Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - Clearwater Paper Corp | clw-2020x331x8kexhibit991.htm |

| 8-K - CLW Q1 2020 8K - Clearwater Paper Corp | clwq120208k.htm |

Clearwater Paper Corporation FIRST QUARTER 2020 SUPPLEMENTAL INFORMATION May 5, 2020 ARSEN S. KITCH PRESIDENT, CHIEF EXECUTIVE OFFICER AND DIRECTOR MICHAEL J. MURPHY SENIOR VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

Forward-Looking Statements This presentation of supplemental information contains, in addition to historical information, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding our response to COVID-19 and the impact of COVID-19 on consumer behavior, our business and operations; industry trends in response to COVID-19 and potential recession; improvements to our cost structure; Q2 2020 outlook for net income (loss), Adjusted EBITDA, operating income (loss), adjusted operating income (loss), net earnings (loss), adjusted net earnings (loss), net earnings (loss) per diluted common share, and adjusted net earnings (loss) per diluted common share, product pricing and sales mix, product volumes shipped, costs, net sales and adjusted operating margin; our capital structure and liquidity; and near-term strategic positioning and market assessment. These forward- looking statements are based on management’s current expectations, estimates, assumptions and projections that are subject to change. Our actual results of operations may differ materially from those expressed or implied by the forward-looking statements contained in this presentation. Important factors that could cause or contribute to such differences include the risks and uncertainties described from time to time in the company's public filings with the Securities and Exchange Commission, including but not limited to the following: • impact of COVID-19 on our operations and our supplier’s operations and on customer demand; • competitive pricing pressures for our products, including as a result of increased capacity as additional manufacturing facilities are operated by our competitors and the impact of foreign currency fluctuations on the pricing of products globally; • the loss of, changes in prices in regard to, or reduction in, orders from a significant customer; • changes in the cost and availability of wood fiber and wood pulp; • changes in transportation costs and disruptions in transportation services; • changes in customer product preferences and competitors' product offerings; • larger competitors having operational and other advantages; • customer acceptance and timing and quantity of purchases of our tissue products, including the existence of sufficient demand for and the quality of tissue produced by our expanded Shelby, North Carolina operations; • consolidation and vertical integration of converting operations in the paperboard industry; • our ability to successfully implement our operational efficiencies and cost savings strategies, along with related capital projects, and achieve the expected operational or financial results of those projects, including from the continuous digester at our Lewiston, Idaho facility; • changes in the U.S. and international economies and in general economic conditions in the regions and industries in which we operate; • manufacturing or operating disruptions, including IT system and IT system implementation failures, equipment malfunctions and damage to our manufacturing facilities; • cyber-security risks; • changes in costs for and availability of packaging supplies, chemicals, energy and maintenance and repairs; • labor disruptions; • cyclical industry conditions; • changes in expenses, required contributions and potential withdrawal costs associated with our pension plans; • environmental liabilities or expenditures; • reliance on a limited number of third-party suppliers for raw materials; • our ability to attract, motivate, train and retain qualified and key personnel; • our substantial indebtedness and ability to service our debt obligations; • restrictions on our business from debt covenants and terms; • negative changes in our credit agency ratings; and • changes in laws, regulations or industry standards affecting our business. Forward-looking statements contained in this presentation present management’s views only as of the date of this presentation. We undertake no obligation to publicly update forward-looking statements, to retract future revisions of management's views based on events or circumstances occurring after the date of this presentation. Page 2 © Clearwater Paper Corporation 2020

Introductions Arsen S. Kitch President, Chief Executive Officer and Director • With Clearwater Paper since 2013, previous experience: • Senior Vice President and General Manager Consumer Products Division • Vice President, Finance and Financial Planning and Analysis • Prior roles with Nestlé USA, KKR Capstone and Frito-Lay • Bachelor’s from University of California, Berkeley and MBA from Stanford Graduate School of Business Michael J. Murphy Senior Vice President, Chief Financial Officer • Finance, treasury, strategy and M&A roles - Kapstone Paper and Boise, Inc. • 17 years of investment banking with J.P. Morgan and John Nuveen & Co. • Bachelor’s from Northwestern University and MBA from University of Chicago Booth School of Business Page 3 © Clearwater Paper Corporation 2020

COVID-19 - Q1 Operational Update Committed to protecting our two most important assets: our employees and reputation with customers Taking care of our employees: • Temperature checks and sanitation practices • Social distancing guidelines • Remote work access and travel restrictions • Enhanced benefits Focusing on business continuity and customer service: • No material disruption in Q1 production or supply chain • Creative solutions to optimize shipments were highly successful • Clearwater Paper’s reputation for reliability grew in Q1 Page 4 © Clearwater Paper Corporation 2020

COVID-19 - Q1 Business Update Consumer Products Division Operational performance: • 15.2 million cases of tissue shipped in Q1 • ~19% above past four quarter trend • Demonstrated ability to execute against increased demand Industry context: • Retail tissue sales up over 90% in March per IRI • Inventory drawdown aided Q1 sales Industry trends: • Expect elevated demand to continue in near-term • Shift from “away-from-home” to “at-home” consumption will alter normal demand trends Page 5 © Clearwater Paper Corporation 2020

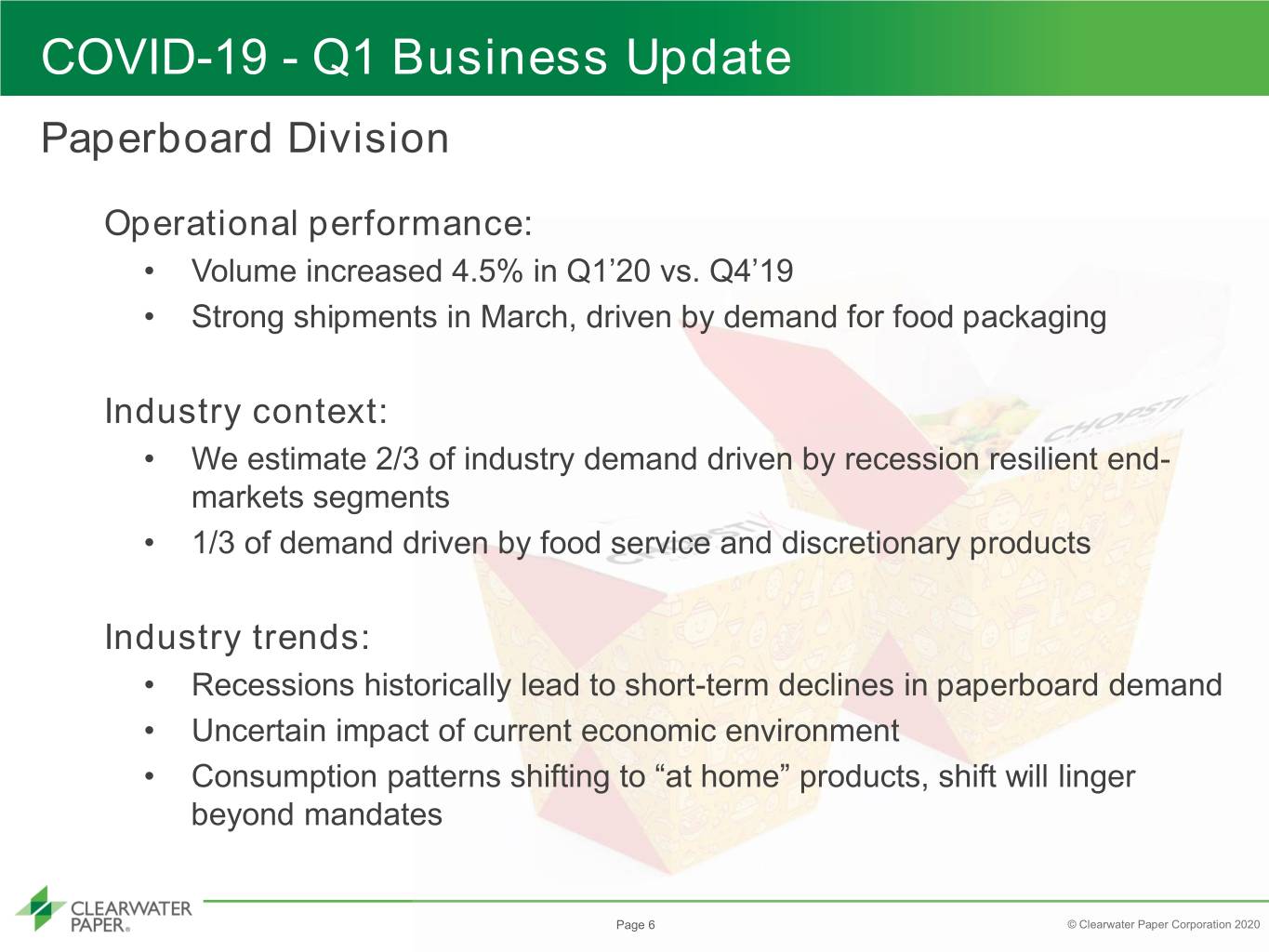

COVID-19 - Q1 Business Update Paperboard Division Operational performance: • Volume increased 4.5% in Q1’20 vs. Q4’19 • Strong shipments in March, driven by demand for food packaging Industry context: • We estimate 2/3 of industry demand driven by recession resilient end- markets segments • 1/3 of demand driven by food service and discretionary products Industry trends: • Recessions historically lead to short-term declines in paperboard demand • Uncertain impact of current economic environment • Consumption patterns shifting to “at home” products, shift will linger beyond mandates Page 6 © Clearwater Paper Corporation 2020

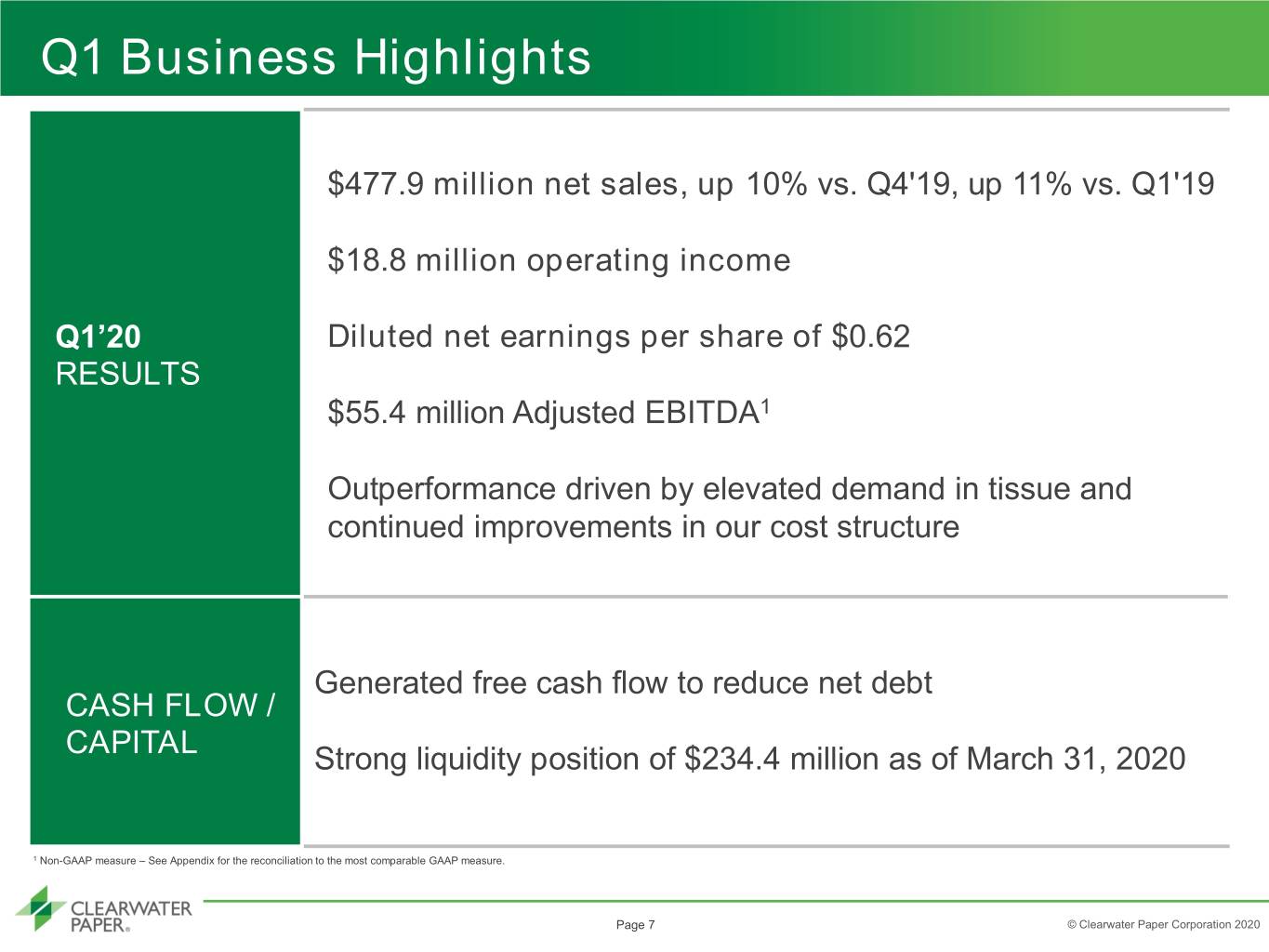

Q1 Business Highlights $477.9 million net sales, up 10% vs. Q4'19, up 11% vs. Q1'19 $18.8 million operating income Q1’20 Diluted net earnings per share of $0.62 RESULTS $55.4 million Adjusted EBITDA1 Outperformance driven by elevated demand in tissue and continued improvements in our cost structure Generated free cash flow to reduce net debt CASH FLOW / CAPITAL Strong liquidity position of $234.4 million as of March 31, 2020 1 Non-GAAP measure – See Appendix for the reconciliation to the most comparable GAAP measure. Page 7 © Clearwater Paper Corporation 2020

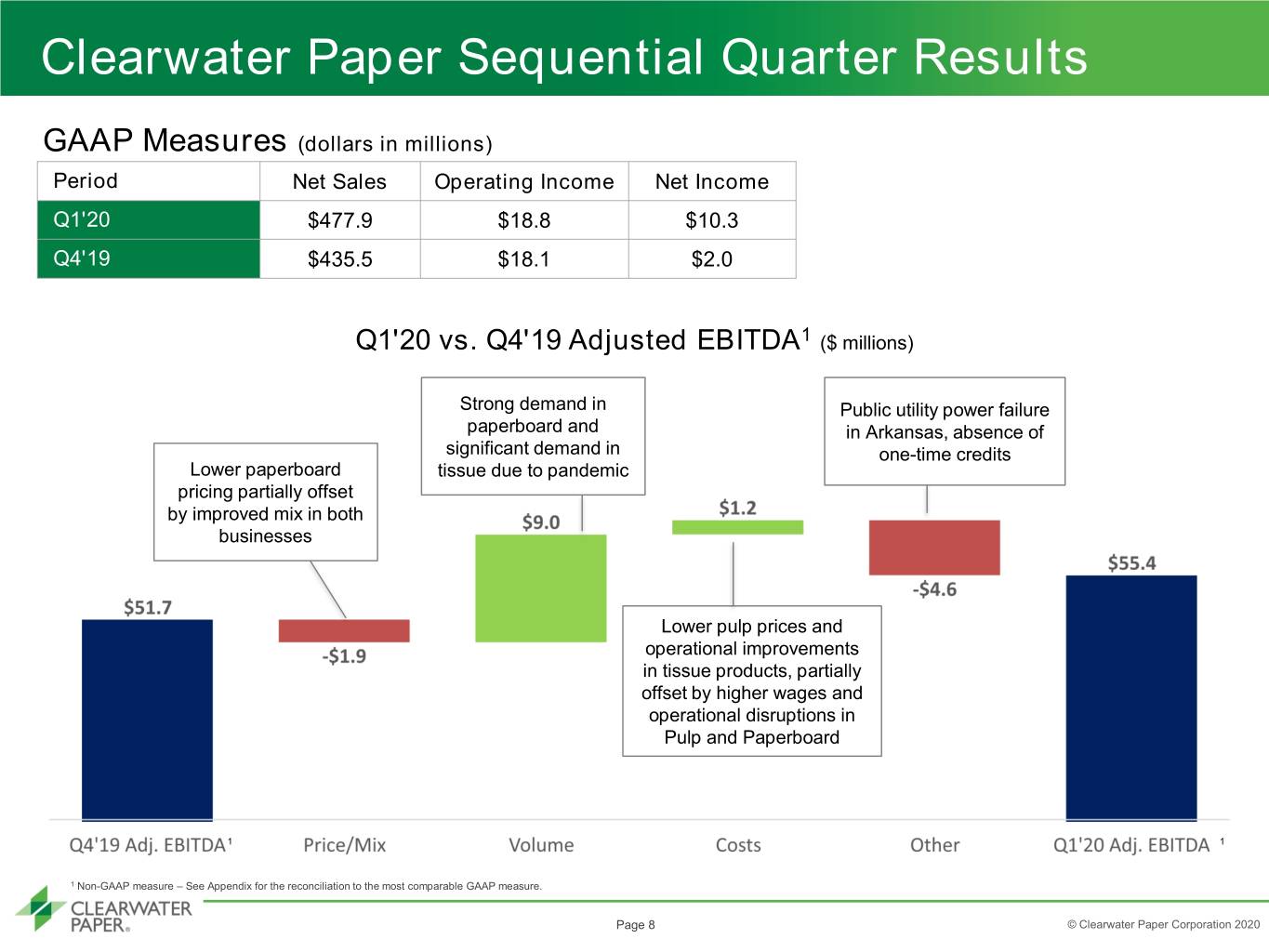

Clearwater Paper Sequential Quarter Results GAAP Measures (dollars in millions) Period Net Sales Operating Income Net Income Q1'20 $477.9 $18.8 $10.3 Q4'19 $435.5 $18.1 $2.0 Q1'20 vs. Q4'19 Adjusted EBITDA1 ($ millions) Strong demand in Public utility power failure paperboard and in Arkansas, absence of significant demand in one-time credits Lower paperboard tissue due to pandemic pricing partially offset by improved mix in both businesses Lower pulp prices and operational improvements in tissue products, partially offset by higher wages and operational disruptions in Pulp and Paperboard 1 1 1 Non-GAAP measure – See Appendix for the reconciliation to the most comparable GAAP measure. Page 8 © Clearwater Paper Corporation 2020

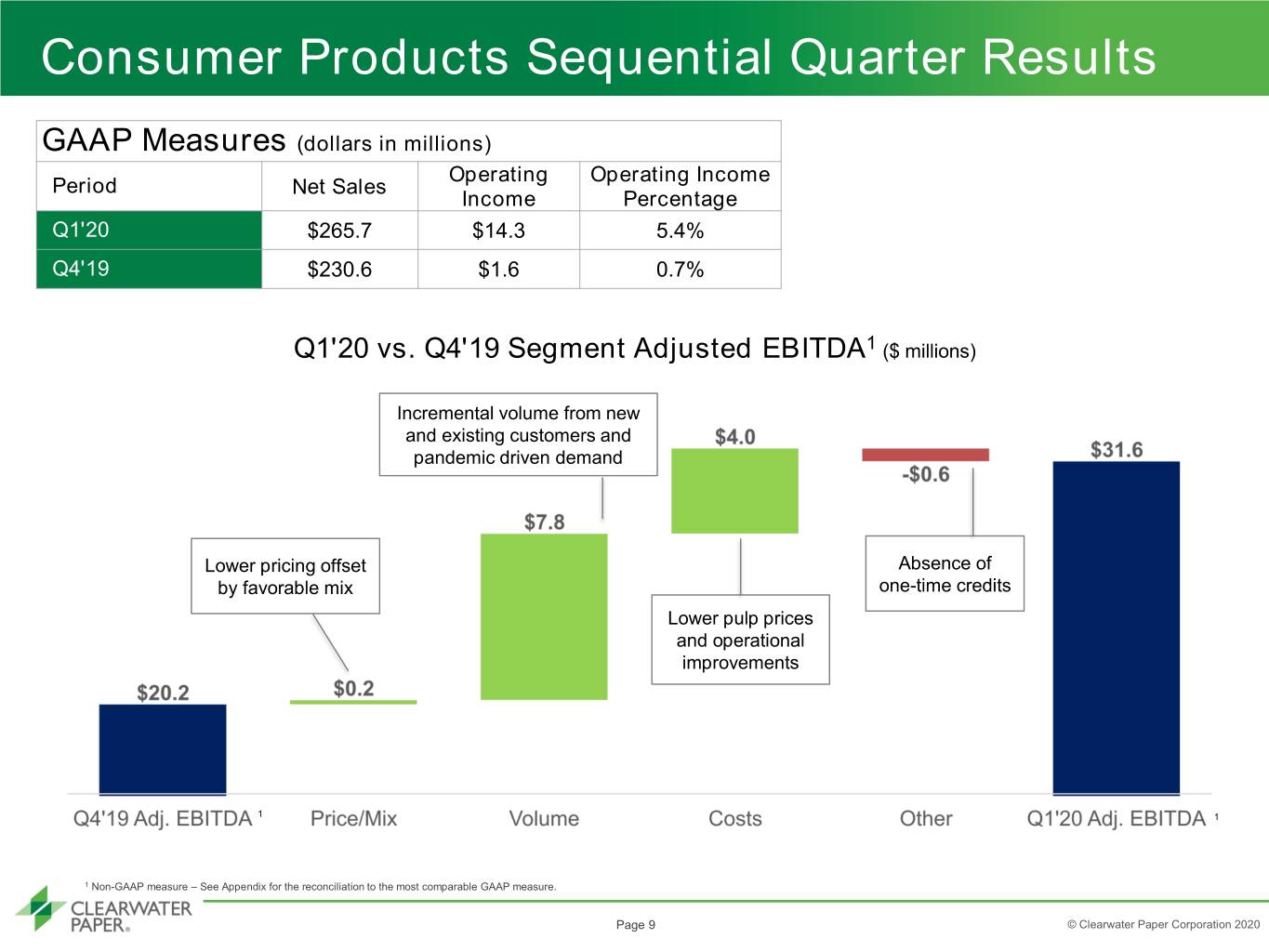

Consumer Products Sequential Quarter Results GAAP Measures (dollars in millions) Operating Operating Income Period Net Sales Income Percentage Q1'20 $265.7 $14.3 5.4% Q4'19 $230.6 $1.6 0.7% Q1'20 vs. Q4'19 Segment Adjusted EBITDA1 ($ millions) Incremental volume from new and existing customers and pandemic driven demand Lower pricing offset Absence of by favorable mix one-time credits Lower pulp prices and operational improvements 1 1 1 Non-GAAP measure – See Appendix for the reconciliation to the most comparable GAAP measure. Page 9 © Clearwater Paper Corporation 2020

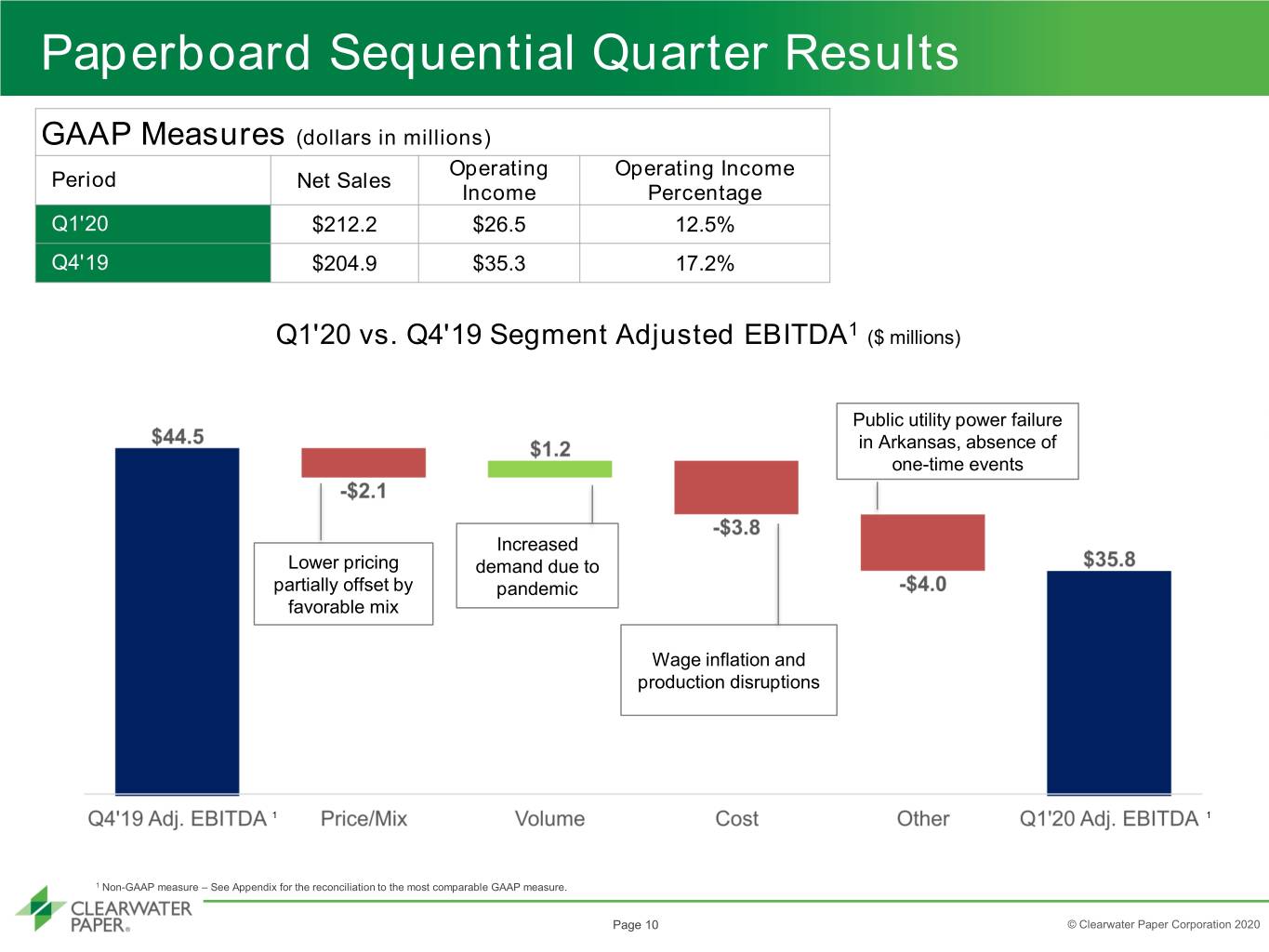

Paperboard Sequential Quarter Results GAAP Measures (dollars in millions) Operating Operating Income Period Net Sales Income Percentage Q1'20 $212.2 $26.5 12.5% Q4'19 $204.9 $35.3 17.2% Q1'20 vs. Q4'19 Segment Adjusted EBITDA1 ($ millions) Public utility power failure in Arkansas, absence of one-time events Increased Lower pricing demand due to partially offset by pandemic favorable mix Wage inflation and production disruptions 1 1 1 Non-GAAP measure – See Appendix for the reconciliation to the most comparable GAAP measure. Page 10 © Clearwater Paper Corporation 2020

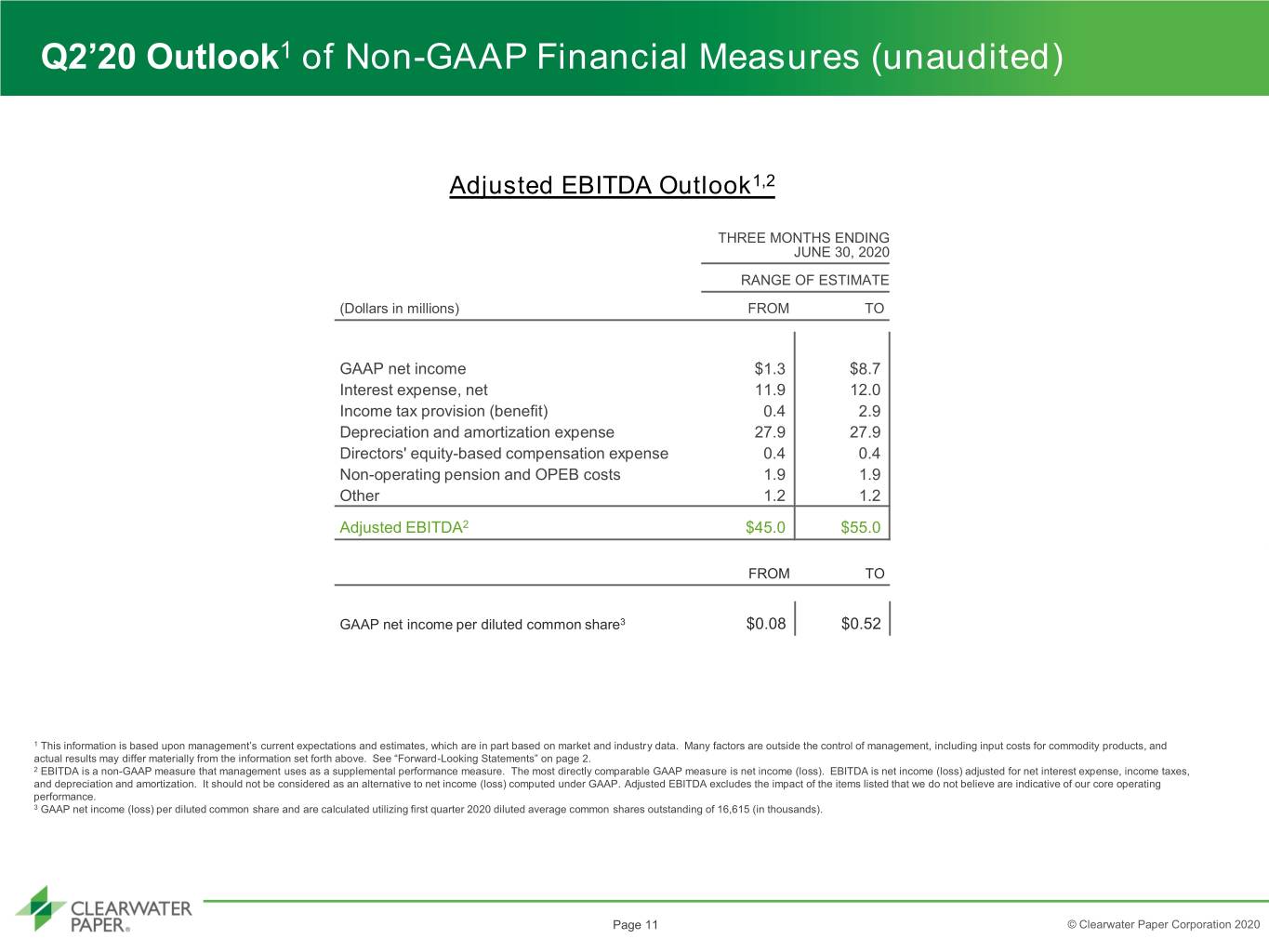

Q2’20 Outlook1 of Non-GAAP Financial Measures (unaudited) Adjusted EBITDA Outlook1,2 OUTLOOK THREE MONTHS ENDING JUNE 30, 2020 RANGE OF ESTIMATE (Dollars in millions) FROM TO GAAP net income $1.3 $8.7 Interest expense, net 11.9 12.0 Income tax provision (benefit) 0.4 2.9 Depreciation and amortization expense 27.9 27.9 Directors' equity-based compensation expense 0.4 0.4 Non-operating pension and OPEB costs 1.9 1.9 Other 1.2 1.2 Adjusted EBITDA2 $45.0 $55.0 FROM TO GAAP net income per diluted common share3 $0.08 $0.52 1 This information is based upon management’s current expectations and estimates, which are in part based on market and industry data. Many factors are outside the control of management, including input costs for commodity products, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 2. 2 EBITDA is a non-GAAP measure that management uses as a supplemental performance measure. The most directly comparable GAAP measure is net income (loss). EBITDA is net income (loss) adjusted for net interest expense, income taxes, and depreciation and amortization. It should not be considered as an alternative to net income (loss) computed under GAAP. Adjusted EBITDA excludes the impact of the items listed that we do not believe are indicative of our core operating performance. 3 GAAP net income (loss) per diluted common share and are calculated utilizing first quarter 2020 diluted average common shares outstanding of 16,615 (in thousands). Page 11 © Clearwater Paper Corporation 2020

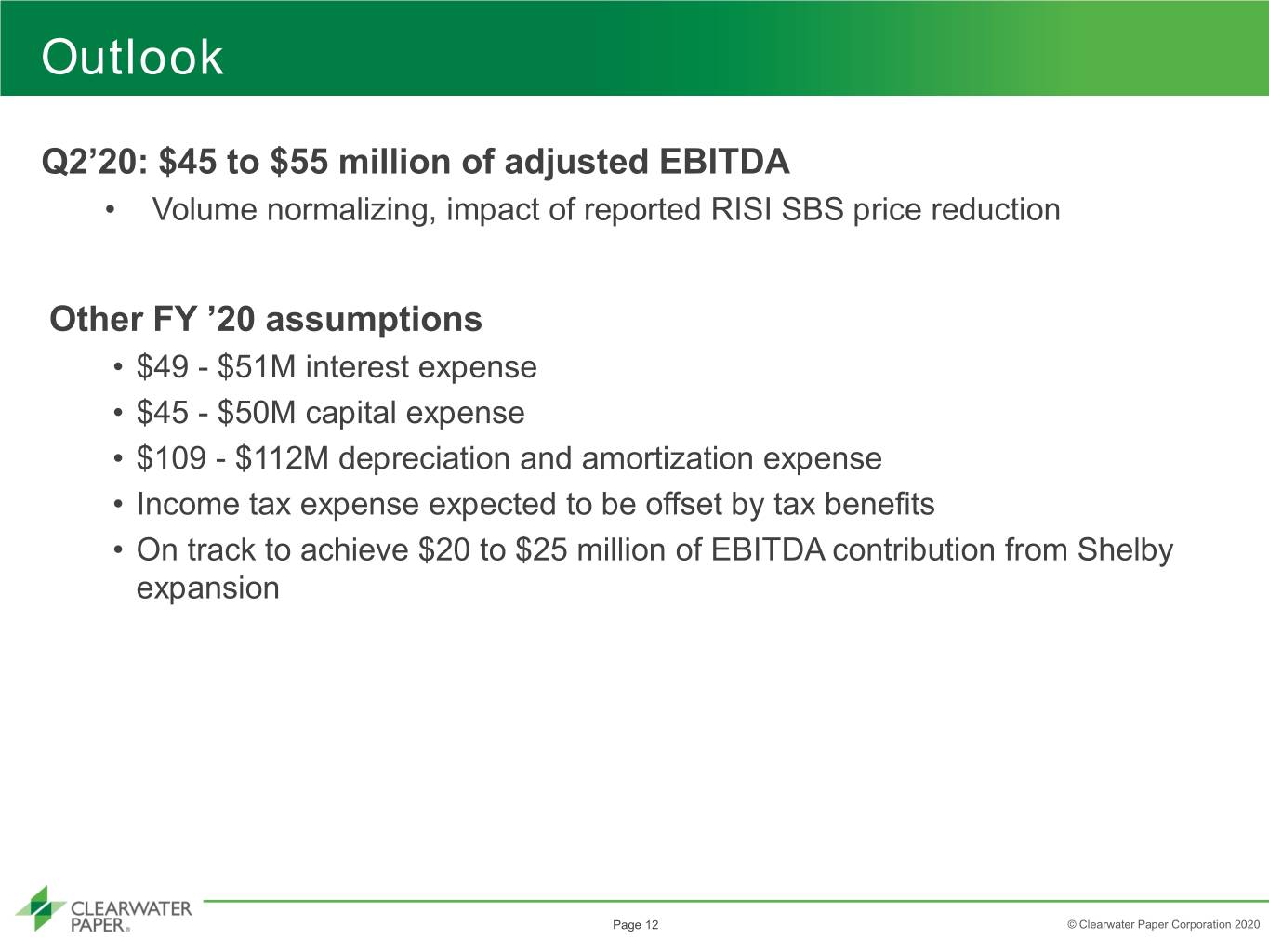

Outlook Q2’20: $45 to $55 million of adjusted EBITDA • Volume normalizing, impact of reported RISI SBS price reduction Other FY ’20 assumptions • $49 - $51M interest expense • $45 - $50M capital expense • $109 - $112M depreciation and amortization expense • Income tax expense expected to be offset by tax benefits • On track to achieve $20 to $25 million of EBITDA contribution from Shelby expansion Page 12 © Clearwater Paper Corporation 2020

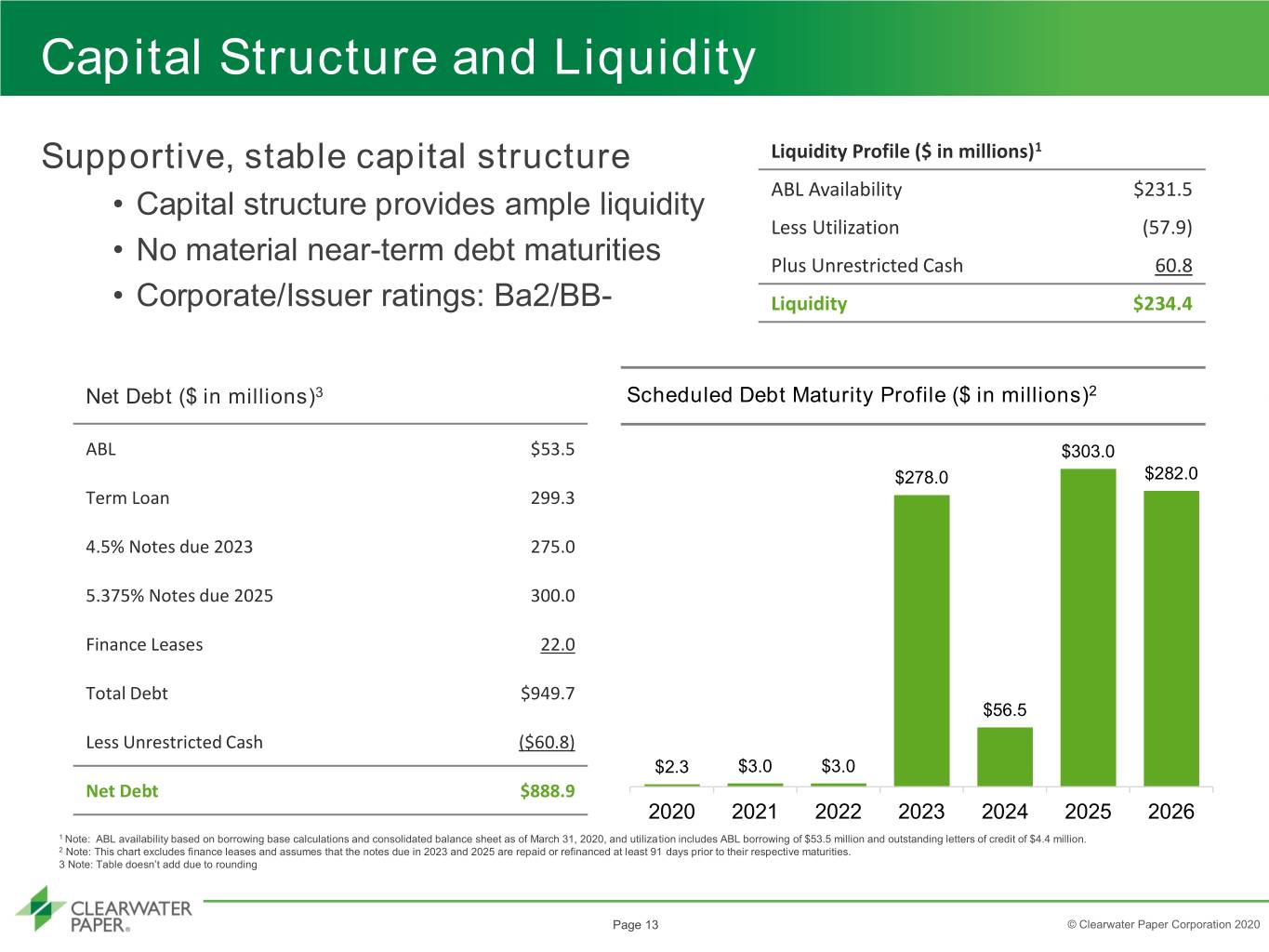

Capital Structure and Liquidity Supportive, stable capital structure Liquidity Profile ($ in millions)1 • Capital structure provides ample liquidity ABL Availability $231.5 Less Utilization (57.9) • No material near-term debt maturities Plus Unrestricted Cash 60.8 • Corporate/Issuer ratings: Ba2/BB- Liquidity $234.4 Net Debt ($ in millions)3 Scheduled Debt Maturity Profile ($ in millions)2 ABL $53.5 $303.0 $278.0 $282.0 Term Loan 299.3 4.5% Notes due 2023 275.0 5.375% Notes due 2025 300.0 Finance Leases 22.0 Total Debt $949.7 $56.5 Less Unrestricted Cash ($60.8) $2.3 $3.0 $3.0 Net Debt $888.9 2020 2021 2022 2023 2024 2025 2026 1 Note: ABL availability based on borrowing base calculations and consolidated balance sheet as of March 31, 2020, and utilization includes ABL borrowing of $53.5 million and outstanding letters of credit of $4.4 million. 2 Note: This chart excludes finance leases and assumes that the notes due in 2023 and 2025 are repaid or refinanced at least 91 days prior to their respective maturities. 3 Note: Table doesn’t add due to rounding Page 13 © Clearwater Paper Corporation 2020

Value Proposition Well positioned across two attractive businesses Consumer Products: 1. Tissue is need-based and economically resilient 2. Shift to private-branded over branded product continues with long runway 3. Clearwater has national scale and superior supply chain performance Paperboard: 1. Diversified range of end-markets, well invested national footprint 2. Focused on non-integrated customers, with strong service and quality commitment 3. Well positioned for trends towards sustainable packaging and food service products Shift from capital investment to value creation Strategy is to prioritize free cash flow and reduce debt • Deliver benefits from Shelby expansion • Operational improvements • Aggressively manage working capital • Prudent capital allocation Page 14 © Clearwater Paper Corporation 2020

Appendix © Clearwater Paper Corporation 2020

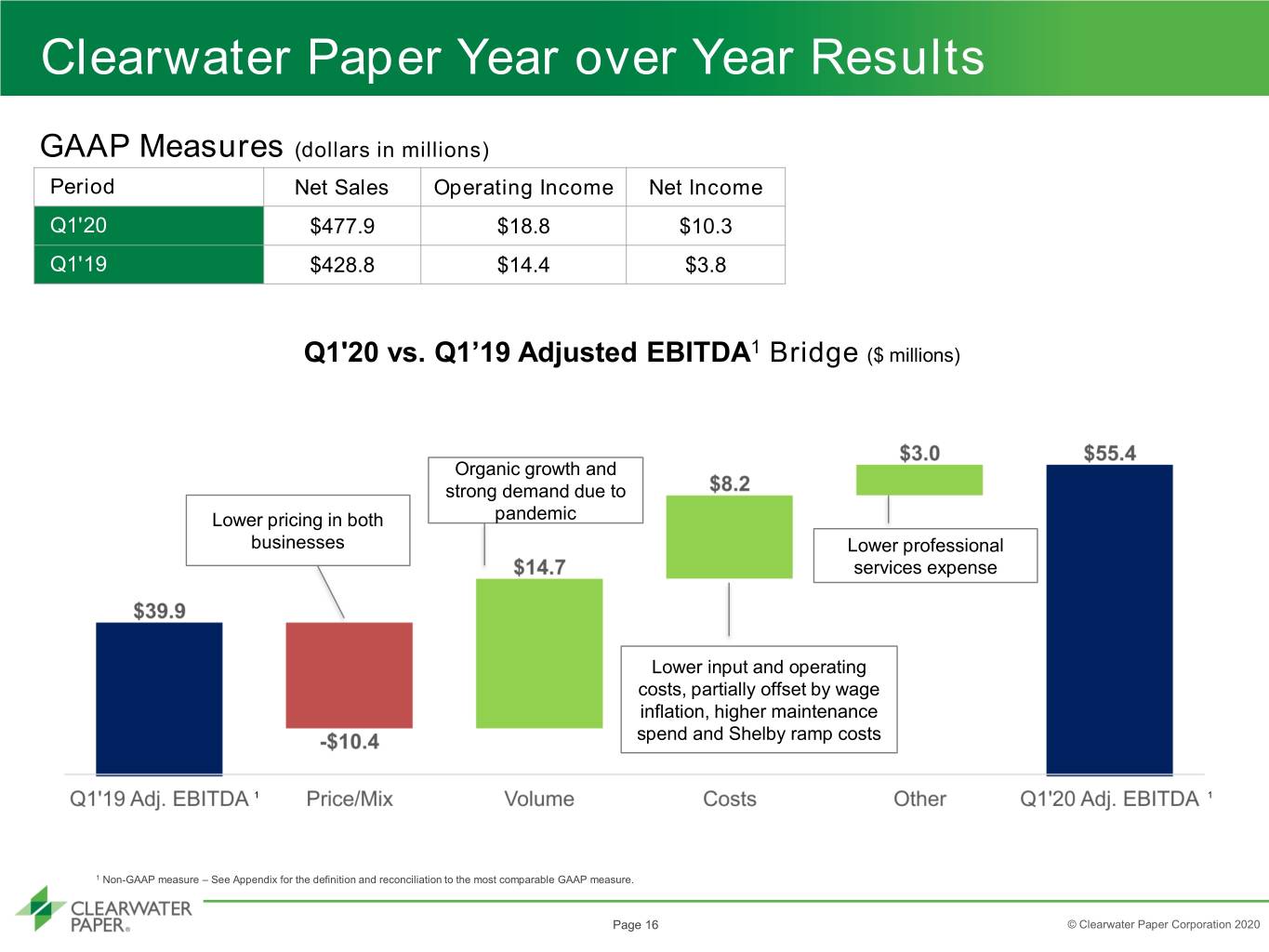

Clearwater Paper Year over Year Results GAAP Measures (dollars in millions) Period Net Sales Operating Income Net Income Q1'20 $477.9 $18.8 $10.3 Q1'19 $428.8 $14.4 $3.8 Q1'20 vs. Q1’19 Adjusted EBITDA1 Bridge ($ millions) Organic growth and strong demand due to Lower pricing in both pandemic businesses Lower professional services expense Lower input and operating costs, partially offset by wage inflation, higher maintenance spend and Shelby ramp costs 1 1 1 Non-GAAP measure – See Appendix for the definition and reconciliation to the most comparable GAAP measure. Page 16 © Clearwater Paper Corporation 2020

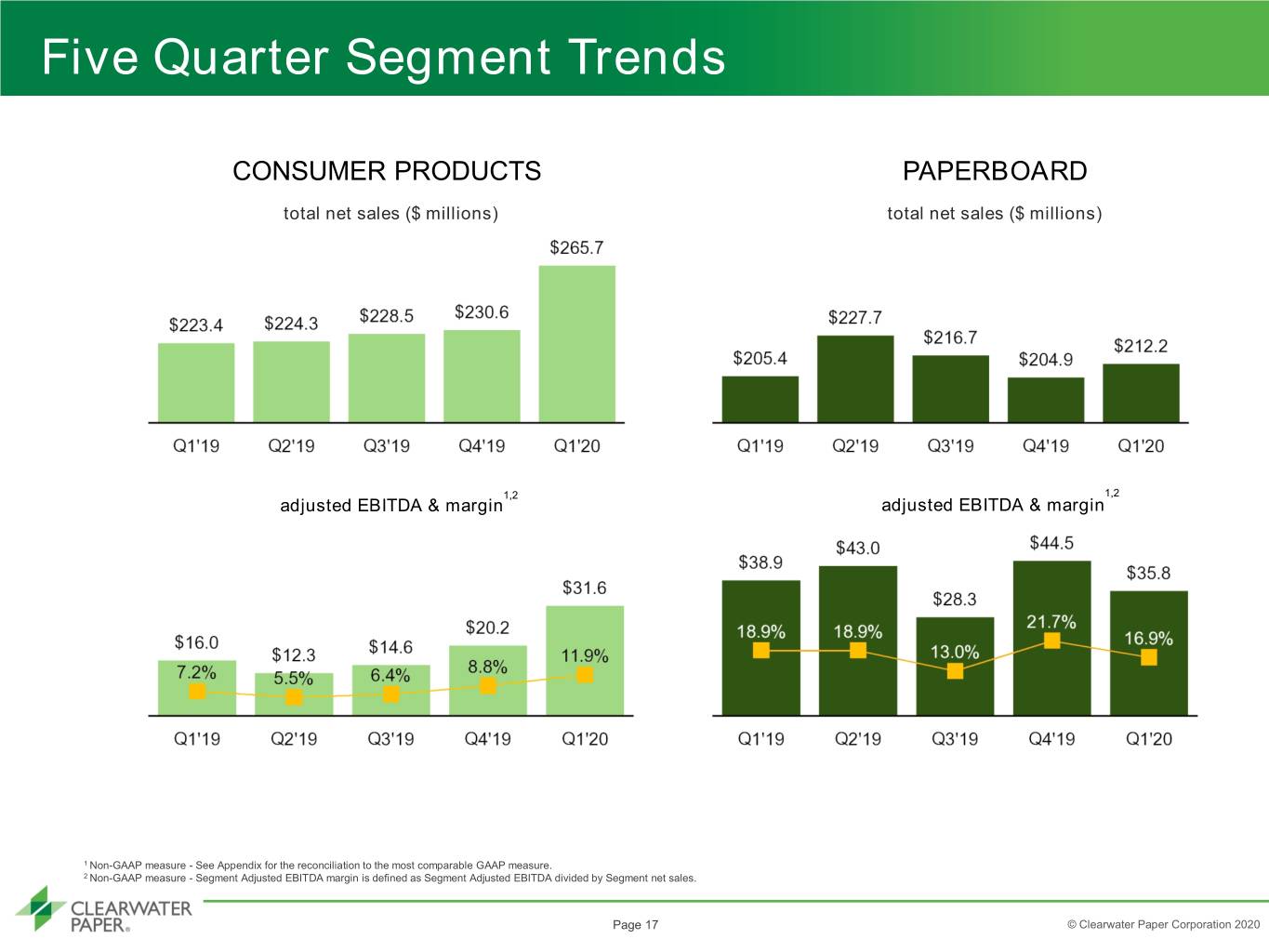

Five Quarter Segment Trends CONSUMER PRODUCTS PAPERBOARD total net sales ($ millions) total net sales ($ millions) 1,2 1,2 adjusted EBITDA & margin adjusted EBITDA & margin 1 Non-GAAP measure - See Appendix for the reconciliation to the most comparable GAAP measure. 2 Non-GAAP measure - Segment Adjusted EBITDA margin is defined as Segment Adjusted EBITDA divided by Segment net sales. Page 17 © Clearwater Paper Corporation 2020

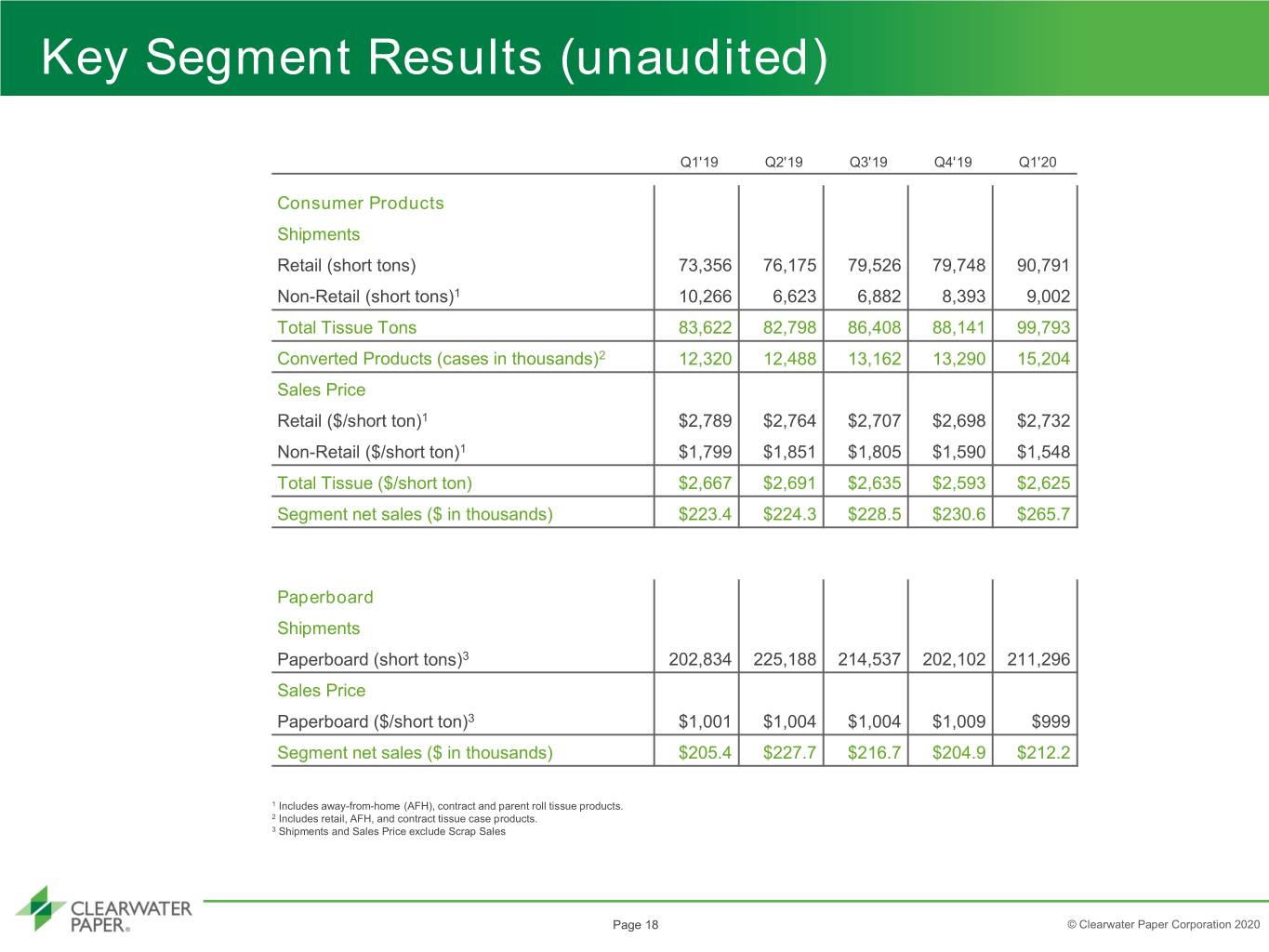

Key Segment Results (unaudited) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Consumer Products Shipments Retail (short tons) 73,356 76,175 79,526 79,748 90,791 Non-Retail (short tons)1 10,266 6,623 6,882 8,393 9,002 Total Tissue Tons 83,622 82,798 86,408 88,141 99,793 Converted Products (cases in thousands)2 12,320 12,488 13,162 13,290 15,204 Sales Price Retail ($/short ton)1 $2,789 $2,764 $2,707 $2,698 $2,732 Non-Retail ($/short ton)1 $1,799 $1,851 $1,805 $1,590 $1,548 Total Tissue ($/short ton) $2,667 $2,691 $2,635 $2,593 $2,625 Segment net sales ($ in thousands) $223.4 $224.3 $228.5 $230.6 $265.7 Paperboard Shipments Paperboard (short tons)3 202,834 225,188 214,537 202,102 211,296 Sales Price Paperboard ($/short ton)3 $1,001 $1,004 $1,004 $1,009 $999 Segment net sales ($ in thousands) $205.4 $227.7 $216.7 $204.9 $212.2 1 Includes away-from-home (AFH), contract and parent roll tissue products. 2 Includes retail, AFH, and contract tissue case products. 3 Shipments and Sales Price exclude Scrap Sales Page 18 © Clearwater Paper Corporation 2020

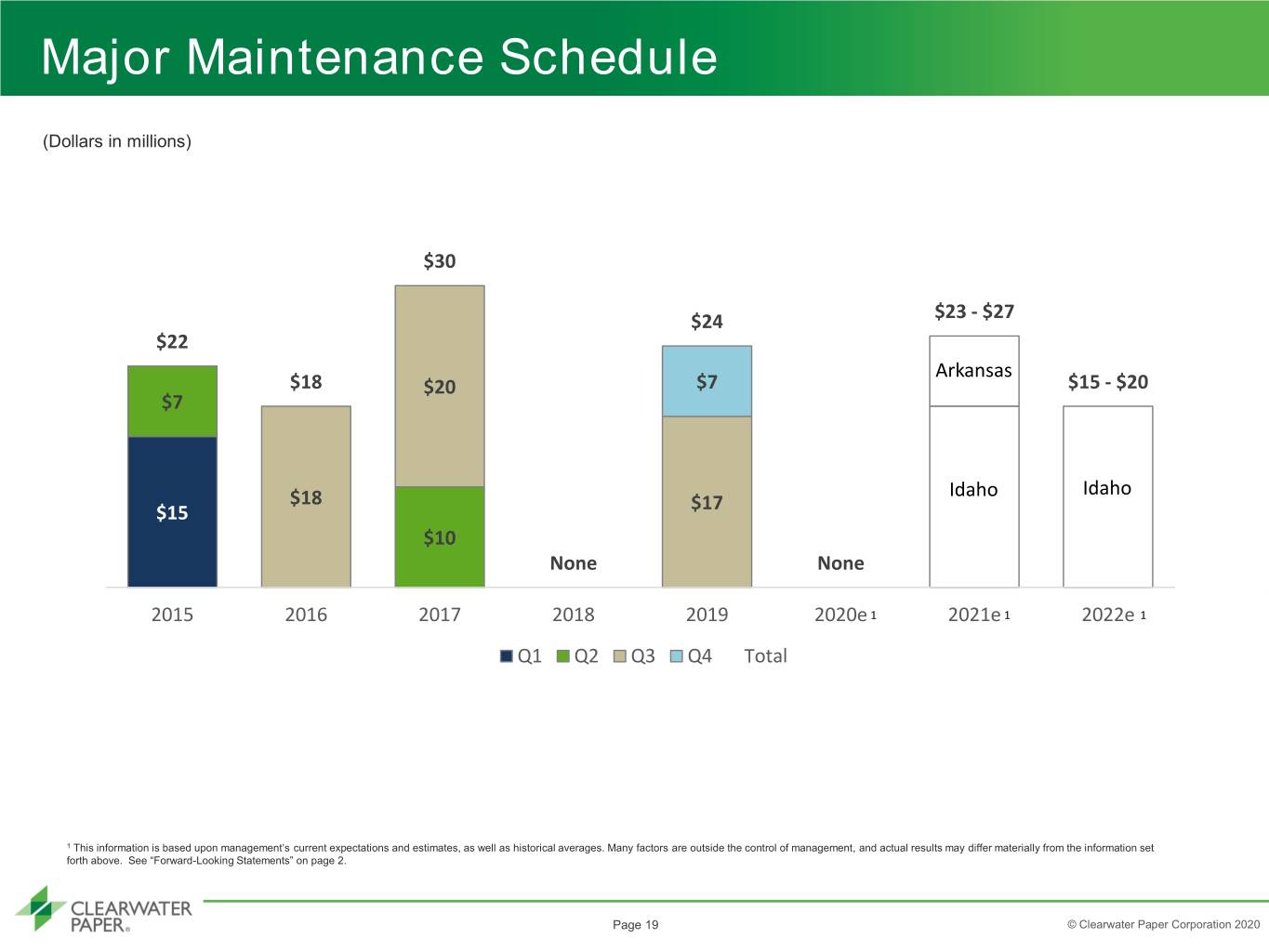

Major Maintenance Schedule (Dollars in millions) $30 $24 $23 - $27 $22 Arkansas $18 $20 $7 $15 - $20 $7 $18 Idaho Idaho $15 $17 $10 None None 2015 2016 2017 2018 2019 2020e 1 2021e 1 2022e 1 Q1 Q2 Q3 Q4 Total 1 This information is based upon management’s current expectations and estimates, as well as historical averages. Many factors are outside the control of management, and actual results may differ materially from the information set forth above. See “Forward-Looking Statements” on page 2. Page 19 © Clearwater Paper Corporation 2020

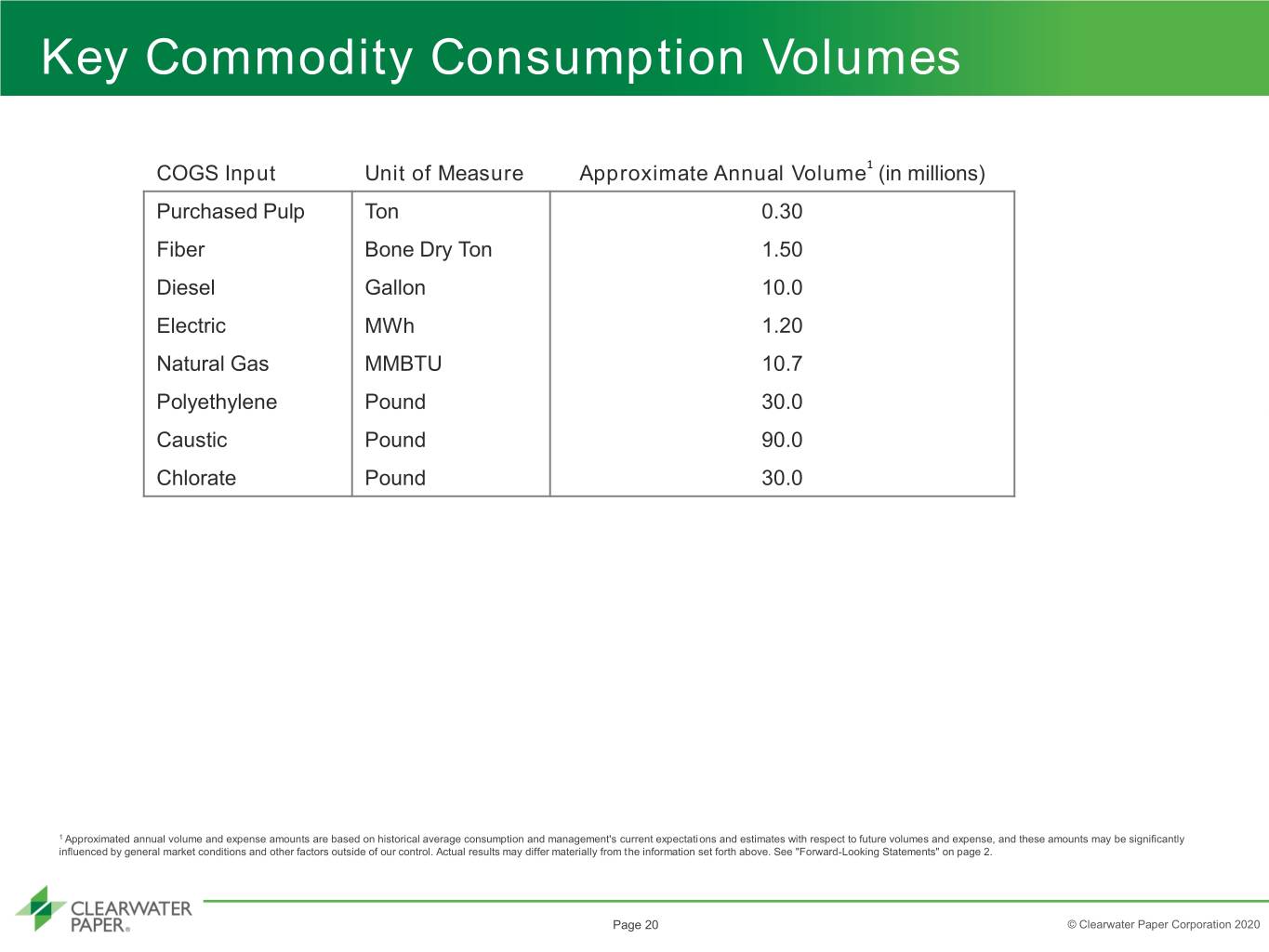

Key Commodity Consumption Volumes COGS Input Unit of Measure Approximate Annual Volume 1 (in millions) Purchased Pulp Ton 0.30 Fiber Bone Dry Ton 1.50 Diesel Gallon 10.0 Electric MWh 1.20 Natural Gas MMBTU 10.7 Polyethylene Pound 30.0 Caustic Pound 90.0 Chlorate Pound 30.0 1 Approximated annual volume and expense amounts are based on historical average consumption and management's current expectations and estimates with respect to future volumes and expense, and these amounts may be significantly influenced by general market conditions and other factors outside of our control. Actual results may differ materially from the information set forth above. See "Forward-Looking Statements" on page 2. Page 20 © Clearwater Paper Corporation 2020

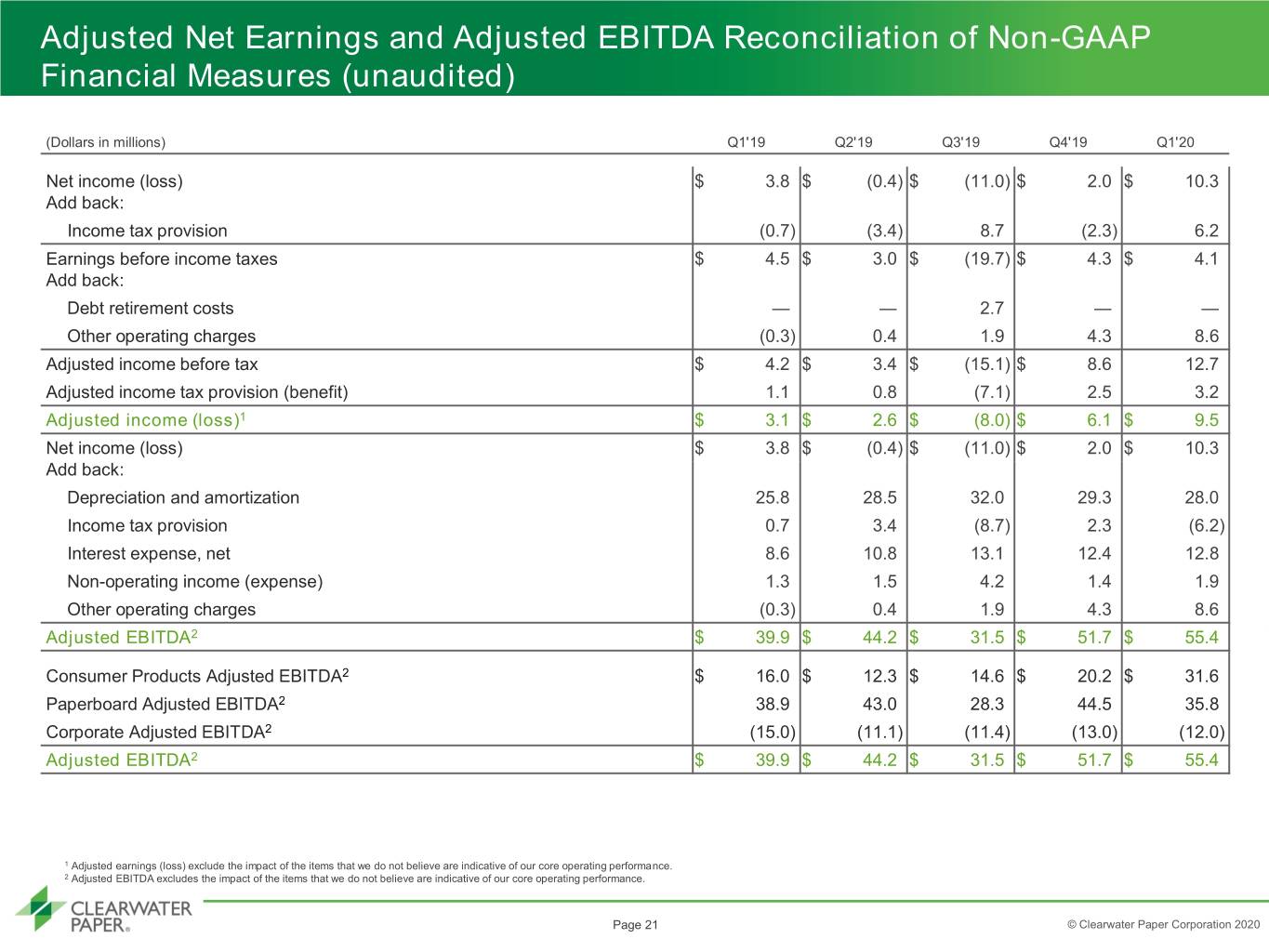

Adjusted Net Earnings and Adjusted EBITDA Reconciliation of Non-GAAP Financial Measures (unaudited) (Dollars in millions) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Net income (loss) $ 3.8 $ (0.4) $ (11.0) $ 2.0 $ 10.3 Add back: Income tax provision (0.7) (3.4) 8.7 (2.3) 6.2 Earnings before income taxes $ 4.5 $ 3.0 $ (19.7) $ 4.3 $ 4.1 Add back: Debt retirement costs — — 2.7 — — Other operating charges (0.3) 0.4 1.9 4.3 8.6 Adjusted income before tax $ 4.2 $ 3.4 $ (15.1) $ 8.6 12.7 Adjusted income tax provision (benefit) 1.1 0.8 (7.1) 2.5 3.2 Adjusted income (loss)1 $ 3.1 $ 2.6 $ (8.0) $ 6.1 $ 9.5 Net income (loss) $ 3.8 $ (0.4) $ (11.0) $ 2.0 $ 10.3 Add back: Depreciation and amortization 25.8 28.5 32.0 29.3 28.0 Income tax provision 0.7 3.4 (8.7) 2.3 (6.2) Interest expense, net 8.6 10.8 13.1 12.4 12.8 Non-operating income (expense) 1.3 1.5 4.2 1.4 1.9 Other operating charges (0.3) 0.4 1.9 4.3 8.6 Adjusted EBITDA2 $ 39.9 $ 44.2 $ 31.5 $ 51.7 $ 55.4 Consumer Products Adjusted EBITDA2 $ 16.0 $ 12.3 $ 14.6 $ 20.2 $ 31.6 Paperboard Adjusted EBITDA2 38.9 43.0 28.3 44.5 35.8 Corporate Adjusted EBITDA2 (15.0) (11.1) (11.4) (13.0) (12.0) Adjusted EBITDA2 $ 39.9 $ 44.2 $ 31.5 $ 51.7 $ 55.4 1 Adjusted earnings (loss) exclude the impact of the items that we do not believe are indicative of our core operating performance. 2 Adjusted EBITDA excludes the impact of the items that we do not believe are indicative of our core operating performance. Page 21 © Clearwater Paper Corporation 2020

Segment Adjusted EBITDA Reconciliation of Non-GAPP Financial Measures (unaudited) (Dollars in millions) Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Consumer Products segment income (loss) $ 1.3 $ (5.1) $ (4.4) $ 1.6 $ 14.3 Depreciation and amortization 14.7 17.4 19.0 18.6 17.3 Adjusted EBITDA Consumer Products1 $ 16.0 $ 12.3 $ 14.6 $ 20.2 $ 31.6 Paperboard segment income $ 29.4 $ 33.5 $ 17.1 $ 35.3 $ 26.5 Depreciation and amortization 9.5 9.5 11.2 9.2 9.3 Adjusted EBITDA Pulp and Paperboard1 $ 38.9 $ 43.0 $ 28.3 $ 44.5 $ 35.8 Corporate segment loss $ (16.6) $ (12.7) $ (13.2) $ (14.5) $ (13.4) Depreciation and amortization 1.6 1.6 1.8 1.5 1.4 Adjusted EBITDA Corporate1 $ (15.0) $ (11.1) $ (11.4) $ (13.0) $ (12.0) Adjusted EBITDA1 $ 39.9 $ 44.2 $ 31.5 $ 51.7 $ 55.4 1 Adjusted EBITDA excludes the impact of the items that we do not believe are indicative of our core operating performance. Page 22 © Clearwater Paper Corporation 2020

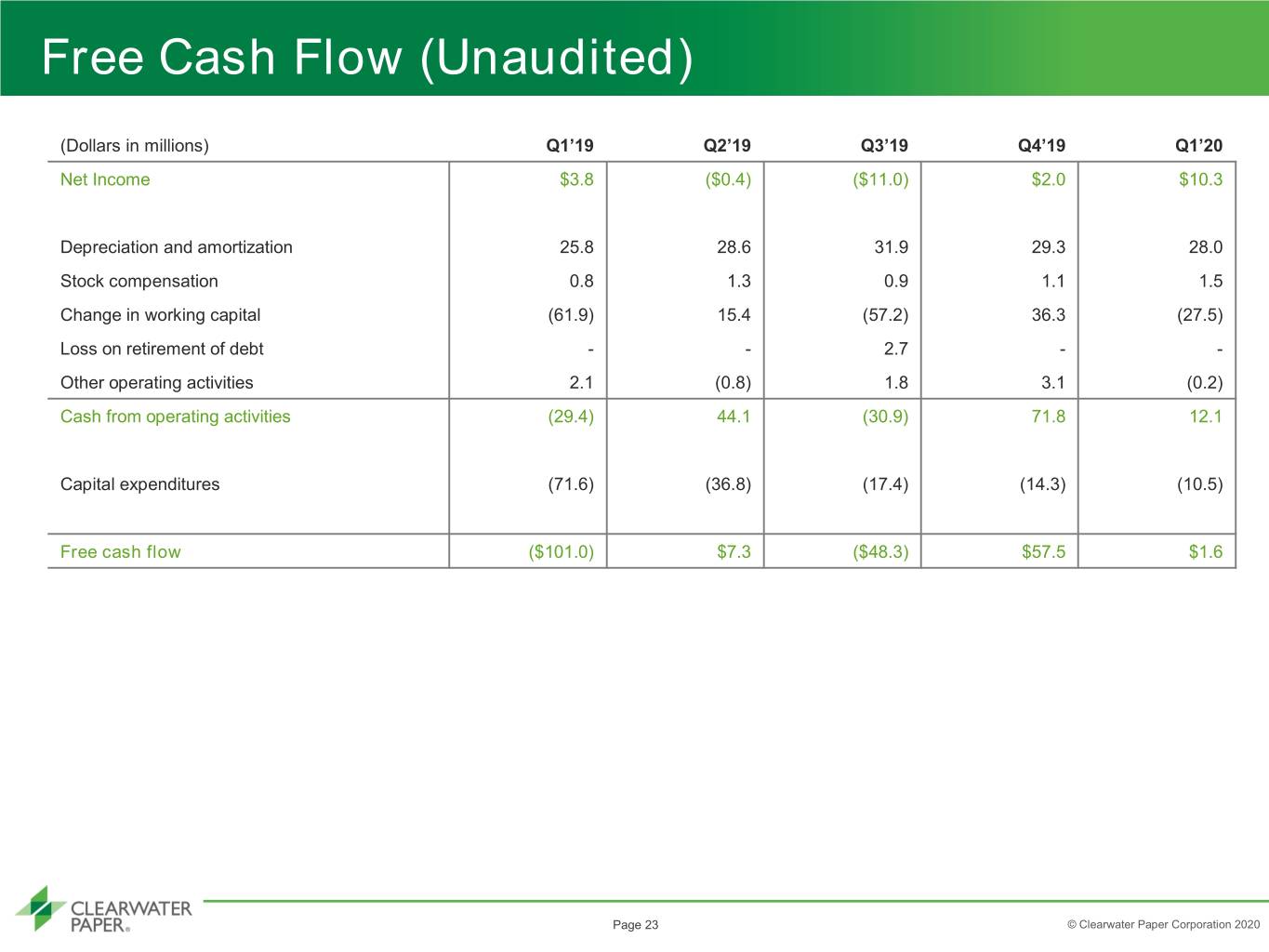

Free Cash Flow (Unaudited) (Dollars in millions) Q1’19 Q2’19 Q3’19 Q4’19 Q1’20 Net Income $3.8 ($0.4) ($11.0) $2.0 $10.3 Depreciation and amortization 25.8 28.6 31.9 29.3 28.0 Stock compensation 0.8 1.3 0.9 1.1 1.5 Change in working capital (61.9) 15.4 (57.2) 36.3 (27.5) Loss on retirement of debt - - 2.7 - - Other operating activities 2.1 (0.8) 1.8 3.1 (0.2) Cash from operating activities (29.4) 44.1 (30.9) 71.8 12.1 Capital expenditures (71.6) (36.8) (17.4) (14.3) (10.5) Free cash flow ($101.0) $7.3 ($48.3) $57.5 $1.6 Page 23 © Clearwater Paper Corporation 2020