Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Black Knight, Inc. | bkiq12020ex991-er.htm |

| 8-K - 8-K - Black Knight, Inc. | bkiq120208k-er.htm |

BLACK KNIGHT, INC. First Quarter 2020 Financial Results May 5, 2020

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements regarding expectations, hopes, intentions or strategies regarding the future are forward-looking statements. Forward-looking statements are based on Black Knight management's beliefs, as well as assumptions made by, and information currently available to, them. Because such statements are based on expectations as to future financial and operating results and are not statements of fact, actual results may differ materially from those projected. Black Knight undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. The risks and uncertainties that forward-looking statements are subject to include, but are not limited to: changes in general economic, business, regulatory and political conditions, including those resulting from pandemics such as COVID-19, particularly as they affect foreclosures and the mortgage industry; the outbreak of COVID- 19 and measures to reduce its spread, including the effect of governmental or voluntary actions such as business shutdowns and stay-at-home orders; security breaches against our information systems; our ability to maintain and grow our relationships with our clients; changes to the laws, rules and regulations that affect our and our clients’ businesses; our ability to adapt our services to changes in technology or the marketplace or to achieve our growth strategies; our ability to protect our proprietary software and information rights; the effect of any potential defects, development delays, installation difficulties or system failures on our business and reputation; risks associated with the availability of data; the effects of our existing leverage on our ability to make acquisitions and invest in our business; our ability to successfully integrate strategic acquisitions; risks associated with our investment in Star Parent, L.P. and the operation of its indirect subsidiary The Dun and Bradstreet Corporation (“D&B”); and other risks and uncertainties detailed in the “Statement Regarding Forward- Looking Information,” “Risk Factors” and other sections of our Annual Report on Form 10-K for the year ended December 31, 2019 and other filings with the Securities and Exchange Commission (“SEC”). Non-GAAP Financial Measures This presentation contains non-GAAP financial measures, including Adjusted Revenues, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Earnings and Adjusted EPS. These are important financial measures for us, but are not financial measures as defined by generally accepted accounting principles ("GAAP"). The presentation of this financial information is not intended to be considered in isolation of or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use these non-GAAP financial measures for financial and operational decision making and as a means to evaluate period-to-period comparisons. We believe these measures provide useful information about operating results, enhance the overall understanding of past financial performance and future prospects and allow for greater transparency with respect to key metrics used by management in its financial and operational decision making, including determining a portion of executive compensation. We also present these non-GAAP financial measures because we believe investors, analysts and rating agencies consider them useful in measuring our ability to meet our debt service obligations. By disclosing these non-GAAP financial measures, we believe we offer investors a greater understanding of, and an enhanced level of transparency into, the means by which our management operates the company. These non-GAAP financial measures are not measures presented in accordance with GAAP, and our use of these terms may vary from that of others in our industry. These non-GAAP financial measures should not be considered as an alternative to revenues, net earnings, net earnings per share, net earnings margin or any other measures derived in accordance with GAAP as measures of operating performance or liquidity. We have not provided a reconciliation of forward-looking Adjusted EPS and Adjusted EBITDA to the most directly comparable GAAP financial measures, due primarily to variability and difficulty in making accurate forecasts and projections of non-operating matters that may arise, as not all of the information necessary for a quantitative reconciliation is available to us without unreasonable effort. For the same reasons, we are unable to address the probable significance of the information. See the Appendix for further information. Revenues, EBITDA and EBITDA margin for the Software Solutions and Data and Analytics segments are presented in conformity with Accounting Standards Codification Topic 280, Segment Reporting. These measures are reported to the chief operating decision maker for purposes of making decisions about allocating resources to the segments and assessing their performance. For these reasons, these measures are excluded from the definition of non-GAAP financial measures under the SEC's Regulation G and Item 10(e) of Regulation S-K. Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 2 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

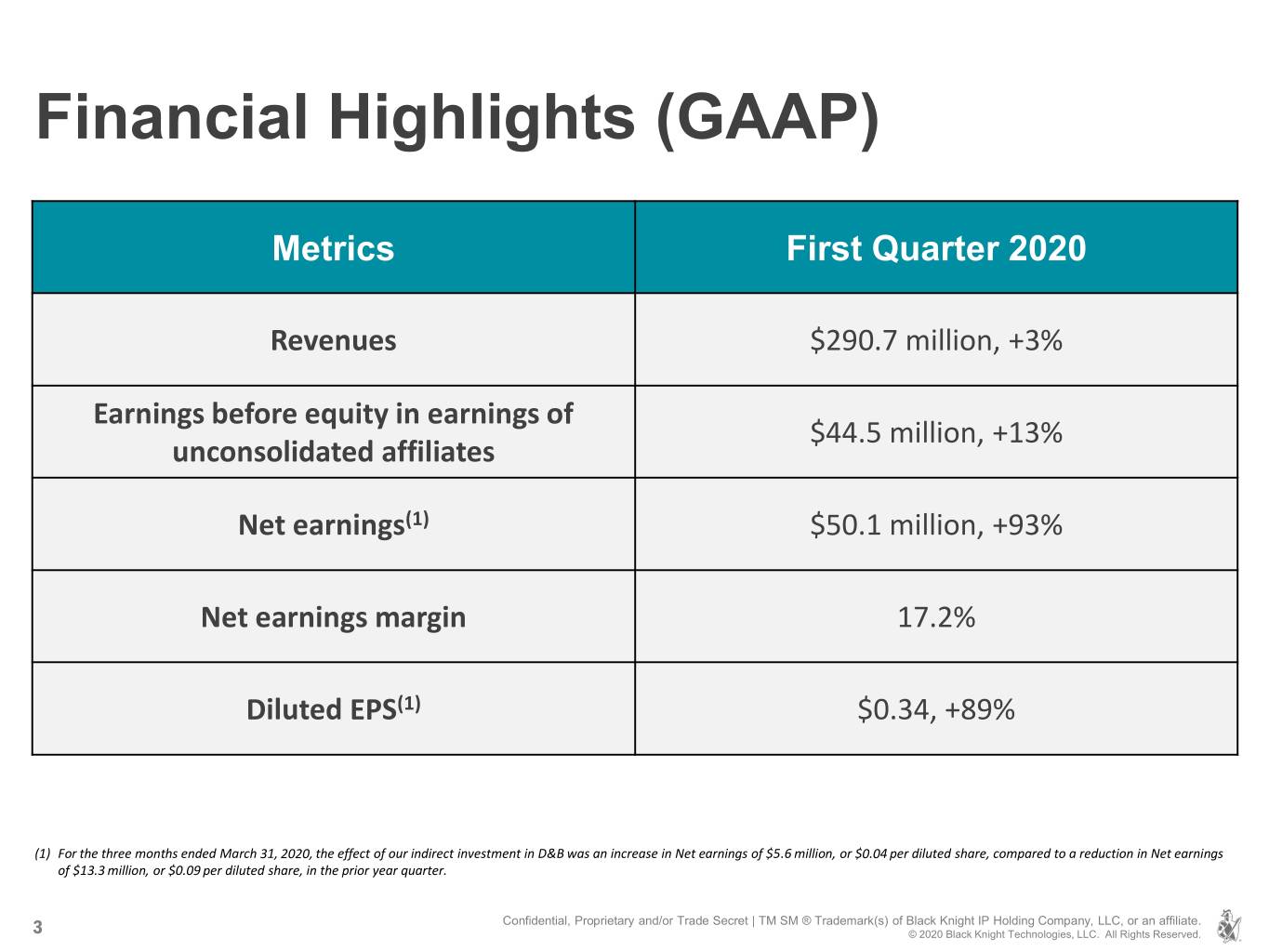

Financial Highlights (GAAP) Metrics First Quarter 2020 Revenues $290.7 million, +3% Earnings before equity in earnings of $44.5 million, +13% unconsolidated affiliates Net earnings(1) $50.1 million, +93% Net earnings margin 17.2% Diluted EPS(1) $0.34, +89% (1) For the three months ended March 31, 2020, the effect of our indirect investment in D&B was an increase in Net earnings of $5.6 million, or $0.04 per diluted share, compared to a reduction in Net earnings of $13.3 million, or $0.09 per diluted share, in the prior year quarter. Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 3 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

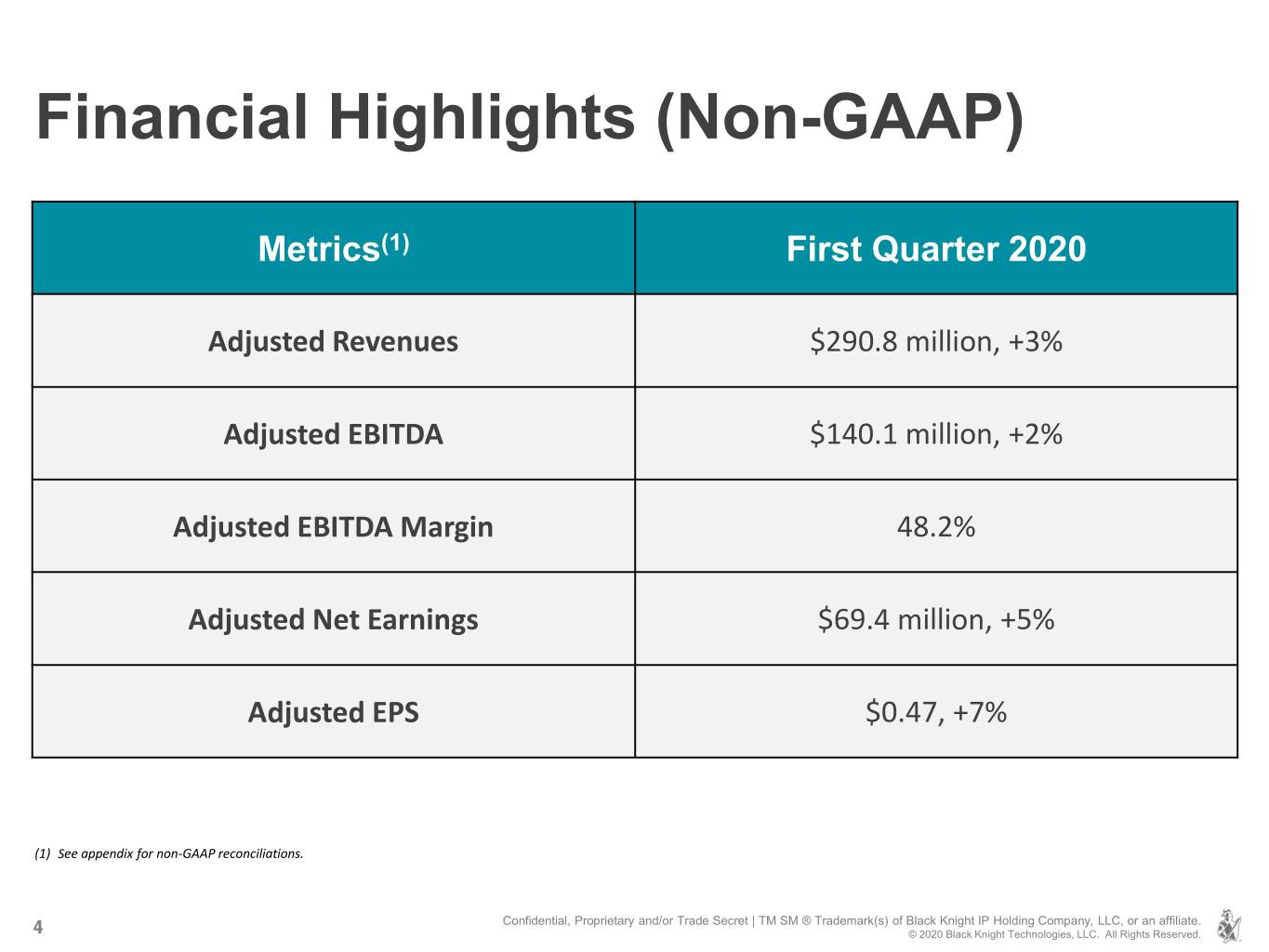

Financial Highlights (Non-GAAP) Metrics(1) First Quarter 2020 Adjusted Revenues $290.8 million, +3% Adjusted EBITDA $140.1 million, +2% Adjusted EBITDA Margin 48.2% Adjusted Net Earnings $69.4 million, +5% Adjusted EPS $0.47, +7% (1) See appendix for non-GAAP reconciliations. Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 4 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

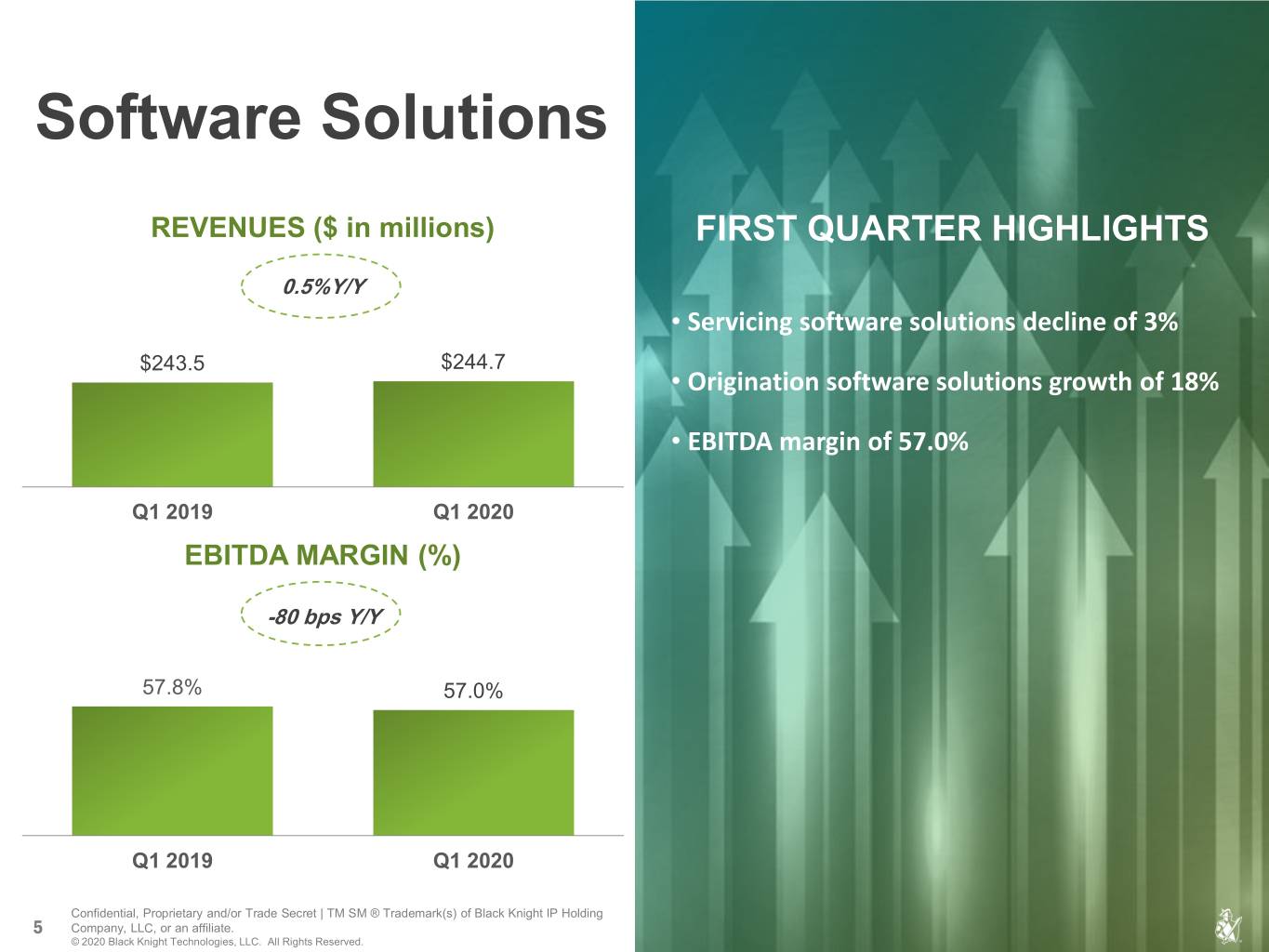

Software Solutions REVENUES ($ in millions) FIRST QUARTER HIGHLIGHTS 0.5%Y/Y • Servicing software solutions decline of 3% $243.5 $244.7 • Origination software solutions growth of 18% • EBITDA margin of 57.0% Q1 2019 Q1 2020 EBITDA MARGIN (%) -80 bps Y/Y 57.8% 57.0% Q1 2019 Q1 2020 Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding 5 Company, LLC, or an affiliate. © 2020 Black Knight Technologies, LLC. All Rights Reserved.

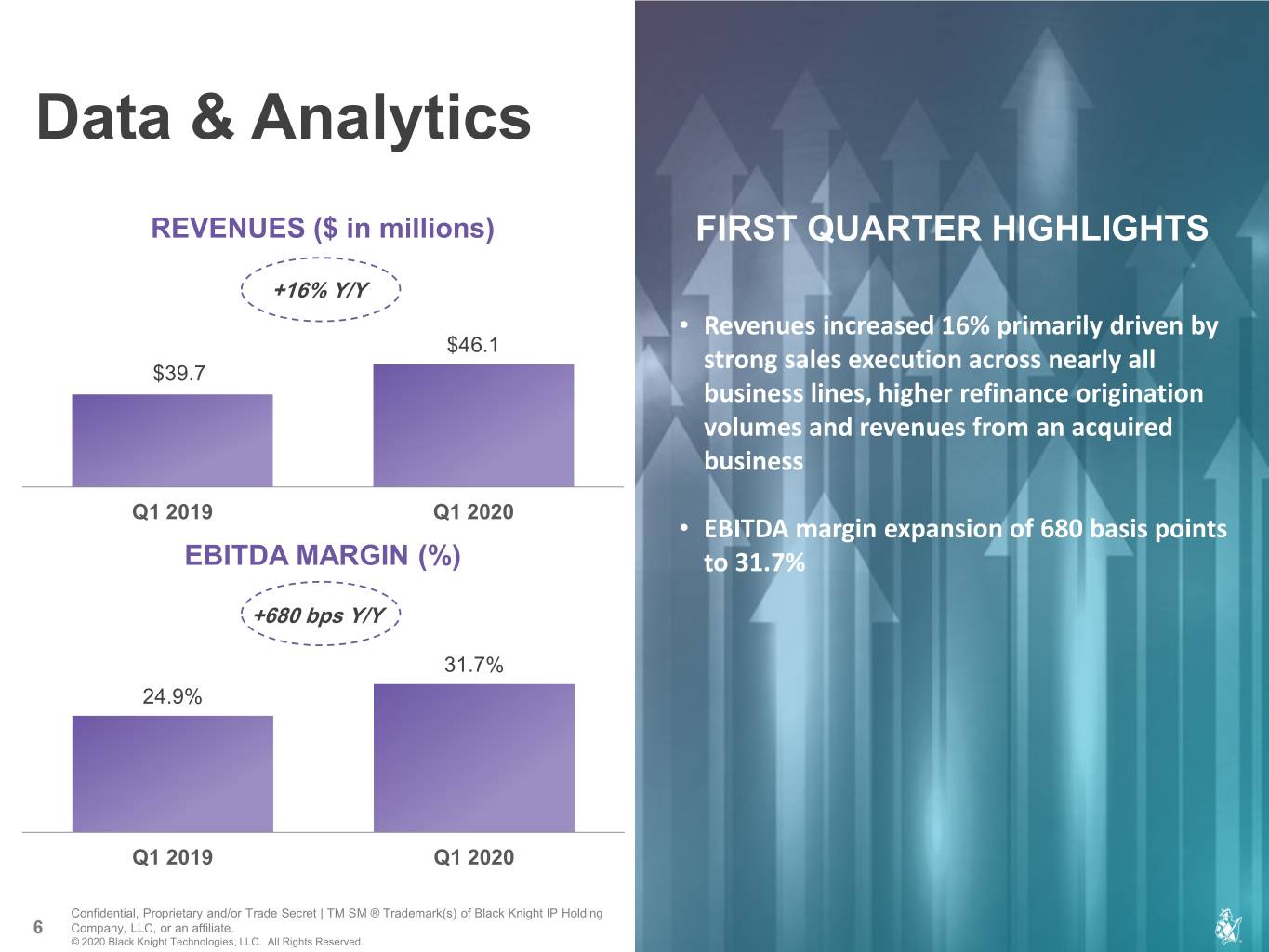

Data & Analytics REVENUES ($ in millions) FIRST QUARTER HIGHLIGHTS +16% Y/Y • Revenues increased 16% primarily driven by $46.1 $39.7 strong sales execution across nearly all business lines, higher refinance origination volumes and revenues from an acquired business Q1 2019 Q1 2020 • EBITDA margin expansion of 680 basis points EBITDA MARGIN (%) to 31.7% +680 bps Y/Y 31.7% 24.9% Q1 2019 Q1 2020 Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding 6 Company, LLC, or an affiliate. © 2020 Black Knight Technologies, LLC. All Rights Reserved.

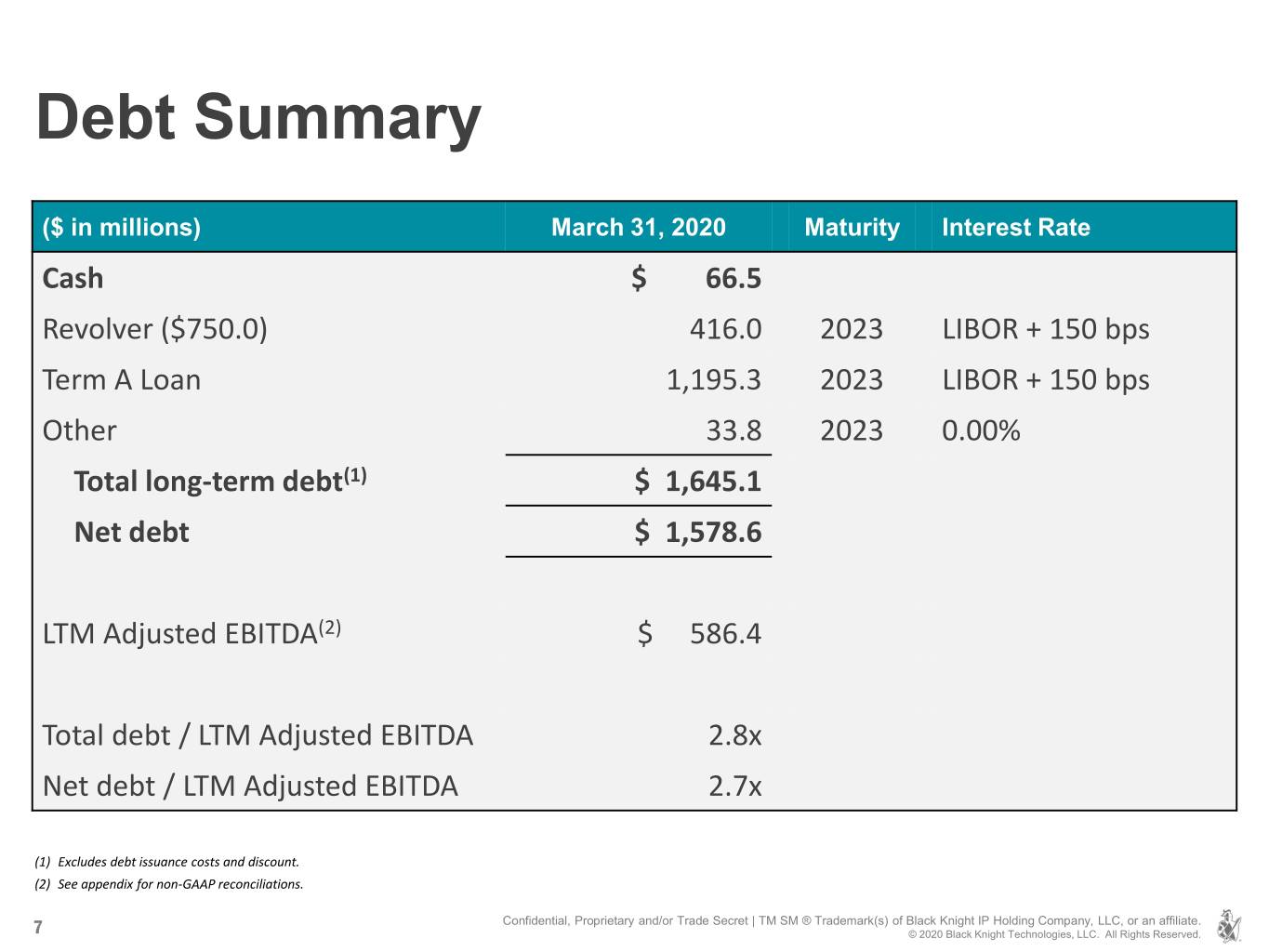

Debt Summary ($ in millions) March 31, 2020 Maturity Interest Rate Cash $ 66.5 Revolver ($750.0) 416.0 2023 LIBOR + 150 bps Term A Loan 1,195.3 2023 LIBOR + 150 bps Other 33.8 2023 0.00% Total long-term debt(1) $ 1,645.1 Net debt $ 1,578.6 LTM Adjusted EBITDA(2) $ 586.4 Total debt / LTM Adjusted EBITDA 2.8x Net debt / LTM Adjusted EBITDA 2.7x (1) Excludes debt issuance costs and discount. (2) See appendix for non-GAAP reconciliations. Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 7 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

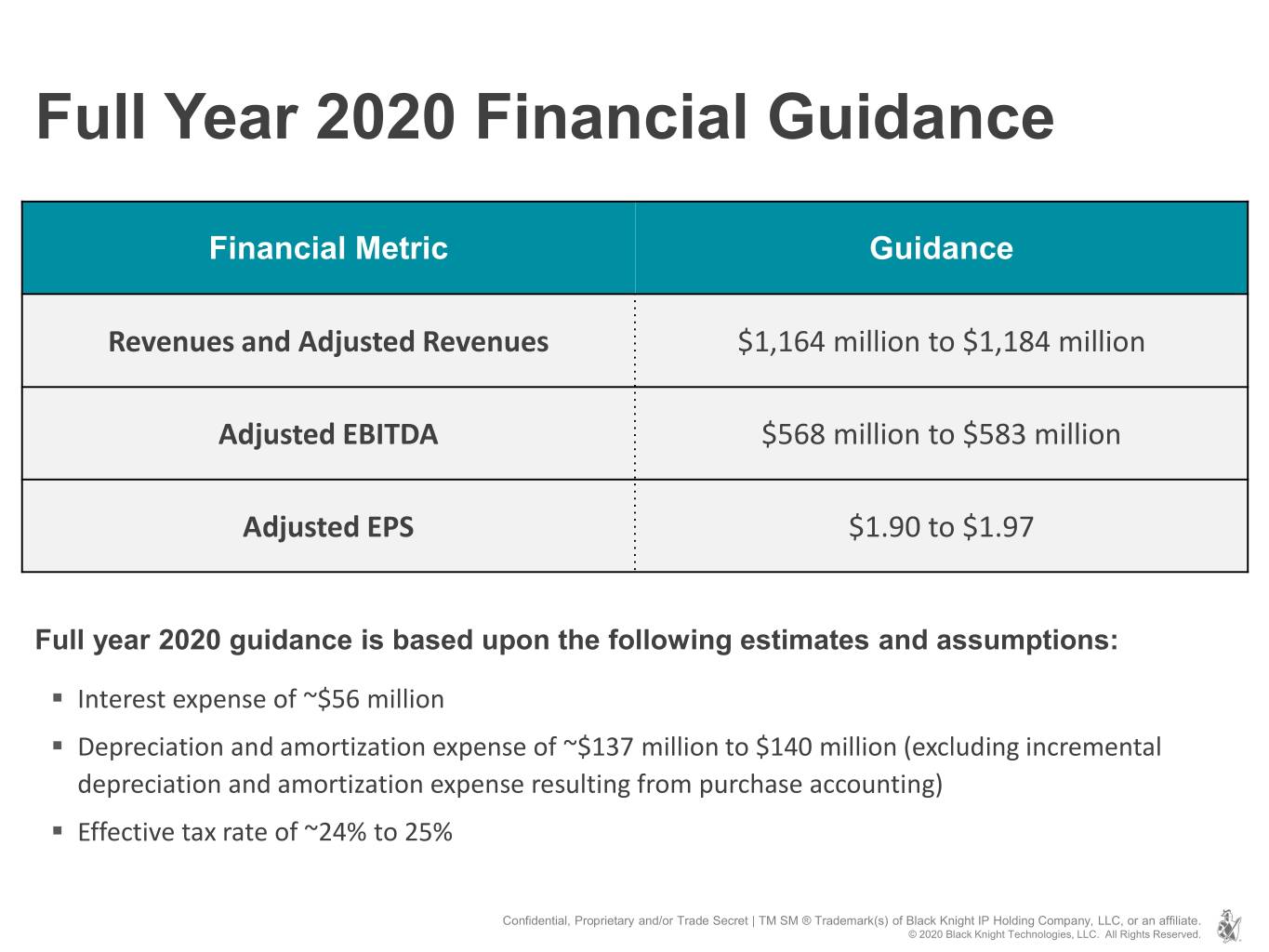

Full Year 2020 Financial Guidance Financial Metric Guidance Revenues and Adjusted Revenues $1,164 million to $1,184 million Adjusted EBITDA $568 million to $583 million Adjusted EPS $1.90 to $1.97 Full year 2020 guidance is based upon the following estimates and assumptions: . Interest expense of ~$56 million . Depreciation and amortization expense of ~$137 million to $140 million (excluding incremental depreciation and amortization expense resulting from purchase accounting) . Effective tax rate of ~24% to 25% Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 8 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

APPENDIX Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. © 2020 Black Knight Technologies, LLC. All Rights Reserved.

Non-GAAP Financial Measures Adjusted Revenues – We define Adjusted Revenues as Revenues adjusted to include the revenues that were not recorded by Black Knight during the periods presented due to the deferred revenue purchase accounting adjustment recorded in accordance with GAAP. These adjustments are reflected in Corporate and Other. Adjusted EBITDA – We define Adjusted EBITDA as Net earnings, with adjustments to reflect the addition or elimination of certain statement of earnings items including, but not limited to: (i) Depreciation and amortization; (ii) Impairment charges; (iii) Interest expense, net; (iv) Income tax expense; (v) Other expense, net; (vi) Equity in (earnings) losses of unconsolidated affiliates, net of tax; (vii) deferred revenue purchase accounting adjustment; (viii) equity-based compensation, including certain related payroll taxes; (ix) costs associated with debt and/or equity offerings; (x) acquisition-related costs, including costs pursuant to purchase agreements; and (xi) costs associated with expense reduction initiatives. These adjustments are reflected in Corporate and Other. Adjusted EBITDA Margin – Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by Adjusted Revenues. Adjusted Net Earnings – We define Adjusted Net Earnings as Net earnings with adjustments to reflect the addition or elimination of certain statement of earnings items including, but not limited to: (i) equity in (earnings) losses of unconsolidated affiliates, net of tax; (ii) the net incremental depreciation and amortization adjustments associated with the application of purchase accounting; (iii) deferred revenue purchase accounting adjustment; (iv) equity-based compensation, including certain related payroll taxes; (v) costs associated with debt and/or equity offerings; (vi) acquisition-related costs, including costs pursuant to purchase agreements; (vii) costs associated with expense reduction initiatives; (viii) significant legal matters; and (ix) adjustment for income tax expense primarily related to the tax effect of the non- GAAP adjustments. Adjusted EPS – Adjusted EPS is calculated by dividing Adjusted Net Earnings by the diluted weighted average shares of common stock outstanding. Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 10 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

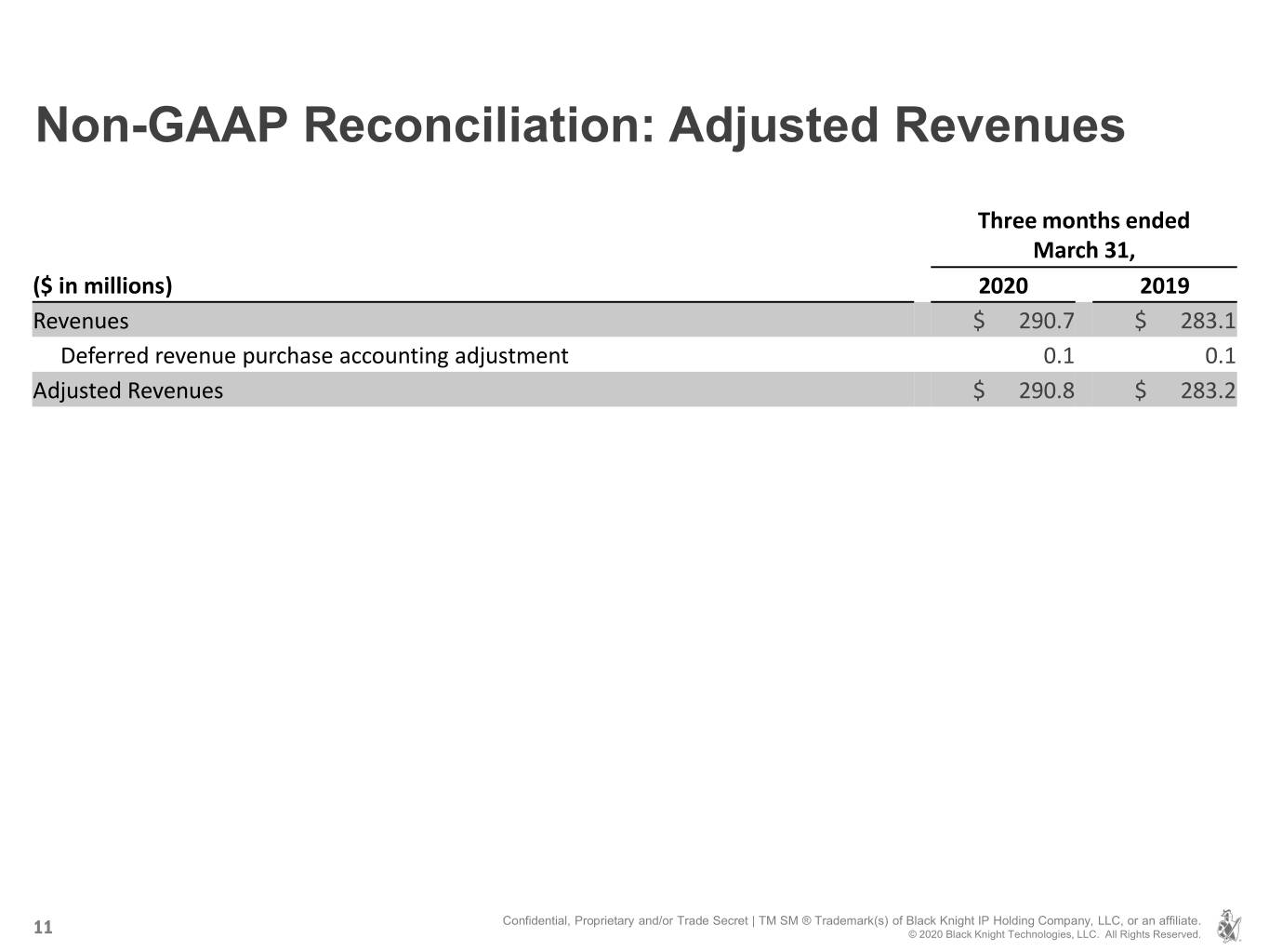

Non-GAAP Reconciliation: Adjusted Revenues Three months ended March 31, ($ in millions) 2020 2019 Revenues $ 290.7 $ 283.1 Deferred revenue purchase accounting adjustment 0.1 0.1 Adjusted Revenues $ 290.8 $ 283.2 Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 11 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

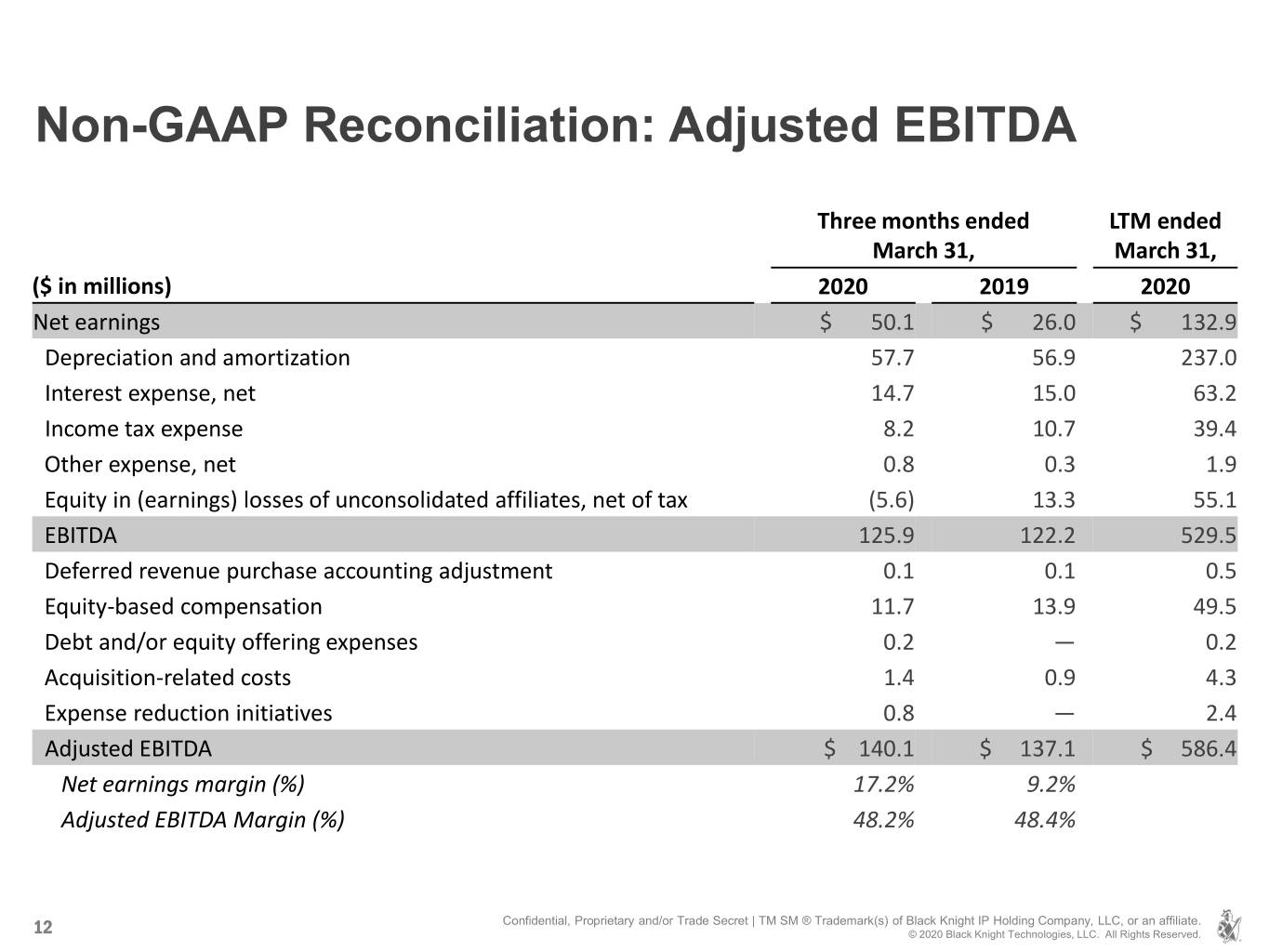

Non-GAAP Reconciliation: Adjusted EBITDA Three months ended LTM ended March 31, March 31, ($ in millions) 2020 2019 2020 Net earnings $ 50.1 $ 26.0 $ 132.9 Depreciation and amortization 57.7 56.9 237.0 Interest expense, net 14.7 15.0 63.2 Income tax expense 8.2 10.7 39.4 Other expense, net 0.8 0.3 1.9 Equity in (earnings) losses of unconsolidated affiliates, net of tax (5.6) 13.3 55.1 EBITDA 125.9 122.2 529.5 Deferred revenue purchase accounting adjustment 0.1 0.1 0.5 Equity-based compensation 11.7 13.9 49.5 Debt and/or equity offering expenses 0.2 — 0.2 Acquisition-related costs 1.4 0.9 4.3 Expense reduction initiatives 0.8 — 2.4 Adjusted EBITDA $ 140.1 $ 137.1 $ 586.4 Net earnings margin (%) 17.2% 9.2% Adjusted EBITDA Margin (%) 48.2% 48.4% Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 12 © 2020 Black Knight Technologies, LLC. All Rights Reserved.

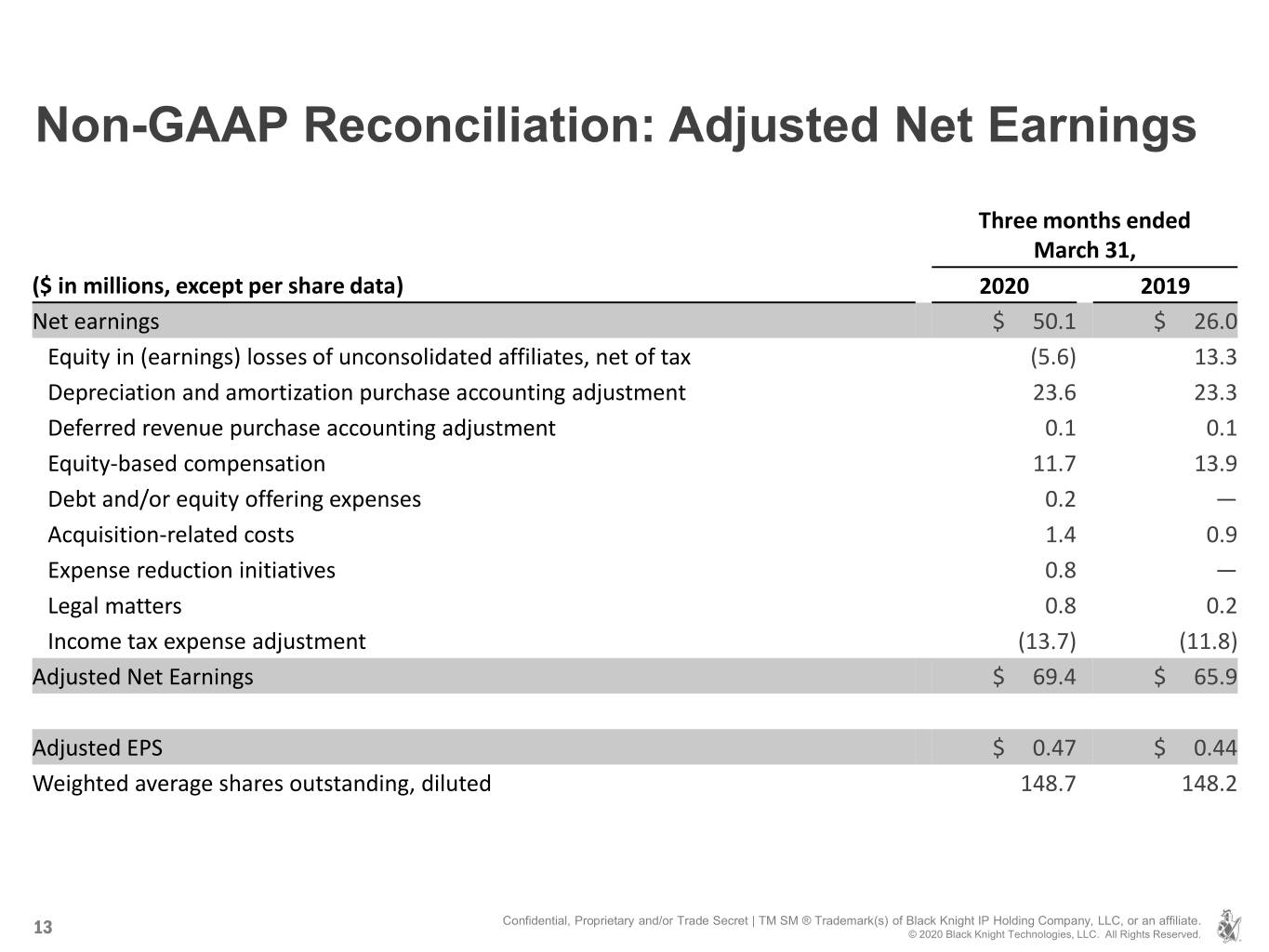

Non-GAAP Reconciliation: Adjusted Net Earnings Three months ended March 31, ($ in millions, except per share data) 2020 2019 Net earnings $ 50.1 $ 26.0 Equity in (earnings) losses of unconsolidated affiliates, net of tax (5.6) 13.3 Depreciation and amortization purchase accounting adjustment 23.6 23.3 Deferred revenue purchase accounting adjustment 0.1 0.1 Equity-based compensation 11.7 13.9 Debt and/or equity offering expenses 0.2 — Acquisition-related costs 1.4 0.9 Expense reduction initiatives 0.8 — Legal matters 0.8 0.2 Income tax expense adjustment (13.7) (11.8) Adjusted Net Earnings $ 69.4 $ 65.9 Adjusted EPS $ 0.47 $ 0.44 Weighted average shares outstanding, diluted 148.7 148.2 Confidential, Proprietary and/or Trade Secret | TM SM ® Trademark(s) of Black Knight IP Holding Company, LLC, or an affiliate. 13 © 2020 Black Knight Technologies, LLC. All Rights Reserved.