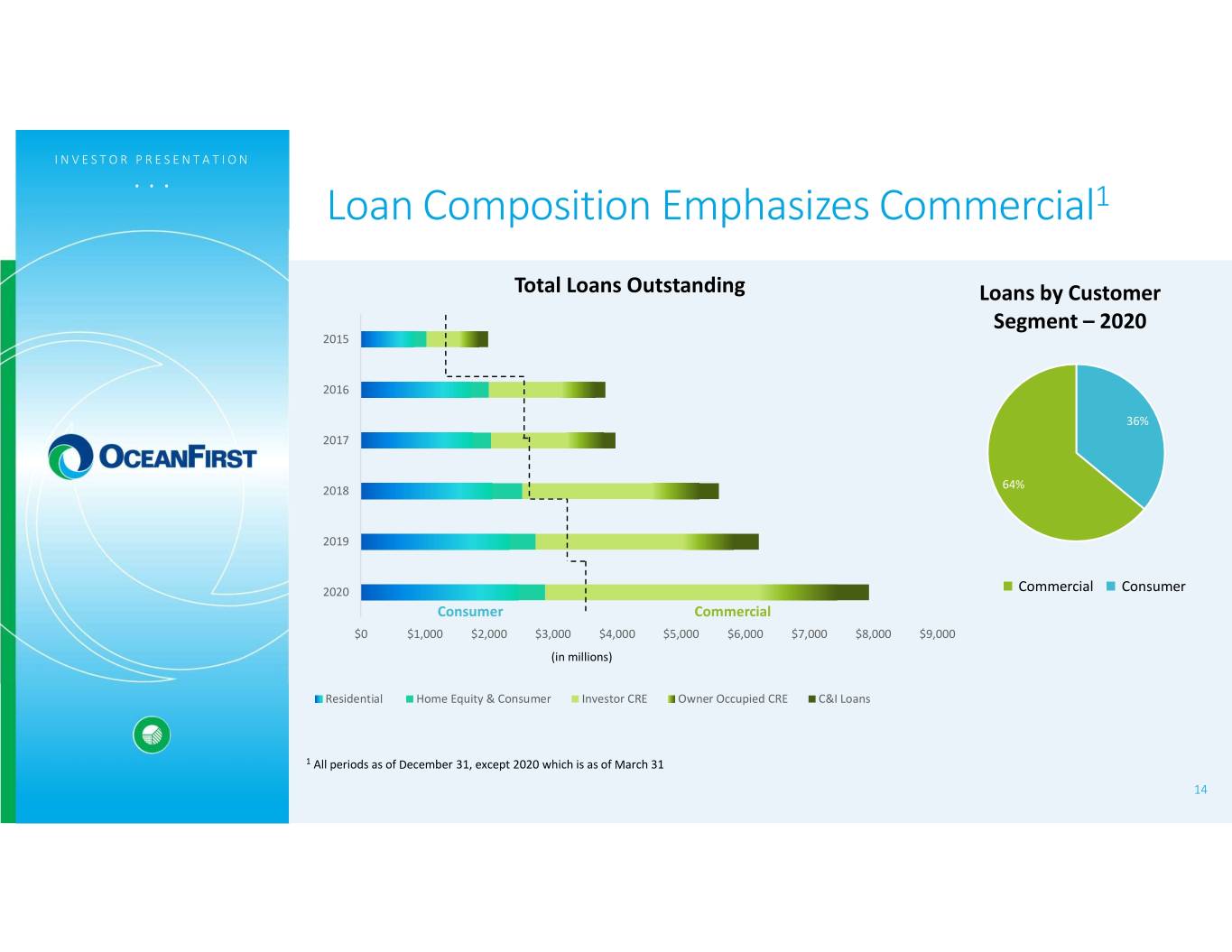

INVESTOR PRESENTATION . . . Loan Composition Emphasizes Commercial1 Total Loans Outstanding Loans by Customer Segment – 2020 2015 2016 36% 2017 2018 64% 2019 2020 Commercial Consumer Consumer Commercial $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 (in millions) Residential Home Equity & Consumer Investor CRE Owner Occupied CRE C&I Loans 1 All periods as of December 31, except 2020 which is as of March 31 14

INVESTOR PRESENTATION . . . Conservative CRE Portfolio Reflects Strategic Execution CRE to Total Risk Based Capital 0 100 200 300 400 500 600 700 800 Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Capacity to grow Investor CRE Peer 7 by $209 million while Peer 8 remaining under 300% Peer 9 Peer 10 OCFC 274 OceanFirst Actual Peer 11 Peer 12 Peer 13 Peer 14 Peer Group Average 324 Peer Group Average Peer 15 Peer 16 Peer 17 Peer 18 Peer 19 Peer 20 Peer 21 Domestic CRE Loans (Construction, Multifamily & Other Nonfarm Non-residential) to Total Risk Based Capital. Supervisory guideline is 300% of TRBC. Peers include: BHLB, BPFH, BRKL, CBU, CUBI, DCOM, EBSB, EGBN, FCF, FFIC, INDB, LBAI, NBTB, NWBI, PFS, SASR, STBA, TMP, TOWN, WSBC and WSFS. Source: BankRegData.com 15 As of December 31, 2019

INVESTOR PRESENTATION . . . Generating Consistent & Attractive Returns 16.0% 1.50% 1.35% 14.0% 1.20% 12.0% 1.05% 10.0% Assets on Return 0.90% 8.0% 0.75% 0.60% 6.0% 0.45% 4.0% 0.30% 2.0% ReturnTangibleon Equity Common 0.15% 0.0% 0.00% 20151 20161 20171 2018 1 20191 2020 1, 2 Core Return on Tangible Common Equity Core Return on Assets • Continued focus on improving efficiencies through acquisition synergies and branch consolidations 1 For 2015, 2016, 2017, 2018, 2019 and 2020, excludes merger related expenses. For 2016, also excludes Federal Home Loan Bank prepayment fee and loss on sale of investment securities. For 2017, 2018, 2019 and 2020, also excludes the effect of branch consolidation expense. For 2017 and 2018, also excludes the effect of additional income tax expense (benefit) related to the Tax Cuts and Jobs Act. For 2019, also excludes the effect of compensation expense due to the retirement of an executive officer, non-recurring professional fees, and income tax benefit related to change in New Jersey tax code. For 2020, also excludes the Two River and Country opening credit loss expense under the CECL model. 2 For 2020, Q1 results are annualized 16

INVESTOR PRESENTATION . . . Credit Metrics Reflect Conservative Culture Non-Performing Loans by Source (Percent of Loans Receivable) NET CHARGE-OFFS 0.05% 0.15% 0.10% 0.05% 0.02% 0.06% 1.00% 0.91% 0.90% 0.80% 0.70% 0.60% 0.52% 0.50% 0.40% 0.35% 0.31% 0.30% 0.29% 0.21% 0.20% 0.10% Non-Performing Non-Performing Loans as Percent Total of Loans Receivable 0.00% 2015 2016 2017 2018 2019 YTD 2020 Residential Consumer Commercial Real Estate Commercial & Industrial 17

. . . Our Strategy 18

INVESTOR PRESENTATION . . . Asset Growth Supplemented by Strategic M&A Opportunistic Acquisitions of Local Community Banks Target Closing Date Transaction Value Total Assets Colonial American Bank July31,2015 ~$12million $ 142million Cape Bancorp May2,2016 ~$196million $1,518million Ocean Shore Holding Co. November 30, 2016 ~$146million $1,097million Sun Bancorp, Inc. January 31, 2018 ~$475million $2,044million Capital Bank of New Jersey January 31, 2019 ~$77million $495million Two River Bancorp January 1, 2020 ~$197million $1,109 million Country Bank Holding January 1, 2020 ~$113million $798million Company Inc. Weighted average(1): Price/Tangible Book Value 158%; Core Deposit Premium 9.0% 19 (1) At time of announcement.

INVESTOR PRESENTATION . . . New Jersey Expansion Opportunities • New Jersey is an attractive market 1 • Statewide Total Population of 8.9 million • Most densely populated state • 11th most populous state • Median household income of $72,000 • Significant opportunities for acquisitions to build customer base • Support expansion in Metropolitan Philadelphia and Metropolitan New York Population of 4.3 million with deposits of $130 billion Headquarters OceanFirst Bank Branches OceanFirst Bank Loan Offices 20 1 US Census Bureau

INVESTOR PRESENTATION . . . Regional Opportunities for M&A Philadelphia Area New York City Metro Area • 7 Banks with Assets Between $400M and $1B • 7 Banks with Assets Between $400M and $1B • 9 Banks with Assets Between $1B and $10B • 6 Banks with Assets Between $1B and $10B New Jersey • 17 Banks with Assets Between $400M and $1B • 19 Banks with Assets Between $1B and $10B Headquarters OceanFirst Bank Branches OceanFirst Bank Loan Offices Regional banking data as of June 30, 2019 21 Source: FDIC

INVESTOR PRESENTATION . . . Digital Culture – 5 Years of Transformation Continuous Investment In Talent and Technologies • Funded from ongoing earnings and branch consolidations Artificial Intelligence Digital Customer Team Onboarding Team Wearables and Digital Strategy & First FinTech Equity Project Management $43 Million Nest Egg Data Science Team eWallets Innovation Team Investment Office Assets Milestone 2015 2016 2017 2018 2019 2020 Launch Account Upgrade Mobile App Replace Personal Launch Nest Egg Mobile Biometrics AI Driven Marketing Opening via & Online Banking Financial Mgmt. Hybrid Robo-Advisor Telephone 100% Certified Replace Online & Certified Digital Build Alexa Voice Best Rated Digital Digital Banker Mobile Account Banker Training Skill (1st Phase) Bank in NJ!* Milestone Opening 2016 FTE 2020 FTE 7 82 22 *Source: ratings from Google My Business, Google App Store & Apple App Store

INVESTOR PRESENTATION . . . Digital Capabilities & Customer Ratings Mobile Capabilities Survey Mobile App Customer Ratings (# of features, out of 18) (Apple & Google) OceanFirst 12 OceanFirst 4.7 # Ratings = 5,029 National / 4.6 National / Regional 10 Regional Large MidAtlantic 4.5 FinTechs / 10 Digital FinTechs / Digital 4.4 Large 8 MidAtlantic Proxy Peer Group 3.6 Median # Ratings = 970 • A few notables include: • A few notables include: • BofA 17 • USAA 4.8 • Chase 13 • Chime 4.7 • USAA 10 • Chase 4.6 • TD 7 • M&T 4.3 23 Source: S&P Global 2019 US Mobile Banking Report. Source: iTunes App and Google App as of April, 2020.

INVESTOR PRESENTATION . . . Digital Customer Acquisition Attaining Scale… … And Attracting Valuable Customers • Digital marketing campaign Customer Usage Statistics* Online Branch launched in December 2018 Digital Usage 95.6% 76.0% • Artificial Intelligence campaigns added in Mobile Usage 79.1% 57.0% September 2019 Direct Deposits / Month 1.3 0.9 • Retail Checking opened in 1Q: Mobile Deposits / Month 0.26 0.14 • Online exceeds average branch by 7x Debit Card Transactions / Month 13.3 13.4 • Online exceeds bottom 32% Average Balance $3,502 $9,020 of entire branch network * Retail checking accounts opened between January and December 2019 as of • Online Account Avg. Deposit 3/31/2020. Rate < 0.25% 24

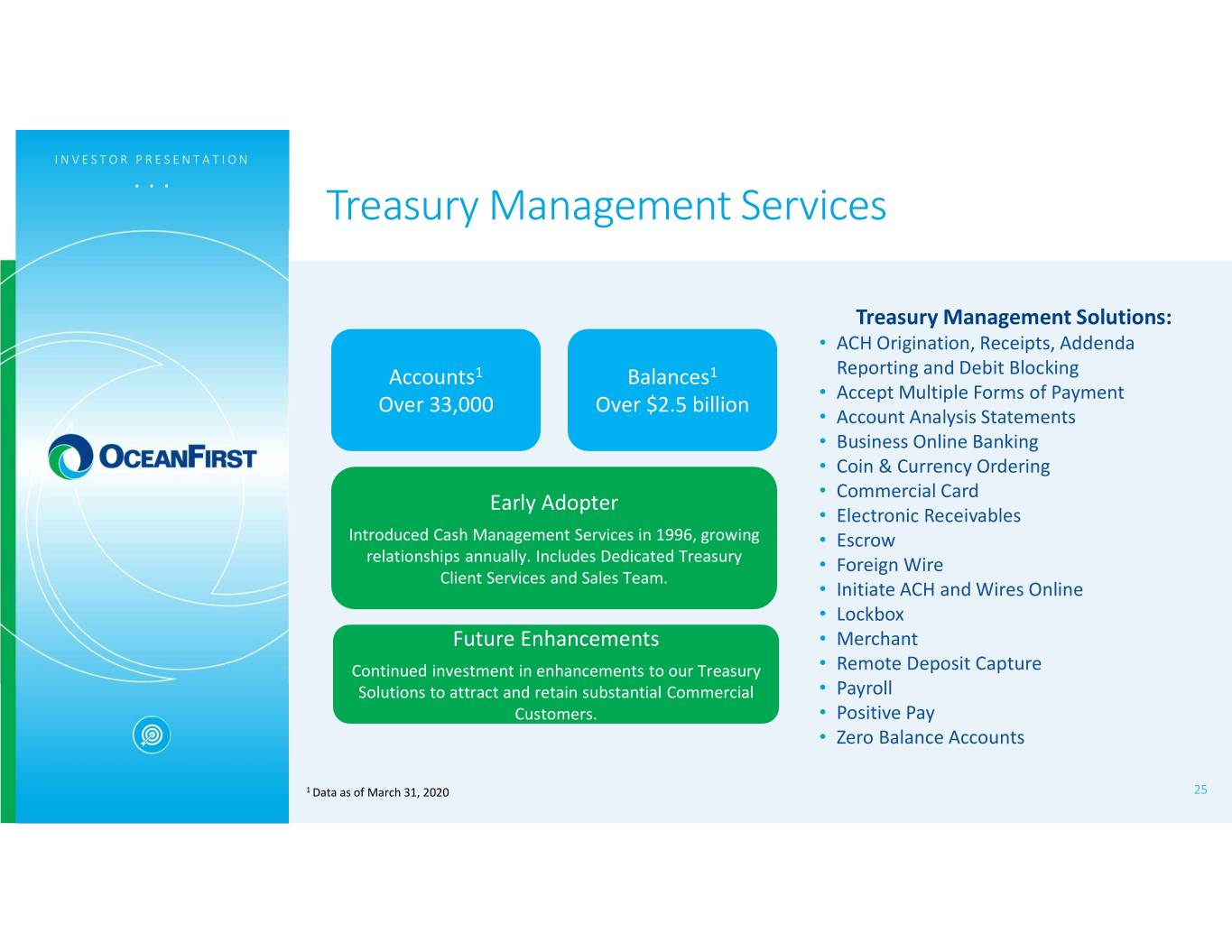

INVESTOR PRESENTATION . . . Treasury Management Services Treasury Management Solutions: • ACH Origination, Receipts, Addenda Accounts1 Balances1 Reporting and Debit Blocking • Accept Multiple Forms of Payment Over 33,000 Over $2.5 billion • Account Analysis Statements • Business Online Banking • Coin & Currency Ordering • Commercial Card Early Adopter • Electronic Receivables Introduced Cash Management Services in 1996, growing • Escrow relationships annually. Includes Dedicated Treasury • Foreign Wire Client Services and Sales Team. • Initiate ACH and Wires Online • Lockbox Future Enhancements • Merchant Continued investment in enhancements to our Treasury • Remote Deposit Capture Solutions to attract and retain substantial Commercial • Payroll Customers. • Positive Pay • Zero Balance Accounts 1 Data as of March 31, 2020 25

INVESTOR PRESENTATION . . . Protecting Our Clients with Cyber Security • Remains current with evolving industry-wide standards • Real-time analytical tools in place for fraud protection and firewall security • Use of top tier, neural-based, real-time debit card fraud analytics • Qualified, certified senior InfoSec personnel, backed up by: • Ongoing significant investments in technology, education and training • Board of Directors with cyber security focus and expertise 26

INVESTOR PRESENTATION . . . Strategic Capital Allocation Generates Shareholder Returns Returned Capital to Shareholders $65 $60 $55 $50 $45 • Stable & competitive dividend $40 • 93rd consecutive quarter $35 $30 • Historical Payout Ratio of 30% to 40% $25 $20 • Repurchased 648,851 shares YTD $15 Annual Annual Return Capital of Millions) ($ 2020; over 2.0 million shares remain $10 $5 available for repurchase $0 2014 2015 2016 2017 2018 2019 2020 • Strategic acquisitions in critical new Cash Dividends Share Repurchases markets Total Cash Returned to Shareholders: $192.2 million 27

INVESTOR PRESENTATION . . . An Experienced Management Team Years at Executive Title Selected Experience OceanFirst1 Chairman, President, Patriot National Bancorp Christopher D. Maher 7 Chief Executive Officer Dime Community Bancshares Executive Vice President, Wachovia Bank N.A. Joseph J. Lebel III 14 Chief Operating Officer First Fidelity Executive Vice President, Michael J. Fitzpatrick 27 KPMG Chief Financial Officer Executive Vice President, Thacher Proffit & Wood Steven J. Tsimbinos 9 General Counsel Lowenstein Sandler PC Executive Vice President, Office of the Comptroller of the Currency Grace M. Vallacchi 2 Chief Risk Officer First Union Executive Vice President, Sun National Bancorp Michele Estep 11 Chief Administrative Officer Key Bank Citigroup Executive Vice President, Karthik Sridharan <1 JP Morgan Chase Chief Information Officer Bank of America • Substantial insider ownership of 9%, including Directors and Executive Officers, ESOP and OceanFirst Foundation. 28 1 Includes years at acquired banks.

INVESTOR PRESENTATION . . . OceanFirst Foundation: Serving Our Communities • Over $40 million has been granted to organizations serving OceanFirst’s market • Provided $250,000 in grants dedicated to assisting the non-profit organizations helping our neighbors during the coronavirus pandemic • First foundation established in the country during a mutual conversion to IPO (July 1996) • Major initiatives include over $2.6 million to more than 1,800 students pursing higher education and over $7 million to organizations improving the health and wellness of those in need • OceanFirst Foundation has assets of $18.3 million 29

INVESTOR PRESENTATION . . . Investment Thesis • Organic Growth Including Low-Cost and Durable Deposit Base • Cost of deposits is one of the lowest in the state of New Jersey at 70 basis points • Strength of Assets • Strong and diversified balance sheet underpins flexibility to grow the business • Digital Innovation • Digital products and customer experience on par with national banks and FinTechs, far outpacing regional and community banks • Disciplined and Strategic M&A • Acquired attractive and underappreciated assets in exurban markets at favorable prices • Bench Strength • Deep banking, regulatory, M&A, and integration experience • Conservative Risk Culture • Commitment to management of credit, interest rate and regulatory / compliance risk • Insider Ownership • Substantial insider ownership aligned with shareholder interest 30

. . . Investor Relations Inquiries Jill A. Hewitt Senior Vice President, Director of Investor Relations & Corporate Communications jhewitt@oceanfirst.com (732) 240-4500, ext. 7513 31

. . . Appendix 32

INVESTOR PRESENTATION . . . Country Bank Holding Company, Inc. Acquisition • 100% Stock deal, valued at $113 million • Expands branch network to support NYC lending efforts • Favorable financial terms1 • Price/Tangible Book Value of 151% • Price/Core Deposit Premium of 7.5% • Effective execution • Announcement – August 9, 2019 • Regulatory Approval – November 15, 2019 (49-days from application) • Shareholder Approval – December 10, 2019 • Closing – January 1, 2020 • Systems Integrations – Targeting early 2021 - CYHC Branches 33 Source: Company reports; SNL Financial. 1At time of announcement.

INVESTOR PRESENTATION . . . Two River Bancorp Acquisition • 75% stock and 25% cash, valued at $197 million • Strengthens presence in Monmouth County and expands market area into northern New Jersey • Favorable financial terms1 • Price/Tangible Book Value of 174% • Price/Core Deposit Premium of 9.5% • Effective execution • Announcement – August 9, 2019 • Regulatory Approval – November 15, 2019 (49-days from application) • Shareholder Approval – December 5, 2019 • Closing – January 1, 2020 • Systems Integrations – Targeting Q2 2020 - TRCB Branches - OCFC Branches 34 Source: Company reports; SNL Financial. 1At time of announcement.

INVESTOR PRESENTATION . . . OceanFirst Milestones – 118 Years of Growth Crossed $10 billion IPO to Mutual threshold Depositors Created OceanFirst Colonial American Adopted National Two River Bancorp Foundation Bank Acquired Bank Charter Acquired Established Commercial LPO Country Bank Founded, Established Sun Bancorp, Inc. Trust and Asset Expansion into Holding Company, Point Pleasant, NJ Commercial Lending Acquired Management Mercer County Inc. Acquired 1902 1985 1996 1999 2000 2014 2015 2016 2018 2019 2020 Capital Bank of Branch Expansion Branch Expansion OceanFirstFoundation Cape Bancorp New Jersey into into Exceeds $25 Million in Acquired Acquired Middlesex County Monmouth County Cumulative Grants Ocean Shore Holding Co. Acquired 35

INVESTOR PRESENTATION . . . Favorable Competitive Position Community Banks serving Mega Banks OceanFirst Bank Central & Southern NJ # of Branches Dep. In Mkt. # of Dep. In Mkt. Dep. In Mkt. Institution ($000) Institution # of Branches Branches ($000) ($000) 61 6,216,001 TD Bank (Canada) 125 22,671,261 Manasquan 12 1,438,759 PNC Bank (PA) 140 19,082,286 OceanFirst Republic 16 1,406,958 Competitive Position Bank of America (NC) 107 17,283,936 Bank of Princeton 15 973,294 • Responsive Wells Fargo (CA) 137 15,766,624 1ST Constitution 18 813,930 • Flexible Santander Bank 75 6,777,791 Sturdy Savings 14 724,096 (Spain) • Capable • Lending Limit Two River* 11 791,795 • Technology • Trust • Treasury Management • Consumer & Commercial • Competing Favorably Against Banking Behemoths and Local Community Banks *Acquired by OCFC effective January 1, 2020 Source: FDIC Summary of Deposits, June 30, 2019 36 Note: Market area is defined as 11 counties in Central and Southern New Jersey

INVESTOR PRESENTATION . . . Commercial Portfolio Segmentation 1 Total Commercial Loan Exposure by Real Estate Investment by Industry Classification Property Classification Miscellaneous 13.0% Office 26.0% Miscellaneous Hotel/Motel 12.0% 3.0% Other Services 3.0% Industrial/ Accommodations/ Warehouse Food Services 6.0% 7.0% Multi-Family 21.0% Healthcare 4.0% Wholesale Trade Single Purpose 3.0% 4.0% Retail Trade 4.0% 1-4 Family 8.0% Construction Retail Store Shopping Real Estate 3.0% 8.0% Investment Center 64.0% 11.0% • Diversified portfolio provides protection against industry-specific credit events 1 As of March 31, 2020 and excludes Two River and Country Bank. 37

INVESTOR PRESENTATION . . . Commercial Loan Forbearance Commercial Portfolio Forbearance Requests Total Outstanding Balance: $5bn Total Forbearance Requests: $775M Forbearance requests *WA LTV: 55% are well-secured and *WA DSCR: 1.9 represent just 16% of No delinquency last 24 months: 93% commercial portfolio Data as of April 17, 2020 *WA LTV and WA DSCR as of most recent financial review 38 Forbearance requests require credit approval

INVESTOR PRESENTATION . . . Commercial Loan Forbearance (Credit Attributes) Forbearance requests are moderating . . . 39 Data as of April 17, 2020

INVESTOR PRESENTATION . . . Residential and Consumer Loan Forbearance Residential and Consumer Portfolio Forbearance Requests Total Outstanding Balance: $3bn Total Forbearance Requests: $311M WA LTV: 70% WA FICO Score: 742 WA LTV: 70% As of forbearance request date 40 Data as of April 17, 2020

INVESTOR PRESENTATION . . . Residential and Consumer Loan Forbearance (Credit Attributes) Forbearance requests are moderating FICO Score Payment History Vintage . . . 41 Data as of April 17, 2020